- FLEX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Flex (FLEX) DEF 14ADefinitive proxy

Filed: 25 Jun 24, 4:06pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant |  | Filed by a party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

FLEX LTD.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

| No fee required |

| Fee paid previously with preliminary materials |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Message from

our CEO

| “We will continue to execute on our strategy to unlock the full potential of Flex.” |

Revathi Advaithi

CEO

June 25, 2024

Dear Shareholders and Colleagues,

We set our Flex Forward strategy five years ago with the goal of creating shareholder value through profitable growth and margin expansion, leading to greater financial resiliency through the cycles. This result would come from winning the right kind of growth, expanding our services, and continuing to build upon our operational excellence. Ultimately, this is about solving complexity, and delivering greater value for our customers.

This strategy has been tested repeatedly over the last several years, and each time we have demonstrated it is working. I am very proud of our performance in fiscal 2024, particularly as we navigated a highly dynamic environment, while making progress towards our longer-term goals. We achieved record adjusted margins, delivered another year of double-digit adjusted earnings-per-share growth over the prior year, and generated substantial value for our shareholders.

Importantly, these results demonstrate the resiliency we have built into our business as we continue to navigate the various macrocycles effectively. Through these challenges, we continue to help our customers solve increased complexity and deliver on our commitments to our stakeholders.

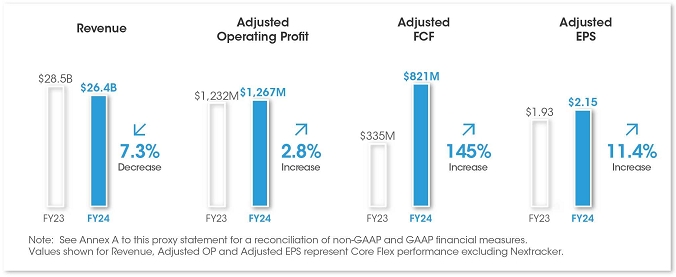

Financial Outcomes*

Fiscal 2024 was another milestone year for Flex. Based on Flex continuing operations (excluding Nextracker), we achieved record annual adjusted operating margins of 4.8%, up 50 basis points from fiscal 2023. We delivered 11% adjusted earnings-per-share growth, reaching a record $2.15. All of this was accomplished despite a 7% revenue decline due to the increased headwinds in the global economy.

We currently exist in a time where macro uncertainty is more of the norm rather than the exception. We believe Flex is in a much better position to manage through these times and it is reflected in our results. For example, over the last three years, as revenue grew at a 5% compounded annual growth rate, adjusted operating margins expanded by over 100 basis points, and this is the fourth year in a row we’ve generated double-digit adjusted EPS growth.

Additionally, these global disruptions are also driving business opportunities for Flex, as companies look for help navigating regionalization trends and structural disruptions to value chains.

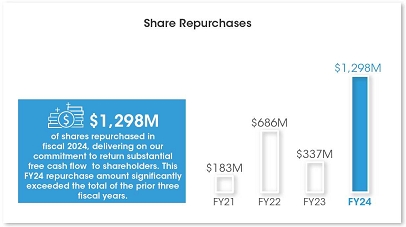

This year, we returned a record $1.3 billion to shareholders through stock repurchases. We also completed the Nextracker separation on January 2nd. Our decision and subsequent actions to separate Nextracker generated substantial value through multiple phases of the transaction. This included the initial public offering, a follow-on

* See Annex A to our proxy statement for a reconciliation of GAAP to non-GAAP financial measures referenced in this letter.

offering, and finally the tax-free spin-off of our remaining interest in Nextracker to our shareholders, which alone returned value of approximately $3.5 billion.

Flex Forward Strategy

We continue to make progress on our transformative long-term strategy, shifting to higher value business, expanding our service offerings, and building on our Flex product portfolio in cloud power and automotive.

In the early phases of our strategic shift, we prioritized higher-value end markets with favorable secular drivers and profitability profiles, such as cloud, automotive, industrial, and healthcare. We have also worked to build synergies across the Flex platform, including areas of technical expertise, vertical integration, and value-added services.

In fiscal 2024, our cross-industry expertise strategy continued to bear fruit particularly in the cloud and automotive end markets. Through focused investment in advanced compute and power systems expertise our cloud-facing business reached $3 billion. This is a combination of $2 billion from our AI-supportive customized, fully integrated rack solution, including liquid-cooling capabilities, in our CEC business unit, and $1 billion from our data center power products portfolio, that falls under our Industrial business unit.

We are differentiated by providing the most comprehensive data center offering in the industry. Our end-to-end manufacturing services and capabilities across the globe are unmatched, including components, metal fabrication, vertical integration, logistics, post-sale services, and more.

Furthermore, Flex is the only EMS provider with its own comprehensive set of data center power products, from embedded power at the board and rack level to critical facilities power, with a portfolio that is truly grid-to-chip.

Our cross-industry expertise in compute and power also extends into the automotive sector. All vehicles, regardless of the powertrain type, are becoming more like “edge data centers on wheels.” Additionally, the adoption of EV and hybrid powertrains adds further challenges, requiring more complex power systems.

We are providing more than just hardware manufacturing. Our flexible business model differentiates us in the market giving us a broad spectrum of collaborative engagements with top automakers, including both joint and full product design within compute and power. We see our offerings resonating with automakers as fiscal 2024 was another strong year of new wins following back-to-back years of record new program wins.

Data center and automotive are two markets with very strong, long-term secular drivers. Given our positioning and the strong market growth dynamics, we believe these two businesses combined can reach approximately 40% of Flex total revenue, as we look out towards fiscal 2029.

Manufacturing Services Excellence

Our strong ability to execute comes from our foundation in manufacturing services. We are always focused on increasing our technical capabilities, driving faster deployment and greater efficiencies through our advanced, flexible automation strategy, and ensuring we have the optimal global footprint to effectively support our customers in a regionalizing world.

On this foundation, we continue to expand our services and vertical integration capabilities to serve more of our customers’ needs and increase our addressable market.

We started our journey to expand these services years ago, where we saw the opportunity to move beyond simple electronics production. We expanded into high-performance plastics and metals, and created vast components services, and global logistics and refurbishment capabilities.

Putting this all together, our global network of integrated manufacturing and service locations increases resiliency and time to market. Our initiatives and investments in automation, capabilities, and systems enable us to achieve productivity gains to help drive margins and prepare us for the future.

Looking Forward

We expect fiscal 2025 to experience similar economic headwinds in the global economy as we saw in fiscal 2024. Despite these challenges, fiscal 2025 should be another year of strong strategic and financial progress.

We will navigate the near-term currents, invest in our future opportunities, and continue to execute on our strategy to unlock the full potential of Flex. We remain very optimistic about our future, and we greatly appreciate the continued partnership of our customers, colleagues, and our shareholders.

Regards,

FLEX LTD.

(Incorporated in the Republic of Singapore)

(Company Registration Number 199002645H)

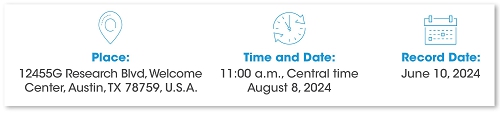

Thursday 11:00 a.m., Central time

Flex Ltd. 12455G Research Blvd, Welcome Center Austin, TX 78759 U.S.A.

| Notice of Annual General Meeting of Shareholders To Be Held on August 8, 2024

To Our Shareholders:

You are cordially invited to attend, and notice is hereby given of, the annual general meeting of shareholders of Flex Ltd., which will be held at our offices located at 12455G Research Blvd, Welcome Center, Austin, TX 78759 U.S.A., at 11:00 a.m., Central time, on August 8, 2024, for the purposes summarized below and described in more detail in the accompanying proxy statement.

We urge you to read the entire proxy statement carefully before voting. Unless the context requires otherwise, references in this notice and the proxy statement to “Flex,” the “Company,” “we,” “us,” “our” and similar terms mean Flex Ltd. or, as the case may be, Flex Ltd. and its subsidiaries. Flex is incorporated in the Republic of Singapore under the Companies Act 1967, which we refer to as the “Singapore Companies Act” or the “Companies Act 1967”. | |||

Vote via Internet at www.proxyvote.com |  | |||

| Vote by Mail Sign and return your proxy card in the postage-paid envelope |  | |||

| Vote in Person at the Meeting on August 8, 2024 at 11:00 a.m., Central time |  | |||

| Please refer to our proxy materials or the information forwarded by your bank or other holder of record to see which voting methods are available to you. | ||||

| 2024 Proxy Statement |

We are pleased to furnish proxy materials to our shareholders on the Internet, as permitted by Securities and Exchange Commission (“SEC”) rules. Commencing on or about June 25, 2024, we will make available to our shareholders (including all of our registered shareholders) a Notice of Availability of Proxy Materials on the Internet (referred to as the Notice) containing instructions on how to: (i) access the proxy statement and our annual report, (ii) submit their proxies via the Internet, and (iii) request a printed copy of our proxy materials.

You may revoke your proxies at any time before they are voted. Registered shareholders who are present at the meeting may revoke their proxies and vote in person or, if they prefer, may abstain from voting in person and allow their proxies to be voted.

We are asking shareholders to vote on five proposals at the meeting:

| • | To re-elect all nine directors of the Company nominated for re-election (Proposal No. 1); |

| • | To approve the re-appointment of Deloitte & Touche LLP as our independent auditors for the 2025 fiscal year and to authorize the Board of Directors, upon the recommendation of the Audit Committee, to fix their remuneration (Proposal No. 2); |

| • | To approve, on a non-binding, advisory basis, our executive compensation (Proposal No. 3); |

| • | To approve a general authorization for the Board of Directors to allot and issue ordinary shares (Proposal No. 4); and |

| • | To approve a renewal of the Share Purchase Mandate permitting Flex to purchase or otherwise acquire its own issued ordinary shares (Proposal No. 5). |

Each of the resolutions proposed for approval by our shareholders is as follows:

| 1. | To re-elect each of the following Directors, who will retire pursuant to Article 94 of our Constitution, to the Board of Directors: |

| (a) | Revathi Advaithi; | |

| (b) | John D. Harris II; | |

| (c) | Michael E. Hurlston; | |

| (d) | Erin L. McSweeney; | |

| (e) | Charles K. Stevens, III; | |

| (f) | Maryrose T. Sylvester; | |

| (g) | Lay Koon Tan; | |

| (h) | Patrick J. Ward; and | |

| (i) | William D. Watkins. |

| 2. | To consider and vote upon a proposal to re-appoint Deloitte & Touche LLP as our independent auditors for the fiscal year ending March 31, 2025, and to authorize our Board of Directors, upon the recommendation of the Audit Committee of the Board of Directors, to fix their remuneration. |

Each of the resolutions proposed for approval or vote by our shareholders is shown below:

| 3. | To consider and vote on the following non-binding, advisory resolution: |

| “RESOLVED THAT, the shareholders of Flex approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers, as disclosed pursuant to Item 402 of SEC Regulation S-K, including the Compensation Discussion and Analysis and the compensation tables and related disclosures contained in the section of the accompanying proxy statement captioned ‘Executive Compensation’.” |

| 2024 Proxy Statement |

| This resolution is being proposed to shareholders as required pursuant to Section 14A of the U.S. Securities Exchange Act of 1934, as amended. The shareholders’ vote on this resolution is advisory and non-binding in nature, will have no legal effect and will not be enforceable against Flex or its Board of Directors. |

| 4. | To pass the following resolution as an Ordinary Resolution: |

| “RESOLVED THAT, pursuant to the provisions of Section 161 of the Companies Act 1967, but subject otherwise to the provisions of the Companies Act 1967 and the Constitution of the Company, authority be and hereby is given to our Directors to: |

| (a) | (i) | allot and issue ordinary shares in the capital of the Company (“Ordinary Shares”); and/or | |

| (ii) | make or grant offers, agreements, options, performance shares, performance units, restricted share units, or other compensatory equity awards (each, an “Instrument” and, collectively, “Instruments”) that might or would require Ordinary Shares to be allotted and issued, whether after the expiration of this authority or otherwise (including but not limited to the creation and issuance of warrants, debentures or other instruments convertible into Ordinary Shares), | ||

| at any time to and/or with such persons and upon such terms and conditions and for such purposes as our Directors may in their absolute discretion deem fit, and with such rights or restrictions as our Directors may think fit to impose and as are set forth in the Constitution of the Company; and | |||

| (b) | (notwithstanding that the authority conferred by this resolution may have ceased to be in force) allot and issue Ordinary Shares pursuant to any Instrument made or granted by our Directors while this resolution was in force, provided that: |

| (i) | the aggregate number of Ordinary Shares to be issued pursuant to this resolution (including Ordinary Shares to be issued pursuant to Instruments made or granted pursuant to this resolution) does not exceed 20% of the total number of issued Ordinary Shares as of the date of the passing of this resolution; and | |

| (ii) | unless revoked or varied by the Company in a general meeting, that such authority shall continue in force until the earlier of (1) the conclusion of the next annual general meeting of the Company or (2) the expiration of the period within which the next annual general meeting of the Company is required by law to be held.” |

| 5. | To pass the following resolution as an Ordinary Resolution: |

| “RESOLVED THAT: |

| (a) | for the purposes of Sections 76C and 76E of the Companies Act 1967, the exercise by our Directors of all of our powers to purchase or otherwise acquire issued ordinary shares in the capital of the Company (“Ordinary Shares”) not exceeding in aggregate the number of issued Ordinary Shares representing 20% of the total number of issued Ordinary Shares outstanding as of the date of the passing of this resolution (excluding treasury shares and any Ordinary Shares which are held by our subsidiary(ies) under Sections 21(4B) or 21(6C) of the Companies Act 1967, as at that date) at such price or prices as may be determined by our Directors from time to time up to the maximum purchase price described in paragraph (c) below, whether by way of: |

| (i) | market purchases on the Nasdaq Global Select Market or any other stock exchange on which our Ordinary Shares may for the time being be listed and quoted; and/or | |

| (ii) | off-market purchases (if effected other than on the Nasdaq Global Select Market or, as the case may be, any other stock exchange on which our Ordinary Shares may for the time being be listed and quoted) in accordance with any equal access scheme(s) as may be determined or formulated by our Directors as they consider fit, which scheme(s) shall satisfy all the conditions prescribed by the Companies Act 1967, | |

| and otherwise in accordance with all other laws and regulations and rules of the Nasdaq Global Select Market or, as the case may be, any other stock exchange on which our Ordinary Shares may for the time being be listed and quoted as may be applicable, be and hereby is authorized and approved generally and unconditionally; | ||

| (b) | unless varied or revoked by our shareholders in a general meeting, the authority conferred on our Directors pursuant to the mandate contained in paragraph (a) above may be exercised by our Directors at any time and from time to time during the period commencing from the date of the passing of this resolution and expiring on the earlier of: |

| (i) | the date on which the next annual general meeting of the Company is held; or | |

| (ii) | the date by which the next annual general meeting of the Company is required by law to be held; |

| 2024 Proxy Statement |

| (c) | the maximum purchase price (excluding brokerage, commission, applicable goods and services tax, and other related expenses) that may be paid for an Ordinary Share purchased or acquired by the Company pursuant to the mandate contained in paragraph (a) above, shall not exceed: |

| (i) | in the case of a market purchase of an Ordinary Share, the highest independent bid or the last independent transaction price, whichever is higher, of our Ordinary Shares quoted or reported on the Nasdaq Global Select Market or, as the case may be, any other stock exchange on which our Ordinary Shares may for the time being be listed and quoted, or shall not exceed any volume weighted average price, or other price determined under any pricing mechanism, permitted under SEC Rule 10b-18, at the time the purchase is effected; and | |

| (ii) | in the case of an off-market purchase pursuant to an equal access scheme, at a premium of up to but not greater than 5% above the average of the closing price per Ordinary Share over the five trading days before the day on which the purchases are made; and |

| (d) | our Directors, acting independently or individually, be and hereby are authorized to complete and do all such acts and things (including executing such documents as may be required) as such Director(s) may consider expedient or necessary to give effect to the transactions contemplated and/or authorized by this resolution.” |

At the 2024 annual general meeting, our shareholders will have the opportunity to discuss and ask any questions that they may have regarding our Singapore audited financial statements for the fiscal year ended March 31, 2024, together with the directors’ statement and auditors’ report thereon, in compliance with Singapore law. Shareholder approval of our audited financial statements is not being sought by the accompanying proxy statement and will not be sought at the 2024 annual general meeting.

Receipt of Notice. The Board of Directors has fixed the close of business on June 10, 2024 as the record date for determining those shareholders of the Company who are entitled to receive copies of this notice and accompanying proxy statement. However, all shareholders of record on August 8, 2024, the date of the 2024 annual general meeting, will be entitled to vote at the 2024 annual general meeting.

Representation in person or by proxy of at least 33-1/3% of all outstanding Ordinary Shares of the Company is required to constitute a quorum to transact business at a general meeting of our shareholders.

A shareholder entitled to attend and vote at the 2024 annual general meeting is entitled to appoint a proxy to attend and vote on the shareholder’s behalf. A proxy need not also be a shareholder. Even if you plan to attend the meeting, we encourage you to vote promptly. You may vote your shares through one of the methods described in the enclosed proxy statement. A proxy card submitted by mail must be received by Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717 not less than 48 hours before the time appointed for holding the 2024 annual general meeting. Please review the instructions on the proxy card and notice of availability of proxy materials regarding the submission of proxies via the Internet, which provide, among other things, for the transmission of voting instructions up until 11:59 p.m. Eastern time on the day before the meeting. You may revoke your proxy at any time before it is voted. Registered shareholders who are present at the meeting may revoke their proxies and vote in person or, if they prefer, may abstain from voting in person and allow their proxies to be voted.

Only funds legally available for purchasing or acquiring our issued Ordinary Shares in accordance with our Constitution and the applicable laws of Singapore will be used by us to purchase or acquire our own issued Ordinary Shares pursuant to the proposed renewal of the Share Purchase Mandate referred to in this notice. We intend to use our internal sources of funds and/or borrowed funds to finance the purchase or acquisition of our issued Ordinary Shares. The amount of financing required for us to purchase or acquire our issued Ordinary Shares, and the impact on our financial position, cannot be ascertained as of the date of this notice, as these will depend on, among other things, the number of Ordinary Shares purchased or acquired, the price at which such Ordinary Shares are purchased or acquired, and whether

| 2024 Proxy Statement |

the Ordinary Shares purchased or acquired are held in treasury or cancelled. Our net tangible assets and the consolidated net tangible assets of the Company and its subsidiaries will be reduced by the purchase price (including any expenses) of any Ordinary Shares purchased or acquired and cancelled or held as treasury shares. We do not anticipate that the purchase or acquisition of our Ordinary Shares in accordance with the Share Purchase Mandate would have a material impact on our financial condition and cash flows.

By submitting an instrument appointing a proxy or representative to attend, speak and vote at the 2024 annual general meeting and any adjournment thereof, a shareholder of the Company (i) consents to the collection, use and disclosure of the shareholder’s personal data by us (or our agents or service providers) so we (or our agents or service providers) can process, administer and analyze proxies and representatives appointed for the 2024 annual general meeting (including any adjournment thereof) and prepare and compile the attendance lists, minutes and other documents relating to the 2024 annual general meeting (including any adjournment thereof), and in order for us (or our agents or service providers) to comply with any applicable laws, listing rules, take-over rules, regulations or guidelines (collectively, the “Purposes”), (ii) warrants that where the shareholder discloses the personal data of the shareholder’s proxy or representative to us (or our agents or service providers), the shareholder has obtained the prior consent of such individual for the collection, use and disclosure by us (or our agents or service providers) of such personal data for the Purposes, and (iii) agrees that the shareholder will indemnify us in respect of any penalties, liabilities, claims, demands, losses and damages as a result of the shareholder’s breach of warranty.

By order of the Board of Directors,

Tay Hong Chin Regina

Company Secretary

Singapore

June 25, 2024

You should read the entire proxy statement carefully before you return your proxy card or otherwise submit your proxy appointment through electronic communications in the manner set out in the proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the 2024 Annual General Meeting of Shareholders to Be Held on August 8, 2024. This notice of the annual general meeting, our proxy statement and our annual report to shareholders are available on our website at https://investors.flex.com/financials/annual-reports/.

| 2024 Proxy Statement |

Table of Contents

| 2024 Proxy Statement i |

This summary highlights selected information in this proxy statement. Please review the entire proxy statement and our 2024 Annual Report on Form 10-K before voting.

| Proposal | Recommendation | Page Reference | |||

| 1. | Re-election of directors |  | FOR each director nominee | 33 | |

| 2. | Re-appointment of Deloitte & Touche LLP |  | FOR | 42 | |

| 3. | Advisory vote on executive compensation |  | FOR | 45 | |

| 4. | General authorization to allot and issue ordinary shares |  | FOR | 84 | |

| 5. | Authorization to repurchase ordinary shares |  | FOR | 85 | |

Each Ordinary Share is entitled to one vote for each director nominee and one vote for each of the other proposals. Your vote is important to us, and we encourage you to vote using one of these methods:

| Vote in Person at the Meeting |  | If you are a beneficial holder and hold your shares through a bank, broker, or other nominee, you must request a “legal proxy” from the nominee in order to vote at the meeting. You will find instructions on how to request a “legal proxy” at www.proxyvote.com. |

| Vote via Internet |  | at www.proxyvote.com Follow the instructions on your Notice. If you are a beneficial holder and hold your shares through a bank, broker, or other nominee, your nominee may not permit you to vote online. |

| Vote by |  | Sign and return your proxy card. If you do not have a proxy card, you can request one by contacting us at: |

| Flex Ltd. 12455G Research Blvd Austin, Texas 78759, U.S.A. Telephone: (512) 425-4100 | ||

| 2024 Proxy Statement 1 |

Flex is the advanced, end-to-end manufacturing partner of choice that helps market-leading brands design, build, deliver and manage innovative products that improve the world. Through the collective strength of a global workforce across approximately 30 countries with responsible, sustainable operations, Flex supports our customers’ entire product lifecycle with a broad array of services in every major region. Our full suite of specialized capabilities includes design and engineering, supply chain, manufacturing, post-production and post-sale services. Flex partners with customers across a diverse set of industries including cloud, communications, enterprise, automotive, industrial, consumer devices, lifestyle, healthcare, and energy.

Our purpose is to make great products for our customers that create value and improve people’s lives. Our vision is to be the most trusted global technology, supply chain and manufacturing solutions partner to improve the world, and our mission is to achieve our vision and fulfill our purpose. People are at the heart of everything we do. We believe in creating a work environment that empowers every team member to thrive, while prioritizing employee safety, well-being and inclusiveness. Flex continues to further a dynamic, ever-evolving culture where employees embody behaviors aligned with our values. Our values define and drive us and our Ways of Working bring our values to life through actions, provide a framework for how we make decisions and support ongoing progress on our Flex Forward strategy.

Our strategy is to continue investing in areas where we can differentiate and add value, whether through product lifecycle capabilities, manufacturing and product technologies or developing differentiated processes and business methods. For example, we have developed a comprehensive set of data center power products, from embedded power at the board and rack level to critical facilities power solutions, which, combined with our traditional data center contract manufacturing business, provide integrated end to end solutions for our customers. We are strengthening our capabilities in factory automation, robotics, artificial intelligence, simulation, digital twins, connectivity and other disruptive technologies. We select ethical partners and integrate the supply chain so that our customers can operate efficiently and responsibly. We are committed to investing in our employees and communities, which includes addressing critical environmental issues.

Our two reporting business segments are as follows(1):

| FLEX RELIABILITY SOLUTIONS | Automotive power electronics, compute platforms, and motion and interfaces across powertrains Health Solutions medical devices, medical equipment, and drug delivery Industrial industrial devices, embedded and critical power, capital equipment, and renewables | FLEX AGILITY SOLUTIONS | Communications, Enterprise and Cloud data center, edge, and communications infrastructure Lifestyle appliances, floorcare, audio, and smart living Consumer Devices mobile and high-velocity consumer devices | ||

| (1) | On January 2, 2024, Flex completed the spin-off (the “Spin-off”) of its remaining interests in Nextracker Inc. (“Nextracker”) to Flex shareholders on a pro-rata basis based on the number ordinary shares of Flex held by each shareholder of Flex (the “Distribution”) as of December 29, 2023, which was the record date of the Distribution, pursuant to the Agreement and Plan of Merger, dated as of February 7, 2023.As a result of the completion of the Spin-off, Nextracker became a fully independent public company, we no longer directly or indirectly hold any shares of Nextracker common stock or any securities convertible into or exchangeable for shares of Nextracker common stock and subsequent to the third quarter ended December 31, 2023 we no longer consolidate Nextracker into our financial results. We now report our financial performance based on the above two operating and reportable segments. |

| 2024 Proxy Statement 2 |

During fiscal year 2024, we navigated a highly dynamic environment, and delivered solid results. This is reflective of our execution, resiliency, and dedication to deliver for our customers and all our stakeholders. Our combination of manufacturing capabilities, cross-industry expertise, products, and services continued to create points of differentiation and contributed to our success in key markets.

We returned $1.298 billion to investors in fiscal year 2024, through the largest stock repurchases in a single year. We also completed the final step in unlocking the value of Nextracker’s utility-scale solar tracker business, demonstrating our willingness to optimize the value of our portfolio of assets. On January 2, 2024, Flex completed the tax-free Spin-off of all of its approximately $3.5 billion remaining interest in Nextracker to Flex shareholders on a pro rata basis.

Our vision is to become the most trusted global technology, supply chain, and manufacturing solutions partner to improve the world. Sustainability is a cornerstone to making that vision a reality.

Building on over 20 years of sustainability investment, our disciplined practices stand strong to help address broader environmental and social challenges, cultivate a workplace that empowers every team member to thrive, lead with integrity, and accelerate a more sustainable value chain.

Our efforts have been widely recognized, garnering awards for our sustainability program and efforts from the Manufacturing Leadership Council and from the Sustainability Environmental Achievement and Leadership (SEAL) Award in the Sustainable Service category. In addition, Environment & Energy Leader Awards recognized the Flex Supplier Greenhouse Gas Emissions Reduction Program as a Top Project of the Year. Below are some highlights of our sustainability practices.

| 2030 Sustainability Goals | Continuing our purpose-driven journey, we made progress toward our 2030 sustainability goals against a framework centered on our world, our people, and our approach to business practices spanning several pillars. | ||

| Commitment to Net Zero GHGs by 2040 | In 2022, we announced our commitment to reach net zero greenhouse gas (GHG) emissions by 2040. | ||

| Diversity, Equity and Inclusion (DE&I) | Diversity, equity, and inclusion are key priorities and strengths at Flex and are embedded in the fabric of our culture. We continued efforts in support of our corporate goals to increase the number of employees and leaders from underrepresented groups and are focused on evolving strategies and programs to help improve representation and promote diversity across the organization. As of March 31, 2024, women represented 44% of our global employees, and underrepresented minorities represented 52% of our U.S. employees. | ||

| Flex Foundation | We partner with nonprofit organizations, community leaders and governments to promote inclusive and sustainable economic growth, employment, and decent work for all. We help protect the environment, support resource conservation and provide disaster relief. We accomplish this through grants, corporate and employee donations, and volunteerism. In calendar year 2023, our Flex Foundation partnered with several organizations, including the American Red Cross, Dress for Success, United Way of Chennai, and WWF Romania, among others, and donated more than $1,400,000 in grants to support well-known organizations globally, including Give2Asia and Save the Children. | ||

| 2024 Proxy Statement 3 |

Flex strives for excellence in corporate governance practices, which we recognize is fundamental to maintaining the trust of our shareholders, customers, and employees. Flex’s management and its Board of Directors (the “Board” or the ”Board of Directors”) continually evaluate our processes and implement procedures designed to maintain strong governance and operational standards.

| Board Structure and Independence | |

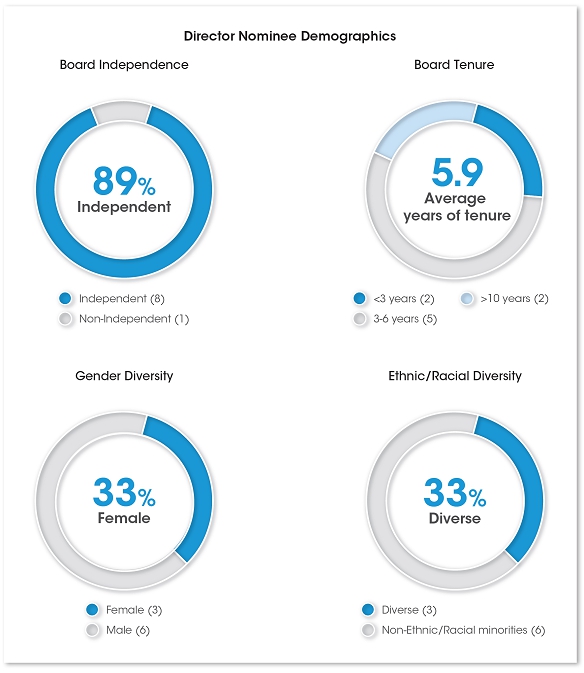

| • | Highly qualified Board with a diverse mix of perspectives and tenures, and a highly engaged independent Chair with clearly delineated duties |

| • | All directors are independent except for our CEO, and all 3 committees are fully independent |

| • | Continuously evaluate Board composition, and perform an annual review and determination of our Board leadership structure. In May 2024, we announced Board leadership changes consistent with our Board succession plan. |

| • | Purposefully nominate directors with diverse backgrounds and skillsets to best oversee the management of Flex |

| • | Active Board refreshment: Since June 2020, five new directors have joined our diverse and deeply experienced Board; average tenure of our nominees is 5.9 years. The current slate of directors represents a balance of short-, mid- and longer-term tenures of service. |

| • | Regular executive sessions of independent directors without management present |

| Board Oversight | |

| • | We regularly assess our corporate governance structure designed to maintain high standards of oversight and accountability |

| • | Board fully engaged in Flex’s strategic planning process, conducting an in-depth strategy review and overseeing progress throughout the year |

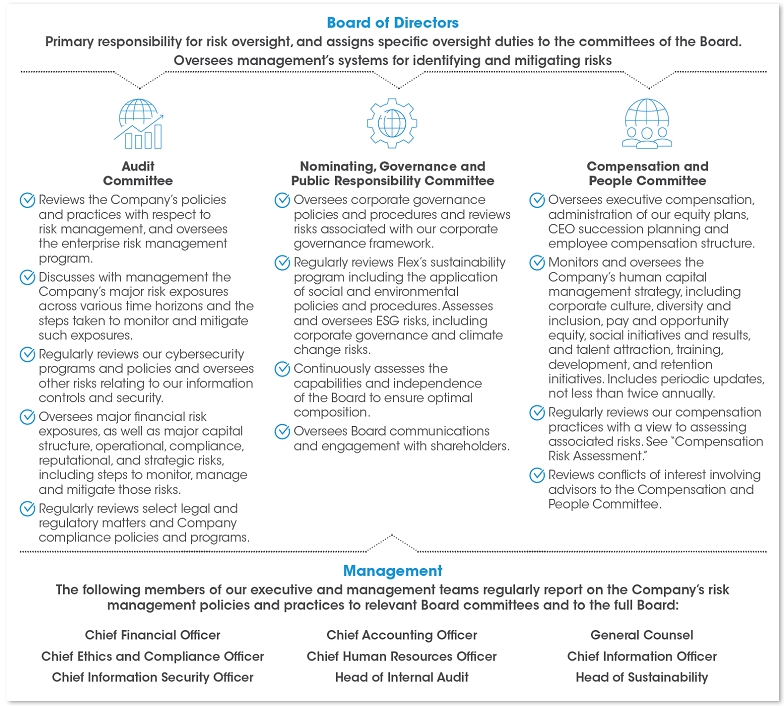

| • | The Audit Committee oversees the integrity of the Company’s financial statements, as well as management of enterprise-wide risks and legal, compliance and cybersecurity risks |

| • | The Compensation and People Committee oversees the Company’s executive compensation programs to align with long-term Company strategy and its human capital management strategy, as well as key talent metrics |

| • | The Nominating, Governance and Public Responsibility Committee oversees the application of the Company’s corporate governance and sustainability policies, considering such matters as human rights, social issues, climate change and environmental risks and opportunities, and continuously assesses the capabilities and independence of the Board to ensure optimal composition |

| • | Directors have significant interaction with senior business leaders and access to other employees |

| Strong Corporate Governance Practices | |

| • | Annual elections for all directors |

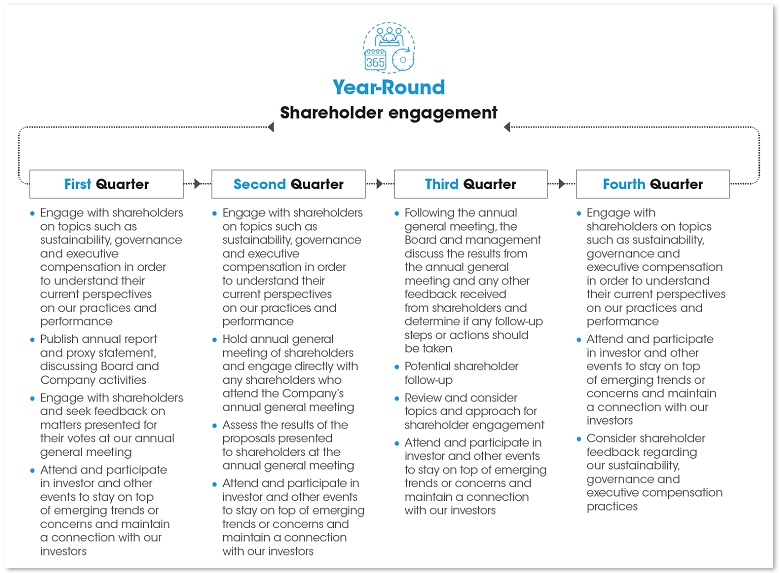

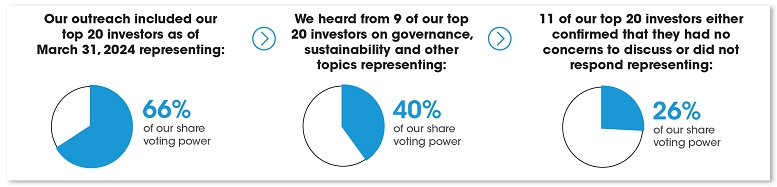

| • | Responsive, active and ongoing shareholder engagement |

| • | Prohibit short sales, hedging, and pledging of Flex securities by executive officers and directors |

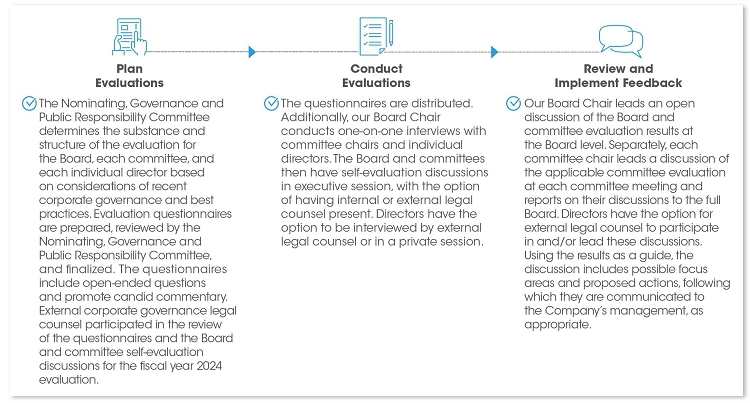

| • | Annual Board, committee and individual director evaluations, and ongoing attention to Board composition and refreshment |

| • | Limits on outside public company board service |

| • | Clawback policy for our executive officers |

| • | Robust share ownership requirements for executive officers and directors |

| • | Comprehensive director orientation and continuing education programs |

| 2024 Proxy Statement 4 |

As previously announced, Michael D. Capellas, our current independent Chair of the Board, is not standing for re-election and will be retiring from the Board at the annual general meeting. Mr. Capellas has served on our Board for 10 years, including as Chair since 2017, and the Company is very grateful to him for his valuable contributions during his many years of dedicated Board service. In furtherance of our Board leadership succession plan, also as previously announced, William D. Watkins will succeed Mr. Capellas as our independent Chair of the Board following the annual general meeting, subject to his re-election to the Board.

You are asked to vote on the election of the following nine nominees to serve on our Board, all of whom presently serve on the Board. The information below reflects the expected membership and leadership of each of the Board’s committees after the annual general meeting. Our Board believes that its composition appropriately reflects the knowledge, experience, skills, diversity and other characteristics required to fulfill its duties.

| Board Committees | ||||||

| Name and Principal Occupation | Independent | Director Since | Audit | NG&PR | Compensation and People | Other Public Company Boards |

| Revathi Advaithi Chief Executive Officer, Flex Ltd. | No | 2019 | Uber Technologies, Inc. | |||

| John D. Harris II Retired Vice President of Business Development, Raytheon Company and Chief Executive Officer, Raytheon International, Inc. | Yes | 2020 |  | Cisco Systems, Inc. ExxonMobil Corporation Kyndryl Holdings, Inc. | ||

| Michael E. Hurlston President and Chief Executive Officer, Synaptics Incorporated | Yes | 2020 |   | Astera Labs, Inc. Synaptics Incorporated | ||

| Erin L. McSweeney Executive Vice President and Chief People Officer, UnitedHealth Group Incorporated | Yes | 2020 |  |  | None | |

| Charles K. Stevens, III Retired Executive Vice President and Chief Financial Officer, General Motors Company | Yes | 2018 |   |  | Genuine Parts Company Masco Corporation | |

| Maryrose T. Sylvester Retired U.S. Managing Director and U.S. Head of Electrification, ABB Ltd | Yes | 2022 |  | Harley-Davidson, Inc. Vontier Corporation Waste Management, Inc. | ||

| Lay Koon Tan Retired President, Chief Executive Officer and member of the Board of Directors, STATS ChipPAC Ltd. | Yes | 2012 |   | None | ||

| Patrick J. Ward Retired Vice President and Chief Financial Officer, Cummins Inc. | Yes | 2022 |   | Corteva, Inc. | ||

| William D. Watkins + Retired Chief Executive Officer, Imergy Power Systems, Inc. | Yes | 2009 |  + + | Nextracker Inc. | ||

| + | Mr. Watkins will be the independent Chair of the Board and Chair of the Nominating, Governance and Public Responsibility Committee effective upon the conclusion of the annual general meeting, subject to his re-election. |

| Chair |

| Audit Committee Financial Expert |

| 2024 Proxy Statement 5 |

| 2024 Proxy Statement 6 |

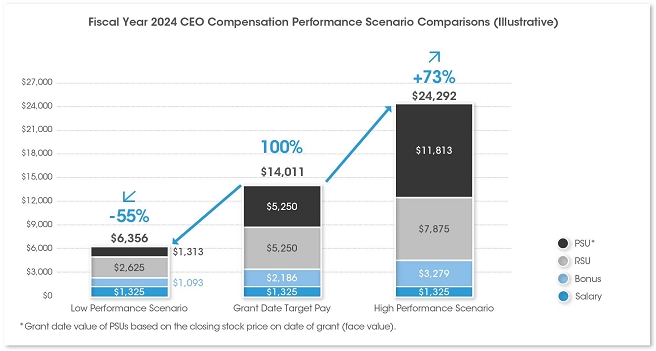

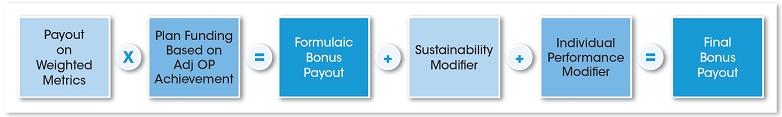

Our pay-for-performance compensation philosophy aims to tie actual pay delivery to performance. We believe above-target performance should be rewarded when achieved, and below-target performance should lead to reduced compensation, including zero payouts for incentive elements when performance thresholds are not met. We also believe we should deliver a significant portion of executive pay in the form of equity awards, which are directly aligned with value delivered to shareholders.

| Base salaries | None of our named executive officers’ (or “NEOs’”) base salaries were increased for fiscal year 2024, including our CEO. | |

| Bonus payouts | Bonus payouts ranged from 75% to 95% of target for the NEOs | |

| Individual performance and sustainability modifiers | Individual performance increased some of the NEOs’ incentive bonus payouts by 5 – 10 percentage points based on achievement of individual goals, while the Compensation and People Committee exercised its discretion to adjust the positive sustainability performance rating to neutral for the NEOs. | |

| Long-term incentive award values | Long-term incentive award values were increased for our CEO and our President, Global Operations and Components. These increases resulted in total target compensation being competitively positioned versus our compensation peer group. | |

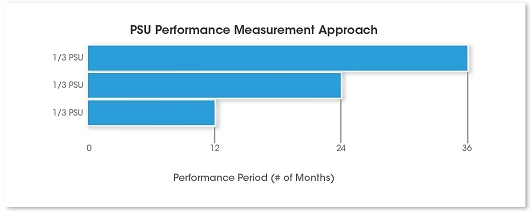

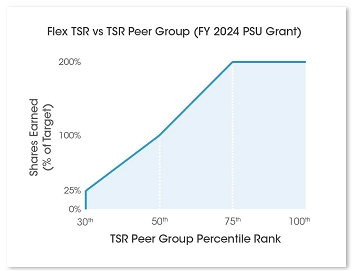

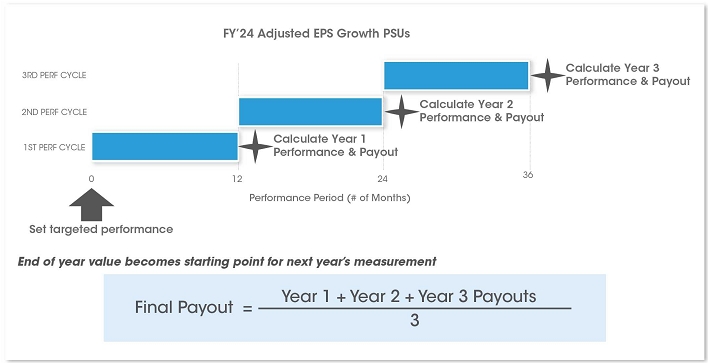

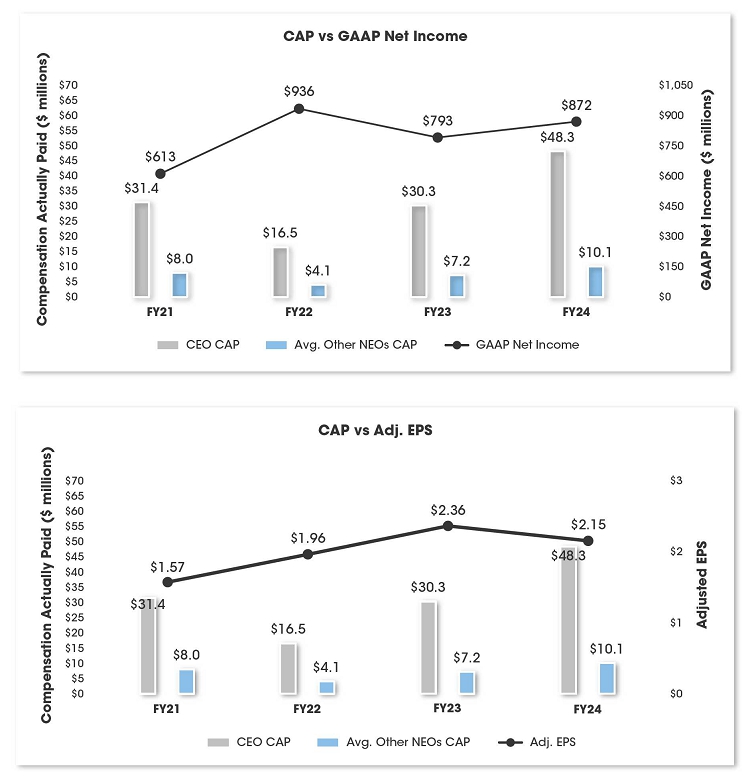

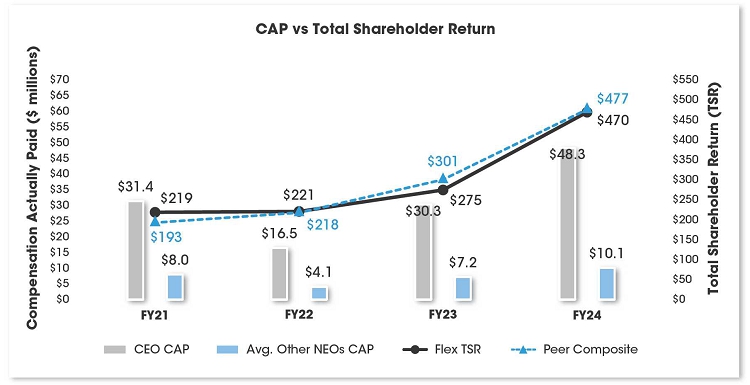

| Performance share unit (PSU) payouts = 200% | Maximum payout of 200% was earned for the relative total shareholder return (rTSR) PSUs for the three-year performance cycle ending in fiscal year 2024 (rTSR PSUs that vested in June 2023), as the maximum performance level was achieved. Maximum payout of 200% was also earned for the Adjusted EPS PSUs for the three-year performance cycle ending on March 31, 2024. |

| 2024 Proxy Statement 7 |

Flex’s purpose is to make great products for our customers that create value and improve people’s lives. Sustainability is at the core of our purpose and is embedded in our culture. We work to have a lasting positive impact in the form of value for all our stakeholders by taking an ecosystem approach to sustainability. We seek to address material issues, risks, and opportunities by conforming to internal and external standards and thoughtfully executing our social and environmental management system, programs, and initiatives.

We strive for social and environmental betterment through our robust management systems. Our sustainability system, which is modeled largely on the Responsible Business Alliance (RBA) requirements, consolidates several management systems into one, and incorporates current environmental, labor, human rights, health, safety, and ethics standards. As a founding member of the RBA, Flex is committed to modeling its requirements. Our sustainability program is aligned with international frameworks including the Global Reporting Initiative (GRI), Science Based Targets initiative (SBTi),Task Force on Climate-related Financial Disclosures (TCFD), and CDP (formerly the Carbon Disclosure Project), among others.

Through our sustainability strategy and program, we drive disciplined practices to help address the broader environmental and social challenges of our world, cultivate a workplace that enhances experiences and opportunities for our people, lead with integrity, and help accelerate a more sustainable value chain.

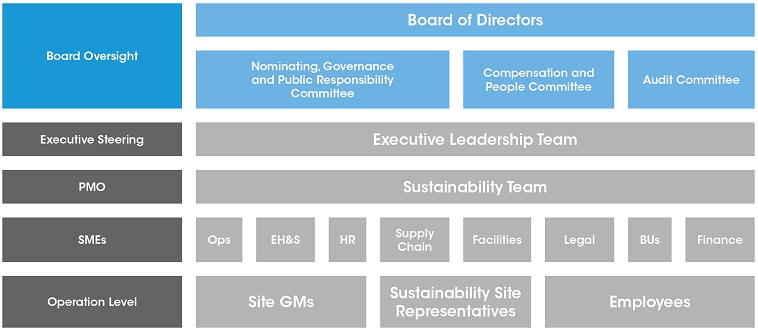

Given our commitment to sustainability, we recognize the importance of a strong foundation of sustainability governance. Our Board of Directors engages in a review of Flex’s sustainability program twice annually. Our Nominating, Governance and Public Responsibility Committee oversees Flex’s sustainability risks and remediation efforts, such as the Company’s sustainability, including environmental, social and governance, policies and programs. These policies and programs also address human rights, climate change, and risk mitigation.

Our executive management team receives regular sustainability updates, meeting with our global sustainability program office (PMO). In addition, we have a sustainability leadership committee, a multidisciplinary group composed of global leaders throughout the Company who represent the key functional areas with responsibility for sustainability efforts, including operations, human resources, supply chain, legal, finance and facilities/EHS. This committee meets monthly to share information with team members across various functions within Flex who are directly responsible for implementing and managing sustainability initiatives in support of our commitments.

| 2024 Proxy Statement 8 |

We endeavor to align our efforts with global sustainability organizations and initiatives, including the United Nations Global Compact, that contribute to broader calls to action and collective progress toward a healthier future. In 2021, we joined the Science Based Targets initiative, and in connection with joining such initiative, we have adopted greenhouse gas emissions reduction targets necessary to meet the Paris Agreement goals, including limiting global warming to 1.5°C above preindustrial levels. In 2022, we announced our commitment to reach net zero greenhouse gas (GHG) emissions by 2040.

| 2024 Proxy Statement 9 |

In calendar year 2021, continuing our purpose-driven journey, we developed and launched a comprehensive set of long-term sustainability goals that focus on key areas where we can make a measurable, direct, and positive impact. We established our 2030 sustainability goals against a framework centered on our world, our people, and our approach to business practices spanning several pillars.

We are committed to:

| • | Reducing our environmental impact; |

| • | Investing in our communities; |

| • | Advancing a safe, inclusive, and respectful work environment for all; |

| • | Partnering with our customers and suppliers to help mitigate value chain emissions; and |

| • | Driving sustainability-focused practices with transparency. |

Notable 2030 goals include:

| • | We commit to reduce absolute scope 1 and 2 GHG emissions 50% by 2030 from a 2019 base year(1). |

| • | We commit to reduce total case incident rate (TCIR), a workplace health and safety metric, to below 0.2 by 2025. |

| • | We commit that 50% of our ‘Preferred Suppliers’ will set their own GHG emissions reduction targets by 2025 and 100% of ‘Preferred Suppliers’ by 2030. |

| (1) | The target boundary includes biogenic emissions and removals from bioenergy feedstocks. |

Our global workforce of approximately 148,000 employees including our contractor workforce are some of the industry’s best makers, problem-solvers, innovators, craftspeople, and leaders and represent a global mosaic of cultures, experiences, expertise, perspectives, and abilities. We believe that our performance is driven by our workforce, who move forward through a values-driven, high-performing, and dynamic culture underlined by integrity, collaboration, resilient ingenuity and sustainability. To maintain competitiveness and world-class capabilities, we regularly review and refine our human capital management programs, policies, and procedures to ensure that we consistently work to attract, select, develop, engage and retain strong, diverse talent. Our policies, philosophy, and strategies support the inclusion of all people in our working environment. Further, we are committed to respecting the human rights of our employees and improving their quality of life.

Because our employees are central to our success as a business, the Board plays an active role in overseeing our human capital management efforts. The Compensation and People Committee of our Board is responsible for assisting the Board in discharging this oversight duty and continues to work closely with the executive management team in helping to shape our culture and focus efforts on developing formal human capital management and talent development initiatives to better support our workforce as the Company continues to evolve.

The Compensation and People Committee’s oversight activities in this area include, among other aspects, receiving periodic updates (not less than twice annually) regarding, and overseeing any significant change to, our human capital management strategy including corporate culture, diversity and inclusion, pay and opportunity equity, social initiatives and results, and talent attraction, training, development and retention programs. Additionally, the Compensation and People Committee reviews the performance of and succession planning for our CEO and executive officers.

| 2024 Proxy Statement 10 |

Culture underlies our stakeholder experience. Our values are intended to reflect and guide our behaviors and shape our culture. We endeavor for our values-driven culture to align us as we pursue our purpose, uphold our mission, live our values, advance toward our vision, and activate our strategy.

In support of cultivating an inclusive, high-performing culture with our workforce, we continued to proliferate our “Ways of Working,” four specific behaviors that bring our values to life through actions, provide a framework for how we make decisions, and support ongoing progress on our Flex Forward strategy. The purpose of these behaviors is to enable us to put our culture into practice and provide an accountability system through training and development as well as performance management systems to ensure our desired behaviors become a part of our everyday working norms.

In calendar year 2023, we continued to drive awareness of and education on our leadership competencies to provide a common language and framework for our people leaders throughout the organization as it relates to leadership expectations, behaviors and skills necessary to lead the business and our people. Building on our vision, mission, values, and Ways of Working, we use this framework to assess, hire, train, and nurture our talent to develop the skills necessary for our ongoing success. In calendar year 2023, we continued regular communications and supporting our leaders globally through quarterly training and team discussions to build an understanding of our Ways of Working, important leadership expectations and inclusion practices. We also continued to execute programs to embed our culture into our daily actions including employee engagement through surveys and roundtable discussions with our executive leadership, development and volunteer programs, and recognition programs.

Diversity, equity, and inclusion are key priorities and strengths at Flex and are embedded in the fabric of our culture. We recognize the value of our human capital as an asset to our business. We also recognize that the sum of the individual differences, life experiences, knowledge, inventiveness, innovation, self-expression, unique capabilities, and talent that our employees invest in their work represents a significant part of our culture, enhances our reputation, contributes to our success, and serves as a competitive advantage. We embrace and encourage our employees’ differences, and nurture a sense of collective pride and belonging. We strive to ensure that all Flex employees are empowered to do their best and are given opportunities to reach their full potential.

In the last year, we continued our efforts in this area through employee programs. Our employee resource groups (“ERGs”) work to create a community that fosters belonging, builds cultural awareness, and develops a new generation of diverse leaders at Flex by establishing a sustainable structure with executive support that challenges bias and promotes unity. With approximately 15,000 members, we maintain ERG chapters globally across seven identities: Asian and Pacific Islander, Black, LatinX, LGBTQ+, People with Disabilities, Women, and Veterans. Our ERGs help to create a sense of community and support retention and attraction. Each ERG has an executive sponsor and is supported by senior leaders across the Company. We also held cultural awareness activities throughout the year to highlight specific groups including People with DiversAbilities Awareness Weeks, Black History Month, Asian Pacific Heritage Month, PRIDE Month, LatinX Heritage Month, and Women’s History Month, among others. Our global awareness months create continuous learning opportunities and strengthen our culture of inclusion across our diverse workforce.

In calendar year 2023, we continued to offer leadership development opportunities for underrepresented communities. In partnership with McKinsey, we continued to offer leadership development offerings through their Management Accelerator and Executive Leadership Program. We also continued SheLeads, our global leadership development program for women employees, offered leadership coaching and peer-mentoring to 35 gender and ethnically diverse leaders, and continued to implement on-demand inclusion training offerings. Additionally, we provided self-service tools and training on diversity, equity and inclusion practices to help employees build self-awareness, empathy and cultural competency, embrace inclusivity and improve diversity in recruiting. Furthermore, we leveraged external community partnerships with organizations such as Catalyst, the Business Roundtable, the National Society of Black Engineers (NSBE), and Women in Electronics to amplify our impact in recruiting and retaining diverse talent. Each of these initiatives contributes to our employees’ skills, confidence, and readiness for career advancement, which improves our ability to promote from within.

As of March 31, 2024, women represented 44% of our global employees, and underrepresented minorities (those who identify as Black/African American, Hispanic/Latinx, Native American, Asian/Pacific Islander and/or two or more races) represented 52% of our U.S. employees. Approximately 21% of our executive team and approximately 23% of our leadership team (director level and above) are female. Approximately 23% of our executive team and approximately 33% of our U.S. leadership team (director level and above) are comprised of underrepresented minorities.

We continued efforts in support of our corporate goals to increase the number of employees and leaders from underrepresented groups and are focused on evolving strategies and programs to help improve representation and promote diversity across the organization. Additionally, we remain committed to parity in pay and opportunity.

| 2024 Proxy Statement 11 |

Human Rights

We are committed to respecting the human rights of all people throughout our operations and in our value chain. Accordingly, the Company works to foster a culture that respects and promotes human rights. Our commitment to human rights is outlined in our Code of Business Conduct and Ethics. We have also adopted a Human Rights Policy to, among other things, create awareness and establish expectations related to legal requirements, ethical practices, and human rights. Our Human Rights Policy is aligned with the United Nations Guiding Principles on Business and Human Rights and is inclusive of rights outlined in the United Nations Universal Declaration of Human Rights to the extent those rights apply to business operations. It applies to our Company, all employees on a worldwide basis and to our value chain, including our suppliers and vendors. We have also adopted a Company statement on forced labor and human trafficking which describes our global practices to address forced labor. Additionally, we provide a Human Rights Policy micro-learning course, available in 15 languages, with the objective of highlighting this policy for new employees.

In addition to these policies, Flex is an active participant in globally recognized external initiatives, including the UN Guiding Principles on Business and Human Rights, as well as the Responsible Business Alliance (RBA), the world’s largest industry coalition dedicated to responsible business conduct in global supply chains. Through the RBA’s efforts, including its Responsible Labor Initiative, we work with others across industries to ensure that the rights of workers vulnerable to forced labor in global supply chains are consistently respected and promoted. Flex is also an active member of the Global Business Initiative on Human Rights. The mission of this organization is to advance human rights in a business context through cross-industry peer learning, outreach, and thought-leadership to shape policy and practice.

Talent attraction, development, and retention are critical to our success and core to our mission as a company. To support the advancement of our employees, we provide training and development programs and opportunities encouraging advancement from within while we continue to fill our team with strong and experienced external talent. We leverage both formal and informal programs, including in-person, virtual, social and self-directed learning, mentoring, coaching, and external development to identify, foster, and retain top talent. Employees have access to courses through our learning and development platform, Flex Learn. In calendar year 2023, our employees completed more than six million hours of training programs.

We are also focused on completing talent and performance reviews. Our in-depth talent reviews serve to identify high potential talent to advance in roles with greater responsibility, assess learning and development needs, and establish and refresh succession plans for critical leadership roles across the enterprise. We recently updated our performance ratings to allow for more differentiation and clear performance feedback, and also integrated our values and Ways of Working into our performance assessment process. Our performance assessment process promotes transparent communication of team member performance, which we believe is a key factor in our success. The performance and the talent reviews enable ongoing assessments, reviews, and mentoring to identify career development and learning opportunities for our employees.

As a part of our efforts to improve employee experiences at Flex, we conduct the annual enterprise-wide employee engagement Flex Voice survey. Our leadership uses the results of the survey to continue developing our strengths and identify and take action on opportunities for improvement. This year, 93% of employees completed the Flex Voice survey and the results reflected continued engagement.

Our total rewards are designed to attract, motivate, and retain employees at all levels of the Company. Our compensation philosophy is driven by the desire to attract and retain top talent, while ensuring that compensation aligns with our corporate financial objectives and the long-term interests of our shareholders. Our pay structures offer competitive salaries, bonuses, and equity awards in the countries where we operate.

In each of the countries where we have operations, our comprehensive benefit plans offer a locally competitive mix of some or all of the following: medical, dental and vision insurance, short and long-term disability, flexible spending accounts, various types of voluntary coverage, and other benefit programs. We routinely benchmark our salaries and benefits against market peers to ensure our total rewards package remains competitive.

| 2024 Proxy Statement 12 |

Flex is committed to providing a safe and injury-free workplace. We promote a “zero-injury” culture through health and safety management systems that implement a data-driven and risk-based approach in monitoring and reporting performance regularly. In calendar year 2023, we decreased our health and safety incident rate by 19% compared to 2022. Furthermore, as a part of our 2030 Sustainability Goals, we have committed to reducing total case incident rate to below 0.2 by 2025 and to certifying all manufacturing operations as ‘RBA factory of choice’ by 2025.

We provide programs and tools aimed at improving physical, mental, financial, and social well-being. Our programs give access to a variety of innovative, flexible, and convenient health and wellness programs for our global employees, including on-site health centers in some of our major factories and providing all employees with access to emotional and mental health programs.

During the 2023 calendar year, we continued our focus on sustainability activities as highlighted below.

| • | We engaged with local non-governmental organizations (NGOs) and promoted employee volunteerism to help improve the quality of life in our communities and contribute to broader calls to action. |

| • | From 79 sites around the world, over 53,000 employees participated in our seventh annual Earth Day Challenge by planting over 17,400 trees and cleaning more than 7 million square meters of land, besides creating awareness to care for our resources in innovative ways. |

| • | We completed 953 community activities around the globe. |

| • | Approximately 14,000 of our volunteers gave nearly 56,000 hours back to their local communities.(1) |

| • | 100% of our major sites (sites with 1,000 or more employees) partnered with local NGOs in 2023. |

| (1) | Number of volunteers are counted as participants of volunteering activities throughout the year (may include repeated employees). |

| • | We remain committed to fostering a safe, ethical, and inclusive work environment for all employees. |

| • | We engaged our employees and received their feedback through coffee talks and town halls, lunch and learn sessions, management workshops, leadership skills trainings, recognition programs and annual surveys, and continue to undertake such employee engagement. |

| • | For over a decade, we have supported our employees at certain facilities with access to ongoing education through our employee scholarship program. Depending on the specifics of a site and the employee’s educational program, we provide full or partial funding for our employees to receive external education and fulfill credentials including technical certifications and undergraduate and graduate degrees. |

| • | We ensure all of our sites have a health and safety management system, which we verify through audits, which follow RBA methodology and are performed by our EHS team. Additionally, all sites are required to convene committees to address safety issues and concerns and we undertake targeted respect and dignity audits of high-risk sites. |

| • | In calendar year 2023, we decreased our health and safety incident rate by 19% compared to 2022. |

| • | We are active members of different councils including Manufacturing Alliance, GBI on Human Rights, UN Global Compact, Business for Social Responsibility (BSR) and the Boston College Center for Corporate Citizenship (BCCCC) Advisory Board on ESG Reporting, among others. |

| • | During our global People with DiversAbilities Awareness Weeks, approximately 40,000 employees participated in over 200 initiatives in several countries. |

| • | We continued SheLeads, our global leadership development program for women employees, offered leadership coaching and peer-mentoring to 35 gender and ethnically diverse leaders, and continued to implement on-demand inclusion training offerings. |

| • | We partnered with organizations such as the Business Roundtable, Catalyst, Women in Electronics, Women in Automotive, and NSBE to amplify our impact in recruiting and retaining diverse talent. |

| • | With approximately 15,000 members, our ERGs held several cultural awareness activities throughout the past year to highlight specific groups including People with Diversabilities Awareness Weeks, Black History Month, Asian Pacific Heritage Month, PRIDE Month, LatinX Heritage Month, and Women’s History Month. |

| 2024 Proxy Statement 13 |

| • | Our Code of Business Conduct and Ethics, which we recently updated and refreshed in March 2023, guides the behaviors and decision making of our employees, Board, contractors and all who do business with us. |

| • | We provide a number of ways for employees and partners to voice concerns and receive assistance, from our Ethics Hotline and Web Portal to our open door policy, through which we can provide guidance and prioritize the investigation and remediation of ethics and compliance issues that arise. |

| • | Flex was named one of the 2024 World’s Most Ethical Companies® by the Ethisphere Institute. |

| • | We conduct regular due diligence activities for our suppliers to manage risks and evaluate sustainability performance. We screened 100% of our new global suppliers using social and environmental criteria in calendar year 2023. |

| • | We made progress on our goal to partner with our customers and suppliers to reduce greenhouse GHG through their own emissions reduction targets. In 2023, 51% of our preferred suppliers set their own GHG reduction targets. |

In addition to being a founding member of the RBA, we are also a member of the Responsible Minerals Initiative, Global Business Initiative on Human Rights, GRI Community, the Business for Social Responsibility Network, the Business Ethics Leadership Alliance by Ethisphere Company, the UN Global Compact Network, the Boston College Center for Corporate Citizenship, the Ellen MacArthur Foundation, and Manufacturers Alliance. Flex has continued our commitment to the World Business Council for Sustainable Development Pledge for safe water, sanitation, and hygiene (WASH) access. Additionally, our CEO is a member of the Business Roundtable (“BRT”) and has signed the BRT Statement on the Purpose of a Corporation, which declares that corporations have a role beyond meeting investors’ financial expectations. Finally, our CEO is a member of the World Economic Forum’s Alliance of CEO Climate Leaders and The Valuable 500, a global business collective comprised of CEOs and their companies committed to disability inclusion.

Our commitment to sustainability has earned us positive feedback from shareholders and recognition from some of the most prestigious sustainability ratings agencies.

Flex | • Flex received strong marks from CDP (formerly known as Carbon Disclosure Project) for supplier engagement, water security and climate change, receiving an A- in each category • Flex maintained an AA rating from MSCI for the third consecutive year • For the eighth consecutive year, Flex is a constituent of Financial Times Stock Exchange-Russell Group’s FTSE4Good Index, receiving a score of 4.1 out of 5 • Flex was recognized as one of the 2024 World’s Most Ethical Companies® by the Ethisphere Institute • Flex received a Platinum sustainability rating from Ecovadis in 2023 | |

Further information regarding our sustainability program and achievements, including demographic data, can be found in our annual sustainability reports at flex.com/company/sustainability. The information on our website and in the sustainability reports is not a part of this proxy statement and is not incorporated by reference.

| 2024 Proxy Statement 14 |

We are proud of Flex’s legacy of corporate governance throughout the past 50+ years. We continually build on that legacy with ethical business oversight, robust risk management, and pay-for-performance compensation programs in order to ensure accountability to our shareholders, customers, employees, and communities.

Our Board of Directors oversees and provides policy guidance on our strategic and business planning processes, oversees the conduct of our business by senior management, and is principally responsible for the succession planning for our key executives, including our Chief Executive Officer. We strive to maintain optimal board composition to ensure diverse, insightful and dedicated oversight of our vision, purpose, and mission.

Our governance policies provide the Board with flexibility to select the appropriate leadership structure for Flex at any given time, and do not preclude the CEO from also serving as Chair of the Board.

Our Board annually evaluates its leadership structure. In doing so, our Board considers the skills, experiences and qualifications of our then-serving directors, the evolving needs of our business, and the functioning of our leadership structure. During the Board’s recent evaluation, which took into account our Board succession plan, upon the recommendation of the Nominating, Governance and Public Responsibility Committee, the Board concluded that the most effective leadership structure for Flex at the present time is for the roles of CEO and Chair of the Board to be separated, and for the Chair of the Board to be an independent director. Currently our Board of Directors believes that having an independent Chair ensures a greater role for the independent directors in carrying out their oversight duties, and also provides the continuity of leadership necessary for the Board to fulfill its responsibilities.

Ms. Advaithi has served as our Chief Executive Officer and a member of our Board of Directors since February 11, 2019. The Board appointed Mr. Capellas, an independent director, as Chair of the Board in 2017. As previously announced, Mr. Capellas is not standing for re-election at the annual general meeting, and Mr. Watkins, an independent director who has served on our Board since 2009, will succeed Mr. Capellas as Chair, subject to Mr. Watkins’ re-election to the Board.

The following chart demonstrates how the Company has separated these two leadership roles.

| Independent Chair of the Board |  | Chief Executive Officer | |||

| Michael D. Capellas (until annual meeting) William D. Watkins (after annual meeting) | Revathi Advaithi | |||||

• Oversees CEO succession • Oversees the Board evaluation process • Calls meetings of the Board and independent directors and presides at all Board meetings and executive sessions of the directors • Provides management with feedback regarding the information that is necessary for the independent directors to effectively and responsibly perform their duties • Acts as a liaison between the independent directors and the CEO on sensitive/critical issues | • Sets strategic direction for the Company • Provides day-to-day leadership over Company operations • Focuses on execution of business strategy, growth and development • Guides senior management through the implementation of our strategic initiatives • Sets the tone-at-the-top for company culture • Develops and oversees enterprise-wide initiatives |

| 2024 Proxy Statement 15 |

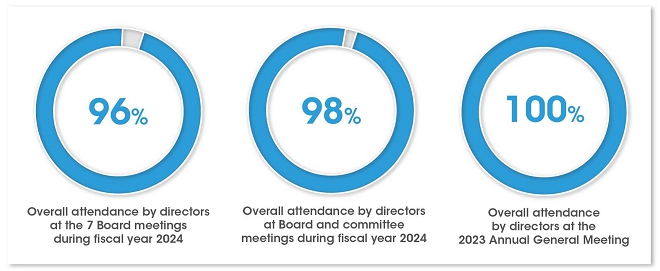

Each of our directors is committed to providing prudent oversight of our business through regularly scheduled meetings, special meetings, ad hoc conversations, and time spent with management. In fiscal year 2024, our Board of Directors held a total of 7 meetings, and our Audit Committee, Compensation and People Committee and Nominating, Governance and Public Responsibility Committee held, collectively, 24 meetings. We have a rigorous attendance tracking program and recorded an average attendance rate of 97.6% (with every director attending over 75% of the Board and applicable committee meetings held during their period of service in fiscal year 2024).

All directors are encouraged to attend the annual general meeting, but attendance is not required. Every director who was standing for re-election at the 2023 annual general meeting was in attendance.

Our independent directors generally meet in executive sessions at each regularly scheduled Board meeting without management present in order to promote discussion and consideration of such matters as our independent directors deem appropriate. During fiscal year 2024, our independent directors met in executive session at each regularly scheduled Board meeting.

As required by the listing standards of The Nasdaq Stock Market LLC (“Nasdaq”), a majority of the members of our Board must qualify as “independent,” as affirmatively determined by our Board. Flex’s director independence guidelines incorporate the definition of “independence” adopted by Nasdaq. Using these guidelines, our Board has determined that each of the Company’s directors, other than Ms. Advaithi, is independent. Mr. Marc A. Onetto was determined to be independent during the period that he served as a director. This means that the directors designated as “independent” do not have any business or family relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director or has any otherwise disqualifying relationship.

In making the independence determinations, the Board and the Nominating, Governance and Public Responsibility Committee considered certain transactions, relationships, and arrangements involving some of the directors and concluded that such transactions, relationships, and arrangements did not impair the independence of the director. In particular, the following relationships were considered:

Mr. Hurlston is the President and Chief Executive Officer and a member of the board of directors of Synaptics Incorporated (“Synaptics”), with which Flex conducted business on an arms’-length basis in the ordinary course during fiscal year 2024. In each of the last three fiscal years, payments that Flex made to, or received from, Synaptics for goods or services did not exceed 1% of the Company’s or Synaptics’ consolidated gross revenues for that year and, therefore, fell significantly below the 5% threshold in Nasdaq’s independence standards.

Ms. McSweeney is the Executive Vice President and Chief People Officer of UnitedHealth Group Incorporated (“UHG”), with which Flex conducted business on an arms’-length basis in the ordinary course during fiscal year 2024. In each of the last three fiscal years, payments that Flex made to, or received from, UHG for goods or services did not exceed 1% of the Company’s or UHG’s consolidated gross revenues for that year and, therefore, fell significantly below the 5% threshold in Nasdaq’s independence standards.

| 2024 Proxy Statement 16 |

In addition to the above, Messrs. Capellas, Harris, Hurlston, Stevens, and Watkins served as non-employee directors of other companies with respect to which Flex purchased or sold goods and services on an arms’-length basis in the ordinary course of its business during fiscal year 2024, including Avaya Holdings Corp., Astera Labs, Inc., Cisco Systems, Inc., Eastman Chemical Company, and Nextracker Inc.

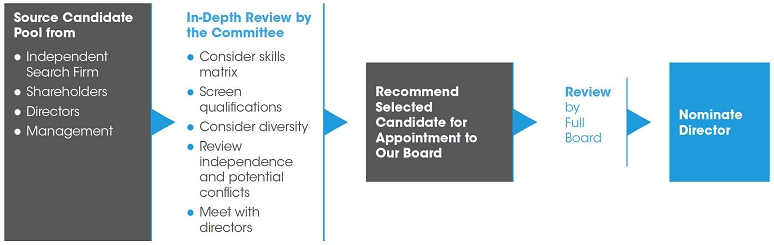

Our Board, led by the Nominating, Governance and Public Responsibility Committee, regularly considers Board succession and refreshment, and also considers at least annually the skills needed on our Board as our business evolves, and strives to achieve a balance and diversity of knowledge, experience, and capabilities on our Board and to ensure that our Board has the benefit of a variety of skills derived from our directors’ business and professional experiences. To that end, the Nominating, Governance and Public Responsibility Committee engages in Board succession planning by assessing the need to adjust the size of the Board or supplement the Board’s expertise in a substantive area, and by determining whether prospective nominees have relevant skills and experience. For more information on specific qualities and skills we look for in potential directors, see Proposal 1, which begins on page 33.

Our Board does not have a policy to impose term limits or a mandatory retirement age for directors because such a policy may deprive the Board of the service of directors who have developed, through valuable experience over time, an increased insight into the Company and its operations. The Board believes that its regular consideration of Board succession and refreshment, and its annual evaluation process for deciding whether to re-nominate individuals for election, are currently more effective means of ensuring board refreshment and renewal, while also allowing for continuity of service.

The Board seeks to balance the deep Company and industry knowledge that comes from longer-serving directors with fresh ideas and perspectives brought by newer directors. Accordingly, Flex has maintained a deliberate mix of newer-and longer-tenured directors on the Board. Since June 2020, five new directors have joined our Board, three of whom are either women or racially or ethnically diverse, and each of whom have different backgrounds and experiences to further enhance the oversight of Flex’s strategic goals and initiatives and contribute to the expansion of the Board’s knowledge and capabilities. The average tenure of the director nominees, under six years, reflects an appropriate balance between different perspectives brought by newer- and longer-serving directors. Additionally, the Nominating, Governance and Public Responsibility Committee oversaw board succession planning for the Chair of the Board role, and in May 2024 we announced the succession of the role from Mr. Capellas, our current Chair, to Mr. Watkins following our annual general meeting.