Exhibit 99.1

Exhibit 99.1

Cascade Microtech Investor Day

Business Model and Growth Plan

Agenda

Financial Report – Jeff Killian

Technology Strategies – Eric Strid

Market Update – Mike Kondrat

Sales and Customer Support– Paul O’Mara

Business Unit Overview – Steve Harris

2 |

| November 30, 2010 |

Safe Harbor and Non-GAAP Measures

This presentation includes “forward-looking” statements within the meaning of the Securities Litigation Reform Act of 1995. Such forward-looking statements include statements regarding Cascade’s anticipated revenue growth, increased revenue from certain products, related increases in customer demand, future quarterly earnings, correlation between bookings and revenues, facility changes and utilization, and integration and restructuring of product lines. Words such as expects, anticipates, intends, plans, believes, sees, estimates and variations of such words and similar expressions are intended to identify these and other forward-looking statements. All such statements are based on current expectations, estimates and projections about the Company’s business based in part on assumptions made by management. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements due to numerous factors, including changes in demand for the Company’s products and product mix; the timing of shipments and customer orders; constraints on supplies of components; excess or shortage of production capacity; difficulties or unexpected costs or delays in the integration of the operations, employees, products, sales channels, strategies, and technologies of acquired businesses; difficulties or unexpected costs or delays in the consolidation of facilities and manufacturing operations; the inability to achieve anticipated savings from cost reduction efforts; the potential failure of expected market opportunities to materialize; the potential inability to realize expected benefits and synergies; potential diversion of management’s attention from our existing business as well as that of acquired businesses; potential adverse effects on relationships with our existing suppliers, customers or partners and other risks discussed from time to time in the Company’s Securities and Exchange Commission filings and reports, including the Company’s Annual Report on Form 10-K. In addition, such statements could be affected by general industry and market conditions and growth rates and general domestic and international economic conditions. Such forward-looking statements speak only as of the date on which they are made and the company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this presentation.

3 |

| November 30, 2010 |

Executive Officers

Extensive business, technical and market experience

Michael D. Burger

President and CEO

Steve Harris

Executive Vice President

Jeff Killian

VP Finance and CFO

Mike Kondrat

VP Marketing

Steve Mahon

VP Operations

Paul O’Mara

VP Sales and Support

Ellen Raim

VP Human Resources

Eric Strid

Co-founder and CTO

4 |

| November 30, 2010 |

Company Overview

About Us

HQ Beaverton, OR

9 locations around the world

4 |

| R&D sites |

Employees

415 employees 74 in R&D

Technological Innovation

25+ years in high performance wafer probing Extensive IP Portfolio (>160 patents)

Global Presence

Worldwide customer support

5 |

| November 30, 2010 |

What We Do

We are experts in enabling precision mechanical, optical, or electrical measurements of integrated circuits on-wafer.

We do this by offering probe stations, engineering probes, production probe cards and sockets.

Our products are used in a diverse set of applications

Semiconductor companies, Universities, Government, Military and Commercial entities.

This enables our customers to

Accurately model and characterize semiconductor devices and processes?? Reduce their product costs with improved yield

6 |

| November 30, 2010 |

Outstanding Customers in All Major Sectors

The Who’s Who in the Semiconductor Industry

Fabless

Integrated Device Manufacturer

Foundry

Government/Institute Research University Research Subcons

7 |

| November 30, 2010 |

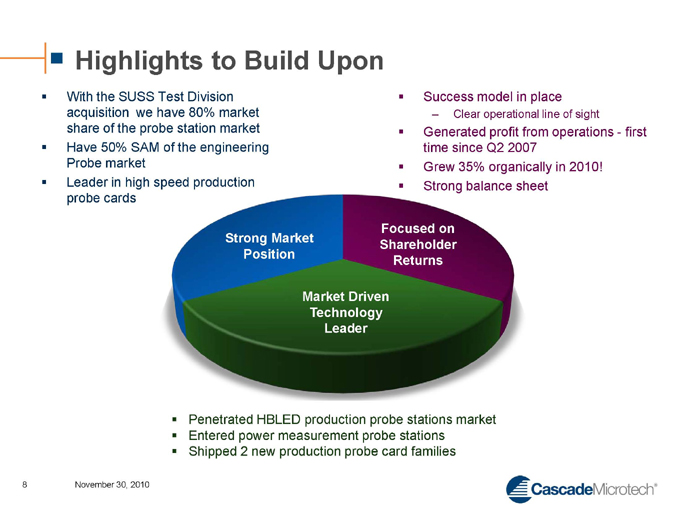

Highlights to Build Upon

With the SUSS Test Division acquisition we have 80% market share of the probe station market

Have 50% SAM of the engineering Probe market

Leader in high speed production probe cards

Success model in place

– Clear operational line of sight

Generated profit from operations—first time since Q2 2007

Grew 35% organically in 2010!

Strong balance sheet

Strong Market Position

Focused on Shareholder Returns

Market Driven Technology Leader

Penetrated HBLED production probe stations market

Entered power measurement probe stations

Shipped 2 new production probe card families

8 |

| November 30, 2010 |

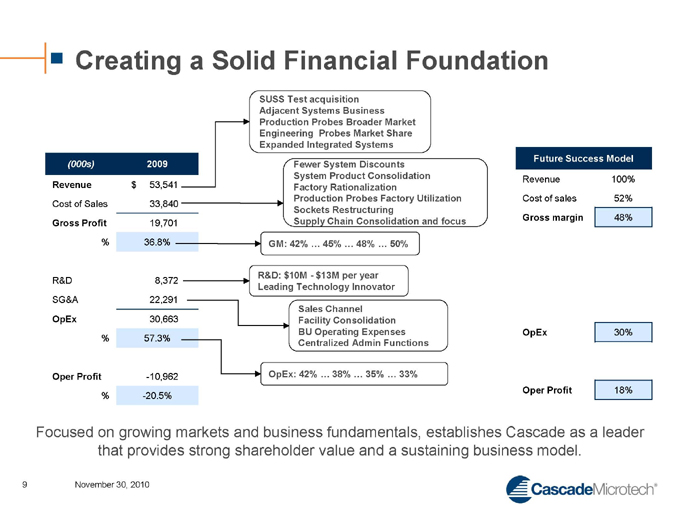

Creating a Solid Financial Foundation

(000s) 2009

Revenue $53,541

Cost of Sales 33,840

Gross Profit 19,701

% 36.8%

R&D 8,372

SG&A 22,291

OpEx 30,663

% 57.3%

Oper Profit -10,962

% -20.5%

SUSS Test acquisition Adjacent Systems Business Production Probes Broader Market Engineering Probes Market Share Expanded Integrated Systems

Fewer System Discounts System Product Consolidation Factory Rationalization Production Probes Factory Utilization Sockets Restructuring Supply Chain Consolidation and focus

GM: 42% … 45% … 48% … 50%

R&D: $10M—$13M per year Leading Technology Innovator

Sales Channel Facility Consolidation BU Operating Expenses Centralized Admin Functions

OpEx: 42% … 38% … 35% … 33%

Future Success Model

Revenue 100%

Cost of sales 52%

Gross margin 48%

OpEx 30%

Oper Profit 18%

Focused on growing markets and business fundamentals, establishes Cascade as a leader that provides strong shareholder value and a sustaining business model.

9 November 30, 2010

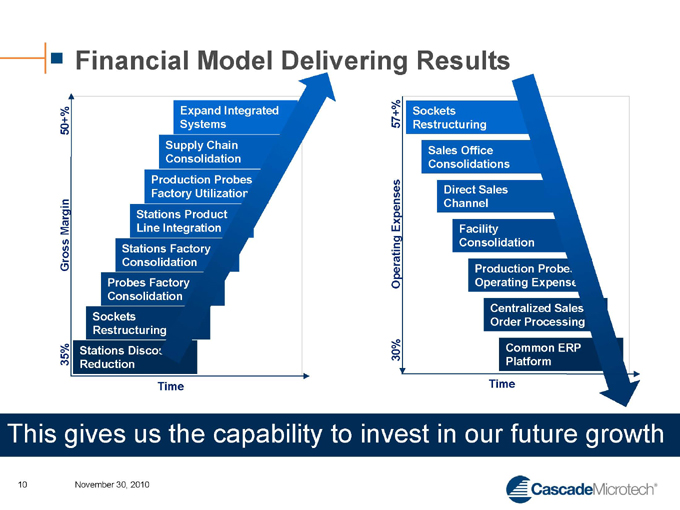

Financial Model Delivering Results

35%

Gross Margin

50+%

Expand Integrated Systems

Supply Chain Consolidation

Production Probes Factory Utilization

Stations Product Line Integration

Stations Factory Consolidation

Probes Factory Consolidation

Sockets Restructuring

Stations Discount Reduction

Time

30%

Operating Expenses

57+%

Sockets Restructuring

Sales Office Consolidations

Direct Sales Channel

Facility Consolidation

Production Probes Operating Expenses

Centralized Sales Order Processing

Common ERP Platform

Time

This gives us the capability to invest in our future growth

10 November 30, 2010

Cascade Microtech Future Vision

Our base for expansion has been strengthened

Strong Who’s Who global customers

Beginning to deliver profitability

Strong management team in place

How do we grow?

Capitalizing on megatrends in our ecosystem

Expanding into growing adjacent market segments

Leveraging our technology leadership

Intel 22nm Test Chip

11 November 30, 2010

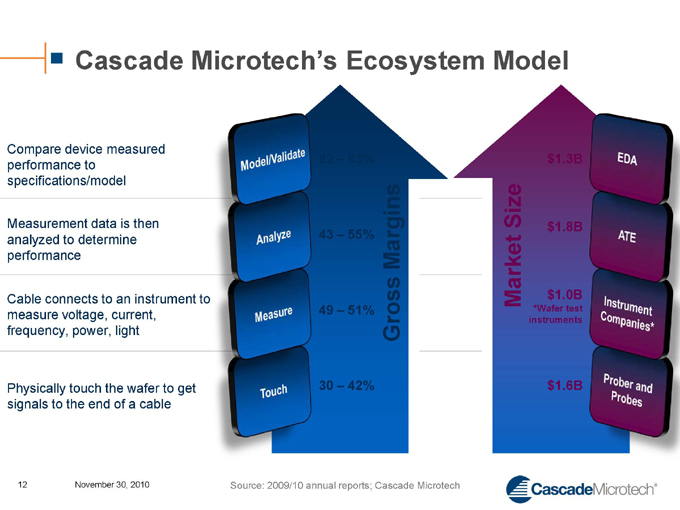

Cascade Microtech’s Ecosystem Model

Compare device measured performance to specifications/model

Measurement data is then analyzed to determine performance

Cable connects to an instrument to measure voltage, current, frequency, power, light

Physically touch the wafer to get signals to the end of a cable

82 – 83%

43 – 55%

49 – 51%

30 – 42%

Gross Margins

Market Size

$1.3B

$1.8B

$1.0B

*Wafer test instruments

$1.6B

Source: 2009/10 annual reports; Cascade Microtech

12 November 30, 2010

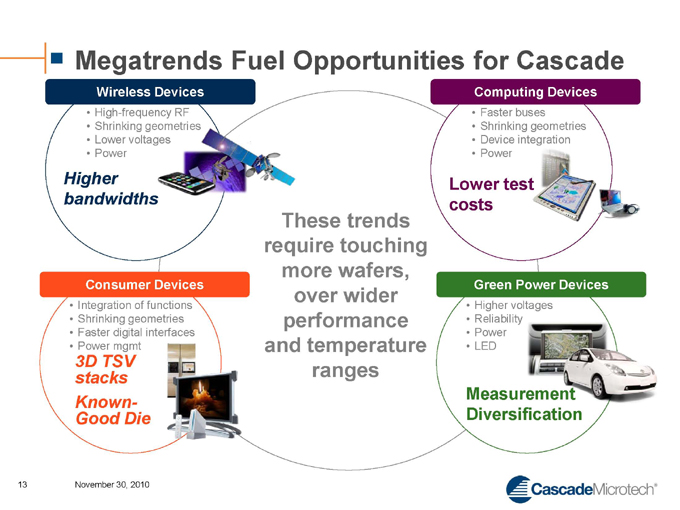

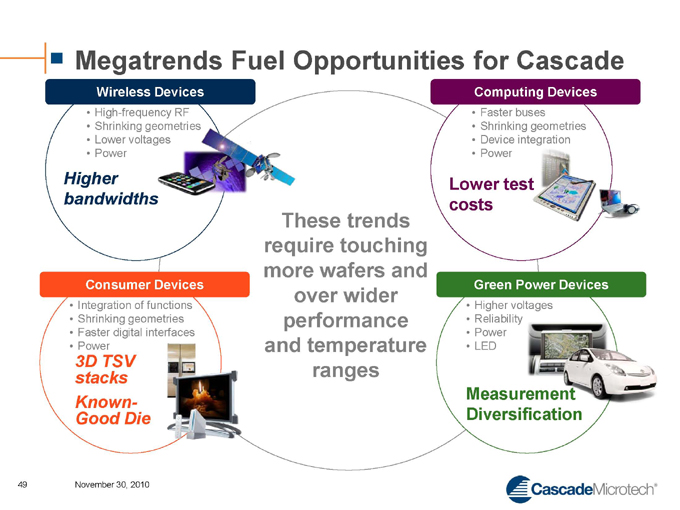

Megatrends Fuel Opportunities for Cascade

Wireless Devices

High-frequency RF

Shrinking geometries

Lower voltages

Power

Higher bandwidths

Consumer Devices

Integration of functions

Shrinking geometries

Faster digital interfaces

Power mgmt

3D TSV

stacks

Known-

Good Die

These trends require touching more wafers, over wider performance and temperature ranges

Computing Devices

Faster buses

Shrinking geometries

Device integration

Power

Lower test costs

Green Power Devices

Higher voltages

Reliability

Power

LED

Measurement

Diversification

13 November 30, 2010

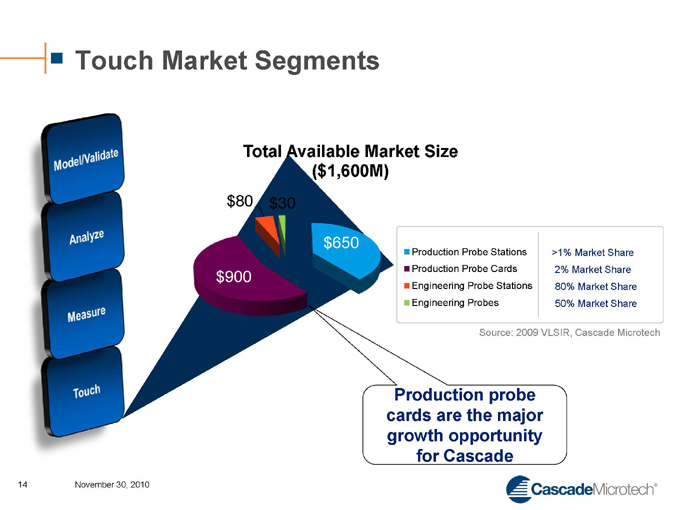

Touch Market Segments

Total Available Market Size ($1,600M)

$80

$30

$900

$650

Production Probe Stations >1% Market Share

Production Probe Cards 2% Market Share

Engineering Probe Stations 80% Market Share

Engineering Probes 50% Market Share

Source: 2009 VLSIR, Cascade Microtech

Production probe cards are the major growth opportunity for Cascade

14 November 30, 2010

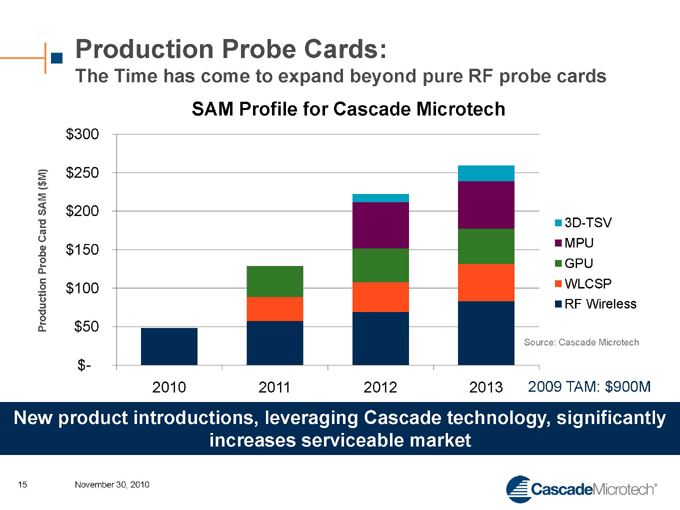

Production Probe Cards:

The Time has come to expand beyond pure RF probe cards SAM Profile for Cascade Microtech

Production Probe Card SAM ($M)

$300

$250

$200

$150

$100

$50

$-

2010

2011

2012

2013

3D-TSV MPU GPU WLCSP RF Wireless

Source: Cascade Microtech

2009 TAM: $900M

New product introductions, leveraging Cascade technology, significantly increases serviceable market

15 November 30, 2010

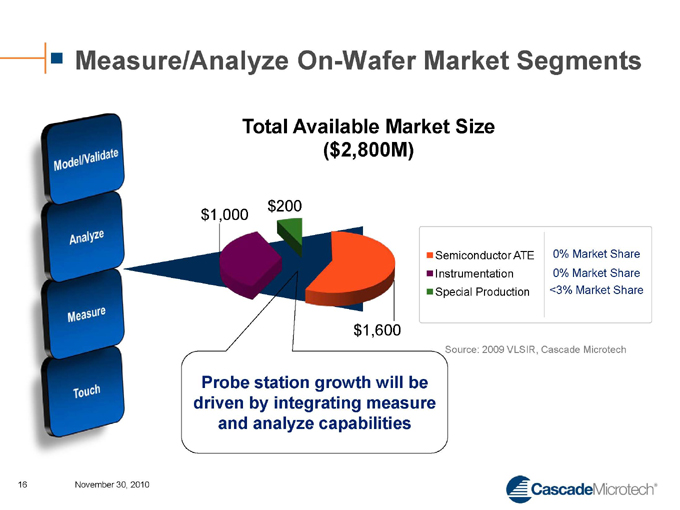

Measure/Analyze On-Wafer Market Segments

Total Available Market Size

($2,800M)

$200

$1,000

$1,600

Probe station growth will be driven by integrating measure and analyze capabilities

Semiconductor ATE 0% Market Share

Instrumentation 0% Market Share

Special Production <3% Market Share

Source: 2009 VLSIR, Cascade Microtech

16 November 30, 2010

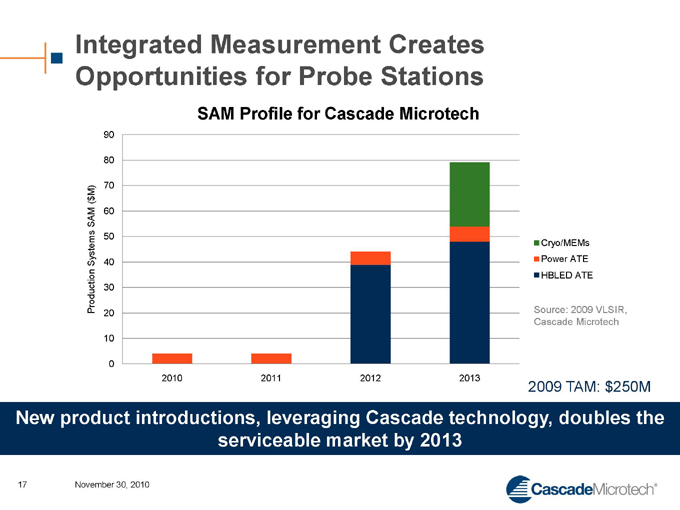

Integrated Measurement Creates Opportunities for Probe Stations

SAM Profile for Cascade Microtech

Production Systems SAM ($M)

90

80

70

60

50

40

30

20

10

0

2010

2011

2012

2013

Cryo/MEMs Power ATE HBLED ATE

Source: 2009 VLSIR, Cascade Microtech

2009 TAM: $250M

New product introductions, leveraging Cascade technology, doubles the serviceable market by 2013

17 November 30, 2010

Cascade Microtech Highlights

Strong management team

Focused on execution

Strong Who’s Who global customers

Strong relationships mean strong partnerships

Focused on delivering sustained profitability via new business model

Encouraging results; improving balance sheet

Investing in growth opportunities

Strong differentiated leadership position

Leveraging technology into high growth areas

18 November 30, 2010

Financial Report

Jeff Killian

Vice President Finance Chief Financial Officer

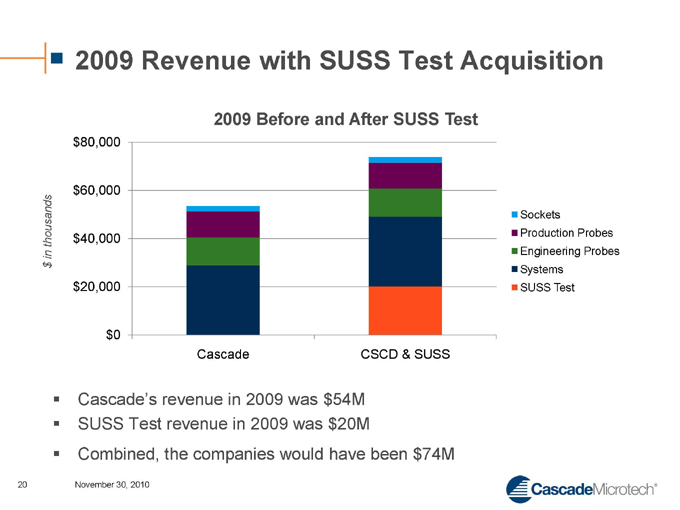

2009 Revenue with SUSS Test Acquisition

2009 Before and After SUSS Test

$ in thousands

$80,000 $60,000 $40,000 $20,000 $0

Cascade

CSCD & SUSS

Sockets

Production Probes Engineering Probes Systems SUSS Test

Cascade’s revenue in 2009 was $54M

SUSS Test revenue in 2009 was $20M

Combined, the companies would have been $74M

20 November 30, 2010

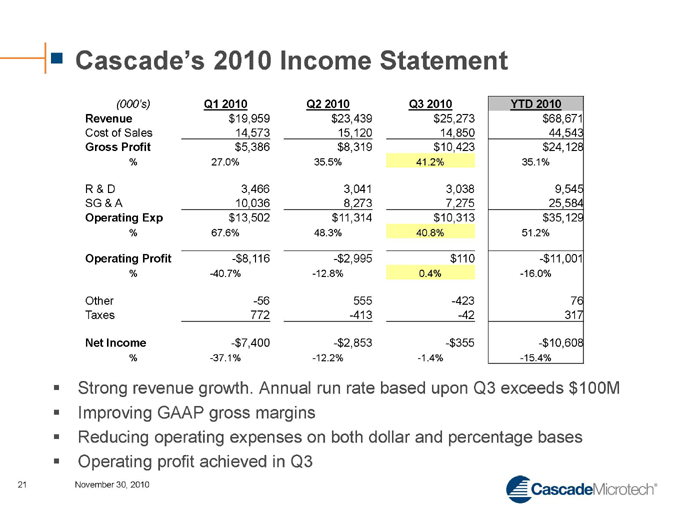

Cascade’s 2010 Income Statement

(000’s) Q1 2010 Q2 2010 Q3 2010 YTD 2010

Revenue $19,959 $23,439 $25,273 $68,671

Cost of Sales 14,573 15,120 14,850 44,543

Gross Profit $5,386 $8,319 $10,423 $24,128

% 27.0% 35.5% 41.2% 35.1%

R & D 3,466 3,041 3,038 9,545

SG & A 10,036 8,273 7,275 25,584

Operating Exp $13,502 $11,314 $10,313 $35,129

% 67.6% 48.3% 40.8% 51.2%

Operating Profit - -$8,116 -$2,995 $110 -$11,001

% -40.7% -12.8% 0.4% -16.0%

Other -56 555 -423 76

Taxes 772 -413 -42 317

Net Income -$7,400 -$2,853 - -$355 -$10,608

% -37.1% -12.2% -1.4% -15.4%

Strong revenue growth. Annual run rate based upon Q3 exceeds $100M??

Improving GAAP gross margins??

Reducing operating expenses on both dollar and percentage bases??

Operating profit achieved in Q3

21 November 30, 2010

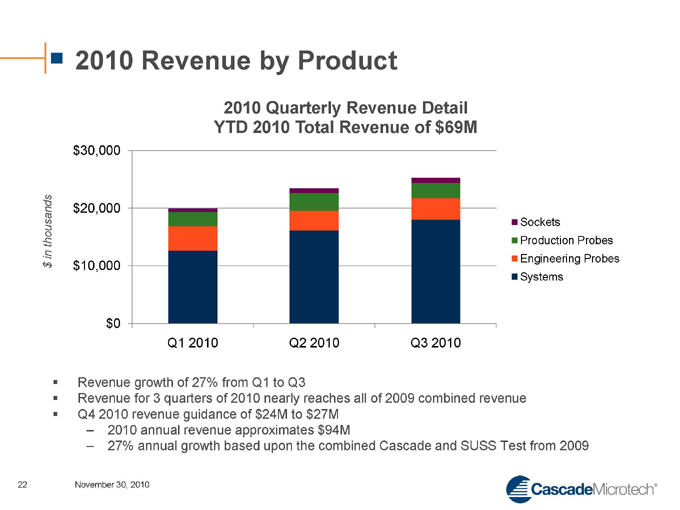

2010 Revenue by Product

2010 Quarterly Revenue Detail YTD 2010 Total Revenue of $69M

$ in thousands

$30,000 $20,000 $10,000 $0

Q1 2010

Q2 2010

Q3 2010

Sockets

Production Probes Engineering Probes Systems

Revenue growth of 27% from Q1 to Q3

Revenue for 3 quarters of 2010 nearly reaches all of 2009 combined revenue

Q4 2010 revenue guidance of $24M to $27M

2010 annual revenue approximates $94M

27% annual growth based upon the combined Cascade and SUSS Test from 2009

22 November 30, 2010

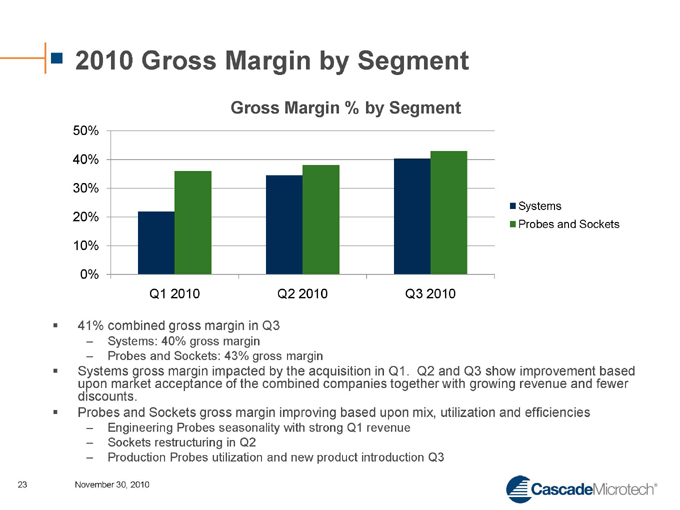

2010 Gross Margin by Segment

Gross Margin % by Segment

50% 40% 30% 20% 10% 0%

Q1 2010

Q2 2010

Q3 2010

Systems

Probes and Sockets

41% combined gross margin in Q3

Systems: 40% gross margin

Probes and Sockets: 43% gross margin

Systems gross margin impacted by the acquisition in Q1. Q2 and Q3 show improvement based upon market acceptance of the combined companies together with growing revenue and fewer discounts.

Probes and Sockets gross margin improving based upon mix, utilization and efficiencies

Engineering Probes seasonality with strong Q1 revenue

Sockets restructuring in Q2

Production Probes utilization and new product introduction Q3

23 November 30, 2010

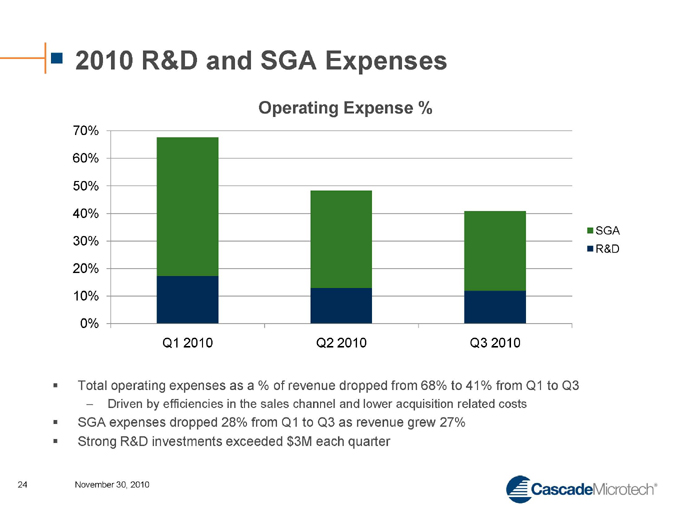

2010 R&D and SGA Expenses

Operating Expense %

70% 60% 50% 40% 30% 20% 10% 0%

Q1 2010 Q2 2010 Q3 2010

SGA R&D

Total operating expenses as a % of revenue dropped from 68% to 41% from Q1 to Q3 – Driven by efficiencies in the sales channel and lower acquisition related costs

SGA expenses dropped 28% from Q1 to Q3 as revenue grew 27%

Strong R&D investments exceeded $3M each quarter

24 November 30, 2010

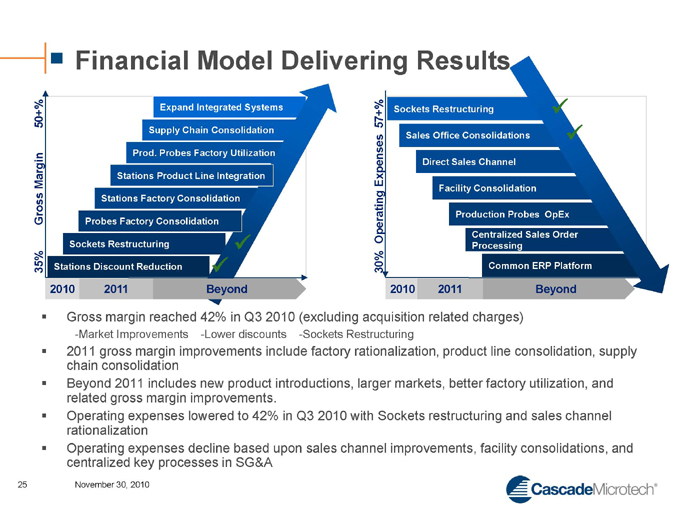

Financial Model Delivering Results

35%

Gross Margin

50+%

Expand Integrated Systems

Supply Chain Consolidation

Prod. Probes Factory Utilization

Stations Product Line Integration

Stations Factory Consolidation

Probes Factory Consolidation

Sockets Restructuring

Stations Discount Reduction

2010

2011

Beyond

30%

Operating Expenses

57+%

Sockets Restructuring

Sales Office Consolidations

Direct Sales Channel

Facility Consolidation

Production Probes OpEx

Centralized Sales Order

Processing

Common ERP Platform

2010

2011

Beyond

Gross margin reached 42% in Q3 2010 (excluding acquisition related charges)

-Market Improvements -Lower discounts -Sockets Restructuring

2011 gross margin improvements include factory rationalization, product line consolidation, supply chain consolidation??

Beyond 2011 includes new product introductions, larger markets, better factory utilization, and related gross margin improvements.

Operating expenses lowered to 42% in Q3 2010 with Sockets restructuring and sales channel rationalization??

Operating expenses decline based upon sales channel improvements, facility consolidations, and centralized key processes in SG&A

25 November 30, 2010

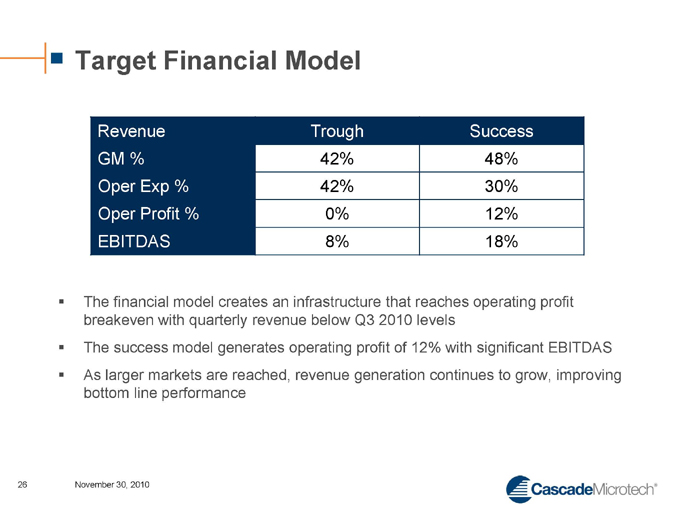

Target Financial Model

Revenue Trough Success

GM % 42% 48%

Oper Exp % 42% 30%

Oper Profit % 0% 12%

EBITDAS 8% 18%

The financial model creates an infrastructure that reaches operating profit breakeven with quarterly revenue below Q3 2010 levels

The success model generates operating profit of 12% with significant EBITDAS

As larger markets are reached, revenue generation continues to grow, improving bottom line performance

26 November 30, 2010

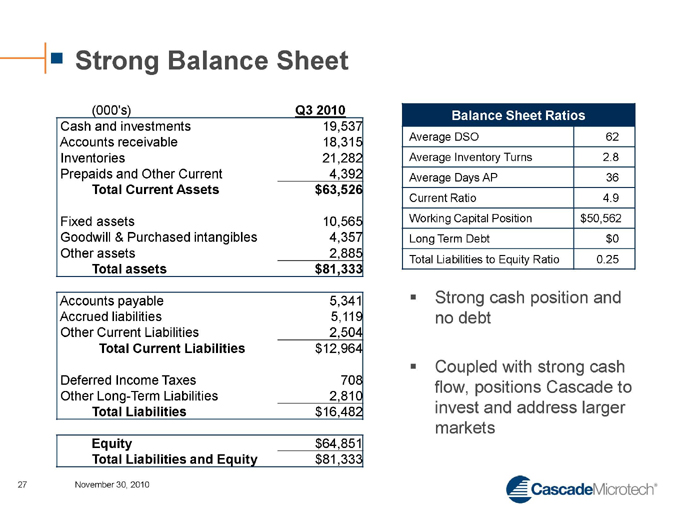

Strong Balance Sheet

(000’s) Q3 2010

Cash and investments 19,537

Accounts receivable 18,315

Inventories 21,282

Prepaids and Other Current 4,392

Total Current Assets $63,526

Fixed assets 10,565

Goodwill & Purchased intangibles 4,357

Other assets 2,885

Total assets $81,333

Accounts payable 5,341

Accrued liabilities 5,119

Other Current Liabilities 2,504

Total Current Liabilities $12,964

Deferred Income Taxes 708

Other Long-Term Liabilities 2,810

Total Liabilities $16,482

Equity $64,851

Total Liabilities and Equity $81,333

Balance Sheet Ratios

Average DSO 62

Average Inventory Turns 2.8

Average Days AP 36

Current Ratio 4.9

Working Capital Position $50,562

Long Term Debt $0

Total Liabilities to Equity Ratio 0.25

Strong cash position and no debt

Coupled with strong cash flow, positions Cascade to invest and address larger markets

27 November 30, 2010

Summary

Position Cascade for the semiconductor business cycles

– Leverage the resources within the combined organization

– Adjust infrastructure to lower costs and expenses

Clearly defined initiatives and action plans

– Achieve operating profit break even at lower revenue levels

Retain positive EBITDAS during down-cycles

– Produce significant profits and EBITDAS during up-cycles

Combine the business model with a strong balance sheet – Positioned to invest and address larger markets

28 November 30, 2010

Technology Strategies

Eric Strid

Chief Technology Officer

Electronic System Drivers

IT productivities

5 |

| billion cell phone subscribers want smarter phones |

Tipping points: telepresence, voice recognition, automated surveillance…

Pervasive computing for shopping, security, healthcare,…

Wireless and Internet bandwidth will increase ~100X by 2020

Energy

Higher system efficiencies: LEDs, power supplies in everything

Renewable sources: wind, PV, storage systems

Electrified transportation: autos, rail

Massive ramps in LEDs, power devices, PV

30 November 30, 2010

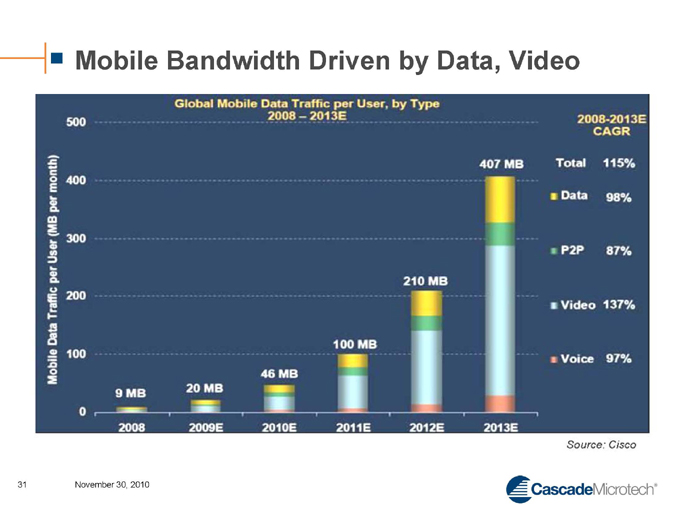

Mobile Bandwidth Driven by Data, Video

31 November 30, 2010

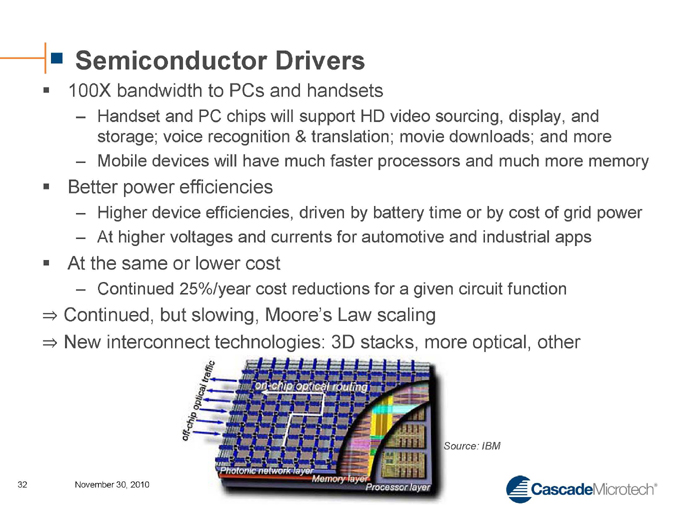

Semiconductor Drivers

100X bandwidth to PCs and handsets

– Handset and PC chips will support HD video sourcing, display, and storage; voice recognition & translation; movie downloads; and more

– Mobile devices will have much faster processors and much more memory

Better power efficiencies

– Higher device efficiencies, driven by battery time or by cost of grid power

– At higher voltages and currents for automotive and industrial apps

At the same or lower cost

– Continued 25%/year cost reductions for a given circuit function

Continued, but slowing, Moore’s Law scaling

New interconnect technologies: 3D stacks, more optical, other

Source: IBM

32 November 30, 2010

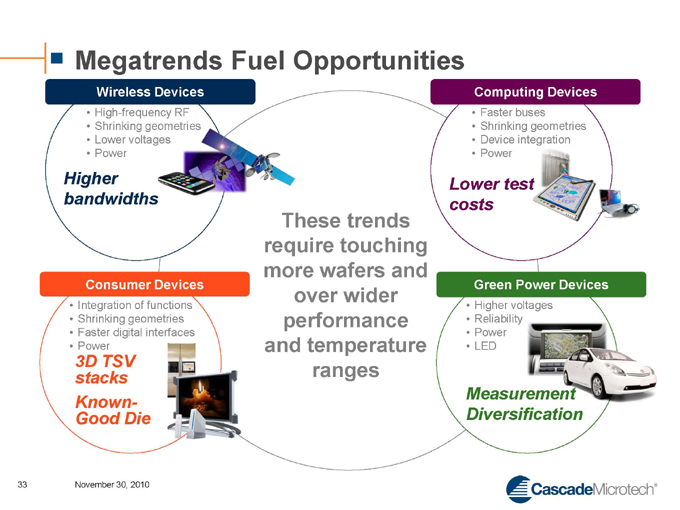

Megatrends Fuel Opportunities

Wireless Devices

High-frequency RF

Shrinking geometries

Lower voltages

Power

Higher

bandwidths

Consumer Devices

Integration of functions

Shrinking geometries

Faster digital interfaces

Power

3D TSV

stacks

Known-

Good Die

These trends require touching more wafers and over wider performance and temperature ranges

Computing Devices

Faster buses

Shrinking geometries

Device integration

Power

Lower test costs

Green Power Devices

Higher voltages

Reliability

Power

LED

Measurement Diversification

33 November 30, 2010

Megatrends Fuel Opportunities

Wireless Devices

High-frequency RF

Shrinking geometries

Lower voltages

Power

Higher bandwidths

34 November 30, 2010

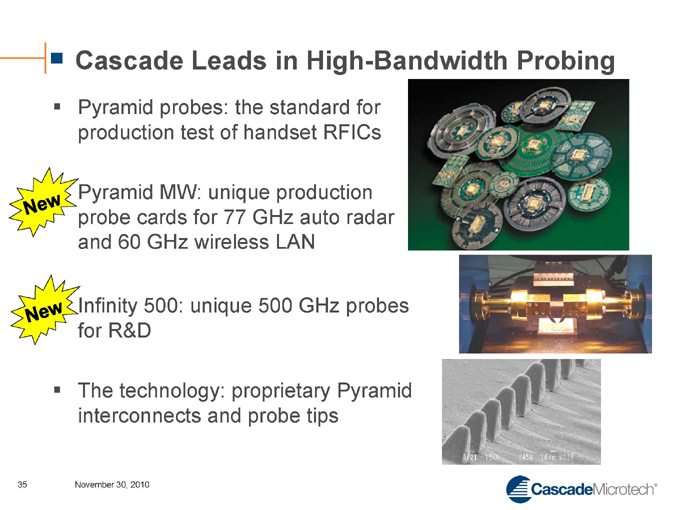

Cascade Leads in High-Bandwidth Probing

Pyramid probes: the standard for production test of handset RFICs

New Pyramid MW: unique production probe cards for 77 GHz auto radar and 60 GHz wireless LAN

New Infinity 500: unique 500 GHz probes for R&D

The technology: proprietary Pyramid interconnects and probe tips

35 November 30, 2010

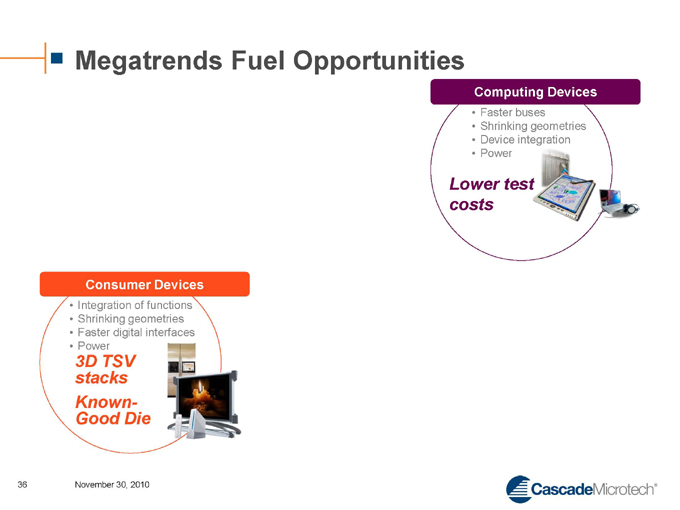

Megatrends Fuel Opportunities

Consumer Devices

Integration of functions

Shrinking geometries

Faster digital interfaces

Power

3D TSV

stacks

Known-

Good Die

Computing Devices

Faster buses

Shrinking geometries

Device integration

Power

Lower test

costs

36 November 30, 2010

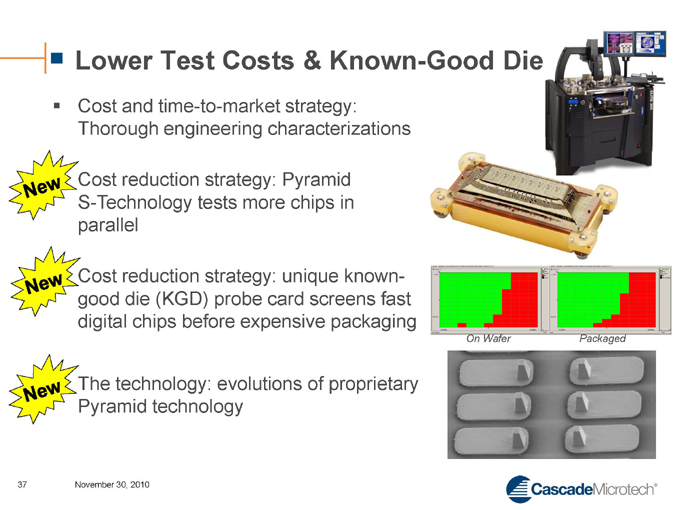

Lower Test Costs & Known-Good Die

Cost and time-to-market strategy: Thorough engineering characterizations

New Cost reduction strategy: Pyramid S-Technology tests more chips in parallel

New Cost reduction strategy: unique known-good die (KGD) probe card screens fast digital chips before expensive packaging

New The technology: evolutions of proprietary Pyramid technology

On Wafer

Packaged

37 November 30, 2010

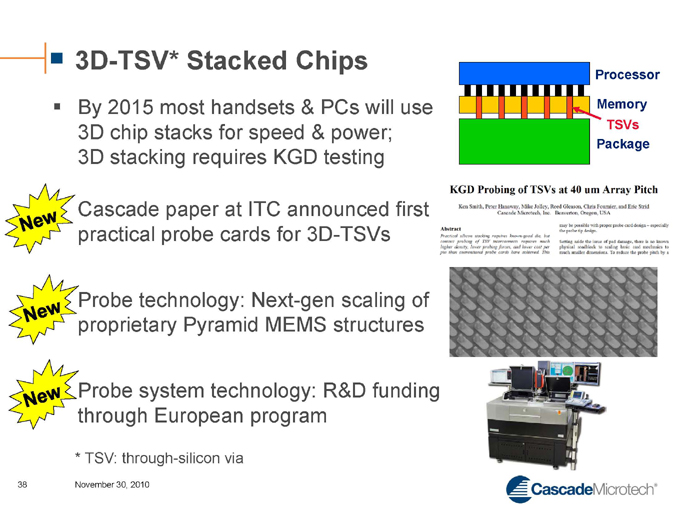

3D-TSV* Stacked Chips

By 2015 most handsets & PCs will use 3D chip stacks for speed & power; 3D stacking requires KGD testing

New

Cascade paper at ITC announced first practical probe cards for 3D-TSVs

New

Probe technology: Next-gen scaling of proprietary Pyramid MEMS structures

New

Probe system technology: R&D funding through European program

* |

| TSV: through-silicon via |

Processor Memory TSVs Package

KGD Probing of TSVs at 40 um Array Pitch

Ken Smith, Peter Hanaway, Mike Jolley, Reed Gleason, Chris Fournier, and Eric Strid Cascade Microtech, Inc. Beaverton, Oregon, USA

Abstract

Practical silicon stacking requires known-good die, but contact probing of TSV interconnects requires much higher density, lower probing forces, and lower cost per pin than conventional probe cards have achieved. This may be possible with proper probe card design – especially the probe tip design.

Setting aside the issue of pad damage, there is no known physical roadblock to scaling basic card mechanics to much smaller dimensions. To reduce the probe pitch by a

38 November 30, 2010

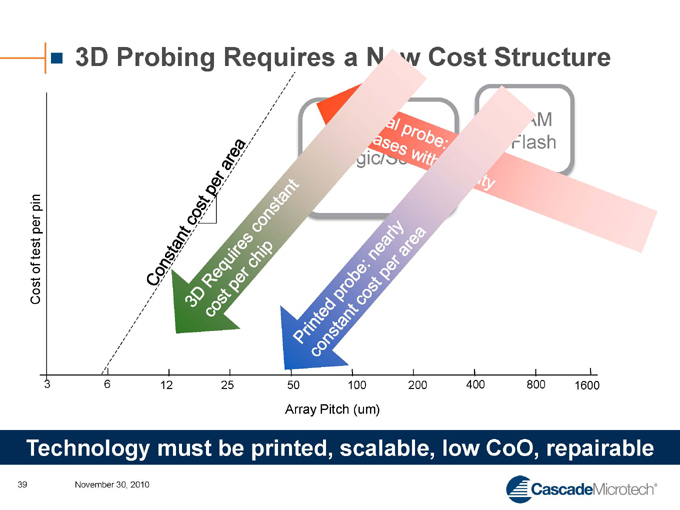

3D Probing Requires a New Cost Structure

Cost of test per pin

Logic/SoC

DRAM

& Flash

Constant cost per area

3D Requires constant cost per chip

Printed probe: nearly constant cost per area

3 |

|

6 |

|

12

25

50

100

200

400

800

1600

Array Pitch (um)

Technology must be printed, scalable, low CoO, repairable

39 November 30, 2010

Megatrends Fuel Opportunities

Green Power Devices

Higher voltages

Reliability

Power

LED

Measurement Diversification

40 November 30, 2010

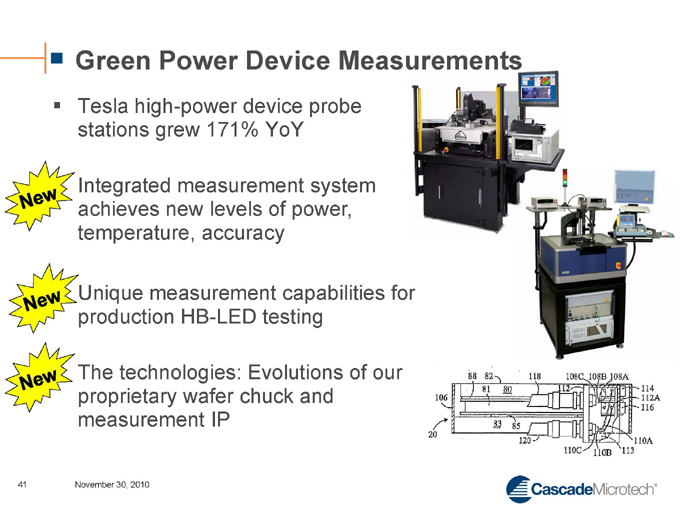

Green Power Device Measurements

Tesla high-power device probe stations grew 171% YoY

NEW

Integrated measurement system achieves new levels of power, temperature, accuracy

Unique measurement capabilities for production HB-LED testing

The technologies: Evolutions of our proprietary wafer chuck and measurement IP

41 November 30, 2010

Summary

Must continue to reduce cost per test while enabling much faster chips and better power efficiencies

Our probe stations business unit is the market and technology leader

Cascade has developed a wealth of new probe technologies poised to enable testing of known-good dies and 3D ICs

We’re very excited about these products!

42 November 30, 2010

Market Update

Mike Kondrat

Vice President Marketing

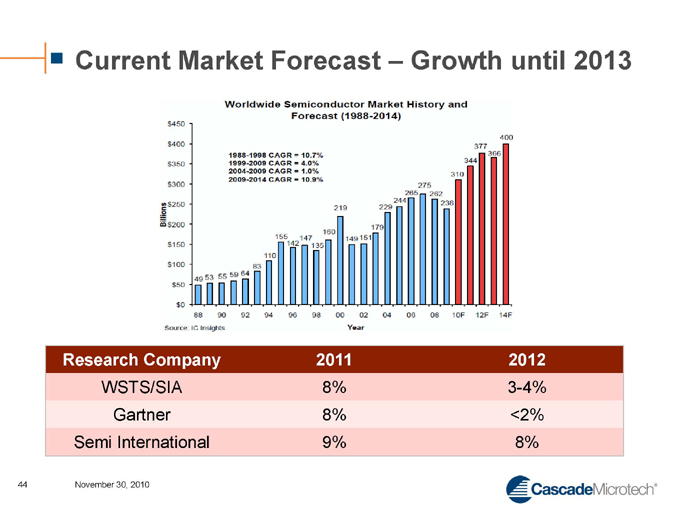

Current Market Forecast – Growth until 2013

Research Company 2011 2012

WSTS/SIA 8% 3-4%

Gartner 8% <2%

Semi International 9% 8%

44 November 30, 2010

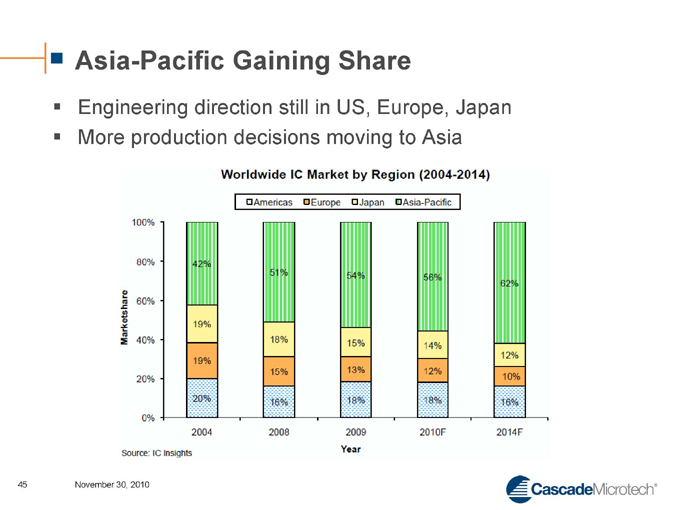

Asia-Pacific Gaining Share

Engineering direction still in US, Europe, Japan

More production decisions moving to Asia

45 November 30, 2010

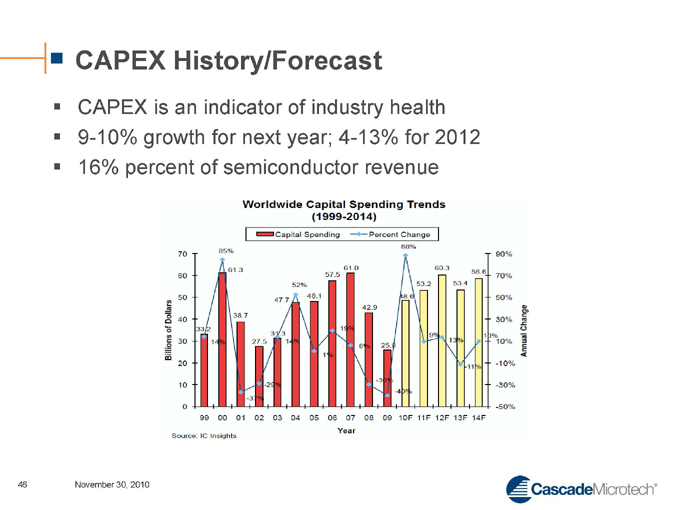

CAPEX History/Forecast

CAPEX is an indicator of industry health 9-10% growth for next year; 4-13% for 2012 16% percent of semiconductor revenue

46 November 30, 2010

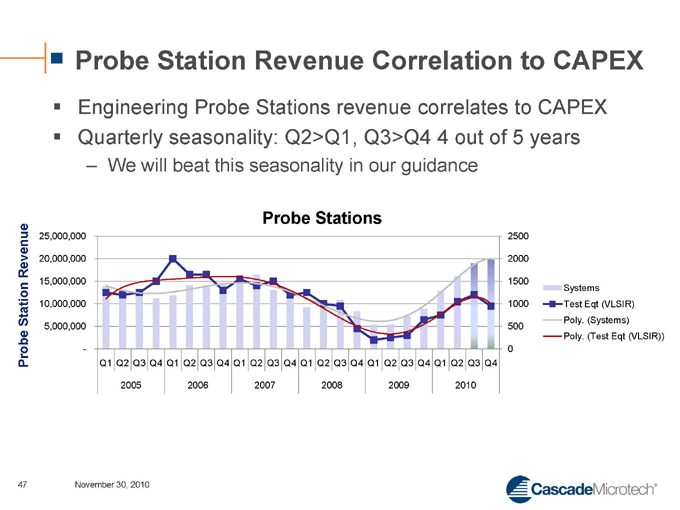

Probe Station Revenue Correlation to CAPEX

Engineering Probe Stations revenue correlates to CAPEX Quarterly seasonality: Q2>Q1, Q3>Q4 4 out of 5 years

– We will beat this seasonality in our guidance

Probe Stations

Probe Station Revenue

25,000,000

20,000,000

15,000,000

10,000,000

5,000,000

2500

2000

1500

1000

500

0

Systems

Test Eqt (VLSIR)

Poly. (Systems)

Poly. (Test Eqt (VLSIR))

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2005

2006

2007

2008

2009

2010

47 November 30, 2010

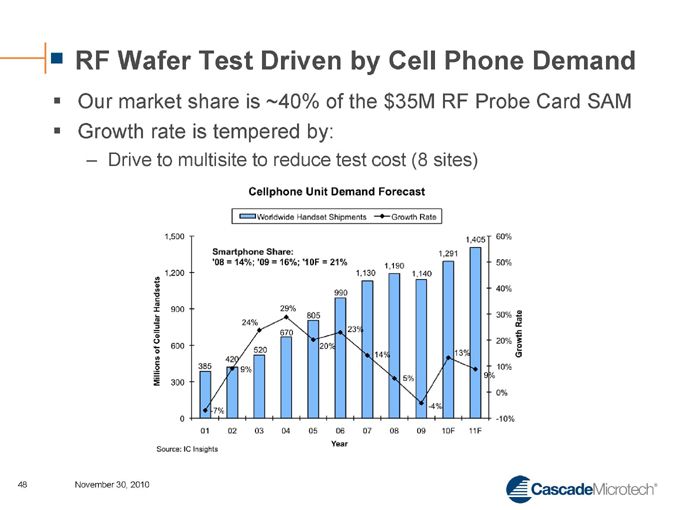

RF Wafer Test Driven by Cell Phone Demand

Our market share is ~40% of the $35M RF Probe Card SAM Growth rate is tempered by:

– Drive to multisite to reduce test cost (8 sites)

48 November 30, 2010

Megatrends Fuel Opportunities for Cascade

Wireless Devices

High-frequency RF

Shrinking geometries

Lower voltages

Power

Higher

bandwidths

Consumer Devices

Integration of functions

Shrinking geometries

Faster digital interfaces

Power

3D TSV

stacks

Known-

Good Die

These trends require touching more wafers and over wider performance and temperature ranges

Computing Devices

Faster buses

Shrinking geometries

Device integration

Power

Lower test costs

Green Power Devices

Higher voltages

Reliability

Power

LED

Measurement Diversification

49 November 30, 2010

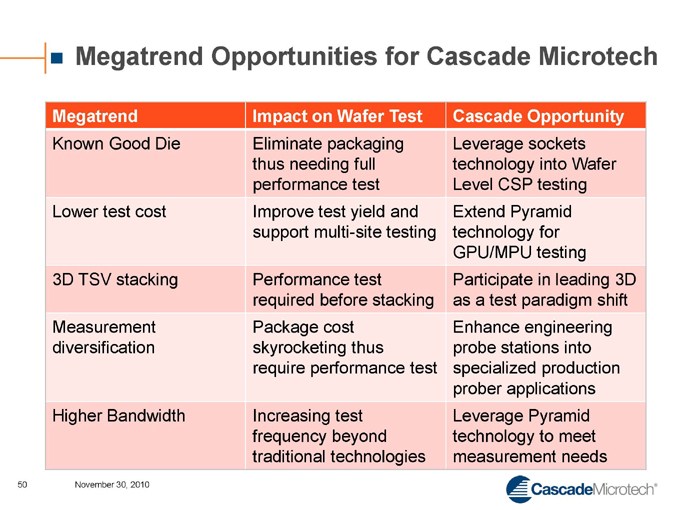

Megatrend Opportunities for Cascade Microtech

Megatrend Impact on Wafer Test Cascade Opportunity

Known Good Die Eliminate packaging thus needing full performance test Leverage sockets technology into Wafer Level CSP testing

Lower test cost Improve test yield and support multi-site testing Extend Pyramid technology for GPU/MPU testing

3D TSV stacking Performance test required before stacking Participate in leading 3D as a test paradigm shift

Measurement diversification Package cost skyrocketing thus require performance test Enhance engineering probe stations into specialized production prober applications

Higher Bandwidth Increasing test frequency beyond traditional technologies Leverage Pyramid technology to meet measurement needs

50 November 30, 2010

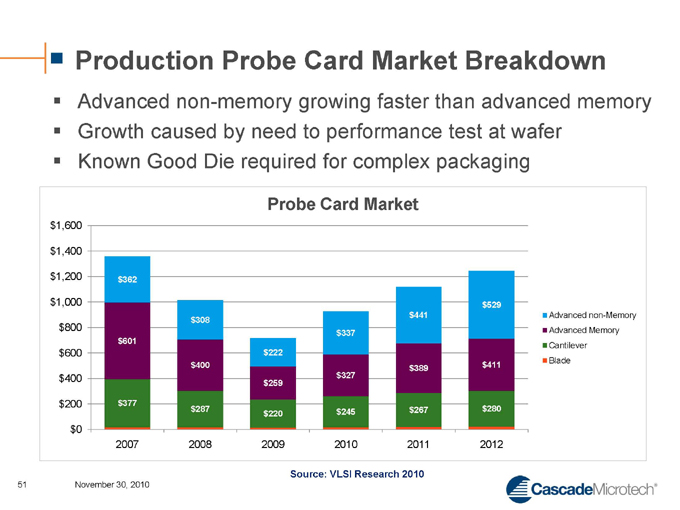

Production Probe Card Market Breakdown

Advanced non-memory growing faster than advanced memory Growth caused by need to performance test at wafer Known Good Die required for complex packaging

Probe Card Market

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

$362

$601

$377

$308

$400

$287

$222

$259

$220

$337

$327

$245

$441

$389

$267

$529 $411 $280

Advanced non-Memory Advanced Memory Cantilever Blade

2007

2008

2009

2010

2011

2012

Source: VLSI Research 2010

51 November 30, 2010

Market Forecast Summary – 2011

Market will have good growth after fantastic growth Base probe station business will grow with CAPEX

– HBLED production will be stronger

Advanced non-memory production probe market is growing

– Market is ready for new Cascade Microtech products

52 November 30, 2010

Sales and Customer Support

Paul O’Mara

Vice President Sales and Support

Near Term Market Trends

300mm market strong in major semiconductor customers Applications a strong driver

– HBLEDs, Power

– Specialty probe stations (vacuum, cryogenic, board test) 150/200mm market strong in institutions/education Smart handset and PCs leading the way for production customers

54 November 30, 2010

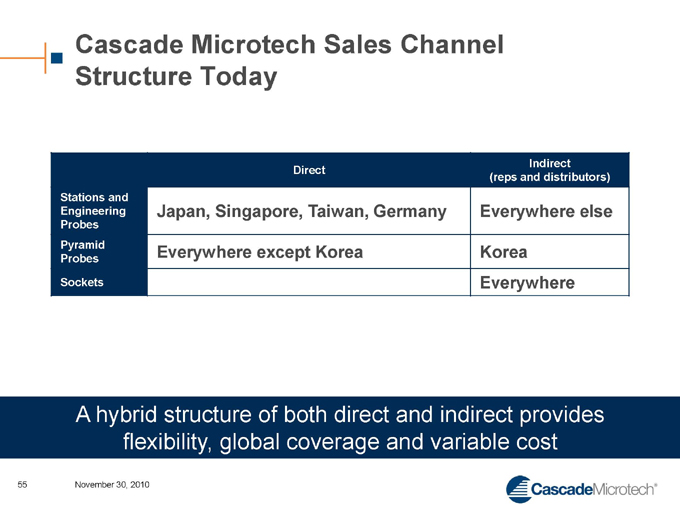

Cascade Microtech Sales Channel Structure Today

Direct Indirect (reps and distributors)

Stations and Engineering Probes Japan, Singapore, Taiwan, Germany Everywhere else

Pyramid Probes Everywhere except Korea Korea

Sockets Everywhere

A hybrid structure of both direct and indirect provides flexibility, global coverage and variable cost

55 November 30, 2010

Channel Initiatives

Cascade direct channel

– Selling Engineering Probes and ultimately accessories and small systems directly

– One world price Major account focus

– Taking top 20 global accounts direct

Top 20 customers represent 41% of revenue for 9 months ending September 2010

– Advantages

Allows Cascade to get closer to key accounts

Closer to key customer roadmaps

Expect deeper account penetration

56 November 30, 2010

Driving Revenue Growth

Close co-operation with the business units Engineering probes direct channel Tesla-Power Probe Station

– Power is a growth market

– Targeting accounts with power measurement needs

BlueRay Probe Station

– Targeting additional HBLED customers in high growth market

S-Technology Probe Card

– Successor to VLSI core technology

– Well received and now beginning to ramp

57 November 30, 2010

Superior technology and extraordinary support where and when you need it

35% of employees are field-based to better ensure customer success Strategically placed service centers across the world accelerate response time Unrivaled application expertise in precision electrical test and measurement

58 November 30, 2010

Summary

Our markets are showing strength

Transitioning channel to gain greater direct access to our key customers, reduce selling costs, enhance competitive position and align with strategic initiatives Ready to take new product offerings to market Continue to invest in world class customer support

59 November 30, 2010

Business Units & R&D

Steve Harris

Executive Vice President

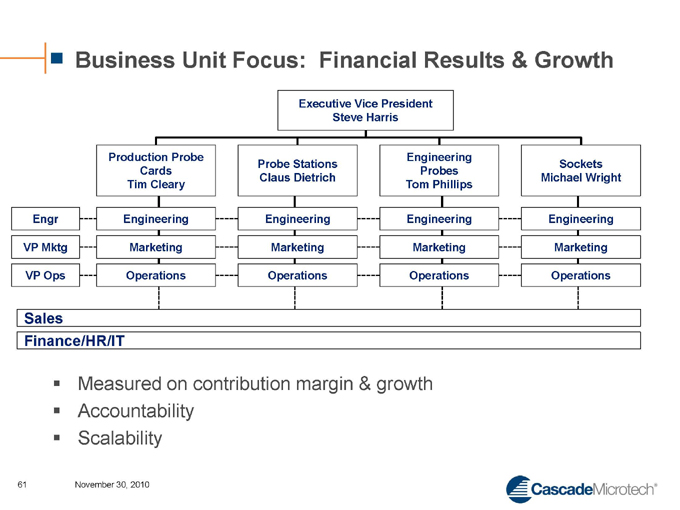

Business Unit Focus: Financial Results & Growth

Executive Vice President

Steve Harris

Production Probe Cards Tim Cleary Probe Stations Claus Dietrich Engineering Probes Tom Phillips Sockets Michael Wright

Engr Engineering Engineering Engineering Engineering

VP Mktg Marketing Marketing Marketing Marketing

VP Ops Operations Operations Operations Operations

Sales Finance/HR/IT

Measured on contribution margin & growth ??Accountability?? Scalability

61 November 30, 2010

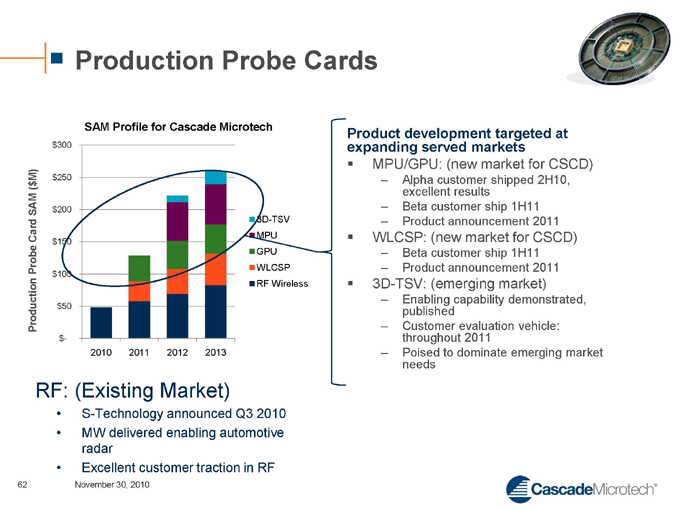

Production Probe Cards

Production Probe Card SAM ($M)

$300

$250

$200

$150

$100

$50

$-

2010

2011

2012

2013

3D-TSV

MPU

GPU

WLCSP

RF Wireless

Product development targeted at expanding served markets

MPU/GPU: (new market for CSCD)

– Alpha customer shipped 2H10, excellent results

– Beta customer ship 1H11

– Product announcement 2011

WLCSP: (new market for CSCD)

– Beta customer ship 1H11

– Product announcement 2011

3D-TSV: (emerging market)

– Enabling capability demonstrated, published

– Customer evaluation vehicle: throughout 2011

– Poised to dominate emerging market needs

RF: (Existing Market)

S-Technology announced Q3 2010

MW delivered enabling automotive radar

Excellent customer traction in RF

62 November 30, 2010

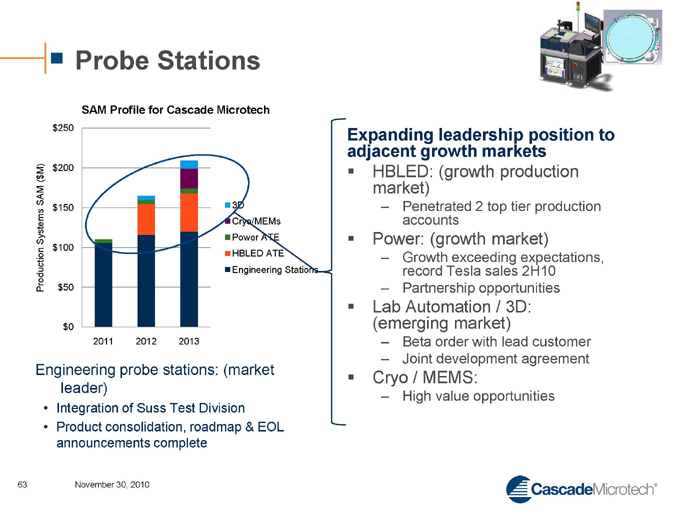

Probe Stations

SAM Profile for Cascade Microtech

Production Systems SAM ($M)

$250

$200

$150

$100

$50

$0

2011

2012

2013

3D Cryo/MEMs Power ATE HBLED ATE Engineering Stations

Expanding leadership position to adjacent growth markets

HBLED: (growth production market)

– Penetrated 2 top tier production accounts

Power: (growth market)

– Growth exceeding expectations, record Tesla sales 2H10

– Partnership opportunities

Lab Automation / 3D: (emerging market)

– Beta order with lead customer

– Joint development agreement

Cryo / MEMS:

– High value opportunities

Engineering probe stations: (market leader)

Integration of Suss Test Division

Product consolidation, roadmap & EOL announcements complete

63 November 30, 2010

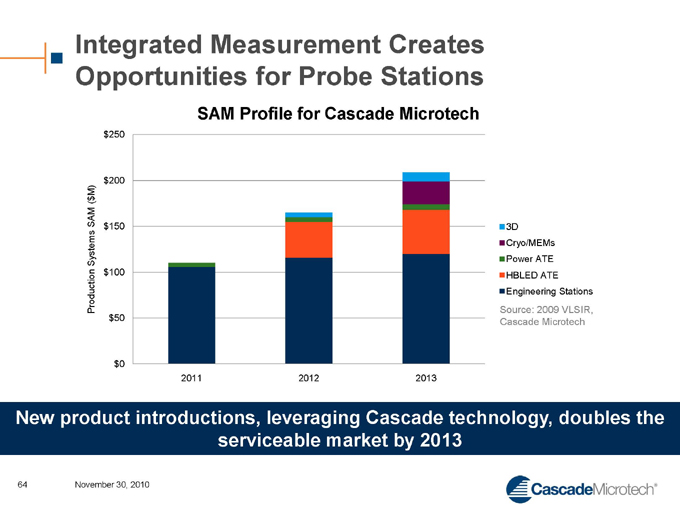

Integrated Measurement Creates Opportunities for Probe Stations

SAM Profile for Cascade Microtech

Production Systems SAM ($M)

$250

$200

$150

$100

$50

$0

2011

2012

2013

3D Cryo/MEMs Power ATE HBLED ATE Engineering Stations Source: 2009 VLSIR, Cascade Microtech

New product introductions, leveraging Cascade technology, doubles the serviceable market by 2013

64 November 30, 2010

Engineering Probes

50% Market Share

One competitor

80% of Probe Stations – probes should match or exceed that share??Opportunity to grow market share??Delivering good contribution margin

Re-invigorating business!

Customer focus to capture market share??Repair program:

– Announced 2H10

– Enthusiastic response by customers

Direct sales model / worldwide pricing:

– Closer access to customer

– Better pricing to customer

– Specials team

New product development:

– Production capable & best cost of ownership for volume customers

– Unity MW

65 November 30, 2010

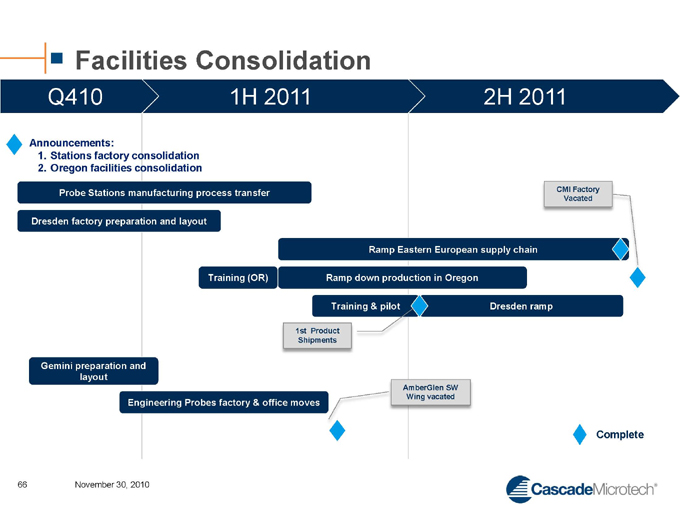

Facilities Consolidation

Q410

1H 2011

2H 2011

Announcements:

1. Stations factory consolidation

2. Oregon facilities consolidation

Probe Stations manufacturing process transfer

Dresden factory preparation and layout

Gemini preparation and layout

Engineering Probes factory & office moves

Training (OR)

Ramp Eastern European supply chain Ramp down production in Oregon Training & pilot Dresden ramp

CMI Factory Vacated

1st Product Shipments

AmberGlen SW Wing vacated

Complete

66 November 30, 2010

Summary

Success model driven by each business unit Metric driven culture

– Contribution margin

– Return on R&D

– Growth

Cost structure improvements

– Factory consolidations

– Supply chain leverage

– COGS and margin improvements

Business Units provide scalability, accountability

67 November 30, 2010

Cascade Microtech Highlights

Strong management team

– Focused on execution

Strong Who’s Who global customers

– Strong relationships mean strong partnerships Focused on delivering sustained profitability via new business model

– Encouraging results; improving balance sheet Investing in growth opportunities

– Strong differentiated leadership position Leveraging technology into high growth areas

68 November 30, 2010

Thank you

Investor Relations Day