2025 Notice of annual general meeting The annual general meeting of Rio Tinto Limited will be held at 9:30am (AWST) on Thursday, 1 May 2025 at the BelleVue Ballroom, Level 3, the Perth Convention and Exhibition Centre, 21 Mounts Bay Road, Perth, Western Australia. This document is important and requires your immediate attention. If you are unclear about the action you should take, contact your stockbroker, solicitor, accountant or other professional adviser immediately. If it becomes necessary or appropriate to make alternate arrangements to hold the meeting, shareholders will be given as much notice as possible. Updates will be made available at riotinto.com/agm. If you are unable to attend the annual general meeting in person, you can participate in the meeting online. Details on how to participate online can be found on page 6 of this notice. Further information will be made available at riotinto.com/agm. Exhibit 99.7

Letter from the Chair Dear shareholders, I am pleased to invite you to Rio Tinto Limited’s annual general meeting (AGM), which will be held at 9:30am (AWST) on Thursday, 1 May 2025 at the BelleVue Ballroom, Level 3, the Perth Convention and Exhibition Centre, 21 Mounts Bay Road, Perth, Western Australia. This notice of meeting describes the business that will be proposed at the AGM and sets out the procedures for your participation and voting. Your participation is highly valued and an important opportunity for the Board and shareholders to discuss the Group’s priorities and performance. Please note that only shareholders, proxy holders and corporate representatives in attendance at the meeting, either in person or online, will be eligible to ask questions of the Directors. Board changes As we reported last year, the size of the Board peaked at 14 Directors as we retained the expertise and experience of our longer-serving Directors during a transitional period as newer Directors familiarised themselves with the Group. That transitional phase is now largely concluded so we will make the following changes to the Board during 2025. At the conclusion of this year’s Rio Tinto Limited AGM, Sam Laidlaw will step down as a Director of the Company. Sam was appointed to the Board in February 2017 and has served as Chair of our People & Remuneration Committee and as the Senior Independent Director. I would like to express my sincere thanks to Sam, on behalf of the Board, for his outstanding contribution to Rio Tinto. Ben Wyatt will succeed Sam as Chair of the People & Remuneration Committee and Sharon Thorne will become our Senior Independent Director. In the second half of 2025, Simon Henry will step down as a Director. Simon was appointed to the Board in April 2017 and has served as Chair of the Audit & Risk Committee since May 2019. We are grateful to Simon for his invaluable contribution to the Group. Sharon Thorne will succeed Simon as Chair of the Audit & Risk Committee. Kaisa Hietala will also step down as a Director at the conclusion of this year’s Rio Tinto Limited AGM. The recent growth in our Lithium business has increasingly created potential conflicts of interest with Kaisa’s non-executive directorship with Exxon Mobil. Out of an abundance of caution, Kaisa has offered to resolve this potential conflict by stepping down from the Rio Tinto Board. Kaisa has been a very welcome and valuable addition to the Board since her appointment in March 2023, and her guidance on energy transition and business transformation in particular have contributed significantly and insightfully to our discussions. While she will be greatly missed, we have accepted her decision to step down and wish Kaisa well for the future. 2025 Climate Action Plan This year we are seeking shareholder approval for our 2025 Climate Action Plan (2025 CAP). The Plan sets out our continued strategy to provide the materials that are needed for the energy transition, retain our commitments to reduce emissions from our operations and work with our partners to cut emissions through the value chain. The 2025 CAP is underpinned by a clear pathway to reduce Scope 1 and 2 emissions by 50% by 2030 and ultimately targets net zero operational emissions by 2050. It details how Rio Tinto will decarbonise its operations and value chain through partnerships, disciplined investment in projects and by developing new technologies. These actions are putting us in a strong position today, and for a low-carbon future. Board recommendation The Board is unanimously of the opinion that all of the resolutions proposed in this notice are in the best interests of shareholders and of Rio Tinto as a whole. Accordingly, they recommend that you vote FOR all of the resolutions. A resolution has been requisitioned by certain shareholders of Rio Tinto plc which requests that a review of Rio Tinto’s dual-listed companies structure is undertaken. The resolution, in the form requisitioned, will be proposed at the Rio Tinto plc AGM in accordance section 338 of the UK Companies Act 2006. As at the date of this notice, no equivalent resolution has been requisitioned in relation to the Rio Tinto Limited AGM and no action is required to be taken by Rio Tinto Limited shareholders. The Board considers that the resolution is not in the best interests of Rio Tinto as a whole and has recommended that shareholders of Rio Tinto plc vote against the resolution. Further details of the resolution and the reasons for the Board’s recommendation are included in the Rio Tinto plc notice of AGM which is available at riotinto.com/agm. Voting and results Shareholders who are unable to participate in the meeting are strongly encouraged to complete and submit a proxy form by no later than 9:30am (AWST) on Tuesday, 29 April 2025 in line with the instructions on page 5. Submitting a proxy form will ensure your vote is recorded, but does not prevent you from participating and voting at the meeting either in person, or if you would like to do so online, as described on page 6. The corresponding Rio Tinto plc AGM will take place in London on Thursday, 3 April 2025. The overall results of the votes from both meetings on Resolutions 1 to 19 (inclusive), along with the result of the vote on Resolution 20 at the Rio Tinto Limited AGM, will be announced to the relevant stock exchanges and posted on our website after the end of the Rio Tinto Limited AGM. I look forward to welcoming you to the AGM and thank you for your continued support of Rio Tinto. Yours sincerely Dominic Barton Chair 19 February 2025 2 Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Notice of annual general meeting Notice is given that the AGM of Rio Tinto Limited (the Company) will be held at the BelleVue Ballroom, Level 3, the Perth Convention and Exhibition Centre, 21 Mounts Bay Road, Perth, Western Australia at 9:30am (AWST) on Thursday 1 May 2025, for the purposes set out below: The Board recommends that shareholders vote FOR all resolutions. Resolution 1 Receipt of the 2024 Annual Report To receive the financial statements, Strategic Report and the reports of the Directors and auditors for the year ended 31 December 2024. Resolution 2 Approval of the Directors’ Remuneration Report: Implementation Report To receive and approve the Directors’ Remuneration Report: Implementation Report for the year ended 31 December 2024, as set out in the 2024 Annual Report on pages 119-122 and 127-145, comprising the Annual Statement by the People & Remuneration Committee Chair and the Implementation Report (together, the Implementation Report). This resolution is advisory and is required for UK law purposes. Resolution 3 Approval of the Directors’ Remuneration Report To approve the Directors’ Remuneration Report for the year ended 31 December 2024, as set out in the 2024 Annual Report on pages 119-145. This resolution is advisory and is required for Australian law purposes. Resolution 4 To elect Sharon Thorne as a Director Resolution 5 To re-elect Dominic Barton BBM as a Director Resolution 6 To re-elect Peter Cunningham as a Director Resolution 7 To re-elect Dean Dalla Valle as a Director Resolution 8 To re-elect Simon Henry as a Director Resolution 9 To re-elect Susan Lloyd-Hurwitz as a Director Resolution 10 To re-elect Martina Merz as a Director Resolution 11 To re-elect Jennifer Nason as a Director Resolution 12 To re-elect Joc O’Rourke as a Director Resolution 13 To re-elect Jakob Stausholm as a Director Resolution 14 To re-elect Ngaire Woods CBE as a Director Resolution 15 To re-elect Ben Wyatt as a Director Resolution 16 Re-appointment of auditors To re-appoint KPMG LLP as auditors of Rio Tinto plc to hold office until the conclusion of Rio Tinto’s 2026 AGMs. Resolution 17 Remuneration of auditors To authorise the Audit & Risk Committee to determine the auditors’ remuneration. 3Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Notice of annual general meeting Resolution 18 Authority to make political donations To authorise Rio Tinto plc, and any company which is a subsidiary of Rio Tinto plc at the time this resolution is passed or becomes a subsidiary of Rio Tinto plc at any time during the period for which this resolution has effect, to: (a) make donations to political parties and independent election candidates; (b) make donations to political organisations other than political parties; and (c) incur political expenditure, provided that in each case any such donations or expenditure made by Rio Tinto plc or a subsidiary of Rio Tinto plc shall not exceed £50,000 per company, and that the total amount of all such donations and expenditure made by all companies to which this authority relates shall not exceed £100,000. This authority shall expire at the close of the AGM of Rio Tinto Limited held in 2026 (or, if earlier, at the close of business on 30 June 2026). Resolution 19 2025 Climate Action Plan To approve Rio Tinto Group’s 2025 Climate Action Plan, as set out in pages 41-75 of the 2024 Annual Report. This resolution is advisory. Resolution 20 Renewal of on-market share buy-back authority To approve buy-backs by Rio Tinto Limited of fully paid ordinary shares in Rio Tinto Limited (Ordinary Shares) in the period following this approval until (and including) the date of the Rio Tinto Limited 2026 AGM or 7 May 2026 (whichever is the later) or, if earlier, the date on which shareholders next give approval to buy-backs by Rio Tinto Limited of fully paid Ordinary Shares pursuant to on-market buy-backs by Rio Tinto Limited in accordance with the Listing Rules of the ASX, but only to the extent that the number of Ordinary Shares bought back pursuant to the authority in this resolution does not in that period exceed 55.6 million Ordinary Shares. Note: In accordance with Rio Tinto’s dual listed companies (DLC) structure, as Joint Decision Matters, Resolutions 1 to 19 (inclusive), will be voted on by Rio Tinto plc and Rio Tinto Limited shareholders as a joint electorate. Resolution 20 will be voted on by Rio Tinto Limited shareholders only. Resolutions 1 to 20 (inclusive) will be proposed as ordinary resolutions. By order of the Board Tim Paine Company Secretary Level 43, 120 Collins Street Melbourne Victoria 3000 19 February 2025 4 Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Further information about the meeting Shareholders entitled to vote For the purposes of the Corporations Act 2001 (Cth) (the Australian Corporations Act), Rio Tinto Limited has determined that securities of Rio Tinto Limited that are quoted securities at 7:00pm (AEST) on Tuesday, 29 April 2025 will be taken, for the purposes of the meeting, to be held by the persons who held them at that time. Voting exclusions Resolutions 2 and 3 Rio Tinto will disregard any votes cast on: – Resolutions 2 and 3 by or on behalf of any person named in the Remuneration Report for the year ended 31 December 2024 as a member of Key Management Personnel (KMP) (as defined in the Australian Corporations Act), or their closely related parties, regardless of the capacity in which the vote is cast; and – Resolutions 2 and 3 as a proxy by a person who is a member of KMP at the date of the meeting or their closely related parties, unless the vote is cast as proxy for a person entitled to vote on the relevant resolutions (as applicable): – in accordance with a direction in the proxy form; or – by the chair of the meeting pursuant to an express authorisation to exercise the proxy. Voting by proxy A shareholder entitled to attend and vote at the meeting is entitled to appoint up to two proxies. A proxy need not be a shareholder of Rio Tinto Limited. If a shareholder appoints two proxies, the shareholder may specify the proportion or number of votes each proxy is appointed to exercise. If no proportion or number is specified, each proxy may exercise half the shareholder’s votes. Fractions of votes will be disregarded. The proxy form contains instructions for appointing two proxies. Directing your proxy how to vote If a shareholder wishes to indicate how their proxy should vote, mark the appropriate boxes on the proxy form. If the shareholder directs the proxy how to vote on a resolution, and the proxy decides to vote as proxy on that resolution, the proxy must vote the way specified (subject to the other provisions of this notice, including the voting exclusions noted above). If the proxy is not directed, then the proxy may vote or abstain as they decide (subject to the other provisions of this notice, including the voting exclusions noted above). Chair as proxy If an appointed proxy does not attend the meeting or a proxy form is returned which does not contain the name of the proxy, the chair of the meeting will be taken to have been appointed as the proxy. If a shareholder specifies the way to vote on a resolution and the proxy defaults to the chair of the meeting, the chair must vote the proxy as directed. If the chair of the meeting is appointed, or taken to be appointed, as a proxy and the shareholder does not direct the proxy how to vote, then by completing and returning the proxy form, the shareholder will be expressly authorising the chair to vote as the chair sees fit, even though the Resolutions 2 and 3 are connected directly or indirectly with the remuneration of a member of KMP. Voting intention of the chair The chair of the meeting intends to exercise all undirected proxies in favour of the resolutions. Proxy lodgement Shareholders can lodge their proxy forms online at www.investorvote.com.au and follow the prompts. To use this facility you will need your Shareholder Reference Number (SRN) or Holder Identification Number (HIN), postcode and control number as shown on the proxy form. You will be taken to have signed the proxy form if you complete the instructions on the website by 9:30am (AWST) on Tuesday, 29 April 2025. If using the proxy form mailed to you, the proxy form, together with any power of attorney or authority under which it is signed, must be received by Rio Tinto Limited’s share registry at Computershare Investor Services Pty Ltd, GPO Box 242, Melbourne, Victoria, 3001, or Yarra Falls, 452 Johnston Street, Abbotsford, Victoria, 3067 or at Rio Tinto Limited’s registered office or by facsimile to 1800 783 447 (within Australia) or +61 3 9473 2555 (outside Australia), by 9:30am (AWST) on Tuesday, 29 April 2025. For intermediary online subscribers only (custodians), please visit www.intermediaryonline.com to submit your proxy. Voting arrangements under the dual listed companies structure The voting arrangements for shareholders under the Group’s DLC structure are explained in the shareholder information section in the 2024 Annual Report. Discussion and asking questions Shareholders eligible to vote at this meeting may submit written questions to the auditors, KPMG, to be answered at the meeting, provided the questions are relevant to the content of the auditors’ report or the conduct of the audit of the financial report for the year ended 31 December 2024. Shareholders may also pre-submit written questions to the Company. All written questions must be received by no later than 5:00pm (AEST) on Thursday, 24 April 2025. Written questions can be submitted online at www.investorvote.com.au or sent to Computershare Investor Services Pty Ltd, GPO Box 242, Melbourne, Victoria, 3001, or Yarra Falls, 452 Johnston Street, Abbotsford, Victoria, 3067 or Rio Tinto Limited’s registered office or by facsimile to 1800 783 447 (within Australia) or +61 3 9473 2555 (outside Australia). Webcast and photography The AGM will be webcast live and can be accessed at riotinto.com/agm. The live webcast may include the question and answer sessions with shareholders as well as background footage of those in attendance. Photographs may also be taken at the meeting and published in the media or used in future Rio Tinto publications. If you attend the AGM in person you may be included in the webcast recording and photographs. 5Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Further information about the meeting Online participation Shareholders who are unable to attend in person can participate in the meeting, view and listen to proceedings, ask written and audio questions and vote in real time online. To access the meeting, visit http://meetings.lumiconnect.com/300-723-033-330 on your computer, tablet or smartphone. You will need the latest version of Chrome, Safari, Edge or Firefox. Please ensure your browser is compatible. Meeting ID for the AGM is: 300-723-033-330 Your username is your Shareholder Reference Number (SRN) or Holder Identification Number (HIN). Your password is your postcode registered on your holding if you are an Australian shareholder. For overseas shareholders it is your three letter country code. The list of country codes will be available at riotinto.com/agm. Appointed proxies: To obtain your username and password to participate in the meeting, please contact Computershare Investor Services from the day prior to the meeting: – by phone: +61 3 9415 4024; or – by email at RioProxy@Computershare.com.au. Guests: Guests can access the live meeting webcast at: http://meetings.lumiconnect.com/300-723-033-330.. Online registration will open at 8:30am (AWST), on Thursday, 1 May 2025 (one hour before the scheduled start time for the meeting). For the best shareholder experience, Rio Tinto recommends using a computer to access the Lumi website. Further details on accessing Lumi and joining the meeting, asking questions and voting, including the online user guide, will be made available prior to the meeting at riotinto.com/agm. Alternate arrangements If it becomes necessary or appropriate to make alternative or supplementary arrangements to hold the meeting, shareholders will be given as much notice as possible. Information relating to alternate arrangements will be communicated to shareholders by announcement to the ASX and published at riotinto.com/agm. 6 Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions Resolution 1 Receipt of the 2024 Annual Report The Directors are required by company law to present the 2024 Annual Report comprising the 2024 financial statements, the Strategic Report, the Directors’ Report and the Auditors’ Report to the AGM. These can be accessed at riotinto.com/annualreport. Resolution 2 Approval of the Directors’ Remuneration Report: Implementation Report The Implementation Report for the year ended 31 December 2024, comprising the Annual Statement by the People & Remuneration Committee Chair and the Implementation Report, is set out on pages 119-122 and 127-145 of the 2024 Annual Report. The Implementation Report describes the remuneration arrangements in place for each Executive Director, other members of the Executive Committee and the Non-Executive Directors (including the Chair) during 2024. The Annual Statement by the People & Remuneration Committee Chair provides context to 2024 remuneration outcomes, together with information to help shareholders understand what the executives were paid in 2024. This resolution is advisory and is required for UK law purposes. Resolution 3 Approval of the Directors’ Remuneration Report The Directors’ Remuneration Report for the year ended 31 December 2024 consists of the Annual Statement by the People & Remuneration Committee Chair, Remuneration at a glance – a summary of the Remuneration Policy and the Implementation Report. The Remuneration Report is set out on pages 119-145 of the 2024 Annual Report. This resolution is advisory and is required for Australian law purposes. Resolutions 4-15 Election and re-election of Directors The Board has adopted a policy, whereby all Directors are required to seek re-election by shareholders on an annual basis. Accordingly, other than Sharon Thorne, who was appointed to the Board as an independent Non-Executive Director with effect from 1 July 2024 and is seeking election for the first time, and Sam Laidlaw and Kaisa Hietala, who will step down from the Board at the conclusion of the Company’s AGM and therefore will not be seeking re-election, all other Directors will retire and offer themselves for re-election. Rio Tinto has satisfactorily undertaken checks into Sharon’s background and experience prior to her appointment. Sharon brings significant financial expertise to the Board and will succeed Simon Henry as Chair of the Audit & Risk Committee when Simon steps down from the Board later this year. More generally, the Board is of the view that all of the Directors seeking election or re-election continue to be effective and their contribution supports the long-term sustainable success of the Company. Each Director demonstrates the level of commitment required in connection with their role and the needs of the business (including making sufficient time available for Board and committee meetings and other duties). The skills and experience of each Director, which can be found below and on pages 102-103 of the 2024 Annual Report, demonstrate why their contribution is, and continues to be, important to Rio Tinto’s long-term sustainable success. The Board has also adopted a framework on Directors’ independence and is satisfied that each Non-Executive Director standing for election or re-election at the meeting is independent in accordance with this framework. Biographical details in support of each Director’s election or re-election are provided below. Sharon Thorne Independent Non-Executive Director, BA (Hons), Chartered Accountant (England and Wales). Age 60. Appointed July 2024. Member of the Audit & Risk Committee. Skills and experience: Sharon has extensive experience of auditing and advising clients across a broad range of sectors. She had a 36-year career with Deloitte, becoming an audit partner in 1998. During her time at Deloitte, she held numerous Executive and Board roles before becoming Deputy CEO Deloitte North-West Europe in 2017 and Global Chair from 2019, before retiring at the end of 2023. Sharon is an advocate for collective action on environmental sustainability and climate change and is a strong believer in the need for greater diversity, equity, and inclusion in business and civil society, and she has long championed greater diversity in senior leadership roles. Current external appointments: Governor, London Business School; Trustee, Royal United Services Institute; Advisory Board Member, Common Goal; and Advisory Council Member, Deloitte Centre for Sustainable Progress. Sharon is recommended for election. 7Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions Dominic Barton BBM Chair, BA (Hons), M.Phil, Age 62. Appointed April 2022; Chair from May 2022. Chair of the Nominations Committee. Member of People & Remuneration Committee and Sustainability Committee. Skills and experience: Dominic spent over 30 years at McKinsey & Company, including 9 years as the Global Managing Partner, and has also held a broad range of public sector leadership positions. He has served as Canada’s Ambassador to China, Chair of Canada’s Advisory Council for Economic Growth, and Chair of the International Advisory Committee to the President of South Korea on National Future and Vision. Dominic brings a wealth of global business experience, including deep insight of geopolitics, corporate sustainability and governance. His business acumen and public sector experience position him to provide balanced guidance to Rio Tinto. Current external appointments: Chair of LeapFrog Investments. Dominic is recommended for re-election. Peter Cunningham Chief Financial Officer, BA (Hons), Chartered Accountant (England and Wales). Age 58. Appointed June 2021. Skills and experience: As Chief Financial Officer, Peter brings extensive commercial expertise from working across the Group in various geographies. He is strongly focused on the decarbonisation of our assets, investing in the commodities essential for the energy transition, and delivering attractive returns to shareholders while maintaining financial discipline. During over 3 decades with Rio Tinto, Peter has held a number of senior leadership roles, including Group Controller, Chief Financial Officer – Organisational Resources, Global Head of Health, Safety, Environment & Communities, Head of Energy and Climate Strategy, and Head of Investor Relations. Current external appointments: None. Peter is recommended for re-election. Dean Dalla Valle Independent Non-Executive Director, MBA. Age 65. Appointed June 2023. Chair of Sustainability Committee, Member of People & Remuneration Committee and Nominations Committee. Skills and experience: Dean brings over 4 decades of operational and project management experience in the resources and infrastructure sectors. He draws on 40 years’ experience at BHP where he was Chief Commercial Officer, President of Coal and Uranium, President and Chief Operating Officer Olympic Dam, President Cannington, Vice President Ports Iron Ore and General Manager Illawarra Coal. He has had direct operating responsibility in 11 countries, working across major mining commodities and brings a wealth of experience in engaging with a broad range of stakeholders globally, including governments, investors and communities. Dean was Chief Executive Officer of Pacific National from 2017 to 2021. Current external appointments: Chair of Hysata. Dean is recommended for re-election. Simon Henry Independent Non-Executive Director, MA, FCMA. Age 63. Appointed April 2017. Chair of Audit & Risk Committee, Member of Nominations Committee. Skills and experience: Simon has significant experience in global finance, corporate governance, mergers and acquisitions, international relations, and strategy. He draws on over 30 years’ experience at Royal Dutch Shell plc, where he was Chief Financial Officer between 2009 to 2017. Current external appointments: Senior Independent Director of Harbour Energy plc, Adviser to the Board of Oxford Flow Ltd, member of the Board of the Audit Committee Chairs’ Independent Forum, member of the Advisory Board of the Centre for European Reform and Advisory Panel of the Chartered Institute of Management Accountants (CIMA), and trustee of the Cambridge China Development Trust. Simon is recommended for re-election. 8 Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions Susan Lloyd-Hurwitz Independent Non-Executive Director, BA (Hons) MBA (Dist). Age 57. Appointed June 2023. Member of People & Remuneration Committee. Skills and experience: Susan brings significant experience in the built environment sector with a global career spanning over 30 years. Most recently Susan was Chief Executive Officer and Managing Director of Mirvac Group for over a decade. Prior to this, she was Managing Director at LaSalle Investment Management, and held senior executive positions at MGPA, Macquarie Group and Lendlease Corporation. Current external appointments: President of Chief Executive Women, Chair of the Australian National Housing Supply and Affordability Council and the Australian Centre for Gender Equality and Inclusion @ Work Advisory Board, Non-Executive Director of Macquarie Group and Spacecube, Member of the Sydney Opera House Trust and Global Board member at INSEAD. Susan is recommended for re-election. Martina Merz Independent Non-Executive Director, B.Eng. Age 61. Appointed February 2024. Member of Sustainability Committee. Skills and experience: Martina brings over 38 years of extensive leadership and operational experience, most recently as CEO of industrial engineering and steel production conglomerate ThyssenKrupp AG. She has held numerous leadership roles, including at Robert Bosch GmbH and at Chassis Brakes International. Martina also has extensive listed company experience and is known for her expertise in the areas of strategy, risk management, legal/compliance and human resources. Current external appointments: Member of the Supervisory Board at AB Volvo and Member of the Shareholder Council of the Foundation Carl-Zeiss-Stiftung as the owner of Zeiss AG and Scott AG. Martina is recommended for re-election. Jennifer Nason Independent Non-Executive Director, BA, BCom (Hons). Age 64. Appointed March 2020. Member of Audit & Risk and People & Remuneration Committee. Skills and experience: Jennifer has over 38 years’ experience in corporate finance and capital markets. She was the Global Chair of Investment Banking at JP Morgan, based in the US, and for the past 20 years, led the Technology, Media and Telecommunications global client practice. During her time at JP Morgan, she worked in the metals and mining sector team in Australia and co-founded and chaired the Investment Banking Women’s Network and sat on the Executive Committee for the Investment Bank. Current external appointments: Co-Chair of the American Australian Business Council, Non-Executive Director of Accenture and Independent Trustee of Dodge and Cox. Jennifer is recommended for re-election. Joc O’Rourke Independent Non-Executive Director, BSc, EMBA. Age 64. Appointed October 2023. Member of the Audit & Risk Committee. Skills and experience: Joc has over 35 years’ experience across the mining and minerals industry. He was the Chief Executive Officer of The Mosaic Company, the world’s leading integrated producer and marketer of concentrated phosphate and potash, from 2015 to 2023. He also served as President of Mosaic until recently and previously held roles there including Executive Vice President of Operations and Chief Operating Officer. Prior to this, he was President of Australia Pacific at Barrick Gold Corporation, leading gold and copper mines in Australia and Papua New Guinea. Joc is known for his deep knowledge of the mining industry, and passion for improving safety and operational performance. Current external appointments: Non-Executive Director at the Toro Company and The Weyerhaeuser Company. Joc is recommended for re-election. 9Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions Jakob Stausholm Chief Executive, Ms Economics. Age 56. Appointed Chief Financial Officer September 2018; Chief Executive from January 2021. Skills and experience: As Chief Executive, Jakob brings strategic and commercial expertise and governance experience. He is committed to building trust with communities, building a strong workplace culture, and to continuously improving operational performance while delivering attractive returns to shareholders. Jakob joined Rio Tinto in 2018 as Chief Financial Officer. He has over 20 years’ experience, primarily in senior finance roles at Maersk Group and Royal Dutch Shell plc, including in capital-intensive, long-cycle businesses, as well as in innovative technology and supply chain optimisation. He was also a Non-Executive Director of Woodside Petroleum and Statoil (now Equinor). Current external appointments: None. Jakob is recommended for re-election. Ngaire Woods CBE Independent Non-Executive Director, BA/LLB, DPhil. Age 62. Appointed September 2020. Member of Sustainability Committee and Nominations Committee. Skills and experience: Ngaire is the founding Dean of the Blavatnik School of Government, Professor of Global Economic Governance and the Founder of the Global Economic Governance Programme at Oxford University. As a recognised expert in public policy, international development and governance, she has served as an adviser to the African Development Bank, the Asian Infrastructure Investment Bank, the Center for Global Development, the International Monetary Fund, and the European Union. Current external appointments: Trustee of the Schwarzman Education Foundation and Member of the Conseil d’administration of L’Institut national du service public. Ngaire is recommended for re-election. Ben Wyatt Independent Non-Executive Director, LLB, MSc. Age 50. Appointed September 2021. Member of Audit & Risk Committee and People & Remuneration Committee. Skills and experience: Ben had a prolific career in the Western Australian Parliament before retiring in 2021. He held a number of ministerial positions and became the first Indigenous treasurer of an Australian parliament. His extensive knowledge of public policy, finance, international trade and Indigenous affairs brings valuable insight and adds to the depth of knowledge on the Board. Ben was previously an officer in the Australian Army Reserves, and went on to have a career in the legal profession as a barrister and solicitor. Current external appointments: Non-Executive Director of Woodside Energy Group Ltd, Telethon Kids Institute and West Coast Eagles, and member of the Advisory Committee of Australian Capital Equity. Ben is recommended for re-election. Resolutions 16-17 Re-appointment and remuneration of auditors Under UK law, the shareholders are required to approve the appointment of Rio Tinto plc’s auditor each year. The appointment runs until the conclusion of Rio Tinto’s 2026 AGMs. Under Rio Tinto’s DLC structure, the appointment of Rio Tinto plc’s auditors is a Joint Decision Matter and has therefore been considered by Rio Tinto Limited and Rio Tinto plc shareholders at each AGM since the DLC structure was established in 1995. On recommendation of the Audit & Risk Committee, the Board proposes the re-appointment of Rio Tinto plc’s current auditors. KPMG LLP have expressed their willingness to continue in office for a further year. In accordance with UK company law and good corporate governance practice, shareholders are also asked to authorise the Audit & Risk Committee to determine the auditors’ remuneration. 10 Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions Resolution 18 Authority to make political donations Under UK law there is a prohibition against making political donations without authorisation of a company’s shareholders in a general meeting. The authority being sought is not proposed or intended to alter Rio Tinto’s policy of not making political donations, within the normal meaning of that expression. However, the definitions of political donation, political expenditure and/or political organisation in the UK Companies Act are defined very widely. Because of this, it may be that some of Rio Tinto’s activities could fall within this definition and, without the necessary authorisation, Rio Tinto’s ability to communicate its views effectively to political audiences and to relevant interest groups could be inhibited. In particular, the definition of political organisations may extend to bodies such as those concerned with policy review, law reform, the representation of the business community and special interest groups, such as those concerned with the environment. As a result, the definition may cover legitimate business activities that would not, in the ordinary sense, be considered to be political donations or political expenditure. The authority that the Board is requesting is a precautionary measure to ensure Rio Tinto does not inadvertently breach the UK Companies Act. In accordance with the United States Federal Election Campaign Act, Rio Tinto provides administrative support for the Rio Tinto America Political Action Committee (PAC). The PAC was created in 1990 and encourages voluntary employee participation in the political process. All Rio Tinto America PAC employee contributions are reviewed for compliance with federal and state law and are publicly reported in accordance with US election laws. The PAC is controlled by neither Rio Tinto nor any of its subsidiaries but instead by a governing board of five employee members on a voluntary basis. In 2024, contributions to Rio Tinto America PAC by 14 employees amounted to US$14,815, and Rio Tinto America PAC donated US$10,500 in political contributions in 2024. Accordingly, the Directors believe that supporting the authority sought in this resolution is in the interests of shareholders. Any expenditure that may be incurred under this authority will be disclosed in next year’s Annual Report. Details of political expenditure by Rio Tinto during the past year are set out on page 150 in the 2024 Annual Report. Words and expressions used in Resolution 18 that are defined in Part 14 of the UK Companies Act shall have the same meanings for the purposes of Resolution 18. Resolution 19 2025 Climate Action Plan Resolution 19 is a non-binding advisory vote in relation to Rio Tinto’s 2025 Climate Action Plan (2025 CAP). The 2025 CAP is set out in pages 41-75 of the 2024 Annual Report and is available at riotinto.com/annualreport. It sets out the company’s climate ambitions and strategy, emissions targets and the actions to achieve them. We will continue to publish our progress annually in line with reporting standards and to regularly engage with shareholders and other stakeholders on our climate commitments. Rio Tinto has a key role to play in the global transition to a low carbon economy. This includes producing the materials the world needs to decarbonise such as the copper, aluminium and iron ore increasingly required for electrification and transition of energy systems and by reducing our own operational emissions, and helping our customers reduce theirs. Our first CAP was approved by shareholders at our 2022 AGMs with the support of 84.3% of the votes cast, and included a commitment to report on our progress annually and to update the CAP every 3 years. The 2025 CAP builds on our 2022 CAP by detailing our strategy to grow production of transition materials, retaining our commitments to reduce operational emissions and demonstrating that working together with our customers, suppliers and others will support the decarbonising of our value chains. In particular, the 2025 CAP includes: – How our Group Scenarios are utilised to identify climate risks and portfolio opportunities, and are applied to test the resilience of our strategy and business under a range of outcomes. – The carbon footprint of our operations and value chain, the medium and long-term decarbonisation targets for our Scope 1 and 2 emissions and how we are working with customers and suppliers on the emissions of our value chains. – The pathway and approach to reducing operational emissions including: 1) developing renewable electricity solutions at our Pacific Aluminium Operations and other assets, 2) transitioning from diesel usage by our mining operations’ mobile equipment, and 3) addressing hard-to-abate processing emissions in our smelting and refining facilities. – How we are integrating high-integrity nature-based solutions into our decarbonisation strategy and the limited use of offsets towards our 2030 decarbonisation targets. – Capital and other expenditure allocated to achieving our decarbonisation targets and the disciplined investment approach taken to determining allocation of this capital. – How we are working with communities and host countries to facilitate a transition that puts people at the centre while working to minimise impacts and optimise socio-economic opportunities. – Our approach to supporting policies which enable the decarbonisation of operational emissions, the production of metals and minerals required for the energy transition, and progress towards the goals of the Paris Agreement directly with host governments and indirectly via industry associations. – The strategies which are enhancing our physical resilience to a changing climate, and supporting the viability of our assets, people, and communities. – Details of the integration of decarbonisation progress into short- and long-term incentives, and how the Board engages on climate issues. 11Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions The CAP is underpinned by a clear pathway to achieving 50% reductions in Scope 1 and 2 emissions by 2030 and ultimately targeting net zero operational emissions by 2050. The Board regularly reviews progress against our climate commitments, is fully aligned with this action plan and believes it will deliver value for our shareholders, our customers and wider society, positioning Rio Tinto strongly for the low carbon future. This advisory vote in no way removes the Board’s responsibility for the Group’s climate strategy, but rather offers shareholders the opportunity for a more informed dialogue on Rio Tinto’s climate ambition, in addition to other engagement opportunities. The Board recommends that shareholders vote in favour of the proposed 2025 CAP which retains ambitious emissions reduction targets and strengthens the company by positioning Rio Tinto to produce the materials in increasing demand from the energy transition and reducing our exposure to volatile fossil fuel prices and higher carbon penalty costs. The Board is ultimately responsible for determining our climate strategy, and this vote is non-binding. The Board will consider the outcome and discussions from the meeting in advancing the 2025 CAP. The Board and the management team are committed to ensuring that the CAP will guide the actions of all Group product groups, entities and functions. Resolution 20 Renewal of on-market share buy-back authority The Board is seeking shareholder approval to buy back Ordinary Shares during the period until the 2026 AGM or 7 May 2026 inclusive (whichever is the later) on-market, but subject to the cap set out below. The Board continually assesses the Company’s capital structure to ensure it has an effective and appropriate balance. The Company’s ability to return surplus capital to shareholders in an efficient and effective manner will be enhanced by the approval of this resolution, which will provide the Company with the flexibility to undertake an on-market buy-back where shareholder approval is required. Such authority would expire if a new buy-back approval is given by shareholders, and in any event is in addition to Rio Tinto Limited’s ability to undertake buy-backs under the Australian Corporations Act where shareholder approval is not required. On-market buy-backs allow Rio Tinto Limited to buy back shares over time, depending on market conditions and prices. Any such on-market buy-backs would occur in accordance with the Listing Rules of the ASX from time to time. Currently the Listing Rules state that the price at which Rio Tinto Limited buys back Ordinary Shares on market must not be more than 5% above the average market price (as that term is defined in those Listing Rules) of Ordinary Shares calculated over the last five days on which sales were recorded on the ASX prior to the day on which shares are to be bought back. Should the Board decide to proceed with on-market buy-backs authorised under this resolution, such buy-backs would only occur if the Board believes that they could be undertaken without prejudicing the Group’s ability to maintain its dividend policy. The Board does not consider that any such buy-backs would pose any significant disadvantage to shareholders. Size of any buy-backs The authority sought by this resolution permits Rio Tinto Limited to buy back Ordinary Shares on market up to a limit of 55.6 million Ordinary Shares. This number represents approximately 15% of the 371,216,214 Ordinary Shares on issue in the capital of Rio Tinto Limited as at 7 February 2025, being the latest practicable date for information to be included in this notice (the Latest Practicable Date). Subject to the above limit, the number of Ordinary Shares to be bought back (if any) will be determined by the Directors. Financial impact on Rio Tinto Limited The consideration paid under any on-market buy-backs undertaken pursuant to this resolution would be cash and all Ordinary Shares bought back by Rio Tinto Limited would be cancelled. No decision has been made as to how any future buy-backs would be funded. The Board only intends to proceed with such buy-backs and fund them by debt if the funding required for any such buy-backs would be within the debt capacity of the Group and so would not be expected to have any adverse effect on existing operations or current investment plans. By way of illustration, the purchase of Ordinary Shares in the Company with a total value of A$1 billion at exchange rates prevailing on 31 December 2024 would (if funded by debt), increase the Group’s net debt and reduce equity attributable to shareholders by US$622 million and, on the basis of the Group’s 2024 financial statements, would increase the ratio of net debt to total capital by 0.9 percentage points, from 8.7% to approximately 9.6%. If they proceed, the precise impact of any buy-backs would not be known until they are completed, as this would depend on market prices, the number of Ordinary Shares repurchased and the timing of the repurchases. Effect on control Under any on-market buy-back by Rio Tinto Limited, the percentage of shares bought back from a shareholder would depend on the number they seek to sell, the price at which they offer to sell and the number of shares Rio Tinto Limited buys back. Given the maximum aggregate size of any buy-backs authorised under Resolution 20, they would not be expected to have any change of control implications for Rio Tinto Limited or the Group. On its own, an on-market buy-back by Rio Tinto Limited would reduce the number of Ordinary Shares in Rio Tinto Limited on issue as a proportion of the total number of ordinary shares on issue in the Group (that is, the ordinary shares on issue in Rio Tinto Limited and in Rio Tinto plc combined). However, the buy-back of Rio Tinto plc ordinary shares would also reduce the number of Rio Tinto plc ordinary shares on issue. Given the limit on the size of the buy-backs permitted under the authority being sought, the Board believes that even if there is a change in this proportion, it would not have any material impact on the control of the Group or on the relative voting power of the shareholders in each of Rio Tinto Limited or Rio Tinto plc. 12 Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions Other information Share price information The closing price of Rio Tinto Limited’s Ordinary Shares on the ASX on the Latest Practicable Date was A$120.77. The highest and lowest closing prices and the average closing prices for the Ordinary Shares on the ASX during each of the prior four months were as follows: Month Lowest closing price A$(a) Highest closing price A$(a) Average closing price A$(b) February 2025 (to 7 February 2025) 114.91 120.77 118.36 January 2025 114.65 120.61 118.04 December 2024 116.16 125.28 119.35 November 2024 113.66 123.31 117.67 (a) Based on the closing prices of the Company’s ordinary shares on the ASX for each trading day over the relevant month. (b) Calculated as the average of the closing prices of the Company’s ordinary shares on the ASX for each trading day over the relevant month. Australian tax considerations On-market buy-back If Rio Tinto Limited were to undertake an on-market buy-back, all of the price paid to shareholders to buy back their Ordinary Shares would, for Australian taxation purposes, be treated as consideration in respect of the sale of their shares. As such, no part of the price paid would be treated as a deemed dividend and so for a vendor shareholder, the disposal would be treated in the same way as any other disposal of shares on-market by the shareholder. For Rio Tinto Limited, the effect of an on-market buy-back may be to reduce its available franking credits, even though no part of the price paid to shareholders will be treated as a deemed dividend for tax purposes. General comments While on-market buy-backs by Rio Tinto Limited may result in a reduction of available franking credits, the Board would only undertake such buy-backs where it believed that they would not prejudice Rio Tinto Limited’s ability to fully frank its dividends for the reasonably foreseeable future. Capital management programme As in previous years, and to facilitate the Group’s ongoing capital management programme, Rio Tinto plc shareholder approval will be sought to renew the authority for Rio Tinto plc and Rio Tinto Limited (or any of its subsidiaries) to make on-market purchases of shares in Rio Tinto plc. This includes the authority to allow shares in Rio Tinto plc purchased by Rio Tinto Limited (or any of its subsidiaries) to be repurchased by Rio Tinto plc on the terms set out in an agreement approved by Rio Tinto plc’s shareholders and for those shares to be cancelled. If Rio Tinto Limited (or any of its subsidiaries) were to purchase Rio Tinto plc shares on-market it would sell them to Rio Tinto plc for cancellation. From the perspective of the Group’s cash and gearing, whether Rio Tinto plc shares are bought back directly by Rio Tinto plc, or bought by Rio Tinto Limited and sold to Rio Tinto plc, is not material, as the latter of these transactions is internal to the Group. If a nominal price were paid by Rio Tinto plc for any shares bought from Rio Tinto Limited, it would result in a reduction of Rio Tinto Limited’s retained earnings (to the extent of any difference between the price paid for the shares by Rio Tinto Limited and the sale price of those shares to Rio Tinto plc). However, the Directors would only proceed if they were confident they could do so without prejudicing Rio Tinto Limited’s ability to maintain its dividend policy and to continue to be in a position to fully frank its dividends for the foreseeable future. No new Ordinary Shares in Rio Tinto Limited have been issued since July 2009. However, to retain additional flexibility in the conduct of its capital management initiatives, the Board may consider issuing new shares in connection with employee share and incentive plans. 13Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

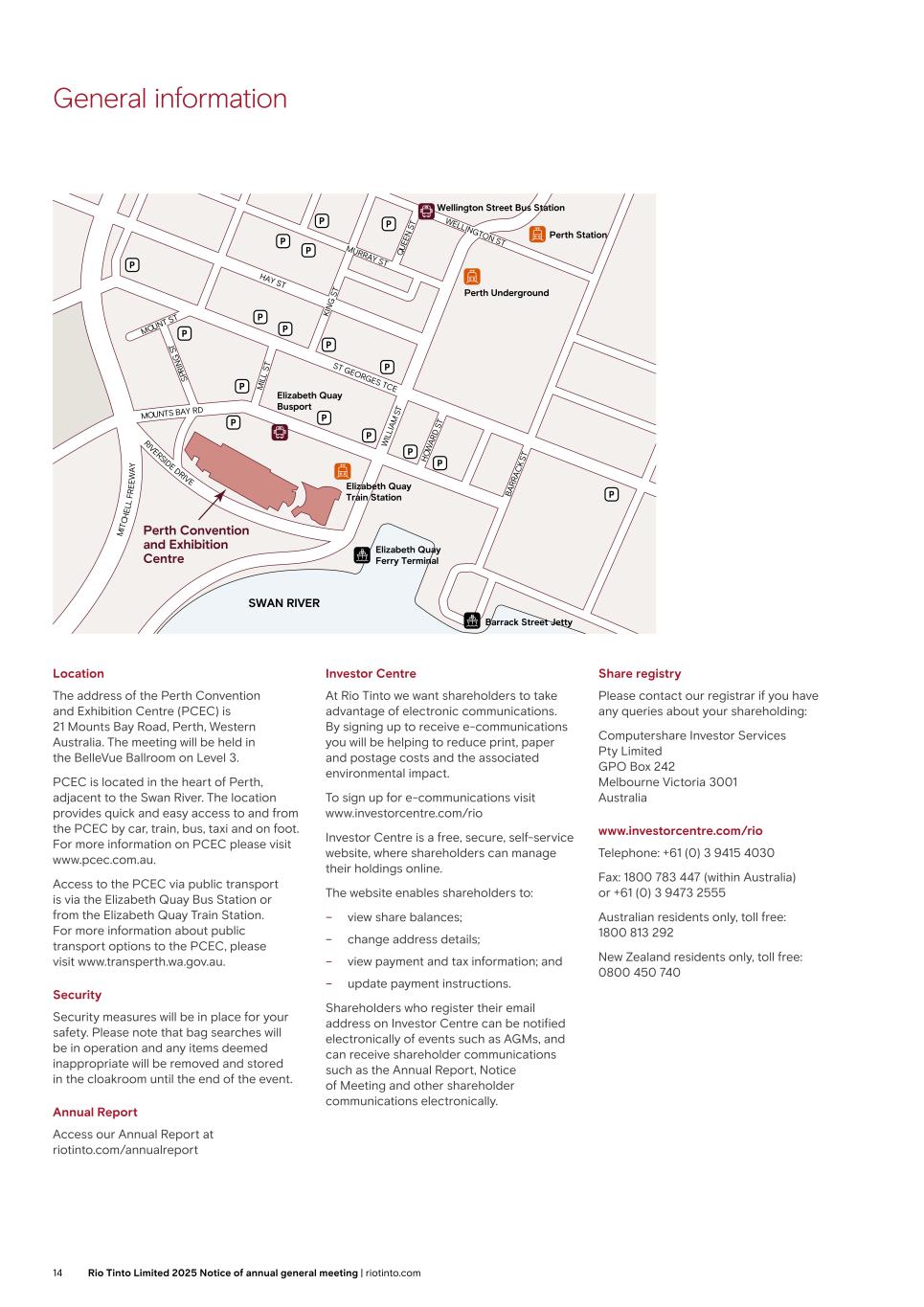

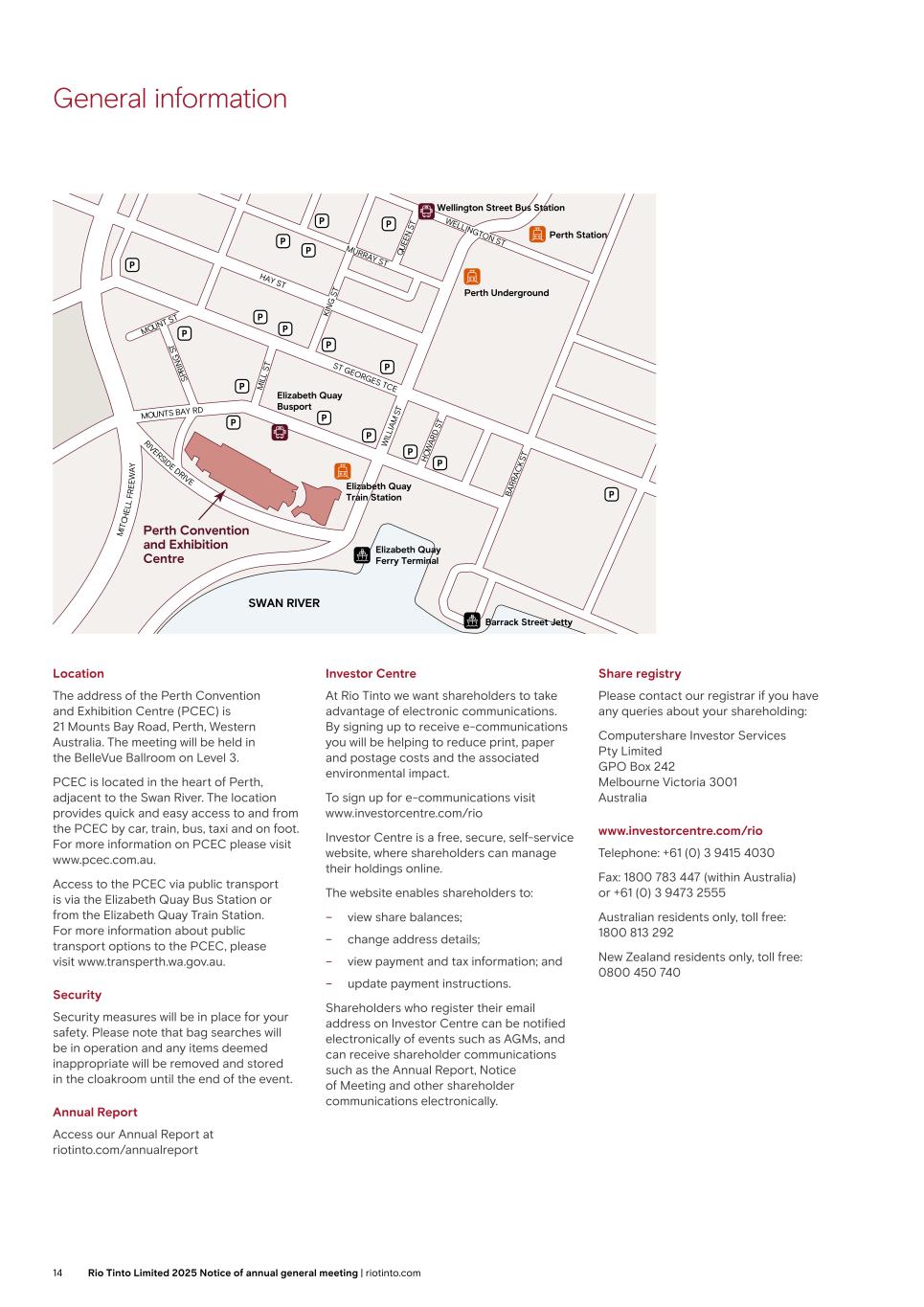

General information Location The address of the Perth Convention and Exhibition Centre (PCEC) is 21 Mounts Bay Road, Perth, Western Australia. The meeting will be held in the BelleVue Ballroom on Level 3. PCEC is located in the heart of Perth, adjacent to the Swan River. The location provides quick and easy access to and from the PCEC by car, train, bus, taxi and on foot. For more information on PCEC please visit www.pcec.com.au. Access to the PCEC via public transport is via the Elizabeth Quay Bus Station or from the Elizabeth Quay Train Station. For more information about public transport options to the PCEC, please visit www.transperth.wa.gov.au. Security Security measures will be in place for your safety. Please note that bag searches will be in operation and any items deemed inappropriate will be removed and stored in the cloakroom until the end of the event. Annual Report Access our Annual Report at riotinto.com/annualreport Investor Centre At Rio Tinto we want shareholders to take advantage of electronic communications. By signing up to receive e-communications you will be helping to reduce print, paper and postage costs and the associated environmental impact. To sign up for e-communications visit www.investorcentre.com/rio Investor Centre is a free, secure, self-service website, where shareholders can manage their holdings online. The website enables shareholders to: – view share balances; – change address details; – view payment and tax information; and – update payment instructions. Shareholders who register their email address on Investor Centre can be notified electronically of events such as AGMs, and can receive shareholder communications such as the Annual Report, Notice of Meeting and other shareholder communications electronically. Share registry Please contact our registrar if you have any queries about your shareholding: Computershare Investor Services Pty Limited GPO Box 242 Melbourne Victoria 3001 Australia www.investorcentre.com/rio Telephone: +61 (0) 3 9415 4030 Fax: 1800 783 447 (within Australia) or +61 (0) 3 9473 2555 Australian residents only, toll free: 1800 813 292 New Zealand residents only, toll free: 0800 450 740 M IT CH EL L FR EE W A Y MOUNTS BAY RD W IL LI AM S T RIVERSIDE DRIVE ST GEORGES TCE MOUNT ST SP RI N G S T M IL L ST H O W AR D S T BA RR AC K ST HAY ST MURRAY ST WELLINGTON ST KI N G S T Q U EE N S T Perth Convention and Exhibition Centre SWAN RIVER Elizabeth Quay Busport Perth Underground Elizabeth Quay Train Station Wellington Street Bus Station Perth Station Elizabeth Quay Ferry Terminal Barrack Street Jetty 14 Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

This page has been left blank intentionally. 15Rio Tinto Limited 2025 Notice of annual general meeting | riotinto.com

Rio Tinto Limited ABN 96 004 458 404 Registered office: Level 43, 120 Collins Street Melbourne Victoria 3000