Delivering superior returns J-S Jacques, chief executive UBS Australasia Conference, Sydney 12 November 2018

Cautionary statements ©2018, Rio Tinto, All Rights Reserved This presentation has been prepared by Rio Tinto plc and Rio Tinto Limited (“Rio Tinto”). By accessing/attending this presentation you acknowledge that you have read and understood the following statement. Forward-looking statements This document, including but not limited to all forward looking figures, contains certain forward-looking statements with respect to the financial condition, results of operations and business of the Rio Tinto Group. These statements are forward-looking statements within the meaning of Section 27A of the US Securities Act of 1933, and Section 21E of the US Securities Exchange Act of 1934. The words “intend”, “aim”, “project”, “anticipate”, “estimate”, “plan”, “believes”, “expects”, “may”, “should”, “will”, “target”, “set to” or similar expressions, commonly identify such forward-looking statements. Examples of forward-looking statements include those regarding estimated ore reserves, anticipated production or construction dates, costs, outputs and productive lives of assets or similar factors. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors set forth in this presentation. For example, future ore reserves will be based in part on market prices that may vary significantly from current levels. These may materially affect the timing and feasibility of particular developments. Other factors include the ability to produce and transport products profitably, demand for our products, changes to the assumptions regarding the recoverable value of our tangible and intangible assets, the effect of foreign currency exchange rates on market prices and operating costs, and activities by governmental authorities, such as changes in taxation or regulation, and political uncertainty. In light of these risks, uncertainties and assumptions, actual results could be materially different from projected future results expressed or implied by these forward-looking statements which speak only as to the date of this presentation. Except as required by applicable regulations or by law, the Rio Tinto Group does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events. The Group cannot guarantee that its forward-looking statements will not differ materially from actual results. In this presentation all figures are US dollars unless stated otherwise. Disclaimer Neither this presentation, nor the question and answer session, nor any part thereof, may be recorded, transcribed, distributed, published or reproduced in any form, except as permitted by Rio Tinto. By accessing/ attending this presentation, you agree with the foregoing and, upon request, you will promptly return any records or transcripts at the presentation without retaining any copies. This presentation contains a number of non-IFRS financial measures. Rio Tinto management considers these to be key financial performance indicators of the business and they are defined and/or reconciled in Rio Tinto’s annual results press release and/or Annual report. Reference to consensus figures are not based on Rio Tinto’s own opinions, estimates or forecasts and are compiled and published without comment from, or endorsement or verification by, Rio Tinto. The consensus figures do not necessarily reflect guidance provided from time to time by Rio Tinto where given in relation to equivalent metrics, which to the extent available can be found on the Rio Tinto website. By referencing consensus figures, Rio Tinto does not imply that it endorses, confirms or expresses a view on the consensus figures. The consensus figures are provided for informational purposes only and are not intended to, nor do they, constitute investment advice or any solicitation to buy, hold or sell securities or other financial instruments. No warranty or representation, either express or implied, is made by Rio Tinto or its affiliates, or their respective directors, officers and employees, in relation to the accuracy, completeness or achievability of the consensus figures and, to the fullest extent permitted by law, no responsibility or liability is accepted by any of those persons in respect of those matters. Rio Tinto assumes no obligation to update, revise or supplement the consensus figures to reflect circumstances existing after the date hereof.

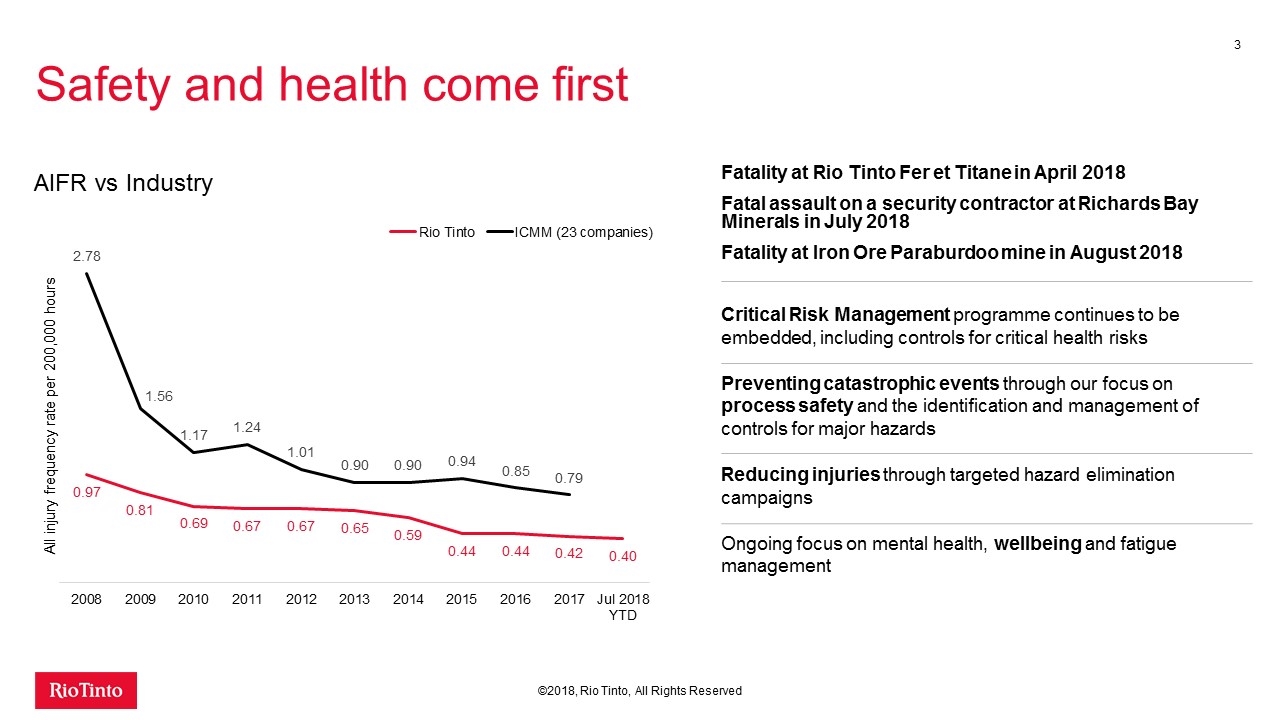

©2018, Rio Tinto, All Rights Reserved Critical Risk Management programme continues to be embedded, including controls for critical health risks Preventing catastrophic events through our focus on process safety and the identification and management of controls for major hazards Reducing injuries through targeted hazard elimination campaigns Ongoing focus on mental health, wellbeing and fatigue management Fatality at Rio Tinto Fer et Titane in April 2018 Fatal assault on a security contractor at Richards Bay Minerals in July 2018 Fatality at Iron Ore Paraburdoo mine in August 2018 AIFR vs Industry Safety and health come first

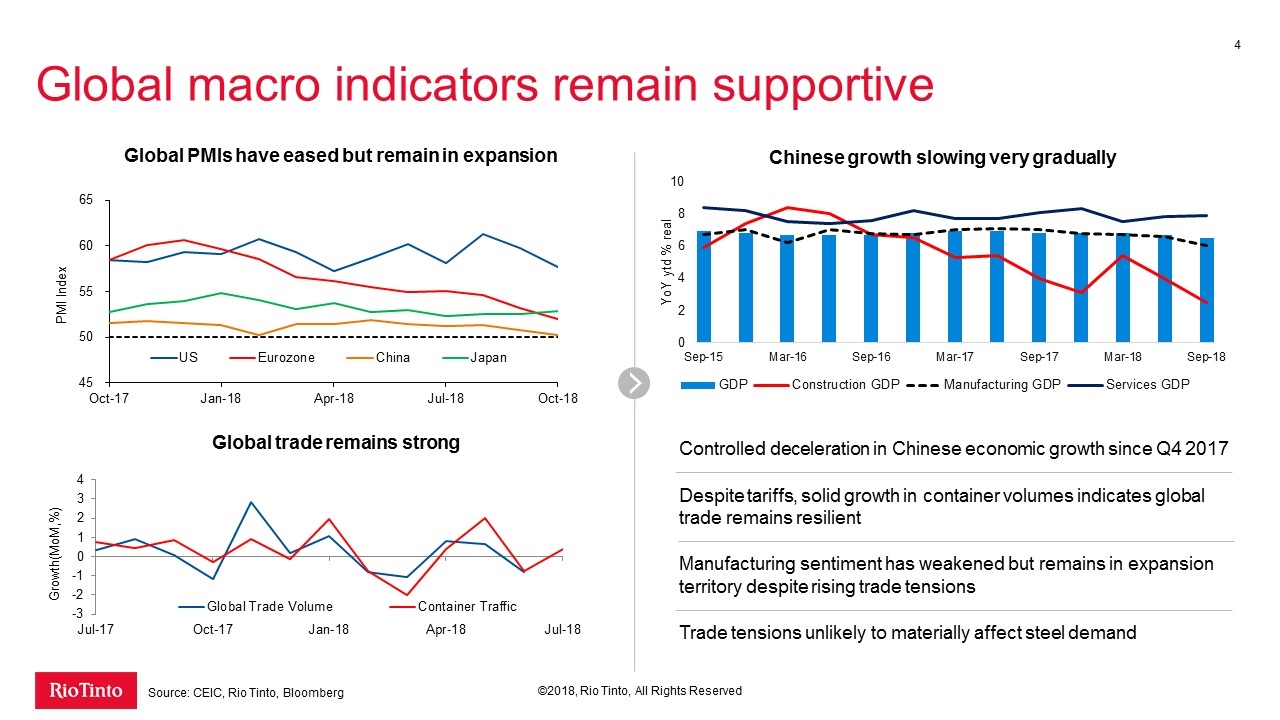

Global PMIs have eased but remain in expansion Controlled deceleration in Chinese economic growth since Q4 2017 Despite tariffs, solid growth in container volumes indicates global trade remains resilient Manufacturing sentiment has weakened but remains in expansion territory despite rising trade tensions Trade tensions unlikely to materially affect steel demand Chinese growth slowing very gradually Source: CEIC, Rio Tinto, Bloomberg ©2018, Rio Tinto, All Rights Reserved Global trade remains strong Global macro indicators remain supportive

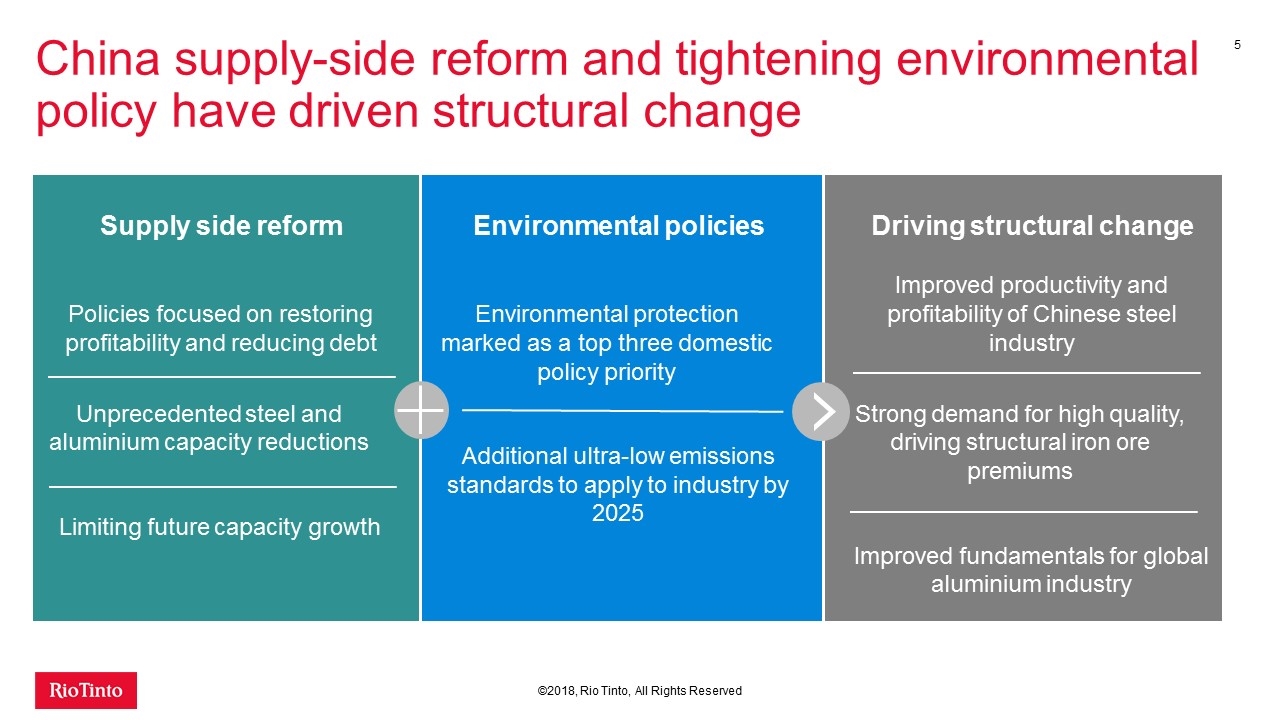

China supply-side reform and tightening environmental policy have driven structural change Supply side reform Policies focused on restoring profitability and reducing debt Unprecedented steel and aluminium capacity reductions Limiting future capacity growth ©2018, Rio Tinto, All Rights Reserved Environmental policies Environmental protection marked as a top three domestic policy priority Additional ultra-low emissions standards to apply to industry by 2025 Driving structural change Improved productivity and profitability of Chinese steel industry Strong demand for high quality, driving structural iron ore premiums Improved fundamentals for global aluminium industry

Disciplined capital allocation World-class assets Portfolio Operating excellence Performance Capabilities People & Partners Balance sheet strength Superior shareholder returns Compelling growth Superior cash generation Our strategy will deliver value through the cycle ©2018, Rio Tinto, All Rights Reserved

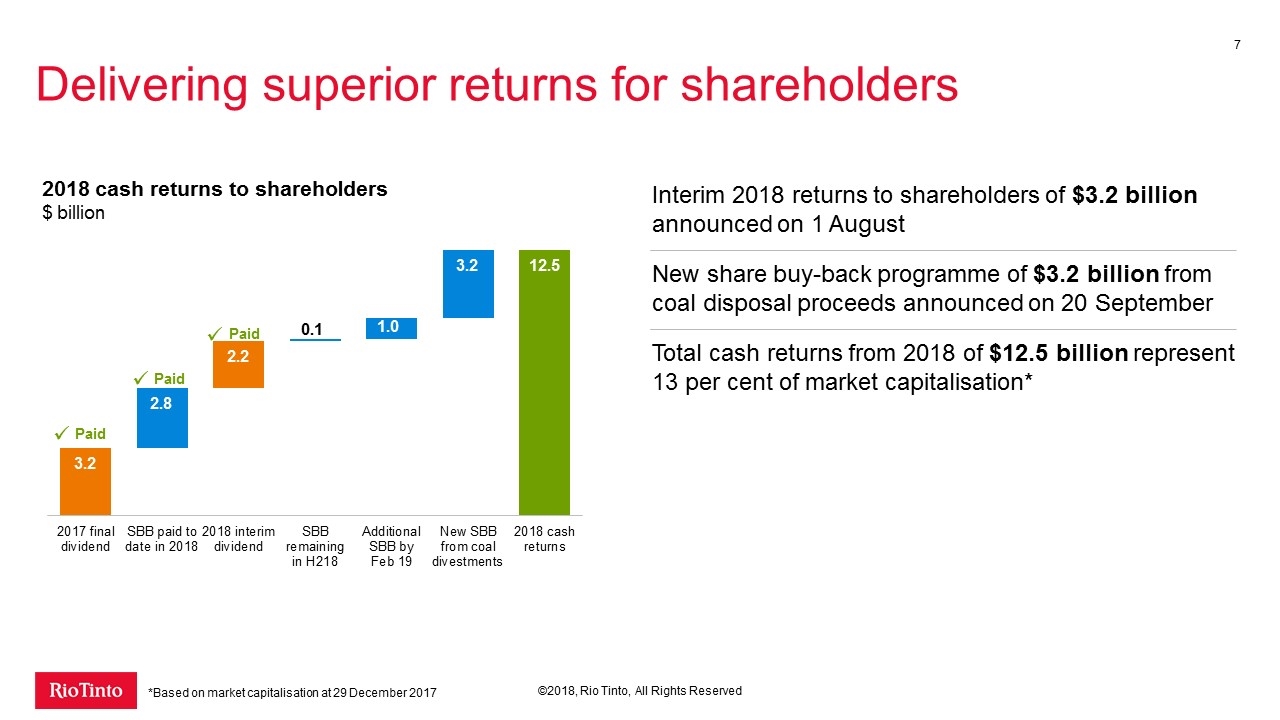

Delivering superior returns for shareholders ©2018, Rio Tinto, All Rights Reserved 2018 cash returns to shareholders $ billion Paid ü Paid ü Interim 2018 returns to shareholders of $3.2 billion announced on 1 August New share buy-back programme of $3.2 billion from coal disposal proceeds announced on 20 September Total cash returns from 2018 of $12.5 billion represent 13 per cent of market capitalisation* Paid ü *Based on market capitalisation at 29 December 2017

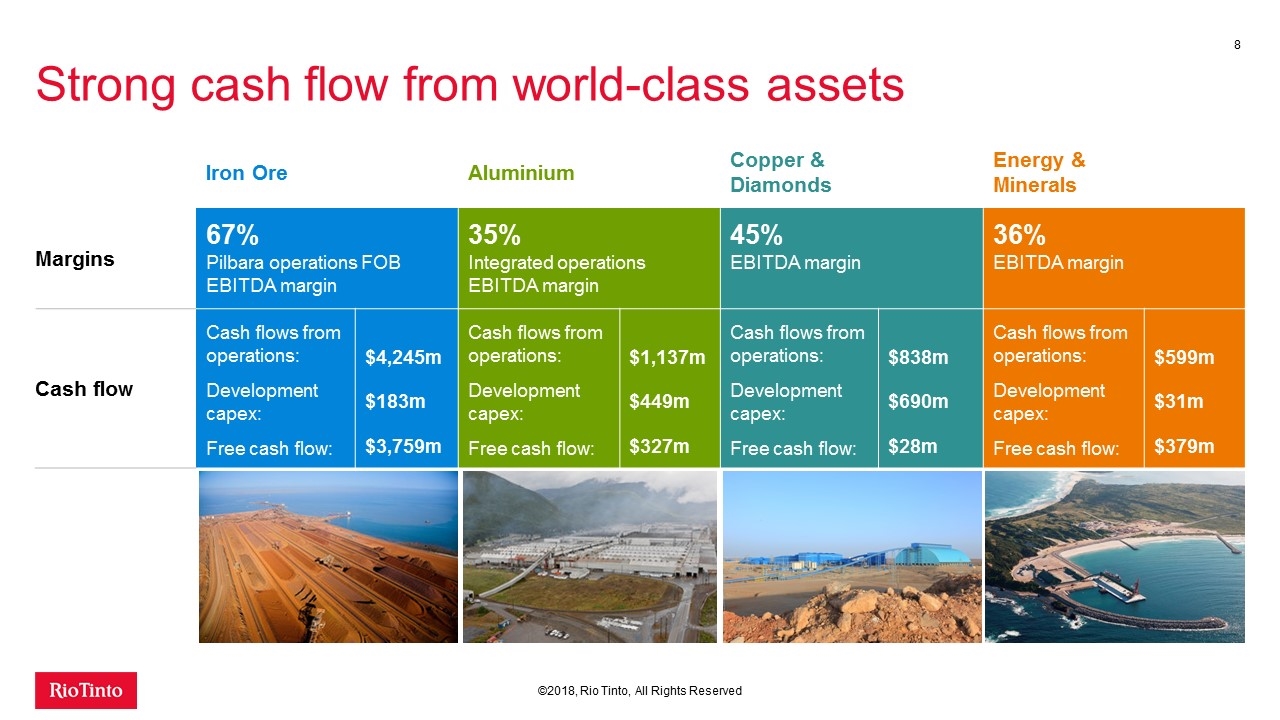

Strong cash flow from world-class assets Iron Ore Aluminium Copper & Diamonds Energy & Minerals Margins 67% Pilbara operations FOB EBITDA margin 35% Integrated operations EBITDA margin 45% EBITDA margin 36% EBITDA margin Cash flow Cash flows from operations: Development capex: Free cash flow: $4,245m $183m $3,759m Cash flows from operations: Development capex: Free cash flow: $1,137m $449m $327m Cash flows from operations: Development capex: Free cash flow: $838m $690m $28m Cash flows from operations: Development capex: Free cash flow: $599m $31m $379m ©2018, Rio Tinto, All Rights Reserved

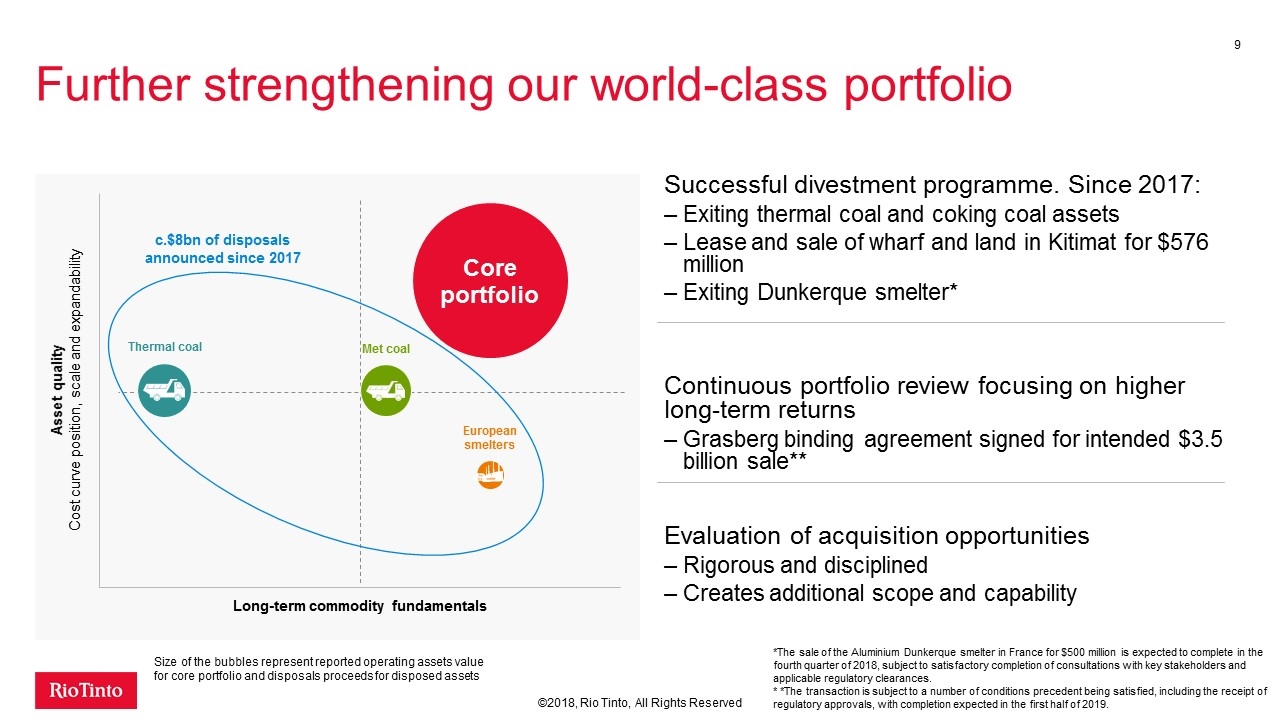

Further strengthening our world-class portfolio Successful divestment programme. Since 2017: Exiting thermal coal and coking coal assets Lease and sale of wharf and land in Kitimat for $576 million Exiting Dunkerque smelter* Continuous portfolio review focusing on higher long-term returns Grasberg binding agreement signed for intended $3.5 billion sale** Evaluation of acquisition opportunities Rigorous and disciplined Creates additional scope and capability ©2018, Rio Tinto, All Rights Reserved Size of the bubbles represent reported operating assets value for core portfolio and disposals proceeds for disposed assets Long-term commodity fundamentals Asset quality Cost curve position, scale and expandability c.$8bn of disposals announced since 2017 *The sale of the Aluminium Dunkerque smelter in France for $500 million is expected to complete in the fourth quarter of 2018, subject to satisfactory completion of consultations with key stakeholders and applicable regulatory clearances. * *The transaction is subject to a number of conditions precedent being satisfied, including the receipt of regulatory approvals, with completion expected in the first half of 2019.

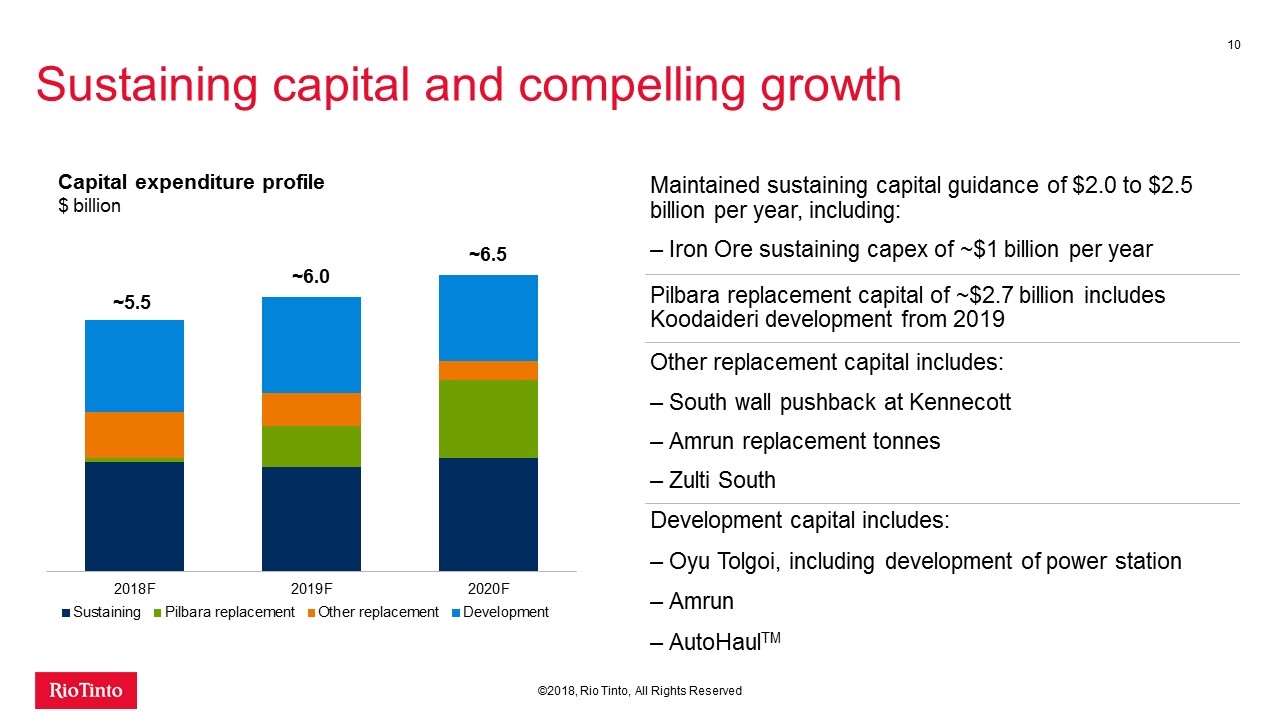

Sustaining capital and compelling growth ©2018, Rio Tinto, All Rights Reserved Maintained sustaining capital guidance of $2.0 to $2.5 billion per year, including: Iron Ore sustaining capex of ~$1 billion per year Pilbara replacement capital of ~$2.7 billion includes Koodaideri development from 2019 Other replacement capital includes: South wall pushback at Kennecott Amrun replacement tonnes Zulti South Development capital includes: Oyu Tolgoi, including development of power station Amrun AutoHaulTM Capital expenditure profile $ billion ~ ~6.0 ~6.5

High-return growth optionality ©2018, Rio Tinto, All Rights Reserved Iron Ore Aluminium Copper Industrial Minerals Optimising the world’s premier iron ore business Building optionality into the lowest cost bauxite and aluminium business Building the largest and highest quality copper development Extensive exploration programme and high-return niche growth Increasing flexibility of Pilbara system $1.9 billion Amrun bauxite project to complete first shipment in Q4 201 with full ramp-up in 2019 $5.3 billion Oyu Tolgoi underground first drawbell production in 2020 Zulti South mineral sands project in feasibility study Koodaideri project in feasibility study Further bauxite expansion options in northern Australia $0.9 billion Kennecott South Wall Pushback Jadar lithium/borates in pre-feasibility study – high-growth option in battery minerals Pursuing additional productivity and automation initiatives Brownfield Canadian aluminium expansion optionality First full year of increased Escondida capacity in 2018 H1 2018 E&E spend of $232 million in 17 countries across 8 commodities Significant resource optionality to maintain high-quality product Resolution copper pre-feasibility study to be completed by 2021

Disciplined capital allocation World-class assets Portfolio Operating excellence Performance Capabilities People & Partners Balance sheet strength Superior shareholder returns Compelling growth Superior cash generation Our strategy will deliver value through the cycle ©2018, Rio Tinto, All Rights Reserved