UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number : 811-06113

The Caldwell & Orkin Funds, Inc.

(Exact name of registrant as specified in charter)

2502 N. Rocky Point Drive, Suite 665

Tampa, Florida 33607

(Address of principal executive offices) (Zip code)

Derek Pilecki

2502 N. Rocky Point Drive, Suite 665

Tampa, Florida 33607

(Name and address of agent for service)

Copies to:

Jennifer Merchant

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45256

Registrant’s telephone number, including area code: 1-813-282-7870

Date of fiscal year end: April 30

Date of reporting period: April 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | Caldwell & Orkin - |

| Table of Contents | Gator Capital Long/Short Fund |

| April 30, 2024 (Unaudited) | |

| | |

| Management’s Discussion of Fund Performance | 2 |

| Investment Results | 6 |

| Fund Holdings | 8 |

| Schedule of Investments | 9 |

| Schedule of Securities Sold Short | 12 |

| Statement of Assets and Liabilities | 14 |

| Statement of Operations | 15 |

| Statements of Changes in Net Assets | 16 |

| Financial Highlights | 17 |

| Notes to Financial Statements | 18 |

| Report of Independent Registered Public Accounting Firm | 25 |

| Liquidity Risk Management Program | 27 |

| Disclosure of Fund Expenses | 28 |

| Additional Information | 29 |

| Privacy Policy Disclosure | 33 |

| Caldwell & Orkin - | Management’s Discussion |

| Gator Capital Long/Short Fund | of Fund Performance |

| | April 30, 2024 (Unaudited) |

| | |

May 15, 2024

Dear Fellow Shareholder:

The Caldwell & Orkin – Gator Capital Long/Short Fund (the “Fund”) increased 27.41% over the six-month period ending on April 30, 2024. The S&P 500® Total Return Index (“S&P 500®”) increased 20.98% during the same period. For the 12-month period ending April 30, 2024, the Fund gained 34.65% while the S&P 500® gained 22.66%.

Past performance is no guarantee of future results.

Management Discussion and Analysis

The Fund outperformed the S&P 500® over the course of the fiscal year. The Fund outperformed Financial stocks (S&P 1500 Financials) which also performed in line with the broader market. Long positions in insurance, brokerage, asset management, and student lending drove the outperformance for the year. A number of short positions in the brokerage real estate, and banking sectors detracted from performance.

The top five equity contributors during the 2024 fiscal year were Jackson Financial, (long), Robinhood Markets (long), Victory Capital (long), SLM Corp. (long), and Meta (long) were the largest contributors to performance for the year.

The top five equity detractors during the 2024 fiscal year were Charles Schwab Corp. (short), Vornado (short), Empire State Realty Trust (short), Bank of Hawaii (short), and Progressive Corp. (short).

We ended the fiscal year with gross long exposure of 99% and gross short exposure of 31% for a total gross exposure of 130% and a net exposure of 69%.

Opportunity in Regional Banks

The recent turmoil at New York Community Bank (“NYCB”) has dragged down the stocks of small-to-mid-sized banks at the start of calendar year 2024. The exchange traded fund for mid-sized banks, the SPDR S&P Regional Banking ETF (“KRE”), underperformed the ETF for large banks, which is the Invesco KBW Bank ETF (“KBWB”), in the first calendar quarter of 2024. The KRE was down 3.33% while the KBWB was up 10.01%. The underperformance of the mid-sized banks versus the large banks continued in April. Large banks are perceived by investors as having less credit risk, more robust credit reserves, and more liquid balance sheets.

There are obvious headwinds that the banks are facing: tepid loan growth, competitive deposit environment, and an uncertain credit environment; however, we see opportunity in selected small-to-mid-sized regional banks (“SMID banks”). We think stock investors are overly pessimistic in their assessment of SMID bank credit concerns. We believe the larger issues for SMID banks are interest rate risk and loan volume growth. Regarding interest rates, we see banks having a wide disparity of performance based on the positioning of their securities portfolios, their percentage of fixed rate loans, and how they manage their deposit franchise. Many banks have navigated the move in higher rates well and remain well-positioned for

| 2 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | Management’s Discussion |

| Gator Capital Long/Short Fund | of Fund Performance |

| | April 30, 2024 (Unaudited) |

| | |

the current environment. We also see differences in how banks manage their loan growth. Some banks continue to grow loans and deposits and accept that margins in the near-term are narrower due to the inverted yield curve and competitive deposit environment. We think these banks will be rewarded when the yield curve normalizes, and they realize wider net interest margins on a larger book of business.

Credit Risk

Credit risk is perilous for banks. The current environment poses four areas where banks may experience heightened credit losses. The first area is office buildings. The second area is rent-regulated apartment buildings in New York City. The third is commercial estate properties (“CRE”) where the rapid rise in interest rates has caused the value of CRE to decline. The fourth is rapidly rising debt costs for borrowers with floating rate debt.

So far in the Q1 bank earnings season, banks have reported better than expected credit metrics. The increases in non-performing assets and criticized loans are not alarming given that bank credit metrics were at record lows in 2022 and 2023. We’ll have to remain vigilant about credit risk to see if metrics deteriorate in the coming quarters. In the meantime, we will stay focused on banks with historically strong credit cultures. As we meet with bank management teams, we remain alert for any changes in risk appetites. Many market participants have a negative view of bank managements’ ability to see pending problems in their loan portfolios. We note that risk management and monitoring of loan portfolios has improved from when we started investing in bank stocks. We realize that bank stock investors may need to see the other side of the credit cycle before putting higher multiples on bank stocks and this contributes to the current opportunity we see.

Interest Rate Risk

Market participants are divided on the outlook for banks. Some investors see an opportunity because banks are cheap and poised to benefit from interest rate cuts. Others are concerned about potential credit losses or rising interest rates. We believe selective opportunities exist, with certain banks offering attractive valuations and potential for earnings growth, while others are at risk as they have significant holdings of fixed-rate loans and securities on their books.

Banks benefit from higher reinvestment yields, but some banks have more near-term opportunity. If a bank has a lot of loans and securities maturing in the next year at low yields, they can take the proceeds from the loan payoff to make a new loan at today’s higher yield. Unfortunately, many banks made a lot of 5-year and 7-year fixed-rate loans in 2021 and 2022 that won’t mature until 2026 or as late as 2029.

In a more robust deposit environment, banks would generate loan growth which would allow new production to be put on the books at normalized spreads.

In 2022 and very early 2023, almost all banks paid aggressively low deposit rates even as the Federal Reserve raised the Federal Funds rate. Most bank customers had become accustomed to the zero-interest rate environment and were not in the habit of managing their

| Annual Report | April 30, 2024 | 3 |

| Caldwell & Orkin - | Management’s Discussion |

| Gator Capital Long/Short Fund | of Fund Performance |

| | April 30, 2024 (Unaudited) |

| | |

excess cash for higher yields. The media focus on Silicon Valley Bank’s failure in March 2023 caused many bank customers to change how they managed their excess cash. This change in customer behavior forced banks with weaker deposit franchises to raise deposit rates to retain customers and deposits.

Banks have deposit franchises with varying degrees of strength. Many different factors can create a strong deposit franchise such as a long history in a marketplace, a strong branch and ATM network, a strong sales culture within the bank of asking for additional deposits from customers, and the size of the bank. Banks with weak deposit franchises use higher rates to attract price sensitive customers.

When Silicon Valley bank failed, the banks with weak deposit franchises had to raise their deposit rates more aggressively to retain their deposits. During Q2 and Q3 of 2023, these banks raised deposit rates to a level that stabilized their customer bases. We estimate this level is about 3.75% to 4.00%. Although these banks have weak deposit franchises, their net interest margins (“NIM”) have already compressed. In a stable rate environment, they should have loans and securities repricing to higher rates as they mature and their NIMs should gradually widen. In a declining rate scenario, they should be able to reprice their deposit rates lower. This will lead to wider NIMs. There is also the possibility that they will strengthen their deposit franchises and attract less rate sensitive deposits. We think this scenario is less likely, but there are a few banks where this is a possibility.

Banks with stronger deposit franchises are experiencing continued deposit cost pressures. They have not had to raise deposit rates as aggressively because their customers are not as price sensitive, however, with money market rates above 5%, even customers of these banks with strong deposit franchises are looking to better manage their excess cash. This has put continued pressure on these banks to retain deposits. Even JP Morgan Chase has not been immune. On its most recent earnings conference call, the CFO said that the bank expects to see continued movements by customers to seek higher deposit rates.

We believe the current high level of interest rate risk will dissipate with time. We believe the inverted yield curve and the significant rate increases by the Federal Reserve is causing the small-to-regional banks to under-earn compared to our estimate of their normalized earnings power. Despite this under-earning, we observe that the small-to-mid-sized regional banks trade at the low end of both absolute and relative valuations. It is a classic value situation of the market assigning a low multiple on stocks with depressed earnings.

Best Opportunities in Regional Banks

Within SMID banks we group our favorites into three buckets: Puerto Rican banks, growth banks, and small banks with unique stories.

Puerto Rican Banks

Banking in Puerto Rico is an oligopoly. In 2006, there were 11 banks in Puerto Rico and the economy had just entered a recession that would last 15 years. Through bank failures and consolidation, there are just three commercial banks operating in Puerto Rico. We have seen

| 4 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | Management’s Discussion |

| Gator Capital Long/Short Fund | of Fund Performance |

| | April 30, 2024 (Unaudited) |

| | |

the Puerto Rican banks expand their margins and improve their returns. We also see early signs that bank stock investors are taking note by placing higher valuations on the Puerto Rican banks.

Growth Banks

We have written about Growth Banks in the past. We continue to like this group of banks. They have cultures that foster organic growth. For banks to grow, they must generate capital through retained earnings. So, many of these growth banks also have high returns on capital. One way to identify these banks is to screen for banks with the highest tangible book value per share growth over a 10-year or 20-year timeframe.

Small Banks with Unique Stories

We also own smaller banks that have unique stories. While each of these positions is small due to liquidity considerations, we think each will generate attractive returns.

Conclusion

Thank you for entrusting us with a portion of your wealth. We are grateful for investors like you who believe and trust in our strategy. As always, we welcome the opportunity to speak with you and discuss the Fund.

Sincerely,

Derek S. Pilecki, CFA

Portfolio Manager

The discussion of individual companies should not be considered a recommendation of such companies by the Fund’s investment adviser.

The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment returns and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 800-467-7903 or visit www.CaldwellOrkin.com for current month-end performance.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

Investors should consider the investment objective, risks, and charges and expenses of the Fund before investing. The prospectus and the summary prospectus contain this and other information about the Fund and should be read carefully before investing. The prospectus may be obtained at Please call 800-467-7903 or visit www.CaldwellOrkin.com.

| Annual Report | April 30, 2024 | 5 |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Investment Results |

| | April 30, 2024 (Unaudited) |

| | |

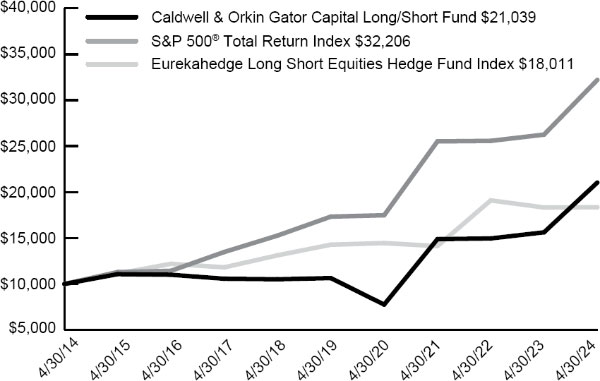

| Average Annual Total Returns(a) as of April 30, 2024 |

| |

| | One Year | Three Year | Five Year | Ten Year |

| Caldwell & Orkin - Gator Capital Long/Short Fund | 34.65% | 12.23% | 14.60% | 7.72% |

| S&P 500® Total Return Index(b) | 22.66% | 8.06% | 13.19% | 12.41% |

| Eurekahedge Long Short Equities Hedge Fund Index(c) | 9.74% | 1.58% | 6.77% | 6.06% |

| | | | | |

| Total annualized Fund operating expenses for the Caldwell & Orkin - Gator Capital Long/Short Fund (the “Fund”) was 3.14% as described in the Prospectus, dated August 28, 2023. This amount includes Acquired Fund Fees and Expenses, as well as interest and dividend expenses related to short sales, which if excluded would result in an annual operating expense rate of 2.00%. Additional information about the Fund’s current fees and expenses for the fiscal year ended April 30, 2024 is contained in the Financial Highlights. |

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performance would have been lower. The table does not reflect the deduction of taxes. The Fund’s returns represent past performance and do not guarantee future results. |

| (b) | The S&P 500® Total Return Index is a capitalization-weighted, unmanaged index of 500 large U.S. companies chosen for market capitalization, liquidity and industry group representation and includes reinvested dividends. You cannot invest directly in an index. |

| (c) | The Eurekahedge Long Short Equities Hedge Fund Index (“Eurekahedge Index”) is an unmanaged index comprised of long/short equity hedge funds. According to its sponsor, Eurekahedge Pte. Ltd., the Eurekahedge Index is an equally weighted index of 895 constituent funds designed to provide a broad measure of the performance of underlying hedge fund managers. The returns of the Eurekahedge Index do not include sales charges or fees, which would lower performance. You cannot invest directly in an index. |

You should consider the Fund’s investment objective, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objective, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month-end by calling (800) 467-7903.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

| 6 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Investment Results |

| | April 30, 2024 (Unaudited) |

| | |

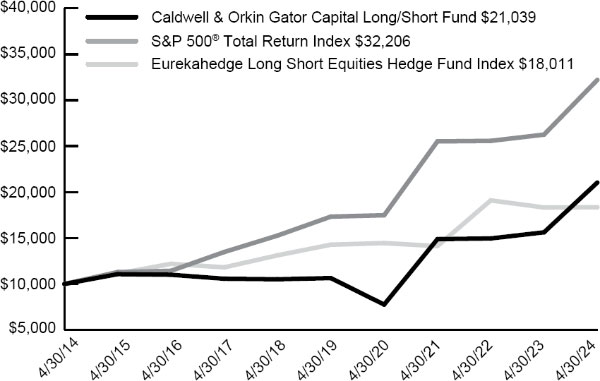

Comparison of the Growth of a $10,000 Investment in the Caldwell & Orkin - Gator Capital Long/Short Fund, the S&P 500® Total Return Index, and the Eurekahedge Long Short Equities Hedge Fund Index

The chart above assumes an initial investment of $10,000 made on April 30, 2014 and held through April 30, 2024. The S&P 500® Total Return Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The Eurekahedge Long Short Equities Hedge Fund Index is an unmanaged index comprised of long/short equity hedge funds. Individuals cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (800) 467-7903.

| Annual Report | April 30, 2024 | 7 |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Fund Holdings |

| | April 30, 2024 (Unaudited) |

| | |

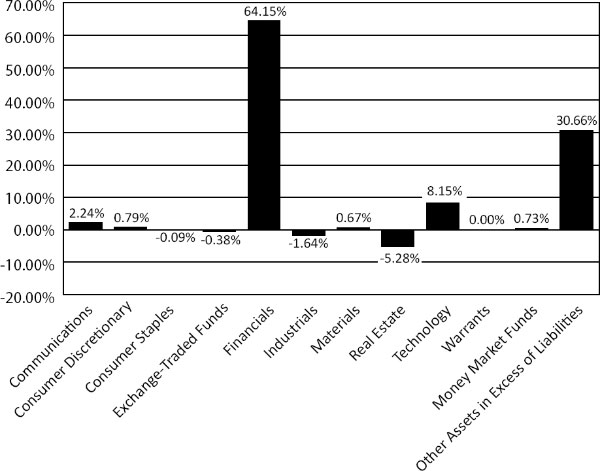

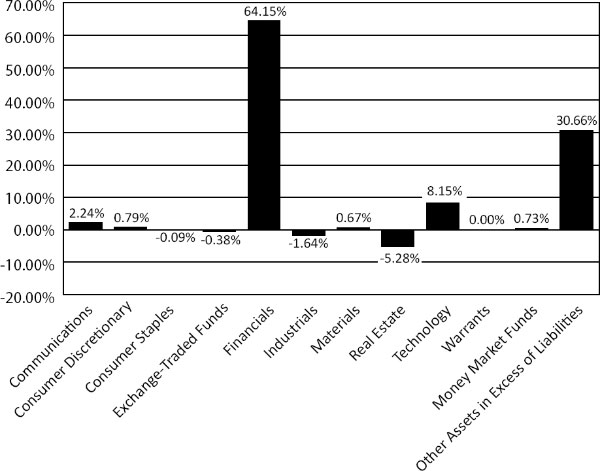

Net Sector Exposure

April 30, 2024*

| * | Sector weightings are calculated as a percentage of net assets and include short positions. Portfolio holdings are subject to change. |

The Caldwell & Orkin - Gator Capital Long/Short Fund’s (the “Fund”) investment objective is to provide long-term capital growth with a short-term focus on capital preservation.

Availability of Portfolio Schedule – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT, within sixty days after the end of the period. The Fund’s Form N-PORT reports are available at the SEC’s website at www.sec.gov and on the Fund’s website at www.gatorcapital.com.

| 8 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Schedule of Investments |

| | April 30, 2024 |

| | |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — LONG — 91.76% | | | | | | | | |

| Banks — 37.66% | | | | | | | | |

| Axos Financial, Inc.(a) | | | 25,000 | | | $ | 1,265,250 | |

| Banc of California, Inc. | | | 56,600 | | | | 774,854 | |

| Bridgewater Bancshares, Inc.(a) | | | 24,000 | | | | 261,120 | |

| Business First Bancshares, Inc. | | | 2,040 | | | | 41,188 | |

| ConnectOne Bancorp, Inc. | | | 14,142 | | | | 253,283 | |

| Customers Bancorp, Inc.(a) | | | 17,100 | | | | 780,957 | |

| Dime Community Bancshares, Inc. | | | 7,063 | | | | 128,547 | |

| Financial Institutions, Inc. | | | 13,100 | | | | 225,582 | |

| First BanCorp | | | 42,000 | | | | 724,500 | |

| First Business Financial Services, Inc. | | | 7,500 | | | | 248,025 | |

| First Citizens BancShares, Inc., Class A | | | 900 | | | | 1,518,084 | |

| First Internet Bancorp | | | 10,000 | | | | 310,500 | |

| Meridian Bancorp, Inc. | | | 10,986 | | | | 101,730 | |

| New York Community Bancorp, Inc. | | | 50,000 | | | | 132,500 | |

| OFG Bancorp | | | 19,991 | | | | 721,875 | |

| Old Second Bancorp, Inc. | | | 43,900 | | | | 601,430 | |

| OP Bancorp | | | 38,573 | | | | 352,171 | |

| Pinnacle Financial Partners, Inc. | | | 11,000 | | | | 843,700 | |

| UMB Financial Corp. | | | 15,000 | | | | 1,194,900 | |

| Webster Financial Corp. | | | 15,000 | | | | 657,450 | |

| Western Alliance Bancorp | | | 19,500 | | | | 1,108,185 | |

| Wintrust Financial Corp. | | | 5,101 | | | | 492,961 | |

| | | | | | | | 12,738,792 | |

| Casinos & Gaming — 0.79% | | | | | | | | |

| Las Vegas Sands Corp. | | | 6,000 | | | | 266,160 | |

| | | | | | | | | |

| Coal Mining — 0.67% | | | | | | | | |

| SunCoke Energy, Inc. | | | 22,000 | | | | 226,820 | |

| | | | | | | | | |

| Computer Hardware & Storage — 1.78% | | | | | | | | |

| Dell Technologies, Inc., Class C | | | 4,000 | | | | 498,560 | |

| Hewlett Packard Enterprise Co. | | | 6,000 | | | | 102,000 | |

| | | | | | | | 600,560 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Annual Report | April 30, 2024 | 9 |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Schedule of Investments |

| | April 30, 2024 |

| | |

| | | Shares | | | Fair Value | |

| Consumer Finance — 10.31% | | | | | | | | |

| Navient Corp. | | | 56,000 | | | $ | 841,120 | |

| OneMain Holdings, Inc. | | | 12,500 | | | | 651,375 | |

| SLM Corp. | | | 68,000 | | | | 1,440,920 | |

| Synchrony Financial | | | 12,600 | | | | 554,148 | |

| | | | | | | | 3,487,563 | |

| Data & Transaction Processors — 3.26% | | | | | | | | |

| Visa, Inc., Class A | | | 1,900 | | | | 510,359 | |

| WEX, Inc.(a) | | | 2,801 | | | | 591,739 | |

| | | | | | | | 1,102,098 | |

| Data Processing & Outsourced Services — 3.11% | | | | | | | | |

| PayPal Holdings, Inc.(a) | | | 15,500 | | | | 1,052,760 | |

| | | | | | | | | |

| Diversified Banks — 3.27% | | | | | | | | |

| Barclays PLC, Sponsored - ADR | | | 108,000 | | | | 1,105,920 | |

| | | | | | | | | |

| Institutional Brokerage — 3.47% | | | | | | | | |

| Interactive Brokers Group, Inc., Class A | | | 10,200 | | | | 1,174,224 | |

| | | | | | | | | |

| Insurance Brokers & Services — 0.31% | | | | | | | | |

| Kingstone Companies, Inc.(a) | | | 22,629 | | | | 105,225 | |

| | | | | | | | | |

| Internet Media & Services — 2.54% | | | | | | | | |

| Meta Platforms, Inc., Class A(a) | | | 2,000 | | | | 860,340 | |

| | | | | | | | | |

| Investment Companies — 0.87% | | | | | | | | |

| BBX Capital, Inc.(a) | | | 32,801 | | | | 295,209 | |

| | | | | | | | | |

| Life Insurance — 5.56% | | | | | | | | |

| Genworth Financial, Inc., Class A(a) | | | 39,000 | | | | 231,270 | |

| Jackson Financial, Inc., Class A | | | 24,100 | | | | 1,646,512 | |

| | | | | | | | 1,877,782 | |

| Private Equity — 6.06% | | | | | | | | |

| The Carlyle Group, Inc. | | | 20,000 | | | | 896,000 | |

| Victory Capital Holdings, Inc., Class A | | | 22,694 | | | | 1,154,217 | |

| | | | | | | | 2,050,217 | |

| Real Estate Services — 0.72% | | | | | | | | |

| Anywhere Real Estate, Inc.(a) | | | 49,941 | | | | 242,713 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| 10 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Schedule of Investments |

| | April 30, 2024 |

| | |

| | | Shares | | | Fair Value | |

| Wealth Management — 11.38% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 2,500 | | | $ | 1,029,475 | |

| Robinhood Markets, Inc., Class A(a) | | | 91,500 | | | | 1,508,835 | |

| Stifel Financial Corp. | | | 12,000 | | | | 959,040 | |

| Virtus Investment Partners, Inc. | | | 1,600 | | | | 350,912 | |

| | | | | | | | 3,848,262 | |

| TOTAL COMMON STOCKS — LONG— (Cost $22,654,539) | | | | | | | 31,034,645 | |

| PREFERRED STOCKS — LONG — 7.36% | | | | | | | | |

| Specialty Finance — 7.36% | | | | | | | | |

| AG Mortgage Investment Trust, Inc., Series C, 8.00% | | | 36,000 | | | | 861,120 | |

| Chimera Investment Corp., Series B, 8.00% | | | 14,391 | | | | 356,753 | |

| Chimera Investment Corp., Series D, 8.00% | | | 19,717 | | | | 478,532 | |

| Federal National Mortgage Association, Series O, 7.00%(a) | | | 9,625 | | | | 62,659 | |

| Federal National Mortgage Association, Series R, 7.63%(a) | | | 20,250 | | | | 71,685 | |

| SLM Corp., Series B, 1.70% | | | 8,276 | | | | 657,859 | |

| | | | | | | | 2,488,608 | |

| TOTAL PREFERRED STOCKS — LONG— (Cost $1,942,854) | | | | | | | 2,488,608 | |

| WARRANTS — LONG — 0.00% | | | | | | | | |

| Ampco-Pittsburgh Corp., Expires 08/01/25, Strike Price $6 | | | 7,860 | | | | 707 | |

| | | | | | | | | |

| TOTAL WARRANTS — LONG— (Cost $2,358) | | | | | | | 707 | |

| MONEY MARKET FUNDS — 0.73% | | | | | | | | |

| First American Treasury Obligations Fund - Class X, 5.23%(b) | | | 248,033 | | | | 248,033 | |

| | | | | | | | | |

| TOTAL MONEY MARKET FUNDS (Cost $248,033) | | | | | | | 248,033 | |

| TOTAL INVESTMENTS — 99.85% (Cost $24,847,784) | | | | | | | 33,771,993 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.15% | | | | | | | 52,085 | |

| NET ASSETS — 100.00% | | | | | | $ | 33,824,078 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of April 30, 2024. |

ADR - American Depositary Receipt

See accompanying notes which are an integral part of these financial statements.

| Annual Report | April 30, 2024 | 11 |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Schedule of Securities Sold Short |

| | April 30, 2024 |

| | |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — SHORT — (30.11)% | | | | | | | | |

| Banks — (16.79)% | | | | | | | | |

| Bank of Hawaii Corp. | | | (12,200 | ) | | $ | (691,618 | ) |

| Capitol Federal Financial, Inc. | | | (130,000 | ) | | | (620,100 | ) |

| City Holding Co. | | | (883 | ) | | | (89,201 | ) |

| Columbia Banking System, Inc. | | | (32,700 | ) | | | (615,087 | ) |

| Commerce Bancshares, Inc. | | | (4,746 | ) | | | (259,511 | ) |

| First Financial Bankshares, Inc. | | | (6,250 | ) | | | (184,750 | ) |

| First Interstate BancSystem, Inc., Class A | | | (24,000 | ) | | | (640,800 | ) |

| Hingham Institution for Savings | | | (3,000 | ) | | | (506,700 | ) |

| Northwest Bancshares, Inc. | | | (9,142 | ) | | | (96,906 | ) |

| Park National Corp. | | | (1,700 | ) | | | (223,907 | ) |

| Renasant Corp. | | | (19,000 | ) | | | (552,140 | ) |

| Seacoast Banking Corporation of Florida | | | (8,500 | ) | | | (196,095 | ) |

| Texas Capital Bancshares, Inc.(a) | | | (8,900 | ) | | | (510,860 | ) |

| United Bankshares, Inc. | | | (15,100 | ) | | | (490,146 | ) |

| | | | | | | | (5,677,821 | ) |

| Commercial Vehicles — (0.02)% | | | | | | | | |

| Nikola Corp.(a) | | | (10,000 | ) | | | (6,206 | ) |

| | | | | | | | | |

| Diversified Banks — (1.09)% | | | | | | | | |

| Bank of America Corp. | | | (10,000 | ) | | | (370,100 | ) |

| | | | | | | | | |

| Industrial Wholesale & Rental — (1.62)% | | | | | | | | |

| SiteOne Landscape Supply, Inc.(a) | | | (3,500 | ) | | | (549,115 | ) |

| | | | | | | | | |

| Infrastructure Software — (0.05)% | | | | | | | | |

| Upstart Holdings, Inc.(a) | | | (800 | ) | | | (17,704 | ) |

| | | | | | | | | |

| Internet Media & Services — (0.30)% | | | | | | | | |

| Opendoor Technologies, Inc.(a) | | | (50,800 | ) | | | (101,092 | ) |

| | | | | | | | | |

| Investment Management — (1.62)% | | | | | | | | |

| T. Rowe Price Group, Inc. | | | (5,000 | ) | | | (547,850 | ) |

| | | | | | | | | |

| Multi Asset Class REITs — (1.54)% | | | | | | | | |

| Vornado Realty Trust | | | (20,000 | ) | | | (520,600 | ) |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| 12 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Schedule of Securities Sold Short |

| | April 30, 2024 |

| | |

| | | Shares | | | Fair Value | |

| Non-Alcoholic Beverages — (0.05)% | | | | | | | | |

| Oatly Group AB - ADR(a) | | | (15,651 | ) | | $ | (17,999 | ) |

| | | | | | | | | |

| Office REITs — (4.02)% | | | | | | | | |

| Boston Properties, Inc. | | | (5,200 | ) | | $ | (321,828 | ) |

| Corporate Office Properties Trust | | | (15,000 | ) | | | (359,550 | ) |

| Cousins Properties, Inc. | | | (16,000 | ) | | | (367,040 | ) |

| JBG SMITH Properties | | | (20,700 | ) | | | (310,707 | ) |

| | | | | | | | (1,359,125 | ) |

| P&C Insurance — (0.07)% | | | | | | | | |

| Lemonade, Inc.(a) | | | (1,442 | ) | | | (24,846 | ) |

| | | | | | | | | |

| Packaged Food — (0.03)% | | | | | | | | |

| Beyond Meat, Inc.(a) | | | (1,600 | ) | | | (10,848 | ) |

| | | | | | | | | |

| Real Estate Services — (0.44)% | | | | | | | | |

| Compass, Inc., Class A(a) | | | (47,400 | ) | | | (149,310 | ) |

| | | | | | | | | |

| Wealth Management — (2.47)% | | | | | | | | |

| Charles Schwab Corp. (The) | | | (11,300 | ) | | | (835,634 | ) |

| | | | | | | | | |

| TOTAL COMMON STOCKS SHORT (Proceeds Received $12,077,193) | | | | | | | (10,188,250 | ) |

| EXCHANGE-TRADED FUNDS — SHORT — (0.39)% | | | | | | | | |

| Direxion Daily Financial Bear 3X Shares | | | (11,700 | ) | | | (131,625 | ) |

| TOTAL EXCHANGE-TRADED FUNDS SHORT (Proceeds Received $499,663) | | | | | | | (131,625 | ) |

| TOTAL SECURITIES SOLD SHORT — (30.51)% (Proceeds Received $12,576,856) | | | | | | $ | (10,319,875 | ) |

| | | | | | | | | |

| (a) | Non-income producing security. |

ADR - American Depositary Receipt

See accompanying notes which are an integral part of these financial statements.

| Annual Report | April 30, 2024 | 13 |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Statement of Assets and Liabilities |

| | April 30, 2024 |

| | |

| ASSETS | | | | |

| Investments is securities at fair value (cost $24,847,784) | | $ | 33,771,993 | |

| Deposit held by broker for securities sold short | | | 10,546,711 | |

| Receivable for fund shares sold | | | 125 | |

| Dividends and interest receivable | | | 8,838 | |

| Prepaid expenses | | | 15,941 | |

| Total Assets | | | 44,343,608 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for dividends declared on short sales | | | 5,727 | |

| Securities sold short, at value (proceeds received $12,576,856) | | | 10,319,875 | |

| Payable for investments purchased | | | 126,976 | |

| Payable to Adviser | | | 31,356 | |

| Payable to Administrator | | | 5,515 | |

| Other accrued expenses | | | 30,081 | |

| Total Liabilities | | | 10,519,530 | |

| | | | | |

| Net Assets | | $ | 33,824,078 | |

| | | | | |

| Net Assets consist of: | | | | |

| Paid-in capital | | | 22,705,534 | |

| Accumulated earnings | | | 11,118,544 | |

| Net Assets | | $ | 33,824,078 | |

| | | | | |

| Shares outstanding, par value $0.10 per share (30,000,000 authorized shares) | | | 820,450 | |

| | | | | |

| Net asset value, offering price and redemption price per share(a) | | $ | 41.23 | |

| | | | | |

| (a) | Redemption price may differ from net asset value if redemption fee is applied. |

See accompanying notes which are an integral part of these financial statements.

| 14 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Statement of Operations |

| | For the year ended April 30, 2024 |

| | |

| INVESTMENT INCOME | | | | |

| Dividend income (net of foreign taxes withheld of $8,430) | | $ | 1,087,324 | |

| Interest income | | | 87,189 | |

| Total investment income | | | 1,174,513 | |

| | | | | |

| EXPENSES | | | | |

| Investment Advisory fees | | | 256,402 | |

| Legal | | | 45,047 | |

| Director’s fees and expenses | | | 37,500 | |

| Miscellaneous | | | 34,522 | |

| Administration | | | 28,297 | |

| Fund accounting | | | 25,920 | |

| Registration | | | 23,041 | |

| Transfer agent | | | 20,147 | |

| Compliance Services | | | 18,500 | |

| Audit and tax preparation | | | 17,715 | |

| Report printing | | | 13,667 | |

| Insurance | | | 7,900 | |

| Custodian | | | 7,752 | |

| Sub transfer agent fees | | | 3,999 | |

| Pricing | | | 1,928 | |

| Dividend expense on securities sold short | | | 275,873 | |

| Total expenses | | | 818,210 | |

| Fees contractually waived | | | (30,059 | ) |

| Net operating expenses | | | 788,151 | |

| Net investment income | | | 386,362 | |

| | | | | |

| NET REALIZED AND CHANGE IN UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

| Net realized gain (loss) from: | | | | |

| Investments | | | 839,826 | |

| Securities sold short | | | (275,733 | ) |

| Change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 7,735,431 | |

| Securities sold short | | | (959,597 | ) |

| NET REALIZED AND CHANGE IN UNREALIZED GAIN ON INVESTMENTS AND SECURITIES SOLD SHORT | | | 7,339,927 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 7,726,289 | |

| | | | | |

See accompanying notes which are an integral part of these financial statements.

| Annual Report | April 30, 2024 | 15 |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Statements of Changes in Net Assets |

| | |

| | | For the Year Ended | | | For the Year Ended | |

| | | April 30, 2024 | | | April 30, 2023 | |

| INCREASE (DECREASE) IN NET ASSETS DUE TO: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income (loss) | | $ | 386,362 | | | $ | (23,658 | ) |

| Net realized gain on investments, securities sold short and foreign currency transactions | | | 564,093 | | | | 1,036,540 | |

| Net change in unrealized appreciation (depreciation) of investments, securities sold short and foreign currency translations | | | 6,775,834 | | | | (155,038 | ) |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | 7,726,289 | | | | 857,844 | |

| | | | | | | | | |

| CAPITAL TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 6,915,076 | | | | 1,424,532 | |

| Amount paid for shares redeemed | | | (1,182,806 | ) | | | (1,798,559 | ) |

| Proceeds from redemption fees (Note 1) | | | 1,504 | | | | 2,410 | |

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM CAPITAL TRANSACTIONS | | | 5,733,774 | | | | (371,617 | ) |

| TOTAL INCREASE IN NET ASSETS | | | 13,460,063 | | | | 486,227 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 20,364,015 | | | | 19,877,788 | |

| End of year | | $ | 33,824,078 | | | $ | 20,364,015 | |

| | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | |

| Shares sold | | | 190,228 | | | | 49,562 | |

| Shares redeemed | | | (34,800 | ) | | | (62,809 | ) |

| Net increase (decrease) in shares outstanding | | | 155,428 | | | | (13,247 | ) |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| 16 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Financial Highlights |

| | |

(For a share outstanding during each year)

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | April 30, | | | April 30, | | | April 30, | | | April 30, | | | April 30, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 30.62 | | | $ | 29.31 | | | $ | 29.17 | | | $ | 15.21 | | | $ | 20.86 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income(a) | | | 0.53 | | | | (0.04 | ) | | | (0.32 | ) | | | (0.10 | ) | | | (0.20 | ) |

| Net realized and unrealized gain (loss) on investments | | | 10.08 | | | | 1.35 | | | | 0.46 | | | | 14.06 | | | | (5.45 | ) |

| Total from investment operations | | | 10.61 | | | | 1.31 | | | | 0.14 | | | | 13.96 | | | | (5.65 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Paid-in capital from redemption fees | | | — | (b) | | | — | (b) | | | — | (b) | | | — | (b) | | | — | (b) |

| Net asset value, end of year | | $ | 41.23 | | | $ | 30.62 | | | $ | 29.31 | | | $ | 29.17 | | | $ | 15.21 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return(c) | | | 34.65 | % | | | 4.47 | % | | | 0.48 | % | | | 91.78 | % | | | (27.09 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 33,824 | | | $ | 20,364 | | | $ | 19,878 | | | $ | 20,963 | | | $ | 12,259 | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Ratio of net expenses to average net assets(d) | | | 3.07 | % | | | 3.13 | % | | | 3.07 | % | | | 3.56 | % | | | 3.60 | % |

| Ratio of expenses to average net assets before waiver by Adviser | | | 3.19 | % | | | 3.55 | % | | | 3.38 | % | | | 4.10 | % | | | 4.08 | % |

| Ratio of net investment income (loss) to average net assets | | | 1.51 | % | | | (0.12 | )% | | | (1.07 | )% | | | (0.47 | )% | | | (1.00 | )% |

| Portfolio Turnover Rate | | | 40 | % | | | 52 | % | | | 55 | % | | | 38 | % | | | 87 | % |

| | | | | | | | | | | | | | | | | | | | | |

| (a) | Calculated using average shares outstanding. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (d) | Excluding dividend and interest expense, the ratios of net expenses to average net assets were 2.00%, 2.00%, 2.00%, 2.00% and 2.00% for the fiscal years ended April 30, 2024, 2023, 2022, 2021 and 2020, respectively. |

See accompanying notes which are an integral part of these financial statements.

| Annual Report | April 30, 2024 | 17 |

Caldwell & Orkin -

Gator Capital Long/Short Fund | Notes to Financial Statements |

| | April 30, 2024 |

1. ORGANIZATION

The Caldwell & Orkin - Gator Capital Long/Short Fund (the “Fund”) is the only investment portfolio of The Caldwell & Orkin Funds, Inc. (the “Company”), an open-end, diversified management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and incorporated under the laws of the State of Maryland on August 15, 1989. The Fund’s investment objective is to provide long-term capital growth with a short-term focus on capital preservation. Gator Capital Management, LLC (the “Adviser”), the Fund’s investment adviser, uses a fundamental driven, multi-dimensional investment process focusing on active allocation, security selection and surveillance to achieve the Fund’s investment objective.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Regulatory Update – Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds – Effective January 24, 2023, the Securities and Exchange Commission (the “SEC”) adopted rule and form amendments to require mutual funds and exchange traded funds to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, will no longer appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024. At this time, management is evaluating the impact of these amendments on the shareholder reports for the Fund.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities Valuation

Securities are stated at the closing price on the date at which the net asset value (“NAV”) is being determined. If the date of determination is not a trading date, or the closing price is not otherwise available, the last bid price is used for a fair value instead. Debt securities are valued at the price provided by an independent pricing service. Any assets or securities for which

| 18 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

Caldwell & Orkin -

Gator Capital Long/Short Fund | Notes to Financial Statements | |

| | April 30, 2024 | |

market quotations are not readily available are valued at fair value as determined in good faith by or under the direction of the Fund’s Board of Directors (the “Board”) in accordance with the Fund’s Fair Value Pricing Policy.

Securities Transactions and Related Investment Income

The Fund follows industry practice and records securities transactions on trade date for financial reporting purposes. Dividend income is recorded on the ex-dividend date. Realized gains and losses from investment transactions are determined using the specific identification method. Interest income which includes amortization of premium and accretion of discount, is accrued as earned.

Fair Value Measurements

A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – quoted prices which are not active quoted prices for similar assets or liabilities in active markets or inputs other than quoted process that are observable (either directly or indirectly) for substantially the full term of the asset of liability |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

| Annual Report | April 30, 2024 | 19 |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | April 30, 2024 |

The following is a summary of the inputs used as of April 30, 2024 in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets | | | | | | | | |

| Common Stocks* | | $ | 31,034,645 | | | $ | — | | | $ | — | | | $ | 31,034,645 | |

| Preferred Stocks* | | | 2,425,949 | | | | 62,659 | | | | — | | | | 2,488,608 | |

| Warrants | | | — | | | | 707 | | | | — | | | | 707 | |

| Money Market Funds | | | 248,033 | | | | — | | | | — | | | | 248,033 | |

| Total | | $ | 33,708,627 | | | $ | 63,366 | | | $ | — | | | $ | 33,771,993 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Securities Sold Short | | | | | | | | | | | | | | | | |

| Common Stocks* | | $ | (10,188,250 | ) | | $ | — | | | $ | — | | | $ | (10,188,250 | ) |

| Exchange-Traded Funds | | | (131,625 | ) | | | — | | | | — | | | | (131,625 | ) |

| Total | | $ | (10,319,875 | ) | | $ | — | | | $ | — | | | $ | (10,319,875 | ) |

| | | | | | | | | | | | | | | | | |

| * | Refer to the Fund’s Schedule of Investments for industry classifications. |

The Fund did not hold any assets at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

Share Valuation

The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the New York Stock Exchange is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s NAV per share.

The Fund charges a 2.00% redemption fee on shares held less than 90 days. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as paid-in capital and such fees become part of the Fund’s daily NAV calculation. For the fiscal year ended April 30, 2024 the Fund recorded $1,504 in redemption fee proceeds.

Federal Income Taxes

The Fund makes no provision for federal income tax or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also

| 20 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | April 30, 2024 |

intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued and applied to net investment income, net realized gains and unrealized appreciation as such income and/or gains are earned.

The Fund recognizes tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the fiscal year ended April 30, 2024, the Fund did not incur any interest or penalties.

3. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

The Fund has entered into a management agreement (the “Management Agreement”) with the Adviser pursuant to which the Adviser provides space, facilities, equipment and personnel necessary to perform administrative and investment management services for the Fund. The Management Agreement provides that the Adviser is responsible for the management of the Fund’s portfolio. For such services and expenses assumed by the Adviser, the Fund pays a monthly advisory fee at incremental annual rates as follows:

| Advisory Fee | Average Daily Net Assets |

| 1.00% | Up to $250 million |

| 0.90% | In excess of $250 million but not greater than $500 million |

| 0.80% | In excess of $500 million |

The Adviser has agreed to reimburse the Fund to the extent necessary to prevent the Fund’s annual ordinary operating expenses (excluding taxes, expenses related to the execution of portfolio transactions and the investment activities of the Fund such as, for example, interest, dividend expenses on securities sold short, brokerage commissions and fees and expenses charged to the Fund by any investment company in which the Fund invests and extraordinary charges such as litigation costs) from exceeding 2.00% of the Fund’s average net assets. For the fiscal year ended April 30, 2024, the Adviser waived fees and reimbursed expenses in the amount of $30,059 for the Fund. During the fiscal year ended April 30, 2024, the Adviser earned $256,402 from the Fund, before the waiver described above.

| Annual Report | April 30, 2024 | 21 |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | April 30, 2024 |

Ultimus Fund Solutions, LLC (the “Administrator”) provides fund accounting, fund administration and transfer agency services under a Master Services Agreement to the Fund. The Fund pays the Administrator fees for its services under the Master Services Agreement. In addition, the Fund pays out-of-pocket expenses including, but not limited to postage, supplies and costs of pricing the Fund’s securities. For the fiscal year ended April 30, 2024, the Administrator earned fees of $28,297 for administration services, $25,920 for fund accounting services, and $20,147 for transfer agent services.

Ultimus Fund Distributors, LLC (the “Distributor”) serves as distributor to the Fund. The Fund does not pay the Distributor for these services. The Distributor is a wholly-owned subsidiary of the Administrator.

Certain officers of the Fund are also officers of the Administrator and the Distributor.

4. DIRECTOR COMPENSATION

The Fund pays each Director, in cash, an annual fee of $8,000 per year, plus $1,500 for each in-person meeting attended and $1,000 for each telephonic meeting attended. The Fund also reimburses Directors’ actual out-of-pocket expenses relating to attendance at meetings.

5. INVESTMENT PORTFOLIO TRANSACTIONS

During the fiscal year ended April 30, 2024, the Fund purchased $16,795,442 and sold $8,605,215 of securities, excluding securities sold short and short-term investments.

Short Sales and Segregated Cash

Short sales are transactions in which the Fund sells a security it does not own, in anticipation of a decline in the market value of that security. To initiate such a transaction, the Fund must borrow the security to deliver to the buyer upon the short sale; the Fund is then obligated to replace the security borrowed by purchasing it in the open market at some later date, completing the transaction.

The Fund will incur a loss if the market price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund will realize a gain if the security declines in value between those dates.

All short sales must be fully collateralized. The Fund maintains the collateral in segregated accounts consisting of cash and/or U.S. Government securities sufficient to collateralize the market value of its short positions. Typically, the segregated cash with brokers and other financial institutions exceeds the minimum required. Deposits with brokers for securities sold short are invested in money market instruments. Segregated cash is held at the custodian in the name of the broker per a tri-party agreement between the Fund, the custodian, and the broker.

| 22 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | April 30, 2024 |

The Fund may also sell short “against the box”, i.e., the Fund enters into a short sale as described above, while holding an offsetting long position in the same security which it sold short. If the Fund enters into a short sale against the box, it will segregate an equivalent amount of securities owned by the Fund as collateral while the short sale is outstanding.

The Fund limits the value of its short positions (excluding short sales “against the box”) to 60% of the Fund’s total net assets. At April 30, 2024, the Fund had approximately 30% of its total net assets in short positions.

For the fiscal year ended April 30, 2024, the cost of investments purchased to cover short sales and the proceeds from investments sold short were $4,463,918 and $2,910,801, respectively.

6. FEDERAL TAX INFORMATION

As of April 30, 2024, the net unrealized appreciation (depreciation) of investments, including short securities, for tax purposes was as follows:

| Gross unrealized appreciation | | $ | 12,613,609 | |

| Gross unrealized depreciation | | | (1,481,974 | ) |

| Net unrealized appreciation on investments | | $ | 11,131,635 | |

| Tax cost of investments | | $ | 12,320,483 | |

At April 30, 2024, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 386,362 | |

| Accumulated capital losses | | | (399,453 | ) |

| Unrealized appreciation | | | 11,131,635 | |

| Total accumulated earnings (deficit) | | $ | 11,118,544 | |

The difference between book basis and tax basis unrealized appreciation is attributable primarily to the tax deferral of wash losses and investments in partnerships and certain other investments.

As of April 30, 2024, the Fund has available for tax purposes an unused capital loss carryforward of $399,453 of short-term capital losses with no expiration, which is available to offset against future taxable net capital gains. During the fiscal year ended April 30, 2024, the Fund utilized $427,161 of available capital loss carryforward.

GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. There were no reclassifications for the tax year ended April 30, 2024.

| Annual Report | April 30, 2024 | 23 |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Notes to Financial Statements |

| | April 30, 2024 |

7. COMMITMENTS AND CONTINGENCIES

Under the Fund’s organizational documents, its officers and directors are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that may contain general indemnification clauses, which may permit indemnification to the extent permissible under applicable law. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

8. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

| 24 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | Report of Independent Registered |

| Gator Capital Long/Short Fund | Public Accounting Firm |

| | April 30, 2024 |

To the Shareholders and Board of Directors

of Caldwell & Orkin - Gator Capital Long/Short Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Caldwell & Orkin - Gator Capital Long/Short Fund (the “Fund”), a series of shares of The Caldwell & Orkin Funds, Inc., including the schedule of investments, as of April 30, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of April 30, 2024, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the Fund’s auditor since 1998.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included

| Annual Report | April 30, 2024 | 25 |

| Caldwell & Orkin - | Report of Independent Registered |

| Gator Capital Long/Short Fund | Public Accounting Firm |

| | April 30, 2024 |

confirmation of securities owned as of April 30, 2024 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

June 25, 2024

| 26 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | Liquidity Risk Management Program | |

| Gator Capital Long/Short Fund | |

| | April 30, 2024 (Unaudited) | |

The Fund has adopted and implemented a written liquidity risk management program as required by Rule 22e-4 (the “Liquidity Rule”) under the Investment Company Act. The program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources. The Funds’ Board of Directors approved the appointment of a committee to serve as Liquidity Program Administrator (LPA), which committee includes representatives from the Fund’s investment manager. The LPA is responsible for the program’s administration and oversight and for reporting to the Board on at least an annual basis regarding the program’s operation and effectiveness. The Liquidity Assessment written report that was presented to the Board of Directors at the March 1, 2024 Board meeting and covered the period from January 1, 2023 - December 31, 2023 (the “Review Period”).

During the Review Period, the Fund did not experience unusual stress or disruption to its operations related to purchase and redemption activity. Also, during the Review Period, the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. During the Review Period, the Fund did not hold illiquid securities and the Fund was not required to establish a highly liquid investment minimum. The Report concluded that the Fund takes many factors into consideration when determining the best methods for managing the liquidity of the portfolio and that the Fund’s liquidity risk management program operating appropriately during the Review Period.

| Annual Report | April 30, 2024 | 27 |

Caldwell & Orkin -

Gator Capital Long/Short Fund | Disclosure of Fund Expenses | |

| | April 30, 2024 (Unaudited) | |

We believe it is important for you to understand the impact of fees and expenses on your investment in the Fund. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs related to the purchase and redemption of Fund shares, including redemption fees and brokerage commissions (if applicable); and (2) ongoing costs, including management fees, administrative expenses, portfolio transaction costs and other Fund expenses. A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The below example is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from November 1, 2023 through April 30, 2024. The table below illustrates the Fund’s expenses in two ways:

Based on Actual Fund Returns

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Based on a Hypothetical 5% Return for Comparison Purposes

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | | Beginning | | Ending | | Expenses | | Annualized |

| | | Account Value | | Account Value | | Paid During | | Expense |

| | | November 1, 2023 | | April 30, 2024 | | Period(a) | | Ratio |

| Actual | | $1,000.00 | | $1,274.10 | | $17.27 | | 3.05% |

| Hypothetical(b) | | $1,000.00 | | $1,009.68 | | $15.26 | | 3.05% |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

| 28 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Additional Information |

| | April 30, 2024 (Unaudited) |

| | |

Caldwell & Orkin Board of Directors and Officers (as of April 30, 2024)

Name, Position(s)

Held with Fund,

and Age | Term of

Office and

Length of

Time

Served | Principal Occupation(s) During

Past Five Years | Number of

Funds in

Fund

Complex

Overseen

by Director | Other

Directorships

Held by

Director

During the

Past 5 Years |

| DISINTERESTED DIRECTORS |

Frederick T. Blumer

Director and Chairman

of the Board

Year of Birth: 1958 | Indefinite Term, Director Since 1990, Chairman Since 2004 | Mr. Blumer is the Chairman & CEO of Mile Auto, Inc. (since March 2017) and Chairman of Vehcon, Inc. (since 2012), and was CEO of Vehcon, Inc. (from 2012-2017). | One | None |

Rhett E. Ingerick Director and Chairman of the Audit Committee

Year of Birth: 1974 | Indefinite Term, Since 2018 | Mr. Ingerick is a Principal BI & Analytics Developer for Kforce Inc. (2018-Present). Prior to that he was a Senior BI & Analytics Developer for Kforce Inc. (2015-2018) and Senior Integration Developer for Talbots, Inc. (2014-2015). | One | Gator Series Trust (2013-2020) |

| Annual Report | April 30, 2024 | 29 |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Additional Information |

| | April 30, 2024 (Unaudited) |

Name, Position(s)

Held with Fund,

and Age | Term of

Office and

Length of

Time

Served | Principal Occupation(s) During

Past Five Years | Number of

Funds in

Fund

Complex

Overseen

by Director | Other

Directorships

Held by

Director

During the

Past 5 Years |

| DISINTERESTED DIRECTORS |

Bevin E. Franks

Director

Year of Birth: 1971 | Indefinite Term, Since 2018 | Ms. Franks is currently a Senior Consultant for Helios Consulting (April 2023 - present). Prior to that she was AVP of Business Integrations for Aveanna Healthcare (March 2022-April 2023), Director of Finance and Accounting Integration for Aveanna Healthcare (December 2020-March 2022), Workday Administration Manager for Aveanna Healthcare (February 2020-December 2020), Independent Contract Project Manager for Watkins Associated Industries (October 2018-November 2019), Choreographer and Ballet Teacher at Dance Stop Studios (August 2016-May 2019), and Dance and Movement Consultant for Walton High School Marching Band and Color Guard (May 2017-November 2019). In addition, she was Executive Director for Roswell United Methodist Church Foundation (April 2012-May 2016). | One | Gator Series Trust (2013-2020) |

| 30 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Additional Information |

| | April 30, 2024 (Unaudited) |

Name, Position(s)

Held with Fund,

and Age | Term of

Office and

Length of

Time

Served | Principal Occupation(s) During

Past Five Years | Number of

Funds in

Fund

Complex

Overseen

by Director | Other

Directorships

Held by

Director

During the

Past 5 Years |

| INTERESTED DIRECTOR |

Derek Pilecki*

President and Principal

Executive Officer

Year of Birth: 1970 | Indefinite Term, Since 2018 | Mr. Pilecki is President and Chief Investment Officer for Gator Capital Management, LLC (2008-Present). | N/A | Gator Series Trust (2013-2020) |

| * | Mr. Pilecki is an interested Director because he is an employee of the Manager. |

Name, Position(s)

Held with Fund,

and Age | Term of

Office and

Length of

Time

Served | Principal Occupation(s) During

Past Five Years | Number of

Funds in

Fund

Complex

Overseen | Other

Directorships

Held |

| OFFICERS WHO ARE NOT DIRECTORS |

Charles C. Black Chief

Compliance Officer Year of Birth: 1979 | Since 2016 | Mr. Black is the Vice President and Head of Compliance Services (April 2021-Present) and was Director of Compliance Services (November 2019-March 2021) at CCO Technology, LLC (d/b/a Joot). Previously, Mr. Black was a Senior Compliance Officer at Ultimus Fund Solutions, LLC (2015-2019), Chief Compliance Officer of Ultimus Managers Trust (January 2016-2019). | N/A | N/A |

| Annual Report | April 30, 2024 | 31 |

| Caldwell & Orkin - | |

| Gator Capital Long/Short Fund | Additional Information |

| | April 30, 2024 (Unaudited) |

Name, Position(s)

Held with Fund,

and Age | Term of

Office and

Length of

Time

Served | Principal Occupation(s) During

Past Five Years | Number of

Funds in

Fund

Complex

Overseen | Other

Directorships

Held |

| OFFICERS WHO ARE NOT DIRECTORS |

Jennifer L. Merchant

Secretary

Year of Birth: 1975 | Since 2022 | Ms. Merchant is Assistant Vice President, Legal Administration, Ultimus Fund Solutions, LLC (February 2022-Present). Previously, Ms. Merchant was Legal Services Director (October 2021-February 2022), and Legal Counsel (September 2019-October 2021), Washington State Treasurer; Investment Officer, Washington State Investment Board (October 2010-August 2019). | N/A | N/A |

Zachary P. Richmond

Treasurer and Principal

Financial Officer

Year of Birth: 1980 | Since 2020 | Mr. Richmond is Vice President of Financial Administration for Ultimus Fund Solutions, LLC (February 2019-Present). Previously, Mr. Richmond was Assistant Vice President, Associate Director of Financial Administration for Ultimus Fund Solutions, LLC (December 2015-February 2019). | N/A | N/A |

The Fund’s Statement of Additional Information (“SAI”) includes information about the directors and is available, without charge, upon request. You may call toll-free (800) 467-7903 to request a copy of the SAI or to make shareholder inquiries.

| 32 | 1-800-467-7903 | https://gatorcapital.com/mutual-funds/gator-capital-long-short-fund/ |

CUSTOMER PRIVACY NOTICE

| FACTS | WHAT DOES CALDWELL & ORKIN FUNDS, INC. DO WITH YOUR PERSONAL INFORMATION? |

| | |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ Assets ■ Retirement Assets ■ Transaction History ■ Checking Account Information ■ Purchase History ■ Account Balances ■ Account Transactions ■ Wire Transfer Instructions When you are no longer our customer, we continue to share your information as described in this notice. |

| |

| How? | All financial companies need to share your personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Caldwell & Orkin Funds, Inc. chooses to share; and whether you can limit this sharing. |

| |

| Reasons we can share your personal information | Does Caldwell &

Orkin Funds, Inc.

share? | Can you limit

this sharing? |

For our everyday business purposes – Such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

For our marketing purposes – to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | No | We don’t share |

For our affiliates’ everyday business purposes – information about your transactions and experiences | No | No |

For our affiliates’ everyday business purposes – information about your creditworthiness | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| For our affiliates’ marketing purposes | Yes | Yes* |

| | | | |

| Questions? | Call (800) 467-7903 |

| |

To limit our

sharing | *Call (813) 282-7870 Please note:

If you are a new customer, we can begin sharing your information 30 days from the date we sent this notice. When you are no longer our customer, we continue to share your information as described in this notice. However, you can contact us at any time to limit our sharing. |

| Annual Report | April 30, 2024 | 33 |

| Page 2 | |

| Who we are |

Who is providing this

notice? | Caldwell & Orkin Funds, Inc. Caldwell & Orkin - Gator Capital Long/Short Fund Ultimus Fund Distributors, LLC (Distributor) Ultimus Fund Solutions, LLC (Administrator) |

| What we do |

How does Caldwell

& Orkin Funds, Inc.

protect my personal

information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

How does Caldwell

& Orkin Funds, Inc.

collect my personal