Searchable text section of graphics shown above

[LOGO]

Input/Output

HOWARD WEIL CONFERENCE

Giving Seismic a Whole New Image

April 2005

Forward Looking Statements

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements as to expectations, beliefs and future financial performance, such as statements relating to the Company’s business prospects, future sales, market growth, gross margin and other statements that are not of historical fact.

Investors are cautioned that all forward-looking statements are based on management’s current expectations and include known and unknown risks, uncertainties and other factors, many of which the Company is unable to predict or control, that may cause the Company’s actual results or performance to materially differ from any future results or performance expressed or implied. These risks and uncertainties include the timing and development of the Company’s products and services and market acceptance of the Company’s new and revised product offerings, and other risk factors disclosed by the Company from time to time in its filings with the SEC, including in its Annual Report on Form 10-K for the year ended December 31, 2004.

[LOGO] |

| [LOGO] |

| [LOGO] |

2

Company Overview

• The largest global independent seismic imaging company

• Expected 2005 revenues $320-$365 million

• Provides full range of seismic imaging technologies & solutions

• Headquartered in Houston, TX

[GRAPHIC]

3

Company Overview

I/O Products & Services - Imaging Systems Group

Land Acquisition Systems

[GRAPHIC]

Streamer and Ocean Bottom Cable Acquisition Systems

[GRAPHIC]

5

Company Overview –

I/O Products & Services - Seismic Integrated Services

Imaging and Processing Services

[GRAPHIC]

6

Company Overview –

2004 Sources of Revenue

[CHART]

• 33% Americas

• 32% CIS/Asia

• 35% Europe/Africa/Middle East

7

Energy Sector Overview

• Looming supply gap

• Rising F&D costs

• Pressure to find new reserves

• Increasing capex

[CHART]

Source: McKinsey & Co.

8

Promising Trends For Seismic

• Demand for hydrocarbons is outstripping increases in supply.

• New hydrocarbon provinces appear on the brink of reopening (with the application of Western technology) – Libya, Iraq, CIS.

• Oil companies accepting the need for custom designed surveys that target specific reservoir challenges (vs. general spec shoots).

• Many of the remaining reservoir challenges require wide azimuth geometries and higher density sensor spacing (to improve resolution) as well as shear waves (to increase content).

9

Seismic Activity Trends

GROWING WORLDWIDE E&P EXPENDITURES

[CHART]

LAND CREW DEPLOYMENT TRENDS

Major North American Contractor

[CHART]

Annual Geophone Output - I/O Sensor

[CHART]

10

Our Strategy

• Lead the emerging 3rd wave of seismic technology

• Full Wave Adoption

• Provide full range of seismic imaging solutions

• Planning to Interpretation

• Reduce full-cycle seismic imaging costs and time

• Field Logistics require technology solutions

• Form closer, more direct relationships with oil & gas companies

• They are the ones with the problem

11

Full-wave Imaging

The dawn of the next era in seismic

Technology “S-Curves” in Seismology

[CHART]

[GRAPHIC]

12

Traditional Seismic is in Its Twilight

Legacy tools and approaches rooted in decades of history

1917 |

| 1926 |

| 1963 |

| 1972 |

| 1980’s | ? |

|

|

|

|

|

|

|

|

|

|

First theoretical |

| First crew |

| First digital recording |

| Bright spot |

| 3D Era |

|

Industry has grown used to tradition

[GRAPHIC]

Arrays of analog geophones

• Coiled springs

• Recording uni-dimensional particle motion

• 6-128 geophones per array (mechanical noise filtering)

• Tried and true, but…

…should this be at the heart of E&P?

Connected by miles & tons of cable

• 50 tons on the average land crew

• 40% of field operational time spent on cable repair and maintenance

• HSE risks

13

At the Core of Full-wave Imaging

MEMS digital sensors

[GRAPHIC] |

| [GRAPHIC] |

| [GRAPHIC] |

| [GRAPHIC] |

| [GRAPHIC] |

|

|

|

|

|

|

|

|

|

|

|

Gold plated silicon wafer |

| ASIC |

| Integrated sensor |

| 3 sensor packages |

| VectorSeis |

|

From Silicon Wafer to Field-ready Sensor

(for both land & seabed applications)

14

Why Full-wave Imaging?

The benefits – Enhanced imaging

Enhanced imaging |

| [GRAPHIC] |

|

| |

Geophysical drivers

• Capture (and preserve) low and high frequency data

• Improve spatial resolution

• Improve vector fidelity

• Better characterize / isolate noise

• Better account for near-surface velocity anomalies

• Improve velocity modeling

• Enhance reservoir characterization using shear-wave information |

|

• Higher resolution images

• Accurate imaging of subsurface structures

• Enhanced utility for reservoir characterization

• Lithology

• Reservoir plumbing

• Fluid type

• Fluid movement |

15

Full-wave Fundamentals

The benefits – Improved field productivity and cycle time

Improved efficiencies |

| [GRAPHIC] |

|

| |

Operational drivers

• Capture benefits from single point recording

• Less gear, less weight

• Faster sensor “plants”

• Easier orientation

• Shorten the processing cycle

• Adaptive filtering speeds noise removal phase

• Eliminate iterations on velocity modeling by |

|

• More acquisition per crew per season

• Improved HSE performance

• Lower per survey costs

• Faster decision making |

16

Full Wave Adoption (2004)

• Eight worldwide contractors with VectorSeis capabilities

• Full Wave survey spending up 5x to $38 million

• 70% increase in full wave surveys performed

• 3D surveys up 4x

• 38 oil companies have acquired Full Wave surveys

• 11 of them used Full Wave repeatedly

• Estimate that 70% of surveys done by VectorSeis Systems

17

Transition to Seismic Imaging Solutions Company

[GRAPHIC] |

| [GRAPHIC] |

| [GRAPHIC] |

| [GRAPHIC] |

|

|

|

|

|

|

|

Planning |

| Acquisition |

| Processing |

| Interpretation |

|

|

|

|

|

|

|

Data Flow | Image |

| [LOGO] | |||

|

|

|

|

|

|

|

|

|

|

| 4D |

|

|

|

|

|

|

|

|

|

Technology Specs |

| System 4 A/C |

| Multi- |

|

|

|

|

|

| Component |

|

|

Significance Models |

| System 4 VectorSeis |

|

|

|

|

|

|

|

| PSDM |

|

|

Illumination Analysis |

| Streamer Technology |

|

|

|

|

|

|

|

| PSTM |

|

|

|

| VectorSeis Ocean |

|

|

|

|

|

|

|

| Velocity |

|

|

|

| Geophones |

| modeling |

|

|

|

|

|

|

|

|

|

|

| Sources |

| Noise |

|

|

|

|

|

| reduction |

|

|

|

| Navigation Technology |

|

|

|

|

|

|

|

| Geometry |

|

|

Infrastructure – Crews, Trucks, Boats

18

Form Closer Relationships with End-Users

Apache Partnership

[GRAPHIC]

“The quality of our initial I/O VectorSeis data is excellent.

Apache has invested a great deal in this seismic shoot,

and I believe the data will help us significantly.

VectorSeis has tremendous potential.”

• Steve Farris, President, CEO & COO of Apache

19

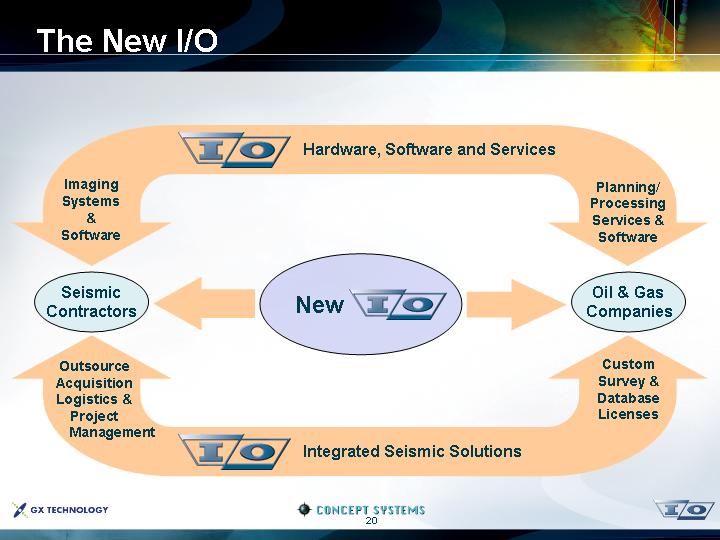

The New I/O

|

| [LOGO] Hardware, Software and Services |

|

|

Imaging |

|

|

| Planning/ |

|

|

|

|

|

Seismic |

| New [LOGO] |

| Oil & Gas |

|

|

|

|

|

Outsource |

|

|

| Custom |

|

| [LOGO] Integrated Seismic Solutions |

|

|

20

Investment Highlights

• I/O + GXT + Concept Systems = technology only seismic solutions company

• Customized technologies that when integrated across the value chain create significant competitive advantages

• Leadership in new generation seismic technologies to help close the supply-demand gap

• Improved seismic sector fundamentals as oil & gas companies return to the drill bit and focus on production enhancement

• Visible growth avenues with GXT and new technologies

• Strong new management team tailored to strategy

27