Exhibit 17(d)

120 BROADWAY, NEW YORK, NY 10271

212-425-6116

OUTSIDE NYC TOLL FREE 1-800-594-7078

www.lebenthal.com

Dear Shareholders:

During this past year the municipal bond market, even with a volatile political and economic environment, has performed relatively well. Since our last annual report, the Federal Reserve Board (the "Fed") has been steadily raising short-term interest rates by 0.25% each time they have met. Over this period short-term rates have risen from 2% to 4%. The Fed's stated intention has been to put the brakes on an expected spike in inflation and remove monetary accommodation. Given the economic shocks of record-high oil prices, hurricane disasters, budget deficits and the war, this was a reasonable expectation.

Meanwhile, the threat of inflationary pressures – always bad news for bonds – never substantially changed into actual inflation. Inflation has risen only slightly over this period, to 3.3% from less than 3% a year ago. Although short-term rates rose from 2% to 4%, the yield on ten-year bonds rose modestly, and the yield on 30-year bonds actually dropped over the course of the fiscal year, leading to a flattening yield curve. Currently financial analysts are trying to gauge what is the significance of this curve. It could be a harbinger of a recession, given the high price of oil and our economic dependence upon it. When the curve last looked like this, at the start of 2001, the economy was poised for a recession. Perhaps it is the result of purchases by foreign central banks holding large dollar reserves as a result of the trade deficit. In addition, this may be the result of a supply and demand anomaly: the 30-year bond hasn't bee n issued since 2001 but demand has remained strong for a limited supply of longer maturity Treasuries as pension funds continue to address future funding concerns. With more typical supply of Treasuries along the maturity curve, the yield curve may have a more normal slope to it. It is interesting to note that the Treasury is expected to start issuing the 30-year bond again in February of 2006. If the economy does not slow down, then it is reasonable to expect that the outlook for longer maturity bonds would be for them to go down in price and up in yield. Gold has historically been a barometer of inflation, and has dramatically increased in price over the last few months. Together we believe that these issues imply that if a recession is not in the works, long-term rates have to go up. In our view, there is simply too great a divergence between a flat yield curve and these inflation-causing factors.

We believe that the credit quality of municipal bonds became stronger over the course of the year and remains so today. The increases in economic activity, higher housing prices, and lower unemployment numbers have added tax receipts to municipal treasuries. In New York, the improvement in the credit quality of both the State and the City is reflected by the increase in each of their debt ratings. While the State's rating was upgraded just after the end of our fiscal year, this upgrade was a result of the trends that were occurring during the year, including a budget that was passed on time. In New Jersey, the story is a little more difficult, as there are more problems that face the new Governor. Years of unaddressed financial stress coupled with his election platform to ameliorate the imbalances in property taxes will require more financial leadership in Trenton.

On the supply side, there was $375 billion in new bonds issued by state and local governments for the first eleven months of 2005. That puts the market at approximately $8 billion in supply less than the record set for the entire calendar 2003. A large percentage of this was refunding of older bonds with higher interest rates, as issuers took advantage of the general low level of rates to reduce the interest cost paid by municipalities on

their indebtedness. Given the overall improvement in the underlying credit quality of state and local treasuries, a large portion of these new securities are being issued with bond insurance.

Demand remains strong as households continue to find tax-free debt to be an important portion of their investment portfolios. Investors seem to have learned one key lesson over the last few years. Portfolios should be diversified, with fixed income investments providing some stability during times of turbulence in the equity markets.

Subsequent Events

Effective December, 2, 2005, the Board of Directors of Lebenthal Funds, Inc. has appointed Fund Asset Management, L.P. ("Fund Asset Management"), a subsidiary of Merrill Lynch & Co. ("Merrill Lynch"), to act as investment adviser to the Funds and FAM Distributors, Inc., another subsidiary of Merrill Lynch, to act as the Funds' principal underwriter. Such appointments were effective upon the closing of the sale of The Advest Group, Inc. ("Advest") to Merrill Lynch by AXA Financial, Inc. ("AXA"). Boston Advisors, Inc., through its Lebenthal Asset Management division, has served as the investment adviser to the Funds and is a subsidiary of Advest. Fund Asset Management is acting as investment adviser to each Fund pursuant to an interim management contract, which is substantially identical to the Fund's prior management contract with Boston Advisors. Such interim management contracts will remain in effect until the earlier of (i) shareholder approval of a new management contract, (ii) the closing of the proposed reorganizations discussed below or (iii) 150 days from December 2, 2005. This arrangement is intended to be temporary until shareholders are presented with and act upon proposals to combine two of the Funds, Lebenthal New York Municipal Bond Fund and Lebenthal New Jersey Municipal Bond Fund, with other mutual funds with similar investment objectives that are managed by Fund Asset Management or one of its affiliates. The Board of Directors has authorized the liquidation of Lebenthal Taxable Municipal Bond Fund.

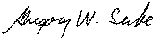

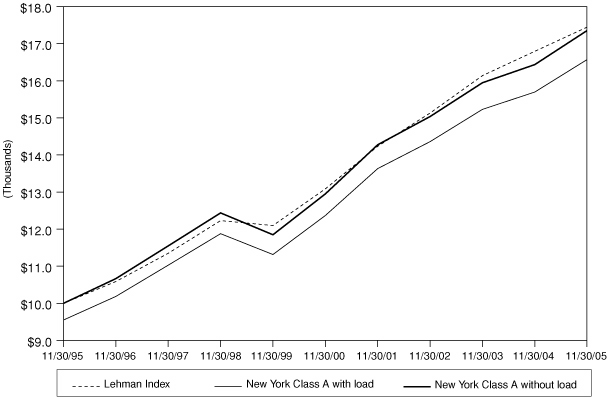

LEBENTHAL NEW YORK MUNICIPAL BOND FUND - CLASS A

PERFORMANCE COMPARISON CHART

The following chart compares the average annual total return of Lebenthal New York Municipal Bond Fund - Class A (with and without the 4.5% sales load) for the one year, five year and ten year periods against the Lehman Brothers Municipal Bond Index (the "Lehman Index") for the same time periods. It is important to keep in mind that the Lehman Index excludes the effects of any fees or sales charges, and does not reflect state-specific bond market performance.

Lebenthal New York Municipal Bond Fund - Class A

Performance Comparison Chart

| | One

Year | | Five

Year | | Ten

Year | |

| New York - Class A | |

| with sales load | | | 0.84 | % | | | 5.06 | % | | | 5.18 | % | |

| w/o sales load | | | 5.59 | % | | | 6.03 | % | | | 5.67 | % | |

| Lehman Index | | | 3.88 | % | | | 5.92 | % | | | 5.72 | % | |

Past performance is not predictive of future performance. The performance information and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

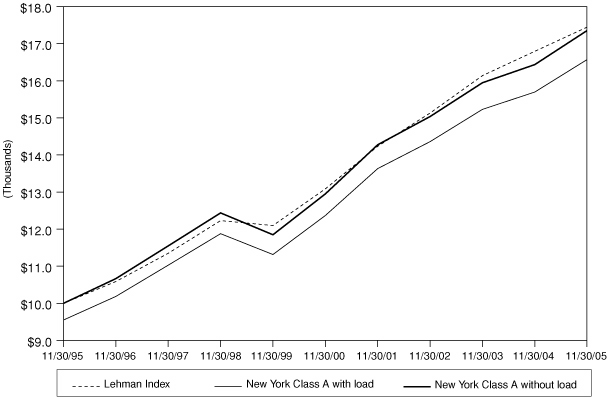

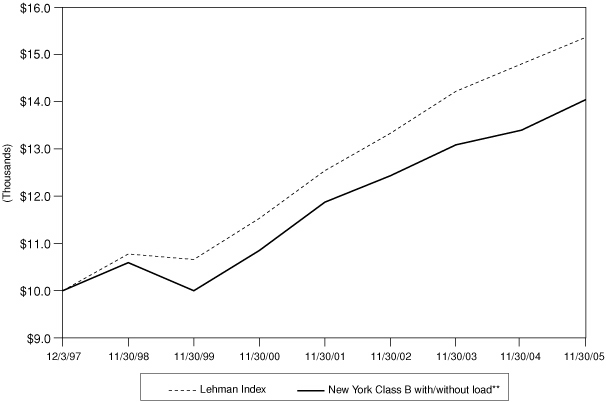

LEBENTHAL NEW YORK MUNICIPAL BOND FUND - CLASS B

PERFORMANCE COMPARISON CHART

The following chart compares the average annual total return of Lebenthal New York Municipal Bond Fund - Class B (with and without the 5% back-end contingent deferred sales load) for the one year, five year and since inception periods against the Lehman Brothers Municipal Bond Index (the "Lehman Index") for the same time periods. It is important to keep in mind that the Lehman Index excludes the effects of any fees or sales charges, and does not reflect state-specific bond market performance.

Lebenthal New York Municipal Bond Fund - Class B

Performance Comparison Chart

| | | One

Year | | Five

Year | | Average Annual Total Return

Since Commencement of

Operations December 3, 1997 | |

| New York - Class B | |

| with sales load | | | 0.89 | % | | | 5.14 | % | | | 4.35 | % | |

| w/o sales load | | | 4.89 | % | | | 5.31 | % | | | 4.35 | % | |

| Lehman Index | | | 3.88 | % | | | 5.92 | % | | | 5.53 | %* | |

Past performance is not predictive of future performance. The performance information and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

* Commences on December 1, 1997.

** Assumes Class B shares have been held for the entire period.

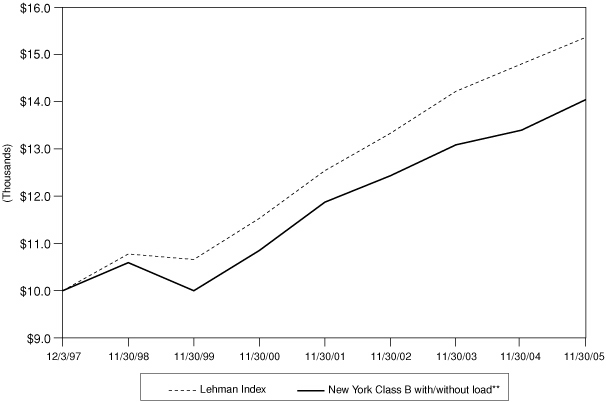

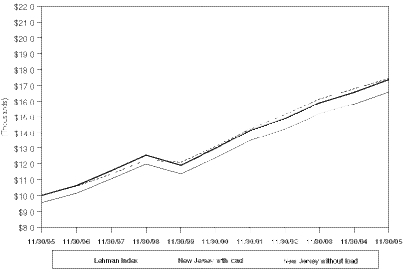

LEBENTHAL NEW JERSEY MUNICIPAL BOND FUND

PERFORMANCE COMPARISON CHART

The following chart compares the average annual total return of Lebenthal New Jersey Municipal Bond Fund (with and without the 4.5% sales load) for the one year, five year and ten year periods against the Lehman Brothers Municipal Bond Index (the "Lehman Index") for the same time periods. It is important to keep in mind that the Lehman Index excludes the effects of any fees or sales charges, and does not reflect state-specific bond market performance.

Lebenthal New Jersey Municipal Bond Fund

Performance Comparison Chart

| | | One

Year | | Five

Year | | Ten

Year | |

| New Jersey | |

| with sales load | | | 0.17 | % | | | 5.06 | % | | | 5.20 | % | |

| w/o sales load | | | 4.89 | % | | | 6.03 | % | | | 5.68 | % | |

| Lehman Index | | | 3.88 | % | | | 5.92 | % | | | 5.72 | % | |

Past performance is not predictive of future performance. The performance information and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

LEBENTHAL TAXABLE MUNICIPAL BOND FUND

PERFORMANCE COMPARISON CHART

The following chart compares the average annual total return of Lebenthal Taxable Municipal Bond Fund (with and without the 4.5% sales load) for the one year, five year and ten year periods against the Lehman Brothers Long U.S. Credit Index (the "Lehman Index") (formerly known as the Lehman Brothers Long Corporate Bond Index) for the same time periods. It is important to keep in mind that the Lehman Index excludes the effects of any fees or sales charges.

Lebenthal Taxable Municipal Bond Fund

Performance Comparison Chart

| | | One

Year | | Five

Year | | Ten

Year | |

| Taxable Fund | |

| with sales load | | | (0.82 | )% | | | 6.68 | % | | | 6.77 | % | |

| w/o sales load | | | 3.85 | % | | | 7.67 | % | | | 7.26 | % | |

| Lehman Index | | | 4.45 | % | | | 9.45 | % | | | 7.45 | % | |

Past performance is not predictive of future performance. The performance information and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

LEBENTHAL FUNDS, INC.

UNDERSTANDING YOUR FUND'S EXPENSES

Shareholder Expense Example

As a mutual fund shareholder you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees and (2) ongoing costs, including management fees, distribution (12b-1) fees, shareholder servicing fees and other Fund expenses. These costs are described in more detail in the Fund's prospectus. The examples below are intended to help you understand your ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

Actual Expenses

The first line in the table for each Class of shares shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from June 1, 2005 through November 30, 2005. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual Fund returns and expenses. To estimate the expenses you paid over the period, simply divide your account by $1,000 (for example $8,600 account value divided by $1,000 = $8.6) and multiply th e result by the number in the Expenses Paid During Period column as shown below for your Fund and Class.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

LEBENTHAL FUNDS, INC.

UNDERSTANDING YOUR FUND'S EXPENSES (CONTINUED)

Lebenthal New York Municipal Bond Fund

| Class A | | Beginning

Account Value

6/1/05 | | Ending

Account Value

11/30/05 | | Expenses Paid

During Period*

6/1/05-11/30/05 | |

| Actual | | $ | 1,000.00 | | | $ | 1,009.20 | | | $ | 4.63 | | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.46 | | | $ | 4.66 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,004.90 | | | $ | 7.79 | | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.30 | | | $ | 7.84 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.92% and 1.55% for the Class A and Class B shares respectively, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

Lebenthal New Jersey Municipal Bond Fund

| Single Class | | Beginning

Account Value

6/1/05 | | Ending

Account Value

11/30/05 | | Expenses Paid

During Period*

6/1/05-11/30/05 | |

| Actual | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 4.76 | | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.31 | | | $ | 4.81 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.95% multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

Lebenthal Taxable Municipal Bond Fund

| Single Class | | Beginning

Account Value

6/1/05 | | Ending

Account Value

11/30/05 | | Expenses Paid

During Period*

6/1/05-11/30/05 | |

| Actual | | $ | 1,000.00 | | | $ | 983.20 | | | $ | 4.97 | | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.05 | | | $ | 5.06 | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.00% multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

LEBENTHAL NEW YORK MUNICIPAL BOND FUND

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2005

| | | | | | | Ratings (Unaudited) | |

Face

Amount | |

| | Value

(Note 1) | | Moody's | | Standard

& Poor's | |

| MUNICIPAL BONDS (97.58%) | | | |

| $ | 3,000,000 | | | Battery Park City Authority–New York Revenue, Refunding–Series A, 5.00%,

due 11/01/24 | | $ | 3,142,650 | | | Aaa | | AAA | |

| | 1,000,000 | | | Chautauqua, New York Tobacco Asset Securitization Corporation, 6.75%,

due 07/01/40 | | | 1,070,370 | | | NR | | NR | |

| | 880,000 | | | East Williston, New York Union Free School District–Series A, 5.00%,

due 06/15/18 | | | 942,066 | | | Aa2 | | NR | |

| | 4,000,000 | | | Erie County, New York Tobacco Asset Securitization Corporation–Series A,

6.25%, Prerefunded to 07/15/10, due 07/15/40 | | | 4,475,280 | | | Ba1 | | AAA | |

| | 3,250,000 | | | Essex County, New York Industrial Development Agency Civic Facility

(Moses Ludington Nursing Home), (FHA Insured), 6.375%, due 02/01/50 | | | 3,553,192 | | | | | AAA | |

| | 1,000,000 | | | Liberty New York Development Corporation Revenue, 5.25%, due 10/01/35 | | | 1,099,670 | | | Aa3 | | A+ | |

| | 100,000 | | | Long Island Power Authority–New York Electric System–Series 2B,

(LOC-Bayerische Landesbank), 2.97%, due 12/01/05, (a) | | | 100,000 | | | VMIG1 | | A-1+ | |

| | 500,000 | | | Long Island Power Authority–New York Electrical Systems Revenue,

(LOC-WestLB AG), 2.94%, due 12/01/05, (a) | | | 500,000 | | | VMIG1 | | A-1+ | |

| | 5,000,000 | | | Long Island Power Authority–New York Electrical Systems Revenue–Series A

(FSA Insured), 5.00%, due 09/01/27 | | | 5,140,450 | | | Aaa | | AAA | |

| | 1,715,000 | | | Madison County, New York Industrial Development Agency, Colgate

University–Series A, (MBIA Insured), 5.00%, due 07/01/39 | | | 1,763,500 | | | Aaa | | AAA | |

| | 5,000,000 | | | Metropolitan Transportation Authority New York–Series A (FGIC Insured),

5.00%, due 11/15/25 | | | 5,219,250 | | | Aaa | | AAA | |

| | 550,000 | | | Metropolitan Transportation Authority New York–Series A, (FGIC Insured),

5.00%, Prerefunded to 11/15/11, due 11/15/31 | | | 590,953 | | | Aaa | | AAA | |

| | 1,000,000 | | | Monroe County, New York Industrial Development Agency (Southview Towers

Project), (SONYMA–HUD Insured), Subject to AMT, 6.25%, due 02/01/31 | | | 1,082,010 | | | Aa1 | | NR | |

| | 5,000,000 | | | Monroe County, New York Tobacco Asset Securitization Corporation, 6.375%,

Prerefunded to 06/01/10, due 06/01/35 | | | 5,620,600 | | | Aaa | | BBB | |

| | 575,000 | | | Nassau County, New York Interim Finance Authority–Series A2, (AMBAC Insured),

5.125%, due 11/15/21 | | | 590,628 | | | Aaa | | AAA | |

| | 2,600,000 | | | Nassau County, New York Interim Finance Authority–Series B, (AMBAC Insured),

5.00%, due 11/15/18 | | | 2,768,376 | | | Aaa | | AAA | |

| | 1,000,000 | | | New York City Housing Development Corporation (Multifamily Housing)–Series E,

(SONYMA Insured), 6.25%, due 05/01/36 | | | 1,068,400 | | | Aa2 | | AA | |

| | 2,500,000 | | | New York City Industrial Development Agency (Saint Francis College), 5.00%,

due 10/01/34 | | | 2,526,525 | | | NR | | A– | |

| | 5,625,000 | | | New York City Municipal Water Finance–Series D, 5.00%, due 06/15/37 | | | 5,767,819 | | | Aa2 | | AA+ | |

| | 210,000 | | | New York City Municipal Water Finance–Series D, (AMBAC Insured), 5.00%,

due 06/15/39 | | | 216,031 | | | Aaa | | AAA | |

| | 2,600,000 | | | New York City Transitional Finance Authority, Future Tax Secured–Series B,

5.00%, due 08/01/23 | | | 2,703,896 | | | Aa1 | | AAA | |

| | 700,000 | | | New York City Transitional Finance Authority, Future Tax Secured–Series C,

5.00%, due 08/01/24 | | | 723,597 | | | Aa1 | | AAA | |

See Notes to Financial Statements.

LEBENTHAL NEW YORK MUNICIPAL BOND FUND

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2005

| | | | | | | Ratings (Unaudited) | |

Face

Amount | |

| | Value

(Note 1) | | Moody's | | Standard

& Poor's | |

| MUNICIPAL BONDS (Continued) | | | |

| $ | 1,350,000 | | | New York City Transitional Finance Authority, Future Tax Secured–Series C,

5.00%, due 02/01/33 | | $ | 1,384,492 | | | Aa1 | | AAA | |

| | 420,000 | | | New York City Transitional Finance Authority–Series B, 5.50%, due 02/01/17 | | | 455,549 | | | Aa1 | | AAA | |

| | 575,000 | | | New York City Transitional Finance Authority–Series C, 5.375%, Prerefunded to

02/01/11, due 02/01/18 | | | 629,700 | | | Aa1 | | AAA | |

| | 425,000 | | | New York City Transitional Finance Authority–Series C, 5.375%, due 02/01/18 | | | 457,368 | | | Aa1 | | AAA | |

| | 4,700,000 | | | New York City, New York, (FSA Insured), 2.97%, due 12/01/05, (a) | | | 4,700,000 | | | VMIG1 | | A-1+ | |

| | 1,965,000 | | | New York City, New York–Series D, (FSA–CR Insured), 5.125%, due 08/01/18 | | | 2,087,302 | | | Aaa | | AAA | |

| | 500,000 | | | New York City, New York–Series G, 5.25%, due 08/01/15 | | | 535,890 | | | A1 | | A+ | |

| | 1,550,000 | | | New York Counties Tobacco Trust I, 6.50%, Prerefunded to 06/01/10,

due 06/01/35 | | | 1,750,368 | | | Aaa | | BBB | |

| | 750,000 | | | New York Counties Tobacco Trust I, 6.50%, due 06/01/35 | | | 796,508 | | | Ba1 | | BBB | |

| | 1,010,000 | | | New York Counties Tobacco Trust I, 6.625%, Prerefunded to 06/01/10,

due 06/01/42 | | | 1,145,774 | | | Aaa | | BBB | |

| | 490,000 | | | New York Counties Tobacco Trust I, 6.625%, due 06/01/42 | | | 524,854 | | | Ba1 | | BBB | |

| | 1,680,000 | | | New York State Dormitory Authority (Columbia University)–Series B, 5.00%,

due 07/01/21 | | | 1,769,443 | | | Aaa | | AAA | |

| | 1,800,000 | | | New York State Dormitory Authority (Columbia University)–Series B, 5.00%,

due 07/01/23 | | | 1,882,782 | | | Aaa | | AAA | |

| | 3,000,000 | | | New York State Dormitory Authority (Cornell University)–Series B, 2.97%,

due 12/01/05, (a) | | | 3,000,000 | | | VMIG1 | | A-1+ | |

| | 2,000,000 | | | New York State Dormitory Authority (Court Facilities)–Series A, 5.375%,

Prerefunded to 05/15/13, due 05/15/23 | | | 2,211,760 | | | A2 | | A+ | |

| | 4,500,000 | | | New York State Dormitory Authority (Court Facilities)–Series A, 5.50%,

Prerefunded to 05/15/13, due 05/15/20 | | | 5,012,820 | | | A2 | | A+ | |

| | 1,660,000 | | | New York State Dormitory Authority (Fordham University), (FGIC Insured),

5.00%, due 07/01/22 | | | 1,736,393 | | | Aaa | | AAA | |

| | 5,940,000 | | | New York State Dormitory Authority (Highlands Living), (FHA Insured), 6.60%,

due 02/01/34 | | | 6,014,666 | | | NR | | AA | |

| | 1,815,000 | | | New York State Dormitory Authority (Manhattan College), (RADIAN Insured),

5.50%, due 07/01/17 | | | 1,971,217 | | | NR | | AA | |

| | 2,400,000 | | | New York State Dormitory Authority (Manhattan College), (RADIAN Insured),

5.50%, due 07/01/18 | | | 2,606,568 | | | NR | | AA | |

| | 2,285,000 | | | New York State Dormitory Authority (Master Board of Cooperative Education

Program), (FSA Insured), 5.00%, due 08/15/23 | | | 2,384,832 | | | Aaa | | AAA | |

| | 2,500,000 | | | New York State Dormitory Authority (New York State University)–Series A,

(FGIC Insured), 5.125%, Prerefunded to 05/15/12, due 05/15/31 | | | 2,728,700 | | | Aaa | | AAA | |

| | 1,205,000 | | | New York State Dormitory Authority (New York University)–Series 1,

(AMBAC Insured), 5.50%, due 07/01/19 | | | 1,369,904 | | | Aaa | | AAA | |

| | 1,000,000 | | | New York State Dormitory Authority (New York University)–Series 1,

(AMBAC Insured), 5.50%, due 07/01/22 | | | 1,145,080 | | | Aaa | | AAA | |

See Notes to Financial Statements.

LEBENTHAL NEW YORK MUNICIPAL BOND FUND

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2005

| | | | | | | Ratings (Unaudited) | |

Face

Amount | |

| | Value

(Note 1) | | Moody's | | Standard

& Poor's | |

| MUNICIPAL BONDS (Continued) | | | |

| $ | 1,000,000 | | | New York State Dormitory Authority (Nursing Home–Menorah Campus),

(FHA Insured), 6.10%, due 02/01/37 | | $ | 1,046,990 | | | NR | | AAA | |

| | 250,000 | | | New York State Dormitory Authority (Rochester University)–Series A, 5.25%,

due 07/01/23 | | | 265,968 | | | A1 | | A+ | |

| | 200,000 | | | New York State Dormitory Authority (Rochester University)–Series A, 5.25%,

due 07/01/24 | | | 212,554 | | | A1 | | A+ | |

| | 2,400,000 | | | New York State Dormitory Authority (W.K. Nursing Home), (FHA Insured),

6.125%, due 02/01/36 | | | 2,486,352 | | | NR | | AAA | |

| | 715,000 | | | New York State Dormitory Authority–Series B, (FHA Insured), 6.65%,

due 08/15/30 | | | 820,477 | | | Aa2 | | NR | |

| | 5,525,000 | | | New York State Energy Research & Development Authority–Pollution Control

Revenue, (AMBAC Insured), 5.15%, due 11/01/25 | | | 5,809,261 | | | Aaa | | AAA | |

| | 985,000 | | | New York State Environmental Facilities Corporation, Personal Income

Tax- Series A, (FGIC Insured), 5.00%, due 01/01/23 | | | 1,034,811 | | | Aaa | | AAA | |

| | 1,810,000 | | | New York State Housing Finance Agency (Housing Project Mortgage)–Series A,

(FSA Insured), 6.125%, due 11/01/20 | | | 1,861,350 | | | Aaa | | AAA | |

| | 500,000 | | | New York State Power Authority–Series A, 5.00%, due 11/15/19 | | | 527,290 | | | Aa2 | | AA– | |

| | 2,980,000 | | | New York State Thruway Authority (General Revenue)–Series E, 5.00%,

due 01/01/25 | | | 3,043,563 | | | Aa3 | | AA– | |

| | 950,000 | | | New York State Thruway Authority (Highway and Bridge), Second

Generation–Series B, (FSA Insured), 5.00%, Prerefunded to 04/01/13,

due 04/01/17 | | | 1,026,760 | | | Aaa | | AAA | |

| | 1,535,000 | | | New York State Thruway Authority (Highway and Bridge)–Series A, (FGIC Insured),

5.50%, Prerefunded to 04/01/11, due 04/01/17 | | | 1,691,202 | | | Aaa | | AAA | |

| | 2,190,000 | | | New York State Thruway Authority (Highway and Bridge)–Series C,

(AMBAC Insured), 5.00%, due 04/01/20 | | | 2,302,873 | | | Aaa | | AAA | |

| | 225,000 | | | New York State Urban Development Corporation, Personal Income

Tax Series C-1 (FGIC Insured), 5.50%, Prerefunded to 03/15/13, due 03/15/19 | | | 250,299 | | | Aaa | | AAA | |

| | 1,000,000 | | | New York State Urban Development Corporation, Subordinated Lien Corporation

Purpose–Series A, 5.125%, due 07/01/20 | | | 1,054,260 | | | A2 | | A | |

| | 1,520,000 | | | New York State Urban Development Corporation, Subordinated Lien Corporation

Purpose–Series A, 5.125%, due 07/01/21 | | | 1,600,256 | | | A2 | | A | |

| | 3,800,000 | | | New York State Urban Development Corporation (Correctional Facilities),

(FSA Insured), 5.25%, Prerefunded to 01/01/11, due 01/01/30 | | | 4,099,896 | | | Aaa | | AAA | |

| | 1,000,000 | | | Niagara County, Tobacco Asset Securitization Corporation, 6.25%, due 05/15/40 | | | 1,051,670 | | | Ba1 | | | |

| | 1,000,000 | | | Port Authority New York & New Jersey, Consolidated–132nd Series, 5.00%,

due 09/01/25 | | | 1,039,850 | | | A1 | | AA– | |

| | 335,000 | | | Red Hook, New York Central School District, Refunding, (FSA Insured), 5.125%,

due 06/15/18 | | | 357,891 | | | Aaa | | NR | |

| | 3,000,000 | | | Sales Tax Asset Receivable Corp., New York–Series A, (AMBAC Insured), 5.00%,

due 10/15/29 | | | 3,121,980 | | | Aaa | | AAA | |

See Notes to Financial Statements.

LEBENTHAL NEW YORK MUNICIPAL BOND FUND

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2005

| | | | | | | Ratings (Unaudited) | |

Face

Amount | |

| | Value

(Note 1) | | Moody's | | Standard

& Poor's | |

| MUNICIPAL BONDS (Concluded) | |

| $ | 1,000,000 | | | Sales Tax Asset Receivable Corp., New York–Series A, (AMBAC Insured),

5.25%, due 10/15/27 | | $ | 1,070,950 | | | Aaa | | AAA | |

| | 2,400,000 | | | Triborough, New York State Bridge & Tunnel Authority, (MBIA Insured),

5.25%, due 11/15/23 | | | 2,579,760 | | | Aaa | | AAA | |

| | 1,485,000 | | | Triborough, New York State Bridge & Tunnel Authority–Series A, 5.00%,

Prerefunded to 01/01/12, due 01/01/32 | | | 1,595,157 | | | Aa2 | | AA– | |

| | 265,000 | | | Triborough, New York State Bridge & Tunnel Authority–Series A, 5.00%,

due 01/01/32 | | | 269,717 | | | Aa2 | | AA– | |

| | 2,000,000 | | | Triborough, New York State Bridge & Tunnel Authority–Series B, 5.00%,

due 11/15/27 | | | 2,061,540 | | | Aa2 | | AA– | |

| | 1,000,000 | | | Triborough, New York State Bridge & Tunnel Authority–Series B, 5.125%,

due 11/15/29 | | | 1,051,810 | | | Aa2 | | AA– | |

| | 885,000 | | | Westchester County, New York Health Care Corporation–Series B,

(County Guaranteed), 5.25%, due 11/01/17 | | | 942,056 | | | Aaa | | AAA | |

| | | Total Municipal Bonds (Cost $137,231,188) | | | 143,243,776 | | | | | | |

| Shares | | | | | | | | | |

| CLOSED-END FUNDS (1.11%) | |

| | 10,000 | | | Nuveen Insured New York Premium | | | 143,800 | | | | | | |

| | 100,000 | | | Van Kampen Trust Investment Grade New York Municipals | | | 1,490,000 | | | | | | |

| | | Total Closed-End Funds (Cost $1,684,316) | | | 1,633,800 | | | | | | |

| | | Total Investments (98.69%) (Cost $138,915,504)† | | | 144,877,576 | | | | | | |

| | | Cash and Other Assets, Net of Liabilities (1.31%) | | | 1,922,472 | | | | | | |

| | | NET ASSETS (100.00%) | | $ | 146,800,048 | | | | | | |

† Aggregate cost for federal income tax purposes is $138,901,821.

Aggregate unrealized appreciation and depreciation, based on cost for federal income tax purposes, are $6,331,871 and $356,116 respectively, resulting in net unrealized appreciation of $5,975,755.

(a) Variable rate security. The stated rate represents the rate at November 30, 2005. The date shown is next reset date.

Key

AMBAC = Ambac Indemnity Corporation.

AMT = Alternative Minimum Tax.

CR = Custodian Receipt.

FGIC = Financial Guaranty Insurance Corporation.

FHA = Federal Housing Administration.

FSA = Financial Security Assurance, Inc.

HUD = Department of Housing and Urban Development.

LOC = Letter of Credit.

MBIA = Municipal Bond Insurance Association.

NR = Not Rated.

RADIAN = Radian Guaranty, Inc.

SONYMA = State of New York Mortgage Agency.

See Notes to Financial Statements.

LEBENTHAL NEW JERSEY MUNICIPAL BOND FUND

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2005

| | | | | | | Ratings (Unaudited) | |

Face

Amount | |

| | Value

(Note 1) | | Moody's | | Standard

& Poor's | |

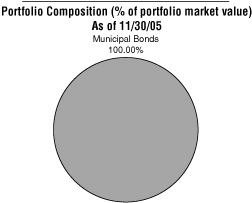

| MUNICIPAL BONDS (100.89%) | | | |

| $ | 415,000 | | | Branchburg, New Jersey Board of Education, (FGIC Insured), 5.00%,

due 07/15/21 | | $ | 435,381 | | | Aaa | | AAA | |

| | 350,000 | | | Delaware River Port Authority, Refunding Port District Project Series A,

(FSA Insured), 5.20%, due 01/01/27 | | | 367,090 | | | Aaa | | AAA | |

| | 500,000 | | | Freehold Township, New Jersey Board of Education (MBIA Insured), 5.00%,

due 02/15/22 | | | 522,640 | | | Aaa | | AAA | |

| | 250,000 | | | Gloucester County, New Jersey Improvement Authority–Series A, (MBIA Insured),

5.00%, due 07/15/23 | | | 262,283 | | | Aaa | | AAA | |

| | 400,000 | | | Gloucester County, New Jersey Pollution Control Financing Authority

(Exxon Mobil), 2.80%, due 12/01/05, (a) | | | 400,000 | | | VMIG1 | | A-1+ | |

| | 650,000 | | | Mercer County, New Jersey Improvement Authority, Government Leasing

Program, (AMBAC Insured), (County Guaranteed), 5.00%, due 12/15/18 | | | 690,371 | | | Aaa | | AAA | |

| | 200,000 | | | Middlesex County, New Jersey Import Authority, (MBIA Insured), 5.00%,

due 08/01/22 | | | 207,808 | | | Aaa | | AAA | |

| | 115,000 | | | Morris County, New Jersey Improvement Authority, School Improvement,

(County Guaranteed), 5.00%, due 08/15/16 | | | 122,243 | | | Aaa | | NR | |

| | 200,000 | | | New Jersey Economic Development Authority, Cigarette Tax, 5.75%,

due 06/15/29 | | | 209,612 | | | Baa2 | | BBB | |

| | 50,000 | | | New Jersey Economic Development Authority, Heath VLG–96 Project,

(LOC–First Union National Bank), 6.00%, due 05/01/16,* | | | 50,844 | | | NR | | AA– | |

| | 25,000 | | | New Jersey Economic Development Authority, Heath VLJ–96 Project,

(LOC–First Union National Bank), 6.00%, Prerefunded to 05/01/06,

due 05/01/16,* | | | 25,526 | | | NR | | AA– | |

| | 250,000 | | | New Jersey Economic Development Authority, Liberty State Park Project–Series C,

(FSA Insured), 5.00%, due 03/01/27 | | | 259,935 | | | Aaa | | AAA | |

| | 100,000 | | | New Jersey Economic Development Authority, New Jersey American Water Co.

Project A, (FGIC Insured), Subject to AMT, 6.875%, due 11/01/34 | | | 101,280 | | | Aaa | | AAA | |

| | 100,000 | | | New Jersey Economic Development Authority, Public Service Electric & Gas

Company Project, (MBIA Insured), Subject to AMT, 6.40%, due 05/01/32 | | | 101,001 | | | Aaa | | AAA | |

| | 150,000 | | | New Jersey Economic Development Authority, Refunding–Burlington Coat

Factory, (LOC–First Union National Bank), 6.125%, due 09/01/10 | | | 150,549 | | | Aa3 | | NR | |

| | 100,000 | | | New Jersey Economic Development Authority, Stolthaven Project–Series A,

(LOC–Citibank N.A.), 2.90%, due 12/01/05, (a) | | | 100,000 | | | P1 | | A-1+ | |

| | 300,000 | | | New Jersey Economic Development Authority, Water Facilities Revenue Project B,

(AMBAC Insured), 3.03%, due 12/01/05, (a) | | | 300,000 | | | VMIG1 | | A-1+ | |

| | 125,000 | | | New Jersey Health Care Facilities Financing Authority, General Hospital Center at

Passaic, (FSA Insured), 6.75%, due 07/01/19 | | | 151,915 | | | Aaa | | AAA | |

| | 150,000 | | | New Jersey Health Care Facilities Financing Authority, Robert Wood Johnson

University Hospital, 5.75%, due 07/01/25 | | | 159,087 | | | A2 | | A– | |

| | 150,000 | | | New Jersey Health Care Facilities Financing Authority, Saint Joseph's Hospital &

Medical Center, (Connie Lee Insured), 6.00%, due 07/01/26 | | | 155,131 | | | NR | | AAA | |

| | 500,000 | | | New Jersey State, Variable Purpose, (FGIC Insured), 5.00%, Prerefunded to

08/01/12, due 08/01/22 | | | 537,685 | | | Aaa | | AAA | |

See Notes to Financial Statements.

LEBENTHAL NEW JERSEY MUNICIPAL BOND FUND

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2005

| | | | | | | Ratings (Unaudited) | |

Face

Amount | |

| | Value

(Note 1) | | Moody's | | Standard

& Poor's | |

| MUNICIPAL BONDS (Concluded) | |

| $ | 250,000 | | | New Jersey State Educational Facilities Authority, Kean University–Series D,

(FGIC Insured), 5.25%, due 07/01/23 | | $ | 268,910 | | | Aaa | | AAA | |

| | 500,000 | | | New Jersey State Educational Facilities Authority, Montclair State

University–Series F, (FGIC Insured), 5.00%, due 07/01/31 | | | 511,960 | | | Aaa | | AAA | |

| | 275,000 | | | New Jersey State Educational Facilities Authority, Princeton University–Series D,

5.00%, due 07/01/26 | | | 287,884 | | | Aaa | | AAA | |

| | 100,000 | | | New Jersey State Educational Facilities Authority, Rowan University–Series C,

(FGIC Insured), 5.00%, due 07/01/31 | | | 102,761 | | | Aaa | | AAA | |

| | 20,000 | | | New Jersey State Higher Education Assistance Authority, Student Loan–Series A,

(AMBAC Insured), Subject to AMT, 5.30%, due 06/01/17 | | | 20,336 | | | Aaa | | AAA | |

| | 100,000 | | | New Jersey State Housing & Mortgage Finance Agency, Multi-Family Housing

Revenue Bond–Series A, (AMBAC Insured), Subject to AMT, 6.25%, due 05/01/28 | | | 102,487 | | | Aaa | | AAA | |

| | 300,000 | | | New Jersey State Housing & Mortgage Finance Agency, Multi-Family Housing

Revenue Bond–Series B, (FSA Insured), 6.15%, due 11/01/20 | | | 315,315 | | | Aaa | | AAA | |

| | 325,000 | | | New Jersey State Transport Trust Fund Authority, Transport Systems–Series C,

5.50%, Prerefunded to 06/15/13, due 06/15/24 | | | 361,874 | | | Aaa | | AAA | |

| | 400,000 | | | New Jersey State Turnpike Authority, Highway Improvement–Series A,

(FGIC Insured), 5.00%, due 01/01/19 | | | 422,852 | | | Aaa | | AAA | |

| | 400,000 | | | Old Bridge, New Jersey Board of Education, (MBIA Insured), 5.00%,

due 07/15/30 | | | 411,224 | | | Aaa | | AAA | |

| | 70,000 | | | Puerto Rico Housing Bank & Finance Agency, Single Family Mortgage,

Affordable Housing Mortgage–Portfolio I, (GNMA/FNMA/FHLMC Insured),

Subject to AMT, 6.25%, due 04/01/29 | | | 71,163 | | | Aaa | | NR | |

| | 300,000 | | | Tobacco Settlement Financing Corporation, New Jersey, 6.125%, due 06/01/42 | | | 310,299 | | | Baa3 | | BBB | |

| | 250,000 | | | Tobacco Settlement Financing Corporation, New Jersey, 7.00%, due 06/01/41 | | | 283,805 | | | Baa3 | | BBB | |

| | 400,000 | | | Trenton City, New Jersey, (MBIA Insured), 5.00%, due 12/01/26 | | | 417,936 | | | Aaa | | | |

| | 500,000 | | | Union County, New Jersey Improvement Authority, Madison Redevelopment

Project, (FSA Insured), 5.00%, due 03/01/25 | | | 520,770 | | | Aa1 | | NR | |

| | 250,000 | | | University Medicine & Dentistry, New Jersey, (AMBAC Insured), 5.00%,

due 04/15/22 | | | 262,878 | | | Aaa | | AAA | |

| | 250,000 | | | University Medicine & Dentistry, New Jersey–Series A, (AMBAC Insured), 5.125%,

due 12/01/22 | | | 265,365 | | | Aaa | | AAA | |

| | 100,000 | | | University Puerto Rico Revenue–Series O, (MBIA Insured), 5.375%, due 06/01/30 | | | 100,874 | | | Aaa | | AAA | |

| | 250,000 | | | Willingboro New Jersey Utilities Authority–Series H, (AMBAC Insured), 5.25%,

Prerefunded to 01/01/10, due 01/01/21 | | | 266,612 | | | Aaa | | NR | |

| | | Total Municipal Bonds (Cost $10,262,938) | | | 10,615,686 | | | | | | |

| | | Total Investments (100.89%) (Cost $10,262,938)† | | | 10,615,686 | | | | | | |

| | | | | Liabilities in Excess of Cash and Other Assets (–0.89%) | | | (93,391 | ) | | | | | |

| | | NET ASSETS (100.00%) | | $ | 10,522,295 | | | | | | |

See Notes to Financial Statements.

LEBENTHAL NEW JERSEY MUNICIPAL BOND FUND

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2005

† Aggregate cost for federal income tax purposes is $10,262,820.

Aggregate unrealized appreciation and depreciation, based on cost for federal income tax purposes, are $368,559 and $15,693 respectively, resulting in net unrealized appreciation of $352,866.

(a) Variable rate security. The stated rate represents the rate at November 30, 2005. The date shown is next reset date.

* Restricted security subject to restrictions on resale under federal securities laws. Security represents 0.73% of net assets.

Key

AMBAC = Ambac Indemnity Corporation.

AMT = Alternative Minimum Tax.

Connie Lee = College Construction Loan Insurance Association.

FGIC = Financial Guaranty Insurance Corporation.

FHLMC = Federal Home Loan Mortgage Corporation.

FNMA = Federal National Mortgage Association.

FSA = Financial Security Assurance, Inc.

GNMA = Government National Mortgage Association.

LOC = Letter of Credit.

MBIA = Municipal Bond Insurance Association.

NR = Not Rated.

See Notes to Financial Statements.

LEBENTHAL TAXABLE MUNICIPAL BOND FUND

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2005

| | | | | | | Ratings (Unaudited) | |

Face

Amount | |

| | Value

(Note 1) | | Moody's | | Standard

& Poor's | |

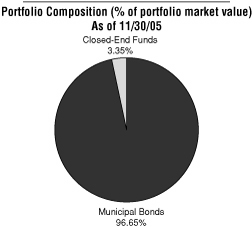

| MUNICIPAL BONDS (91.43%) | | | |

| $ | 350,000 | | | Allen County, Indiana War Memorial Coliseum Additions Building

Corporation–Series B, (AMBAC Insured), 6.875%, due 11/01/25 | | $ | 376,918 | | | Aaa | | NR | |

| | 300,000 | | | Bridgeport, Connecticut Taxable Pension Bonds, General Obligation,

(FGIC Insured), 7.64%, due 01/15/30 | | | 377,523 | | | Aaa | | AAA | |

| | 600,000 | | | Broward County, Florida Airport Systems Revenue, Taxable–Series J-2,

(AMBAC Insured), 6.90%, due 10/01/21 | | | 690,606 | | | Aaa | | AAA | |

| | 150,000 | | | Connecticut State Health & Educational Facilities Authority, Maefair Health Care,

9.20%, due 11/01/24 | | | 207,174 | | | A1 | | AA | |

| | 150,000 | | | Connecticut State Health & Educational Facilities Authority, Shady Knoll Center,

8.90%, due 11/01/24 | | | 202,810 | | | A1 | | AA | |

| | 250,000 | | | Cuyahoga County, Ohio Economic Development, Gateway Arena Project–Series A,

8.625%, due 06/01/22 | | | 315,703 | | | Aa2 | | NR | |

| | 300,000 | | | Dallas, Texas, Taxable Pension–Series A, 5.195%, due 02/15/35 | | | 291,330 | | | Aa1 | | AA+ | |

| | 225,000 | | | Detroit, Michigan Downtown Development Authority Tax Increment Revenue,

Taxable-Development Area No.1 Project-B, (MBIA Insured), 6.68%, due 07/01/28 | | | 259,261 | | | Aaa | | AAA | |

| | 100,000 | | | Florida Housing Finance Agency, Mariner Club–K-2, (AMBAC Insured), 8.25%,

due 09/01/15 | | | 103,786 | | | Aaa | | AAA | |

| | 250,000 | | | Fresno County, California Pension Obligation, (FGIC Insured), 6.67%,

due 08/15/18 | | | 280,155 | | | Aaa | | AAA | |

| | 500,000 | | | Glendale, Arizona Municipal Property Corporate Excise Tax–Series B,

(AMBAC Insured), 5.58%, due 07/01/32 | | | 501,775 | | | Aaa | | AAA | |

| | 425,000 | | | Harrisburg, Pennsylvania, Resource Recovery Facilities Authority–Series B,

(FSA Insured), 8.05%, Prerefunded to 09/01/10, due 09/01/25 | | | 488,635 | | | Aaa | | AAA | |

| | 75,000 | | | Idaho Housing Agency, (HUD Section 8 Insured), 8.50%, due 07/01/09 | | | 75,864 | | | A2 | | | |

| | 250,000 | | | Industry, California, General Obligation, (MBIA Insured), 6.70%, due 07/01/21 | | | 257,160 | | | Aaa | | AAA | |

| | 265,000 | | | Kern County, California Pension Obligation, (MBIA Insured), 7.26%,

due 08/15/14 | | | 300,568 | | | Aaa | | AAA | |

| | 400,000 | | | Los Angeles, California Certificates of Participation, Real Property–AK, 7.25%,

due 04/01/29 | | | 413,988 | | | A2 | | NR | |

| | 200,000 | | | Los Angeles, California Community Redevelopment Agency, Monterey–Series D,

(FSA Insured), 6.60%, due 09/01/20 | | | 215,982 | | | Aaa | | AAA | |

| | 100,000 | | | Maryland State Transportation Authority Limited, Baltimore–Washington

International, (MBIA Insured), 6.48%, due 07/01/22 | | | 111,521 | | | Aaa | | NR | |

| | 500,000 | | | Miami Dade County, Florida Educational Facilities Authority, Taxable–University of

Miami–Series B (AMBAC Insured), 5.36%, due 04/01/24 | | | 506,435 | | | Aaa | | AAA | |

| | 200,000 | | | Michigan State Housing Development Authority–Series A, (AMBAC Insured),

8.30%, due 11/01/15 | | | 236,088 | | | Aaa | | AAA | |

| | 10,000 | | | Minnesota State Housing Finance Agency, Single Family Mortgage–Series G,

8.05%, due 01/01/12 | | | 10,020 | | | Aa1 | | AA+ | |

| | 250,000 | | | New Jersey Economic Development Authority, State Pension Funding,

Revenue–Series B (FSA Insured), 0.00%**, due 02/15/21 | | | 111,968 | | | Aaa | | AAA | |

See Notes to Financial Statements.

LEBENTHAL TAXABLE MUNICIPAL BOND FUND

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2005

| | | | | | | Ratings (Unaudited) | |

Face

Amount | |

| | Value

(Note 1) | | Moody's | | Standard

& Poor's | |

| MUNICIPAL BONDS (Continued) | | | |

| $ | 10,000 | | | New Jersey State Turnpike Authority, Turnpike Revenue,–Taxable Series B,

(AMBAC Insured), 4.252%, Prerefunded to 1/01/15, due 01/01/16 | | $ | 9,500 | | | Aaa | | AAA | |

| | 580,000 | | | New York State Dormitory Authority Revenues, Highland Hospital–Series B,

(MBIA/FHA Insured), 7.45%, Prerefunded to 02/01/08, due 08/01/35 | | | 637,930 | | | Aaa | | AAA | |

| | 300,000 | | | New York State Housing Finance Agency, Multi-family Housing–Series B,

(FHA Insured), 8.25%, due 05/15/35 | | | 306,522 | | | Aa1 | | AAA | |

| | 500,000 | | | Ohio State, Developmental Assistance, (MBIA Insured), 5.32%, due 10/01/18 | | | 496,290 | | | Aaa | | AAA | |

| | 300,000 | | | Oregon School Boards Association, Taxable-Pension–Series B, (FGIC Insured),

5.55%, due 06/30/28 | | | 305,538 | | | Aaa | | AAA | |

| | 500,000 | | | Oregon State, General Obligation, Taxable–Series B, 5.762%, due 06/01/23 | | | 530,085 | | | Aa3 | | AA– | |

| | 330,000 | | | Philadelphia, Pennsylvania School District Taxable–Series C, (FSA Insured),

5.09%, due 07/01/20 | | | 319,747 | | | Aaa | | AAA | |

| | 600,000 | | | Richland Lexington, South Carolina Airport District, Columbia Metropolitan

Airport–Series B, (FSA Insured), 6.59%, due 01/01/17 | | | 656,040 | | | Aaa | | AAA | |

| | 300,000 | | | Rosemont, Illinois Tax Increment Project 5, (FGIC Insured), 6.95%, due 12/01/20 | | | 330,057 | | | Aaa | | AAA | |

| | 225,000 | | | Sacramento County, California–Series A, (MBIA Insured), 7.68%, due 08/15/21 | | | 281,797 | | | Aaa | | AAA | |

| | 130,000 | | | San Diego State University Foundation–Series B, (MBIA Insured), 6.70%,

due 03/01/22 | | | 138,711 | | | Aaa | | AAA | |

| | 185,000 | | | Texas State, Department of Housing and Community Affairs–Series C-1,

(MBIA Insured), 7.76%, due 09/01/17 | | | 188,972 | | | Aaa | | AAA | |

| | 275,185 | | | Tobacco Settlement Funding Corporation, Louisiana Revenue–Series 2001A,

6.36%, due 05/15/25 | | | 273,911 | | | Baa3 | | BBB | |

| | 500,000 | | | University of New Mexico, Certificates of Participation, (MBIA Insured), 8.00%,

due 06/30/25 | | | 553,935 | | | Aaa | | AAA | |

| | 500,000 | | | West Haven, Connecticut, (MBIA Insured), 5.84%, due 03/15/22 | | | 518,820 | | | Aaa | | AAA | |

| | | Total Municipal Bonds (Cost $10,930,309) | | | 11,883,125 | | | | | | |

| Shares | | | | | | | | | |

| CLOSED-END FUNDS (3.17%) | | | |

| | 16,900 | | | BlackRock Income Trust Incorporated | | | 100,386 | | | | | | |

| | 37,900 | | | Hyperion Total Return Fund Incorporated | | | 311,538 | | | | | | |

| | | Total Closed-End Funds (Cost $427,618) | | | 411,924 | | | | | | |

| | | Total Investments (94.60%) (Cost $11,357,927)† | | | 12,295,049 | | | | | | |

| | | | | Cash and Other Assets, Net of Liabilities (5.40%) | | | 701,635 | | | | | | |

| | | NET ASSETS (100.00%) | | $ | 12,996,684 | | | | | | |

See Notes to Financial Statements.

LEBENTHAL TAXABLE MUNICIPAL BOND FUND

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2005

† Aggregate cost for federal income tax purposes is $11,358,158.

Aggregate unrealized appreciation and depreciation, based on cost for federal income tax purposes, are $978,327 and $41,436 respectively, resulting in net unrealized appreciation of $936,891.

** Zero Coupon Bond.

Key

AMBAC = Ambac Indemnity Corporation.

FGIC = Financial Guaranty Insurance Corporation.

FHA = Federal Housing Administration.

FSA = Financial Security Assurance, Inc.

HUD = Department of Housing and Urban Development.

MBIA = Municipal Bond Insurance Association.

NR = Not Rated.

See Notes to Financial Statements.

LEBENTHAL FUNDS, INC.

STATEMENTS OF ASSETS AND LIABILITIES

NOVEMBER 30, 2005

| | | Lebenthal New York

Municipal

Bond Fund | | Lebenthal New Jersey

Municipal

Bond Fund | | Lebenthal Taxable

Municipal

Bond Fund | |

| ASSETS | |

Investment in securities, at value (cost $138,915,504

$10,262,938 and $11,357,927) | | $ | 144,877,576 | | | $ | 10,615,686 | | | $ | 12,295,049 | | |

| Cash | | | 23,496 | | | | 83,383 | | | | 180,216 | | |

| Receivables: | |

| Securities sold | | | 2,643,921 | | | | — | | | | 474,326 | | |

| Capital shares sold | | | 55,579 | | | | — | | | | — | | |

| Interest and dividends | | | 1,911,496 | | | | 179,613 | | | | 219,351 | | |

| Due from Manager | | | — | | | | 11,273 | | | | 2,474 | | |

| Total assets | | | 149,512,068 | | | | 10,889,955 | | | | 13,171,416 | | |

| LIABILITIES | |

| Payables: | |

| Capital shares redeemed | | | 2,112,120 | | | | 314,491 | | | | 99,679 | | |

| Dividends declared | | | 284,238 | | | | 22,843 | | | | 36,539 | | |

| Distribution fee payable (Note 3) | | | 115,779 | | | | — | | | | — | | |

| Management fee payable (Note 2) | | | 28,502 | | | | 2,265 | | | | 2,853 | | |

| Administration fee payable | | | 15,411 | | | | 7,083 | | | | 5,904 | | |

| Directors' fee payable | | | 703 | | | | 418 | | | | 694 | | |

| Accrued expenses and other liabilities | | | 155,267 | | | | 20,560 | | | | 29,063 | | |

| Total liabilities | | | 2,712,020 | | | | 367,660 | | | | 174,732 | | |

| NET ASSETS | | $ | 146,800,048 | | | $ | 10,522,295 | | | $ | 12,996,684 | | |

| NET ASSETS consist of: | |

| Par value | | $ | 17,540 | | | $ | 1,452 | | | $ | 1,679 | | |

| Paid in capital | | | 138,331,166 | | | | 9,928,933 | | | | 11,989,788 | | |

| Undistributed(Accumulated) net investment income/(loss) | | | (284,238 | ) | | | 16 | | | | (36,539 | ) | |

| Accumulated net realized gain on investments | | | 2,773,508 | | | | 239,146 | | | | 104,634 | | |

| Unrealized appreciation on investments — net | | | 5,962,072 | | | | 352,748 | | | | 937,122 | | |

| Total net assets | | $ | 146,800,048 | | | $ | 10,522,295 | | | $ | 12,996,684 | | |

| CLASS A | |

| Net Assets | | $ | 139,912,458 | | | $ | 10,522,295 | | | $ | 12,996,684 | | |

| Shares outstanding (Note 4) | | | 16,718,227 | | | | 1,452,278 | | | | 1,679,202 | | |

| Net asset value and redemption price per share | | $ | 8.37 | | | $ | 7.25 | | | $ | 7.74 | | |

| Maximum offering price per share* | | $ | 8.76 | | | $ | 7.59 | | | $ | 8.10 | | |

| CLASS B | |

| Net Assets | | $ | 6,887,590 | | | $ | — | | | $ | — | | |

| Shares outstanding (Note 4) | | | 821,581 | | | | — | | | | — | | |

| Net asset value, and redemption price per share** | | $ | 8.38 | | | $ | — | | | $ | — | | |

* The sales charge for Class A shares is 4.5% of the offering price on a single sale of less than $50,000, reduced on sales of $50,000 or more and certain other sales.

** Class B shares are sold without an initial sales charge, but are subject to a 5% contingent deferred sales charge if shares are redeemed within 11 months, reduced on shares held over 12 months.

See Notes to Financial Statements.

LEBENTHAL FUNDS, INC.

STATEMENTS OF OPERATIONS

YEAR ENDED NOVEMBER 30, 2005

| | | Lebenthal New York

Municipal

Bond Fund | | Lebenthal New Jersey

Municipal

Bond Fund | | Lebenthal Taxable

Municipal

Bond Fund | |

| INVESTMENT INCOME | |

| Income: | |

| Interest | | $ | 7,659,991 | | | $ | 570,661 | | | $ | 985,441 | | |

| Dividends | | | 818,405 | | | | 57,372 | | | | 65,918 | | |

| Total income | | | 8,478,396 | | | | 628,033 | | | | 1,051,359 | | |

| Expenses: | |

| Management fee (Note 2) | | | 377,403 | | | | 32,749 | | | | 43,666 | | |

| Distribution fee: | |

| Class A (Note 3) | | | 405,545 | | | | 32,749 | | | | 43,666 | | |

| Class B (Note 3) | | | 77,333 | | | | — | | | | — | | |

| Shareholder servicing fees: | |

| Class A | | | 91,393 | | | | 34,260 | | | | 35,372 | | |

| Class B | | | 32,660 | | | | — | | | | — | | |

| Administration fee | | | 152,748 | | | | 22,819 | | | | 26,396 | | |

| Printing | | | 37,851 | | | | 3,667 | | | | 4,021 | | |

| Custodian fee | | | 23,146 | | | | 5,710 | | | | 7,124 | | |

| Legal and compliance fees | | | 183,727 | | | | 14,068 | | | | 20,582 | | |

| Auditing and accounting fees | | | 94,398 | | | | 45,097 | | | | 49,849 | | |

| Directors' fees | | | 29,281 | | | | 2,673 | | | | 3,905 | | |

| Registration fees: | |

| Class A | | | 7,907 | | | | 3,608 | | | | 12,426 | | |

| Class B | | | 4,211 | | | | — | | | | — | | |

| Other | | | 75,915 | | | | 7,306 | | | | 9,343 | | |

| Total expenses | | | 1,593,518 | | | | 204,706 | | | | 256,350 | | |

| Less: Reimbursement of expenses by Manager (Note 2) | | | — | | | | (46,944 | ) | | | (37,802 | ) | |

| Fees waived by Distributor (Note 3) | | | (38,947 | ) | | | (32,749 | ) | | | (43,666 | ) | |

| Fees paid indirectly (Note 1) | | | (463 | ) | | | (566 | ) | | | (219 | ) | |

| Net expenses | | | 1,554,108 | | | | 124,447 | | | | 174,663 | | |

| Net investment income | | | 6,924,288 | | | | 503,586 | | | | 876,696 | | |

REALIZED AND UNREALIZED GAIN/(LOSS) ON

INVESTMENTS | |

| Net realized gain on investments | | | 2,934,128 | | | | 241,240 | | | | 123,929 | | |

| Net realized gain from underlying funds' distributions | | | 6,346 | | | | — | | | | — | | |

Change in unrealized appreciation/depreciation of

investments | | | (543,247 | ) | | | (82,498 | ) | | | (279,140 | ) | |

| Net realized and unrealized gain/(loss) on investments | | | 2,397,227 | | | | 158,742 | | | | (155,211 | ) | |

| Increase in net assets from operations | | $ | 9,321,515 | | | $ | 662,328 | | | $ | 721,485 | | |

See Notes to Financial Statements.

LEBENTHAL FUNDS, INC.

STATEMENTS OF CHANGES IN NET ASSETS

YEARS ENDED NOVEMBER 30, 2005 AND 2004

| | | Lebenthal New York Municipal

Bond Fund | | Lebenthal New Jersey Municipal

Bond Fund | |

| | | Year

Ended

November 30, 2005 | | Year

Ended

November 30, 2004 | | Year

Ended

November 30, 2005 | | Year

Ended

November 30, 2004 | |

| INCREASE (DECREASE) IN NET ASSETS | |

| Operations: | |

| Net investment income | | $ | 6,924,288 | | | $ | 7,504,752 | | | $ | 503,586 | | | $ | 574,485 | | |

| Net realized gain on investments | | | 2,940,474 | | | | 145,624 | | | | 241,240 | | | | 121,609 | | |

Change in unrealized appreciation/

depreciation of investments | | | (543,247 | ) | | | (2,509,956 | ) | | | (82,498 | ) | | | (172,753 | ) | |

Increase in net assets from

operations | | | 9,321,515 | | | | 5,140,420 | | | | 662,328 | | | | 523,341 | | |

Dividends from net investment

income: | |

| Class A shares | | | (6,651,921 | )* | | | (7,197,169 | )** | | | (503,647 | )* | | | (574,168 | )** | |

| Class B shares | | | (265,726 | )* | | | (301,409 | )** | | | — | | | | — | | |

Distributions from net realized

capital gains: | |

| Class A Shares | | | (49,904 | ) | | | (1,104,110 | ) | | | (53,186 | ) | | | — | | |

| Class B Shares | | | (2,390 | ) | | | (58,481 | ) | | | — | | | | — | | |

| Capital share transactions (Note 4) | | | (22,947,669 | ) | | | (15,564,404 | ) | | | (3,046,063 | ) | | | (1,419,237 | ) | |

| Total decrease | | | (20,596,095 | ) | | | (19,085,153 | ) | | | (2,940,568 | ) | | | (1,470,064 | ) | |

| Net assets: | |

| Beginning of period | | | 167,396,143 | | | | 186,481,296 | | | | 13,462,863 | | | | 14,932,927 | | |

| End of period (1) | | $ | 146,800,048 | | | $ | 167,396,143 | | | $ | 10,522,295 | | | $ | 13,462,863 | | |

(1) Includes Undistributed/

(Accumulated) Net Investment

Income/(Loss) | | $ | (284,238 | ) | | $ | (315,128 | ) | | $ | 16 | | | $ | 17 | | |

(Unaudited Information)

* 99.75% and 99.12% designated as exempt interest dividends for federal income tax purposes for New York Municipal Bond Fund and New Jersey Municipal Bond Fund, respectively.

** 98.96% and 98.97% designated as exempt interest dividends for federal income tax purposes for New York Municipal Bond Fund and New Jersey Municipal Bond Fund, respectively.

See Notes to Financial Statements.

LEBENTHAL FUNDS, INC.

STATEMENTS OF CHANGES IN NET ASSETS (CONTINUED)

YEARS ENDED NOVEMBER 30, 2005 AND 2004

| | | Lebenthal Taxable Municipal

Bond Fund | |

| | | Year

Ended

November 30, 2005 | | Year

Ended

November 30, 2004 | |

| INCREASE (DECREASE) IN NET ASSETS | |

| Operations: | |

| Net investment income | | $ | 876,696 | | | $ | 1,001,332 | | |

| Net realized gain on investments | | | 123,929 | | | | 56,101 | | |

| Change in unrealized appreciation/depreciation of investments | | | (279,140 | ) | | | (45,236 | ) | |

| Increase in net assets from operations | | | 721,485 | | | | 1,012,197 | | |

| Dividends from net investment income | | | (880,575 | ) | | | (1,001,146 | ) | |

| Distributions from net realized capital gains | | | (32,263 | ) | | | — | | |

| Capital share transactions (Note 4) | | | (5,238,812 | ) | | | (1,702,284 | ) | |

| Total decrease | | | (5,430,165 | ) | | | (1,691,233 | ) | |

| Net assets: | |

| Beginning of period | | | 18,426,849 | | | | 20,118,082 | | |

| End of period (1) | | $ | 12,996,684 | | | $ | 18,426,849 | | |

| (1) Includes Undistributed/(Accumulated) Net Investment (Loss) | | $ | (36,539 | ) | | $ | (47,272 | ) | |

See Notes to Financial Statements.

LEBENTHAL FUNDS, INC.

FINANCIAL HIGHLIGHTS

Selected data for a share of capital stock outstanding throughout each period:

| | | Lebenthal New York

Municipal Bond Fund—Class A | |

| | | Year Ended November 30, | |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

| Per Share Operating Performance: | |

| Net asset value, beginning of period | | $ | 8.26 | | | $ | 8.41 | | | $ | 8.33 | | | $ | 8.31 | | | $ | 7.92 | | |

| Income from investment operations: | |

| Net investment income | | | 0.34 | | | | 0.35 | | | | 0.36 | | | | 0.38 | (a) | | | 0.41 | | |

Net realized and unrealized gain/(loss) on

investments | | | 0.11 | | | | (0.10 | ) | | | 0.11 | | | | 0.05 | | | | 0.39 | | |

| Total from investment operations | | | 0.45 | | | | 0.25 | | | | 0.47 | | | | 0.43 | | | | 0.80 | | |

| Less distributions: | |

| Dividends from net investment income | | | (0.34 | ) | | | (0.35 | ) | | | (0.36 | ) | | | (0.41 | ) | | | (0.41 | ) | |

| Distributions from net realized gain on investments | | | (0.00 | )** | | | (0.05 | ) | | | (0.03 | ) | | | — | | | | — | | |

| Total distributions | | | (0.34 | ) | | | (0.40 | ) | | | (0.39 | ) | | | (0.41 | ) | | | (0.41 | ) | |

| Net asset value, end of period | | $ | 8.37 | | | $ | 8.26 | | | $ | 8.41 | | | $ | 8.33 | | | $ | 8.31 | | |

| Total Return | |

| (without deduction of sales load) | | | 5.59 | % | | | 3.07 | % | | | 5.76 | % | | | 4.93 | % | | | 10.20 | % | |

| Ratios/Supplemental Data | |

| Net assets, end of period (000) | | $ | 139,912 | | | $ | 159,634 | | | $ | 177,154 | | | $ | 165,093 | | | $ | 147,456 | | |

| Ratio to average net assets: | |

| Expenses | | | 0.88 | %* | | | 0.87 | %* | | | 0.85 | %* | | | 0.88 | %* | | | 0.81 | %* | |

| Net investment income | | | 4.11 | % | | | 4.21 | % | | | 4.30 | % | | | 4.58 | % (a) | | | 4.93 | % | |

| Portfolio turnover | | | 36.05 | % | | | 11.38 | % | | | 16.64 | % | | | 13.05 | % | | | 46.32 | % | |

* Includes fees paid indirectly of less than 0.01% of average net assets.

** Amount represents less than ($0.01) per share.

(a) If the Fund had not adopted the provision of the AICPA Audit and Accounting Guide for Investment Companies, which requires the amortization of premiums and accretion of discounts on debt securities using the effective interest method, net investment income per share and the ratio of net investment income to average net assets would have been the same as noted above.

See Notes to Financial Statements.

LEBENTHAL FUNDS, INC.

FINANCIAL HIGHLIGHTS (CONTINUED)

Selected data for a share of capital stock outstanding throughout each period:

| | | Lebenthal New York

Municipal Bond Fund—Class B | |

| | | Year Ended November 30, | |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

| Per Share Operating Performance: | |

| Net asset value, beginning of period | | $ | 8.27 | | | $ | 8.42 | | | $ | 8.34 | | | $ | 8.31 | | | $ | 7.92 | | |

| Income from investment operations: | |

| Net investment income | | | 0.29 | | | | 0.29 | | | | 0.31 | | | | 0.33 | (a) | | | 0.35 | | |

Net realized and unrealized gain/(loss) on

investments | | | 0.11 | | | | (0.10 | ) | | | 0.10 | | | | 0.05 | | | | 0.39 | | |

| Total from investment operations | | | 0.40 | | | | 0.19 | | | | 0.41 | | | | 0.38 | | | | 0.74 | | |

| Less distributions: | |

| Dividends from net investment income | | | (0.29 | ) | | | (0.29 | ) | | | (0.30 | ) | | | (0.35 | ) | | | (0.35 | ) | |

| Distributions from net realized gain on investments | | | (0.00 | )** | | | (0.05 | ) | | | (0.03 | ) | | | — | | | | — | | |

| Total distributions | | | (0.29 | ) | | | (0.34 | ) | | | (0.33 | ) | | | (0.35 | ) | | | (0.35 | ) | |

| Net asset value, end of period | | $ | 8.38 | | | $ | 8.27 | | | $ | 8.42 | | | $ | 8.34 | | | $ | 8.31 | | |

| Total Return | |

| (without deduction of sales load) | | | 4.89 | % | | | 2.37 | % | | | 5.02 | % | | | 4.34 | % | | | 9.39 | % | |

| Ratios/Supplemental Data | |

| Net assets, end of period (000) | | $ | 6,888 | | | $ | 7,763 | | | $ | 9,328 | | | $ | 7,807 | | | $ | 6,142 | | |

| Ratio to average net assets: | |

| Expenses † | | | 1.55 | %* | | | 1.55 | %* | | | 1.55 | %* | | | 1.55 | %* | | | 1.55 | %* | |

| Net investment income | | | 3.44 | % | | | 3.53 | % | | | 3.59 | % | | | 3.90 | % (a) | | | 4.16 | % | |

| Portfolio turnover | | | 36.05 | % | | | 11.38 | % | | | 16.64 | % | | | 13.05 | % | | | 46.32 | % | |

* Includes fees paid indirectly of less than 0.01% of average net assets.

** Amount represents less than ($0.01) per share.

† If the Investment Manager had not waived fees and reimbursed expenses and the Administrator and Distributor had not waived fees, the ratio of operating expenses to average assets would have been 2.05%, 2.00%, 1.96%, 2.08%, and 2.11%, for the years ended November 30, 2005, 2004, 2003, 2002 and 2001, respectively.

(a) If the Fund had not adopted the provision of the AICPA Audit and Accounting Guide for Investment Companies, which requires the amortization of premiums and accretion of discounts on debt securities using the effective interest method, net investment income per share and the ratio of net investment income to average net assets would have been the same as noted above.

See Notes to Financial Statements.

LEBENTHAL FUNDS, INC.

FINANCIAL HIGHLIGHTS (CONTINUED)

Selected data for a share of capital stock outstanding throughout each period:

| | | Lebenthal New Jersey

Municipal Bond Fund | |

| | | Year Ended November 30, | |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

| Per Share Operating Performance: | |

| Net asset value, beginning of period | | $ | 7.21 | | | $ | 7.20 | | | $ | 7.05 | | | $ | 6.99 | | | $ | 6.73 | | |

| Income from investment operations: | |

| Net investment income | | | 0.28 | | | | 0.29 | | | | 0.30 | | | | 0.31 | (a) | | | 0.33 | | |

Net realized and unrealized gain on

investments | | | 0.07 | | | | 0.01 | | | | 0.15 | | | | 0.06 | | | | 0.26 | | |

| Total from investment operations | | | 0.35 | | | | 0.30 | | | | 0.45 | | | | 0.37 | | | | 0.59 | | |

| Less distributions: | |

| Dividends from net investment income | | | (0.28 | ) | | | (0.29 | ) | | | (0.30 | ) | | | (0.31 | ) | | | (0.33 | ) | |

| Distributions from net realized gain on investments | | | (0.03 | ) | | | — | | | | — | | | | — | | | | — | | |

| Total distributions | | | (0.31 | ) | | | (0.29 | ) | | | (0.30 | ) | | | (0.31 | ) | | | (0.33 | ) | |

| Net asset value, end of period | | $ | 7.25 | | | $ | 7.21 | | | $ | 7.20 | | | $ | 7.05 | | | $ | 6.99 | | |

| Total Return | |

| (without deduction of sales load) | | | 4.89 | % | | | 4.26 | % | | | 6.47 | % | | | 5.39 | % | | | 8.90 | % | |

| Ratios/Supplemental Data | |

| Net assets, end of period (000) | | $ | 10,522 | | | $ | 13,463 | | | $ | 14,933 | | | $ | 13,078 | | | $ | 11,356 | | |

| Ratio to average net assets: | |

| Expenses † | | | 0.95 | %* | | | 0.95 | %* | | | 0.95 | %* | | | 0.95 | %* | | | 0.93 | %* | |

| Net investment income | | | 3.85 | % | | | 4.03 | % | | | 4.17 | % | | | 4.41 | % (a) | | | 4.66 | % | |

| Portfolio turnover | | | 32.66 | % | | | 8.80 | % | | | 15.63 | % | | | 21.46 | % | | | 30.46 | % | |

* Includes fees paid indirectly of less than 0.01% of average net assets.

† If the Investment Manager had not waived fees and reimbursed expenses and the Administrator and Distributor had not waived fees, the ratio of operating expenses to average assets would have been 1.56%, 1.37%, 1.32%, 1.48%, and 1.47%, for the years ended November 30, 2005, 2004, 2003, 2002 and 2001, respectively.

(a) If the Fund had not adopted the provision of the AICPA Audit and Accounting Guide for Investment Companies, which requires the amortization of premiums and accretion of discounts on debt securities using the effective interest method, net investment income per share would have been the same as noted above and the ratio of net investment income to average net assets would have been 4.40%.

See Notes to Financial Statements.

LEBENTHAL FUNDS, INC.

FINANCIAL HIGHLIGHTS (CONCLUDED)

Selected data for a share of capital stock outstanding throughout each period:

| | | Lebenthal Taxable

Municipal Bond Fund | |

| | | Year Ended November 30, | |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

| Per Share Operating Performance: | |

| Net asset value, beginning of period | | $ | 7.85 | | | $ | 7.84 | | | $ | 7.80 | | | $ | 7.49 | | | $ | 7.11 | | |

| Income from investment operations: | |

| Net investment income | | | 0.39 | | | | 0.40 | | | �� | 0.41 | | | | 0.44 | (a) | | | 0.47 | | |

Net realized and unrealized gain/(loss) on

investments | | | (0.09 | ) | | | 0.01 | | | | 0.04 | | | | 0.33 | | | | 0.40 | | |

| Total from investment operations | | | 0.30 | | | | 0.41 | | | | 0.45 | | | | 0.77 | | | | 0.87 | | |

| Less distributions: | |

| Dividends from net investment income | | | (0.40 | ) | | | (0.40 | ) | | | (0.41 | ) | | | (0.46 | ) | | | (0.49 | ) | |

| Distributions from net realized gain on investments | | | (0.01 | ) | | | — | | | | (0.00 | )** | | | — | | | | — | | |

| Total distributions | | | (0.41 | ) | | | (0.40 | ) | | | (0.41 | ) | | | (0.46 | ) | | | (0.49 | ) | |

| Net asset value, end of period | | $ | 7.74 | | | $ | 7.85 | | | $ | 7.84 | | | $ | 7.80 | | | $ | 7.49 | | |

| Total Return | |

| (without deduction of sales load) | | | 3.85 | % | | | 5.41 | % | | | 5.80 | % | | | 10.36 | % | | | 12.22 | % | |

| Ratios/Supplemental Data | |

| Net assets, end of period (000) | | $ | 12,997 | | | $ | 18,427 | | | $ | 20,118 | | | $ | 15,738 | | | $ | 13,601 | | |

| Ratio to average net assets: | |

| Expenses † | | | 1.00 | %* | | | 1.00 | %* | | | 1.00 | %* | | | 1.00 | %* | | | 1.00 | %* | |

| Net investment income | | | 5.03 | % | | | 5.15 | % | | | 5.09 | % | | | 5.83 | % (a) | | | 6.34 | % | |

| Portfolio turnover | | | 8.52 | % | | | 13.69 | % | | | 7.83 | % | | | 22.46 | % | | | 54.63 | % | |

* Includes fees paid indirectly of less than 0.01% of average net assets.

** Amount represents less than ($0.01) per share.

† If the Investment Manager had not waived fees and reimbursed expenses and the Administrator and Distributor had not waived fees, the ratio of operating expenses to average assets would have been 1.47%, 1.30%, 1.24%, 1.34%, and 1.35%, for the years ended November 30, 2005, 2004, 2003, 2002 and 2001, respectively.

(a) If the Fund had not adopted the provision of the AICPA Audit and Accounting Guide for Investment Companies, which requires the amortization of premiums and accretion of discounts on debt securities using the effective interest method, net investment income per share and the ratio of net investment income to average net assets would have been the same as noted above.

See Notes to Financial Statements.

LEBENTHAL FUNDS, INC.

NOTES TO FINANCIAL STATEMENTS

1. Summary of Accounting Policies

Lebenthal Funds, Inc. (the "Company") is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company consisting of Lebenthal New York Municipal Bond Fund (the "New York Bond Fund"), Lebenthal New Jersey Municipal Bond Fund (the "New Jersey Bond Fund") and Lebenthal Taxable Municipal Bond Fund (the "Taxable Bond Fund") (each, a "Fund" and collectively, the "Funds"). Effective December 3, 1997, the New York Bond Fund began to offer a second class of shares, Class B. Class B shares are sold without an initial sales charge but will have a higher expense ratio than Class A shares due to higher 12b-1 fees. The Company's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America as follows:

a) Valuation of Securities -

Municipal obligations are stated on the basis of valuations provided by a pricing service approved by the Board of Directors, which uses information with respect to transactions in bonds, quotations from bond dealers, market transactions in comparable securities and various relationships between securities in determining value. If a pricing service is not used, municipal obligations will be valued at quoted prices provided by municipal bond dealers. Other securities for which transaction prices are readily available are stated at market value (determined on the basis of the last reported sales price, or a similar means). Short-term investments that will mature in sixty (60) days or less are stated at amortized cost, which approximates market value. All other securities and assets are valued at their fair market value as determined in good faith by or under the direction of the Board of Directors.

b) Federal Income Taxes -

It is the Funds' policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of their tax-exempt and taxable income to their shareholders. Therefore, no provision for Federal income tax is required.

c) Dividends and Distributions -

Dividends from net investment income are declared daily and paid monthly. Distributions of net capital gains, if any, realized on sales of investments are made after the close of the Funds' fiscal year, as declared by the Funds' Board of Directors.

d) General -

Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Interest income is recorded on the accrual basis and dividend income is recorded on the ex-dividend date. Premiums and original issue discounts on securities purchased are amortized over the life of the respective securities. For the New York Bond Fund, investment income and realized and unrealized gains and losses are allocated to each class based upon the relative daily net assets of each class of share. Expenses that are directly attributable to a class are charged only to

LEBENTHAL FUNDS, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

Summary of Accounting Policies (Continued)

that class. Expenses not directly attributable to a specific class are allocated based upon the relative daily net assets of each class of shares.

e) Fees Paid Indirectly -

Funds leaving excess cash in demand deposit accounts may receive credits which are available to offset custody expenses. The Statements of Operations report gross custody expense, and reflect the amount of such credits as a reduction in total expenses, of $463, $566, and $219, for the New York Bond Fund, New Jersey Bond Fund, and Taxable Bond Fund, respectively.

f) Estimates -

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Funds to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

2. Investment Management Fees and Other Transactions with Affiliates

Under the Management Contract, the Funds pay a management fee to Boston Advisors, Inc. (the "Manager"), a division of Boston Advisors, Inc., equal to 0.25% of each Fund's average daily net assets up to $50 million; 0.225% of such assets between $50 million and $100 million; and 0.20% of such assets in excess of $100 million. The Manager manages the portfolio of securities of each Fund and makes decisions with respect to the purchase and sale of investments. Although not required to do so, the Manager has voluntarily agreed to reimburse expenses for the New Jersey Bond Fund and Taxable Bond Fund in the amount of $46,944 and $37,802, respectively. As this waiver is voluntary, it may be terminated at any time.

For the year ended November 30, 2005, Advest, Inc. (the "Distributor"), an affiliate of the Manager, retained commissions from the sales of shares of the Company in the following amounts:

| | | Commissions retained

by Advest, Inc. | |

| Lebenthal New York Municipal Bond Fund — Class A | | $ | 188,239 | | |

| Lebenthal New York Municipal Bond Fund — Class B | | | 13,567 | | |

| Lebenthal New Jersey Municipal Bond Fund | | | 13,322 | | |

| Lebenthal Taxable Municipal Bond Fund | | | 16,782 | | |

| | | $ | 231,910 | | |

The Directors of the Company who are unaffiliated with the Manager or the Distributor are paid $6,250 per annum, plus an additional $1,000 for the Audit Committee Chair.

LEBENTHAL FUNDS, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

3. Distribution Plan

Pursuant to a Distribution Plan adopted under Rule 12b-1 of the Investment Company Act of 1940, as amended, the Company and the Distributor have entered into a Distribution Agreement. For its services under the Distribution Agreement, the Distributor receives a fee equal to 0.25% of the Fund's average daily net assets for the New York Bond Fund — Class A shares, the New Jersey Bond Fund, and the Taxable Bond Fund, and, 1.00% for the New York Bond Fund — Class B shares. For the year ended November 30, 2005, the Distributor voluntarily waived fees of $38,947, $32,749 and $43,666 for the New York Bond Fund — Class B shares, the New Jersey Bond Fund, and the Taxable Bond Fund, respectively. There were no additional expenses borne by the Company pursuant to the Distribution Plan.

4. Capital Stock

Transactions in capital stock were as follows:

| | | Lebenthal New York Municipal Bond Fund —

Class A

Year Ended

November 30, 2005 | | Lebenthal New York Municipal Bond Fund —

Class A

Year Ended

November 30, 2004 | |

| | | Shares | | Amount | | Shares | | Amount | |

| Sold | | | 936,091 | | | $ | 7,887,988 | | | | 1,164,657 | | | $ | 9,682,633 | | |

Issued as reinvestment

of dividends | | | 619,374 | | | | 5,214,190 | | | | 788,015 | | | | 6,559,017 | | |

| Redeemed | | | (4,170,728 | ) | | | (35,070,428 | ) | | | (3,684,987 | ) | | | (30,392,551 | ) | |

| Net decrease | | | (2,615,263 | ) | | $ | (21,968,250 | ) | | | (1,732,315 | ) | | $ | (14,150,901 | ) | |

Maximum shares authorized

($0.001 par value) | | | 4,000,000,000 | | | | | | | | | | | | | | |

| | | Lebenthal New York Municipal Bond Fund —

Class B

Year Ended

November 30, 2005 | | Lebenthal New York Municipal Bond Fund —

Class B

Year Ended

November 30, 2004 | |

| | | Shares | | Amount | | Shares | | Amount | |

| Sold | | | 18,091 | | | $ | 152,499 | | | | 40,386 | | | $ | 336,410 | | |

Issued as reinvestment

of dividends | | | 25,657 | | | | 216,282 | | | | 34,928 | | | | 291,471 | | |

| Redeemed | | | (160,705 | ) | | | (1,348,200 | ) | | | (244,039 | ) | | | (2,041,384 | ) | |

| Net decrease | | | (116,957 | ) | | $ | (979,419 | ) | | | (168,725 | ) | | $ | (1,413,503 | ) | |

Maximum shares authorized

($0.001 par value) | | | 4,000,000,000 | | | | | | | | | | | | | | |

LEBENTHAL FUNDS, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

Capital Stock (Continued)

| | | Lebenthal New Jersey Municipal Bond Fund

Year Ended

November 30, 2005 | | Lebenthal New Jersey Municipal Bond Fund

Year Ended

November 30, 2004 | |

| | | Shares | | Amount | | Shares | | Amount | |

| Sold | | | 72,422 | | | $ | 529,915 | | | | 92,622 | | | $ | 667,415 | | |

Issued as reinvestment

of dividends | | | 54,515 | | | | 398,936 | | | | 57,925 | | | | 416,144 | | |

| Redeemed | | | (542,090 | ) | | | (3,974,914 | ) | | | (356,135 | ) | | | (2,502,796 | ) | |

| Net decrease | | | (415,153 | ) | | $ | (3,046,063 | ) | | | (205,588 | ) | | $ | (1,419,237 | ) | |

Shares authorized

($0.001 par value) | | | 4,000,000,000 | | | | | | | | | | | | | | |

| | | Lebenthal Taxable Municipal Bond Fund

Year Ended

November 30, 2005 | | Lebenthal Taxable Municipal Bond Fund

Year Ended

November 30, 2004 | |

| | | Shares | | Amount | | Shares | | Amount | |

| Sold | | | 71,563 | | | $ | 568,491 | | | | 212,503 | | | $ | 1,683,791 | | |

Issued as reinvestment

of dividends | | | 78,840 | | | | 624,260 | | | | 86,012 | | | | 675,630 | | |

| Redeemed | | | (817,644 | ) | | | (6,431,563 | ) | | | (517,404 | ) | | | (4,061,705 | ) | |

| Net decrease | | | (667,241 | ) | | $ | (5,238,812 | ) | | | (218,889 | ) | | $ | (1,702,284 | ) | |

Shares authorized

($0.001 par value) | | | 4,000,000,000 | | | | | | | | | | | | | | |

5. Investment Transactions