UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

| |

| Filed by a party other than the Registrant | o |

|

| |

| Check the appropriate box: | |

|

| |

| o | Preliminary Proxy Statement |

|

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| |

| x | Definitive Proxy Statement |

|

| |

| o | Definitive Additional Materials |

|

| |

| o | Soliciting Material under §240.14a-12 |

CASCADE BANCORP

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

|

| |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

1100 NW Wall Street

Bend, Oregon 97703

April 13, 2016

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Cascade Bancorp (“Cascade” or the “Company”) to be held on Monday, May 23, at 5:30 p.m. Pacific Time at Bank of the Cascades, 1100 N.W. Wall Street, Bend, Oregon, 97703.

The attached Notice of Annual Meeting of Shareholders and Proxy Statement contain details of the business to be conducted at the meeting. During the meeting, we will also report on the operations of the Company and its subsidiary. Directors and officers of the Company, as well as a representative of BDO USA, LLP, the Company’s independent registered public accounting firm, will be present to respond to appropriate shareholder questions.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the meeting in person, please vote your proxy over the Internet, by telephone or by mail promptly.

Your continued interest and support of Cascade are sincerely appreciated.

Sincerely,

Andrew J. Gerlicher

Secretary

CASCADE BANCORP

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the 2016 Annual Meeting of Shareholders of Cascade Bancorp (“Cascade” or the “Company”) will be held at Bank of the Cascades, 1100 N.W. Wall Street, Bend, Oregon, 97703, on Monday, May 23, 2016, at 5:30 p.m. Pacific Time (the “Meeting”) for the following purposes:

| |

| 1. | To elect as directors the 11 nominees named in the accompanying Proxy Statement; |

| |

| 2. | To ratify the appointment of BDO USA, LLP as Cascade’s independent registered public accounting firm for the fiscal year ending December 31, 2016; |

| |

| 3. | To approve an amendment to the 2008 Performance Incentive Plan to increase the number of shares available for issuance under such plan; |

| |

| 4. | To approve, on a non-binding advisory basis, the compensation paid to Cascade’s Named Executive Officers, as described in the accompanying Proxy Statement; and |

| |

| 5. | To transact other business that may properly come before the Meeting. |

If you were a shareholder of record of Cascade as of the close of business on March 24, 2016, you are entitled to receive notice of, and to vote at, the Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on May 23, 2016. We are pleased to take advantage of the Securities and Exchange Commission rules that allow companies to furnish their proxy materials to their shareholders over the Internet. We believe this method will allow shareholders to access the information they need, while lowering our costs and reducing the environmental impact of our annual meeting. Accordingly, we have mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to certain of our shareholders. The Notice contains instructions about how to access our proxy materials and vote over the Internet or vote by telephone. If you would like to receive a paper copy of our proxy materials, please follow the instructions included in the Notice.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Meeting, please vote by signing and dating your proxy card and returning it in the enclosed postage prepaid envelope promptly, or vote electronically over the Internet or by telephone. See “How do I vote?” on page 2 of the accompanying Proxy Statement for further details. You do not need to keep your proxy card for admission to the Meeting. If your shares are held in the name of a bank, broker or other nominee, you must follow the instructions you receive from the holder of record in order to vote your shares.

By Order of the Board of Directors,

Andrew J. Gerlicher

Secretary

April 13, 2016

Bend, Oregon

PROXY STATEMENT

OF

CASCADE BANCORP

1100 N.W. Wall Street

Bend, Oregon 97703

(877) 617-3400

ANNUAL MEETING OF SHAREHOLDERS

May 23, 2016

APPROXIMATE DATE OF AVAILABILITY OF PROXY MATERIALS - APRIL 13, 2016

INFORMATION ABOUT THE MEETING AND VOTING

When and where is the Meeting?

The 2016 Annual Meeting of Shareholders of Cascade Bancorp (“Cascade,” the “Company,” “we” or “us”) will be held at Bank of the Cascades, 1100 N.W. Wall Street, Bend, Oregon, 97703, on Monday, May 23, 2016 at 5:30 p.m. Pacific Time (the “Meeting”).

Why am I receiving these materials?

We are furnishing these proxy materials to our shareholders in connection with the solicitation of proxies by the Company’s Board of Directors (the “Board”) to be voted at the Meeting. The Board asks that you vote on the matters listed in the Notice of Annual Meeting, which are more fully described in this Proxy Statement.

The Company is making its proxy materials available to some larger shareholders by mail and to all other shareholders on the Internet or, upon request, will deliver printed copies of its proxy materials by mail or electronic copies by email.

What is a proxy?

A proxy is your legal designation of another person to vote the stock you own. If you designate someone as your proxy or proxy holder in a written document, that document also is called a proxy or a proxy card. Ryan R. Patrick and Terry E. Zink have been designated as proxies or proxy holders for the Meeting.

Who may vote at the Meeting?

If you were a shareholder of Cascade as of the close of business on March 24, 2016, (the “Record Date”), you are entitled to vote at the Meeting and at any adjournments or postponements thereof. As of the Record Date, there were 72,788,354 shares outstanding held by 880 holders of record.

What items will be voted on at the Meeting?

You will be voting on the following matters at the Meeting:

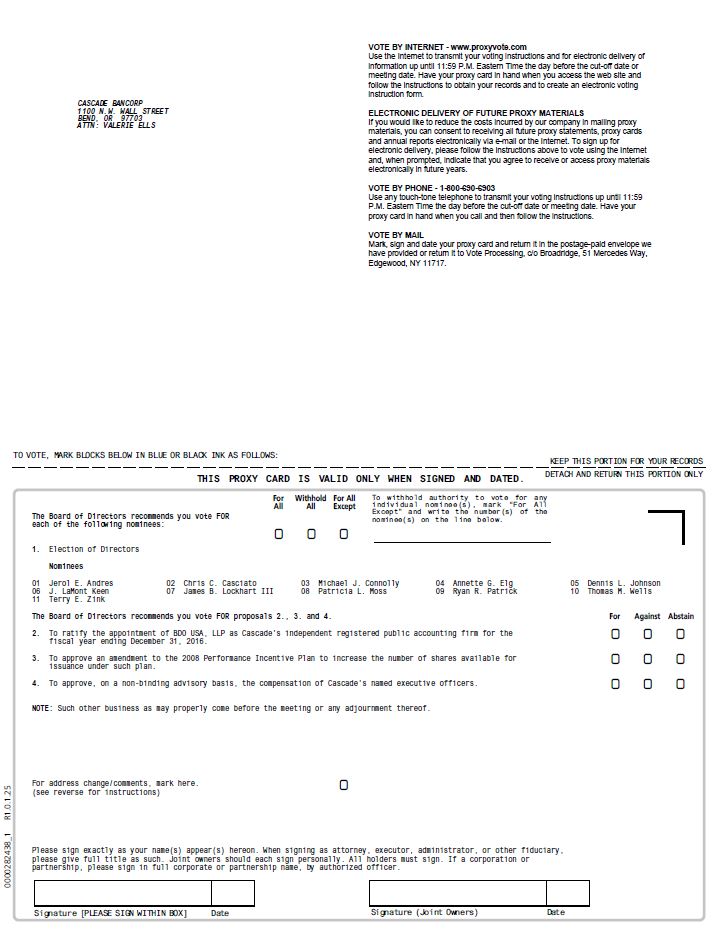

Proposal 1- To elect as directors the 11 nominees named in this Proxy Statement.

Proposal 2- To ratify the appointment of BDO USA, LLP as Cascade’s independent registered public accounting firm for the fiscal year ending December 31, 2016.

Proposal 3- To approve an amendment to the 2008 Performance Incentive Plan to increase the number of shares available for issuance under such plan.

Proposal 4- To approve, on a non-binding advisory basis, the compensation paid to our Named Executive Officers, as described in this Proxy Statement.

Why did some shareholders receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to the rules of the Securities and Exchange Commission (“SEC”), we have elected to provide our shareholders with access to our proxy materials over the Internet. Accordingly, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders of record who hold fewer than 50,000 shares of the Company’s common stock. All shareholders can access the proxy materials over the Internet or request to receive a printed set of the proxy materials by mail or an electronic set of the proxy materials via email. Instructions on how to access the proxy materials over the Internet or to request copies by mail or email are included in the Notice and under “Information Available to Shareholders” on page 49 of this Proxy Statement. In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

How do I vote?

Registered Shareholders. Registered shareholders (shareholders who hold shares of our common stock registered in their own name with our transfer agent, American Stock Transfer & Trust Company, as opposed to through a bank, broker or other nominee) may vote:

(1) over the Internet at www.proxyvote.com and following the instructions;

(2) by telephone by calling 1-800-690-6903 and following the instructions;

(3) if you request a printed copy of the proxy materials, which will include a proxy card, by completing, signing, dating and returning the proxy card promptly; or

(4) in person at the annual meeting.

We encourage you to vote electronically or by telephone. Votes submitted over the Internet or by telephone must be received by 8:59 p.m. Pacific Time on May 22, 2016.

Street Name Shareholders. Shareholders who hold shares of our common stock through a bank, broker or other nominee (“street name shareholders”) who receive or request printed copies of the proxy materials should be provided with voting instruction cards by the institution that holds their shares. If you are a street name shareholder who has received or requested a printed copy of the proxy materials and have not received a voting instruction card from your bank, broker or other nominee, please contact the institution that holds your shares.

Street name shareholders may also be eligible to vote their shares over the Internet or by telephone by following the voting instructions provided by the bank, broker or other nominee that holds the shares, using either the Internet address or the toll-free telephone number provided on the voting instruction card (if the bank, broker or other nominee provides these voting methods). Otherwise, please complete, sign and date the voting instruction card and return it promptly.

Can I change or revoke my vote?

Any shareholder giving a proxy may change or revoke it at any time before the polls are closed for voting at the Meeting.

If you are a shareholder of record, you may change or revoke your proxy by (1) voting over the Internet or by telephone, (2) timely delivering a later dated proxy or a written notice of revocation to our Secretary at the address listed under “Shareholder Proposals for 2016 Annual Meeting” on page 49 of this Proxy Statement or (3) attending the Meeting and voting in person. Your attendance at the Meeting will not itself revoke a proxy.

If you are a street name shareholder, you must follow the instructions found on the voting instruction card provided by the bank, broker or other nominee, or contact your bank, broker or other nominee in order to change or revoke your previously given voting instructions.

How will my shares be voted if I do not specify a choice with respect to each proposal?

Shareholders should specify their choice for each matter as provided on the Internet, by telephone or on a proxy card. If you indicate when voting over the Internet or by telephone that you wish to vote as recommended by the Board of Directors, or if you return a signed proxy card without giving specific voting instructions, then the proxy holders will vote your shares

“FOR” the election of all nominees for director, “FOR” the ratification of the appointment of BDO USA, LLP, “FOR” the amendment to the 2008 Performance Incentive Plan and “FOR” the approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers.

As to any other business that may properly come before the Meeting, the proxy holders will vote the shares of our common stock represented by the proxy in the manner as the Board of Directors may recommend, or otherwise in the proxy holders’ discretion. The Board of Directors does not presently know of any other such business.

How will my shares be voted if I do not provide my proxy?

If you own your shares as a registered holder, which means that your shares of our common stock are registered in your name with American Stock Transfer & Trust Company, our transfer agent, your shares will be voted only if you submit your vote over the Internet or by telephone or if you return a signed proxy card. Otherwise, your shares will not be represented at the Meeting and will not count toward the quorum requirement, which is explained under “- How do we determine a quorum?” below, unless you attend the Meeting to vote them in person.

If you are a street name shareholder, your bank, broker or other nominee may or may not vote your shares if you have not provided voting instructions to the bank, broker or other nominee. Whether the bank, broker or other nominee may vote your shares depends on the proposals before the Meeting. Under the rules that govern brokers, banks, brokers and other nominees may vote your shares in their discretion on “routine matters.” The ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm is a routine matter for which banks, brokers and other nominees may vote on behalf of their clients if no voting instructions are provided.

Under the rules that govern brokers, when a proposal is not a “routine matter” and your bank, broker or other nominee has not received your voting instructions with respect to that proposal, your bank, broker or other nominee cannot vote your shares on that proposal. This is called a “broker non-vote.” The election of the director nominees to the Board of Directors, the approval of the amendment to the 2008 Performance Incentive Plan and the approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers are not routine matters and, if your bank, broker or other nominee has not received your voting instructions with respect to these proposals, your bank, broker or other nominee cannot vote your shares on these proposals.

How do we determine a quorum?

We must have a quorum to conduct any business at the Meeting. Shareholders holding at least a majority of the outstanding shares of common stock must either attend the Meeting or submit proxies to establish a quorum. Abstentions, withheld votes in the election of directors and shares held of record by a bank, broker or its nominee that are voted on any matter will be included in the number of shares present. Broker shares that are not voted on any matter (“broker non-votes”) will not be included in determining whether a quorum is present.

What is the voting requirement to approve each proposal?

Approval of Director Nominees

The election of each nominee for director requires the affirmative vote of the holders of a plurality of the shares of our common stock voted in the election of directors.

Ratification of Appointment of the Company’s Independent Registered Public Accounting Firm

The appointment of the Company’s independent registered public accounting firm will be ratified if the number of shares voted in favor of the proposal exceeds the number of shares voted against it.

Approval of Amendment to the 2008 Performance Incentive Plan

The proposed amendment to the 2008 Performance Incentive Plan will be ratified if the number of shares voted in favor of the proposal exceeds the number of shares voted against it.

The Advisory Vote on Executive Compensation

The compensation of our executive officers named in the Summary Compensation Table on page 27 of this Proxy Statement (“Named Executive Officers” or “NEOs”) will be approved, on a non-binding advisory basis, if the number of shares voted in favor of the proposal exceeds the number of shares voted against it.

How are abstentions and broker non-votes counted?

Abstentions and broker non-votes will not be included in the number of votes cast or the vote totals for the election of directors, the ratification of the appointment of BDO USA, LLP, the approval of the amendment to the 2008 Performance Incentive Plan or the approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers and will not affect the outcome of the vote for these proposals.

What are the voting recommendations of the Board of Directors?

The Board of Directors recommends that shareholders vote “FOR” each of the nominees for director, “FOR” the ratification of the appointment of BDO USA, LLP, “FOR” the amendments to the 2008 Performance Incentive Plan and “FOR” the approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers.

Who is paying the cost of this proxy solicitation?

Cascade will bear the cost of soliciting proxies from its shareholders. In addition to using the mail and Internet, proxies may be solicited by personal interview, telephone, and electronic communication. Cascade requests that banks, brokerage houses, other institutions, nominees, and fiduciaries forward proxy soliciting material to their principals and obtain authorization for the execution of proxies. Officers and other employees of Cascade and its bank subsidiary, Bank of the Cascades (the “Bank”), acting on Cascade’s behalf, may solicit proxies personally. Cascade may pay compensation for soliciting proxies, and will, upon request, pay the standard charges and expenses of banks, brokerage houses, other institutions, nominees, and fiduciaries for forwarding proxy materials to and obtaining proxies from their principals.

What does it mean if I receive more than one proxy card or voting instruction card?

If you receive more than one proxy card or voting instruction card, it means you have multiple accounts with our transfer agent, American Stock Transfer & Trust Company, or with one or more banks, brokers or other nominees. To vote all your shares, you will need to sign and return all proxy cards or voting instruction cards. We encourage you to consolidate your accounts with the same name and address with American Stock Transfer & Trust Company or your bank, broker or other nominee in a single account whenever possible. For additional information, please contact our transfer agent at the contact information listed under “Information Available to Shareholders” on page 49 of this Proxy Statement.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table describes, as of March 24, 2016, the beneficial ownership of our common stock by each director and each nominee for director, each of our Named Executive Officers, all of our directors, and executive officers as a group, and those persons known to beneficially own more than 5% of our common stock.

|

| | | | | | | | | | | | | | | | | | |

| Beneficial Owner’s Name | | Shares of Common Stock | | Nonvested Restricted Stock | | Stock Options Exercisable | | Shares held in 401(K) Plan | | Total Shares of Common Stock Owned(1) | | Percent of Class |

| 5% Owners: | | |

| | |

| | |

| | |

| | |

| | |

|

Green Equity Investors V, L.P.(2) 11111 Santa Monica Blvd., Suite 2000 Los Angeles, CA 90025 | | 11,473,443 |

| | — |

| | — |

| | — |

| | 11,473,443 |

| | 15.76 | % |

Green Equity Investors Side V, L.P.(2) 11111 Santa Monica Blvd., Suite 2000 Los Angeles, CA 90025 | | 11,473,443 |

| | — |

| | — |

| | — |

| | 11,473,443 |

| | 15.76 | % |

WL Ross & Co. LLC(3) 1166 Avenue of the Americas New York, NY 10036 | | 11,473,960 |

| | — |

| | — |

| | — |

| | 11,473,960 |

| | 15.76 | % |

Lightyear Fund II, L.P.(4) 9 West 57th Street, 31st Floor New York, NY 10019 | | 11,491,842 |

| | — |

| | — |

| | — |

| | 11,491,842 |

| | 15.79 | % |

Lightyear Co-Invest Partnership II, L.P.(4) 9 West 57th Street, 31st Floor New York, NY 10019 | | 11,491,842 |

| | — |

| | — |

| | — |

| | 11,491,842 |

| | 15.79 | % |

David F. Bolger(5) 79 Chestnut Street Ridgewood, NJ 07450-2533 | | 6,577,072 |

| | — |

| | — |

| | — |

| | 6,577,072 |

| | 9.04 | % |

Wellington Management Group LLP 280 Congress Street Boston, MA 02210 | | 4,805,190 |

| | — |

| | — |

| | — |

| | 4,805,190 |

| | 6.60 | % |

| Officers and Directors: | | |

| | | | | | | | |

| | |

|

| Jerol E. Andres, Director | | 22,668 |

| | — |

| | — |

| | — |

| | 22,668 |

| | 0.03 | % |

| Michael J. Connolly, Director | | 18,399 |

| | — |

| | — |

| | — |

| | 18,399 |

| | 0.03 | % |

| Chris C. Casciato, Director | | — |

| | — |

| | — |

| | — |

| | — |

| | — | % |

| Annette G. Elg, Director | | 5,692 |

| | — |

| | — |

| | — |

| | 5,692 |

| | 0.01 | % |

| Dennis L. Johnson, Director | | 5,692 |

| | — |

| | — |

| | — |

| | 5,692 |

| | 0.01 | % |

| J. LaMont Keen, Director | | 19,817 |

| | — |

| | — |

| | — |

| | 19,817 |

| | 0.03 | % |

| James B. Lockhart III, Director | | 17,882 |

| | — |

| | — |

| | — |

| | 17,882 |

| | 0.02 | % |

| Patricia L. Moss, Vice Chairman | | 43,885 |

| | — |

| | — |

| | 1,807 |

| | 45,692 |

| | 0.06 | % |

| Ryan R. Patrick, Chairman | | 37,481 |

| | — |

| | — |

| | 1,527 |

| | 39,008 |

| | 0.05 | % |

Thomas M. Wells, Director(6) | | 6,627,316 |

| | — |

| | — |

| | — |

| | 6,627,316 |

| | 9.10 | % |

| Terry E. Zink, Director and Officer | | 63,006 |

| | 101,531 |

| | 19,412 |

| | — |

| | 183,949 |

| | 0.25 | % |

| Gregory D. Newton, Officer | | 32,466 |

| | 39,096 |

| | 8,030 |

| | — |

| | 79,592 |

| | 0.11 | % |

| Charles N. Reeves, Officer | | 47,761 |

| | 36,704 |

| | 12,987 |

| | — |

| | 97,452 |

| | 0.13 | % |

| Peggy L. Biss, Officer | | 29,032 |

| | 33,942 |

| | 7,069 |

| | 1,202 |

| | 71,245 |

| | 0.10 | % |

| Daniel J. Lee, Officer | | 70,035 |

| | 32,204 |

| | — |

| | 39,257 |

| | 141,496 |

| | 0.19 | % |

| All Directors and Executive Officers as a Group (15) | | 7,041,132 |

| | 243,477 |

| | 47,498 |

| | 43,793 |

| | 7,375,900 |

| | 10.13 | % |

________________

| |

| (1) | The number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any shares as to which the person has sole or shared voting power or investment power and also any shares which the person has the right to acquire within 60 days through the exercise of any stock option or other right. Unless otherwise indicated below or in the table above, each person has sole voting and investment power with respect to the shares shown as beneficially owned. Percentage of beneficial ownership is based on 72,788,354 shares of common stock outstanding as of March 24, 2016. |

| |

| (2) | Green Equity Investors V, L.P., a Delaware limited partnership (“GEI V”) is the record owner of 8,826,972 shares of Common Stock and Green Equity Investors Side V, L.P., a Delaware limited partnership (“GEI Side V”) is the record owner of 2,646,471 shares of Common Stock. GEI Capital V, LLC, a Delaware limited liability company (“Capital”) is the general partner of GEI V and GEI Side V. Capital’s principal business is to act as the general partner of GEI V and GEI Side V. Green V Holdings, LLC, a Delaware limited liability company (“Holdings”) is a limited partner of GEI V and GEI Side V. Holdings’ principal business is to serve as a limited partner of GEI V and GEI Side V. Leonard Green & Partners, L.P., a Delaware limited partnership (“LGP”) is an affiliate of Capital. LGP’s principal business is to act as the management company of GEI V, GEI Side V and other affiliated funds. LGP Management, Inc., a Delaware corporation (“LGPM”) is the general partner of LGP. LGPM’s principal business is to act as the general partner of LGP. Due to their relationships with GEI V and GEI Side V, each of Capital, Holdings, LGP and LGPM may be deemed to have shared voting power with respect to the common stock deemed to be beneficially owned by GEI V and GEI Side V. As such, GEI V, GEI Side V, Capital, Holdings, LGP and LGPM may be deemed to have shared beneficial ownership over such shares of common stock. Each of GEI V, GEI Side V, Capital, Holdings, LGP and LGPM, however, disclaims beneficial ownership of such shares of common stock as to which they are not the record owner. |

| |

| (3) | The 11,473,960 shares of Common Stock are held directly by WLR CB Acquisition Co LLC. Wilbur L. Ross, Jr. is the managing member of El Vedado, LLC, the general partner of WL Ross Group, L.P., which in turn is the managing member of WLR Recovery Associates IV LLC. WLR Recovery Associates IV LLC is the general partner of WLR Recovery Fund IV, L.P., which is the sole manager of WLR CB Acquisition Co LLC, and WL Ross & Co. LLC is the investment manager of WL Ross Group, L.P. Accordingly, WLR Recovery Fund IV, L.P., WLR Recovery Associates IV LLC, WL Ross Group, L.P., El Vedado, LLC, Wilbur L. Ross, Jr. and WL Ross & Co. LLC may be deemed to share voting and dispositive power over the Common Stock held by WLR CB Acquisition Co LLC. |

| |

| (4) | Lightyear Fund II, L.P., a Delaware limited partnership (“Lightyear Fund II”), is the record owner of 11,438,500 shares of Common Stock. Lightyear Co-Invest Partnership II, L.P., a Delaware limited partnership (“Co-Invest”), is the record owner of 30,250 shares of Common Stock. Lightyear Capital II, LLC, a Delaware limited liability company, is the record owner of 23,092 shares of Common Stock. Lightyear Fund II GP, L.P., (“Lightyear Fund II GP”) is the general partner of Lightyear Fund II. The principal business of Lightyear Fund II GP is acting as general partner of Lightyear Fund II. Lightyear Fund II GP Holdings, LLC (“Lightyear Fund II GP Holdings”) is the general partner of Lightyear Fund II GP and Co-Invest. The principal business of Lightyear Fund II GP Holdings is acting as general partner of Lightyear Fund II GP and Co-Invest. The managing member of Lightyear Fund II GP Holdings is LY Holdings, LLC. The principal business of LY Holdings, LLC is acting as managing member of Lightyear Fund II GP Holdings. The managing member of LY Holdings, LLC is Mark F. Vassallo. The present principal occupation of Mr. Vassallo is as Managing Partner of Lightyear Capital LLC. Lightyear Capital LLC is the sole member of Lightyear Capital II, LLC. The present business of Lightyear Capital LLC is acting as an investment advisory firm. The managing member of Lightyear Capital LLC is Mr. Vassallo. Lightyear Fund II GP could be deemed to have voting or dispositive power over the shares owned by Lightyear Fund II. Each of Lightyear Fund II GP Holdings, LY Holdings, and Mr. Vassallo could be deemed to have shared voting or dispositive power over the shares owned by Lightyear Fund II and Co-Invest. Each of Lightyear Capital LLC and Mr. Vassallo could be deemed to have shared voting power over the shares owned by Lightyear Capital II, LLC. |

| |

| (5) | Mr. Bolger is the record owner of 6,577,072 shares of common stock. Two-Forty Associates LLC is the record owner of 19,232 shares of common stock. Mr. Bolger has the shared power to vote or to direct the vote or to dispose or direct the disposition of 6,577,072 shares of common stock. Mr. Bolger owns 16% of the membership interests of Two-Forty Associates LLC. James T. Bolger, Mr. Bolger’s son, is managing member of Two-Forty Associates LLC, owns 28% of its membership interests and has shared power to vote or to direct the vote or to dispose or direct the disposition of 19,232 shares of common stock held by Two-Forty Associates LLC. |

| |

| (6) | Mr. Wells is the record owner of 50,244 shares of common stock. “Shares of Common Stock” and “Total Shares of Common Stock Owned” columns also include 6,577,072 shares of common stock owned of record by David F. Bolger and as to which Mr. Wells has shared voting and investment power pursuant to a power of attorney. |

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Board of Directors consists of 11 directors. The Board has nominated the 11 persons listed under the heading “Nominees” for election at the Meeting to serve as directors until the 2017 Annual Meeting of Shareholders and until their successors have been elected and qualified. Shareholders cannot vote for more directors than there are nominees.

If any nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of a substitute designated by the Board. However, in lieu of designating a substitute, the Board may reduce the number of directors. At this time, the Board knows of no reason why any nominee might be unavailable or unwilling to serve.

The Bylaws of the Company do not allow nominations from the floor at the Meeting. Any shareholder wishing to nominate a person for election as a director must submit that nomination to the Secretary of Cascade as outlined in this Proxy Statement under “Nominating and Corporate Governance Committee.”

Nominees

The nominees are all current directors. Each nominee has agreed to be named in this Proxy Statement and to serve if elected. The age indicated and other information in each nominee’s biography is as of the Record Date.

|

| | | | |

| Nominees for Election: | | Age | | Year First Elected Director |

| Jerol E. Andres | | 72 | | 1993 |

| Chris C. Casciato | | 57 | | 2011* |

| Michael J. Connolly | | 50 | | 2011* |

| Annette G. Elg | | 59 | | 2014 |

| Dennis L. Johnson | | 61 | | 2014 |

| J. LaMont Keen | | 63 | | 2012 |

| James B. Lockhart III | | 69 | | 2011* |

| Patricia L. Moss | | 62 | | 1993 |

| Ryan R. Patrick | | 60 | | 1998 |

| Thomas M. Wells | | 64 | | 2006* |

| Terry E. Zink | | 64 | | 2012 |

________________

| |

| * | On January 28, 2011, the Company sold 44,193,750 shares of common stock at a price of $4.00 per share, for total gross proceeds of $176,775,000. As a condition of the closing of the sale of common stock, private equity funds affiliated with Lightyear Capital LLC (“Lightyear”), private equity funds affiliated with Leonard Green & Partners, L.P. (“Leonard Green”), and an affiliate of WL Ross & Co. LLC (“WL Ross”), were each entitled to have one person nominated by them elected to the Board of Directors of the Company and the Bank. Accordingly, on January 28, 2011, upon the closing of the transaction, Chris C. Casciato, a Managing Director of Lightyear, Michael J. Connolly, then a Partner of Leonard Green, and James B. Lockhart III, Vice Chairman of WL Ross, were elected to the Board of Directors of each of the Company and the Bank. |

Most of the 44,193,750 shares of common stock were sold pursuant to the Amended and Restated Securities Purchase Agreement between the Company and Lightyear, the Securities Purchase Agreement between the Company and Leonard Green, the Securities Purchase Agreement between the Company and WL Ross, and the Amended and Restated Securities Purchase Agreement between the Company and David F. Bolger, each dated November 16, 2010 (the “Securities Purchase Agreements”). Per the Securities Purchase Agreements, Lightyear, Leonard Green, WL Ross and David F. Bolger have the right to nominate one candidate for election to the Company’s Board of Directors. Each of Lightyear, Leonard Green, WL Ross and David F. Bolger is also entitled to be represented on the board of directors of the Bank. The rights to representation briefly outlined above will continue with respect to each of Lightyear, Leonard Green, WL Ross and David F. Bolger until such investor together with his or its affiliates ceases to own at least 5% of the outstanding shares of common stock of the Company. Thomas M. Wells previously served as the Cascade Bancorp Board of Directors designee

for Mr. Bolger pursuant to a shareholders agreement between Mr. Bolger and the Company; Mr. Bolger’s right to nominate one director to the Company’s Board of Directors under the shareholders agreement terminated on January 28, 2011, but continues pursuant to the terms of his Securities Purchase Agreement.

Set forth below is certain information furnished to us by the director nominees. There are no family relationships among any of the directors or executive officers. For director qualifications, please see the “Director Qualifications and Experience” table, included on page 14.

Jerol E. Andres. Mr. Andres is currently retired. From 1988 to 2011 Mr. Andres served as Chief Executive Officer and President of JELD-WEN Development, Inc., a real estate development company. He also served as the Board Chair of Clear Choice Health Plans Inc. Currently, Mr. Andres serves on the boards of the Redmond Chamber of Commerce, Redmond Proficiency Academy and Partners in Care Hospice. He is also a partner of Workhorse Solutions, LLC, which provides consulting services to the hospitality and resort real estate industry.

Chris C. Casciato. Mr. Casciato is a Managing Director and member of the Investment Committee of Lightyear Capital. He joined Lightyear Capital in 2008 after having spent over 20 years at Goldman, Sachs & Co., where he was a partner and held several positions, including Chief Operating Officer of Goldman Sachs’ global investment banking business. He serves on the board of directors of the following Lightyear portfolio companies: Community & Southern Holdings, Inc. and its subsidiary, Community & Southern Bank; Clarion Partners; and Strategic Growth Bancorp. Mr. Casciato is Lightyear’s designated nominee pursuant to the terms of the Amended and Restated Securities Purchase Agreement between the Company and Lightyear.

Michael J. Connolly. Mr. Connolly is a partner and managing director of Breakaway Capital Partners, LLC, a lower-middle market lending fund based in Los Angeles that he co-founded in 2014. From 2007 through 2013, he was a partner of Leonard Green & Partners, L.P., a Los Angeles-based private equity firm that manages approximately $15 billion in assets. From 2001 through 2007, Mr. Connolly was an investment banker at UBS Securities, LLC, most recently as Managing Director and co-head of UBS Securities’ Los Angeles Investment Banking office. Before joining UBS, he was a Senior Vice President at Donaldson, Lufkin and Jenrette from 1992 through 2000. He serves on the boards of Motorini, Inc., Malibu Boats, Inc., and Fiesta ParentCo, L.L.C., the parent company of the Palms Casino Resort in Las Vegas. Mr. Connolly is Leonard Green’s designated nominee pursuant to the terms of the Securities Purchase Agreement between the Company and Leonard Green.

Annette G. Elg. Ms. Elg is the Senior Vice President and Chief Financial Officer of J. R. Simplot Company, one of the largest privately held food and agribusiness companies in the U.S. She has been with Simplot for over 26 years progressing through various finance and operational positions. She has held her current role since 2002. Prior to joining Simplot, Ms. Elg spent 10 years with the Boise office of the public accounting firm of Arthur Andersen & Co. Ms. Elg represents Simplot as a Director of Primex, Ltd., a captive insurance company, and is involved in various community activities, including Ballet Idaho, Boise Art Museum and Learning Lab. She is the Chairman-elect of the University of Idaho College of Business and Economics Advisory Board.

Dennis L. Johnson. Mr. Johnson has been President and Chief Executive Officer of United Heritage Mutual Holding Company since 2001, and United Heritage Financial Group and United Heritage Life Insurance Company, which are insurance, annuity, and financial products companies, since 1999. He served as President and CEO of United Heritage Financial Services, a broker-dealer, from 1994 to 1998 and served as General Counsel of United Heritage Mutual Holding Company and certain of its affiliates from 1983 to 1999. He is a former trustee of the Public Employees Retirement System of Idaho and currently serves on the Idaho State Treasurer’s Investment Advisory Board. He also sits on the Board of Directors of IDACORP, Inc. and Idaho Power Company.

J. LaMont Keen. Mr. Keen is the former President and Chief Executive Officer of IDACORP, Inc., serving from 2006 to 2014, and was Chief Executive Officer of IDACORP, Inc. subsidiary Idaho Power Company from 2005 through 2013 where he was employed for 40 years. He has served as a director of IDACORP, Inc. and Idaho Power Company since 2004.

James B. Lockhart III. Mr. Lockhart is Vice Chairman of WL Ross & Co. LLC and a member of the Management Committee and Investment Committees for the WLR Recovery Funds, Invesco Mortgage Recovery Funds as well as other funds. His responsibilities include overseeing financial services portfolio companies and sourcing new opportunities in the financial services industry. Prior to joining WL Ross in September 2009, he was the Director of the Federal Housing Finance Agency, regulator of Fannie Mae, Freddie Mac and the twelve Federal Home Loan Banks, and its predecessor agency, the Office of Federal Housing Enterprise Oversight, since May 2006. He served as the Chairman of Federal Housing Finance Oversight Board and a member of the Financial Stability Oversight Board with the Chairman of the Federal Reserve Board, the Secretaries of Treasury and HUD, and the Chairman of SEC. Previously Mr. Lockhart served as the Deputy Commissioner and Chief Operating Officer of Social

Security, Secretary to its Board of Trustees and a member of President Bush’s Management Council. Mr. Lockhart also served in the previous Bush Administration as Executive Director of the Pension Benefit Guaranty Corporation.

Mr. Lockhart co-founded and served as managing director of NetRisk, a risk management software and consulting firm serving major financial institutions, banks, insurance companies and investment management firms worldwide. He held senior positions at National Reinsurance, Smith Barney, Alexander & Alexander and Gulf Oil, in Europe and the U.S. He has served as a member of the American Benefits Council’s Board of Directors and of the Advisory Board to the Task Force for the Critical Review of the US Actuarial Profession. He is a director of Capital Markets Cooperative, Shellpoint Partners and the Bruce Museum. In 2009, he received The American Financial Leadership Award from the Financial Services Roundtable. He is a Fellow of the Association of Corporate Treasurers in the UK. Mr. Lockhart is a co-chair with former Senator Conrad (D-ND) on the Bipartisan Policy Center’s Commission on Retirement Security and Personal Savings.

Patricia L. Moss. Ms. Moss currently serves as Vice Chairman of the Board. Ms. Moss served as Chief Executive Officer of the Bank and President and Chief Executive Officer of the Company from 1998 to 2012. She currently serves as a director of MDU Resources, Inc., the Oregon Growth Board and the Aquila Tax Free Trust of Oregon. Ms. Moss is a former board member of Clear One Health Plans and has served on various community boards, including Central Oregon Community College, Oregon State University Cascades Campus and St. Charles Medical Center. Ms. Moss also serves as a Trustee on the Company’s Profit Sharing/401(k) Plan and as Chairman of the Bank of the Cascades Foundation.

Ryan R. Patrick, CPA. Mr. Patrick, a certified public accountant, has been a partner in the firm of Patrick Casey & Co., LLP since 2000. His experience includes financial reporting and business and tax consulting for a wide range of clients, including individuals, corporations, partnerships, estates and trusts. Mr. Patrick is a former director of St. Charles Health System, which operates St. Charles Medical Centers throughout Central Oregon. He is also a former director of CentWise Drug of Redmond Inc.

Thomas M. Wells. Mr. Wells is the senior partner and Chief Financial Officer of the law firm Wells, Jaworski & Liebman, LLP, with offices in New York and New Jersey. Mr. Wells serves as the sole trustee of the David F. Bolger Revocable Trust, the owner of approximately 9.04% of Cascades’ outstanding shares. In addition to his legal practice, Mr. Wells serves as a Director and Chief Executive Officer of the Bolger Foundation, as a Director and President of the Wells Mountain Foundation, and as Managing Member of Wells Mountain LLC, a real estate development, ownership and hospitality company.

Terry E. Zink. Mr. Zink has been the President and Chief Executive Officer and a director of the Company as well as Chief Executive Officer of the Bank since January 1, 2012. Mr. Zink was also President of the Bank from 2012 until February 2016. Prior to joining Bank of the Cascades, Mr. Zink served as President and Chief Executive Officer of Fifth Third Bank Chicago, an affiliate of the Fifth Third Bancorp network. He was also responsible for the oversight of the other 18 affiliates within the Fifth Third Bancorp network and the strategic oversight of the Retail and Small Business Banking lines. As an Executive Officer of Fifth Third Bank, Mr. Zink managed the Bank’s strategic growth throughout 13 states. This role included overseeing operations of approximately 22,000 employees, 1,300 branches, and more than $110 billion in assets. Prior to joining Fifth Third Bank, Mr. Zink served nearly 17 years with Wells Fargo & Company in several senior management positions in California and Arizona.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR ELECTION AS DIRECTORS.

THE BOARD OF DIRECTORS COMPOSITION AND RESPONSIBILITIES

Board of Directors Composition and Leadership

The Cascade Board of Directors currently is made up of 11 directors. The Board affirmatively determined that each of the following directors and director nominees is an “independent director” as defined under the NASDAQ rules: Mr. Andres, Mr. Casciato, Mr. Connolly, Ms. Elg, Mr. Johnson, Mr. Hewitt, Mr. Keen, Mr. Lockhart, Mr. Patrick and Mr. Wells.

Responsibilities of the Board of Directors

Each director is responsible for discharging his or her duties in good faith in the best interests of the Company, and with the care a prudent person would reasonably exercise under the circumstances. Directors have a duty to effectively monitor management’s capabilities, compensation, leadership and performance, without undermining management’s ability to successfully operate the business. The Board is authorized to retain outside legal, accounting or other advisors, as necessary, to carry out its responsibilities.

Directors are expected to avoid any action, position or interest that conflicts with an interest of the Company, or gives the appearance of a conflict. Directors are expected to disclose all business relationships with the Company and recuse themselves from discussions and decisions affecting those relationships. The Company annually solicits information from directors in order to monitor potential conflicts of interest and to make its determination of director independence.

Board Leadership Structure

The same person currently does not serve as both Chief Executive Officer of the Company and Chairman of the Board. We believe this structure is in the best interest of the Company as it allows our Chief Executive Officer, Mr. Zink, to focus his time and energy running the day-to-day operations of the Company and the Bank, while allowing our Chairman, Mr. Patrick, to oversee and lead the Board in its fundamental role of navigating a variety of issues and providing independent oversight of and advice to management.

Role of the Board of Directors in Risk Oversight

The Board has ultimate authority and responsibility for overseeing risk management of the Company. Some aspects of risk oversight are fulfilled at the full Board level. Additionally the Board, or a committee of the Board, receives specific periodic reports from executive management on credit risk, liquidity risk, interest rate risk, capital risk, operational risk and economic risk. The Audit and Enterprise Risk Management Committee (the “Audit Committee”) oversees financial, accounting and internal control risk management. The head of the Company’s internal audit function and the independent registered public accounting firm report directly to the Audit Committee. The Compensation Committee oversees the management of risks that may be posed by the Company’s compensation practices and programs.

Meeting Attendance

Directors are expected to attend scheduled Board and committee meetings, to review pre-meeting materials and to take an active and effective role in all meetings and deliberations.

During fiscal year 2015, the Board met 17 times. Each director attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of all meetings held by Board committees on which he or she served.

The Company encourages its directors to attend the annual meeting of shareholders. Two directors attended the 2015 annual meeting of shareholders.

Non-Management Directors — Stock Ownership Guidelines

The Board has adopted stock ownership guidelines applicable to all non-management directors of the Company other than those non-management directors who serve as a nominee of Lightyear, Leonard Green or WL Ross. The guidelines generally provide that any non-employee director should own, within four years of the beginning of his or her board service, Company common stock having a fair market value equal to four times the director’s annual cash retainer. In 2013, the Board updated the guidelines to exempt non-management directors who serve as a nominee of Lightyear, Leonard Green or WL Ross.

Related Person Transactions Policy and Procedure

The Board has adopted a written Related Person Transactions Policy. The purpose of the policy is to describe the procedures used to identify, review, approve and disclose, if necessary, any transaction or series of transactions in which: (i) Cascade was, is or will be a participant; (ii) the amount involved exceeds $120,000; and (iii) a related person had, has or will have a direct or indirect material interest. A related person as defined in the policy is (i) a member of the Board, (ii) a nominee for the Board, (iii) an executive officer, (iv) a person who beneficially owns more than 5% of Cascade’s common stock, or (v) any immediate family member of any of the people listed above.

Under the policy, the related person is required to notify and provide information regarding the related person transaction to the Company’s Chief Financial Officer. If the Chief Financial Officer determines that the proposed transaction is a related person transaction in which the related person’s interest is material, the Nominating and Corporate Governance Committee (or “Governance Committee”) must review the transaction for approval or disapproval. In determining whether or not to approve a related person transaction, the Governance Committee is required to consider all relevant facts and circumstances. No committee member is permitted to participate in the review of a related person transaction if he or she has an interest in the transaction.

Communications with Directors

Shareholders and other interested parties wishing to communicate with the Board or with a particular committee or director may do so in writing addressed to the Board or to the particular director. The written communication should be delivered to our Secretary at the address of our main office, 1100 N.W. Wall Street, Bend, Oregon 97703. Our Secretary will promptly forward such communications to the applicable committee, director or to the Chairman of the Board for consideration.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board has designated the following committees: Compensation Committee; Audit and Enterprise Risk Management Committee; and Nominating and Corporate Governance Committee.

The current composition of each Board committee is set forth below:

|

| | | | |

| Compensation Committee | | Audit and Enterprise Risk Management Committee | | Nominating and Corporate Governance Committee |

| Jerol E. Andres (chair) | | J. LaMont Keen (chair) | | Thomas M. Wells (chair) |

| Chris C. Casciato | | Jerol E. Andres | | Annette G. Elg |

| Michael J. Connolly | | Annette G. Elg | | J. LaMont Keen |

| Dennis L. Johnson | | Michael J. Connolly | | James B. Lockhart III |

| | Ryan R. Patrick | | Ryan R. Patrick |

Compensation Committee

The Board has determined that all of the members of the Compensation Committee are (i) “independent” within the meaning of the NASDAQ listing standards, (ii) “non-employee directors” within the meaning of Rule 16b-3 of the Exchange Act and (iii) “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended. As more fully described in its charter, the Compensation Committee provides assistance to the Board by discharging its responsibilities relating to the compensation of the Company’s Named Executive Officers, other key executive officers and directors. The Board has delegated authority to the Compensation Committee to approve compensation for the NEOs (other than our Chief Executive Officer (“CEO”)) and other key executive officers and to recommend the compensation of the CEO to the Board of Directors for approval. The Compensation Committee meets at least twice annually and additionally on an as-needed basis. A copy of the Compensation Committee Charter is available on the Company’s website at www.botc.com (click on “About Us,” “Investor Information” and then “Governance Documents” on the left side of the page). The Compensation Committee met five times during 2015.

For more information about the Compensation Committee’s activities see “Executive Compensation- Our Decision Making Process - The Role of the Compensation Committee” below.

Audit and Enterprise Risk Management Committee

The Audit and Enterprise Risk Management Committee consists of five directors, each of whom meets the independence standards for members of public company audit committees set forth in the NASDAQ listing rules and SEC rules. The Audit Committee operates under a written charter adopted by the Board. The Board has determined that Mr. Keen, Mr. Andres, Mr. Connolly, Ms. Elg and Mr. Patrick qualify as audit committee financial experts as defined in Item 407(d)(5)(ii) of Regulation S-K. The Audit Committee Charter is available on the Company’s website at www.botc.com (click on “About Us,” “Investor Information” and then “Governance Documents” on the left side of the page). The Audit Committee met 11 times during 2015.

The Audit Committee assists the Board in fulfilling its oversight responsibilities relating to corporate accounting and reporting practices of the Company, and to assure the quality and integrity of the Company’s consolidated financial statements. The purpose of the Audit Committee is to serve as an independent and objective party to: (i) monitor the Company’s financial reporting process and internal control system; (ii) oversee, review and appraise the audit activities of the Company’s independent registered public accounting firm and internal auditing function; (iii) maintain complete, objective and open communication between the Board, the independent accountants, financial management, and the internal audit function; and (iv) oversee the Company’s risk assessment and risk management policies and practices. The Audit Committee provides oversight and evaluation of the process by which management certifies the effectiveness of the Company’s system of internal controls. The Audit Committee reviews and discusses with the independent registered public accounting firm its attestation report on the Company’s system of internal control over financial reporting and its findings as to deficiencies in the system of controls, if any.

The Company’s independent registered public accounting firm reports directly to the Audit Committee. The Audit Committee is solely responsible for appointing or replacing the Company’s independent registered public accounting firm, recommending the submission of such appointment to a shareholder vote, and assuring the independence and providing oversight and supervision thereof. Any non-audit services provided by the auditor must be pre-approved by the Audit Committee. For more information about the Audit Committee’s activities see “Report of the Audit and Enterprise Risk Management Committee of the Board of Directors” below.

Nominating and Corporate Governance Committee

As more fully described in its charter, the Nominating and Corporate Governance Committee (the “Governance Committee”) provides assistance to the Board by identifying qualified individuals as prospective Board members and recommends to the Board the director nominees for election at the annual meeting of shareholders. The Governance Committee oversees the annual review and evaluation of the performance of the Board and its committees, develops and recommends corporate governance guidelines to the Board of Directors, and leads and oversees a search process in the event of a CEO vacancy. In addition, the Governance Committee examines, evaluates, and monitors the independence of directors for general Board positions, as well as for specific committee duties, and evaluates specific qualifications for members serving as audit committee financial experts. The Governance Committee also reviews and approves or ratifies any material potential conflict of interest or transaction between Cascade and any “related person” as defined under applicable SEC rules. See “Related Person Transactions Policy and Procedures” above. The Governance Committee met two times during 2015.

The Governance Committee’s charter provides that, in identifying candidates for membership on the Board, the Governance Committee shall take into account all factors and criteria it considers appropriate, including whether the director/potential director assists in achieving a mix of Board members that represents a diversity of background and experience, including with respect to age, gender, race, place of residence and specialized experience. The Governance Committee also considers it appropriate to identify the impact a candidate will have on the Company and the Board in terms of skill set, expertise, experience, business development contributions, background, character, individual success in chosen fields, public company expertise, geographic diversity, and independence of candidates.

The Governance Committee will consider shareholder recommendations for candidates for the Board using the same process. There are no differences in the manner in which the Governance Committee evaluates director candidates based on whether the candidate is recommended by a shareholder. Shareholder recommendations for potential directors must be in writing and the shareholder submitting a nomination must have continuously held at least $2,000 in market value of Company common stock for at least one year and hold the stock through the date of the annual meeting at which the nomination will be made. Any shareholder who intends to nominate a director at an annual meeting must deliver notice to the Company's Secretary not less than 60 nor more than 90 days prior to the meeting date; provided, however, that if less than 65 days’ notice or prior public disclosure of the meeting date is given or made to shareholders, the shareholder’s notice of a director nomination must be received by the close of business on the 15th day following the day on which such notice or prior public disclosure of the date of the annual meeting was made, whichever first occurs. The shareholder notice must include, for each nominee, the name,

age, business address and residence address of the nominee, the principal occupation or employment of the nominee, the number of Cascade shares beneficially owned by the nominee, and other information that would be required under the rules of the SEC in a proxy statement soliciting proxies for the election of the nominee. Additional information is required with respect to the shareholder giving the notice. The Governance Committee requires evidence that the nominee’s qualifications meet the criteria and considerations as outlined in the Governance Committee charter or as published by the Company from time to time. Refer to the Governance Committee Charter, available on the Company’s website www.botc.com (click on “About Us,” “Investor Information” and then “Governance Documents” on the left side of the page), and the Company’s Bylaws for minimum qualifications of director candidates and procedures for shareholders in communicating nominations to the Board. The Company's Bylaws are available on the Company’s website www.botc.com, or upon written request to the Company's Secretary at 1100 N.W. Wall Street, Bend, Oregon 97703.

Director Qualifications and Experience

The following table identifies the experience, qualifications, attributes and skills that the Board considered in making its decision to appoint and nominate directors to the Board. This information supplements the biographical information provided above. The vertical axis displays the primary factors reviewed by the Governance Committee in evaluating a board candidate.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Andres | | Casciato | | Connolly | | Elg | | Hewitt | | Johnson | | Keen | | Lockhart | | Moss | | Patrick | | Wells | | Zink |

| Experience, Qualifications, Skill or Attribute | | | | | | | | | | | | | | | | | | | | | | | | |

| Professional standing in chosen field | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X |

Expertise in financial services or related

industry | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X |

| Audit Committee Financial Expert (actual or potential) | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | | | |

| Civic and community involvement | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X |

| Other public company experience | | X | | X | | X | | | | X | | X | | X | | X | | X | | | | X | | X |

| Leadership and team building skills | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X |

| Diversity by race, gender or culture | | | | | | | | X | | | | | | | | | | X | | | | | | |

| Specific skills/knowledge | | | | | | | | | | | | | | | | | | | | | | | | |

| – finance | | | | X | | X | | X | | X | | X | | X | | X | | X | | X | | | | X |

| – marketing | | X | | | | | | | | | | | | | | | | | | | | | | X |

| – public affairs | | | | X | | X | | | | X | | | | X | | X | | X | | | | | | X |

| – human resources | | | | | | | | | | X | | | | | | | | X | | | | X | | |

| – governance | | | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X |

DIRECTOR COMPENSATION FOR FISCAL YEAR 2015

|

| | | | | | | | | | | | | | | | | | |

| Name | | Fees

Earned or

Paid in Cash

($) | | Stock

Awards

($) | | Option

Awards

($) | | Non-Equity

Incentive Plan

Compensation

($) | | All Other

Compensation

($) | | Total

($) |

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) |

| Jerol E. Andres | | 47,500 |

| | 26,000 |

| | — |

| | — |

| | — |

| | 73,500 |

|

| Chris C. Casciato | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Michael J. Connolly | | 44,000 |

| | 26,000 |

| | — |

| | — |

| | — |

| | 70,000 |

|

| Annette G. Elg | | 37,500 |

| | 26,000 |

| | — |

| | — |

| | — |

| | 63,500 |

|

| Henry H. Hewitt | | 21,750 |

| | 12,999 |

| | — |

| | — |

| | — |

| | 34,749 |

|

| Dennis L. Johnson | | 39,500 |

| | 26,000 |

| | — |

| | — |

| | — |

| | 65,500 |

|

| J. LaMont Keen | | 46,500 |

| | 26,000 |

| | — |

| | — |

| | — |

| | 72,500 |

|

| James B. Lockhart III | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Patricia L. Moss | | 44,000 |

| | 26,000 |

| | — |

| | — |

| | 235,756 |

| | 305,756 |

|

| Ryan R. Patrick | | 57,500 |

| | 26,000 |

| | — |

| | — |

| | — |

| | 83,500 |

|

| Thomas M. Wells | | 42,000 |

| | 26,000 |

| | — |

| | — |

| | — |

| | 68,000 |

|

| Lightyear Capital LLC | | 39,500 |

| | 26,000 |

| | — |

| | — |

| | — |

| | 65,500 |

|

| WL Ross and Co. LLC | | 37,000 |

| | 26,000 |

| | — |

| | — |

| | — |

| | 63,000 |

|

Fees Earned or Paid in Cash (column b): Each Company director received an annual cash retainer of $26,000 in 2015. Directors also received $9,000 cash to compensate them for their expected attendance at 17 board meetings. Based on a July

2015 retirement, Mr. Hewitt received a prorated annual cash retainer and attendance fee of $13,000 and $4,500, respectively. The Chairman of the Board (Mr. Patrick) received an additional fee of $20,000. The following Directors received cash compensation for acting as Committee Chairs: Andres (Compensation) $7,500, Hewitt (Loan, prior to retirement) $2,000, Connolly (Loan) $2,000, Moss (Trust) $4,000, Wells (Nominating & Corporate Governance) $4,000, Keen (Audit) $9,000. The Loan and Trust committees are Bank-level committees. Directors also received cash compensation for their anticipated attendance at various committee meetings. The fee schedule for attending committee meetings was $500. At the start of the year, fees are calculated based on anticipated number of committee meetings and fees are then paid out pro-rata on a monthly basis. Employee directors do not receive fees for serving on the Board.

Stock Awards (column c): Amounts in this column represent the aggregate grant date fair value of the stock awards granted to the directors in 2015. The amounts were calculated based on the closing price of our common stock on the Nasdaq on the date of grant. On June 10, 2015, each director each received 5,210 shares of common stock at a $4.99 stock price with the exception of Mr. Hewitt, who received a prorated 2,605 shares of common stock at a $4.99 stock price due to his scheduled retirement from the Board. Upon retirement Mr. Hewitt’s accumulated 24,088 shares of restricted stock units vested, which resulted in Mr. Hewitt realizing $120,199 in value upon the vesting of such shares.

Option Awards (column d): The Company historically has not granted any stock options to directors other than nonqualified stock options. The Company did not grant any stock options to the directors in 2015.

All Other Compensation (column f): Messrs. Andres, Hewitt, Patrick, and Wells are party to Deferred Fee Agreements, with interest credited annually at a rate of 4.32%. After his retirement from the Board, Mr. Hewitt began to receive payments in July 2015.

Ms. Moss is party to the Supplemental Executive Retirement Plan (“SERP”) and Deferred Bonus Plan, each of which was initiated while Ms. Moss was CEO of the Company before becoming a director. The SERP provides for a benefit starting at $18,892 per month, escalating at 2.5% per year with payments continuing for 20 years. The deferred bonus plan has interest credited annually at a rate of 4.32%.

Messrs. Andres and Patrick are party to a director emeritus agreement. The director emeritus agreement provides for a benefit of $18,000 per year for a minimum of 10 years. The benefit will be paid from the director’s normal retirement date until the later of the director’s death or 120 months. The annual benefit payments are subject to a 2.5% annual increase during retirement.

EXECUTIVE OFFICERS

The following table sets forth certain information about the Company’s executive officers. Biographical information about Mr. Zink is given under “Election of Directors - Nominees” above.

|

| | | | |

| Name | | Age | | Position |

| Terry E. Zink | | 64 | | President and Chief Executive Officer of Cascade Bancorp and Chief Executive Officer of Bank of the Cascades since January 1, 2012. |

Gregory D. Newton(1) | | 65 | | Executive Vice President and Chief Financial Officer of Cascade Bancorp and Bank of the Cascades since 2002. |

Charles N. Reeves(2) | | 48 | | Executive Vice President and Chief Operating Officer of Cascade Bancorp and President and Chief Operating Officer of Bank of the Cascades since February 2016. |

Daniel J. Lee(3) | | 59 | | Executive Vice President and Chief Credit Officer of Cascade Bancorp and Bank of the Cascades since April 2012. |

Peggy Biss(4) | | 58 | | Executive Vice President and Chief Administrative Officer of Cascade Bancorp and Bank of the Cascades since 2014. |

________________

| |

| (1) | Gregory D. Newton. Mr. Newton’s extensive 30 year banking experience includes treasury and accounting experience spanning asset and liability management, investments, funding and derivative management. He has served in key treasury and controllership roles with banks in Seattle, as well as the Federal Reserve. Mr. Newton joined Cascade Bancorp in 1997. He currently serves as investor relations contact. Mr. Newton earned a Bachelor’s Degree at the University of Washington and completed MBA coursework at Seattle University and is a non-public CPA. He is active in the community and the Oregon Bankers Association. |

| |

| (2) | Charles N. Reeves. Mr. Reeves was appointed President and Chief Operating Officer of Bank of the Cascades in February 2016, having served as Chief Banking Officer since joining Cascade in August 2012. Mr. Reeves has over 20 years of banking and financial expertise, most recently as Bancorp Senior Vice President of Special Assets at Fifth Third Bank, a $115 billion bank in the Midwest. Prior to his Special Assets role, Mr. Reeves served as President of Fifth Third Bank’s Chicago region from 2008 through 2010, overseeing all lines of business. Reeves holds a Bachelor of Arts from Miami University in Oxford, Ohio. Throughout his career Reeves has been actively involved with community and industry leadership programs, including serving on the board of directors for several organizations. |

| |

| (3) | Daniel J. Lee. Mr. Lee joined Bank of the Cascades in April 2012 as Chief Credit Officer. He has over 30 years of banking and financial expertise. Prior to joining Cascade, Mr. Lee served in executive positions with a number of community and regional banks including District Head of Corporate Banking for KeyBank, Regional President for Irwin Union Bank, and Chief Credit Officer for Union Federal Bank. Mr. Lee holds a Bachelor’s Degree and MBA from Indiana University, attended the Stonier Graduate School of Banking and has been designated a Certified Turnaround Professional through the Turnaround Management Association. Throughout his career, Mr. Lee has been actively involved with his community and served on the board of Government Relations Council of the American Bankers Association. |

| |

| (4) | Peggy Biss. Ms. Biss began working for the Bank in 1978 and held the position of Chief Human Resources Officer until 2014 when she was named Chief Administrative Officer. In her current role, Ms. Biss oversees the Bank’s branch operations support and customer service functions in addition to the human resources and training departments. Prior to establishing the human resources department in 1988, Ms. Biss held positions in operations, lending and branch management. Ms. Biss is a Society for Human Resource Management Senior Certified Professional (SHRM-SCP), a Senior Professional in Human Resources (SPHR) as certified by the Human Resources Certification Institute and is a graduate of Pacific Coast Banking School. For more than 30 years, Ms. Biss has been actively involved with community and industry programs. She is a member of the Society of Human Resource Managers and the Oregon Bankers Association. |

EXECUTIVE COMPENSATION

Compensation Discussion & Analysis (“CD&A”)

This CD&A explains our executive compensation program for our Named Executive Officers listed below. The CD&A also describes the Compensation Committee’s (“Committee”) process for making pay decisions, as well as its rationale for specific decisions related to fiscal 2015.

|

| | |

| Name | | Title |

| Terry E. Zink | | President & Chief Executive Officer |

| Gregory D. Newton | | Executive Vice President, Chief Financial Officer |

| Charles N. Reeves | | Executive Vice President, Chief Banking Officer |

| Daniel Lee | | Executive Vice President, Chief Credit Officer |

| Peggy L. Biss | | Executive Vice President, Chief Administrative Officer |

Executive Summary

2015 Business Strategy & Highlights

In fiscal 2015, our leadership team continued to capitalize on the strong Pacific Northwest growth markets in pursuit of our strategic goal - to grow the Company to $5 billion in assets over time through both organic loan growth and value-enhancing bank acquisitions in the Northwest. We saw very strong year-over-year growth in loans, revenue and profitability, as evidenced by the following financial achievements1:

| |

| • | Net income for 2015 was $20.6 million, which generated $0.29 per share, compared to $3.7 million, or $0.06 per share, for 2014. |

| |

| • | Net interest income was up $13.4 million, or 20.6%, during 2015 and non-interest income was up $4.8 million, or nearly 25%. |

| |

| • | Non-interest expenses improved during 2015 by approximately $7.0 million, or 8.6%. |

| |

| • | Return on average tangible assets for 2015 was 0.87% compared to 0.19% in 2014. |

| |

| • | Return on average tangible stockholders’ equity was 8.56% in 2015 compared to 1.77% in 2014. |

| |

| • | Year-over-year loan growth was 13.1%, including organic loan growth of approximately $149.7 million, or 11.8%, for the year. |

| |

| • | Year-over-year total deposit growth for 2015 was approximately $102 million, or 5.1%, and the increase in non-interest bearing deposits was 17.5%, while interest checking balances were up 12.0%. |

In addition to these financial achievements and a robust pipeline of new business, our leadership team has enhanced the prospective franchise value by improving the strategic position of Cascade. In March 2016, we completed our previously announced acquisition of approximately $470 million in deposits along with 12 Oregon branch locations and three Washington branch locations from Bank of America, National Association. This acquisition will strengthen Cascade’s core deposit and customer relationship base in the Southern and Coastal counties of Oregon, with its deposit market share increasing to a top tier ranking in many of these communities.

________________________________________

1Certain non-GAAP financial measures, specifically organic loan growth, return on average tangible assets and return on average tangible stockholders’ equity, are important measures of the strength of the Company’s capital and its ability to generate earnings on its tangible capital invested by its shareholders. Presentation of these non-GAAP financial measures provides useful supplemental information to our investors and others that contributes to a proper understanding of the financial results and capital levels of the Company. Management also uses these non-GAAP financial measures in making financial, operating and planning decisions and in evaluating the Company’s performance. These non-GAAP disclosures should not be viewed as a substitute for financial results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found on pages 29 and 30 of our Annual Report on Form 10-K for the year ended December 31, 2015.

Also enhancing our strategic positioning, Cascade opened a business banking center in downtown Seattle in the fourth quarter of 2015, staffed by experienced lenders and treasury management personnel. This office enhances our ability to grow aggregate loans and diversify our loan portfolio. Additionally, in March of 2015, the Bank further diversified its lending activities with the addition of an equipment finance line of business led by an experienced aircraft lender.

Our credit quality metrics also improved in 2015 and franchise value was enhanced with the realization of $6.4 million in net recoveries on loans previously charged off.

These accomplishments are predicated on the commitment and focus of the NEOs under the leadership of Terry Zink. Since his appointment as CEO in January of 2012, the Company has built a solid platform for profitable growth. We have had a significant reduction in adversely risk rated loans and improvement of our credit quality metrics to levels that are generally consistent with those of our industry peers - enabling the termination of the prior regulatory agreements in 2013. During this period, the Company has also returned to profitability and diversified its revenue channels, enabling recapture of its $50 million deferred tax asset. In May 2014, we acquired Home Federal Bank in a transaction that rationalized the combined branch network and captured important economies of scale with the aim of improved profitability and the enhancement of franchise value. Importantly, the Bank has also enhanced its organic growth in terms of both loans and deposits.

2015 Compensation Actions At-A-Glance

Our NEOs are compensated through pay elements designed to drive sustained business performance, build an internal culture of ownership and create long-term value for our shareholders. The Committee took the following compensation-related actions for fiscal 2015:

| |

| • | Base Salaries: None of our NEOs received salary adjustments in 2015, with the exceptions of Mr. Newton. This adjustment was based on his increased responsibility within the organization and to better align his base salary with market practice. More information about base salaries can be found on page 21 of this Proxy Statement. |

| |

| • | Annual Cash Incentives and Discretionary Bonuses: Consistent with our business achievements and the contributions of our NEOs, the Committee approved annual incentive payouts for each of the NEOs of 180% of target. Separate from these incentive payouts, the Committee also approved one-time cash bonuses to Messrs. Newton and Lee and Ms. Biss. Mr. Newton’s bonus was based on his increased scope of responsibility and role within the bank. Mr. Lee and Ms. Biss received these cash payments in lieu of merit increases to their base salaries. More information about these awards can be found on pages 21 - 23 of this Proxy Statement. |

| |

| • | Long-Term Incentives: The Committee believes that Mr. Zink, along with the other NEOs, are at the core of our success over the last few years and that their vision, leadership and deep experience are critical to the ongoing success of the Company. To this end, and as also disclosed in last year’s Proxy Statement, on February 3, 2015, the Committee approved a one-time stock option award grant to each of the NEOs. This award is fully focused on the goal of creating shareholder value and only provides value to the NEOs if the price of the Company’s stock appreciates over time. More information about these awards can be found on page 23 of this Proxy Statement. |

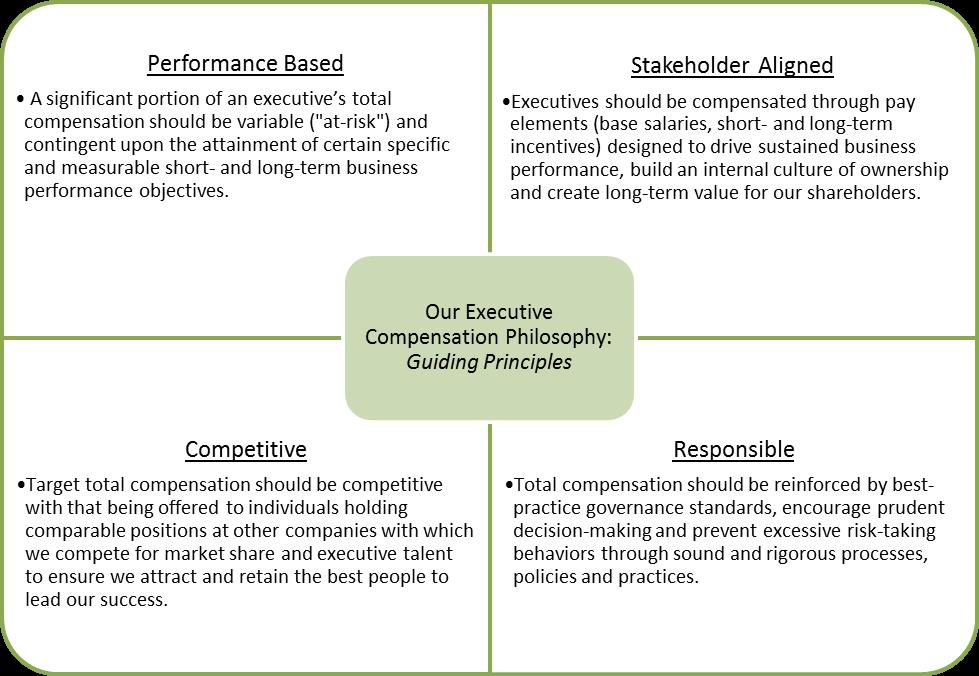

Compensation Practices & Policies

Our executive compensation program is designed to encourage prudent decision-making and prevent excessive risk-taking behaviors through the following processes, policies and practices, which we believe reflect corporate governance best practices.

|

| | | | |

| What We Do | | What We Don’t Do |

| a | Emphasis on variable compensation | | x | No single-trigger vesting upon a change in control |

| a | Stock ownership guidelines | | x | No repricing of stock options without shareholder approval |

| a | Annual risk assessment | | x | No tax gross ups |

| a | Independent compensation consultant | | x | No special perquisites |

| a | Clawback policy | | x | No bonus guarantees |

2015 Say-On-Pay

Maintaining an open dialogue with our shareholders about our executive compensation program is a priority - especially as we continue to grow at a rapid pace. Our goal is to ensure that our shareholders have a good understanding of how our