UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: | 811-06120 |

| |

Exact name of registrant as specified in charter: | Aberdeen Israel Fund, Inc. |

| |

Address of principal executive offices: | 1735 Market Street, 32nd Floor Philadelphia, PA 19103 |

| |

| |

Name and address of agent for service: | Ms. Andrea Melia Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 |

| |

Registrant’s telephone number, including area code: | 866-839-5205 |

| |

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | December 31, 2011 |

Item 1. Reports to Stockholders.

Closed-end funds have a one-time initial public offering and then are subsequently traded on the secondary market through one of the stock exchanges. The investment return and principal value will fluctuate so that an investor’s shares may be worth more or less than the original cost. Shares of closed-end funds may trade above (a premium) or below (a discount) the net asset value (NAV) of the fund’s portfolio. Past performance does not guarantee future results. Foreign securities are more volatile, harder to price and less liquid than U.S. securities. These risks may be enhanced in emerging market countries. Concentrating investments in a single country, region or industry may subject a fund to greater price volatility and risk of loss than more diverse funds. Investors should consider a fund’s investment objectives, risks, charges and expenses carefully before investing. A copy of the prospectus for Aberdeen Australia Equity Fund, Inc., Aberdeen Chile Fund, Inc. and Aberdeen Global Income Fund, Inc. that contains this and other information about the fund may be obtained by calling 866-839-5205. Please read the prospectus carefully before investing. Investing in funds involves risk, including possible loss of principal. Aberdeen Asset Management Inc., 1735 Market Street, 32nd Floor, Philadelphia, PA 19103. NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

Letter to Shareholders (unaudited)

Dear Shareholder,

We present this Annual Report which covers the activities of Aberdeen Israel Fund, Inc. (the “Fund”) for the twelve-month period ended December 31, 2011. The Fund’s principal investment objective is to seek long-term capital appreciation by investing primarily in equity securities of Israeli companies.

Net Asset Value Performance

For the year ended December 31, 2011, the total return to shareholders of the Fund based on the net asset value (“NAV”) of the Fund was (19.7)%, assuming reinvestment of dividends, versus a return of (26.0)% for the Fund’s benchmark, the TA-100 Index.

Share Price Performance

For the year ended December 31, 2011, based on market price, the Fund’s total return was (20.9)%, assuming reinvestment of dividends. The Fund’s share price decreased 26.7% over the twelve month period from $17.40 on December 31, 2010 to $12.75 on December 31, 2011. The Fund’s share price on December 31, 2011 represented a discount of 12.7% to the NAV per share of $14.60 on that date, compared with a discount of 11.3% to the NAV per share of $19.62 on December 31, 2010. As of February 21, 2012, the share price was $13.40, representing a discount of 13.0% to the NAV per share of $15.41.

Termination of Sub-Advisory Agreement

Aberdeen’s investment philosophy with respect to equity investing is based on the belief that strong long term returns are achieved by identifying and buying high quality stocks at reasonable valuations and holding them for the long term. Aberdeen identifies good companies from rigorous first hand research with intensive on-going scrutiny at the company level. Since taking over as investment adviser to the Fund in July 2009, Aberdeen has continued to develop research coverage in the Israeli region and now has appropriate resources and expertise to manage the Fund without the assistance of Analyst Exchange and Trading Services, Ltd. (“Analyst Exchange”) as sub-adviser going forward.

On December 7, 2011, the Fund and Aberdeen Asset Management Investment Services Limited announced the termination of the Sub-Advisory Agreement with Analyst Exchange effective February 4, 2012.

Market Review

Israeli equities fell sharply in 2011, with the benchmark TA-100 Index falling by 26% in U.S. Dollar terms. The biggest decline coincided with the end of the U.S.’ second round of quantitative easing in August.

Subsequently, the Israel equity market suffered from substantial volatility.

Sentiment was buffeted by external headwinds, which included Europe’s ongoing sovereign debt crisis, the unprecedented downgrade of US sovereign debt rating, worries over a double dip recession in the West and fears that Asia’s growth could stall in the wake of China’s aggressive credit curbs, as well as political changes sweeping the Middle East and North Africa region. Within Israel, consumer confidence was shaken by the high costs of living which led to widespread social protests.

These factors, however, were counterbalanced by the domestic economy’s strong expansion. Year-on-year GDP expanded by 4.8%, even as growth tapered off in the last quarter. Unemployment fell to 5.7%, the lowest in 20 years. Inflation peaked in the first-half of the year and eased significantly towards the end, falling within the central bank’s target range. S&P also upgraded Israel’s sovereign credit rating by a notch to A+.

With regard to the Fund’s private equity holdings, the twelve months ended December 2011 have been a volatile period for Israel’s technology sector. The values of the Fund’s underlying investments have decreased as a result of writedowns of investment values. Some markdowns were the result of financings done at lower valuations or markdowns driven by valuation criteria. We also saw a slowdown in capital call and an increase in distribution activities. For the period of January through December 2011, the Fund received distributions from limited partnerships totaling $699,264, compared to a total of $163,473 during the same period of 2010. The largest distribution in 2011 came from Concord Ventures II in the amount of $299,477, composed mainly of distribution proceeds from the sale of Wintegra. There were no capital calls in the twelve months ended December 2011 compared to $52,063 of capital calls made during the same period of the prior year. The unfunded commitments of the Fund have remained unchanged at $940,620 in December 31, 2011.

Outlook

A difficult year lies ahead as the fundamental problems that have beset the global economy and equity markets still prevail. Europe’s debt crisis remains unresolved, while growth remains shaky in the U.S., despite tentative signs of economic recovery.

Israel’s long-term prospects remain intact, however, in spite of these challenges. Its resilient economy is backed by a stable banking system and the timely and targeted action of policymakers.

| Aberdeen Israel Fund, Inc. | 1 |

Letter to Shareholders (unaudited) (concluded)

February 21, 2012

Investor Relations Information

For information about the Fund, daily updates of share price, NAV and details of recent distributions, please contact Aberdeen Asset Management Inc. by:

· Calling toll free at 1-866-839-5205 in the United States,

· Emailing InvestorRelations@aberdeen-asset.com, or

· Visiting the website at www.aberdeenisl.com.

For additional information about Aberdeen Closed-End Funds, please visit our Closed-End Investor Center at www.aberdeen-asset.us/cef.

From the site you will also be able to review performance, download literature and sign up for email services. The site houses topical information about the funds, including fact sheets from Morningstar that are updated daily and monthly manager reports. If you sign up for our email service online, we can ensure that you will be among the first to know about Aberdeen’s latest closed-end fund news.

Included within this report is a reply card with postage paid envelope. Please complete and mail the card if you would like to be added to our enhanced email service and receive future communications from Aberdeen.

Yours sincerely,

Christian Pittard

President

2 | Aberdeen Israel Fund, Inc. | |

Dividend Reinvestment and Direct Stock Purchase Plan

The Fund has a Dividend Reinvestment and Direct Stock Purchase Plan (the “Plan”), which is sponsored and administered by Computershare Trust Company, N.A., the Fund’s transfer agent.

The Plan allows registered stockholders and first time investors to buy and sell shares and automatically reinvest dividends and capital gains through our transfer agent. This is a cost-effective way to invest in the Fund.

Please note that for both purchases and reinvestment purposes, shares will be purchased in the open market at the current share price and cannot be issued directly by the Fund.

For more information about the Plan and a brochure that includes the terms and conditions of the Plan, please call Computershare at 1-800-647-0584 or visit www.computershare.com/buyaberdeen.

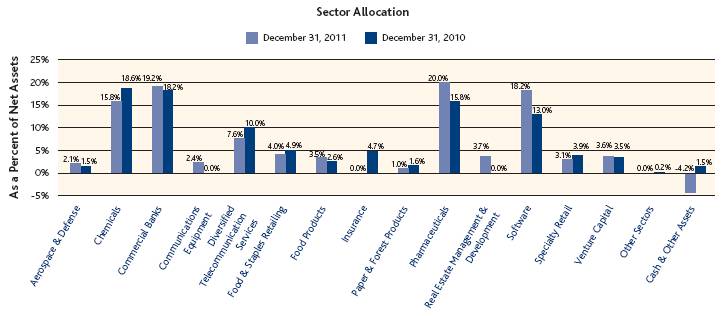

Portfolio Summary (unaudited)

December 31, 2011

| Aberdeen Israel Fund, Inc. | 3 |

Portfolio Summary (unaudited) (continued)

December 31, 2011

Top 10 Holdings, by Issuer (unaudited)

December 31, 2011

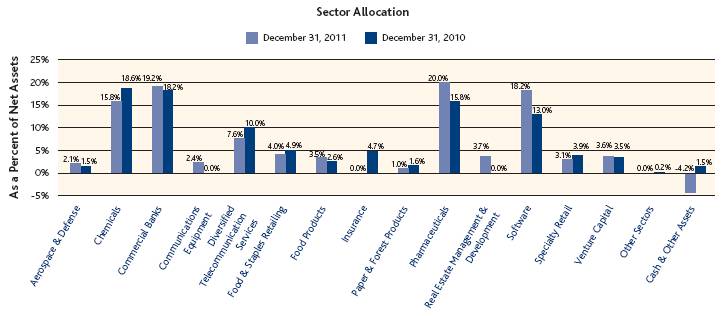

Holding | | | Sector | | Percent of Net Assets | |

1. | | Check Point Software Technologies Limited | | Software | | 14.3% | |

2. | | Perrigo Co. | | Pharmaceuticals | | 10.7% | |

3. | | Teva Pharmaceutical Industries Limited | | Pharmaceuticals | | 9.3% | |

4. | | Mizrahi Tefahot Bank Limited | | Commercial Banks | | 9.2% | |

5. | | Israel Chemicals Limited | | Chemicals | | 8.8% | |

6. | | Bezeq Israeli Telecommunication Corp. Limited | | Diversified Telecommunication Services | | 7.6% | |

7. | | Bank Leumi Le-Israel | | Commercial Banks | | 4.9% | |

8. | | Frutarom Industries Limited | | Chemicals | | 4.3% | |

9. | | Shufersal Limited | | Food & Staples Retailing | | 4.0% | |

10. | | Azrieli Group | | Real Estate Management & Development | | 3.7% | |

Average Annual Returns (unaudited)

December 31, 2011

| | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Net Asset Value (NAV) | | (19.65)% | | 21.27% | | 3.77% | | 7.48% | |

Market Value | | (20.88)% | | 20.41% | | 0.84% | | 8.15% | |

Aberdeen Asset Management Investment Services Limited has voluntarily waived fees and/or reimbursed expenses, without which performance would be lower. Waivers and/or reimbursements are subject to change and may be discontinued at any time. Returns represent past performance. Total investment return at net asset value is based on changes in the net asset value of Fund shares and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the Fund’s dividend reinvestment program. Total investment return at market value is based on changes in the market price at which the Fund’s shares traded on the stock exchange during the period and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the Fund’s dividend reinvestment program. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on market price and NAV. Past performance is no guarantee of future results. The current performance of the Fund may be lower or higher than the figures shown. The Fund’s yield, return, market price and NAV will fluctuate. Performance information current to the most recent month-end is available by calling 866-839-5205.

The annualized gross expense ratio is 1.83%. The annualized net expense ratio after fee waivers and/or expense reimbursements is 1.60%.

4 | Aberdeen Israel Fund, Inc. | |

Portfolio of Investments

December 31, 2011

No. of

Shares | | Description | | Value | |

EQUITY SECURITIES—104.2% | | | |

ISRAEL—103.9% | | | |

AEROSPACE & DEFENSE—2.1% | | | |

32,000 | | Elbit Systems Limited(a) | | $ 1,317,573 | |

CHEMICALS—15.8% | | | |

301,000 | | Frutarom Industries Limited(a) | | 2,684,299 | |

526,500 | | Israel Chemicals Limited(a) | | 5,483,105 | |

2,705 | | The Israel Corp. Limited(a) | | 1,694,091 | |

| | | | 9,861,495 | |

COMMERCIAL BANKS—19.2% | | | |

525,000 | | Bank Hapoalim Limited(a) | | 1,716,726 | |

1,057,000 | | Bank Leumi Le-Israel(a) | | 3,035,341 | |

168,000 | | First International Bank of Israel Limited(a)(b) | | 1,504,425 | |

718,900 | | Mizrahi Tefahot Bank Limited(a) | | 5,708,502 | |

| | | | 11,964,994 | |

COMMUNICATIONS EQUIPMENT—2.4% | | | |

110,000 | | Ituran Location & Control Limited(a) | | 1,515,760 | |

DIVERSIFIED TELECOMMUNICATION SERVICES—7.6% | | | |

2,591,000 | | Bezeq Israeli Telecommunication Corp. Limited(a) | | 4,754,453 | |

FOOD & STAPLES RETAILING—4.0% | | | |

703,143 | | Shufersal Limited(a) | | 2,478,955 | |

FOOD PRODUCTS—3.5% | | | |

147,000 | | Osem Investments Limited(a) | | 2,151,550 | |

PAPER & FOREST PRODUCTS—1.0% | | | |

15,637 | | Hadera Paper Limited(a)(b) | | 608,076 | |

PHARMACEUTICALS—20.0% | | | |

68,000 | | Perrigo Co.(a) | | 6,696,700 | |

143,820 | | Teva Pharmaceutical Industries Limited, ADR | | 5,804,575 | |

| | | | 12,501,275 | |

REAL ESTATE MANAGEMENT & DEVELOPMENT—3.7% | | | |

98,000 | | Azrieli Group(a) | | 2,319,325 | |

SOFTWARE—18.2% | | | |

169,853 | | Check Point Software Technologies Limited(b) | | 8,924,077 | |

32,000 | | NICE Systems Limited, ADR(b) | | 1,102,400 | |

83,000 | | Retalix Limited(a)(b) | | 1,348,232 | |

| | | | 11,374,709 | |

SPECIALTY RETAIL—3.1% | | | |

525,500 | | Golf & Co., Limited(a) | | 1,930,216 | |

See Notes to Financial Statements.

| Aberdeen Israel Fund, Inc. | 5 |

Portfolio of Investments (concluded)

December 31, 2011

No. of

Shares | | Description | | Value | |

EQUITY SECURITIES (continued) | | | |

ISRAEL (continued) | | | |

VENTURE CAPITAL—3.3% | | | |

1,250,001 | (c) | ABS GE Capital Giza Fund, L.P.(a)(b)(d)(e) | | $ 85,300 | |

1,674,588 | (c) | BPA Israel Ventures, LLC(a)(b)(d)(e)(f) | | 450,399 | |

2,000,000 | (c) | Concord Ventures Fund II, L.P.(a)(b)(d)(e) | | 71,930 | |

250,440 | (c) | Delta Fund I, L.P.(a)(b)(d)(e) | | 148,678 | |

1,250,000 | (c) | Giza GE Venture Fund III, L.P.(a)(b)(d)(e) | | 236,725 | |

1,000,000 | (c) | K.T. Concord Venture Fund, L.P.(a)(b)(d)(e) | | 42,945 | |

708,684 | (c) | Neurone Ventures II, L.P.(a)(b)(d)(e)(f) | | 112,925 | |

1,000,000 | (c) | Pitango Fund II, LLC(a)(b)(d)(e) | | 85,313 | |

2,001,470 | (c) | SVE Star Ventures Enterprises GmbH & Co. No. IX KG(a)(b)(d)(e) | | 446,428 | |

1,375,001 | (c) | Walden-Israel Ventures III, L.P.(a)(b)(d)(e) | | 384,615 | |

| | | | 2,065,258 | |

| | Total Israel (cost $58,374,285) | | 64,843,639 | |

GLOBAL—0.3% | | | |

VENTURE CAPITAL—0.3% | | | |

2,237,292 | (c) | Emerging Markets Ventures l, L.P. (cost $837,931)(a)(b)(d)(e)(f) | | 149,026 | |

| | Total Equity Securities (cost $59,212,216) | | 64,992,665 | |

| | | | | |

Principal

Amount

(000’s) | | | | | |

SHORT-TERM INVESTMENT—1.4% | | | |

UNITED KINGDOM—1.4% | | | |

$875 | | Bank of America London, overnight deposit, 0.03%, 01/03/12 (cost $875,000) | | 875,000 | |

| | Total Investments—105.6% (cost $60,087,216) | | 65,867,665 | |

| | Liabilities in Excess of Cash and Other Assets—(5.6)% | | (3,480,976 | ) |

| | Net Assets—100.0% | | $62,386,689 | |

(a) Security was fair valued as of December 31, 2011. Security is valued at fair value as determined in good faith by, or under the direction of, the Board of Directors (the “Board”) under procedures established by the Board. (See Note 2).

(b) Non-income producing security.

(c) Represents contributed capital.

(d) Restricted security, not readily marketable. (See Note 7).

(e) Illiquid Security.

(f) As of December 31, 2011, the aggregate amount of open commitments for the Fund is $940,620. (See Note 7).

ADR American Depositary Receipts.

See Notes to Financial Statements.

6 | Aberdeen Israel Fund, Inc. | |

Statement of Assets and Liabilities | | | |

| | | |

As of December 31, 2011 | | | |

| | | |

| | | |

| | | |

Assets | | | |

Investments, at value (Cost $60,087,216) | | $65,867,665 | |

Cash (including $326,127 of foreign currencies with a cost of $332,935) | | 327,116 | |

Israeli tax refunds receivable | | 1,044,296 | |

Dividends receivable | | 1,388 | |

Prepaid expenses | | 6,376 | |

Total assets | | 67,246,841 | |

Liabilities | | | |

Dividends and distributions (Note 2) | | 4,545,460 | |

Investment advisory fees payable (Note 3) | | 153,998 | |

Accrued expenses and other liabilities | | 160,694 | |

Total liabilities | | 4,860,152 | |

| | | |

Net Assets | | $62,386,689 | |

Net Assets consist of | | | |

Capital stock, $0.001 par value (Note 5) | | $ 4,273 | |

Paid-in capital | | 53,720,874 | |

Accumulated net realized gain on investments and foreign currency related transactions | | 2,887,901 | |

Net unrealized appreciation on investments and foreign currency translation | | 5,773,641 | |

Net Assets applicable to shares outstanding | | $62,386,689 | |

Net asset value per share, based on 4,272,691 shares issued and outstanding | | $ 14.60 | |

| | | |

See Notes to Financial Statements. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Aberdeen Israel Fund, Inc. | 7 |

| | |

| | |

| | |

| | | | | |

Statement of Operations | | | |

| | | |

For the Year Ended December 31, 2011 | | | |

| | | |

| | | |

Investment Income | | | |

Income: | | | |

Dividends and other income | | $ 2,368,064 | |

Adjustments for prior year reclaims | | 531,934 | |

Less: Net of current year withholding and reclaims | | (313,829 | ) |

Total investment income | | 2,586,169 | |

Expenses: | | | |

Investment advisory fees (Note 3) | | 880,147 | |

Directors’ fees and expenses | | 110,595 | |

Independent auditor’s fees and expenses | | 77,737 | |

Reports to shareholders and proxy solicitation | | 64,853 | |

Custodian’s fees and expenses | | 64,409 | |

Investor relations fees and expenses (Note 3) | | 57,796 | |

Legal fees and expenses | | 53,937 | |

Transfer agent’s fees and expenses | | 30,135 | |

Administration fees (Note 3) | | 28,171 | |

Insurance expense | | 19,970 | |

Miscellaneous | | 29,382 | |

Total expenses | | 1,417,132 | |

Less: Fee waivers (Note 3) | | (181,823 | ) |

Net expenses | | 1,235,309 | |

| | | |

Net investment income | | 1,350,860 | |

Net Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency Related Transactions | | | |

Net realized gain/(loss) on: | | | |

Investment transactions* | | 5,335,423 | |

Foreign currency transactions | | (51,297 | ) |

Net change in unrealized appreciation/(depreciation) of investments and foreign currency translation | | (23,528,465 | ) |

Net realized and unrealized loss on investments and foreign currency transactions | | (18,244,339 | ) |

Net Decrease in Net Assets Resulting from Operations | | $(16,893,479 | ) |

| | | |

* Includes realized gain distributions from underlying venture capital investments of $473,714. | | | |

| | | |

| | | |

See Notes to Financial Statements. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

8 | Aberdeen Israel Fund, Inc. | |

| | |

| | |

| | |

| | | | | |

Statement of Changes in Net Assets | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | For the Year Ended

December 31,

2011 | | For the Year Ended

December 31,

2010 | |

Increase/(Decrease) in Net Assets | | | | | |

Operations: | | | | | |

Net investment income | | $ 1,350,860 | | $ 1,418,890 | |

Net realized gain on investments and foreign currency related transactions | | 5,284,126 | | 2,268,687 | |

Net change in unrealized appreciation/(depreciation) on investments and foreign currency translations | | (23,528,465 | ) | 11,181,735 | |

Net increase/(decrease) in net assets resulting from operations | | (16,893,479 | ) | 14,869,312 | |

Dividends and distributions to shareholders from: | | | | | |

Net investment income | | (1,304,837 | ) | (1,289,925 | ) |

Net realized gain on investments | | (3,240,623 | ) | — | |

Total dividends and distributions to shareholders | | (4,545,460 | ) | (1,289,925 | ) |

Total increase/(decrease) in net assets | | (21,438,939 | ) | 13,579,387 | |

Net Assets | | | | | |

Beginning of year | | 83,825,628 | | 70,246,241 | |

End of year* | | $62,386,689 | | $83,825,628 | |

| | | | | |

* Includes undistributed net investment income of $0 and $118,849, respectively. |

| | | | | |

| | | | | |

See Notes to Financial Statements. | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Aberdeen Israel Fund, Inc. | 9 |

| | |

| | |

| | |

| | | | | | | |

Financial Highlights

| | For the Fiscal Years Ended December 31, | |

| | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | |

Net asset value, beginning of year | | $19.62 | | $16.44 | | $8.99 | | $20.85 | | $18.51 | |

Net investment income(a) | | 0.32 | | 0.33 | | 0.03 | | 0.20 | | 0.28 | |

Net realized and unrealized gain/(loss) on investments and foreign currency related transactions | | (4.27 | ) | 3.15 | | 7.42 | | (9.83 | ) | 4.26 | |

Net increase/(decrease) in net assets resulting from operations | | (3.95 | ) | 3.48 | | 7.45 | | (9.63 | ) | 4.54 | |

Dividends and distributions to shareholders: | | | | | | | | | | | |

Net investment income | | (0.31 | ) | (0.30 | ) | — | | (0.30 | ) | (0.38 | ) |

Net realized gain | | (0.76 | ) | — | | — | | (1.93 | ) | (1.82 | ) |

Total dividends and distributions to shareholders | | (1.07 | ) | (0.30 | ) | — | | (2.23 | ) | (2.20 | ) |

Net asset value, end of year | | $14.60 | | $19.62 | | $16.44 | | $8.99 | | $20.85 | |

Market value, end of year | | $12.75 | | $17.40 | | $15.14 | | $8.02 | | $23.49 | |

Total Investment Return Based on: | | | | | | | | | | | |

Market value(b) | | (20.88% | ) | 16.88% | | 88.78% | | (57.01% | ) | 38.96% | |

Net asset value | | (19.65% | ) | 21.37% | | 82.87% | | (45.71% | ) | 24.28% | |

Ratio/Supplementary Data | | | | | | | | | | | |

Net assets, end of year (000 omitted) | | $62,387 | | $83,826 | | $70,246 | | $38,382 | | $88,844 | |

Average net assets (000 omitted) | | $77,324 | | $73,076 | | $53,545 | | $76,165 | | $88,234 | |

Ratio of expenses to average net assets(c) | | 1.60% | | 1.67% | | 1.85% | | 1.73% | | 1.71% | |

Ratio of expenses to average net assets, excluding fee waivers | | 1.83% | | 1.91% | | 2.12% | | 2.02% | | 1.99% | |

Ratio of net investment income to average net assets | | 1.75% | | 1.94% | | 0.24% | | 1.14% | | 1.34% | |

Portfolio turnover rate | | 21.89% | | 11.59% | | 49.51% | | 19.43% | | 9.32% | |

(a) | Based on average shares outstanding. |

(b) | Total investment return is calculated assuming a purchase of common stock on the first day and a sale on the last day of each reporting period. Dividends and distributions, if any, are assumed, for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. |

(c) | Ratios reflect actual expenses incurred by the Fund. Amounts are net of fee waivers. |

See Notes to Financial Statements.

10 | Aberdeen Israel Fund, Inc. | |

Notes to Financial Statements

December 31, 2011

1. Organization

Aberdeen Israel Fund, Inc. (the “Fund”), formerly The First Israel Fund, Inc., was incorporated in Maryland on March 6, 1990 and commenced investment operations on October 29, 1992, the Fund is registered under the Investment Company Act of 1940, as amended, as a closed-end, non-diversified management investment company. The Fund trades on the NYSE Amex under the ticker symbol “ISL”.

The Fund seeks long-term capital appreciation by investing primarily in equity securities of Israeli companies.

The Board of Directors of the Fund (the “Board”) has removed the limitation set forth in the Fund’s original prospectus requiring that the portion of the Fund’s investments not invested in Israeli securities be invested in securities of companies that are substantially involved in or with Israel. However, the Fund has adopted a policy to invest under normal circumstances, at least 80% of the value of its assets in investments that are tied economically to Israel.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The financial statements of the Fund are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The U.S. Dollar is used as both the functional and reporting currency.

(a) Security Valuation:

Securities for which market quotations are readily available are valued at current market value as of the “Valuation Time.” The Valuation Time is as of the close of regular trading on the New York Stock Exchange (usually 4:00 p.m. Eastern Time). Equity securities are typically valued at the last quoted sale price. If there is no sale price available, the last quoted mean price provided by an independent pricing service approved by the Board is used. Securities traded on NASDAQ are valued at the NASDAQ official closing price. Prices are taken from the primary market or exchange on which each security trades. Investment companies are valued at net asset value as reported by such company.

Most securities listed on a foreign exchange are valued either at fair value (see description below) or at the last sale price at the close of the exchange on which the security is principally traded. Foreign securities, currencies, and other assets and liabilities denominated in foreign currencies are translated into U.S. Dollars at the exchange rate of said

currencies against the U.S. Dollar, as of the Valuation Time, as provided by an independent pricing service approved by the Board.

Debt and other fixed-income securities (other than short-term obligations) are valued at the last quoted bid price and, for foreign debt securities, at the last quoted bid price by using a combination of daily quotes and matrix evaluations provided by an independent pricing service, the use of which has been approved by the Board. In the event such quotes are not available from such pricing agents, then the security may be priced based on bid quotations from broker-dealers. Short-term debt securities of sufficient credit quality, such as commercial paper and U.S. Treasury Bills having a remaining maturity of 60 days or less at the time of purchase, are valued at amortized cost, which approximates fair value.

Securities for which market quotations are not readily available, or for which an independent pricing service does not provide a value or provides a value that does not represent fair value in the judgment of the Fund’s investment adviser or designee, are valued at fair value under procedures approved by the Board. In addition, fair value determinations are required for securities whose value is affected by a “significant” event that materially affects the value of a domestic or foreign security which occurs subsequent to the time of the close of the principal market on which such domestic or foreign security trades and before the Valuation Time (i.e., a “subsequent event”). Typically, this will involve events occurring after the close of a foreign market on which a security trades and before the next Valuation Time.

The Fund’s equity securities that are traded on a foreign exchange or market which closes prior to the Fund’s Valuation Time are fair valued by an independent pricing service. The fair value of each such security generally is calculated by applying a valuation factor provided by the independent pricing service to the last sales price for that security. If the pricing service is unable to provide a fair value for a security, the security will continue to be valued at the last sale price at the close of the exchange on which it is principally traded, subject to adjustment by the Fund’s Pricing Committee. This fair valuation model takes into account comparisons to the valuation of American Depositary Receipts (ADRs), exchange-traded funds, futures contracts and certain indices. When the fair value prices are utilized, the value assigned to the foreign securities may not be the same as quoted or published prices of the securities on their primary markets.

The Fund values restricted securities at fair value. The Fund’s estimate of fair value assumes a willing buyer and a willing seller neither of whom are acting under the compulsion to buy or sell. Although these securities may be resold in privately negotiated transactions, the prices realized on such sales could differ from the prices originally paid by the Fund or the current carrying values, and the difference could be material.

| Aberdeen Israel Fund, Inc. | 11 |

Notes to Financial Statements (continued)

December 31, 2011

The Fund also invests in venture capital private placement securities, which are classified as Level 3 investments. In determining the fair value of these investments, management uses the market approach which includes as the primary input the capital balance reported; however, adjustments to the reported capital balance may be made based on various factors, including, but not limited to, the attributes of the interest held, including the rights and obligations, and any restrictions or illiquidity of such interests, and the fair value of these venture capital investments.

For the year ended December 31, 2011, there have been no significant changes to the valuation procedures approved by the Board.

The Fund is required to disclose information regarding the fair value measurements of its assets and liabilities. Fair value is defined as the price that the Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment. The disclosure requirements utilize a three-tier hierarchy to maximize the use of observable market data, minimize the use of unobservable inputs and establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable.

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability, which are based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s

own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

Level 1 – quoted prices in active markets for identical securities.

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments, information provided by underlying investee companies such as publicly traded prices, financial statements, capital statements).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Equity securities generally are valued at the last quoted sale price or official closing price reported on the exchange (US or foreign) or over-the-counter market on which they trade and are categorized as Level 1 securities. Securities for which no sales are reported are valued at the last quoted mean price provided by an independent pricing service. For international equity securities traded on a foreign exchange or market which closes prior to the Fund’s Valuation Time, in order to adjust for events which occur between the close of the foreign exchange they are traded on and the close of the New York Stock Exchange, a fair valuation model is used (as described above). This fair valuation model takes into account comparisons to the valuation of American Depository Receipts (ADRs), exchange-traded funds, futures contracts, and certain indices, and these securities are categorized as Level 2.

The following is a summary of the inputs used as of December 31, 2011 in valuing the Fund’s investments carried at value. Refer to the Schedule of Investments for a detailed breakout of the security types:

Investments, at value | | Level 1* | | Level 2* | | Level 3* | | Balance as of

12/31/2011 | |

Aerospace & Defense | | $– | | $1,317,573 | | $– | | $1,317,573 | |

Chemicals | | – | | 9,861,495 | | – | | 9,861,495 | |

Commercial Banks | | – | | 11,964,994 | | – | | 11,964,994 | |

Communications Equipment | | – | | 1,515,760 | | – | | 1,515,760 | |

Diversified Telecommunication Services | | – | | 4,754,453 | | – | | 4,754,453 | |

Food & Staples Retailing | | – | | 2,478,955 | | – | | 2,478,955 | |

Food Products | | – | | 2,151,550 | | – | | 2,151,550 | |

Paper & Forest Products | | – | | 608,076 | | – | | 608,076 | |

Pharmaceuticals | | 5,804,575 | | 6,696,700 | | – | | 12,501,275 | |

12 | Aberdeen Israel Fund, Inc. | |

Notes to Financial Statements (continued)

December 31, 2011

Investments, at value | | Level 1* | | Level 2* | | Level 3* | | Balance as of

12/31/2011 | |

Real Estate Management & Development | | $– | | $2,319,325 | | $– | | $2,319,325 | |

Software | | 10,026,477 | | 1,348,232 | | – | | 11,374,709 | |

Specialty Retail | | – | | 1,930,216 | | – | | 1,930,216 | |

Venture Capital | | – | | – | | 2,214,284 | | 2,214,284 | |

Short-Term Investments | | – | | 875,000 | | – | | 875,000 | |

Total | | $15,831,052 | | $47,822,329 | | $2,214,284 | | $65,867,665 | |

* For the year ended December 31, 2011, there were no transfers in or out of Level 1, Level 2 and Level 3 fair value measurements and no significant changes to the fair valuation methodologies.

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining value:

Investments,

at value | | Balance

as of

12/31/2010 | | Accrued

discounts/

premiums | | Realized

gain/(loss) | | Change in

unrealized

appreciation/

(depreciation) | | Purchases | | Sales | | Transfers

into

Level 3 | | Transfers

out of

Level 3 | | Balance

as of

12/31/2011 | |

Venture Capital | | $2,982,112 | | $– | | $– | | $(542,312) | | $– | | $(225,516) | | $– | | $– | | $2,214,284 | |

Total | | $2,982,112 | | $– | | $– | | $(542,312) | | $– | | $(225,516) | | $– | | $– | | $2,214,284 | |

Change in unrealized appreciation/depreciation relating to investments still held at December 31, 2011 is $(542,312).

(b) Short-Term Investment:

The Fund sweeps available cash into a short-term time deposit available through Brown Brothers Harriman & Co. (“BBH & Co.”), the Fund’s custodian. The short-term time deposit is a variable rate account classified as a short-term investment.

(c) Foreign Currency Transactions:

Foreign currency amounts are translated into U.S. Dollars on the following basis:

(I) | market value of investment securities, other assets and liabilities at the rate of exchange at the Valuation Time; and |

| |

(II) | purchases and sales of investment securities, income and expenses at the relevant rates of exchange prevailing on the respective dates of such transactions. |

The Fund does not isolate that portion of gains and losses on investments in equity securities which is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities. Accordingly, realized and unrealized foreign currency gains and losses with respect to such securities are included in the reported net realized and unrealized gains and losses on investment transactions balances.

The Fund reports certain foreign currency related transactions and foreign taxes withheld on security transactions as components of realized gains for financial reporting purposes, whereas such foreign currency related transactions are treated as ordinary income for U.S. federal income tax purposes.

Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation/depreciation in value of investments, and translation of other assets and liabilities denominated in foreign currencies.

Net realized foreign exchange gains or losses represent foreign exchange gains and losses from transactions in foreign currencies and forward foreign currency contracts, exchange gains or losses realized between the trade date and settlement date on security transactions, and the difference between the amounts of interest and dividends recorded on the Fund’s books and the U.S. Dollar equivalent of the amounts actually received.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin, including unanticipated movements in the value of the foreign currency relative to the U.S. Dollar. Generally, when the U.S. Dollar rises in value against foreign currency, the Fund’s investments

| Aberdeen Israel Fund, Inc. | 13 |

Notes to Financial Statements (continued)

December 31, 2011

denominated in that currency will lose value because its currency is worth fewer U.S. Dollars; the opposite effect occurs if the U.S. Dollar falls in relative value.

(d) Security Transactions and Investment Income:

Securities transactions are recorded on the trade date. Realized and unrealized gains/(losses) from security and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Interest income and expenses are recorded on an accrual basis.

(e) Distributions:

On an annual basis, the Fund intends to distribute its net realized capital gains, if any, by way of a final distribution to be declared during the calendar quarter ending December 31. Dividends and distributions to shareholders are recorded on the ex-dividend date.

Dividends and distributions to shareholders are determined in accordance with federal income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatments for foreign currencies.

(f) Federal Income Taxes:

The Fund intends to continue to qualify as a “regulated investment company” by complying with the provisions available to certain investment companies, as defined in Subchapter M of the Internal Revenue Code, and to make distributions of net investment income and net realized capital gains sufficient to relieve the Fund from all, or substantially all, federal income taxes. Therefore, no federal income tax provision is required.

Pursuant to a ruling the Fund received from the Israeli tax authorities, the Fund, subject to certain conditions, will not be subject to Israeli tax on capital gains derived from the sale of securities listed on the Tel Aviv Stock Exchange (“TASE”). Gains derived from Israeli securities not listed on TASE (unlisted securities) will be subject to a 25% Israeli tax provided the security is an approved investment. Generally, stock of corporations that produce a product or provide a service that support the infrastructure of Israel are considered approved investments. Any gains sourced to unlisted unapproved securities are subject to a 40% Israeli tax and an inflationary tax. For the year ended December 31, 2011, the Fund did not incur any Israeli capital gains taxes. The Fund accrues any capital gains tax estimated to be payable as if the security had been sold at the time unrealized gains are recorded.

Dividends derived from listed or approved Israeli securities are subject to a 20% withholding tax, while dividends from unlisted or unapproved securities are subject to a 25% withholding tax. The Fund accrued for a refund of a portion of these amounts withheld. Interest on debt obligations (whether listed or not) is subject to withholding tax of 25% to 35%. Withholding taxes are accrued when the related income is earned in an amount management believes is ultimately payable after any reclaims of taxes withheld. As of December 31, 2011 the fund has filed the necessary returns with the Israel tax authority to reclaim a portion of the withholding taxes as previous paid in the amount of $1,044,296 as noted in the Statement of Assets and Liabilities.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is ‘‘more likely than not’’ to be sustained assuming examination by tax authorities. Management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Since tax authorities can examine previously filed tax returns, the Fund’s U.S. federal tax returns for each of the four years up to the years ended December 31, 2011 are subject to such review.

(g) Partnership Accounting Policy:

The Fund records its pro-rata share of the income/(loss) and capital gains/(losses) allocated from the underlying partnerships and adjusts the cost of the underlying partnerships accordingly. These amounts are included in the Fund’s Statement of Operations.

3. Agreements and Transactions With Affiliates

(a) Investment Adviser and Sub-Adviser:

Aberdeen Asset Management Investment Services Limited (“AAMISL”) serves as the Fund’s investment adviser with respect to all investments. AAMISL is a direct wholly-owned subsidiary of Aberdeen Asset Management PLC. AAMISL receives as compensation for its advisory services from the Fund, an annual fee, calculated weekly and paid quarterly, equal to 1.30% of the first $50 million of the Fund’s average weekly market value or net assets (whichever is lower), 1.25% on amounts from $50-$100 million, 1.20% on amounts from $100-$150 million, 1.15% on amounts from $150-$200 million and 1.05% for amounts above $200 million. AAMISL has agreed to waive a portion of its advisory fee. For the year ended December 31, 2011, AAMISL earned $880,147 for advisory services to the Fund, of which AAMISL waived $181,823.

Analyst Exchange and Trading Services Ltd. (“Analyst Exchange”) is the sub-adviser to the Fund. Analyst Exchange is paid a fee, out of the

14 | Aberdeen Israel Fund, Inc. | |

Notes to Financial Statements (continued)

December 31, 2011

advisory fee payable to AAMISL, calculated weekly and paid quarterly at an annual rate of 0.30% of the Fund’s average weekly market value or net assets (whichever was lower). In addition, Analyst Exchange is paid a reimbursement by AAMISL for any Israeli Value Added taxes (currently 15.5%) and $25,000 annually to cover expenses incurred in the execution of sub-advisory services. For the year ended December 31, 2011, Analyst Exchange earned $262,045 for sub-advisory services to the Fund. As noted in the “Subsequent Events,” the sub-advisory agreement with Analyst Exchange has been terminated effective February 4, 2012.

Analyst Exchange has certain commercial arrangements with banks and brokers in Israel from which Analyst Exchange receives a portion of the commissions on the Fund’s trades executed in Israel. For the year ended December 31, 2011, no such commissions were received.

(b) Fund Administration:

BBH & Co. is the Administrator for the Fund and certain other funds advised by AAMISL and its affiliates (collectively the “Funds”). The Funds pay BBH & Co. a monthly administration and fund accounting service fee at an annual rate of 0.02% of the Funds’ aggregate assets up to $250 million, 0.015% for the next $250 million and 0.01% in excess of $500 million.

Each Fund pays its pro rata portion of the fee based on its level of assets. For the year ended December 31, 2011, BBH & Co. earned $28,171 from the Fund for administrative and fund accounting services.

(c) Investor Relations:

Under the terms of the Investor Relations Services Agreement, Aberdeen Asset Management Inc. (“AAMI”), an affiliate of AAMISL, provides investor relations services to the Fund and certain other Funds. For the year ended December 31, 2011, the Fund paid fees of approximately $59,575 for investor relations services. Investor relations

fees and expenses in the Statement of Operations include certain out-of-pocket expenses.

(d) Director Purchase Plan:

Fifty percent (50%) of the annual retainer of the Independent Directors is invested in Fund shares and, at the option of each Independent Director, 100% of the annual retainer can be invested in shares of the Fund. During the fiscal year ended December 31, 2011, 2,224 shares were purchased pursuant to the Directors compensation plan. As of December 31, 2011, Directors as a group owned less than 1% of the Fund’s outstanding shares.

4. Investment Transactions

For the year ended December 31, 2011, Fund purchases and sales of securities, other than short-term investments, were $18,274,970 and $16,706,306, respectively.

5. Capital

The authorized capital stock of the Fund is 100,000,000 shares of common stock, $0.001 par value. As of December 31, 2011, the Fund had 4,272,691 shares outstanding.

6. Credit Facility

The Fund renewed its joint credit facility along with certain other Funds. The current facility matures on November 9, 2012. The Funds agreed to a $10 million committed revolving joint credit facility with BBH & Co. for temporary or emergency purposes. Under the terms of the joint credit facility, the Funds pay an aggregate commitment fee on the average unused amount of the credit facility. In addition, the Funds pay interest on borrowings at the Overnight LIBOR rate plus a spread. For the year ended December 31, 2011, the Fund had no borrowings under the joint credit facility.

| | Aberdeen Israel Fund, Inc. | 15 |

Notes to Financial Statements (continued)

December 31, 2011

7. Restricted Securities

Certain of the Fund’s investments are restricted as to resale and are valued at fair value as determined in good faith by, or under the direction of, the Board under procedures established by the Board in the absence of readily ascertainable market values.

Security | | Acquisition Date(s) | | Cost | | Fair Value

At 12/31/11 | | Percent of

Net Assets | | Distributions

Received | | Open

Commitments | |

| | | | | | | | | | | | | |

ABS GE Capital Giza Fund, L.P. | | 02/03/98 – 02/13/02 | | $985,303 | | $85,300 | | 0.14 | | $1,660,765 | | $– | |

BPA Israel Ventures, LLC | | 10/05/00 – 12/09/05 | | 1,160,529 | | 450,399 | | 0.72 | | 97,293 | | 625,412 | |

Concord Ventures Fund II, L.P. | | 09/29/00 – 12/15/06 | | 1,183,141 | | 71,930 | | 0.11 | | 465,568 | | – | |

Delta Fund I, L.P. | | 11/15/00 – 03/28/07 | | 153,322 | | 148,678 | | 0.24 | | 105,209 | | – | |

Emerging Markets Ventures l, L.P. | | 01/22/98 – 01/10/06 | | 837,931 | | 149,026 | | 0.24 | | 2,498,364 | | 262,708 | |

Giza GE Venture Fund III, L.P. | | 01/31/00 – 11/23/06 | | 834,089 | | 236,725 | | 0.38 | | 329,171 | | – | |

K.T. Concord Venture Fund, L.P. | | 12/08/97 – 09/29/00 | | 593,654 | | 42,945 | | 0.07 | | 661,582 | | – | |

Neurone Ventures II, L.P. | | 11/24/00 – 12/21/10 | | 165,528 | | 112,925 | | 0.18 | | 401,834 | | 52,500 | |

Pitango Fund II, LLC | | 10/31/96 – 08/01/01 | | 371,350 | | 85,313 | | 0.14 | | 1,215,237 | | – | |

SVE Star Ventures Enterprises GmbH & Co. No. IX KG | | 12/21/00 – 08/08/08 | | 1,500,361 | | 446,428 | | 0.71 | | 460,338 | | – | |

| | | | | | | | | | | | | |

Walden-Israel Ventures III, L.P. | | 02/23/01 – 10/20/10 | | 845,933 | | 384,615 | | 0.62 | | 1,141,882 | | – | |

Total | | | | $8,631,141 | | $2,214,284 | | 3.55 | | $9,037,243 | | $940,620 | |

The Fund may incur certain costs in connection with the disposition of the above securities.

8. Share Repurchase Program

Effective December 6, 2011, the Board of the Fund authorized management to make open market purchases from time to time in an amount up to 10% of the Fund’s outstanding shares whenever the Fund’s outstanding shares are trading at a discount to net asset value of 12% or more. Open market purchases may also be made within the discretion of management if the discount is less than 12%. The Board has instructed management to report repurchase activity to it regularly, and to post the number of shares repurchased on the funds’s website on a monthly basis. For the period ended December 31, 2011 the Fund did not repurchase any shares.

9. Portfolio Investment Risks

(a) Risks Associated with Foreign Securities and Currencies:

Investments in securities of foreign issuers carry certain risks not ordinarily associated with investments in securities of U.S. issuers. Such risks include, among others, currency risk, information risk and political risk. Currency risk results from securities denominated in currencies other than U.S. Dollars that are subject to changes in value due to fluctuations in exchange rates. Information risk arises with respect to

foreign securities when key information about foreign issuers may be inaccurate or unavailable. Political risk includes future political and economic developments, and the possible imposition of exchange controls or other foreign governmental laws and restrictions. In addition, with respect to certain countries, there is the possibility of expropriation of assets, confiscatory taxation, political or social instability or diplomatic developments, which could adversely affect investments in those countries. Other risks of investing in foreign securities include liquidity and valuation risks.

Certain countries also may impose substantial restrictions on investments in their capital markets by foreign entities, including restrictions on investments in issuers of industries deemed sensitive to relevant national interests. These factors may limit the investment opportunities available and result in a lack of liquidity and high price volatility with respect to securities of issuers from developing countries.

Some countries require governmental approval for the repatriation of investment income, capital or the proceeds of sales of securities by foreign investors. In addition, if there is deterioration in a country’s balance of payments or for other reasons, a country may impose temporary restrictions on foreign capital remittances abroad. Amounts

16 | Aberdeen Israel Fund, Inc. | | |

Notes to Financial Statements (continued)

December 31, 2011

repatriated prior to the end of specified periods may be subject to taxes as imposed by a foreign country.

(b) Risks Associated with Israeli Markets:

Investments in Israel may involve certain considerations and risks not typically associated with investments in the United States, including the possibility of future political and economic developments and the level of Israeli governmental supervision and regulation of its securities markets. The Israeli securities markets are substantially smaller, less liquid and more volatile than the major securities markets in the United States. Consequently, acquisition and disposition of securities by the Fund may be inhibited.

(c) Risks Associated with Restricted Securities:

The Fund, subject to local investment limitations, may invest up to 30% of its assets (at the time of commitment) in illiquid equity securities, including securities of private equity funds (whether in corporate or partnership form) that invest primarily in emerging markets. When investing through another investment fund, the Fund will bear its proportionate share of the expenses incurred by that underlying fund, including management fees. Such securities are

expected to be illiquid which may involve a high degree of business and financial risk and may result in substantial losses. Because of the current absence of any liquid trading market for these investments, the Fund may take longer to liquidate these positions than would be the case for publicly traded securities. Although these securities may be resold in privately negotiated transactions, the prices realized on such sales could be substantially less than those originally paid by the Fund or the current carrying values and these differences could be material. Further, companies whose securities are not publicly traded may not be subject to the disclosure and other investor protection requirements applicable to companies whose securities are publicly traded.

10. Contingencies

In the normal course of business, the Fund may provide general indemnifications pursuant to certain contracts and organizational documents. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

11. Tax Information

Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

The tax character of distributions paid during the fiscal years ended December 31, 2011 and December 31, 2010 was as follows:

| | December 31, 2011 | | December 31, 2010 | |

Distributions paid from: | | | | | |

Ordinary Income | | $1,296,737 | | $1,289,925 | |

Long Term Capital Gains | | 3,248,723 | | | |

Total tax character of distributions | | $4,545,460 | | $1,289,925 | |

The tax basis of components of distributable earnings differ from the amounts reflected in the Statement of Assets and Liabilities by temporary book/tax differences. These differences are primarily due to timing differences due to partnership investments and wash sales. At December 31, 2011, the components of accumulated earnings on a tax basis, for the Fund were as follows:

Undistributed Long-Term Capital Gain | | $3,002 | |

Unrealized Appreciation | | 8,658,540 | |

Total accumulated earnings | | $8,661,542 | |

| | Aberdeen Israel Fund, Inc. | 17 |

Notes to Financial Statements (concluded)

December 31, 2011

For the year end December 31, 2011, the Fund did not have a capital loss carry forwards for U.S. federal income tax purposes. The Fund utilized $1,312,501 of capital loss carry forwards. Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

The United States federal income tax basis of the Fund’s investments and the net unrealized appreciation as of December 31, 2011 were as follows:

Tax Basis of

Investments | | Appreciation | | Depreciation | | Net Unrealized Appreciation | |

$57,202,317 | | $20,625,737 | | $(11,960,389) | | $8,665,348 | |

GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. Accordingly, during the current year, $(164,872) has been reclassified from undistributed net investment income and $6,253 from paid in capital to accumulated net realized gain on investments and foreign currency related transactions as a result of permanent differences primarily attributable to partnership investments, distribution reclass, foreign currency transactions and non-deductible expense. These reclassifications have no effect on net assets or net asset values per share.

12. Recent Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS.” The ASU establishes common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with U.S. GAAP and International Financial Reporting Standards (“IFRS”) and is effective for interim and annual periods beginning after December 15, 2011. Management is currently evaluating the impact the ASU may have on financial statement disclosures.

13. Subsequent Events

Management has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no adjustments were required to the Financial Statements as of December 31, 2011.

On December 6, 2011, the Board, including a majority of the Directors that are not deemed “interested persons” (as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended) of the Fund or the Fund’s investment adviser, voted to terminate the Fund’s sub-advisory agreement with Analyst Exchange, effective February 4, 2012. The Board voted after it received and evaluated such information as it deemed necessary to make an informed decision as to whether the termination of the sub-advisory agreement was in the best interests of the Fund and shareholders, as detailed in the “Supplemental Information” of “Board Approval of Investment Advisory Agreement.”

Effective March 1, 2012, Aberdeen PLC is merging a number of its companies (the “Merging Companies”), including AAMISL, into Aberdeen Asset Managers Limited (“AAML”). The merger will be achieved by transferring all the assets and liabilities of the Merging Companies to AAML, a Scottish company that is authorized and regulated in the UK by the Financial Services Authority and acts as the Group’s main operating company in the United Kingdom. AAML will continue to conduct the businesses of the Merging Companies as their successor and will have all necessary regulatory licenses, authorizations and permissions in order to carry on the business of the Merging Companies, including registration with the U.S. Securities and Exchange Commission. There will be no change to the portfolio management team or the level or nature of the services provided to the Fund and the same resources available to AAMISL for the management and compliance oversight of the Fund will be available to AAML. Counsel to the Fund has provided a legal opinion confirming that the transaction will not be deemed an assignment under the U.S. Investment Company Act of 1940, as amended.

18 | Aberdeen Israel Fund, Inc. | | |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of

Aberdeen Israel Fund, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Aberdeen Israel Fund, Inc. (the “Fund”), at December 31, 2011, the results of its operations for the year then ended and the changes in its net assets and financial highlights for the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at December 31, 2011 by correspondence with the custodian and venture capital issuers, provides a reasonable basis for our opinion.

Boston, Massachusetts

February 24, 2012

| | Aberdeen Israel Fund, Inc. | 19 |

Tax Information (unaudited)

For the year ended December 31, 2011, the Fund designates approximately $1,296,737, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for reduced tax rates. These lower rates range from 5% to 15% depending on an individual’s tax bracket. If the Fund pays a distribution during a calendar year, complete information will be reported in conjunction with Form 1099-DIV.

The Fund has made an election under Section 853 to pass through foreign taxes paid by the Fund to its shareholders. The amount of foreign taxes that were passed through to shareholders for the year ended December 31, 2011, was $411,002. The amount of foreign source income was $2,367,934. Shareholders should refer to their Form 1099-DIV to determine the amount includable on their respective tax returns for 2011.

During the year ended December 31, 2011, the Fund declared $3,248,723 in dividends that were designated as long-term capital gains dividends.

Proxy Voting and Portfolio Holdings Information (unaudited)

Information regarding how the Fund voted proxies related to its portfolio securities during the 12-month period ended June 30 of each year, as well as the policies and procedures that the Fund uses to determine how to vote proxies relating to its portfolio securities are available:

· By calling 1-866-839-5205;

· On the website of the Securities and Exchange Commission, www.sec.gov.

The Fund files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

The Fund makes the information on Form N-Q available to shareholders on the Fund’s website or upon request and without charge by calling Investor Relations toll-free at 1-866-839-5205.

20 | Aberdeen Israel Fund, Inc. | | |

Supplemental Information (unaudited)

Board Approval of Investment Advisory Agreement

The Investment Company Act of 1940 (the “Investment Company Act”) and the terms of the investment advisory agreement (the “Advisory Agreement”) between the Aberdeen Israel Fund, Inc. (the “Fund”) and Aberdeen Asset Management Investment Services Limited (the “Adviser”) require that, following its initial two-year approval period, the Advisory Agreement be approved annually at an in-person meeting by the Board of Directors (the “Board”), including a majority of the Directors who have no direct or indirect interest in the investment advisory agreement and are not “interested persons” of the Fund, as defined in the Investment Company Act (the “Independent Directors”).

At its meeting on December 6, 2011, the Board voted unanimously to renew the Advisory Agreement between the Fund and the Adviser. In connection with its evaluation of the Advisory Agreement, the Board reviewed a broad range of information requested for this purpose and considered a variety of factors, including the following:

(i) | The nature, extent and quality of the services provided by the Adviser; |

| |

(ii) | The performance of the Fund; |

| |

(iii) | The management fee rate and the total net expense ratio of the Fund, both on an absolute basis and as compared both to a relevant peer group of funds and to fees charged by the Adviser to others; |

| |

(iv) | The extent to which economies of scale could be realized by the Adviser and shared with the shareholders; |

| |

(v) | The costs of services provided and profits realized by the Adviser; |

| |

(vi) | Other benefits realized by the Adviser from its relationship with the Fund; and |

| |

(vii) | Any other factors that the Board deemed relevant to its consideration. |

In addition to its review of information presented to the Board during the contract renewal process, the Board considered knowledge gained from discussions with management at regular and special meetings throughout the year. The Independent Directors were represented by independent counsel throughout the review process and convened executive sessions without management present. In its deliberations, the Board did not identify any single factor that was all-important or controlling and each Director may have attributed different weights to the various factors.

Certain of the Board considerations outlined above are discussed in more detail below.

Nature, Extent and Quality of Services. The Board received and considered various data and information regarding the nature, extent and quality of services provided under the Advisory Agreement. The Board considered, among other things, information about the background and experience of senior management and investment personnel who were responsible for managing the Fund. The Board also received presentations from and participated in information sessions with senior investment personnel of the Adviser. The Board considered information provided regarding the portfolio managers and other resources dedicated to the Fund and the investment philosophy and process followed by those individuals responsible for managing the Fund. The Board, in particular, received information from the Adviser about its resources, including personnel, devoted to focusing on the geographic area in which the Fund invests. The Board was satisfied that the Adviser had appropriate resources to cover the geographic area to manage the Fund in a manner consistent with its investment objective. Accordingly, at the same time as it voted to reapprove the Advisory Agreement, the Board voted to terminate the existing Investment Sub-Advisory Agreement with Analyst Exchange and Trading Services Ltd.

The Board also evaluated the ability of the Adviser, based on its resources, reputation and other attributes, to attract and retain qualified investment professionals. In this regard, the Board considered information regarding the general nature of the compensation structure applicable to portfolio managers and other key personnel.

In addition, the Board considered and evaluated materials and information received regarding the Adviser’s investment and legal compliance program and record with respect to the U.S. registered closed-end funds managed by the Adviser. The Board met in-person with and received quarterly reports from the Fund’s Chief Compliance Officer.

Furthermore, the Board received and considered information about the financial viability of the Adviser to satisfy itself that the Adviser had adequate resources to perform the services required under the Advisory Agreement.

Based on the foregoing and other relevant information reviewed, the Board concluded that, overall, the nature, extent and quality of the services provided to the Fund supported renewal of the Advisory Agreement.

Investment Performance. In addition to reports received at its regular quarterly meetings, the Board received and considered information on the investment performance history of the Fund, including comparison to benchmark index returns over various time periods. The Board was provided with reports, independently prepared by Strategic Insight

| | Aberdeen Israel Fund, Inc. | 21 |

Supplemental Information (unaudited) (concluded)

Mutual Fund Research and Consulting, LLC (“Strategic Insight”), which included a comprehensive analysis of the Fund’s performance.

The Board recognized that the Fund outperformed its benchmark index, the TA-100 Index (the “Index”), in certain periods under review and underperformed in other periods. The Board emphasized the Fund’s performance since 2009, which has been higher than or in line with the Index. The Fund was not compared to a Morningstar Category Average because the Fund is the only unleveraged fund in the Morningstar Foreign Small/Mid Value Category. The Adviser provided information about factors that contributed to the Fund’s performance results since 2009 when it assumed responsibility for managing the Fund. The Board concluded that it was generally satisfied with the Fund’s performance and that the Adviser was taking appropriate actions with respect to investment performance.

Fees and Economies of Scale. The Board considered the management fee rate charged by the Adviser to the Fund. The Board received an analysis from Strategic Insight that compared the Fund’s management fee rate to the management fee rate of a peer group of funds on a gross basis and on a net basis after taking into consideration any waivers or reimbursements. The Board noted that the gross management fee rate for the Fund was in-line with the average and median gross management fee rates for its peer group. The Board also noted that the net management fee rate for the Fund was in-line with the average and median net management fee rates of its peer group. Furthermore, the Board concluded that the contractual breakpoints utilized by the Fund adequately took into account potential economies of scale.

The Board also reviewed information prepared by Strategic Insight that showed that the Fund’s 2010 total net expense ratio was higher than the average and median ratios of its peer group. The Board considered the differences between the Fund and the funds in the peer group and noted that the Fund was the only fund in the peer group that invested primarily in Israeli equity and debt securities. The Board also noted that the average net asset size of all the Fund’s peer group was greater than the Fund’s average net asset size. The Board noted that the most significant factors contributing to the Fund’s expense results were the Fund’s custody and “Other” expenses. The Board considered the higher costs associated with custody of foreign assets and management’s explanation regarding the Fund’s “Other Expenses.”

Costs of Services Provided and Profitability. The Board considered, among other things, the Adviser’s estimates of its costs in providing advisory services to the Fund, and the Adviser’s resulting profitability, including an adjusted estimate of the Adviser’s potential profitability without the use of a sub-adviser. Based on its review of the cost and profit information provided by the Adviser, in light of the nature, extent

and quality of services provided to the Fund, the Board did not deem the Adviser’s actual or adjusted potential profitability to be excessive.

Information about Services to Other Clients. The Board considered information about the nature and extent of services and fee rates offered by the Adviser to other clients, including other registered investment companies and unregistered or institutional accounts. The Adviser advised the Board that, due to the unique strategy of the Fund, the Adviser did not manage any other closed-end funds that were directly comparable. The Board considered that the Adviser was subject to a broader and more extensive regulatory regime in connection with management of the Fund compared to the Adviser’s management of unregistered or institutional accounts. The Board did not deem the fee rate under the Advisory Agreement to be excessive relative to these other fee rates, given its understanding of similarities and differences in the nature and extent of services offered and other factors.

Fall-Out Benefits and Other Factors. The Board also considered information regarding potential “fall-out” or ancillary benefits that could be realized by the Adviser as a result of its relationship with the Fund. In this regard, the Board was advised that the Adviser and its affiliates may derive reputational benefits from their association with the Fund. The Board also noted, however, that such benefits were difficult to quantify with certainty.

Additionally, the Board considered that the Adviser has the authority to receive research and other services from a broker that may be useful to various clients in exchange for conducting portfolio brokerage transactions through such broker. The Board noted that the Adviser also may enter into commission sharing arrangements with certain brokers for the receipt of goods or services that relate to the execution of trades or the provision of research. The Board considered the Adviser’s representations that it evaluates any soft-dollar or commission sharing arrangements for compliance with applicable US or UK regulations, particularly with respect to the safe harbor contained in Section 28(e) of the Securities Exchange Act of 1934, and for compliance with its best execution obligations.

* * * * *

After an evaluation of the above-described factors and based on its deliberations and analysis of the information provided and alternatives considered, the Board, including all of the Independent Directors, unanimously approved the Advisory Agreement and the compensation payable thereunder.

22 | Aberdeen Israel Fund, Inc. | | |

Management of the Fund (unaudited)

The names of the Directors and Officers of the Fund, their addresses, ages, and principal occupations during the past five years are provided in the tables below. Directors that are deemed “interested persons” (as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended) of the Fund or the Fund’s investment adviser.

Board of Directors Information

Name, Address and Age | | Position(s) Held

With the Fund | | Term of Office

and Length of

Time Served | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Fund Complex*

Overseen by

Director | | Other Directorships

Held by Director |

| | | | | | | | | | |

Independent Directors | | | | | | | | | | |

| | | | | | | | | | |

Enrique R. Arzac

c/o Aberdeen Asset

Management Inc.

Attn: US Legal

1735 Market Street,

32nd Floor,

Philadelphia, PA 19103

Age: 70 | | Chairman of the Board of Directors, Nominating Committee Chairman and Audit and Valuation Committee Member | | Since 1996; Chairman since 2005; current term ends at the 2012 annual meeting | | Professor of Finance and Economics, Graduate School of Business, Columbia University (Since 1971). | | 5 | | Director of Epoch Holding Corporation; Director of The Adams Express Company; Director of Petroleum and Resources Corporation; Director of Mirae Asset Management (6); Director of Credit Suisse Funds (3); Director of Credit Suisse Asset Management Income Fund Inc. and Credit Suisse High Bond Yield Fund |

| | | | | | | | | | |

James J. Cattano