The names of and certain information regarding each nominee are set forth below.

Dr. Pottshas served as a director of Cell Genesys since May 1997. Previously, Dr. Potts had served as a director of Somatix Therapy Corporation from 1995 to 1997. His career spans more than 40 years of distinguished service in science and medicine. He earned his M.D. in 1957 from the University of Pennsylvania, and then trained at Massachusetts General Hospital and National Heart Institute. He then joined the National Institutes of Health, where he became head of the section on polypeptide hormones prior to becoming chief of endocrinology at Massachusetts General Hospital in 1968. Dr. Potts served as physician-in-chief at Massachusetts General Hospital and Jackson Professor of Clinical Medicine at Harvard Medical School from 1981 to 1996. In September 1996, Dr. Potts moved from the post of physician-in-chief to director of research at Massachusetts General Hospital and Jackson Distinguished Professor of Clinical Medicine at Harvard Medical School.

Dr. Shenkwas appointed a director of Cell Genesys in August 2001. Dr. Shenk, Elkins Professor of Molecular Biology at Princeton University since 1984, has served as a member of Cell Genesys’ Scientific Advisory Board since 1997. Dr. Shenk, a world-renowned expert in virology and gene therapy, is also a member of Merck & Co., Inc.’s board of directors and brings over 20 years of experience in the biopharmaceutical field. Dr. Shenk is a member of the National Academy of Sciences and the Institute of Medicine, the American Academy of Arts and Sciences, and the American Academy of Microbiology. He is a past president of the American Society for Virology, he is president-elect of the American Society for Microbiology, and he has published more than 200 scientific papers in various journals and has authored multiple patents. Dr. Shenk, who trained as a postdoctoral fellow in molecular biology at Stanford Medical Center, received his B.S. in biology from the University of Detroit and his Ph.D. in microbiology from Rutgers University.

Mr. Stephas served as a director of Cell Genesys since February 1993. From 1973 until his retirement in 1992, Mr. Step served in various positions in senior management of Eli Lilly and Company, most recently as executive vice president, president of the pharmaceutical division and a member of the board of directors and its executive committee. Mr. Step is a past chairman of the board of the Pharmaceutical Manufacturers Association and a past president of the International Federation of Pharmaceutical Manufacturers Association. Mr. Step is also a director of Ceregene, Inc., Scios, Inc. and Guidant Corporation. Mr. Step holds a B.A. in economics from the University of Nebraska and an M.S. in finance and accounting from the University of Illinois.

Dr. Vermahas served as a director of Cell Genesys since May 1997. From 1996 to 1997, Dr. Verma served as a director of Somatix Therapy Corporation. Dr. Verma joined The Salk Institute in 1974 and is currently co-director of the Laboratory of Genetics. Currently, Dr. Verma is also an adjunct professor, department of biology, at the University of California, San Diego and has been a member of the faculty since 1979. Dr. Verma is also a member of the National Academy of Sciences, Institute of Medicine and past president of the American Society for Gene Therapy. Dr. Verma is a director of Ceregene, Inc. Dr. Verma holds a degree in Biochemistry from the Lucknow University in India and a Ph.D. in Biochemistry from the Weizmann Institute in Rehovoth, Israel.

There are no family relationships among directors or executive officers of the Company.

Board Meetings and Committees

The board of directors of the Company held a total of five meetings during the fiscal year ended December 31, 2002. No incumbent director attended fewer than 75 percent of the total number of meetings of the board of directors and its committees of which he or she was a member, if any.

The board of directors has an audit committee, a compensation committee and a nominating and governance committee.

The audit committee of the board of directors, which consists of Messrs. Gower and Step and Ms. Crowell, met eight times during fiscal year 2002. The audit committee is responsible for engagement of the Company’s independent auditors, and is primarily responsible for reviewing and approving the scope of the audit and other services performed by the Company’s independent auditors and for reviewing and evaluating the Company’s accounting principles and its systems of internal accounting controls.

The compensation committee of the board of directors, which consists of Dr. Potts and Messrs. Carter and Step, met four times during fiscal year 2002. The compensation committee reviews and approves the Company’s compensation policies as well as the compensation of, and grant of stock options to, the Company’s executive officers.

The nominating and governance committee of the board of directors, which consists of Ms. Crowell, Dr. Potts and Dr. Shenk, met twice during 2002. The committee makes recommendations as to the size and composition of the board;

4

reviews qualifications of potential candidates for election to the board; recommends the slate of nominees for presentation at the annual stockholders’ meeting; makes recommendations with respect to the membership of committees; and assesses the performance of the board and its members. It is this committee that is responsible for planning succession to the position of chief executive officer. This committee also oversees issues of corporate governance as they apply to the Company and recommends amendments to the Company’s corporate governance procedures where appropriate. The nominating and governance committee will consider nominees by stockholders in accordance with the Company’s bylaws.

Compensation of Directors

Directors who are not employees of the Company receive an annual retainer of $15,000 and a fee of $1,000 for each board meeting attended, as well as reimbursement of expenses incurred in attending board meetings.

In July 2002, the Company forgave the remaining balance of $100,000 of an outstanding loan between the Company and Dr. Verma (see “Certain Transactions”) as recognition of Dr. Verma’s service to the Company.

Required Vote

The eight nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to be voted for them will be elected as directors.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF THE NOMINEES.

PROPOSAL TWO

APPROVAL OF AMENDMENTS TO 1998 INCENTIVE STOCK PLAN

General

The 1998 Incentive Stock Plan (the “Incentive Plan”) was adopted by the board of directors and initially approved by the stockholders in June 1998. The Incentive Plan will terminate by its own terms in 2008.

Options granted under the Incentive Plan may be either incentive stock options, within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), or nonstatutory options. In addition, the Incentive Plan provides for the grant of stock purchase rights. All such options and purchase rights are collectively referred to below as “Rights.” The Incentive Plan is not a qualified deferred compensation plan under Code Section 401(a) and is not subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”).

Proposal

In April 2003, the board of directors approved an amendment to the Incentive Plan to increase the number of shares reserved for future issuance by 500,000 shares, bringing the total number of shares authorized to be issued under the Incentive Plan to 3,760,000 shares. In addition, the board approved a further amendment to the Incentive Plan to prohibit future option repricings under the Incentive Plan without the approval of the Company’s stockholders. The stockholders are being requested to approve these amendments to the Incentive Plan.

As of March 31, 2003, options to purchase 262,534 shares had been exercised, options to purchase 2,671,431 shares were outstanding with a weighted average exercise price of $14.02, and options to purchase 326,035 shares remained available for future grant under the Incentive Plan (without giving effect to the proposed increase in authorized shares). The closing market price of the Company’s common stock on March 31, 2003 was $7.39.

5

SUMMARY OF THE INCENTIVE PLAN

Purposes of the Plan

The purposes of the Incentive Plan are to attract and retain the best available personnel, to provide additional long-term incentives to employees and directors of the Company and to promote the success of the Company’s business.

Administration; Limits on Grants

The Incentive Plan is administered by the board of directors or by a compensation committee appointed by the board of directors and consisting of at least two members of the board (in either case, the “Administrator”). The Incentive Plan is currently administered by the compensation committee. The compensation committee approves the grant of stock options. The board has sole discretion to interpret any provision of the Incentive Plan. Unless stockholder approval is obtained (or there has been a stock dividend, merger or other change to the Company’s capital structure), neither the board nor the compensation committee may lower the price of a previously granted option or stock purchase right, nor place the option or right with another type of award.

The federal tax code places limits on the deductibility, for federal income tax purposes, of compensation paid to certain executive officers of the Company. In order to preserve the Company’s ability to deduct the compensation income associated with options and stock purchase rights granted to such persons, the Plan provides that no employee, director or consultant may be granted, in any fiscal year of the Company, options and stock purchase rights to purchase more than 250,000 shares of common stock. Notwithstanding this limit, however, in connection with an individual’s initial employment with the Company, he or she may be granted options or stock purchase rights to purchase up to an additional 250,000 shares of common stock.

In addition to the foregoing limitation, there is a limit on the aggregate market value of shares subject to all incentive stock options held by an optionee which may vest during any calendar year. See “Tax Information — Incentive Stock Options” below.

Eligibility

The Incentive Plan provides that Rights may be granted to the Company’s employees, directors and consultants, and to employees of and consultants to the Company’s majority-owned subsidiaries, though Rights under the Incentive Plan are generally reserved for grants to the Company’s executive officers. Only employees may be granted “incentive stock options” as defined in Section 422 of the Code. The Administrator selects the optionees and determines the number of shares to be subject to each option.

Terms of Options

Each option granted under the Incentive Plan is evidenced by a written stock option agreement between the Company and the optionee and is subject to the following additional terms and conditions:

(a) Duration and Termination of Options. Options granted under the Incentive Plan have a maximum term of ten years from the date of grant. An option granted to a person who, immediately before the grant of such option, owns more than ten percent of the voting power or value of all classes of stock of the Company may not have a term of more than five years. No option may be exercised after the expiration of its term.

(b) Exercise of the Option. The Administrator determines on the date of grant of each option when the option will be exercisable. Options granted to employees and directors generally become exercisable (“vest”) over four years. An option granted under the Incentive Plan is exercised by giving written notice of exercise to the Company, specifying the number of shares of common stock to be purchased and tendering payment of the purchase price to the Company. Payment for shares issued upon exercise of an option may, depending on the terms of the option agreement, consist of cash, check, promissory notes, surrender of shares of common stock owned by the optionee for at least six months on the date of surrender (so long as such shares have a fair market value on the date of such surrender equal to the aggregate exercise price of the shares being exercised), consideration received by the Company in connection with a cashless exercise program, a reduction in the amount of any Company liability to the optionee, any combination of the foregoing methods or any other consideration and method to the extend permitted by applicable law.

6

(c) Exercise Price. The exercise price of options granted under the Incentive Plan is determined by the Administrator. The exercise price of incentive stock options (or nonqualified stock options intended to qualify as “performance based” under Section 162(m) of the Code) may not be less than 100 percent of the fair market value of the common stock on the date of grant. However, the exercise price of incentive stock options granted to a person who owns more than ten percent of the voting power or value of all classes of stock of the Company must not be less than 110 percent of the fair market value on the date of grant. The aggregate fair market value of shares (determined on the grant date) covered by incentive stock options which first become exercisable during any calendar year may not exceed $100,000. Stock option repricings without stockholder approval are prohibited under the terms of the plan. The common stock is currently traded on the Nasdaq National Market. While the Company’s stock is traded on the Nasdaq National Market, the fair market value is the reported closing price.

(d) Termination of Service. Except as described below, if an optionee’s employment by or services to the Company terminate for any reason, the option is exercisable within a period of time determined by the Administrator and set forth in the option agreement, to the extent vested on the date of termination. For terminations other than as a result of death or disability, the time period is generally 3 months. However, the time period cannot extend beyond the expiration date of the option. In the event of death or disability, options are generally exercisable for a period of twelve months following the death or disability.

(e) Nontransferability of Options. An option is generally not transferable by the optionee, other than by will or the laws of descent and distribution. During the optionee’s lifetime, only the optionee may exercise the option.

Stock Purchase Rights

In the case of stock purchase rights, unless the Administrator determines otherwise, the restricted stock purchase agreement grants the Company a repurchase option exercisable upon the voluntary or involuntary termination of the purchaser’s employment with the Company for any reason (including death or disability). The purchase price for shares repurchased pursuant to the restricted stock purchase agreement is the original price paid by the purchaser and may be paid by cancellation of any indebtedness of the purchaser to the Company. The repurchase option lapses at a rate determined by the Administrator.

Changes in Capitalization

In the event of changes in the common stock by reason of stock dividends, split-ups or combinations of shares, reclassifications, recapitalizations, mergers, consolidations, reorganizations, or liquidations, the Administrator will adjust the exercise price and the number and class of shares subject to each option or stock purchase right as the Administrator deems appropriate. Such adjustment is final and conclusive.

In the event of a liquidation or dissolution, any unexercised options or stock purchase rights will terminate. The Administrator may, in its discretion, provide that each optionee will have the right to exercise all of the optionee’s options and stock purchase rights, including those not otherwise exercisable, until the date thirty (30) days prior to the consummation of the liquidation or dissolution.

In connection with any merger or sale of substantially all of the assets of the Company, each outstanding option or stock purchase right must be assumed or a substantially equivalent option or right substituted by the successor corporation. If the successor corporation refuses to assume the options and stock purchase rights or to substitute substantially equivalent options and stock purchase rights, the optionee will have the right to exercise the option or stock purchase right for all the optioned stock, including shares not otherwise exercisable. In such event, the Administrator will notify the optionee that the option or stock purchase right is fully exercisable for thirty (30) days from the date of such notice and that the option or stock purchase right terminates upon expiration of such period.

Amendment and Termination

The board may at any time amend or terminate the Incentive Plan without approval of the stockholders. The Company currently intends to obtain stockholder approval of any amendment to the Incentive Plan to the extent necessary to comply with Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with Section 422 of the Code, or with any other applicable law or regulation, including requirements of the Nasdaq Stock Market. Also, unless stockholder approval is obtained (or there has been a stock dividend, merger or other change to the Company’s capital

7

structure), neither the board nor the compensation committee may lower the price of a previously granted option or stock purchase right, nor replace the option or right with another type of award. Any amendment or termination of the Incentive Plan is subject to the rights of optionees under agreements entered into prior to such amendment or termination.

Tax Information

The following is a brief summary of the federal income tax consequences of transactions under the Incentive Plan based on federal securities and income tax laws in effect at March 1, 2003. This summary is not intended to be exhaustive and does not discuss the tax consequences of a participant’s death or provisions of the income tax laws of any municipality, state or foreign country in which an optionee may reside.

Stock Options

Options granted under the Incentive Plan may be either incentive stock options, as defined in Section 422 of the Code, or nonstatutory options.

Incentive Stock Options. No taxable income is recognized by the optionee upon grant or exercise of an incentive stock option (unless the alternative minimum tax rules apply). If the optionee does not dispose of the shares received upon exercise of an incentive stock option in a manner that disqualifies incentive stock option tax treatment within two years after the date of grant and within one year after the date of exercise, then (i) upon the resale of the shares, any amount realized in excess of the option exercise price will be treated as long-term capital gain and any loss sustained will be long-term capital loss, and (ii) no deduction will be allowed to the Company for federal income tax purposes. The exercise of an incentive stock option may result in alternative minimum tax liability to the optionee.

If the shares acquired upon the exercise of an incentive stock option are disposed of before the expiration of either holding period described above, generally (i) the optionee will recognize income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares at exercise (or, if less, the amount realized on the disposition of the shares) over the option exercise price paid for such shares, and (ii) the Company is entitled to a tax deduction in the same amount. Any further gain or loss realized by the participant will be taxed as short-term or long-term capital gain or loss, as the case may be, and will not result in any deduction by the Company.

Nonstatutory Stock Options. Generally, with respect to nonstatutory stock options, (i) no income is recognized by the optionee at the time the option is granted; (ii) generally, at exercise, ordinary income is recognized by the optionee in an amount equal to the difference between the option exercise price and the fair market value of the shares on the date of exercise, and the Company is entitled to a tax deduction in the same amount; and (iii) at disposition, any gain or loss is treated as a capital gain or loss. In the case of an optionee who is also an employee, any income recognized upon exercise of a nonstatutory stock option will constitute wages for which withholding will be required.

Stock Purchase Rights

Stock purchase rights will generally be taxed in the same manner as nonstatutory stock options. However, restricted stock is generally issued upon the exercise of a stock purchase right. At the time of purchase, restricted stock is subject to a “substantial risk of forfeiture” within the meaning of Section 83 of the Code, because the Company may repurchase the stock when the purchaser ceases to provide services to the Company. As a result of this substantial risk of forfeiture, the purchaser will not recognize ordinary income at the time of purchase. Instead, the purchaser will recognize ordinary income on the dates when the stock is no longer subject to a substantial risk of forfeiture (i.e., when the Company’s right of repurchase lapses). The purchaser’s ordinary income is measured as the difference between the purchase price and the fair market value of the stock on the date the stock is no longer subject to the right of repurchase.

The purchaser may accelerate to the date of purchase his or her recognition of ordinary income, if any, and begin his or her capital gains holding period by timely filing (i.e., within thirty days of the purchase) an election pursuant to Section 83(b) of the Code. In such event, the ordinary income recognized, if any, is measured as the difference between the purchase price and the fair market value of the stock on the date of purchase, and the capital gain holding period commences on such date. The ordinary income recognized by a purchaser who is an employee will be subject to tax withholding by the Company.

8

Participation in the Incentive Plan

As of the date of this proxy statement, there has been no determination by the Administrator with respect to future awards under the Incentive Plan. Accordingly, future awards are not determinable. The following table shows the number of options granted to the named groups under the Incentive Plan during the year ended December 31, 2002.

PLAN BENEFITS

1998 Incentive Stock Plan

| Name and Position (1) | Number of

Options (2) | | Weighted Average

Exercise Price Per Share ($/sh) |

|

| |

|

| Current Executive Officers as a Group | 410,000 | | | $ | 14.15 | |

| Non-Executive Director Group | — | | | | n/a | |

| Non-Executive Employee Group | — | | | | n/a | |

|

(1)

| The table of option grants under “Executive Officer Compensation — Option Grants in Last Fiscal Year” appearing later in this proxy statement provides information with respect to the grant of options to the Company’s Chief Executive Officer and the other officers named in the Summary Compensation Table below during the last fiscal year.

|

| (2) | All options were granted at no less than fair market value on the date of grant. |

Required Vote

The affirmative vote of the holders of a majority of the shares of the Company’s common stock voting in person or by proxy on this proposal at the annual meeting is required to approve the amendment to the 1998 Incentive Stock Plan.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE AMENDMENTS TO THE 1998 INCENTIVE STOCK PLAN.

PROPOSAL THREE

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The audit committee of the board of directors has selected Ernst & Young LLP as independent auditors of the Company to audit the financial statements of the Company for the fiscal year ending December 31, 2003. Ernst & Young LLP has audited the Company’s financial statements since the year ended December 31, 1989. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting with the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

Fees Billed To The Company By Ernst & Young LLP During Fiscal Years 2001 and 2002

Audit Fees

The aggregate fees billed by Ernst & Young LLP for professional services rendered for the audit of the Company’s annual financial statements for fiscal years 2001 and 2002 and for reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q for those years, as well as in registration statements filed by the Company during those years under the Securities Act of 1933, as amended, were:

| | 2002 | | 2001 |

| |

| |

|

| Audit fees | $ | 142,270 | | $ | 153,900 |

| Audit-related fees | | — | | | — |

| Tax fees | $ | 19,636 | | $ | 20,486 |

| All other fees | | — | | | — |

9

The audit committee of the board of directors has considered whether the provision of the services covered in this section is compatible with maintaining Ernst & Young LLP’s independence.

Required Vote

The ratification of the appointment of Ernst & Young LLP and the authorization of the audit committee of the board of directors to agree to Ernst & Young LLP’s fee are being submitted to the stockholders at the Annual Meeting. If such appointment is not ratified, the audit committee will reconsider its decision to appoint Ernst & Young LLP as the Company’s independent auditors. The affirmative vote of the holders of a majority of the shares of the Company’s common stock voting in person or by proxy on this proposal at the Annual Meeting is required to ratify the appointment of the independent auditors.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT AUDITORS.

10

OTHER INFORMATION

Stock Ownership of Principal Stockholders and Management

The following table sets forth the beneficial ownership of common stock of the Company as of March 31, 2003 by: (a) each person known to the Company to beneficially own five percent or more of the outstanding shares of its common stock; (b) each of the Company’s directors; (c) each of the Company’s executive officers named in the Summary Compensation Table below; and (d) all current directors and executive officers as a group. Unless otherwise indicated below, the address of each of the individuals named below is: c/o Cell Genesys, Inc., 500 Forbes Boulevard, South San Francisco, California 94080.

| Name and Address of Beneficial Owner | Shares

Beneficially Owned (1) | | Percentage(%)

Beneficially Owned (2) |

|

| |

|

| Legg Mason, Inc. | 2,783,686 | | | 7.5 |

| 100 Light Street | | | | |

| Baltimore, MD 21202 | | | | |

| Mazama Capital Management, Inc. | 2,764,128 | | | 7.5 |

| One SW Columbia | | | | |

| Portland, OR 97258 | | | | |

| Deutsche Bank AG | 1,993,580 | | | 5.4 |

| Taunusanlage 12 D-60325 | | | | |

| Frankfurt Am Main, Germany | | | | |

| David W. Carter (3) | 45,000 | | | * |

| Nancy M. Crowell (4) | 26,875 | | | * |

| James M. Gower (5) | 81,536 | | | * |

| John T. Potts, Jr., M.D. (6) | 69,625 | | | * |

| Thomas E. Shenk, Ph.D. (7) | 91,749 | | | * |

| Stephen A. Sherwin, M.D. (8) | 1,217,142 | | | 3.2 |

| Eugene L. Step (9) | 76,000 | | | * |

| Inder M. Verma, Ph.D. (10) | 138,196 | | | * |

| Dale G. Ando, M.D. (11) | 97,306 | | | * |

| Robert H. Tidwell (12) | 94,999 | | | * |

| Joseph J. Vallner, Ph.D. (13) | 267,750 | | | * |

| Peter K. Working, Ph.D. (14) | 60,000 | | | * |

| All current executive officers and directors as | 2,678,317 | | | 6.9 |

| a group (16 persons) (15) | | | | |

| | | | | |

| | | | |

* Less than one percent

| | | | |

(1)

| The information in this table is based upon information supplied by directors and officers and, in the case of five percent stockholders, upon information contained in Schedules 13G filed with the Securities and Exchange Commission. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, and the information is not necessarily indicative of beneficial ownership for any other purpose. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table, to the Company’s knowledge, have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them.

|

(2)

| Percentage of beneficial ownership is based on 36,951,569 shares of common stock outstanding as of March 31, 2003. Shares of common stock subject to options or warrants currently exercisable, or exercisable within 60 days, are deemed outstanding for computing the percentage of the person holding such options but are not deemed outstanding for computing the percentage of any other person.

|

(3)

| Consists of 45,000 shares subject to options that are exercisable within 60 days after March 31, 2003.

|

11

(4)

| Consists of 26,875 shares subject to options that are exercisable within 60 days after March 31, 2003.

|

(5)

| Includes 75,000 shares subject to options that are exercisable within 60 days after March 31, 2003.

|

(6)

| Consists of 69,625 shares subject to options that are exercisable within 60 days after March 31, 2003.

|

(7)

| Includes 67,749 shares subject to options that are exercisable within 60 days after March 31, 2003.

|

(8)

| Includes 754,792 shares subject to options that are exercisable within 60 days after March 31, 2003. Additionally, includes 30,000 shares held in irrevocable trust for Dr. Sherwin’s child for which Dr. Sherwin disclaims beneficial ownership.

|

(9)

| Consists of 76,000 shares subject to options that are exercisable within 60 days after March 31, 2003.

|

(10)

| Includes 91,000 shares subject to options that are exercisable within 60 days after March 31, 2003.

|

(11)

| Includes 88,491 shares subject to options that are exercisable within 60 days after March 31, 2003.

|

(12)

| Consists of 94,999 shares subject to options that are exercisable within 60 days after March 31, 2003.

|

(13)

| Consists of 267,750 shares subject to options that are exercisable within 60 days after March 31, 2003.

|

(14)

| Consists of 60,000 shares subject to options that are exercisable within 60 days after March 31, 2003.

|

| (15) | Includes 2,104,356 shares subject to options that are exercisable within 60 days after March 31, 2003. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s executive officers and directors, and persons who own more than 10 percent of a registered class of the Company’s equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Such executive officers, directors and 10 percent stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms that they file.

Based solely on its review of copies of such forms received by the Company, or written representations from certain reporting persons that no filings on Forms 5 were required for such persons, the Company believes that, during 2002, its executive officers, directors and 10 percent stockholders complied with all applicable Section 16(a) filing requirements.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Company’s board of directors is composed of Dr. Potts and Messrs. Carter and Step, none of whom is or has been an officer or employee of the Company. The Compensation Committee makes recommendations to the board of directors concerning salaries and incentive compensation of officers of the Company. Dr. Sherwin, chairman of the board and chief executive officer of the Company, is not a member of the Compensation Committee and cannot vote on matters decided by the Compensation Committee. He participates in Compensation Committee discussions regarding salaries and incentive compensation for all employees of and consultants to the Company, except that Dr. Sherwin is excluded from discussions regarding his own salary and incentive compensation. None of the executive officers of the Company has served on the board of directors or compensation committee of any other entity, any of whose officers served on the Company’s Compensation Committee, and none of the executive officers of the Company has served on the compensation committee of any other entity, any of whose officers served on the Company’s board of directors.

12

EXECUTIVE OFFICER COMPENSATION

Summary Compensation Table

The following table sets forth certain information concerning the compensation of the Company’s chief executive officer and each of the four other most highly compensated executive officers (collectively, the “Named Officers”) for services rendered to the Company in all capacities during the last three fiscal years.

Annual Compensation

| Name and Principal Position | Year | | Salary ($) | | Bonus ($) (1) | | Other Annual

Compensation ($) | | Long-Term

Compensation | | All Other

Compensation

($) (11) |

|

Securities

Underlying

Options (2) |

|

| |

| |

| |

| |

| |

|

| Stephen A. Sherwin, M.D | 2002 | | 465,000 | | 150,000 | | | | | 100,000 (4) | | 3,000 |

| Chairman and | 2001 | | 445,000 | | 200,000 | | | | | 80,000 (3) | | 3,000 |

| Chief Executive Officer | 2000 | | 415,000 | | 250,000 | | | | | | | |

| | | | | | | | | | | | | |

| Dale G. Ando, M.D | 2002 | | 240,000 | | 55,000 | | | | | 22,500 (4) | | |

| Vice President, | 2001 | | 230,000 | | 57,500 | | | | | 22,500 (3) | | |

| Clinical Research | 2000 | | 215,500 | | 54,000 | | | | | | | |

| | | | | | | | | | | | | |

| Robert H. Tidwell | 2002 | | 248,335 | | 60,000 | | | | | 22,500 (4) | | 3,000 |

| Sr. Vice President, | | | | | | | | | | 50,000 (5) | | |

| Corporate Development | 2001 | | 230,000 | | 57,500 | | | | | 10,000 (3) | | 3,000 |

| | 2000 | | 81,923 | | 20,000 | | | 25,000 (10) | | 100,000 (6) | | |

| | | | | | | | | | | | | |

| Joseph J. Vallner, Ph.D | 2002 | | 330,000 | | 100,000 | | | | | 37,500 (4) | | |

| President and | 2001 | | 315,000 | | 100,000 | | | | | 46,500 (3) | | |

| Chief Operating Officer | | | | | | | | | | 100,000 (7) | | |

| | 2000 | | 275,000 | | 110,000 | | | | | | | |

| | | | | | | | | | | | | |

| Peter K. Working, Ph.D | 2002 | | 243,335 | | 60,000 | | | | | 10,000 (4) | | 3,000 |

| Sr. Vice President, | | | | | | | | | | 50,000 (8) | | |

| Research & Development | 2001 | | 79,320 | | 20,000 | | | | | 100,000 (9) | | 3,000 |

|

(1)

| These bonuses, which were awarded for and accrued in the year noted, were paid in the subsequent year.

|

(2)

| Cell Genesys has no restricted stock awards, stock appreciation rights or long-term incentive plan payouts.

|

(3)

| Consists of options granted February 6, 2001, related to performance during 2000.

|

(4)

| Consists of options granted February 7, 2002, related to performance during 2001.

|

(5)

| Mr. Tidwell was promoted to Senior Vice President, Corporate Development on July 24, 2002, and was granted an option to purchase 50,000 shares with an expiration date of July 24, 2012, in the context of this promotion.

|

(6)

| Mr. Tidwell joined the Company as Vice President, Corporate Development in August 2000. On August 31, 2000, he was granted an option to purchase 100,000 shares with an expiration date of August 31, 2010.

|

(7)

| Dr. Vallner was promoted in July 2001, to President and Chief Operating Officer from Executive Vice President and Chief Operating Officer. On July 25, 2001, he was granted an option to purchase 100,000 shares with an expiration date of July 25, 2011, in the context of this promotion.

|

(8)

| Dr. Working was promoted to Senior Vice President, Research and Development on July 24, 2002, and he was granted an option to purchase 50,000 shares with an expiration date of July 24, 2012 in the context of this promotion.

|

(9)

| Dr. Working joined the Company as Vice President, Research and Development in August 2001. On August 31, 2001, he was granted an option to purchase 100,000 shares with an expiration date of August 31, 2011.

|

(10)

| Mr. Tidwell received the payment classified under Other Annual Compensation in connection with his initial employment with the Company.

|

13

| (11) | In January 2001, the Company introduced a 401(k) Employer Match for all participating employees under its Defined Contribution Plan managed by Charles Schwab. The 401(k) match equals 100 percent of the first $3,000 contributed by the employee participant. |

Option Grants in Last Fiscal Year

The following table sets forth each grant of stock options to the Named Officers in fiscal year 2002:

| Name | Number of

Securities

Underlying

Options

Granted (1) | Individual Grants | | Expiration

Date | | Potential Realizable

Value at Assumed

Annual Rate of Stock

Price Appreciation

For Option Term ($) (3) | |

|

| | Percent of

Total Options

Granted to

Employees in

2002 (2) | | Exercise

Price ($)

(per share) |

|

| 5% | | 10% | |

|

| |

| |

| |

| |

| |

| |

| Stephen A. Sherwin, M.D | 100,000 (4) | | 5.8% | | 15.42 | | 02/07/2012 | | 969,756 | | 2,457,551 | |

| Dale G. Ando, M.D | 22,500 (4) | | 1.3% | | 15.42 | | 02/07/2012 | | 218,195 | | 552,949 | |

| Robert H. Tidwell | 22,500 (4) | | 1.3% | | 15.42 | | 02/07/2012 | | 218,195 | | 552,949 | |

| | 50,000 (5) | | 2.9% | | 11.95 | | 07/24/2012 | | 375,765 | | 952,261 | |

| Joseph J. Vallner, Ph.D | 37,500 (4) | | 2.2% | | 15.42 | | 02/07/2012 | | 363,658 | | 921,582 | |

| Peter K. Working, Ph.D | 10,000 (4) | | 0.6% | | 15.42 | | 02/07/2012 | | 96,976 | | 245,755 | |

| | 50,000 (6) | | 2.9% | | 11.95 | | 07/24/2012 | | 375,765 | | 952,261 | |

|

(1)

| Options granted under the Incentive Plan have a maximum term of 10 years but may be terminated earlier upon termination of employment. Shares vest over a four-year period at the rate of 1/48th per month.

|

(2)

| Based on an aggregate of 1,726,145 options granted to employees in 2002.

|

(3)

| The potential realizable value is calculated based on the 10-year term of the option and the fair market value of the common stock at the time the option was granted, compounded annually. The five percent and 10 percent assumed annualized rates of compound stock price appreciation are provided in compliance with the rules of the SEC and are not meant to represent the Company’s estimate or a projection by the Company of future common stock prices.

|

(4)

| Consists of options granted February 7, 2002, related to performance during 2001.

|

(5)

| Consists of options granted in connection with Mr. Tidwell’s promotion to Senior Vice President, Corporate Development.

|

| (6) | Consists of options granted in connection with Dr. Working’s promotion to Senior Vice President, Research and Development. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

The following table sets forth certain information concerning option exercises in 2002 and unexercised options held at December 31, 2002 by the Named Officers:

| Name | Shares

Acquired

on Exercise | | Value

Realized ($)(1) | | Number of Securities

Underlying Unexercised

Options at December 31, 2002

Exercisable/Unexercisable | | Value of Unexercised

In-the-Money Options

at December 31, 2002 ($)

Exercisable/Unexercisable (2) | |

|

| |

| |

| |

| |

| | | | | | | | | | | | |

| Stephen A. Sherwin, M.D | 11,460 | | 107,965 | | 723,751 / 136,249 | | | | 3,325,037 / | 28,893 | |

| Dale G. Ando, M.D | — | | — | | 79,584 / 34,687 | | | | 346,985 / | 9,287 | |

| Robert H. Tidwell | — | | — | | 73,489 / 109,011 | | | | 0 / | 0 | |

| Joseph J. Vallner, Ph.D | — | | — | | 224,626 / 159,374 | | | | 419,743 / | 110,457 | |

| Peter K. Working, Ph.D | — | | — | | 40,833 / 119,167 | | | | 0 / | 0 | |

|

(1)

| Fair market of the underlying securities on the date of exercise, minus the aggregate exercise price of the securities.

|

| (2) | Fair market value of the underlying securities based on a closing price of our common stock at December 31, 2002 of $11.15 per share, less the exercise price. |

14

Equity Compensation Plan Table

Information as of December 31, 2002 regarding equity compensation plans approved and not approved by stockholders is summarized in the following table:

| Plan Category | | (A)

Number of Shares to

be Issued Upon

Exercise of

Outstanding Options | | (B)

Weighted-Average

Exercise Price of

Outstanding

Options | | (C)

Number of Shares

Remaining Available for

Future Issuance Under

Equity Compensation Plans

(Excluding Shares Reflected

in Column (A)) |

| |

| |

| |

|

| Equity compensation plans | | | 3,521,268 | | | | $ | 12.51 | | | | 891,888 | (1) |

| approved by stockholders | | | | | | | | | | | | | |

| Equity compensation plans not | | | 2,189,115 | | | | $ | 15.98 | | | | 2,803,787 | (2) |

| approved by stockholders | | | | | | | | | | | | | |

| | |

| | | |

| | | |

| |

| Total | | | 5,710,383 | | | | $ | 13.84 | | | | 3,695,675 | |

|

(1)

| Includes 504,388 shares available for future issuance under our 1998 Incentive Stock Option Plan, as amended in 2000, generally used for grants to executive officers. Also includes 200,000 shares available under our 2002 Employee Stock Purchase Plan and 187,500 shares available under our 2001 Director Option Plan, used for grants to our outside Directors.

|

| (2) | Consists of 2,803,787 shares available for future issuance under our 2001 Non-Statutory Option Plan, used for grants to non-executive officer employees and consultants. A narrative description of our 2001 Non-Statutory Option Plan is set forth in the notes of the financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2002. |

Change-in-Control Agreements and Employment Contracts

Since the time of his initial employment in March 1990, the Company has agreed to maintain Dr. Sherwin’s salary for twelve months after termination of his employment with the Company, unless the Company terminates Dr. Sherwin for cause or he terminates his employment voluntarily.

The Company has implemented change-in-control agreements for certain executive officers. Under these agreements, the Company has agreed to provide Dale G. Ando, M.D., Christine McKinley, Matthew J. Pfeffer, Michael W. Ramsay, Robert H. Tidwell, Joseph J. Vallner, Ph.D. and Peter K. Working, Ph.D. with severance payments in an aggregate amount equal to twelve months salary plus bonus and certain employee benefits, following a change in control of the Company and (i) termination without cause by the Company or (ii) constructive termination. Also, under a similar change-in-control agreement, the Company has agreed to provide Dr. Sherwin with severance payments in an aggregate amount equal to two years salary plus bonus and certain employee benefits. Included in Dr. Sherwin’s change-in-control agreement is a provision for payments by the Company of certain taxes that may be incurred as a consequence of the agreement. Dr. Sherwin’s change-in-control agreement, when applicable, will supersede his employment contract.

Corporate Governance

The Company and its Board of Directors are committed to the best possible practices of corporate governance as an important component in building and maintaining stockholder value. To this end, the Company regularly reviews its corporate governance policies and practices to ensure that they are consistent with the highest standards of other companies. The Company has also been closely monitoring guidance issued or proposed by the Securities and Exchange Commission (“SEC”), new listing standards of Nasdaq, and provisions of the Sarbanes-Oxley Act. As a result of this review and in anticipation of final adoption of new rules and a number of other emerging best practices, we have implemented the following:

Director Independence

- We have confirmed that a majority of our directors are independent as defined by currently available SEC and NASDAQ regulations.

- The Company’s independent directors have commenced holding formal meetings convened separately from management and chaired by an independent director.

15

- Audit and compensation committees consist solely of independent directors, and the nominating and governance committee consists solely of outside directors, a majority of whom are also independent.

Audit Committee

- All audit committee members possess the required level of financial literacy.

- The audit committee charter has been amended to formalize and make explicit the following:

- The audit committee’s ability to retain independent consultants and experts as it sees fit, at Company expense

- The audit committee’s right to appoint, review and assess the performance of our independent auditors

- The audit committee’s ability to hold regular executive sessions with our independent auditors, the Company controller, and other Company officers directly, as it considers appropriate

- The audit committee’s requirement to review and approve non-audit services by our independent auditors, as well as related party transactions

- The audit committee’s duty to establish a formal complaint monitoring procedure (whistleblower policy) to enable confidential and anonymous reporting to the audit committee

- The audit committee’s authority over independent auditors rotation policy

Other Governance Matters

- We have established a formal Code of Business Conduct and Ethics which applies to all officers, directors and employees

- We have established a requirement that any waiver of an amendment to the Code of Business Conduct and Ethics involving a director or officer be reviewed by the nominating and governance committee and disclosed to our shareholders

- We have adopted an updated Insider Trading Policy including new control procedures which comply with current SEC and Nasdaq regulations

- We have established a policy whereby directors will automatically submit a letter of resignation from the Board upon significant change in employment

- We have established a policy to ensure procedures whereby the Board will review its own performance on an annual basis

- The Company has prohibited loans to our officers and directors

More details on our corporate governance initiatives, including copies of our Code of Business Conduct and Ethics and our committee charters can be found in the “Corporate Governance” section of our web site at http://www.cellgenesys.com.

CERTAIN TRANSACTIONS

In September 1996, while a director of Somatix Therapy Corporation, Dr. Verma received a $400,000 loan from Somatix Therapy Corporation, secured by his shares of Somatix common stock. Cell Genesys assumed Dr. Verma’s loan following its acquisition of Somatix. A portion of Dr. Verma’s shares of common stock in Cell Genesys secured the loan following the acquisition. The loan bore an interest rate of 8.5 percent per annum and was due and payable in full on September 1, 2002. In July 2002, the Company forgave the remaining balance of $100,000 of the loan as recognition of Dr. Verma’s service to the Company. The Company retains certain directors, from time to time, under scientific consulting agreements. During 2002, Dr. Verma earned $100,000 pursuant to such a consulting agreement, approximately $9,000 of which was applied to the payment of interest on his loan from the Company, described above.

Dr. Potts, Dr. Shenk and Dr. Verma serve on the Company’s Scientific Advisory Board. The Company provides a stock option grant of 2,500 shares annually, vesting 100 percent on the date of grant, to each non-employee member of the Scientific Advisory Board. Additionally, Dr. Potts serves as liaison between the Company’s Medical Advisory Board and the board of directors; he does not receive additional compensation for this service.

16

REPORT OF THE COMPENSATION COMMITTEE

Decisions regarding compensation of the Company’s executive officers are made by the compensation committee of the board of directors (the “Compensation Committee”). The Compensation Committee is comprised of three independent directors, Mr. Carter, Dr. Potts and Mr. Step. The Compensation Committee is responsible for setting compensation policy and determining the annual compensation of the executive officers of the Company, including base salaries, bonuses, if any, and stock options. Periodically, including during 2002, an outside compensation expert is retained to thoroughly review certain aspects of the Company’s compensation policy and practice relative to the competitive environment. The Company’s executive pay programs are designed to attract and retain executives who will contribute to the Company’s long-term success, to reward executives for achieving both short- and long-term goals of the Company, to link executive and stockholder interests through equity-based compensation plans, and to provide a compensation package that recognizes both individual contributions and company performance. A substantial portion of each executive’s total compensation is intended to be variable and to relate to, and be contingent upon, performance. The Compensation Committee evaluates the performance and determines the compensation of the chief executive officer and other executive officers of the Company annually, based upon individual performance and the achievement of corporate goals.

General Compensation Policy

Cell Genesys’ executive compensation programs seek to accomplish several major goals:

- To recruit and retain highly qualified executive officers by offering overall compensation that is competitive with that offered for comparable positions in companies in the biotechnology industry of comparable size and at a comparable stage of development;

- To motivate executives to achieve important business and performance objectives and to reward them when such objectives are met; and

- To align the interests of executive officers with the long-term interests of stockholders through participation in the Company’s stock option plan.

The achievement of these goals is based on a mix of compensation elements, as described below:

Base Salary:Base salaries for all employees, including executive officers, are determined based on an established job grade and salary matrix that is designed to provide a base salary that is competitive with comparable companies. In monitoring the job grade and salary matrix, the Compensation Committee compared compensation information derived from surveys including compensation levels for companies of similar size and stage of development. Included in the survey are some, but not all, of the companies included in the Nasdaq Pharmaceutical Index, with the primary focus on biotechnology companies at a similar stage in the San Francisco Bay Area which may compete for the same pool of employees. The assessment confirmed that Cell Genesys’ base compensation was comparable to the industry averages.

Adjustments to each individual’s base salary, including executive officers, are made in connection with annual performance reviews. The amounts of such increases are calculated using merit increase guidelines based on the employee’s position within the relevant compensation range and the results of their performance review. The recommended percentage increases are adjusted annually to reflect the Compensation Committee’s assessment of appropriate salary adjustments given the results of competitive surveys and general economic conditions.

Performance-Based Incentive Plan:Officers and other key employees may earn an annual bonus, set as a percentage of base salary, based on the achievement of individual objectives and corporate goals. Corporate goals are established at the start of each year by the Compensation Committee in conjunction with the full board of directors. Awards made to executive officers are based upon the achievement of corporate goals as well as the department goals of the individual officers. These goals may include progress made in preclinical programs and clinical trials, strategic alliances, financing activities and the financial results of Cell Genesys. Cell Genesys’ compensation policy with respect to annual bonus was also compared to relevant market data and found to be comparable to industry averages. From time to time the Compensation Committee may elect to defer an annual cash bonus and employ increased stock-based compensation in order to conserve the Company’s financial resources and retain key employees and align the interests of the employees with those of the stockholders.

Stock-Based Incentive Compensation:Stock options enable Cell Genesys to provide long-term incentives to its employees, which align the interests of all employees, including the executive officers, with those of the stockholders.

17

Options are exercisable in the future at the fair market value at the time of grant, so that an option holder is rewarded only by the appreciation in price of the Cell Genesys common stock. Stock options are granted upon commencement of employment and generally have a four-year vesting period and expire 10 years after the date of grant. Periodic grants of stock options are generally made annually to all eligible employees based on performance, with additional grants made to certain employees following a significant change in job responsibility, scope or title. Guidelines for the number of options granted to each eligible employee are determined by the Compensation Committee based on several factors, including a valuation analysis reflecting market-based compensation, salary grade and the performance of each participant. The size of the resulting grants developed under this procedure are targeted to be at or above competitive levels as a reflection of both providing an incentive for favorable performance of Cell Genesys, as well as the risk attached to the future growth of the biotechnology industry.

CEO Compensation

Dr. Sherwin’s compensation for fiscal 2002 is consistent with the compensation policy of Cell Genesys described above and the Compensation Committee’s evaluation of his overall leadership and management of the Company. Fiscal 2002 was a year of significant accomplishment for Cell Genesys both with respect to product development and business activities. Under Dr. Sherwin’s leadership, Cell Genesys made significant progress in each of its clinical and preclinical programs, including trials of GVAXt prostate cancer vaccine, GVAXt lung cancer vaccine, GVAXt pancreatic cancer vaccine and its oncolytic virus therapy programs in prostate cancer and bladder cancer. Additionally, the Company expanded its patent position related to the Company’s proprietary oncolytic virus therapies through issuance of a broad patent that includes specific composition of matter claims covering adenovirus-derived oncolytic viruses. During 2002, the Company significantly expanded its manufacturing facilities with the completion of construction of its facility in Hayward, California and a new facility dedicated to patient-specific GVAXt cancer vaccines in Memphis, Tennessee. The Company’s GVAXt vaccine collaboration, together with other collaborations in gene therapy and the Company’s gene activation licensing program, contributed to approximately $39 million in revenues during 2002 and a year-end cash balance of approximately $167 million. Throughout 2002, Dr. Sherwin has strived to ensure that Cell Genesys’ assets were utilized effectively and to their best advantage while continuing to optimally manage Cell Genesys’ financial resources. Dr. Sherwin’s compensation during 2002 reflects his leadership, management and the achievements of Cell Genesys during 2002.

Compliance with Internal Revenue Code Section 162(m)

As a result of Section 162(m) of the Internal Revenue Code, which was enacted into law in 1993, the Company may not take a federal income tax deduction for compensation paid to certain executive officers, to the extent that compensation exceeds $1 million for any officer in any one year. This limitation became effective for each year beginning after December 31, 1993 and applies to all compensation paid to the covered executive officers which is not considered to be performance-based. Compensation that does qualify as performance-based compensation will not have to be taken into account for purposes of this limitation.

The cash compensation paid to the Company’s executive officers during 2002 did not exceed the $1 million limit for any executive officer, nor is the cash compensation to be paid to the Company’s executive officers for 2003 expected to reach that level. Because it is unlikely that the cash compensation payable to any of the Company’s executive officers in the foreseeable future will approach the $1 million limitation, the Compensation Committee has decided not to take any action at this time to limit or restructure the elements of cash compensation payable to the Company’s executive officers. The Committee will reconsider this decision should the individual compensation of any executive officer approach the $1 million level.

The foregoing report has been submitted by the undersigned in our capacity as members of the Compensation Committee of the Company’s board of directors.

| | MEMBERS OF THE COMPENSATION COMMITTEE David W. Carter

John T. Potts, Jr., M.D.

Eugene L. Step |

18

AUDIT COMMITTEE REPORT

The audit committee of the board of directors (the “Audit Committee”) is composed of directors Messrs. Gower and Step and Ms. Crowell, none of whom is or has been an officer or employee of the Company. The primary role of the Audit Committee is to provide oversight and monitoring of Company management and the independent auditors and their activities with respect to the Company’s financial reporting process. The board of directors has determined that each member of the Audit Committee is “independent” as defined in the listing standards of the National Association of Securities Dealers. The board of directors has adopted a written charter for the Audit Committee, a copy of which is included as Appendix A to the Company’s proxy statement distributed in connection with the Company’s 2003 Annual Meeting of Stockholders. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the committee under generally accepted auditing standards, including the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). In addition, the Audit Committee has received the written disclosures and the letter from the independent auditors required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with the independent auditors the auditors’ independence from management and the Company.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for the audit. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting. The Audit Committee has recommended, subject to stockholder approval, the selection of the Company’s independent auditors. This recommendation was based on a variety of factors, including a review of the qualifications of Ernst & Young LLP’s engagement team, the quality control procedures the firm has established, and any issues raised by the most recent quality control review of the firm, as well as its reputation for integrity and competence in the fields of accounting and auditing. The Audit Committee considered whether the provision of non-audit services provided by Ernst & Young LLP is compatible with maintaining Ernst & Young LLP’s independence and has discussed with Ernst & Young LLP the auditors’ independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the board of directors (and the board of directors has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission.

The foregoing report has been submitted by the undersigned in our capacity as members of the Audit Committee of the Company’s board of directors

| | MEMBERS OF THE AUDIT COMMITTEE Nancy M. Crowell

James M. Gower

Eugene L. Step |

19

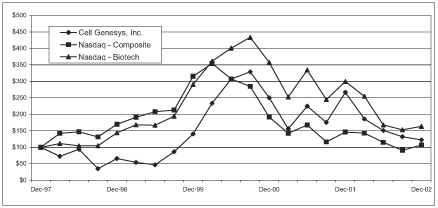

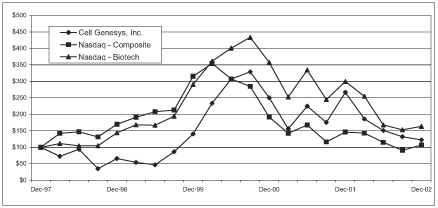

Stockholder Return Comparison

The graph below compares the cumulative total return on the Company’s common stock for fiscal years 1998 to 2002 compared to the CRSP Total Return Index for the Nasdaq Composite and the CRSP Total Return Index for the Nasdaq Biotechnology Stocks. The stock price performance shown on the graph below is not necessarily indicative of future price performance.

Comparison of Cumulative Stockholder Return*

* Assumes $100 invested on December 31, 1997 in the Company’s common stock and in each index listed above. The total return for the Company’s common stock and the indices used assumes the reinvestment of dividends, even though dividends have never been declared on the Company’s common stock.

20

OTHER MATTERS

The Company knows of no other matters to be submitted at the Annual Meeting. If any other matters properly come before the meeting, it is the intention of the persons named in the enclosed proxy to vote the shares they represent as the board of directors may recommend.

It is important that your shares be represented at the meeting, regardless of the number of shares that you hold. Please complete, date, execute and return, at your earliest convenience, the accompanying proxy card in the envelope which has been enclosed.

Dated: April 30, 2003

21

APPENDIX A

Cell Genesys, Inc.

Audit Committee Charter

The Audit Committee (“the Committee”) of the Board of Directors (“the Board”) of Cell Genesys, Inc. (“the Company”) will have the oversight responsibility, authority and specific duties as described below.

COMPOSITION

The Committee members will be appointed by, and will serve at the discretion of, the Board of Directors. The Committee will consist of at least three members of the Board of Directors. Members of the Committee must meet the following criteria (as well as any criteria required by the Securities and Exchange Commission (the “SEC”)):

1.

| Each member will be an independent director, as defined in (i) Nasdaq Rule 4200 and (ii) the rules of the SEC; and

|

| 2. | All Committee members shall be financially literate, and at least one member shall be an “audit committee financial expert,” as defined by and in compliance with the deadlines set forth in SEC and Nasdaq regulations. |

RESPONSIBILITY

The Committee is a part of the Board. Its primary function is to assist the Board in fulfilling its oversight responsibilities with respect to (i) the annual financial information and required reports to be provided to shareholders and the SEC; (ii) the system of internal controls that management has established; (iii) the appointment, compensation and oversight of the Company’s auditors and the external audit process; and (iv) establishing procedures for receiving and reviewing accounting related complaints and concerns by whistleblowers. In addition, the Committee provides an avenue for communication among the independent accountants, financial management and the Board. The Committee should have a clear understanding with the independent accountants that they must maintain an open and transparent relationship with the Committee, and that the ultimate accountability of the independent accountants is to the Committee. The Committee will make regular reports to the Board concerning its activities.

While the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Nor is it the duty of the Committee to conduct investigations, to resolve disagreements, if any, between management and the independent auditor or to assure compliance with laws and regulations and the Company’s business conduct guidelines. It is the responsibility of management to prepare financial statements which are complete and accurate and in accordance with generally accepted accounting principles and the rules and regulations of the SEC. It is the responsibility of the independent auditors to plan and perform the audit to obtain reasonable assurance about whether the annual financial statements are free of material misstatement, and to review the Company’s unaudited interim financial statements.

AUTHORITY

In discharging its duties, the Committee is granted the authority to investigate any matter or activity involving financial accounting and financial reporting, as well as the internal controls of the Company. In that regard, the Committee will have the authority to approve, at the Company’s expense, the retention of external professionals, including independent counsel and such advisors as it deems appropriate, to render advice and counsel in such matters. All employees will be directed to cooperate with respect thereto as requested by members of the Committee.

MEETINGS

The Committee is to meet at least four times annually and as many additional times as the Committee deems necessary. The Committee is to meet in separate executive sessions with the chief financial officer and independent accountants at least once each year and at other times when considered appropriate.

A-1

ATTENDANCE

Committee members will strive to be present at all meetings. As necessary or desirable, the Committee Chair may request that members of management and representatives of the independent accountants be present at Committee meetings.

SPECIFIC DUTIES

In carrying out its oversight responsibilities, the Committee will:

1.

| Review and reassess the adequacy of this charter annually and recommend any proposed changes to the Board for approval. This should be done in compliance with applicable Nasdaq and/or SEC Audit Committee requirements.

|

2.

| Oversee compliance with the requirements of the SEC for disclosure of auditor’s services.

|

3.

| Review with the Company’s management and independent accountants the Company’s accounting and financial reporting controls. Review with the independent accountants whether any matters came to their attention related to significant deficiencies in the design of internal control that, in their judgment, could adversely affect the Company’s ability to record, process, summarize, and report financial data consistent with the assertions of management in the financial statements.

|

4.

| Review with the Company’s management and independent accountants significant accounting and reporting principles and sensitive accounting estimates applied by the Company in preparing its financial statements. Discuss with the independent accountants their judgments about the quality, not just the acceptability, of the Company’s accounting principles used in financial reporting.

|

5.

| Review the scope and general extent of the independent accountants’ annual audit. The Committee’s review should include an explanation from the independent accountants of the factors considered by the accountants in determining the audit scope, including the major risk factors. The independent accountants should confirm to the Committee that no limitations have been placed on the scope or nature of their audit procedures. The Committee will review annually the adequacy of staffing and the fee arrangement with the independent accountants. The Committee shall pre-approve all audit and non-audit services provided by the independent auditors and shall not engage the independent auditors to perform the specific non-audit services proscribed by law or regulation. The Committee may delegate pre-approval authority to a member of the audit committee. The decisions of any Committee member to whom pre-approval authority is delegated must be presented to the full Committee at its next scheduled meeting. In addition, the Committee shall pre-approve any transactions between the Company and its related parties.

|

6.

| Inquire as to the independence of the independent accountants and obtain from the independent accountants, at least annually, a formal written statement delineating all relationships between the independent accountants and the Company as contemplated by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees.

|

7.

| Have a predetermined arrangement with the independent accountants that they will advise the Committee through its Chair and management of the Company of any matters identified through procedures followed for interim quarterly financial statements, and that such notification is to be made prior to the related press release or, if not practicable, prior to filing Forms 10-Q.

|

8.

| At the completion of the annual audit, review with management and the independent accountants the following:

|

–

| The annual financial statements and related footnotes and financial information to be included in the Company’s annual report to shareholders and on Form 10-K.

|

–

| Results of the audit of the financial statements and the related report thereon and, if applicable, a report on changes during the year in accounting principles and their application.

|

–

| Significant changes to the audit plan, if any, and any serious disputes or difficulties with management encountered during the audit. Inquire about the cooperation received by the independent accountants during their audit, including access to all requested records, data and information. Inquire of the independent accountants whether there have been any disagreements with management which, if not satisfactorily resolved, would have caused them to issue a nonstandard report on the Company’s financial statements.

|

A-2

–

| All material alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, including the ramifications of the use of such alternative treatments and disclosures and the treatment preferred by the independent auditor, and other material written communications between the independent auditor and management.

|

–

| Other communications as required to be communicated by the independent accountants by Statement of Auditing Standards (SAS) 61 as amended by SAS 90 relating to the conduct of the audit. Further, receive communication provided by the independent accountants concerning their judgment about the quality of the Company’s accounting principles, as outlined in SAS 61 as amended by SAS 90, and whether or not they object to the application of management’s judgments and estimates to significant accounting principles.

|

| | If deemed appropriate after such review and discussion, recommend to the Board that the financial statements be included in the Company’s annual report on Form 10-K.

|

9.

| After preparation by management and review by independent accountants, approve the report required under SEC rules to be included in the Company’s annual proxy statement. The charter is to be published as an appendix to the proxy statement at least every three years.

|

10.

| Discuss with the independent accountants the quality of the Company’s financial and accounting personnel. Also, elicit the comments of management regarding the responsiveness of the independent accountants to the Company’s needs.

|

11.

| Meet with management and the independent accountants to discuss any relevant significant recommendations that the independent accountants may have, particularly those characterized as material weaknesses or significant deficiencies. Typically, such recommendations will be presented by the independent accountants in the form of a Letter of Comments and Recommendations to the Committee. The Committee should review responses of management to the Letter of Comments and Recommendations from the independent accountants and receive follow-up reports on action taken concerning the aforementioned recommendations.

|

12.

| Have exclusive authority over the selection, retention or termination of the Company’s independent accountants, including a policy or plan for independent auditor rotation as deemed appropriate.

|

13.

| Review with management and the independent accountants the methods used to establish and monitor the Company’s policies with respect to unethical or illegal activities by Company employees that may have a material impact on the financial statements.

|

14.

| Establish procedures for receiving, retaining and treating complaints received by the Company regarding accounting, internal accounting controls or auditing matters and procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

|

15.

| As the Committee may deem appropriate, obtain, weigh and consider expert advice as to Audit Committee related rules of Nasdaq, Statements on Auditing Standards and other accounting, legal and regulatory provisions.

|

16.

| Regularly review its structure, processes and membership requirements.

|

A-3

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

CELL GENESYS, INC.

2003 ANNUAL MEETING OF STOCKHOLDERS

JUNE 12, 2003

The undersigned stockholder of Cell Genesys, Inc., a Delaware corporation (the “Company”), hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement, each dated April 30, 2003, and hereby appoints Stephen A. Sherwin, M.D. and Matthew J. Pfeffer, and each of them, proxies and attorneys-in-fact, with full power to each of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the 2003 Annual Meeting of Stockholders (the “Annual Meeting”) of Cell Genesys, Inc. to be held on Thursday, June 12, 2003 at 10:00 a.m., local time, at the Company's offices at 500 Forbes Boulevard, South San Francisco, California 94080, and at any adjournments thereof, and to vote all shares of Common Stock which the undersigned is entitled to vote on the matters set forth on the reverse side.

| |

|

SEE REVERSE

SIDE | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | SEE REVERSE

SIDE |

| |

|

CELL GENESYS, INC.

C/O EQUISERVE

ATTN: DEBRA LEWIS

150 ROYALL STREET

CANTON, MA 02021 | VOTE BY INTERNET - www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site. You will be prompted to enter your 12-digit Control Number which is located below to obtain your records and to create an electronic voting instruction form.

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call. You will be prompted to enter your 12-digit Control Number which is located below and then follow the simple instructions the Vote Voice provides you.

VOTE BY MAIL

Mark, sign, and date your proxy card and return it in the postage-paid envelope we have provided or return it to Cell Genesys, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. |

| | | |