- MNST Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Monster Beverage (MNST) DEFA14AAdditional proxy soliciting materials

Filed: 12 Jun 23, 6:02am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

Monster Beverage Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

MONSTER BEVERAGE CORPORATION

1 Monster Way

Corona, California 92879

ADDITIONAL MATERIALS

RELATING TO MONSTER BEVERAGE CORPORATION’S PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 22, 2023

June 12, 2023

Dear Stockholder:

This letter addresses advisory reports issued by proxy advisory firms Glass Lewis and Institutional Shareholder Services (“ISS”) on June 5, 2023 and June 7, 2023, respectively, in connection with the Company’s 2023 Annual Meeting of Stockholders of Monster Beverage Corporation (“Monster” or the “Company”) to be held on June 22, 2023. In their reports, Glass Lewis and ISS recommended that you vote against Proposal 5, which is a proposal to approve the amendment and restatement of the Amended and Restated Certificate of Incorporation of the Company, as amended (the “Certificate of Incorporation”), to increase the number of authorized shares of common stock from 1,250,000,000 shares to 5,000,000,000 shares. We respectfully disagree with Glass Lewis and ISS’s recommendations for the reasons outlined below.

The Proposed Increase of Authorized Shares Is Not for Anti –Takeover Use.

Glass Lewis

In its advisory report, Glass Lewis noted a concern that the increase in authorized common stock can be used to enact takeover defenses:

“One significant concern that we believe public shareholders should have about increases to authorized common stock relates to the ability of the board to use authorized but unissued stock to make effective certain takeover defenses.”

Monster’s Response

| · | The Company has demonstrated responsible use of its authorized shares in the past. |

| · | The Company does not maintain a non-shareholder approved poison pill. |

| · | The Company does not intend to use the requested shares for any anti-takeover measures as stated in the proxy statement. |

The Company Currently Does Not Have Sufficient Authorized Shares.

Glass Lewis

In its advisory report, Glass Lewis expressed the following belief:

“We believe the Company currently has sufficient shares for all employee stock plans, acquisitions, and potential stock splits.”

Monster’s Response

| · | The Company disagrees with Glass Lewis’s belief. As reported in the Company’s proxy statement filed on April 28, 2023, the Company had approximately 96.2 million shares available for issuance, representing approximately 8% of available authorized shares, which only allows for an approximate 1.1-for-1 stock split. |

| Stock Split Capacity | |

| April 6, 2023 – Outstanding + Reserved Shares | 1,153,832,406 |

| Current Authorized Shares | 1,250,000,000 |

| Current Maximum Split | ~1.1-for-1 |

1

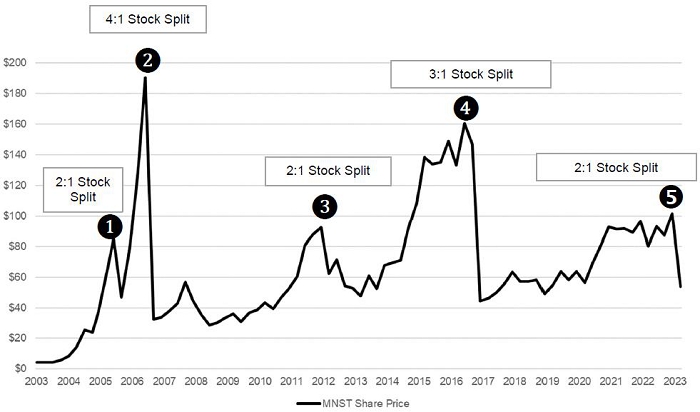

| · | Since 2005, the Company has implemented 5 stock splits as indicated below. |

MNST SHARE PRICE (UNADJUSTED FOR STOCK SPLITS)

The Proposed Increase of Authorized Shares Is Not Excessive.

Glass Lewis

In its advisory report, Glass Lewis stated that the “[r]equested increase is excessive.”

ISS

Similarly, ISS, in its advisory report, noted the following:

“Allowable increase in authorized shares: 1,250,000,000.”

“Because the request exceeds the allowable threshold, support for this proposal is not warranted.”

Monster’s Response

We respectfully disagree with Glass Lewis and ISS’s recommendations.

| · | Since 2006, the Company has increased its authorized shares of common stock three times: |

| Date of Increase | Shares of Common Stock Prior to Increase | Shares of Common Stock Following Increase | Percentage Increase |

| 06/01/2006 | 30,000,000 | 120,000,000 | 300% |

| 01/05/2012 | 120,000,000 | 240,000,000 | 100% |

| 10/11/2016 | 240,000,000 | 1,250,000,000 | 421% |

| 06/22/2023 (Proposed) | 1,250,000,000 | 5,000,000,000 | 300% |

2

Proposal 5 will increase the Company’s number of authorized shares of common stock from 1,250,000,000 shares to 5,000,000,000 shares, representing an increase of 300%. Such increase is equivalent to or smaller than the majority of the Company’s previous increases.

| · | The ISS allowable increase in authorized shares of 1,250,000,000 would restrict the Company to a future 2-for-1 split, whereas the Company has effected stock splits of 4-for-1 and 3-for-1 in the past. The following table lists the last five stock splits since 2005: |

| Date of Stock Split | Split Ratio |

| 08/09/2005 | 2:1 |

| 07/10/2006 | 4:1 |

| 02/16/2012 | 2:1 |

| 11/10/2016 | 3:1 |

| 03/28/2023 | 2:1 |

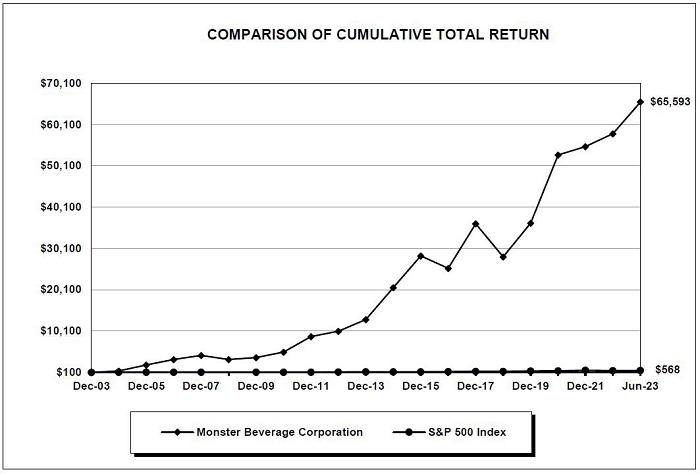

| · | The following graph shows a comparison of cumulative total return of the Company and the S&P 500 Index. Cumulative total return assumes an initial investment of $100 on December 31, 2003. Given the Company’s total return, it is important for the Company to have flexibility to effect a greater than 2-for-1 stock split in the future without incurring the delay of holding a special meeting of stockholders. |

For the reasons stated above, we believe stockholders should vote “FOR” Proposal 5.

If you have any questions or require additional information, please do not hesitate to contact us. Your engagement and feedback are important to us.

We urge you to vote “FOR” Proposal 5 – The Amendment and Restatement of the Certificate of Incorporation to Increase the Number of Authorized Shares of Common Stock from 1,250,000,000 Shares to 5,000,000,000 Shares.

3