UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the

Securities Exchange Act of 1934

Check the appropriate box:

x Preliminary Information Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

o Definitive Information Statement

NATURALNANO, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14c-5(g)

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule, or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

NATURALNANO, INC.

11 Schoen Place

Pittsford, New York 14534

July __, 2013

Dear Stockholders:

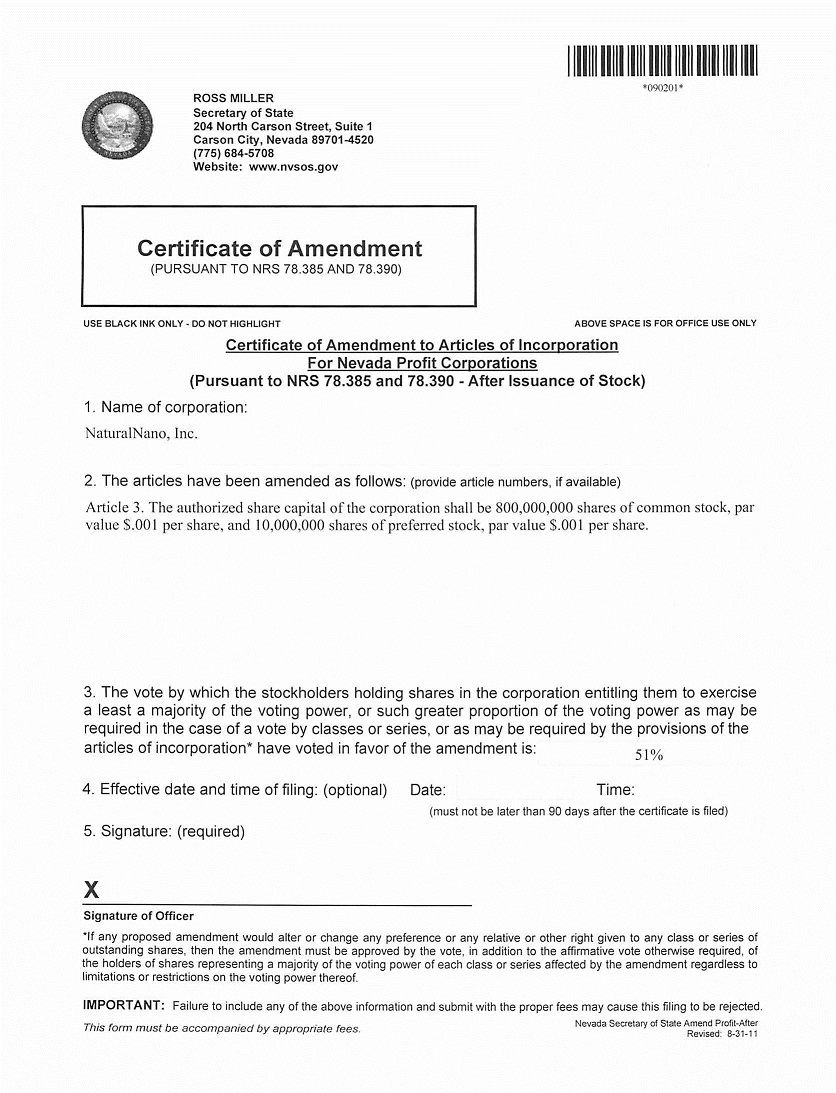

The enclosed Information Statement is being furnished to the holders of record of the shares of the common stock (the “Common Stock”) of NaturalNano, Inc., a Nevada corporation (the “Company” or “NaturalNano”), as of the close of business on the record date July 1, 2013 (the “Record Date”). The purpose of the Information Statement is to notify our stockholders that on July 1, 2013, the Company received an unanimous written consent in lieu of a meeting from the members of the Board of Directors (the “Board”) and a written consent of the holder (the “Series D Stockholder”) of all of the issued and outstanding shares of the Company’s Series D Preferred Stock (the “Written Consent”). The Written Consent adopted resolutions which authorized the Company to act on a proposal to amend its articles of incorporation (the “Articles”) to increase the Company’s authorized share capital from 294,117,647 shares to 800,000,000 shares of common stock (the “Amendment”).

You are urged to read the Information Statement in its entirety for a description of the action taken. The action will become effective on a date that is not earlier than twenty one (21) calendar days after this Information Statement is first mailed to our stockholders.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No action is required by you. The enclosed Information Statement is being furnished to you to inform you that the foregoing action has been approved by the Series D Stockholder. Because the Series D Stockholder has voted in favor of the foregoing action, and has sufficient voting power to approve such action through his ownership of Series D Preferred Stock, which provides that the holder of the Series D Preferred Stock is entitled to 51% of the total votes, no further action is required. Accordingly, no other stockholder consents will be solicited in connection with the transactions described in this Information Statement. The Board is not soliciting your proxy in connection with the adoption of the resolution, and proxies are not requested from stockholders.

This Information Statement is being mailed on or about July __, 2013 to stockholders of record on the Record Date.

| | Sincerely, | |

| | | | |

| | By: | /s/ James Wemett | |

| | | James Wemett | |

| | | President and Chief Financial Officer | |

| | | | |

NATURALNANO, INC.

11 Schoen Place

Pittsford, New York 14534

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

_____________________________________

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being furnished to the holders of record of the shares of the common stock (the “Common Stock”) of NaturalNano, Inc., a Nevada corporation (the “Company or “NaturalNano”), as of the close of business on the record date, July 1, 2013 (the “Record Date”). The purpose of the Information Statement is to notify our stockholders that on July 1, 2013, the Company received an unanimous written consent in lieu of a meeting from the members of the Board of Directors (the “Board”) and a written consent of the holder of all of the issued and outstanding shares of the Company’s Series D Preferred Stock (the “Written Consent”). The Written Consent adopted resolutions which authorized the Company to act on a proposal to amend its articles of incorporation (the “Articles”) to increase the Company’s authorized share capital from 294,117,647 shares to 800,000,000 shares of common stock (the “Amendment”).

The action will become effective on a date that is not earlier than twenty one (21) calendar days after this Information Statement is first mailed to our stockholders, when we file a Certificate of Amendment with the Secretary of State of the State of Nevada.

Because the Series D Stockholder has voted in favor of the foregoing action, and has sufficient voting power to approve such action through his ownership of Series D Preferred Stock, which provides that the Series D Preferred Stock is entitled to 51% of the total votes. Accordingly, no other stockholder consents will be solicited in connection with the Amendment. The Board is not soliciting your proxy in connection with the adoption of the resolution, and proxies are not requested from stockholders.

In accordance with our bylaws, our Board has fixed the close of business on July 1, 2013 as the record date for determining the stockholders entitled to notice of the above noted actions. This Information Statement is being mailed on or about July __, 2013 to stockholders of record on the Record Date.

Our stockholders are not entitled to appraisal rights under the Company’s Articles, bylaws or Nevada corporate law with respect to the Amendment.

DISTRIBUTION AND COSTS

We will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. In addition, we will only deliver one Information Statement to multiple security holders sharing an address, unless we have received contrary instructions from one or more of the security holders. Also, we will promptly deliver a separate copy of this Information Statement and future stockholder communication documents to any security holder at a shared address to which a single copy of this Information Statement was delivered, or deliver a single copy of this Information Statement and future stockholder communication documents to any security holder or holders sharing an address to which multiple copies are now delivered, upon written request to us at our address noted above.

Security holders may also address future requests regarding delivery of information statements by contacting us at the address noted above.

VOTE REQUIRED; MANNER OF APPROVAL

Approval to implement the Amendment requires the affirmative vote of the holders of a majority of the voting power of the Company. The Series D Stockholder has sufficient voting power to approve such action through his ownership of Series D Preferred Stock. Said preferred stock provides that the Series D Preferred Stock votes together as a single class with the Company’s common stock and any other classes or series of shares entitled to vote with the common stock, with the holders of the Series D Preferred Stock entitled to 51% of the total votes. Accordingly, no other vote or consent is required, and stockholder consents will not be solicited in connection with the transaction described in this Information Statement. The Board is not soliciting proxies in connection with the adoption of these proposals, and proxies are not requested from stockholders.

In addition, the Nevada Revised Statutes (“NRS”) require the affirmative vote of the holders of a majority of the voting power of the Company and provides in substance that stockholders may take action without a meeting of the stockholders and without prior notice if a consent or consents in writing, setting forth the action so taken, is signed by the holders of the outstanding voting shares holding not less than the minimum number of votes that would be necessary to approve such action at a stockholders meeting. The action is effective when written consents from holders of record of a majority of the outstanding shares of voting stock are executed and delivered to the Company.

There are currently one hundred (100) shares of the Company’s Series D Preferred Stock issued and outstanding, all of which are held by the Series D Stockholder, James Wemett, our President, Chief Financial Officer and a director. Because the Series D Stockholder has voted in favor of the foregoing action, and has sufficient voting power to approve such action through his ownership of Series D Preferred Stock, no other stockholder votes or consents are necessary to implement the Amendment. In accordance with our bylaws, the Board has fixed the close of business on July __, 2013 as the record date for determining the stockholders entitled to vote or give written consent.

On June 10, 2013, the Board and the Series D Stockholder executed and delivered to the Company the Written Consents. Accordingly, in compliance with the NRS, at least a majority of the outstanding voting shares has approved the Amendment. As a result, no vote or proxy is required by the stockholders to approve the adoption of the foregoing action.

REASON FOR THE AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK FROM 294,117,647 SHARES TO 800,000,000 SHARES.

The Company’s current Articles authorize the issuance of 294,117,647 shares of common stock of which 277,030,466 shares are issued and outstanding; 10,000,000 shares of preferred stock, par value $0.001 per share, of which 147,500 shares of Series B preferred stock are issued and outstanding, 7,590,968 shares of Series C preferred stock are issued and outstanding and 100 shares of Series D preferred stock are issued and outstanding, as of June 24, 2013. Each share of Series B preferred stock and Series C preferred stock is convertible into 160 shares of the Company’s common stock.

As of July 1, 2013, the Company has outstanding promissory notes which are convertible into an aggregate of shares of common stock based on the market price of the Company's common stock on the date of conversion.

The Company also has outstanding warrants and options to purchase shares of the Company’s common stock.

Accordingly, the Company does not have sufficient authorized shares of common stock to satisfy the conversion and/or exercise of all outstanding convertible debt, preferred stock, warrants and options. The Board believes that the Amendment will provide the Company with the ability to meet its obligations to issue shares upon such conversion or exercise of such instruments and in accordance with the Company’s contractual obligations thereunder.

The additional shares of common stock for which authorization is sought would be part of the existing class of the Company’s common stock and, if and when issued, would have the same rights and privileges as the currently outstanding shares of common stock. Current stockholders do not have preemptive rights under the Articles and will not have such rights with respect to additional authorized shares of common stock.

In the future, the issuance of additional authorized shares of common stock may have the effect of diluting the earnings per share and book value per share, as well as the stock ownership and voting rights, of the then outstanding shares of common stock.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table lists, as of July 1, 2013, the number of shares of common stock beneficially owned by (i) each person or entity known to the Company to be the beneficial owner of more than 5% of the outstanding common stock; (ii) each officer and director of our Company; and (iii) all officers and directors as a group. Information relating to beneficial ownership of common stock by our principal stockholders and management is based upon information furnished by each person using “beneficial ownership” concepts under the rules of the Securities and Exchange Commission. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

The percentages below are calculated based on 277,030,466 shares of common stock outstanding as of July 1, 2013. Unless otherwise indicated, the business address of each such person is c/o NaturalNano, Inc., 11 Schoen Place, Pittsfield, New York 14534.

| Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | Percent of Class |

| James Wemett, Sole Officer and Director | | 1,677,665(1)(2)(3) | | 51% |

| Alexander Ruckdaschel, Director | | 73,529 | | * |

| All directors and executive officers as a group (2 persons) | | 1,751,094 | | * |

| | | | | |

____________

*Less than 1%

| (1) | Includes 100 shares of Series D Preferred Stock which entitles the holder to 51% of the issued and outstanding voting shares of the Company. |

| (2) | Includes currently exercisable options to purchase 58,824 shares of common stock at $0.85 per share held by Technology Innovations, LLC (“TI”). James Wemett is an equity holder of TI. |

| (3) | Includes currently exercisable options to purchase 58,824 shares of common stock at $0.85 per share held by Technology Innovations, LLC (“TI”). James Wemett is an equity holder of TI. |

OTHER INFORMATION

For more detailed information about the Company, including financial statements, you may refer to our recent Form 10-Q for the quarterly period ended March 31, 2013, filed with the Securities and Exchange Commission on May 20, 2013. This information may be found at the SEC’s EDGAR database at www.sec.gov. Our audited financial statements are contained in our Form 10-K for the year ended December 31, 2012, also available at www.sec.gov.

Upon written request, we will furnish without charge to record and beneficial holders of our common stock a copy of any and all of the documents referred to in this Information Statement. These documents will be provided by first class mail. Please make your request to the address or phone number below.

OTHER MATTERS

The Board knows of no other matters other than those described in this Information Statement which have been approved or considered by the holders of a majority of the shares of the Company’s voting stock.

IF YOU HAVE ANY QUESTIONS REGARDING THIS INFORMATION STATEMENT, PLEASE CONTACT:

NaturalNano, Inc.

11 Schoen Place

Pittsford, New York 14534

| | By Order of the Board, | |

| | | | |

| | By: | /s/ James Wemett | |

| | | James Wemett | |

| | | President and Chief Financial Officer | |

| | | | |