QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Bradley Pharmaceuticals, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

September , 2006

Dear Fellow Stockholders:

You are cordially invited to attend our Annual Meeting of Stockholders, which will be held on Thursday, October 26, 2006, at 9:00 a.m., Eastern Time, at the offices of Morrison & Foerster LLP, 1290 Avenue of the Americas, New York, New York 10104.

At the Annual Meeting, you will be asked to elect eight directors, three by the holders of the common stock voting separately as a class and five by the holders of the Class B common stock voting separately as a class, to ratify the appointment of Grant Thornton LLP as our auditors, to vote upon a proposal by a stockholder to separate the positions of chairman of the board of directors and chief executive officer and to vote upon any other matter that may properly come before the meeting.

This is a very important Annual Meeting for our Company andyour vote is critical. We at Bradley are grateful for the support that you have given us. We ask you to continue to support your Company and vote for our slate of nominees so that we may continue our efforts to enhance long-term stockholder value through the initiatives we announced on August 28, 2006. These initiatives highlight the Company's existing strategic plan to improve and expand product offerings, strengthen our financial profile, increase alignment with stockholders' interests and focus intensely on operations.

Costa Brava Partnership III L.P. ("Costa Brava"), a stockholder, has notified us that it intends to nominate three directors for election by the holders of common stock at the Annual Meeting.Your Board strongly urges younottosupport the Costa Brava nominees, if they are presented at the meeting. At this year's Annual Meeting, the Company is proposing three carefully selected and highly qualified nominees to our Board to be elected by the holders of our common stock. We believe that this slate will allow us to continue the progress we are making in increasing stockholder value. We believe that Costa Brava's plans for the Company do not benefit the Company or you as stockholders. Costa Brava also presented a proposal for inclusion in our Company's Proxy Statement requesting that the Board of Directors consider a policy of separating the positions of chairman and chief executive officer.Your Board strongly urges youtovoteagainst this proposal. Your Board believes that a single person serving as Chair and Chief Executive Officer and the only management representative on the Board provides unified leadership and direction in enhancing long-term stockholder value. Further, Costa Brava may present a proposal to recommend that the Board of Directors of the Company consider a recapitalization transaction that would adopt a single class of common stock for the Company with equal voting rights, including for the election of the Board of Directors.Your Board urges youtovoteagainst any recapitalization proposal that may be properly presented at the Annual Meeting. Our current dual class capitalization promotes stability and continuity in the leadership and management of the Company, which allows the Company to focus on enhancing long-term stockholder value, and provides the Company with greater flexibility in financing its growth. Please note that if Costa Brava's nominees are elected by the stockholders or its proposals are approved by the stockholders, the Company may be required to pay the significant expenses incurred by Costa Brava in connection with its solicitation.

Please read the enclosed Proxy Statement carefully, and vote for your Board's nominees as listed on the WHITE proxy card. If you do not expect to be present, you are requested to fill in, date and sign the accompanying WHITE proxy card, which is solicited by the Board of Directors of the Company, and to mail it promptly in the enclosed envelope to make sure that your shares are represented at the meeting. You are also able to vote your shares on the Internet as shown on the WHITE proxy card or by telephone using the toll-free number on the WHITE proxy card. If you decide to attend the meeting in person, you may, if you desire, revoke your proxy and vote your shares in person. The Annual Meeting is open to all stockholders or their authorized representatives. In order to attend the Annual Meeting, you must present an admission ticket. You may request a ticket in advance by following the instructions set forth in the notice of meeting.

On behalf of the Board of Directors, I thank you for your continuing support.

Sincerely,

DANIEL GLASSMAN

Chairman, President and CEO

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on October 26, 2006

| Time | | Place |

Thursday, October 26, 2006

9:00 a.m., Eastern Time |

|

Morrison & Foerster LLP

1290 Avenue of the Americas

New York, New York 10104 |

Purposes

- 1.

- To elect eight directors, three by the holders of the common stock voting separately as a class and five by the holders of the Class B common stock voting separately as a class, to serve until the next Annual Meeting of Stockholders or until their respective successors have been elected or appointed; THE BOARD RECOMMENDS A VOTEFOR THE ELECTION OF EACH OF THE BOARD'S NOMINEES ON THE ENCLOSED WHITE PROXY CARD. WE URGE YOU NOT TO VOTE FOR ANY NOMINEES OF COSTA BRAVA AND NOT TO EXECUTE ANY PROXY CARD EXCEPT A WHITE PROXY CARD;

- 2.

- To ratify the Audit Committee's selection of Grant Thornton LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2006; THE BOARD RECOMMENDS A VOTEFOR THIS PROPOSAL;

- 3.

- If properly presented to the meeting, to vote upon a proposal by a stockholder that requests that the Board of Directors establish a policy to separate, whenever possible, the roles of Chair and Chief Executive Officer, so that an independent director who has not served as an executive officer of the Company serves as Chair of the Board of Directors; THE BOARD RECOMMENDS A VOTEAGAINST THIS PROPOSAL;

- 4.

- If properly presented to the meeting, to vote upon a proposal that may be presented by a stockholder to recommend that the Board of Directors of the Company consider a recapitalization transaction that adopts a single class of common stock for the Company with equal voting rights, including for the election of the Board of Directors; THE BOARD RECOMMENDS A VOTEAGAINST THIS PROPOSAL; and

- 5.

- To consider and act upon such other matters as may properly come before the meeting or any adjournment(s) thereof.

Record Date

Only stockholders of record of our common stock and Class B common stock at the close of business on September 21, 2006 shall be entitled to receive notice of, and to vote at, the meeting and any adjournment(s) thereof.

Mailing Date

This Notice and the enclosed Proxy Statement, WHITE proxy card and 2005 Annual Report on Form 10-K are first being mailed to stockholders on or about September , 2006.

Meeting Documents

A WHITE proxy card, Notice of Meeting and Proxy Statement are enclosed herewith. A copy of the Company's Annual Report on Form 10-K for the year ended December 31, 2005, containing financial statements for the year ended December 31, 2005, has also been enclosed in the same mailing with this Proxy Statement but should not be considered soliciting materials.

Voting

If you do not expect to be present at the Annual Meeting, you are requested to fill in, date and sign the accompanying WHITE proxy card, which is solicited by the Board of Directors of the Company, and to mail it promptly in the enclosed envelope to make sure that your shares are represented at the Meeting. You are also able to vote your shares on the Internet as shown on the WHITE proxy card or by telephone using the toll-free number on the WHITE proxy card. If you decide to attend the meeting in person, you may, if you desire, revoke your Proxy and vote your shares in person, provided you obtain an Admission Ticket in the manner provided below and bring it to the meeting.

We urge you to vote only on the WHITE proxy card. Costa Brava has indicated that it intends to present a slate of nominees to be elected by the holders of common stock, intends to present a proposal to separate the roles of Chair and CEO and may present a recapitalization proposal. Your Board of Directors urges youNOT to sign any proxy card that may be sent to you by Costa Brava. If you previously returned a proxy card, you may change any vote you may have cast in favor of the Costa Brava nominees or any stockholder proposal and vote in favor of the Company's nominees and against any stockholder proposal by marking, signing, dating and returning the enclosed WHITE proxy card in the postage-paid envelope. The properly executed proxy card you submit with the latest date will be the one honored.We urge you to disregard any other proxy card sent to you regarding these matters.

See the question and answer section for information on how to vote by proxy card, how to revoke a proxy, and how to vote shares in person, by telephone, or by Internet at the Annual Meeting.

Attending the Meeting

The Annual Meeting is open to all stockholders or their authorized representatives. In order to attend the Annual Meeting, you must present an admission ticket. You may request a ticket in advance by following the instructions below. Stockholders who do not have admission tickets will be admitted only following proof of share ownership. If you hold shares of common stock in your own name, please signify your intention to attend the Annual Meeting when you vote by telephone or over the Internet or check the appropriate box on your proxy card. If you hold your shares through a broker, bank or other holder of record and plan to attend, you must send a written request to attend along with proof that you own the shares (such as a copy of your brokerage or bank account statement) to our corporate secretary at the above address.

ii

Please contact Bradley's proxy solicitor, Georgeson Inc., toll free at 866-856-2826 if you have any questions about voting your shares.

By Order of the Board of Directors,

DANIEL GLASSMAN

Chairman, President and CEO

Dated: September , 2006

YOUR VOTE IS IMPORTANT. PLEASE VOTE. YOU MAY VOTE BY INTERNET, BY TELEPHONE OR BY COMPLETING, DATING, SIGNING AND RETURNING THE ACCOMPANYINGWHITE PROXY CARD IN THE ENCLOSED POSTAGE-PAID RETURN ENVELOPE.

iii

TABLE OF CONTENTS

| | Page

|

|---|

| ABOUT THE MEETING | | 1 |

| POTENTIAL PROXY FIGHT | | 7 |

| PROPOSAL ONE: ELECTION OF DIRECTORS | | 11 |

| | Nominees for Election by the Holders of Common Stock | | 11 |

| | Nominees for Election by the Holders of Class B Common Stock | | 12 |

| | Directors and Executive Officers | | 14 |

| | Certain Board Information | | 15 |

| | Committees of the Board | | 16 |

| CORPORATE GOVERNANCE INFORMATION | | 17 |

| | Executive Sessions | | 17 |

| | Communications with Directors | | 17 |

| | Independent Directors | | 17 |

| | Procedure for Stockholder Proposals and Nomination of Directors | | 18 |

| | Identifying and Evaluating Nominees for Director | | 19 |

| | Director Qualifications | | 19 |

| | Codes of Ethics and Corporate Governance Guidelines | | 19 |

| PROPOSAL TWO: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 20 |

| STOCKHOLDER PROPOSALS | | 21 |

| | Proposal regarding separating the position of chair of the board of directors and chief executive officer | | 21 |

| | Potential proposal regarding recommending a recapitalization proposal | | 22 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 24 |

| EXECUTIVE COMPENSATION | | 26 |

| | Summary Compensation Table | | 26 |

| | Stock Options | | 26 |

| | Option Grants in 2005 | | 27 |

| | Equity Compensation Plan Information | | 28 |

| | Employment Contracts and Termination of Employment and Change-in-Control Arrangements | | 28 |

| | Other Compensation Plans | | 30 |

| | Compensation of Directors | | 30 |

| COMPENSATION COMMITTEE REPORT | | 31 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | 33 |

| RELATED PARTY TRANSACTIONS | | 33 |

| | Compensation Committee Interlocks and Insider Participation | | 33 |

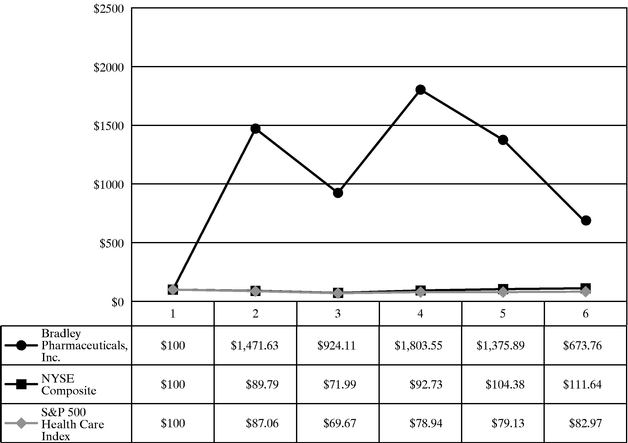

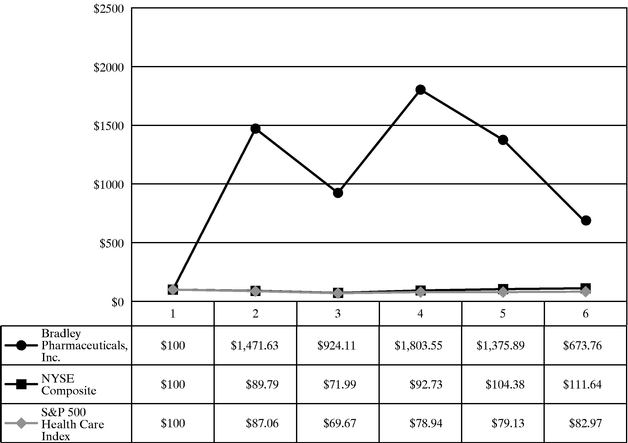

| COMPARATIVE STOCK PERFORMANCE | | 34 |

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM MATTERS | | 35 |

| AUDIT COMMITTEE REPORT | | 36 |

| METHOD AND COST OF PROXY SOLICITATION | | 38 |

| ANNUAL REPORT AND COMPANY INFORMATION | | 38 |

| MISCELLANEOUS | | 39 |

iv

383 Route 46 West

Fairfield, New Jersey 07004

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on October 26, 2006

ABOUT THE MEETING

When and where will the meeting be held?

The 2006 Annual Meeting of Stockholders of Bradley Pharmaceuticals, Inc. (together with its subsidiaries, the "Company" or "Bradley") will be held at 9:00 a.m., Eastern Time, on Thursday, October 26, 2006, at the offices of Morrison & Foerster LLP, 1290 Avenue of the Americas, New York, New York 10104, and at any adjournment(s) thereof (the "Annual Meeting").

Do I need a ticket to attend the Annual Meeting?

Yes. The Annual Meeting is open to all stockholders or their authorized representatives. In order to attend the Annual Meeting, you must present an admission ticket. You may request a ticket in advance by following the instructions below. Stockholders who do not have admission tickets will be admitted only following proof of share ownership. If you hold shares of common stock in your own name, please signify your intention to attend the Annual Meeting when you vote by telephone or over the Internet or check the appropriate box on your proxy card. If you hold your shares through a broker, bank or other holder of record and plan to attend, you must send a written request to attend along with proof that you own the shares (such as a copy of your brokerage or bank account statement) to our corporate secretary at the above address.

What are the purposes of the Annual Meeting?

You will be asked to consider and vote upon:

- •

- The election of eight directors, three by the holders of the common stock voting separately as a class and five by the holders of the Class B common stock voting separately as a class, to serve until the next Annual Meeting of Stockholders or until their respective successors have been elected or appointed;

- •

- To ratify the Audit Committee's selection of Grant Thornton LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2006;

- •

- If properly presented to the meeting, to vote upon a proposal by a stockholder that requests that the Board of Directors consider establishing a policy to separate, whenever possible, the roles of Chair of the Board of Directors and Chief Executive Officer (or CEO), so that an independent director who has not served as an executive officer of the Company serves as Chair;

- •

- If properly presented to the meeting, to vote upon a proposal that may be presented by a stockholder to recommend that the Board of Directors of the Company consider a recapitalization transaction that would adopt a single class of common stock for the Company with equal voting rights, including for the election of the Board of Directors (see "Potential Proxy Fight" in this Proxy Statement); and

- •

- To consider and act upon such other matters as may properly come before the meeting or any adjournment(s) thereof.

The Board of Directors is not aware of any other matters to be presented for action at the Annual Meeting. However, if other matters are presented for a vote and you grant a proxy, the persons named as proxy holders, Daniel Glassman and Alan S. Goldstein, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. Additionally, if, for any unforeseen reason, any of our nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by our Board of Directors.

Who is entitled to vote?

Only stockholders of record at the close of business on Thursday, September 21, 2006, the record date for the Annual Meeting (the "Record Date"), are entitled to receive notice of and to participate in the Annual Meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares that you owned on that date.

How many votes can be cast by the holders of our common stock and Class B common stock?

On September 21, 2006, the Record Date, there were shares of the Company's common stock and 429,752 shares of the Company's Class B common stock outstanding. The holders of common stock and Class B common stock are generally entitled to one vote and five votes, respectively, for each share held on the Record Date, but with respect to the election of directors, so long as there are at least 325,000 shares of Class B common stock issued and outstanding, holders of Class B common stock, voting separately as a class, are entitled to elect the sum of one plus one-half of the total number of directors and holders of common stock, voting separately as a class, are entitled to elect the balance of the directors.

How many votes must be present to hold the meeting?

A quorum of each of the common stock and Class B common stock must be present. A quorum normally is a majority (more than half) of the outstanding shares eligible to vote on the particular matter present at the meeting or represented by proxy. Pursuant to a stipulated final order of the Delaware Court of Chancery, for purposes of this Annual Meeting, a quorum will be the shares of Bradley stock represented at the Annual Meeting, either in person or by proxy, and entitled to vote thereat, notwithstanding any provision of Bradley's Certificate of Incorporation or By-Laws. Abstentions and broker non-votes will be counted towards the quorum. (See "Potential Proxy Fight—Interactions with Costa Brava" for additional information about the order.)

How many votes are required for the election of directors?

The affirmative vote of a majority of the shares of the Company's common stock or Class B common stock, as the case may be, represented in person or by properly executed proxy, is required to approve the election of the Company's nominees for election by those shares of stock. At the Annual Meeting, the holders of common stock are entitled to elect three directors and the holders of Class B common stock are entitled to elect five directors.

How many votes are required for the ratification of the selection of the independent registered public accounting firm and approval of the stockholder proposal regarding separating the position of Chair and CEO?

The affirmative vote of a majority of the voting power of the Company's common stock and Class B common stock, voting together as a class, present or represented and entitled to vote and

2

voting is required for the ratification of the appointment of the Company's independent registered public accounting firm or approval of the stockholder proposal regarding separating the position of Chair and CEO. The New York Stock Exchange has determined that the ratification of the selection of independent auditors is a "routine" item. Therefore, a broker or nominee may vote shares held by it with respect to that item if no instructions are received for it at least 15 days before the Annual Meeting.

How many votes are required for other matters that may properly come before the meeting?

The affirmative vote of a majority of the voting power of the Company's common stock and Class B common stock, voting together as a class, present or represented and entitled to vote and voting is required for all other business that may properly come before the Annual Meeting or any adjournments.

How do I vote?

You may:

- •

- Vote by marking, signing, dating and returning a proxy card. To vote for the Company's nominees, mark, sign, date, and return the enclosed WHITE proxy card in the accompanying envelope and do not sign or return any proxy card sent to you by Costa Brava. Withholding authority to vote for the Costa Brava nominees on any proxy card it sends you is not the same as voting for the Company's nominees. We urge you to disregard any proxy card that Costa Brava may send you and to sign and return the WHITE proxy card;

- •

- Vote via the Internet by following the voting instructions on the WHITE proxy card or the voting instructions provided by your broker, bank, or other holder of record. Internet voting procedures are designed to authenticate your identity, allow you to vote your shares, and confirm that your instructions have been properly recorded. If you submit your vote by Internet, you may incur costs associated with electronic access, such as usage charges from Internet access providers and telephone companies;

- •

- Place your vote by telephone by following the instructions on the WHITE proxy card or the instructions provided by your broker, bank, or other holder of record; or

- •

- Vote in person by attending the Annual Meeting. We will distribute written ballots to any stockholder of record who wishes to vote in person at the Annual Meeting.

How are shares voted that are held in a Company 401(k) plan?

The Bradley Pharmaceuticals 401(k) trust includes an Employee Stock Ownership Plan feature. At the Record Date, shares were held in the trust for participants. The Company's transfer agent, American Stock Transfer & Trust Company, sent a proxy statement, an annual report and a voting instruction form to each participant who held shares through the Company's 401(k) plan at the Record Date. Frontier Trust, as trustee, will vote the shares in accordance with instructions received from participants. Frontier Trust will vote shares for which no instructions were received in the same proportion, for and against, as the shares for which instructions were received.

To allow sufficient time for voting by the trustee, your voting instructions for 401(k) plan shares must be received by 11:59 p.m. Eastern Time on October 24, 2006.

What if I return my proxy card and don't vote on a matter listed on it?

If you return a WHITE proxy card without indicating your vote, your shares will be votedFOR the director nominees listed on the proxy card,FOR ratification of the selection of the auditors,AGAINST

3

the proposal by a stockholder to separate the positions of Chair of the Board of Directors and Chief Executive Officer,AGAINST a possible recapitalization proposal by a stockholder and in the discretion of the person named in the proxy on any other matters that may be properly brought before the meeting.

Can I change my vote?

Yes. Send in a new WHITE proxy card with a later date, cast a new vote by Internet, or send a written notice of revocation to the Company's Secretary at the address on the cover page of this Proxy Statement. If you attend the Annual Meeting and want to vote in person, you can request that your previously submitted proxy not be used. If your shares are held through a broker, bank or other institution in "street name", you will need to obtain a proxy form from the institution that holds your shares.

If you have previously signed a proxy card that is not white, you may change any vote you may have cast in favor of the Costa Brava nominees and vote in favor of the Company's director nominees by marking, signing, dating, and returning the enclosed WHITE proxy card in the accompanying postage-paid envelope.

We urge you to vote only on the WHITE proxy card. We strongly urge you to revoke any proxy card you may have returned other than a WHITE proxy card. Any signed proxy card you return that is not white—even if it reflects votes "AGAINST" the Costa Brava nominees—will cancel any votes reflected on any WHITE proxy card that you may have previously returned. You may also revoke your vote by attending the Annual Meeting in person and giving notice of revocation to the inspector of election.

What does it mean if I receive more than one WHITE proxy card?

If you hold your shares in multiple registrations, or in both registered and street name, you will receive a WHITE proxy card for each account. Please sign, date, and return all WHITE cards you receive. If you choose to vote by phone or Internet, please vote each proxy card you receive. Only your latest dated proxy for each account will be voted.

As previously noted, a proxy fight may be commenced by Costa Brava who may distribute an opposition proxy statement and a different color proxy card. As a result, you will receive proxy cards from both Costa Brava and the Company.Becauseonlythelatestdatedproxycardiscounted, stockholders may receive more than one WHITE proxy card from management regardless of whether or not they have previously voted. To ensure stockholders have management's latest proxy information and materials to vote, management may conduct multiple mailings prior to the Annual Meeting date.

To vote as management recommends, stockholders must use management's WHITE proxy card. Voting against the dissident on the dissident's proxy card will not be counted as a vote for management and can result in the revocation of any previous vote you may have cast for management on the WHITE proxy card.

If you have voted the dissident stockholder's proxy card, you have every right to change your vote by executing management's WHITE proxy card.

Will my shares be voted if I do not sign and return my proxy card?

They could be, but not for the contested election of directors or for a stockholder proposal to which your Board is opposed. If your shares are held in street name and you do not instruct your broker or other nominee how to vote your shares, your broker or nominee may either use its discretion to vote your shares on "routine matters" or leave your shares unvoted. For any "non-routine matters" being considered at the meeting (such as the election of directors in an election contest or a proposal

4

by a stockholder to which your Board is opposed), your broker or other nominee will not have discretionary authority to vote your shares. If your shares are held in street name, your broker, bank, or nominee will include a voting instruction card with this Proxy Statement. We strongly encourage you to vote your shares by returning your WHITE proxy card to your nominee and contact the person responsible for your account to ensure that a WHITE proxy card is voted on your behalf.

Who will act as inspector of election?

The Company will retain an independent third party to act as inspector of election.

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspector of election. The inspector will also determine whether a quorum is present at the Annual Meeting.

The shares represented by the proxy cards received, properly marked, dated, signed, and not revoked, will be voted at the Annual Meeting. If the proxy card specifies a choice with respect to any matter to be acted on, the shares will be voted in accordance with that specified choice. Any WHITE proxy card that is returned signed but not marked will be votedFOR each of the Director nominees,FOR the ratification of the Audit Committee's selection of Grant Thornton LLP as the Company's independent registered public accounting firm,AGAINST the proposal by a stockholder to separate the positions of Chair of the Board of Directors and Chief Executive Officer,AGAINST a possible recapitalization proposal by a stockholder and as the proxy holder deems desirable for any other matters that may properly come before the Annual Meeting. Broker non-votes will not be considered as voting with respect to any matter for which the broker does not have voting authority.

What are abstentions and broker non-votes?

Abstentions and broker non-votes are each included in the determination of the number of shares present and voting for purposes of determining the existence of a quorum. Abstentions are not counted in tabulations of the votes cast on stockholder proposals presented. Broker non-votes will not be counted as votes for or against such proposal. A broker non-vote occurs when a nominee holding shares for a beneficial owner expressly does not vote on a particular matter because the nominee does not have discretionary voting power with respect to the matter and has not received instructions from the beneficial owner.

Who is soliciting my vote?

Your vote is being solicited by and on behalf of the Company's Board of Directors.

How will my vote be solicited?

In addition to sending you these materials, some of our directors and executive officers as well as certain members of management may contact you by telephone, mail, e-mail, or in person. You may also be solicited by means of press releases issued by us, postings on our web site, www.bradpharm.com, and advertisements in periodicals. Appendix A sets forth information relating to our directors, director nominees, executive officers, and certain members of management who are considered "participants" in our solicitation under the rules of the Securities and Exchange Commission (the "SEC") by reason of their position as directors, director nominees, executive officers or certain members of management or because they may be soliciting proxies on our behalf.

We also have retained Georgeson Inc., 17 State Street, New York, NY 10004, to assist us in soliciting your proxy. Georgeson expects that approximately 50 of its employees will assist in the solicitation. Georgeson will ask brokerage houses and other custodians and nominees whether other persons are beneficial owners of Bradley common stock. If so, we will reimburse banks, nominees,

5

fiduciaries, brokers and other custodians for their costs of sending the proxy materials to the beneficial owners of Bradley common stock.

Who pays for the solicitation of my vote?

The Company pays the costs of soliciting your vote, including the costs of preparing, printing and mailing the proxy materials. None of our officers or employees will receive any extra compensation for soliciting you. Georgeson Inc. will receive an estimated fee of up to $250,000 plus reasonable out-of-pocket expenses. Under Georgeson's retention agreement, the Company will also generally indemnify and hold harmless Georgeson and its affiliates against claims, costs and expenses directly relating to Georgeson's services to the Company. Our expenses related to the solicitation in excess of those normally spent for an Annual Meeting as a result of the proxy fight including Georgeson but excluding salaries and wages of our regular employees and officers are expected to be approximately $1.1 million of which approximately $475,000 has been spent to date. These expenses exclude the costs of litigation commenced by Costa Brava of approximately $150,000 to date, which amount could grow significantly.

If Costa Brava's nominees are elected by the stockholders or if any of its proposals are approved by the stockholders, the Company may be required to pay the significant expenses expected to be incurred by Costa Brava in connection with its solicitation, including the numerous litigations it has commenced.

When will this Proxy Statement be sent to stockholders?

This Proxy Statement is first being sent to stockholders on or about September , 2006. A copy of the Company's Annual Report on Form 10-K for the year ended December 31, 2005, containing financial statements for the year ended December 31, 2005, has also been enclosed in the same mailing with this Proxy Statement.

Can I access the Company's proxy materials and annual report electronically?

This Proxy Statement and the Company's 2005 Annual Report on Form 10-K are available on its Internet web site at www.bradpharm.com.

What is "householding" and how does it affect me?

The SEC has adopted a rule concerning the delivery of annual reports and proxy statements that permits the Company, with your permission, to send a single set of these proxy materials to any household at which two or more stockholders reside if the Company believes they are members of the same family. A separate proxy card would still be mailed to each stockholder at the same address. This rule is called "householding" and its purpose is to help reduce printing and mailing costs of proxy materials. The Company has instituted this procedure.

A limited number of brokerage firms have instituted householding. If you and members of your household have multiple accounts holding shares of the Company's common stock or Class B common stock, you may have received householding notification from your broker. Please contact your broker directly if you have questions, require additional copies of this Proxy Statement or our 2005 Annual Report on Form 10-K, or wish to revoke your decision to household. These options are available to you at any time.

6

POTENTIAL PROXY FIGHT

Interactions with Costa Brava

Bradley was initially contacted in June 2006 by Ropes & Gray LLP, as counsel to and on behalf of Costa Brava Partnership III L.P., of which Roark, Rearden and Hamot, LLC ("RRH") is its general partner, and Seth W. Hamot is the President of RRH (collectively, "Costa Brava"). Costa Brava is a hedge fund with approximately $130 million under management that describes itself as focusing on turnaround situations, defaulted and distressed debt, and complex litigation. As of August 16, 2006, Costa Brava reported that it owned 1,640,700 shares of common stock or approximately 9.5% of our outstanding common stock with a weighted average purchase price of approximately $10.20 per share.

Costa Brava has initiated numerous actions intended to disrupt the operations of the Company and distract management's attention from the Company's business.

First, on June 15, 2006, Ropes & Gray LLP sent a letter (the "June 15th Letter") to Mr. Daniel Glassman, our Chairman, President and Chief Executive Officer. The letter alleged that by scheduling a combined 2005/2006 Annual Meeting of Stockholders for July 18, 2006, the original date we proposed to have this Annual Meeting, the Company had violated certain notice requirements under the federal securities laws and deprived Costa Brava of the opportunity to submit a shareholder proposal or a slate of director nominees for election to the Board of Directors at the Annual Meeting. The letter also alleged that Proposal One in the original proxy statement filed by us on June 9, 2006 (the "June Proxy Statement") violated our Certificate of Incorporation and By-Laws by providing that the holders of Class B common stock have the right to elect a supermajority of the Board of Directors (six of nine directors) rather than a simple majority (five of nine directors). The letter made a written demand on us to immediately announce a date by which shareholder proposals may be submitted for inclusion in our proxy statement, file an amended proxy statement that includes all properly submitted shareholder proposals, immediately announce the date by which nominees for election as directors must be submitted to the Company in order to comply with any advance notice requirement, postpone the date of the Annual Meeting to allow Costa Brava and other holders of our common stock to prepare their own proxy statement proposing a slate of director nominees, and provide in its revised proxy materials that holders of Class B common stock have the right to elect only five of the nine directors of the Company.

On June 21, 2006, the Board of Directors of Bradley met to consider Costa Brava's June 15th Letter. While the Board disagreed with the assertions set forth in the June 15th Letter, in an effort to avoid the cost and burden of litigation associated with the matters identified in the June 15th Letter, and without conceding the matters raised, or the accuracy of the allegations, in the June 15th Letter, the Board resolved to reschedule its annual meeting, originally scheduled to occur on July 18, 2006, in part to allow stockholders to submit proposals and otherwise prepare for the annual meeting. The Board of Directors also resolved to reduce the number of directors constituting the Board of Directors from nine to eight members, effective as of the date of the rescheduled annual meeting such that the holders of common stock voting separately as a class would be entitled to elect three directors and the holders of Class B common stock voting separately as a class would be entitled to elect five directors, consistent with Bradley's Certificate of Incorporation and By-Laws.

Second, Costa Brava filed a lawsuit against the Company (the "June Complaint") in the United States District Court for the District of Massachusetts, seeking an order to postpone the annual meeting by 30 days and an order that, under Delaware law, the Company impermissibly delegated to the holders of Class B common stock the right to elect a supermajority of the Board of Directors (six of nine directors) rather than a simple majority (five of nine directors). The Company received a copy of the June Complaint on June 22nd. The June Complaint was moot in light of the Board resolutions described above, and on June 26th, Costa Brava dismissed the June Complaint.

7

On June 21, 2006, Costa Brava also submitted a shareholder proposal for inclusion in our proxy materials for the annual meeting. That proposal is included in this Proxy Statement under the heading "Stockholder Proposals—Proposal regarding separating the position of chair of the board of directors and chief executive officer."

On July 18, 2006, the Company received a letter from Costa Brava indicating its intention to nominate three directors for election at our 2006 annual meeting of stockholders: Douglas E. Linton, John S. Ross and Seth W. Hamot. Costa Brava notified the Company that in the event the Nominating and Corporate Governance Committee decided not to accept these three individuals as part of the Company's slate, Costa Brava intended to nominate these individuals for election as directors and to solicit proxies for their election. In addition, Costa Brava submitted to the Company a demand for the production of stockholder information and related documents pursuant to Section 220 of the General Corporation Law of the State of Delaware (the "Delaware Corporate Law"). By letter dated July 24, 2006, Costa Brava also notified the Company that it intends to submit a proposal to recommend that the Board of Directors of the Company consider a recapitalization transaction that would adopt a single class of common stock for the Company with equal voting rights, including for the election of the Board of Directors.

Third, on August 8, 2006, Costa Brava filed a lawsuit (the "211 Complaint") against the Company in the Court of Chancery of the State of Delaware seeking, among other things, an order pursuant to Section 211 of the Delaware Corporate Law directing the Company to call and hold an annual meeting of stockholders, at the earliest practicable date, but no later than October 1, 2006.

Fourth, on August 9, 2006, Costa Brava filed a lawsuit (the "220 Complaint") against the Company in the Court of Chancery of the State of Delaware seeking an order directing the Company to produce the stockholder information and related documents identified in its July 18, 2006 letter.

Fifth, on August 14, 2006, Costa Brava filed a lawsuit (the "August Complaint") against the Company in the Court of Chancery of the State of Delaware seeking a declaration that (1) the Board of Directors improperly expanded its size from eight to nine seats without permitting the new seat to be appointed by the directors elected by the holders of the Company's common stock; (2) the appointment of the most recent director is invalid and void; and (3) the Company's Class B common stock is entitled to one vote per share, not five votes per share. The August Complaint also seeks to enjoin the Board of Directors from taking further action until it is properly constituted as required by the Company's governing documents and from taking any position that the Company's Class B common stock is entitled to five votes per share.

On August 17, 2006, unrelated to any action by Costa Brava, C. Ralph Daniel, III, M.D. resigned, effective immediately, as a member of the Board of Directors. Dr. Daniel did not have any disagreements with the Company. In an effort to avoid the cost and burden of litigation associated with matters identified in the August Complaint and without conceding the matters raised, or the accuracy of the allegations, in the August Complaint, on August 17, 2006: (1) Leonard S. Jacob, M.D., Ph.D., resigned as a member of the board and Chairman of the Nominating and Corporate Governance Committee; (2) as previously announced but effective immediately, the Board of Directors of the Company set the number of directors at eight members; (3) the Class B Directors filled the vacancy created by the resignation of Dr. Daniel on August 17, 2006 by electing Dr. Jacob as a Class B Director of the Company to serve until the next annual meeting of the stockholders of the Company and until his successor is duly elected and qualified; and (4) the Board of Directors appointed Dr. Jacob as Chairman of the Nominating and Corporate Governance Committee.

On August 22, 2006, the Company produced the stockholder information and related documents under Section 220 of the Delaware Corporate Law to Costa Brava's counsel, and on August 23, 2006, it announced the date of the rescheduled Annual Meeting and Record Date. The 211 and 220 complaints were subsequently dismissed on August 25, 2006 pursuant to stipulated final orders.

8

Take Action to Support Your Board's Initiatives

We recognize and appreciate the support that our stockholders have given us. We ask you to continue to support your Company and vote for our slate of nominees so that we may continue our efforts to enhance long-term stockholder value. In 2006 to date, we have had several important accomplishments. We are a timely filer of reports with the SEC. For the quarter and six months ended June 30, 2006, we reported net sales increased $8,959,980 and $10,510,537, or 31.8% and 17.1%, respectively, and net income increased $4,446,930 and $2,498,310, or 3,887.2% and 110.1%, respectively, from the same periods in the prior year. Our recent agreement with Medigene AG also demonstrates our strong commitment to developing new products that will contribute to the growth of our business.

On August 28, 2006, we announced our initiatives to enhance long-term stockholder value. These initiatives highlight the Company's existing strategic plan to improve and expand product offerings, strengthen our financial profile, increase alignment with stockholders' interests and focus intensely on operations. These initiatives are:

Increase Alignment with Stockholders' Interests

- •

- Actively explore initiatives to improve stockholder value

- •

- Communicate the Company's existing strategic plan in appropriate forums

- •

- Participate in industry and analyst conferences

- •

- Conduct quarterly earnings conference calls

Focus Intensely on Operations

- •

- Improve performance across field sales force

- •

- Establish enhanced goals and actions

- •

- Improve training and accountability throughout field operations

In addition, we believe our slate of directors for this Annual Meeting also demonstrates our commitment to good corporate governance. We continue to increase the number of independent and experienced directors. Following this Annual Meeting, if our slate is elected, our founder, Chairman

9

and CEO, Daniel Glassman, will be the sole non-independent director on the Board and seven of our eight board members will be independent within the meaning of SEC and the New York Stock Exchange ("NYSE") corporate governance standards. The accounting and pharmaceutical industry expertise of the independent board members is enhanced by both the deep knowledge that Mr. Glassman has gained from leading the Company since its founding in 1985 and his commitment to the long-term success of Bradley as our largest individual stockholder and third largest stockholder overall.

We urge you NOT to support Costa Brava

Bradley has tried to be responsive to the issues Costa Brava has raised. Costa Brava and Mr. Hamot, however, continue to attempt to disrupt our normal business operations and divert management's time and attention.

Costa Brava and Mr. Hamot have not offered plans or strategic initiatives that might be beneficial to the Company and our stockholders. They have simply nominated a different slate of directors, one of whom is Mr. Hamot himself. We believe our nominees have broader and deeper industry expertise as well as more experience in senior management and prior board membership.

The Company has already incurred substantial costs as a result of Costa Brava's actions. It is also important to understand that if Costa Brava's nominees are elected by the stockholders or its proposals are approved by the stockholders, the Company may be required to pay the significant expenses incurred by Costa Brava in connection with this proxy fight.

Do not stop the substantial progress we are making by electing the Costa Brava nominees.

For these reasons, we strongly recommend that youNOT vote for any slate of director nominees that may be presented by Costa Brava, and to voteFOR your Board's nominees on the WHITE proxy card.

10

PROPOSAL ONE

ELECTION OF DIRECTORS

The Company's By-Laws provide that the Company's Board of Directors shall consist of such number of directors from three to eleven as shall be determined by the Board of Directors from time to time, which number is currently set at eight.

The Company's Certificate of Incorporation provides that the holders of common stock and Class B common stock are entitled to one vote and five votes, respectively, for each share held on the Record Date, but with respect to the election of directors, so long as there are at least 325,000 shares of Class B common stock issued and outstanding (which there were as of the Record Date), holders of Class B common stock, voting separately as a class, are entitled to elect the sum of one plus one-half of the total number of directors and holders of common stock, voting separately as a class, are entitled to elect the balance of the directors. Thus, the holders of the Class B common stock are entitled to elect five of the directors, and the holders of the common stock are entitled to elect three of the directors, by a majority of the shares of such class present in person or by proxy at the Annual Meeting, assuming a quorum is present.

Unless otherwise specified, all WHITE proxy cards received will be votedFOR the election of the nominees of the Board of Directors named below as directors of the Company for the class of stock represented by that proxy. All of the nominees except Mr. Stagnaro and Mr. Whitehead are presently directors of the Company. The terms of the current directors expire at the Annual Meeting. Mrs. Glassman and Dr. Wolin are not standing for re-election, and Mr. Kriegsman has been nominated to be elected as director by the Class B stockholders. Should any of the nominees not remain a candidate for election at the date of the Annual Meeting (which contingency is not now contemplated or foreseen by the Board of Directors), proxies solicited hereunder will be voted in favor of those nominees who do remain candidates and may be voted for substitute nominees selected by the Board of Directors. A majority vote of the shares of common stock present, in person or by proxy, at the Annual Meeting, is required to elect the nominees for election by the holders of common stock as directors, and a majority vote of the shares of Class B common stock present, in person or by proxy, at the Annual Meeting, is required to elect the nominees for election by the holders of Class B common stock as directors.

Nominees for Election by the Holders of Common Stock

William J. Murphy

William J. Murphy, age 62, has served as one of our directors since February 2006, and effective July 1, 2006, was appointed Chairman of the Audit Committee. From 1997 to 2005, Mr. Murphy held several positions with Computer Horizons Corp., a publicly held information services company, initially as Executive Vice President and Chief Financial Officer, and from March 2003 until October 2005, Mr. Murphy served as President and CEO. From 1980 to 1997, Mr. Murphy was employed by the accounting firm of Grant Thornton LLP, which he joined as Senior Audit Manager, and becoming the partner in charge of its New Jersey practice in 1990. Prior to joining Grant Thornton, Mr. Murphy was a Senior Audit Manager for the accounting firm of Price Waterhouse. Mr. Murphy is a member of the New Jersey State Society of CPAs, the American Institute of Certified Public Accountants and the Financial Executives International. Mr. Murphy also serves as a Director of the Commerce and Industry Association of New Jersey, a not-for-profit pro-business organization.

Thomas P. Stagnaro

Thomas P. Stagnaro, age 63, has been nominated by our Board of Directors. Mr. Stagnaro founded in June 2004 and currently serves as President and CEO of Americas Biotech Distributor, a distributor

11

of U.S. pharmaceutical products in Latin America. He served as President and Chief Executive Officer of Agile Therapeutics, Inc., a private drug development company, from October 2000 to June 2004. From August 1998 to September 2000, Mr. Stagnaro was a consultant to various pharmaceutical and biotechnology companies. From May 1996 to August 1998, Mr. Stagnaro served as President and Chief Executive Officer of 3-Dimensional Pharmaceuticals, Inc. From November 1995 to May 1996, Mr. Stagnaro served as Executive Vice President of North American Biologicals Inc. (NABI) and as President and Chief Executive Officer of Univax Biologics (Univax) from October 1989 to November 1995 when Univax merged into NABI. Mr. Stagnaro served as a director of InKine Pharmaceutical Company Inc. from November 1997 until its merger with Salix Pharmaceuticals, Ltd. in September 2005. Mr. Stagnaro also currently serves as director of Protalex, Inc., a public biopharmaceutical company. Mr. Stagnaro holds three patents related to discoveries of certain protease inhibitors.

Robert S. Whitehead

Robert S. Whitehead, age 56, has been nominated by our Board of Directors. Mr. Whitehead has been President & Chief Executive Officer of CURE Pharmaceuticals, Inc., a specialty pharmaceutical company, since November 2005. Mr. Whitehead served as President and Chief Operating Officer of Auxilium Pharmaceuticals, Inc. from June 2004 until March 2005 and as President and Chief Executive Officer of Prestwick Pharmaceuticals, Inc., from June 2003 to February 2004. From December 2001 to June 2003, Mr. Whitehead served as Senior Vice President and Chief Business Officer at ZymoGenetics, Inc. Prior to joining ZymoGenetics, Mr. Whitehead served as President and Chief Operating Officer of Dura Pharmaceuticals and President, Americas, of Elan Pharmaceuticals. Elan acquired Dura in 2000. In addition to his extensive experience in specialty pharmaceutical companies, Mr. Whitehead served in executive leadership positions for three large multinational pharmaceutical companies, Marion Laboratories (in the United States), Solvay Pharmaceuticals (in the United States) and Searle (in the United States, Mexico, Canada and Europe).

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE FOR DIRECTOR. WHITE PROXY CARDS SOLICITED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY A DIFFERENT CHOICE OR ABSTAIN FROM VOTING ON THIS PROPOSAL.

Nominees for Election by the Holders of Class B Common Stock

Andre Fedida, M.D.

Andre Fedida, M.D., age 51, has served as one of our directors since May 2002. Dr. Fedida is a doctor of gastroenterology currently practicing in Newark, New Jersey. He is also currently on faculty as Assistant Professor of Medicine at Seton Hall University and Saint Michael's Medical Center. Dr. Fedida performed his internship, residency and fellowship at Saint Michael's Medical Center in Newark, New Jersey. Dr. Fedida is a member of the American Medical Association, American College of Physicians, American College of Gastroenterology and the American Society of Gastrointestinal Endoscopy. Dr. Fedida is Mr. Michael Fedida's brother.

Michael Fedida, R.Ph.

Michael Fedida, R.Ph., age 59, has served as one of our directors since April 2004 and has served as Chairman of the Compensation Committee since November 2004. Mr. Fedida is a registered pharmacist and has served for the past fifteen years as an officer and director of several retail pharmacies wholly or partially owned by him, including J&J Pharmacy, J&J St. Michael's Pharmacy Inc., Classic Pharmacy, Perfect Pharmacy and Phoster Pharmacy. Mr. Fedida has served on the Board of Directors of Watson Pharmaceuticals, Inc., a California based specialty pharmaceutical

12

company, since 1995. From 1988 to 1995, Mr. Fedida served on the Board of Directors of Circa Pharmaceuticals, Inc. Watson acquired Circa in 1995. Mr. Fedida is Dr. Andre Fedida's brother.

Daniel Glassman

Daniel Glassman, age 64, is our founder and has served as our Chairman of the Board and Chief Executive Officer since the Company's inception in January 1985. Mr. Glassman, a registered pharmacist, has also served as our President since February 1991. Mr. Glassman has had an over 35-year career in the pharmaceutical industry, including executive managerial positions with companies and major specialty advertising agencies serving the largest pharmaceutical companies. In 1995, Mr. Glassman was awarded the Ernst & Young LLP Entrepreneur of the Year in New Jersey, and in 2005, Mr. Glassman was awarded the degree of Doctor of Humane Letters by the New York College of Podiatric Medicine in recognition of his contributions to medical education. Mr. Glassman received his B.S. in Pharmacy from Columbia University and received his M.B.A. from New York University.

Leonard S. Jacob, M.D., Ph.D.

Leonard S. Jacob, M.D., Ph.D., age 57, has served as one of our directors, and as Chairman of the Nominating and Corporate Governance Committee, since February 2006. Dr. Jacob founded InKine Pharmaceutical Company, Inc. in 1997 and served as Chairman and CEO from its founding until the company was acquired by Salix Pharmaceuticals in September 2005. In 1989, Dr. Jacob co-founded Magainin Pharmaceuticals and served as its Chief Operating Officer until 1996. From 1980 to 1989, Dr. Jacob served in a variety of executive roles, including Worldwide Vice President of SmithKline & French Labs (now Glaxo-SmithKline), and as a member of their Corporate Management Committee. Dr. Jacob currently serves as Chairman of Life Science Advisors, a consulting group to the healthcare industry, and on the Board of Directors for the Colon Cancer Alliance and the Board of Overseers for Temple University School of Medicine. Dr. Jacob also serves on the Boards of MacroMed, Inc. and Glyconix Corp., both private drug delivery companies. In addition, Dr. Jacob is a founding Director of the Jacob Internet Fund, a publicly traded mutual fund.

Steven Kriegsman

Steven Kriegsman, age 64, has served as one of our directors since June 2003, and was Chairman of the Audit Committee from November 2004 until June 30, 2006. Until this Annual Meeting, Mr. Kriegsman was a director elected by the holders of common stock; effective with this Annual Meeting, Mr. Kriegsman will become a director elected by the holders of the Class B common stock. Mr. Kriegsman has been a director, President and Chief Executive Officer of CytRx Corporation, a public company, since July 2002. Mr. Kriegsman previously served as a director and the Chairman of Global Genomics from June 2000 until June 2002. Mr. Kriegsman is an inactive Chairman and founder of Kriegsman Capital Group LLC, a financial advisory firm specializing in the development of alternative sources of equity capital for emerging growth companies in the healthcare industry. Mr. Kriegsman has advised such companies as SuperGen Inc., Closure Medical Corporation, Novoste Corporation, Miravant Medical Technologies and Maxim Pharmaceuticals.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE FOR DIRECTOR. WHITE PROXY CARDS SOLICITED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY A DIFFERENT CHOICE OR ABSTAIN FROM VOTING ON THIS PROPOSAL.

13

Directors and Executive Officers

Our current directors and executive officers, and their ages are as follows:

Name

| | Age

| | Position(s)

|

|---|

| Daniel Glassman | | 64 | | Chairman of the Board, President and Chief Executive Officer |

| Andre Fedida, M.D.(1)(2)(3) | | 51 | | Director |

| Michael Fedida, R.Ph.(1)(3) | | 59 | | Director and Chairman of the Compensation Committee |

| Iris Glassman | | 63 | | Treasurer and Director* |

| Leonard S. Jacob, M.D., Ph.D.(3) | | 57 | | Director and Chairman of the Nominating and Corporate Governance Committee |

| Steven Kriegsman(2) | | 64 | | Director |

| William J. Murphy(2) | | 62 | | Director and Chairman of the Audit Committee |

| Alan Wolin, Ph.D.(1)(2)(3) | | 73 | | Secretary and Director* |

| Bradley Glassman | | 33 | | Senior Vice President, Sales and Marketing |

| Alan Goldstein | | 46 | | Vice President, Corporate Development |

| Ralph Landau, Ph.D. | | 45 | | Vice President, Chief Scientific Officer |

| R. Brent Lenczycki | | 34 | | Vice President, Chief Financial Officer |

| William Renzo | | 41 | | Vice President, Trade/Managed Care Relations |

- *

- Mrs. Glassman is resigning as a director and Treasurer and Dr. Wolin is resigning as a director and as Secretary of the Company, effective as of the date of the Annual Meeting and the election of their successors.

- (1)

- Member of Compensation Committee

- (2)

- Member of Audit Committee

- (3)

- Member of Nominating and Corporate Governance Committee

Our executive officers, excluding the officers who are also members of the Board of Directors, are as follows:

Bradley Glassman has served as our Senior Vice President, Sales and Marketing since January 2004. From July 2001 to December 2003, Mr. Glassman served as our Vice President, Sales and Marketing. From April 2000 through June 2001, Mr. Glassman served as our Vice President, Marketing. In addition, from January 1998 to March 2000, Mr. Glassman served as our Director of Corporate Development, and from May 1996 to December 1997, he served as a Corporate Development Analyst. Mr. Glassman received his B.A. and M.B.A. from Tulane University. Mr. Glassman is the son of Daniel and Iris Glassman.

Iris Glassman has served as our Treasurer, a non-salaried position, since the Company's inception in 1985. Mrs. Glassman, the spouse of Mr. Daniel Glassman, also has served as one of our directors since January 1985 and is resigning as a director and Treasurer effective as of the date of the Annual Meeting. Mrs. Glassman has over 25 years of diversified administrative and financial management experience. For more than the past 25 years, Mrs. Glassman has served as a senior executive in several privately held companies engaged in the medical publication and market research industries. Mrs. Glassman received her B.S. from the City College of New York.

Alan Goldstein has served as our Vice President, Corporate Development since March 2004. Mr. Goldstein joined us in June 2002 as Director, Corporate Development. From November 2000 to May 2002, Mr. Goldstein served as Counsel in the corporate department of the international law firm of Kaye Scholer LLP. From March 1998 to October 2000, Mr. Goldstein was a partner in the New York law firm of Winick & Rich, P.C. specializing in corporate finance matters. From January 1994 to February 1998, Mr. Goldstein was a partner in the New York law firm of Reid & Priest LLP, having

14

worked previously as an associate at that firm and one of its predecessors, Spengler Carlson Gubar Brodsky & Frischling, since 1987. Mr. Goldstein received his B.A. from the University of Michigan and his J.D. from the University of Pittsburgh.

Ralph Landau, Ph.D., has served as our Vice President and Chief Scientific Officer since January 2003. Dr. Landau joined us in October 2002 as Vice President, Manufacturing. From 2001 to 2002, Dr. Landau served as Director, Program Management/Business Development for Elan Pharmaceutical Technologies. From 1997 to 2001, Dr. Landau held the positions of Associate Director, with responsibilities in Drug Supply Management, Project Management and Process Technologies for Novartis Pharmaceuticals. Additionally, Dr. Landau has published articles in 28 peer-reviewed publications. Dr. Landau received his B.S. from the New Jersey Institute of Technology and his Ph.D. from the University of Delaware, and serves on the advisory committees for Rutgers University and the New Jersey Institute of Technology.

R. Brent Lenczycki, CPA, has served as our Vice President and Chief Financial Officer since January 2001. Since joining Bradley Pharmaceuticals in 1998, Mr. Lenczycki has held the positions of Manager of Finance and Purchasing, Director of Finance and since April 2000, Vice President, Finance. From 1995 to 1998, Mr. Lenczycki held positions in public accounting at Arthur Andersen LLP, and prior to 1995, as an internal auditor for Harrah's Hotel and Casino. Mr. Lenczycki received his B.S. from St. Joseph's University and his M.B.A. from Tulane University.

William Renzo has served as our Vice President of Trade/Managed Care Relations since November 2005. From 2003 to 2005, Mr. Renzo served as the General Manager of JOM Pharmaceutical Services, Puerto Rico, a subsidiary of Johnson & Johnson, where he designed and executed the reorganization of the company and managed Sales, Marketing, Human Resources, Financial and Administrative operations of the company. Mr. Renzo joined the sales department of Pfizer, Inc. in 1987 and advanced to the role of Area Manager, Mid-Atlantic Region in 1999. He was then appointed Pfizer's General Manager, Puerto Rico and the Caribbean in 2000, where he managed the company's operations in Puerto Rico and 24 countries. Mr. Renzo holds a B.S. from Seton Hall University and an M.B.A. Magna Cum Laude from Fairleigh Dickinson University.

Alan Wolin, Ph.D., has served as one of our directors since May 1997 and Secretary, a non-salaried position, since February 2004; Dr. Wolin is resigning as a director and as Secretary of the Company effective as of the date of the Annual Meeting. Since 1988, Dr. Wolin has served as an independent consultant to numerous companies in the food, drug and cosmetic industries. Prior to 1987, Dr. Wolin served in various capacities for Mars, Inc., the world's largest candy company, including as Director of Consumer Quality Assurance and Quality Coordination. In this position, Dr. Wolin was responsible for overseeing product quality and addressing public health issues relating to Mars, Inc.'s products. Dr. Wolin received his B.S., M.S. and Ph.D. from Cornell University.

Certain Board Information

As a general matter, all Board members are expected to attend our Annual Meetings of Stockholders, unless an emergency prevents them from doing so. At our 2004 Annual Meeting of Stockholders, our last annual meeting, three members of our Board of Directors were present. During the year ended December 31, 2005, there were 15 meetings of the Board of Directors, respectively. In 2004, all directors attended at least 75% of these meetings and the meetings of the Committees of the Board of which they were members (or for the director who first joined the Board of Directors in 2004, held during the period that he served). In 2005, all directors attended at least 75% of these meetings and the meetings of the Committees of the Board of which they were members. The Board has an Audit Committee, Compensation Committee and a Nominating and Corporate Governance Committee. Each of these committees operates under separate written charters that were adopted by our Board of Directors. The current charter for each of these committees is available on our web site at www.bradpharm.com.

15

Committees of the Board

Audit Committee. The Audit Committee is comprised of directors that are independent of the management of the Company and independent of any relationship that, in the opinion of the Board of Directors, would interfere with the exercise of their independent judgment as members of the Audit Committee. Each member of this Committee is independent within the meaning of SEC regulations, the listing standards of the NYSE and the Company's Corporate Governance Guidelines. The Audit Committee's responsibilities include overseeing the adequacy and effectiveness of systems and controls in place to reasonably assure the fair presentation of our financial statements; appointing, dismissing and overseeing the qualifications and performance of and determining the compensation paid to the external auditors; reviewing and approving the scope of audits and related fees; interfacing directly with the external auditors and otherwise; monitoring compliance with legal and regulatory requirements; and reviewing and setting internal policies and procedures regarding audits, accounting and other financial controls. The current charter of the Audit Committee, which is available on our web site at www.bradpharm.com, provides a detailed description of its responsibilities. During 2004 and 2005, the Audit Committee held nine and 18 meetings, respectively. The current members of the Audit Committee are Mr. Murphy (Chairman), Dr. Fedida, Mr. Kriegsman and Dr. Wolin. Mr. Murphy and Mr. Kriegsman are each qualified as an audit committee financial expert within the meaning of SEC regulations.

Compensation Committee. The Compensation Committee's responsibilities include approving and evaluating the compensation of directors and officers; establishing policies to retain senior executives, with the objective of aligning the compensation of senior management with the business of the Company and the interests of the Company's stockholders; and ensuring that the compensation policies of the Company meet or exceed all legal and regulatory requirements and any other requirements imposed on the Company by the Board. During 2004 and 2005, the Compensation Committee held two and four meetings, respectively. The current charter of the Compensation Committee, which is available on our web site at www.bradpharm.com, provides a detailed description of its responsibilities. The current members of the Compensation Committee are Mr. Fedida (Chairman), Dr. Fedida and Dr. Wolin. All of the current members of the Compensation Committee are independent within the meaning of the listing standards of the NYSE, SEC regulations and the Company's Corporate Governance Guidelines.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee, formed in April 2004, is responsible for establishing criteria for membership on the Board of Directors, identifying individuals qualified to become members of the Board of Directors, reviewing and considering candidates to the Board of Directors selected by stockholders, conducting appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates to the Board of Directors, ensuring that the Audit, Compensation and Nominating and Corporate Governance Committees have the benefit of qualified and experienced "independent" directors, and developing and recommending to the Board of Directors a set of effective corporate governance policies and procedures applicable to the Company. The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. All director candidates, including those recommended by stockholders, are evaluated on the same basis. Stockholders wishing to recommend director candidates for consideration by the Nominating and Corporate Governance Committee may do so by following the procedures set forth in "Corporate Governance Information—Procedure for Stockholder Proposals and Nomination of Directors." The Nominating and Corporate Governance Committee held no meetings in 2004, the year in which it was formed, and held four meetings during 2005. The current charter of the Nominating and Governance Committee, which is available on our web site at www.bradpharm.com, provides a detailed description of its responsibilities. The current members of the Nominating and Corporate Governance Committee are Dr. Jacob (Chairman), Dr. Fedida, Mr. Fedida and Dr. Wolin. All of the members of the Nominating and Corporate Governance Committee are independent within the meaning of the listing standards of the NYSE, SEC regulations and the Company's Corporate Governance Guidelines.

16

CORPORATE GOVERNANCE INFORMATION

Executive Sessions

Our non-management directors meet periodically in executive sessions to discuss such topics as they determine. The non-management directors will designate from time to time one non-management director to serve as the Presiding Director to chair these executive sessions. In addition, the Presiding Director will advise the Chairman of the Board of Directors and, as appropriate, committee chairs, with respect to agendas and information needs relating to Board and committee meetings; provide advice with respect to the selection of committee chairs; and perform such other duties as the Board of Directors may from time to time delegate to assist the Board of Directors in the fulfillment of its responsibilities.

Communications with Directors

Our Nominating and Corporate Governance Committee created a process by which stockholders may communicate directly with non-management directors. Any stockholder wishing to contact non-management directors may do so in writing by sending a letter addressed to the name(s) of the director(s), c/o Secretary, Bradley Pharmaceuticals, Inc., 383 Route 46 West, Fairfield, New Jersey 07004. Communications will be distributed, as appropriate, to the named director(s) and possibly other directors or the entire Board of Directors, depending on the facts and circumstances outlined in the communication.

Independent Directors

Our Board of Directors adopted the following director independence standards: (i) a director who is an employee, or whose immediate family member is an executive officer, of the Company may not be deemed independent until three years after the termination of such employment relationship; employment as an interim Chairman of the Board or Chief Executive Officer will not disqualify a director from being considered independent following that employment; (ii) a director who receives, or whose immediate family member receives, more than $100,000 per year in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), may not be deemed independent until three years after he or she ceases to receive more than $100,000 in compensation; compensation received by a director for former service as an interim Chairman of the Board or Chief Executive Officer and compensation received by an immediate family member for service as a non-executive employee of the Company will not be considered in determining independence under this test; (iii) a director who is affiliated with or employed by, or whose immediate family member is affiliated with or employed in a professional capacity by, a present or former internal or external auditor of the Company may not be deemed independent until three years after the end of the affiliation or the employment or auditing relationship; (iv) a director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of the Company's current executive officers serve on that company's compensation committee may not be deemed independent until three years after the end of such service or the employment relationship; and (v) a director who is an executive officer, general partner or employee, or whose immediate family member is an executive officer or general partner, of an entity that makes payments to, or receives payments from, the Company for property or services in an amount which, in any single fiscal year, is the greater of $1 million or 2% of such other entity's consolidated gross revenues, may not be deemed independent until three years after falling below that threshold. For purposes of these independence standards, the following terms have the following meanings: (y) "Affiliate" means any consolidated subsidiary of the Company and any other company or entity that controls, is controlled by or is under common control with the Company, as evidenced by the power to elect a majority of the board of directors or comparable governing body of such entity; and (z) "Immediate Family" means spouse,

17

parents, children, siblings, mothers- and fathers-in-law, sons- and daughters-in-law, brothers- and sisters-in-law and anyone (other than domestic help) sharing a person's home, but excluding any person who is no longer an immediate family member as a result of legal separation or divorce, or death or incapacitation.

These independence standards meet the listing standards currently adopted by the NYSE with respect to the determination of director independence. In accordance with these standards, a director must be determined to have no material relationship with us other than as a director. The standards specify the criteria by which the independence of our directors will be determined, including strict guidelines for directors and their immediate families with respect to past employment or affiliation with us or our independent registered public accounting firm. The Board of Directors has determined that every director, with the exception of Mr. Glassman and Mrs. Glassman, is currently independent within the meaning of SEC regulations, the listing standards of the NYSE and our independence standards.

Mr. Glassman is considered a non-independent director because of his position as a senior executive of Bradley. Mrs. Glassman is considered a non-independent director because her spouse, Mr. Glassman, is an executive officer of Bradley; Mrs. Glassman has resigned as a director effective as of the Annual Meeting. See "Committees of the Board-Audit Committee" for additional information regarding director independence. Following the Annual Meeting, our founder, Chairman, President and Chief Executive Officer will be the only management member of our Board of Directors, and all seven other directors will be independent under SEC and NYSE corporate governance standards.

Procedure for Stockholder Proposals and Nomination of Directors

The Board of Directors currently proposes to hold its 2007 Annual Meeting of Stockholders in June 2007. Stockholder proposals to be included in the Proxy Statement for the 2007 Annual Meeting of Stockholders must be received by us at our principal executive offices at Bradley Pharmaceuticals, Inc., 383 Route 46 West, Fairfield, New Jersey 07004 by no later than January 15, 2007. The proposal should be submitted in writing and sent to the attention of the Secretary of the Company.