Benchmark Electronics Second Quarter 2023 Earnings July 31, 2023

Forward-Looking 2023 Statements This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts and may include words such as “anticipate,” “believe,” “intend,” “plan,” “project,” “forecast,” “strategy,” “position,” “continue,” “estimate,” “expect,” “may,” “will,” “could,” “predict,” and similar expressions of the negative or other variations thereof. In particular, statements, express or implied, concerning the Company’s outlook and guidance for third quarter 2023 results, future operating results or margins, the ability to generate sales and income or cash flow, expected revenue mix, the Company’s business strategy and strategic initiatives, the Company’s repurchases of shares of its common stock, the Company’s expectations regarding restructuring charges and amortization of intangibles, and the Company’s intentions concerning the payment of dividends, among others, are forward-looking statements. Although the Company believes these statements are based on and derived from reasonable assumptions, they involve risks, uncertainties and assumptions that are beyond the Company’s ability to control or predict, relating to operations, markets and the business environment generally, including those discussed under Part I, Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2022, and in any of the Company’s subsequent reports filed with the Securities and Exchange Commission. Events relating to the possibility of customer demand fluctuations, supply chain constraints, continuing inflationary pressures, the effects of foreign currency fluctuations and high interest rates, geopolitical uncertainties including trade restrictions, or the ability to utilize the Company’s manufacturing facilities at sufficient levels to cover its fixed operating costs, may have resulting impacts on the Company’s business, financial condition, results of operations, and the Company’s ability (or inability) to execute on its plans. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes, including the future results of our operations, may vary materially from those indicated. Undue reliance should not be placed on any forward-looking statements. Forward-looking statements are not guarantees of performance. All forward-looking statements included in this document are based upon information available to the Company as of the date of this document, and the Company assumes no obligation to update. Non-GAAP Financial Information Management discloses non‐GAAP information to provide investors with additional information to analyze the Company’s performance and underlying trends. A detailed reconciliation between GAAP results and results excluding certain items (“non-GAAP”) is included in the following tables attached to this document. In situations where a non-GAAP reconciliation has not been provided, the Company was unable to provide such a reconciliation without unreasonable effort due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. Management uses non‐GAAP measures that exclude certain items in order to better assess operating performance and help investors compare results with our previous guidance. This document also references “free cash flow”, which the Company defines as cash flow from operations less additions to property, plant and equipment and purchased software. The Company’s non‐GAAP information is not necessarily comparable to the non‐GAAP information used by other companies. Non‐GAAP information should not be viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of the Company’s profitability or liquidity. Readers should consider the types of events and transactions for which adjustments have been made.

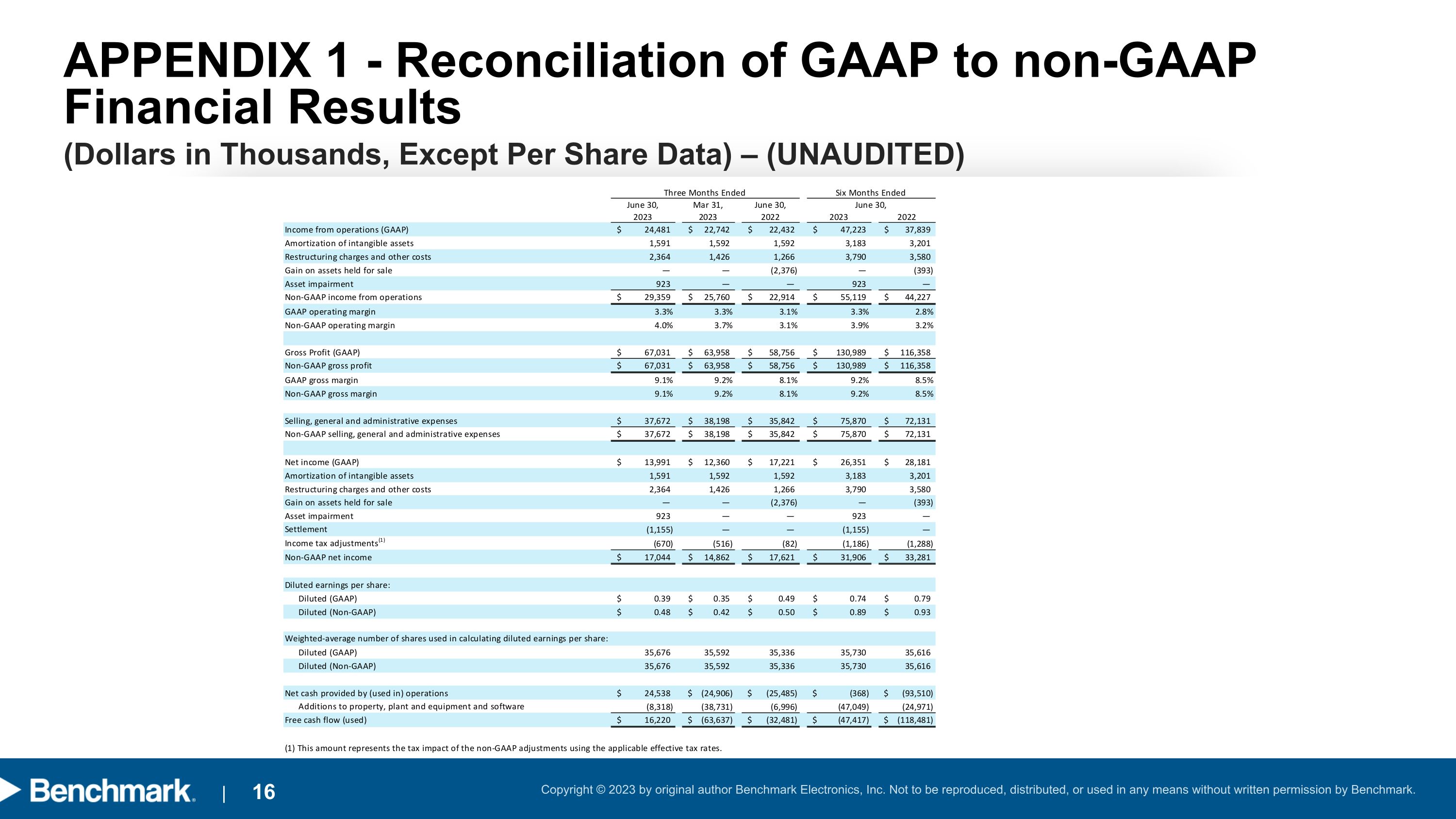

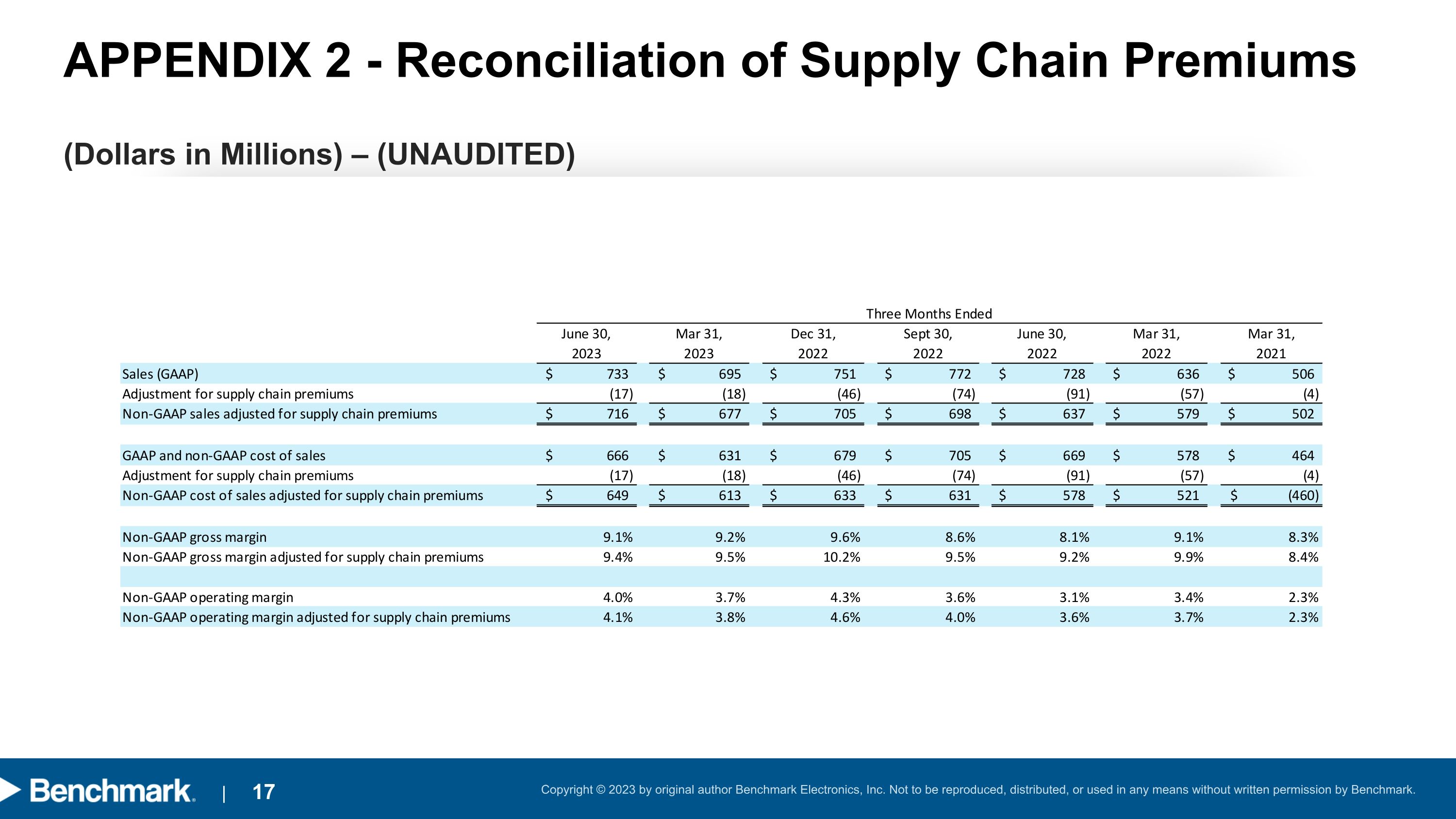

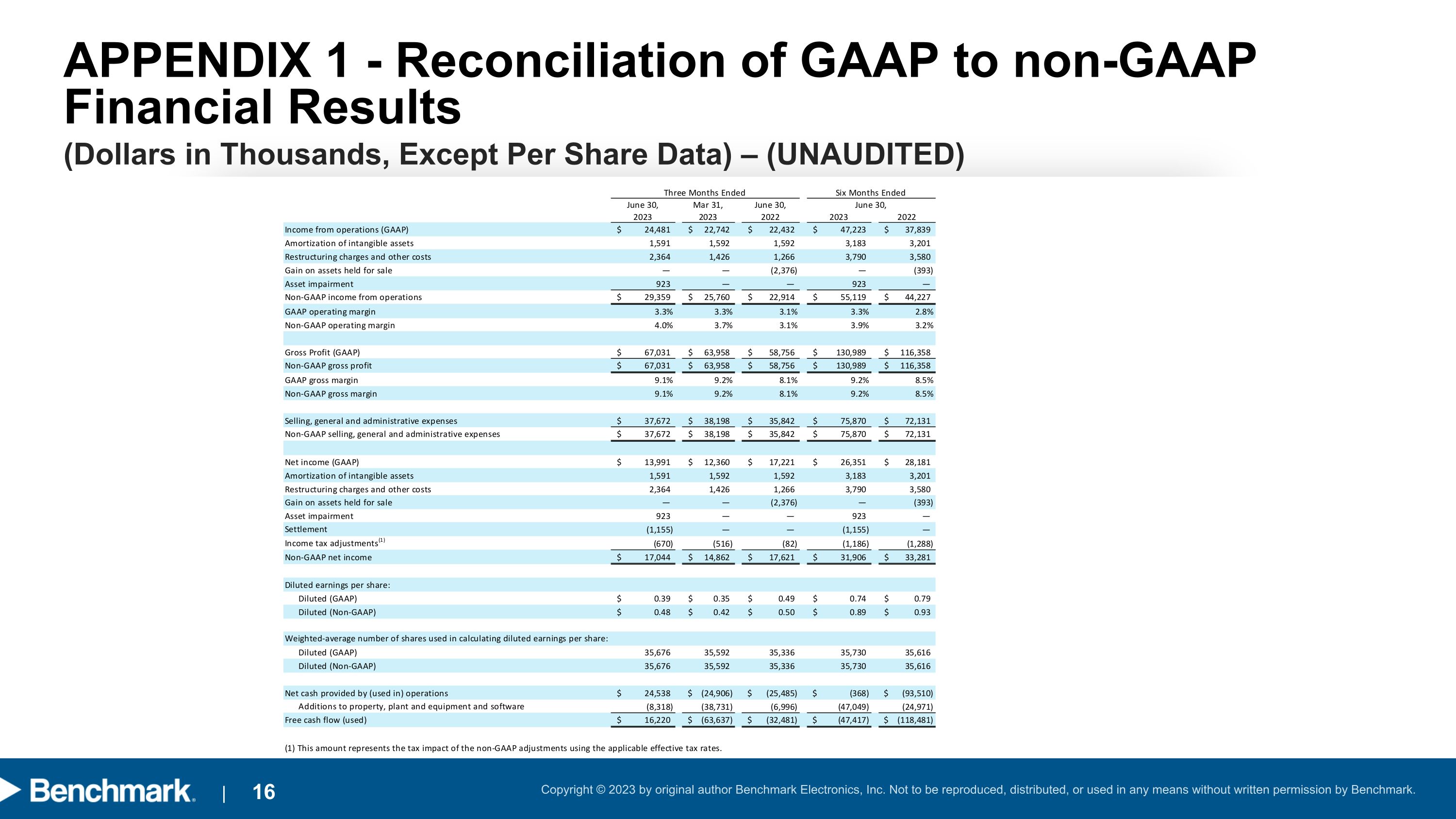

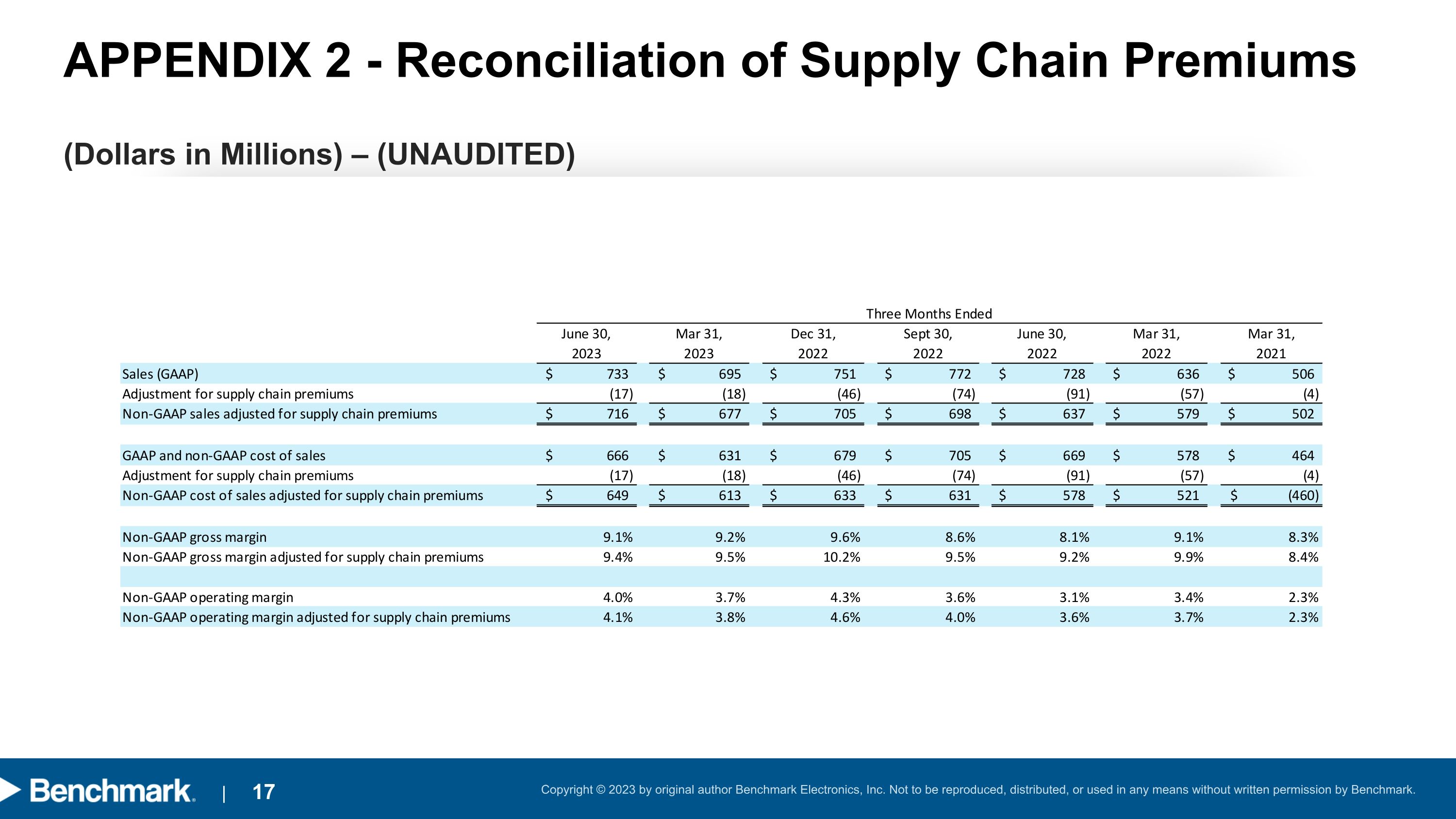

Second Quarter 2023 Results Total revenue of $733 million, up 6% sequentially and 1% year-over-year. Supply chain premiums (SCP)* reduced by $74 million year-over-year Excluding SCP, year-over-year revenue grew 12% with double-digit growth in 4 of 6 sectors GAAP and non-GAAP operating margin of 3.3% and 4.0%** Improved 20 and 90 basis points year-over-year, respectively GAAP EPS of $0.39 with non-GAAP EPS of $0.48**, the high end of guidance range Generated positive operating cash flow and free cash flow in the quarter * Component pass-through revenue for supply chain premiums (SCP) with no impact on non-GAAP operating income or EPS ** See APPENDIX 1 for a reconciliation of GAAP to nonGAAP Financial Result

Roop Lakkaraju Chief Financial Officer

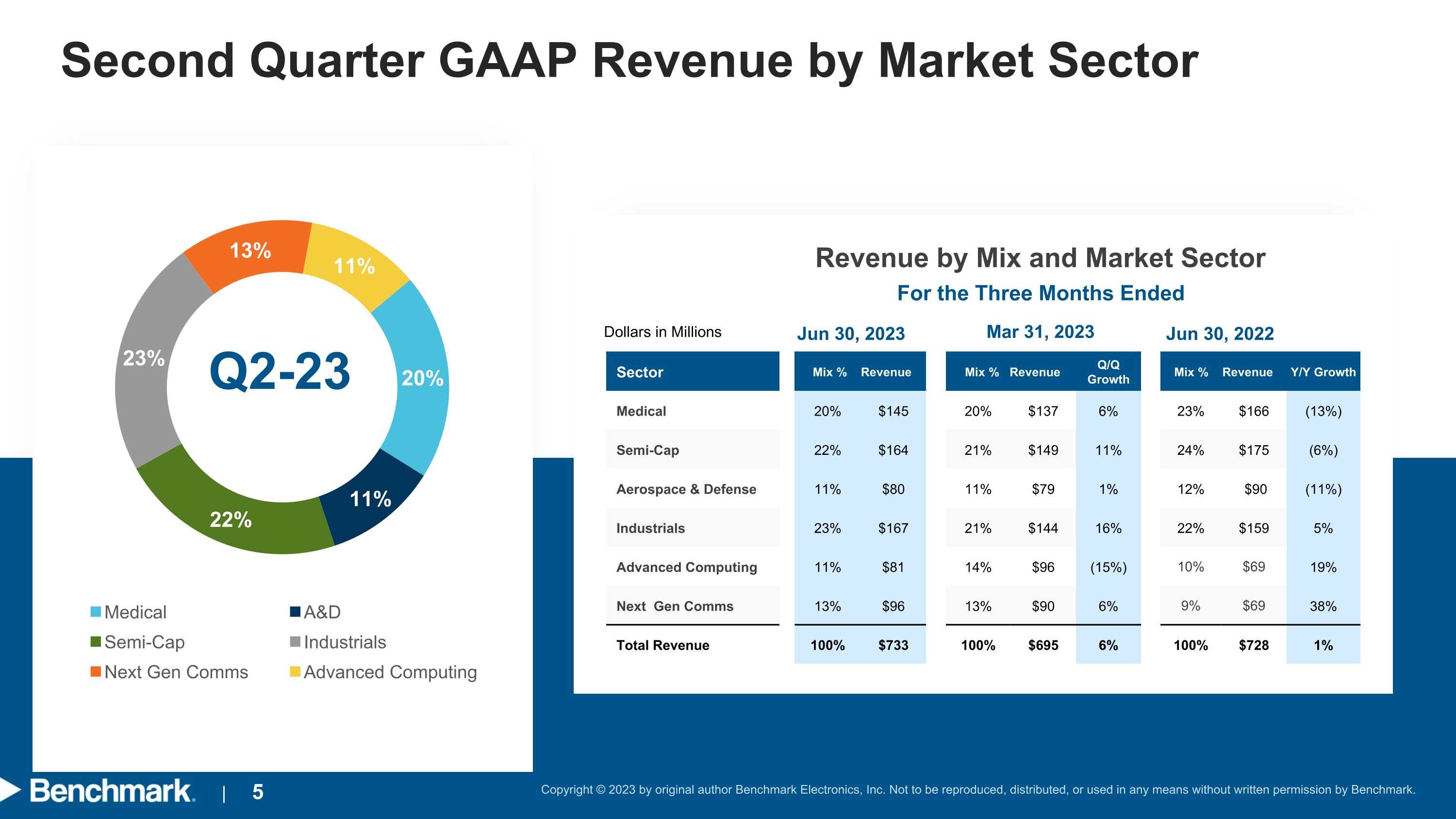

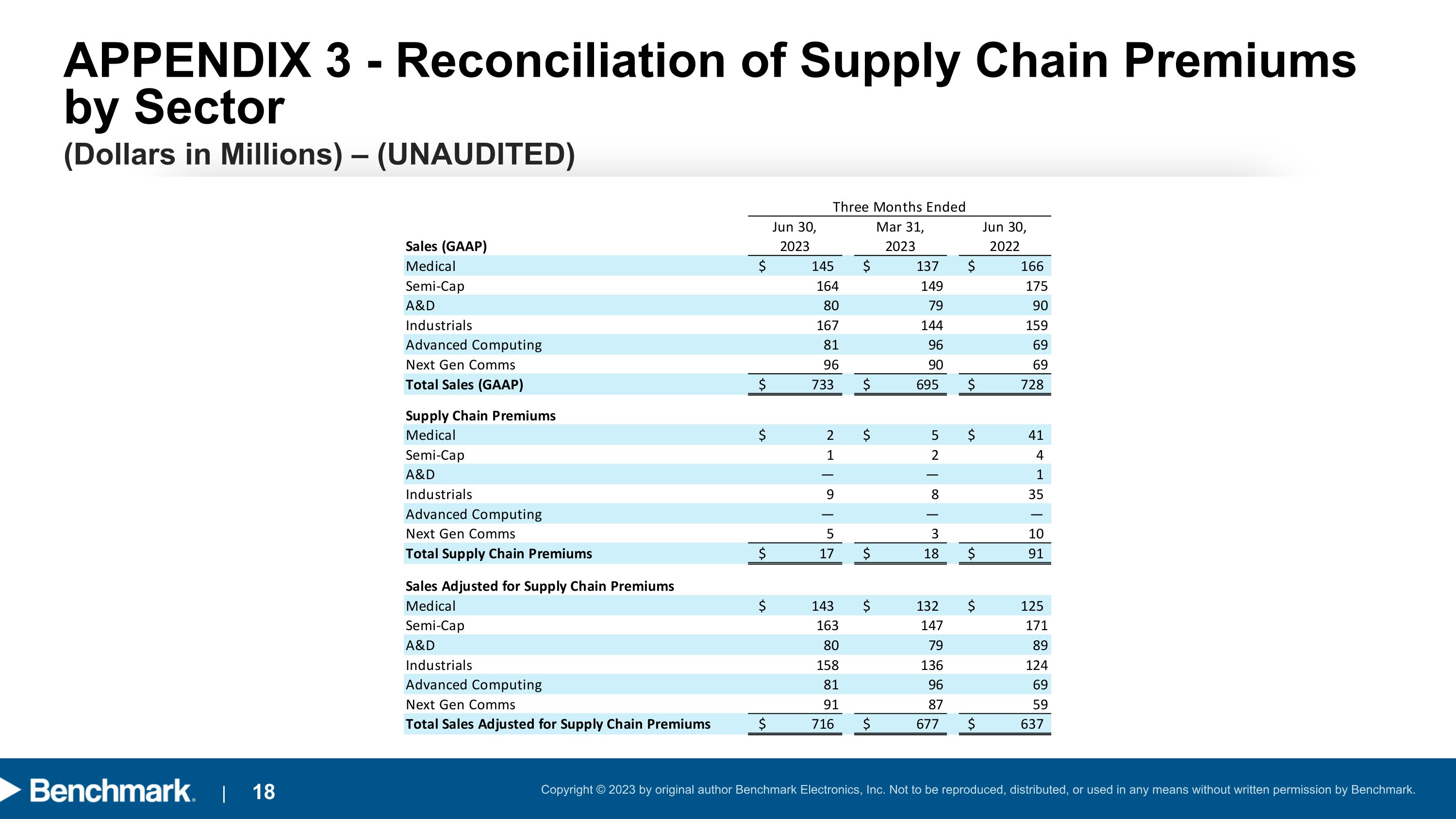

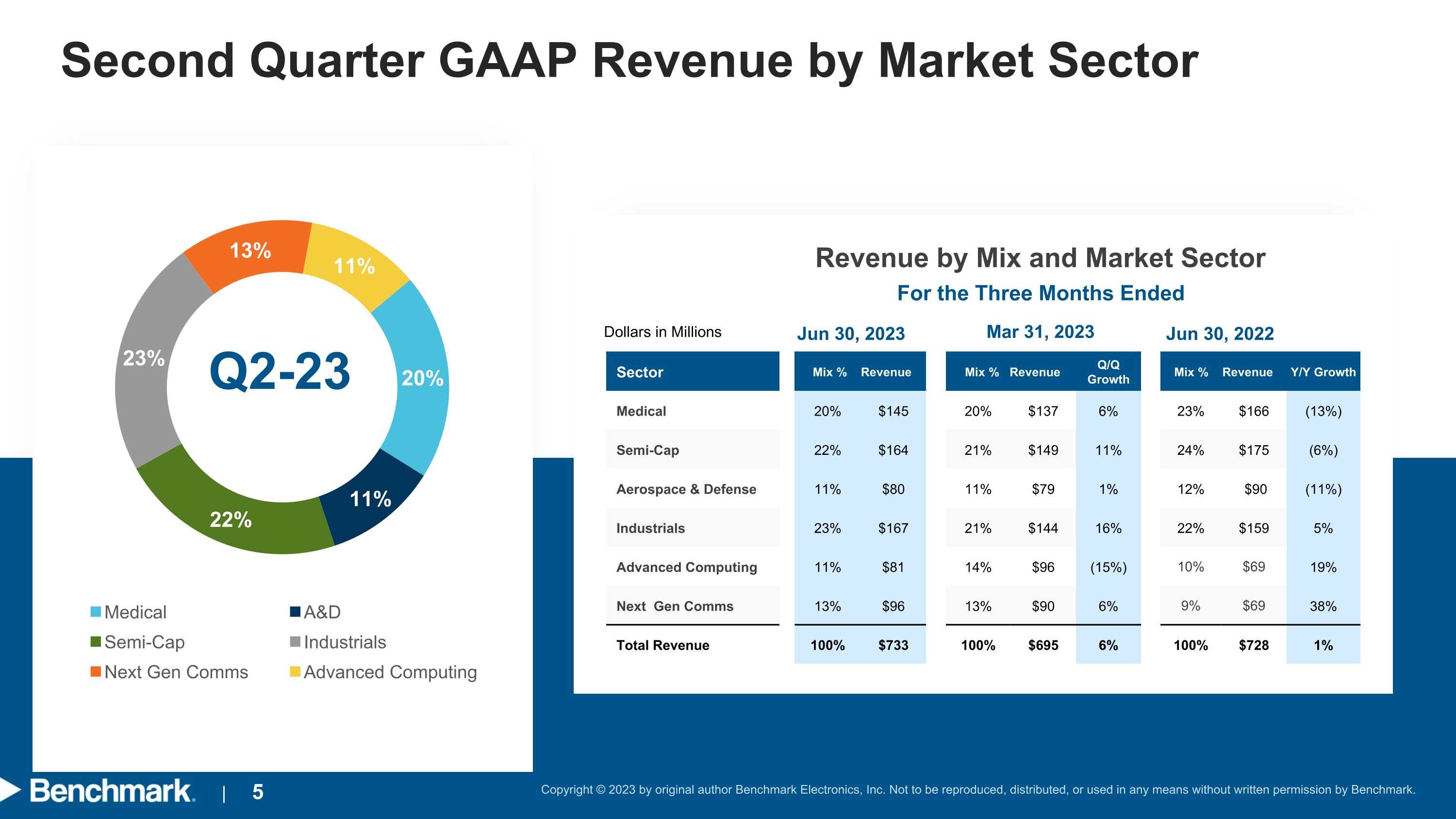

Second Quarter GAAP Revenue by Market Sector Q2-23 Jun 30, 2023 Revenue by Mix and Market Sector Mar 31, 2023 Jun 30, 2022 For the Three Months Ended Dollars in Millions Sector Mix % Revenue Mix % Revenue Q/Q Growth Mix % Revenue Y/Y Growth Medical 20% $145 20% $137 6% 23% $166 (13%) Semi-Cap 22% $164 21% $149 11% 24% $175 (6%) Aerospace & Defense 11% $80 11% $79 1% 12% $90 (11%) Industrials 23% $167 21% $144 16% 22% $159 5% Advanced Computing 11% $81 14% $96 (15%) 10% $69 19% Next Gen Comms 13% $96 13% $90 6% 9% $69 38% Total Revenue 100% $733 100% $695 6% 100% $728 1%

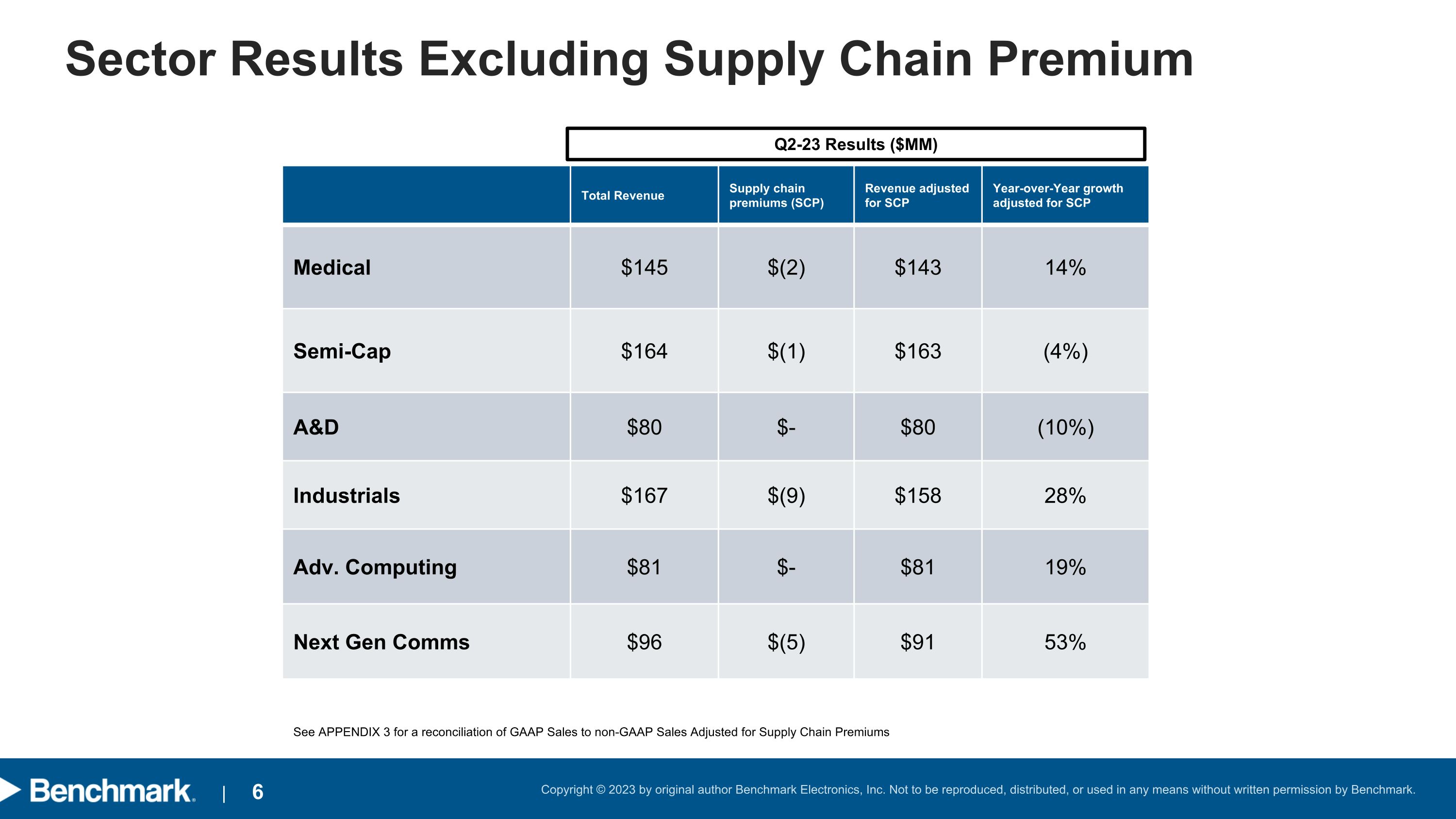

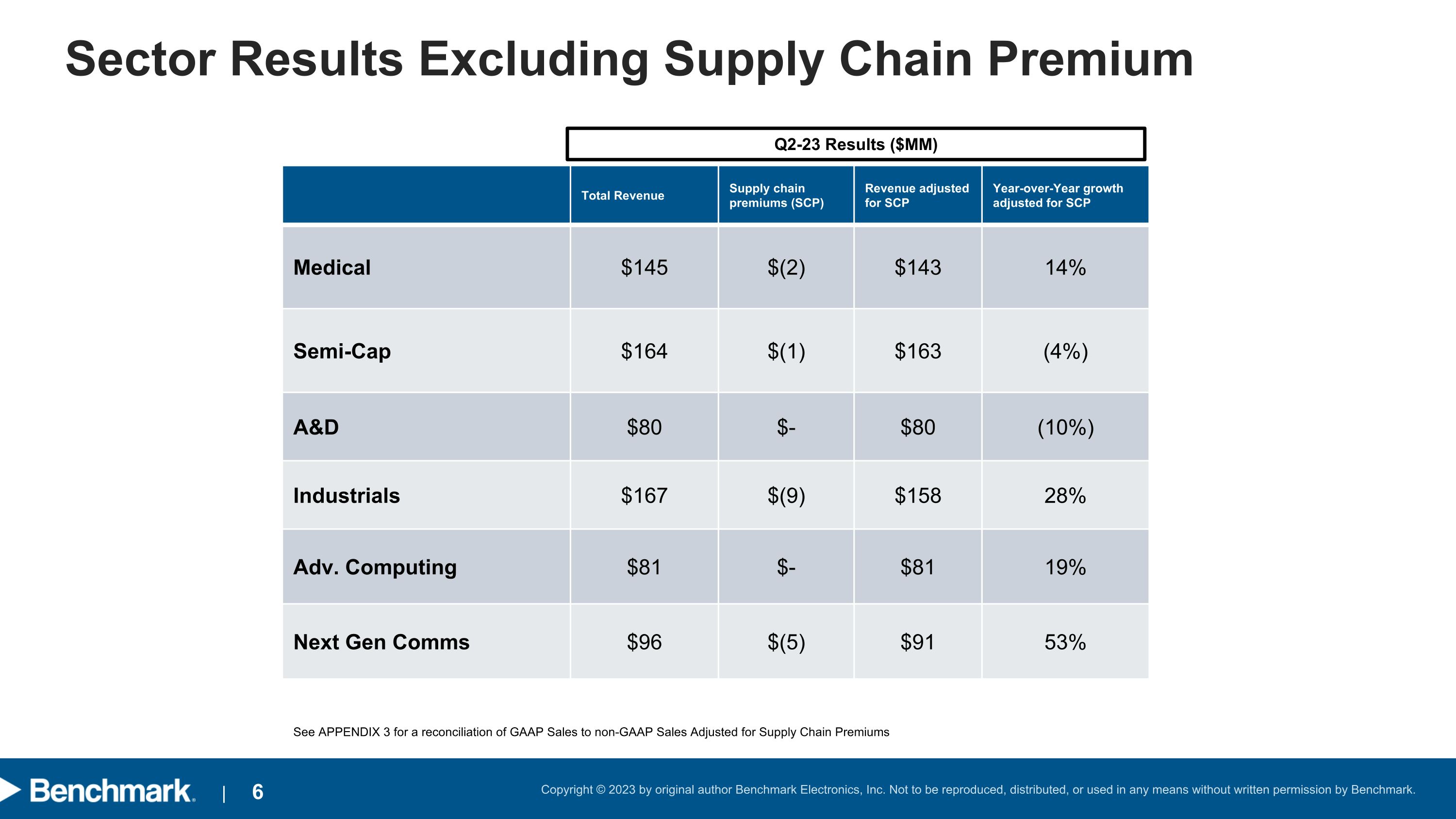

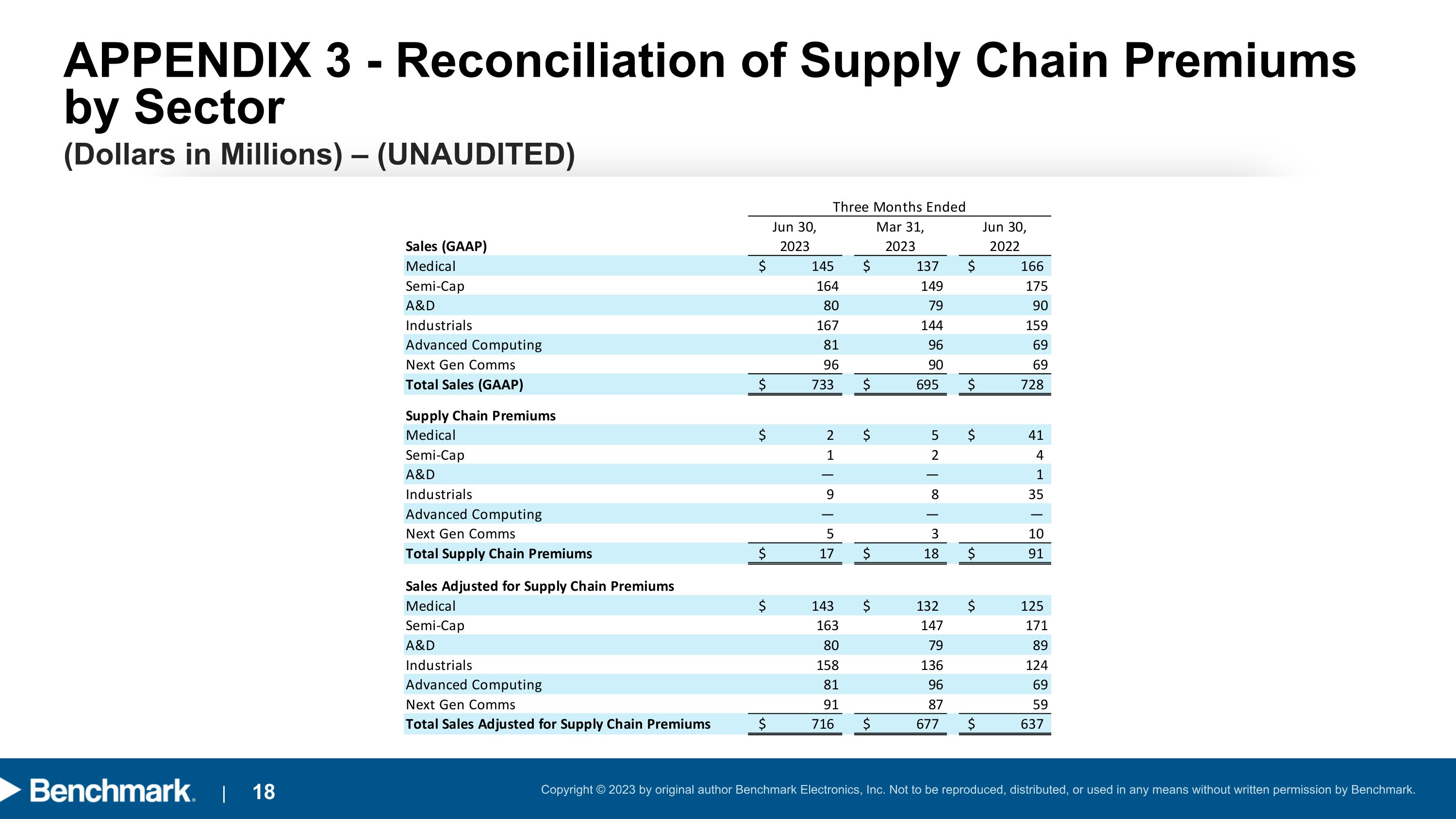

Sector Results Excluding Supply Chain Premium Q2-23 Results ($MM) Total Revenue Supply chain premiums (SCP) Revenue adjusted for SCP Year-over-Year growth adjusted for SCP Medical $145 $(2) $143 14% Semi-Cap $164 $(1) $163 (4%) A&D $80 $- $80 (10%) Industrials $167 $(9) $158 28% Adv. Computing $81 $- $81 19% Next Gen Comms $96 $(5) $91 53% See APPENDIX 3 for a reconciliation of GAAP Sales to non-GAAP Sales Adjusted for Supply Chain Premiums

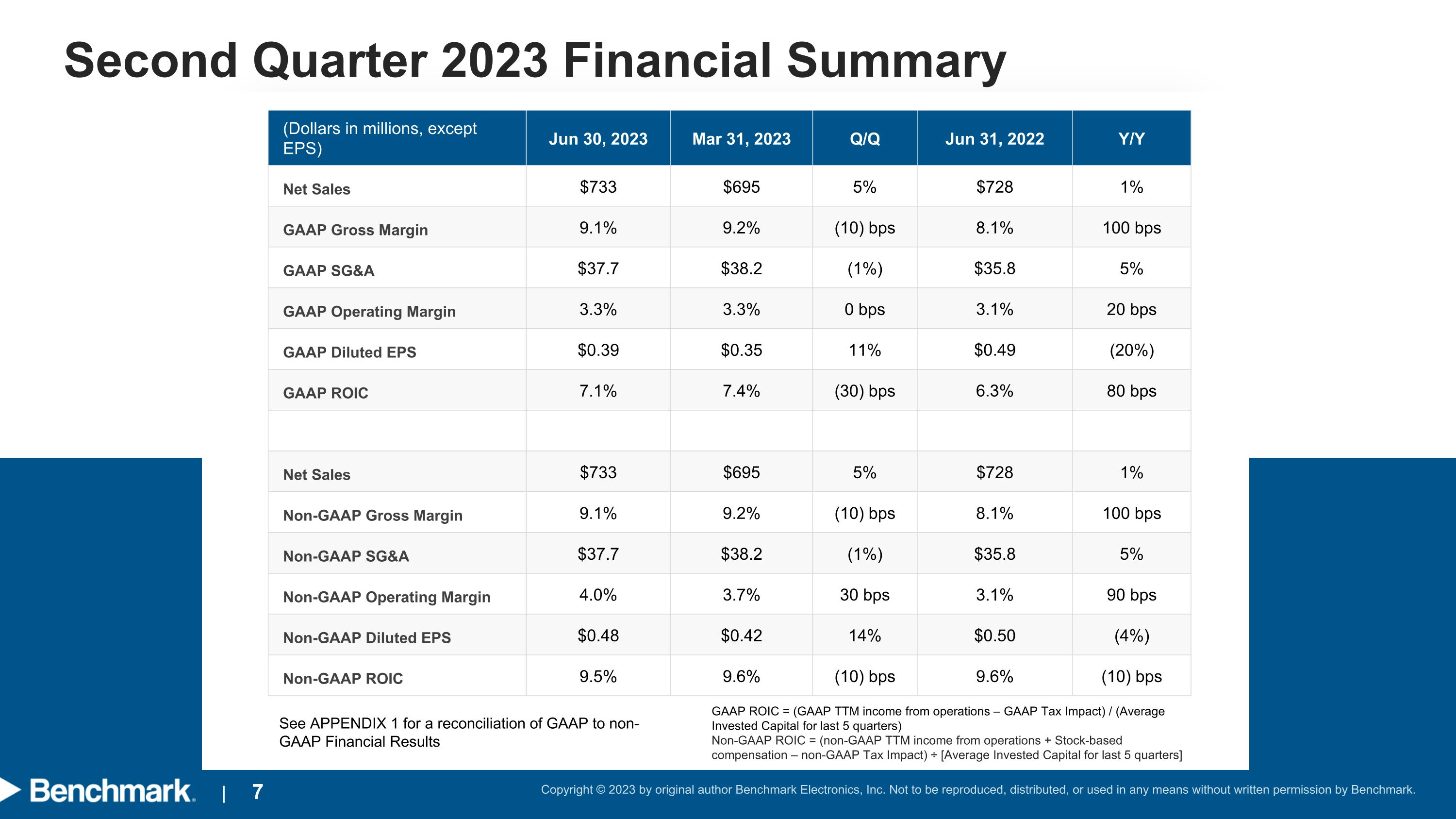

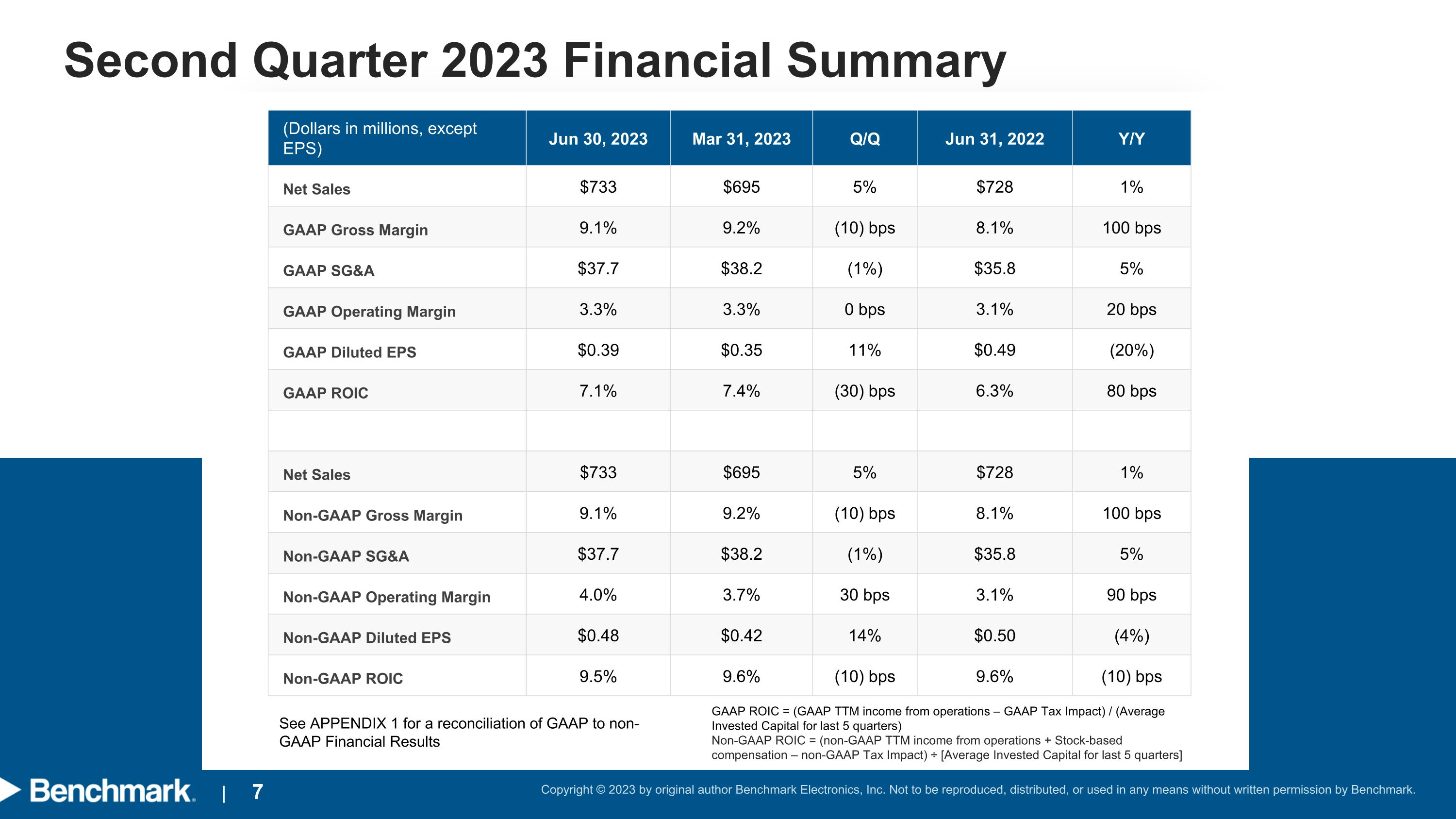

Second Quarter 2023 Financial Summary (Dollars in millions, except EPS) Jun 30, 2023 Mar 31, 2023 Q/Q Jun 31, 2022 Y/Y Net Sales $733 $695 5% $728 1% GAAP Gross Margin 9.1% 9.2% (10) bps 8.1% 100 bps GAAP SG&A $37.7 $38.2 (1%) $35.8 5% GAAP Operating Margin 3.3% 3.3% 0 bps 3.1% 20 bps GAAP Diluted EPS $0.39 $0.35 11% $0.49 (20%) GAAP ROIC 7.1% 7.4% (30) bps 6.3% 80 bps Net Sales $733 $695 5% $728 1% Non-GAAP Gross Margin 9.1% 9.2% (10) bps 8.1% 100 bps Non-GAAP SG&A $37.7 $38.2 (1%) $35.8 5% Non-GAAP Operating Margin 4.0% 3.7% 30 bps 3.1% 90 bps Non-GAAP Diluted EPS $0.48 $0.42 14% $0.50 (4%) Non-GAAP ROIC 9.5% 9.6% (10) bps 9.6% (10) bps See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results GAAP ROIC = (GAAP TTM income from operations – GAAP Tax Impact) / (Average Invested Capital for last 5 quarters) Non-GAAP ROIC = (non-GAAP TTM income from operations + Stock-based compensation – non-GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters]

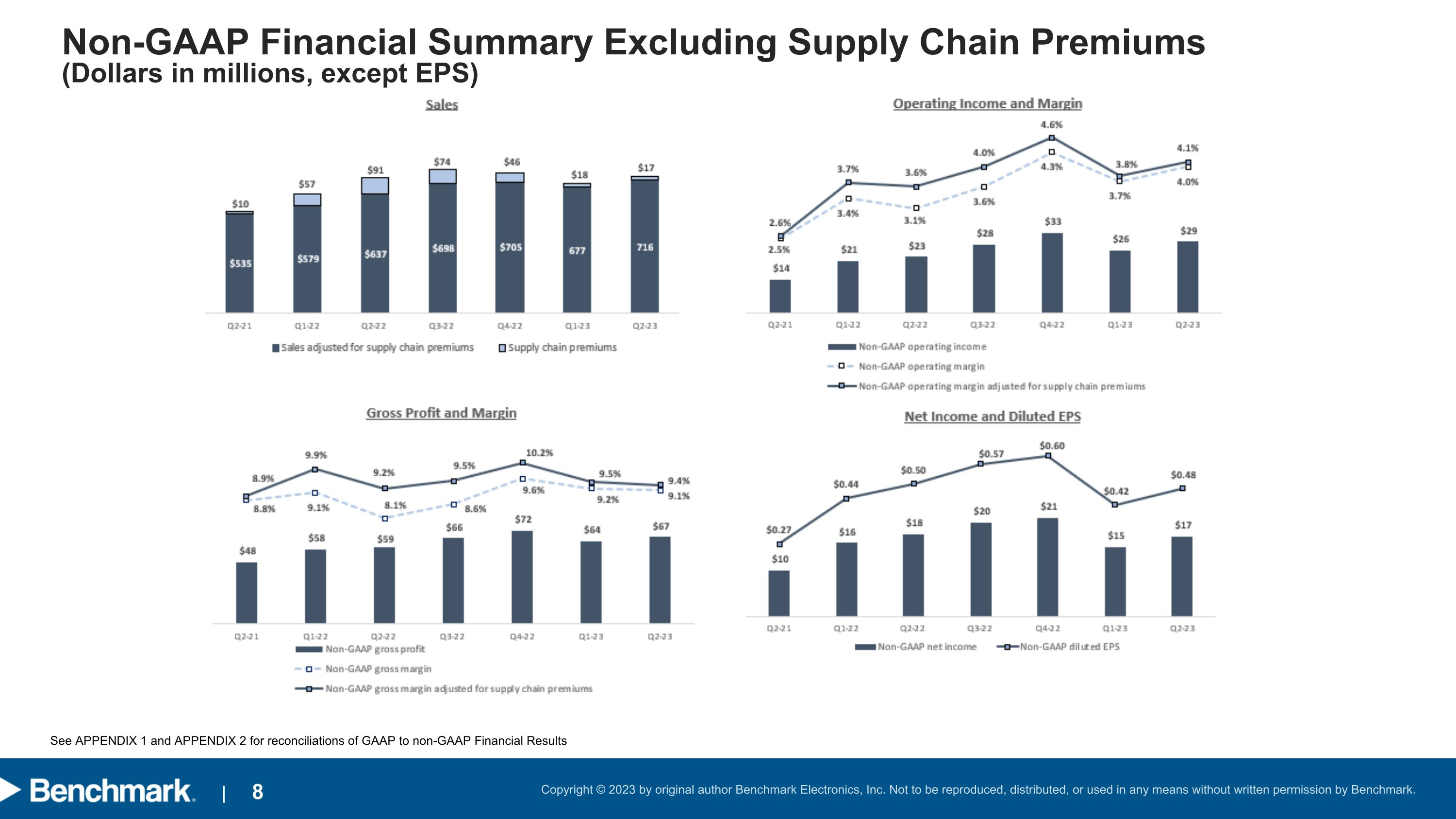

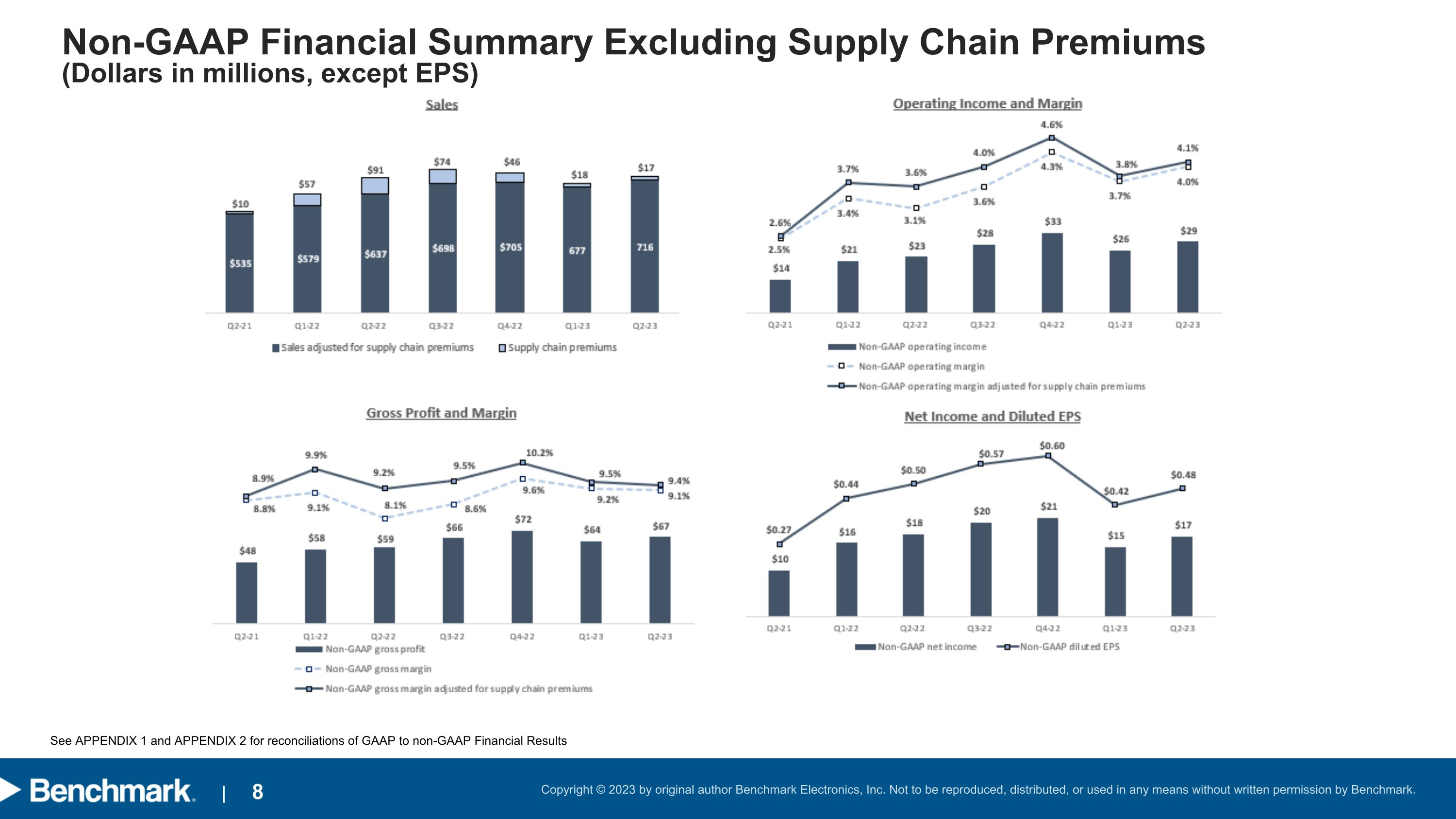

Non-GAAP Financial Summary Excluding Supply Chain Premiums (Dollars in millions, except EPS) See APPENDIX 1 and APPENDIX 2 for reconciliations of GAAP to non-GAAP Financial Results

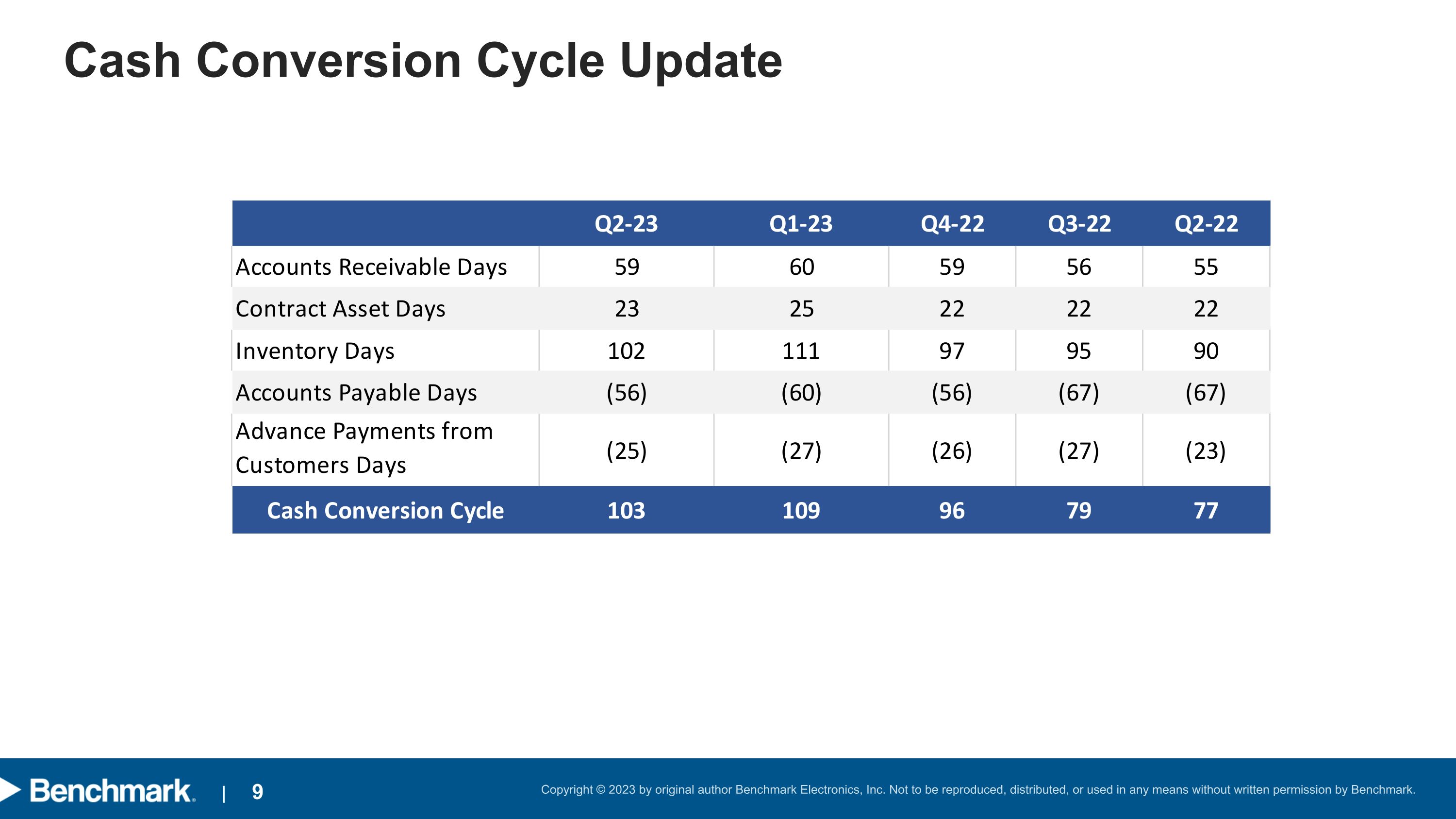

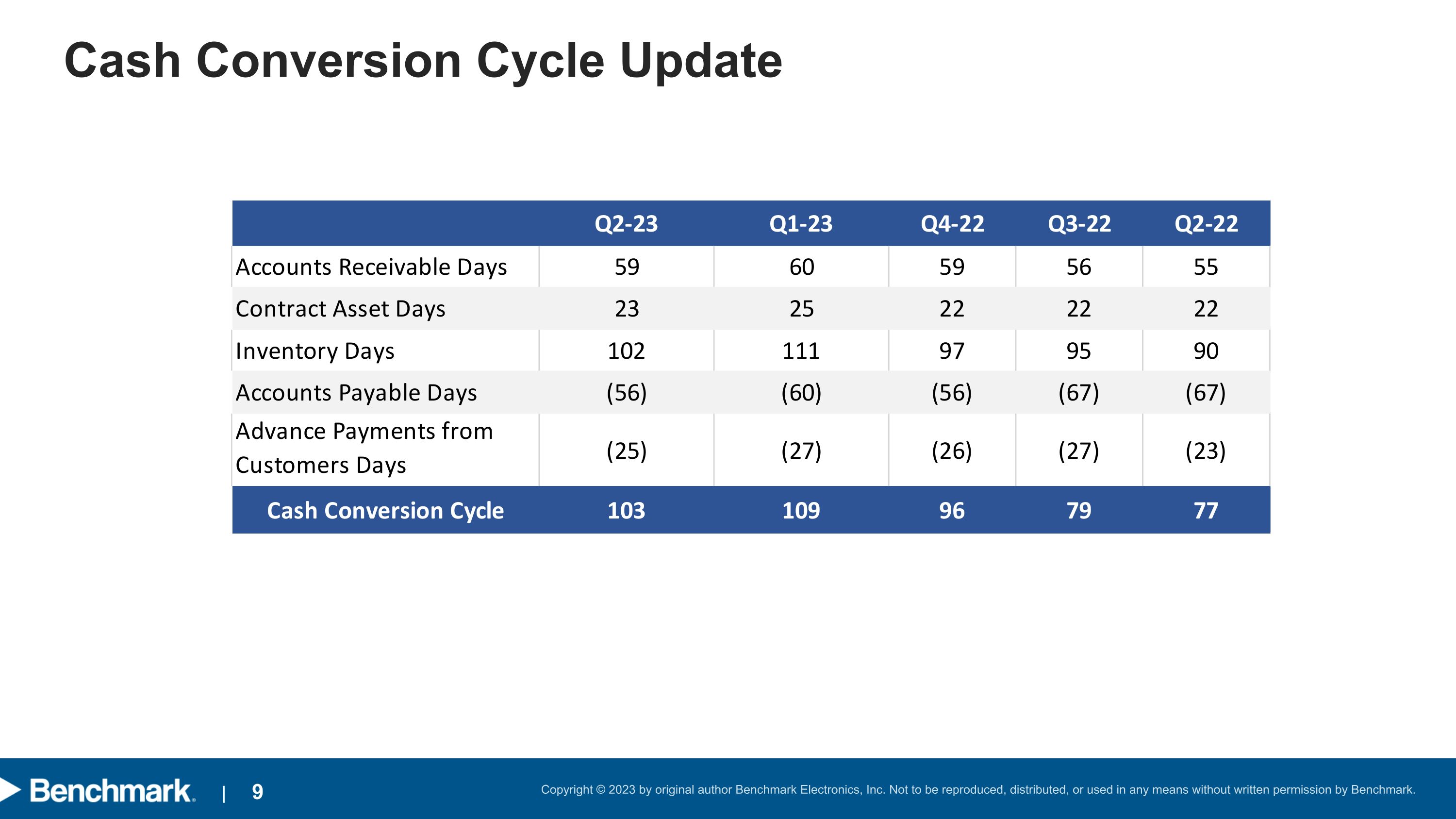

Cash Conversion Cycle Update

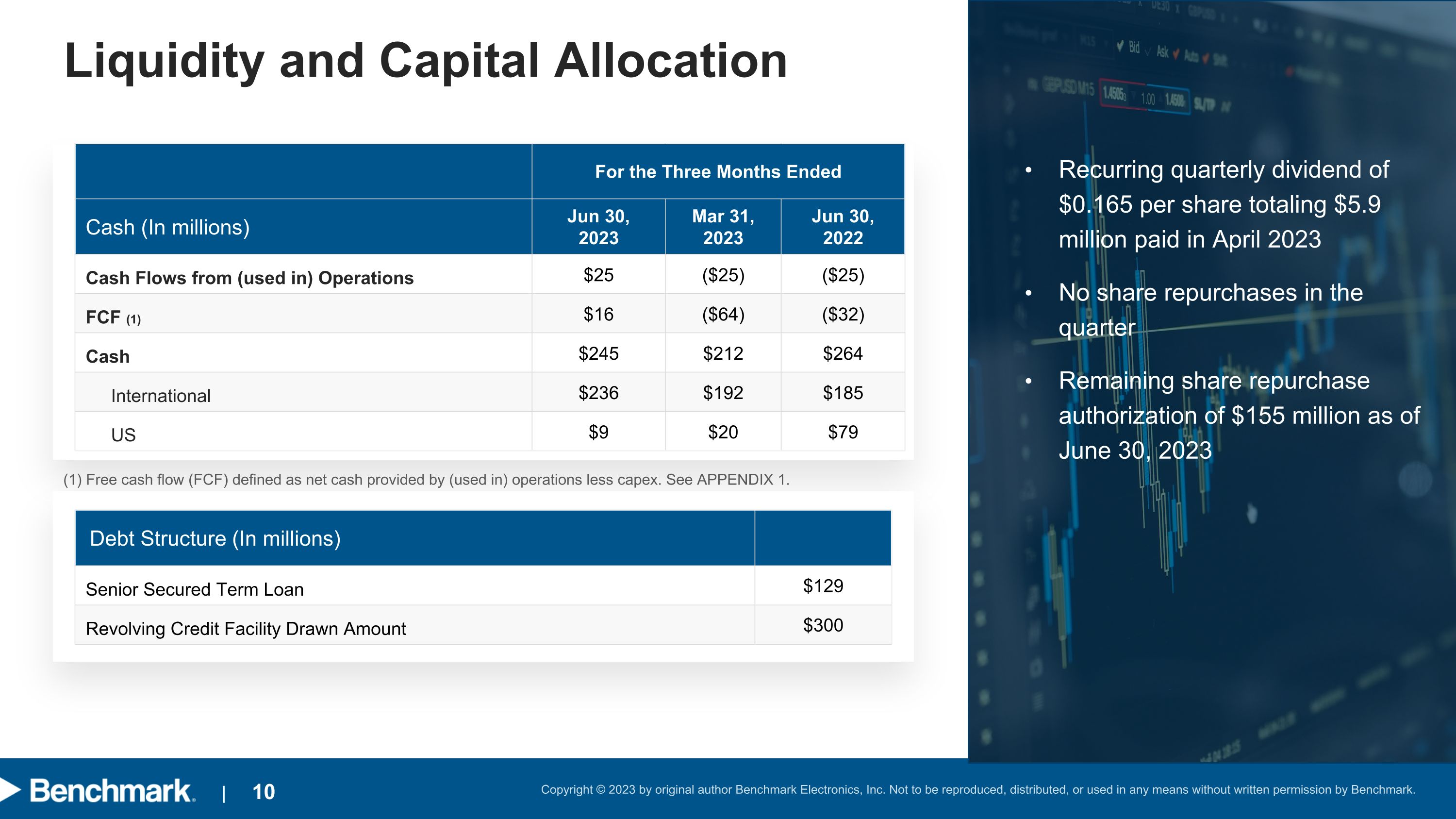

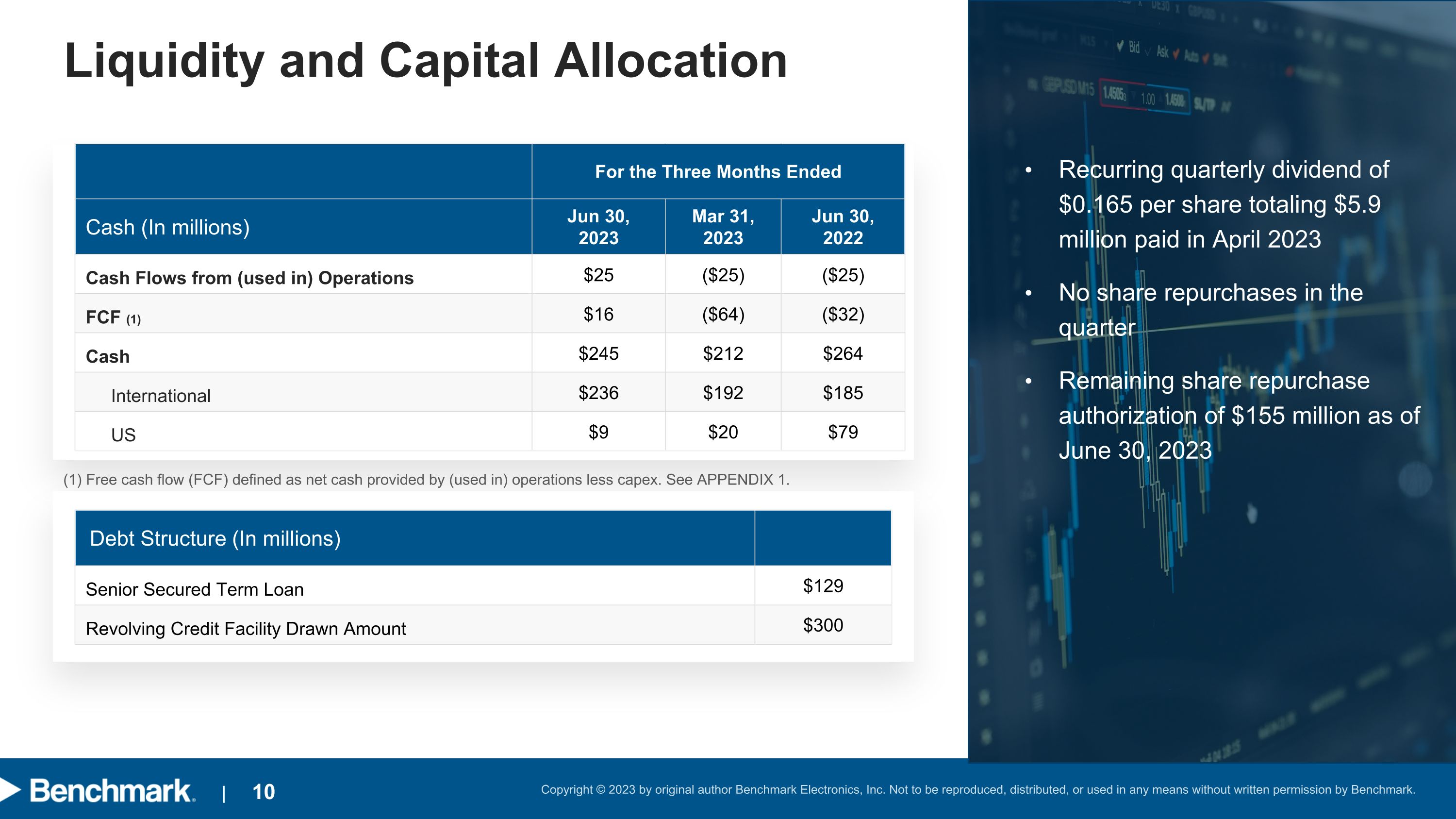

Liquidity and Capital Allocation (1) Free cash flow (FCF) defined as net cash provided by (used in) operations less capex. See APPENDIX 1. Debt Structure (In millions) Senior Secured Term Loan $129 Revolving Credit Facility Drawn Amount $300 Recurring quarterly dividend of $0.165 per share totaling $5.9 million paid in April 2023 No share repurchases in the quarter Remaining share repurchase authorization of $155 million as of June 30, 2023 For the Three Months Ended Cash (In millions) Jun 30, 2023 Mar 31, 2023 Jun 30, 2022 Cash Flows from (used in) Operations $25 ($25) ($25) FCF (1) $16 ($64) ($32) Cash $245 $212 $264 International $236 $192 $185 US $9 $20 $79

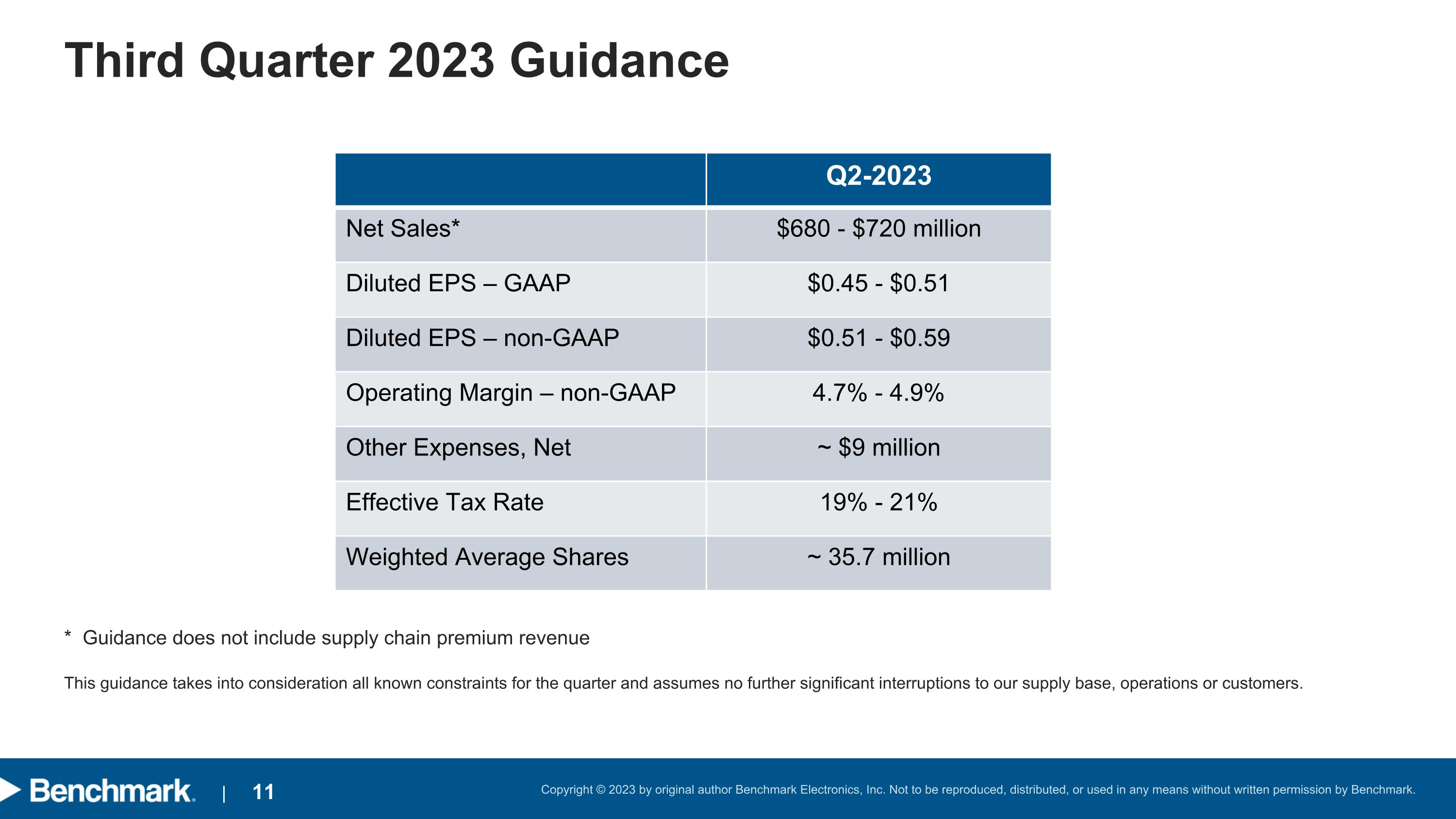

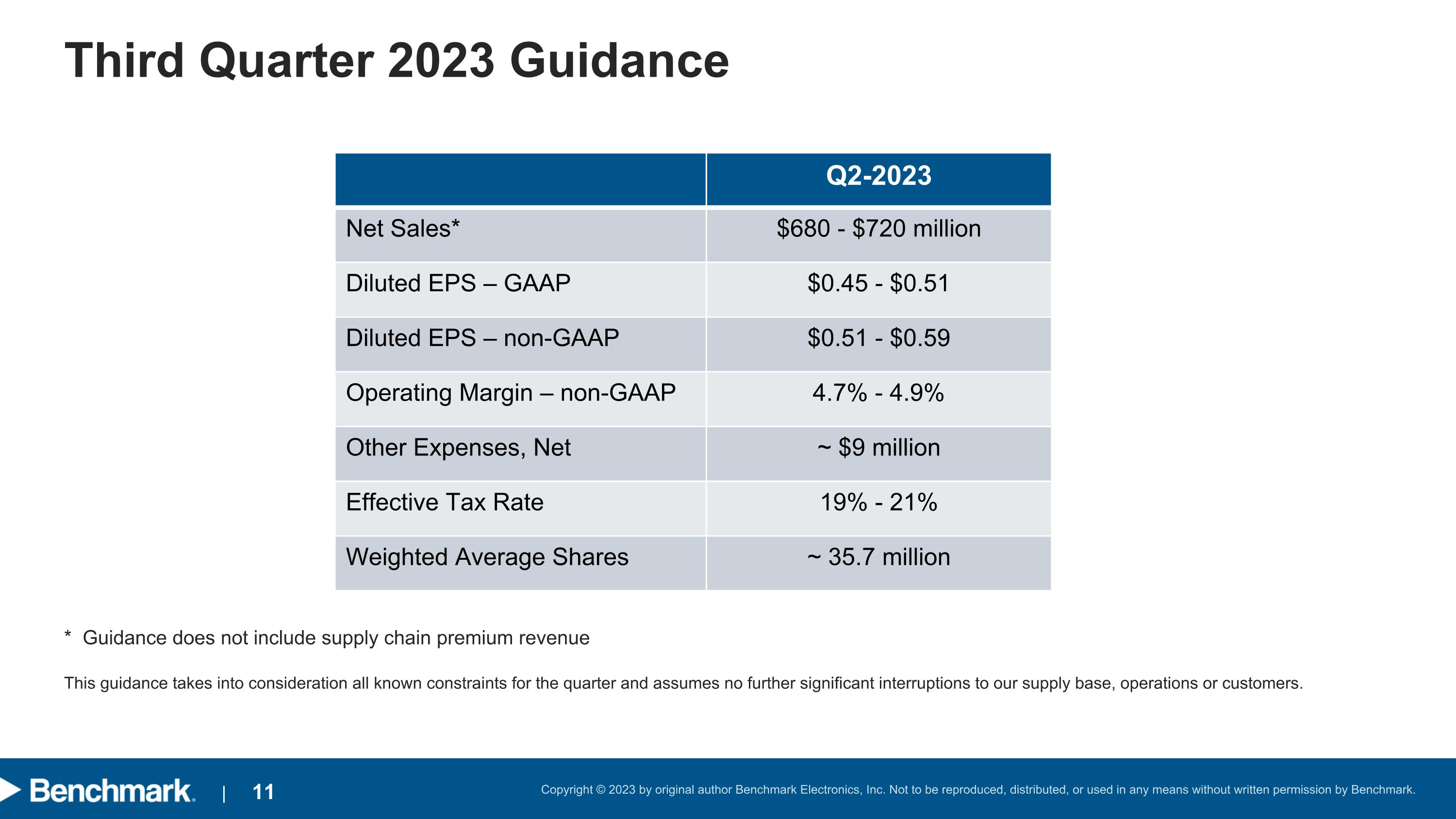

Third Quarter 2023 Guidance Q2-2023 Net Sales* $680 - $720 million Diluted EPS – GAAP $0.45 - $0.51 Diluted EPS – non-GAAP $0.51 - $0.59 Operating Margin – non-GAAP 4.7% - 4.9% Other Expenses, Net ~ $9 million Effective Tax Rate 19% - 21% Weighted Average Shares ~ 35.7 million * Guidance does not include supply chain premium revenue This guidance takes into consideration all known constraints for the quarter and assumes no further significant interruptions to our supply base, operations or customers.

Business Trends Jeff Benck - CEO

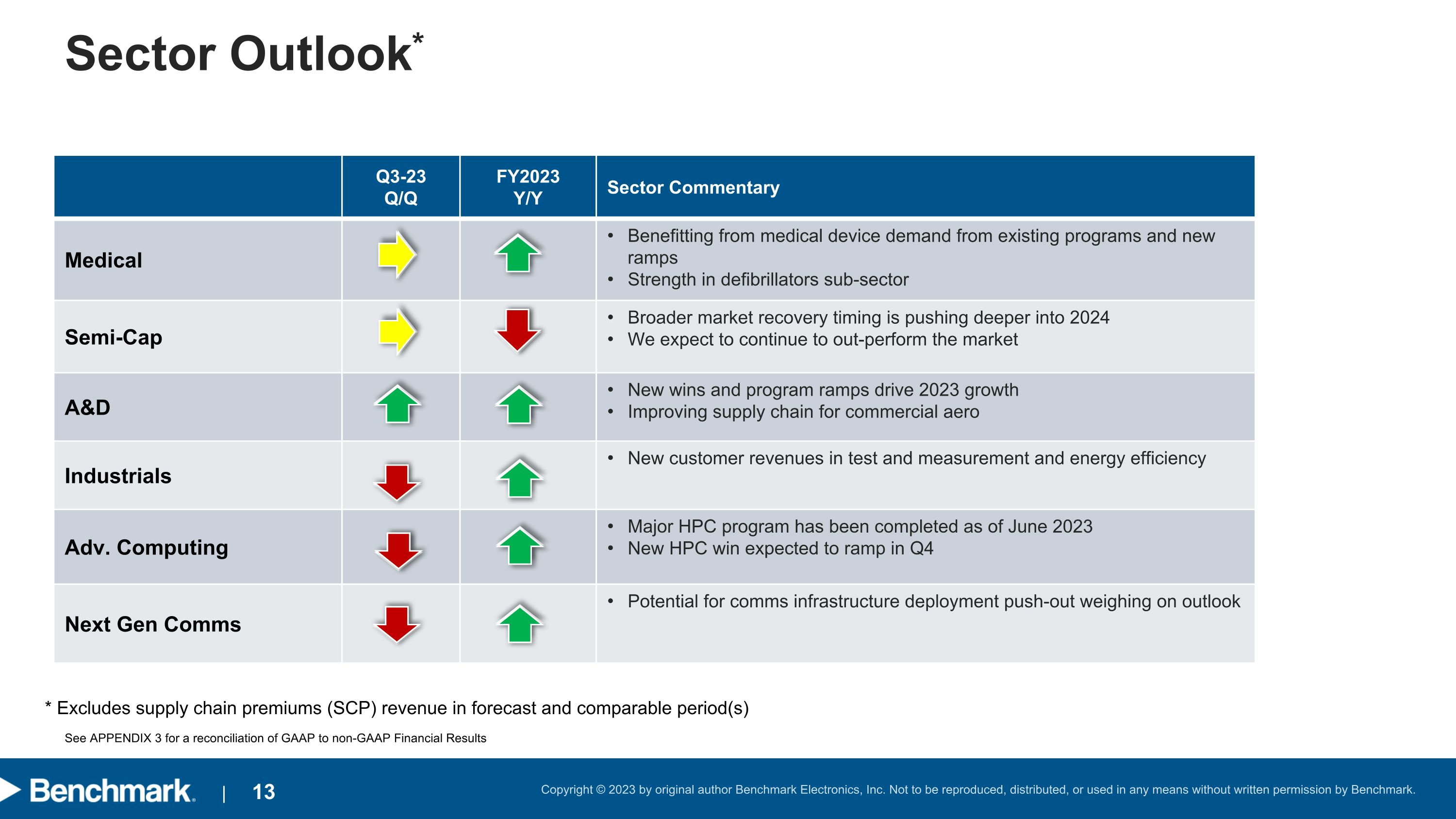

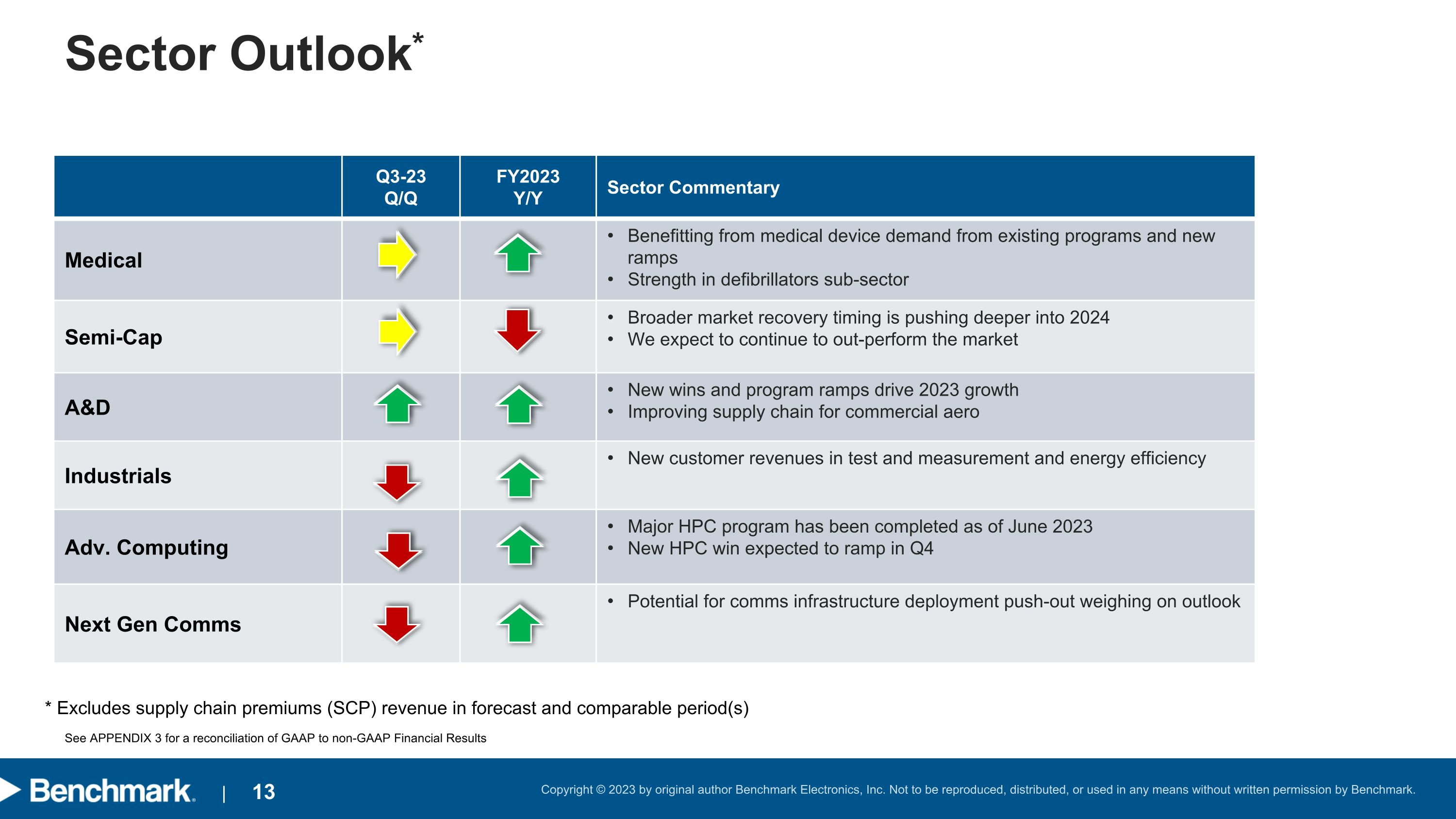

Sector Outlook* * Excludes supply chain premiums (SCP) revenue in forecast and comparable period(s) Q3-23 Q/Q FY2023 Y/Y Sector Commentary Medical Benefitting from medical device demand from existing programs and new ramps Strength in defibrillators sub-sector Semi-Cap Broader market recovery timing is pushing deeper into 2024 We expect to continue to out-perform the market A&D New wins and program ramps drive 2023 growth Improving supply chain for commercial aero Industrials New customer revenues in test and measurement and energy efficiency Adv. Computing Major HPC program has been completed as of June 2023 New HPC win expected to ramp in Q4 Next Gen Comms Potential for comms infrastructure deployment push-out weighing on outlook See APPENDIX 3 for a reconciliation of GAAP to non-GAAP Financial Results

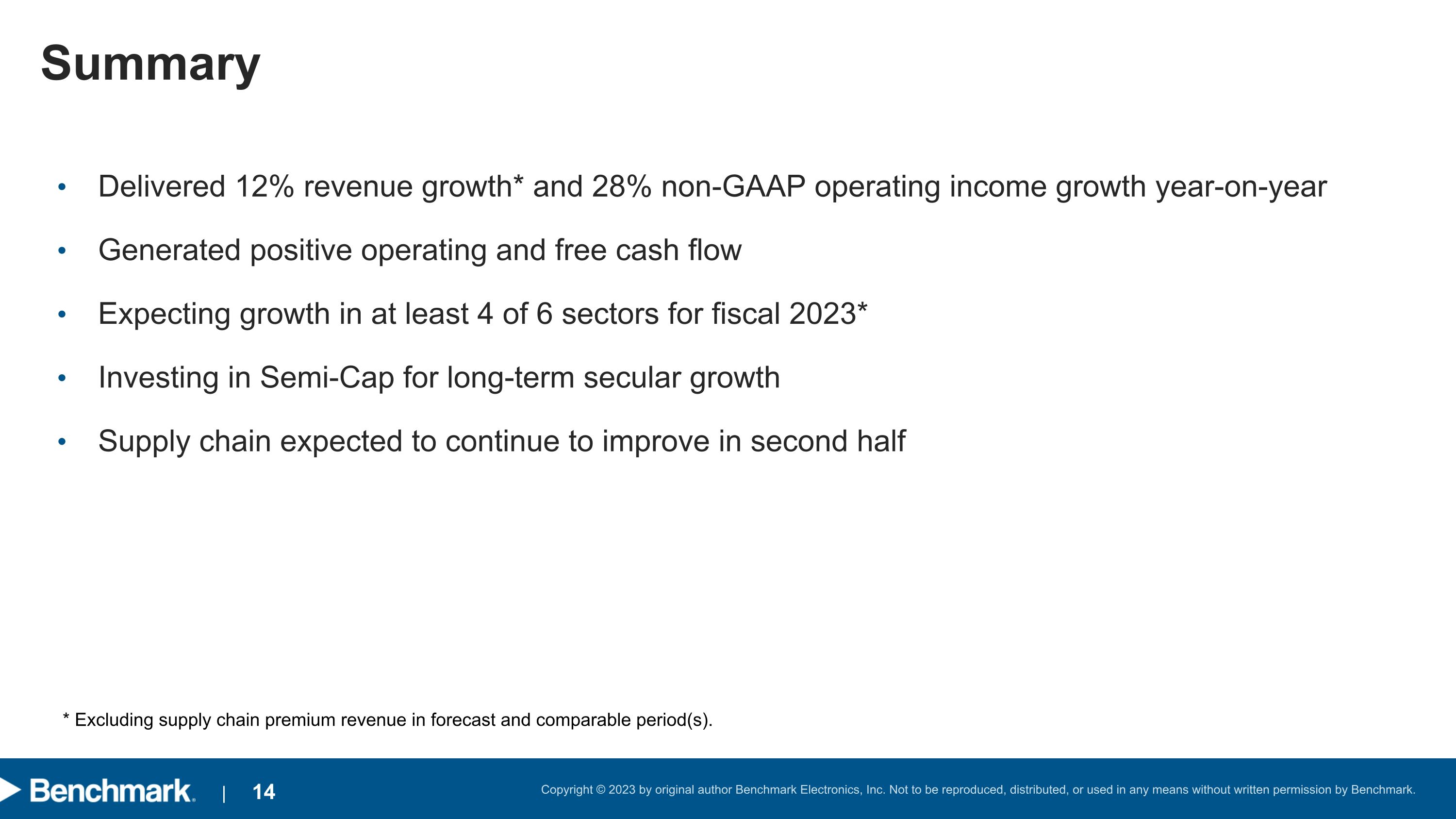

Summary Delivered 12% revenue growth* and 28% non-GAAP operating income growth year-on-year Generated positive operating and free cash flow Expecting growth in at least 4 of 6 sectors for fiscal 2023* Investing in Semi-Cap for long-term secular growth Supply chain expected to continue to improve in second half * Excluding supply chain premium revenue in forecast and comparable period(s).

Appendix

(Dollars in Thousands, Except Per Share Data) – (UNAUDITED) APPENDIX 1 - Reconciliation of GAAP to non-GAAP Financial Results

(Dollars in Millions) – (UNAUDITED) APPENDIX 2 - Reconciliation of Supply Chain Premiums

(Dollars in Millions) – (UNAUDITED) APPENDIX 3 - Reconciliation of Supply Chain Premiums by Sector