Provided within this supplemental information package are measures not defined in accordance with U.S. generally accepted accounting principles (“GAAP”). We believe our presentation of thesenon-GAAP measures assists investors and analysts in analyzing and comparing our operating and financial performance between reporting periods. Thesenon-GAAP measures discussed below are not substitutes of other measures of financial performance presented in accordance with GAAP. In addition, other real estate investment trusts (“REITs”) may compute these measures differently, so comparisons among REITs may not be helpful.

Adjusted Cost of Operations – Adjusted cost of operations represents cost of operations, excludingnon-cash stock compensation expense for employees whose compensation expense is recorded in cost of operations, which can vary significantly period to period based upon the performance of the company. The GAAP measure most directly comparable to adjusted cost of operations is cost of operations.

Cash NOI – We utilized cash NOI to evaluate the cash flow performance of our business parks. Cash NOI represents NOI adjusted to excludenon-cash items included in revenue and in cost of operations. Thenon-cash revenue includes straight-line rent, amortization of above and below market rents, net, and amortization of lease incentives and tenant improvement reimbursements. Thenon-cash expenses are equal to stock compensation expense for employees whose compensation expense is recorded in cost of operations. We believe that cash NOI assists investors in analyzing cash flow performance of our business parks. The GAAP measure most directly comparable to cash NOI is net income.

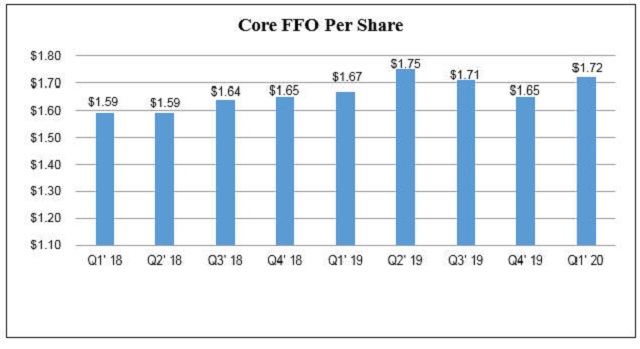

Core FFO and Core FFO per share – Core FFO represents FFO excluding the net impact of (i) income allocated to preferred shareholders to the extent redemption value exceeds the related carrying value and (ii) other nonrecurring income or expense items as appropriate. Core FFO per share represents Core FFO allocable to diluted shares and units divided by the weighted average diluted shares and units. We believe our presentation of Core FFO and Core FFO per share assists investors and analysts in analyzing and comparing our operating and financial performance between reporting periods. The GAAP measures most directly comparable to Core FFO and Core FFO per share are net income and earnings per share, respectively.

Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate (“EBITDAre”) – EBITDAre is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) and is often utilized to evaluate the performance of real estate companies. EBITDAre is calculated as GAAP net income before interest, depreciation and amortization and adjusted to exclude gains or losses from sales of depreciable real estate assets and impairment charges on real estate assets. We believe our presentation of EBITDAre assists investors and analysts in evaluating the operating performance of our business activities, including the impact of general and administrative expenses, and without the impact from gains or losses from sales of depreciable real estate assets. The GAAP measure most directly comparable EBITDAre is net income.

Free Cash Available after Fixed Charges– Free cash available after fixed charges represents FAD less dividends and distributions.

Funds Available for Distribution (“FAD”) – FAD is anon-GAAP measure that represents Core FFO adjusted to (a) deduct recurring capital improvements that maintains the condition of our real estate, tenant improvements and lease commissions and (b) remove certainnon-cash revenue or expenses such as straight-line rent andnon-cash stock compensation expense. We believe our presentation of FAD assists investors and analysts in analyzing and comparing our operating and financial performance between reporting periods. FAD is not a substitute for GAAP net cash flow in evaluating our liquidity or ability to pay dividends, because they exclude investing and financing activities presented on our statements of cash flows. The GAAP measure most directly comparable to FAD is operating cash flow from our statements of cash flows.

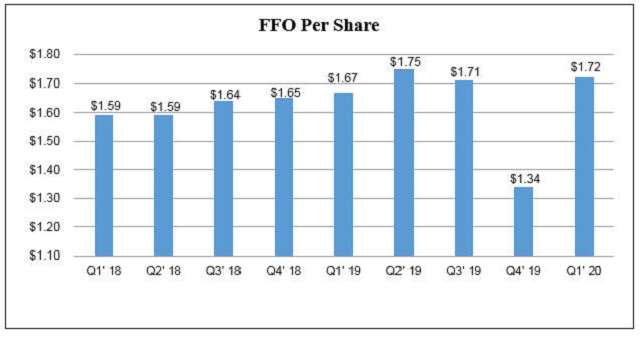

Funds from Operations (“FFO”) and FFO per share – FFO and FFO per share arenon-GAAP measures defined by NAREIT and are considered helpful measures of REIT performance by REITs and many REIT analysts. FFO represents GAAP net income before real estate depreciation and amortization expense, gains or losses on sales of operating properties and land and impairment charges on real estate assets, which are excluded because it does not accurately reflect changes in the value of our business parks. FFO per share represents FFO allocable to diluted shares and units, divided by aggregate diluted shares and units. The GAAP measure most directly comparable to FFO and FFO per share are net income and earnings per share, respectively.

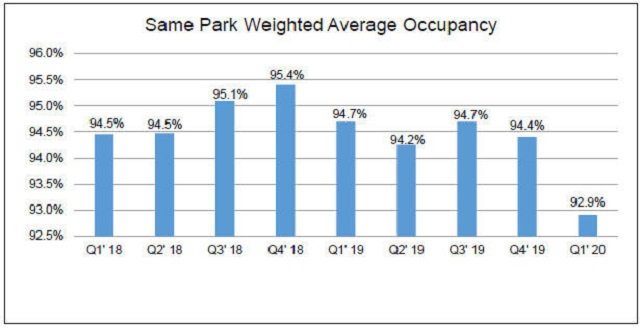

Net Operating Income (“NOI”) – We utilize NOI, anon-GAAP financial measure, to evaluate the operating performance of our business parks. We define NOI as rental income less adjusted cost of operations (described below). We believe NOI assists investors in analyzing the performance and value of our business parks by excluding (i) corporate overhead (i.e. general and administrative expenses) because it does not relate to the results of our business parks, (ii) depreciation and amortization expense because it does not accurately reflect changes in the fair value of our business parks and (iii) stock compensation expense because this expense item can vary significantly from period to period and thus impact comparability across periods. The GAAP measure most directly comparable to NOI is net income.

Retained Cash – Retain cash represents free cash available after fixed charges less(i) non-recurring property renovations and funds used for development and redevelopment.

3