UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06135

Templeton Institutional Funds

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Alison Baur

Franklin Templeton

One Franklin Parkway

San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (954) 527-7500

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

| ITEM 1. | REPORT TO STOCKHOLDERS. |

(a) The Report to Shareholders is filed herewith

| | |

TIF Foreign Smaller Companies Series | |

| Advisor Class [TFSCX] |

| Annual Shareholder Report | December 31, 2024 |

|

This annual shareholder report contains important information about TIF Foreign Smaller Companies Series for the period January 1, 2024, to December 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 321-8563.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Advisor Class | $109 | 1.10% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended December 31, 2024, Advisor Class shares of TIF Foreign Smaller Companies Series (Fund) returned -2.49%. The Fund compares its performance to the MSCI AC World ex-U.S. Small Cap Index-NR, which returned 3.36% for the same period.

| |

Top contributors to performance: |

| ↑ | Stock selection in the consumer discretionary, real estate and communication services sectors contributed to relative performance for the year. |

| ↑ | Geographically, stock selection in Canada and Japan contributed to relative returns. |

| ↑ | Asics (Japan), Tsumura (Japan), Johnson Health Tech (Taiwan), OneSpaWorld (Bahamas) and Topcon (Japan). |

| |

Top detractors from performance: |

| ↓ | Stock selection in the industrial, consumer staples and information technology sectors detracted from relative performance for the year. |

| ↓ | Geographically, stock selection and overweights in the Eurozone and Latin America detracted from relative returns. |

| ↓ | i-SENS (South Korea), Dexco (Brazil), Hana Microelectronics (South Korea), Sanlorenzo (Italy) and M. Dias Branco (Brazil). |

| TIF Foreign Smaller Companies Series | PAGE 1 | 458-ATSR-0225 |

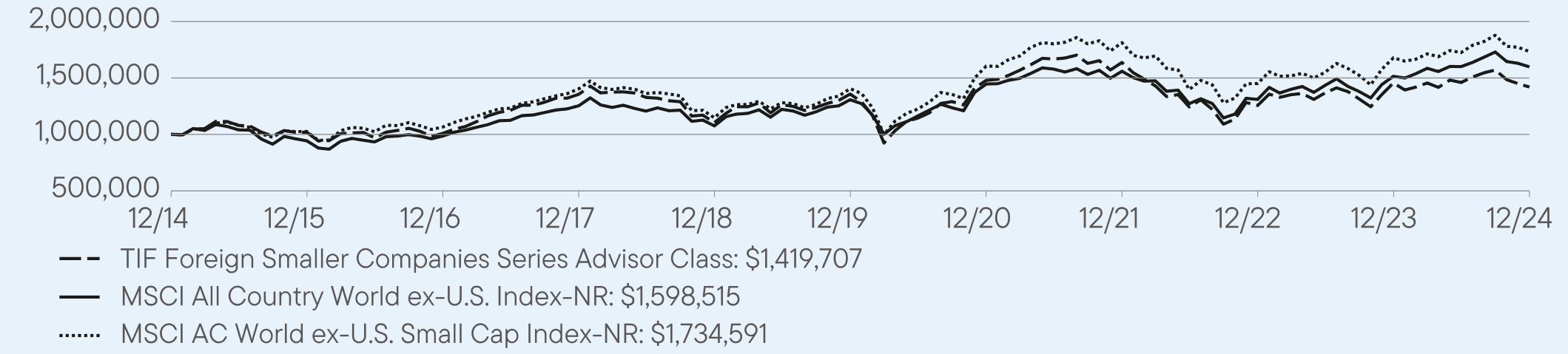

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $1,000,000 INVESTMENT – Advisor Class 12/31/2014 — 12/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended December 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Advisor Class | -2.49 | 0.90 | 3.57 |

MSCI All Country World ex-U.S. Index-NR | 5.53 | 4.10 | 4.80 |

MSCI AC World ex-U.S. Small Cap Index-NR | 3.36 | 4.30 | 5.66 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) 321-8563 or visit ftinstitutional.com.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of December 31, 2024)

| |

Total Net Assets | $111,846,256 |

Total Number of Portfolio Holdings* | 104 |

Total Management Fee Paid | $1,485,884 |

Portfolio Turnover Rate | 29.65% |

| * | Does not include derivatives, except purchased options, if any. |

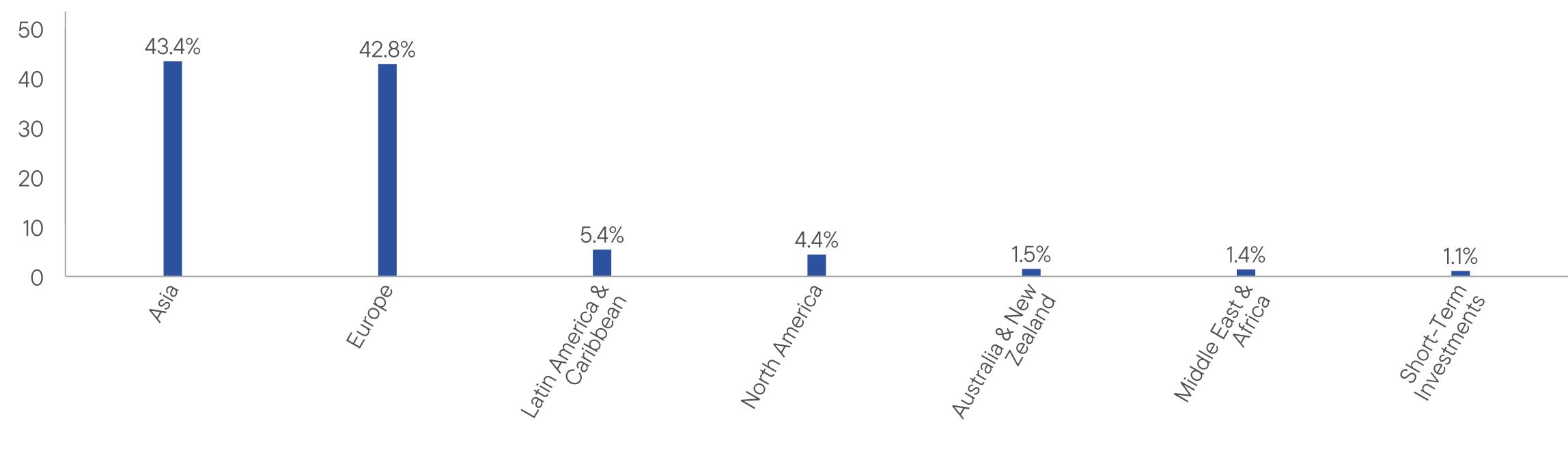

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| TIF Foreign Smaller Companies Series | PAGE 2 | 458-ATSR-0225 |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 321-8563. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| TIF Foreign Smaller Companies Series | PAGE 3 | 458-ATSR-0225 |

100000010187831010088135533411048741357475147902616375681256318145601214197071000000943379985785125383710758181307280144653115597081310106151469115985151000000102602710661291403511114806214054631605632181317714510331678242173459143.442.85.44.41.51.41.1

| | |

TIF International Equity Series | |

| Primary Shares [TFEQX] |

| Annual Shareholder Report | December 31, 2024 |

|

This annual shareholder report contains important information about TIF International Equity Series for the period January 1, 2024, to December 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 321-8563.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Primary Shares | $96 | 0.92% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended December 31, 2024, Primary Shares of TIF International Equity Series (Fund) returned 8.40%. The Fund compares its performance to the MSCI All Country World ex-U.S. Index-NR and the MSCI EAFE Index-NR, which returned 5.53% and 3.82%, respectively, for the same period.

| |

Top contributors to performance: |

| ↑ | Stock selection in the materials, financials and industrials sectors contributed to relative performance for the year. In materials, we continued to favor construction materials firms offering strong economic and secular tailwinds as well as packaging companies and industrial metals firms that, in our analysis, have sound balance sheets, good cost positions and upside exposure to structural demand drivers such as electrification and the green energy transition. |

| ↑ | Geographically, stock selection in Japan and the Eurozone contributed to relative returns. We continued to favor Japanese companies that, in our view, benefit from domestic tailwinds such as corporate reforms to boost returns on shareholder equity. The majority of our European holdings are globally focused, with a reach far outside their domestic market. |

| ↑ | Sumitomo Mitsui Financial Group (Japan), Hitachi (Japan), Deutsche Telekom (Germany), CRH (Ireland) and Standard Chartered (United Kingdom). |

| |

Top detractors from performance: |

| ↓ | Stock selection in the consumer discretionary and health care sectors and an overweight and stock selection in the energy sector detracted from relative performance for the year. In health care, we remained focused on fundamentals, including free cash flow generation, cost discipline, earnings growth trajectories, competitive advantages and structural growth drivers. |

| ↓ | Geographically, lack of exposure to China and stock selection in the U.K. detracted. We maintained a zero weighting in China and do not believe recent stimulus measures are enough to address longer-term structural issues. Long-term fundamental analysis of individual companies has led us to favor indirect Chinese exposure and other Asian-market equities. |

| ↓ | Adecco Group (Switzerland), Kering (France), Samsung Electronics (South Korea), ICON (Ireland) and BP (United Kingdom). |

| TIF International Equity Series | PAGE 1 | 454-ATSR-0225 |

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $1,000,000 INVESTMENT – Primary Shares 12/31/2014 — 12/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended December 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Primary Shares | 8.40 | 6.12 | 4.47 |

MSCI All Country World ex-U.S. Index-NR | 5.53 | 4.10 | 4.80 |

MSCI EAFE Index-NR | 3.82 | 4.73 | 5.20 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) 321-8563 or visit ftinstitutional.com.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of December 31, 2024)

| |

Total Net Assets | $101,339,074 |

Total Number of Portfolio Holdings* | 53 |

Total Management Fee Paid | $771,803 |

Portfolio Turnover Rate | 30.90% |

| * | Does not include derivatives, except purchased options, if any. |

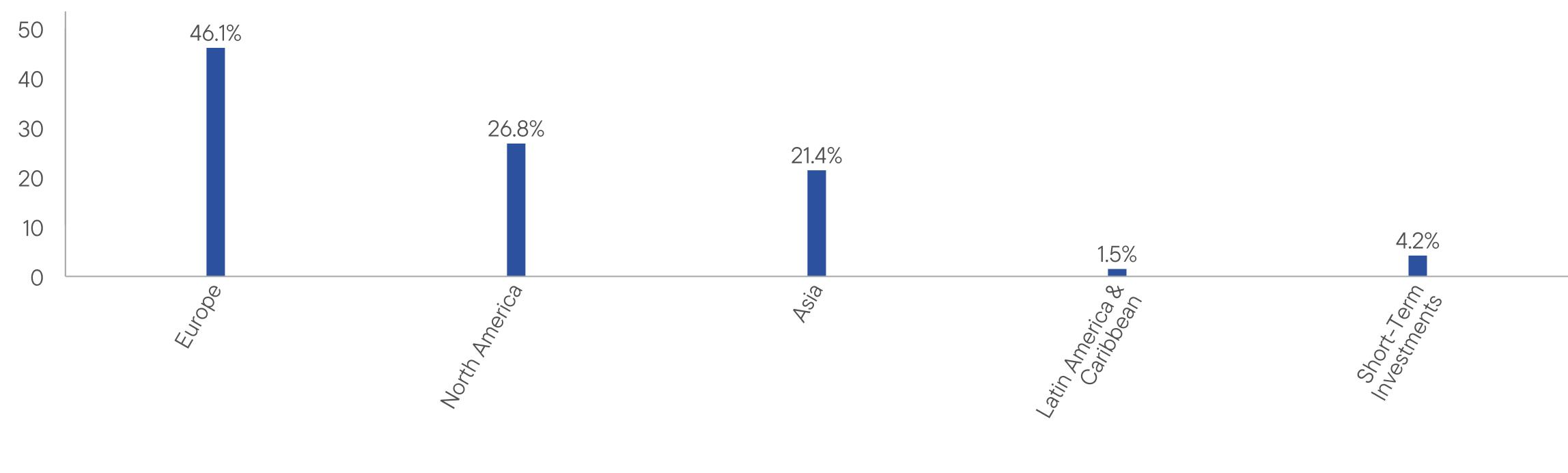

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| TIF International Equity Series | PAGE 2 | 454-ATSR-0225 |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 321-8563. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| TIF International Equity Series | PAGE 3 | 454-ATSR-0225 |

100000097326898591212118401031620115095012119771281628116330414289481549033100000094337998578512538371075818130728014465311559708131010615146911598515100000099185810017791252568107983513175561420532158053313521191598717165983946.126.821.41.54.2

| | |

TIF International Equity Series | |

| Service Shares [TFESX] |

| Annual Shareholder Report | December 31, 2024 |

|

This annual shareholder report contains important information about TIF International Equity Series for the period January 1, 2024, to December 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 321-8563.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Service Shares | $120 | 1.15% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended December 31, 2024, Service Shares of TIF International Equity Series (Fund) returned 8.21%. The Fund compares its performance to the MSCI All Country World ex-U.S. Index-NR and the MSCI EAFE Index-NR, which returned 5.53% and 3.82%, respectively, for the same period.

| |

Top contributors to performance: |

| ↑ | Stock selection in the materials, financials and industrials sectors contributed to relative performance for the year. In materials, we continued to favor construction materials firms offering strong economic and secular tailwinds as well as packaging companies and industrial metals firms that, in our analysis, have sound balance sheets, good cost positions and upside exposure to structural demand drivers such as electrification and the green energy transition. |

| ↑ | Geographically, stock selection in Japan and the Eurozone contributed to relative returns. We continued to favor Japanese companies that, in our view, benefit from domestic tailwinds such as corporate reforms to boost returns on shareholder equity. The majority of our European holdings are globally focused, with a reach far outside their domestic market. |

| ↑ | Sumitomo Mitsui Financial Group (Japan), Hitachi (Japan), Deutsche Telekom (Germany), CRH (Ireland) and Standard Chartered (United Kingdom). |

| |

Top detractors from performance: |

| ↓ | Stock selection in the consumer discretionary and health care sectors and an overweight and stock selection in the energy sector detracted from relative performance for the year. In health care, we remained focused on fundamentals, including free cash flow generation, cost discipline, earnings growth trajectories, competitive advantages and structural growth drivers. |

| ↓ | Geographically, lack of exposure to China and stock selection in the U.K. detracted. We maintained a zero weighting in China and do not believe recent stimulus measures are enough to address longer-term structural issues. Long-term fundamental analysis of individual companies has led us to favor indirect Chinese exposure and other Asian-market equities. |

| ↓ | Adecco Group (Switzerland), Kering (France), Samsung Electronics (South Korea), ICON (Ireland) and BP (United Kingdom). |

| TIF International Equity Series | PAGE 1 | 444-ATSR-0225 |

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $1,000,000 INVESTMENT – Service Shares 12/31/2014 — 12/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended December 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Service Shares | 8.21 | 6.00 | 4.33 |

MSCI All Country World ex-U.S. Index-NR | 5.53 | 4.10 | 4.80 |

MSCI EAFE Index-NR | 3.82 | 4.73 | 5.20 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) 321-8563 or visit ftinstitutional.com.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of December 31, 2024)

| |

Total Net Assets | $101,339,074 |

Total Number of Portfolio Holdings* | 53 |

Total Management Fee Paid | $771,803 |

Portfolio Turnover Rate | 30.90% |

| * | Does not include derivatives, except purchased options, if any. |

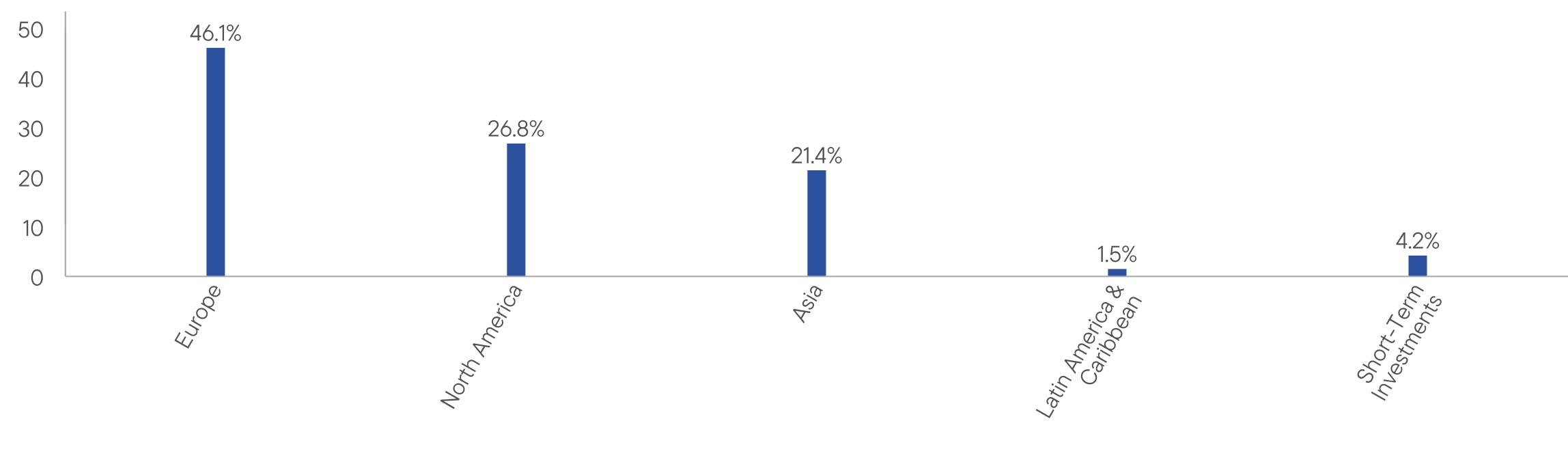

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| TIF International Equity Series | PAGE 2 | 444-ATSR-0225 |

HOW HAS THE FUND CHANGED?

The net expense ratio increased during the period primarily due to an increase in transfer agency fees.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by May 1, 2025, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 321-8563 or

prospectus@franklintempleton.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 321-8563. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| TIF International Equity Series | PAGE 3 | 444-ATSR-0225 |

100000097195898318012066461025478114174212006291268909114992314120911528038100000094337998578512538371075818130728014465311559708131010615146911598515100000099185810017791252568107983513175561420532158053313521191598717165983946.126.821.41.54.2

(b) Not applicable

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 19(a) (1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

| | | |

| | | The Board of Trustees of the Registrant has determined that Ann Torre Bates and David W. Niemiec possess the technical attributes identified in Instruction 2(b) of Item 3 to Form N-CSR to qualify as an “audit committee financial expert,” and has designated Ann Torre Bates and David W. Niemiec as the Audit Committee’s financial experts. Ann Torre Bates and David W. Niemiec are “independent” Trustees pursuant to paragraph (a) (2) of Item 3 to Form N-CSR. |

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

(a) Audit Fees. The aggregate fees billed in the last two fiscal years ending December 31, 2023 and December 31, 2024 (the “Reporting Periods”) for professional services rendered by the Registrant’s principal accountant (the “Auditor”) for the audit of the Registrant’s annual financial statements, or services that are normally provided by the Auditor in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $82,442 in December 31, 2023 and $85,081 in December 31, 2024.

(b) Audit-Related Fees. The aggregate fees billed in the Reporting Periods for assurance and related services by the Auditor that are reasonably related to the performance of the Registrant’s financial statements were $3,000 in December 31, 2023 and $0 in December 31, 2024. The services for which these fees were paid included attestation services.

(c) Tax Fees. The aggregate fees billed in the Reporting Periods for professional services rendered by the Auditor for tax compliance, tax advice and tax planning (“Tax Services”) were $0 in December 31, 2023 and $21,000 in December 31, 2024. These services consisted of (i) review or preparation of U.S. federal, state, local and excise tax returns; (ii) U.S. federal, state and local tax planning, advice and assistance regarding statutory, regulatory or administrative developments, and (iii) tax advice regarding tax qualification matters and/or treatment of various financial instruments held or proposed to be acquired or held.

There were no fees billed for tax services by the Auditor to the Registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Registrant (“Service Affiliates”) during the Reporting Periods that required pre-approval by the Audit Committee.

(d) All Other Fees. The aggregate fees billed in the Reporting Periods for products and services provided by the Auditor to the Registrant, other than the services reported in paragraphs (a) through (c) of this item, were $0 in December 31, 2023 and $0 in December 31, 2024.

There were no other non-audit services rendered by the Auditor to the Service Affiliates requiring pre-approval by the Audit Committee in the Reporting Periods.

(e) Audit Committee’s pre-approval policies and procedures described in paragraph (c) (7) of Rule 2-01 of Regulation S-X.

(1) The Registrant’s Audit Committee is directly responsible for approving the services to be provided by the Auditors, including:

(i) pre-approval of all audit and audit related services;

(ii) pre-approval of all non-audit related services to be provided to the Registrant by the Auditors;

(iii) pre-approval of all non-audit related services to be provided by the Auditors to the Registrant and the Service Affiliates where the non-audit services relate directly to the operations or financial reporting of the Registrant; and

(iv) establishment by the Audit Committee, if deemed necessary or appropriate, as an alternative to committee pre-approval of services to be provided by the Auditors, as required by paragraphs (ii) and (iii) above, of policies and procedures to permit such services to be pre-approved by other means, such as through establishment of guidelines or by action of a designated member or members of the committee; provided the policies and procedures are detailed as to the particular service and the committee is informed of each service and such policies and procedures do not include delegation of Audit Committee responsibilities, as contemplated under the Securities Exchange Act of 1934, to management; subject, in the case of (ii) through (iv), to any waivers, exceptions or exemptions that may be available under applicable law or rules.

(2) None of the services described in paragraphs (b) through (d) of this Item were performed in reliance on paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) Non-audit fees billed by the Auditor for services rendered to the Registrant and the Service Affiliates during the Reporting Periods were $118,626 in December 31, 2023 and $182,840 in December 31, 2024.

(h) Yes. The Registrant’s audit committee has considered whether the provision of non-audit services that were rendered to Service Affiliates, which were not pre-approved (not requiring pre-approval), is compatible with maintaining the Auditor’s independence. All services provided by the Auditor to the Registrant or to the Service Affiliates, which were required to be pre-approved, were pre-approved as required.

(i) Not applicable.

(j) Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

| ITEM 6. | SCHEDULE OF INVESTMENTS. |

| (a) | Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR. |

| ITEM 7. | FINANCIAL STATEMENTS AND FINANCIAL HIGLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

Templeton

Institutional

Funds

Financial

Statements

and

Other

Important

Information

Annual

|

December 31, 2024

Foreign

Smaller

Companies

Series

International

Equity

Series

Financial

Statements

and

Other

Important

Information—Annual

Financial

Highlights

and

Schedules

of

Investments

2

Financial

Statements

13

Notes

to

Financial

Statements

16

Report

of

Independent

Registered

Public

Accounting

Firm

30

Tax

Information

31

Changes

In

and

Disagreements

with

Accountants

32

Results

of

Meeting(s)

of

Shareholders

32

Remuneration

Paid

to

Directors,

Officers

and

Others

32

Board

Approval

of

Management

and

Subadvisory

Agreements

32

Templeton

Institutional

Funds

Financial

Highlights

Foreign

Smaller

Companies

Series

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Year

Ended

December

31,

2024

2023

2022

2021

2020

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$18.67

$16.35

$21.80

$23.03

$21.40

Income

from

investment

operations

a

:

Net

investment

income

b

.........................

0.28

0.26

0.31

0.28

0.17

Net

realized

and

unrealized

gains

(losses)

...........

(0.72)

2.30

(5.38)

2.07

1.74

Total

from

investment

operations

....................

(0.44)

2.56

(5.07)

2.35

1.91

Less

distributions

from:

Net

investment

income

..........................

(0.63)

(0.24)

(0.32)

(0.28)

(0.22)

Net

realized

gains

.............................

(1.66)

—

(0.06)

(3.30)

(0.06)

Total

distributions

...............................

(2.29)

(0.24)

(0.38)

(3.58)

(0.28)

Net

asset

value,

end

of

year

.......................

$15.94

$18.67

$16.35

$21.80

$23.03

Total

return

....................................

(2.49)%

15.75%

(23.19)%

10.72%

8.95%

Ratios

to

average

net

assets

Expenses

before

waiver

and

payments

by

affiliates

......

1.10%

1.09%

1.02%

1.04%

1.04%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

1.10%

c

1.09%

c

1.02%

c

1.04%

c

1.03%

Net

investment

income

...........................

1.50%

1.49%

1.76%

1.13%

0.87%

Supplemental

data

Net

assets

,

end

of

year

(000’s)

.....................

$111,846

$191,256

$353,380

$739,717

$725,098

Portfolio

turnover

rate

............................

29.65%

36.62%

16.54%

31.09%

34.89%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Benefit

of

waiver

and

payments

by

affiliates

rounds

to

less

than

0.01%.

Templeton

Institutional

Funds

Schedule

of

Investments,

December

31,

2024

Foreign

Smaller

Companies

Series

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Industry

Shares

a

Value

a

Common

Stocks

93.9%

Austria

1.1%

a

DO

&

CO

AG

...................

Commercial

Services

&

Supplies

6,620

$

1,234,319

Bahamas

2.0%

OneSpaWorld

Holdings

Ltd.

........

Diversified

Consumer

Services

112,553

2,239,805

Belgium

1.7%

Barco

NV

......................

Electronic

Equipment,

Instruments

&

Components

85,541

925,398

b

Kinepolis

Group

NV

..............

Entertainment

24,827

1,013,426

1,938,824

Brazil

2.7%

Arcos

Dorados

Holdings,

Inc.

,

A

.....

Hotels,

Restaurants

&

Leisure

102,404

745,501

Camil

Alimentos

SA

...............

Food

Products

729,300

691,230

Dexco

SA

......................

Paper

&

Forest

Products

1,195,100

1,150,168

M

Dias

Branco

SA

................

Food

Products

145,600

472,759

3,059,658

Canada

2.6%

b

Canaccord

Genuity

Group,

Inc.

......

Capital

Markets

207,800

1,461,517

Computer

Modelling

Group

Ltd.

......

Software

199,904

1,481,080

2,942,597

China

1.6%

c

JNBY

Design

Ltd.

,

Reg

S

..........

Textiles,

Apparel

&

Luxury

Goods

350,500

789,021

Xtep

International

Holdings

Ltd.

......

Textiles,

Apparel

&

Luxury

Goods

1,309,663

942,862

1,731,883

Denmark

0.6%

Matas

A/S

......................

Specialty

Retail

34,090

641,815

Finland

1.9%

Fiskars

OYJ

Abp

.................

Household

Durables

42,496

657,651

Huhtamaki

OYJ

..................

Containers

&

Packaging

42,566

1,507,761

2,165,412

France

0.6%

Kaufman

&

Broad

SA

.............

Household

Durables

20,607

697,668

Germany

4.6%

Duerr

AG

......................

Machinery

24,662

547,123

Gerresheimer

AG

................

Life

Sciences

Tools

&

Services

9,924

730,591

Jenoptik

AG

....................

Electronic

Equipment,

Instruments

&

Components

41,022

959,314

a,c

Montana

Aerospace

AG

,

144A

,

Reg

S

.

Aerospace

&

Defense

57,096

901,718

Rational

AG

....................

Machinery

1,691

1,448,355

Stabilus

SE

.....................

Machinery

17,181

539,821

5,126,922

Greece

0.7%

JUMBO

SA

.....................

Specialty

Retail

30,596

808,782

Hong

Kong

3.3%

Techtronic

Industries

Co.

Ltd.

.......

Machinery

148,000

1,945,601

VTech

Holdings

Ltd.

..............

Communications

Equipment

254,300

1,724,286

3,669,887

India

1.3%

Exide

Industries

Ltd.

..............

Automobile

Components

291,724

1,416,709

Templeton

Institutional

Funds

Schedule

of

Investments

Foreign

Smaller

Companies

Series

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Industry

Shares

a

Value

a

Common

Stocks

(continued)

Indonesia

0.6%

Industri

Jamu

Dan

Farmasi

Sido

Muncul

Tbk.

PT

......................

Personal

Care

Products

17,554,500

$

643,501

Israel

1.3%

a

Nayax

Ltd.

.....................

Electronic

Equipment,

Instruments

&

Components

51,266

1,507,447

Italy

9.3%

Brunello

Cucinelli

SpA

.............

Textiles,

Apparel

&

Luxury

Goods

13,982

1,527,384

b,c

Carel

Industries

SpA

,

144A

,

Reg

S

...

Building

Products

29,145

559,720

c

Cromwell

European

Real

Estate

Investment

Trust

,

Reg

S

..........

Diversified

REITs

479,100

783,439

Intercos

SpA

....................

Personal

Care

Products

89,223

1,280,501

Interpump

Group

SpA

.............

Machinery

39,696

1,760,509

LU-VE

SpA

.....................

Building

Products

22,941

659,435

Sanlorenzo

SpA

.................

Leisure

Products

49,354

1,661,651

c

Technogym

SpA

,

144A

,

Reg

S

......

Leisure

Products

200,810

2,180,324

10,412,963

Japan

18.7%

Anicom

Holdings,

Inc.

.............

Insurance

121,000

491,834

Asics

Corp.

.....................

Textiles,

Apparel

&

Luxury

Goods

100,300

1,956,631

Bunka

Shutter

Co.

Ltd.

............

Building

Products

63,200

772,001

CKD

Corp.

.....................

Machinery

74,700

1,197,126

Glory

Ltd.

......................

Machinery

37,500

613,163

Idec

Corp.

......................

Electrical

Equipment

43,100

674,972

IDOM,

Inc.

.....................

Specialty

Retail

145,600

1,036,129

Kaneka

Corp.

...................

Chemicals

56,100

1,330,729

MEITEC

Group

Holdings,

Inc.

.......

Professional

Services

96,800

1,815,367

Morinaga

&

Co.

Ltd.

..............

Food

Products

34,200

589,928

Nichiha

Corp.

...................

Building

Products

69,200

1,278,402

Nissei

ASB

Machine

Co.

Ltd.

........

Machinery

43,200

1,382,383

Qol

Holdings

Co.

Ltd.

.............

Consumer

Staples

Distribution

&

Retail

64,900

604,205

Roland

Corp.

...................

Leisure

Products

37,100

917,568

Sato

Holdings

Corp.

..............

Commercial

Services

&

Supplies

44,200

612,701

Shima

Seiki

Manufacturing

Ltd.

......

Machinery

97,400

643,281

TechnoPro

Holdings,

Inc.

..........

Professional

Services

78,300

1,464,041

Topcon

Corp.

...................

Electronic

Equipment,

Instruments

&

Components

80,500

1,435,153

Tsumura

&

Co.

..................

Pharmaceuticals

70,800

2,106,311

20,921,925

Mexico

0.4%

a,c

Grupo

Traxion

SAB

de

CV

,

A

,

144A

,

Reg

S

.......................

Ground

Transportation

441,143

402,616

New

Zealand

1.4%

Summerset

Group

Holdings

Ltd.

.....

Health

Care

Providers

&

Services

216,203

1,587,457

Norway

1.4%

TGS

ASA

......................

Energy

Equipment

&

Services

151,349

1,516,461

Philippines

2.7%

Century

Pacific

Food,

Inc.

..........

Food

Products

2,332,900

1,690,269

Puregold

Price

Club,

Inc.

...........

Consumer

Staples

Distribution

&

Retail

2,514,700

1,341,144

3,031,413

Portugal

0.7%

b

Corticeira

Amorim

SGPS

SA

........

Containers

&

Packaging

87,951

732,011

Templeton

Institutional

Funds

Schedule

of

Investments

Foreign

Smaller

Companies

Series

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Industry

Shares

a

Value

a

Common

Stocks

(continued)

Singapore

1.0%

Digital

Core

REIT

Management

Pte.

Ltd.

Specialized

REITs

1,973,200

$

1,145,374

South

Korea

3.3%

a

AMOREPACIFIC

Group

...........

Personal

Care

Products

45,608

640,213

BNK

Financial

Group,

Inc.

..........

Banks

135,309

945,231

DGB

Financial

Group,

Inc.

..........

Banks

140,359

775,420

a

i-SENS,

Inc.

....................

Health

Care

Equipment

&

Supplies

73,179

753,368

a

NongShim

Co.

Ltd.

...............

Food

Products

2,224

562,077

3,676,309

Sweden

2.8%

c

Dometic

Group

AB

,

144A

..........

Automobile

Components

140,237

657,282

Electrolux

Professional

AB

,

B

.......

Machinery

171,129

1,059,517

a,d

Karnov

Group

AB

................

Interactive

Media

&

Services

15,751

117,146

c

Thule

Group

AB

,

144A

,

Reg

S

.......

Leisure

Products

43,624

1,342,454

3,176,399

Switzerland

4.6%

Bucher

Industries

AG

.............

Machinery

3,813

1,371,937

Logitech

International

SA

..........

Technology

Hardware,

Storage

&

Peripherals

7,363

606,343

c

Medacta

Group

SA

,

144A

,

Reg

S

....

Health

Care

Equipment

&

Supplies

11,113

1,305,323

Siegfried

Holding

AG

..............

Life

Sciences

Tools

&

Services

1,718

1,868,758

5,152,361

Taiwan

6.8%

Giant

Manufacturing

Co.

Ltd.

........

Leisure

Products

104,482

450,222

Johnson

Health

Tech

Co.

Ltd.

.......

Leisure

Products

271,000

1,523,172

King

Yuan

Electronics

Co.

Ltd.

......

Semiconductors

&

Semiconductor

Equipment

261,000

883,744

Merida

Industry

Co.

Ltd.

...........

Leisure

Products

136,000

625,226

Nien

Made

Enterprise

Co.

Ltd.

......

Household

Durables

64,000

714,448

Primax

Electronics

Ltd.

............

Electronic

Equipment,

Instruments

&

Components

341,000

789,338

Shin

Zu

Shing

Co.

Ltd.

............

Machinery

173,000

1,104,916

Topkey

Corp.

...................

Leisure

Products

106,000

660,510

Tripod

Technology

Corp.

...........

Electronic

Equipment,

Instruments

&

Components

143,000

859,186

7,610,762

Thailand

1.9%

Hana

Microelectronics

PCL

.........

Electronic

Equipment,

Instruments

&

Components

803,700

578,453

Major

Cineplex

Group

PCL

.........

Entertainment

2,400,800

1,035,101

Mega

Lifesciences

PCL

............

Pharmaceuticals

510,200

497,063

TOA

Paint

Thailand

PCL

...........

Chemicals

127,700

56,181

2,166,798

United

Kingdom

10.7%

Coats

Group

plc

.................

Textiles,

Apparel

&

Luxury

Goods

814,404

962,457

Fevertree

Drinks

plc

..............

Beverages

105,585

887,967

Greggs

plc

.....................

Hotels,

Restaurants

&

Leisure

41,774

1,456,991

Johnson

Service

Group

plc

.........

Commercial

Services

&

Supplies

412,128

699,619

Man

Group

plc

..................

Capital

Markets

688,590

1,837,522

Oxford

Instruments

plc

............

Electronic

Equipment,

Instruments

&

Components

32,617

879,956

Pagegroup

plc

..................

Professional

Services

282,881

1,213,761

Rathbones

Group

plc

.............

Capital

Markets

65,981

1,367,969

Savills

plc

......................

Real

Estate

Management

&

Development

75,381

977,668

Warpaint

London

plc

..............

Personal

Care

Products

96,750

629,831

Templeton

Institutional

Funds

Schedule

of

Investments

Foreign

Smaller

Companies

Series

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

See

Abbreviations

on

page

29

.

a

a

Industry

Shares

a

Value

a

Common

Stocks

(continued)

United

Kingdom

(continued)

a,c

Watches

of

Switzerland

Group

plc

,

144A

Specialty

Retail

143,315

$

999,994

11,913,735

United

States

1.6%

Axis

Capital

Holdings

Ltd.

..........

Insurance

7,651

678,032

a,b

IMAX

Corp.

.....................

Entertainment

42,004

1,075,302

1,753,334

Total

Common

Stocks

(Cost

$

78,839,896

)

......................................

105,025,147

Short

Term

Investments

1.1%

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

U.S.

Government

and

Agency

Securities

0.9%

United

States

0.9%

e

FHLB

,

4.2

%,

1/02/25

..............

1,000,000

999,767

Total

U.S.

Government

and

Agency

Securities

(Cost

$

999,887

)

....................

999,767

Shares

f

Investments

from

Cash

Collateral

Received

for

Loaned

Securities

0.2%

Money

Market

Funds

0.2%

g,h

Institutional

Fiduciary

Trust

-

Money

Market

Portfolio

,

4.183

%

.........

218,982

218,982

Total

Investments

from

Cash

Collateral

Received

for

Loaned

Securities

(Cost

$

218,982

)

...................................................................

218,982

a

a

a

a

a

Total

Short

Term

Investments

(Cost

$

1,218,869

)

.................................

1,218,749

a

a

a

Total

Investments

(Cost

$

80,058,765

)

95.0

%

....................................

$106,243,896

Other

Assets,

less

Liabilities

5.0

%

.............................................

5,602,360

Net

Assets

100.0%

...........................................................

$111,846,256

a

a

a

*

The

principal

amount

is

stated

in

U.S.

dollars

unless

otherwise

indicated.

a

Non-income

producing.

b

A

portion

or

all

of

the

security

is

on

loan

at

December

31,

2024.

See

Note

1(e).

c

Security

was

purchased

pursuant

to

Rule

144A

or

Regulation

S

under

the

Securities

Act

of

1933.

144A

securities

may

be

sold

in

transactions

exempt

from

registration

only

to

qualified

institutional

buyers

or

in

a

public

offering

registered

under

the

Securities

Act

of

1933.

Regulation

S

securities

cannot

be

sold

in

the

United

States

without

either

an

effective

registration

statement

filed

pursuant

to

the

Securities

Act

of

1933,

or

pursuant

to

an

exemption

from

registration.

At

December

31,

2024,

the

aggregate

value

of

these

securities

was

$9,921,891,

representing

8.9%

of

net

assets.

d

A

portion

or

all

of

the

security

purchased

on

a

delayed

delivery

basis.

See

Note

1(c).

e

The

rate

shown

represents

the

yield

at

period

end.

f

See

Note

1(e)

regarding

securities

on

loan.

g

See

Note

3(d)

regarding

investments

in

affiliated

management

investment

companies.

h

The

rate

shown

is

the

annualized

seven-day

effective

yield

at

period

end.

Templeton

Institutional

Funds

Financial

Highlights

International

Equity

Series

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

Year

Ended

December

31,

2024

2023

2022

2021

2020

Primary

Shares

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$10.91

$10.19

$11.96

$15.22

$15.54

Income

from

investment

operations

a

:

Net

investment

income

b

.........................

0.24

0.49

c

0.26

0.26

1.03

d

Net

realized

and

unrealized

gains

(losses)

...........

0.67

1.77

(1.40)

0.55

(0.32)

Total

from

investment

operations

....................

0.91

2.26

(1.14)

0.81

0.71

Less

distributions

from:

Net

investment

income

..........................

(0.30)

(0.90)

(0.10)

(1.46)

(0.67)

Net

realized

gains

.............................

(1.31)

(0.64)

(0.53)

(2.61)

(0.36)

Total

distributions

...............................

(1.61)

(1.54)

(0.63)

(4.07)

(1.03)

Net

asset

value,

end

of

year

.......................

$10.21

$10.91

$10.19

$11.96

$15.22

Total

return

....................................

8.40%

22.84%

(9.23)%

5.75%

5.30%

Ratios

to

average

net

assets

Expenses

before

waiver

and

payments

by

affiliates

......

0.97%

0.92%

0.87%

0.94%

0.87%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

0.92%

0.88%

0.83%

0.91%

0.84%

Net

investment

income

...........................

2.02%

4.31%

c

2.35%

1.64%

7.51%

d

Supplemental

data

Net

assets

,

end

of

year

(000’s)

.....................

$101,210

$127,735

$196,051

$386,291

$447,139

Portfolio

turnover

rate

............................

30.90%

18.18%

e

46.42%

44.73%

89.34%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Net

investment

income

per

share

includes

approximately

$0.23

per

share

related

to

an

adjustment

for

EU

reclaims

in

connection

with

certain

Fund

holdings.

Excluding

this

amount,

the

ratio

of

net

investment

income

to

average

net

assets

would

have

been

2.34%.

d

Net

investment

income

per

share

includes

approximately

$0.77

per

share

related

to

an

adjustment

for

EU

reclaims

in

connection

with

certain

Fund

holdings.

Excluding

this

amount,

the

ratio

of

net

investment

income

to

average

net

assets

would

have

been

1.86%

and

total

return

would

have

been

(0.03)%.

e

Excludes

the

value

of

portfolio

activity

as

a

result

of

in-kind

transactions.

See

Note

9

for

prior

year

information.

Templeton

Institutional

Funds

Financial

Highlights

International

Equity

Series

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Year

Ended

December

31,

2024

2023

2022

2021

2020

Service

Shares

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$11.23

$10.45

$12.24

$15.48

$15.79

Income

from

investment

operations

a

:

Net

investment

income

b

.........................

0.22

0.49

c

0.20

0.24

1.17

d

Net

realized

and

unrealized

gains

(losses)

...........

0.69

1.84

(1.38)

0.58

(0.47)

Total

from

investment

operations

....................

0.91

2.33

(1.18)

0.82

0.70

Less

distributions

from:

Net

investment

income

..........................

(0.28)

(0.91)

(0.08)

(1.45)

(0.65)

Net

realized

gains

.............................

(1.31)

(0.64)

(0.53)

(2.61)

(0.36)

Total

distributions

...............................

(1.59)

(1.55)

(0.61)

(4.06)

(1.01)

Net

asset

value,

end

of

year

.......................

$10.55

$11.23

$10.45

$12.24

$15.48

Total

return

....................................

8.21%

22.68%

(9.29)%

5.69%

5.16%

Ratios

to

average

net

assets

Expenses

before

waiver

and

payments

by

affiliates

......

1.19%

0.86%

1.01%

1.04%

1.01%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

1.15%

0.82%

0.97%

1.00%

0.98%

Net

investment

income

...........................

1.82%

4.26%

c

1.71%

1.52%

8.42%

d

Supplemental

data

Net

assets

,

end

of

year

(000’s)

.....................

$129

$136

$123

$521

$448

Portfolio

turnover

rate

............................

30.90%

18.18%

e

46.42%

44.73%

89.34%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Net

investment

income

per

share

includes

approximately

$0.23

per

share

related

to

an

adjustment

for

EU

reclaims

in

connection

with

certain

Fund

holdings.

Excluding

this

amount,

the

ratio

of

net

investment

income

to

average

net

assets

would

have

been

2.29%.

d

Net

investment

income

per

share

includes

approximately

$0.78

per

share

related

to

an

adjustment

for

EU

reclaims

in

connection

with

certain

Fund

holdings.

Excluding

this

amount,

the

ratio

of

net

investment

income

to

average

net

assets

would

have

been

2.77%

and

total

return

would

have

been

(0.14)%.

e

Excludes

the

value

of

portfolio

activity

as

a

result

of

in-kind

transactions.

See

Note

9

for

prior

year

information.

Templeton

Institutional

Funds

Schedule

of

Investments,

December

31,

2024

International

Equity

Series

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Industry

Shares

a

Value

a

Common

Stocks

94.8%

Canada

5.1%

Manulife

Financial

Corp.

...........

Insurance

71,700

$

2,202,700

Royal

Bank

of

Canada

............

Banks

24,800

2,990,251

5,192,951

Chile

1.5%

Antofagasta

plc

..................

Metals

&

Mining

75,601

1,497,618

China

1.1%

NXP

Semiconductors

NV

..........

Semiconductors

&

Semiconductor

Equipment

5,586

1,161,050

Denmark

1.2%

a,b

Orsted

A/S

,

144A

,

Reg

S

...........

Independent

Power

and

Renewable

Electricity

Producers

26,634

1,202,625

France

8.4%

Cie

de

Saint-Gobain

SA

...........

Building

Products

21,154

1,879,780

Danone

SA

.....................

Food

Products

22,021

1,488,174

Kering

SA

......................

Textiles,

Apparel

&

Luxury

Goods

4,452

1,099,624

TotalEnergies

SE

................

Oil,

Gas

&

Consumable

Fuels

41,877

2,333,172

Veolia

Environnement

SA

..........

Multi-Utilities

60,699

1,703,064

8,503,814

Germany

12.7%

Daimler

Truck

Holding

AG

..........

Machinery

34,503

1,321,537

Deutsche

Boerse

AG

..............

Capital

Markets

7,997

1,842,160

Deutsche

Telekom

AG

.............

Diversified

Telecommunication

Services

150,332

4,504,413

Fresenius

Medical

Care

AG

.........

Health

Care

Providers

&

Services

25,264

1,150,290

Infineon

Technologies

AG

..........

Semiconductors

&

Semiconductor

Equipment

53,451

1,744,734

SAP

SE

.......................

Software

9,277

2,281,903

12,845,037

Hungary

0.9%

Richter

Gedeon

Nyrt.

.............

Pharmaceuticals

37,000

969,184

India

1.2%

Reliance

Industries

Ltd.

............

Oil,

Gas

&

Consumable

Fuels

89,606

1,269,055

Japan

12.6%

Ebara

Corp.

....................

Machinery

125,700

1,928,567

Hitachi

Ltd.

.....................

Industrial

Conglomerates

49,410

1,210,054

Honda

Motor

Co.

Ltd.

.............

Automobiles

223,428

2,127,215

KDDI

Corp.

.....................

Wireless

Telecommunication

Services

42,041

1,339,031

Mitsubishi

Electric

Corp.

...........

Electrical

Equipment

130,458

2,202,881

Sumitomo

Mitsui

Financial

Group,

Inc.

.

Banks

141,458

3,395,027

Tokyo

Electron

Ltd.

...............

Semiconductors

&

Semiconductor

Equipment

3,762

565,502

12,768,277

Netherlands

3.1%

ING

Groep

NV

..................

Banks

133,738

2,095,887

SBM

Offshore

NV

................

Energy

Equipment

&

Services

58,381

1,028,091

3,123,978

Norway

1.2%

Norsk

Hydro

ASA

................

Metals

&

Mining

223,861

1,231,388

South

Korea

2.8%

Samsung

Electronics

Co.

Ltd.

.......

Technology

Hardware,

Storage

&

Peripherals

43,972

1,569,221

Templeton

Institutional

Funds

Schedule

of

Investments

International

Equity

Series

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Industry

Shares

a

Value

a

Common

Stocks

(continued)

South

Korea

(continued)

Shinhan

Financial

Group

Co.

Ltd.

....

Banks

37,877

$

1,228,231

2,797,452

Sweden

1.8%

Securitas

AB

,

B

..................

Commercial

Services

&

Supplies

144,325

1,784,427

Switzerland

0.9%

Adecco

Group

AG

................

Professional

Services

35,645

880,529

Taiwan

3.5%

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.

......................

Semiconductors

&

Semiconductor

Equipment

108,298

3,519,691

United

Kingdom

15.4%

AstraZeneca

plc

.................

Pharmaceuticals

19,762

2,576,563

BAE

Systems

plc

................

Aerospace

&

Defense

91,716

1,315,692

Barratt

Redrow

plc

...............

Household

Durables

255,490

1,400,567

HSBC

Holdings

plc

...............

Banks

122,122

1,199,617

JD

Sports

Fashion

plc

.............

Specialty

Retail

1,093,030

1,306,440

Lloyds

Banking

Group

plc

..........

Banks

2,316,380

1,581,922

Smith

&

Nephew

plc

..............

Health

Care

Equipment

&

Supplies

144,719

1,793,419

Standard

Chartered

plc

............

Banks

217,312

2,675,373

Unilever

plc

.....................

Personal

Care

Products

31,885

1,811,726

15,661,319

United

States

21.4%

BP

plc

.........................

Oil,

Gas

&

Consumable

Fuels

570,000

2,817,493

CNH

Industrial

NV

................

Machinery

172,588

1,955,422

CRH

plc

.......................

Construction

Materials

32,589

3,016,771

GFL

Environmental,

Inc.

...........

Commercial

Services

&

Supplies

33,256

1,481,222

a

ICON

plc

.......................

Life

Sciences

Tools

&

Services

5,823

1,221,141

Sanofi

SA

......................

Pharmaceuticals

31,549

3,066,903

Shell

plc

.......................

Oil,

Gas

&

Consumable

Fuels

104,022

3,242,470

Smurfit

WestRock

plc

.............

Containers

&

Packaging

45,577

2,458,504

Swiss

Re

AG

....................

Insurance

16,703

2,419,172

21,679,098

Total

Common

Stocks

(Cost

$

71,676,076

)

......................................

96,087,493

a

a

a

a

a

Escrows

and

Litigation

Trusts

0.0%

a,c

Hemisphere

Properties

India

Ltd.,

Escrow

Account

................

2,094,964

—

Total

Escrows

and

Litigation

Trusts

(Cost

$

–

)

...................................

—

Total

Long

Term

Investments

(Cost

$

71,676,076

)

................................

96,087,493

Templeton

Institutional

Funds

Schedule

of

Investments

International

Equity

Series

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

Short

Term

Investments

4.2%

a

a

Industry

Shares

a

Value

a

a

a

a

a

a

Money

Market

Funds

4.2%

United

States

4.2%

d,e

Institutional

Fiduciary

Trust

-

Money

Market

Portfolio

,

4.183

%

.........

4,241,876

$

4,241,876

Total

Money

Market

Funds

(Cost

$

4,241,876

)

...................................

4,241,876

a

a

a

a

a

Total

Short

Term

Investments

(Cost

$

4,241,876

)

.................................

4,241,876

a

a

a

Total

Investments

(Cost

$

75,917,952

)

99.0

%

....................................

$100,329,369

Other

Assets,

less

Liabilities

1.0

%

.............................................

1,009,705

Net

Assets

100.0%

...........................................................

$101,339,074

a

a

a

a

Non-income

producing.

b

Security

was

purchased

pursuant

to

Rule

144A

or

Regulation

S

under

the

Securities

Act

of

1933.

144A

securities

may

be

sold

in

transactions

exempt

from

registration

only

to

qualified

institutional

buyers

or

in

a

public

offering

registered

under

the

Securities

Act

of

1933.

Regulation

S

securities

cannot

be

sold

in

the

United

States

without

either

an

effective

registration

statement

filed

pursuant

to

the

Securities

Act

of

1933,

or

pursuant

to

an

exemption

from

registration.

At

December

31,

2024,

the

value

of

this

security

was

$1,202,625,

representing

1.2%

of

net

assets.

c

Fair

valued

using

significant

unobservable

inputs.

See

Note

10

regarding

fair

value

measurements.

d

See

Note

3(d)

regarding

investments

in

affiliated

management

investment

companies.

e

The

rate

shown

is

the

annualized

seven-day

effective

yield

at

period

end.

Templeton

Institutional

Funds

Schedule

of

Investments

International

Equity

Series

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

At

December

31,

2024,

the

Fund

had

the

following futures

contracts

outstanding.

See

Note

1(d).

See

Note 6 regarding

other

derivative

information.

Futures

Contracts

Description

Type

Number

of

Contracts

Notional

Amount

*

Expiration

Date

Value/

Unrealized

Appreciation

(Depreciation)

Equity

contracts

MSCI

EAFE

Index

............................

Long

20

$

2,267,500

3/21/25

$

(

73,233

)

Total

Futures

Contracts

......................................................................

$(73,233)

*

As

of

period

end.

Templeton

Institutional

Funds

Financial

Statements

Statements

of

Assets

and

Liabilities

December

31,

2024

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

Foreign

Smaller

Companies

Series

International

Equity

Series

Assets:

Investments

in

securities:

Cost

-

Unaffiliated

issuers

..................................................

$79,839,783

$71,676,076

Cost

-

Non-controlled

affiliates

(Note

3

d

)

.......................................

218,982

4,241,876

Value

-

Unaffiliated

issuers

(Includes

securities

loaned

of

$2,855,495

and

$—,

respectively)

$106,024,914

$96,087,493

Value

-

Non-controlled

affiliates

(Note

3

d

)

......................................

218,982

4,241,876

Cash

...................................................................

5,337,981

1,300

Foreign

currency,

at

value

(cost

$22

and

$79,

respectively)

...........................

22

79

Receivables:

Investment

securities

sold

..................................................

180,326

—

Capital

shares

sold

.......................................................

13,867

175,618

Dividends

..............................................................

327,740

3,185,531

European

Union

tax

reclaims

(Note

1

f

)

........................................

207,475

182,814

Deposits

with

brokers

for:

Futures

contracts

.......................................................

—

79,817

Total

assets

.........................................................

112,311,307

103,954,528

Liabilities:

Payables:

Investment

securities

purchased

.............................................

1,921

—

Capital

shares

redeemed

..................................................

25,513

17,188

Management

fees

........................................................

91,134

198

Custodian

fees

..........................................................

42,977

15,641

Transfer

agent

fees

.......................................................

5,116

5,202

Professional

fees

........................................................

53,778

65,241

Trustees'

fees

and

expenses

................................................

355

13

IRS

closing

agreement

payments

for

European

Union

tax

reclaims

(Note

1

f

)

............

—

2,483,272