UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06110

Western Asset Funds, Inc.

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: May 31

Date of reporting period: November 30, 2014

ITEM 1. REPORT TO STOCKHOLDERS.

The Semi-Annual Report to Stockholders is filed herewith.

| | |

| Semi-Annual Report | | November 30, 2014 |

WESTERN ASSET

HIGH YIELD FUND

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks to maximize total return, consistent with prudent investment management.

Letter from the president

Dear Shareholder,

We are pleased to provide the semi-annual report of Western Asset High Yield Fund for the six-month reporting period ended November 30, 2014. Please read on for Fund performance information and a detailed look at prevailing economic and market conditions during the Fund’s reporting period.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com/individualinvestors. Here you can gain immediate access to market and investment information, including:

| Ÿ | | Fund prices and performance, |

| Ÿ | | Market insights and commentaries from our portfolio managers, and |

| Ÿ | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Kenneth D. Fuller

President and Chief Executive Officer

December 26, 2014

| | |

| II | | Western Asset High Yield Fund |

Investment commentary

Economic review

Despite weakness in early 2014, the U.S. economy expanded at a strong pace during the six months ended November 30, 2014 (the “reporting period”). The U.S. Department of Commerce reported that in the fourth quarter of 2013, U.S. gross domestic product (“GDP”)i growth was 3.5%. Severe winter weather then played a key role in a sharp reversal in the economy, a 2.1% contraction during the first quarter of 2014; this was the first negative GDP report in three years. Negative contributions were widespread: private inventory investment, exports, state and local government spending and nonresidential and residential fixed investment. Thankfully, this setback was very brief, as second quarter GDP growth was 4.6%. The rebound in GDP growth was driven by several factors, including an acceleration in personal consumption expenditures (“PCE”), increased private inventory investment and exports, as well as an upturn in state and local government spending. After the reporting period ended, the Department of Commerce reported that third quarter GDP growth was 5.0%, driven by contributions from PCE, exports, nonresidential fixed investment and government spending and the strongest reading for GDP growth since the third quarter of 2003.

The U.S. manufacturing sector continued to support the economy. Based on figures for the Institute for Supply Management’s Purchasing Managers’ Index (“PMI”)ii, U.S. manufacturing expanded during all six months of the reporting period (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion). After a reading of 55.3 in June 2014, the PMI generally rose over the next three months, reaching a high of 59.0 in August, its best reading since March 2011. While PMI dipped to 56.6 in September, it rose back to 59.0 in October and was 58.7 in November.

The improving U.S. job market was one of the factors supporting the overall economy during the reporting period. When the period began, unemployment, as reported by the U.S. Department of Labor, was 6.1%. After ticking up to 6.2% in July 2014, unemployment then generally declined throughout the remainder of the reporting period and reached a low of 5.8% in October and November 2014, the lowest level since July 2008.

Growth outside the U.S. was mixed. In its October 2014 World Economic Outlook, the International Monetary Fund (“IMF”) said “Despite setbacks, an uneven global recovery continues. In advanced economies, the legacies of the pre-crisis boom and the subsequent crisis, including high private and public debt, still cast a shadow on the recovery. Emerging markets are adjusting to rates of economic growth lower than those reached in the pre-crisis boom and the post-crisis recovery.” From a regional perspective, the IMF forecasts 2014 growth will be 0.8% in the Eurozone, versus -0.4% in 2013. Japan’s economy is projected to expand 0.9% in 2014, compared to 1.5% in 2013. Elsewhere the IMF projects that overall growth in emerging market countries will decelerate in 2014, with expected growth of 4.4% versus 4.7% in 2013.

| | |

| Western Asset High Yield Fund | | III |

Investment commentary (cont’d)

Market review

Q. How did the Federal Reserve Board (“Fed”)iii respond to the economic environment?

A. The Fed took a number of actions as it sought to meet its dual mandate of fostering maximum employment and price stability. As it has since December 2008, the Fed kept the federal funds rateiv at a historically low range between zero and 0.25%. The Fed also ended its asset purchase program that was announced in December 2012. At that time, the Fed said it would continue purchasing $40 billion per month of agency mortgage-backed securities (“MBS”), as well as $45 billion per month of longer-term Treasuries. Following the meeting that concluded on December 18, 2013, prior to the beginning of the reporting period, the Fed announced that it would begin reducing its monthly asset purchases, saying “Beginning in January 2014, the Committee will add to its holdings of agency MBS at a pace of $35 billion per month rather than $40 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $40 billion per month rather than $45 billion per month.”

At each of the Fed’s next six meetings (January, March, April, June, July and September 2014), it announced further $10 billion tapering of its asset purchases. At its meeting that ended on October 29, 2014, the Fed announced that its asset purchase program had concluded. Finally, on December 17, 2014, after the reporting period ended, the Fed said that “Based on its current assessment, the Committee judges that it can be patient… to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time…”

Q. What actions did international central banks take during the reporting period?

A. Given the economic challenges in the Eurozone, the European Central Bank (“ECB”)v took a number of actions to stimulate growth. In November 2013, before the beginning of the reporting period, the ECB cut rates from 0.50% to a new record low of 0.25%. On June 5, 2014, the ECB made a number of additional moves in an attempt to support the region’s economy and ward off deflation: The ECB reduced rates to a new low of 0.15% and announced it would charge commercial banks 0.10% to keep money at the ECB. This “negative deposit rate” was aimed at encouraging commercial banks to lend some of their incremental cash which, in turn, could help to spur growth. On September 4, 2014, the ECB reduced rates to yet another record low of 0.05% and it began charging commercial banks 0.20% to keep money at the ECB. Furthermore, the ECB started purchasing securitized loans and covered bonds in October 2014. In other developed countries, the Bank of England kept rates on hold at 0.50% during the reporting period, as did Japan at a range of zero to 0.10%, its lowest level since 2006. At the end of October 2014, the Bank of Japan announced that it would increase its asset purchases by between 10 trillion yen and 20 trillion yen ($90.7 billion to $181.3 billion) to approximately 80 trillion yen ($725 billion) annually, in an attempt to stimulate growth. Elsewhere, after holding rates steady at 6.0% since July 2012, the People’s Bank of China cut the rate to 5.6% on November 21, 2014 in an effort to stimulate growth.

| | |

| IV | | Western Asset High Yield Fund |

Q. Did Treasury yields trend higher or lower during the six months ended November 30, 2014?

A. Short-term Treasury yields moved higher, whereas long-term Treasury yields declined during the reporting period. When the reporting period began, the yield on the two-year Treasury was 0.37%. It fell as low as 0.34% on October 15, 2014, and was as high as 0.59% in mid-September 2014, before ending the period at 0.47%. The yield on the ten-year Treasury began the period at 2.48%. It peaked at 2.66% on June 17, 2014 and fell as low as 2.15% on October 15, 2014 and ended the period at 2.18%.

Q. What factors impacted the spread sectors (non-Treasuries) during the reporting period?

A. The spread sectors generated positive results during the reporting period. Spread sectors generated positive results in June 2014 as intermediate- and long-term interest rates declined and investor demand was solid. Performance fluctuated with investor sentiment over the last five months of the reporting period given uncertainties regarding future Fed monetary policy, concerns over global growth and a host of escalating geopolitical issues. The overall bond market, as measured by the Barclays U.S. Aggregate Indexvi, gained 1.91% during the six months ended November 30, 2014.

Q. How did the high-yield bond market perform over the six months ended November 30, 2014?

A. The U.S. high-yield bond market, as measured by the Barclays U.S. Corporate High Yield — 2% Issuer Cap Indexvii, returned -0.59% for the six months ended November 30, 2014. While the underlying fundamentals in the high-yield market remained solid and defaults were well below their long-term average, the asset class was dragged down at times given periods of investor risk aversion.

Q. How did the emerging markets debt asset class perform over the reporting period?

A. The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)viii gained 0.18% during the six months ended November 30, 2014. The asset class posted positive returns during each of the first three months covered by the reporting period. Demand was strong overall as investors looked to generate incremental yield in the low interest rate environment. However, the asset class experienced a sharp selloff in September, triggered by a number of factors, including rising U.S. interest rates, expectations for future Fed rate hikes, concerns over global growth and weak investor demand.

Performance review

For the six months ended November 30, 2014, Class I shares of Western Asset High Yield Fund returned -2.48%. The Fund’s unmanaged benchmark, the Barclays U.S. Corporate High Yield — 2% Issuer Cap Index, returned -0.59% for the same period. The Lipper High Yield Funds Category Average1 returned -1.18% over the same time frame.

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended November 30, 2014, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 643 funds in the Fund’s Lipper category, and excluding sales charges. |

| | |

| Western Asset High Yield Fund | | V |

Investment commentary (cont’d)

| | | | |

Performance Snapshot as of November 30, 2014

(unaudited) | |

| (excluding sales charges) | | 6 months | |

| Western Asset High Yield Fund: | | | | |

Class A | | | -2.69 | % |

Class C | | | -3.02 | % |

Class R | | | -2.76 | % |

Class I | | | -2.48 | % |

Class IS | | | -2.46 | % |

Barclays U.S. Corporate High Yield —

2% Issuer Cap Index | | | -0.59 | % |

Lipper High Yield Funds

Category Average1 | | | -1.18 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value, investment returns and yields will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/individualinvestors.

All share class returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply or the deduction of taxes that a shareholder would pay on Fund distributions. If sales charges were reflected, the performance quoted would be lower. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

Performance of Class A2 shares is not shown because the inception date for this share class was August 1, 2014.

The 30-Day SEC Yields for the period ended November 30, 2014 for Class A, Class C, Class R, Class I and Class IS shares were 5.70%, 5.22%, 5.72%, 6.37% and 6.39%, respectively. Absent fee waivers and/or expense reimbursements, the 30-Day SEC Yield for Class R shares would have been 5.25%. The 30-Day SEC Yield is subject to change and is based on the yield to maturity of the Fund’s investments over a 30-day period and not on the dividends paid by the Fund, which may differ.

|

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s current prospectus dated July 30, 2014, the gross total annual operating expense ratios for Class A, Class C, Class R, Class I and Class IS shares were 0.88%, 1.96%, 1.49%, 0.69% and 0.61%, respectively.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

As a result of expense limitation arrangements, the ratio of expenses, other than interest, brokerage commissions, taxes, extraordinary expenses and deferred organizational expenses, to average net assets is not expected to exceed 1.05% for Class A shares, 1.80% for Class C shares, 1.30% for Class R shares and 0.65% for Class IS shares. In addition, total annual fund operating expenses for Class IS shares will not exceed total annual fund operating

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended November 30, 2014, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 643 funds in the Fund’s Lipper category, and excluding sales charges. |

| | |

| VI | | Western Asset High Yield Fund |

expenses for Class I shares, subject to recapture as described below. These expense limitation arrangements cannot be terminated prior to December 31, 2016 without the Board of Directors’ consent.

The manager is permitted to recapture amounts waived and/or reimbursed to a class within two years after the fiscal year in which the manager earned the fee or incurred the expense if the class’ total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Fund, in the class’ total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Kenneth D. Fuller

President and Chief Executive Officer

December 26, 2014

RISKS: Fixed-income securities involve interest rate, credit, inflation and reinvestment risks. As interest rates rise, the value of fixed-income securities falls. Derivatives, such as options, futures and swaps, can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. International investments are subject to special risks including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. The use of leverage may increase volatility and possibility of loss. Securities rated below investment grade are commonly known as “junk bonds” or “high yield securities.” Risks of high-yield securities include greater price volatility, illiquidity and possibility of default. Asset-backed, mortgage-backed or mortgage-related securities are subject to prepayment and extension risks. Please see the Fund’s prospectus for a more complete discussion of these and other risks, and the Fund’s investment strategies.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole. Forecasts and predictions are inherently limited and should not be relied upon as an indication of actual or future performance.

| | |

| Western Asset High Yield Fund | | VII |

Investment commentary (cont’d)

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Institute for Supply Management’s PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the U.S. manufacturing sector. |

| iii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iv | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| v | The European Central Bank (“ECB”) is responsible for the monetary system of the European Union and the euro currency. |

| vi | The Barclays U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| vii | The Barclays U.S. Corporate High Yield — 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Barclays U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. |

| viii | The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. |

| | |

| VIII | | Western Asset High Yield Fund |

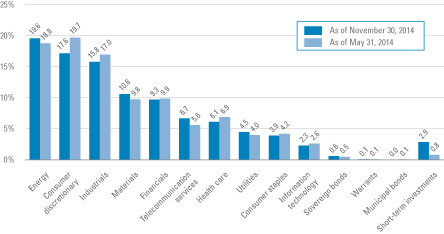

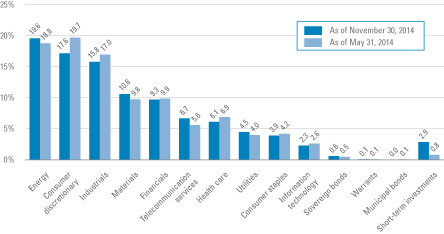

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of November 30, 2014 and May 31, 2014 and does not include derivatives, such as futures contracts, forward foreign currency contracts and swap contracts. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| | |

| Western Asset High Yield Fund 2014 Semi-Annual Report | | 1 |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on June 1, 2014 and held for the six months ended November 30, 2014, unless otherwise noted.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on actual total return1 | | | | | Based on hypothetical total return1 | |

| | | Actual

Total Return

Without

Sales

Charge2 | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period | | | | | | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 | |

| Class A | | | -2.69 | % | | $ | 1,000.00 | | | $ | 973.10 | | | | 0.99 | % | | $ | 4.90 | 3 | | | | Class A | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,020.10 | | | | 0.99 | % | | $ | 5.01 | |

| Class A24 | | | -2.14 | | | | 1,000.00 | | | | 978.60 | | | | 0.90 | | | | 2.90 | 5 | | | | Class A2 | | | 5.00 | | | | 1,000.00 | | | | 1,020.56 | | | | 0.90 | | | | 4.56 | |

| Class C | | | -3.02 | | | | 1,000.00 | | | | 969.80 | | | | 1.80 | | | | 8.89 | 3 | | | | Class C | | | 5.00 | | | | 1,000.00 | | | | 1,016.04 | | | | 1.80 | | | | 9.10 | |

| Class R | | | -2.76 | | | | 1,000.00 | | | | 972.40 | | | | 1.30 | | | | 6.43 | 3 | | | | Class R | | | 5.00 | | | | 1,000.00 | | | | 1,018.55 | | | | 1.30 | | | | 6.58 | |

| Class I | | | -2.48 | | | | 1,000.00 | | | | 975.20 | | | | 0.70 | | | | 3.47 | 3 | | | | Class I | | | 5.00 | | | | 1,000.00 | | | | 1,021.56 | | | | 0.70 | | | | 3.55 | |

| Class IS | | | -2.46 | | | | 1,000.00 | | | | 975.40 | | | | 0.63 | | | | 3.12 | 3 | | | | Class IS | | | 5.00 | | | | 1,000.00 | | | | 1,021.91 | | | | 0.63 | | | | 3.19 | |

| | |

| 2 | | Western Asset High Yield Fund 2014 Semi-Annual Report |

| 1 | For the six months ended November 30, 2014, unless otherwise noted. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A and Class A2 shares or the applicable contingent deferred sales charge (“CDSC”) with respect to Class C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements and/or expense reimbursements. In the absence of compensating balance arrangements and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 365. |

| 4 | For the period August 1, 2014 (inception date) to November 30, 2014. |

| 5 | Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to the class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal period (119), then divided by 365. |

| | |

| Western Asset High Yield Fund 2014 Semi-Annual Report | | 3 |

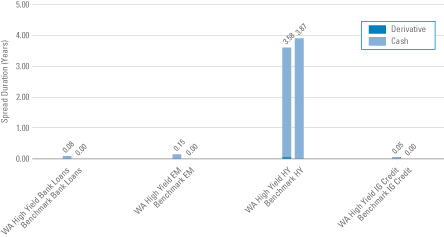

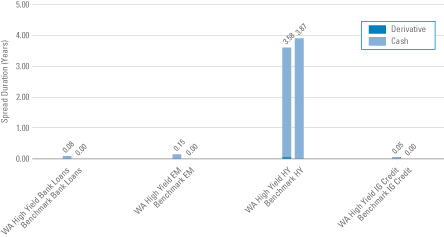

Spread duration (unaudited)

Economic exposure — November 30, 2014

Spread duration measures the sensitivity to changes in spreads. The spread over Treasuries is the annual risk-premium demanded by investors to hold non-Treasury securities. Spread duration is quantified as the % change in price resulting from a 100 basis points change in spreads. For a security with positive spread duration, an increase in spreads would result in a price decline and a decline in spreads would result in a price increase. This chart highlights the market sector exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

| | |

| Benchmark | | — Barclays U.S. Corporate High Yield — 2% Issuer Cap Index |

| EM | | — Emerging Markets |

| HY | | — High Yield |

| IG Credit | | — Investment Grade Credit |

| WA High Yield | | — Western Asset High Yield Fund |

| | |

| 4 | | Western Asset High Yield Fund 2014 Semi-Annual Report |

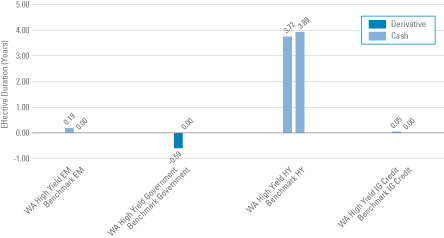

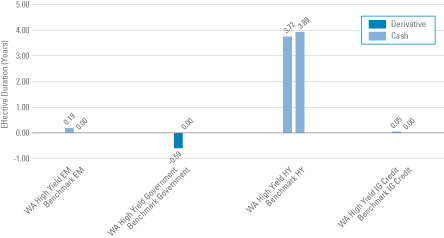

Effective duration (unaudited)

Interest rate exposure — November 30, 2014

Effective duration measures the sensitivity to changes in relevant interest rates. Effective duration is quantified as the % change in price resulting from a 100 basis points change in interest rates. For a security with positive effective duration, an increase in interest rates would result in a price decline and a decline in interest rates would result in a price increase. This chart highlights the interest rate exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

| | |

| Benchmark | | — Barclays U.S. Corporate High Yield — 2% Issuer Cap Index |

| EM | | — Emerging Markets |

| HY | | — High Yield |

| IG Credit | | — Investment Grade Credit |

| WA High Yield | | — Western Asset High Yield Fund |

| | |

| Western Asset High Yield Fund 2014 Semi-Annual Report | | 5 |

Schedule of investments (unaudited)

November 30, 2014

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Corporate Bonds & Notes — 86.7% | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 15.7% | | | | | | | | | | | | | | | | |

Automobiles — 0.6% | | | | | | | | | | | | | | | | |

Chrysler Group LLC/CG Co.-Issuer Inc., Secured Notes | | | 8.250 | % | | | 6/15/21 | | | | 680,000 | | | $ | 758,200 | |

General Motors Co., Senior Notes | | | 5.200 | % | | | 4/1/45 | | | | 280,000 | | | | 287,812 | |

General Motors Financial Co. Inc., Senior Notes | | | 4.375 | % | | | 9/25/21 | | | | 1,710,000 | | | | 1,771,987 | |

Total Automobiles | | | | | | | | | | | | | | | 2,817,999 | |

Distributors — 0.2% | | | | | | | | | | | | | | | | |

LKQ Corp., Senior Notes | | | 4.750 | % | | | 5/15/23 | | | | 830,000 | | | | 805,100 | |

Diversified Consumer Services — 0.3% | | | | | | | | | | | | | | | | |

Service Corp. International, Senior Notes | | | 7.500 | % | | | 4/1/27 | | | | 497,000 | | | | 561,610 | |

StoneMor Partners LP/Cornerstone Family Services of WV, Senior Notes | | | 7.875 | % | | | 6/1/21 | | | | 870,000 | | | | 904,800 | (a) |

Total Diversified Consumer Services | | | | | | | | | | | | | | | 1,466,410 | |

Hotels, Restaurants & Leisure — 4.1% | | | | | | | | | | | | | | | | |

1011778 BC ULC/New Red Finance Inc., Secured Notes | | | 6.000 | % | | | 4/1/22 | | | | 1,300,000 | | | | 1,332,500 | (a) |

24 Hour Holdings III LLC, Senior Notes | | | 8.000 | % | | | 6/1/22 | | | | 600,000 | | | | 541,500 | (a) |

Bossier Casino Venture Holdco Inc. | | | 11.000 | % | | | 2/9/18 | | | | 289,071 | | | | 289,332 | (a)(b)(c) |

Bossier Casino Venture Holdco Inc., Senior Secured Bonds | | | 14.000 | % | | | 2/9/18 | | | | 1,540,695 | | | | 1,372,605 | (a)(b)(c)(d) |

Caesars Entertainment Resort Properties LLC, Secured Notes | | | 11.000 | % | | | 10/1/21 | | | | 230,000 | | | | 210,162 | (a) |

Carrols Restaurant Group Inc., Senior Secured Notes | | | 11.250 | % | | | 5/15/18 | | | | 860,000 | | | | 922,350 | |

CEC Entertainment Inc., Senior Notes | | | 8.000 | % | | | 2/15/22 | | | | 530,000 | | | | 514,100 | (a) |

Downstream Development Quapaw, Senior Secured Notes | | | 10.500 | % | | | 7/1/19 | | �� | | 800,000 | | | | 820,000 | (a) |

Fontainebleau Las Vegas Holdings LLC/Fontainebleau Las Vegas Capital Corp., Senior Secured Notes | | | 10.250 | % | | | 6/15/15 | | | | 1,455,000 | | | | 3,637 | (a)(e) |

Greektown Holdings LLC/Greektown Mothership Corp., Senior Secured Notes | | | 8.875 | % | | | 3/15/19 | | | | 600,000 | | | | 610,500 | (a) |

Hilton Worldwide Finance LLC/Hilton Worldwide Finance Corp., Senior Notes | | | 5.625 | % | | | 10/15/21 | | | | 1,450,000 | | | | 1,522,500 | (a) |

Landry’s Holdings II Inc., Senior Notes | | | 10.250 | % | | | 1/1/18 | | | | 420,000 | | | | 434,700 | (a) |

Landry’s Inc., Senior Notes | | | 9.375 | % | | | 5/1/20 | | | | 1,961,000 | | | | 2,086,014 | (a) |

MCE Finance Ltd., Senior Notes | | | 5.000 | % | | | 2/15/21 | | | | 2,470,000 | | | | 2,383,550 | (a) |

MGM Resorts International, Senior Notes | | | 6.625 | % | | | 12/15/21 | | | | 590,000 | | | | 629,825 | |

NCL Corp. Ltd., Senior Notes | | | 5.250 | % | | | 11/15/19 | | | | 2,560,000 | | | | 2,579,200 | (a) |

Paris Las Vegas Holding LLC/Harrah’s Las Vegas LLC/Flamingo Las Vegas Holding LLC, Senior Secured Notes | | | 8.000 | % | | | 10/1/20 | | | | 390,000 | | | | 382,200 | (a) |

Seven Seas Cruises S de RL LLC, Senior Secured Notes | | | 9.125 | % | | | 5/15/19 | | | | 620,000 | | | | 671,894 | |

Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 17,306,569 | |

Household Durables — 2.3% | | | | | | | | | | | | | | | | |

Century Intermediate Holding Co. 2, Senior Notes | | | 9.750 | % | | | 2/15/19 | | | | 1,700,000 | | | | 1,799,875 | (a)(d) |

See Notes to Financial Statements.

| | |

| 6 | | Western Asset High Yield Fund 2014 Semi-Annual Report |

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Household Durables — continued | | | | | | | | | | | | | | | | |

Shea Homes LP/Shea Homes Funding Corp., Senior Secured Notes | | | 8.625 | % | | | 5/15/19 | | | | 1,660,000 | | | $ | 1,759,600 | |

Standard Pacific Corp., Senior Notes | | | 6.250 | % | | | 12/15/21 | | | | 900,000 | | | | 942,750 | |

Standard Pacific Corp., Senior Notes | | | 5.875 | % | | | 11/15/24 | | | | 290,000 | | | | 291,450 | |

Toll Brothers Finance Corp., Senior Notes | | | 4.000 | % | | | 12/31/18 | | | | 230,000 | | | | 231,725 | |

Toll Brothers Finance Corp., Senior Notes | | | 6.750 | % | | | 11/1/19 | | | | 210,000 | | | | 236,250 | |

William Lyon Homes Inc., Senior Notes | | | 5.750 | % | | | 4/15/19 | | | | 1,160,000 | | | | 1,162,900 | |

William Lyon Homes Inc., Senior Notes | | | 8.500 | % | | | 11/15/20 | | | | 540,000 | | | | 588,600 | |

William Lyon Homes PNW Finance Corp., Senior Notes | | | 7.000 | % | | | 8/15/22 | | | | 510,000 | | | | 525,300 | (a) |

Woodside Homes Co. LLC/Woodside Homes Finance Inc., Senior Notes | | | 6.750 | % | | | 12/15/21 | | | | 2,190,000 | | | | 2,190,000 | (a) |

Total Household Durables | | | | | | | | | | | | | | | 9,728,450 | |

Media — 5.6% | | | | | | | | | | | | | | | | |

Altice SA, Senior Secured Notes | | | 7.750 | % | | | 5/15/22 | | | | 260,000 | | | | 268,775 | (a) |

Carmike Cinemas Inc., Secured Notes | | | 7.375 | % | | | 5/15/19 | | | | 340,000 | | | | 360,825 | |

CCO Holdings LLC/CCO Holdings Capital Corp., Senior Notes | | | 6.625 | % | | | 1/31/22 | | | | 1,421,000 | | | | 1,511,589 | |

CCO Holdings LLC/CCO Holdings Capital Corp., Senior Notes | | | 5.125 | % | | | 2/15/23 | | | | 1,000,000 | | | | 980,000 | |

Clear Channel Worldwide Holdings Inc., Senior Subordinated Notes | | | 7.625 | % | | | 3/15/20 | | | | 360,000 | | | | 372,600 | |

DISH DBS Corp., Senior Notes | | | 5.875 | % | | | 7/15/22 | | | | 1,780,000 | | | | 1,840,298 | |

DISH DBS Corp., Senior Notes | | | 5.000 | % | | | 3/15/23 | | | | 720,000 | | | | 698,850 | |

DISH DBS Corp., Senior Notes | | | 5.875 | % | | | 11/15/24 | | | | 1,310,000 | | | | 1,319,825 | (a) |

Gannett Co. Inc., Senior Notes | | | 4.875 | % | | | 9/15/21 | | | | 550,000 | | | | 552,750 | (a) |

Gibson Brands Inc., Senior Secured Notes | | | 8.875 | % | | | 8/1/18 | | | | 2,520,000 | | | | 2,431,800 | (a) |

iHeartCommunications Inc., Senior Notes | | | 10.000 | % | | | 1/15/18 | | | | 830,000 | | | | 661,925 | |

MDC Partners Inc., Senior Notes | | | 6.750 | % | | | 4/1/20 | | | | 900,000 | | | | 929,250 | (a) |

MediaNews Group Inc. | | | 12.000 | % | | | 12/31/18 | | | | 900,000 | | | | 900,000 | (c) |

New Cotai LLC/New Cotai Capital Corp., Senior Secured Notes | | | 10.625 | % | | | 5/1/19 | | | | 2,316,035 | | | | 2,605,539 | (a)(d) |

Numericable-SFR, Senior Secured Bonds | | | 6.000 | % | | | 5/15/22 | | | | 2,330,000 | | | | 2,366,744 | (a) |

Numericable-SFR, Senior Secured Bonds | | | 6.250 | % | | | 5/15/24 | | | | 840,000 | | | | 855,750 | (a) |

Univision Communications Inc., Senior Secured Notes | | | 6.875 | % | | | 5/15/19 | | | | 1,200,000 | | | | 1,260,000 | (a) |

Virgin Media Finance PLC, Senior Notes | | | 4.875 | % | | | 2/15/22 | | | | 620,000 | | | | 554,900 | |

Virgin Media Finance PLC, Senior Notes | | | 6.000 | % | | | 10/15/24 | | | | 2,310,000 | | | | 2,419,725 | (a) |

WMG Acquisition Corp., Senior Notes | | | 6.750 | % | | | 4/15/22 | | | | 950,000 | | | | 921,500 | (a) |

Total Media | | | | | | | | | | | | | | | 23,812,645 | |

Specialty Retail — 1.9% | | | | | | | | | | | | | | | | |

CST Brands Inc., Senior Notes | | | 5.000 | % | | | 5/1/23 | | | | 510,000 | | | | 513,825 | |

Dufry Finance SCA, Senior Notes | | | 5.500 | % | | | 10/15/20 | | | | 1,740,000 | | | | 1,831,524 | (a) |

See Notes to Financial Statements.

| | |

| Western Asset High Yield Fund 2014 Semi-Annual Report | | 7 |

Schedule of investments (unaudited) (cont’d)

November 30, 2014

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Specialty Retail — continued | | | | | | | | | | | | | | | | |

Edcon Pty Ltd., Senior Secured Notes | | | 9.500 | % | | | 3/1/18 | | | | 1,100,000 | | | $ | 902,000 | (a) |

GameStop Corp., Senior Notes | | | 5.500 | % | | | 10/1/19 | | | | 880,000 | | | | 884,400 | (a) |

Group 1 Automotive Inc., Senior Notes | | | 5.000 | % | | | 6/1/22 | | | | 1,110,000 | | | | 1,096,125 | (a) |

Guitar Center Inc., Senior Bonds | | | 9.625 | % | | | 4/15/20 | | | | 2,400,000 | | | | 1,578,000 | (a) |

Spencer Spirit Holdings Inc., Senior Notes | | | 9.000 | % | | | 5/1/18 | | | | 1,208,000 | | | | 1,214,040 | (a)(d) |

Total Specialty Retail | | | | | | | | | | | | | | | 8,019,914 | |

Textiles, Apparel & Luxury Goods — 0.7% | | | | | | | | | | | | | | | | |

Chinos Intermediate Holdings A Inc., Senior Notes | | | 7.750 | % | | | 5/1/19 | | | | 650,000 | | | | 614,250 | (a)(d) |

Empire Today LLC/Empire Today Finance Corp., Senior Secured Notes | | | 11.375 | % | | | 2/1/17 | | | | 840,000 | | | | 604,800 | (a) |

Hanesbrands Inc., Senior Notes | | | 6.375 | % | | | 12/15/20 | | | | 870,000 | | | | 926,115 | |

William Carter Co., Senior Notes | | | 5.250 | % | | | 8/15/21 | | | | 700,000 | | | | 726,250 | |

Total Textiles, Apparel & Luxury Goods | | | | | | | | | | | | | | | 2,871,415 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 66,828,502 | |

| Consumer Staples — 3.5% | | | | | | | | | | | | | | | | |

Beverages — 1.2% | | | | | | | | | | | | | | | | |

Carolina Beverage Group LLC/Carolina Beverage Group Finance Inc., Secured Notes | | | 10.625 | % | | | 8/1/18 | | | | 820,000 | | | | 830,250 | (a) |

Constellation Brands Inc., Senior Notes | | | 4.250 | % | | | 5/1/23 | | | | 940,000 | | | | 936,522 | |

Constellation Brands Inc., Senior Notes | | | 4.750 | % | | | 11/15/24 | | | | 1,530,000 | | | | 1,560,600 | |

Crestview DS Merger Subordinated II Inc., Secured Notes | | | 10.000 | % | | | 9/1/21 | | | | 1,330,000 | | | | 1,569,400 | |

Total Beverages | | | | | | | | | | | | | | | 4,896,772 | |

Food & Staples Retailing — 0.3% | | | | | | | | | | | | | | | | |

Beverages & More Inc., Senior Secured Notes | | | 10.000 | % | | | 11/15/18 | | | | 1,400,000 | | | | 1,337,000 | (a) |

Food Products — 1.8% | | | | | | | | | | | | | | | | |

Dole Food Co. Inc., Senior Secured Notes | | | 7.250 | % | | | 5/1/19 | | | | 910,000 | | | | 912,275 | (a) |

H.J. Heinz Co., Secured Notes | | | 4.250 | % | | | 10/15/20 | | | | 520,000 | | | | 526,552 | |

Hearthside Group Holdings LLC/Hearthside Finance Co., Senior Notes | | | 6.500 | % | | | 5/1/22 | | | | 900,000 | | | | 888,750 | (a) |

Simmons Foods Inc., Secured Notes | | | 7.875 | % | | | 10/1/21 | | | | 1,510,000 | | | | 1,536,425 | (a) |

Sun Merger Sub Inc., Senior Notes | | | 5.875 | % | | | 8/1/21 | | | | 1,770,000 | | | | 1,876,200 | (a) |

Wells Enterprises Inc., Senior Secured Notes | | | 6.750 | % | | | 2/1/20 | | | | 544,000 | | | | 567,120 | (a) |

WhiteWave Foods Co., Senior Notes | | | 5.375 | % | | | 10/1/22 | | | | 1,125,000 | | | | 1,181,250 | |

Total Food Products | | | | | | | | | | | | | | | 7,488,572 | |

Tobacco — 0.2% | | | | | | | | | | | | | | | | |

Alliance One International Inc., Secured Notes | | | 9.875 | % | | | 7/15/21 | | | | 970,000 | | | | 919,075 | |

Total Consumer Staples | | | | | | | | | | | | | | | 14,641,419 | |

See Notes to Financial Statements.

| | |

| 8 | | Western Asset High Yield Fund 2014 Semi-Annual Report |

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Energy — 18.9% | | | | | | | | | | | | | | | | |

Energy Equipment & Services — 2.5% | | | | | | | | | | | | | | | | |

Atwood Oceanics Inc., Senior Notes | | | 6.500 | % | | | 2/1/20 | | | | 1,920,000 | | | $ | 1,766,400 | |

CGG, Senior Notes | | | 6.500 | % | | | 6/1/21 | | | | 1,470,000 | | | | 1,308,300 | |

FTS International Inc., Senior Secured Notes | | | 6.250 | % | | | 5/1/22 | | | | 1,250,000 | | | | 1,025,000 | (a) |

Gulfmark Offshore Inc., Senior Notes | | | 6.375 | % | | | 3/15/22 | | | | 910,000 | | | | 755,300 | |

Hercules Offshore Inc., Senior Notes | | | 8.750 | % | | | 7/15/21 | | | | 540,000 | | | | 248,400 | (a) |

Hercules Offshore Inc., Senior Notes | | | 7.500 | % | | | 10/1/21 | | | | 2,420,000 | | | | 1,246,300 | (a) |

Hercules Offshore Inc., Senior Notes | | | 6.750 | % | | | 4/1/22 | | | | 970,000 | | | | 489,850 | (a) |

KCA Deutag UK Finance PLC, Senior Secured Notes | | | 7.250 | % | | | 5/15/21 | | | | 1,150,000 | | | | 966,000 | (a) |

Key Energy Services Inc., Senior Notes | | | 6.750 | % | | | 3/1/21 | | | | 730,000 | | | | 562,100 | |

Pacific Drilling SA, Senior Secured Notes | | | 5.375 | % | | | 6/1/20 | | | | 980,000 | | | | 774,200 | (a) |

Parker Drilling Co., Senior Notes | | | 6.750 | % | | | 7/15/22 | | | | 880,000 | | | | 686,400 | |

Petroleum Geo-Services ASA, Senior Notes | | | 7.375 | % | | | 12/15/18 | | | | 890,000 | | | | 756,500 | (a) |

Total Energy Equipment & Services | | | | | | | | | | | | | | | 10,584,750 | |

Oil, Gas & Consumable Fuels — 16.4% | | | | | | | | | | | | | | | | |

Access Midstream Partners LP/ACMP Finance Corp., Senior Notes | | | 4.875 | % | | | 5/15/23 | | | | 1,790,000 | | | | 1,825,800 | |

Access Midstream Partners LP/ACMP Finance Corp., Senior Notes | | | 4.875 | % | | | 3/15/24 | | | | 845,000 | | | | 861,900 | |

Antero Resources Corp., Senior Notes | | | 5.125 | % | | | 12/1/22 | | | | 1,360,000 | | | | 1,319,200 | (a) |

Arch Coal Inc., Senior Notes | | | 7.000 | % | | | 6/15/19 | | | | 530,000 | | | | 213,325 | |

Arch Coal Inc., Senior Notes | | | 9.875 | % | | | 6/15/19 | | | | 1,120,000 | | | | 492,800 | |

Atlas Pipeline Partners LP/Atlas Pipeline Finance Corp., Senior Notes | | | 4.750 | % | | | 11/15/21 | | | | 1,500,000 | | | | 1,470,000 | |

Atlas Pipeline Partners LP/Atlas Pipeline Finance Corp., Senior Notes | | | 5.875 | % | | | 8/1/23 | | | | 1,000,000 | | | | 1,030,000 | |

Berry Petroleum Co., Senior Notes | | | 6.750 | % | | | 11/1/20 | | | | 650,000 | | | | 598,000 | |

Berry Petroleum Co., Senior Notes | | | 6.375 | % | | | 9/15/22 | | | | 180,000 | | | | 154,800 | |

Blue Racer Midstream LLC/Blue Racer Finance Corp., Senior Notes | | | 6.125 | % | | | 11/15/22 | | | | 720,000 | | | | 727,200 | (a) |

California Resources Corp., Senior Notes | | | 6.000 | % | | | 11/15/24 | | | | 1,340,000 | | | | 1,195,112 | (a) |

Calumet Specialty Products Partners LP/Calumet Finance Corp., Senior Notes | | | 9.625 | % | | | 8/1/20 | | | | 760,000 | | | | 826,500 | |

Calumet Specialty Products Partners LP/Calumet Finance Corp., Senior Notes | | | 7.625 | % | | | 1/15/22 | | | | 980,000 | | | | 994,700 | |

Carrizo Oil & Gas Inc., Senior Notes | | | 7.500 | % | | | 9/15/20 | | | | 610,000 | | | | 619,150 | (a) |

Chesapeake Energy Corp., Senior Notes | | | 6.875 | % | | | 11/15/20 | | | | 1,000,000 | | | | 1,120,000 | |

Chesapeake Energy Corp., Senior Notes | | | 6.125 | % | | | 2/15/21 | | | | 820,000 | | | | 887,650 | |

Chesapeake Energy Corp., Senior Notes | | | 4.875 | % | | | 4/15/22 | | | | 760,000 | | | | 752,400 | |

See Notes to Financial Statements.

| | |

| Western Asset High Yield Fund 2014 Semi-Annual Report | | 9 |

Schedule of investments (unaudited) (cont’d)

November 30, 2014

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Oil, Gas & Consumable Fuels — continued | | | | | | | | | | | | | | | | |

Cloud Peak Energy Resources LLC/Cloud Peak Energy Finance Corp., Senior Notes | | | 6.375 | % | | | 3/15/24 | | | | 1,170,000 | | | $ | 1,143,675 | |

Comstock Resources Inc., Senior Notes | | | 7.750 | % | | | 4/1/19 | | | | 180,000 | | | | 166,500 | |

Comstock Resources Inc., Senior Notes | | | 9.500 | % | | | 6/15/20 | | | | 800,000 | | | | 790,000 | |

Corral Petroleum Holdings AB, Senior Notes | | | 15.000 | % | | | 12/31/17 | | | | 1,979,907 | | | | 1,727,469 | (a)(d) |

Crestwood Midstream Partners LP, Senior Notes | | | 6.125 | % | | | 3/1/22 | | | | 1,240,000 | | | | 1,233,800 | |

CVR Refining LLC/Coffeyville Finance Inc., Secured Notes | | | 6.500 | % | | | 11/1/22 | | | | 770,000 | | | | 768,075 | |

Dynagas LNG Partners LP/Dynagas Finance Inc., Senior Notes | | | 6.250 | % | | | 10/30/19 | | | | 220,000 | | | | 211,200 | |

Ecopetrol SA, Senior Notes | | | 5.875 | % | | | 9/18/23 | | | | 537,000 | | | | 585,330 | |

El Paso Corp., Medium-Term Notes | | | 7.750 | % | | | 1/15/32 | | | | 470,000 | | | | 594,080 | |

Enterprise Products Operating LLP, Subordinated Notes | | | 7.034 | % | | | 1/15/68 | | | | 25,000 | | | | 27,813 | (f) |

EXCO Resources Inc., Senior Notes | | | 8.500 | % | | | 4/15/22 | | | | 820,000 | | | | 699,050 | |

Gulfport Energy Corp., Senior Notes | | | 7.750 | % | | | 11/1/20 | | | | 310,000 | | | | 316,200 | (a) |

Halcon Resources Corp., Senior Notes | | | 9.750 | % | | | 7/15/20 | | | | 430,000 | | | | 328,950 | |

Halcon Resources Corp., Senior Notes | | | 8.875 | % | | | 5/15/21 | | | | 2,960,000 | | | | 2,279,200 | |

Hiland Partners LP/Hiland Partners Finance Corp., Senior Notes | | | 7.250 | % | | | 10/1/20 | | | | 960,000 | | | | 1,003,200 | (a) |

Kinder Morgan Inc., Senior Secured Notes | | | 5.625 | % | | | 11/15/23 | | | | 1,200,000 | | | | 1,315,500 | (a) |

Linn Energy LLC/Linn Energy Finance Corp., Senior Notes | | | 6.500 | % | | | 9/15/21 | | | | 600,000 | | | | 519,000 | |

LUKOIL International Finance BV, Senior Notes | | | 6.125 | % | | | 11/9/20 | | | | 1,070,000 | | | | 1,034,020 | (a) |

Magnum Hunter Resources Corp., Senior Notes | | | 9.750 | % | | | 5/15/20 | | | | 1,620,000 | | | | 1,539,000 | |

MarkWest Energy Partners LP/MarkWest Energy Finance Corp., Senior Notes | | | 4.875 | % | | | 12/1/24 | | | | 2,070,000 | | | | 2,038,950 | |

MEG Energy Corp., Senior Notes | | | 6.375 | % | | | 1/30/23 | | | | 700,000 | | | | 617,750 | (a) |

MEG Energy Corp., Senior Notes | | | 7.000 | % | | | 3/31/24 | | | | 1,220,000 | | | | 1,107,150 | (a) |

Milagro Oil & Gas Inc., Secured Notes | | | 10.500 | % | | | 5/15/16 | | | | 1,910,000 | | | | 1,337,000 | (e) |

Murphy Oil USA Inc., Senior Notes | | | 6.000 | % | | | 8/15/23 | | | | 840,000 | | | | 888,300 | |

Murray Energy Corp., Senior Secured Notes | | | 9.500 | % | | | 12/5/20 | | | | 1,730,000 | | | | 1,825,150 | (a) |

Natural Resource Partners LP/Natural Resource Partners Finance Corp., Senior Notes | | | 9.125 | % | | | 10/1/18 | | | | 1,000,000 | | | | 1,010,000 | |

New Gulf Resources LLC/NGR Finance Corp., Senior Secured Notes | | | 11.750 | % | | | 5/15/19 | | | | 1,620,000 | | | | 1,425,600 | |

NGL Energy Partners LP/NGL Energy Finance Corp., Senior Notes | | | 5.125 | % | | | 7/15/19 | | | | 670,000 | | | | 649,900 | (a) |

NGL Energy Partners LP/NGL Energy Finance Corp., Senior Notes | | | 6.875 | % | | | 10/15/21 | | | | 820,000 | | | | 828,200 | (a) |

Pacific Drilling V Ltd., Senior Secured Notes | | | 7.250 | % | | | 12/1/17 | | | | 810,000 | | | | 745,200 | (a) |

Parsley Energy LLC/Parsley Finance Corp., Senior Notes | | | 7.500 | % | | | 2/15/22 | | | | 1,070,000 | | | | 1,044,588 | (a) |

Petrobras Global Finance BV, Senior Notes | | | 4.375 | % | | | 5/20/23 | | | | 1,840,000 | | | | 1,699,350 | |

Petrobras Global Finance BV, Senior Notes | | | 6.250 | % | | | 3/17/24 | | | | 450,000 | | | | 461,178 | |

See Notes to Financial Statements.

| | |

| 10 | | Western Asset High Yield Fund 2014 Semi-Annual Report |

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Oil, Gas & Consumable Fuels — continued | | | | | | | | | | | | | | | | |

Puma International Financing SA, Senior Bonds | | | 6.750 | % | | | 2/1/21 | | | | 1,010,000 | | | $ | 1,019,090 | (a) |

PVR Partners LP/Penn Virginia Resource Finance Corp. II, Senior Notes | | | 6.500 | % | | | 5/15/21 | | | | 250,000 | | | | 258,750 | |

QEP Resources Inc., Senior Notes | | | 5.375 | % | | | 10/1/22 | | | | 300,000 | | | | 285,000 | |

QEP Resources Inc., Senior Notes | | | 5.250 | % | | | 5/1/23 | | | | 1,565,000 | | | | 1,471,100 | |

Quicksilver Resources Inc., Senior Notes | | | 11.000 | % | | | 7/1/21 | | | | 960,000 | | | | 451,200 | |

Regency Energy Partners LP/Regency Energy Finance Corp., Senior Notes | | | 5.000 | % | | | 10/1/22 | | | | 250,000 | | | | 245,000 | |

Regency Energy Partners LP/Regency Energy Finance Corp., Senior Notes | | | 4.500 | % | | | 11/1/23 | | | | 1,360,000 | | | | 1,278,400 | |

Rice Energy Inc., Senior Notes | | | 6.250 | % | | | 5/1/22 | | | | 1,700,000 | | | | 1,632,000 | (a) |

Rockies Express Pipeline LLC, Senior Notes | | | 5.625 | % | | | 4/15/20 | | | | 1,250,000 | | | | 1,293,750 | (a) |

Rockies Express Pipeline LLC, Senior Notes | | | 6.875 | % | | | 4/15/40 | | | | 600,000 | | | | 684,450 | (a) |

RSP Permian Inc., Senior Notes | | | 6.625 | % | | | 10/1/22 | | | | 680,000 | | | | 661,300 | (a) |

Samson Investment Co., Senior Notes | | | 9.750 | % | | | 2/15/20 | | | | 1,980,000 | | | | 1,143,450 | |

Sanchez Energy Corp., Senior Notes | | | 7.750 | % | | | 6/15/21 | | | | 2,370,000 | | | | 2,334,450 | |

Shelf Drilling Holdings Ltd., Senior Secured Notes | | | 8.625 | % | | | 11/1/18 | | | | 880,000 | | | | 783,200 | (a) |

Sidewinder Drilling Inc., Senior Notes | | | 9.750 | % | | | 11/15/19 | | | | 1,150,000 | | | | 1,017,750 | (a) |

Summit Midstream Holdings LLC/Summit Midstream Finance Corp., Senior Notes | | | 5.500 | % | | | 8/15/22 | | | | 1,870,000 | | | | 1,851,300 | |

Targa Resources Partners LP/Targa Resources Partners Finance Corp., Senior Notes | | | 6.375 | % | | | 8/1/22 | | | | 1,849,000 | | | | 1,959,940 | |

Teine Energy Ltd., Senior Notes | | | 6.875 | % | | | 9/30/22 | | | | 500,000 | | | | 465,000 | (a) |

Tesoro Logistics LP/Tesoro Logistics Finance Corp., Senior Notes | | | 5.500 | % | | | 10/15/19 | | | | 950,000 | | | | 966,625 | (a) |

Tesoro Logistics LP/Tesoro Logistics Finance Corp., Senior Notes | | | 6.250 | % | | | 10/15/22 | | | | 100,000 | | | | 102,000 | (a) |

Triangle USA Petroleum Corp., Senior Notes | | | 6.750 | % | | | 7/15/22 | | | | 600,000 | | | | 489,000 | (a) |

Ultra Petroleum Corp., Senior Notes | | | 5.750 | % | | | 12/15/18 | | | | 1,370,000 | | | | 1,330,612 | (a) |

Westmoreland Coal Co./Westmoreland Partners, Senior Secured Notes | | | 10.750 | % | | | 2/1/18 | | | | 890,000 | | | | 933,610 | |

Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 69,705,892 | |

Total Energy | | | | | | | | | | | | | | | 80,290,642 | |

| Financials — 6.9% | | | | | | | | | | | | | | | | |

Banks — 2.9% | | | | | | | | | | | | | | | | |

Banco Espirito Santo SA, Senior Notes | | | 5.875 | % | | | 11/9/15 | | | | 700,000 | EUR | | | 861,711 | (g) |

Bank of America Corp., Junior Subordinated | | | 6.500 | % | | | 10/23/24 | | | | 220,000 | | | | 226,325 | (f)(h) |

Bank of America Corp., Junior Subordinated Notes | | | 5.200 | % | | | 6/1/23 | | | | 480,000 | | | | 440,160 | (f)(h) |

Barclays Bank PLC, Subordinated Notes | | | 7.625 | % | | | 11/21/22 | | | | 560,000 | | | | 618,100 | |

Barclays PLC, Junior Subordinated Bonds | | | 8.250 | % | | | 12/15/18 | | | | 600,000 | | | | 623,926 | (f)(h) |

See Notes to Financial Statements.

| | |

| Western Asset High Yield Fund 2014 Semi-Annual Report | | 11 |

Schedule of investments (unaudited) (cont’d)

November 30, 2014

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Banks — continued | | | | | | | | | | | | | | | | |

CIT Group Inc., Senior Notes | | | 5.000 | % | | | 8/15/22 | | | | 1,410,000 | | | $ | 1,454,062 | |

CIT Group Inc., Senior Notes | | | 5.000 | % | | | 8/1/23 | | | | 1,610,000 | | | | 1,658,300 | |

Citigroup Inc., Junior Subordinated Bonds | | | 6.300 | % | | | 5/15/24 | | | | 1,170,000 | | | | 1,162,395 | (f)(h) |

HSBC Holdings PLC, Junior Subordinated Bonds | | | 6.375 | % | | | 9/17/24 | | | | 950,000 | | | | 971,850 | (f)(h) |

JPMorgan Chase & Co., Junior Subordinated Bonds | | | 5.150 | % | | | 5/1/23 | | | | 680,000 | | | | 651,100 | (f)(h) |

M&T Bank Corp., Junior Subordinated Bonds | | | 6.875 | % | | | 6/15/16 | | | | 570,000 | | | | 579,682 | (h) |

Royal Bank of Scotland NV, Subordinated Notes | | | 7.750 | % | | | 5/15/23 | | | | 450,000 | | | | 527,903 | |

Royal Bank of Scotland PLC, Subordinated Notes | | | 13.125 | % | | | 3/19/22 | | | | 2,640,000 | AUD | | | 2,630,278 | (f)(g) |

Total Banks | | | | | | | | | | | | | | | 12,405,792 | |

Consumer Finance — 1.1% | | | | | | | | | | | | | | | | |

Ally Financial Inc., Senior Notes | | | 8.000 | % | | | 11/1/31 | | | | 430,000 | | | | 540,725 | |

First Cash Financial Services Inc., Senior Notes | | | 6.750 | % | | | 4/1/21 | | | | 380,000 | | | | 395,200 | |

Navient Corp., Senior Notes | | | 5.875 | % | | | 10/25/24 | | | | 1,240,000 | | | | 1,205,900 | |

SLM Corp., Medium-Term Notes, Senior Notes | | | 8.450 | % | | | 6/15/18 | | | | 1,260,000 | | | | 1,423,800 | |

SLM Corp., Medium-Term Notes, Senior Notes | | | 8.000 | % | | | 3/25/20 | | | | 230,000 | | | | 259,613 | |

TMX Finance LLC/TitleMax Finance Corp., Senior Secured Notes | | | 8.500 | % | | | 9/15/18 | | | | 910,000 | | | | 873,600 | (a) |

Total Consumer Finance | | | | | | | | | | | | | | | 4,698,838 | |

Diversified Financial Services — 1.0% | | | | | | | | | | | | | | | | |

ILFC E-Capital Trust I, Junior Subordinated Notes | | | 4.840 | % | | | 12/21/65 | | | | 1,000,000 | | | | 950,000 | (a)(f) |

International Lease Finance Corp., Senior Notes | | | 8.875 | % | | | 9/1/17 | | | | 530,000 | | | | 606,187 | |

International Lease Finance Corp., Senior Notes | | | 8.250 | % | | | 12/15/20 | | | | 2,040,000 | | | | 2,473,500 | |

Total Diversified Financial Services | | | | | | | | | | | | | | | 4,029,687 | |

Insurance — 0.3% | | | | | | | | | | | | | | | | |

Fidelity & Guaranty Life Holdings Inc., Senior Notes | | | 6.375 | % | | | 4/1/21 | | | | 1,380,000 | | | | 1,469,700 | (a) |

Real Estate Investment Trusts (REITs) — 0.9% | | | | | | | | | | | | | | | | |

CB Richard Ellis Services Inc., Senior Notes | | | 5.250 | % | | | 3/15/25 | | | | 1,100,000 | | | | 1,141,250 | |

CTR Partnership LP/CareTrust Capital Corp., Senior Notes | | | 5.875 | % | | | 6/1/21 | | | | 1,170,000 | | | | 1,193,400 | |

Geo Group Inc., Senior Notes | | | 5.125 | % | | | 4/1/23 | | | | 1,010,000 | | | | 989,800 | |

Geo Group Inc., Senior Notes | | | 5.875 | % | | | 10/15/24 | | | | 330,000 | | | | 336,600 | |

Total Real Estate Investment Trusts (REITs) | | | | | | | | | | | | | | | 3,661,050 | |

Real Estate Management & Development — 0.7% | | | | | | | | | | | | | | | | |

Greystar Real Estate Partners LLC, Senior Secured Notes | | | 8.250 | % | | | 12/1/22 | | | | 1,300,000 | | | | 1,329,250 | (a) |

Howard Hughes Corp., Senior Notes | | | 6.875 | % | | | 10/1/21 | | | | 1,580,000 | | | | 1,666,900 | (a) |

Total Real Estate Management & Development | | | | | | | | | | | | | | | 2,996,150 | |

Total Financials | | | | | | | | | | | | | | | 29,261,217 | |

See Notes to Financial Statements.

| | |

| 12 | | Western Asset High Yield Fund 2014 Semi-Annual Report |

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Health Care — 4.8% | | | | | | | | | | | | | | | | |

Biotechnology — 0.1% | | | | | | | | | | | | | | | | |

Grifols Worldwide Operations Ltd., Senior Notes | | | 5.250 | % | | | 4/1/22 | | | | 575,000 | | | $ | 592,250 | (a) |

Health Care Equipment & Supplies — 0.7% | | | | | | | | | | | | | | | | |

Lantheus Medical Imaging Inc., Senior Notes | | | 9.750 | % | | | 5/15/17 | | | | 2,850,000 | | | | 2,782,313 | |

Health Care Providers & Services — 3.2% | | | | | | | | | | | | | | | | |

Acadia Healthcare Co. Inc., Senior Notes | | | 12.875 | % | | | 11/1/18 | | | | 774,000 | | | | 882,360 | |

Centene Corp., Senior Notes | | | 4.750 | % | | | 5/15/22 | | | | 500,000 | | | | 505,000 | |

DJO Finance LLC/DJO Finance Corp., Senior Notes | | | 9.875 | % | | | 4/15/18 | | | | 810,000 | | | | 854,145 | |

DJO Finance LLC/DJO Finance Corp., Senior Subordinated Notes | | | 9.750 | % | | | 10/15/17 | | | | 1,050,000 | | | | 1,052,625 | |

ExamWorks Group Inc., Senior Notes | | | 9.000 | % | | | 7/15/19 | | | | 1,460,000 | | | | 1,554,900 | |

Fresenius Medical Care U.S. Finance II Inc., Senior Notes | | | 5.625 | % | | | 7/31/19 | | | | 1,000,000 | | | | 1,075,000 | (a) |

Fresenius Medical Care U.S. Finance II Inc., Senior Notes | | | 5.875 | % | | | 1/31/22 | | | | 1,420,000 | | | | 1,537,150 | (a) |

Fresenius Medical Care U.S. Finance II Inc., Senior Notes | | | 4.750 | % | | | 10/15/24 | | | | 30,000 | | | | 30,075 | (a) |

HCA Inc., Notes | | | 7.690 | % | | | 6/15/25 | | | | 1,415,000 | | | | 1,570,650 | |

HCA Inc., Senior Notes | | | 7.500 | % | | | 2/15/22 | | | | 250,000 | | | | 286,250 | |

HCA Inc., Senior Secured Notes | | | 5.000 | % | | | 3/15/24 | | | | 850,000 | | | | 860,625 | |

IASIS Healthcare LLC/IASIS Capital Corp., Senior Notes | | | 8.375 | % | | | 5/15/19 | | | | 2,270,000 | | | | 2,383,500 | |

Universal Hospital Services Inc., Secured Notes | | | 7.625 | % | | | 8/15/20 | | | | 1,140,000 | | | | 1,031,700 | |

Total Health Care Providers & Services | | | | | | | | | | | | | | | 13,623,980 | |

Pharmaceuticals — 0.8% | | | | | | | | | | | | | | | | |

JLL/Delta Dutch Newco BV, Senior Notes | | | 7.500 | % | | | 2/1/22 | | | | 2,120,000 | | | | 2,183,600 | (a) |

Salix Pharmaceuticals Ltd., Senior Notes | | | 6.000 | % | | | 1/15/21 | | | | 1,160,000 | | | | 1,183,200 | (a) |

Total Pharmaceuticals | | | | | | | | | | | | | | | 3,366,800 | |

Total Health Care | | | | | | | | | | | | | | | 20,365,343 | |

| Industrials — 14.3% | | | | | | | | | | | | | | | | |

Aerospace & Defense — 2.0% | | | | | | | | | | | | | | | | |

Alliant Techsystems Inc., Senior Notes | | | 5.250 | % | | | 10/1/21 | | | | 210,000 | | | | 212,625 | (a) |

CBC Ammo LLC/CBC FinCo Inc., Senior Notes | | | 7.250 | % | | | 11/15/21 | | | | 1,710,000 | | | | 1,692,900 | (a) |

Ducommun Inc., Senior Notes | | | 9.750 | % | | | 7/15/18 | | | | 1,980,000 | | | | 2,143,350 | |

Erickson Inc., Secured Notes | | | 8.250 | % | | | 5/1/20 | | | | 2,009,000 | | | | 1,888,460 | |

Huntington Ingalls Industries Inc., Senior Notes | | | 5.000 | % | | | 12/15/21 | | | | 1,450,000 | | | | 1,473,562 | (a) |

LMI Aerospace Inc., Secured Notes | | | 7.375 | % | | | 7/15/19 | | | | 630,000 | | | | 623,700 | (a) |

Triumph Group Inc., Senior Notes | | | 5.250 | % | | | 6/1/22 | | | | 450,000 | | | | 454,500 | |

Total Aerospace & Defense | | | | | | | | | | | | | | | 8,489,097 | |

Air Freight & Logistics — 0.2% | | | | | | | | | | | | | | | | |

XPO Logistics Inc., Senior Notes | | | 7.875 | % | | | 9/1/19 | | | | 760,000 | | | | 807,500 | (a) |

See Notes to Financial Statements.

| | |

| Western Asset High Yield Fund 2014 Semi-Annual Report | | 13 |

Schedule of investments (unaudited) (cont’d)

November 30, 2014

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Airlines — 1.8% | | | | | | | | | | | | | | | | |

Air Canada, Pass-Through Trust, Secured Notes | | | 6.625 | % | | | 5/15/18 | | | | 330,000 | | | $ | 341,022 | (a) |

America West Airlines, Pass-Through Certificates, Secured Notes | | | 7.100 | % | | | 4/2/21 | | | | 66,997 | | | | 74,032 | |

American Airlines, Pass-Through Trust, Secured Bonds | | | 5.625 | % | | | 1/15/21 | | | | 310,944 | | | | 318,717 | (a) |

American Airlines, Pass-Through Trust, Senior Secured Bonds | | | 5.600 | % | | | 7/15/20 | | | | 1,416,813 | | | | 1,445,149 | (a) |

Delta Air Lines Inc., Pass-Through Trust, Secured Notes | | | 6.875 | % | | | 5/7/19 | | | | 392,022 | | | | 435,145 | (a) |

Delta Air Lines Inc., Secured Notes | | | 6.375 | % | | | 1/2/16 | | | | 230,000 | | | | 239,200 | (a) |

United Airlines Inc., Pass Through Trust, Secured Notes | | | 4.750 | % | | | 4/11/22 | | | | 1,390,000 | | | | 1,374,363 | |

United Airlines Inc., Pass-Through Certificates | | | 7.373 | % | | | 12/15/15 | | | | 184,685 | | | | 194,140 | |

United Airlines Inc., Pass-Through Certificates | | | 8.388 | % | | | 11/1/20 | | | | 277,501 | | | | 286,173 | |

United Airlines Inc., Pass-Through Certificates, Secured Bond | | | 5.375 | % | | | 8/15/21 | | | | 300,000 | | | | 304,500 | |

United Airlines Inc., Pass-Through Certificates, Secured Notes | | | 9.250 | % | | | 5/10/17 | | | | 388,710 | | | | 424,666 | |

US Airways, Pass-Through Trust, Secured Bonds | | | 6.750 | % | | | 6/3/21 | | | | 1,851,637 | | | | 1,976,623 | |

Total Airlines | | | | | | | | | | | | | | | 7,413,730 | |

Building Products — 0.8% | | | | | | | | | | | | | | | | |

Ashton Woods USA LLC/Ashton Woods Finance Co., Senior Notes | | | 6.875 | % | | | 2/15/21 | | | | 1,420,000 | | | | 1,384,500 | (a) |

Griffon Corp., Senior Notes | | | 5.250 | % | | | 3/1/22 | | | | 1,900,000 | | | | 1,816,875 | |

Total Building Products | | | | | | | | | | | | | | | 3,201,375 | |

Commercial Services & Supplies — 1.9% | | | | | | | | | | | | | | | | |

Garda World Security Corp., Senior Notes | | | 7.250 | % | | | 11/15/21 | | | | 660,000 | | | | 660,000 | (a) |

JM Huber Corp., Senior Notes | | | 9.875 | % | | | 11/1/19 | | | | 450,000 | | | | 498,375 | (a) |

Monitronics International Inc., Senior Notes | | | 9.125 | % | | | 4/1/20 | | | | 1,180,000 | | | | 1,168,200 | |

Taylor Morrison Communities Inc./Monarch Communities Inc., Senior Notes | | | 7.750 | % | | | 4/15/20 | | | | 202,000 | | | | 216,140 | (a) |

Taylor Morrison Communities Inc./Monarch Communities Inc., Senior Notes | | | 5.250 | % | | | 4/15/21 | | | | 710,000 | | | | 713,550 | (a) |

United Rentals North America Inc., Senior Notes | | | 5.750 | % | | | 11/15/24 | | | | 2,870,000 | | | | 2,977,625 | |

West Corp., Senior Notes | | | 5.375 | % | | | 7/15/22 | | | | 1,960,000 | | | | 1,871,800 | (a) |

Total Commercial Services & Supplies | | | | | | | | | | | | | | | 8,105,690 | |

Construction & Engineering — 1.5% | | | | | | | | | | | | | | | | |

Aecom Technology Corp., Senior Notes | | | 5.875 | % | | | 10/15/24 | | | | 1,450,000 | | | | 1,533,375 | (a) |

Ausdrill Finance Pty Ltd., Senior Notes | | | 6.875 | % | | | 11/1/19 | | | | 1,450,000 | | | | 1,214,375 | (a) |

Michael Baker Holdings LLC/Michael Baker Finance Corp., Senior Notes | | | 8.875 | % | | | 4/15/19 | | | | 2,660,000 | | | | 2,633,400 | (a)(d) |

Modular Space Corp., Secured Notes | | | 10.250 | % | | | 1/31/19 | | | | 860,000 | | | | 864,300 | (a) |

Total Construction & Engineering | | | | | | | | | | | | | | | 6,245,450 | |

Electrical Equipment — 0.6% | | | | | | | | | | | | | | | | |

International Wire Group Holdings Inc., Senior Secured Notes | | | 8.500 | % | | | 10/15/17 | | | | 610,000 | | | | 646,600 | (a) |

See Notes to Financial Statements.

| | |

| 14 | | Western Asset High Yield Fund 2014 Semi-Annual Report |

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Electrical Equipment — continued | | | | | | | | | | | | | | | | |

NES Rentals Holdings Inc., Senior Secured Notes | | | 7.875 | % | | | 5/1/18 | | | | 710,000 | | | $ | 734,850 | (a) |

WESCO Distribution Inc., Senior Notes | | | 5.375 | % | | | 12/15/21 | | | | 1,040,000 | | | | 1,059,500 | |

Total Electrical Equipment | | | | | | | | | | | | | | | 2,440,950 | |

Machinery — 1.1% | | | | | | | | | | | | | | | | |

CTP Transportation Products LLC/CTP Finance Inc., Senior Secured Notes | | | 8.250 | % | | | 12/15/19 | | | | 680,000 | | | | 724,200 | (a) |

Dematic SA/DH Services Luxembourg Sarl, Senior Notes | | | 7.750 | % | | | 12/15/20 | | | | 2,295,000 | | | | 2,426,963 | (a) |

Global Brass and Copper Inc., Senior Secured Notes | | | 9.500 | % | | | 6/1/19 | | | | 820,000 | | | | 894,825 | |

SPL Logistics Escrow LLC/SPL Logistics Finance Corp., Senior Secured Notes | | | 8.875 | % | | | 8/1/20 | | | | 550,000 | | | | 589,875 | (a) |

Total Machinery | | | | | | | | | | | | | | | 4,635,863 | |

Marine — 0.7% | | | | | | | | | | | | | | | | |

Horizon Lines LLC, Secured Notes | | | 13.000 | % | | | 10/15/16 | | | | 232,137 | | | | 227,061 | (b)(d) |

Horizon Lines LLC, Senior Secured Notes | | | 11.000 | % | | | 10/15/16 | | | | 734,000 | | | | 741,340 | (b) |

Navios Maritime Acquisition Corp./Navios Acquisition Finance U.S. Inc., Senior Secured Notes | | | 8.125 | % | | | 11/15/21 | | | | 1,100,000 | | | | 1,122,000 | (a) |

Ultrapetrol Bahamas Ltd., Senior Secured Notes | | | 8.875 | % | | | 6/15/21 | | | | 990,000 | | | | 1,059,300 | |

Total Marine | | | | | | | | | | | | | | | 3,149,701 | |

Professional Services — 0.1% | | | | | | | | | | | | | | | | |

IHS Inc., Senior Notes | | | 5.000 | % | | | 11/1/22 | | | | 510,000 | | | | 517,650 | (a) |

Road & Rail — 1.0% | | | | | | | | | | | | | | | | |

Flexi-Van Leasing Inc., Senior Notes | | | 7.875 | % | | | 8/15/18 | | | | 1,030,000 | | | | 1,063,475 | (a) |

Florida East Coast Holdings Corp., Senior Notes | | | 9.750 | % | | | 5/1/20 | | | | 380,000 | | | | 382,850 | (a) |

Florida East Coast Holdings Corp., Senior Secured Notes | | | 6.750 | % | | | 5/1/19 | | | | 630,000 | | | | 644,175 | (a) |

Jack Cooper Holdings Corp., Senior Secured Notes | | | 9.250 | % | | | 6/1/20 | | | | 1,570,000 | | | | 1,664,200 | (a) |

Jurassic Holdings III Inc., Secured Notes | | | 6.875 | % | | | 2/15/21 | | | | 620,000 | | | | 610,700 | (a) |

Total Road & Rail | | | | | | | | | | | | | | | 4,365,400 | |

Trading Companies & Distributors — 1.2% | | | | | | | | | | | | | | | | |

Ashtead Capital Inc., Secured Notes | | | 5.625 | % | | | 10/1/24 | | | | 820,000 | | | | 865,100 | (a) |

Ashtead Capital Inc., Senior Secured Notes | | | 6.500 | % | | | 7/15/22 | | | | 1,770,000 | | | | 1,898,325 | (a) |

H&E Equipment Services Inc., Senior Notes | | | 7.000 | % | | | 9/1/22 | | | | 1,440,000 | | | | 1,530,000 | |

KLX Inc., Senior Notes | | | 5.875 | % | | | 12/1/22 | | | | 940,000 | | | | 956,450 | (a) |

Total Trading Companies & Distributors | | | | | | | | | | | | | | | 5,249,875 | |

Transportation — 1.4% | | | | | | | | | | | | | | | | |

CMA CGM, Senior Notes | | | 8.500 | % | | | 4/15/17 | | | | 400,000 | | | | 408,000 | (a) |

Hapag-Lloyd AG, Senior Notes | | | 9.750 | % | | | 10/15/17 | | | | 1,400,000 | | | | 1,435,000 | (a) |

Neovia Logistics Intermediate Holdings LLC/Logistics Intermediate Finance Corp., Senior Notes | | | 10.000 | % | | | 2/15/18 | | | | 1,180,000 | | | | 1,206,550 | (a)(d) |

See Notes to Financial Statements.

| | |

| Western Asset High Yield Fund 2014 Semi-Annual Report | | 15 |

Schedule of investments (unaudited) (cont’d)

November 30, 2014

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Transportation — continued | | | | | | | | | | | | | | | | |

Syncreon Group BV/Syncreon Global Finance US Inc., Senior Notes | | | 8.625 | % | | | 11/1/21 | | | | 2,200,000 | | | $ | 2,139,500 | (a) |

Watco Cos., LLC/Watco Finance Corp., Senior Notes | | | 6.375 | % | | | 4/1/23 | | | | 910,000 | | | | 925,925 | (a) |

Total Transportation | | | | | | | | | | | | | | | 6,114,975 | |

Total Industrials | | | | | | | | | | | | | | | 60,737,256 | |

| Information Technology — 2.2% | | | | | | | | | | | | | | | | |

Electronic Equipment, Instruments & Components — 0.5% | | | | | | | | | | | | | | | | |

Interface Security Systems Holdings Inc./Interface Security Systems LLC, Senior Secured Notes | | | 9.250 | % | | | 1/15/18 | | | | 1,660,000 | | | | 1,684,900 | |

KEMET Corp., Senior Secured Notes | | | 10.500 | % | | | 5/1/18 | | | | 230,000 | | | | 237,475 | |

Total Electronic Equipment, Instruments & Components | | | | | | | | | | | | | | | 1,922,375 | |

Internet Software & Services — 0.7% | | | | | | | | | | | | | | | | |

Ancestry.com Inc., Senior Notes | | | 9.625 | % | | | 10/15/18 | | | | 490,000 | | | | 486,325 | (a)(d) |

Ancestry.com Inc., Senior Notes | | | 11.000 | % | | | 12/15/20 | | | | 790,000 | | | | 888,750 | |

Equinix Inc., Senior Notes | | | 5.375 | % | | | 1/1/22 | | | | 850,000 | | | | 854,250 | |

Equinix Inc., Senior Notes | | | 5.750 | % | | | 1/1/25 | | | | 860,000 | | | | 866,450 | |

Total Internet Software & Services | | | | | | | | | | | | | | | 3,095,775 | |

IT Services — 0.9% | | | | | | | | | | | | | | | | |

Compiler Finance Subordinated Inc., Senior Notes | | | 7.000 | % | | | 5/1/21 | | | | 1,650,000 | | | | 1,435,500 | (a) |

First Data Corp., Senior Notes | | | 12.625 | % | | | 1/15/21 | | | | 660,000 | | | | 785,400 | |

First Data Corp., Senior Subordinated Notes | | | 11.750 | % | | | 8/15/21 | | | | 1,102,000 | | | | 1,275,565 | |

Interactive Data Corp., Senior Notes | | | 5.875 | % | | | 4/15/19 | | | | 500,000 | | | | 501,875 | (a) |

Total IT Services | | | | | | | | | | | | | | | 3,998,340 | |

Software — 0.1% | | | | | | | | | | | | | | | | |

Audatex North America Inc., Senior Notes | | | 6.000 | % | | | 6/15/21 | | | | 370,000 | | | | 383,875 | (a) |

Total Information Technology | | | | | | | | | | | | | | | 9,400,365 | |

| Materials — 9.7% | | | | | | | | | | | | | | | | |

Chemicals — 1.4% | | | | | | | | | | | | | | | | |

Axiall Corp., Senior Notes | | | 4.875 | % | | | 5/15/23 | | | | 500,000 | | | | 483,750 | |

Eagle Spinco Inc., Senior Subordinated Notes | | | 4.625 | % | | | 2/15/21 | | | | 940,000 | | | | 923,550 | |

Eco Services Operations LLC/Eco Finance Corp., Senior Notes | | | 8.500 | % | | | 11/1/22 | | | | 560,000 | | | | 579,600 | (a) |

Hexion US Finance Corp., Senior Secured Notes | | | 6.625 | % | | | 4/15/20 | | | | 1,270,000 | | | | 1,228,725 | |

HIG BBC Intermediate Holdings LLC/HIG BBC Holdings Corp., Senior Notes | | | 10.500 | % | | | 9/15/18 | | | | 830,000 | | | | 813,400 | (a)(d) |

Kerling PLC, Senior Secured Notes | | | 10.625 | % | | | 2/1/17 | | | | 724,000 | EUR | | | 924,565 | (a) |

KP Germany Erste GmbH, Senior Secured Notes | | | 11.625 | % | | | 7/15/17 | | | | 440,000 | EUR | | | 597,726 | (a) |

KP Germany Erste GmbH, Senior Secured Notes | | | 11.625 | % | | | 7/15/17 | | | | 330,000 | EUR | | | 448,295 | (g) |

Total Chemicals | | | | | | | | | | | | | | | 5,999,611 | |

See Notes to Financial Statements.

| | |

| 16 | | Western Asset High Yield Fund 2014 Semi-Annual Report |

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Construction Materials — 0.5% | | | | | | | | | | | | | | | | |

American Builders & Contractors Supply Co. Inc., Senior Notes | | | 5.625 | % | | | 4/15/21 | | | | 1,110,000 | | | $ | 1,121,100 | (a) |

Hardwoods Acquisition Inc., Senior Secured Notes | | | 7.500 | % | | | 8/1/21 | | | | 1,200,000 | | | | 1,206,000 | (a) |

Total Construction Materials | | | | | | | | | | | | | | | 2,327,100 | |

Containers & Packaging — 3.2% | | | | | | | | | | | | | | | | |

Ardagh Finance Holdings SA, Senior Notes | | | 8.625 | % | | | 6/15/19 | | | | 2,120,000 | | | | 2,183,600 | (a)(d) |

Ardagh Packaging Finance PLC/Ardagh MP Holdings USA Inc., Senior Notes | | | 9.125 | % | | | 10/15/20 | | | | 510,000 | | | | 546,975 | (a) |

Ardagh Packaging Finance PLC/Ardagh MP Holdings USA Inc., Senior Notes | | | 7.000 | % | | | 11/15/20 | | | | 202,941 | | | | 206,493 | (a) |

Ardagh Packaging Finance PLC/Ardagh MP Holdings USA Inc., Senior Notes | | | 6.750 | % | | | 1/31/21 | | | | 1,470,000 | | | | 1,499,400 | (a) |

BWAY Holding Co., Senior Notes | | | 9.125 | % | | | 8/15/21 | | | | 990,000 | | | | 1,019,700 | (a) |

Coveris Holdings SA, Senior Notes | | | 7.875 | % | | | 11/1/19 | | | | 2,250,000 | | | | 2,334,375 | (a) |

Graphic Packaging International Inc., Senior Notes | | | 4.875 | % | | | 11/15/22 | | | | 530,000 | | | | 532,650 | |

Pactiv LLC, Senior Bonds | | | 8.375 | % | | | 4/15/27 | | | | 1,795,000 | | | | 1,893,725 | |

Pactiv LLC, Senior Notes | | | 7.950 | % | | | 12/15/25 | | | | 640,000 | | | | 665,600 | |

Reynolds Group Issuer Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer (Luxembourg) SA, Senior Secured Notes | | | 5.750 | % | | | 10/15/20 | | | | 2,490,000 | | | | 2,561,587 | |

Total Containers & Packaging | | | | | | | | | | | | | | | 13,444,105 | |

Metals & Mining — 3.7% | | | | | | | | | | | | | | | | |

ArcelorMittal, Senior Notes | | | 6.750 | % | | | 2/25/22 | | | | 1,675,000 | | | | 1,820,516 | |

Barminco Finance Pty Ltd., Senior Notes | | | 9.000 | % | | | 6/1/18 | | | | 1,480,000 | | | | 1,272,800 | (a) |

Coeur Mining Inc., Senior Notes | | | 7.875 | % | | | 2/1/21 | | | | 970,000 | | | | 761,450 | |

FMG Resources (August 2006) Pty Ltd., Senior Notes | | | 6.875 | % | | | 2/1/18 | | | | 702,222 | | | | 660,089 | (a) |

FMG Resources (August 2006) Pty Ltd., Senior Notes | | | 6.875 | % | | | 4/1/22 | | | | 2,800,000 | | | | 2,506,000 | (a) |

Midwest Vanadium Pty Ltd., Senior Secured Notes | | | 11.500 | % | | | 2/15/18 | | | | 1,385,000 | | | | 207,750 | (a)(b)(e) |

Mirabela Nickel Ltd., Subordinated Notes | | | 1.000 | % | | | 9/10/44 | | | | 14,936 | | | | 0 | (a)(b)(c)(i) |

Prince Mineral Holding Corp., Senior Secured Notes | | | 12.000 | % | | | 12/15/19 | | | | 800,000 | | | | 872,000 | (a) |

Ryerson Inc./Joseph T. Ryerson & Son Inc., Senior Secured Notes | | | 9.000 | % | | | 10/15/17 | | | | 830,000 | | | | 846,600 | |

Schaeffler Holding Finance BV, Senior Secured Bonds | | | 6.875 | % | | | 8/15/18 | | | | 300,000 | | | | 313,875 | (a)(d) |

Schaeffler Holding Finance BV, Senior Secured Notes | | | 6.875 | % | | | 8/15/18 | | | | 1,320,000 | EUR | | | 1,727,525 | (a)(d) |

Schaeffler Holding Finance BV, Senior Secured Notes | | | 6.750 | % | | | 11/15/22 | | | | 1,340,000 | | | | 1,413,700 | (a)(d) |

St. Barbara Ltd., Senior Secured Notes | | | 8.875 | % | | | 4/15/18 | | | | 710,000 | | | | 575,100 | (a) |

Thompson Creek Metals Co. Inc., Senior Notes | | | 12.500 | % | | | 5/1/19 | | | | 1,802,000 | | | | 1,910,120 | |

Thompson Creek Metals Co. Inc., Senior Secured Notes | | | 9.750 | % | | | 12/1/17 | | | | 590,000 | | | | 632,038 | |

Total Metals & Mining | | | | | | | | | | | | | | | 15,519,563 | |

See Notes to Financial Statements.

| | |

| Western Asset High Yield Fund 2014 Semi-Annual Report | | 17 |

Schedule of investments (unaudited) (cont’d)

November 30, 2014

Western Asset High Yield Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Paper & Forest Products — 0.9% | | | | | | | | | | | | | | | | |

Appvion Inc., Secured Notes | | | 9.000 | % | | | 6/1/20 | | | | 1,880,000 | | | $ | 1,372,400 | (a) |

Resolute Forest Products Inc., Senior Notes | | | 5.875 | % | | | 5/15/23 | | | | 1,270,000 | | | | 1,212,850 | |

Verso Paper Holdings LLC/Verso Paper Inc., Senior Secured Notes | | | 11.750 | % | | | 1/15/19 | | | | 1,460,000 | | | | 1,423,500 | |

Total Paper & Forest Products | | | | | | | | | | | | | | | 4,008,750 | |

Total Materials | | | | | | | | | | | | | | | 41,299,129 | |

| Telecommunication Services — 6.6% | | | | | | | | | | | | | | | | |

Diversified Telecommunication Services — 2.7% | | | | | | | | | | | | | | | | |

CCOH Safari LLC, Senior Bonds | | | 5.500 | % | | | 12/1/22 | | | | 160,000 | | | | 161,800 | |

CCOH Safari LLC, Senior Bonds | | | 5.750 | % | | | 12/1/24 | | | | 260,000 | | | | 261,625 | |

CenturyLink Inc., Senior Notes | | | 6.450 | % | | | 6/15/21 | | | | 1,050,000 | | | | 1,144,500 | |