As filed with the Securities and Exchange Commission on July 15, 2024

Securities Act File No._________

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. 1

Post-Effective Amendment No. ___

(Check appropriate box or boxes)

CAVANAL HILL® FUNDS

(Exact Name of Registrant as Specified in the Charter)

4400 Easton Commons, Suite 200

Columbus, Ohio 43219

(Address of Principal Executive Office) (Zip Code)

(800) 762-7085

(Registrant’s Telephone Number, including Area Code)

Bill King,

President

Cavanal Hill Funds

4400 Easton Commons, Suite 200

Columbus, Ohio 43219

(Name and Address of Agent for Service)

with a copy to:

Amy E. Newsome

Frederic Dorwart, Lawyers PLLC

124 East Fourth Street

Tulsa, OK 74103

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933.

Title of securities being registered: Shares of common stock, par value $0.00001 per share.

Calculation of Registration Fee under the Securities Act of 1933: No filing fee is required because of reliance on Section 24(f) and Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Prospectus/Information Statement

Important merger information

On April 25, 2024, the Board of Trustees (the “Board”) of the Cavanal Hill Funds approved the merger of the Cavanal Hill Moderate Duration Fund (the “Target Fund”) into the Cavanal Hill Limited Duration Fund (the “Acquiring Fund”), two funds within the same fund family (the “Merger”). The Merger does not require approval by Target Fund shareholders. We Are Not Asking You for a Proxy and You are Requested Not To Send Us a Proxy.

Please read the information below.

The enclosed document is a Prospectus/Information Statement containing information regarding the Target Fund and Acquiring Fund. Shareholders of the Target Fund are being provided with this document to provide them with information regarding the principal aspects of the Merger. We encourage you to read the full text of the enclosed Prospectus/Information Statement.

What is happening?

The Board of the Target Fund believes that this merger will benefit current Target Fund shareholders. In the Merger, the Target Fund will transfer all of its assets and liabilities to the Acquiring Fund in exchange for shares of corresponding classes of the Acquiring Fund. The Merger is expected to be a tax- free reorganization for United States federal income tax purposes. Immediately following the Merger, you will hold shares of the Acquiring Fund with a dollar value equal to the dollar value of the Target Fund shares you previously held. Specifically, shareholders in the A share class of the Target Fund will receive A shares of the Acquiring Fund. Shareholders in the Investor share class of the Target Fund will receive Investor shares of the Acquiring Fund and shareholders in the Institutional share class of the Target Fund will receive Institutional shares of the Acquiring Fund as shown in the below chart:

| Target Fund | Acquiring Fund |

| Cavanal Hill Moderate Duration Fund | Cavanal Hill Limited Duration Fund |

| A Shares | A Shares |

| Investor Shares | Investor Shares |

| Institutional Shares | Institutional Shares |

What do we view as key benefits of the Merger?

Cavanal Hill Investment Management, Inc. (“CHIM”) considered various factors in recommending the Merger, including the following:

· The Acquiring Fund has a larger asset base and shorter duration. The size of a fund can influence decisions regarding continuing viability. Longer term investments in a high interest rate environment can also influence viability, and, in turn, the size of a fund. Each of the Acquiring Fund and Target Fund have seen recent reductions in size, with the Target Fund affected to a greater extent. Management believes that a single fund will benefit the larger combined asset base and may provide operational efficiencies. By acting now to merge the Target Fund with the larger, and shorter duration, Acquiring Fund will offer greater long-term product viability than if the Target Fund and Acquiring Fund were to remain separate.

· The Acquiring Fund has outperformed the Target Fund for each of the trailing 1, 3, 5, and 10 year periods and in each of the periods ended December 31, 2022, and December 31, 2023. CHIM acknowledges that, from each fund’s inception through the period ended December 31, 2021, the Target Fund posted better performance than the Acquiring Fund. However, given the persistent high interest rate environment affecting each of the Acquiring Fund and the Target Fund, CHIM anticipates that the Acquiring Fund’s recent comparably superior performance will continue while interest rates remain high.

· The Acquiring Fund has outperformed the Target Fund in recent times due in large part to the high interest rate environment, which negatively impacts funds with longer durations more than it does funds with shorter durations. As rates have remained high, the Registrant determined that merging the Target Fund, with its less favorable investment duration in a high rate environment, into the Acquiring Fund, with its more favorable investment duration in a high rate environment. Further, the resulting combined fund, with a larger asset base and a duration more favorable in a higher interest rate period, was preferable to liquidating the Target Fund altogether.

· CHIM is the investment advisor of the Target Fund and the Acquiring Fund and neither of the Target Fund nor the Acquiring Fund have a sub-advisor. As a result, shareholders of the Target Fund will retain the same investment adviser after consummation of the Merger, providing continuity of services from an investment manager familiar with the investment objectives and practices of a bond fund.

Why has the Board approved the Merger?

In addition to the key benefits described above, among the factors the Board considered in approving the merger were the following:

· The investment objective and principal investment strategy of the Target Fund are materially similar to those of the Acquiring Fund.

· The principal investment risks of the Target Fund are materially similar to those of the Acquiring Fund.

· The Acquiring Fund’s management fee is 5 bps lower than the management fee of the Target Fund, and other fees and expenses of the Acquiring Fund are lower than or equal to those of the Target Fund. However, the total annual fund operating expenses of the Acquiring Fund are currently 21 bps higher than those of the Target Fund because of the Target Fund’s higher fee waivers, which will not apply to the Acquiring Fund after consummation of the Merger. The existing contractual agreement from CHIM to waive or reimburse certain expenses for the Target Fund expires on December 31, 2024. Although shareholders of the Target Fund will pay higher overall fees after the Merger, the Board considered the recommendation of CHIM regarding the overall benefits to Target Fund shareholders as described above and the reasonableness of the higher Acquiring Fund fees in view of its recent performance.

· Shareholders will not bear the Merger-related expenses (other than brokerage and transaction costs associated with the sale or purchase of portfolio securities in connection with the Merger, which are expected to be less than $0.01 per share).

· The Merger is expected to be a tax-free reorganization for U.S. federal income tax purposes.

Whom should I call with questions about the Merger?

If you have any questions about the Merger or the Prospectus/Information Statement, please do not hesitate to contact CHIM at 1-800-762-7085.

CAVANAL HILL FUNDS

4400 EASTON COMMONS, SUITE 200

COLUMBUS, OHIO 43219

1-800-762-7085

[•], 2024

Dear Shareholder,

On April 25, 2024, the investment advisor to the Cavanal Hill Funds, a Massachusetts business trust, Cavanal Hill Investment Management, Inc., proposed to the Board of Trustees of the Trust (the “Board”) the merger of funds outlined in the table below (the “Merger”). The Board approved the Merger and the related Agreement and Plan of Reorganization.

| Target Fund | Acquiring Fund |

| Cavanal Hill Moderate Duration Fund | Cavanal Hill Limited Duration Fund |

This is a general summary of how the Merger will work:

| · | The Target Fund will transfer all of its assets to the Acquiring Fund. |

| · | The Acquiring Fund will assume all of the liabilities of the Target Fund. |

| · | The Acquiring Fund will issue new shares that will be distributed to you in a dollar amount equal to the value of the Target Fund shares you held prior to the Merger. |

| · | You will become a shareholder of the Acquiring Fund and your investment will be managed according to the Acquiring Fund’s investment strategies. |

| · | You will not incur any sales charges or similar transaction charges in connection with the Merger. However, any future purchases or reinvestments in the Acquiring Fund after the Merger will be subject to applicable sales charges as disclosed in the Acquiring Fund’s prospectus. |

| · | It is expected that the Merger will not be a taxable event to the Target Fund, the Acquiring Fund or their shareholders for United States federal income tax purposes. |

Details about the Target Fund’s and the Acquiring Fund’s investment objectives, principal investment strategies, management, past performance, principal risks, fees, and expenses, along with additional information about the Merger, are contained in the attached Prospectus/Information Statement. Please read it carefully.

Thank you for investing with the Cavanal Hill Funds. We appreciate your business and are committed to helping you meet your financial needs.

Sincerely,

Bill King

President

Cavanal Hill Funds

PRELIMINARY PROSPECTUS/INFORMATION STATEMENT

SUBJECT TO COMPLETION

The information in this Prospectus/Information Statement is not complete and may be changed.

We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This Prospectus/Information Statement is not an offer to sell these securities and is

not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

CAVANAL HILL FUNDS

4400 EASTON COMMONS, SUITE 200

COLUMBUS, OHIO 43219

1-800-762-7085

SUBJECT TO COMPLETION, DATED July 15, 2024

PROSPECTUS/INFORMATION STATEMENT

This Prospectus/Information Statement (“Prospectus/Information Statement”) contains information you should know before the completion of the merger of your Target Fund into the Acquiring Fund (as set forth in the table below) (the “Merger”), each of which is a series of the Cavanal Hill Funds (the “Trust”), a registered open-end management investment company established in 1987 as a Massachusetts business trust. Upon consummation of the Merger, you will receive shares of the Acquiring Fund in exchange for your shares of the Target Fund.

| Target Fund | Acquiring Fund |

| Cavanal Hill Moderate Duration Fund | Cavanal Hill Limited Duration Fund |

The Target Fund and Acquiring Fund listed above are collectively referred to as the “Funds.”

Please read carefully this Prospectus/Information Statement and retain it for future reference. Additional information concerning each Fund and the Merger has been filed with the Securities and Exchange Commission (the “SEC”).

This Prospectus/Information Statement should be read in conjunction with the following described items, which are hereby incorporated by reference and are legally deemed to be part of this Prospectus/Information Statement:

1. The Prospectus and Statement of Additional Information, each dated December 28, 2023, as supplemented to date, for the Cavanal Hill Moderate Duration Fund and Cavanal Hill Limited Duration Fund; which were filed electronically with the Securities and Exchange Commission on December 22, 2023, File Nos. 033-35190 and 811-06114, on Form N-1A, accession no. 0001213900-23-097946.

2. The financial statements, including the notes to the financial statements, and the reports of the independent registered public accounting firm thereon contained in the annual report for the Cavanal Hill Moderate Duration Fund and Cavanal Hill Limited Duration Fund, each for the period ended August 31, 2023, filed electronically with the Securities and Exchange Commission on November 3, 2023, File No 811-06114, accession no. 0001213900-23-083470.

3. The financial statements, including the notes to the financial statements, contained in the semi- annual report for the Cavanal Hill Moderate Duration Fund and Cavanal Hill Limited Duration Fund, for the fiscal half-year ended February 29, 2024, filed electronically with the Securities and Exchange Commission on May 3, 2024, File No. 811-06114, accession no. 0001213900-24-039427.

Copies of the above-referenced documents pertaining to either or each of the Target Fund and the Acquiring Fund are available upon request, without charge, by writing to the Cavanal Hill Funds, 4400 Easton Commons, Suite 200, Columbus, Ohio 43219, 1-800-762-7085, or visiting the Cavanal Hill Funds website at www.cavanalhillfunds.com.

You may also view or obtain these documents from the SEC: by phone at 1.800.SEC.0330 (duplicating fee required); in person or by mail at Public Reference Section, Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549-0213 (duplicating fee required); by email at publicinfo@sec.gov (duplicating fee required); or by internet at www.sec.gov.

The SEC has not approved or disapproved these securities or determined if this Prospectus/Information Statement is truthful or complete. Any representation to the contrary is a criminal offense.

The shares offered by this Prospectus/Information Statement are not deposits of a bank, are not insured, endorsed or guaranteed by the FDIC or any government agency and involve investment risk, including possible loss of your original investment.

i

This section summarizes the primary features and consequences of the Merger. This summary is qualified in its entirety by reference to the information contained elsewhere in this Prospectus/Information Statement, in the Merger Statement of Additional Information (“Merger SAI”), in each Fund’s prospectus, in each Fund’s financial statements contained in its annual report dated August 31, 2023, semi-annual report dated February 29, 2024, and in the Statement of Additional Information (“SAI”), each being incorporated herein by this reference, and in the related Agreement and Plan of Merger (the “Plan”), a form of which is attached as Exhibit A hereto.

The Plan sets forth the key features of the Merger covered thereby and generally provides for the following:

| · | the transfer of all of the assets of the Target Fund to the Acquiring Fund in exchange for new shares of the Acquiring Fund; |

| · | the assumption by the Acquiring Fund of all of the liabilities of the Target Fund; |

| · | the liquidation of the Target Fund by distributing the shares of the Acquiring Fund to the Target Fund’s shareholders; and |

| · | the assumption of the costs of the Merger by Cavanal Hill Investment Management, Inc. (“CHIM”). |

The Merger is scheduled to take place on or about July 31, 2024. For a more complete description of the Merger, see the section entitled “Merger Information - Agreement and Plan of Merger,” as well as Exhibit A.

REASONS FOR THE MERGER AND BOARD OF TRUSTEES APPROVAL

At a meeting held on April 25, 2024, the Board of Trustees of the Trust (the “Board”), including a majority of Trustees who are not “interested persons” of the Trust, as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (the “Independent Trustees”), considered and unanimously approved the Merger.

Prior to approving the Merger, the Board received the recommendation from CHIM that the Merger be approved. In recommending the approval of the Merger to the Board, CHIM noted that it considered various factors, including asset size, performance and profitability. CHIM indicated to the Board that the proposal to merge the Target Fund into the Acquiring Fund is intended to rationally consolidate product offerings of the Trust’s fund family by combining funds with materially similar investment objectives, principal investment strategies and risk profiles.

Before approving the Merger, the Board reviewed, among other things, information about the Funds and the Merger. This information included, among other things, a comparison of a number of factors, such as the relative sizes of the Funds, the performance records of the Funds, and the expenses of the Funds, as well as the similarities and differences between the Funds’ investment objectives, principal investment strategies and specific portfolio characteristics. The Board also considered that the Merger will not be a taxable event to the Target Fund, the Acquiring Fund or their shareholders for United States federal income tax purposes

The Board, including all of the Independent Trustees, has concluded that the Merger would be in the best interests of the Target Fund, and that existing shareholders’ interests will not be diluted as a result of the Merger. Accordingly, the Board approved the Plan on behalf of the Target Fund’s shareholders and on behalf of the Acquiring Fund’s shareholders.

For further information about the considerations of the Board, please see the section entitled “Board Considerations.”

1

MERGER SUMMARY (OBJECTIVES, STRATEGIES, RISKS, PERFORMANCE, EXPENSE, MANAGEMENT AND TAX INFORMATION)

The following section provides a comparison of the Funds’ investment objectives, principal investment strategies, fundamental investment policies, risks, performance records, and expenses. It also provides information about what the management and share class structure of the Acquiring Fund will be after the Merger. The information below is only a summary; for more detailed information, please see the rest of this Prospectus/Information Statement and each Funds’ prospectus(es) and SAI. References to “we” in the principal investment strategy discussion for a Fund generally refer to CHIM.

2

CAVANAL HILL MODERATE DURATION FUND INTO CAVANAL HILL LIMITED DURATION FUND

SHARE CLASS INFORMATION

The following table illustrates the share class of the Acquiring Fund you will receive in exchange for your Target Fund shares as a result of the Merger.

| If you own this class of shares of the Cavanal Hill Moderate Duration Fund: | You will receive this class of shares of the |

| A Class | A Class |

| Investor Class | Investor Class |

| Institutional Class | Institutional Class |

The Acquiring Fund shares you will receive as a result of the Merger will have the same dollar value as your Target Fund shares as of the close of business on the business day immediately prior to the Merger.

The procedures for buying, selling and exchanging shares of the Funds are identical. For additional information, see the section entitled “Exchanging Shares.” Additional information on how you can buy, sell or exchange shares of each Fund is available in the Funds’ prospectuses and SAI. In addition, the distribution policies for the Funds are the same.

INVESTMENT OBJECTIVE AND STRATEGY COMPARISON

The following section compares the investment objectives, principal investment strategies and fundamental investment policies of the Funds. The investment objectives of the Funds may be changed without shareholder approval.

The Funds’ investment objectives are materially similar though stated in different terms. The Target Fund’s investment objective is “[t]o seek total return,” and the Acquiring Fund’s investment objective is “[p]rimarily to seek income and secondarily to seek capital appreciation.” Total return is defined as a percentage change, over a specified time period, in a mutual fund’s net asset value, with the ending net asset value adjusted to account for the reinvestment of all distributions of dividends and capital gains. As such, while the wording of the objectives is not identical, CHIM pursues achievement of the investment objectives in the same manner, rendering the investment objectives materially similar.

The Funds’ principal investment strategies are identical with the exception of (i) a paragraph in the Target Fund’s principal investment strategy defining “total return,” a term used in the Target Fund’s investment objective, (ii) the durations for which each fund holds its investments, and (iii) a minimum threshold for interest-bearing bonds. With respect to item (ii) in the preceding sentence, the Target Fund holds its investments for a period ranging from three to five years, whereas the Acquiring Fund holds its investments for a period of less than three and one-half years. However, each of the Target Fund and Acquiring Fund invest in the same types of instruments.

3

With respect to item (iii) in the preceding paragraph, the Acquiring Fund normally invests at least 65% of its net assets in interest-bearing bonds, whereas the Target Fund does not necessarily make such investments, although it may if CHIM chooses to pursue such investments.

Cavanal Hill Moderate Duration Fund | Cavanal Hill Limited Duration Fund | |

| INVESTMENT OBJECTIVES | INVESTMENT OBJECTIVES | |

To seek total return. | Primarily to seek income and secondarily to seek capital appreciation. | |

PRINCIPAL INVESTMENT STRATEGIES | PRINCIPAL INVESTMENT STRATEGIES | |

To pursue its objective, the Fund invests, under normal market conditions, primarily in debt obligations such as bonds, notes and debentures, and bills issued by U.S. corporations or the U.S. government, its agencies, or instrumentalities, municipal securities, mortgage-backed securities, asset-backed securities, collateralized mortgage obligations and fixed income ETFs. Such debt obligations are “investment grade,” rated within the four highest ratings categories assigned by a nationally recognized statistical ratings organization or, if not rated, found by the Adviser under guidelines approved by the Trust’s Board of Trustees to be of comparable quality. The Fund also invests in money market instruments.

Total return is defined as a percentage change, over a specified time period, in a mutual fund’s net asset value, with the ending net asset value adjusted to account for the reinvestment of all distributions of dividends and capital gains.

If the rating of a security is downgraded after purchase, the portfolio management team will determine whether it is in the best interest of the Fund’s shareholders to continue to hold the security. In making that determination, the factors considered at the time of purchase are reviewed. The Fund does not apply an automatic sale trigger.

In managing the portfolio, the portfolio management team searches for inefficiencies not only at the macro, or top down level, but also at the individual security level. Purchase and sale decisions are based on the Adviser’s judgment about issuers, risk, prices of securities, market conditions, potential returns, and other economic factors.

Under normal circumstances the Fund invests at least 80% of its net assets in bonds and maintains an average portfolio duration between three and five years. This policy will not be changed without at least 60 days prior notice to shareholders.

Duration provides a measure of a fund’s sensitivity to changes in interest-rates. In general, the longer a fund’s duration, the more its price will fluctuate when interest rates change. A fund with a duration of 10 years is twice as sensitive to interest rate changes as a fund with a five-year duration. A fund with a five-year duration would generally be expected to lose 5% from its net asset value if interest rates rose by one percentage point or gain 5% if interest rates fell by one percentage point.

| To pursue its objective, under normal circumstances, the Fund invests primarily in debt obligations such as bonds, notes and debentures, and bills issued by U.S. corporations or by the U.S. government, its agencies or instrumentalities, municipal securities, mortgage-backed securities, asset-backed securities, and collateralized mortgage obligations and fixed income ETFs. Such debt obligations are “investment grade,” rated within the four highest ratings categories assigned by a nationally recognized statistical ratings organization or, if not rated, found by the Adviser under guidelines approved by the Trust’s Board of Trustees to be of comparable quality. The Fund also invests in money market instruments.

If the rating of a security is downgraded after purchase, the portfolio management team will determine whether it is in the best interest of the Fund’s shareholders to continue to hold the security. In making that determination, the factors considered at the time of purchase are reviewed. The Fund does not apply an automatic sale trigger.

In managing the portfolio, the portfolio management team searches for inefficiencies not only at the macro, or top down level, but also at the individual security level. Purchase and sale decisions are based on the Adviser’s judgment about issuers, risk, prices of securities, market conditions, potential returns, and other economic factors.

Under normal circumstances, the Fund invests at least 80% of its net assets in bonds and maintains an average portfolio duration of less than three and one-half years. These policies will not be changed without at least 60 days prior notice to shareholders. In addition, the Fund normally invests at least 65% of its net assets in interest-bearing bonds.

Duration provides a measure of a fund’s sensitivity to changes in interest-rates. In general, the longer a fund’s duration, the more its price will fluctuate when interest rates change. A fund with a duration of 10 years is twice as sensitive to interest rate changes as a fund with a five-year duration. A fund with a five-year duration would generally be expected to lose 5% from its net asset value if interest rates rose by one percentage point or gain 5% if interest rates fell by one percentage point. |

4

The fundamental investment policies of the Funds, which may only be changed with shareholder approval, are identical. For a comparative chart of the Funds’ fundamental investment policies, please see Exhibit B.

PRINCIPAL RISK COMPARISON

Except with respect to an additional “Portfolio Turnover Risk” listed in connection with the Acquiring Fund’s limited investment duration, the principal risks of the Target Fund are identical to those of the Acquiring Fund due to the similarity of the Funds’ investment objectives and principal investment strategies, as noted above. “Portfolio Turnover Risk” presents itself as a principal risk when a fund, such as the Acquiring Fund, holds its investments for a shorter specified period resulting in comparatively increased turnover, and thus applies to the Acquiring Fund rather than the Target Fund because the Acquiring Fund has a shorter duration (less than three-and-one-half years) than does the Target Fund (three to five years). Shareholders of the Target Fund were provided with more than 30 days advance notice of the intended change in duration associated with the proposed merger. The Portfolio Turnover Risk is a direct result of that change.

The table below compares the principal risk factors of the Target Fund with those of the Acquiring Fund. These risks are described in the section entitled “Risk Descriptions.”

| Cavanal Hill Moderate Duration Fund | Cavanal Hill Limited Duration Fund |

| Interest Rate Risk | Interest Rate Risk |

| Credit Risk | Credit Risk |

| Liquidity Risk | Liquidity Risk |

| Prepayment/Call Risk | Prepayment/Call Risk |

| Market Risk | Market Risk |

| Mortgage-Backed Securities Risk | Mortgage-Backed Securities Risk |

| Collateralized Mortgage Obligations Risk | Collateralized Mortgage Obligations Risk |

| Asset-Backed Securities Risk | Asset-Backed Securities Risk |

| Exchange Traded Fund Risk | Exchange Traded Fund Risk |

| Valuation Risk | Valuation Risk |

| Management Risk | Portfolio Turnover Risk |

| Regulatory Risk | Management Risk |

| Regulatory Risk |

The Funds have other investment policies, practices and restrictions which, together with their related risks, are set forth in the Funds’ prospectuses and the SAI.

FUND PERFORMANCE COMPARISON

The following bar charts and tables illustrate how each Funds’ returns have varied from year to year and compare each Funds’ returns with those of one or more broad-based securities market indexes. Past performance (before and after taxes) is not necessarily an indication of future results. Current month-end performance information is available for the Funds on the Cavanal Hill Funds website at www.cavanalhillfunds.com

Moderate Duration Fund (Target Fund) Annual Total Returns for Investor Shares (Periods Ended 12/31)

The bar chart and the performance table below illustrate some of the risks and return volatility of an investment in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Target Fund’s average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance. The Target Fund’s past performance (before or after taxes) does not necessarily indicate how the Fund will perform in the future. Prior to December 30, 2016, the Target Fund was named the Intermediate Bond Fund. Updated performance information may be obtained on the Target Fund’s website www.cavanalhillfunds.com or by calling 1-800-762-7085.

5

This bar chart shows changes in the Target Fund’s performance from year to year1. The returns for A Shares and Institutional Shares will differ from the returns for Investor Shares (which are shown in the bar chart) because of differences in the expenses of each class.

1The performance information shown above is based on a calendar year. The Fund’s total return from 1/1/24 to 3/31/24 was 0.35%.

This table compares the Target Fund’s average annual total returns for periods ended December 31, 2023 to those of the Bloomberg U.S. Intermediate Aggregate Bond Index. The A Shares commenced operations on May 1, 2011 with a sales charge of 3.75% which was reduced to 2.00% on December 31, 2014. The stated returns assume the highest historical federal marginal income and capital gains tax rates. These after-tax returns do not reflect the effect of any applicable state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors holding shares through tax-deferred programs, such as IRA or 401(k) plans. After-tax returns are shown only for the Investor Shares and after-tax returns for other shares will vary.

| Average Annual Total Returns (Periods Ended 12/31/23) | 1 Year | 5 Years | 10 Years | |||

| Investor Shares | ||||||

| Return Before Taxes | 5.51% | 0.77% | 1.77% | |||

| Return After Taxes on Distributions | 4.29% | -0.06% | 0.44% | |||

| Return After Taxes on Distributions and Sale of Fund Shares | 3.24% | 0.24% | 0.58% | |||

| Institutional Shares | ||||||

| Return Before Taxes | 5.78% | 1.02% | 1.42% | |||

| A Shares | ||||||

| Return Before Taxes (With Load) | 3.33% | 0.37% | 0.97% | |||

| Bloomberg U.S. Intermediate Aggregate Bond Index (reflects no deduction for expenses, fees or taxes) | 5.18% | 1.14% | 1.62% |

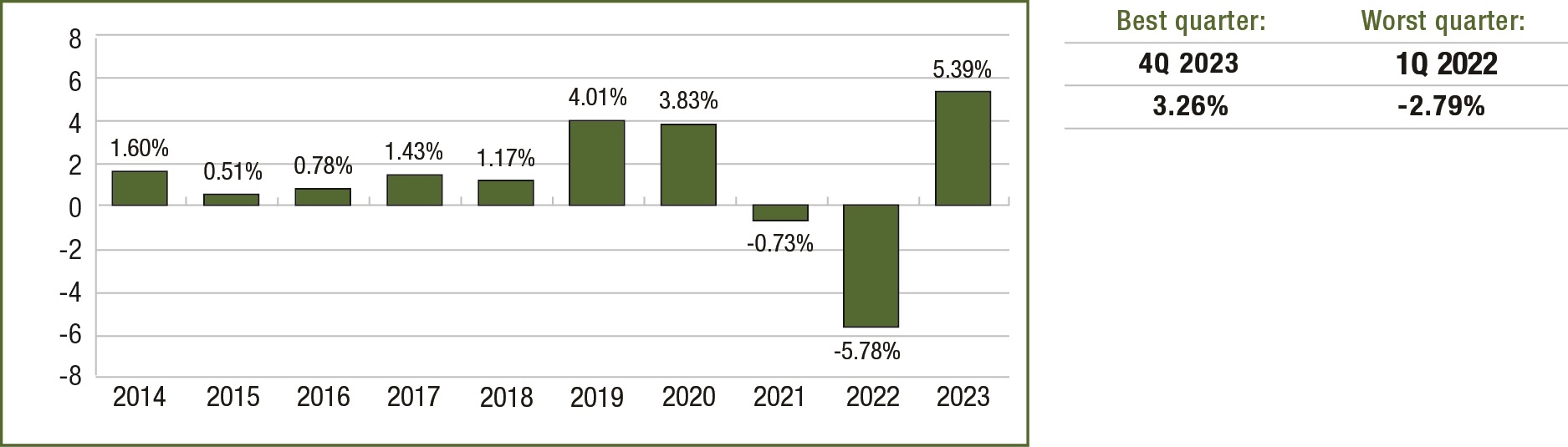

Limited Duration Fund (Acquiring Fund) Annual Total Returns for Investor Shares (Periods Ended 12/31)

The bar chart and the performance table below illustrate some of the risks and return volatility of an investment in the Acquiring Fund by showing changes in the Acquiring Fund’s performance from year to year and by showing how the Acquiring Fund’s average annual returns for 1, 5, and 10 years compare with those of a broad measure of market performance. The Acquiring Fund’s past performance (before or after taxes) does not necessarily indicate how the Fund will perform in the future. Prior to December 30, 2016, the Acquiring Fund was named the Short-Term Income Fund. Updated performance information may be obtained on the Fund’s website www.cavanalhillfunds.com or by calling 1-800-762-7085.

6

This bar chart shows changes in the Acquiring Fund’s performance from year to year1. The returns for A Shares and Institutional Shares will differ from the returns for Investor Shares (which are shown in the bar chart) because of differences in the expenses of each class.

1The performance information shown above is based on a calendar year. The Fund’s total return from 1/1/24 to 3/31/24 was 1.12%.

This table compares the Acquiring Fund’s average annual total returns for periods ended December 31, 2023 to those of the ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index and the Bloomberg U.S. Aggregate Bond Index, which was added in response to rule changes with a compliance date of July 24, 2024. The A Shares commenced operations on May 1, 2011 with a sales charge of 2.50% which was reduced to 2.00% on December 31, 2014. The stated returns assume the highest historical federal marginal income and capital gains tax rates. These after-tax returns do not reflect the effect of any applicable state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors holding shares through tax-deferred programs, such as IRA or 401(k) plans. After-tax returns are shown only for the Investor Shares and after-tax returns for other shares will vary.

| Average Annual Total Returns (Periods Ended 12/31/23) | 1 Year | 5 Years | 10 Years | |||

| Investor Shares | ||||||

| Return Before Taxes | 5.39% | 1.26% | 1.18% | |||

| Return After Taxes on Distributions | 4.15% | 0.42% | 0.47% | |||

| Return After Taxes on Distributions and Sale of Fund Shares | 3.17% | 0.61% | 0.59% | |||

| Institutional Shares | ||||||

| Return Before Taxes | 5.64% | 1.48% | 1.43% | |||

| A Shares | ||||||

| Return Before Taxes (With Load) | 3.18% | 0.83% | 0.98% | |||

| ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index (reflects no deduction for expenses, fees or taxes) | 4.88% | 1.55% | 1.46% | |||

Bloomberg U.S. Aggregate Bond Index (reflects no deduction for expenses, fees or taxes) | 5.53% | 1.10% | 1.81% |

SHAREHOLDER FEE AND FUND EXPENSE COMPARISON

This section compares the fees and expenses you pay if you buy, hold, and sell shares of the Target Fund and the Acquiring Fund.

For information about the share class of the Acquiring Fund that you will receive in connection with the Merger, please see the section entitled “Share Class Information” above.

The following tables entitled allow you to compare the maximum sales charges of the Funds and includes a Pro Forma1 column that shows you what the sales charges will be assuming the Merger takes place. The sales charges for each class of shares of the Target Fund are identical to those of the class of shares of the Acquiring Fund. The Target Fund shareholders will not pay any front-end or deferred sales charges in connection with the Merger. However, any future purchases or reinvestments in the Acquiring Fund after the Merger will be subject to applicable sales charges as disclosed in the Acquiring Fund’s prospectus.

1 Will need pro forma figures.

7

The following tables entitled “Annual Fund Operating Expenses” allow you to compare the annual operating expenses of the Funds. The total annual fund operating expenses for both Funds set forth in the following tables are based on the actual expenses incurred by each class for each Fund as of February 29, 2024.

| Shareholder Fees (fees paid directly from your investment) | Cavanal Hill Moderate Duration Fund (Pre- Merger) | Cavanal Hill Limited Duration Fund (Pre- Merger) | Cavanal Hill Limited Duration Fund Pro Forma | |||

| A Shares | ||||||

| Maximum Sales Charge (Load) imposed on Purchases (as a percentage of offering price) | 2.00% | 2.00% | 2.00% | |||

| Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of original purchase price or redemption proceeds) | 1.00%* | 1.00%* | 1.00%* | |||

| Investor Shares | ||||||

| Maximum Sales Charge (Load) imposed on Purchases (as a percentage of offering price) | None | None | None | |||

| Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of original purchase price or redemption proceeds) | None | None | None | |||

| Institutional Shares | ||||||

| Maximum Sales Charge (Load) imposed on Purchases (as a percentage of offering price) | None | None | None | |||

| Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of original purchase price or redemption proceeds) | None | None | None | |||

| * | Class A Shares are available with no front-end sales charge on investments of $200,000 or more. There is, however, a contingent deferred sales charge (CDSC) of 1.00% on any Class A Shares upon which a dealer concession was paid that are sold within one year of purchase. |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment). | Cavanal Hill Moderate Duration Fund (Pre- Merger) | Cavanal Hill Limited Duration Fund (Pre- Merger) | Cavanal Hill Limited Duration Fund Pro Forma | |||

| A Shares | ||||||

| Management Fees | 0.20% | 0.15% |

0.15% | |||

| Distribution and/or Service (12b-1) Fees | 0.25% | 0.25% |

0.25% | |||

| Other Expenses |

1.29% |

0.59% |

0.55% | |||

| Shareholder Servicing Fees |

0.10% |

0.10% |

0.10% | |||

| Acquired Fund Fees |

0.01% |

0.00% |

0.01% | |||

| Total Annual Fund Operating Expenses |

1.85% |

1.09% |

1.06% | |||

| Less Fee Waivers |

-1.10Ω% |

— |

— | |||

| Total Annual Fund Operating Expenses After Fee Waivers |

0.75% |

1.09% |

1.06% |

8

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment). | Cavanal Hill Moderate Duration Fund (Pre- Merger) | Cavanal Hill Limited Duration Fund (Pre- Merger) | Cavanal Hill Limited Duration Fund Pro Forma | |||

| Investor Shares | ||||||

| Management Fees | 0.20% | 0.15% |

0.15% | |||

| Distribution and/or Service (12b-1) Fees | 0.25% | 0.25% |

0.25% | |||

| Other Expenses |

1.29% |

0.59% |

0.55% | |||

| Shareholder Servicing Fees |

0.25% |

0.25% |

0.25% | |||

| Acquired Fund Fees |

0.01% |

0.00% |

0.01% | |||

| Total Annual Fund Operating Expenses |

2.00% |

1.24% |

1.21% | |||

| Less Fee Waivers |

-1.25%Ω |

-0.25%† |

-0.25% | |||

| Total Annual Fund Operating Expenses After Fee Waivers |

0.75% |

0.99% |

0.96% |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment). | Cavanal Hill Moderate Duration Fund (Pre- Merger) | Cavanal Hill Limited Duration Fund (Pre- Merger) | Cavanal Hill Limited Duration Fund Pro Forma | |||

| Institutional Shares | ||||||

| Management Fees | 0.20% | 0.15% |

0.15% | |||

| Distribution and/or Service (12b-1) Fees |

— | — |

— | |||

| Other Expenses |

1.29% |

0.59% |

0.55% | |||

| Shareholder Servicing Fees |

0.25% |

0.25% |

0.25% | |||

| Acquired Fund Fees |

0.01% |

0.00% |

0.01% | |||

| Total Annual Fund Operating Expenses |

1.75% |

0.99% |

0.96% | |||

| Less Fee Waivers |

-1.24Ω |

-0.23%† |

-0.23% | |||

| Total Annual Fund Operating Expenses After Fee Waivers |

0.51% |

0.76% |

0.73% |

| † | Affiliates of CHIM have contractually agreed to waive all Shareholder Servicing Fees to which they are entitled. The affiliate waivers result in a reduction of the Shareholder Servicing Fee paid by all purchasers of a Class to the extent shown in the table. Contractual waivers are in place for the period through December 31, 2024 and may only be terminated or modified with the approval of the Fund’s Board of Trustees. |

| Ω | CHIM has contractually agreed to waive fees payable to it or reimburse certain expenses so that expenses (other than extraordinary expenses and any Acquired Fund Fees and Expenses) for each Class do not exceed 0.49%, plus class-specific fees until December 31, 2024. Affiliates of CHIM have contractually agreed to waive all Shareholder Servicing Fees to which they are entitled. The affiliate waivers result in a reduction of the Shareholder Servicing Fee paid by all purchasers of a Class to the extent shown in the table. Contractual waivers are in place for the period through December 31, 2024 and may only be terminated or modified with the approval of the Fund’s Board of Trustees. If the Merger is consummated, the termination date will be extended until the one-year anniversary of the effective date of this Prospectus/Information Statement. |

9

Examples of Fund Expenses

This example is intended to help you compare the cost of investing in the Funds with the cost of investing in other mutual funds. The example assumes that you invest $10,000 a Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Funds’ operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Cavanal Hill Moderate Duration Fund and Cavanal Hill Limited Duration Fund A Shares (Pre-Merger) | 1 Year | 3 Year | 5 Year | 10 Year | ||||

| Moderate Duration Fund | $275 | $665 | $1,080 | $2,237 | ||||

| Limited Duration Fund | $309 | $521 | $789 | $1,502 |

Cavanal Hill Moderate Duration Fund and Cavanal Hill Limited Duration Fund Investor Shares (Pre-Merger) | 1 Year | 3 Year | 5 Year | 10 Year | ||||

| Moderate Duration Fund | $77 | $445 | $962 | $2,227 | ||||

| Limited Duration Fund | $101 | $359 | $657 | $1,478 |

Cavanal Hill Moderate Duration Fund and Cavanal Hill Limited Duration Fund Institutional Shares (Pre-Merger) | 1 Year | 3 Year | 5 Year | 10 Year | ||||

| Moderate Duration Fund | $51 | $367 | $832 | $1,959 | ||||

| Limited Duration Fund | $78 | $281 | $525 | $1,192 |

Portfolio Turnover

The Acquiring Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Acquiring Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Acquiring Fund’s performance. During the period ending February 29, 2024, the Acquiring Fund’s portfolio turnover rate was 6% of the average value of its portfolio.

The Target Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Target Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Target Fund’s performance. During the period ending February 29, 2024, the Target Fund’s portfolio turnover rate was 17% of the average value of its portfolio.

FUND MANAGEMENT INFORMATION

The manager for each of the Target Fund and the Acquiring Fund is listed below. Further information about the management of the Funds can be found under the section entitled “Management of the Funds.

Investment Adviser

Cavanal Hill® Investment Management, Inc. serves as the investment adviser for the Funds.

Portfolio Managers

The following individuals are jointly and primarily responsible for the day-to-day management of each Funds’ portfolio:

Michael P. Maurer, CFA, is a Senior Vice President of Cavanal Hill Investment Management, Inc. and has been a portfolio manager of the Fund since 2003.

Russell Knox, CFA, is a Vice President of Cavanal Hill Investment Management, Inc. and has been a portfolio manager of the Fund since 2013.

10

TAX INFORMATION

The tax treatment of the Target Fund and the Acquiring Fund, and the tax consequences to shareholders in each Fund, are similar. A Fund’s distributions are generally taxable to a shareholder as ordinary income, capital gains, or a combination of the two, unless a shareholder is investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Retirement accounts may be taxed at a later date.

It is the policy of each Fund to elect to be treated as and to qualify each year as a RIC under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). By following such policy, each Fund expects to eliminate or reduce to a nominal amount the federal income taxes to which such Fund may be subject.

In order to qualify for the special tax treatment accorded regulated investment companies and their shareholders, a Fund must, among other things, (a) derive at least 90% of its gross income for each taxable year from (i) dividends, interest, payments with respect to certain securities loans, and gains from the sale or other disposition of stock, securities, or foreign currencies, or other income (including, but not limited to, gains from options, futures, or forward contracts) derived with respect to its business of investing in such stock, securities, or currencies and (ii) net income derived from interests in “qualified publicly traded partnerships” (“QPTPs”, as defined below); (b) diversify its holdings so that, at the end of each quarter of the Fund’s taxable year (i) at least 50% of the market value of its total assets is represented by cash, cash items (including receivables), U.S. government securities, securities of other regulated investment companies, and other securities, limited in respect of any one issuer to a value not greater than 5% of the value of the Fund’s total assets and 10% of the outstanding voting securities of such issuer, and (ii) not more than 25% of the value of its total assets is invested, including through corporations in which a Fund owns a 20% or more voting stock interest, (x) in the securities (other than those of the U.S. government or other regulated investment companies) of any one issuer or of two or more issuers which the Fund controls and which are engaged in the same, similar, or related trades or businesses, or (y) in the securities of one or more QPTPs; and (c) each taxable year distribute at least 90% of the sum of its investment company taxable income (as that term is defined in the Code without regard to the deduction for dividends paid — generally taxable ordinary income, and the excess, if any, of its net short-term capital gain over its net long-term capital loss) and net tax-exempt interest income, for such year.

Each Fund will distribute, at least annually, its net investment income and net realized capital gain. Distributions of any net investment income (other than distributions properly designated as qualified dividend income and exempt-interest dividends, as discussed below) generally are taxable to shareholders as ordinary income. Taxes on distributions of capital gain are determined by how long the Fund owned the investments that generated the gains, rather than how long a shareholder has owned his or her Shares. Distributions of net capital gain (that is, the excess of net long-term capital gain from the sale of investments that the Fund owned for more than one year over net short-term capital loss), if any, that are properly designated by the Fund as capital-gain dividends (“Capital Gain Dividends”), will be taxable as long-term capital gain regardless of how long a shareholder has held Fund Shares. Distributions of gains from the sale of investments that a Fund owned for one year or less will be taxable as ordinary income. Distributions of long-term capital gain generally will be subject to a 20% tax rate in the hands of shareholders who are individuals, with lower rates applying to taxpayers in tax rate brackets lower than the highest rate bracket, and will not be eligible for the dividends-received deduction. Distributions from capital gain are generally made after applying any capital loss carryover. Distributions are taxable to Fund shareholders whether received in cash or reinvested in additional Fund Shares.

11

Except with respect to an additional “Portfolio Turnover Risk” listed in connection with the Acquiring Fund’s limited investment duration, the principal risks of the Target Fund are identical to those of the Acquiring Fund due to the similarity of the Funds’ investment objectives and principal investment strategies, as noted above. An investment in the Acquiring Fund is subject to certain risks. There is no assurance that the return of the Acquiring Fund will be positive or that the Acquiring Fund will meet its investment objective. An investment in the Acquiring Fund is not a deposit of any bank; is not insured, or guaranteed by the Federal Deposit Insurance Corporation or any other government agency; and is subject to investment risks, including possible loss of your original investment. Like most investments, your investment in the Acquiring Fund could result in a loss of money. The following provides additional information regarding the various risks of investing in the Acquiring Fund as referenced in the section entitled “Merger Summary - Principal Risk Comparison”.

Loss of money is a risk of investing in the Acquiring Fund. In addition, the principal risks of investing in the Fund, which could adversely affect the Fund’s net asset value, yield or total return are:

Interest Rate Risk — The value of the Fund’s interest-bearing investments may decline due to an increase in interest rates. In general, the longer a security’s maturity, the greater the interest rate risk. For a portfolio with a duration of 3 years, each 1% rise in interest rates would reduce the value of the portfolio by an estimated 3%. The Fund’s yield may decrease due to a decline in interest rates. Very low or negative interest rates may magnify interest rate risk. Recent and any future declines in interest rate levels could cause the Fund’s earnings to fall below the Fund’s expense ratio, resulting in a negative yield and a decline in the Fund’s share price. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, may result in heightened market volatility and may detract from Fund performance to the extent the Fund is exposed to such interest rates.

Credit Risk — Credit risk is the possibility that the issuer of a debt instrument or a counterparty to an agreement fails to fulfill its obligations, reducing the Fund’s return. This includes failure by a bond issuer to repay interest and principal.

Liquidity Risk — Certain securities may be difficult or impossible to sell at the time and the price that would normally prevail in the market. The portfolio manager may have to lower the price, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance. This includes the risk of missing out on an investment opportunity because the assets necessary to take advantage of it are tied up in less advantageous investments. If a Fund is required to sell securities quickly or at a particular time (including sales to meet redemption requests) the Fund could realize a loss.

Prepayment/Call Risk — There is a chance that the repayment of an asset-backed or mortgage-backed obligation will occur sooner than expected. Call risk is the possibility that, during periods of falling interest rates, a bond issuer will “call” — or repay — its bond before the bond’s maturity date.

Market Risk — The value of the Fund’s assets will fluctuate as the markets in which the Fund invests fluctuate. The value of the Fund’s investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, such as inflation (or expectations for inflation), deflation (or expectations for deflation), interest rates, global demand for particular products or resources, market instability, debt crises and downgrades, embargoes, tariffs, sanctions and other trade barriers, regulatory events, other governmental trade or market control programs and related geopolitical events. In addition, the value of the Fund’s investments may be negatively affected by the occurrence of global events such as war, military conflict, acts of terrorism, social unrest, environmental disasters, natural disasters or events, recessions, supply chain disruptions, political instability, and infectious disease epidemics or pandemics.

Mortgage-Backed Securities Risk — The value of the Fund’s mortgage-backed securities can fall if the owners of the underlying mortgages pay off their mortgages sooner than expected, which could happen when interest rates fall, or later than expected, which could happen when interest rates rise. If the underlying mortgages are paid off sooner than expected, the Fund may have to reinvest this money in mortgage-backed or other securities that have lower yields.

Collateralized Mortgage Obligations Risk — There are risks associated with collateralized mortgage obligations that relate to the risks of the underlying mortgage pass-through securities (i.e., an increase or decrease in prepayment rates, resulting from a decrease or increase in mortgage interest rates, will affect the yield, average life, and price of collateralized mortgage obligations).

Asset-Backed Securities Risk — Payment of interest and repayment of principal may be impacted by the cash flows generated by the assets backing asset-backed securities. The value of the Fund’s asset-backed securities may also be affected by changes in interest rates, the availability of information concerning the interests in and structure of the pools of purchase contracts, financing leases or sales agreements that are represented by these securities, the creditworthiness of the servicing agent for the pool, the originator of the loans or receivables, or the entities that provide any supporting letters of credit, surety bonds, or other credit enhancements.

12

Exchange Traded Fund (ETF) Risk — The ETFs in which the Fund invests are subject to the risks applicable to the types of securities and investments used by the ETFs. Because an ETF charges its own fees and expenses, fund shareholders will indirectly bear these costs. The use of leverage in an ETF can magnify any price movements, resulting in high volatility. Due to daily rebalancing, leverage, and liquidity, inverse ETFs may perform worse than the inverse movement of the underlying referenced financial asset, index or commodity’s return.

Valuation Risk — The risk associated with the assessment of appropriate pricing in a changing market where trading information may not be readily available.

Portfolio Turnover Risk — A Fund may engage in active and frequent trading to achieve its principal investment objectives. This may result in the realization and distribution to shareholders of higher capital gains as compared to a fund with less active trading policies, which would increase an investor’s tax liability unless shares are held through a tax deferred or exempt vehicle. Frequent trading also increases transaction costs, which could detract from a Fund’s performance.

Management Risk — There is no guarantee that the investment techniques and risk analyses used by the Fund’s portfolio managers will produce the desired results.

Regulatory Risk — The risk that a change in laws or regulations will materially affect a security, business, sector or market. A change in laws or regulations made by the government or a regulatory body can increase the costs of operating a business, reduce the attractiveness of investment and/or change the competitive landscape. Regulatory risk also includes the risk associated with federal and state laws which may restrict the remedies that a lender has when a borrower defaults on loans. These laws include restrictions on foreclosures, redemption rights after foreclosure, federal and state bankruptcy and debtor relief laws, restrictions on “due on sale” clauses, and state usury laws.

To the extent that the Fund makes investments with additional risks, those risks could increase volatility or reduce performance. The Fund may trade securities actively, which could increase its transaction costs (thus lowering performance) and may increase the amount of taxes that you pay.

For more information about these risks, please refer to the section titled “Investment Practices and Risks” in the Fund’s prospectus.

The following provides additional information regarding the manager of the Target Fund and the Acquiring Fund and also provides expenses related to the operation of the Target Fund and the Acquiring Fund.

MANAGER

Cavanal Hill Investment Management (CHIM), headquartered at One Williams Center, 15th Floor, Tulsa, Oklahoma 74172, provides advisory and fund-level administrative services to the Target Fund and to the Acquiring Fund pursuant to an investment management agreement. CHIM is a registered investment adviser that provides advisory services for registered mutual funds, closed-end funds and other funds and accounts.

MANAGEMENT FEES

As compensation for the investment management services CHIM provides to both the Target Fund and the Acquiring Fund, CHIM is entitled to receive a fee, computed daily and paid monthly, based on the lower of (1) such fee as may, from time to time, be agreed upon in writing by the Funds and CHIM or (2) the average daily net assets of each such Fund, at the annual rates indicated below. As noted below, the management fee schedule for the Target Fund is identical to the management fee schedule for the Acquiring Fund.

13

Each Fund pays CHIM fees in return for providing investment management services at the rates set forth in the table below:

| FUND | % OF AVERAGE NET ASSETS | ||

| Bond Funds | |||

| • Limited Duration Fund | 0.15% | ||

| • Moderate Duration Fund | 0.20% Ω |

| Ω | CHIM has contractually agreed to waive fees payable to it or reimburse certain expenses so that expenses (other than extraordinary expenses and any Acquired Fund Fees and Expenses) for each Class do not exceed 0.49%, plus class-specific fees until December 31, 2024. Affiliates of CHIM have contractually agreed to waive all Shareholder Servicing Fees to which they are entitled. The affiliate waivers result in a reduction of the Shareholder Servicing Fee paid by all purchasers of a Class to the extent shown in the table. Contractual waivers are in place for the period through December 31, 2024 and may only be terminated or modified with the approval of the Fund’s Board of Trustees. If the Merger is approved, the termination date will be extended until the one-year anniversary of the consummation of the Merger. |

A discussion regarding the basis for the Board approving the Investment Advisory Agreement with CHIM is available in the Funds’ annual report to shareholders for the period ended August 31, 2023.

14

At a regular Board meeting held on April 25, 2024 (the “Meeting”), the Board, including the Independent Trustees considered the Merger. In advance of the Meeting, CHIM provided extensive background materials and analyses to the Board. These materials included the rationale for the proposed Merger, as well as information on the investment objectives and principal investment strategies of both the Target Fund and the Acquiring Fund; their respective fee arrangements, operating expense ratios, asset sizes, risk profiles and investment performance; and analyses of certain tax information, transaction cost information and the projected benefits of the Merger. Representatives of CHIM presented these materials and responded to questions at the Meeting.

The Board reviewed and discussed these materials and analyses with CHIM and among themselves. The Board was assisted in its evaluation of the Merger by independent legal counsel, with whom they met separately and from whom they received separate legal advice. After such review, discussion and evaluation, the Board unanimously approved the Plan for the Merger at the Meeting. In its deliberations, the Board considered that some of the projected benefits of the Merger would accrue to CHIM and its affiliates, in addition to those that would accrue to the shareholders of the Target Fund and the Acquiring Fund. In this regard, the Board noted that CHIM and its affiliates are likely to benefit from the elimination of duplicative expenses and the reduction of other associated operational costs resulting from the consolidation of funds with identical objectives and strategies. The Board took into account these benefits, among others, in the context of focusing on Fund shareholder benefits and evaluating the Merger overall, and determined that merging the Target Fund into the Acquiring Fund would be in the best interests of both Funds. The Board further determined that the interests of the shareholders of both the Target Fund and the Acquiring Fund would not be diluted as a result of the Merger.

In approving the Plan, the Board did not identify any particular information or consideration that was all-important or controlling, and each Trustee likely attributed different weights to various factors.

The Board approved the Merger for the following reasons:

Overall Basis For Approval. The Board considered a number of factors in determining that the Merger would be in the best interests of the Target Fund and its shareholders. After taking into account the Funds’ materially similar investment objectives and investments strategies, the Board considered CHIM’s assessment that the Merger would result in a bond fund investing primarily in debt obligations such as bonds, notes and debentures, and bills issued by U.S. corporations or by the U.S. government, its agencies or instrumentalities, municipal securities, mortgage-backed securities, asset-backed securities, and collateralized mortgage obligations and fixed income ETFs and holding such investments for a “moderate” duration of three to five years being merged into a bond fund investing in identical investments but holding such investments for a “limited” duration of less than three and one-half years.

Portfolio Management. The Board considered that the Target Fund’s current portfolio managers are also the portfolio managers of the Acquiring Fund and will continue to serve as the portfolio managers of the Acquiring Fund after the Merger.

The Board considered that the investment objectives of the Target Fund and Acquiring Fund – (i) to seek total return and (ii) primarily to seek income and secondarily to seek capital appreciation, respectively, are materially similar although stated in different terms. The Board considered that the principal investment strategies of the Target Fund and Acquiring Fund are identical except to the extent that the Acquiring Fund’s principal investment strategy defines “Total Return” whereas the Target Fund’s principal investment strategy does not.

The Board noted that the Acquiring Fund’s management fee is 5 bps lower than the management fee of the Target Fund, and other fees and expenses of the Acquiring Fund are lower than or equal to those of the Target Fund. However, the total annual fund operating expenses of the Acquiring Fund are currently 21 bps higher than those of the Target Fund because of the Target Fund’s higher fee waivers. Shareholders of the Target Fund will pay higher overall fees after the Merger, in large part because fee waivers that have been in place for the Target Fund, which expire on December 31, 2024, have not applied to the Acquiring Fund, due to its relative superior performance. The Board considered the recommendation of CHIM regarding the overall benefits to Target Fund shareholders as described above and the reasonableness of the higher Acquiring Fund fees in light of recent performance and expiring fee waivers.

15

Greater Potential Economies Of Scale And Viability. The Board also considered that shareholders of both the Target Fund and the Acquiring Fund may benefit from the potential for greater economies of scale and viability in the future by consolidating the Target Fund, a bond fund investing primarily in debt obligations such as bonds, notes and debentures, and bills issued by U.S. corporations or by the U.S. government, its agencies or instrumentalities, municipal securities, mortgage-backed securities, asset-backed securities, and collateralized mortgage obligations and fixed income ETFs and holding such investments for a “moderate” duration of three to five years being merged into a bond fund investing in identical investments but holding the investments for a “limited” duration of less than three and one-half years, making the Acquiring Fund less sensitive to increased interests rates and creating conditions that are expected by CHIM to have greater potential for asset growth and viability following the Merger.

Compatible Objectives And Investment Strategies. As described in the section entitled “Merger Summary (Objectives, Strategies, Risks, Performance, Expense, Management and Tax Information) - Investment Objective and Strategy Comparison” above, the Board considered that the investment objective of the Target Fund – to seek total return – is materially similar to that of the Acquiring Fund – primarily to seek income and secondarily to seek capital appreciation.

The Acquiring Fund and the Target Fund also have materially similar principal investment strategies, except that the (i) Target Fund’s principal investment strategy defines “Total Return” whereas the Acquiring Fund’s principal investment strategy does not, (ii) the Target Fund holds its investments for a longer duration than the Acquiring Fund, and (iii) the Acquiring Fund contains an additional minimum investment threshold for interest-bearing bonds. With respect to item (ii) in the preceding sentence, the Target Fund holds its investments for a period ranging from three to five years, whereas the Acquiring Fund holds its investments for a period of less than three and one-half years. However, each of the Target Fund and Acquiring Fund invest in the same types of instruments.

With respect to item (iii) in the preceding paragraph, the Acquiring Fund normally invests at least 65% of its net assets in interest-bearing bonds; the Target Fund has also invested 65% of its net assets in interest-bearing bonds since inception.

The Board considered the Merger in light of the current interest rate environment and the impact of interest rates on the duration of certain investments. The Board also considered transaction costs and other related fees with respect to the Merger, as well as the tax implications.

Comparative Performance. The Board reviewed the performance of the Target Fund relative to that of the Acquiring Fund. •The Acquiring Fund has outperformed the Target Fund for each of the trailing 1, 3, 5, and 10 year periods and in each of the periods ended December 31, 2022, and December 31, 2023. CHIM acknowledges that, from each fund’s inception through the period ended December 31, 2021, the Target Fund posted better performance than the Acquiring Fund. However, given market conditions affecting each of the Acquiring Fund and the Target Fund. CHIM anticipates that the Acquiring Fund’s recent superior performance will continue. In reviewing comparative performance, the Board considered that the Funds’ investment objectives and principal investment strategies are materially similar. Shareholders should consult the chart in the section entitled “Merger Summary (Objectives, Strategies, Risks, Performance, Expense, Management and Tax Information) - Fund Performance Comparison” for more detailed performance information, including information about each Funds’ performance relative to that of its primary benchmark index. Of course, past performance is not predictive of future results.

Expenses Of The Merger. The Board was advised that CHIM or its affiliates will bear all expenses incurred in connection with the Merger (other than any brokerage or other transaction costs associated with the sale or purchase of portfolio securities in connection with the Merger). Expenses borne by CHIM in connection with the Merger are estimated to be approximately $115,000.00.

Conclusion. Ultimately, in the exercise of its business judgment, the Board determined that participating in the Merger would be in the best interests of both the Target Fund and the Acquiring Fund. The Board further determined that the interests of the shareholders of both the Target Fund and the Acquiring Fund would not be diluted as a result of the Merger.

16

The following summary of the Plan is qualified in its entirety by reference to Exhibit A attached hereto.

The Plan provides that the Acquiring Fund will acquire all of the assets of the Target Fund in exchange for shares of equal value of the Acquiring Fund (measured on the business day immediately preceding the Merger) and the assumption by the Acquiring Fund of all of the liabilities of the Target Fund, on a date and time agreed by the Funds and CHIM (immediately after the close of business on the day the Merger closes, the “Effective Time” and the date on which the Merger occurs, the “Closing Date”).

The number of full and fractional shares of each class of the Acquiring Fund to be received by each corresponding class of the Target Fund will be determined by dividing the value of assets net of known liabilities attributable to the Target Fund class by the net asset value (“NAV”) of one share of the applicable Acquiring Fund class. The Plan specifies that the method of determining the value of the assets net of liabilities and the NAV of each class of the Acquiring Fund shall be the same method used in determining the NAV of the Acquiring Fund in the ordinary course.

The valuation will be conducted on the business day immediately preceding the Closing Date or upon such other date as the parties may agree, as of the last time that the Acquiring Fund ordinarily calculates its NAV, or as of such other time as the parties may agree (the “Valuation Date”).

Prior to the Closing Date, the Target Fund will declare a distribution which, together with all previous distributions, shall have the effect of distributing to the Target Fund’s shareholders (in shares of the Target Fund, or in cash, as the shareholder has previously elected) substantially all of the Target Fund’s undistributed investment company taxable income (computed without regard to any deduction for dividends paid) for all taxable periods ending on or prior to the Closing Date, and all of its undistributed net capital gain realized in all taxable periods ending on or prior to the Closing Date (after reduction by any available capital loss carryforwards).

At the Effective Time or as soon as reasonably practicable thereafter, the Target Fund will liquidate and distribute pro rata to the Target Fund shareholders of record of each class as of the close of business on the Valuation Date the full and fractional shares of the corresponding class of the Acquiring Fund received by the Target Fund based on the shares of the Target Fund class owned by such shareholders. After these distributions and the winding up of its affairs, the Target Fund will be terminated as a series of the Trust in accordance with applicable law and its Amended and Restated Declaration of Trust (“Declaration of Trust”).

A majority of the Board may terminate the Plan on behalf of the Target Fund or Acquiring Fund under certain circumstances. In addition, completion of the Merger is subject to numerous conditions set forth in the Plan, including the accuracy of various representations and warranties, and receipt of a tax opinion generally to the effect that the Merger will qualify as a tax-free “reorganization” for U.S. federal income tax purposes.

CHIM will bear all expenses incurred in connection with the Merger (except for brokerage or other transaction costs associated with the sales or purchase of Portfolio securities in connection with the Merger).

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE MERGER

The following discussion summarizes the material U.S. federal income tax consequences of the Merger that are applicable to you as a Target Fund shareholder. It is based on the Code, applicable U.S. Treasury regulations, judicial authority, and administrative rulings and practice, all as of the date of this Prospectus/Information Statement and all of which are subject to change, including changes with retroactive effect. The discussion below does not address any state, local, or foreign tax consequences of the Merger. Your tax treatment may vary depending upon your particular situation. You also may be subject to special rules not discussed below if you are a certain kind of Target Fund shareholder, including, but not limited to: an insurance company; a tax-exempt organization; a financial institution or broker-dealer; a person who is neither a citizen nor resident of the United States or an entity that is not organized under the laws of the United States or a political subdivision thereof; a holder of Target Fund shares as part of a hedge, straddle, conversion or other integrated transaction; a person with “applicable financial statements” within the meaning of Section 451(b) of the Code; a person who does not hold Target Fund shares as a capital asset at the time of the Merger; or an entity taxable as a partnership for U.S. federal income tax purposes.

17

The exchange of the Target Fund’s assets solely for the corresponding Acquiring Fund’s shares and the latter’s assumption of the Target Fund’s liabilities is intended to qualify for federal income tax purposes as a tax-free reorganization under section 368(a)(1) of the Code. As a condition to consummation of the Merger, each Fund will receive an opinion from K&L Gates LLP, tax counsel (“Opinion”), substantially to the effect that – based on the facts and assumptions stated therein and conditioned on the representations and warranties made in the Plan and in separate letters, if requested, addressed to tax counsel being true and complete immediately after the close of business on the Closing Date and consummation of the Merger in accordance with the Plan (without the waiver or modification of any terms or conditions thereof and without taking into account any amendment thereof that tax counsel has not approved) – for federal income tax purposes:

| (a) | The Acquiring Fund’s acquisition of the Target Fund’s assets in exchange solely for shares of the Acquiring Fund and the Acquiring Fund’s assumption of the Target Fund’s liabilities, followed by the Target Fund’s distribution of those shares pro rata to the Shareholders actually or constructively in exchange for their Target Shares and in complete liquidation of the Target Fund, will qualify as a “reorganization” (as defined in section 368(a)), and each Fund will be “a party to a reorganization” within the meaning of section 368(b) of the Code; |

| (b) | The Target Fund will recognize no gain or loss on the transfer of its assets to the Acquiring Fund in exchange solely for the Acquiring Fund’s shares and its assumption of the Target Fund’s liabilities or on the subsequent distribution of those shares to the Target Fund’s shareholders in exchange for their Target Fund shares; |

| (c) | The Acquiring Fund will recognize no gain or loss on its receipt of the Target Fund’s assets in exchange solely for the Acquiring Fund’s shares and its assumption of the Target Fund’s liabilities; |

| (d) | The Acquiring Fund’s basis in each asset it receives from the Target Fund will be the same as the Target Fund’s basis therein immediately before the Merger, and the Acquiring Fund’s holding period for each such asset will include the Target Fund’s holding period therefor (except where the Acquiring Fund’s investment activities have the effect of reducing or eliminating an asset’s holding period); |

| (e) | A Target Fund shareholder will recognize no gain or loss on the exchange of all its Target Fund shares solely for the Acquiring Fund’s shares pursuant to the Merger; and |

| (f) | A Target Fund shareholder’s aggregate basis in the corresponding Acquiring Fund’s shares it receives in the Merger will be the same as the aggregate basis in its Target Fund shares it actually or constructively surrenders in exchange for those Acquiring Fund shares, and its holding period for those Acquiring Fund shares will include, in each instance, its holding period for those Target Fund shares, provided the shareholder holds them as capital assets at the Effective Time. |