Investor Meeting

November 2007

0

Disclaimer

This presentation contains forward-looking statements. Forward-looking statements

are based on current expectations and projections about future events and are

subject to risks, uncertainties and assumptions about our Company, economic and

market sectors and the industry in which we do business, among other things. These

statements are not guarantees of future performance, and we undertake no

obligation to publicly update any forward-looking statements whether as a result of

new information, future events or otherwise. Actual events and results may differ

from those expressed in any forward-looking statements due to a number of factors.

Factors that could cause our actual performance, future results and actions to differ

materially from any forward-looking statements include, but are not limited to, those

discussed in risk factors within our Form 10-K for the fiscal year ended February 3,

2007, and our Form 10-Q for the fiscal quarter ended August 4, 2007, as filed with the

Securities and Exchange Commission.

1

Who We Were in 2001

One of the largest national mall-based specialty retail chains focused on young

women’s apparel operating 571 stores in 44 states, Puerto Rico and

Washington, D.C., with four concepts:

Wet seal (406 stores) - junior fast-fashion apparel brand

Contempo Casual (51 stores) – converting to Wet Seal

Arden B with (84 stores) - young contemporary woman (20-40)

Zutopia (30 stores) – tween fashion brand

Arden B mix included significant fashion basics and wear-to-work merchandise

2

Who We Were in 2001 (cont’d)

Sales of $590 million, a same-store sales increase of 4.7%, operating

margin of 7.8%; and an ROE of 16%+

Wet Seal and Arden B generated similar operating margins

Cash and cash equivalents of $132M;inventory turnover of nearly 7x; no

debt; market capitalization of $594M.

3

Who We Were in 2001 (cont’d)

Comprehensive merchandising information systems in place to support

growth

Central information source for merchandise, inventory management, purchasing, replenishment,

receiving and distribution.

Converted to a new point-of-sale software program in fiscal 2002, in order to enhance customer

service capabilities at the store level

Integrated planning, allocation and distribution functions

Planners and allocators work with District/Regional Directors and merchandise buyers to manage

inventory levels and coordinate the allocation of merchandise to each store

Approximately 18% of retail receipts imported from foreign vendors

Daily, store-ready merchandise deliveries and regular markdowns to speed

sale of slow-moving inventory:

Unsold merchandise periodically shipped to clearance stores

4

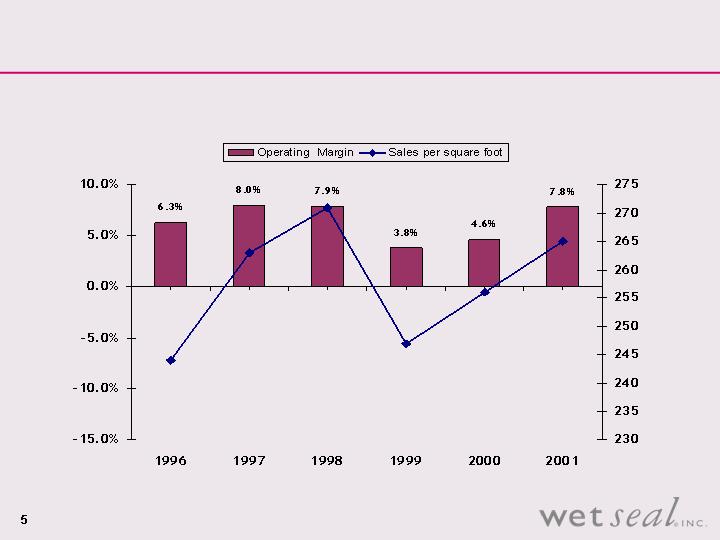

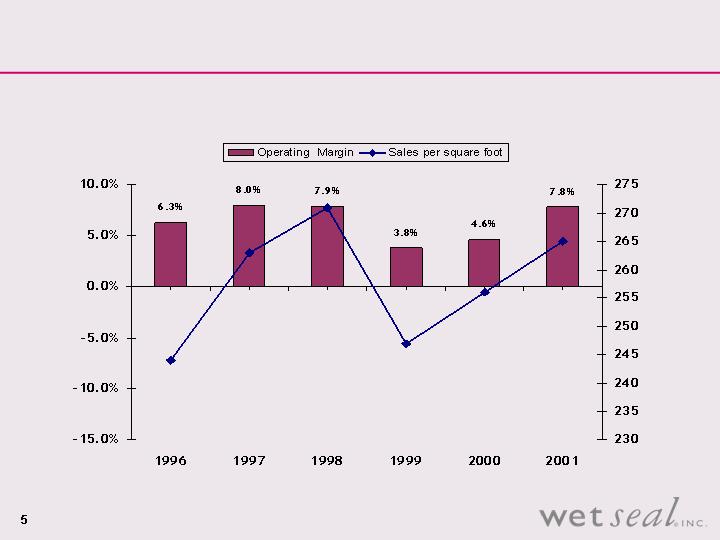

Consistently profitable through Fiscal 2001

5

Who We Are Now

California based specialty fashion apparel retailer with two distinct contemporary

brands:

Wet Seal with 396 stores as of the end of F3Q07

Arden B with 94 stores as of the end of F3Q07

In Fiscal 2007, forecasted sales of $600 to $603 million and operating margin of 1.6% to

2.2%

Forecasted cash and marketable securities at $100M; inventory turnover of 6x; debt of

$3.6 million;

Current market capitalization of approximately $200 million.

Competition includes:

Wet Seal

Aeropostale Gap

American Eagle Old Navy

Charlotte Russe Pacific Sunwear

Express Urban Outfitters

Forever 21 Target

Arden B

bebe

BCBG

Banana Republic

Zara

6

Who We Are Now - Wet Seal

Brand position: Founded in 1962, junior

apparel brand that is trend-focused and value

competitive

Target: 13 to 19 year-old seeking wear-now

fashion at a value

Stores: Average 4,000 square feet and

generated $321 in sales/sq ft in fiscal 2006

7

Who We Are Now – Arden B.

Brand Position: Launched in 1998, fashion

brand for the feminine contemporary woman

with sex appeal

Target: 25 to 35 year-old with core focus on 28

year olds

Stores: Average 3,200 square feet and

generated $459 in sales/sq ft in fiscal 2006

8

Financial Performance 2002 – 2007E

Operating margin adjusted to exclude benefit for Arden B loyalty program sales adjustment, asset impairments,

store closure costs and Michael Gold non-cash stock compensation expense.

9

Strategic Opportunities and Action Plan – Wet Seal

Operating margins have deteriorated as investments in infrastructure failed to drive

sales growth, particularly in Arden B

Merchandise margin opportunities exist:

Wet Seal:

Strategic Opportunities:

Planning and allocation

Merchandise mix

Markdown cadence

2008 Action Plan:

Complete store profiles and integrate into planning and allocation

Implement size optimization

Conduct focus groups and market research

Increase focus on key categories/expand bottoms offering

Add denim brands to the mix

Employ management in weekly review of inventory position and markdown plans

10

Merchandise margin opportunities exist:

Arden B:

Strategic Opportunities:

Merchandise mix

Inventory management

Sourcing

Price rationalization

Fit enhancements

2008 Action Plan:

Better align merchandise mix with customer needs

Conduct focus groups and market research

Offer a trend-right not leading-edge assortment

Create better balance of wear-to-work, everyday and occasion

Add fashion basics across key categories

Employ management in weekly review of inventory position and markdown plans

Hire new head of sourcing for Arden B and Wet Seal

Reassess sourcing process

Employ more consistent pricing practices and better promotional discipline

Strategic Opportunities and Action Plan – Arden B

11

Store operations:

Strategic Opportunities:

Better alignment of incentive compensation with performance

Utilization of customer feedback

New store productivity

2008 Action Plan:

Establish stronger accountability – develop incentive plans aligned with sales

growth and profitability

Re-align both divisions by February 2008 to reduce costs

Eliminate excess tasks to facilitate greater focus on sales

Increase store visits by senior management

Employ more detailed analysis and monitoring of new store performance

Strategic Opportunities and Action Plan – Store Operations

12

Real Estate:

Strategic Opportunities:

Improve new store economics

Address pressure from rising occupancy and store construction costs

Test off-mall locations

2008 Action Plan:

Rebuild the pipeline for store growth

Rationalize current deals in the pipeline/reduce 2008 store openings

Increase senior management involvement in site review and new store economic

analysis

Strategic Opportunities and Action Plan – Real Estate

13

Marketing:

Strategic Opportunities:

Better align to divisional merchandise strategies

Build connection to customers

Redeploy marketing spend to focus on more effective channels, i.e. grassroots

marketing

Capitalize on internet database

2008 Action Plan:

Layout specific plans for each division by January 2008

Conduct focus groups for both divisions/store manager feedback

Increase emphasis on visual and grass roots

Optimize direct mail campaign

Raise the focus on customer acquisition

Increase use of internet to drive store traffic

Strategic Opportunities and Action Plan - Marketing

14

IT:

Strategic Opportunities:

Increased efficiency/lower operating costs

Systems development

2008 Action Plan:

Conduct independent review of infrastructure to determine immediate cost

savings

Develop short term and long term systems strategies

Install better project management and cost controls

Physical Distribution and Transport:

Strategic Opportunities:

Facilitate more efficient store operations

2008 Action Plan:

Deliver merchandise floor-ready

Resume daily shipping to stores

Strategic Opportunities and Action Plan – IT and Distribution

15

Grow Retail Store Base

Wet Seal

600 – 700 Store

Opportunity

63 Net New Stores in FY2007

Arden B

200 – 250 Store

Opportunity

4 Net New Stores in FY2007

Wet Seal vs. The Competition

(1)

Management estimate.

(2)

Industry Average includes Abercrombie & Fitch, Aéropostale, American Eagle, Charlotte Russe,

Express, Forever 21, Gap, Hot Topic, J. Crew, Limited, Old Navy, Pacific Sunwear and Urban

Outfitters. North American stores only for Gap, Old Navy and Urban Outfitters.

Arden B vs. The Competition

(1) Management estimate.

(2)

Industry Average includes Anthropologie, Banana Republic, BCBG, bebe, Club Monaco, Express,

J. Crew, Limited and Zara.

16

Financials

Steve Benrubi, CFO

17

Store Count and Total Sales

18

EPS History: 2001 – 2007E

19

Fiscal Third Quarter Income Statement Results

20

$000's

Net Sales

$150,277

100.0%

$143,272

100.0%

Gross Profit

43,034

28.6%

48,127

33.6%

Selling General & Administrative

45,914

30.6%

46,095

32.2%

Asset Impairment

1,567

1.0%

-

-

Operating Income (Loss)

(4,447)

-3.0%

$2,032

1.4%

Net Income (Loss)

($3,319)

-2.2%

$2,401

1.7%

Diluted EPS

($0.04)

$0.02

Diluted Shares Outstanding (000's)

90,015

101,493

2007

2006

Balance Sheet Results as of the End of Fiscal Third Quarter

21

November 3, 2007

October 28, 2006

Cash and marketable securities

80,062

$

77,099

$

Inventory

51,830

44,640

Other current assets

16,038

9,077

Net PPE

72,164

50,293

Long-term assets

5,656

6,540

Total assets

225,750

$

187,649

$

Current liabilities

74,650

$

65,275

$

Total debt

3,350

7,274

Other long-term liabilities

31,248

24,469

Convertible preferred stock

2,167

9,441

Shareholders' equity

114,335

81,190

Total liabilities & shareholders' equity

225,750

$

187,649

$

Business Outlook

Fourth Quarter Fiscal 2007

Comps -4% to -6%

EPS $0.03 to $0.06

Fiscal 2007 free cash flow $10 - $13 million (after capital investment

of $14 million in new stores)

Fiscal 2008

Net Store Openings 20 to 25

Tax rate 3%

22

Investment Highlights

Well-Established Brands:

Wet Seal - fashion and value oriented retailer to teens

Arden B – fashion brand for young women

Retail Expansion Opportunity: Wet Seal operates 396 stores with

potential for 600-700; Arden B operates 94 stores with potential

for 200-250

Increased Store Productivity Potential: Merchandising, planning &

allocation and operational initiatives underway

Significant Operating Income Recovery Potential: WTSLA forecasts

a 1.6% - 2.2% operating margin in FY 2007 well below historical

peak of 8%

23