UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| ¨ | Confidential, for Use of Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive proxy statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

ADEPT TECHNOLOGY, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transactions applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

ADEPT TECHNOLOGY, INC.

3011 Triad Drive

Livermore, California 94551

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held November 14, 2006

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of Adept Technology, Inc., a Delaware corporation, will be held on Tuesday, November 14, 2006 at 8:00 a.m. local time, at Adept’s principal executive offices located at 3011 Triad Drive, Livermore, California 94551, for the following purposes:

1. To elect seven directors to serve until the next annual meeting of stockholders or until their successors are duly elected and qualified;

2. To approve an amendment to the 2004 Director Stock Option Plan to increase the number of shares of Adept common stock that may be issued to non-employee directors thereunder;

3. To ratify the selection of Armanino McKenna LLP to serve as the independent auditors of Adept for its fiscal year ending June 30, 2007; and

4. To transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof, including any motion to adjourn to a later date to permit further solicitation of proxies if necessary.

Whether or not you plan to attend the meeting, please vote as soon as possible.

The foregoing items of business are more fully described in the proxy statement accompanying this notice. Only stockholders of record at the close of business on September 25, 2006 are entitled to notice of and to vote at the annual meeting and any adjournment thereof.

|

By Order of the Board of Directors of Adept Technology, Inc. |

|

|

Steven L. Moore Corporate Secretary |

Livermore, California

October 20, 2006

YOUR VOTE IS IMPORTANT

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. IN ORDER TO ASSURE YOUR REPRESENTATION AT THE MEETING WHETHER OR NOT YOU ATTEND, YOU ARE REQUESTED TO COMPLETE, SIGN AND DATE THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE. ANY STOCKHOLDER ATTENDING THE MEETING MAY VOTE IN PERSON EVEN IF HE OR SHE HAS RETURNED A PROXY. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

ADEPT TECHNOLOGY, INC.

PROXY STATEMENT FOR

ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the Board of Directors of Adept Technology, Inc., a Delaware corporation, for use at the annual meeting of stockholders to be held Tuesday, November 14, 2006 at 8:00 a.m. local time, or at any adjournment or postponement of the annual meeting, for the purposes specified in this proxy statement and in the accompanying Notice of Annual Meeting of Stockholders. The annual meeting will be held at the principal executive office of Adept located at 3011 Triad Drive, Livermore, California 94551. Adept’s telephone number at that location is (925) 245-3400.

When proxies are properly dated, executed and returned, the shares they represent will be voted at the annual meeting according to the instructions of the stockholder. If no specific instructions are given, the shares will be voted:

| | • | | for the election of the seven nominees for directors listed in this proxy statement to serve until the next annual meeting of stockholders or until their successors are duly elected and qualified; |

| | • | | to approve an amendment to the 2004 Director Stock Option Plan to increase the number of shares of Adept common stock that may be issued thereunder to non-employee directors; |

| | • | | to ratify the selection of Armanino McKenna LLP to serve as the independent auditors of Adept for its fiscal year ending June 30, 2007; and |

| | • | | at the discretion of the proxy holders, upon such other business as may properly come before the annual meeting or any adjournment or postponement thereof, including any motion to adjourn to a later date to permit further solicitation of proxies if necessary. |

These proxy solicitation materials were first mailed on or about October 20, 2006 to all stockholders entitled to vote at the annual meeting. A copy of Adept’s Annual Report to Stockholders on Form 10-K is being mailed concurrently with these proxy solicitation materials.

Record Date and Shares Outstanding

Stockholders of record at the close of business on September 25, 2006, referred to in this proxy statement as the record date, are entitled to notice of and to vote at the annual meeting. As of the record date, 7,585,486 shares of Adept’s common stock, $0.001 par value, were issued and outstanding.

Revocability of Proxies

Any proxy given as a result of this solicitation may be revoked by the person giving it at any time before its use by delivering to the Secretary of Adept a written notice of revocation or a duly executed proxy bearing a later date or by attending the meeting and voting in person.

Voting and Quorum; Vote Required

Each holder of common stock is entitled to one vote for each share of common stock held by that stockholder on the record date.

1

The election of directors at the annual meeting requires the affirmative vote of a plurality of the votes cast at the annual meeting. That is, if there were more than the seven nominees currently proposed for election to the Board, which we do not expect, the seven nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to be voted for them shall be elected directors.

Each other item to be voted on at the annual meeting, including the proposal regarding the amendment of the 2004 Director Stock Option Plan, requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting.

A quorum comprising the holders of a majority of the outstanding shares of common stock entitled to vote on the record date must be present or represented by proxy to transact business at the annual meeting. If the persons present or represented by proxy constitute less than a majority of the outstanding stock as of the record date, the meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum.

Votes will be tabulated by the inspector of elections appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Abstentions and Broker Non-Votes

Broker non-votes and abstentions will be counted as present for purposes of determining the presence or absence of a quorum, but will not be counted for purposes of determining the number of votes cast regarding any particular proposal except as specifically discussed in this paragraph. Because directors are elected by plurality, abstentions and broker non-votes will be entirely excluded from the vote and will have no effect on its outcome. Proposals Two and Three must be approved by a majority of the shares cast, provided that the total votes cast in favor represents at least a majority of the quorum required for the meeting. As a result, broker non-votes generally have no effect and abstentions, which are treated as shares present or represented and voting, will count as a vote against on Proposals Two and Three.

“Broker non-votes” include shares for which a bank, broker or other nominee (i.e., record) holder has not received voting instructions from the beneficial owner and for which the nominee holder does not have discretionary power to vote on a particular matter. Under the rules that govern brokers who are record owners of shares that are held in brokerage accounts for the beneficial owners of the shares, brokers who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on routine matters but have no discretion to vote them on non-routine matters. The proposals to be voted upon at the annual meeting include both routine matters, such as the election of directors (Proposal One) and the ratification of independent auditors (Proposal Three), and non-routine matters, including the amendment to the 2004 Director Stock Option Plan (Proposal Two).

Recommendations of the Board of Directors

Adept’s Board of Directors recommends that you voteFOR each of the nominees of the Board of Directors (Proposal One);FOR the amendment of the 2004 Director Stock Option Plans (Proposal Two); andFOR the ratification of the selection of Armanino McKenna LLP as Adept’s independent auditors for the fiscal year ending June 30, 2007 (Proposal Three).

Solicitation of Proxies

The cost of this solicitation will be borne by Adept, which is making this solicitation on its own behalf. In addition, Adept may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to the beneficial owners. Proxies may also be solicited by certain of Adept’s directors, officers and employees, without additional compensation, personally or by telephone or facsimile.

2

Stockholders Sharing the Same Last Name and Address

Adept has adopted a procedure called “householding,” which has been approved by the Securities and Exchange Commission, referred to in this proxy statement as the SEC, for certain beneficial owners of its common stock. In accordance with this procedure, we are delivering only one copy of the annual report and proxy statement to certain stockholders who share the same address and have the same last name, unless we have received contrary instructions from an affected stockholder. This procedure is designed to reduce duplicate mailing and save significant printing and postage costs as well as natural resources. Stockholders who participate in householding will continue to receive separate proxy cards.

If you received a householded mailing this year and you would like to have additional copies of our annual report and/or proxy statement mailed to you or you would like to opt out of this practice for future mailings, please submit your request to Adept’s Corporate Secretary in writing at 3011 Triad Drive, Livermore, California 94551, or call Adept at (925) 245-3400. Adept will deliver a separate copy of the annual report and/or proxy statement to you promptly upon receipt of your request. You may also contact us at the address and phone number above if you received multiple copies of the annual meeting materials and would prefer to receive a single copy in the future.

CORPORATE GOVERNANCE

As of the date of this proxy statement, Adept’s common stock is listed on the NASDAQ Global Market under the symbol “ADEP”.

Adept and its Board of Directors regularly review and evaluate Adept’s corporate governance practices. In light of the Sarbanes-Oxley Act of 2002, the regulations promulgated under the Sarbanes-Oxley Act by the SEC, and the corporate governance listing standards of NASDAQ, in August 2005, the Board approved a revised Code of Business Conduct for Adept (originally adopted in 2004), which was reviewed in August 2006, and in August 2006 the Board approved revised Corporate Governance Guidelines for the Board of Directors. Adept’s Board committee charters and Code of Business Conduct, as well as other corporate governance documents are posted on the investor relations page of its website at www.adept.com. Printed copies of these documents are also available without charge to stockholders upon written request directed to Adept’s Corporate Secretary at Office of the Corporate Secretary, Adept Technology, Inc., 3011 Triad Drive, Livermore, California 94551-9559.

Corporate Governance Guidelines

The Board of Directors of Adept has adopted Corporate Governance Guidelines for the Board, which cover topics relating to the Board including, but not limited to, Board membership criteria and the composition of the Board, the selection of new directors, Board leadership, Board compensation, responsibilities of directors regarding attendance, continuing education of directors, access to senior management and outside advisors, meeting procedures, committee matters and CEO evaluation. The Nominating and Corporate Governance Committee reviews the Corporate Governance Guidelines annually, and the Board may amend the Corporate Governance Guidelines at any time.

Code of Business Conduct

Adept has adopted a Code of Business Conduct to provide standards for ethical conduct, which applies to the Board of Directors, officers, and all Adept employees, including without limitation, Adept’s Chief Executive Officer and principal financial officers. The Code of Business Conduct covers topics including, but not limited to, the expected standards of employee conduct, conflicts of interest, certain internal controls and reporting, compliance with securities and other laws, confidentiality of information, insider trading, and competition and fair dealing and contains compliance standards and procedures.

3

Any waiver of a provision of the Code of Business Conduct with respect to a director or executive officer may only be made by the Board or its Nominating and Corporate Governance Committee. Adept will file with the SEC on Form 8-K and post on its website all amendments to the Code of Business Conduct and waivers of its provisions made with respect to any director or executive officer in accordance with the applicable SEC and NASDAQ rules.

Identification and Evaluation of Director Nominees

The Nominating and Corporate Governance Committee employs a variety of methods to identify and evaluate director nominees. The Nominating and Corporate Governance Committee periodically assesses the appropriate size of the Board, and whether any vacancies on the Board are expected due to retirement or otherwise, and the need for particular expertise on the Board.

If vacancies are anticipated or otherwise arise, the Nominating and Corporate Governance Committee considers individuals for potential candidacy as a director. Additionally, candidates may come to the attention of the committee through current Board members, officers, professional search firms, stockholders or other persons. These candidates are evaluated at regular or special meetings of the Nominating and Corporate Governance Committee, and may be considered at any point during the year.

In connection with this evaluation, the Nominating and Corporate Governance Committee determines whether to interview the prospective nominee, and as warranted, one or more members of the Nominating and Corporate Governance Committee, and others as appropriate, interview prospective nominees in person or by telephone. After completing this evaluation and interview process, the Nominating and Corporate Governance Committee makes a recommendation to the full Board as to the persons who should be nominated or elected by the Board, and the Board determines whether to reject, elect or nominate the candidate, as the case may be, after considering the recommendation of the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee will consider individuals recommended by stockholders for nomination as a director pursuant to the provisions of Adept’s Bylaws relating to stockholder nominations and applicable law. A stockholder who wishes to recommend a prospective nominee for the Board should notify Adept’s Corporate Secretary or the Nominating and Corporate Governance Committee in writing with the supporting material required by Adept’s Bylaws and described under “Stockholder Proposals and Nominations” below, and any other material the stockholder considers necessary or appropriate.

While the Board currently has no defined minimum criteria for consideration or service as a director, the Nominating and Corporate Governance Committee evaluates prospective nominees against the standards and qualifications set out in Adept’s Corporate Governance Guidelines and other relevant factors as it deems appropriate, including the current composition of the Board and the need for particular expertise; all with reference to issues of business and industry experience, judgment, industry-specific skills, independence, and other relevant characteristics, within the context of an assessment of the perceived needs of the Board at that point in time and applicable law. Specifically, at least a majority of directors on the Board must be “independent directors” as defined in the NASDAQ corporate governance listing standards and as determined by the Board.

In connection with Adept’s 2003 equity financing described below, Adept agreed that Special Situations Fund III, L.P., referred to in this proxy statement as SSF, could designate one person to be a nominee for election to Adept’s Board of Directors and to use its commercially reasonable efforts to cause such designee to be elected to the Board of Directors or to remove and replace such designee if so requested by SSF and/or its affiliates, as long as SSF and the investors in the 2003 financing affiliated with SSF collectively beneficially own at least five percent of Adept’s outstanding common stock.

In addition, in connection with Adept’s 2006 financing described below, Adept agreed that Crosslink Capital, referred to in this proxy statement as Crosslink, could designate one person to be a nominee for election

4

to Adept’s Board of Directors and to use its commercially reasonable efforts to cause such designee to be elected to the Board of Directors or to remove and replace such designee if so requested by Crosslink and/or its affiliates, as long as Crosslink and its affiliated investors in the 2006 financing collectively beneficially own at least five percent of Adept’s outstanding common stock.

Director Independence

A majority of the Board of Directors of Adept are “independent directors.” In determining independence, the Board applies the standards of the Securities Exchange Act of 1934, as amended, which is referred to in this proxy statement as the Exchange Act, and the corporate governance listing standards of NASDAQ. In making these determinations, the Board considers all relevant facts and circumstances and applies the following standards:

| | • | | the director has no relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director; |

| | • | | the director is not, and was not at any time during the past three years, employed by Adept or any subsidiary; |

| | • | | the director has not, and his or her family members have not, accepted any payments from Adept or any subsidiary of Adept in excess of $60,000 in a 12-month period in the current or any of the past three years, except (i) compensation for Board or Board committee service; (ii) payments arising solely from investments in Adept’s securities; (iii) compensation paid to a family member who is a non-executive employee of Adept or a subsidiary of Adept; (iv) benefits under a tax-qualified retirement plan, or non-discretionary compensation; (v) loans permitted under Section 13(k) of the Exchange Act; |

| | • | | the director is not a family member of an individual who is, or at any time during the past three years was, employed by Adept or by any subsidiary as an executive officer; |

| | • | | the director is not, and his or her family members are not, a partner in, or a controlling stockholder or an executive officer of, any organization to which Adept made, or from which Adept received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, other than (i) payments arising solely from investments in the company’s securities, or (ii) payments under non-discretionary charitable contribution matching programs; |

| | • | | the director is not, and his or her family members are not, employed as an executive officer of another entity where at any time during the past three years any of the executive officers of Adept served on the compensation committee of such other entity; and |

| | • | | the director is not, and does not have a family member who is a current partner of Adept’s outside auditor, nor was the director or any family member of the director a partner or employee of Adept’s outside auditor who worked on Adept’s audit at any time during any of the past three years. |

The Board has determined that all of Adept’s directors other than Mr. Bucher, Adept’s Chief Executive Officer, are “independent directors” within the meaning of the corporate governance listing standards of NASDAQ.

Board Meetings

The Board of Directors of Adept held six meetings during the fiscal year ended June 30, 2006, referred to in this proxy statement as Fiscal 2006, in addition to taking actions by unanimous written consent. Each director attended at least 89% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings of committees on which he served, during the period in which he served as a director in Fiscal 2006. Adept’s Corporate Governance Guidelines strongly encourage directors to attend its annual meetings of stockholders and any special meetings of stockholders. Three of Adept’s five directors then in office attended the last annual meeting of stockholders.

5

Under Adept’s Corporate Governance Guidelines, Adept’s independent directors meet at regularly scheduled and special executive sessions without management.

Contacting the Board of Directors

Stockholders interested in communicating directly with the Board, the Chairman of the Board of Directors, or the non-management directors as a group may do so by sending a letter to the Adept Technology, Inc. Board of Directors, c/o the Office of the Corporate Secretary, Adept Technology, Inc., 3011 Triad Drive, Livermore, California 94551-9559. Information regarding communications with the Board of Directors regarding audit and accounting matters or other matters is posted on the investor relations page of Adept’s website at www.adept.com.

Inquiries and other communications may be submitted anonymously and confidentially.

Company counsel will review all such correspondence addressed to the Corporate Secretary and forward it to the Chairman of the Board, Chairman of the Nominating and Corporate Governance Committee, Audit Committee or to any individual director, group of directors or Committee of the Board to whom the communication is directed, as applicable, if the communication is relevant to, and consistent with, Adept’s business and financial operations, policies and corporate philosophies.

Company counsel has the authority (which has been delegated by the Corporate Secretary), in the company counsel’s discretion, to discard or disregard any inappropriate communications or to take other appropriate actions with respect to any such communications that are reasonably determined to be of a commercial or frivolous nature, unduly hostile, threatening, illegal, or not reasonably related to Adept or its business. In some cases, the company counsel may determine that communications be forwarded elsewhere in the company for review and possible response.

The foregoing procedures do not apply to (i) stockholder proposals pursuant to Exchange Act Rule 14a-8 (discussed under “Stockholder Proposals and Nominations” below) and communications made in connection with such proposals, which shall be handled in a manner consistent with Adept’s Bylaws and applicable law or (ii) service of process or any other notice in a legal proceeding.

Committees of the Board of Directors

The Board of Directors has the following standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Copies of the current charters of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee can be accessed on Adept’s website at www.adept.com.

Audit Committee.The Audit Committee is responsible for representing and assisting the Board of Directors in (i) its oversight of the quality and integrity of Adept’s financial statements and other SEC filings, (ii) its oversight of the effectiveness of Adept’s system of internal controls, and auditing, accounting and financial reporting processes, (iii) the appointment and oversight of Adept’s independent auditors, including reviewing the auditors’ qualifications, independence and performance, (iv) the pre-approval of all audit and allowable non-audit services provided by Adept’s independent auditors, and (v) compliance with legal and ethical requirements associated with accounting and audit matters, corporate securities trading, investor communications, and (unless addressed by another independent body of the Board, such as by the Nominating and Corporate Governance Committee in the exercise of their responsibilities regarding the Code of Business Conduct) related party transactions. Each of the members of the Audit Committee are independent as defined in the NASDAQ corporate governance listing standards and Rule 10A-3 of the Exchange Act. In addition, each of the members of the Audit Committee is able to read and understand fundamental financial statements as required by the corporate governance listing standards of NASDAQ. The Audit Committee met seven times during Fiscal

6

2006 and was comprised of three non-employee directors. Mr. Codd served until his resignation from the Board of Directors in November 2005 and Mr. Juelis joined the Audit Committee as its Chairman following his election to the Board by the stockholders at the November 2005 Annual Meeting of Stockholders. The current members of the Audit Committee include Messrs. Juelis (Chairman), Kelly and Mock. The Board has determined that Messrs. Juelis and Kelly are “audit committee financial experts” as defined by rules promulgated by the SEC.

Compensation Committee.The Compensation Committee is responsible for determining salaries, incentives and other forms of compensation for officers of Adept and administering executive incentive compensation and employee benefit plans. The Compensation Committee met two times during Fiscal 2006, in addition to taking certain actions by written consent, and was comprised of three non-employee directors, including Messrs. Mock and Majteles. Mr. Codd served until his resignation from the Board of Directors in November 2005, at which time Mr. Juelis replaced Mr. Codd on the Compensation Committee. Mr. Martin joined the Compensation Committee following his appointment to the Board in May 2006 in replacement of Mr. Juelis. The Compensation Committee currently consists of Messrs. Mock (Chairman), Majteles and Martin. Each of the members of the Compensation Committee is “independent” as defined by the corporate governance listing standards of NASDAQ and a “non-employee director” for purposes of Rule 16b-3 of the Exchange Act.

Nominating and Corporate Governance Committee.The Nominating and Corporate Governance Committee (i) identifies, screens and recommends qualified candidates to serve as directors of Adept, (ii) evaluates Adept’s Board, its committees and the continued service of its directors, (iii) evaluates stockholder nominees recommended by stockholders and (iv) develops and reviews the company’s corporate governance and policies and code of business conduct. The Nominating and Corporate Governance Committee met two times during Fiscal 2006 and was comprised of three non-employee directors. Mr. Kelly served on the Committee during all of 2006. Mr. Codd served on the Nominating and Corporate Governance Committee until his resignation from the Board in November 2005 at which time he was replaced by Mr. Juelis. Mr. Mock served until his resignation from the Committee in July 2006 at which time he was replaced by Mr. Finnie, who was also appointed Chairman of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee currently consists of Messrs. Finnie (Chairman), Juelis and Kelly, each of whom has been determined to be “independent” as defined by the corporate governance listing standards of NASDAQ.

Compensation of Directors and Designation Arrangements

Until June 2004, no director received any cash compensation for service as a director of Adept or for attendance at Board or committee meetings, except for reimbursement of travel and lodging expenses incurred in attending these meetings. The Board approved payment beginning in Fiscal 2006 to each non-employee director of an annual retainer of $10,000 and to the chairman of the Audit Committee, an additional annual retainer of $5,000. In January 2006, the Board increased the annual retainer for non-employee directors to $20,000 and approved an annual retainer of $30,000 for service by a non-employee, independent director as Chairman of the Board. In addition, each non-employee director receives $1,000 for each Board meeting attended in person and $500 for each meeting attended by telephone. Adept paid such annual retainers and board meeting payments for the first half of Fiscal 2006 in arrears. Beginning with the third quarter of Fiscal 2006, Adept pays such annual retainers and board meeting payments quarterly in arrears. As previously contemplated by the 2004 Director Option Plan approved by Adept’s stockholders in 2004, upon joining the Board of Directors, each new non-employee director would be automatically granted an option to purchase 3,000 shares of common stock and, annually, each non-employee director would be granted an option to purchase 1,000 shares of common stock for so long as the individual remains a member of the Board. As a result of amendments to the 2004 Director Option Plan in March 2005 and January 2006, each new non-employee director is automatically granted an option to purchase 10,000 shares of common stock and, annually, each non-employee director is granted an option to purchase 3,000 shares of common stock for so long as the individual remains a member of the Board. Each annual non-employee director grant will be made on the date of the first Board meeting following the annual stockholders meeting (which would generally occur on the same day). Messrs. Kelly, Mock and Majteles each received an annual grant of an option to purchase 2,000 shares of Adept common stock on November 3, 2005 at

7

an exercise price of $8.00 per share. In connection with joining the Board: Mr. Juelis received an initial grant of an option to purchase 10,000 shares of common stock on November 3, 2005 at an exercise price of $8.00; Mr. Martin received an initial grant of an option to purchase 10,000 shares of common stock on May 2, 2006 at an exercise price of $10.20; and Mr. Finnie received an initial grant of an option to purchase 10,000 shares of common stock on June 22, 2006 at an exercise price of $12.438. All the options were granted at the fair market value of the common stock on the grant date. Initial grants to non-employee directors vest at a rate of 25% on the first anniversary of the date of grant and at a rate of 1/48th of the shares subject to the options per month thereafter, and the annual grants become exercisable at a rate of 1/48th of the shares subject to the options on the monthly anniversary of the date of grant.

Upon consummation of Adept’s 2003 equity financing, the investors affiliated with SSF Entities exercised their right to designate a director nominee and designated Robert J. Majteles to serve as a member of our Board of Directors. Mr. Majteles joined the Board of Directors in 2003. Mr. Majteles is the founder of Treehouse Capital, LLC, an investment firm. Special Situations Fund III, L.P., Special Situations Fund III QP, L.P., Special Situations Cayman Fund, L.P., Special Situations Private Equity Fund, L.P. and Special Situations Fund, L.P. have entered into an agreement with Mr. Majteles and Treehouse Capital pursuant to which Treehouse Capital, through Mr. Majteles, provides certain management and financial advisory services for the funds on request. If Mr. Majteles’ services are requested by the funds with respect to a particular portfolio investment, Treehouse Capital is entitled to ten percent of the funds’ net gain (as defined) or net loss (as defined) on the investment during the term of the agreement, offset by certain fees that may be paid by the portfolio company to Treehouse Capital or Mr. Majteles directly. Under the agreement, Mr. Majteles is required to act independently of the funds in discharging his fiduciary duties to stockholders of any company for which he serves as a member of the Board of Directors and also is obligated not to disclose to the funds or use for his own benefit any confidential information he obtains in connection with his service for a particular portfolio company. Mr. Majteles does not have or share voting or dispositive power over any securities held by the funds. Mr. Majteles has agreed to serve as a member of Adept’s Board of Directors pursuant to this agreement.

Upon consummation of Adept’s 2006 common stock financing in June 2006, the Crosslink Entities exercised their right pursuant to the purchase agreement, as discussed below, to designate a director nominee and designated Charles H. Finnie to serve as a member of our Board of Directors.

8

PROPOSAL ONE

ELECTION OF DIRECTORS

General

A Board of seven directors is to be elected at the annual meeting. Five of the seven current directors of Adept are nominees for re-election. The Board has authorized the nomination at the annual meeting of the persons named in this proxy statement as candidates. Unless otherwise instructed, the proxy holders will vote the proxies received by them for Adept’s seven nominees named below and for any additional nominee named by the Board as discussed above. In the event that any nominee of Adept is unable or declines to serve as a director at the time of the annual meeting, the proxies will be voted for any nominee who will be designated by the current Board of Directors to fill the vacancy. Adept is not aware of any nominee who will be unable or will decline to serve as a director. The Board of Directors will consider the names and qualifications of candidates for the Board submitted by stockholders in accordance with the procedures set forth in “Stockholder Proposals and Nominations” at the end of this proxy statement and Adept’s bylaws. In the event that additional persons are nominated for election as directors (other than any additional nominee named by the Board as discussed above), the proxy holders intend to vote all proxies received by them in favor of the nominees listed below and any additional nominee named by the Board as discussed above as possible, and, in this event, the specific nominees to be voted for will be determined by the proxy holders. The term of office for each person elected as a director will continue until the next annual meeting of stockholders or until a successor has been elected and qualified.

Vote Required

The seven nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to be voted for them (a plurality) shall be elected directors.

Nominees

The names of the nominees and certain information about their business experience as of September 25, 2006 are set forth below:

| | | | | | |

Name of Nominee | | Age | | Position(s) with Adept | | Director Since |

Robert H. Bucher | | 51 | | President and Chief Executive Officer; Director | | 2003 |

Charles H. Finnie (3) | | 47 | | Director | | 2006 |

A. Richard Juelis (1)(3) | | 58 | | Director | | 2005 |

Michael P. Kelly (1)(3) | | 58 | | Chairman of the Board | | 1997 |

Robert J. Majteles (2) | | 41 | | Director | | 2003 |

Herbert J. Martin (2) | | 65 | | Director | | 2006 |

Cary R. Mock (1)(2) | | 63 | | Director | | 1990 |

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Nominating and Corporate Governance Committee. |

There is no family relationship between any director or executive officer of Adept.

Robert H. Bucher has served as Adept’s President and Chief Executive Officer since November 2003. From November 2003 until January 2006 he also served as Chairman of the Board. Prior to joining Adept, Mr. Bucher was a consultant providing management advisory and financial investment to pre-IPO technology product and service businesses. From October 1998 to June 2002, Mr. Bucher was President and Chief Executive Officer of Norsat International Inc., a Canadian company that evolved under his leadership from a manufacturer and distributor of satellite components to a digital media infrastructure solution provider. Mr. Bucher held the position of Executive Vice President of Worldwide Operations at Measurex Corporation, an optimization,

9

automation and solution system provider to the process industries from 1995 to 1998. Mr. Bucher holds a B.S. degree in Engineering from the University of Guelph, Canada.

Charles H. Finnie has served as a director of Adept since June 2006. Mr. Finnie joined Crosslink Capital in January 2006 as General Partner, focused on investments in software, services, online marketing and communications. From 2002 to 2004, Mr. Finnie managed technology investments for Apex Capital. From 2000 to 2002, he held executive positions with Global Streams, Inc, a provider of video communications hardware and software, which he co-founded in July 2000. Prior to that, he was a general partner and research analyst at Volpe Brown Whelan, an investment bank. Mr. Finnie holds a B.A. degree in Politics from Princeton University and a master’s degree in International Affairs from Columbia University. Mr. Finnie was designated as a director nominee by Crosslink pursuant to its rights under the purchase agreement relating to Adept’s 2006 Financing.

A. Richard Juelis has served as a director of Adept since November 2005. Since June 2005, Mr. Juelis has been Vice President, Finance and Chief Financial Officer of World Heart Corporation, a publicly-traded medical device company focused on the development and commercialization of cardiac ventricular assist devices. From November 1994 to March 2005, Mr. Juelis served as Chief Financial Officer of Cellegy Pharmaceuticals, Inc. a publicly-traded specialty biopharmaceutical firm. Prior to this, he served as Chief Financial Officer for Vivus Inc. and Xoma Corporation, both publicly-traded biotechnology companies, and held domestic and international finance and general management positions with two major pharmaceutical companies. Mr. Juelis holds a B.S. in Chemistry from Fordham University and an MBA from Columbia University, and is a Certified Management Accountant (CMA).

Michael P. Kelly has served as a director of Adept since April 1997, additionally serving as Lead Independent Director of the Board of Directors from October 2003 to January 2006 and since January 2006 as Chairman of the Board. Since October 2005, Mr. Kelly has served as Chief Executive Officer of Kinsale Associates, Inc., a merchant bank. From July 2005 to October 2005, Mr. Kelly served as Chief Executive Officer of Cape Semiconductor Inc., a fabless semiconductor company. Prior to that, from 1994 to 2005, Mr. Kelly was Vice-Chairman and Senior Managing Director of Broadview International, LLC, an international mergers and acquisitions advisory firm and a division of Jefferies Inc. Mr. Kelly is also a director of Epicor Software Corporation, a provider of enterprise business software solutions. Mr. Kelly received a B.A. in Accounting from Western Illinois University and an M.B.A. from St. Louis University. Mr. Kelly is a Certified Public Accountant.

Robert J. Majteles has served as a director of Adept since November 2003. Mr. Majteles is the founder of Treehouse Capital LLC, an investment firm. Prior to launching Treehouse in 2001, Mr. Majteles served as Chief Executive Officer of three different technology companies and was a merchant banker and a mergers and acquisitions attorney. Currently, Mr. Majteles is also on the Board of Directors of Vertical Communications, Inc., a provider of converged IP telephony systems and voice applications; World Heart Corporation; Unify Corporation, an embedded database and development tools company; and Macrovision, a developer of digital rights management and software licensing technologies. In addition, Mr. Majteles is a Lecturer at the Lester Center for Entrepreneurship, Haas School of Business, University of California, Berkeley. Mr. Majteles received a B.A. degree from Columbia University and a law degree from Stanford University. Mr. Majteles was designated as a director nominee by Special Situations Funds pursuant to its rights under the purchase agreement relating to Adept’s 2003 financing.

Herbert J. Martin has served as a director of Adept since May 2006. Since March 2006 he has served as Chief Executive Officer and Director of D-Wave Systems, a private firm engaged in the development of quantum computing systems based in Vancouver, Canada. From September 2003 to February 2006, Mr. Martin was a management consultant to the technology industry. From October 2000 to September 2003 he served as Chief Executive Officer of Salira Optical Network Systems, a supplier of broadband access systems. Mr. Martin has more than twenty years’ experience managing technology companies, with particular emphasis on global channel and business development. Mr. Martin holds a B.S. in Electronic Engineering and an MBA from Santa Clara University.

10

Cary R. Mock has served as a director of Adept since December 1990. Mr. Mock was independently employed from January 2003 until his retirement in June 2004. From January 1996 to January 2003, Mr. Mock served as President of C.R. Mock & Associates, a financial advisory firm specializing in acquisitions and related corporate development activities. From October 1983 to December 1995, Mr. Mock served as Director of Acquisitions and Divestitures for Westinghouse Electric Corporation, and previously served in various other positions since joining Westinghouse in 1964. Mr. Mock received a B.S. in Electrical Engineering from the Massachusetts Institute of Technology and an M.B.A. from the State University of New York at Buffalo.

The Board of Directors recommends a vote FOR the election of all seven nominees listed above and for any additional director named by the Board, as discussed under “General” in this proposal above. Unless marked to the contrary, proxies received will be voted FOR the election of all seven nominees listed above and for any additional director named by the Board, as discussed under “General” in this proposal above.

11

PROPOSAL TWO

APPROVAL OF AMENDMENT TO 2004 DIRECTOR STOCK OPTION PLAN

In August 2004, the Board of Directors adopted the Adept Technology, Inc. 2004 Director Option Plan, referred to as the 2004 Director Plan, and reserved 60,000 shares of common stock for issuance thereunder on a post-reverse split basis. In March 2005 and January 2006, the Board amended the 2004 Director Plan, so that each new non-employee director is automatically granted an option to purchase 10,000 shares of common stock and, annually, each non-employee director was granted an option to purchase 3,000 shares of common stock. In August 2006, the Board of Directors approved the amendment of the 2004 Director Plan to increase the number of shares reserved thereunder by an additional 72,000 shares of common stock, subject to stockholder approval. Adept believes stock options are an important element of non-employee director compensation because they help ensure that directors’ interests are aligned with those of Adept’s stockholders. Further, stock options are a key part of a total compensation package designed to enable Adept to attract, retain, and motivate directors suitable to promote Adept’s growth and competitive success. During 2005, Mr. Juelis joined the Board with one non-employee director resigning. During 2006, two new non-employee directors have joined Adept’s Board of Directors, and the size of the Board has increased from five to seven directors. As a result of the growth in the size of the Board of Directors, the shares of common stock authorized for issuance under the 2004 Director Plan will be insufficient to provide for annual grants to the existing directors in fiscal 2007 or necessarily permit compensation of new directors in connection with any changes in the constitution of the Board under a plan exclusively for non-employee directors. The company does not currently intend to use its 2005 Equity Incentive Plan to award equity compensation to non-employee directors. Adept stockholders are being asked to approve the amendment to the 2004 Director Plan.

As of the record date, 44,000 options to purchase shares of Adept common stock have been granted under the 2004 Director Plan. As of such record date, Adept had 7,585,486 shares outstanding and approximately 57,000 shares subject to outstanding options for non-employee directors. On October 16, 2006, our common stock closed at a price of $10.10 per share and the weighted-average exercise price of outstanding options held by current non-employee directors was approximately $29.65.

Vote Required

Approval of the 2004 Director Plan amendment requires the affirmative vote of a majority of the shares represented and voting on this proposal at the annual meeting. Abstentions will be treated as being present and entitled to vote on the proposal and, therefore, will have the effect of votes against the proposal. Broker non-votes will be treated as not being entitled to vote on the proposal and, therefore, are not counted for purposes of determining whether the proposal has been approved. Unless marked to the contrary, proxies received will be votedFORapproval of the amendment to the 2004 Director Plan.

The Board of Directors recommends a vote FOR adoption of the Amendment of the Adept Technology, Inc. 2004 Director Option Plan.

Summary of 2004 Director Option Plan, As Amended

The following is a summary of the 2004 Director Plan, as amended, and is qualified in its entirety by reference to its full text, a copy of which is attached hereto asAppendix A.

Overview

The 2004 Director Plan provides for non-discretionary grants of stock options. Options granted under the 2004 Director Plan are not intended to qualify as incentive stock options, as defined under Section 422 of the Code.

12

Purpose

The purposes of the 2004 Director Plan are to attract and retain the best available individuals for service as non-employee directors of Adept, to encourage their continued service as non-employee directors, and to provide non-employee directors with an increased economic and proprietary interest in Adept to encourage them to contribute to the success and progress of Adept. Adept believes stock options are an important element of director compensation because they help ensure that directors’ interests are aligned with those of Adept’s stockholders. Further, options are a key part of a total compensation package designed to enable Adept to attract, retain, and motivate directors suitable to promote Adept’s growth and competitive success.

Eligibility

The 2004 Director Plan provides that options may be granted only to members of Adept’s Board of Directors who are not employees of Adept or any of its subsidiaries or any parent. These individuals are referred to in this proxy statement as non-employee directors of Adept. Currently six of Adept’s seven directors are non-employee directors and are eligible to participate in the 2004 Director Plan.

Administration

The 2004 Director Plan is administered by the Board of Directors of Adept and from time to time may be amended by the Board, however; neither the Board, nor any other person, has any discretion to select which non-employee directors will be granted options under the 2004 Director Plan or to determine the number of shares to be covered by options granted to non-employee directors (subject to the Board’s ability to amend the plan). The Board of Directors does have the authority to approve the form of option agreement that will be used to evidence grants of options under the 2004 Director Plan. The form of option agreement may only contain terms and conditions that are not inconsistent with the provisions of the 2004 Director Plan, as determined by the Board of Directors.

Stock Subject to the 2004 Director Plan

Subject to certain anti-dilution provisions discussed below, the maximum aggregate number of shares of Adept’s common stock that currently may be issued pursuant to options granted under the 2004 Director Plan is 60,000, which will be increased to 132,000 upon approval of the proposed amendment by the stockholders. Whenever any option expires, is canceled, forfeited or is otherwise terminated, in whole or in part, for any reason without having been exercised or payment having been made in respect thereof, the shares of Adept’s common stock subject to that portion of the option may again be the subject of options granted under the 2004 Director Plan. In addition, if any shares of Adept’s common stock are delivered to Adept in payment or satisfaction of the exercise price or tax obligation with respect to a option the maximum number of shares available for grants of future options under the 2004 Director Plan will be increased by that number of shares.

Terms and Conditions of Options

Non-Discretionary Grants. Stock option grants under the 2004 Director Plan are non-discretionary. Each person (other than a person who is already a member of Adept’s Board of Directors and also an employee of Adept or a parent or subsidiary) who first becomes a non-employee director of Adept after the effective date of the 2004 Director Plan is automatically granted, on the date such person becomes a non-employee director, a one-time option to purchase 10,000 shares of Adept’s common stock. At the meeting of the Board of Directors that next follows the annual meeting of Adept’s stockholders in each year (generally the same day as the stockholder meeting), each non-employee director who has been a director for at least six months prior to such meeting of the Board of Directors is automatically granted an option to purchase 3,000 shares of Adept’s common stock.

Exercise Price. In no event may options be granted with an exercise price below 100% of the stock’s fair market value on the date of the grant. In addition, the exercise price for options granted to participants who own

13

stock of Adept representing more than 10% of the combined voting power of all classes of stock of Adept may not be less than 110% of the stock’s fair market value on the date of the grant.

Vesting. Each option granted under the plan becomes exercisable over a four-year period following the date of grant. Stock options granted upon a person first becoming a non-employee director become exercisable as to one-fourth of the shares subject to the option on the first anniversary of the grant date and then at a rate of 1/48th of the shares each month thereafter. Subsequent option grants become exercisable at a rate of 1/48th of the shares subject to the option on each monthly anniversary of its date of grant, beginning with the first such monthly anniversary. In all cases, vesting is conditioned upon continued service from the grant date and during each vesting period by the non-employee director as a director of Adept.

Expiration. Options granted under the 2004 Director Plan expire ten years after the date of grant.

Termination of Service as a Director. If the non-employee director’s status as a director of Adept is terminated for any reason, other than death or disability, options may be exercised to the extent they were exercisable on the date of termination within three months after the termination, but in no event later than the expiration date of the term of the option. If a non-employee director should die or become disabled while a director of Adept, options may be exercised to the extent they were exercisable on the date of termination at any time within 12 months after the date of death or disability but in no event later than the expiration of the term of the option.

Transferability, Payment and Other Provisions Applicable to Options. Unless otherwise determined by Adept’s Board of Directors, options granted under the 2004 Director Plan are nontransferable by the optionee other than by will or the laws of descent and distribution, and are exercisable only by the optionee during his or her lifetime, or upon the death of a Director, his or her successors or assigns. The option agreement may contain other terms, provisions and conditions not inconsistent with the 2004 Director Plan as may be determined by Adept’s Board of Directors.

Adjustment Upon Changes in Capitalization or Merger

If there is any change in the stock subject to the 2004 Director Plan or subject to any option granted under the 2004 Director Plan through a stock split, reverse stock split, stock dividend, combination or reclassification of Adept’s common stock, or any other increase or decrease in the number of issued shares of Adept’s common stock effected without receipt of consideration by Adept, the number of shares authorized for issuance under the 2004 Director Plan, the number of shares subject to non-discretionary option grants and the number of shares subject to and per share exercise price of options outstanding under the 2004 Director Plan will be proportionately adjusted.

In the event of a proposed sale of the assets of Adept or the merger of Adept with or into another corporation, all options outstanding under the 2004 Director Plan may be assumed or an equivalent option may be substituted by the successor corporation. If an option is assumed or substituted with an equivalent option, the option or equivalent option will continue to vest as described above for so long as the non-employee director remains a director of Adept, the successor corporation or an affiliate, but upon the termination of his or her status as a director of Adept, the successor or an affiliate, all of his or her outstanding options shall become immediately and fully vested and exercisable. If the successor corporation does not agree to assume options granted under the 2004 Director Plan or to substitute them with an equivalent option, each such outstanding option shall become fully vested and exercisable on the date that the non-employee director is notified that his or her options will not be assumed or substituted and remain exercisable for a period of thirty days thereafter.

Amendment and Termination

The Board of Directors may amend, alter, suspend, or terminate the 2004 Director Plan at any time. Approval of Adept’s stockholders is required for any amendment to the 2004 Director Plan to the extent

14

necessary or desirable to comply with Rule 16b-3 promulgated under Section 16 of the Exchange Act, or any successor rule or statute or other applicable law, including the requirements of any exchange or automatic quotation system on which Adept’s common stock may be listed. No action by Adept’s Board of Directors or stockholders may alter or impair any option previously granted under the 2004 Director Plan without the consent of the non-employee director. Unless terminated earlier, the 2004 Director Plan will terminate ten years after its effective date and no further options will be granted.

Federal Income Tax Considerations

The following is a general summary of the United States federal income tax consequences to Adept and the participants resulting from the grant and exercise of options granted under the 2004 Director Plan and the disposition of the stock acquired upon the exercise of such options. This summary is based on the federal income tax laws that are in effect as of the date of this proxy statement, all of which are subject to change on a retroactive or prospective basis. The summary does not purport to be complete and does not discuss any tax consequences under state, local or foreign tax laws. In addition, the tax consequences to a participant may differ depending upon the participant’s individual circumstances. Adept urges the participant to consult his or her personal tax advisor, prior to exercising his or her options, with regard to all tax consequences arising from the grant or exercise of options, and the disposition of any stock acquired pursuant to the exercise of an option.

Stock options granted under the 2004 Director Plan are subject to federal income tax treatment pursuant to rules governing options that are not incentive stock options.

There are no tax consequences to the non-employee director or Adept by reason of the grant of an option under the 2004 Director Plan. Upon exercise of the option, the non-employee director generally will recognize taxable ordinary income equal to the excess of Adept’s common stock’s fair market value on the exercise date over the option exercise price, and Adept will be entitled to a deduction in the same amount. Upon disposition of the stock acquired upon exercise of an option, the optionee generally will recognize a capital gain or loss equal to the difference between the selling price and the sum of the amount paid to exercise the option plus any amount recognized as ordinary income upon exercise of the option. This gain or loss will be long or short term depending on whether or not the stock was held for more than one year. A director’s disposition of stock acquired upon exercise of an option has no tax consequences to Adept.

Plan Benefits

Options under the 2004 Director Plan may only be granted to non-employee directors of Adept. As a result, Adept’s non-employee directors, as a group, will receive all options that may be granted under the 2004 Director Plan. As of the record date, 44,000 options to purchase shares of Adept common stock have been granted under the 2004 Director Plan, 42,000 options granted under the Director Plan are currently outstanding, and 17,709 shares of common stock remain authorized for issuance thereunder.

Adept recommends that stockholders vote FOR this proposal. The proxy will be voted FOR this proposal unless otherwise directed.

15

EQUITY COMPENSATION PLAN INFORMATION

The following table gives information about our common stock that may be issued upon exercise of options and rights under all of our equity compensation plans as of June 30, 2006, including options granted under the now-expired 1995 Director Option Plan and 1993 Stock Plan, as well as Adept’s currently effective 2001 Stock Option Plan, 2003 Stock Option Plan, 2004 Director Plan, 2005 Equity Incentive Plan and 1998 Employee Stock Purchase Plan.

Each of the plans requires stockholder approval to materially increase the number of shares of common stock authorized for issuance or reduce the exercise price of any outstanding option under such plans, in some cases where required by law or the requirements of the applicable exchange where Adept common stock is listed.

| | | | | | | | | |

Plan Category | | Number of securities to be

issued upon exercise of

outstanding options and

rights

(a) | | | Weighted-average

exercise price of

outstanding options and

rights

(b) | | Number of securities

remaining available for

future issuance under equity

compensation plans

(excluding securities reflected

in column (a))

(c) | |

Equity compensation plans approved by security holders | | 564,324 | (1) | | $ | 16.79 | | 770,122 | (3) |

Equity compensation plans not approved by security holders (2) | | 356,579 | | | $ | 7.87 | | 55,101 | |

Total | | 920,903 | | | $ | 13.33 | | 825,223 | |

| | | | | | | | | |

| (1) | Excludes purchase rights accruing under our 1998 Employee Stock Purchase Plan, for which remaining available rights are included in column (c). |

| (2) | Issued under our 2001 Stock Option Plan. The Board of Directors adopted the 2001 Plan in August 2001 and provided that 520,000 shares of common stock be reserved for issuance thereunder. Options under the 2001 Plan may be granted, as complies with applicable law, to employees either from time to time at the discretion of the Compensation Committee of the Board of Directors or automatically upon the occurrence of specified events, including, without limitation, reduction of at will employees’ salaries and the achievement of performance goals. The exercise price of the options is at 100% of the fair market value of Adept’s common stock on the date of the grant. Options generally vest over a time period generally consisting of monthly vesting in equal installments over a four-year period. Options granted in 2001 for reduction of at will employees’ salaries vest in equal monthly increments over the salary reduction period. All stock options granted under the 2001 Plan have an expiration date of 10 years from the date of the grant. In October 2003, the Board amended the 2001 Plan to require stockholder approval to materially increase the number of shares of common stock authorized for issuance or reduce the exercise price of any outstanding option under the plan. |

| (3) | Includes 284,648 shares available for issuance under the 1998 Employee Stock Purchase Plan as of July 1, 2006. The aggregate number of shares of Adept common stock available for issuance under the 1998 Employee Stock Purchase Plan is subject to an annual increase as of the first day of Adept’s fiscal year in an amount equal to the lesser of: (i) 120,000 shares, (ii) 3% of the common stock outstanding on the last day of the prior fiscal year, or (iii) a lesser amount as determined by Adept’s Board. At June 30, 2006, 3% of Adept’s outstanding shares was equal to approximately 227,501 shares, thus the authorized shares were increased by 120,000. Also includes 540,575 shares available for issuance at the end of Fiscal 2006 under the 2003 Stock Option Plan, the 2004 Director Plan and the 2005 Equity Incentive Plan, but does not include the 72,000 shares proposed in this proxy statement to be authorized for issuance under the 2004 Director Plan if approved by the stockholders. |

16

PROPOSAL THREE

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

On October 17, 2005, Adept’s Board of Directors, based on the selection recommendation of the Audit Committee, decided not to renew the engagement of its then current independent auditors, Ernst & Young LLP, and retained Armanino McKenna LLP as its independent auditors with respect to the audit of Adept’s financial statements for Fiscal 2006.

During Adept’s two most recent fiscal years ended June 30, 2005, and during the subsequent interim period preceding the replacement of Ernst & Young LLP, there was no disagreement between Adept and Ernst & Young LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to Ernst & Young LLP’s satisfaction, would have caused Ernst & Young LLP to make reference to the subject matter of the disagreement in connection with its reports. The audit reports of Ernst & Young LLP on the consolidated financial statements of Adept as of and for the last two fiscal years ended June 30, 2005 did not contain any adverse opinion or disclaimer of opinion, nor were these opinions qualified or modified as to uncertainty, audit scope or accounting principles.

During Adept’s two most recent fiscal years ended June 30, 2005, and during the subsequent interim period preceding the replacement of Ernst & Young LLP in October 2005, Adept did not consult with Armanino McKenna LLP regarding the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on Adept’s financial statements.

The Audit Committee of the Board of Directors has selected Armanino McKenna LLP as independent auditors of Adept for the fiscal year ending June 30, 2007 and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the annual meeting. Armanino McKenna LLP has audited Audit’s financial statements since Fiscal 2006. A representative of Armanino McKenna LLP is expected to be present at the annual meeting, and will have an opportunity to make a statement and to respond to appropriate questions.

Stockholder ratification of the selection of Armanino McKenna LLP as Adept’s independent auditors is not required by Adept’s bylaws or otherwise. However, the Board is submitting the selection of Armanino McKenna LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain Armanino McKenna LLP. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of different independent auditors at any time during the year, if it determines that such a change would be in the best interests of Adept and its stockholders.

Ratification of the selection of Armanino McKenna LLP to serve as the independent auditors of Adept for the fiscal year ending June 30, 2007 requires the affirmative vote of a majority of the shares represented and voting at the annual meeting, which shares voting affirmatively also constitute at least a majority of the required quorum. Because the affirmative vote of a majority of the quorum is required, if the number of abstentions or broker non-votes results in the votes “for” the proposal not equaling at least a majority of the quorum, the proposal will not be approved. This will be the case even though the number of votes “for” the proposal exceeds the number of votes “against” the proposal.

The Board of Directors recommends that stockholders vote FOR the selection of Armanino McKenna LLP to serve as the independent auditors of Adept for the fiscal year ending June 30, 2007. Unless marked to the contrary, proxies received will be voted FOR ratification of the selection of Armanino McKenna LLP.

17

REPORT OF THE AUDIT COMMITTEE

In accordance with its written charter adopted by the Board of Directors, the Audit Committee primarily assists the Board in fulfilling its responsibility for the oversight of the quality and integrity of the accounting and financial reporting practices of Adept and reviewing the independence and performance of Adept’s independent auditors. Management has the primary responsibility for the financial statements and the reporting process. Adept’s independent auditors are responsible for expressing an opinion on the conformity of our consolidated financial statements with accounting principles generally accepted in the United States. The independent auditors report directly to the Audit Committee and have unrestricted access to the Committee.

During Fiscal 2006, the Audit Committee reviewed and discussed with Adept’s independent auditors, the overall scope and plans for the Fiscal 2006 year-end audit. In addition, the Audit Committee met with management and the independent auditors to review and discuss the audited financial statements as of and for the fiscal year ended June 30, 2006. The Audit Committee also reviewed and discussed the independent auditor’s evaluation of internal controls, and the results of the independent auditors’ examination of the financial statements, both with and without the presence of management.

In addition, the Audit Committee has discussed with the independent auditors their judgments as to the acceptability and quality of Adept’s accounting principles, and such other matters required to be discussed by Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees). Further, the Audit Committee has received from the independent auditors the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with them their independence from Adept and its management. In addition, the Audit Committee has considered whether the independent auditors’ provision of other non-audit services to Adept is compatible with their independence. The Audit Committee did not identify any factors that would indicate the impairment of such independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited consolidated financial statements be included in Adept’s Annual Report on Form 10-K for the fiscal year ended June 30, 2006 for filing with the SEC. The Audit Committee also recommended the reappointment of Armanino McKenna LLP as independent auditors of Adept and the Board concurred with such recommendation.

Respectfully submitted by the Audit Committee of the Board of Directors of Adept Technology, Inc. for the fiscal year ended June 30, 2006.

A. Richard Juelis, Chairman

Michael P. Kelly

Cary R. Mock

18

FEES BILLED TO ADEPT BY INDEPENDENT PUBLIC ACCOUNTANTS DURING

FISCAL YEARS 2006 AND 2005

Until October 2005, Adept’s independent public accountants were Ernst & Young, LLP. On October 17, 2005, Adept terminated Ernst & Young LLP and engaged the independent public accounting firm Armanino McKenna LLP. See the discussion regarding Ernst & Young LLP above under “Proposal Three—Ratification of Independent Auditors.”

The following table presents fees billed to Adept for professional services rendered by Armanino McKenna LLP for Fiscal 2006 and by Ernst & Young LLP for the fiscal years ended June 30, 2006 and June 30, 2005.

| | | | | | | | | | | |

| | | Fees billed by Armanino McKenna LLP

for fiscal year ended | | Fees billed by Ernst & Young LLP

for fiscal year ended |

| | | June 30,

2006 | | June 30,

2005 | | June 30,

2006 | | June 30,

2005 |

Audit Fees (1) | | $ | 536,975 | | — | | $ | 99,641 | | $ | 528,981 |

Audit-Related Fees (2) | | | — | | — | | | — | | | — |

| | | | | | | | | | | |

Audit and audit-related fees | | | 536,975 | | — | | | 99,641 | | | 528,981 |

Tax Fees (3) | | | — | | — | | | — | | | — |

All Other Fees | | | — | | — | | | — | | | — |

| | | | | | | | | | | |

Total fees | | $ | 536,975 | | — | | $ | 99,641 | | $ | 528,981 |

| (1) | Includes fees for the audit of Adept’s consolidated financial statements included in Adept’s Annual Report on Form 10-K, fees for the review of the interim condensed consolidated financial statements included in Adept’s Quarterly Reports on Form 10-Q and amendments thereto on Form 10-Q/A, and fees for services that are normally provided by Adept’s independent public accountants in connection with statutory and regulatory filings or engagements. Amount reflects fees billed to date and unbilled accrued fees for services rendered in connection with the audit of the financial statements for Fiscal 2006. Additional fees may be incurred and billed for these services. |

| (2) | Includes fees for assurance and related services that are reasonably related to the performance of the audit or review of Adept’s consolidated financial statements that are not reported under “Audit Fees.” |

| (3) | Includes fees for tax compliance, tax advice and tax planning. |

AUDIT COMMITTEE PRE-APPROVAL OF AUDIT AND PERMISSIBLE NON-AUDIT SERVICES OF INDEPENDENT AUDITORS

Pursuant to the Audit Committee charter, the Audit Committee must approve all audit and permissible non-audit services provided by Armanino McKenna LLP prior to the engagement of Armanino McKenna LLP with respect to such services. As the Audit Committee has not delegated any pre-approval authority, the Audit Committee has not adopted any specific pre-approval policies and procedures for delegates relating to the engagement of its independent auditors. None of the services described in the table above were approved by the Audit Committee under thede minimis exception provided by Rule 2-01(c)(7)(i)(C) of Regulation S-X.

The Audit Committee has determined that the fees for services rendered were compatible with maintaining Armanino McKenna LLP’s independence from Adept.

19

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the outstanding shares of Adept common stock held by:

| | • | | each person known by Adept to beneficially own more than 5% of Adept’s outstanding common stock; |

| | • | | each director of Adept; |

| | • | | each of the executive officers and former executive officers of Adept named in the Summary Compensation Table below; and |

| | • | | all current directors and executive officers of Adept as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC, and includes voting and investment power with respect to shares. Shares of common stock subject to options or issuable upon conversion of convertible securities currently exercisable or exercisable within 60 days after the record date are deemed outstanding for computing the percentage ownership of the person holding the options, but are not deemed outstanding for computing the percentage of any other person. Unless otherwise indicated, the principal address of each of the following persons is c/o Adept Technology, Inc., 3011 Triad Drive, Livermore, California 94551.

| | | | | | | | | |

| | | Common Shares Beneficially Owned (1) | |

Beneficial Owner | | Shares Owned | | Options / Warrants to

Purchase Shares | | Total Shares

Beneficially Owned | | Percent | |

5% Holders | | | | | | | | | |

Austin W. Marxe and David M. Greenhouse (2) c/o Special Situations Funds 153 East 53rd Street New York, NY 10022 | | 2,482,484 | | 888,890 | | 3,371,374 | | 39.8 | % |

Jon D. Gruber and J. Patterson McBaine (3) c/o Gruber & McBaine Capital Management, LLC 50 Osgood Place San Francisco, California 94133 | | 815,042 | | 222,221 | | 1,037,263 | | 13.2 | % |

Kopp Investment Advisors, LLC (4) 7701 France Avenue South, Suite 500 Edina, Minnesota 55435 | | 971,422 | | — | | 971,422 | | 12.8 | % |

Crosslink Capital Inc. (5) Two Embarcadero Center, Suite 2200 San Francisco, CA 94111 | | 731,251 | | — | | 731,251 | | 9.6 | % |

Officers and Former Officers of the Company | | | | | | | | | |

Robert H. Bucher | | — | | 147,500 | | 147,500 | | 1.9 | % |

John D. Dulchinos | | 13,406 | | 38,359 | | 51,765 | | * | |

Matthew J. Murphy | | 1,711 | | 40,693 | | 42,404 | | * | |

Robert R. Strickland (6) | | — | | 26,187 | | 26,187 | | * | |

Lee A. Blake (7) | | 4,060 | | 12,550 | | 16,610 | | * | |

Gordon M. Deans | | — | | 11,686 | | 11,686 | | * | |

Non-employee Directors of the Company | | | | | | | | | |

Michael P. Kelly, Chairman | | — | | 8,283 | | 8,283 | | * | |

Charles H. Finnie (8) | | — | | — | | — | | — | |

A. Richard Juelis | | 2,500 | | 2,500 | | 5,000 | | * | |

Robert J. Majteles | | — | | 3,583 | | 3,583 | | * | |

Herbert J. Martin (9) | | — | | — | | — | | — | |

Cary R. Mock | | — | | 5,883 | | 5,883 | | * | |

All current executive officers and directors as a group (11 persons) | | 17,617 | | 261,827 | | 279,444 | | 3.56 | % |

20

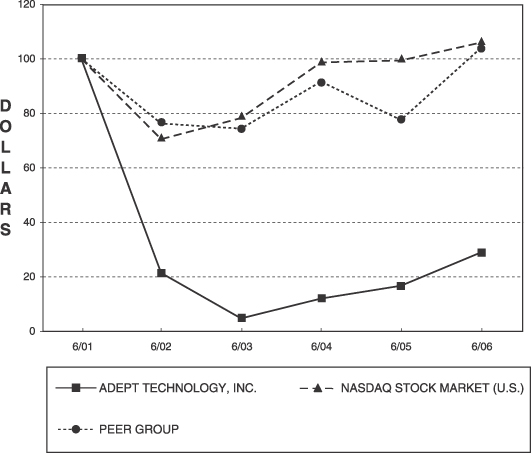

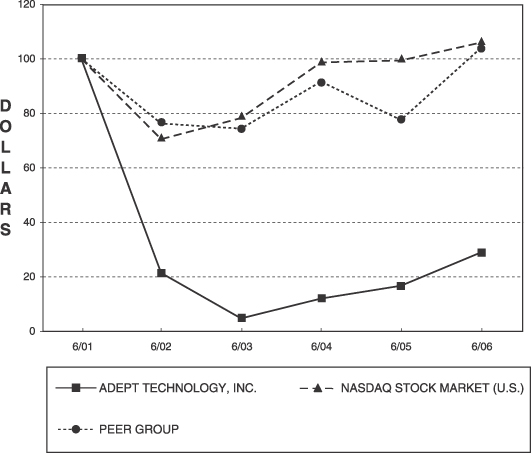

This table is based upon information supplied by officers, directors and principal stockholders, and Schedules 13D and 13G filed with the SEC. Beneficial ownership of greater than five percent of Adept’s outstanding common stock reflects ownership as of the most recent date indicated under filings with the SEC except as noted below, while beneficial ownership of executive officers and directors is as of September 25, 2006. All numbers have been adjusted to reflect the one-for-five reverse stock split effective February 25, 2005.