- MNST Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Monster Beverage (MNST) 8-KRegulation FD Disclosure

Filed: 22 Sep 05, 12:00am

Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Safe Harbor Statement |

| [LOGO] |

This material contains certain “forward-looking” statements. These statements are based on management’s current expectations and are naturally subject to uncertainty and changes in circumstances. Actual results may vary materially from the expectations contained herein and listeners are cautioned not to place undue reliance on any forward-looking comments. For a review of specific risk factors, please refer to our statements filed at the Securities and Exchange Commission. Hansen Natural Corporation undertakes no obligation to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

2

• Hansen’s is a 70 year old trusted brand that stands for high quality, “better for you” natural beverages.

• Hansen’s formulates and markets unique premium beverages at the forefront of consumer trends.

• Hansen’s enjoys leadership positions across several categories, including the natural soda and energy categories.

4

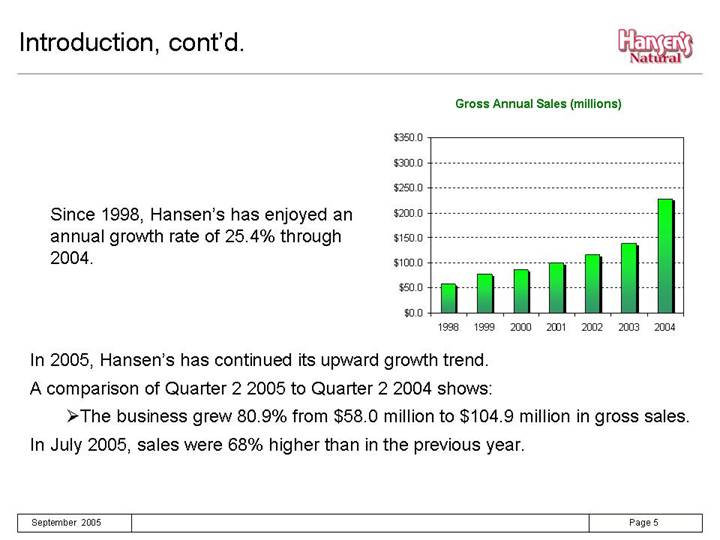

Since 1998, Hansen’s has enjoyed an annual growth rate of 25.4% through 2004.

Gross Annual Sales (millions)

[CHART]

In 2005, Hansen’s has continued its upward growth trend.

A comparison of Quarter 2 2005 to Quarter 2 2004 shows:

• The business grew 80.9% from $58.0 million to $104.9 million in gross sales.

In July 2005, sales were 68% higher than in the previous year.

5

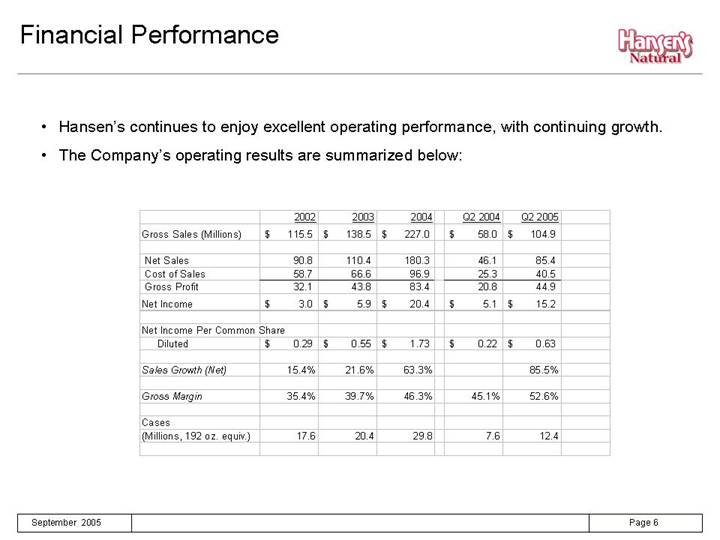

Financial Performance

• Hansen’s continues to enjoy excellent operating performance, with continuing growth.

• The Company’s operating results are summarized below:

|

| 2002 |

| 2003 |

| 2004 |

| Q2 2004 |

| Q2 2005 |

| |||||

Gross Sales (Millions) |

| $ | 115.5 |

| $ | 138.5 |

| $ | 227.0 |

| $ | 58.0 |

| $ | 104.9 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Net Sales |

| 90.8 |

| 110.4 |

| 180.3 |

| 46.1 |

| 85.4 |

| |||||

Cost of Sales |

| 58.7 |

| 66.6 |

| 96.9 |

| 25.3 |

| 40.5 |

| |||||

Gross Profit |

| 32.1 |

| 43.8 |

| 83.4 |

| 20.8 |

| 44.9 |

| |||||

Net Income |

| $ | 3.0 |

| $ | 5.9 |

| $ | 20.4 |

| $ | 5.1 |

| $ | 15.2 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Net Income Per Common Share |

|

|

|

|

|

|

|

|

|

|

| |||||

Diluted |

| $ | 0.29 |

| $ | 0.55 |

| $ | 1.73 |

| $ | 0.22 |

| $ | 0.63 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Sales Growth (Net) |

| 15.4 | % | 21.6 | % | 63.3 | % |

|

| 85.5 | % | |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Gross Margin |

| 35.4 | % | 39.7 | % | 46.3 | % | 45.1 | % | 52.6 | % | |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Cases |

|

|

|

|

|

|

|

|

|

|

| |||||

(Millions, 192 oz. equiv.) |

| 17.6 |

| 20.4 |

| 29.8 |

| 7.6 |

| 12.4 |

| |||||

6

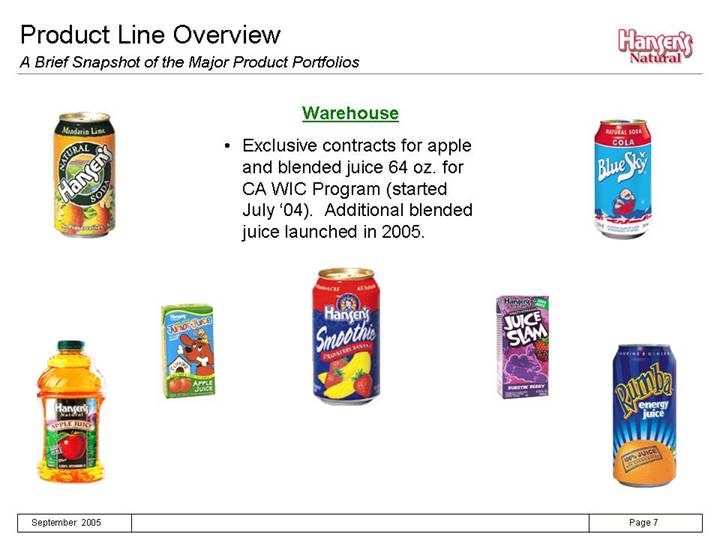

Product Line Overview

A Brief Snapshot of the Major Product Portfolios

Warehouse

• Exclusive contracts for apple and blended juice 64 oz. for CA WIC Program (started July ’04). Additional blended juice launched in 2005.

[GRAPHIC]

7

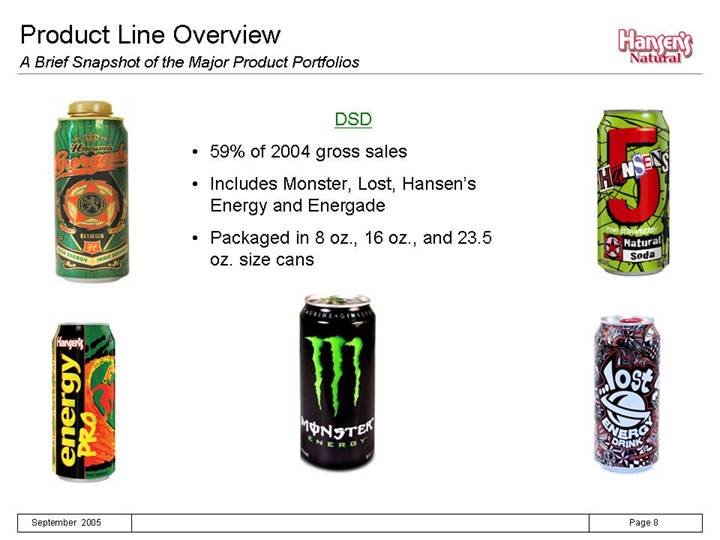

DSD

• 59% of 2004 gross sales

• Includes Monster, Lost, Hansen’s Energy and Energade

• Packaged in 8 oz., 16 oz., and 23.5 oz. size cans

[GRAPHIC]

8

Hansen’s Natural Soda Portfolio

Soda Product Attributes

• All natural, no preservatives, caffeine free, and in the case of Hansen’s, sodium free

• Great tasting

• No artificial colors or flavors

11

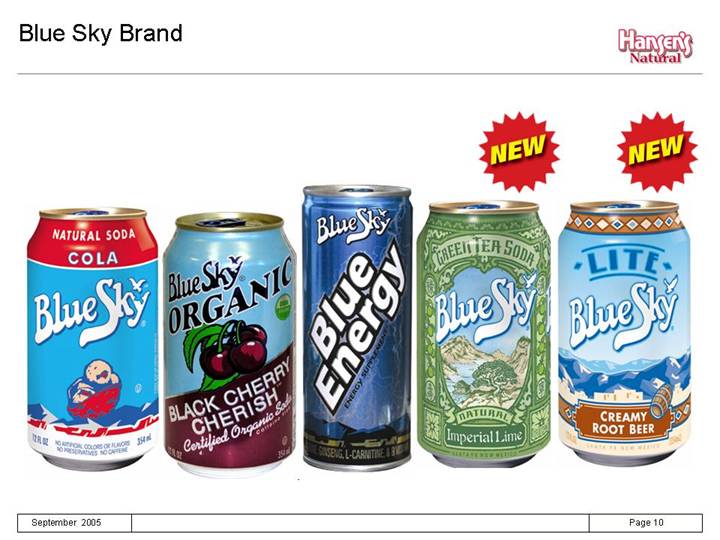

• Hansen’s is the leading natural soda in the U.S.

• Blue Sky is the leading natural soda in the health food category

• Substantial growth in Hansen’s diet sodas sweetened with Splenda

• Predominantly Western distribution at mainstream grocery, club, health food, and specialty. Eastern distribution presently limited to health food, health food sections of grocery chains, and specialty.

• Brand has unlimited potential due to its premium natural positioning to secure large share of the otherwise flat CSD market through national expansion.

12

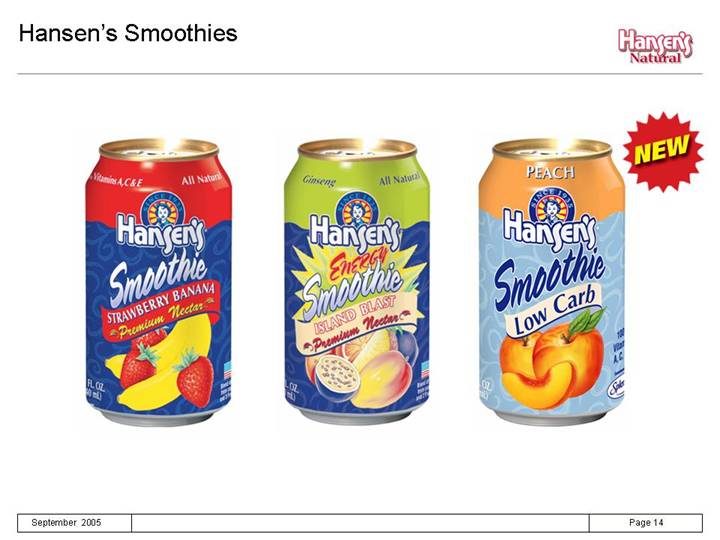

Hansen’s Juice Portfolio

Juice Product Attributes

• Great tasting/premium positioning

• Enhanced with vitamins and/or calcium

• First shelf-stable smoothies in the U.S.

17

• Hansen’s apple juice is the #1 shelf-stable bottled juice in Southern and Northern California.* Hansen’s apple grape juice is the #4 and #8 shelf-stable bottled juice in Southern and Northern California, respectively.*

• Apple and blended juice WIC contracts provide expansive distribution in California and promotional opportunities, particularly to Hispanic demographics

• Lite 64 oz. juices and low carb smoothies new for 2005

• Substantial opportunities for distribution expansion

* Source: Information Resources Inc., Northern and Southern California, $2 million+ Food [chain grocery] category, 12 week dollar sales period ending May 15, 2005

18

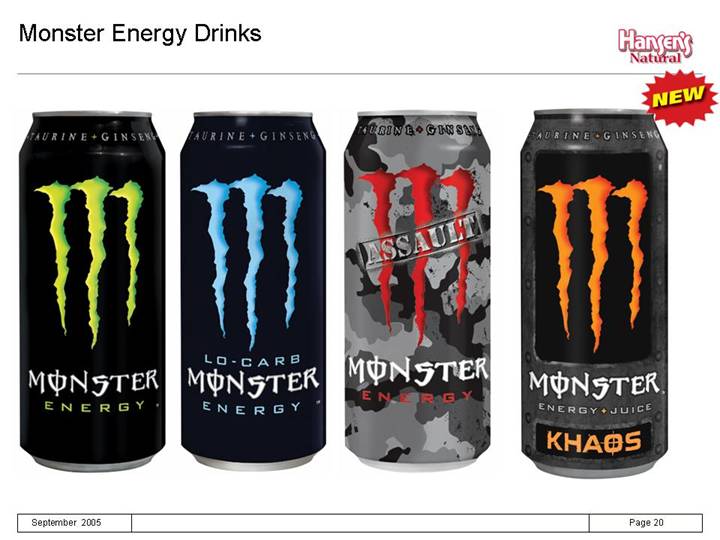

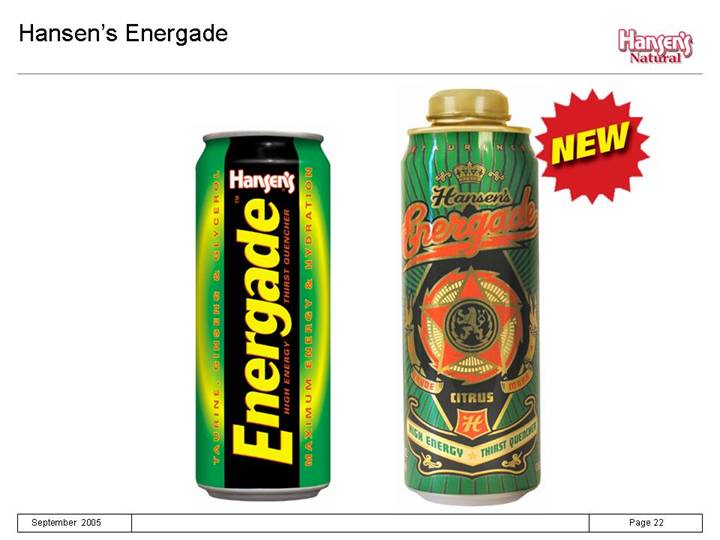

Hansen’s Energy Portfolio

Energy Product Attributes

• Great tasting

• 16 oz. value size

• Efficacious formulations, taste profiles, and image are important contributors to success

• Products cover broad energy demographics

24

• Energy market is the fastest growing segment of U.S. beverage industry.

• $1 billion at wholesale in 2004. Projected 2005 growth between 30%-35%. (1) 2005, 2Q sales-convenience suggest growth 60%+ (per Nielsen).(2)

• Monster is one of the fastest growing major energy drinks in U.S. (per Nielsen).(2)

• Monster has highest sales per point in convenience channel in most major U.S. markets, excluding Red Bull (per Nielsen).(2)

• We believe that convenience channel represents approximately 60% of total energy market.

• Lost is a key brand appealing to teenage / college consumer.

• Energade has broad demographic appeal due to unique energy/ sports drink combination.

(1) Source: Beverage Marketing Corporation

(2) Source: AC Nielsen 12 Wks Ending 6/18/05 Total US - Convenience Trade Major Market

25

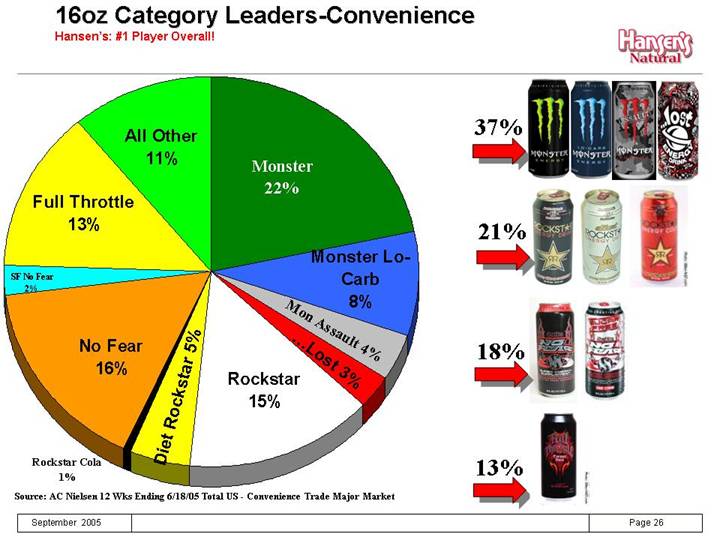

16oz Category Leaders-Convenience

Hansen’s: #1 Player Overall!

[CHART]

[GRAPHIC]

Source: AC Nielsen 12 Wks Ending 6/18/05 Total US - Convenience Trade Major Market

26

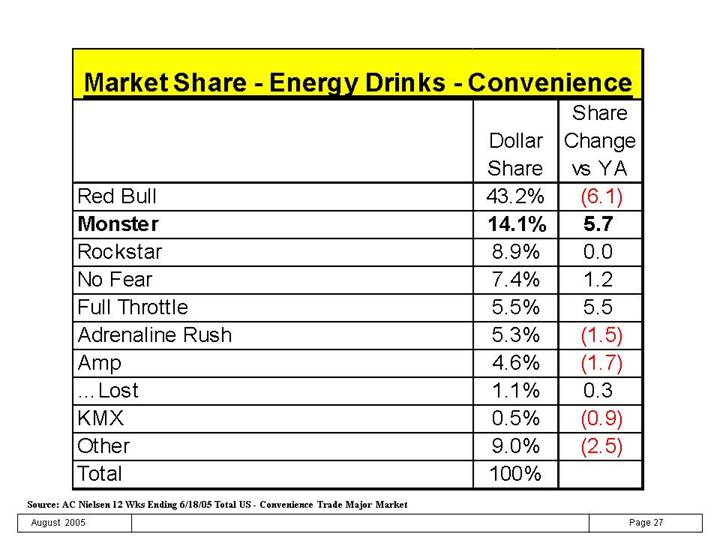

Market Share - Energy Drinks - Convenience

|

| Dollar |

| Share |

|

Red Bull |

| 43.2 | % | (6.1 | ) |

Monster |

| 14.1 | % | 5.7 |

|

Rockstar |

| 8.9 | % | 0.0 |

|

No Fear |

| 7.4 | % | 1.2 |

|

Full Throttle |

| 5.5 | % | 5.5 |

|

Adrenaline Rush |

| 5.3 | % | (1.5 | ) |

Amp |

| 4.6 | % | (1.7 | ) |

…Lost |

| 1.1 | % | 0.3 |

|

KMX |

| 0.5 | % | (0.9 | ) |

Other |

| 9.0 | % | (2.5 | ) |

Total |

| 100 | % |

|

|

Source: AC Nielsen 12 Wks Ending 6/18/05 Total US - Convenience Trade Major Market

27

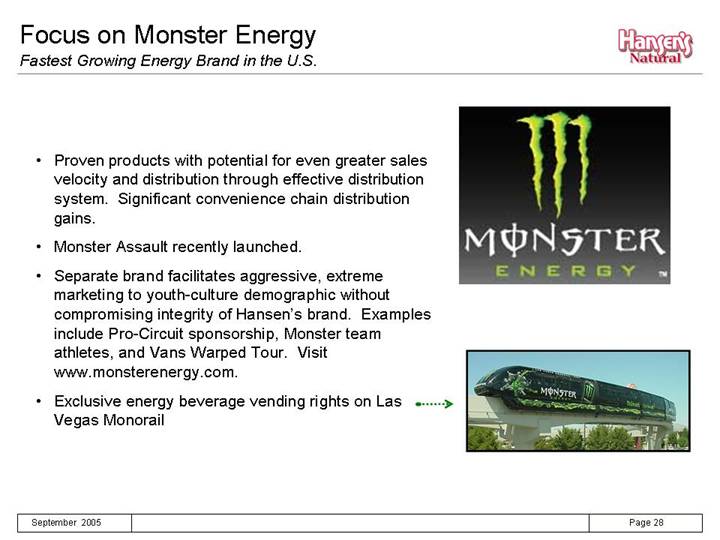

Focus on Monster Energy

Fastest Growing Energy Brand in the U.S.

• Proven products with potential for even greater sales velocity and distribution through effective distribution system. Significant convenience chain distribution gains.

• Monster Assault recently launched.

• Separate brand facilitates aggressive, extreme marketing to youth-culture demographic without compromising integrity of Hansen’s brand. Examples include Pro-Circuit sponsorship, Monster team athletes, and Vans Warped Tour. Visit www.monsterenergy.com.

• Exclusive energy beverage vending rights on Las Vegas Monorail

[GRAPHIC]

28

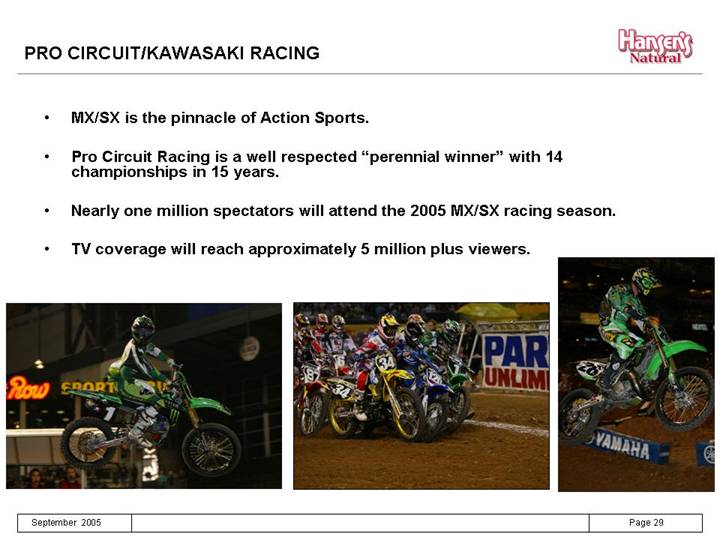

PRO CIRCUIT/KAWASAKI RACING

• MX/SX is the pinnacle of Action Sports.

• Pro Circuit Racing is a well respected “perennial winner” with 14 championships in 15 years.

• Nearly one million spectators will attend the 2005 MX/SX racing season.

• TV coverage will reach approximately 5 million plus viewers.

[GRAPHIC]

29

MONSTER ENERGY PRO 2005

• Monster Energy Pro Presented by Billabong

• North Shore, Oahu, Hawaii February 15th - - 25th

• World Famous Bonsai Pipeline

• ASP 4-star event, $60,000 prize purse

• 30-minute Fox Sports Net TV Program (Summer ‘05)

• Billabong Hosted Web Cast

[GRAPHIC]

30

BILLABONG XXL BIG WAVE AWARDS

[GRAPHIC]

The Billabong XXL Award will be won by the surfer who, by any means available, catches and successfully rides the single biggest wave of the year based on analysis of the available images.

• Billabong Biggest Wave Award

• Monster Biggest Paddle Wave Award

• Monster Tube of the Year Award

31

[LOGO] |

| Van’s Warped Tour |

|

|

[GRAPHIC]

• Most popular, longest running Action Sports/Music Festival in the United States.

• MONSTER has been a sponsor for 3 years.

• 49 concert dates throughout U.S. and Canada.

• MONSTER is the “Official Energy Drink” of the Vans Warped Tour 2005.

32

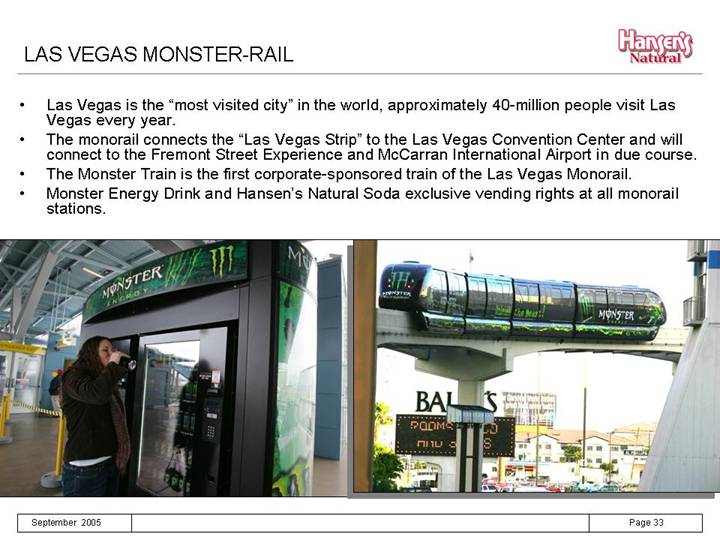

LAS VEGAS MONSTER-RAIL

• Las Vegas is the “most visited city” in the world, approximately 40-million people visit Las Vegas every year.

• The monorail connects the “Las Vegas Strip” to the Las Vegas Convention Center and will connect to the Fremont Street Experience and McCarran International Airport in due course.

• The Monster Train is the first corporate-sponsored train of the Las Vegas Monorail.

• Monster Energy Drink and Hansen’s Natural Soda exclusive vending rights at all monorail stations.

[GRAPHIC]

33

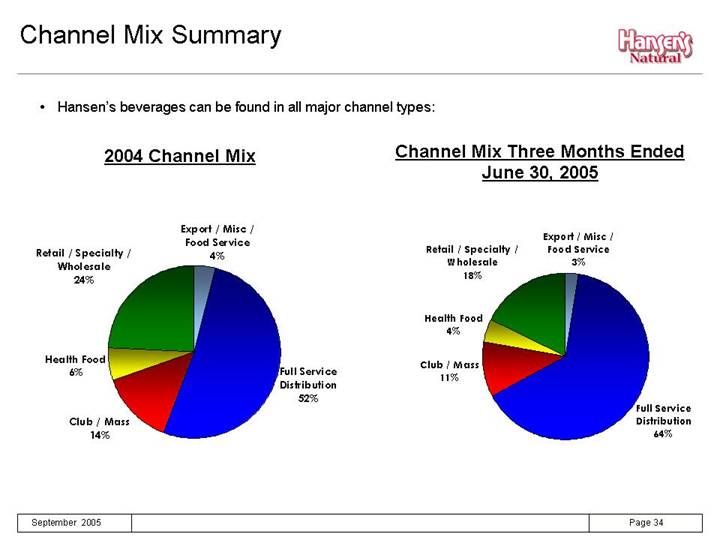

Channel Mix Summary

• Hansen’s beverages can be found in all major channel types:

2004 Channel Mix |

| Channel Mix Three Months Ended |

|

|

|

[CHART] |

| [CHART] |

34

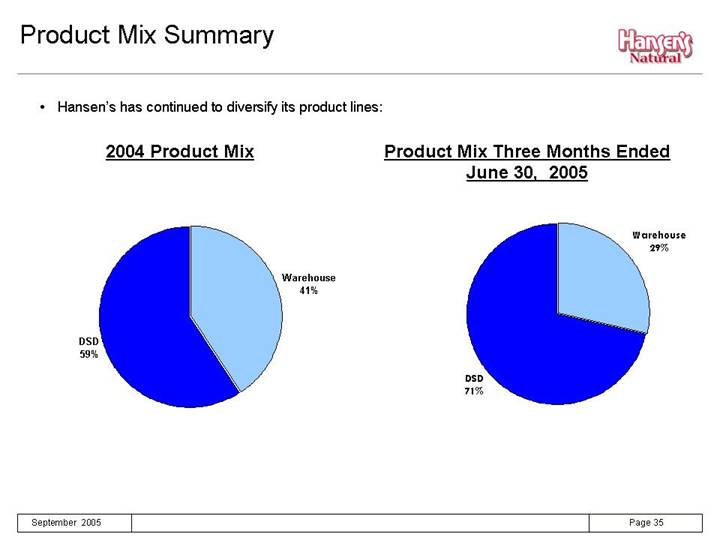

Product Mix Summary

• Hansen’s has continued to diversify its product lines:

2004 Product Mix |

| Product Mix Three Months Ended |

|

|

|

[CHART] |

| [CHART] |

35

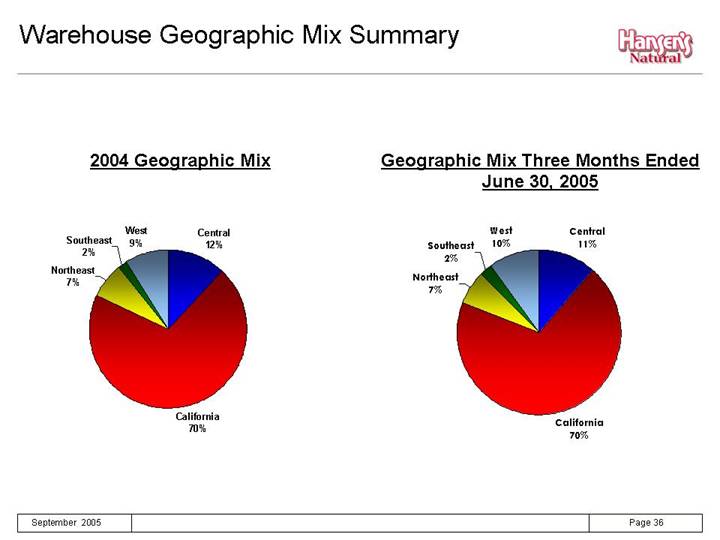

Warehouse Geographic Mix Summary

2004 Geographic Mix |

| Geographic Mix Three Months Ended |

|

|

|

[CHART] |

| [CHART] |

36

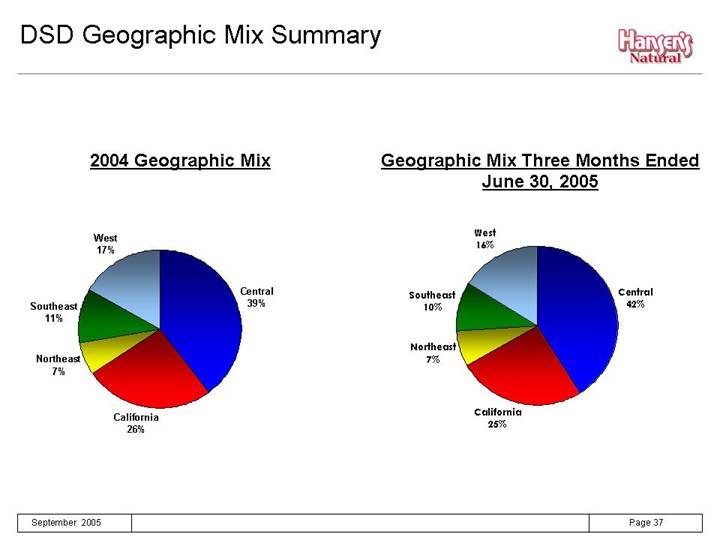

DSD Geographic Mix Summary

2004 Geographic Mix |

| Geographic Mix Three Months Ended |

|

|

|

[CHART] |

| [CHART] |

37

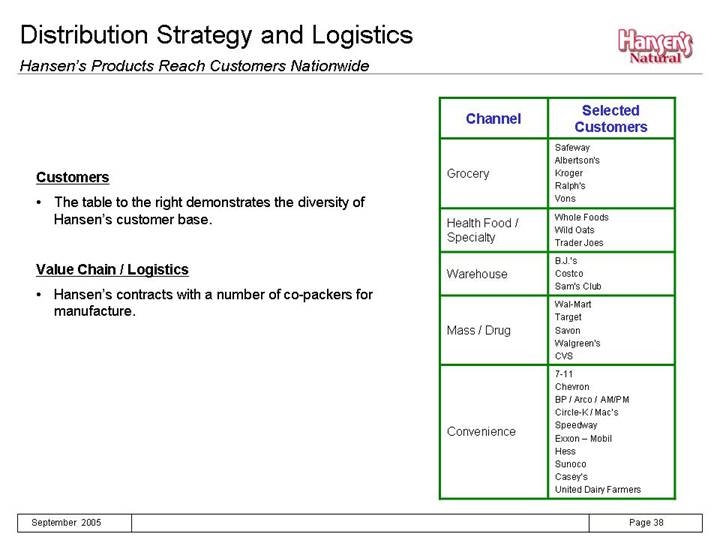

Distribution Strategy and Logistics

Hansen’s Products Reach Customers Nationwide

Customers

• The table to the right demonstrates the diversity of Hansen’s customer base.

Value Chain / Logistics

• Hansen’s contracts with a number of co-packers for manufacture.

Channel |

| Selected |

|

| Safeway |

|

| Albertson’s |

Grocery |

| Kroger |

|

| Ralph’s |

|

| Vons |

Health Food / |

| Whole Foods |

Specialty |

| Wild Oats |

|

| Trader Joes |

|

| B.J.’s |

Warehouse |

| Costco |

|

| Sam’s Club |

|

| Wal-Mart |

|

| Target |

Mass / Drug |

| Savon |

|

| Walgreen’s |

|

| CVS |

|

| 7-11 |

|

| Chevron |

|

| BP / Arco / AM/PM |

|

| Circle–K / Mac’s |

Convenience |

| Speedway |

|

| Exxon - Mobil |

|

| Hess |

|

| Sunoco |

|

| Casey’s |

|

| United Dairy Farmers |

38

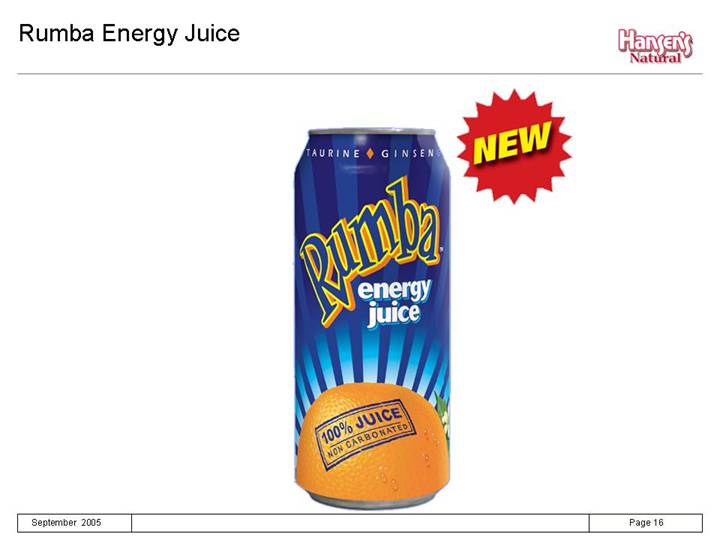

Growth Strategy

Four-Pronged Approach

• Grow existing brands

• Develop and launch new products / brands including:

Rumba Energy Juice

Joker Mad Energy

Monster 23.5 oz and 8 oz. cans

Monster Khaos

…lost Five-O

…lost Perfect 10

Fizzit

Others

• Expand distribution

• Increase quality and penetration of existing distribution

39

Conclusion

• Hansen’s continues to excel in its markets.

• The Hansen’s brand is respected and trusted in the marketplace by an extremely loyal base of consumers.

• The premium healthier brand image enjoyed by Hansen’s Natural Sodas offers unlimited opportunity to capture substantial additional share of the CSD market, through national distribution.

• Monster, Lost, Hansen’s Energy, Energade and Rumba provide an unparalleled platform to lead the energy category (together with Red Bull). In fact, as this category continues to grow, the Hansen’s portfolio is better positioned to address the broader, emerging consumer base than Red Bull or any of the competition.

40