Exhibit 99.1

Input/Output, Inc.

Company Investment Profile

December 2005

This Company Investment Profile is being produced by Input/Output in continuation of the Company’s goal to provide greater transparency and communication with its stakeholders. The Company’s objective with this Company Profile is to differentiate itself by providing a more thorough understanding of its long-term vision, strategy and products, including the continued development of I/O’s leading position as a full-service seismic solution company. For more information on Input/Output, please visit us at

www.i-o.com.

Corporate Headquarters

12300 Parc Crest Drive

Stafford, Texas, 77477

United States of America

For More Information, Please Contact Us

by Telephone, Email, or Visit Us Online:

281-933-3339

ir@i-o.com

www.i-o.com

©2005 Input/Output, Inc.

All Rights Reserved.

| Company Investment Profile | December 2005 |

Reader Advisory, Risks and Forward Looking Statements

This Company Investment Profile is presented as a brief company overview for the information of investors, analysts and other parties with an interest in Input/Output, Inc. (herein referred to as “the Company” and by its abbreviation, “I/O”). The information included herein contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements include statements concerning expected future financial positions, segment sales, results of operations, cash flows, funds from operations, financing plans, gross margins, business strategy, budgets, projected costs and expenses, capital expenditures, competitive position, product offerings, technology developments, access to capital and growth opportunities, future sales and market growth, and other statements that are not of historical fact. Actual results may vary materially from those described in these forward-looking statements. All forward-looking statements reflect numerous assumptions and involve a number of risks and uncertainties. These risks and uncertainties include the timing and development of the Company’s products and services and market acceptance of the Company’s new and revised product offerings; risks associated with competitor’s product offerings and pricing pressures resulting therefrom; the relatively small number of customers that the Company currently relies upon; the fact that a significant portion of the Company’s revenues is derived from foreign sales; the Company’s ability to successfully manage the integration of its acquisitions into the Company’s operations; the risks that sources of capital may not prove adequate; the Company’s inability to produce products to preserve and increase market share; collection of receivables; and technological and marketplace changes affecting the Company’s product line. Additional risk factors, which could affect actual results, are disclosed by the Company from time to time in its filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2004.

Many risks, uncertainties and assumptions are associated with I/O, its operations and the oil & gas production industry it serves. Before making any investment decision, the Company urges the reader to closely consider the variety of risks to its business which are described in greater detail under the heading “Risk Factors” in its SEC filings, most notably beginning page 32 in its most recent Form 10-K, filed March 16, 2005. The information contained in this document is only current as of the date indicated on the cover and the Company undertakes no obligation to update this document.

Use of EBITDA & Regulation G Reconciliation

This Company Investment Profile contains references to the non-GAAP financial measure of Earnings (net income) before Interest, Taxes, Depreciation, and Amortization, or EBITDA. This term, as used and defined by Input/Output, may not be comparable to similarly titled measures employed by other companies and is not a measure of performance calculated in accordance with GAAP. EBITDA should not be considered in isolation or as a substitute for operating income, net income or loss, cash flows provided by operating, investing and financing activities, or other income or cash flow statement data prepared in accordance with GAAP. However, the Company believes EBITDA is useful to an investor in evaluating I/O’s operating performance because:

• It is widely used by investors in the energy industry to measure a company’s operating performance without regard to items such as interest expense, depreciation and amortization, which can vary substantially from company to company depending upon accounting methods and book value of assets, capital structure and the method by which assets were acquired.

• It helps investors more meaningfully evaluate and compare the results of the Company’s operations from period to period by removing the impact of the Company’s capital structure and asset base from Input/Output’s operating results.

• It is used by Input/Output’s management as a measure of operating performance, in presentations to its board of directors, as a basis for strategic planning and forecasting, as a component for setting incentive compensation and to assess compliance in financial ratios, among others.

Reconciliations of this financial measure to the most directly comparable GAAP financial measure are provided in the table below. Management’s opinion regarding the usefulness of such measure to investors and a description of the ways in which management uses such measure can be found in the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission.

| | Historical Results | | 9-Mth YTD | |

Year Ended December 31, | | 2001 | | 2002 | | 2003 | | 2004 | | Results | |

Financial Summary ($ MM) | | | | | | | | | | | | | | | | |

Revenues | | $ | 212.1 | | $ | 118.6 | | $ | 150.0 | | $ | 247.3 | | $ | 233.6 | |

Income (Loss) from Operations | | $ | 7.9 | | $ | (64.0 | ) | $ | (21.0 | ) | $ | 2.5 | | $ | 5.5 | |

Reconciliation of EBITDA to GAAP Net Income (Loss)

($ MM) | | | | | | | | | | | |

Net income (loss) | | $ | 9.3 | | $ | (118.7 | ) | $ | (23.2 | ) | $ | (3.0 | ) | $ | (0.1 | ) |

Interest expense | | 0.7 | | 3.1 | | 4.1 | | 6.2 | | 4.7 | |

Other income | | (4.7 | ) | (2.3 | ) | (1.9 | ) | (1.3 | ) | (.5 | ) |

Income tax (benefit) expense | | 3.1 | | 56.8 | | 0.3 | | 0.7 | | .3 | |

Depreciation and amortization expense | | 17.5 | | 13.2 | | 11.4 | | 24.7 | | 24.1 | |

EBITDA | | $ | 26.0 | | $ | (47.9 | ) | $ | (9.2 | ) | $ | 27.3 | | $ | 28.6 | |

Reserve for Russian receivables | | — | | — | | — | | 5.2 | | — | |

Impairment of long-lived assets/Goodwill | | — | | 21.4 | | 1.1 | | — | | — | |

Adjusted EBITDA | | $ | 26.0 | | $ | (26.5 | ) | $ | (8.1 | ) | $ | 32.5 | | $ | 28.6 | |

December 9, 2005

Company Investment Profile | |

INPUT/OUTPUT, INC.

NYSE: IO |

|

Giving Seismic a Whole New Image TM | |

| www.i-o.com | |

2005: Issue II

This Company Investment Profile is being produced by Input/Output as a series of “Issues” to provide greater transparency and communication with its stakeholders.

• Leading the Full-Wave Digital (FWD) Technology Era. I/O is leading the industry with a value-added slate of integrated seismic technologies and services. I/O provides solutions for the entire seismic workflow. The end result delivers high resolution images with less equipment in less time. This translates to faster, better decisions made by oil & gas companies, ultimately leading to higher returns on capital employed.

• New Company for a New Era. Combined with its industry-leading VectorSeis® sensor, the 2004 strategic acquisitions of Concept Systems (CSL) and GX Technology (GXT) have shaped I/O as a leader in FWD, further transforming I/O’s platform from an oilfield equipment manufacturer (OEM) to a FWD seismic solutions company.

• Direct Marketing to End Users. I/O has strategically expanded its customer base, now marketing its technology solution directly to oil & gas companies, the seismic end-user, as well as seismic contractors. Underscoring this transition, it is estimated that greater than 30% of 2006 revenues will be generated from businesses that did not exist or contribute in 2002.

• Strong, Visible Growth. With GXT and CSL, I/O believes it is now set to capture the market benefits and opportunities of FWD. By 2009, total revenues could potentially range from $750-$850 million (less than 30% of which is estimated to be from the OEM legacy business), which would translate to an average annual growth rate of 25%.

• FWD Adoption Rate Accelerating. While greater than 90% of all seismic acquisition is still being done with analog technologies, spending on FWD is increasing as Oil Majors move from successful 2-D full-wave testing to 3D FWD implementation. I/O believes that within five to ten years, 50%-70% of all seismic imaging done onshore will utilize FWD technology.

• The Right Team. In 2003, Bob Peebler joined as CEO of I/O. He was responsible for successfully building Landmark Graphics in the midst of the burgeoning 3D Era before selling to Halliburton in 1996. Mr. Peebler has since built a management team specifically tailored to execute I/O’s break-out strategy.

Price (Dec. 9, 2005) | | $7.95 | |

Stock Data | | | |

| | | |

Fiscal Year end: | | December | |

Symbol / Exchange: | | IO / NYSE | |

52-Week Range: | | $5.28-$8.94 | |

Common Shares O/S (1): | | 79.0 MM | |

Market Capitalization: | | $627.8 MM | |

Total Enterprise Value (TEV) (2): | | $713.3 MM | |

Avg. Daily Stock Volume (2005): | | 798,081 | |

Insider Ownership (1): | | 11.2 | % |

Public Float: | | 89.1 | % |

Top 10 Institutional Owners (3): | | 50.1 | % |

Financial Data & Guidance (3/31/05 data, unaudited)

Select Income Statement: ($MM) | | 2004 | | 9-Mth YTD | |

Revenues: | | $ | 247.3 | | $ | 233.6 | |

EBITDA (4): | | $ | 32.5 | | $ | 28.6 | |

EPS: | | $ | (0.05 | ) | $ | 0.00 | |

TEV / EBITDA (5): | | 21.9x | | 24.9x | |

P / E (5): | | NM | | NM | |

Select Balance Sheet: ($MM) | | 2004 | | 3Q05 | |

Total Cash: | | $ | 14.9 | | $ | 15.7 | |

Total Debt: | | $ | 85.9 | | $ | 71.4 | |

Total Stockholders’ Equity: | | $ | 314.5 | | $ | 315.1 | |

Net Debt / Net Capital: | | 18.4 | % | 13.4 | % |

Business Composition | | | | | |

| | | | | |

Revenues | | 9-Mth, 2004 | | 9-Mth, 2005 | |

Land Imaging Systems | | $ | 95.6mm | | $ | 106.8mm | |

Seismic Imaging Solutions | | $ | 27.8mm | | $ | 71.2mm | |

Marine Imaging Systems | | $ | 43.7mm | | $ | 44.0mm | |

Data Management Solutions | | $ | 11.5mm | | $ | 11.7mm | |

Stock Price & Volume (YTD 2005) |

|

(1) As disclosed in SEC Form 14A, Definitive Proxy filed April 1, 2005.

(2) Total Enterprise Value (TEV) is defined as current Market Capitalization plus $30 million in preferred stock issued February 2005, plus Total Debt less Total Cash as of latest fiscal quarter end.

(3) As tracked by Thomson Financial.

(4) EBITDA is a non-GAAP financial measure; see inside front cover for GAAP reconciliation.

(5) Based on midpoint of 2005E Company guidance.

THE COMPANY

Input/Output, Inc. (NYSE: IO) is a technology-focused seismic solutions company that provides advanced acquisition equipment, survey design, advanced software and seismic processing services to the global oil & gas industry. Founded in 1968, I/O has achieved a solid leadership position in its core business markets. I/O’s seismic solutions fundamentally deliver a better image and greater productivity. All the Company’s efforts are focused on providing one end goal: a higher return on capital employed for both exploration and production (E&P) and seismic contractor customers.

As such, I/O has transformed from an OEM supplier to an industry leading seismic solutions company by merging its superior OEM businesses, including its VectorSeis sensor, with the advanced services of Concept Systems and GX Technology. The combination of products and services now within the I/O family solidifies its position as an industry leader in the next generation seismic solutions era – Full Wave Digital (FWD).

STRATEGY

With over $100 million invested in FWD sensors and systems R&D, I/O is committed to providing its client with state-of-the-art digital technology designed to help facilitate hydrocarbon discoveries and reduce drilling risk. Legacy seismic technologies have proven to be extremely useful in oil & gas development, but are arguably reaching their technical limits.

In order to identify the oil & gas reservoirs necessary to satisfy the world’s growing demand for energy, a new generation of seismic technology will be required. And I/O is at the forefront of these developing seismic solutions, both for land and marine applications.

I/O’s FWD solutions – spanning hardware and software products as well as advanced processing and imaging services – promise to extend the application of seismic technology across the reservoir life cycle by delivering higher resolution images at lower costs, and in shorter periods of time to key decision-makers in the oil & gas companies.

I/O’s strategy is more than just developing and integrating digital seismic technologies. The strategy is centered around the concept and applications of FWD, providing value-added solutions throughout the seismic work flow by Giving Seismic a Whole New Image.

I/O’S VISION

I/O’s vision for FWD is a complete seismic solution, including how surveys are designed, how the data is acquired, and how the data is processed, imaged and interpreted. I/O intends to be the industry leader of cutting-edge seismic products and advanced technical services that will strategically position I/O to capture the lion’s share of revenues generated during the next era of seismic imaging.

Looking out over the next five years, I/O believes this market could drive future I/O revenues to potentially over $700 million annually, nearly three times the level of 2004.

THE NEW INPUT/OUTPUT

In 2003, with new management at the helm, I/O set out to change its course. The course was cemented with the ongoing development and commercialization of the VectorSeis sensor, and the subsequent strategic acquisitions of Concept Systems and GX Technology in 2004.

I/O has purposefully moved beyond its 35-year legacy to become a full-service seismic solutions company. I/O is now positioned to address the most difficult geophysical challenges found worldwide.

To take full advantage of this market evolution, four main anchor points underscore the Company’s long-term strategy. These include:

• Lead the industry into the next seismic technology era – FWD.

• Provide the full range of seismic imaging solutions, from survey design to final image rendering and interpretation.

• Reduce E&P companies’ full-cycle seismic solutions cost and time.

• Form closer, more direct relationships with oil & gas companies, as they are the end-user and direct beneficiary of value-added seismic products and services.

If you believe in the new era of FWD, then Management encourage you to take a closer look at Input/Output.

2

THE NEW I/O: PROVIDING A COMPLETE SEISMIC SOLUTION

GLOBAL PRESENCE VIA 20 INTERNATIONAL OFFICES

• Founded in 1968 (NYSE:IO)

• Transformation started in 2003

• Focus on Full Wave Digital

• Develop Next-Era Technologies

• Provide Integrated Solutions

• Key acquisitions of GX Techology and Concept Systems

• Currently #1 or #2 in core markets

• 2005E Revenues of $330-$350 million.

• Key Clients: E&P Companies and Seismic Contractors

• 1,000 employees world-wide (60% in US)

3

Table of Contents

Section | | | | Page | |

Executive Summary | | | | | |

Company Overview | | 1. | | 5 | |

Market Trends & Drivers | | 2. | | 9 | |

Seismic Industry Sector Size | | 3. | | 11 | |

I/O’s Product & Services Offerings | | 4. | | 12 | |

Why Full-Wave Digital? | | 5. | | 27 | |

Financial Overview | | 6. | | 28 | |

Institutional & Insider Ownership | | 7. | | 35 | |

Management & Board of Directors | | 8. | | 36 | |

Glossary of Terms | | 9. | | 40 | |

4

1. Company Overview

LEADING PROVIDER OF SEISMIC PRODUCTS AND SERVICES

I/O’s research and development activities have delivered cutting-edge products and value-add services that have positioned the Company as a visionary of next generation seismic solutions. I/O’s seismic solutions, centered on FWD, offer a complete range of hardware and software products, coupled with advanced technical seismic services, including survey design, processing and imaging.

I/O is driving a revolution in the technology platform used in subsurface imaging. While many in the industry slowly transition away from conventional, 30-year old technologies (centered upon analog recording of pressure-wave (P-wave) only data), the core of I/O’s strategy centers upon accelerating the adoption of FWD, which, in part, records higher quality P-wave and has the ability to record shear-wave (S-wave). Through advanced processing techniques, offered by I/O’s GXT group, these recorded waves deliver high-definition images of the subsurface which enables geophysicists to better identify subtle structural, rock, and fluid-oriented features in the earth. I/O’s award-winning VectorSeis sensor and AZIM™ processing technology are just two of several tools in I/O’s FWD arsenal that have earned accolades from oil & gas companies worldwide.

I/O’s products and services are also making 4D seismic a more viable tool for E&P companies, as they attempt to optimize field economics through higher reserve recovery and production volumes. By acquiring successive seismic images on the same producing field, geophysicists can identify by-passed oil, optimize exploitation drilling investments, and better manage injection programs. I/O’s Concept Systems team delivers a comprehensive portfolio of software and services to measure and assure the quality of marine 4D acquisition, which includes accurately controlling the position of the towed streamer vessels, source energy systems and in-water recording cables. Time-lapse (4D) seismic continues to prove itself as a successful reservoir management tool.

THE IMAGE-DRIVEN™ MODEL

I/O’s Image-Driven approach is producing value-added results and has positioned the Company for strong revenue growth over the next five years, particularly in higher margin services like processing and imaging.

Most seismic service companies move through the work flow with processing often constrained by survey design parameters and the technologies used to acquire the data. By contrast, the Image-Driven approach attacks the seismic workflow in reverse. I/O’s expert employees work closely with oil & gas companies upfront to define the nature of the imaging challenge at hand, and then work backwards to select the appropriate mix of processing applications, acquisition technologies, and survey design parameters needed to optimize the image. Breakthrough products and services are developed to ultimately deliver the most accurate subsurface image for I/O’s oil & gas customers.

DEFINING FULL-WAVE DIGITAL

Simply put, FWD is 1) the acquisition of both p-wave and s-wave utilizing multi-component digital recorders, 2) the highly-technical processing of digitally recorded sound waves utilizing advanced computing software programs done efficiently and effectively, and 3) the critical knowledge base of industry scientists that can understand and interpret complex subsurface imagery. From digital VectorSeis equipment to advanced GXT services, I/O believes that it has the core competency in-house to lead the FWD era.

For greater detail of FWD, refer to I/O’s document entitled Full-Wave Digital Primer, dated June 2005 located online at

www.i-o.com.

5

STRATEGIC ACQUISITIONS UNDERPIN BUSINESS MODEL

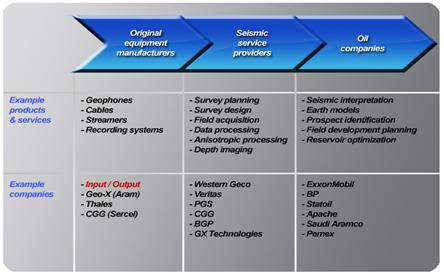

I/O has made numerous acquisitions since its inception; however, two strategic acquisitions in 2004, Concept Systems and GXT, greatly expanded the Company’s seismic capabilities and transformed I/O into a technology-focused seismic solutions provider. As a result, the Company is now an active participant in the complete seismic value chain, with solutions that span the seismic workflow.

I/O offers a unique business model within the seismic services industry. By design, the Company is not deeply invested in vessels, crews or heavy assets. However, I/O can provide the same end-to-end seismic services as a fully integrated contractor. Through a service known as ISS (Integrated Seismic Solutions), I/O’s GXT group provides full-scope seismic services, including survey design, technology selection, field acquisition, processing, and final image rendering. By working in partnership with experienced seismic contractors on ISS projects, I/O aligns with the priorities and objectives of the Company’s customers, focuses on the value-added elements of the seismic workflow, and delivers I/O solutions with minimal capital intensity and asset utilization burden.

Concept Systems. Acquired in February 2004, Concept Systems Limited (CSL) is a 21 year-old company based in Edinburgh, Scotland. CSL has 85 employees whose backgrounds span key disciplines such as geoscience, engineering, applied mathematics, and computer science. The inclusion of professionals with mathematics and computational science training reflects CSL’s original mission to provide advanced navigation solutions to operators of marine streamer vessels in a pre-GPS (global positioning system) world. With this foundation, CSL went on to develop the software and services to help streamer vessel operators acquire, control, and integrate data from all the disparate subsystems of streamer seismic technologies in a highly reliable, cost-effective manner. The CSL software platform effectively acts as the “auto-pilot” for the entire marine operation.

Apart from having a leading market position in its expertise, one of the longer term strategic elements of acquiring CSL is its application to I/O’s other areas of seismic. The Company has already begun efforts in the streamer, seabed, and land segments to imbed key features of Concept Systems software into I/O’s acquisition platforms. I/O believes this tight integration between software and hardware will extend the functionality and appeal of the Company’s offerings in the marketplace.

GX Technology (GXT). Acquired in June 2004, GXT is a 16 year-old company based in Houston, Texas. GXT has more than 175 full-time employees, many of whom are advanced degree holders in geophysics, supplemented by a team of technical contractors.

GXT has been a transforming event for I/O, both tactically as an industry leader in advanced processing and imaging services, and strategically as I/O now deals directly with the end-users of seismic, the oil & gas companies.

GXT leads the seismic industry in data processing and imaging services, including, Pre-stack depth migration (PreSDM), static and data conditioning, 3D-SRME (surface related multiple elimination), velocity modeling for structurally complex environments and FWD processing.

6

GXT believes it now has significant synergy and scale, with the ability to understand how seismic waves travel laterally and vertically within the Earth, both on and offshore. Moreover, GXT’s client list includes super-majors, independents, and national oil companies, many of whom have been long-standing customers. Trust-based relationships have been forged with many of these oil & gas companies, ranging from image-critical processing to full seismic solution offerings.

THE I/O BUSINESS MODEL

Then… A Limited OEM Provider of Legacy Equipment

…and Now: Pioneering FWD Seismic Solution to the End-User

7

REALIZING THE REVENUE POTENTIAL OF FWD

Near term, I/O recognizes the tremendous cyclicality of the seismic industry, and in particular the volatility that frustrates many investors on a quarter-to-quarter basis. Even now in 2005, I/O’s earnings and financial performance are sometimes misconstrued as the Company not participating on the current rebound in the seismic industry. In truth, the performance improvement in the Company’s OEM legacy business has been partially obscured by the necessary strategic and R&D investment into FWD. I/O strongly believes that having a full suite of industry-leading FWD products and services sets the Company apart from its competitors and strategically positions I/O to participate in better margin and higher revenue potential seismic businesses, particularly processing and imaging.

Once the shift in investment mindset is made to the long term, I/O believes the Company’s growth picture becomes far clearer, driven by the market evolution currently underway. Indeed, I/O believes that total revenues in five years (fiscal 2009) could be triple the levels recorded in calendar 2004. I/O revenue forecast is predicated on the adoption of FWD technology, and more importantly, the demand for new services (such as processing and interpretation) that goes with it.

I/O has experienced significant improvement in business segment gross profit margins. I/O’s operating margins are improving and management expects further improvement as the Company’s customers economically benefit from FWD. With both equipment and processing margins on an upward trend, I/O expects to realize stronger blended operating margins over the next few years. Company-wide operating margin should approach the high 30% to low 40% range, up from historical margins in the 20% to 30% range.

Furthermore, I/O is confident that the focus on FWD has positioned the Company to dominate the next era in seismic imaging. Based on I/O’s market expectations, revenue potential for 2009 could be in the range of $750-$850 million. Achievement of such levels would translate into a 5-year compound average annual revenue growth of 25% to 28% for the Company. From effectively 100% in 2002, revenues associated with I/O’s legacy businesses are expected to contribute less than 30% by 2009.

8

2. Market Trends and Drivers

INDUSTRY DRIVERS

With escalating global demand for hydrocarbons, particularly in high GDP growth countries like China and India, pressure is mounting for oil & gas companies to find new world-class reserve deposits and increase recoverable reserves from known oil & gas producing basins. The effort put forth to assure available hydrocarbon supply will require significant E&P investments in new technologies, including seismic, drilling and production. These investments should facilitate new oil & gas discoveries in some of the most challenging environments around the world and aid to harness steep decline rates of mature basins.

Key trends impacting the seismic industry:

• Global oil demand outpacing new reserve supply

• Increasing spending by E&P companies, re-investment of cash flow to early-stage exploration activities

• Rising Finding Costs, E&P companies doing more to increase reserve additions

• Expanding seismic capacity with the latest technologies

Signs of Demand Outstripping Supply

As shown below, expected global oil demand is projected to outstrip supply, according to the International Energy Agency (IEA) projected forecast. Despite every attempt to optimize existing field production and explore new frontier regions, the industry continues to struggle with steep decline rates of mature fields. Upward commodity pressure is further exacerbated by persistent geopolitical uncertainties in the Middle East and former Soviet Union. In the Gulf of Mexico, recent hurricane activity has jolted onshore and offshore infrastructure which is expected to curtail supply for some time. Consequently, the industry will spend millions of dollars for rebuild and repair instead of allocating capital to exploration (reserve add) opportunities.

As such, investors are weary that supply can not keep up with world oil demand as demonstrated by high commodity prices. The 12-month NYMEX crude oil strip is currently trading around $60/bbl, up nearly 44% year-to-date. Likewise, the 12-month NYMEX natural gas strip is trading at approximately $11/Mmbtu, up 71% year-to-date.

Source: McKinsey & Co.

9

Higher E&P Spending Drives Seismic Activity

During the past five years, E&P capital spending has been steadily increasing, with expectations that 2006 spending will continue this trend. Driven by record high commodity prices, oil & gas companies are clearly focused on investing activities that have an immediate impact on near-term production volumes. However, windfall cash flow generated by both Major Oils and Independent Producers will eventually be re-invested toward exploration projects that have the capability to replace production and add new reserves.

Worldwide E&P Spending ($ Billions)

Source: Citigroup Smith Barney E&P Spending Survey (2001-2005)

In 2005, spending trends are pointing toward increased activity in early-stage exploration services. The 2D marine vessel market remains tight and the 3D acquisition market is showing solid improvement, both in the North Sea and Gulf of Mexico. While the marine market was first to improve, the land market is strengthening as it recovers from excess crew and equipment capacity in many key regions. I/O believes the land business activity, particularly in North America, is beginning to accelerate and that the Company will benefit as contractors and operators look to replace aging seismic equipment with the latest technology.

Expanding Seismic Capacity

Both in the marine and land segments, seismic acquisition contractors are renewing equipment and expanding capacity. The technology upgrade cycle has begun offshore, with contractors purchasing new technologies that significantly improve the quality of 3D and 4D seismic images as well as acquisition efficiency, including digital source controllers, low-noise streamers, acoustic positioning gear, and streamer control systems – all marine equipment offered by I/O. Advanced seismic technologies are also beginning to solve complex land applications, driving seismic activity in frontier regions.

Rising Finding & Development Costs

Finding & development (F&D) costs have risen dramatically from the late 1990’s. One study shows worldwide F&D costs for 12 U.S. and European integrated oil & gas companies (the Majors) to have reached $9.57 per barrel of oil equivalent (BOE), a 36% rise from 2003 and nearly double the 10-year average. In effect, capital employed by the Majors for E&P in 2004 found 85% fewer barrels than the average found over the last 10-years.

With drilling costs on the rise, I/O believes E&P companies will continue to demand, and pay for, advanced 3D and 4D technology. Furthermore, higher-resolution subsurface imagery, driven by FWD, will prove to be a valuable tool to locating new fields and optimizing existing ones.

Worldwide Finding and Development Costs (Major Integrated Oils)

Source: Banc of America Securities; 2004 Operating Trends and Finding Cost Study (April 2005)

10

3. Seismic Industry Sector Size

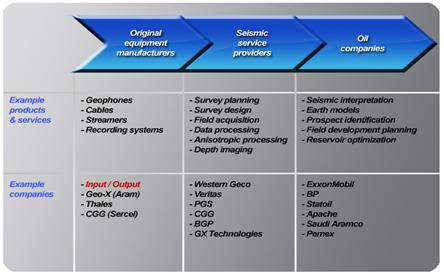

$7 BILLION SEISMIC SECTOR

While only encompassing less than 5% of oil & gas companies’ total worldwide capital expenditures, the global seismic industry in 2005 is expected to reach approximately $6.9 billion in revenues. The majority of this estimated market (51%) is comprised of marine equipment and services, followed by land equipment and services (34%). Notably, equipment alone is estimated to be only $770 million, or 11% of the market, vastly limiting the opportunities of any company focusing solely on the highly-commoditized OEM market.

Comprising the remaining 14% of the global seismic market is the higher margin “processing” segment. Looking forward, I/O believes that it is this segment that will experience the greatest growth and expansion in this new era, driven by the need to understand and economically benefit from the enormous amounts of new and complex data generated by FWD seismic acquisition.

2005E Industry Revenue – A $7 Billion Sector

It is for this fundamental reason that I/O has pursued a break-out strategy from the rest of the seismic herd, assembling the industry’s first technology-focused FWD seismic solutions company.

FULL-WAVE DIGITAL MARKET

I/O believes that FWD will inevitably become the standard by which both contractors and oil & gas companies acquire, process and image 3D and 4D seismic. As the industry’s ability to process and image FWD data (particularly shear waves) advances, there will be a spill-over effect to the equipment manufactures and contractors for even more FWD surveys.

Future break-through technological advances across the seismic workflow, particularly in the areas of processing and imaging, will further drive the industry toward the FWD era. This era promises to deliver superior high-resolution subsurface imagery, allowing oil & gas companies to make better drilling and production engineering decisions, thus substantially reducing the inherent risk in the exploration and development of oil & gas reserves.

In 2004, FWD spending rose more than five-fold to $36.9 million versus $7.2 million in 2003. There was a near 70% increase in FWD surveys performed in 2004, or approximately 40 surveys compared to 24 surveys in 2003. I/O estimates that 80% of all FWD surveys done have been performed utilizing VectorSeis equipment, giving the Company a leading market share position in the digital acquisition equipment market.

The FWD adoption rate continues to improve in 2005. Based on activity for the first nine months of 2005, the Company estimates FWD spending has reached $31.8 million, on track to increase over 2004 levels. Further evidence that adoption rate is increasing is the fact that larger 3D surveys are being performed worldwide. I/O expects fewer surveys in 2005 versus 2004, but because these surveys are large, more money will be spent.

In order to accelerate the move up the “S-curve,” market education will be critical, both in what is possible today and what could be tomorrow. A key milestone involves developing detailed real-world examples of customers who have benefited from FWD. These real-world applications, and their economic impact, are being recorded today and will greatly advance FWD adoption in the future.

11

4. I/O’s Product and Service Offerings

A LEADING, TECHNOLOGY-FOCUSED, SEISMIC SOLUTIONS PROVIDER

The I/O family of companies is unique in the industry. No other single company has the breadth and depth of I/O solution capabilities. The I/O legacy is firmly rooted in advanced hardware and equipment. Yet the Company transformed itself in 2004, through the acquisitions of Concept Systems and GX Technology, to become a leading, technology-focused seismic solutions provider. In addition to a full suite of land and marine hardware, I/O now provides valuable services including survey design and advanced imaging services, as well as seismic data integration software.

Collectively, this portfolio of tools gives I/O a peer-advantaged capability in developing and delivering customized, integrated solutions across the entire seismic workflow. Working back from the Company’s oil & gas customer’s imaging objective, I/O develops tailored solutions that integrate advanced hardware, software and expert services.

The Company’s ultimate goal is to make data transfers more seamless, improve image quality, and reduce cycle time and cost at every stage of the seismic workflow.

When existing seismic data is insufficient or non-existent, I/O’s customers collaborate with the Company’s GXT group to design an Integrated Seismic Solutions (ISS) program. ISS is an end-to-end, full-scope solution that includes:

• Survey design and planning

• Technology evaluation and selection

• Project management services, including coordination of the field acquisition process by experienced contractors

• Seismic data processing and advanced imaging

Complex environments present unique imaging challenges. To properly image the subsurface in these situations, I/O customers are applying novel, integrated technical solutions that frequently include FWD technology.

I/O’s FWD technologies are helping oil & gas companies and seismic contractors tackle complex imaging challenges where a solutions approach – spanning hardware, software, survey design and imaging services – is required. Complex imaging environments in which FWD solutions show great potential include: Arctic, desert and fractured reservoir environments.

With time-lapse (4D) surveys growing in both number and importance, I/O has dedicated its resources to the development of solutions for reservoir monitoring, especially in the marine environment. Whether for seabed or towed streamer acquisition, I/O marine 4D solutions ensure that surveys are designed, acquired, and processed for maximum repeatability across successive surveys.

By implementing new mindsets and new workflows, I/O can work hand-in-hand with oil & gas companies to address old problems with new solutions.

12

LEADING EDGE SURVEY DESIGN SOFTWARE AND SERVICES

Data acquisition is the foundation for the seismic lifecycle. E&P companies require accurate information to make critical decisions about the potential of a reservoir. For example, in areas like the desert or the Arctic, E&P companies are faced with increasingly difficult challenges as subsurface imaging objectives and field operations become more complex.

In order to meet these challenges, companies require flexible and robust survey design tools that provide accurate analysis to assess how to effectively image their subsurface targets. Software solutions from Concept Systems and Green Mountain Geophysics (GMG) address those needs for offshore and onshore projects by optimizing survey design and planning to deliver the right information to help make those critical decisions.

Concept Systems offers an integrated family of products that address the requirements for planning, in-field acquisition and post survey analysis of 2D, 3D and 4D seismic surveys. To complement its real-time navigation and positioning systems, Concept Systems supplies a range of software tools for survey calculation, planning and mapping, navigation data processing and attribute analysis.

GMG’s software is recognized worldwide as the standard for seismic survey design, illumination modeling, acquisition project tracking, and near-surface refraction statics. The GMG team of experienced geophysicists and software developers works in partnership with its customers to create intuitive tools to optimize acquisition planning and facilitate critical, time-sensitive decision-making in the field to keep crew productivity flowing. Contractors and oil & gas companies alike gain greater assurance that the seismic data being acquired will deliver a superior seismic image.

Survey design is the foundation of every acquisition project. I/O’s geophysical design services help clients achieve their imaging objectives by helping to plan cost effective, fit-for-purpose acquisition programs. The company’s survey design experts assist in optimizing seismic acquisition plans, even for challenging applications such as FWD and time-lapse (4D) imaging.

I/O offers oil & gas companies and seismic acquisition contractors a comprehensive range of survey design solutions. Working side-by-side with clients, I/O’s multi-skilled teams develop customized solutions to challenging geophysical and operational problems. The Company’s solutions closely integrate with the workflow processes of I/O’s clients, becoming a seamless extension to their own capabilities. I/O survey design services include:

• Survey design and planning project management

• FWD survey design

• 4D survey design

• Software training

• Technical seminars

13

LAND IMAGING SYSTEMS

I/O’s technologies are recognized as the most innovative solutions for land seismic data acquisition. From sources to sensors, I/O’s advanced Land Imaging Systems have been used on every continent in the search for oil & gas reserves.

Enabling cost-effective recording of high quality seismic data is a key requirement for any acquisition system. I/O has initiated and supported the growth of land 3D acquisition by introducing the innovative System Two recording system in the early 1990’s. That spirit of innovation continued with the more recent release of System Four® and now with I/O’s latest offering, FireFly™. Together, System Four and FireFly provide the ability to efficiently acquire analog or FWD data in all environments – from the Arctic, mountain highlands and the desert to the jungle and marsh/transition zone (TZ) areas. I/O recording systems’ product line includes: System Four, FireFly, and RSR/VRSR.

Highly Efficient Cable-based Recording

System Four enables the acquisition of seismic data using conventional, analog geophones and FWD VectorSeis accelerometers, or a combination of both, even on the same survey. The hybrid design of System Four allows contractors to maximize the utilization of existing geophone strings while simultaneously providing the flexibility to deliver the improved image quality that result from acquiring FWD data.

In 2003, I/O introduced System Four to usher in the era of FWD recording with the VectorSeis sensor. Enhancements to the original system architecture have occurred since that point. A cable-based version was introduced in 2003. In 2004, an analog geophone version was introduced. And, in late 2005, a new release of System Four was brought to the market. System Four incorporates numerous features and enhancements that I/O customers requested to make the original system even more flexible, productive, and user-friendly in the field.

I/O’s System Four is designed to maximize productivity and enable FWD imaging. System Four, which supports both digital VectorSeis and analog geophone acquisition, serves as the platform of choice for robust, efficient, user-friendly data acquisition in all land and transition zone environments.

System Four enables high channel/station count operations and multicomponent data acquisition, delivering improved spatial sampling, broader bandwidth data and improved image quality compared to competing recording systems. System Four has been engineered to maximize operational efficiency and deliver more uptime and more shots per day than any recording system available in the industry.

Sensors – I/O’s Precision Geophones

I/O’s Sensor subsidiary is the leading designer and manufacturer of precision geophones used in seismic data acquisition. Sensor has access to the vast wealth of knowledge acquired and developed by the I/O group of companies. This valuable asset base, coupled with Sensor’s own specialized skills and knowledge, provides a diversity of technologies and innovation.

Field proven analog geophones are available in either single or multi-channel configurations, and serve a variety of industries. Sensor geophones are unsurpassed in their ability to operate within tight tolerance limits and to stay in specification under the most demanding of field conditions. Sensor geophones are the most reliable geophones in the industry and deliver the lowest total cost of ownership over their operational lifetimes.

14

Unleashing the Power of FWD Imaging – Introducing FireFly

In November 2005, I/O changed the game in seismic imaging with the introduction of FireFly, the world’s first cableless system for FWD land acquisition. The FireFly system enables the recording of cost-effective fully-sampled, FWD surveys. FireFly delivers step-change improvements in image quality. By removing the constraints of cables, geophysicists are able to custom-design surveys for multiple subsurface targets and to increase receiver station density significantly to fully sample the subsurface. When connected to VectorSeis, I/O’s MEMS-based 3C (multicomponent) sensor, FWD data can be recorded with the highest vector fidelity available in the marketplace. The cableless design of FireFly also greatly improves field productivity while reducing HSE exposure. FireFly is purpose-designed to deliver key benefits to both E&P companies and seismic acquisition contractors. These benefits include:

Reduced System Weight

A standard seismic survey involves cables and miscellaneous ground equipment that weigh 25 tons or more. Because weight directly contributes to the costs of transporting gear and mobilizing a seismic crew, the cables themselves increase the cost of acquisition. FireFly was designed to eliminate much of the excess weight associated with cables that can account for up to 20% of the operational cost of a “typical” survey onshore in North America.

Improved Operational Efficiency

Deploying, rolling, troubleshooting and repairing a cable-based system is a manpower-intensive operation. It is estimated that 25-50% of the individuals tasked with spread deployment and retrieval are involved in cable-based activity, while 50-75% of troubleshooting personnel are focused on cable problems. By eliminating cables, FireFly will reduce manpower and logistics intensity compared to conventional seismic operations.

Reduced Health, Safety, and Environmental (HSE) Risks

By removing heavy cables and reducing manpower intensity during acquisition operations, FireFly offers a land system with much less health and safety risk to field crews. Additionally, the removal of cables and smaller spread footprint dramatically reduces the risk of damage to sensitive environmental areas.

Improved System Availability

Up to 50% of operational time is spent on cable troubleshooting, meaning only 50% of the average crew’s day is spent on actual data acquisition activities. With conventional acquisition systems, uptime is further reduced as the number of stations increase because of the increased risk for line failures and the time-consuming, sequential, trial-and-error approaches for troubleshooting. As a single-station system, FireFly overcomes these cable-based limitations and delivers productivity improvements that actually increase as station counts increase.

Improved Illumination by Fully Sampling the Subsurface

Cable-based architectures impose constraints on how surveys are designed. For instance, sensors are required to be spaced in gridded geometries that prevent surveys from being tailored to unique surface, near-surface and subsurface challenges. Many geophysicists see the ideal survey design as having upwards of 50,000 stations, a goal made operationally impractical by cable-based systems. FireFly imposes no such constraints, taking the industry one step closer in its quest to obtaining fully sampled data from the subsurface.

FireFly will be undergoing final engineering and field testing during 2006 in preparation for full field operations in early 2007. In the interim, E&P companies and seismic acquisition contractors can experience what the FWD, full sampling era of seismic will be like with System Four, I/O’s cable-based land acquisition platform that supports up to 10,000 live stations of digital VectorSeis sensors.

15

VectorSeis Full-wave Digital Sensors

I/O’s award-winning VectorSeis sensors are the essential elements in FWD seismic acquisition. Whether acquiring only conventional, P-wave seismic data or multi-component data, VectorSeis allows geophysicists to measure true 3D ground motion and record the full seismic wavefield with unsurpassed vector fidelity. When VectorSeis is used to acquire seismic data, geophysicists obtain enhanced subsurface images that allow them to better plan their exploration and development drilling programs. Although FWD imaging delivers significant benefits in any acquisition environment, it is especially advantaged in challenging situations such as Arctic, desert, and fractured reservoir environments.

VectorSeis acquires FWD seismic data in both land and marine environments using four of I/O’s advanced imaging platforms:

• FireFly – cableless land acquisition system

• System Four – cable-based land acquisition system

• VRSR – radio-based land acquisition system

• VectorSeis Ocean – redeployable ocean bottom cable (OBC) system for the seabed

VectorSeis is a digital, single-point sensor that contains three identical, highly sensitive MEMS (micro-electro-mechanical systems) accelerometer chips manufactured by I/O’s exclusive supply partner – Colibrys of Switzerland. The single-point VectorSeis sensors do not suffer the directional bias, signal smear and frequency loss effects of a geophone array and therefore more accurately samples the true seismic wavefield with a broader bandwidth.

VectorSeis delivers enhanced images of the subsurface by; 1) accurately measuring the full seismic wavefield, 2) recording the full frequency bandwidth that the Earth returns, and 3) eliminating intra-array statics issues.

With only one sensor at each receiver station and no need to level during deployment, VectorSeis receivers deliver significant efficiency improvements during field operations. The results are lower acquisition costs and less time from first shot to final data delivery.

16

Radio-based Land Acquisition for Difficult Environments

The RSR (Remote Seismic Recorder) and VRSR (VectorSeis Remote Seismic Recorder) are radio-controlled systems that enable the acquisition of seismic data using analog geophones and digital VectorSeis accelerometers. These radio systems are uniquely suited for work in the most difficult of operating environments such as environmentally-sensitive wetlands and urban areas where recording spread flexibility is required.

Like System Four, the VRSR enables FWD data acquisition, delivering broader bandwidth data and improved image quality compared to competing surveys recorded with conventional analog geophones. The use of I/O’s VectorSeis accelerometers enable I/O’s customers to realize the benefits of FWD imaging applications by:

• Acquiring high vector fidelity seismic data

• Recording the maximum bandwidth of reflected seismic energy

• Measuring anisotropy with both single-point receivers and sources

• Improved productivity

The RSR and VRSR have been engineered to maximize operational efficiency in those areas where recording spread flexibility is required or where cable faults are a significant everyday challenge.

Energy Source Systems

I/O is the leading provider of highly reliable vehicles and seismic energy source controllers. Years of experience in designing and manufacturing vibrators have resulted in durability, ease of maintenance and more efficient operations in all terrains. Coupled with Pelton controller technology, contractors and oil & gas companies can be assured that their seismic data will be of the highest integrity.

I/O’s AHV-IV rubber tire, buggy vibrators are recognized by seismic contractors worldwide as the industry workhorse. The AHV-IV, with its field-proven reliability and ability to deliver up to 60,000 lb of peak force, sets the standard for tire-based vibrator products in the seismic industry. I/O’s AHV-IV was designed with features that make the vehicle reliable and easy to maintain, even in demanding acquisition environments.

The Company’s newest offering – the XVib – is a tracked vibrator that delivers the maneuverability and reduced environmental impact required for Arctic tundra and desert operations.

The XVib’s superior design results in more shots per day by minimizing productivity-reducing challenges in the acquisition operation, including fewer go-arounds and offset shots, and less trail preparation. The XVib also supports the delivery of the highest quality seismic images by allowing source lines to be optimized for geophysical objectives, not operational challenges.

Seismic acquisition operations are inherently risky, presenting contractors and oil & gas companies with numerous HSE challenges. The XVib was designed to mitigate these HSE risks and support cost-effective surveys with the highest operational integrity.

17

Pelton - Pioneers of Source Controllers

I/O’s Pelton subsidiary pioneered source control technology when the Vibroseis energy source method was first introduced in the late 1960s. Pelton’s source controllers deliver improved crew productivity, maximum safety and enhanced seismic images. Their ability to work with almost all recording systems, vibrators and detonators also makes them the most versatile source control systems in the industry.

Pelton source controllers serve as the “intelligence” of the source network – whether the seismic energy source is dynamite or Vibroseis. Vib Pro allows for accurate and versatile vibrator sweep generation, relying on advanced digital control for reliable performance. Shot Pro II, I/O’s dynamite source controller, performs with high reliability while ensuring the maximum safety and efficiency of the field crew. The newly released, VibNet fleet, ensures the proper positioning of vibrator fleets and enables source driven acquisition for improved productivity and enhanced imaging.

Land Imaging Services

I/O has been supplying innovative, advanced technology products to the land geophysical industry for decades. More recently, I/O has begun to offer services to both oil & gas companies and seismic acquisition contractors that enable them to more effectively apply appropriate technologies to the specific acquisition and imaging challenges they face.

The I/O family of companies specializes in developing services that help customers obtain step-change improvements in image quality and productivity, including:

• Survey Design – By acquiring and integrating the technologies of Green Mountain Geophysics (GMG), Concept Systems and GX Technology (GXT), I/O has developed a unique and comprehensive suite of software-centric products and services that ensure optimal target illumination, while minimizing data acquisition and processing costs.

• Data Processing – GXT’s experience in solving complex imaging challenges has made it a recognized leader in advanced depth imaging, high resolution velocity analysis, noise removal and multiple attenuation. The addition of AXIS Geophysics has added additional capabilities in FWD imaging and azimuthal velocity modeling. With processing centers around the world, GXT has the expertise and local knowledge to solve the most complex imaging challenges I/O’s customers might encounter.

• Project Management – The Integrated Seismic Solutions (ISS) team at GX Technology provides end-to-end project management for all phases of a seismic program. The full-scope ISS offering includes customized survey design, technology consulting, advanced data processing, and final image rendering. In every ISS program, whether proprietary or multi-client, ISS experts oversee the entire project, including selecting and managing experienced seismic acquisition contractors, to ensure the highest quality images result.

• Training – I/O offers a full range of courses that cover all aspects of land seismic systems technology from maintenance and operation to software installation, analysis and troubleshooting.

18

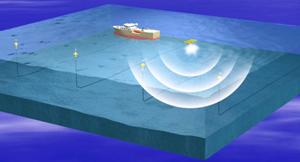

MARINE IMAGING

I/O is a leading provider of imaging systems, software and survey design services for towed streamer and seabed marine seismic acquisition. The Company’s comprehensive toolkit of marine solutions allows for one-stop shopping when outfitting modern streamer vessels and ocean bottom cable (OBC) crews, or when designing and implementing 2D, 3D, 4D or FWD seismic programs.

The Company’s marine offerings are underpinned by two of the most trusted names in the seismic business – DigiCOURSE and Concept Systems. Known throughout the oil & gas industry for solid track records of innovation, field performance and reliability, DigiCOURSE and Concept Systems technologies provide I/O customers with the necessary confidence to cost-effectively acquire seismic data of the highest quality, even in complex imaging environments.

I/O’s state-of-the-art products and services include:

• 2D, 3D and 4D survey design

• Towed streamer acquisition systems

• Seabed acquisition systems

• Energy sources

• Data integration software (Concept Systems)

• Project management

• Data processing

While I/O offers fully-integrated solutions for 2D and 3D marine seismic imaging, the Company’s latest technologies are focused on two high-growth application areas:

Full-Wave Imaging – Acquire multicomponent (and enhanced P-wave) data to improve subsurface image quality and image complex targets. I/O’s seismic acquisition platform for redeployable, full-wave data recording on the ocean bottom is VectorSeis Ocean (VSO).

4D Imaging – Obtain timely, reliable information about fluid movements within a reservoir. The key to successful 4D imaging is repeatability. I/O technologies and services are designed to maximize repeatability across successive, time-lapse surveys. Concept Systems offers a suite of software and services to design and assure the quality of 4D programs. DigiCOURSE source control and streamer positioning and control systems ensure field operations proceed as planned.

Towed Streamer

Ninety percent of all offshore hydrocarbons are located using seismic data acquired with towed streamer technology. I/O products are utilized in virtually every offshore data acquisition project. Some of the Company’s leading brand, products and applications include:

DigiCOURSE – Provides integrated, high performance streamer positioning and control solutions with unmatched service, quality, and reliability. For over 30 years, I/O’s products have been used by every major seismic contractor and oil & gas company. The scope of DigiCOURSE’s product line now includes source and streamer systems.

Concept Systems – Designs integrated navigation, data management and quality control systems that set the industry standard by offering radical improvements in operational efficiency and profitability.

Data acquisition systems – The MSX streamer and shipboard recording technology is a field-proven, 24-bit integrated data acquisition platform. The recent introduction of the DigiSTREAMER solid cable enables I/O’s customers to acquire low noise, cost-effective streamer data in an environmentally-friendly manner.

19

Streamer positioning and steering systems – Since accurate streamer positioning is critical to successful 3D and 4D projects, I/O’s DigiRANGE II has been field-proven in its ability to deliver reliable streamer positioning. DigiRANGE II is a key building block in I/O’s program to deliver a highly accurate streamer steering and control solution using DigiFIN.

High repeatability energy sources – For maximum 3D and 4D imaging performance, I/O provides source systems that accommodate all marine requirements. The DigiSHOT source controller ensures that energy with highly repeatable source signatures can be consistently and cost effectively delivered into the subsurface.

Data integration software – Concept Systems’ industry leading software products for navigation, quality control and data management are designed to integrate data flows from multiple marine hardware systems, ensuring improved seismic images are acquired more efficiently and with reduced HSE risk on every survey.

Enhanced resolution 2D and 3D imaging – I/O is uniquely able to offer a complete, cost effective instrumentation solution.

4D seismic solutions – The Company offers a purpose-built suite of streamer acquisition technology for time-lapse imaging. Known as Digi4D, this technology suite is designed to ensure maximum repeatability across successive seismic surveys. Digi4D includes, DigiSHOT, DigiRANGE II, DigiFIN, and DigiSTREAMER. The Digi4D solution enables oil & gas companies to acquire data and produce images with sufficient fidelity to track fluid movements in the reservoir.

Seabed Acquisition Technologies

As oil & gas companies seek to recover reserves in areas that are harder to access or from reservoirs that are more difficult to image, seabed seismic is emerging as a valuable part of the marine imaging toolkit. Seabed seismic offers a number of benefits over traditional towed streamer acquisition, including the ability to capture FWD seismic data. This delivers broader bandwidth P-wave data for higher resolution seismic images and converted-wave data to improve reservoir characterization and image through gas clouds.

I/O’s seabed acquisition technologies also improves the illumination of complex (e.g., subsalt) targets by supporting wide azimuth survey geometries. Logistically, seabed acquisition is not impeded by infrastructure-obstructed areas. Furthermore, receivers can be permanently deployed on the seafloor for maximum 4D repeatability and cost-effective time-lapse acquisitions.

20

Breakthrough Technologies – VectorSeis Ocean (VSO)

In 2004, I/O introduced VectorSeis Ocean (VSO), an innovative system for seismic acquisition using redeployable, ocean bottom cable (OBC). Like all of the Company’s seabed imaging solutions, VSO was purpose-designed to create value for I/O’s customers across multiple dimensions, by:

• Reducing the cost to acquire and process seismic data

• Decreasing cycle time across the seismic workflow, enabling assets to be brought on-stream more quickly

• Improving image quality and utility

• Reducing HSE risk profiles

Breakthrough Solutions

I/O offers a comprehensive suite of technologies and services for seabed application that span the entire seismic workflow, including:

• Survey design and 4D repeatability services

• Redeployable imaging systems (VectorSeis Ocean)

• Permanent reservoir monitoring systems

• Operations management software (GATOR, from Concept Systems)

• Energy sources systems

• Project management services

• Data Processing

Energy Sources

The starting point for any successful seismic imaging project is a safe and well controlled energy source. Today, as 4D becomes a routine business tool for asset teams, the fidelity and repeatability of the energy source is more important than ever. I/O’s complete suite of marine energy source solutions include both digital and analog source controllers.

Digital Source Control

DigiSHOT is a 2nd generation digital source controller from I/O that ensures the delivery of highly repeatable source signatures into the subsurface. Deployed using simple, low cost umbilical support cables, DigiSHOT is a image-enhancing solution that is becoming a vital element of 4D time lapse programs.

Field trials and a growing number of production installations have demonstrated that DigiSHOT:

• Reduces timing errors by up to 80%

• Ensures repeatable 4D signatures

• Maximizes energy delivery to the subsurface

• Reduces source downtime

• Lowers crew operating costs by enabling the use of smaller umbilicals, which reduces deck space requirement, drag and fuel consumption.

Digital source control is fast being recognized as a requirement for 4D seismic. I/O’s DigiSHOT is the leading source control system available in the market today.

21

Analog Air Gun Controllers

Many vessels still use traditional analog, air gun controllers. These controllers rely on passing small analog control and monitoring signals through long and expensive umbilicals, which are highly susceptible to leakage in the marine environment. As a result, source signatures are often not adequate for high resolution 3D and highly repeatable 4D applications.

I/O has been providing air guns to the seismic industry since acquiring the Exploration Products Division of Western Geophysical in 1996. The I/O Sleeve Gun offers several key benefits over traditional air guns. The recent introduction of the SV2K solenoid has made I/O’s Sleeve Gun the leader in reliability, with a 500,000 shot warranty. I/O’s Sleeve Guns also have an enhanced safety profile, whereby the guns can be retrieved and deployed without being pressurized.

The Sleeve Gun also has enhanced usability in 4D applications due to its single port design. Traditional air guns use multiple ports, and the resulting discharge of air becomes rapidly disorganized. In a compact array, these disorganized bubbles can interfere with each other in an unpredictable and non-repeatable fashion. I/O’s Sleeve Gun uses a single 360 degree port, resulting in a predictable, spherical bubble with a reliable and repeatable interaction with adjacent guns.

Energy Source Design services

The Company works with a number of industry partners to adapt I/O’s technology to many unique data acquisition configurations, including portable source systems, high repeatability point sources, high energy sources, and wide arrays.

Concept Systems

As previously mentioned, I/O’s Concept Systems subsidiary is a world leader in real-time navigation and data integration software and services. Concept Systems offers an integrated family of products addressing the navigation and data management requirements of 2D, 3D and 4D seismic surveys in the marine environment, including both towed streamer and seabed operations. Concept Systems has earned an international reputation for anticipating customer needs and providing tools which deliver dramatic efficiency improvements and operational cost savings in the highly competitive seismic acquisition market.

Integrated navigation systems provide real-time positioning, survey control and automated data management in solution suites that include:

• SPECTRA – An integrated navigation and control system for 2D, 3D and 4D towed streamer operations that sets the industry standard. Integrates with SPRINT and REFLEX for 3D and 4D applications.

• GATOR – An integrated command and control system for navigation, quality control, and data management during multi-vessel seabed acquisition, including both OBC and transition zone (TZ) operations. Integrates with REFLEX for comprehensive coverage analysis.

• ORCA – The next-generation survey-wide control system for towed streamer acquisition. Builds on the foundations of SPECTRA, SPRINT and REFLEX to provide new levels of instrument room automation and productivity enhancement for the vessel operator.

These integrated navigation systems are complemented by a range of post-survey analysis tools for navigation processing, binning and attribute analysis, and data quality control in solution suites that include:

• SPRINT – Navigation processing and quality control software for marine geophysical surveys. Integrates with the SPECTRA navigation and control system.

22

• REFLEX – Binning and attribute analysis software for navigation and seismic data analysis in the marine, transition zone and land environments. Integrates with SPECTRA and GATOR for 3D and 4D applications.

• SWAT – A Survey Wide Analysis Tool (SWAT) that provides remote web-based assessment of survey progress and quality assurance of the acquisition operation. Integrates with SPECTRA, SPRINT and REFLEX.

In addition to a portfolio of standard-setting software products, Concept Systems offers oil & gas companies and seismic acquisition contractors a comprehensive range of geophysical services delivered by expert personnel who are supported by an extensive library of software tools and sophisticated web-based delivery mechanisms.

Concept Systems is customer focused and believes in building close client relationships. I/O provides 24 hour worldwide support on mission critical products. Concept’s commitment to continuous technology development and systems integration ensures that customers are able to keep pace with advances in acquisition technology wherever their operations might take them.

ADVANCED PROCESSING SERVICES

I/Os GX Technology (GXT) subsidiary is a pioneer in the growing full-service seismic industry. From a recognized leadership platform in pre-stack depth migration (PreSDM), GXT has expanded its offerings to include a variety of advanced imaging services for both marine and land acquisition environments. Third-party market research has confirmed that GXT is a leader in a range of advanced imaging service areas, including:

• Statics and data conditioning, especially in areas with challenging near-surface velocity anomalies such as desert or Arctic regions.

• Noise removal, especially I/O’s 3D-SRME (surface related multiple elimination) technique to remove multiples from data acquired in the marine environment.

• Velocity modeling to build and analyze velocity models in the most structurally complex environments, including salt-prone regions and areas of the subsurface that are steeply dipping, stratigraphically complex, or impacted by anisotropy.

• Pre-stack depth migration solutions, including 2D and 3D Kirchoff, 2D and 3D shot-based wave equation, and 3D plane wave equation PreSDM – to convert data acquired in the time domain to an extremely accurate, depth-based domain.

• FWD processing, to remove source-generated or ambient noise from data acquired with single-point sensors like VectorSeis, capture broadband P-wave data, and develop higher resolution images of the subsurface.

23

GXT is Image-Driven in its approach to seismic data processing, which leads to better images for the Company’s customers. Unlike some seismic contractors who are driven by asset-utilization considerations, GXT is 100% focused on delivering upon the imaging objectives of the oil & gas companies. The team works backwards from the imaging objectives that uniquely define each project and, to the extent possible, ensure the processing workflows, acquisition technologies, and survey design parameters are optimized to meet I/O’s customers’ goals.

With experts strategically located throughout the Americas, Europe, and West Africa, GXT is prepared to deliver seismic images of the highest utility within the budget and timing constraints outlined by I/O’s customers.

ADVANCED IMAGING SERVICES

Seismic imaging is an area characterized by ongoing innovation. Imaging leaders possess the technology platforms, professional expertise, R&D commitment, and experience base to continually push the envelope. Within the Company, I/O has two recognized leaders in advanced imaging – GXT and AXIS Geophysics – providing I/O with the tools and capabilities to take on the most challenging imaging projects around the world. Whether data was acquired offshore or on land, or whether it was 2D or 3D, I/O offers advanced imaging services that include:

• Azimuthal velocity analysis to account for subsurface anisotropy that causes seismic velocities to vary as a function of compass direction or azimuth.

• Fracture detection to integrate seismic, engineering, and geologic data to model the connectivity of naturally-fractured reservoirs and optimize drilling programs and field development plans.

• FWD imaging, including vector filters to remove source-generated noise, tools to deliver higher bandwidth P-wave signals from single-point sensors like VectorSeis, and algorithms and workflows for processing converted-wave data.

• AVO and inversion tools to predict rock properties, including wavelet-based approaches that overcome the limitations of traditional AVO and extend applications of the technique to harder rocks, deeper horizons, thinly-bedded or fractured reservoirs, and areas with low signal-to-noise ratios.

• 4D imaging solutions that ensure noise suppression, multiple attenuation, data regularization, and amplitude and phase matching across successive, time-lapse surveys.

• Geophysical and reservoir analysis services including AVO – and inversion-based rock properties prediction, pore pressure prediction, well log analysis and attribute modeling, and interpretation services to complement the geophysical analyses undertaken by I/O’s oil & gas company customers.

24

DATA LIBRARIES

GXT owns one of the most up-to-date seismic data libraries in the industry, consisting of 2D, 3D and FWD data from around the world. I/O’s Image-Driven approach and customized workflows ensure that I/O delivers an optimized dataset that is ready for immediate interpretation by I/O’s oil & gas company customers.

GXT’s excellence in all areas of advanced image processing, guarantees that the Company’s customers are getting highly differentiated images to help them make informed decisions regarding exploration acreage and future development programs.

The majority of the data libraries licensed by GXT consist of ultra-deep 2D lines that oil & gas companies use to better evaluate the evolution of the petroleum system at the basin-level, including identifying source rocks, migration pathways, and play types. In many cases, the availability of geoscience data extends beyond seismic information to include magnetic, gravity, well log, and electromagnetic (EM) information, helping to paint the most comprehensive picture of the subsurface possible.

Known as Spans, these ultra-deep geophysical data libraries currently exist for major basins worldwide, including:

• GulfSpan – GulfSpan is an ultradeep seismic data library that provides critical insight into the geologic evolution, deep basin architecture, basin fill and structural history of the northern Gulf of Mexico region. The GulfSpan data library totals more than 12,000 miles of customized pre-stack depth-imaged data, recorded to allow consistent imaging to depths of 18,000 meters or 59,400 feet. GulfSpan was the first Span program to be originated by GXT.

• AfricaSpan – AfricaSpan is a regional seismic and geologic program designed to provide better understanding of the multiple, active petroleum systems that exist along the West African margin from Angola to Gabon. It provides the industry with the first regionally consistent advanced seismic dataset. Over 13,000 kilometers of new, high quality seismic data was acquired off the coasts of Angola, Congo and Southern Gabon to provide a dip and strike structural grid related to the major features of the Aptian Salt Basin.

• CaribeSpan – CaribeSpan is a basin-wide, ultradeep regional seismic data program and geologic study spanning the offshore areas of the southern Caribbean and the northern margin of South America. With 30,000 km of high-quality, deep-focused, depth-migrated seismic data, CaribeSpan was the area’s first regional seismic dataset. CaribeSpan data extends to several countries, including Trinidad and Tobago, Grenada, Guyana and Suriname.

• ColombiaSpan – ColombiaSpan provides a regional 2D seismic framework of the waters off the coast of Colombia, which is in desperate need of depth imaging to properly target deep shelf reservoirs and identify untapped reserves. ColombiaSpan was designed to deliver superior insight into the geologic evolution and basin architecture of the region.

• NovaSpan – NovaSpan was designed with the active participation of oil & gas companies and regional experts, with the goal of better understanding the regional geology and more specifically, the deeper, less explored areas of the basin. Utilizing its Image-Driven approach, GXT managed the entire project to ensure the highest-quality survey design, acquisition, and processing.

Additional Spans are in the detailed planning stage worldwide.

25

GXT seismic libraries consist primarily of datasets that were commissioned by multiple oil & gas companies and custom-designed to their imaging objectives. In some cases, the companies that originally commissioned the surveys have exclusive access to the data for a set period. After the exclusivity period ends, GXT is free to license the data to other clients. By retaining title to these data libraries, GXT is able to resell highly customized datasets to other oil & gas customers that may have not been involved in underwriting the original imaging program.

COMBINING TECHNOLOGIES INTO FWD

In June 2005, I/O issued a detailed analysis of the Company’s FWD products and services, entitled Full-Wave Digital Primer, which can be downloaded at www.i-o.com.

I/O believes FWD seismic will increasingly become the seismic standard such that, by the end of the next five years, the majority of seismic data collected on land and a significant portion of the data collected in the marine environment from the seabed will be FWD. While the industry is still in the early stages of utilizing shear-wave data, I/O believes it leads the industry in processing and understanding shear-wave effects.

The following section, “Why Full-Wave Digital?,” briefly explains the major advantages of FWD versus conventional analog technologies and key benefits of generating superior images and improving operating efficiencies.

26

5. Why Full-Wave Digital?

The goal of FWD recording is to measure true seismic ground motion by making use of 100% of the seismic signal.

To better understand why I/O believes that the industry is in a fundamental secular shift to adopting FWD, investors need to recognize the constraints of conventional seismic. While there have been significant enhancements to the underlying analog technologies since the 3D era began nearly 25 years ago, conventional 3D seismic suffers from several broadly acknowledged limitations, including:

• Conventional sensors are fundamentally based on a mechanical, coil-spring geophone, technology originally developed in the 1920’s.

• These sensors capture only a portion of the full seismic bandwidth (frequency in hertz) returned by the Earth, and

• These sensors need to be routinely calibrated and wear over time.

• Single component geophones measure ground motion in a single direction (up and down), even though reflected energy is coming from all directions.

• This means it captures only a portion of the full seismic wavefield, specifically capturing only the vertical P-wave.