Exhibit 99.1

Forward-Looking Statements

This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements include statements that address activities, events or developments that Bradley

expects, believes or anticipates will or may occur in the future, such as Bradley’s plans to in-license, develop and launch

new and enhanced products with long-term intellectual property protection or other significant barriers to market entry,

sales and earnings estimates, other predictions of financial performance, timing of payments on indebtedness, launches

by Bradley of new products, market acceptance of Bradley's products, and the achievement of initiatives to enhance

corporate governance and long-term shareholder value. Forward-looking statements are based on Bradley's experience

and perception of current conditions, trends, expected future developments and other factors it believes are appropriate

under the circumstances and are subject to numerous risks and uncertainties, many of which are beyond Bradley's

control. These risks and uncertainties include Bradley's ability to: launch VEREGEN™ and ELESTRIN™ during 2007;

predict the safety and efficacy of these products in a commercial setting; estimate sales; maintain adequate inventory of

levels; comply with the restrictive covenants under its credit facility; refinance its credit facility; access the capital

markets on attractive terms or at all; favorably resolve the pending SEC informal inquiry; maintain or increase sales of its

products; or effectively react to other risks and uncertainties described from time to time in Bradley's SEC filings, such

as fluctuation of quarterly financial results, estimation of product returns, chargebacks, rebates and allowances,

concentration of customers, reliance on third party manufacturers and suppliers, litigation or other proceedings (including

the pending class action and shareholder derivative lawsuits), government regulation, stock price volatility and ability to

achieve strategic initiatives to enhance long-term shareholder value. Further, Bradley cannot accurately predict the

impact on its business of the approval, introduction, or expansion by competitors of generic or therapeutically equivalent

or comparable versions of Bradley's products or of any other competing products. In addition, actual results may differ

materially from those projected. Bradley undertakes no obligation to publicly update any forward-looking statement,

whether as a result of new information, future events or otherwise.

Company Overview

Unique specialty pharmaceutical company committed to

adding value

Founded: 1985, Daniel Glassman, President and CEO

Operating segments:

Dermatology

Podiatry

Gastroenterology

OB/GYN

May 2003, BDY lists on NYSE from Nasdaq

Employees(1): 301

(1) As of December 31, 2006

Strong track record of sales growth

2006 Net Sales: $144.8 million

CAGR(1) : 33.4% since 2001

Experienced Management Team

Company Overview

(1) Compound annual growth rate (CAGR) from 2001 to 2006

Name

Title

Experience (yrs)

Daniel Glassman

President and CEO

36

Brent Lenczycki

VP, Chief Financial Officer

10

Bradley Glassman

SVP, Sales & Marketing

10

Alan Goldstein

VP, Corporate Development

21

Ralph Landau, Ph.D.

VP, Chief Scientific Officer

14

Company Overview

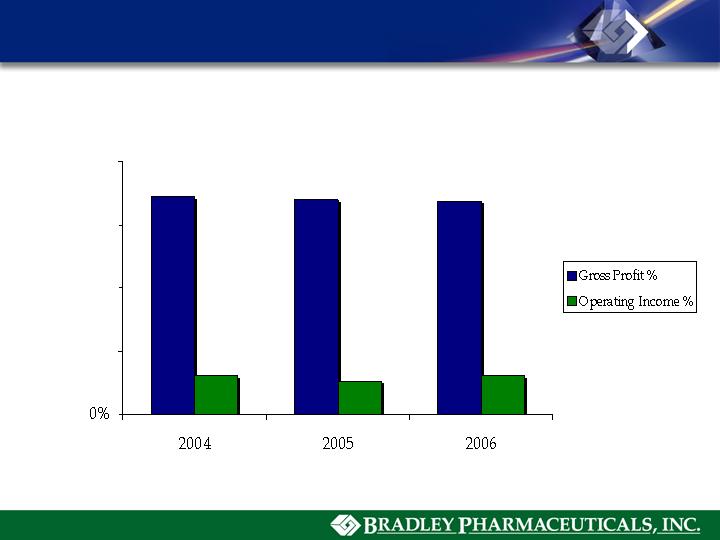

Net Sales

2004

2005

2006

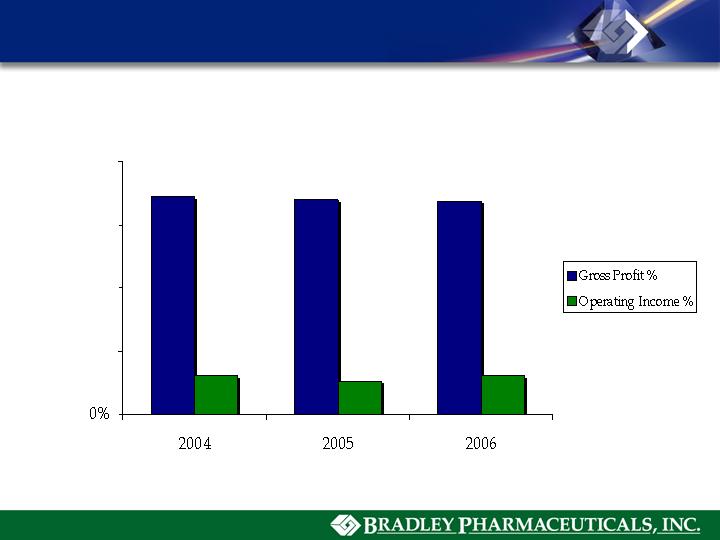

Gross Profit & Operating Income(1)

(1) Operating income is net sales minus cost of sales, SG&A, R&D and D&A expense (excludes interest expense, interest income

and income tax expense).

(2) Includes $3,475,000 compensation cost for share-based payment arrangements, $2,100,000 in legal and advisor fees relating to

proxy contest, and $8,500,000 in R&D expense relating to MediGene AG and BioSante Pharmaceuticals license agreements

100%

Company Overview

(2)

86.2%

85.1%

84.5%

15.7%

13.8%

15.8%

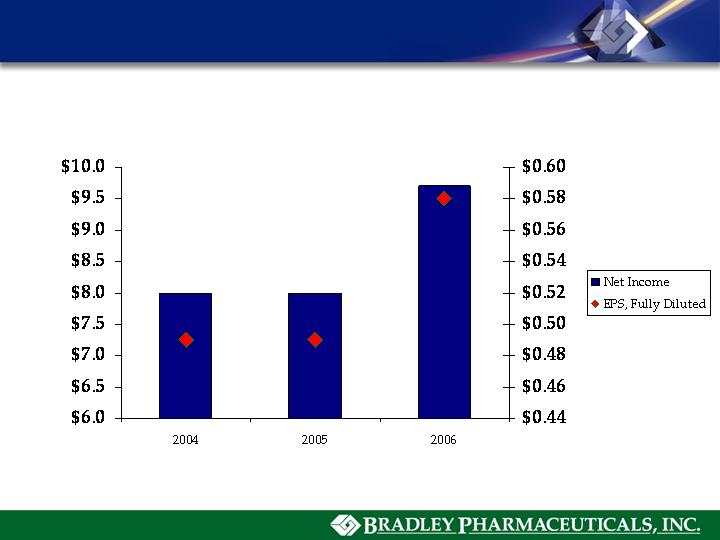

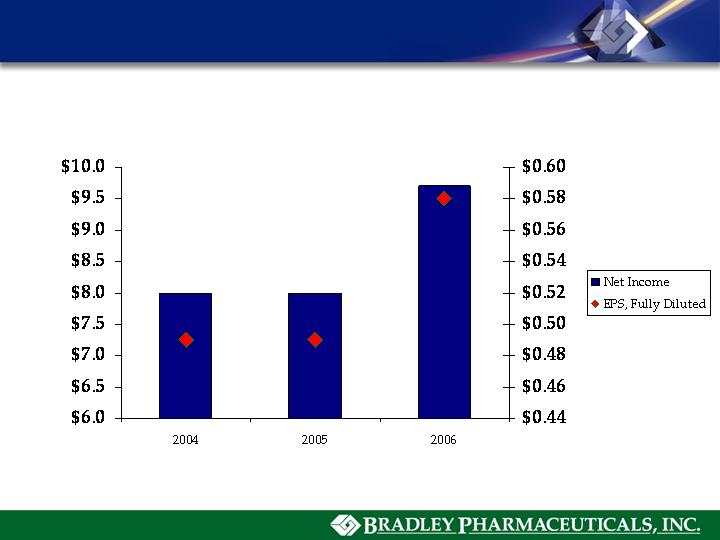

Net Income and EPS, Fully Diluted(1)

(1) 2004, 2005, 2006 EPS fully diluted calculations based on 18,410,000, 17,950,000, and 16,550,000 diluted shares.

(2) Includes $13,475,000 compensation cost for share-based payment arrangements, $2,100,000 in legal and advisor fees relating to

proxy contest, and $8,500,000 in R&D expense relating to MediGene AG and BioSante Pharmaceuticals license agreements

Company Overview

(2)

Product Returns and Inventory Improvement Initiatives

Continue efforts to reduce wholesaler inventory levels

Improve effective dating of products – In progress

Expiration date testing

Optimize product production schedules

Raised minimum dating requirements prior to shipping

Shift product mix to patent-protected products – In progress

Longer lifecycles

Lower risk of generic intrusion

Company Overview

Success built on core marketing and sales expertise

Company Overview

Late-stage product candidates that upon approval

leverage our sales and marketing capabilities

New products through lifecycle management and

new indications for existing brands

Brands that fill unmet physician and patient needs

Commercialize

Commercialize

Adoxa®

Rosula ®

Zoderm®

Solaraze® Gel

KeralacTM

KerolTM

Carmol® 40

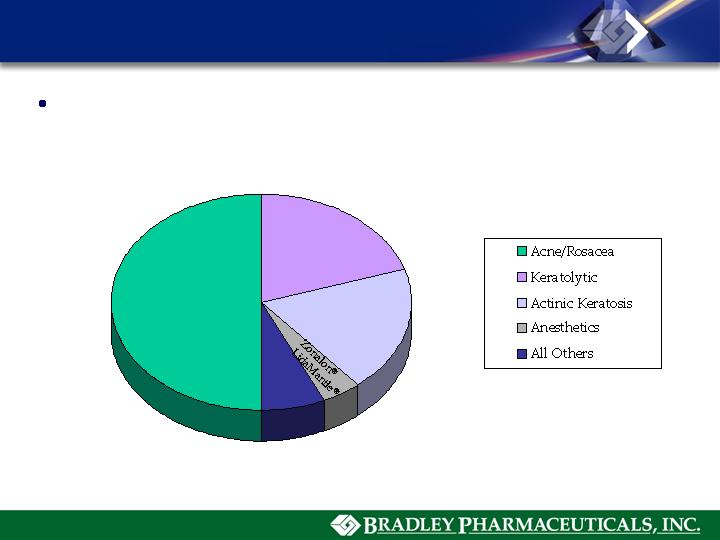

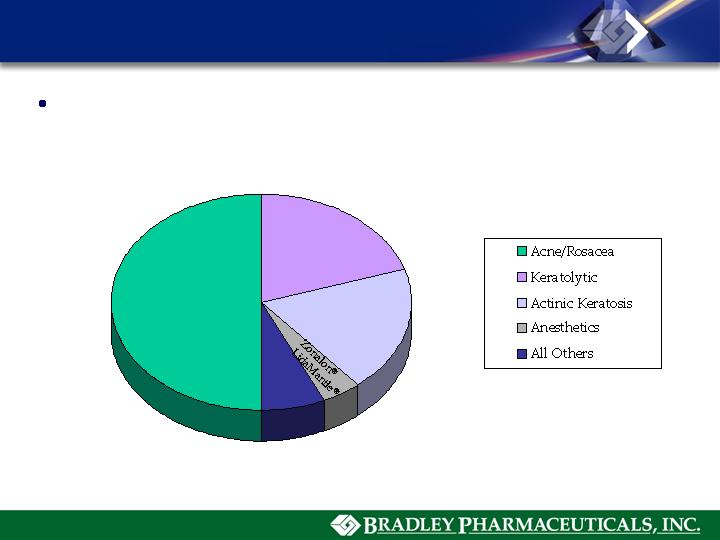

Doak Dermatologics - Major Brands

2006 Net Sales = $114.5 M

48.5%

18.4%

20.6%

5.0%

7.5%

Pamine®

AnaMantle HC®

Flora-Q ®

Glutofac ZX/MX ®

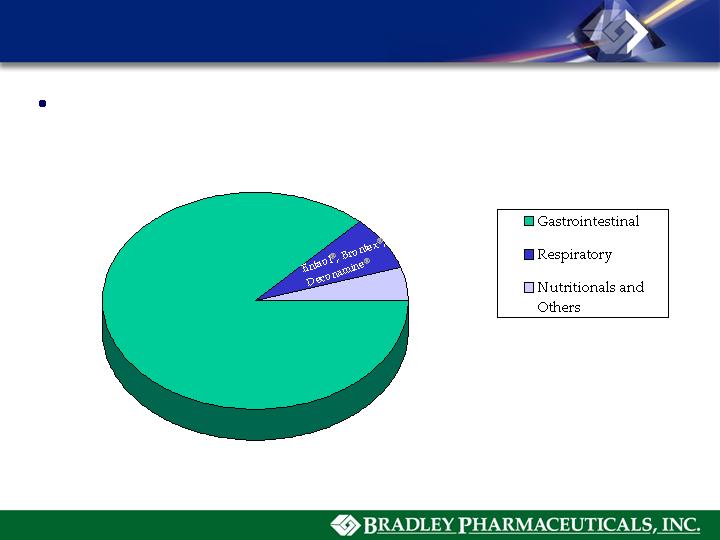

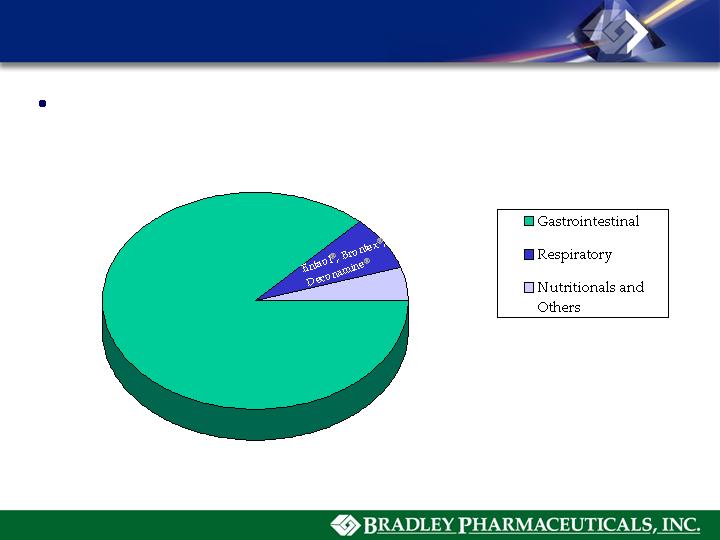

Kenwood Therapeutics - Major Brands

Commercialize

2006 Net Sales = $30.3 M

85.5%

6.8%

7.7%

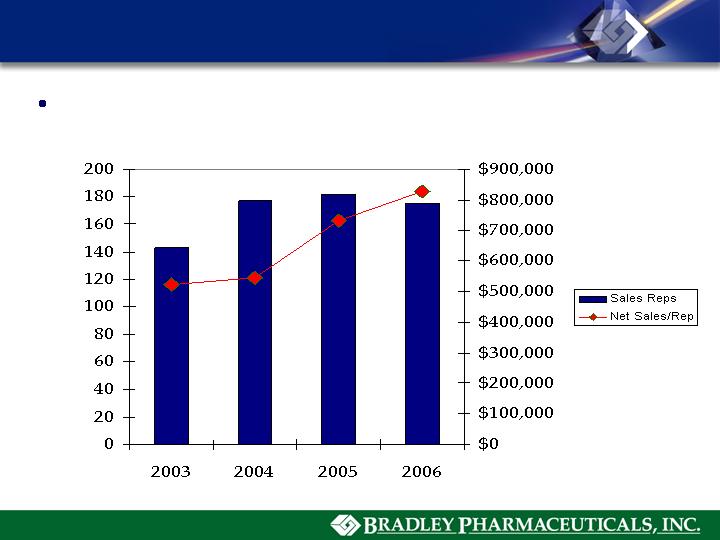

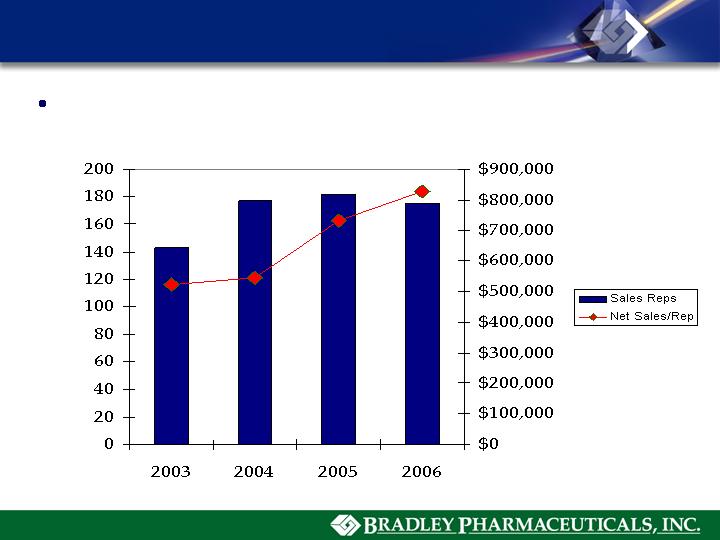

Synergistic Promotion and Sales Execution

Commercialize

Sales Force Productivity

National Field Force Focused on “QAD” Selling Model

Commercialize

Leverage Dynamic Physician Relationships

Kenwood Therapeutics

Gastroenterology and Colon Rectal Surgery

Headquarters Physician Territory

Major Conference Exhibitor

Digestive Disease Week

American College of Gastroenterology

Sponsored more than 60 GE specialty society meetings

OB/GYN

Major Conference Exhibitor

American College of Obstetricians and Gynecologists

Sponsored four regional OB/GYN specialty society meetings

Commercialize

Leverage Dynamic Physician Relationships

Doak Dermatologics

Podiatry

“See the Podiatrist” Campaign

Major Sponsor, Superbones/Superskin™ CME

Pharmacists

“Profiles in Pharmacy” Campaign

Leaders in Community Pharmacy Advisory Board

Physicians Assistants/Dermatology

CME Sponsorship

Major Supporter, SDPA

Commercialize

Leverage Dynamic Physician Relationships

Doak Dermatologics

Dermatology

Headquarters Physician Territory

Key Opinion Leader Endorsements

Skin Cancer Screening Tour

Conducted more than 5,500 free screenings

Generated more than 55 million media impressions

regarding importance of seeing a dermatologist

Commercialize

Growing, Patent-Protected Brands

Solaraze® Gel (diclofenac sodium 3%)

Indication: Actinic Keratosis

Strong brand growth

2006 Net Sales: $23.6 million, up 80% over 2005

Estimated market share: 17.5% (1)

Safety and efficacy:

90% mean decrease in target lesions vs. baseline

58% of patients experienced 100% AK lesion clearance based on

Target Lesion Number Score vs. baseline

Well-tolerated with few side-effects

Additional clinical studies in progress

Patent expiration: 2014 - 2016

Commercialize

(1) Wolters Kluwer, based on 2006 TRx

Develop

Develop

Develop Brands Through Lifecycle Management

Introduce new products and line extensions filling unmet

patient and physician needs

Develop Brands Through Clinical Support

Doak Dermatologics - Current and on-going studies:

Keralac™ Nail Gel:

Brittle Nails (Dr. Scher)

Dystrophic Nails (Dr. Robbins)

Solaraze® Gel:

Effectiveness Post Cryosurgery, multi-center (Dr. Rigel)

AK of the Lip Study (Dr. Nelson)

Proof of Concept, new indications (Dr. Elewski, Dr. Wolf, Dr.

Kaplan and Dr. Draelos)

Zoderm®: Acne Tolerability/Efficacy, multi-center

Kenwood Therapeutics - Current and on-going studies:

Flora-Q®:

IBD, maintenance of remission

Diarrhea-predominant IBS

Develop

In-License

Merger/Acquisition/Licensing Activity – Last 5 Yrs

Merger/Acquisition/Licensing Activity – Prior

In-License

Company

Transaction

Adams Respiratory

ENTSOL®

BioSante

ElestrinTM

Lundbeck

Flora-Q®

MediGene AG

VeregenTM

Company

Transaction

Mission Pharmacal

AnaMantle HC®

Quintiles

Bioglan

SkyePharma

Solaraze®

Company

Transaction

Bayer

LidaMantle®

Berlex

Deconamine®

Doak Pharmacal

Doak Pharmacal

Hoechst

Duadacin®

Kenwood Labs

Kenwood Labs

Procter & Gamble

Brontex®

Roche

Carmol®

Company

Transaction

Sandoz

AcidMantle®

Schering-Plough

Tyzine®, Nitroglyn® , Ircon ®,

Ipsatol®

Upjohn

Pamine®, Adeflor®

Upsher-Smith

Lubrin®

Tsumora

Trans-Ver-Sal ®, Glandosane®

Patent-Protected Brands

VeregenTM (sinecatechins)

In-licensed U.S. rights from MediGene AG

Indication: Treatment of external genital and perianal warts

FDA approval: 10/31/06

Hypothesized mode of action (1) includes anti-inflammatory,

antiviral, anti-oxidant and immune modulatory

Market considerations:

Launch timing: Fourth quarter 2007

Doak Dermatologics: 1st position detail to dermatologists

Kenwood Therapeutics: 1st position detail to high-decile HPV

prescribing OB/GYN and primary care physicians

U.S. market size (2): $200 million

Patent expiration: 2017

(1) Source: MediGene AG

(2) Wolters Kluwer, retail and mail order TRx dollars, discounted 20%

In-License

Patent-Protected Brands

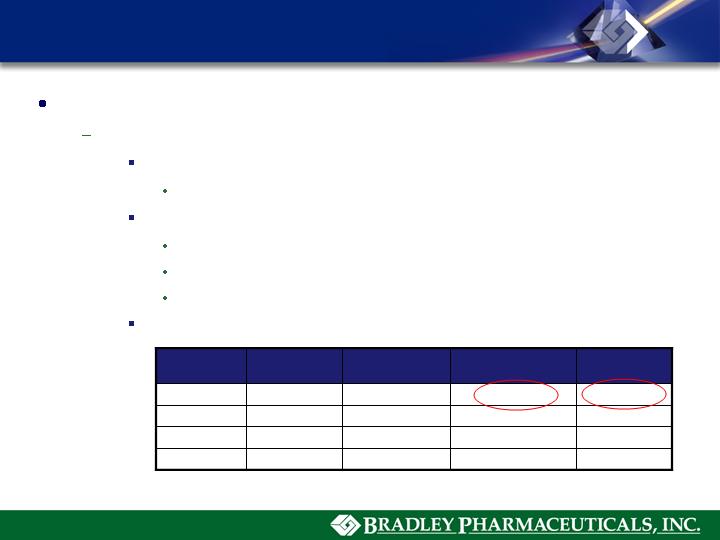

VeregenTM : Advantages over Aldara ®

Clears newly emerging warts

Relatively high clearance in males

Relatively low recurrence rates

Summary of Combined Pivotal Data

Aldara®(1)

VeregenTM

Source: MediGene AG

13 – 27.5%(3)

6.2%

Recurrence Rate:

Not Investigated

50% (F 72%, M 33%)

54.9% (F 61%, M 49%)

56.7% (F 64%, M 50%)

Efficacy(2) :

Clearance of all warts

Clearance of baseline warts

(1) Aldara® pivotal data; no head-to-head comparison

(2) Based on the intent-to-treat population

(3) 13% reported in pivotal studies; higher numbers reported in publications

In-License

Patent-Protected Brands

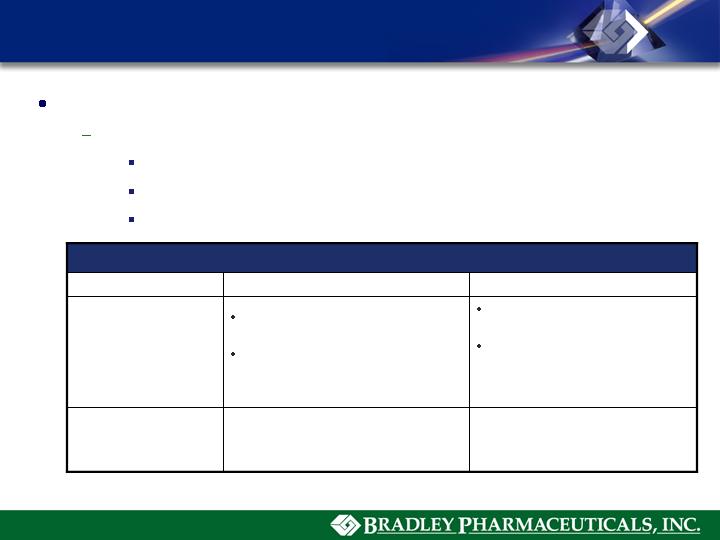

VeregenTM : Better Safety Profile vs. Aldara ®

Systemic side effects unlikely

Skin reactions mild, and decrease with time

No requirements for drug holidays

Summary of Combined Pivotal Data

Aldara® (1)

VeregenTM

Source: MediGene AG

•3x/week

•3x/day (compliance 90%)

•Potential for 2x/day regimen

(additional studies required)

Dosage/

Administration:

Systemic side effects reported in

some patients

Severe reactions reported with

3x/week application (Integrated

“drug holidays”) in dosing

program

Systemic side effects highly

unlikely

Majority of local reactions mild to

moderate and reduce with time. No

requirements for drug holidays

Safety:

(1) Aldara® pivotal data; no head-to-head comparison

In-License

Patent-Protected Brands

ElestrinTM (estradiol) Gel

In-Licensed U.S. rights from BioSante Pharmaceuticals

Indication: Treatment of moderate-to-severe vasomotor

symptoms in menopausal women

FDA approval: 12/15/06

Market considerations:

Transdermal gel offering the lowest effective dose of estradiol

Launch timing: June 2007

Kenwood Therapeutics: 1st position detail to high-decile

estradiol prescribing OB/GYN and primary care physicians

U.S. market size(1) : $1.3 billion, with transdermal segment

expected to grow > $300 million over the next several years

Patent expiration: 2017-2021

(1) Wolters Kluwer, retail and mail order TRx dollars, discounted 20%

In-License

Patent-Protected Brands

ElestrinTM Gel:

Advantages over oral estradiol therapies

Reduced risk of thromboembolic events

Advantages over estradiol patches

Less irritating

Cosmetically appealing

Dose titration possible with metered dose dispenser

Advantages over other topical estradiol products

In-License

Unknown

Unknown

Spray bottle

Spray

EvamistTM(1)

Both thighs

Not determined

Satchet

Emulsion

Estrasorb®

Full arm

Not determined

Metered pump

Gel

Estrogel®

Upper arm

12.5µg

Metered pump

Gel

ElestrinTM

Application

Site

Lowest Effective

Dose

Packaging

Formulation

Product

(1) NDA filed October 2006

Successful track record of strong sales and profits

Experienced senior management team

Well established relationships with key specialty

physician opinion leaders and physician audiences

Winning strategy for creating value built upon core

marketing and sales expertise, which enables us to:

Commercialize brands that fill unmet patient and physician

needs

Develop new products through lifecycle management of

existing brands

In-License late-stage, patent-protected product candidates that

upon approval leverage our sales and marketing capabilities

Growing portfolio of patent-protected drugs

Why Bradley Pharmaceuticals

4/4/07