SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Definitive Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Additional Materials

☑ Soliciting Material Pursuant to §240.14a-12

PS BUSINESS PARKS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☑ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

On May 2, 2022 PS Business Parks, Inc. issued supplemental information regarding its performance for the first quarter of 2022.

| | | | | |

| Section | Page |

| Corporate Data: | |

| |

| |

| |

| |

| Consolidated Financial Results: | |

| |

| |

| |

| |

| |

| |

| |

| Portfolio Data: | |

| |

| |

| |

| |

| Industry Concentration and Top Ten Customers | |

| |

| Appendices and Definitions: | |

| |

| |

| |

| |

| |

| |

| |

| |

First Quarter 2022 Supplemental Financial Reporting Package 2

Additional Information and Where to Find It

In connection with the proposed transaction, the Company will file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including the Company’s proxy statement on Schedule 14A (the “Proxy Statement”). This document is not a substitute for the Proxy Statement or any other document that the Company may file with the SEC or send to its stockholders in connection with the proposed transactions. BEFORE MAKING ANY VOTING DECISION, STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s website, http://www.sec.gov. In addition, the documents (when available) may be obtained free of charge by accessing the Investor Relations section of the Company’s website at https://ir.psbusinessparks.com or by contacting the Company’s Investor Relations by email at info@psbusinessparks.com.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Company common stock in respect of the proposed transaction. Information about the directors and executive officers of the Company is set forth in the proxy statement for the Company’s 2022 annual meeting of stockholders, which was filed with the SEC on March 25, 2022, in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, which was filed with the SEC on February 22, 2022 and in other documents filed by the Company with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available. Investors should read the Proxy Statement carefully when it becomes available before making any voting or investment decisions.

Forward-Looking Statements

When used within this supplemental information package, the words “may,” “believes,” “anticipates,” “plans,” “expects,” “seeks,” “estimates,” “intends,” and similar expressions are intended to identify “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties, and other factors, which may cause the actual results and performance of the Company to be materially different from those expressed or implied in the forward-looking statements, including but not limited to: (i) the duration and severity of the COVID-19 pandemic and its impact on our business and our customers; (ii) changes in general economic and business conditions, including as a result of the economic fallout of the COVID-19 pandemic; (iii) potential regulatory actions to close our facilities or limit our ability to evict delinquent customers; (iv) decreases in rental rates or increases in vacancy rates/failure to renew or replace expiring leases; (v) tenant defaults; (vi) the effect of the recent credit and financial market conditions; (vii) our failure to maintain our status as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”); (viii) the economic health of our customers; (ix) the health of our officers and directors; (x) increases in operating costs; (xi) casualties to our properties not covered by insurance; (xii) the availability and cost of capital; (xiii) increases in interest rates and its effect on our stock price; (xiv) security breaches, including ransomware, or a failure of our networks, systems or technology which could adversely impact our operations or our business, customer and employee relationships or result in fraudulent payments; (xv) the impact of inflation; and (xvi) other factors discussed in the Company’s SEC reports, including quarterly reports on Form 10-Q, reports on Form 8-K, and annual reports on Form 10-K.

First Quarter 2022 Supplemental Financial Reporting Package 3

| | | | | | | | |

| Executive Management Team |

| | |

| Stephen W. Wilson | | President and Chief Executive Officer |

| Maria R. Hawthorne | | Interim Chief Operating Officer |

| Adeel Khan | | Chief Financial Officer and Corporate Secretary |

| Trenton Groves | | SVP, Chief Accounting Officer |

| Board of Directors |

| | |

| Ronald L. Havner, Jr. | | Chairman of the Board |

| Stephen W. Wilson | | Director, President and Chief Executive Officer |

| Maria R. Hawthorne | | Director, Interim Chief Operating Officer |

| Jennifer Holden Dunbar | | Director |

| M. Christian Mitchell | | Director |

| Irene H. Oh | | Director |

| Kristy M. Pipes | | Director |

| Gary E. Pruitt | | Director |

| Robert S. Rollo | | Director |

| Joseph D. Russell, Jr. | | Director |

| Peter Schultz | | Director |

| | |

| Investor Relations Information |

| Adeel Khan |

| T: 818.244.8080, Ext. 8975 |

| akhan@psbusinessparks.com |

| | | | | | | | | | | |

| Equity Research Coverage |

| FIRM | ANALYST | PHONE | EMAIL |

| Citi | Manny Korchman | 212-816-1382 | emmanuel.korchman@citi.com |

| Green Street Advisors | Vince Tibone | 949-640-8780 | vtibone@greenstreetadvisors.com |

| JP Morgan | Anthony Paolone | 212-622-6682 | anthony.paolone@jpmorgan.com |

| KeyBanc | Craig Mailman | 917-368-2316 | cmailman@key.com |

| Wells Fargo | Blaine Heck | 443-263-6529 | blaine.heck@wellsfargo.com |

PS Business Parks, Inc. is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding PS Business Parks, Inc.'s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of PS Business Parks, Inc. or its management. PS Business Parks, Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations.

First Quarter 2022 Supplemental Financial Reporting Package 4

| | | | | |

| Company Overview As Of March 31, 2022 |

| | | | | | | | |

| Company Overview | | |

| Total # of Properties | | 96 |

| | |

| Total Square Feet | | 27,010,000 |

| | |

| | |

| | |

| Total Occupancy (Period End) | | 95.5% |

| | |

| Same Park Occupancy (Period End) | | 95.9% |

| | |

| Same Park YTD GAAP NOI growth | | 7.7% |

| | |

| Same Park YTD Cash NOI growth | | 8.6% |

| | |

(S&P/Moody's) (2) (3) | | BBB+, BBB-/Baa2 (under review) |

| | |

| Net Debt to Total Combined Market Capitalization | | n/a |

| | |

| Net Debt and Preferred Equity to Total Combined Market Capitalization | | 11.4% |

| | |

| Net Debt to Adjusted EBITDAre | | 2.8x |

| | |

| Multifamily | | |

| Average rent per unit | | $2,123 |

| | |

| Weighted average occupancy | | 95.0% |

| | |

| Period end occupancy | | 96.9% |

| | |

| Percent leased | | 97.0% |

| | |

| Economic Occupancy | | 89.9% |

| | |

| | | | | | | | | | | | | | |

(2) S&P downgraded PSB to 'BBB+' and subsequently downgraded PSB's preferred stock to 'BBB-'. S&P placed all their ratings on PSB, including our 'BBB+' issuer credit rating, on CreditWatch with negative implications. The CreditWatch placement reflects that S&P could lower their ratings upon closing of the transaction, based on the pro forma capital structure and their view of the acquirer's aggressive financial policy. S&P no longer view PSB as being moderately strategic to Public Storage. Public Storage, which holds approximately 41% common equity interest in PSB, has agreed to Blackstone's acquisition bid. S&P previously considered PSB to be moderately strategic to Public Storage and, as such, S&P believed that Public Storage would provide support to PSB under a stress scenario. As a result, S&P applied a one-notch improvement to their standalone rating on PSB. The transaction changes S&P's view, such that they no longer expect Public Storage to support PSB under a hypothetical stress scenario. As a result, S&P downgraded PSB by one notch to 'BBB+'. S&P also lowered their ratings on PSB's preferred stock by one notch to 'BBB-', two notches below its issuer credit rating, in line with S&P's criteria. |

(3) Moody’s Investors Service (“Moody’s”) has placed on review for downgrade the ratings of PS Business Parks, Inc. (PSB), including its Baa2 preferred stock rating and the (P)Baa1 senior unsecured shelf rating of its main operating subsidiary, PS Business Parks, L.P. The review for downgrade follows the announcement that the REIT, which owns a portfolio primarily comprised of multi-tenant industrial and flex properties, has entered into a definitive agreement by which affiliates of Blackstone Real Estate will acquire all of PSB’s outstanding shares in a transaction valued at about $7.6 billion. The review for downgrade reflects the likelihood that PSB’s credit profile will deteriorate under Blackstone’s ownership, with the potential for meaningfully higher leverage and secured debt levels that could result in a multi-notch downgrade of the REIT’s ratings, including crossing over to non-investment grade territory, upon transaction close. |

First Quarter 2022 Supplemental Financial Reporting Package 5

| | | | | |

| Financial and Portfolio Highlights and Capitalization Data (unaudited, in thousands except share and per share data and portfolio statistics) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| March 31, 2022 | | December 31, 2021 | | September 31, 2021 | | June 30, 2021 | | March 31, 2021 | | |

| Financial Results: | | | | | | | | | | | |

| Rental income | $ | 112,840 | | | $ | 110,844 | | | $ | 110,448 | | | $ | 109,364 | | | $ | 108,047 | | | |

| Net income | $ | 101,145 | | | $ | 357,009 | | | $ | 78,463 | | | $ | 70,050 | | | $ | 47,507 | | | |

Net Operating Income (NOI) (1) | $ | 78,726 | | | $ | 78,106 | | | $ | 77,357 | | | $ | 77,515 | | | $ | 74,829 | | | |

Cash NOI (1) | $ | 78,105 | | | $ | 77,641 | | | $ | 77,332 | | | $ | 77,813 | | | $ | 73,978 | | | |

Core FFO (1) | $ | 63,823 | | | $ | 63,485 | | | $ | 60,328 | | | $ | 61,816 | | | $ | 58,419 | | | |

Core FFO per common stock - diluted (1) | $ | 1.82 | | | $ | 1.81 | | | $ | 1.72 | | | $ | 1.77 | | | $ | 1.67 | | | |

| EBITDAre | $ | 67,601 | | | $ | 74,224 | | | $ | 72,599 | | | $ | 73,503 | | | $ | 70,624 | | | |

| Dividend declared per share of common stock | $ | 1.05 | | | $ | 1.05 | | | $ | 1.05 | | | $ | 1.05 | | | $ | 1.05 | | | |

| Portfolio Statistics: | | | | | | | | | | | |

Total square footage at period end (2) | 27,010,000 | | | 27,010,000 | | | 26,869,000 | | | 26,151,000 | | | 26,151,000 | | | |

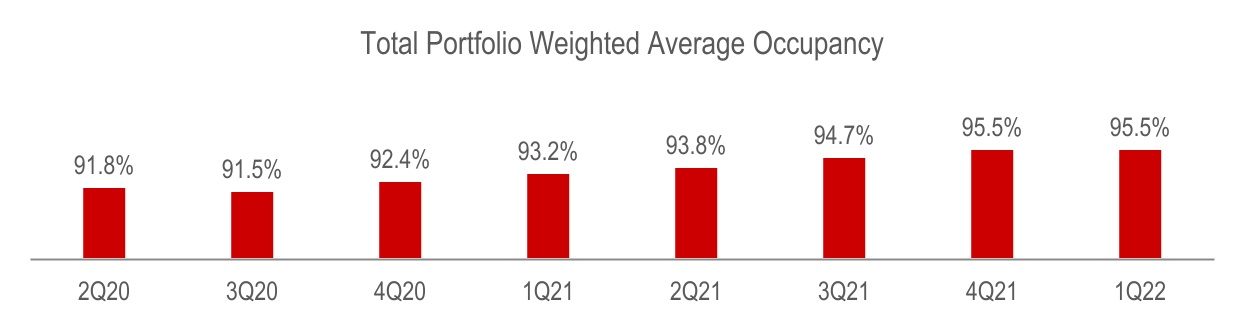

| Weighted average occupancy | 95.5 | % | | 95.5 | % | | 94.7 | % | | 93.8 | % | | 93.2 | % | | |

| Period end Occupancy | 95.5 | % | | 95.9 | % | | 95.5 | % | | 94.5 | % | | 93.6 | % | | |

| Rent Change - GAAP | 23.4 | % | | 16.4 | % | | 15.4 | % | | 10.7 | % | | 16.4 | % | | |

| Rent Change - Cash | 10.7 | % | | 6.1 | % | | 5.0 | % | | 3.1 | % | | 6.4 | % | | |

| Same Park Performance: | | | | | | | | | | | |

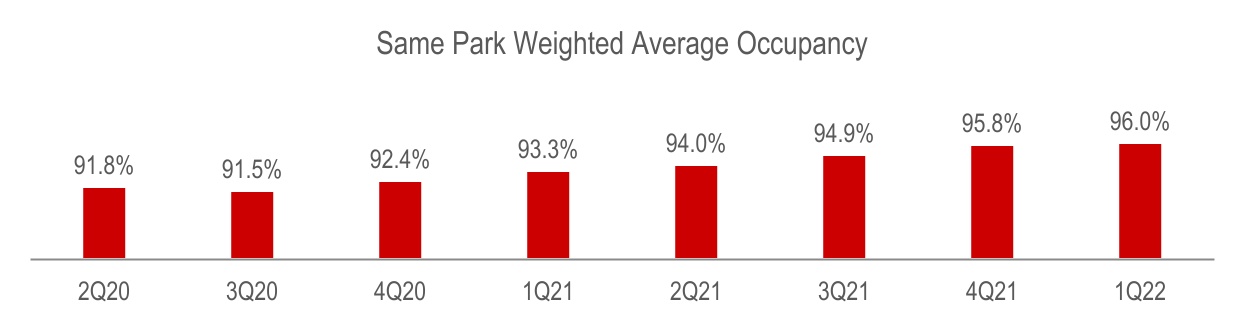

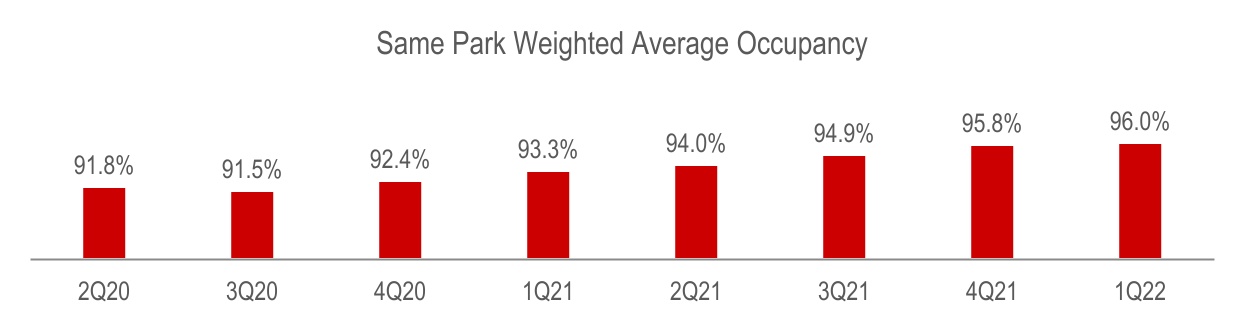

| Same Park weighted average occupancy | 96.0 | % | | 95.8 | % | | 94.9 | % | | 94.0 | % | | 93.3 | % | | |

| Same Park income per occupied square foot | $16.84 | | $16.60 | | $16.62 | | $16.40 | | $16.10 | | |

Same Park GAAP NOI growth (1) (3) | 7.7 | % | | 8.9 | % | | 10.0 | % | | 11.4 | % | | 0.7 | % | | |

Same Park Cash NOI growth (1) (3) | 8.6 | % | | 8.1 | % | | 12.7 | % | | 16.2 | % | | 0.5 | % | | |

| Capitalization: | | | | | | | | | | | |

Total shares and units issued and outstanding at period end (4) | 34,932,798 | | | 34,895,162 | | | 34,851,508 | | | 34,846,819 | | | 34,822,294 | | | |

| Total equity market capitalization | $ | 5,871,505 | | | $ | 6,426,642 | | | $ | 5,462,625 | | | $ | 5,160,177 | | | $ | 5,382,830 | | | |

Series W, X, Y and Z Preferred Stock (5) | $ | 755,000 | | | $ | 755,000 | | | $ | 944,750 | | | $ | 944,750 | | | $ | 944,750 | | | |

| Total consolidated debt | $ | 20,000 | | | $ | 32,000 | | | $ | — | | | $ | — | | | $ | — | | | |

Unrestricted cash (6) | $ | (20,000) | | | $ | (27,074) | | | n/a | | n/a | | n/a | | |

| Total combined market capitalization (net debt plus equity) | $ | 6,626,505 | | | $ | 7,186,568 | | | $ | 6,407,375 | | | $ | 6,104,927 | | | $ | 6,327,580 | | | |

| Ratios: | | | | | | | | | | | |

| Net debt & preferred equity to total combined market capitalization | 11.4 | % | | 10.6 | % | | 14.1 | % | | 13.8 | % | | 14.0 | % | | |

Net debt to total combined market capitalization (6) | 0.0 | % | | 0.1 | % | | n/a | | n/a | | n/a | | |

Ratio of EBITDAre to fixed charges and preferred distributions (7) | 6.9x | | 6.9x | | 5.9x | | 6.0x | | 5.8x | | |

Net debt and preferred equity to EBITDAre (8) | 2.8x | | 2.6x | | 3.1x | | 2.8x | | 3.1x | | |

(1)For definition/discussion of non-GAAP financial measures and reconciliations to their nearest GAAP equivalents, see the definitions section & reconciliation section beginning on page 29 and page 10 of this report, respectively. (2)Excludes assets sold.

(3)Represents the quarter over quarter percentage change in NOI and Cash NOI for the Same Park Portfolio.

(4)Total shares and units issued and outstanding at period end is comprised of common stock and common operating partnership units.

(5)Series W Preferred Stock redeemed in November 2021.

(6)Unrestricted cash balance is $104.2 million as of March 31, 2022 Cash used for net debt calculation is $20.0 million or the current outstanding debt balance.

(7)For each period shown, ratio of total fixed charges to EBITDAre is calculated using the respective quarter’s annualized fixed charges divided by the respective quarter’s annualized EBITDAre.

(8)For each period shown, ratio of debt and preferred equity to EBITDAre is calculated using total net debt and preferred equity reported during the quarter divided by the respective quarter’s annualized EBITDAre.

First Quarter 2022 Supplemental Financial Reporting Package 6

| | | | | |

| Consolidated Balance Sheets (unaudited, in thousands) |

| | | | | | | | | | | | | | |

| March 31, 2022 | | December 31, 2021 | |

| | | | |

| ASSETS | | | | |

| | | | |

| Cash and cash equivalents | $ | 104,204 | | | $ | 27,074 | | (a) |

| | | | |

| Real estate facilities, at cost | | | | |

| Land | 865,214 | | | 867,345 | | |

| Buildings and improvements | 2,244,104 | | | 2,239,137 | | |

| 3,109,318 | | | 3,106,482 | | |

| Accumulated depreciation | (1,197,811) | | | (1,178,397) | | |

| 1,911,507 | | | 1,928,085 | | (b) |

| Properties held for sale, net | — | | | 33,609 | | |

| Land and building held for development, net | 97,212 | | | 78,990 | | |

| 2,008,719 | | | 2,040,684 | | |

| Rent receivable | 2,988 | | | 1,621 | | |

| Deferred rent receivable | 37,484 | | | 37,581 | | (c) |

| Other assets | 13,176 | | | 16,262 | | |

| Total assets | $ | 2,166,571 | | | $ | 2,123,222 | | (d) |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| | | | |

| Accrued and other liabilities | $ | 95,509 | | | $ | 97,151 | | (e) |

| Credit facility | 20,000 | | | 32,000 | | |

| Total liabilities | 115,509 | | | 129,151 | | |

| | | | |

| Equity | | | | |

| PS Business Parks, Inc.’s stockholders’ equity | | | | |

| Preferred stock | 755,000 | | | 755,000 | | |

| Common stock | 276 | | | 275 | | |

| Paid-in capital | 754,387 | | | 752,444 | | (f) |

| Accumulated earnings | 270,243 | | | 226,737 | | (g) |

| Total PS Business Parks, Inc.’s stockholders’ equity | 1,779,906 | | | 1,734,456 | | |

| Noncontrolling interests | 271,156 | | | 259,615 | | |

| Total equity | 2,051,062 | | | 1,994,071 | | |

| Total liabilities and equity | $ | 2,166,571 | | | $ | 2,123,222 | | |

See Appendix A for additional detail related to the tickmarks shown in the table above.

First Quarter 2022 Supplemental Financial Reporting Package 7

| | | | | |

| Consolidated Statements of Operations, Quarterly Results (unaudited and in thousands, except per share amounts) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | March 31,

2022 | | December 31,

2021 | | September 30,

2021 | | June 30,

2021 | | March 31,

2021 | | |

| | | | | | | | | | | |

| Rental income | $ | 112,840 | | | $ | 110,844 | | | $ | 110,448 | | | $ | 109,364 | | | $ | 108,047 | | | |

| | | | | | | | | | | |

| Expenses: | | | | | | | | | | | |

| Cost of operations | 34,114 | | | 32,738 | | | 33,091 | | | 31,849 | | | 33,218 | | | |

| Depreciation and amortization | 23,132 | | | 24,130 | | | 23,857 | | | 22,514 | | | 22,985 | | | |

General and administrative (1) | 11,324 | | | 4,728 | | | 5,148 | | | 4,799 | | | 4,382 | | | |

| Total operating expenses | 68,570 | | | 61,596 | | | 62,096 | | | 59,162 | | | 60,585 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Interest and other income | 246 | | | 946 | | | 411 | | | 923 | | | 256 | | | |

Interest and other expense (2) | (330) | | | (3,943) | | | (224) | | | (268) | | | (211) | | | |

| Gain on sale of real estate facilities | 56,959 | | | 310,758 | | | 29,924 | | | 19,193 | | | — | | | |

| Net income | 101,145 | | | 357,009 | | | 78,463 | | | 70,050 | | | 47,507 | | | |

| Allocation to noncontrolling interests | (19,049) | | | (70,915) | | | (13,850) | | | (12,094) | | | (7,411) | | | |

| Net income allocable to PS Business Parks, Inc. | 82,096 | | | 286,094 | | | 64,613 | | | 57,956 | | | 40,096 | | | |

| Allocation to preferred stockholders | (9,580) | | | (10,485) | | | (12,046) | | | (12,047) | | | (12,046) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Preferred securities redemption charge | — | | | (6,434) | | | — | | | — | | | — | | | |

| Allocation to restricted stock unit holders | (523) | | | (1,785) | | | (350) | | | (314) | | | (164) | | | |

| Net income allocable to common stockholders | $ | 71,993 | | | $ | 267,390 | | | $ | 52,217 | | | $ | 45,595 | | | $ | 27,886 | | | |

| | | | | | | | | | | |

| Net income per share of common stock | | | | | | | | | | | |

| Basic | $ | 2.61 | | | $ | 9.70 | | | $ | 1.90 | | | $ | 1.66 | | | $ | 1.01 | | | |

| Diluted | $ | 2.60 | | | $ | 9.66 | | | $ | 1.89 | | | $ | 1.65 | | | $ | 1.01 | | | |

| | | | | | | | | | | |

| Weighted average common stock outstanding | | | | | | | | | | | |

| Basic | 27,607 | | | 27,565 | | | 27,543 | | | 27,531 | | | 27,495 | | | |

| Diluted | 27,691 | | | 27,671 | | | 27,635 | | | 27,632 | | | 27,594 | | | |

(1)General and administrative expense in Q1 22 includes the impact of a one-time cash payment of $6.7 million for RSUs to the former CEO less a $0.6 million reversal of stock compensation expense.

(2)Other expense includes $3.6 million related to state tax provision for the Three Months Ended December 31, 2021.

First Quarter 2022 Supplemental Financial Reporting Package 8

| | | | | |

| Consolidated Statements of Operations and EBITDAre, Quarterly Results (unaudited and in thousands, except per share amounts) |

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | | | |

| 2022 | | 2021 | | | | | | |

| | | | | | | | | |

| Rental income | $ | 112,840 | | | $ | 108,047 | | (a) | | | | | |

| | | | | | | | | |

| Expenses | | | | | | | | | |

| Cost of operations | 34,114 | | | 33,218 | | (b) | | | | | |

| Depreciation and amortization | 23,132 | | | 22,985 | | | | | | | |

| General and administrative | 11,324 | | | 4,382 | | (c) | | | | | |

| Total operating expenses | 68,570 | | | 60,585 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Interest and other income | 246 | | | 256 | | (d) | | | | | |

| Interest and other expense | (330) | | | (211) | | (e) | | | | | |

| Gain on sale of real estate facilities | 56,959 | | | — | | | | | | | |

| Net income | 101,145 | | | 47,507 | | | | | | | |

| Allocation to noncontrolling interests | (19,049) | | | (7,411) | | | | | | | |

| Net income allocable to PS Business Parks, Inc. | 82,096 | | | 40,096 | | | | | | | |

| Allocation to preferred stockholders | (9,580) | | | (12,046) | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Allocation to restricted stock unit holders | (523) | | | (164) | | | | | | | |

| Net income allocable to common stockholders | $ | 71,993 | | | $ | 27,886 | | | | | | | |

| | | | | | | | | |

| Net income per share of common stock | | | | | | | | | |

| Basic | $ | 2.61 | | | $ | 1.01 | | | | | | | |

| Diluted | $ | 2.60 | | | $ | 1.01 | | | | | | | |

| | | | | | | | | |

| Weighted average common stock outstanding | | | | | | | | | |

| Basic | 27,607 | | | 27,495 | | | | | | | |

| Diluted | 27,691 | | | 27,594 | | | | | | | |

| | | | | | | | | |

EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION FOR REAL ESTATE (EBITDAre) (1) |

| Three Months Ended March 31, | | | | |

| 2022 | | 2021 | | $ Change | | | | |

| Net income | $ | 101,145 | | | $ | 47,507 | | | $ | 53,638 | | | | | |

| Net interest (income) expense | 283 | | | 132 | | | 151 | | | | | |

| Depreciation and amortization | 23,132 | | | 22,985 | | | 147 | | | | | |

| Gain on sale of real estate facilities and development rights | (56,959) | | | — | | | (56,959) | | | | | |

| | | | | | | | | |

| EBITDAre | $ | 67,601 | | | $ | 70,624 | | | $ | (3,023) | | | | | |

See Appendix B for additional detail related to the tickmarks shown in the table above.

(1) Refer to Page 29, Definitions and Non-GAAP Disclosures, for the definitions of EBITDAre. First Quarter 2022 Supplemental Financial Reporting Package 9

| | | | | |

| Non-GAAP FFO, Core FFO and FAD Reconciliations (unaudited and in thousands, except per share amounts) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | March 31, 2022 | | December 31, 2021 | | September 30, 2021 | | June 30, 2021 | | March 31, 2021 | | | | |

| | | | | | | | | | | | | |

| Net income allocable to common stockholders | $ | 71,993 | | | $ | 267,390 | | | $ | 52,217 | | | $ | 45,595 | | | $ | 27,886 | | | | | |

| Adjustments | | | | | | | | | | | | | |

| Gain on sale of real estate facilities | (56,959) | | | (310,758) | | | (29,924) | | | (19,193) | | | — | | | | | |

| Depreciation and amortization | 23,132 | | | 24,130 | | | 23,857 | | | 22,514 | | | 22,985 | | | | | |

| Net income allocable to noncontrolling interests | 19,049 | | | 70,915 | | | 13,850 | | | 12,094 | | | 7,411 | | | | | |

| Net income allocable to restricted stock unit holders | 523 | | | 1,785 | | | 350 | | | 314 | | | 164 | | | | | |

| FFO allocated to joint venture partner | (23) | | | (11) | | | (22) | | | (18) | | | (27) | | | | | |

FFO allocable to diluted common stock and units (1) | 57,715 | | | 53,451 | | | 60,328 | | | 61,306 | | | 58,419 | | | | | |

| CEO cash payment for RSUs net of reversal of stock compensation | 6,108 | | | — | | | — | | | — | | | — | | | | | |

| Preferred securities redemption charge | — | | | 6,434 | | | — | | | — | | | — | | | | | |

| Income tax expense | — | | | 3,600 | | | — | | | — | | | — | | | | | |

| Maryland reincorporation costs | — | | | — | | | — | | | 510 | | | — | | | | | |

| | | | | | | | | | | | | |

Core FFO allocable to diluted common stock and units (1) | $ | 63,823 | | | $ | 63,485 | | | $ | 60,328 | | | $ | 61,816 | | | $ | 58,419 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| FAD | | | | | | | | | | | | | |

FFO allocable to diluted common stock and units (1) | $ | 57,715 | | | $ | 53,451 | | | $ | 60,328 | | | $ | 61,306 | | | $ | 58,419 | | | | | |

| Adjustments: | | | | | | | | | | | | | |

| Recurring capital improvements | (2,010) | | | (3,233) | | | (3,837) | | | (3,701) | | | (565) | | | | | |

| Tenant improvements | (3,027) | | | (3,462) | | | (3,876) | | | (3,918) | | | (2,422) | | | | | |

| Capitalized lease commissions | (1,304) | | | (3,274) | | | (1,995) | | | (1,439) | | | (1,784) | | | | | |

| Total recurring capital expenditures for assets sold or held for sale | (8) | | | (117) | | | (471) | | | (394) | | | (634) | | | | | |

| Total multifamily capital expenditures | — | | | (6) | | | — | | | (7) | | | — | | | | | |

| Cash paid for taxes in lieu of stock upon vesting of restricted stock units | (931) | | | (260) | | | (478) | | | (5) | | | (3,197) | | | | | |

| Preferred securities redemption charge | — | | | 6,434 | | | — | | | — | | | — | | | | | |

Non-cash rental income (2) | (1,157) | | | (857) | | | (453) | | | (183) | | | (1,307) | | | | | |

| Non-cash stock compensation expense | 940 | | | 2,073 | | | 2,341 | | | 2,301 | | | 1,780 | | | | | |

FAD allocable to diluted common stock and units (1) | $ | 50,218 | | | $ | 50,749 | | | $ | 51,559 | | | $ | 53,960 | | | $ | 50,290 | | | | | |

| | | | | | | | | | | | | |

Non-recurring property renovations (1) | (1,511) | | | (1,686) | | | (176) | | | (432) | | | (411) | | | | | |

| Investment in multifamily development | (12,455) | | | (12,903) | | | (13,516) | | | (7,539) | | | (9,485) | | | | | |

| Investment in industrial development | (3,796) | | | (1,223) | | | (165) | | | (93) | | | (1,123) | | | | | |

| | | | | | | | | | | | | |

| Total non-recurring capital expenditures | $ | (17,762) | | | $ | (15,812) | | | $ | (13,857) | | | $ | (8,064) | | | $ | (11,019) | | | | | |

| Free cash available after non-recurring capital expenditures | $ | 32,456 | | | $ | 34,937 | | | $ | 37,702 | | | $ | 45,896 | | | $ | 39,271 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Distributions | $ | (36,892) | | | $ | (36,833) | | | $ | (36,793) | | | $ | (36,813) | | | $ | (36,724) | | | | | |

Retained cash (1) | $ | (4,436) | | | $ | (1,896) | | | $ | 909 | | | $ | 9,083 | | | $ | 2,547 | | | | | |

| | | | | | | | | | | | | |

| Weighted average outstanding | | | | | | | | | | | | | |

| Common stock | 27,607 | | | 27,565 | | | 27,543 | | | 27,531 | | | 27,495 | | | | | |

| Operating partnership units | 7,305 | | | 7,305 | | | 7,305 | | | 7,305 | | | 7,305 | | | | | |

| Restricted stock units | 45 | | | 46 | | | 33 | | | 32 | | | 47 | | | | | |

| Common stock equivalents | 84 | | | 106 | | | 92 | | | 101 | | | 99 | | | | | |

| Total diluted common stock and units | 35,041 | | | 35,022 | | | 34,973 | | | 34,969 | | | 34,946 | | | | | |

| | | | | | | | | | | | | |

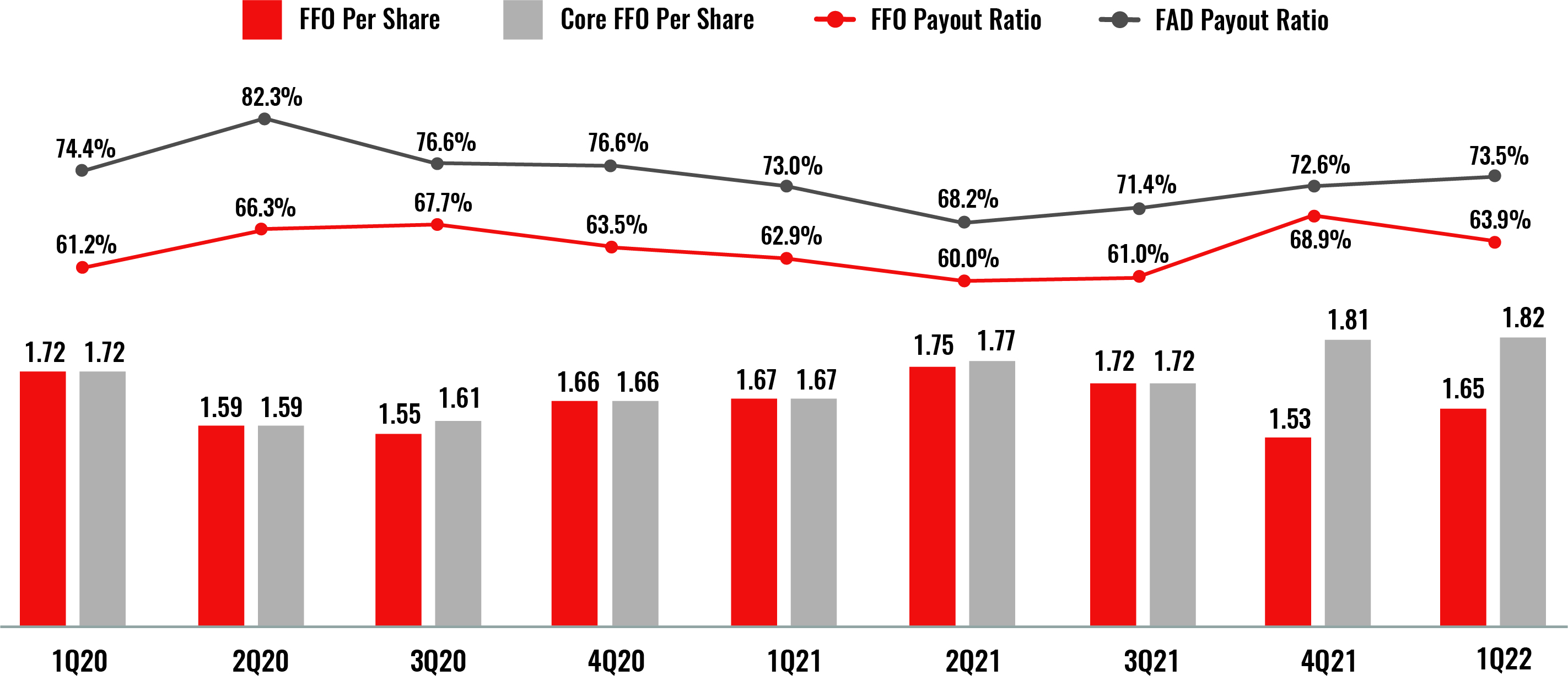

| FFO per share | $ | 1.65 | | | $ | 1.53 | | | $ | 1.72 | | | $ | 1.75 | | | $ | 1.67 | | | | | |

| Core FFO per share | $ | 1.82 | | | $ | 1.81 | | | $ | 1.72 | | | $ | 1.77 | | | $ | 1.67 | | | | | |

FAD distribution payout ratio (3) (4) | 73.5 | % | | 72.6 | % | | 71.4 | % | | 68.2 | % | | 73.0 | % | | | | |

| | | | | | | | | | | | | |

First Quarter 2022 Supplemental Financial Reporting Package 10

| | | | | |

| Non-GAAP FFO, Core FFO and FAD Reconciliations (cont'd) (unaudited and in thousands, except per share amounts) |

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2022 | | 2021 | | | | |

| | | | | | | |

| Net income allocable to common stockholders | $ | 71,993 | | | $ | 27,886 | | | | | |

| Adjustments | | | | | | | |

| Gain on sale of real estate facilities | (56,959) | | | — | | | | | |

| Depreciation and amortization | 23,132 | | | 22,985 | | | | | |

| Net income allocable to noncontrolling interests | 19,049 | | | 7,411 | | | | | |

| Net income allocable to restricted stock unit holders | 523 | | | 164 | | | | | |

| FFO allocated to joint venture partner | (23) | | | (27) | | | | | |

FFO allocable to diluted common stock and units (1) | 57,715 | | | 58,419 | | | | | |

| CEO cash payment for RSUs net of reversal of stock compensation | 6,108 | | | — | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Core FFO allocable to diluted common stock and units (1) | $ | 63,823 | | | $ | 58,419 | | | | | |

| | | | | | | |

| FAD | | | | | | | |

FFO allocable to diluted common stock and units (1) | $ | 57,715 | | | $ | 58,419 | | | | | |

| Adjustments: | | | | | | | |

| Recurring capital improvements | (2,010) | | | (565) | | | | | |

| Tenant improvements | (3,027) | | | (2,422) | | | | | |

| Capitalized lease commissions | (1,304) | | | (1,784) | | | | | |

| Total recurring capital expenditures for assets sold or held for sale | (8) | | | (634) | | | | | |

| | | | | | | |

| Cash paid for taxes in lieu of stock upon vesting of restricted stock units | (931) | | | (3,197) | | | | | |

| | | | | | | |

Non-cash rental income (2) | (1,157) | | | (1,307) | | | | | |

| Non-cash stock compensation expense | 940 | | | 1,780 | | | | | |

FAD allocable to diluted common stock and units (1) | $ | 50,218 | | | $ | 50,290 | | | | | |

| Non-recurring capital expenditures | | | | | | | |

Non-recurring property renovations (1) | (1,511) | | | (411) | | | | | |

| Investment in multifamily development | (12,455) | | | (9,485) | | | | | |

| Investment in industrial development | (3,796) | | | (1,123) | | | | | |

| | | | | | | |

| Total non-recurring capital expenditures | $ | (17,762) | | | $ | (11,019) | | | | | |

| Free cash available after non-recurring capital expenditures | $ | 32,456 | | | $ | 39,271 | | | | | |

| Distributions | | | | | | | |

| Distributions to common stockholders | $ | (29,010) | | | $ | (28,872) | | | | | |

| Distributions to noncontrolling interests - common units | (7,671) | | | (7,671) | | | | | |

| Distributions to restricted stock unit holders | (188) | | | (164) | | | | | |

| Distributions to noncontrolling interests - joint venture | (23) | | | (17) | | | | | |

| Total Distributions | (36,892) | | | (36,724) | | | | | |

Retained cash (1) | (4,436) | | | 2,547 | | | | | |

First Quarter 2022 Supplemental Financial Reporting Package 11

| | | | | |

| Non-GAAP FFO, Core FFO and FAD Reconciliations (cont'd) (unaudited and in thousands, except per share amounts) |

| | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended March 31, | | |

| 2022 | | 2021 | | | | |

| Weighted average outstanding | | | | | | | |

| Common stock | 27,607 | | | 27,495 | | | | | |

| Operating partnership units | 7,305 | | | 7,305 | | | | | |

| Restricted stock units | 45 | | | 47 | | | | | |

| Common stock equivalents | 84 | | | 99 | | | | | |

| Total diluted common stock and units | 35,041 | | | 34,946 | | | | | |

| | | | | | | |

| FFO per share | $ | 1.65 | | | $ | 1.67 | | | | | |

| Core FFO per share | $ | 1.82 | | | $ | 1.67 | | | | | |

FAD distribution payout ratio (3) (4) | 73.5 | % | | 73.0 | % | | | | |

| | | | | |

| (1) | Refer to page 29, Definitions and Non-GAAP Disclosures, for the definition of FFO, Core FFO, FAD, Non-Recurring Property Renovations and Retained Cash. |

| (2) | Non-cash rental income includes amortization of deferred rent receivable (net of write-offs), in-place lease intangible, tenant improvement reimbursements, and lease incentives. |

| |

| (3) | FAD distribution payout ratio is equal to total distributions to common stockholders, unit holders, restricted stock unit holders and our joint venture partner divided by FAD during the same reporting period. |

| (4) | For the three months ended December 31, 2021, the FAD distribution ratio excludes of $4.60 special dividend distributions to common stockholders, noncontrolling interest, and restricted stock unit holders. |

First Quarter 2022 Supplemental Financial Reporting Package 12

| | | | | | | | |

| NOI and Cash NOI (unaudited, in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NET OPERATING INCOME | | | | | | | | | CASH NET OPERATING INCOME (2) |

| | Three Months Ended March 31, | | | | | Three Months Ended March 31, | | |

| | 2022 | | 2021 | | % Change | | | | | | | | | 2022 | | 2021 | | % Change | | | | | | |

| Rental income | | | | | | | | | | | | | | | | | | | | | | | | |

Same Park (1) (3) (4) (5) | $ | 105,014 | | | $ | 98,012 | | | 7.1% | | | | | | | | | $ | 104,096 | | | $ | 96,638 | | | 7.7% | | | | | | |

Non-Same Park (1) | 3,348 | | | 1,246 | | | 168.7% | | | | | | | | | 3,074 | | | 1,270 | | | 142.0% | | | | | | |

| Multifamily | 2,369 | | | 2,327 | | | 1.8% | | | | | | | | | 2,369 | | | 2,327 | | | 1.8% | | | | | | |

| Assets sold or held for sale | 2,109 | | | 6,462 | | | (67.4)% | | | | | | | | | 2,144 | | | 6,505 | | | (67.0)% | | | | | | |

| Total rental income | 112,840 | | | 108,047 | | | 4.4% | | | | | | | | | 111,683 | | | 106,740 | | | 4.6% | | | | | | |

Cost of operations (1) (6) | | | | | | | | | | | | | | | | | | | | | | | | |

Same Park (1) | 30,900 | | | 29,175 | | | 5.9% | | | | | | | | | 30,404 | | | 28,754 | | | 5.7% | | | | | | |

Non-Same Park (1) | 1,060 | | | 422 | | | 151.2% | | | | | | | | | 1,035 | | | 417 | | | 148.2% | | | | | | |

| Multifamily | 1,224 | | | 1,067 | | | 14.7% | | | | | | | | | 1,224 | | | 1,067 | | | 14.7% | | | | | | |

| Assets sold or held for sale | 930 | | | 2,554 | | | (63.6)% | | | | | | | | | 915 | | | 2,524 | | | (63.7)% | | | | | | |

| Total cost of operations | 34,114 | | | 33,218 | | | 2.7% | | | | | | | | | 33,578 | | | 32,762 | | | 2.5% | | | | | | |

| Net operating income | | | | | | | | | | | | | | | | | | | | | | | | |

Same Park (1) | 74,114 | | | 68,837 | | | 7.7% | | | | | | | | | 73,692 | | | 67,884 | | | 8.6% | | | | | | |

Non-Same Park (1) | 2,288 | | | 824 | | | 177.7% | | | | | | | | | 2,039 | | | 853 | | | 139.0% | | | | | | |

| Multifamily | 1,145 | | | 1,260 | | | (9.1)% | | | | | | | | | 1,145 | | | 1,260 | | | (9.1)% | | | | | | |

| Assets sold or held for sale | 1,179 | | | 3,908 | | | (69.8)% | | | | | | | | | 1,229 | | | 3,981 | | | (69.1)% | | | | | | |

| Total net operating income | $ | 78,726 | | | $ | 74,829 | | | 5.2% | | | | | | | | | $ | 78,105 | | | $ | 73,978 | | | 5.6% | | | | | | |

(1)Refer to page 29, Definition and Non-GAAP Disclosures, for the definitions of Same Park, Non-Same Park, and Cash Rental Income. See Appendix C for Same Park Cost of Operations table. (2)Cash NOI excludes $0.5 million stock based compensation for the three months ended March 31, 2022 and 2021, respectively.

(3)Same Park rental income and Cash Rental Income include lease buyout income of $0.2 million and $0.4 million for the three months ended March 31, 2022 and 2021, respectively.

(4)Same Park rental income is presented net of (a) accounts receivable write-offs (recoveries) of $0.1 million and $0.0 million for the three months ended March 31, 2022 and 2021, respectively, and (b) deferred rent receivable write-offs of $0.0 million and $0.1 million for the three months ended March 31, 2022 and 2021, respectively.

(5)Same Park Cash Rental Income is presented net of (a) accounts receivable write-offs (recoveries) of $0.1 million and $0.0 million for the three months ended March 31, 2022 and 2021, respectively, and (b) rent deferrals and abatements $0.0 million and $0.3 million for the three months ended March 31, 2022 and 2021, respectively.

(6)Refer to Appendix B for a reconciliation of Cash Rental Income to rental income and Cost of Operations to Cost of Operations under Cash NOI as reported on our GAAP statements of income.

First Quarter 2022 Supplemental Financial Reporting Package 13

| | | | | |

| Same Park Cash NOI by Region and Type (1) (in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | | | |

| | March 31, 2022 | | March 31, 2021 | | Period Change by Product Type | | Total |

| | Industrial | | Flex | | Office | | Total | | Industrial | | Flex | | Office | | Total | | Industrial | Flex | Office | | % Change |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Cash NOI (1) | | | | | | | | | | | | | | | | | | | | | |

| Northern California | $ | 20,195 | | | $ | 2,156 | | | $ | 1,540 | | | $ | 23,891 | | | $ | 17,448 | | | $ | 1,982 | | | $ | 1,863 | | | $ | 21,293 | | | 15.7% | 8.8% | (17.3)% | | 12.2% |

| Southern California | 9,220 | | | 2,404 | | | 119 | | | 11,743 | | | 7,750 | | | 2,372 | | | 117 | | | 10,239 | | | 19.0% | 1.3% | 1.7% | | 14.7% |

| Dallas | 2,277 | | | 1,377 | | | n/a | | 3,654 | | | 1,963 | | | 1,160 | | | n/a | | 3,123 | | | 16.0% | 18.7% | n/a | | 17.0% |

| Austin | 1,494 | | | 3,835 | | | n/a | | 5,329 | | | 1,406 | | | 4,012 | | | n/a | | 5,418 | | | 6.3% | (4.4)% | n/a | | (1.6)% |

| Northern Virginia | 3,771 | | | 3,562 | | | 5,199 | | | 12,532 | | | 3,416 | | | 3,631 | | | 5,398 | | | 12,445 | | | 10.4% | (1.9)% | (3.7)% | | 0.7% |

| South Florida | 9,197 | | | 444 | | | 8 | | | 9,649 | | | 8,233 | | | 347 | | | 22 | | | 8,602 | | | 11.7% | 28.0% | (63.6)% | | 12.2% |

| Seattle | 2,436 | | | 1,283 | | | 74 | | | 3,793 | | | 2,219 | | | 1,344 | | | 65 | | | 3,628 | | | 9.8% | (4.5)% | 13.8% | | 4.5% |

| Suburban Maryland | 830 | | | n/a | | 2,271 | | | 3,101 | | | 788 | | | n/a | | 2,348 | | | 3,136 | | | 5.3% | n/a | (3.3)% | | (1.1)% |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Total | $ | 49,420 | | | $ | 15,061 | | | $ | 9,211 | | | $ | 73,692 | | | $ | 43,223 | | | $ | 14,848 | | | $ | 9,813 | | | $ | 67,884 | | | 14.3% | 1.4% | (6.1)% | | 8.6% |

| Percentage by Product Type | 67.1 | % | | 20.4 | % | | 12.5 | % | | 100.0 | % | | 63.7 | % | | 21.9 | % | | 14.4 | % | | 100.0 | % | | | | | | |

(1)Refer to page 29, Definitions and Non-GAAP Disclosures, for the definitions of Same Park and Cash NOI. First Quarter 2022 Supplemental Financial Reporting Package 14

| | | | | |

| Capitalization Summary (unaudited and in thousands, except share and per share data) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | As of March 31, 2022 | | As of December 31, 2021 |

| | | | Total | | % Total Market Capitalization | | Wtd Avg Rate | | Total | | % Total Market Capitalization | | Wtd Avg Rate |

| Common Stock: | | | | | | | | | | | | | |

| Common stock, $0.01 par value, 100,000,000 shares authorized, 27,627,443 and 27,589,807 shares issued and outstanding at March 31, 2022 and December 31, 2021, respectively | | | $ | 4,643,621 | | | 70.1% | | | | $ | 5,081,215 | | | 70.7% | | |

Common operating partnership units (7,305,355 units outstanding as of March 31, 2022 and December 31, 2021, respectively) (1) | | | 1,227,884 | | | 18.5% | | | | 1,345,427 | | | 18.7% | | |

Total common equity and operating partnership units (1) | | | $ | 5,871,505 | | | 88.6% | | | | $ | 6,426,642 | | | 89.4% | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Preferred Equity: | | | | | | | | | | | | | |

| 5.250% Series X preferred stock (9,200,000 depository shares outstanding) callable 9/21/22 | | | 230,000 | | | 3.5% | | | | 230,000 | | | 3.2% | | |

| 5.200% Series Y preferred stock (8,000,000 depository shares outstanding) callable 12/7/22 | | | 200,000 | | | 3.0% | | | | 200,000 | | | 2.8% | | |

| 4.875% Series Z preferred stock (13,000,000 depository shares outstanding) callable 11/4/24 | | | 325,000 | | | 4.9% | | | | 325,000 | | | 4.5% | | |

| | | | | | | | | | | | | |

| Total preferred equity | | | $ | 755,000 | | | 11.4% | | 5.08% | | $ | 755,000 | | | 10.5% | | 5.08% |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Unsecured Debt: | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Credit facility borrowing ($400.0 million at LIBOR + 0.70%) | | | $ | 20,000 | | | 0.3% | | 0.82% | | 32,000 | | 0.4% | | 0.80% |

| | | | | | | | | | | | | |

Unrestricted cash (2) | | | (20,000) | | | (0.3)% | | | | (27,074) | | | (0.4)% | | |

| Net debt | | | $ | — | | | 0.0% | | | | $4,926 | | 0.1% | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total net debt and preferred equity | | | $ | 755,000 | | | 11.4% | | 4.97% | | $759,926 | | 10.6% | | 4.90% |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total implied market capitalization | | | $ | 6,626,505 | | | 100.0% | | | | $7,186,568 | | 100.0% | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Interest expense and related expenses (annualized) (3) (4) | | | $ | 1,144 | | | | | | | $ | 1,000 | | | | | |

Preferred distributions (annualized) (5) | | | 38,320 | | | | | | | 41,940 | | | | | |

| Total fixed charges and preferred distributions (annualized) | | | $ | 39,464 | | | | | | | $ | 42,940 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Ratio of EBITDAre to fixed charges and preferred distributions (6) | | | 6.9x | | | | | | 6.9x | | | | |

Ratio of net debt and preferred equity to EBITDAre (7) | | | 2.8x | | | | | | 2.6x | | | | |

(1)Total common equity is calculated as the total number of common stock and operating partnership units outstanding multiplied by the Company’s closing share price at the end of each respective period. Closing share prices on

March 31, 2022 and December 31, 2021 were $168.08 and $184.17, respectively.

(2)Unrestricted cash balance is $104.2 million as of March 31, 2022. Cash used for net debt calculation is $20 million matching the debt balance as of March 31, 2022.

(3)Interest expense and related expenses includes facility fees associated with our unsecured credit facility.

(4)We annualized Interest expense and related charges for the three months ended March 31, 2022, in the amount of $286,000.

(5)We annualized preferred distributions for the three months ended March 31, 2022, in the amount of $9.6 million.

(6)For each period shown, ratio of total fixed charges to EBITDAre is calculated using the respective quarter’s annualized fixed charges divided by the respective quarter’s annualized EBITDAre.

(7)For each period shown, ratio of debt and preferred equity to EBITDAre is calculated using total net debt and preferred equity reported during the quarter divided by the respective quarter’s annualized EBITDAre.

First Quarter 2022 Supplemental Financial Reporting Package 15

| | | | | |

| Analysis of Capital Expenditures (unaudited and in thousands, except per square foot data) |

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2022 | | 2021 |

Commercial Recurring Capital Expenditures (1) | | | |

| Same Park | | | |

| Capital improvements | $ | 1,979 | | | $ | 559 | |

| Tenant improvements | 2,328 | | | 2,373 | |

| Lease commissions | 1,065 | | | 1,755 | |

| Total Same Park Recurring Capital Expenditures | $ | 5,372 | | | $ | 4,687 | |

| Same Park Recurring Capital Expenditures as a percentage of Cash NOI | 7.3% | | 6.9% |

| | | |

| | | |

| Non-Same Park | | | |

| Capital improvements | 31 | | | 6 | |

| Tenant improvements | 699 | | | 49 | |

| Lease commissions | 239 | | | 29 | |

| Total Non-Same Park Recurring Capital Expenditures | 969 | | | 84 | |

| Non-Same Park Recurring Capital Expenditures as a percentage of Cash NOI | 47.5% | | 9.8% |

| | | |

| | | |

| Total Recurring Capital Expenditures | 6,341 | | | 4,771 | |

| Total Recurring Capital Expenditures as a percentage of Cash NOI | 8.4% | | 6.9% |

| | | |

| | | |

| Assets sold or held for sale Recurring Capital Expenditures | 8 | | | 634 | |

| Total commercial Recurring Capital Expenditures | 6,349 | | | 5,405 | |

| Total Commercial Recurring Capital Expenditures as a percentage of Cash NOI | 8.2% | | 7.4% |

| | | |

| | | |

Non-recurring Property Renovations (1) | 1,511 | | | 411 | |

| Total capital expenditures (excluding multifamily) | 7,860 | | | 5,816 | |

| | | |

| Total capital expenditures | $ | 7,860 | | | $ | 5,816 | |

| | | |

Development costs (2) | $ | 16,251 | | | $ | 10,608 | |

(1)Refer to page 29, Definitions and Non-GAAP Disclosures, for the definitions of Recurring Capital Expenditures and Non-recurring Property Renovations. (2)Development costs for the three months ended March 31, 2022 comprises Brentford ($9.6M), 212 Industrial Park ($3.3M), and Boca ($1.2M). See Developments page. We also have additional entitlement related costs for certain projects which comprise Colma Creek ($1.7M), Charlton ($0.3M), Overlake <($0.1M), and The Mile <($0.1M).

First Quarter 2022 Supplemental Financial Reporting Package 16

| | | | | |

| Portfolio Summary (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | |

| PROPERTY INFORMATION |

| | Three Months Ended March 31, | | |

| | 2022 | | 2021 | | % Change | | | | | | |

Total Portfolio (1) | | | | | | | | | | | |

| Total square footage at period end | 27,010,000 | | | 26,151,000 | | | 3.3 | % | | | | | | |

| Weighted average occupancy | 95.5 | % | | 93.2 | % | | 2.3 | % | | | | | | |

| Period end occupancy | 95.5 | % | | 93.6 | % | | 1.9 | % | | | | | | |

Cash rental income per occupied square foot (2) (3) | $ | 16.61 | | | $ | 16.11 | | | 3.1 | % | | | | | | |

| Industrial | $ | 14.66 | | | $ | 13.84 | | | 5.9 | % | | | | | | |

| Flex | $ | 20.21 | | | $ | 19.87 | | | 1.7 | % | | | | | | |

| Office | $ | 24.88 | | | $ | 25.05 | | | (0.7) | % | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Same Park Portfolio (2) | | | | | | | | | | | |

| Total square footage at period end | 25,749,000 | | | 25,749,000 | | | — | | | | | | | |

| Weighted average occupancy | 96.0 | % | | 93.3 | % | | 2.7 | % | | | | | | |

| Period end occupancy | 95.9 | % | | 93.8 | % | | 2.1 | % | | | | | | |

Cash rental income per occupied square foot (2) (4) | $ | 16.84 | | | $ | 16.10 | | | 4.6 | % | | | | | | |

| Industrial | $ | 14.87 | | | $ | 13.79 | | | 7.8 | % | | | | | | |

| Flex | $ | 20.21 | | | $ | 19.87 | | | 1.7 | % | | | | | | |

| Office | $ | 24.88 | | | $ | 25.05 | | | (0.7) | % | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Non-Same Park Portfolio (2) | | | | | | | | | | | |

| Total square footage at period end | 1,261,000 | | | 402,000 | | | 213.7 | % | | | | | | |

| Weighted average occupancy | 86.4 | % | | 86.7 | % | | (0.3) | % | | | | | | |

| Period end occupancy | 86.3 | % | | 77.8 | % | | 8.5 | % | | | | | | |

Cash rental income per occupied square foot (2) (5) | $ | 11.25 | | | $ | 16.83 | | | (33.2) | % | | | | | | |

| Industrial | $ | 11.25 | | | $ | 16.83 | | | (33.2) | % | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Multifamily Portfolio | | | | | | | | | | | |

| Number of units | 395 | | | 395 | | | — | | | | | | | |

| Weighted average occupancy | 95.0 | % | | 94.2 | % | | 0.8 | % | | | | | | |

| Period end occupancy | 96.9 | % | | 93.6 | % | | 3.3 | % | | | | | | |

Average rent per unit (6) | $ | 2,123 | | | $ | 2,021 | | | 5.0 | % | | | | | | |

(1)Operating metrics for our multifamily asset are excluded from total portfolio operating metrics.

(2)Refer to page 29, Definitions and Non-GAAP Disclosures, for the definitions of Revenue per Occupied Square Foot, Same Park and Non-Same Park. (3)Included in the calculation of Total Park revenue per occupied square foot is (a) lease buyout income of $0.3 million and $0.4 million for the three months ended March 31, 2022 and 2021, respectively, (b) accounts receivable write-offs (recoveries) of $0.1 million and $0.0 million for the three months ended March 31, 2022 and 2021, respectively, and (c) deferred rent receivable write-offs of $0.0 million and $0.1 million for the three months ended March 31, 2022 and 2021, respectively.

(4)Included in the calculation of Same Park revenue per occupied square foot is (a) lease buyout income of $0.2 million and $0.4 million for the three months ended March 31, 2022 and 2021, respectively, (b) accounts receivable write-offs (recoveries) of $0.1 million and $0.0 million for the three months ended March 31, 2022 and 2021, and (c) deferred rent receivable write-offs of $0.0 million and $0.1 million for the three months ended March 31, 2022 and 2021, respectively.

(5)Included in the calculation of Non-Same Park revenue per occupied square foot is (a) lease buyout income of $0.0 for both of the three months ended March 31, 2022 and 2021, (b) accounts receivable write-offs of $0.0 million and $0.0 for the three months ended March 31, 2022 and 2021, respectively, and (c) deferred rent receivable write-offs of $0.0 million for both of the three months ended March 31, 2022 and 2021.

(6)Average rent per unit is defined as the total potential monthly rental revenue (actual rent for occupied apartment units plus market rent for vacant apartment units) divided by the total number of rentable apartment units.

First Quarter 2022 Supplemental Financial Reporting Package 17

| | | | | |

| Total Portfolio Overview by Markets and Product Type (unaudited, in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Square Footage of Properties by Product Type as of March 31, 2022 |

| Markets | Industrial | | Flex | | Office | | Total | | % of Total |

| Northern California | 6,391 | | | 593 | | | 340 | | | 7,324 | | | 27.1 | % |

| Southern California | 2,989 | | | 582 | | | 31 | | | 3,602 | | | 13.3 | % |

| Dallas | 2,242 | | | 793 | | | n/a | | 3,035 | | | 11.3 | % |

| Austin | 755 | | | 1,208 | | | n/a | | 1,963 | | | 7.3 | % |

| Northern Virginia | 1,810 | | | 1,242 | | | 1,726 | | | 4,778 | | | 17.7 | % |

| South Florida | 3,728 | | | 126 | | | 12 | | | 3,866 | | | 14.3 | % |

| Seattle | 1,052 | | | 270 | | | 28 | | | 1,350 | | | 5.0 | % |

| Suburban Maryland | 341 | | | n/a | | 751 | | | 1,092 | | | 4.0 | % |

| Total | 19,308 | | | 4,814 | | | 2,888 | | | 27,010 | | | 100.0 | % |

| Percentage by Product Type | 71.5 | % | | 17.8 | % | | 10.7 | % | | 100.0 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Weighted Average Occupancy Rates by Product Type for the Three Months Ended March 31, 2022 | | |

| Markets | Industrial | | Flex | | Office | | Total | | | | | | | | |

| Northern California | 99.2% | | 95.1% | | 71.1% | | 97.6% | | | | | | | | |

| Southern California | 98.3% | | 95.0% | | 93.0% | | 97.8% | | | | | | | | |

| Dallas | 94.9% | | 92.5% | | n/a | | 94.3% | | | | | | | | |

| Austin | 99.8% | | 90.7% | | n/a | | 94.2% | | | | | | | | |

| Northern Virginia | 91.2% | | 95.8% | | 87.2% | | 91.0% | | | | | | | | |

| South Florida | 98.0% | | 97.0% | | 100.0% | | 98.0% | | | | | | | | |

| Seattle | 97.5% | | 90.6% | | 65.0% | | 95.4% | | | | | | | | |

| Suburban Maryland | 100.0% | | n/a | | 88.6% | | 92.1% | | | | | | | | |

| Percentage by Product Type | 97.5% | | 93.5% | | 85.6% | | 95.5% | | | | | | | | |

First Quarter 2022 Supplemental Financial Reporting Package 18

| | | | | |

| Same Park Overview by Markets and Product Type (unaudited, in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Square Footage of Same Park Properties by Product Type as of March 31, 2022 |

| Markets | Industrial | | Flex | | Office | | Total | | % of Total |

| Northern California | 6,391 | | | 593 | | | 340 | | | 7,324 | | | 28.5 | % |

| Southern California | 2,916 | | | 582 | | | 31 | | | 3,529 | | | 13.7 | % |

| Dallas | 1,300 | | | 793 | | | n/a | | 2,093 | | | 8.1 | % |

| Austin | 755 | | | 1,208 | | | n/a | | 1,963 | | | 7.6 | % |

| Northern Virginia | 1,564 | | | 1,242 | | | 1,726 | | | 4,532 | | | 17.6 | % |

| South Florida | 3,728 | | | 126 | | | 12 | | | 3,866 | | | 15.0 | % |

| Seattle | 1,052 | | | 270 | | | 28 | | | 1,350 | | | 5.3 | % |

| Suburban Maryland | 341 | | | n/a | | 751 | | | 1,092 | | | 4.2 | % |

| Total | 18,047 | | | 4,814 | | | 2,888 | | | 25,749 | | | 100.0 | % |

| Percentage by Product Type | 70.1 | % | | 18.7 | % | | 11.2 | % | | 100.0 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Same Park Weighted Average Occupancy Rates by Product Type for the Three Months Ended March 31, 2022 | | |

| Markets | Industrial | | Flex | | Office | | Total | | | | | | | | |

| Northern California | 99.2% | | 95.1% | | 71.1% | | 97.6% | | | | | | | | |

| Southern California | 98.4% | | 95.0% | | 93.0% | | 97.8% | | | | | | | | |

| Dallas | 93.1% | | 92.5% | | n/a | | 92.9% | | | | | | | | |

| Austin | 99.8% | | 90.7% | | n/a | | 94.2% | | | | | | | | |

| Northern Virginia | 99.1% | | 95.8% | | 87.2% | | 93.7% | | | | | | | | |

| South Florida | 98.0% | | 97.0% | | 100.0% | | 98.0% | | | | | | | | |

| Seattle | 97.5% | | 90.6% | | 65.0% | | 95.4% | | | | | | | | |

| Suburban Maryland | 100.0% | | n/a | | 88.6% | | 92.1% | | | | | | | | |

| Percentage by Product Type | 98.3% | | 93.5% | | 85.6% | | 96.0% | | | | | | | | |

First Quarter 2022 Supplemental Financial Reporting Package 19

| | | | | |

| Q1 2022 Production Statistics (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Portfolio Activity (1) |

| Industrial | Leasing

Volume | | Customer

Retention | | Transaction Costs

per Executed Foot | | Transaction Costs as a % of Rents (2) | | Cash Rental Rate Change (2) | | GAAP Rent Change (2) |

| Northern California | 226,000 | | | 81.0% | | $ | 2.01 | | | 3.7% | | 14.5% | | 29.6% |

| Southern California | 247,000 | | | 81.3% | | 1.94 | | | 4.3% | | 12.1% | | 23.4% |

| Dallas | 158,000 | | | 52.3% | | 3.20 | | | 9.4% | | 14.0% | | 21.1% |

| Austin | 28,000 | | | 0.0% | | 3.19 | | | 7.3% | | 19.9% | | 47.7% |

| Northern Virginia | 192,000 | | | 97.4% | | 4.54 | | | 7.6% | | 6.7% | | 17.9% |

| South Florida | 299,000 | | | 66.2% | | 1.36 | | | 2.7% | | 25.1% | | 51.0% |

| Seattle | 45,000 | | | 71.9% | | 1.80 | | | 3.1% | | 18.4% | | 37.7% |

| Suburban Maryland | 9,000 | | | 100.0% | | 1.09 | | | 3.3% | | -1.6% | | 0.5% |

| Industrial Totals by Market | 1,204,000 | | | 74.1% | | $ | 2.41 | | | 4.9% | | 15.4% | | 30.9% |

| | | | | | | | | | | |

| Flex | | | | | | | | | | | |

| Northern California | 43,000 | | | 91.5% | | $ | 0.75 | | | 2.5% | | 6.4% | | 13.1% |

| Southern California | 44,000 | | | 81.1% | | 4.88 | | | 7.6% | | 8.0% | | 20.4% |

| Dallas | 51,000 | | | 79.0% | | 2.46 | | | 8.9% | | 7.8% | | 18.9% |

| Austin | 108,000 | | | 90.3% | | 7.28 | | | 10.2% | | 5.1% | | 16.8% |

| Northern Virginia | 34,000 | | | 53.0% | | 3.74 | | | 9.9% | | -0.9% | | 0.4% |

| South Florida | 6,000 | | | 58.5% | | 2.10 | | 3.0% | | 16.6% | | 34.1% |

| Seattle | 32,000 | | | 51.1% | | 2.80 | | | 6.5% | | 7.7% | | 16.8% |

| Flex Totals by Market | 318,000 | | | 75.4% | | $ | 4.36 | | | 8.5% | | 5.9% | | 15.6% |

| | | | | | | | | | | |

| Office | | | | | | | | | | | |

| Northern California | 19,000 | | | 91.7% | | $ | 0.04 | | | 0.1% | | -6.6% | | -5.8% |

| Southern California | 1,000 | | | 30.9% | | — | | | — | | 1.0% | | 9.0% |

| Northern Virginia | 85,000 | | | 69.1% | | 9.97 | | | 16.8% | | -8.4% | | 1.1% |

| | | | | | | | | | | |

| Seattle | 1,000 | | | 100.0% | | — | | — | | 6.2% | | 15.3% |

| Suburban Maryland | 22,000 | | | 76.2% | | 8.15 | | | 23.8% | | -1.3% | | 4.0% |

| Office Totals by Market | 128,000 | | | 72.3% | | $ | 8.00 | | | 15.1% | | -6.8% | | -0.1% |

| | | | | | | | | | | | |

| Company Totals by Type | 1,650,000 | | | 74.2% | | $ | 3.22 | | | 6.4% | | 10.7% | | 23.4% |

(1)Average lease term for leases executed during the quarter-ended March 31, 2022 was 3.5 years.

(2)Refer to page 29, Definitions and Non-GAAP Disclosures, for the definitions of Transaction Costs as a Percentage of Rents, Cash Rental Rate Change, and GAAP Rent Change. First Quarter 2022 Supplemental Financial Reporting Package 20

| | | | | |

| Lease Expirations by Type (unaudited, in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Lease Expirations - Total Portfolio |

| Year of Lease Expiration | Leased Square Footage | | Annualized Rental Income (1) | | % Total | | % of Total Annualized Rental Income |

| 2022 | 4,227 | | | $ | 74,554 | | | 16.2 | % | | 16.2 | % |

| 2023 | 6,169 | | | 105,479 | | | 22.9 | % | | 22.9 | % |

| 2024 | 5,159 | | | 92,695 | | | 20.1 | % | | 20.1 | % |

| 2025 | 3,931 | | | 71,604 | | | 15.5 | % | | 15.5 | % |

| 2026 | 2,508 | | | 45,027 | | | 9.7 | % | | 9.7 | % |

| Thereafter | 3,851 | | | 71,996 | | | 15.6 | % | | 15.6 | % |

| Total | 25,845 | | | $ | 461,355 | | | 100.0 | % | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Lease Expirations - Industrial |

| Year of Lease Expiration | Leased Square Footage | | Annualized Rental Income (1) | | % of Industrial | | % of Total Annualized Rental Income |

| 2022 | 2,808 | | | $ | 41,965 | | | 14.1 | % | | 9.1 | % |

| 2023 | 4,401 | | | 65,477 | | | 22.0 | % | | 14.2 | % |

| 2024 | 3,634 | | | 58,191 | | | 19.6 | % | | 12.6 | % |

| 2025 | 2,869 | | | 44,807 | | | 15.1 | % | | 9.7 | % |

| 2026 | 1,859 | | | 29,555 | | | 9.9 | % | | 6.4 | % |

| Thereafter | 3,289 | | | 57,073 | | | 19.3 | % | | 12.4 | % |

| Total | 18,860 | | | $ | 297,068 | | | 100.0 | % | | 64.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Lease Expirations - Flex |

| Year of Lease Expiration | Leased Square Footage | | Annualized Rental Income (1) | | % of Flex | | % of Total Annualized Rental Income |

| 2022 | 911 | | | $ | 19,977 | | | 20.6 | % | | 4.4 | % |

| 2023 | 1,095 | | | 22,350 | | | 23.1 | % | | 4.9 | % |

| 2024 | 1,014 | | | 21,106 | | | 21.8 | % | | 4.6 | % |

| 2025 | 716 | | | 16,175 | | | 16.7 | % | | 3.5 | % |

| 2026 | 366 | | | 7,544 | | | 7.8 | % | | 1.6 | % |

| Thereafter | 399 | | | 9,708 | | | 10.0 | % | | 2.1 | % |

| Total | 4,501 | | | $ | 96,860 | | | 100.0 | % | | 21.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Lease Expirations - Office |

| Year of Lease Expiration | Leased Square Footage | | Annualized Rental Income (1) | | % of Office | | % of Total Annualized

Rental Income |

| 2022 | 508 | | | $ | 12,612 | | | 18.6 | % | | 2.7 | % |

| 2023 | 673 | | | 17,652 | | | 26.2 | % | | 3.8 | % |

| 2024 | 511 | | | 13,398 | | | 19.9 | % | | 2.9 | % |

| 2025 | 346 | | | 10,622 | | | 15.8 | % | | 2.3 | % |

| 2026 | 283 | | | 7,928 | | | 11.8 | % | | 1.7 | % |

| Thereafter | 163 | | | 5,215 | | | 7.7 | % | | 1.1 | % |

| Total | 2,484 | | | $ | 67,427 | | | 100.0 | % | | 14.5 | % |

(1)Annualized rental income represents annualized outgoing rents inclusive of related estimated expense recoveries. Actual rental income amounts may vary depending upon re-leasing of expiring spaces.

First Quarter 2022 Supplemental Financial Reporting Package 21

| | | | | |

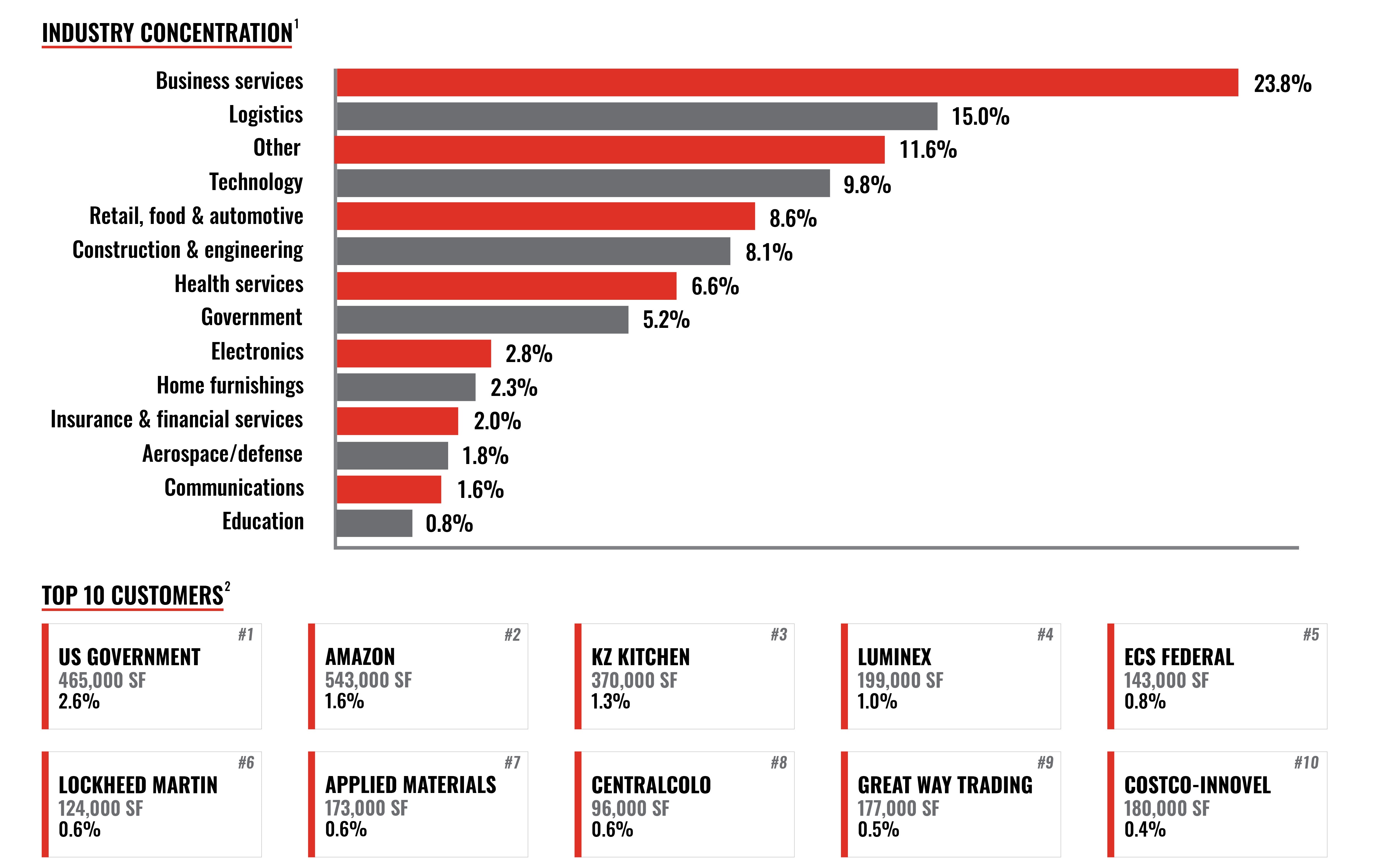

| Industry Concentration and Top Ten Customers (unaudited and dollars in thousands) |

(1)Industry concentration is categorized based on customers’ Standard Industrial Classification Code.

(2)For leases expiring within one year, annualized rental income includes only the income to be received under the existing lease from January 1, 2022 through the respective date of expiration.

First Quarter 2022 Supplemental Financial Reporting Package 22

| | | | | | | | |

| Industrial and Multifamily Development Projects (unaudited, in thousands, except SF, No of Apt Homes, and Avg. Rent Per Home) |

Industrial

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Name | Location | | | New Bldg. SF (1) | Construction Start | Construction Complete (2) | Estimated Stabilization (2) | Land Cost (3) | Project

Cost | Total

Investment | Estimated Stabilized

Cash NOI | Estimated Stabilized

Cash Yield |

| | | | | | | | | | | | |

| Under Construction | | | | | | | | | | | | |

| Boca | Boca Raton, FL | | | 17,235 | 4Q21 | 4Q22 | 4Q23 | $ | 616 | | $ | 4,200 | | $ | 4,816 | | $ | 290 | | 6.0% |

| 212 Industrial Park | Kent, WA | | | 83,152 | 4Q21 | 4Q22 | 3Q23 | 1,515 | | 16,000 | | 17,515 | | 956 | | 5.5% |

| Total/Wgt. Avg. Under Construction | | 100,387 | | | | $ | 2,131 | | $ | 20,200 | | $ | 22,331 | | $ | 1,246 | | 5.6% |

| | | | | | | | | | | | |

______________________

1 New Bldg. SF relates to new development SF (Parking lot building..etc.), New Building SF not included in Portfolio SF as of March 31, 2022.

2 Refer to page 29, Definition and Non-GAAP Disclosures, for the definition of Stabilization. 3 Land cost - Proration of the historical land basis for the overall project.

MultiFamily

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Development Name | Location | No. of Apt. Homes | Net Rentable SF (1) | Construction

Start | Construction Complete (2) | Initial Occupancy.(2) | Estimated Stabilization (3) | Land Cost (4) | Project

Cost | Total

Investment | Avg. Rent

Per Home | Estimated Stabilized Cash NOI (3) | Estimated Stabilized Cash Yield (3) |

| | | | | | | | | | | | | |

| Under Construction | | | | | | | | | | | | |

| Brentford | McLean, VA | 411 | 372,215 | 3Q20 | 1Q23 | 3Q22 | 1Q25 | $ | 18.495 | | $ | 110,000 | | $ | 128,500 | | $ | 2,543 | | TBD | TBD |

| Total/Wtd. Avg. Under Construction | 411 | 372,215 | | | | | $ | 18.495 | | $ | 110,000 | | $ | 128,500 | | $ | 2,543 | | TBD | TBD |

1 Net Rentable SF not included in Portfolio SF as of March 31, 2022.

2 Refer to page 29, Definition and Non-GAAP Disclosures, for the definition of Stabilization. 3 Construction is completed in stages. Initial Occupancy may begin as each stage is completed. Estimated stabilized cash NOI will be presented when initial occupancy is at 50%.

4 Market value of contributed parcel of land at the start of construction/project approval.

First Quarter 2022 Supplemental Financial Reporting Package 23

| | | | | | | | |

| Appendix A - Select Consolidated Balance Sheets Variance Detail (unaudited and dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| (a) | Change in cash and cash equivalents | | | | | | |

| Beginning cash balance at December 31, 2021 | | | | | | $ | 27,074 | |

| Net cash provided by operating activities | | | | | | 66,555 | |

| Net cash provided by investing activities | | | | | | 67,796 | |

| Net cash used in financing activities | | | | | | (57,221) | |

| Ending cash balance at March 31, 2022 | | | | | | $ | 104,204 | |

| | | | | | | |

| (b) | Change in real estate facilities, at cost | | | | | | |

| Beginning balance at December 31, 2021 | | | | | | $ | 1,928,085 | |

| | | | | | | |

| Recurring capital improvements | | | | | | 2,015 | |

| Tenant improvements, gross | | | | | | 3,035 | |

| Capitalized lease commissions | | | | | | 1,307 | |

| Nonrecurring capital improvements | | | | | | 1,511 | |

| Depreciation and amortization of real estate facilities | | | | | | (22,308) | |

| Transfer to land and building held for development, net | | | | | | (2,131) | |

| Transfer to properties held for sale, net | | | | | | (7) | |

| Ending balance at March 31, 2022 | | | | | | $ | 1,911,507 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | Increase |

| (c) | Change in rent receivable | | March 31, 2022 | | December 31, 2021 | | (Decrease) |

| Non-government customers | | $ | 2,381 | | | $ | 1,186 | | | $ | 1,195 | |

| U.S. Government customers | | 607 | | | 435 | | | 172 | |

| | | | | | | |

| | | $ | 2,988 | | | $ | 1,621 | | | $ | 1,367 | |

| | | | | | | |

| | | | | | | Increase |

| (d) | Change in other assets | | March 31, 2022 | | December 31, 2021 | | (Decrease) |

| Lease intangible assets, net | | $ | 7,558 | | | $ | 8,555 | | | $ | (997) | |

| | | | | | | |

| Prepaid property taxes and insurance | | 1,769 | | | 3,439 | | | (1,670) | |

| | | | | | | |

| Other | | 3,849 | | | 4,268 | | | (419) | |

| | | $ | 13,176 | | | $ | 16,262 | | | $ | (3,086) | |

| | | | | | | |

| | | | | | | Increase |

| (e) | Change in accrued and other liabilities | | March 31, 2022 | | December 31, 2021 | | (Decrease) |

| Customer security deposits | | $ | 42,944 | | | $ | 42,027 | | | $ | 917 | |

| Accrued property taxes | | 12,683 | | | 13,289 | | | (606) | |

| Customer prepaid rent | | 12,569 | | | 14,232 | | | (1,663) | |

| | | | | | | |

| Lease intangible liabilities, net | | 5,687 | | | 6,330 | | | (643) | |

| | | | | | | |

| Accrued tax liability | | 3,600 | | | 3,600 | | | — | |

| Other | | 18,026 | | 17,673 | | | 353 |

| | | $ | 95,509 | | | $ | 97,151 | | | $ | (1,642) | |

| | | | | | | |

| (f) | Change in paid-in capital | | | | | | |

| Beginning paid-in capital at December 31, 2021 | | | | | | $ | 752,444 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Exercise of stock options | | | | | | 2,101 | |

| Stock compensation expense, net | | | | | | 773 | |

| | | | | | | |

| Cash paid for taxes in lieu of stock upon vesting of restricted stock units | | | | | | (931) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Ending paid-in capital at March 31, 2022 | | | | | | $ | 754,387 | |

| | | | | | | |

| | | | | | | |

| (g) | Change in accumulated earnings | | | | | | |

| Beginning accumulated earnings at December 31, 2021 | | | | | | $ | 226,737 | |

| Net income | | | | | | 82,096 | |

| | | | | | | |

| Distributions to preferred stockholders | | | | | | (9,580) | |

| Distributions to common stockholders | | | | | | (29,010) | |

| Ending accumulated earnings at March 31, 2022 | | | | | | $ | 270,243 | |

First Quarter 2022 Supplemental Financial Reporting Package 24

| | | | | |

| Appendix B - Consolidated Statements of Operations, Quarter-to-Date (unaudited and in thousands, except per share amounts) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | Increase (Decrease) | | | | |

| | 2022 | | 2021 | | | | | | |

| (a) | Rental income: | | | | | | | | | | | |

| Same Park (1) (2) | $ | 104,096 | | | $ | 96,638 | | | $ | 7,458 | | | | | | | |

| Same Park non-cash rental income (1) (3) | 918 | | | 1,374 | | | (456) | | | | | | | |

| Non-Same Park (1) (2) | 3,074 | | | 1,270 | | | 1,804 | | | | | | | |

| Non-Same Park non-cash rental income (1) (3) | 274 | | | (24) | | | 298 | | | | | | | |

| Multifamily | 2,369 | | | 2,327 | | | 42 | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Rental income from assets sold or held for sale (4) | 2,109 | | | 6,462 | | | (4,353) | | | | | | | |

| | $ | 112,840 | | | $ | 108,047 | | | $ | 4,793 | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| (b) | Cost of operations: | | | | | | | | | | | |

| Same Park (1) | $ | 30,404 | | | $ | 28,754 | | | 1,650 | | | | | | | |

| Same Park non-cash expense (1) (5) | 496 | | | 421 | | | 75 | | | | | | | |

| Non-Same Park (1) | 1,035 | | | 417 | | | 618 | | | | | | | |

| Non-Same Park non-cash expense (1) (5) | 25 | | | 5 | | | 20 | | | | | | | |

| Multifamily | 1,224 | | | 1,067 | | | 157 | | | | | | | |

| | | | | | | | | | | | |

| Operating expenses from assets sold or held for sale (4) | 930 | | | 2,554 | | | (1,624) | | | | | | | |

| | $ | 34,114 | | | $ | 33,218 | | | $ | 896 | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| (c) | General and administrative expenses: | | | | | | | | | | | |

| Compensation expense (6) | $ | 9,286 | | | $ | 1,643 | | | $ | 7,643 | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Stock compensation expense (7) | 404 | | | 1,324 | | | (920) | | | | | | | |

| | | | | | | | | | | | |

| Professional fees and other | 1,634 | | | 1,415 | | | 219 | | | | | | | |

| | $ | 11,324 | | | $ | 4,382 | | | $ | 6,942 | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| (d) | Interest and other income: | | | | | | | | | | | |

| Management fee income | $ | 57 | | | $ | 68 | | | $ | (11) | | | | | | | |

| Interest income | 3 | | | 4 | | | (1) | | | | | | | |

| Other income | 186 | | | 184 | | | 2 | | | | | | | |

| | $ | 246 | | | $ | 256 | | | $ | (10) | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| (e) | Interest and other expense: | | | | | | | | | | | |

| Interest expense and credit facility fee (8) | $ | (140) | | | $ | (58) | | | $ | (82) | | | | | | | |

| Amortization of credit facility origination costs | (146) | | | (78) | | | (68) | | | | | | | |

| Other expense | (44) | | | (75) | | | 31 | | | | | | | |

| | $ | (330) | | | $ | (211) | | | $ | (119) | | | | | | | |