UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED SEPTEMBER 29, 2013

COMMISSION FILE NUMBER: 0-19797

WHOLE FOODS MARKET, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Texas | | 74-1989366 |

| (State of incorporation) | | (IRS Employer Identification No.) |

| | | |

| 550 Bowie Street, Austin, Texas | | 78703 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: 512-477-4455

Securities registered pursuant to section 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, no par value | | NASDAQ Global Select Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

|

| | | |

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of all common stock held by non-affiliates of the registrant as of April 14, 2013 was $16,168,544,914. The number of shares of the registrant’s common stock, no par value, outstanding as of November 15, 2013 was 372,138,322 shares.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report, to the extent not set forth herein, is incorporated by reference from the Registrant’s definitive Proxy Statement for the Annual Meeting of the Stockholders to be held February 24, 2014.

Whole Foods Market, Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended September 29, 2013

Table of Contents

This Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities and Exchange Act of 1934 concerning our current expectations, assumptions, estimates and projections about the future. These forward-looking statements are based on currently available operating, financial and competitive information and are subject to risks and uncertainties that could cause our actual results to differ materially from those indicated in the forward-looking statements. See “Item 1A. Risk Factors” for a discussion of risks and uncertainties that may affect our business.

PART I

Item 1. Business.

General

Whole Foods Market is the leading retailer of natural and organic foods and America’s first national “Certified Organic” grocer. Unless otherwise specified, references to “Whole Foods Market,” “Company,” or “we” in this Report include the Company and its consolidated subsidiaries. The Company incorporated in 1978, opened the first Whole Foods Market store in 1980, and is based in Austin, Texas. We completed our initial public offering in January 1992, and our common stock trades on the NASDAQ Global Select Market under the symbol “WFM.” Our Company mission is to promote the vitality and well-being of all individuals by supplying the highest quality, most wholesome foods available. Since the purity of our food and the health of our bodies are directly related to the purity and health of our environment, our core mission is devoted to the promotion of organically grown foods, healthy eating, and the sustainability of our entire ecosystem. Through our growth, we have had a significant and positive impact on the natural and organic foods movement throughout the United States, helping lead the industry to nationwide acceptance over the last 35 years.

We have one operating segment, natural and organic foods supermarkets. We are the largest retailer of natural and organic foods in the U.S. and the 12th largest food retailer overall based on 2012 sales rankings from Progressive Grocer. As of September 29, 2013, we operated 362 stores in the United States (“U.S.”), Canada, and the United Kingdom (“U.K.”), averaging over seven million customer visits each week. Our stores average 38,000 square feet in size and are supported by our Austin headquarters, regional offices, distribution centers, bakehouse facilities, commissary kitchens, seafood-processing facilities, meat and produce procurement centers, and a specialty coffee and tea procurement and roasting operation.

The following is a summary of our annual percentage sales and net long-lived assets by geographic area for the fiscal years indicated:

|

| | | | | | | | |

| | 2013 |

| | 2012 |

| | 2011 |

|

| Sales: | | | | | |

| United States | 96.7 | % | | 96.8 | % | | 96.9 | % |

| Canada and United Kingdom | 3.3 |

| | 3.2 |

| | 3.1 |

|

| Total sales | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Long-lived assets, net: | | | | | |

| United States | 95.7 | % | | 95.2 | % | | 95.9 | % |

| Canada and United Kingdom | 4.3 |

| | 4.8 |

| | 4.1 |

|

| Total long-lived assets, net | 100.0 | % | | 100.0 | % | | 100.0 | % |

A five-year summary of certain financial and operating information can be found in Part II, “Item 6. Selected Financial Data,” of this Report on Form 10-K. See also Part II, “Item 8. Financial Statements and Supplementary Data.”

Industry Overview

According to Nielsen’s TDLinx and Progressive Grocer, the U.S. grocery industry, which includes conventional supermarkets, supercenters, and limited-assortment and natural/gourmet-positioned supermarkets, had approximately $603 billion in sales in 2012, a 3% increase over the prior year. Within this broader category, natural product sales through retail channels were approximately $81 billion, a 10% increase over the prior year, according to Natural Foods Merchandiser, a leading trade publication for the natural foods industry. We believe the growth in sales of natural and organic foods is being driven by numerous factors, including:

| |

| • | heightened awareness of the role that healthy eating plays in long-term wellness; |

| |

| • | a better-educated and wealthier populace whose median age is increasing each year; |

| |

| • | increasing consumer concern over the purity and safety of food; and |

Our Purpose and Core Values

We believe that much of our success to date is because we remain a uniquely mission-driven company. The purpose of our business is not only to generate profits but to create value for all of our major stakeholders, each of which is linked interdependently. Our higher purpose statement reflects the heart of what we do: “With great courage, integrity and love, we embrace our responsibility to co-create a world where each of us, our communities and our planet can flourish - all the while, celebrating the sheer love and joy of food.” Our Core Values succinctly express this purpose:

| |

| • | We sell the highest quality natural and organic products available. |

| |

| • | We satisfy, delight and nourish our customers. |

| |

| • | We support team member happiness and excellence. |

| |

| • | We create wealth through profits and growth. |

| |

| • | We serve and support our local and global communities. |

| |

| • | We practice and advance environmental stewardship. |

| |

| • | We create ongoing win-win partnerships with our suppliers. |

| |

| • | We promote the health of our stakeholders through healthy eating education. |

Differentiated Product Offering

We offer a broad and differentiated selection of high-quality natural and organic products with a strong emphasis on perishable foods. Our product selection includes, but is not limited to: produce and floral, grocery, meat, seafood, bakery, prepared foods and catering, coffee, tea, beer, wine, cheese, nutritional supplements, vitamins, body care, and lifestyle products including books, pet products, and household products. We estimate our stores carry on average approximately 21,000 SKUs, and we estimate that approximately 30% of our sales, outside of prepared foods and bakery, were organic in fiscal year 2013. The following is a summary of annual percentage sales by product category for the fiscal years indicated:

|

| | | | | | | | |

| | 2013 |

| | 2012 |

| | 2011 |

|

| Perishables: | | | | | |

| Prepared foods and bakery | 19.0 | % | | 18.9 | % | | 18.8 | % |

| Other perishables | 47.2 |

| | 47.0 |

| | 46.8 |

|

| Total perishables | 66.2 |

| | 65.9 |

| | 65.6 |

|

| Non-perishables | 33.8 |

| | 34.1 |

| | 34.4 |

|

| Total sales | 100.0 | % | | 100.0 | % | | 100.0 | % |

Organic foods are foods grown through methods that emphasize the use of renewable resources and the conservation of soil and water to enhance environmental quality. All products labeled as organic and sold within a retail store or used within the production of foods labeled as organic must be verified by an accredited certifying agency. Organic equivalency arrangements in the U.S., Canada, and the European Union help protect organic standards, enhance cooperation, and facilitate trade in organic products. Furthermore, all retailers that handle, store and sell organic products must implement measures to protect organic integrity. In the U.S., under the U.S. Department of Agriculture’s (“USDA”) Organic Rule, which was implemented into federal law in 2002, organic food products are produced using:

| |

| • | agricultural management practices that promote healthy ecosystems and prohibit the use of genetically modified seeds or crops, sewage sludge, long-lasting pesticides, herbicides or fungicides; |

| |

| • | livestock management practices that promote healthy, humanely treated animals by providing organically grown feed, fresh air and outdoor access while using no antibiotics or growth hormones; and |

| |

| • | food-processing practices that protect the integrity of the organic product and disallow irradiation, genetically modified organisms (“GMOs”) or synthetic preservatives. |

Our Quality Standards

We aspire to become an international brand synonymous with not just natural and organic foods, but also with being the highest quality food retailer in every community in which we are located. We believe our strict quality standards differentiate our stores from other supermarkets and enable us to attract and maintain a broad base of loyal customers.

| |

| • | We carefully evaluate each and every product we sell. |

| |

| • | We feature foods that are free of artificial preservatives, colors, flavors, sweeteners and hydrogenated fats. |

| |

| • | We are passionate about great tasting food and the pleasure of sharing it with others. |

| |

| • | We are committed to foods that are fresh, wholesome and safe to eat. |

| |

| • | We seek out and promote organically grown foods. |

| |

| • | We provide food and nutritional products that support health and well-being. |

Exclusive Brands

Our exclusive brands are a key component of our differentiation strategy. In fiscal year 2013, our exclusive brands accounted for approximately 16% of our non-perishable sales and approximately 12% of our total retail sales, up slightly from 15% and 11%, respectively, in fiscal year 2012. Our 365 and 365 Organic Everyday Day Value® brands account for approximately half of our exclusive brand items. Additional brands include the “Whole” family of brands (e.g., Whole Foods Market, Whole Catch, Whole Fields, Whole Pantry, Whole Living, Whole Paws, etc.), Allegro Coffee, Engine 2, Wellshire Farms, and Nature’s Rancher, among others.

Value Programs

We remain committed to the highest quality standards and to providing a clear range of choices in every category, both of which we believe are important in driving our sales growth over the long term. In addition to offering our 365 Everyday Value brands, we have competitively matched prices on thousands of known value items, extended value choices to our perishables departments, promoted our regional and national one-day sales, and focused on improving customer awareness about the value we offer in our stores. We also have The Whole Deal, our printed value guide, available in all our stores in the U.S. and Canada, as well as online. The value guide features supplier-sponsored and Whole Foods Market store brand coupons, budget-conscious recipes, money-saving shopping and cooking tips, and Sure Deals that highlight everyday value pricing on high-quality products our customers love.

Health Starts Here®

We are offering an increasing selection of products in our stores meeting the Health Starts Here nutritional and ingredient standards. Health Starts Here is a mindful approach to healthy eating rooted in four simple principles to build better meals – Whole Food, Plant-Strong™, Healthy Fats, and Nutrient Dense. Products such as frozen items, breads and prepared foods that meet these guidelines carry our “Health Starts Here” logo. In addition, our stores feature signage on the Aggregate Nutrient Density Index (“ANDI®”), a proprietary scoring system that ranks foods based on nutrient density (vitamins, minerals, antioxidants and phytochemicals) per calorie.

Whole Trade® Guarantee

Products with the Whole Trade Guarantee label are sourced from developing countries and meet our high quality standards, provide more money to producers, ensure better wages and working conditions for workers, and utilize sound environmental practices. Approximately 400 products in our stores carry our Whole Trade Guarantee seal, and demand for these products continues to grow. Whole Foods Market donates 1% of sales of these products to Whole Planet Foundation® to help alleviate world poverty.

Locally Grown

We are committed to buying from local producers whose products meet our high quality standards, particularly those who are dedicated to environmentally friendly, sustainable agriculture. For some stores, “local” is defined as within a certain mile radius, and for others, it means within the metro area, state, or tri-state area. Buying local allows us to offer our shoppers the freshest, most flavorful pick of seasonal products; it bolsters local economies by keeping money in the pockets of community growers; and it contributes to responsible land development and the preservation of viable green spaces. Whole Foods Market currently purchases produce from more than 2,000 different farms through various suppliers, and in fiscal year 2013, approximately 25% of the produce sold in our stores came from local farms. In fiscal year 2007, we established a budget of up to $10 million to promote local production through our Local Producer Loan Program, and in fiscal year 2013, we increased our budget to $25 million. As of September 29, 2013, we had disbursed approximately $10 million in loans to 147 local producers company-wide.

Animal Welfare

Whole Foods Market is dedicated to promoting animal welfare on farms and ranches. We encourage innovative animal production practices that improve the lives of animals raised for meat and poultry in our stores. We also have strong standards for food safety at processing. Work on our “animal compassionate” standards started in 2003, and development of an additional tiered standards program transitioned to the Global Animal Partnership foundation in 2008. Global Animal Partnership’s 5-Step™ Animal Welfare Rating system standards have been developed for cattle, pigs, chickens and turkeys. The 5-Step program launched in 2011 and is currently reflected in meat departments in all of our stores in the U.S. and Canada.

Seafood Sustainability

We continue to collaborate with the Marine Stewardship Council (“MSC”) to offer as much MSC-certified seafood as possible. For wild-caught seafood, we label our products with color-coded seafood sustainability ratings developed by partnering organizations Blue Ocean Institute and Monterey Bay Aquarium. Ratings are based on key criteria for sustainable fisheries using science-based, transparent ranking methods. Since April 2012, we have not sold any wild-caught seafood from “red-rated” fisheries. For farmed seafood, our standards continue to be the highest in the industry. The “Responsibly Farmed” logo in our

seafood cases indicates that the farms we source from have passed a third-party audit and meet our quality standards. In addition, in fiscal year 2013, we launched new quality standards for farmed molluscs, including clams, oysters and mussels.

Whole Body Standards

We believe the quality of the items and ingredients people apply to their bodies topically is as important as the food they put into their bodies. While our basic standards for supplements and body care products already set us apart, ensuring high quality and organic integrity in non-food products, our Premium Body Care™ standards raise the bar even higher. This additional tier of premium standards meets our strictest guidelines for quality sourcing, environmental impact, results and safety and was designed to evolve as new science-based studies and research come to light. In addition, all health and beauty products sold in our stores that make organic claims are certified to one of two standards: the USDA’s National Organic Program or NSF International’s 305 Standard for Personal Care Products Containing Organic Ingredients.

Eco-Scale™

In April 2011, we introduced our exclusive Eco-Scale™ rating system and became the first national retailer to launch its own comprehensive set of green cleaning standards to help shoppers make informed choices for their homes and the planet. Under our Eco-Scale rating system, all household cleaning products in our stores are required to list all ingredients on their packaging, a labeling practice not currently required by the U.S. government. This rating system allows shoppers to easily identify a product’s environmental impact and safety based on a red-orange-yellow-green color scale. We are committed to working with our suppliers to evaluate and independently audit every product in our cleaning category, and all brands in our stores meet our baseline orange standard.

Enhanced Standards for Fresh Produce and Floral

On September 26, 2013, we announced plans to launch a comprehensive rating system for the produce and flowers sold in our stores. The new three-tiered rating system, which is expected to roll out in the fall of 2014, will label items as “good,” “better,” and “best.” A science-based index, developed by Whole Foods Market with help from sustainable agriculture experts and input from suppliers, will measure performance on important sustainable farming topics, including pest management, farmworker welfare, pollinator protection, water conservation, soil health, ecosystems, biodiversity, energy, waste and climate. The new ratings will provide deeper transparency to our shoppers, allowing them to make more informed decisions, as well as recognize growers for responsible practices that go beyond their organic and local efforts.

Seasonality

The Company’s average weekly sales and gross profit as a percentage of sales are typically highest in the second and third fiscal quarters, and lowest in the fourth fiscal quarter due to seasonally slower sales during the summer months. Gross profit as a percentage of sales is also lower in the first fiscal quarter due to the product mix of holiday sales. For this reason, results in any quarter are not necessarily indicative of the results that may be achieved for the full fiscal year.

Growth Strategy

We are a Fortune 500 company, ranking number 232 on the 2013 list. Our sales have grown rapidly due to historically strong identical store sales growth, acquisitions and new store openings from approximately $93 million in fiscal year 1991, excluding the effect of pooling-of-interests transactions completed since 1991, to approximately $12.9 billion in fiscal year 2013, a 22-year compounded annual growth rate of approximately 25%.

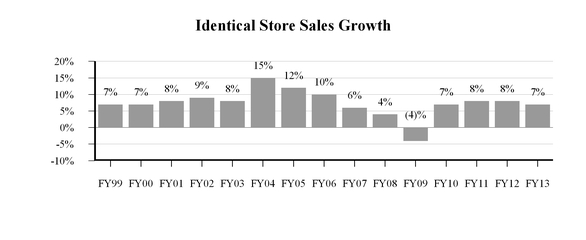

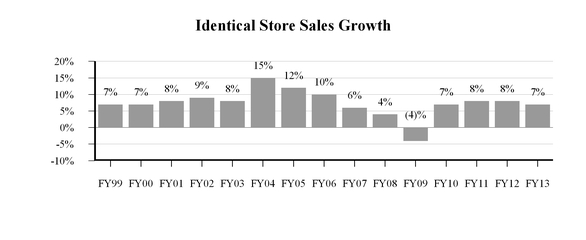

Over the last 15 fiscal years, our comparable store sales growth has averaged 8.2%, and our identical store sales growth has averaged 7.3%. Sales of a store are deemed to be comparable commencing in the fifty-third full week after the store was opened or acquired. Identical store sales exclude sales from relocated stores and remodeled stores with square footage changes greater than 20% from the comparable calculation. Our identical store sales growth for each of the last 15 fiscal years is shown in the following chart:

Our growth strategy is to expand primarily through new store openings, and while we may continue to pursue acquisitions of smaller chains that provide access to desirable geographic areas and experienced team members, such acquisitions are not expected to significantly impact our future store growth or financial results. We have a disciplined, opportunistic real estate strategy, opening stores in existing trade areas as well as new areas, including international locations. We typically target stores located on premium real estate sites, and while we may open stores as small as 15,000 square feet or as large as 75,000 square feet, the majority of our new stores are expected to fall in the range of 35,000 to 45,000 square feet going forward.

Our historical store growth and sales mix for the fiscal years indicated is summarized below:

|

| | | | | | | | | | |

| | 2013 |

| 2012 |

| 2011 |

| 2010 |

| 2009 |

|

| Stores at beginning of fiscal year | 335 |

| 311 |

| 299 |

| 284 |

| 275 |

|

| Stores opened | 26 |

| 25 |

| 18 |

| 16 |

| 15 |

|

| Acquired stores | 6 |

| — |

| — |

| 2 |

| — |

|

| Relocated stores | (5 | ) | (1 | ) | (6 | ) | — |

| (5 | ) |

| Divested or closed stores | — |

| — |

| — |

| (3 | ) | (1 | ) |

| Stores at end of fiscal year | 362 |

| 335 |

| 311 |

| 299 |

| 284 |

|

Stores with major remodels (1) | 2 |

| 2 |

| 1 |

| — |

| 2 |

|

| Total gross square footage at end of fiscal year | 13,779,000 |

| 12,735,000 |

| 11,832,000 |

| 11,231,000 |

| 10,566,000 |

|

| Year-over-year growth | 8% |

| 8% |

| 5% |

| 6% |

| 7% |

|

(1) Defined as remodels with square footage changes greater than 20% completed during the fiscal year.

|

| | | | | | | | | | |

| | 2013 |

| 2012 |

| 2011 |

| 2010 |

| 2009 |

|

| Sales mix: | | | | | |

| Identical stores | 93.5 | % | 93.3 | % | 94.6 | % | 93.2 | % | 91.4 | % |

| New/relocated stores and stores with major remodels | 6.1 |

| 6.2 |

| 4.7 |

| 6.0 |

| 7.8 |

|

| Other sales, primarily non-retail external sales | 0.4 |

| 0.5 |

| 0.7 |

| 0.8 |

| 0.8 |

|

| Total sales | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

Our historical store development pipeline as of the dates indicated is summarized below:

|

| | | | | | | | | | |

| | November 6, 2013 |

| November 7, 2012 |

| November 2, 2011 |

| November 3, 2010 |

| November 4, 2009 |

|

| Stores in development | 94 |

| 79 |

| 62 |

| 52 |

| 53 |

|

| Average size (gross square feet) | 38,000 |

| 37,000 |

| 35,000 |

| 39,000 |

| 45,000 |

|

| Total gross square footage in development | 3,605,000 |

| 2,896,000 |

| 2,192,000 |

| 2,052,000 |

| 2,410,000 |

|

| As a percentage of existing square footage | 26% |

| 22% |

| 18% |

| 18% |

| 23% |

|

Store Description

Each of our stores is designed to fit the size and configuration of the particular location and to reflect the community in which it is located. Our store development work starts early. We conscientiously work to serve our communities to the fullest through volunteer work, partnerships, and incorporating community feedback throughout the design process. We strive to transform food shopping from a chore into a dynamic experience by building and operating stores with a lively, inspirational atmosphere, mission-oriented decor and well-trained team members. We offer an exciting product mix that emphasizes healthy eating and our high quality standards, with a range of choices at every price level, ever-changing selections, samples, open kitchens, scratch bakeries, hand-stacked produce, extensive bulk departments and prepared foods stations. We also incorporate many environmentally sustainable aspects into our store design, and many stores have bicycle parking racks and electric vehicle charging stations. Our stores typically include sit-down eating areas, customer comment boards and customer service booths. In addition, some stores offer special services such as chair massage, personal shopping and home delivery. Others offer sit-down wine bars and tap rooms featuring local and/or craft beer and wine, creating a destination for customer gathering. We believe our stores play a unique role as a third place, besides the home and office, where people can gather, interact and learn while at the same time discovering the many joys of eating and sharing food.

By tailoring our store size, design, product selection and pricing strategy to the particular community, we have been able to move into more segments of the market - urban and suburban, domestic and international. Most of our stores are located in high-traffic shopping areas on premier real estate sites and are either freestanding or in strip centers. We also have a number of urban stores located in high-density, mixed-use developments. In selecting store locations, we use an internally developed model to analyze potential sites based on various criteria such as education levels, population density and income levels within certain drive times. After we have selected a target site, our development group does a comprehensive site study and sales projection and works with our regional teams to develop construction and operating cost estimates. Each project must meet an internal Economic Value Added (“EVA®”) hurdle return, based on our internal weighted average cost of capital, which for new stores generally is expected to be cumulative positive EVA in five years or less. In its simplest definition, EVA is equivalent to net operating profits after taxes minus a charge on the cost of invested capital necessary to generate those profits. Our current internal weighted average cost of capital metric is 8%.

The required cash investment for new stores varies depending on the size of the store, geographic location, degree of landlord incentives and complexity of site development issues. To a significant degree, it also depends on how the project is structured, including costs for elements that often increase or decrease rent, e.g., lease acquisition costs, shell and/or garage costs, and landlord allowances. Because of these differences, the average development cost per square foot may vary significantly from project to project and from year to year.

Purchasing and Distribution

The majority of our purchasing occurs at the regional and national levels, enabling us to negotiate better volume discounts with major vendors and distributors while allowing our store buyers to focus on local products and the unique product mix necessary to keep the neighborhood market feel in our stores. We also remain committed to buying from local producers that meet our high quality standards.

Our produce procurement center facilitates the procurement and distribution of the majority of the produce we sell. We also operate four seafood processing and distribution facilities, a specialty coffee and tea procurement and roasting operation, and 11 regional distribution centers that focus primarily on perishables distribution to our stores across the U.S., Canada and the U.K. In addition, we have three regional commissary kitchens and five bakehouse facilities, all of which distribute products to our stores. Other products are typically procured through a combination of specialty wholesalers and direct distributors.

United Natural Foods, Inc. (“UNFI”) is our single largest third-party supplier, accounting for approximately 32% of our total purchases in fiscal year 2013. Our long-term relationship with UNFI as our primary supplier of dry grocery and frozen food products extends through 2020.

Store Operations

We strive to promote a strong company culture featuring a team approach to store operations that we believe is distinctly more empowering of team members than that of the traditional supermarket. Our Whole Foods Market stores each employ between approximately 50 and 650 team members who generally comprise 10 self-managed teams per store, each led by a team leader. Each team within a store is responsible for a different product offering or aspect of store operations such as prepared foods, grocery, or customer service, among others. We also promote a decentralized approach to store operations in which many decisions are made by teams at the individual store level. In this structure, an effective store team leader is critical to the success of the store. The store team leader works closely with one or more associate store team leaders, as well as with all of the department team leaders, to operate the store as efficiently and profitably as possible.

Team members are involved at all levels of our business. We strive to create a company-wide consciousness of “shared fate” by uniting the interests of team members as closely as possible with those of our shareholders. One way we reinforce this concept is through our Gainsharing program. Under Gainsharing, as part of our annual planning process, each team receives a labor budget expressed as a percentage of their team’s sales, with leverage built into the budgets on an overall company basis. When teams come in under budget due either to higher sales or lower labor costs, a portion of the surplus is divided among the team members and paid out every four weeks, and a portion is set aside in a savings pool. When teams are over budget (or in a labor deficit position), no Gainsharing money is paid out. Instead, the overage is taken out of the team’s savings pool or, in the absence of savings, paid back using future surpluses. The savings pool is paid out annually after the end of the fiscal year to all teams with a positive balance. Rewarding our team members for increases in labor productivity, something they can control, gives them a direct stake in the success of our business. We also encourage stock ownership among team members through our broad-based team member stock option plan, stock purchase plan and 401(k) plan.

Team Members

We created more than 5,600 new jobs throughout the Company in fiscal year 2013. As of September 29, 2013, we had approximately 78,400 team members, including approximately 56,700 full-time, 18,500 part-time and 3,200 seasonal team members. Full-time team members accounted for approximately 75% of all permanent positions at the end of fiscal year 2013, with voluntary turnover of less than 10%. We believe this is very low for the food retailing industry and allows us to better serve our customers.

For the past 16 years, our team members have helped Whole Foods Market become one of FORTUNE magazine’s “100 Best Companies to Work for in America.” We are one of only 13 companies to make the “100 Best” list every year since its inception. All of our team members are non-union, and we consider our team member relations to be very strong.

We believe in empowering our team members to make Whole Foods Market not only a great place to shop but a great place to build a career. Our salary and benefits programs reflect our philosophy of egalitarianism. To ensure they are perceived as fundamentally fair to all stakeholders, our books are open to our team members, including our annual individual compensation report. We also have a salary cap that limits the total cash compensation paid to any team member in a calendar year to 19 times the average annual wage, including bonuses, of all full-time team members. In addition, our co-founder and co-chief executive officer, John Mackey, has voluntarily set his annual salary at $1 and receives no cash bonuses or stock option awards.

All of our full-time and part-time team members are eligible to receive stock options through annual leadership grants or through service-hour grants once they have accumulated 6,000 service hours (approximately three years of full-time employment). Approximately 95% of the equity awards granted under the Company’s stock plan since its inception in 1992 have been granted to team members who are not executive officers. In fiscal year 2013, more than 14,000 team members exercised over 4 million stock options worth approximately $120 million in gains before taxes, or an average of about $8,400 per team member.

As medical costs continue to rise, we periodically restructure how costs are shared between the Company and team members to ensure our health plan remains sustainable. By participating in our company-wide benefits vote every three years, team members can take an active role in choosing the benefits made available by the Company and how they share in the cost. In our most recent vote, held in September 2012, 82% of eligible team members cast a ballot to determine the Company’s medical plan for 2013. Under this plan, Whole Foods Market provides health care coverage at no cost to full-time team members working 30 or more hours per week and having a minimum of 20,000 service hours (approximately 10 years of full-time employment). Full-time team members with 800 to 19,999 service hours paid a premium of $10 per paycheck. In addition, the Company provides personal wellness dollars in the form of either a health reimbursement arrangement (“HRA”) or health savings account (“HSA”). Based on service hours, team members can receive up to $1,800 per year to help cover the cost of deductibles and other allowable out-of-pocket health care expenses not covered by insurance.

We promote the health of our team members through two initiatives, the Total Health Immersion Program and the Healthy Discount Incentive Program. The Total Health Immersion Program provides educational opportunities for team members that are fully paid by the Company. Since launching this program in the fall of 2009, more than 2,400 team members have participated. The Healthy Discount Incentive Program offers additional store discounts of up to 35%, going beyond the standard store discount that all team members receive, based on meeting designated biometric criteria (cholesterol/LDL, BMI or waist-height ratio, blood pressure) and being nicotine-free. In fiscal year 2013, more than 14,000 team members participated in biometric screenings, with approximately 9,200 receiving higher-level discount cards.

Competition

Food retailing is a large, intensely competitive industry. Our competition varies across the Company and includes but is not limited to local, regional, national and international conventional and specialty supermarkets, natural foods stores, warehouse

membership clubs, online retailers, smaller specialty stores, farmers’ markets and restaurants, each of which competes with us on the basis of store ambiance and experience, product selection and quality, customer service, price, convenience or a combination of these factors.

Marketing

We spend much less on advertising and marketing than other supermarkets – approximately 0.4% of our total sales in fiscal year 2013. Instead, we rely heavily on word-of-mouth advocacy by our shoppers, which we believe is more valuable than traditional advertising; and we allocate our marketing budgets among various national and regional programs and our individual stores. We have marketers in every store dedicated to local events, community nonprofits and the best possible in-store experience, and most of our corporate marketing activity is centered on engaging existing shoppers and growing their basket by introducing them to a fantastic and unique product selection while constantly increasing their choices. Dollars that would be spent on traditional media buys are instead typically spent on community nonprofit partnerships that help grow our business and our communities at the same time. We also connect and engage with our customers through social media, e-newsletters, and our own website and blog at www.wholefoodsmarket.com.

Social Media

Social media provides us with a powerful way to communicate and interact with our Internet-savvy customers, giving us insight at both a local and global level as to how we are viewed and what our customers want and expect from us. Company-wide, we publish roughly 1,000 messages per day across 900 social media channels. Our overall social media footprint on Facebook and Twitter is approximately 7 million, with 3 million Facebook “likes” and 4 million Twitter followers making us the #2 retail brand on Twitter. This includes both our global brand accounts and our individual store accounts, which enable us to build deeper community ties and connect more directly to the tastes and needs of the local customers we serve.

Global Responsibility

We seek to be a deeply responsible company in the communities where we do business around the world, providing ethically sourced, high-quality products and transparent information to our customers, reducing our impact on the environment, and actively participating in our local communities. Each store retains a separate budget for making contributions to a variety of philanthropic and community activities, fostering goodwill and developing a high profile within the community. Our goal is to contribute at least 5% of our after-tax profits annually to nonprofit organizations.

Healthy Eating Education

We are providing a revolutionary educational program in our stores to promote the health of our customers. Our Health Starts Here program consists of a simple approach to eating, paired with practical tools and valuable resources, rooted in our four principles:

| |

| • | Whole Food: We believe that food in its purest state – unadulterated by artificial additives, sweeteners, colorings, and preservatives – is the best tasting and most nutritious food available. |

| |

| • | Plant-Strong: No matter what type of diet you follow – including those with dairy, meat and seafood – reconfigure your plate so the majority of each meal is created from an abundance of raw and cooked vegetables, fruits, legumes and beans, nuts, seeds and whole grains. |

| |

| • | Healthy Fats: Get healthy fats from whole plant sources, such as nuts, seeds and avocados. These foods are rich in micronutrients as well. Work to eliminate (or minimize) extracted oils and processed fats. |

| |

| • | Nutrient Dense: Choose foods that are rich in micronutrients when compared to their total caloric content. Micronutrients include vitamins, minerals, antioxidants and phytochemicals. For guidance, look for the Aggregate Nutrient Density Index (“ANDI”) scoring system in our stores. |

The program includes, among other things: in-store healthy-eating centers to display books and answer questions about healthy eating and cooking ideas; store tours focused on making healthy eating choices; a wide variety of educational opportunities for team members; and healthy-eating classes and networking opportunities for our customers. We believe our Health Starts Here program will grow and evolve over time to become a key competitive advantage for us, and by offering an informed approach to food as a source for improved health and vitality, we hope to play a big part in the solution to the health care crisis in America, changing many more lives for the better.

Whole Planet Foundation

Created in 2005, Whole Planet Foundation (www.wholeplanetfoundation.org) is an independent, nonprofit organization whose mission is to empower the poor through microcredit, with a focus on developing-world communities that supply our stores with product. Microcredit is a system pioneered by Professor Muhammad Yunus, founder of the Grameen Bank in Bangladesh and co-recipient of the 2006 Nobel Peace Prize. The philosophy behind microcredit is to provide the poor access to credit without

requiring contracts or collateral, enabling them to lift themselves out of poverty by creating or expanding home-based businesses. Whole Foods Market covers all operating costs for Whole Planet Foundation. Program grants are funded in part by the sale of products under the Company’s Whole Trade Guarantee Program, along with support from customers, suppliers and team members. As of September 29, 2013, Whole Planet Foundation has partnered with various microfinance institutions to facilitate approximately $42 million in various donor-funded grants for 91 projects in 58 countries where the Company sources products. Over 330,000 borrower families (88% women) have received loans, which are being used for home-based businesses including poultry and pig farming, agriculture, furniture making, tailoring, and selling handicrafts, homemade and bakery-made foods, clothing and footwear. It is estimated that each woman supports a family of almost six, which means our support is contributing to the prosperity of nearly two million individuals.

Whole Kids Foundation™

Whole Kids Foundation (www.wholekidsfoundation.org), an independent nonprofit organization founded in July 2011, is dedicated to improving children’s nutrition by supporting schools and inspiring families. The foundation provides grants for school gardens and salad bars and offers cooking and nutrition education for teachers and staff. Through the generosity of Whole Foods Market customers, suppliers and community donors, approximately 1,600 schools in the U.S. and Canada have received school garden grants since 2011. In addition, Whole Foods Market and Whole Kids Foundation, in partnership with Let’s Move Salad Bars to Schools, have provided more than 2,600 salad bars to schools around the country. Our team members and customers continue to support these initiatives, recently donating approximately $3 million during the foundation’s fall 2013 fundraising campaign. Whole Foods Market covers all operating costs for the foundation, allowing 100% of public donations to be dedicated to program support.

Green Mission®

We are committed to supporting wise environmental practices and being a leader in environmental stewardship. Since 2004, we have purchased over 4.3 billion kilowatt hours of wind-based renewable energy, earning seven Environmental Protection Agency (“EPA”) Green Power awards. We have 14 stores and one distribution center using or hosting rooftop solar systems, four stores with fuel cells, one store with a rooftop farm, and a commissary kitchen that is using biofuel from internally generated waste cooking oil. We also have installed electric vehicle charging stations at over 35 stores around the country. We have made a commitment to reduce energy consumption at all of our stores by 25% per square foot by 2015, and we build our new stores with the environment in mind, using green building innovations whenever possible. Nineteen of our stores have received Leadership in Energy and Environmental Design (“LEED”) certification by the U.S. Green Building Council; 20 stores have earned Green Globes certification from the Green Building Initiative; and 30 stores have received GreenChill Certification Awards from the EPA.

We discontinued the use of disposable plastic grocery bags at the checkouts in all stores in 2008 and refund at least a nickel per reusable bag at the checkout. We also were the first national retailer to provide Forest Stewardship Council certified paper bags originating from 100% post-consumer recycled fiber. Unless located in a community that does not support recycling and composting, all of our stores are involved in a recycling program, and most participate in a composting program where food waste and compostable paper items are regenerated into compost. Additionally, in 2007 we introduced fiber packaging in many of our prepared foods departments that is a compostable alternative to traditional petroleum and wood- or tree-based materials. We also are working to eliminate the use of Styrofoam in packing materials shipped to our Company and in product packaging in our stores. We aim to achieve zero waste (defined by the EPA as a 90% diversion rate of waste from landfills) in at least 90% of our stores by 2017.

GMO Transparency

We believe that quality and transparency are inseparable, and providing detailed information about the products we sell is part of our mission. Accordingly, we announced in March 2013 that all products in our stores in the U.S. and Canada must be labeled by 2018 to indicate whether they contain genetically modified organisms (“GMOs”). We are the first national grocery chain to set a deadline for full GMO transparency. Currently, we have thousands of products within our stores that are certified organic and/or Non-GMO Project™ verified. This includes over 5,000 products carrying the “Non-GMO Project Verified” seal.

Recognitions

Whole Foods Market was named “Retailer of the Year” by The World Retail Congress in 2013 and was recognized on a number of lists, including but not limited to: FORTUNE’s “World’s Most Admired Companies,” FORTUNE’s “100 Best Companies to Work for in America,” Ethisphere Institute’s “World’s Most Ethical Companies,” Forbes’ “America’s 25 Most Inspiring Companies,” and USA Today’s “America’s Top 10 Fastest-Growing Retailers.”

Trademarks

Trademarks owned by the Company or its subsidiaries include, but are not limited to: “Whole Foods Market,” the “Whole Foods Market” logo, “365 Everyday Value,” the “365 Everyday Value” logo, “AFA,” “Allegro Coffee Company,” “America’s Healthiest Grocery Store,” “ANDI,” “Awesome Eats,” “Bread & Circus,” “Capers Community Market,” “Dark Rye,” “Eco-Scale,” “Fresh & Wild,” “Fresh Fields,” “Grab & Give,” “Greenlife Grocery,” “Green Mission,” “Harry’s Farmers Market,” “Health Starts Here,” “Ideal Market,” “Improving Lives with Every Purchase,” “Merchant of Vino,” “Mrs. Gooch’s,” “Vine Buys,” “Wellspring,” “Whole Baby,” “Whole Cities Foundation,” “The Whole Deal,” “Whole Foods, Whole People, Whole Planet,” “Whole Journeys,” “Whole Kids,” “Whole Kids Foundation,” “Whole Planet Foundation,” “Whole Ranch,” and “Whole Trade.” The Company and its subsidiaries have registered or applied to register numerous trademarks, service marks, stylized logos, and brand names in the U.S. and in many additional countries throughout the world. In addition, the Company licenses certain trademarks, including “ENGINE 2” and “PLANT-STRONG,” which are trademarks owned by Engine 2 for Life, LLC. The Company considers certain of its trademarks to be of material importance and actively defends and enforces such trademarks. The Company’s trademarks are generally valid and may be renewed indefinitely as long as they are in use and/or their registrations are properly maintained.

Executive Officers of the Registrant

The following table sets forth the name, age, and position of each of the persons who was serving as an executive officer of the Company as of November 15, 2013:

|

| | | |

| Name | Age | | Position |

| John Mackey | 60 | | Co-Chief Executive Officer |

| Walter Robb | 60 | | Co-Chief Executive Officer |

| A.C. Gallo | 60 | | President and Chief Operating Officer |

| Glenda Flanagan | 60 | | Executive Vice President and Chief Financial Officer |

| James Sud | 61 | | Executive Vice President of Growth and Business Development |

| David Lannon | 48 | | Executive Vice President of Operations |

| Kenneth Meyer | 45 | | Executive Vice President of Operations |

John Mackey, co-founder of the Company, has served as Co-Chief Executive Officer since May 2010, was the Chief Executive Officer from 1978 to May 2010 and was President from June 2001 to October 2004. Mr. Mackey co-authored Conscious Capitalism: Liberating the Heroic Spirit of Business, a 2013 Wall Street Journal Best Seller. To date, profits from books sold at Whole Foods Market stores, along with 100% of the royalties received by Mr. Mackey, have resulted in donations of approximately $100,000 to the Whole Planet Foundation.

Walter Robb has served as Co-Chief Executive Officer since May 2010. Mr. Robb also served as the Co-President and Co-Chief Operating Officer from 2004 to May 2010, as Chief Operating Officer from 2001 to September 2004, and as Executive Vice President from 2000 to February 2001. Since joining the Company in 1991, Mr. Robb has also served as Store Team Leader and President of the Northern Pacific Region.

A.C. Gallo has served as President and Chief Operating Officer of the Company since May 2010. Prior to that, he was Co-President and Co-Chief Operating Officer since September 2004. Mr. Gallo also served as Chief Operating Officer from December 2003 to September 2004. Mr. Gallo has held various positions with the Company and with Bread & Circus, Inc., which was acquired by the Company in October 1992, including Vice President and President of the North Atlantic Region, and Executive Vice President of Operations.

Glenda Flanagan has served as Executive Vice President and Chief Financial Officer of the Company since December 1988.

James Sud has served as Executive Vice President of Growth and Business Development of the Company since February 2001. Mr. Sud joined the Company in May 1997 and served as Vice President and Chief Operating Officer until February 2001. Mr. Sud served as a director of the Company from 1980 to 1997.

David Lannon has served as Executive Vice President of Operations of the Company since February 2012. Prior to that, Mr. Lannon had served as President of the Northern California Region since December 2007 and President of the North Atlantic Region from March 2001 to December 2007. Mr. Lannon has held various positions with the Company and with Bread & Circus, Inc., which was acquired by the Company in October 1992, including Store Team Leader, Director of Store Operations and Vice President of the North Atlantic Region.

Kenneth Meyer has served as Executive Vice President of Operations of the Company since February 2012. Mr. Meyer also served as President of the Mid-Atlantic Region from October 2004 to February 2012. Mr. Meyer has held various positions with the Company and with Fresh Fields Market, which was acquired by the Company in August 1996, including Store Team Leader, Vice President of the Southwest Region, and President of the South Region.

Available Information

Our corporate website at www.wholefoodsmarket.com averages approximately 178,000 visits each day and provides detailed information about our Company, history, product offerings and store locations, as well as thousands of recipes and a library of information about environmental, legislative, health, food safety and product quality issues. With a focus on the local experience, it also includes tools for our stores to offer custom content to site visitors in their area. In addition, access to the Company’s corporate governance policies and Securities and Exchange Commission (“SEC”) filings, including annual reports on Form 10-K, quarterly reports on Form 10-Q, interactive data, current reports on Form 8-K, Section 16 filings, and all amendments to those reports, are available through our website free of charge.

We have included our website and blog addresses only as an inactive textual reference. The information contained on our website is not incorporated by reference into this Report on Form 10-K.

Item 1A. Risk Factors.

Disclaimer on Forward-looking Statements

We wish to caution you that there are risks and uncertainties that could cause our actual results to be materially different from those indicated by forward-looking statements that we make from time to time in filings with the Securities and Exchange Commission, news releases, reports, proxy statements, registration statements and other written communications, as well as forward-looking statements made from time to time by representatives of our Company. These risks and uncertainties include the risk factors described below. These risks and uncertainties and additional risks and uncertainties not presently known to us or that we currently deem immaterial may cause our business, financial condition, operating results and cash flows to be materially adversely affected.

Except for the historical information contained herein, the matters discussed in this analysis are forward-looking statements that involve risks and uncertainties, including general business conditions, changes in overall economic conditions that impact consumer spending, including fuel prices and housing market trends, the impact of competition and other factors which are often beyond the control of the Company. The Company does not undertake any obligation to update forward-looking statements.

This information should be considered in conjunction with Part II, “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 8. Financial Statements and Supplementary Data” of this Report on Form 10‑K.

Increased competition may adversely affect our revenues and profitability.

Our competitors include but are not limited to local, regional, national and international supermarkets, natural food stores, warehouse membership clubs, online retailers, small specialty stores, farmers’ markets, and restaurants. Their businesses compete with us for products, customers and locations. In addition, some are expanding more aggressively in offering a range of natural and organic foods. Some of these competitors may have been in business longer or may have greater financial or marketing resources than we do and may be able to devote greater resources to sourcing, promoting and selling their products. As competition in certain areas intensifies, our operating results may be negatively impacted through a loss of sales, reduction in margin from competitive price changes, and/or greater operating costs such as marketing.

Our growth depends on increasing sales in identical stores and on new store openings, and our failure to achieve these goals could negatively impact our results of operations and financial condition.

Our continued growth depends on our ability to increase sales in our identical stores and open new stores. Our operating results may be materially impacted by fluctuations in our identical store sales. Our identical store sales growth could be lower than our historical average for many reasons including the impact of new and acquired stores entering into the identical store base, the opening of new stores that cannibalize store sales in existing areas, general economic conditions, increased competition, price changes in response to competitive factors, possible supply shortages, and cycling against any year of above-average sales results.

Our growth strategy includes opening new stores in existing and new areas and operating those stores successfully. Successful implementation of this strategy is dependent on finding suitable locations, and we face competition from other retailers for such sites. There can be no assurance that we will continue to grow through new store openings. We may not be able to open new stores timely or operate them successfully. Also, we may not be able to successfully hire and train new team members or integrate

those team members into the programs and policies of the Company. We may not be able to adapt our distribution, management information and other operating systems to adequately supply products to new stores at competitive prices so that we can operate the stores in a successful and profitable manner.

Economic conditions that adversely impact consumer spending could materially impact our business.

Our operating results may be materially impacted by changes in overall economic conditions that impact consumer confidence and spending, including discretionary spending. Future economic conditions affecting disposable consumer income such as employment levels, business conditions, changes in housing market conditions, the availability of credit, interest rates, tax rates, fuel and energy costs, the impact of natural disasters or acts of terrorism, and other matters could reduce consumer spending or cause consumers to shift their spending to lower-priced competitors. In addition, there can be no assurance that various governmental activities to stimulate the economy will restore consumer confidence or change spending habits.

We may experience fluctuations in our quarterly results of operations, which may adversely affect our stock price.

Our quarterly operating results and quarter-to-quarter comparisons could fluctuate for many reasons, including, but not limited to, price changes in response to competitive factors, seasonality, holiday shifts, increases in store operating costs, including commodity costs, possible supply shortages, general economic conditions, extreme weather-related disruptions, and other business costs. In addition, our results may be impacted by the timing of new store openings, construction and pre-opening expenses; the timing of acquisitions, store closures and relocations; and the range of operating results generated from newly opened stores.

Our stock price has been volatile and may be negatively affected by reasons unrelated to our operating performance.

In fiscal year 2013, the closing market price per share of our common stock ranged from $41.51 to $59.32. The market price of our common stock could be subject to significant fluctuation in response to various market factors and events. These market factors and events include variations in our sales and earnings results and any failure to meet market expectations; changes in ratings and earnings estimates by securities analysts; publicity regarding us, our competitors, or the natural products industry generally; new statutes or regulations or changes in the interpretation of existing statutes or regulations affecting the natural products industry specifically; and sales of substantial amounts of common stock in the public market or the perception that such sales could occur and other factors. In addition, the stock market, at times, experiences broad price fluctuations that may adversely affect the market price of our common stock.

Adverse publicity may reduce our brand value and negatively impact our business.

We believe our Company has built an excellent reputation as a food retailer, socially responsible corporation and employer, and we believe our continued success depends on our ability to preserve, grow and leverage the value of our brand. Brand value is based in large part on perceptions of subjective qualities, and even isolated incidents can erode trust and confidence, particularly if they result in adverse publicity, governmental investigations or litigation, which can negatively impact these perceptions and our business. In addition, our brand and reputation could be harmed by actions taken by our suppliers that are outside of our control.

Changes in the availability of quality natural and organic products could impact our business.

We source our products from a variety of local, regional, national and international suppliers, and we rely on them to meet our quality standards and supply products in a timely and efficient manner. There is, however, no assurance that quality natural and organic products will be available to meet our needs. If other competitors significantly increase their natural and organic product offerings, if new laws require the reformulation of certain products to meet tougher standards, or if natural disasters or other catastrophic events occur, the supply of these products may be constrained.

Disruption of significant supplier relationships could negatively affect our business.

United Natural Foods, Inc. (“UNFI”) is our single largest third-party supplier, accounting for approximately 32% of our total purchases in fiscal year 2013. Due to this concentration of purchases from a single third-party supplier, the cancellation of our distribution arrangement or the disruption, delay or inability of UNFI to deliver product to our stores may materially and adversely affect our operating results while we establish alternative distribution channels.

Future events could result in impairment of long-lived assets, which may result in charges that adversely affect our results of operations and capitalization.

Our total assets included long-lived assets totaling approximately $2.5 billion as of September 29, 2013. Long-lived assets are evaluated for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Our impairment evaluations require use of financial estimates of future cash flows. Application of alternative assumptions could produce significantly different results. We may be required to recognize impairments of long-lived assets based on future economic factors such as unfavorable changes in estimated future undiscounted cash flows of an asset group.

We have significant lease obligations, which may require us to continue paying rent for store locations that we no longer operate.

The majority of our stores, distribution centers, bakehouses and administrative facilities are leased. We are subject to risks associated with our current and future real estate leases. Our costs could increase because of changes in the real estate markets and supply or demand for real estate sites. We generally cannot cancel our leases, so if we decide to close a location, we may nonetheless be committed to perform our obligations under the applicable lease, including paying the base rent for the remaining lease term. As each lease expires, we may fail to negotiate renewals, either on commercially acceptable terms or any terms at all. As of September 29, 2013, we had 26 leased properties and adjacent spaces that are not being utilized in current operations. These properties represent acquired dormant locations, stores closed post-acquisition, and stores closed due to relocation. See Note 9 to the consolidated financial statements, “Leases,” in Part II, “Item 8. Financial Statements and Supplementary Data,” of this Report on Form 10-K.

Claims under our self-insurance program may differ from our estimates, which could materially impact our results of operations.

The Company uses a combination of insurance and self-insurance plans to provide for the potential liabilities for workers’ compensation, general liability, property insurance, director and officers’ liability insurance, vehicle liability and team member health care benefits. Liabilities associated with the risks that are retained by the Company are estimated, in part, by considering historical claims experience, demographic factors, severity factors and other actuarial assumptions. Our results could be materially impacted by claims and other expenses related to such plans if future occurrences and claims differ from these assumptions and historical trends.

Perishable foods product losses could materially impact our results of operations.

Our stores offer a significant number of perishable products, accounting for approximately 66.2% of our total sales in fiscal year 2013. The Company’s emphasis on perishable products may result in significant product inventory losses in the event of extended power outages, natural disasters or other catastrophic occurrences.

Actual or perceived food safety concerns may adversely affect our sales.

There is increasing governmental scrutiny of and public awareness regarding food safety. We believe that many customers choose to shop our stores because of their interest in health, nutrition and food safety. We believe that our customers hold us to a higher food safety standard than other supermarkets. The real or perceived sale of contaminated food products by us could result in government enforcement action, private litigation, product recalls and other liabilities, the settlement or outcome of which might have a material adverse effect on our operating results.

Pending or future legal proceedings could materially impact our results of operations.

From time to time, we are party to legal proceedings, including matters involving personnel and employment issues, personal injury, intellectual property, product liability, acquisitions, and other proceedings arising in the ordinary course of business. Our results could be materially impacted by the decisions and expenses related to pending or future proceedings.

The loss of key management could negatively affect our business.

We are dependent upon a number of key management and other team members. If we were to lose the services of a significant number of key team members within a short period of time, this could have a material adverse effect on our operations. We do not maintain key person insurance on any team member. Our continued success also is dependent upon our ability to attract and retain qualified team members to meet our future growth needs. We face intense competition for qualified team members, many of whom are subject to offers from competing employers. We may not be able to attract and retain necessary team members to operate our business.

A widespread health epidemic could materially impact our business.

The Company’s business could be severely impacted by a widespread regional, national or global health epidemic. Our stores are a place where customers come together, interact and learn and at the same time discover the many joys of eating and sharing food. A widespread health epidemic may cause customers to avoid public gathering places or otherwise change their shopping behaviors. Additionally, a widespread health epidemic could also adversely impact our business by disrupting production and delivery of products to our stores and by impacting our ability to appropriately staff our stores.

Our investments in money market funds and certain other securities are subject to market risks, which may result in losses.

As of September 29, 2013, we had approximately $194 million in short-term investments classified as cash and cash equivalents and approximately $1.0 billion in available-for-sale marketable securities. We have invested these amounts primarily in state and local municipal obligations, government agency securities, corporate commercial paper, and money market funds meeting certain criteria. These investments are subject to general credit, liquidity, market and interest rate risks, which, if they materialize, could have a negative impact on our results of operations.

Effective tax rate changes and results of examinations by taxing authorities could materially impact our results of operations.

Our future effective tax rates could be adversely affected by the earnings mix being lower than historical results in states or countries where we have lower statutory rates and higher-than-historical results in states or countries where we have higher statutory rates, by changes in the valuation of our deferred tax assets and liabilities, or by changes in tax laws or interpretations thereof. In addition, we are subject to periodic audits and examinations by the Internal Revenue Service (“IRS”) and other state and local taxing authorities. Our results could be materially impacted by the determinations and expenses related to proceedings by the IRS and other state and local taxing authorities. See Note 10 to the consolidated financial statements, “Income Taxes,” in Part II, “Item 8. Financial Statements and Supplementary Data,” of this Report on Form 10-K.

Unions may attempt to organize our team members, which could harm our business.

All of our team members are non-union, and we consider our team member relations to be very strong. From time to time, however, unions have attempted to organize all or part of our team member base at certain stores and non-retail facilities. Responding to such organization attempts is distracting to management and team members and may have a negative financial impact on a store, facility or the Company as a whole.

Changes in accounting standards and estimates could materially impact our results of operations.

Generally accepted accounting principles and related accounting pronouncements, implementation guidelines, and interpretations for many aspects of our business, such as accounting for insurance and self-insurance, inventories, goodwill and intangible assets, store closures, leases, income taxes and share-based payments, are highly complex and involve subjective judgments. Changes in these rules or their interpretation or changes in underlying estimates, assumptions or judgments by our management could significantly change or add significant volatility to our reported earnings without a comparable underlying change in cash flow from operations.

Unfavorable changes in governmental regulation could harm our business.

The Company is subject to various local, state, federal and international laws, regulations and administrative practices affecting our business, and we must comply with provisions regulating health and sanitation standards, food labeling, equal employment, minimum wages, and licensing for the sale of food and, in some stores, alcoholic beverages. Our new store openings could be delayed or prevented or our existing stores could be impacted by difficulties or failures in our ability to obtain or maintain required approvals or licenses. Changes in existing laws or implementation of new laws, regulations and practices (e.g., health care legislation) could have a significant impact on our business.

The USDA’s Organic Rule facilitates interstate commerce and the marketing of organically produced food, and provides assurance to our customers that such products meet consistent, uniform standards. Compliance with this rule could pose a significant burden on some of our suppliers, which may cause a disruption in some of our product offerings.

We cannot predict the nature of future laws, regulations, interpretations or applications, or determine what effect either additional government regulations or administrative orders, when and if promulgated, or disparate local, state, federal and international regulatory schemes would have on our business in the future. They could, however, require the reformulation of certain products to meet new standards, the recall or discontinuance of certain products not able to be reformulated, additional recordkeeping, expanded documentation of the properties of certain products, expanded or different labeling and/or scientific substantiation. Any or all of such requirements could have an adverse effect on our operating results.

Disruptions in our information systems could harm our ability to run our business.

We rely extensively on information systems for point-of-sale processing in our stores, supply chain, financial reporting, human resources and various other processes and transactions. Our information systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, security breaches, including breaches of our transaction processing or other systems that could result in the compromise of confidential customer data, catastrophic events, and usage errors by our team members. If our systems are breached, damaged or cease to function properly, we may have to make significant investments to fix or replace them, suffer interruptions in our operations, face costly litigation, and our reputation with our customers may be harmed. Any material interruption in our information systems may have a material adverse effect on our operating results.

The risk associated with doing business in other countries could materially impact our results of operations.

Though only 3.3% of our total sales in fiscal year 2013, the Company’s international operations are subject to certain risks of conducting business abroad, including fluctuations in foreign currency exchange rates, changes in regulatory requirements, and changes or uncertainties in the economic, social and political conditions in the Company’s geographic areas, among other things.

We may be unable to adequately protect our intellectual property rights, which could harm our business.

We rely on a combination of trademark, trade secret and copyright law and internal procedures and nondisclosure agreements to protect our intellectual property. There can be no assurance that our intellectual property rights can be successfully asserted in the future or will not be invalidated, circumvented or challenged. In addition, the laws of certain foreign countries in which our products may be produced or sold do not protect our intellectual property rights to the same extent as the laws of the United States. Failure to protect our proprietary information could have a material adverse effect on our business.

A failure of our internal control over financial reporting could materially impact our business or stock price.

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting. An internal control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all internal control systems, internal control over financial reporting may not prevent or detect misstatements. Any failure to maintain an effective system of internal control over financial reporting could limit our ability to report our financial results accurately and timely or to detect and prevent fraud, and could expose us to litigation or adversely affect the market price of our common stock. The Company’s management concluded that its internal control over financial reporting was effective as of September 29, 2013. See Part II, “Item 9A. Controls and Procedures – Management’s Report on Internal Control over Financial Reporting.”

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

As of September 29, 2013, we operated 362 stores: 347 stores in 40 U.S. states and the District of Columbia; 8 stores in Canada; and 7 stores in the U.K. We own 13 stores, two distribution facilities and land for one store in development, including the adjacent property. We also own a building and land, which is leased to a third party; a building on leased land, which is leased to third parties; and we have two stores and one parking facility in development on leased land. All other stores, distribution centers, bakehouses and administrative facilities are leased, and we have options to renew most of our leases in five-year increments. In addition, as of September 29, 2013, we had 26 leased properties and adjacent spaces that are not being utilized in current operations, of which 18 are related to our acquisition of Wild Oats Markets in August 2007. We are actively negotiating to sublease or terminate leases related to these locations.

The following table shows the number of our stores by U.S. state, the District of Columbia, Canada and the U.K. as of September 29, 2013:

|

| | | | | | | | | | |

| Location | Number of stores |

| | Location | Number of stores |

| | Location | Number of stores |

|

| Alabama | 1 |

| | Kansas | 2 |

| | Ohio | 6 |

|

| Arizona | 7 |

| | Kentucky | 2 |

| | Oklahoma | 2 |

|

| Arkansas | 1 |

| | Louisiana | 3 |

| | Oregon | 7 |

|

| California | 73 |

| | Maine | 1 |

| | Pennsylvania | 10 |

|

| Canada | 8 |

| | Maryland | 8 |

| | Rhode Island | 3 |

|

| Colorado | 19 |

| | Massachusetts | 28 |

| | South Carolina | 3 |

|

| Connecticut | 9 |

| | Michigan | 6 |

| | Tennessee | 4 |

|

| District of Columbia | 4 |

| | Minnesota | 6 |

| | Texas | 21 |

|

| Florida | 19 |

| | Missouri | 2 |

| | United Kingdom | 7 |

|

| Georgia | 9 |

| | Nebraska | 1 |

| | Utah | 4 |

|

| Hawaii | 3 |

| | Nevada | 5 |

| | Virginia | 10 |

|

| Idaho | 1 |

| | New Jersey | 10 |

| | Washington | 7 |

|

| Illinois | 18 |

| | New Mexico | 4 |

| | Wisconsin | 2 |

|

| Indiana | 3 |

| | New York | 12 |

| | | |