QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý) | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

Alliant Techsystems Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

| Daniel J. Murphy, Jr. Chief Executive Officer | Alliant Techsystems Inc. 5050 Lincoln Drive Edina, MN 55436-1097 |

June 23, 2004

Dear Stockholder:

It is my pleasure to invite you to attend the fourteenth Annual Meeting of Stockholders of ATK (Alliant Techsystems Inc.), which will be held at 2:00 p.m. on Tuesday, August 3, 2004, at our headquarters, 5050 Lincoln Drive, Edina (suburban Minneapolis), Minnesota.

The proposals to be considered at the meeting are described in the Notice of Annual Meeting and Proxy Statement that accompany this letter. We will also present a report on our business operations, and you will have an opportunity to ask questions.

Your vote on the proposals is important. Whether or not you attend the meeting, we encourage you to vote your shares in order to make certain that you are represented at the meeting. You may vote your shares by telephone or Internet as described in the enclosed proxy card or by completing and signing the enclosed proxy card and promptly returning it in the envelope provided. You may, of course, attend the meeting and vote in person.

Our Board of Directors recommends that you vote FOR all of the Board's nominees for election as directors, FOR the ratification of the appointment of the Company's independent auditors, and AGAINST the stockholder proposal described in the Proxy Statement. Our Board of Directors appreciates your support.

If you plan to attend the meeting, please let us know. See the Admission Policy on the next page for instructions on admission to the meeting.

I look forward to seeing you at the Annual Meeting.

Sincerely, | ||

| ||

Daniel J. Murphy, Jr. |

| | Page | |

|---|---|---|

| Notice of Annual Meeting of Stockholders | iii | |

General Information | 1 | |

Security Ownership of Certain Beneficial Owners and Management | 6 | |

Proposal 1—Election of Directors | 8 | |

Corporate Governance | 12 | |

Executive Compensation | 19 | |

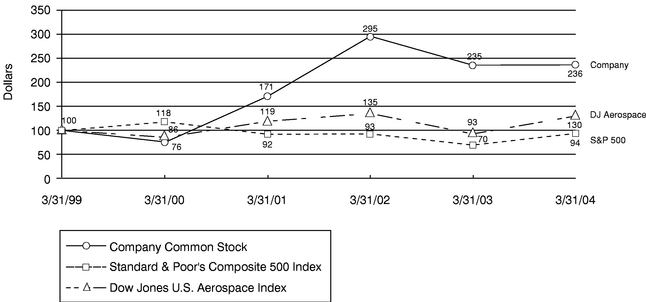

Stockholder Return Performance Graph | 37 | |

Audit Committee Report | 38 | |

Fees Paid to Independent Auditors | 39 | |

Proposal 2—Ratification of Appointment of Independent Auditors | 40 | |

Proposal 3—Stockholder Proposal | 40 | |

Future Stockholder Proposals | 42 | |

Section 16(a) Beneficial Ownership Reporting Compliance | 43 | |

Appendix A—Corporate Governance Principles | A-1 | |

Appendix B—Audit Committee Charter | B-1 | |

Appendix C—Proponents of Stockholder Resolution | C-1 |

All stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting of Stockholders on August 3, 2004. To be admitted to the meeting,you must present the admission ticket attached to the enclosed proxy card and your photo identification, or if you elected to receive stockholder materials electronically, you must request an admission ticket by e-mailing alliant.corporate@atk.com. You may pick up your ticket at the registration table prior to the meeting. Please be prepared to show your photo identification.

Please note that if you hold shares in "street name" (that is, through a bank, broker or other nominee), to obtain an admission ticketyou will need to bring your photo identification and a copy of a statement reflecting your share ownership as of the record date and check in at the registration desk at the meeting. If you attend as a representative of an entity that owns shares of record, you will need to bring proper identification indicating your authority to represent that entity.

ii

ALLIANT TECHSYSTEMS INC.

5050 Lincoln Drive

Edina, MN 55436-1097

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Date and Time: | Tuesday, August 3, 2004, at 2:00 p.m. central time | |||

Place: | Alliant Techsystems Inc. headquarters 5050 Lincoln Drive Edina (suburban Minneapolis), Minnesota | |||

Proposals to be Voted on: | • | Election of eleven directors. | ||

| • | Ratification of the appointment of Deloitte & Touche LLP as the Company's independent auditors for the fiscal year ending March 31, 2005. | |||

| • | A stockholder proposal described in the Proxy Statement, if the proposal is presented at the meeting. | |||

Record Date: | June 7, 2004 | |||

Voting by Proxy: | It is important that your shares be represented and voted at the meeting. Whether or not you plan to attend the meeting in person, please mark, date and sign the enclosed proxy card and mail it in the enclosed envelope. No postage is required if the proxy is mailed in the United States. Most stockholders also have the alternatives of voting their shares on the Internet or by telephone. If Internet or telephone voting is available to you, voting instructions are printed on your proxy card or included with your proxy materials. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the accompanying Proxy Statement. | |||

Admission to the Meeting: | You will be admitted to the meeting only if you have a ticket. See the Admission Policy on the previous page for instructions on obtaining a ticket. | |||

| By Order of the Board of Directors, | ||

Ann D. Davidson Secretary | ||

| June 23, 2004 |

iii

ALLIANT TECHSYSTEMS INC.

5050 Lincoln Drive

Edina, MN 55436-1097

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

August 3, 2004

QUESTIONS AND ANSWERS ABOUT VOTING

| Q: | What am I voting on? | |||

A: | • | Election of eleven directors currently serving on our Board of Directors. | ||

• | Ratification of the appointment of Deloitte & Touche LLP as our independent auditors for the current fiscal year. | |||

• | A stockholder proposal that is described later in this Proxy Statement. If the stockholder proposal is not presented at the Annual Meeting, it will not be voted upon. | |||

Q: | Who is soliciting my vote? | |||

A: | Our Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. Our management prepared this Proxy Statement for the Board of Directors. | |||

Q: | When was this Proxy Statement mailed? | |||

A: | This Proxy Statement was first mailed to stockholders on or about June 23, 2004. | |||

Q: | What if I did not receive a copy of the Company's Annual Report? | |||

A: | A copy of the Annual Report on Form 10-K for our fiscal year ended March 31, 2004, which we call fiscal year 2004, was mailed with this Proxy Statement to all stockholders entitled to vote at the Annual Meeting. If you did not receive a copy, please write to us at our executive offices, or call us at (952) 351-3059. | |||

Q: | Who is entitled to vote at the Annual Meeting? | |||

A: | Stockholders can vote their shares of our common stock at the Annual Meeting if our records show that they owned their shares as of the close of business on June 7, 2004, which was the record date. | |||

During ordinary business hours on the ten days prior to the date of the meeting, a list of stockholders entitled to vote at the meeting will be available in the Secretary's office at the Company's headquarters for inspection by stockholders for any purpose related to the meeting. | ||||

1

Q: | How do I vote my shares without attending the meeting? | |||

A: | You may vote by telephone, Internet or mail, as explained below: | |||

Voting by telephone or Internet: If you are a stockholder of record, which means that you hold a stock certificate for your shares, you may submit your proxy by following the instructions on your proxy card. If you vote by telephone or Internet, you do not need to return your proxy card. Telephone and Internet voting for stockholders of record will be available 24 hours a day, and will close at 11:59 p.m. Eastern Time on August 2, 2004. | ||||

Voting by mail: You may vote by mail by signing, dating and mailing the enclosed proxy card in the envelope provided, which requires no postage if mailed in the United States. | ||||

Q: | How do I vote if my shares are held by my broker or someone else in street name? | |||

A: | • | If you are not a stockholder of record, you will receive voting instructions from the party that holds your shares of record for your account. | ||

• | You cannot vote your shares at the Annual Meeting unless you obtain authorization from the party that holds your shares of record for your account. Your voting instructions from the record holder of your shares may contain instructions on how to obtain this authorization. | |||

Q: | How do I vote if my shares are held in an ATK 401(k) plan? | |||

A: | • | You may vote by mail, telephone or Internet. The plan trustee will vote your shares as you instruct. | ||

• | If you do not sign and return your proxy card or vote by telephone or Internet by the deadline, the trustee will vote your shares, as well as any shares that have not been allocated to participant accounts, in the same manner and proportion as it votes shares for which it received voting instructions. | |||

• | You cannot vote your 401(k) plan shares at the Annual Meeting. | |||

Q: | How do I vote if my shares are held in the ATK Employee Stock Purchase Plan? | |||

A: | If you are a participant in our Employee Stock Purchase Plan, you will receive voting instructions from E*TRADE Securities LLC, which holds the shares of record for your account. | |||

Q: | What shall I do if I receive more than one proxy card? | |||

A: | If you receive more than one proxy card, it may be that: | |||

• | you hold shares in more than one account—such as individually of record, in one of our 401(k) plans, or in street name through a broker, or | |||

• | you have shares that are registered in different variations of your name. | |||

You should vote all of the shares for which you receive a proxy card. If you receive more than one proxy card, and they all are accompanied by return envelopes addressed to the same return address, you may return all of your proxy cards in the same envelope. However, if any of the proxy cards you receive are accompanied by return envelopes addressed to different return addresses, be sure to return each proxy card in the envelope that accompanied it. If you vote by telephone or Internet, vote once for each proxy card you receive. | ||||

Q: | How will my shares be voted if I don't mark my proxy card? | |||

A: | You are encouraged to mark your proxy card indicating how you wish to vote your shares. If you do, your shares will be voted as you instruct, assuming that you properly sign your proxy card and that it is received in time to be voted at the Annual Meeting. If you properly sign and return your proxy card, but you do not indicate how you wish to vote your shares on a proposal, your shares will be voted as follows on that proposal: | |||

• | FOR all of the Board's nominees for election as directors (Proposal 1). | |||

2

• | FOR ratification of the appointment of Deloitte & Touche LLP as the Company's independent auditors for the current fiscal year (Proposal 2). | |||

• | AGAINST the stockholder proposal (Proposal 3). | |||

Q: | Can I change my vote? | |||

A: | You can change your vote before the vote is taken at the Annual Meeting. If you are a stockholder of record, you can change your vote by: | |||

• | signing and delivering to our Corporate Secretary a written request to revoke your proxy vote; | |||

• | signing and mailing a new, properly completed proxy card with a later date than your original proxy card; | |||

• | voting by telephone or the Internet at a later time, until 11:59 p.m. Eastern Time on August 2, 2004; or | |||

• | attending the Annual Meeting and voting in person. | |||

If you are not a stockholder of record, you must instruct the party that holds your shares of record for your account of your desire to change your vote. | ||||

Q: | What constitutes a quorum at the Annual Meeting? | |||

A: | On the record date, there were 37,578,209 shares of our common stock outstanding. This does not include 3,978,889 shares that were held in our treasury and cannot be voted. Each share is entitled to one vote. Holders of a majority of the shares outstanding must be present at the Annual Meeting in order for there to be a quorum. You will be considered present at the Annual Meeting if you are in attendance and vote your shares at the meeting, or if you have submitted a properly completed proxy card or properly voted by telephone or the Internet. | |||

Q: | How will abstentions and broker non-votes affect the quorum and voting? | |||

A: | • | If you withhold your vote on the election of directors or abstain from voting on any other proposal, you will still be considered present at the Annual Meeting for purposes of determining a quorum. | ||

• | If you withhold your vote from a director nominee, this will reduce the number of votes cast for that nominee. | |||

• | If you abstain from voting on one of the other proposals, your shares will still be considered in determining the vote required to approve the proposal, so you will be deemed to have voted against that proposal. | |||

• | If shares are held in nominee street name, such as by a broker, and the nominee cannot vote the shares on a specific proposal because no voting instructions were received from the owner, the failure of the nominee to vote the shares is called a "broker non-vote." Shares affected by broker non-votes will be considered present at the Annual Meeting for purposes of determining a quorum because the shares will have been voted on at least one other proposal. Shares affected by broker non-votes will not, however, be considered in determining the vote required to approve the specific proposal on which the shares could not be voted, and will not be deemed to have voted against the proposal. | |||

Q: | What vote is required to approve the proposals? | |||

A: | If a quorum is present at the Annual Meeting: | |||

• | The eleven nominees for election as directors who receive the largest number of votes properly cast FOR the directors will be elected directors. | |||

3

• | Each other proposal properly presented at the Annual Meeting requires the affirmative vote of a majority of the shares present in person or by proxy and entitled to vote at the Annual Meeting. | |||

Q: | Who will tabulate the votes at the Annual Meeting? | |||

A: | Mellon Investor Services LLC, our transfer agent, will provide inspectors of election to tabulate the votes cast before and at the Annual Meeting. | |||

Q: | How will the solicitation of proxies be handled? | |||

A: | • | Proxies are being solicited primarily by mail, but proxies may also be solicited personally, by telephone, facsimile and similar means. Our directors, officers and other employees may help with the solicitation without additional compensation. | ||

• | We will reimburse brokers, banks and other custodians and nominees for their reasonable expenses in forwarding proxy solicitation materials to the owners of the shares they hold. | |||

• | We will pay all other expenses of preparing, printing and mailing the proxy solicitation materials. | |||

Q: | Can I receive future annual reports and proxy materials electronically via the Internet instead of receiving paper copies through the mail? | |||

A: | Yes. We are offering you the opportunity to access future annual reports and proxy materials over the Internet rather than in printed form. Internet access will give you faster delivery of these documents and reduce our cost of printing and mailing them. To consent to electronic delivery via the Internet, check the applicable box on your proxy card. When we send out future documents, we will notify you by mail with instructions for accessing the documents over the Internet and for voting. As a result of your consent, we may no longer distribute printed materials to you until such consent is revoked. Your consent may be revoked at any time by contacting our transfer agent, Mellon Investor Services, LLC, Overpeck Centre, 85 Challenger Road, Ridgefield Park, NJ 07660 (telephone: 1-800-851-9677; web site: www.melloninvestor.com). If your shares are held in street name, please contact your broker or bank and ask about the availability of electronic delivery. If you do not choose to receive our annual report and proxy materials via the Internet, you will continue to receive these materials in the mail. | |||

OTHER QUESTIONS AND ANSWERS | ||||

Q: | What if other business is brought up at the Annual Meeting? | |||

A: | • | Our Board of Directors does not intend to present any other matters for a vote at the Annual Meeting. The only stockholder proposal that can be presented at the Annual Meeting is the one included in this Proxy Statement as Proposal 3. No other stockholder has given the timely notice required by our By-Laws in order to present a proposal at the Annual Meeting. Similarly, no additional candidates for election as a director can be nominated at the Annual Meeting because no stockholder has given the timely notice required by our By-Laws in order to nominate a candidate for election as a director at the Annual Meeting. If any other business is properly brought before the meeting, the persons named as proxy on the proxy card will vote on the matter using their best judgment. | ||

• | Information regarding the requirements for submitting a stockholder proposal for consideration at next year's annual meeting, or nominating a candidate for election as a director at next year's annual meeting, can be found near the end of this Proxy Statement under the heading "Future Stockholder Proposals." | |||

4

Q: | What if I want to attend the Annual Meeting? | |||

A: | All stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting of Stockholders on August 3, 2004. To be admitted to the meeting, you must present the admission ticket attached to the enclosed proxy card and your photo identification, or if you elected to receive stockholder materials electronically, you must request an admission ticket by e-mailing alliant.corporate@atk.com. You may pick up your ticket at the registration table prior to the meeting. Please be prepared to show your photo identification. | |||

Please note that if you hold shares in "street name" (that is, through a bank, broker or other nominee), to obtain an admission ticket you will need to bring your photo identification and a copy of a statement reflecting your share ownership as of the record date and check in at the registration desk at the meeting. If you attend as a representative of an entity that owns shares of record, you will need to bring proper identification indicating your authority to represent that entity. | ||||

Q: | Where are ATK's executive offices located? | |||

A: | Our executive offices are located at 5050 Lincoln Drive, Edina, MN 55436-1097, which is also the location of the Annual Meeting. | |||

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the number of shares of our common stock beneficially owned (as defined by the Securities and Exchange Commission for proxy statement purposes) as of June 7, 2004 by (1) each person known by the Company to beneficially own more than 5% of the Company's common stock, (2) each of our directors, (3) each executive officer named in the Summary Compensation Table included later in this Proxy Statement, and (4) all of the directors and executive officers as a group. Unless otherwise noted, the persons listed in the table have sole voting and investment powers with respect to the shares of common stock owned by them.

| Name of Beneficial Owner | Shares Owned Directly or Indirectly(2) | Exercisable Stock Option Shares(3) | Total Shares Beneficially Owned | Percent of Shares Outstanding(4) | |||||

|---|---|---|---|---|---|---|---|---|---|

| T. Rowe Price Associates, Inc.(1) | 2,514,600 | -0- | 2,514,600 | 6.7 | % | ||||

| Frances D. Cook | 8,165 | -0- | 8,165 | * | |||||

| Gilbert F. Decker | 13,370 | -0- | 13,370 | * | |||||

| Mark W. DeYoung | 3,289 | 18,826 | 22,115 | * | |||||

| Ronald R. Fogleman | 912 | -0- | 912 | * | |||||

| Jeffrey O. Foote | 2,546 | 35,500 | 38,046 | * | |||||

| Jonathan G. Guss | 17,308 | -0- | 17,308 | * | |||||

| David E. Jeremiah | 16,296 | -0- | 16,296 | * | |||||

| Roman Martinez IV | 1,912 | -0- | 1,912 | * | |||||

| Paul David Miller | 21,266 | 113,750 | 135,016 | * | |||||

| Daniel J. Murphy, Jr. | 4,133 | 20,000 | 24,133 | * | |||||

| Eric S. Rangen | 5,617 | 36,875 | 42,492 | * | |||||

| Robert W. RisCassi | 7,183 | -0- | 7,183 | * | |||||

| Michael T. Smith | 13,258 | -0- | 13,258 | * | |||||

| William G. Van Dyke | 1,783 | -0- | 1,783 | * | |||||

| Nicholas G. Vlahakis | 6,378 | 27,500 | 33,878 | * | |||||

| All directors and executive officers as a group (24 persons) | 158,850 | 401,494 | 560,344 | 1.5 | % |

- *

- Less than 1%.

- (1)

- Based on a Schedule 13G filed with the Securities and Exchange Commission on February 9, 2004, reporting beneficial ownership as of December 31, 2003. The Schedule 13G reported that T. Rowe Price has sole voting power over 403,400 shares and sole dispositive power over 2,514,600 shares. T. Rowe Price reported that it serves as an investment adviser for individual and institutional clients and that no one client accounts for more than 5% of the shares. T. Rowe Price's address is 100 East Pratt Street, Baltimore, Maryland 21202.

- (2)

- Except for T. Rowe Price, includes shares of restricted common stock. Restricted stock held by directors is discussed in the section entitled "Non-Employee Director Restricted Stock Plan" under the heading "Compensation of Directors" later in this Proxy Statement. Restricted stock held by executive officers is discussed in footnote (4) to the Summary Compensation Table later in this Proxy Statement. Includes shares allocated, as of June 7, 2004, to the accounts of executive officers under one of our 401(k) plans. Includes shares allocated, as of June 7, 2004, to the accounts of executive officers who participate in our 1997 Employee Stock Purchase Plan. Mr. Miller's amount

6

includes 168 shares held by his wife. Excludes 237,068 shares held in trust under a master trust agreement for ATK's defined benefit plans. The named fiduciary for that trust is Eric S. Rangen. Although Mr. Rangen may be deemed to "beneficially own" the shares held by the trust because of his voting and investment powers with respect to those shares, Mr. Rangen disclaims beneficial ownership of those shares. Excludes phantom stock units credited to the accounts of individuals who participate in either our Deferred Fee Plan for Non-Employee Directors (described under the heading "Compensation of Directors" later in this Proxy Statement) or our Nonqualified Deferred Compensation Plan (described under the heading "Other Plans and Agreements With Executive Officers" later in this Proxy Statement), which units are payable solely in cash.

- (3)

- Shares covered by stock options exercisable on June 7, 2004, or within 60 days thereafter.

- (4)

- Assumes the issuance of the shares covered by the exercisable stock options held by each person or the group, as applicable.

7

PROPOSAL 1

ELECTION OF DIRECTORS

Eleven directors are to be elected at the Annual Meeting, to hold office until the 2005 annual meeting of stockholders and until their successors have been elected and have qualified or their service ends earlier through death, resignation, retirement or removal from office. Our Board of Directors has nominated for election as directors the eleven nominees listed below, all of whom are currently directors. Each of these nominees was recommended by the Board's Nominating and Governance Committee and has agreed to serve, if elected. The Nominating and Governance Committee asked Admiral Jeremiah to continue to serve until the 2005 annual meeting of stockholders in order to ensure a smooth transition in Company leadership with the addition of two new members to the Board. As permitted by ATK's Corporate Governance Principles, the Nominating and Governance Committee waived the requirement that Admiral Jeremiah retire from the Board based on his age. Although we do not know of any reason why any of the nominees might become unavailable for election, if that should happen, the Board may recommend a substitute nominee. Shares represented by proxies will be voted for any substitute designated by the Board.

Our Board of Directors recommends a vote FOR the election as directors of all of the nominees listed below.

| ||||

| Frances D. Cook, age 58; director since January 2000 | ||||

| • | International business consultant with the Ballard Group LLC since May 1999. | |||

| • | Ambassador to the Sultanate of Oman from 1995-1999. | |||

| • | Deputy Assistant Secretary of State, Political-Military Affairs from 1993-1995. | |||

| • | Ambassador to the Republic of Cameroon from 1989-1993. | |||

| • | Country Director for West Africa, Department of State from 1987-1989. | |||

| • | Deputy Assistant Secretary of State for Refugee Affairs from 1986-1987. | |||

| • | Consul General, Alexandria, Egypt from 1983-1986. | |||

| • | Ambassador to the Republic of Burundi from 1980-1983. | |||

| • | Other directorships: Pegasus Energy Ltd., Save a Child's Heart, and Children of Africa. | |||

| • | Other activities: Member of the Board of Advisors for Global Options Inc.; Senior Fellow, Center for Naval Analyses (CNA); Trustee of Enterpriseworks Worldwide; and member of the Council on Foreign Relations, the Harvard Club of NYC, the Washington Institute for Foreign Affairs and Phi Beta Kappa Alumni. | |||

8

| ||||

| Gilbert F. Decker, age 67; director since December 1997 | ||||

| • | Consultant since September 2001. | |||

| • | Formerly, Executive Vice President, Operations of Walt Disney Imagineering (a provider of master planning, real estate development, attraction and show design, engineering and production support, project management and other development services to The Walt Disney Company) from April 1999 to September 2001. | |||

| • | Private consultant to electronics and aerospace companies from May 1997 to April 1999. Also held Chief Executive Officer positions with Xeruca Holding, Incorporated and Penn Central Federal Systems Company, from March 1985 to April 1992. | |||

| • | Assistant Secretary of the Army-Research, Development and Acquisition from April 1994 to May 1997. | |||

| • | Other public company directorships: The Allied Defense Group, Inc. and Anteon International Corporation. | |||

| • | Other directorships: SOLAICX, Inc. | |||

| • | Other activities: Member of the National Advisory Committee to the Whiting School of Engineering of Johns Hopkins University and the Board on Army Science and Technology of the National Academy of Sciences. | |||

| ||||

| General Ronald R. Fogleman, USAF (Ret.), age 62; director since May 2004 | ||||

| • | Chairman and Chief Executive Officer of Durango Aerospace Incorporated (an international aviation consulting firm) since September 1997. | |||

| • | Prior to his retirement from the U.S. Air Force in September 1997 following a 34-year career, he was Chief of Staff of the U.S. Air Force and a member of the Joint Chiefs of Staff from 1994 to 1997 and Commander-in-Chief of the U.S. Transportation Command (CINCTRANS) from 1992 to 1994. | |||

| • | Other public company directorships: AAR Corp., Mesa Air Group, Inc. and World Airways, Inc. | |||

| • | Other directorships: EAST Inc., First National Bank of Durango, IDC, Rolls-Royce North America and Thales-Raytheon Systems. | |||

| • | Other activities: Senior Vice President of Projects International, an international business advisory company; Chairman of the Falcon Foundation and the Airlift/Tanker Association; and member of the Defense Policy Board, the Board of Trustees for MITRE Corporation, the National Aeronautics and Space Administration Advisory Council, the Jet Propulsion Laboratory Advisory Board, the Council on Foreign Relations, the Pacific Century Institute, the Fort Lewis College Foundation and the Air Force Association. | |||

| ||||

| Jonathan G. Guss,age 45; director since August 1994 | ||||

| • | Director, Chief Executive Officer and President of Bogen Communications International, Inc. (a producer of sound processing equipment and telecommunications peripherals) since December 1997. | |||

| • | Principal and President of Active Management Group, Inc., a firm that provides turnaround management services, since May 1990. | |||

| • | Principal and Chief Executive Officer of EK Management Corp., the general partner of EK Associates, L.P. | |||

9

| ||||

| Admiral David E. Jeremiah, USN (Ret.), age 70; director since April 1995 | ||||

| • | Partner and President of Technology Strategies & Alliances Corporation (a strategic advisory and investment banking firm engaged primarily in the aerospace, defense, telecommunications and electronics industries) since October 1994. | |||

| • | Prior to his retirement from the U.S. Navy in February 1994 following a 39-year career, he was Vice Chairman, Joint Chiefs of Staff from 1990 to 1994 and Commander-in-Chief of the United States Pacific Fleet from 1987 to 1990. | |||

| • | Other public company directorships: Todd Shipyards Corporation. | |||

| • | Other directorships: GEOBIOTICS, LLC and Wackenhut Services, Incorporated. | |||

| • | Other activities: Chairman, ManTech International Advisory Board; member and Vice Chairman of the President's Foreign Intelligence Advisory Board; and member of the Northrop Grumman Corporation (Integrated Systems Sector) Board of Visitors, the Board of Trustees for MITRE Corporation, the Jewish Institute for National Security Affairs Board of Advisors and the Defense Policy Board. | |||

| ||||

| Roman Martinez IV, age 56; director since May 2004 | ||||

| • | Independent investor and financial advisor since May 2003. | |||

| • | Retired as a Managing Director of Lehman Brothers, an investment banking firm, in May 2003, following a 31-year career with the firm. | |||

| • | Other public company directorships: GreenPoint Financial Corp. | |||

| • | Other directorships: New York-Presbyterian Healthcare System, New York-Presbyterian Hospital, and the International Rescue Committee. | |||

| • | Other activities: Member of the Council on Foreign Relations and the Cuba Study Group. | |||

| ||||

| Admiral Paul David Miller, USN (Ret.), age 62; director since January 1999 | ||||

| • | Chairman of the Board of ATK since January 1999. | |||

| • | Chief Executive Officer of ATK from January 1999 through September 2003. | |||

| • | President of ATK from March 2000 to January 2001. | |||

| • | President of Sperry Marine Inc. from November 1994 to January 1999. | |||

| • | Vice President of Litton Industries, Inc. (which acquired Sperry Marine Inc. in May 1996) from September 1997 to January 1999. | |||

| • | Prior to his retirement from the U.S. Navy in November 1994 following a 30-year career, he was Commander-in-Chief, U.S. Atlantic Command, one of five U.S. theater commands, and served concurrently as NATO Supreme Allied Commander-Atlantic. | |||

| • | Other public company directorships: Donaldson Company, Inc. and Teledyne Technologies Incorporated. | |||

| • | Other directorships: SunTrust Bank (the advisory board of one of its subsidiaries). | |||

| ||||

| Daniel J. Murphy, Jr., age 55; director since May 2003 | ||||

| • | Chief Executive Officer of ATK since October 2003. | |||

| • | Group Vice President, Precision Systems Group of ATK from April 2002 through September 2003. | |||

| • | President of ATK Tactical Systems Company from April 2001 to April 2002. | |||

| • | Prior to his retirement from the U.S. Navy in December 2000 following a 30-year career, he served in the grade of Vice Admiral as Commander, U.S. Sixth Fleet and Commander, NATO Striking and Support Forces Southern Europe. | |||

10

| ||||

| General Robert W. RisCassi, USA (Ret.), age 68; director since March 2000 | ||||

| • | Vice President of L-3 Communications Corporation (a leading merchant supplier of secure communications systems and products, avionics and ocean products, microwave components and telemetry, and space and wireless products) since March 1997. | |||

| • | From April 1996 until April 1997, he was Vice President of Land Systems for Lockheed Martin C3I and Systems Integration sector. Prior to the April 1996 acquisition of Loral, he had held the same position for Loral since 1993. | |||

| • | Prior to his retirement from the U.S. Army in August 1993 following a 35-year career, he was Commander-in-Chief of the United Nations Command, ROK/U.S. Combined Forces Command, U.S. Forces Korea and Eighth U.S. Army. He served as the Vice Chief of Staff, U.S. Army from 1988-1990. | |||

| ||||

| Michael T. Smith, age 60; director since December 1997 | ||||

| • | Chairman Emeritus of Hughes Electronics Corporation since May 2001. | |||

| • | From October 1997 to May 2001, he was Chairman and Chief Executive Officer of Hughes Electronics Corporation. | |||

| • | Vice Chairman of Hughes Electronics Corporation from 1992 to October 1997. | |||

| • | Other public company directorships: FLIR Systems, Inc., Ingram Micro Inc. and Teledyne Technologies Incorporated. | |||

| • | Other activities: Trustee of the Keck Graduate Institute of Applied Life Sciences and of Providence College. | |||

| ||||

| William G. Van Dyke, age 58; director since October 2002 | ||||

| • | Chairman of the Board, Chief Executive Officer and President of Donaldson Company, Inc. (a leading worldwide provider of filtration systems and replacement parts) since 1996. | |||

| • | Previously, he held various management positions with Donaldson since 1978. | |||

| • | Other public company directorships: Graco Inc. | |||

| • | Other activities: Trustee of the Carlson School of Management of the University of Minnesota and member of the Executive Committee of the Minnesota Business Partnership. | |||

11

Corporate Governance Principles

Our business is managed through the oversight and direction of our Board of Directors. Our Corporate Governance Principles, which include qualifications for directors, guidelines for determining director independence, and provisions for reporting concerns to the Board's Audit Committee regarding accounting, internal controls and directors' potential conflicts of interest, are attached as Appendix A to this Proxy Statement.

Our Corporate Governance Principles and committee charters are available on our website atwww.atk.com in the section called "Investor Information—Corporate Governance." Our Board regularly reviews corporate governance developments, including legal and regulatory changes, and modifies these principles and charters as warranted. All updates of our policies and procedures will be available on our website.

Business Ethics and Code of Conduct

We have a written Code of Conduct, which applies to all directors, officers and employees. OurBusiness Ethics and Code of Conduct manual is available on our website atwww.atk.com in the sections called "About ATK—Values" and "Investor Information—Corporate Governance." Our corporate governance principles provide that the Board will not permit any waiver of our ethics policies.

Communications with Directors

Procedures for stockholders, or anyone else, to communicate directly with our Board are available on our website atwww.atk.com in the section called "Investor Information—Corporate Governance—Contact B.O.D." Concerns regarding the Company's accounting, internal controls or auditing matters will be referred to the Audit Committee.

Director Independence

One of our Corporate Governance Principles is that a majority of our directors be independent, and that all board committees, be comprised solely of independent directors, except the Finance Committee which must have a majority of members who are independent. Our Board has adopted the independence requirements of the New York Stock Exchange listing rules as its standard for determining director independence. They are as follows:

- •

- No director qualifies as "independent" unless the Board of Directors affirmatively determines that the director has no material relationship with ATK or any of its subsidiaries (either directly or as a partner, shareholder or officer of an organization that has a relationship with ATK or any of its subsidiaries).

- •

- A director who is an employee, or whose immediate family member is an executive officer, of ATK or any of its subsidiaries is not independent until three years after the end of such employment relationship.

- •

- A director who receives, or whose immediate family member receives, more than $100,000 per year in direct compensation from ATK or any of its subsidiaries, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), is not independent until three years after he or she ceases to receive more than $100,000 per year in such compensation.

- •

- A director who is affiliated with or employed by, or whose immediate family member is affiliated with or employed in a professional capacity by, a present or former internal or external auditor

12

- •

- A director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of ATK's or any of its subsidiaries' present executives serve on that company's compensation committee is not "independent" until three years after the end of such service or the employment relationship.

- •

- A director who is an executive officer or an employee, or whose immediate family member is an executive officer, of a company that makes payments to, or receives payments from, ATK or any of its subsidiaries for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million, or 2% of such other company's consolidated gross revenues, is not "independent" until three years after falling below such threshold.

of ATK or any of its subsidiaries is not "independent" until three years after the end of the affiliation or the employment or auditing relationship.

Our Board has determined that each member of the Board, except for Paul David Miller and Daniel J. Murphy, Jr., meets these independence standards. Admiral Miller does not meet these independence standards because he was our Chief Executive Officer until September 30, 2003. Mr. Murphy does not meet these independence standards because he is an executive officer and employee of ATK.

Standing Committees and Meetings of the Board and its Committees

During fiscal year 2004, our Board of Directors met nine times and had the following committees: Audit, Finance, Nominating and Governance, and Personnel and Compensation. Membership on the Audit, Nominating and Governance, and Personnel and Compensation Committees consisted entirely of independent directors.

As a general practice, Board members are expected to attend our annual meetings of stockholders.

The membership of the committees, the name of each committee's chair and the number of meetings held by each of the committees during fiscal year 2004 are summarized in the following table:

| | | | Nominating and Governance | Personnel and Compensation | ||||

|---|---|---|---|---|---|---|---|---|

| | Audit | Finance | ||||||

| Frances D. Cook | X | X | ||||||

| Gilbert F. Decker | X | X | ||||||

| Jonathan G. Guss | X | X | ||||||

| David E. Jeremiah | X | X | ||||||

| Paul David Miller | X | |||||||

| Daniel J. Murphy, Jr. | X | |||||||

| Robert W. RisCassi | X | X | ||||||

| Michael T. Smith | X | X | ||||||

| William G. Van Dyke | X | X | ||||||

| Committee chair | Mr. Smith | Adm. Miller | Gen. RisCassi | Adm. Jeremiah | ||||

| Number of meetings | 6 | 3 | 3 | 5 |

Each director attended at least 90% of the aggregate number of meetings of the Board and the committees on which the director served. Overall attendance at all Board and committee meetings was 97%.

13

Duties of the Committees

Audit Committee

The Audit Committee, among other duties:

- •

- Appoints (subject, if applicable, to the ratification of our stockholders) and may terminate when appropriate, the independent auditors.

- •

- Reviews the planned scope of the annual audit and the independent auditors' letter of comments and management's responses.

- •

- Reviews and provides prior written consent for all auditing services and permitted non-audit services, including the fees and terms thereof, to be performed for ATK by the independent auditors.

- •

- Reviews possible violations of our business ethics and conduct and conflicts of interest policies.

- •

- Reviews any major accounting changes made or contemplated.

- •

- Reviews the performance, qualifications, organizational structure and activities of our internal audit staff.

The Board of Directors has determined that the Chair of the Audit Committee, Michael T. Smith, is an "audit committee financial expert," as defined under applicable federal law and regulations.

A copy of the Audit Committee Charter is attached as Appendix B to this Proxy Statement.

Finance Committee

The Finance Committee, among other duties:

- •

- Provides oversight on matters relating to ATK's capital structure, financing strategies and insurance coverage.

- •

- Oversees the Company's employee benefit plans from a financial and investment perspective.

- •

- Has and exercises such powers and authority as the Board may delegate to it from time to time in accordance with the Company's By-Laws.

Nominating and Governance Committee

The Nominating and Governance Committee, among other duties:

- •

- Identifies and evaluates individuals who might qualify as candidates for election to the Board.

- •

- Makes recommendations to the Board to fill vacancies or new positions on the Board.

- •

- Recommends to the Board the slate of nominees for election as directors at the annual meeting of stockholders.

- •

- Makes recommendations regarding the size and composition of the Board and its committees.

- •

- Evaluates the performance of the Board as a whole.

- •

- Recommends for election by the Board any non-incumbent Chief Executive Officer, Chief Financial Officer or Chief Operating Officer.

- •

- Recommends corporate governance principles and assesses compliance with those principles.

The Nominating and Governance Committee will consider all stockholder recommendations for nominees to the Board. If you wish to recommend a person to the Nominating and Governance

14

Committee for consideration as a candidate for election as a director at an annual meeting of stockholders, you must send your recommendation to our executive offices in the manner described under the heading "Future Stockholder Proposals" near the end of this Proxy Statement. Your recommendation must be accompanied by information concerning the person's qualifications and the written consent of the person to be nominated, if selected as a nominee by the Board of Directors, and to serve on the Board if elected. Additional information regarding the requirements for nominating a person for election as a director at an annual meeting of stockholders is described under the heading "Future Stockholder Proposals" near the end of this Proxy Statement. Stockholder nominations that comply with these procedures will receive the same consideration and evaluation that the Committee gives to its own nominees.

As set forth in its charter, the Committee may retain a search firm to help identify, screen and evaluate director candidates. A candidate must meet certain minimum requirements to be considered for nomination, including the qualifications set forth in ATK's Corporate Governance Principles. In addition, the Committee determines whether the candidate's skills and experience are complementary to those of existing Board members and considers the needs of the Board regarding technical, financial or other expertise and the overall enhancement of its effectiveness. The Chair of the Committee interviews candidates that meet these criteria, and the Committee selects nominees that best meet the Board's needs.

Personnel and Compensation Committee

The Personnel and Compensation Committee, among other duties:

- •

- Approves salary actions pertaining to top management, subject to the Board's approval in the case of the Chief Executive Officer's compensation.

- •

- Administers and grants awards under our executive compensation plans.

- •

- Approves executive compensation actions and plans and other benefit programs that are not required by law or regulation to be approved by the full Board.

- •

- Sets annual incentive targets.

- •

- Recommends officers (other than any non-incumbent Chief Executive Officer, Chief Financial Officer and Chief Operating Officer) for election by the Board.

- •

- Evaluates the performance of ATK's officers.

- •

- Oversees ATK's leadership development and succession planning process.

- •

- Submits the report on executive compensation included in this Proxy Statement.

15

Compensation of Directors

Summary Compensation Information

Only non-employee directors receive compensation for service on the Board of Directors. Their compensation is summarized in the following table.

| Compensation Feature | Dollar Amount | |||

|---|---|---|---|---|

| Annual retainer | $ | 25,000 | ||

| Quarterly retainer for committee chair | 2,500 | |||

| Meeting attendance fees: | ||||

| Board of Directors | 2,000 | |||

| Committees | None | |||

| Per diem payments | 1,000 | |||

| Value of annual restricted stock award | 55,000 | |||

The annual retainer is paid in quarterly installments. Per diem payments of $1,000 (and reimbursement of related expenses) may be made for any day on which our Chief Executive Officer believes that a non-employee director has committed a significant part of the day (outside of normal Board or Board committee service) to business issues beyond the normal scope of the director's responsibilities as a director. No per diem payments were made during fiscal year 2004.

Non-Employee Director Restricted Stock Plan

Under the Non-Employee Director Restricted Stock Plan, each non-employee director receives automatic awards of restricted common stock with a market value of $55,000, as determined by the closing market price of ATK stock on the date of the award, upon first being elected to the Board of Directors and upon reelection at each subsequent annual meeting of stockholders. Common stock issued under this plan entitles participating directors to all of the rights of a stockholder, including the right to vote the shares and receive any cash dividends. All shares are, however, subject to certain restrictions against sale or transfer for a period, which we refer to as the restricted period, starting on the award date and ending on the earliest to occur of the following:

- •

- the third anniversary of the award date;

- •

- the retirement of the director from the Board in compliance with the Board's retirement policy as then in effect;

- •

- the termination of the director's service on the Board as a result of the director's not being nominated for reelection by the Board, but not as a result of the director's declining to serve again;

- •

- the termination of the director's service on the Board because the director, although nominated for reelection by the Board, is not reelected by the stockholders;

- •

- the termination of the director's service on the Board because of (1) the director's resignation at the request of the nominating committee of the Board, (2) the director's removal by action of the stockholders, or (3) the sale, merger or consolidation of, or a similar extraordinary transaction involving, ATK, or;

- •

- the termination of the director's service on the Board because of disability or death.

Restricted stock is released to the director, free and clear of all restrictions, following the expiration of the restricted period.

16

The plan permits the director to elect to defer receipt of the restricted stock in exchange for a credit, in stock units, to a deferred stock unit account. Directors who make a deferral election will have no rights as stockholders of ATK with respect to amounts credited to their deferred stock unit account. If cash dividends are paid on our common stock, we will pay each director an amount equal to the cash dividends that would be paid on the number of shares equal to the number of stock units credited to the director's deferred stock unit account. Payment of stock units credited to the deferred stock unit account will be made in a lump sum in an equal number of shares of our unrestricted common stock at the time specified in the director's deferral election, but no later than as soon as feasible following the director's termination of Board service.

If a director ceases to be a member of the Board for any reason prior to the expiration of the restricted period, the director forfeits all rights in shares for which the restricted period has not expired.

Shares of restricted stock awarded under the plan prior to 2004 are subject to similar restrictions, and shares of restricted stock awarded under a similar predecessor plan are also subject to similar restrictions. The restricted period on these shares will expire either on a specific date previously selected by the director, or on a future date designated by the director at least two years in advance of the designated date.

The following table shows, as of March 31, 2004, the number of shares of our common stock each non-employee director holds that are still subject to the restrictions under the plans described above.

| Name | Number of Shares | |

|---|---|---|

| Frances D. Cook | 7,183 | |

| Gilbert F. Decker | 11,233 | |

| Jonathan G. Guss | 16,633 | |

| David E. Jeremiah | 3,133 | |

| Robert W. RisCassi | 7,183 | |

| Michael T. Smith | 11,233 | |

| William G. Van Dyke | 1,783 |

The shares listed in the table above are included in the table shown earlier in this Proxy Statement under the heading "Security Ownership of Certain Beneficial Owners and Management."

Deferred Fee Plan for Non-Employee Directors

This plan permits a director to defer receipt of all or part of the director's cash fees. A director can elect to have deferred amounts credited either to a "cash account" or a "share account" as phantom stock units (based upon the market price of our common stock). Cash accounts are credited with interest quarterly at our one-year borrowing rate and share accounts will be credited with additional units if dividends are paid on our common stock. Payment of deferred amounts is made in cash following the director's termination of Board service. Phantom stock units credited to share accounts are paid out based on the market price of our common stock at the time of payout. A director may elect to receive payments either in a lump sum or in up to ten annual installments.

17

Currently, four directors participate in this plan. The following table summarizes how those directors currently have their deferred fees credited and how many common stock units were credited to their share accounts as of March 31, 2004.

| Name | Annual Retainer | Meeting Fees | Units as of March 31, 2004 | |||

|---|---|---|---|---|---|---|

| Gilbert F. Decker | Cash account-25% | Cash account-25% | N/A | |||

| Share account-75% | Share account-75% | 3,888 | ||||

| Robert W. RisCassi | Share account-100% | Share account-100% | 3,654 | |||

| Michael T. Smith | Share account-100% | Share account-100% | 6,832 | |||

| William G. Van Dyke | Share account-100% | Share account-100% | 1,109 |

Expense Reimbursement

Non-employee directors are reimbursed for travel and other expenses incurred in the performance of their duties.

Indemnification Agreements

We currently have indemnification agreements with our directors. These agreements require us to:

- •

- indemnify the directors to the fullest extent permitted by law;

- •

- advance to the directors all related expenses, subject to reimbursement if it is subsequently determined that indemnification is not permitted;

- •

- indemnify and advance all expenses incurred by directors seeking to enforce their rights under the indemnification agreements; and

- •

- cover directors under our directors' and officers' liability insurance.

Stock Ownership Guidelines for Non-Employee Directors

The Board has established stock ownership guidelines for non-employee directors of 3,750 shares, to be achieved within five years following a director's election to the Board. The Nominating and Governance Committee of the Board is expected to:

- •

- review the stock ownership of each incumbent director annually prior to the Committee's recommendation to the Board of the nominees for election as directors at the annual meeting of stockholders; and

- •

- take into consideration compliance with the stock ownership guideline, including extenuating circumstances in cases of noncompliance, when recommending the nomination for reelection of incumbent directors.

18

EXECUTIVE COMPENSATION

REPORT OF THE PERSONNEL AND COMPENSATION COMMITTEE

OF THE BOARD ON EXECUTIVE COMPENSATION

The Personnel and Compensation Committee of the Board of Directors is responsible for ATK's executive compensation policies and programs. We annually evaluate the performance of ATK's executive officers and review and approve all compensation paid to the executive officers. Committee membership is composed entirely of independent directors and is determined by the Board. The Committee meets throughout the year at scheduled times, or will take action by written consent when appropriate, to execute our duties. We present the Committee's actions and recommendations to the Board. The Committee has the authority to retain outside compensation consultants and other advisors as we deem appropriate.

Compensation Philosophy

The Committee oversees the design and implementation of the Company's executive compensation programs to ensure that executive compensation is linked to Company performance and the creation of stockholder value. We base our decisions on the following core principles:

- •

- Alignment with Stockholder Interests. We strongly believe the interests of our executives must be clearly aligned with the interests of our stockholders because we believe the Company will achieve the best results when its executives act and are rewarded as owners in the business. Owners understand the importance of taking responsibility for the business, being accountable for results and working to make a difference at all times. ATK has established specific stock ownership guidelines for its executives, and programs have been created that encourage our executives to have an ownership interest in the Company.

- •

- Performance Based. We strongly believe in the principle of pay-for-performance and have built it into our executive compensation programs in a number of ways:

- (1)

- Our executives' total cash compensation varies with ATK's success in achieving financial and non-financial objectives, and long-term incentive compensation rewards the creation of long-term stockholder value.

- (2)

- Total compensation is targeted at the median of peer companies, but we have designed our executive compensation programs to deliver above-market compensation opportunities for above-market performance, and consequences for below target performance.

- (3)

- A significant portion of executive compensation is directly related to the Company's financial performance and is therefore at risk.

- •

- Long-term Focus. Our executive compensation program includes several elements, each with a slightly different purpose, to allow us to balance ATK's short-term and long-term business objectives and to focus executive efforts on the fulfillment of these objectives.

- •

- Competitive. We work to provide a competitive compensation package to our executives because we believe this will help us attract, retain and motivate a talented and diverse executive leadership group that is dedicated to the long-term interests of our stockholders.

Setting Executive Compensation

Annual Review

Each year, the Committee conducts a review of ATK's executive compensation program to: (1) assess ongoing competitiveness; (2) review both Company and individual performance; and

19

(3) establish compensation levels for each executive officer. For our fiscal year 2004 review of executive compensation, the Committee engaged an outside compensation consultant to provide an independent analysis of both our executive compensation programs compared to current industry and marketplace compensation practices, and of individual compensation levels compared to the external market. The outside consultant was hired directly by the Committee and reported directly to the Committee, but did work closely with Company management throughout the process.

As part of this review, we considered the comparable practices of companies participating in nationally known compensation surveys. The companies participating in these surveys represent both the aerospace and defense industries and other companies of similar size from general industry. The results of these surveys were adjusted to reflect ATK's revenue size, so that the comparisons were made to the practices of employers of a similar size. The target compensation levels for our executive officers were set at the median level of those survey participants used for comparative purposes. However, we retain discretion to make adjustments such that the target compensation of individual executive officers may be above or below the median market level, depending upon the executive's overall accountabilities, individual performance and experience.

Balanced Scorecard Accountability System

Individual compensation awards are established based upon the contribution the executive has made to attain the Company's short-term and strategic performance objectives, as well as the executives' anticipated future contribution. Just as it is important to tie our executive's pay directly to the financial results of the Company, we also believe it is important to have an established system for measuring the individual performance of our executives.

To assess the performance of individual executive officers, we review annually objective achievements under a Balanced Scorecard Accountability System. Objective, results-based accountabilities are established annually for each executive officer at the beginning of the fiscal year. At the end of the fiscal year, we review the executive officer's performance against these accountabilities and approve any base salary adjustments and annual incentive payments to the executive officers. While our process for measuring individual performance against these accountabilities is intended to be as objective as possible, we reserve the right to make subjective assessments. We also consider the recommendations of the Chief Executive Officer with respect to his assessment of the performance of the other executive officers.

Components of Our Executive Compensation Program

Base Salary

Base salaries are intended to provide a foundation for attracting and retaining key executive talent and are paid for sustained individual performance. As a result, the base salary component of our executive compensation program is the least variable as it relates to Company performance. We review the base salaries of the executive officers annually before the beginning of each fiscal year. Generally, we decide whether an executive officer receives a base salary increase and the amount of any increase by considering the following:

- •

- the competitive salary levels for executive officers in similar positions at other companies, as shown by the results of current compensation surveys referred to above; and

- •

- the executive officer's individual performance during the preceding 12 months as measured against accountabilities established in the Balanced Scorecard Accountability System.

During fiscal year 2004, all of the executive officers listed in the Summary Compensation Table following this report received a base salary increase.

20

Annual Incentive Compensation

ATK's Management Compensation Plan is a cash-based pay-for-performance annual incentive plan, and its purpose is to motivate and reward eligible employees for their contributions to ATK's performance by making a large portion of their cash compensation variable and dependent upon Company, business unit and individual performance.

Plan Design. All executive officers participate in ATK's Management Compensation Plan. This plan provides for the payment of annual cash compensation if pre-established performance goals are met. Executive officers may elect to defer part or all of the payment of their annual incentive compensation under ATK's nonqualified deferred compensation plan. If an executive officer chooses to defer any annual bonus amount to the ATK stock unit account under the deferred compensation plan, an additional 10% is added to the deferred amount. At the beginning of the fiscal year we:

- •

- designate the executive officers who are eligible to participate in the plan for that fiscal year;

- •

- establish the individual, business unit and Company performance goals for each executive officer; and

- •

- determine the appropriate target award opportunity for each executive officer for achievement of the performance goals at threshold, target and outstanding performance levels. Generally, the executive officers' target award levels are established as a percentage of base salary.

After establishing the incentive amounts described above, we add together the individual target incentive amounts of all participants within each of ATK's organizational units to determine a total target incentive fund for each organizational unit. For purposes of the incentive plan, these organizational units include ATK's subsidiary business units, business groups and the corporate staff. We use a weighting structure to determine how much each organizational unit's incentive fund will be measured by overall Company performance and the performance of the applicable business group or business unit. For example:

- •

- the incentive fund for the corporate staff, including the Chief Executive Officer, is determined based 100% upon overall Company performance; and

- •

- the incentive fund for an executive officer who is also a head of a business group is determined based 50% on group performance and 50% on overall Company performance.

Each organizational unit's earned incentive fund is calculated separately after the end of the fiscal year. The amount of the fund can range from zero to 200% of the target incentive fund, depending upon the overall performance of the Company, business group and business unit, as applicable. We have the ability to increase a fund to 300% of its target at our discretion. However, no bonuses are paid if the threshold performance goals established at the beginning of the year are not achieved.

Each participant's allocation from the organizational unit's earned incentive fund is based 75% upon Company, business group and business unit performance, as applicable, and 25% upon the participant's individual performance. While we determine and approve all annual incentive awards for the executive officers, we do consider the Chief Executive Officer's assessment of the individual performance of each of the executive officers other than himself.

21

Fiscal Year 2004 Annual Incentive Compensation. All of our executive officers participated in the annual incentive program for fiscal year 2004. The fiscal year 2004 goals were as follows:

| Organizational Unit | Weighting | ||

|---|---|---|---|

| Company as a whole: | |||

| Fully diluted EPS | One-third | ||

| Free cash flow | One-third | ||

| Sales | One-third | ||

| Business groups and business units: | |||

| EBIT (earnings before interest and taxes) | One-third | ||

| Cash flow | One-third | ||

| Sales | One-third | ||

The specific EPS, EBIT, cash flow and sales performance goals were based on the Company's three-year strategic plan. In addition, participants with performance goals at the business group and business unit level also had an additional incentive amount to further stress the importance of continuous focus on cash flow. This additional opportunity was equal to 10% of the participant's target amount, and could be earned to the extent that monthly year-to-date cash flow goals for the first 11 months of the fiscal year were met.

For fiscal year 2004, we approved above-target incentive payments to all executive officers. The amount by which these payments exceeded their target amount depended upon the extent to which the Company and each business group exceeded their goals. The Committee adjusted Mr. Foote's bonus payment from 137% of target to 170% of target to reflect the impact of unanticipated changes on his business unit performance. The adjustment amounted to approximately $40,000. We made no other adjustments to the bonus payments for the executive officers.

In addition to the annual incentive payments, three of the six executive officers named in the Summary Compensation Table following this report earned the additional incentive payment for the achievement of the monthly cash flow goals. For Mr. Murphy, while still acting in his role as head of the Precision Systems Group, this amount equaled 3.9% of his target amount (a prorated amount for the portion of the year he was with the Precision Systems Group); for Mr. DeYoung, as head of the Ammunition and Related Products Group, the amount equaled 9% of his target, and for Mr. Foote, as head of the Aerospace Group, the amount equaled 9% of his target. All amounts are reflected in the bonus numbers presented in the Summary Compensation Table.

Long-Term Incentive Compensation

Long-term incentive compensation has been provided to executive officers under ATK's stockholder approved 1990 Equity Incentive Plan. This year, we provided long-term incentive compensation to our executive officers principally through an annual grant of stock options. We determine the terms of each award at the time the award is granted, subject to the provisions of the plan.

Stock Options. We believe that stock options are an appropriate means of long-term incentive compensation because they provide value only when ATK's stockholders benefit from stock price appreciation. Stock options have an exercise price equal to the fair market value of our common stock on the date of grant.

During fiscal year 2004, stock options were granted to five of the six executive officers named in the Summary Compensation Table following this report. In fiscal year 2004, we granted an aggregate of 510,800 options to officers and employees of ATK. The terms of the stock options granted to the executive officers in fiscal year 2004 changed from what we have done in the past to have a seven-year term and cliff vesting on the third anniversary of the date of grant in order to provide vesting terms

22

that encourage an executive officer to remain with ATK over a period of years and focus on long-term stock price. The stock options granted to Mr. Vlahakis, however, vest in one year.

Performance Shares. In the past, we have also granted performance shares because we believe that they are an appropriate means of long-term incentive compensation and provide an effective incentive to achieve predetermined long-term performance goals. We did not grant performance share rights to our executive officers in fiscal year 2004, but we did authorize a payment on performance shares granted for the three-year performance period of fiscal year 2002 to fiscal year 2004. When we granted the performance shares, we set threshold, target and maximum average earnings per share performance goals with respect to the award, with 25% of the award paid if the threshold level was achieved, 50% of the award paid if the target level was achieved, and 100% of the award paid if the maximum level was achieved. No payment would have been made if the threshold level was not achieved. Performance shares were cancelled in the event of an executive officer's resignation (other than retirement) or termination of employment for cause.

In fiscal year 2004, ATK achieved its maximum EPS performance goals and paid out 100% of the performance share awards to Mr. Miller, Mr. Vlahakis and Mr. Rangen. In addition, Mr. DeYoung received a 100% payout on a performance share award we had granted to him based on the successful integration of the Blount acquisition by ATK, as measured by EBIT improvement. All payouts are reflected in the Summary Compensation Table. The payouts were made in the form of common stock, except for Mr. Miller who, at the direction of the Committee, received a cash payment.

We did not grant performance share rights as part of the executive compensation program in fiscal year 2004. However, we remain committed to paying for performance, have kept this incentive as a prominent part of our executive compensation program, and plan to grant performance shares in the executive compensation program for fiscal year 2005.

Compensation of Chief Executive Officer

During fiscal year 2004, we executed on the critical action of transitioning the duties of Chief Executive Officer from Paul David Miller to Daniel J. Murphy. To make this transition as seamless as possible to our stockholders, we used a phased approach, which is reflected in the individual employment agreements described in a later section of this Proxy Statement.

The annual base salary for Mr. Miller increased from $700,000 to $800,000 for fiscal year 2004 in accordance with the terms of his amended employment agreement with the Company. For fiscal year 2004, we established a target annual incentive of $640,000 for Mr. Miller. We approved an incentive payment of $1,280,000, which is 200% of his target incentive amount in accordance with the terms of his employment agreement. This payment was based on ATK's performance, specifically measuring the EPS, cash flow and sales goals against the target level, and individual performance, including his leadership skills in ATK's achievement of its goals for the fiscal year. The allocation of the amount between Company and individual performance was 75% and 25%, respectively. In addition, as outlined in his original employment agreement with the Company, we paid Mr. Miller's relocation costs as he transitioned from his duties as Chief Executive Officer. These specific amounts are outlined in the Summary Compensation Table at the end of this report. In addition, Mr. Miller, along with other executive officers named in the Summary Compensation Table following this report, received a payment of performance shares for the three-year performance period ending March 21, 2004. He received a payout of 100% of the target performance shares, based on the achievement of earnings per share performance goal at the maximum level. We did not grant stock options to Mr. Miller during fiscal year 2004.

At the beginning of fiscal year 2004, Mr. Murphy, still acting in his position as head of the Precision Systems Group, received an increase to his base salary from $220,000 to $300,000. At that time, Mr. Murphy's incentive target was established at $200,000. On October 1, 2003, Mr. Miller

23

officially resigned as Chief Executive Officer and the Board approved the appointment of Mr. Murphy to that position. At that time, we also approved an increase to Mr. Murphy's base salary to $600,000 and an increase in his annual incentive target to $420,000. From the period of October 1, 2003 to February 1, 2004, at the request of the Committee, Mr. Miller was still actively involved in the operations of the Company as part of the transition to Mr. Murphy. On January 21, 2004, we entered into an employment agreement with Mr. Murphy (described in a later section of this Proxy Statement). At that time, Mr. Murphy had successfully completed the transition and, therefore, we increased his base pay to a competitive level of $700,000 and his annual target incentive to $500,000, effective February 1, 2004.

We approved an annual incentive payment for Mr. Murphy of $645,149, which is a combination of performance while head of the Precision Systems Group and as Chief Executive Officer. For the period as head of the Precision Systems Group, Mr. Murphy's bonus was $197,949 or 198% of his target incentive amount. Fifty percent of this payment was based on ATK's performance, specifically measuring the EPS, cash flow and sales goals against the target level, and 50% of this payment was based on Precision Systems Group performance, specifically measuring the EBIT, cash flow and sales goals against target level. In addition, $6,364 of this payment was made for the achievement of the quarterly cash flow goals as explained above. As Chief Executive Officer, Mr. Murphy's bonus amount equaled $447,200 or 200% of his target incentive amount. This payment was based on ATK's performance, specifically measuring the EPS, cash flow and sales goals against the target level and individual performance in recognition of his leadership skills and ATK's achievement of its goals for the fiscal year. The allocation of the amount between Company and individual performance was 75% and 25%, respectively. In January, 2004, we also awarded a special bonus to Mr. Murphy to recognize the success of the Chief Executive Officer transition period. This bonus was paid in the form of 13,000 phantom stock units credited to the Company's Nonqualified Deferred Compensation Plan. Mr. Murphy also received a stock option grant, as described above.

Stock Ownership Guidelines

Effective April 1, 2004, we revised our stock ownership guidelines to increase the number of shares each executive must hold in order to further align the interests of our executive officers with the interests of our stockholders. Stock ownership is reported to the Committee at each meeting and failure to meet the guidelines within the allotted period of time may impact future grants of stock to an executive. The guidelines establish target levels of common stock ownership as follows:

| Position | Guideline | |

|---|---|---|

| Chief Executive Officer | 50,000 shares | |

| Chief Operating Officer and Chief Financial Officer | 16,000 shares | |

| Group Vice Presidents | 12,000 shares | |

| Chief People Officer and General Counsel | 9,000 shares | |

| Corporate Controller, Treasurer & Other Corporate Officers | 6,000 shares | |

| Subsidiary Presidents & Corporate Staff Vice Presidents | 4,000 shares | |

| Group Vice Presidents & Corporate Staff Vice Presidents | 3,500 shares | |

| Corporate Staff Vice Presidents | 1,500 shares |