UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06110

Western Asset Funds, Inc.

(Exact name of registrant as specified in charter)

55 Water Street, New York, NY 10041

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: December 31

Date of reporting period: December 31, 2010

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

December 31, 2010

Annual Repor t

Western Asset

Core Plus Bond

Portfolio

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

| | |

| II | | Western Asset Core Plus Bond Portfolio |

Fund objective

The Fund seeks to maximize total return, consistent with prudent investment management and liquidity needs, by investing to obtain an average duration which is expected to range within 30% of the average duration of the domestic bond market as a whole.

Letter from the president

Dear Shareholder,

We are pleased to provide the annual report of Western Asset Core Plus Bond Portfolio for the twelve-month reporting period ended December 31, 2010. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com/individualinvestors. Here you can gain immediate access to market and investment information, including:

| Ÿ | | Fund prices and performance, |

| Ÿ | | Market insights and commentaries from our portfolio managers, and |

| Ÿ | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

President

February 9, 2011

| | | | |

| Western Asset Core Plus Bond Portfolio | | | III | |

Investment commentary

Economic review

Despite continued headwinds from high unemployment and issues in the housing market, the U.S. economy continued to expand over the twelve months ended December 31, 2010. Toward the end of the reporting period, fears regarding moderating economic growth were replaced with optimism for a strengthening economy in 2011. With investor sentiment improving, U.S. equities moved sharply higher in the fourth quarter, while rising interest rates negatively impacted some sectors of the fixed-income market. All told, during 2010, investors who took on additional risk in their portfolios were generally rewarded.

In September 2010, the National Bureau of Economic Research (“NBER”), the organization charged with determining when recessions start and end, announced that the recession that began in December 2007 had concluded in June 2009. However, the NBER said, “In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity.” The NBER’s point is well-taken given continued areas of weakness in the U.S. economy.

Although the U.S. Department of Commerce continued to report positive U.S. gross domestic product (“GDP”)i growth, the expansion has moderated since peaking at 5.0% in the fourth quarter of 2009. A slower drawdown in business inventories and renewed consumer spending were contributing factors spurring the economy’s solid growth at the end of 2009. However, the economy grew at a more modest pace in 2010. According to the Commerce Department, GDP growth was 3.7%, 1.7% and 2.6% during the first, second and third quarters of 2010, respectively. The initial estimate for fourth quarter GDP was a 3.2% expansion.

Turning to the job market, while the unemployment rate moved lower in December 2010, it remained elevated throughout the reporting period. While 384,000 new jobs were created during the fourth quarter and the unemployment rate fell from 9.8% in November to 9.4% in December 2010, there continued to be some disturbing trends in the labor market. The unemployment rate has now exceeded 9.0% for twenty consecutive months, the longest period since the government began tracking this data in 1949. In addition, the U.S. Department of Labor reported in December that a total of 14.5 million Americans looking for work have yet to find a job, and 44% of these individuals have been out of work for more than six months.

There was mixed news in the housing market during the period. According to the National Association of Realtors (“NAR”), existing-home sales increased 7.0% and 8.0% in March and April, respectively, after sales had fallen for the period from December 2009 through February 2010. The rebound was largely attributed to people rushing to take advantage of the government’s $8,000 tax credit for first-time home buyers that expired at the end of April. However, with the end of the tax credit, existing-home sales then declined from May through July. Sales then generally rose from August through the end of the year. In total, existing-home sales volume in 2010 was 4.9 million, the lowest amount since 1997. Looking at home prices, the NAR reported that the median existing-home price for all housing types rose a tepid 0.3% in 2010. The inventory of unsold homes was an 8.1 month supply in December at the current sales level, versus a 9.5 month supply in November.

The manufacturing sector was one area of the economy that remained relatively strong during 2010. Based on the Institute

| | |

| IV | | Western Asset Core Plus Bond Portfolio |

Investment commentary (cont’d)

for Supply Management’s PMIii, the manufacturing sector has grown seventeen consecutive months since it began expanding in August 2009. After reaching a six-year peak of 60.4 in April 2010 (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion), PMI data indicated somewhat more modest growth through the remainder of the year. However, in December, the manufacturing sector expanded at its fastest pace in seven months, with a reading of 57.0 versus 56.6 in November.

Financial market overview

The financial markets experienced several periods of volatility during the reporting period that tested the resolve of novice and experienced investors alike. During most of the first four months of the reporting period, the financial markets were largely characterized by healthy investor risk appetite and solid results by stocks and lower-quality bonds. The market then experienced sharp sell-offs in late April and in May, and again beginning in mid-November. During those periods, investors tended to favor the relative safety of U.S. Treasury securities. However, these setbacks proved to be only temporary and, in each case, risk aversion was replaced with solid demand for riskier assets.

Due to signs that certain areas of the economy were moderating in the second half of the reporting period, the Federal Reserve Board (“Fed”)iii took further actions to spur the economy. At its August 10th meeting, the Fed announced an ongoing program that calls for using the proceeds from expiring agency debt and agency mortgage-backed securities to purchase longer-dated Treasury securities.

In addition, the Fed remained cautious throughout the reporting period given pockets of weakness in the economy. At its meeting in September 2010, the Fed said, “The Committee will continue to monitor

the economic outlook and financial developments and is prepared to provide additional accommodation if needed to support the economic recovery. . . .” This led to speculation that the Fed may again move to purchase large amounts of agency and Treasury securities in an attempt to avoid a double-dip recession and ward off deflation.

The Fed then took additional action in early November. Citing that “the pace of recovery in output and employment continues to be slow,” the Fed announced another round of quantitative easing to help stimulate the economy, entailing the purchase of $600 billion of long-term U.S. Treasury securities by the end of the second quarter of 2011. This, coupled with the Fed’s previously announced program to use the proceeds of expiring securities to purchase Treasuries, means it could buy a total of $850 billion to $900 billion of Treasury securities by the end of June 2011. At its final meeting of the year in December, the Fed said it “will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.”

Fixed-income market review

Continuing the trend that began in the second quarter of 2009, nearly every spread sector (non-Treasury) outperformed equal-durationiv Treasuries during most of the first four months of the reporting period. Over that time, investor confidence was high given encouraging economic data, continued low interest rates, benign inflation and rebounding corporate profits. Robust investor appetite was then replaced with heightened risk aversion toward the end of April and during the month of May. This was due to the escalating sovereign debt crisis in Europe, uncertainties regarding new financial reforms in the U.S. and some worse-than-expected economic data.

| | | | |

| Western Asset Core Plus Bond Portfolio | | | V | |

Most spread sectors then produced positive absolute returns in June and July, as investor demand for these securities again increased. There was another bout of risk aversion in August, given fears that the economy may slip back into a recession. However, with the Fed indicating the possibility of another round of quantitative easing, most spread sectors rallied in September and October. The spread sectors started to weaken again toward the middle of November as financial troubles in Ireland resulted in a re-emergence of the European sovereign debt crisis. While several spread sectors regained their footing in December, others remained weak given ongoing uncertainties in Europe and concerns regarding economic growth in China and its potential impact on the global economy.

Both short- and long-term Treasury yields fluctuated but, overall, moved lower during the twelve months ended December 31, 2010. When the period began, two- and ten-year Treasury yields were 1.14% and 3.85%, respectively. On April 5, 2010, two- and ten-year Treasury yields peaked at 1.18% and 4.01%, respectively. Subsequent to hitting their highs for the period, yields largely declined during much of the next six months, with two-year Treasuries hitting their low for the year of 0.33% on November 4, 2010. Ten-year Treasuries reached their 2010 trough of 2.41% in early October. Yields then moved sharply higher given expectations for stronger growth in 2011 and the potential for rising inflation.

When the period ended on December 31, 2010, two-year Treasury yields were 0.61% and ten-year Treasury yields were 3.30%. For the twelve months ended December 31, 2010, the Barclays Capital U.S. Aggregate Indexv returned 6.54%.

The U.S. high-yield bond market produced strong results during the reporting period. The asset class posted positive returns during each month, except for May and November 2010 when risk aversion rose sharply. The high-yield market was supported by better-than-expected corporate profits and overall strong investor demand. All told, the Barclays Capital U.S. High Yield – 2% Issuer Cap Indexvi returned 14.94% for the twelve months ended December 31, 2010.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

R. Jay Gerken, CFA

President

January 28, 2011

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Institute for Supply Management's PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the manufacturing sector. |

| iii | The Federal Reserve Board ("Fed") is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iv | Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

| v | The Barclays Capital U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| vi | The Barclays Capital U.S. High Yield – 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Barclays Capital U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. |

| | | | |

| Western Asset Core Plus Bond Portfolio 2010 Annual Report | | | 1 | |

Fund overview

Q. What is the Fund’s investment strategy?

A. The Fund seeks to maximize total return, consistent with prudent investment management and liquidity needs, by investing to obtain the average durationi specified below. The Fund invests in a portfolio of fixed-income securities of various maturities and, under normal market conditions, will invest at least 80% of its net assets in debt and fixed-income securities. Although the Fund may invest in debt and fixed-income securities of any maturity, under normal market conditions, the target dollar-weighted average effective durationii for the Fund is expected to range within 30% of the average duration of the domestic bond market as a whole as measured by Western Asset Management Company (“Western Asset”), the Fund’s adviser. (Generally, this range is 2.5 to seven years.)

The Fund may invest up to 20% of its total assets in non-U.S. dollar-denominated securities. Up to 20% of the Fund’s net assets may be invested in debt securities that are not rated Baa or BBB or above at the time of purchase by one or more nationally recognized statistical rating organizations but are rated at least B-/B3 or, if unrated, securities that we determine to be of comparable quality at the time of purchase. The Fund may invest up to 25% of its total assets in the securities of non-U.S. issuers.

The Fund may also enter into various derivative transactions for both hedging and non-hedging purposes, including for purposes of enhancing returns. These derivative transactions include, but are not limited to, futures, options, swaps and forwards.

At Western Asset, we utilize a fixed- income team approach, with decisions derived from interaction among various investment management sector specialists. The sector teams are comprised of Western Asset’s senior portfolio managers, research ana-

lysts and an in-house economist. Under this team approach, management of client fixed-income portfolios will reflect a consensus of interdisciplinary views within the Western Asset organization.

Q. What were the overall market conditions during the Fund’s reporting period?

A. During the twelve months ended December 31, 2010, the riskier segments of the fixed-income market produced strong results and outperformed U.S. Treasuries. This was due, in part, to improving economic conditions following the lengthy downturn from mid-2008 through mid-2009. Also supporting the spread sectors (non-U.S. Treasuries) was overall solid demand from investors seeking incremental yields given the low rates available from short-term fixed-income securities.

The spread sectors rallied during most of the reporting period, with notable exceptions being in late April and May 2010, as well as August and November 2010. Starting toward the end of April, there was a “flight to quality,” triggered by concerns regarding the escalating sovereign debt crisis in Europe. In addition, investor sentiment was negatively impacted by uncertainties surrounding financial reform legislation in the U.S. and signs that economic growth was moderating. Collectively, this caused investors to flock to the relative safety of Treasury securities, driving their yields lower and prices higher.

Robust investor risk appetite largely resumed during June and July, and again in September and October. These turnarounds occurred as the situation in Europe appeared to stabilize, the financial reform bill was signed into law and the Federal Reserve Board (“Fed”)iii continued to indicate that it would keep short-term rates low for an extended period. Investor risk aversion briefly returned in November

| | |

| 2 | | Western Asset Core Plus Bond Portfolio 2010 Annual Report |

Fund overview (cont’d)

when fears regarding the European debt crisis re-emerged. However, investor sentiment improved in December, given expectations for strengthening economic conditions in 2011.

The yields on two- and ten-year Treasuries began the fiscal year at 1.14% and 3.85%, respectively. Treasury yields fluctuated during the twelve-month reporting period given mixed signals regarding the economy and uncertainties regarding Fed monetary policy. Yields moved sharply lower in October 2010 in anticipation of additional quantitative easing (“QE2”) by the Fed. Yields then reversed course toward the end of the period as certain economic data were stronger than expected and there were concerns regarding future inflation. During the fiscal year, two-year Treasury yields moved as high as 1.18% and as low as 0.33%, while ten-year Treasuries rose as high as 4.01% and fell as low as 2.41%. On December 31, 2010, yields on two- and ten-year Treasuries were 0.61% and 3.30%, respectively.

The Barclays Capital U.S. Aggregate Indexiv returned 6.54% for the twelve months ended December 31, 2010. Comparatively, riskier fixed-income securities, including high-yield bonds, produced stronger results. Over the fiscal year, the Barclays Capital U.S. High Yield – 2% Issuer Cap Indexv (the “Index”) returned 14.94%. While the emerging market debt asset class also generated strong absolute returns during the fiscal year, it lagged the U.S. high-yield market. Over the twelve months ended December 31, 2010, the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)vi returned 12.04%.

Q. How did we respond to these changing market conditions?

A. A number of adjustments were made to the Fund during the reporting period. We reduced our exposure to U.S. Treasuries and cash as we found what we believed to be more attractive opportunities elsewhere. In particular, we increased the Fund’s exposure to agency mortgage-backed securities (“MBS”) and investment grade Financials.

The Fund used U.S. Treasury futures and options, Eurodollar futures and options, and interest rate swaps and swaptions to manage our duration and yield curvevii exposure. Credit default swaps were utilized to manage and hedge our credit exposure. Total return swaps were used to gain exposure to specific portions of the fixed-income market. Euro-bund futures were utilized to manage exposure to the German yield curve. We also used currency forwards to manage our foreign currency exposure. Overall, the use of these derivative instruments contributed to performance during the twelve-month reporting period.

Performance review

For the twelve months ended December 31, 2010, Class I shares of Western Asset Core Plus Bond Portfolio returned 11.97%. The Fund’s unmanaged benchmark, the Barclays Capital U.S. Aggregate Index, returned 6.54% over the same time frame. The Lipper Intermediate Investment Grade Debt Funds Category Average1 returned 7.73% for the same period.

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the twelve-month period ended December 31, 2010, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 567 funds in the Fund’s Lipper category. |

| | | | |

| Western Asset Core Plus Bond Portfolio 2010 Annual Report | | | 3 | |

| | | | | | | | |

| Performance Snapshot as of December 31, 2010 | |

| (unaudited) | | 6 months | | | 12 months | |

| Western Asset Core Plus Bond Portfolio: | |

Class IS1 | | | 3.77 | % | | | 12.10 | % |

Class I1 | | | 3.66 | % | | | 11.97 | % |

Class FI1 | | | 3.63 | % | | | 11.80 | % |

Barclays Capital U.S. Aggregate Index | | | 1.15 | % | | | 6.54 | % |

| Lipper Intermediate Investment Grade Debt Funds Category Average2 | | | 2.25 | % | | | 7.73 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value, investment returns and yields will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/individualinvestors.

All share class returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include the deduction of taxes that a shareholder would pay on Fund distributions. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Performance figures reflect compensating balance arrangements, expense reimbursements and/or fee waivers, without which the performance would have been lower.

The 30-Day SEC Yields for the period ended December 31, 2010 for Class IS, Class I and Class FI shares were 3.31%, 3.26% and 3.04%, respectively. Absent current expense reimbursements and/or fee waivers, the 30-Day SEC Yield for Class FI shares would have been 2.88%. The 30-Day SEC Yield is the average annualized net investment income per share for the 30-day period indicated and is subject to change.

| | | | |

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s most current prospectus dated April 30, 2010, the gross total operating expense ratios for Class IS, Class I and Class FI shares were 0.43%, 0.46% and 0.86%, respectively.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

As a result of an expense limitation arrangement, the ratio of expenses, other than brokerage, interest, taxes, deferred organizational expenses and extraordinary expenses to average net assets will not exceed 0.45% for Class IS shares and 0.70% for Class FI shares. This expense limitation arrangement cannot be terminated prior to April 30, 2011 without the Board of Directors’ consent.

The manager is permitted to recapture amounts forgone or reimbursed to a class within three years after the day on which the manager earned the fee or incurred the expense if the class’ total annual operating expenses have fallen to a level below the lower of the limit described above or the limit then in effect.

Q. What were the leading contributors to performance?

A. The largest contributor to the Fund’s relative performance during the reporting period was our overweight to non-agency MBS. The combination of the government’s aggressive programs to aid the housing market and signs that housing prices appeared to be stabilizing helped these securities generate strong results. In addition, the sector was supported by ongoing demand from asset managers participating in the Public-Private Investment Program (“PPIP”).

| 1 | Class IS, Class I and Class FI shares were formerly known as Institutional Select Class, Institutional Class and Financial Intermediary Class shares, respectively. Fund share classes were renamed in April 2010. |

| 2 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended December 31, 2010, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 580 funds for the six-month period and among the 567 funds for the twelve-month period in the Fund’s Lipper category. |

| | |

| 4 | | Western Asset Core Plus Bond Portfolio 2010 Annual Report |

Fund overview (cont’d)

An overweight to high-yield bonds also enhanced results. The asset class was among the best performing fixed-income sectors during the reporting period given declining default rates and solid demand from investors looking to generate incremental yield. Among the Fund’s strongest high-yield holdings were overweight positions in Ally Financial Inc. (formerly known as GMAC Inc.), Ford Motor Credit Co. and American International Group Inc.

An overweight to the investment grade corporate bond market was also rewarded. The sector performed well due to generally better-than-expected corporate profits and overall robust demand. In particular, our Financials holdings General Electric Capital Corp., Citigroup Inc. and SLM Corp. produced the best results. Additionally, Time Warner Cable Inc., CVS Caremark Corp. and Delta Air Lines Inc. were beneficial for performance.

We tactically adjusted the Fund’s duration during the reporting period. Overall, the portfolio’s duration was longer than that of the benchmark, which enhanced results as interest rates declined during the reporting period.

Q. What were the leading detractors from performance?

A. The largest detractor from relative performance for the period was our non-U.S. dollar exposure. In particular, a short position in the Japanese yen was a drag on results as the yen appreciated versus other currencies over the twelve months ended December 31, 2010.

Elsewhere, our exposure to U.S. Treasury Inflation-Protected Securities (“TIPS”)viii slightly detracted from performance given modest inflation in the U.S. during the reporting period.

Thank you for your investment in Western Asset Core Plus Bond Portfolio. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Western Asset Management Company

January 18, 2011

RISKS: Bonds are subject to a variety of risks, including interest rate, credit and inflation risks. As interest rates rise, bond prices fall, reducing the value of the Fund’s share price. The Fund may invest in high-yield bonds, which are rated below investment grade and carry more risk than higher-rated securities. Investments in asset-backed and mortgage-backed securities involve additional risks, including prepayment and extension risks. Non-U.S. investments are subject to currency fluctuations and social, economic and political risk. These risks are magnified in emerging markets. The Fund may use derivatives, such as options, futures and swaps, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for a more complete discussion of these and other risks, and the Fund’s investment strategies.

| | | | |

| Western Asset Core Plus Bond Portfolio 2010 Annual Report | | | 5 | |

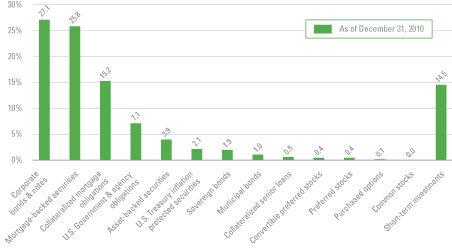

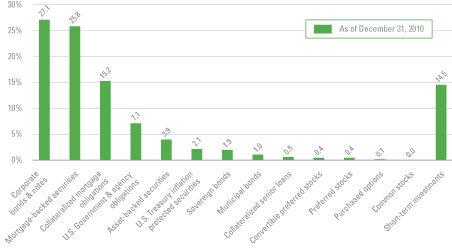

Portfolio holdings and breakdowns are as of December 31, 2010 and are subject to change and may not be representative of the portfolio managers’ current or future investments. Please refer to pages 13 through 48 for a list and percentage breakdown of the Fund’s holdings.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of December 31, 2010 were: Corporate

Bonds & Notes (32.4%), Mortgage-Backed Securities (30.9%), Collateralized Mortgage Obligations (18.1%), U.S. Government & Agency Obligations (8.5%) and Asset-Backed Securities (4.7%). The Fund’s portfolio composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

| ii | Effective duration measures the expected sensitivity of market price to changes in interest rates, taking into account the effects of structural complexities. (For example, some bonds can be prepaid by the issuer.) |

| iii | The Federal Reserve Board ("Fed") is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iv | The Barclays Capital U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| v | The Barclays Capital U.S. High Yield – 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Barclays Capital U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. |

| vi | The JPMorgan Emerging Markets Bond Index Global ("EMBI Global") tracks total returns for U.S. dollar- denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. |

| vii | The yield curve is the graphical depiction of the relationship between the yield on bonds of the same credit quality but different maturities. |

| viii | U.S. Treasury Inflation-Protected Securities ("TIPS") are inflation-indexed securities issued by the U.S. Treasury in five-year, ten-year and twenty-year maturities. The principal is adjusted to the Consumer Price Index, the commonly used measure of inflation. The coupon rate is constant, but generates a different amount of interest when multiplied by the inflation-adjusted principal. |

| | |

| 6 | | Western Asset Core Plus Bond Portfolio 2010 Annual Report |

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of December 31, 2010 and does not include derivatives such as futures contracts, options written and swaps. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| | | | |

| Western Asset Core Plus Bond Portfolio 2010 Annual Report | | | 7 | |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on July 1, 2010 and held for the six months ended December 31, 2010.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on actual total return1 | | | | | | Based on hypothetical total return1 | |

| | | Actual

Total

Return2 | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 | | | | | | | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 | |

| Class IS4 | | | 3.77 | % | | $ | 1,000.00 | | | $ | 1,037.70 | | | | 0.43 | % | | $ | 2.21 | | | | | | | Class IS4 | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.43 | % | | $ | 2.19 | |

| Class I4 | | | 3.66 | | | | 1,000.00 | | | | 1,036.60 | | | | 0.45 | | | | 2.31 | | | | | | | Class I4 | | | 5.00 | | | | 1,000.00 | | | | 1,022.94 | | | | 0.45 | | | | 2.29 | |

| Class FI4 | | | 3.63 | | | | 1,000.00 | | | | 1,036.30 | | | | 0.70 | | | | 3.59 | | | | | | | Class FI4 | | | 5.00 | | | | 1,000.00 | | | | 1,021.68 | | | | 0.70 | | | | 3.57 | |

| 1 | For the six months ended December 31, 2010. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements and/or expense reimbursements. In the absence of compensating balance arrangements and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of compensating balance arrangements and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| 4 | In April 2010, Institutional Select Class, Institutional Class and Financial Intermediary Class shares were renamed Class IS, Class I and Class FI shares, respectively. |

| | |

| 8 | | Western Asset Core Plus Bond Portfolio 2010 Annual Report |

Fund performance (unaudited)

| | | | | | | | | | | | |

| Average annual total returns1 | | | | |

| | | Class IS‡ | | | Class I‡ | | | Class FI‡ | |

| Twelve Months Ended 12/31/10 | | | 12.10 | % | | | 11.97 | % | | | 11.80 | % |

| Five Years Ended 12/31/10 | | | N/A | | | | 6.91 | | | | 6.64 | |

| Ten Years Ended 12/31/10 | | | N/A | | | | 7.23 | | | | N/A | |

| Inception* through 12/31/10 | | | 13.26 | | | | 6.92 | | | | 6.59 | |

| | | | |

| Cumulative total returns1 | |

| Class IS‡ (Inception date of 8/4/08 through 12/31/10) | | | 34.96 | % |

| Class I‡ (12/31/00 through 12/31/10) | | | 101.03 | |

| Class FI‡ (Inception date of 1/8/02 through 12/31/10) | | | 77.34 | |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. |

| * | Inception dates for Class IS, I and FI are August 4, 2008, July 8, 1998 and January 8, 2002, respectively. |

| ‡ | In April 2010, Institutional Select Class, Institutional Class and Financial Intermediary Class shares were renamed Class IS, Class I and Class FI shares, respectively. |

| | | | |

| Western Asset Core Plus Bond Portfolio 2010 Annual Report | | | 9 | |

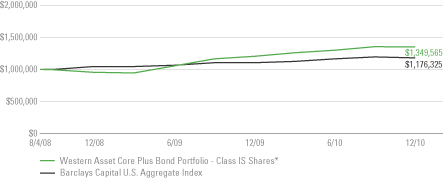

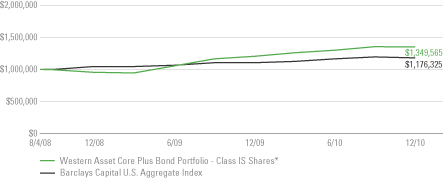

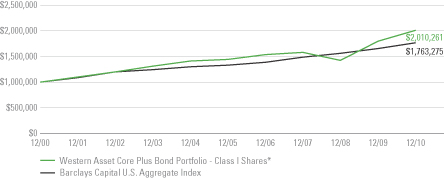

Historical performance

Value of $1,000,000 invested in

Class IS Shares of Western Asset Core Plus Bond Portfolio vs. Barclays Capital U.S. Aggregate Index† —

August 4, 2008 - December 2010

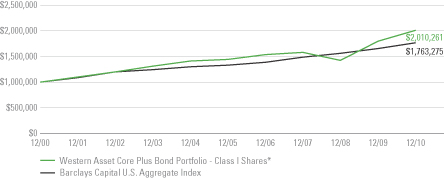

Value of $1,000,000 invested in

Class I Shares of Western Asset Core Plus Bond Portfolio vs. Barclays Capital U.S. Aggregate Index† —

December 2000 - December 2010

| | |

| 10 | | Western Asset Core Plus Bond Portfolio 2010 Annual Report |

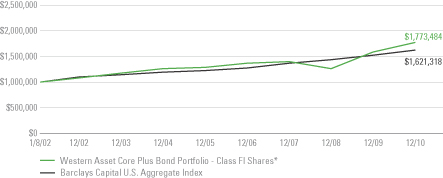

Fund performance (unaudited) (cont’d)

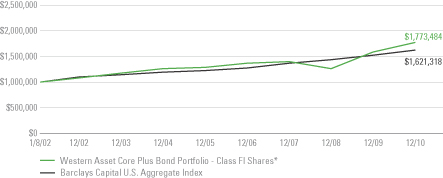

Value of $1,000,000 invested in

Class FI Shares of Western Asset Core Plus Bond Portfolio vs. Barclays Capital U.S. Aggregate Index† —

January 8, 2002 - December 2010

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $1,000,000 invested in Class IS, I and FI shares of Western Asset Core Plus Bond Portfolio on August 4, 2008 (commencement of operations), December 31, 2000 and January 8, 2002 (commencement of operations), respectively, assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through December 31, 2010. The hypothetical illustration also assumes a $1,000,000 investment in the Barclays Capital U.S. Aggregate Index. The Barclays Capital U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. The Index is unmanaged and not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index. |

| * | In April 2010, Institutional Select Class, Institutional Class and Financial Intermediary Class shares were renamed Class IS, Class I and Class FI shares, respectively. |

| | | | |

| Western Asset Core Plus Bond Portfolio 2010 Annual Report | | | 11 | |

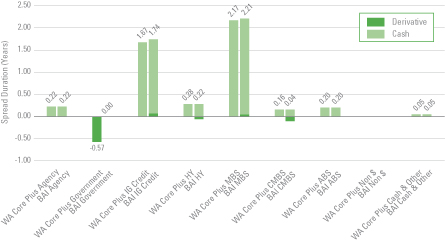

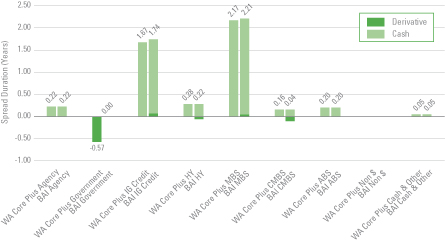

Spread duration (unaudited)

Economic exposure — December 31, 2010

Spread duration measures the sensitivity to changes in spreads. The spread over Treasuries is the annual risk premium demanded by investors to hold non-Treasury securities. Spread duration is quantified as the % change in price resulting from a 100 basis points change in spreads. For a security with positive spread duration, an increase in spreads would result in a price decline and a decline in spreads would result in a price increase. This chart highlights the market sector exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

| | |

| ABS | | — Asset Backed Securities |

| BAI | | — Barclays Capital U.S. Aggregate Index |

| CMBS | | — Commercial Mortgage Backed Securities |

| HY | | — High Yield |

| IG Credit | | — Investment Grade Credit |

| MBS | | — Mortgage Backed Securities |

| Non $ | | — Non-U.S. Dollar |

| WA Core Plus | | —Western Asset Core Plus Bond Portfolio |

| | |

| 12 | | Western Asset Core Plus Bond Portfolio 2010 Annual Report |

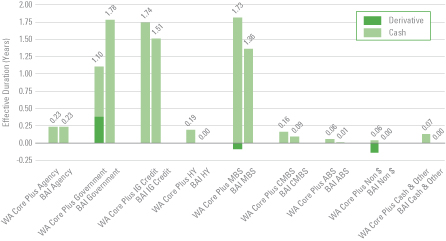

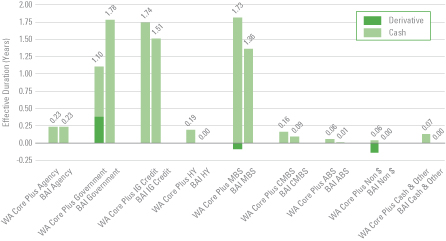

Effective duration (unaudited)

Interest rate exposure — December 31, 2010

Effective duration measures the sensitivity to changes in relevant interest rates. Effective duration is quantified as the % change in price resulting from a 100 basis points change in interest rates. For a security with positive effective duration, an increase in interest rates would result in a price decline and a decline in interest rates would result in a price increase. This chart highlights the interest rate exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

| | |

| ABS | | — Asset Backed Securities |

| BAI | | — Barclays Capital U.S. Aggregate Index |

| CMBS | | — Commercial Mortgage Backed Securities |

| HY | | — High Yield |

| IG Credit | | — Investment Grade Credit |

| MBS | | — Mortgage Backed Securities |

| Non $ | | — Non-U.S. Dollar |

| WA Core Plus | | —Western Asset Core Plus Bond Portfolio |

| | | | |

| Western Asset Core Plus Bond Portfolio 2010 Annual Report | | | 13 | |

Schedule of investments

December 31, 2010

Western Asset Core Plus Bond Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Corporate Bonds & Notes — 32.4% | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 3.1% | | | | | | | | | | | | | | | | |

Automobiles — 0.2% | | | | | | | | | | | | | | | | |

DaimlerChrysler North America Holding Corp., Notes | | | 5.875 | % | | | 3/15/11 | | | | 500,000 | | | $ | 505,070 | |

DaimlerChrysler North America Holding Corp., Notes | | | 7.300 | % | | | 1/15/12 | | | | 3,315,000 | | | | 3,522,131 | |

DaimlerChrysler North America Holding Corp., Notes | | | 6.500 | % | | | 11/15/13 | | | | 1,390,000 | | | | 1,573,576 | |

Ford Motor Credit Co., LLC, Notes | | | 7.000 | % | | | 10/1/13 | | | | 5,000,000 | | | | 5,360,500 | |

Motors Liquidation Co. | | | 9.450 | % | | | 11/1/11 | | | | 2,514,000 | | | | 823,335 | (a) |

Motors Liquidation Co. | | | 8.100 | % | | | 6/15/24 | | | | 368,000 | | | | 124,200 | (a) |

Motors Liquidation Co. | | | 8.375 | % | | | 7/5/33 | | | | 9,520,000 | EUR | | | 4,198,120 | (a) |

Motors Liquidation Co., Debentures | | | 9.400 | % | | | 7/15/21 | | | | 674,000 | | | | 219,050 | (a) |

Motors Liquidation Co., step bond | | | 0.000 | % | | | 3/15/36 | | | | 8,887,000 | | | | 1,555,225 | (a) |

Total Automobiles | | | | | | | | | | | | | | | 17,881,207 | |

Diversified Consumer Services — 0.1% | | | | | | | | | | | | | | | | |

Service Corp. International, Senior Notes | | | 7.500 | % | | | 4/1/27 | | | | 5,385,000 | | | | 5,156,138 | |

Hotels, Restaurants & Leisure — 0.2% | | | | | | | | | | | | | | | | |

Inn of the Mountain Gods Resort & Casino, Senior Notes | | | 12.000 | % | | | 11/15/10 | | | | 1,070,000 | | | | 557,737 | (b)(c)* |

Marriott International Inc. | | | 5.810 | % | | | 11/10/15 | | | | 7,950,000 | | | | 8,632,023 | |

McDonald’s Corp., Medium Term Notes | | | 5.350 | % | | | 3/1/18 | | | | 310,000 | | | | 347,823 | |

MGM MIRAGE Inc., Senior Notes | | | 7.625 | % | | | 1/15/17 | | | | 1,270,000 | | | | 1,187,450 | |

MGM Resorts International, Senior Secured Notes | | | 11.125 | % | | | 11/15/17 | | | | 1,645,000 | | | | 1,891,750 | |

Mohegan Tribal Gaming Authority, Senior Subordinated Notes | | | 8.000 | % | | | 4/1/12 | | | | 245,000 | | | | 204,575 | |

Station Casinos Inc., Senior Notes | | | 7.750 | % | | | 8/15/16 | | | | 9,760,000 | | | | 976 | (a)(c) |

Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 12,822,334 | |

Media — 2.1% | | | | | | | | | | | | | | | | |

CBS Corp. | | | 7.625 | % | | | 1/15/16 | | | | 5,500,000 | | | | 6,413,066 | |

Charter Communications Operating LLC/Charter Communications Operating Capital,

Senior Secured Notes | | | 10.875 | % | | | 9/15/14 | | | | 3,670,000 | | | | 4,101,225 | (d) |

Comcast Cable Communications Inc., Senior Notes | | | 6.750 | % | | | 1/30/11 | | | | 210,000 | | | | 210,864 | |

Comcast Cable Communications LLC, Notes | | | 8.875 | % | | | 5/1/17 | | | | 40,000 | | | | 49,975 | |

Comcast Corp., Notes | | | 6.500 | % | | | 1/15/15 | | | | 3,760,000 | | | | 4,281,617 | |

Comcast Corp., Notes | | | 5.875 | % | | | 2/15/18 | | | | 10,000 | | | | 11,102 | |

Comcast Corp., Notes | | | 6.450 | % | | | 3/15/37 | | | | 11,139,000 | | | | 11,901,632 | |

Comcast Corp., Senior Notes | | | 6.500 | % | | | 1/15/17 | | | | 3,140,000 | | | | 3,619,704 | |

Comcast Corp., Senior Notes | | | 5.650 | % | | | 6/15/35 | | | | 10,050,000 | | | | 9,763,233 | |

Comcast Corp., Senior Notes | | | 6.950 | % | | | 8/15/37 | | | | 8,460,000 | | | | 9,568,835 | |

See Notes to Financial Statements.

| | |

| 14 | | Western Asset Core Plus Bond Portfolio 2010 Annual Report |

Schedule of investments (cont’d)

December 31, 2010

Western Asset Core Plus Bond Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Media — continued | | | | | | | | | | | | | | | | |

Comcast Corp., Senior Notes | | | 6.400 | % | | | 3/1/40 | | | | 4,950,000 | | | $ | 5,305,732 | |

COX Communications Inc., Senior Notes | | | 5.450 | % | | | 12/15/14 | | | | 4,750,000 | | | | 5,229,161 | |

CSC Holdings Inc., Senior Notes | | | 6.750 | % | | | 4/15/12 | | | | 500,000 | | | | 519,375 | |

CSC Holdings LLC, Senior Notes | | | 8.625 | % | | | 2/15/19 | | | | 1,105,000 | | | | 1,248,650 | |

DISH DBS Corp., Senior Notes | | | 7.000 | % | | | 10/1/13 | | | | 6,340,000 | | | | 6,767,950 | |

DISH DBS Corp., Senior Notes | | | 6.625 | % | | | 10/1/14 | | | | 255,000 | | | | 264,562 | |

DISH DBS Corp., Senior Notes | | | 7.750 | % | | | 5/31/15 | | | | 1,610,000 | | | | 1,710,625 | |

EchoStar DBS Corp., Senior Notes | | | 7.125 | % | | | 2/1/16 | | | | 2,065,000 | | | | 2,132,112 | |

Gannett Co. Inc. | | | 6.375 | % | | | 4/1/12 | | | | 4,560,000 | | | | 4,696,800 | |

News America Inc. | | | 6.750 | % | | | 1/9/38 | | | | 200,000 | | | | 212,970 | |

News America Inc., Senior Notes | | | 6.200 | % | | | 12/15/34 | | | | 260,000 | | | | 272,996 | |

News America Inc., Senior Notes | | | 6.650 | % | | | 11/15/37 | | | | 1,330,000 | | | | 1,473,096 | |

Reed Elsevier Capital Inc., Notes | | | 8.625 | % | | | 1/15/19 | | | | 12,205,000 | | | | 15,517,352 | |

Time Warner Cable Inc., Senior Notes | | | 8.750 | % | | | 2/14/19 | | | | 15,640,000 | | | | 19,901,400 | |

Time Warner Cable Inc., Senior Notes | | | 8.250 | % | | | 4/1/19 | | | | 12,830,000 | | | | 15,937,080 | |

Time Warner Cable Inc., Senior Notes | | | 4.125 | % | | | 2/15/21 | | | | 2,150,000 | | | | 2,045,826 | |

Time Warner Cable Inc., Senior Notes | | | 6.750 | % | | | 6/15/39 | | | | 4,955,000 | | | | 5,472,669 | |

Time Warner Cable Inc., Senior Notes | | | 5.875 | % | | | 11/15/40 | | | | 13,640,000 | | | | 13,494,870 | |

Time Warner Entertainment Co., LP, Senior Notes | | | 8.375 | % | | | 7/15/33 | | | | 20,000 | | | | 25,240 | |

United Business Media Ltd., Notes | | | 5.750 | % | | | 11/3/20 | | | | 5,920,000 | | | | 5,683,555 | (d) |

Viacom Inc. | | | 6.250 | % | | | 4/30/16 | | | | 6,750,000 | | | | 7,681,696 | |

Total Media | | | | | | | | | | | | | | | 165,514,970 | |

Multiline Retail — 0.2% | | | | | | | | | | | | | | | | |

Neiman Marcus Group Inc., Senior Notes | | | 9.000 | % | | | 10/15/15 | | | | 4,414,018 | | | | 4,623,684 | (e) |

Sears Holding Corp., Senior Secured Notes | | | 6.625 | % | | | 10/15/18 | | | | 3,460,000 | | | | 3,226,450 | (d) |

Target Corp. | | | 4.000 | % | | | 6/15/13 | | | | 5,340,000 | | | | 5,703,125 | |

Total Multiline Retail | | | | | | | | | | | | | | | 13,553,259 | |

Specialty Retail — 0.3% | | | | | | | | | | | | | | | | |

Autozone Inc. | | | 6.950 | % | | | 6/15/16 | | | | 10,890,000 | | | | 12,609,193 | |

Home Depot Inc. | | | 5.250 | % | | | 12/16/13 | | | | 5,510,000 | | | | 6,047,479 | |

Home Depot Inc. | | | 5.400 | % | | | 3/1/16 | | | | 8,230,000 | | | | 9,222,579 | |

Total Specialty Retail | | | | | | | | | | | | | | | 27,879,251 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 242,807,159 | |

| Consumer Staples — 1.9% | | | | | | | | | | | | | | | | |

Beverages — 0.4% | | | | | | | | | | | | | | | | |

Anheuser-Busch InBev Worldwide Inc., Senior Notes | | | 5.375 | % | | | 1/15/20 | | | | 14,670,000 | | | | 15,896,236 | |

See Notes to Financial Statements.

| | | | |

| Western Asset Core Plus Bond Portfolio 2010 Annual Report | | | 15 | |

Western Asset Core Plus Bond Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Beverages — continued | | | | | | | | | | | | | | | | |

Anheuser-Busch InBev Worldwide Inc., Senior Notes | | | 5.000 | % | | | 4/15/20 | | | | 4,620,000 | | | $ | 4,883,026 | |

Diageo Finance BV | | | 3.250 | % | | | 1/15/15 | | | | 11,360,000 | | | | 11,705,367 | |

PepsiCo Inc., Senior Notes | | | 7.900 | % | | | 11/1/18 | | | | 45,000 | | | | 57,897 | |

Total Beverages | | | | | | | | | | | | | | | 32,542,526 | |

Food & Staples Retailing — 0.6% | | | | | | | | | | | | | | | | |

CVS Caremark Corp., Senior Notes | | | 6.600 | % | | | 3/15/19 | | | | 16,900,000 | | | | 19,787,686 | |

CVS Corp. | | | 5.789 | % | | | 1/10/26 | | | | 104,397 | | | | 105,556 | (d) |

CVS Pass-Through Trust, Secured Notes | | | 5.298 | % | | | 1/11/27 | | | | 484,868 | | | | 481,256 | (d)(f) |

CVS Pass-Through Trust, Secured Notes | | | 5.880 | % | | | 1/10/28 | | | | 5,331,367 | | | | 5,409,418 | |

CVS Pass-Through Trust, Secured Notes | | | 6.036 | % | | | 12/10/28 | | | | 15,665,740 | | | | 16,066,626 | |

CVS Pass-Through Trust, Secured Notes | | | 6.943 | % | | | 1/10/30 | | | | 3,067,018 | | | | 3,334,156 | |

Delhaize Group, Senior Notes | | | 6.500 | % | | | 6/15/17 | | | | 120,000 | | | | 136,041 | |

Kroger Co., Senior Notes | | | 6.400 | % | | | 8/15/17 | | | | 1,270,000 | | | | 1,458,163 | |

Kroger Co., Senior Notes | | | 6.150 | % | | | 1/15/20 | | | | 1,830,000 | | | | 2,073,685 | |

Safeway Inc., Senior Notes | | | 6.350 | % | | | 8/15/17 | | | | 310,000 | | | | 346,173 | |

Wal-Mart Stores Inc., Notes | | | 5.800 | % | | | 2/15/18 | | | | 180,000 | | | | 206,826 | |

Wal-Mart Stores Inc., Notes | | | 6.200 | % | | | 4/15/38 | | | | 2,260,000 | | | | 2,572,818 | |

Total Food & Staples Retailing | | | | | | | | | | | | | | | 51,978,404 | |

Food Products — 0.4% | | | | | | | | | | | | | | | | |

Ahold Lease USA Inc., Pass-Through Certificates, Series 2001 A-2 | | | 8.620 | % | | | 1/2/25 | | | | 7,604,620 | | | | 8,973,452 | (f) |

Kraft Foods Inc., Senior Notes | | | 5.375 | % | | | 2/10/20 | | | | 18,810,000 | | | | 20,244,620 | |

Total Food Products | | | | | | | | | | | | | | | 29,218,072 | |

Household Products — 0.2% | | | | | | | | | | | | | | | | |

Reynolds Group DL Escrow Inc./Reynolds Group Escrow LLC, Senior Secured Notes | | | 7.750 | % | | | 10/15/16 | | | | 13,255,000 | | | | 14,017,163 | (d) |

Tobacco — 0.3% | | | | | | | | | | | | | | | | |

Altria Group Inc., Senior Notes | | | 9.250 | % | | | 8/6/19 | | | | 11,630,000 | | | | 15,177,615 | |

Reynolds American Inc., Senior Notes | | | 7.250 | % | | | 6/1/12 | | | | 1,720,000 | | | | 1,839,273 | |

Reynolds American Inc., Senior Notes | | | 6.750 | % | | | 6/15/17 | | | | 8,430,000 | | | | 9,422,354 | |

Reynolds American Inc., Senior Secured Notes | | | 7.625 | % | | | 6/1/16 | | | | 100,000 | | | | 116,223 | |

Total Tobacco | | | | | | | | | | | | | | | 26,555,465 | |

Total Consumer Staples | | | | | | | | | | | | | | | 154,311,630 | |

| Energy — 4.6% | | | | | | | | | | | | | | | | |

Energy Equipment & Services — 0.1% | | | | | | | | | | | | | | | | |

Baker Hughes Inc., Senior Notes | | | 7.500 | % | | | 11/15/18 | | | | 230,000 | | | | 288,408 | |

Complete Production Services Inc., Senior Notes | | | 8.000 | % | | | 12/15/16 | | | | 5,355,000 | | | | 5,542,425 | |

See Notes to Financial Statements.

| | |

| 16 | | Western Asset Core Plus Bond Portfolio 2010 Annual Report |

Schedule of investments (cont’d)

December 31, 2010

Western Asset Core Plus Bond Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Energy Equipment & Services — continued | | | | | | | | | | | | | | | | |

Transocean Inc., Senior Notes | | | 5.250 | % | | | 3/15/13 | | | | 360,000 | | | $ | 379,536 | |

Transocean Ltd. | | | 6.000 | % | | | 3/15/18 | | | | 6,015,000 | | | | 6,317,506 | |

Total Energy Equipment & Services | | | | | | | | | | | | | | | 12,527,875 | |

Oil, Gas & Consumable Fuels — 4.5% | | | | | | | | | | | | | | | | |

Anadarko Finance Co., Senior Notes | | | 7.500 | % | | | 5/1/31 | | | | 11,507,000 | | | | 12,723,854 | |

Anadarko Petroleum Corp., Senior Notes | | | 6.375 | % | | | 9/15/17 | | | | 5,660,000 | | | | 6,165,478 | |

Anadarko Petroleum Corp., Senior Notes | | | 8.700 | % | | | 3/15/19 | | | | 15,000 | | | | 18,318 | |

Apache Corp., Senior Notes | | | 6.000 | % | | | 1/15/37 | | | | 240,000 | | | | 263,930 | |

Apache Corp., Senior Notes | | | 5.100 | % | | | 9/1/40 | | | | 15,000,000 | | | | 14,574,555 | |

BP Capital Markets PLC, Guaranteed Notes | | | 5.250 | % | | | 11/7/13 | | | | 19,410,000 | | | | 21,021,282 | |

BP Capital Markets PLC, Guaranteed Notes | | | 3.875 | % | | | 3/10/15 | | | | 6,440,000 | | | | 6,642,796 | |

Chesapeake Energy Corp., Senior Notes | | | 6.875 | % | | | 8/15/18 | | | | 270,000 | | | | 274,050 | |

Chesapeake Energy Corp., Senior Notes | | | 7.250 | % | | | 12/15/18 | | | | 5,855,000 | | | | 6,059,925 | |

Chesapeake Energy Corp., Senior Notes | | | 6.625 | % | | | 8/15/20 | | | | 3,720,000 | | | | 3,664,200 | |

Compagnie Generale de Geophysique-Veritas, Senior Notes | | | 7.500 | % | | | 5/15/15 | | | | 1,970,000 | | | | 2,004,475 | |

Compagnie Generale de Geophysique-Veritas, Senior Notes | | | 7.750 | % | | | 5/15/17 | | | | 8,594,000 | | | | 8,808,850 | |

Conoco Funding Co. | | | 7.250 | % | | | 10/15/31 | | | | 810,000 | | | | 1,001,512 | |

ConocoPhillips | | | 5.900 | % | | | 10/15/32 | | | | 10,000 | | | | 10,988 | |

ConocoPhillips Holding Co., Senior Notes | | | 6.950 | % | | | 4/15/29 | | | | 638,000 | | | | 784,098 | |

CONSOL Energy Inc., Senior Notes | | | 8.250 | % | | | 4/1/20 | | | | 5,910,000 | | | | 6,382,800 | (d) |

Devon Energy Corp. | | | 6.300 | % | | | 1/15/19 | | | | 14,500,000 | | | | 17,063,788 | |

Devon Energy Corp., Debentures | | | 7.950 | % | | | 4/15/32 | | | | 970,000 | | | | 1,287,967 | |

El Paso Corp., Medium-Term Notes | | | 7.800 | % | | | 8/1/31 | | | | 3,267,000 | | | | 3,249,825 | |

El Paso Corp., Senior Subordinated Notes | | | 7.000 | % | | | 6/15/17 | | | | 19,000,000 | | | | 20,050,985 | |

Energy Transfer Partners LP | | | 6.125 | % | | | 2/15/17 | | | | 5,305,000 | | | | 5,831,707 | |

Energy Transfer Partners LP, Senior Notes | | | 9.700 | % | | | 3/15/19 | | | | 13,630,000 | | | | 17,616,230 | |

Enterprise Products Operating LLP, Senior Bonds | | | 6.300 | % | | | 9/15/17 | | | | 4,300,000 | | | | 4,852,047 | |

Gazprom, Loan Participation Notes | | | 6.212 | % | | | 11/22/16 | | | | 1,996,000 | | | | 2,115,760 | (d) |

Hess Corp., Notes | | | 8.125 | % | | | 2/15/19 | | | | 22,800,000 | | | | 28,804,836 | |

Hess Corp., Notes | | | 7.875 | % | | | 10/1/29 | | | | 5,290,000 | | | | 6,639,056 | |

Hess Corp., Notes | | | 7.300 | % | | | 8/15/31 | | | | 1,035,000 | | | | 1,241,290 | |

Kerr-McGee Corp., Notes | | | 6.950 | % | | | 7/1/24 | | | | 2,780,000 | | | | 3,021,807 | |

Kerr-McGee Corp., Notes | | | 7.875 | % | | | 9/15/31 | | | | 8,240,000 | | | | 9,445,875 | |

Kinder Morgan Energy Partners LP, Medium-Term Notes | | | 6.950 | % | | | 1/15/38 | | | | 1,447,000 | | | | 1,572,310 | |

Kinder Morgan Energy Partners LP, Notes | | | 6.750 | % | | | 3/15/11 | | | | 40,000 | | | | 40,444 | |

See Notes to Financial Statements.

| | | | |

| Western Asset Core Plus Bond Portfolio 2010 Annual Report | | | 17 | |

Western Asset Core Plus Bond Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Oil, Gas & Consumable Fuels — continued | | | | | | | | | | | | | | | | |

Kinder Morgan Energy Partners LP, Senior Notes | | | 7.125 | % | | | 3/15/12 | | | | 7,670,000 | | | $ | 8,182,310 | |

Kinder Morgan Energy Partners LP, Senior Notes | | | 5.850 | % | | | 9/15/12 | | | | 20,000 | | | | 21,445 | |

Kinder Morgan Energy Partners LP, Senior Notes | | | 5.000 | % | | | 12/15/13 | | | | 1,879,000 | | | | 2,041,475 | |

Kinder Morgan Energy Partners LP, Senior Notes | | | 6.000 | % | | | 2/1/17 | | | | 5,190,000 | | | | 5,730,040 | |

Noble Energy Inc., Senior Notes | | | 8.250 | % | | | 3/1/19 | | | | 14,600,000 | | | | 18,243,999 | |

Occidental Petroleum Corp., Senior Notes | | | 7.000 | % | | | 11/1/13 | | | | 360,000 | | | | 416,240 | |

Peabody Energy Corp., Senior Notes | | | 6.500 | % | | | 9/15/20 | | | | 6,170,000 | | | | 6,586,475 | |

Pemex Project Funding Master Trust, Senior Bonds | | | 6.625 | % | | | 6/15/35 | | | | 21,623,000 | | | | 22,001,273 | |

Pemex Project Funding Master Trust, Senior Notes | | | 0.903 | % | | | 12/3/12 | | | | 104,000 | | | | 103,324 | (d)(g) |

Petrobras International Finance Co., Senior Notes | | | 6.125 | % | | | 10/6/16 | | | | 6,250,000 | | | | 6,875,144 | |

Petrobras International Finance Co., Senior Notes | | | 5.750 | % | | | 1/20/20 | | | | 5,457,000 | | | | 5,662,009 | |

QEP Resources Inc., Senior Notes | | | 6.875 | % | | | 3/1/21 | | | | 6,550,000 | | | | 6,877,500 | |

Range Resources Corp., Senior Subordinated Notes | | | 6.750 | % | | | 8/1/20 | | | | 6,330,000 | | | | 6,527,813 | |

SandRidge Energy Inc., Senior Notes | | | 9.875 | % | | | 5/15/16 | | | | 5,170,000 | | | | 5,467,275 | (d) |

Seariver Maritime Financial Holdings | | | 0.000 | % | | | 9/1/12 | | | | 70,000 | | | | 67,324 | |

Shell International Finance BV, Senior Notes | | | 4.375 | % | | | 3/25/20 | | | | 1,910,000 | | | | 2,003,317 | |

Shell International Finance BV, Senior Notes | | | 6.375 | % | | | 12/15/38 | | | | 11,845,000 | | | | 14,039,049 | |

Williams Cos. Inc., Debentures | | | 7.500 | % | | | 1/15/31 | | | | 733,000 | | | | 823,197 | |

Williams Cos. Inc., Notes | | | 7.875 | % | | | 9/1/21 | | | | 12,737,000 | | | | 15,033,952 | |

Williams Cos. Inc., Senior Notes | | | 7.750 | % | | | 6/15/31 | | | | 392,000 | | | | 442,122 | |

Williams Partners LP, Senior Notes | | | 5.250 | % | | | 3/15/20 | | | | 13,680,000 | | | | 14,180,688 | |

Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 354,561,009 | |

Total Energy | | | | | | | | | | | | | | | 367,088,884 | |

| Financials — 12.5% | | | | | | | | | | | | | | | | |

Capital Markets — 1.8% | | | | | | | | | | | | | | | | |

Bear Stearns Co. Inc., Senior Notes | | | 6.400 | % | | | 10/2/17 | | | | 925,000 | | | | 1,054,535 | |

Bear Stearns Cos. LLC, Senior Notes | | | 7.250 | % | | | 2/1/18 | | | | 4,670,000 | | | | 5,534,240 | |

Credit Suisse Guernsey Ltd., Junior Subordinated Notes | | | 5.860 | % | | | 5/15/17 | | | | 150,000 | | | | 141,750 | (g)(h) |

Goldman Sachs Capital II, Junior Subordinated Bonds | | | 5.793 | % | | | 6/1/12 | | | | 1,810,000 | | | | 1,533,975 | (g)(h) |

Goldman Sachs Group Inc. | | | 5.625 | % | | | 1/15/17 | | | | 1,420,000 | | | | 1,501,562 | |

Goldman Sachs Group Inc., Senior Notes | | | 6.600 | % | | | 1/15/12 | | | | 4,385,000 | | | | 4,636,975 | |

Goldman Sachs Group Inc., Senior Notes | | | 5.300 | % | | | 2/14/12 | | | | 584,000 | | | | 611,085 | |

Goldman Sachs Group Inc., Senior Notes | | | 3.625 | % | | | 8/1/12 | | | | 2,429,000 | | | | 2,506,740 | |

Goldman Sachs Group Inc., Senior Notes | | | 5.450 | % | | | 11/1/12 | | | | 3,892,000 | | | | 4,162,595 | |

Goldman Sachs Group Inc., Senior Notes | | | 4.750 | % | | | 7/15/13 | | | | 1,184,000 | | | | 1,261,284 | |

Goldman Sachs Group Inc., Senior Notes | | | 5.250 | % | | | 10/15/13 | | | | 3,599,000 | | | | 3,894,903 | |

See Notes to Financial Statements.

| | |

| 18 | | Western Asset Core Plus Bond Portfolio 2010 Annual Report |

Schedule of investments (cont’d)

December 31, 2010

Western Asset Core Plus Bond Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Capital Markets — continued | | | | | | | | | | | | | | | | |

Goldman Sachs Group Inc., Senior Notes | | | 5.375 | % | | | 3/15/20 | | | | 44,380,000 | | | $ | 45,860,561 | |

Kaupthing Bank HF, Senior Notes | | | 5.750 | % | | | 10/4/11 | | | | 5,550,000 | | | | 1,484,625 | (a)(c)(d) |

Kaupthing Bank HF, Senior Notes | | | 7.625 | % | | | 2/28/15 | | | | 80,340,000 | | | | 21,490,950 | (a)(c)(d) |

Lehman Brothers Holdings Capital Trust VII, Medium-Term Notes | | | 5.857 | % | | | 5/31/12 | | | | 5,530,000 | | | | 553 | (a)(g)(h) |

Lehman Brothers Holdings Inc., Subordinated Notes | | | 6.500 | % | | | 7/19/17 | | | | 5,280,000 | | | | 528 | (a) |

Merrill Lynch and Co. Inc. | | | 6.050 | % | | | 5/16/16 | | | | 390,000 | | | | 401,821 | |

Morgan Stanley, Medium-Term Notes | | | 0.739 | % | | | 10/18/16 | | | | 7,380,000 | | | | 6,816,006 | (g) |

Morgan Stanley, Medium-Term Notes | | | 5.550 | % | | | 4/27/17 | | | | 16,755,000 | | | | 17,455,359 | |

Morgan Stanley, Subordinated Notes | | | 4.750 | % | | | 4/1/14 | | | | 8,460,000 | | | | 8,663,268 | |

UBS AG Stamford CT, Senior Notes | | | 3.875 | % | | | 1/15/15 | | | | 11,430,000 | | | | 11,780,010 | |

UBS AG Stamford CT, Senior Notes | | | 4.875 | % | | | 8/4/20 | | | | 4,870,000 | | | | 4,954,446 | |

Total Capital Markets | | | | | | | | | | | | | | | 145,747,771 | |

Commercial Banks — 3.6% | | | | | | | | | | | | | | | | |

BAC Capital Trust XIV, Junior Subordinated Notes | | | 5.630 | % | | | 3/15/12 | | | | 2,240,000 | | | | 1,590,848 | (g)(h) |

Bank of Tokyo-Mitsubishi UFJ Ltd., Senior Notes | | | 3.850 | % | | | 1/22/15 | | | | 12,310,000 | | | | 12,834,283 | (d) |

Bank One Corp., Subordinated Notes | | | 5.900 | % | | | 11/15/11 | | | | 2,000,000 | | | | 2,085,658 | |

BankAmerica Institutional Capital A, Junior Subordinated Bonds | | | 8.070 | % | | | 12/31/26 | | | | 459,000 | | | | 461,869 | (d) |

Barclays Bank PLC, Senior Notes | | | 5.200 | % | | | 7/10/14 | | | | 3,015,000 | | | | 3,256,447 | |

Barclays Bank PLC, Subordinated Notes | | | 6.050 | % | | | 12/4/17 | | | | 11,715,000 | | | | 12,017,282 | (d) |

Commonwealth Bank of Australia, Senior Notes | | | 3.750 | % | | | 10/15/14 | | | | 10,260,000 | | | | 10,643,755 | (d) |

Commonwealth Bank of Australia, Senior Notes | | | 5.000 | % | | | 10/15/19 | | | | 4,390,000 | | | | 4,595,096 | (d) |

Credit Agricole SA, Subordinated Notes | | | 8.375 | % | | | 10/13/19 | | | | 22,940,000 | | | | 23,570,850 | (d)(g)(h) |

Glitnir Banki HF, Notes | | | 6.330 | % | | | 7/28/11 | | | | 10,670,000 | | | | 3,174,325 | (a)(c)(d) |

Glitnir Banki HF, Notes | | | 6.375 | % | | | 9/25/12 | | | | 18,040,000 | | | | 5,366,900 | (a)(c)(d) |

HBOS Capital Funding LP, Tier 1 Notes, Perpetual Bonds | | | 6.071 | % | | | 6/30/14 | | | | 60,000 | | | | 48,900 | (d)(g)(h) |

HBOS Treasury Services PLC | | | 5.250 | % | | | 2/21/17 | | | | 4,570,000 | | | | 4,739,323 | (d) |

HSBC Capital Funding LP, Subordinated Notes | | | 4.610 | % | | | 6/27/13 | | | | 2,090,000 | | | | 1,973,602 | (d)(g)(h) |

Hypothekenbank in Essen AG | | | 5.000 | % | | | 1/20/12 | | | | 1,380,000 | | | | 1,435,378 | (d) |

ICICI Bank Ltd., Subordinated Bonds | | | 6.375 | % | | | 4/30/22 | | | | 7,003,000 | | | | 6,674,356 | (d)(g) |

ICICI Bank Ltd., Subordinated Bonds | | | 6.375 | % | | | 4/30/22 | | | | 4,969,000 | | | | 4,981,721 | (d)(g) |

Intesa Sanpaolo SpA, Senior Notes | | | 3.625 | % | | | 8/12/15 | | | | 7,280,000 | | | | 7,037,853 | (d) |

Korea Development Bank | | | 5.500 | % | | | 11/13/12 | | | | 60,000 | | | | 63,637 | |

Landsbanki Islands HF, Senior Notes | | | 6.100 | % | | | 8/25/11 | | | | 28,520,000 | | | | 3,137,200 | (a)(c)(d) |

Lloyds TSB Bank PLC, Medium-Term Notes, Senior Bonds | | | 4.375 | % | | | 1/12/15 | | | | 12,300,000 | | | | 12,297,196 | (d) |

Lloyds TSB Bank PLC, Notes | | | 5.800 | % | | | 1/13/20 | | | | 1,720,000 | | | | 1,698,268 | (d) |

See Notes to Financial Statements.

| | | | |

| Western Asset Core Plus Bond Portfolio 2010 Annual Report | | | 19 | |

Western Asset Core Plus Bond Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Commercial Banks — continued | | | | | | | | | | | | | | | | |

NB Capital Trust IV, Junior Subordinated Notes | | | 8.250 | % | | | 4/15/27 | | | | 6,300,000 | | | $ | 6,378,750 | |

Nordea Bank AB, Senior Notes | | | 3.700 | % | | | 11/13/14 | | | | 9,790,000 | | | | 10,091,189 | (d) |

Nordea Bank AB, Senior Notes | | | 4.875 | % | | | 1/27/20 | | | | 950,000 | | | | 974,607 | (d) |

Rabobank Nederland NV, Junior Subordinated Notes | | | 11.000 | % | | | 6/30/19 | | | | 13,172,000 | | | | 17,024,810 | (d)(g)(h) |

Resona Preferred Global Securities Cayman Ltd., Junior Subordinated Bonds | | | 7.191 | % | | | 7/30/15 | | | | 12,200,000 | | | | 12,108,622 | (d)(g)(h) |

Royal Bank of Scotland Group PLC, Junior Subordinated Notes, Medium-Term Notes | | | 7.640 | % | | | 9/29/17 | | | | 7,500,000 | | | | 4,987,500 | (g)(h) |

Royal Bank of Scotland Group PLC, Senior Notes | | | 6.400 | % | | | 10/21/19 | | | | 20,510,000 | | | | 20,640,300 | |

Royal Bank of Scotland PLC, Senior Notes | | | 4.875 | % | | | 3/16/15 | | | | 4,130,000 | | | | 4,224,676 | |

Royal Bank of Scotland PLC, Senior Notes | | | 3.950 | % | | | 9/21/15 | | | | 21,330,000 | | | | 20,968,072 | |

Santander US Debt SA Unipersonal, Senior Notes | | | 3.724 | % | | | 1/20/15 | | | | 15,000,000 | | | | 14,211,900 | (d) |

Santander US Debt SA Unipersonal, Senior Notes | | | 3.781 | % | | | 10/7/15 | | | | 2,200,000 | | | | 2,067,083 | (d) |

Sumitomo Mitsui Banking Corp., Senior Notes | | | 3.150 | % | | | 7/22/15 | | | | 13,440,000 | | | | 13,679,151 | (d) |

SunTrust Capital, Trust Preferred Securities | | | 6.100 | % | | | 12/15/36 | | | | 3,140,000 | | | | 2,873,100 | (g) |

Wachovia Capital Trust III, Junior Subordinated Bonds | | | 5.800 | % | | | 3/15/11 | | | | 8,420,000 | | | | 7,304,350 | (g)(h) |

Wachovia Corp., Senior Notes | | | 5.750 | % | | | 2/1/18 | | | | 13,275,000 | | | | 14,739,259 | |

Wachovia Corp., Subordinated Notes | | | 5.250 | % | | | 8/1/14 | | | | 720,000 | | | | 767,876 | |

Wells Fargo & Co., Notes | | | 5.300 | % | | | 8/26/11 | | | | 75,000 | | | | 77,302 | |

Wells Fargo & Co., Subordinated Notes | | | 5.000 | % | | | 11/15/14 | | | | 130,000 | | | | 138,043 | |

Wells Fargo Capital X, Capital Securities | | | 5.950 | % | | | 12/15/36 | | | | 6,995,000 | | | | 6,752,022 | |

Total Commercial Banks | | | | | | | | | | | | | | | 283,693,359 | |

Consumer Finance — 0.9% | | | | | | | | | | | | | | | | |

Ally Financial Inc., Senior Notes | | | 6.625 | % | | | 5/15/12 | | | | 177,000 | | | | 183,638 | |

Ally Financial Inc., Senior Notes | | | 8.300 | % | | | 2/12/15 | | | | 320,000 | | | | 352,000 | |

Ally Financial Inc., Senior Notes | | | 8.000 | % | | | 3/15/20 | | | | 950,000 | | | | 1,037,875 | |

American Express Co., Subordinated Debentures | | | 6.800 | % | | | 9/1/66 | | | | 10,485,000 | | | | 10,380,150 | (g) |

American Express Credit Corp., Senior Notes | | | 5.125 | % | | | 8/25/14 | | | | 21,660,000 | | | | 23,353,465 | |

American General Finance Corp., Medium-Term Notes | | | 6.900 | % | | | 12/15/17 | | | | 5,440,000 | | | | 4,392,800 | |

Caterpillar Financial Services Corp., Senior Notes | | | 6.200 | % | | | 9/30/13 | | | | 290,000 | | | | 325,578 | |

HSBC Finance Corp. | | | 7.000 | % | | | 5/15/12 | | | | 160,000 | | | | 171,671 | |

HSBC Finance Corp., Senior Subordinated Notes | | | 6.676 | % | | | 1/15/21 | | | | 17,270,000 | | | | 17,447,553 | (d) |

HSBC Finance Corp., Subordinated Notes | | | 6.375 | % | | | 11/27/12 | | | | 520,000 | | | | 563,766 | |

SLM Corp. | | | 5.000 | % | | | 4/15/15 | | | | 740,000 | | | | 712,886 | |

SLM Corp., Medium-Term Notes, Senior Notes | | | 5.375 | % | | | 5/15/14 | | | | 1,700,000 | | | | 1,708,378 | |

SLM Corp., Medium-Term Notes, Senior Notes | | | 5.050 | % | | | 11/14/14 | | | | 4,690,000 | | | | 4,482,158 | |

See Notes to Financial Statements.

| | |

| 20 | | Western Asset Core Plus Bond Portfolio 2010 Annual Report |

Schedule of investments (cont’d)

December 31, 2010

Western Asset Core Plus Bond Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Consumer Finance — continued | | | | | | | | | | | | | | | | |

SLM Corp., Medium-Term Notes, Senior Notes | | | 5.625 | % | | | 8/1/33 | | | | 4,160,000 | | | $ | 3,264,148 | |

Total Consumer Finance | | | | | | | | | | | | | | | 68,376,066 | |

Diversified Financial Services — 5.5% | | | | | | | | | | | | | | | | |

Air 2 US, Notes | | | 8.027 | % | | | 10/1/19 | | | | 8,656,870 | | | | 8,613,586 | (d) |

Bank of America Corp. | | | 5.750 | % | | | 12/1/17 | | | | 480,000 | | | | 499,500 | |

Bank of America Corp., Senior Notes | | | 4.500 | % | | | 4/1/15 | | | | 25,520,000 | | | | 25,936,869 | |

Bank of America Corp., Senior Notes | | | 7.625 | % | | | 6/1/19 | | | | 5,845,000 | | | | 6,730,138 | |

Bank of America Corp., Senior Notes | | | 5.625 | % | | | 7/1/20 | | | | 20,750,000 | | | | 21,154,459 | |

Bank of America Corp., Subordinated Notes | | | 5.420 | % | | | 3/15/17 | | | | 2,030,000 | | | | 2,011,629 | |

Boeing Capital Corp., Senior Notes | | | 4.700 | % | | | 10/27/19 | | | | 5,760,000 | | | | 6,106,735 | |

Citigroup Inc., Notes | | | 6.500 | % | | | 8/19/13 | | | | 150,000 | | | | 164,709 | |

Citigroup Inc., Senior Notes | | | 6.000 | % | | | 12/13/13 | | | | 20,500,000 | | | | 22,401,067 | |

Citigroup Inc., Senior Notes | | | 6.375 | % | | | 8/12/14 | | | | 5,040,000 | | | | 5,570,243 | |

Citigroup Inc., Senior Notes | | | 5.500 | % | | | 10/15/14 | | | | 1,101,000 | | | | 1,186,269 | |

Citigroup Inc., Senior Notes | | | 6.010 | % | | | 1/15/15 | | | | 18,410,000 | | | | 20,196,249 | |

Citigroup Inc., Senior Notes | | | 5.875 | % | | | 5/29/37 | | | | 6,040,000 | | | | 5,908,872 | |

Citigroup Inc., Senior Notes | | | 6.875 | % | | | 3/5/38 | | | | 33,410,000 | | | | 37,059,675 | |

Citigroup Inc., Subordinated Notes | | | 5.000 | % | | | 9/15/14 | | | | 270,000 | | | | 279,309 | |

Citigroup Inc., Subordinated Notes | | | 6.125 | % | | | 8/25/36 | | | | 180,000 | | | | 172,477 | |

European Investment Bank, Senior Bonds | | | 4.625 | % | | | 3/21/12 | | | | 50,000 | | | | 52,413 | |

General Electric Capital Corp., Medium-Term Notes | | | 5.450 | % | | | 1/15/13 | | | | 1,175,000 | | | | 1,263,594 | |

General Electric Capital Corp., Senior Notes | | | 2.125 | % | | | 12/21/12 | | | | 53,010,000 | | | | 54,464,382 | |

General Electric Capital Corp., Senior Notes | | | 5.625 | % | | | 5/1/18 | | | | 530,000 | | | | 577,972 | |

General Electric Capital Corp., Senior Notes | | | 5.500 | % | | | 1/8/20 | | | | 2,330,000 | | | | 2,491,905 | |

General Electric Capital Corp., Senior Notes | | | 6.875 | % | | | 1/10/39 | | | | 48,530,000 | | | | 56,084,180 | |

General Electric Capital Corp., Subordinated Debentures | | | 6.375 | % | | | 11/15/67 | | | | 47,395,000 | | | | 46,921,050 | (g) |

ILFC E-Capital Trust I | | | 5.900 | % | | | 12/21/65 | | | | 14,410,000 | | | | 10,909,235 | (d)(g) |

ILFC E-Capital Trust II, Bonds | | | 6.250 | % | | | 12/21/65 | | | | 2,760,000 | | | | 2,152,800 | (d)(g) |

International Lease Finance Corp., Senior Secured Notes | | | 6.500 | % | | | 9/1/14 | | | | 5,440,000 | | | | 5,766,400 | (d) |

International Lease Finance Corp., Senior Secured Notes | | | 6.750 | % | | | 9/1/16 | | | | 27,110,000 | | | | 28,939,925 | (d) |

JPMorgan Chase & Co. | | | 4.400 | % | | | 7/22/20 | | | | 10,770,000 | | | | 10,600,329 | |

JPMorgan Chase & Co., Senior Notes | | | 6.300 | % | | | 4/23/19 | | | | 9,630,000 | | | | 10,961,396 | |

JPMorgan Chase & Co., Senior Notes | | | 4.250 | % | | | 10/15/20 | | | | 13,010,000 | | | | 12,706,216 | |

JPMorgan Chase & Co., Subordinated Notes | | | 5.750 | % | | | 1/2/13 | | | | 4,430,000 | | | | 4,800,158 | |

JPMorgan Chase & Co., Subordinated Notes | | | 5.150 | % | | | 10/1/15 | | | | 490,000 | | | | 518,233 | |

See Notes to Financial Statements.

| | | | |

| Western Asset Core Plus Bond Portfolio 2010 Annual Report | | | 21 | |

Western Asset Core Plus Bond Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Diversified Financial Services — continued | | | | | | | | | | | | | | | | |

JPMorgan Chase & Co., Subordinated Notes | | | 6.125 | % | | | 6/27/17 | | | | 60,000 | | | $ | 65,828 | |

MUFG Capital Finance 1 Ltd., Preferred Securities | | | 6.346 | % | | | 7/25/16 | | | | 7,400,000 | | | | 7,456,884 | (g)(h) |

Patrons’ Legacy | | | 5.775 | % | | | 12/23/63 | | | | 8,900,000 | | | | 8,587,610 | (d)(f) |

Pemex Finance Ltd., Notes | | | 9.030 | % | | | 2/15/11 | | | | 500 | | | | 504 | |

PHH Corp. | | | 7.125 | % | | | 3/1/13 | | | | 5,940,000 | | | | 5,925,150 | |

TNK-BP Finance SA, Senior Notes | | | 6.625 | % | | | 3/20/17 | | | | 3,575,000 | | | | 3,798,438 | (d) |

Total Diversified Financial Services | | | | | | | | | | | | | | | 439,036,388 | |

Insurance — 0.5% | | | | | | | | | | | | | | | | |

American International Group Inc., Junior Subordinated Debentures | | | 6.250 | % | | | 3/15/37 | | | | 360,000 | | | | 318,366 | |

ASIF Global Financing XIX | | | 4.900 | % | | | 1/17/13 | | | | 2,180,000 | | | | 2,245,400 | (d) |

Berkshire Hathaway Inc., Senior Notes | | | 3.200 | % | | | 2/11/15 | | | | 14,460,000 | | | | 14,920,985 | |

MetLife Capital Trust IV, Junior Subordinated Notes | | | 7.875 | % | | | 12/15/37 | | | | 8,900,000 | | | | 9,411,750 | (d) |

MetLife Inc., Junior Subordinated Debentures | | | 6.400 | % | | | 12/15/66 | | | | 2,905,000 | | | | 2,730,700 | |

MetLife Inc., Senior Notes | | | 7.717 | % | | | 2/15/19 | | | | 2,120,000 | | | | 2,602,790 | |

MetLife Inc., Senior Notes | | | 4.750 | % | | | 2/8/21 | | | | 6,300,000 | | | | 6,432,445 | |

MetLife Inc., Senior Notes | | | 5.875 | % | | | 2/6/41 | | | | 2,770,000 | | | | 2,920,488 | |

Total Insurance | | | | | | | | | | | | | | | 41,582,924 | |