- ESE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ESCO (ESE) DEF 14ADefinitive proxy

Filed: 14 Dec 22, 4:15pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C., 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934 (AMENDMENT NO. )

| Filed by the registrant | x |

| Filed by a party other than the registrant | ¨ |

Check the appropriate box:

| ¨ | Preliminary proxy statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive proxy statement | |

| ¨ | Definitive additional materials | |

| ¨ | Soliciting material pursuant to Rule 14a-12 |

ESCO TECHNOLOGIES INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| ESCO Technologies Inc. 9900A Clayton Road St. Louis, MO 63124 Vic Richey Chairman, Chief Executive Officer and President |

| December 14, 2022 | |

| Dear Fellow Shareholders,

I am pleased to invite you to attend our 2023 Annual Meeting of Shareholders of ESCO Technologies Inc., to be held on Friday, February 3, 2023 at the Westlake Village Inn, 31943 Agoura Road, Westlake Village, California 91361, at 8:00 a.m. Pacific Time.

The accompanying Notice of Annual Meeting and Proxy Statement describe the items of business that will be discussed and voted on at the Meeting. We value your input and encourage you to review this material as well as our Annual Report for fiscal 2022 and to vote your shares of common stock. You have a choice of voting online, by telephone, by returning the enclosed proxy card by mail, or at the Meeting.

Fiscal 2022 was a remarkable year for ESCO as we successfully navigated a challenging economic environment to deliver 30 percent growth in net earnings and record revenue, orders, and year-end backlog. Our team of dedicated employees worked diligently throughout the year to manage persistent supply chain disruptions, inflationary pressures, and labor shortages. Through teamwork and persistence, we found ways to support our customers and deliver record operation results.

The hard work we have done during this challenging time has us well-positioned to drive profitable growth moving forward, and we are excited about the opportunities ahead as we strive to deliver innovative solutions to the industries we serve. We appreciate your investment in ESCO and remain committed to effectively managing the company to deliver long-term shareholder value.

On behalf of the Board of Directors and all of us at ESCO, thank you for your ongoing support.

Sincerely,

Vic Richey Chairman, Chief Executive Officer and President |

| Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

| Notice of Annual Meeting of Shareholders |

St. Louis, Missouri

December 14, 2022

To the Shareholders of ESCO Technologies Inc.:

The 2023 Annual Meeting of the shareholders of ESCO Technologies Inc. will be held on Friday, February 3, 2023 at the Westlake Village Inn, 31943 Agoura Road, Westlake Village, California 91361, beginning at 8:00 a.m. Pacific Time, for the following purposes:

| 1. | To elect Patrick M. Dewar, Vinod M. Khilnani and Robert J. Phillippy as directors of the Company to serve for three-year terms expiring in 2026; |

| 2. | To approve an extension and certain amendments of the Company’s 2018 Omnibus Incentive Plan; |

| 3. | Say on Pay – An advisory vote to approve the compensation of the Company’s executive officers; |

| 4. | Say on Pay Frequency – An advisory vote on the frequency of the advisory votes on executive compensation; and |

| 5. | To ratify the appointment of the Company’s independent registered public accounting firm for the 2023 fiscal year. |

| Your Board of Directors recommends that you vote: | ||

| ● | FOR all three nominees for director, | |

| ● | FOR Proposals 2, 3 and 5, and | |

| ● | On Proposal 4, to hold the advisory vote on executive compensation every 1 YEAR. | |

Shareholders of record at the close of business on November 28, 2022 are entitled to vote at the Meeting.

Information about each of the above Proposals, as well as instructions for voting and additional relevant information concerning the Company, are set forth in the accompanying Proxy Statement and in the “Important Notice Regarding the Availability of Proxy Materials” sent to all shareholders entitled to vote at the Meeting beginning on or about December 14, 2022.

By Order Of The Board Of Directors,

David M. Schatz

Senior Vice President, General Counsel and Secretary

| This Notice, the Proxy Statement attached to this Notice and our Annual Report to Shareholders for the fiscal year ended September 30, 2022 are available electronically at www.envisionreports.com/ESE and on our website at www.escotechnologies.com. | ||

| Even if you plan to attend the Meeting in person, PLEASE VOTE: | ||

| ● | Electronically via the Internet at www.investorvote.com/ESE; or | |

| ● | By telephone within the United States, U.S. territories or Canada at 1 800 652 VOTE (8683); or | |

| ● | If you requested paper or e-mail copies of the proxy materials, please complete, sign, date and return the proxy card. | |

| Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

| Proxy Statement Table of Contents |

| Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

| Proxy Statement Summary |

This Proxy Statement relates to the 2023 Annual Meeting of the shareholders of ESCO Technologies Inc., sometimes referred to herein as the Company, we, our or us. Our stock is listed on the New York Stock Exchange (NYSE), where our ticker symbol is “ESE”.

This Proxy Statement is provided pursuant to the rules of the Securities and Exchange Commission (SEC) in connection with our Management’s solicitation of votes for the Meeting.

This Summary highlights certain information relating to the Meeting and the items to be voted on at the Meeting. For additional information, including important business, compensation and corporate governance matters, please refer to the following sections of this Proxy Statement and to our 2022 Annual Report on Form 10-K. Unless otherwise noted, all references to 2022 in this Proxy Statement refer to our fiscal year ended September 30, 2022.

| Date and Time | Location | Record Date | Voting |

| Friday, February 3, 2023, at 8:00 a.m. Pacific Time | Westlake Village Inn 31943 Agoura Road Westlake Village, California 91361 | Close of business on November 28, 2022 | Shareholders of record as of the record date are entitled to vote. Each share of common stock is entitled to one vote on each of the director nominees and one vote on all other matters to be considered at the Meeting. |

How to Vote:

| Via the Internet | By Telephone | By Mail | At the Meeting |

|  |  |  |

| www.investorvote.com/ESE | 1-800-652-VOTE (8563) in the U.S. or Canada | Follow the instructions on the proxy card | Attend the Meeting in person and vote by ballot |

PROPOSALS AND BOARD RECOMMENDATIONS

| Proposal | See Page | Required Vote (See “Voting” On Page 5) | Board’s Voting Recommendation |

| 1. Election of Directors | 7 | To be elected, a nominee must receive a majority of the votes cast | FOR each director nominee |

| 2. Extension and Amendments of the Company’s 2018 Omnibus Incentive Plan | 21 | To be approved, this proposal must receive a majority of the votes cast | FOR |

| 3. Say on Pay – Advisory Vote to Approve Executive Compensation | 30 | To be approved, this proposal must receive a majority of the votes cast | FOR |

| 4. Say on Pay Frequency – Advisory Vote on Frequency of Advisory Votes on Executive Compensation | 55 | The frequency which receives the most votes in favor will be considered approved | 1 YEAR |

| 5. Ratification of Appointment of Independent Registered Public Accounting Firm | 56 | To be approved, this proposal must receive a majority of the votes cast | FOR |

| 1 | Proxy Statement Summary | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

Management is not aware of any other matters that will be presented at the Meeting. However, if any other proposal is properly presented for a vote at the Meeting, other than the election of directors and the other proposals described in this Proxy Statement, the proxy holders will vote on it in their own discretion.

The following table provides summary information about our director nominees:

| Nominee | Primary Occupation | Independent | Board Committees | Key Attributes/Qualifications |

| Patrick M. Dewar | Chief Executive of The Trenton Group, LLC | Yes | Audit, Compensation | Extensive strategic and operational experience in the aerospace & defense markets |

| Vinod M. Khilnani | Retired former Chairman & CEO of CTS Corporation | Yes | Audit, Compensation (Chair) | Management experience and business knowledge of operational, financial & corporate governance issues, plus extensive international experience with global operations |

| Robert J. Phillippy | Executive consultant to technology companies | Yes | Audit (Chair), Governance | Extensive experience in mergers & acquisitions, new product innovation & international business development |

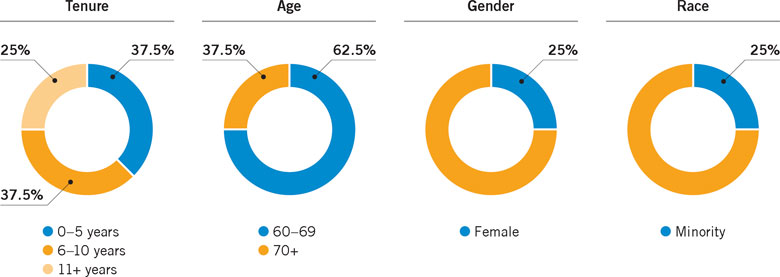

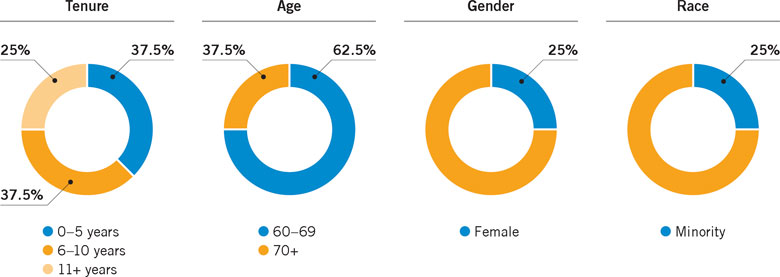

Diversity is one of the factors that our Governance Committee considers in identifying the pool of director search candidates. The Board appreciates the benefits diversity brings and strives to assemble a Board with not only a variety of business and professional backgrounds, but also diversity in areas such as race, ethnicity and gender.

COMPANY OVERVIEW AND BUSINESS HIGHLIGHTS

We are:

| ● | A global provider of highly engineered filtration and fluid control products and integrated propulsion systems for the aviation, navy, space and process markets worldwide, as well as composite-based products and solutions for navy, defense and industrial customers; |

| 2 | Proxy Statement Summary | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

| ● | An industry leader in radio frequency shielding and electromagnetic compatibility test products; and |

| ● | A provider of diagnostic instruments, software and services for the benefit of industrial power users and the electric utility and renewable energy industries. |

| ● | We conduct our business through a number of wholly-owned direct and indirect subsidiaries. Our business is focused on generating predictable and profitable long-term growth through continued innovation and expansion of our product offerings across each of our business segments. Our corporate strategy is centered on a multi-segment approach designed to enhance the strength and sustainability of sales and earnings growth by providing lower risk through diversification. |

In fiscal 2022 we achieved record-breaking financial results despite the overall challenging economic environment. Our broad order strength drove organic growth across our three business segments. Our teams worked diligently throughout the year to offset inflation, supply chain issues, and labor shortages to deliver meaningfully profitable growth. With a solid balance sheet and substantial liquidity, we continue to be well-positioned to fund investments to drive growth and shareholder value creation.

The following are only selected measures of Company performance. For complete financial information, please see the audited financial statements included in our 2022 Annual Report to Shareholders.

| Net Sales | Net Earnings | Diluted Earnings Per Share | ||

| $858M | $82.3M | $3.16 | ||

| Record Sales +20% over prior year | Record Earnings +30% over prior year | +31% over prior year | ||

| Entered Orders | Net Cash Provided by Operating Activities | Leverage Ratio | ||

| $961M | $135M | 0.78X | ||

| Record Orders & Ending Backlog +21% over prior year | Free Cash Flow Conversion of 108% | $589M of liquidity at year end |

| All directors other than the CEO are independent |

| Competitive share ownership guidelines for directors and executive officers |

| All committee chairs are independent |

| Executive compensation driven by pay for performance |

| Each director attended at least 75% of Board and committee meetings |

| Annual shareholder vote on executive compensation |

| Independent directors hold executive sessions during each Board meeting |

| Executive officers and directors may not hedge or pledge company shares |

| Board conducts self-assessments annually |

| Independent directors review CEO performance annually |

| The full Board exercises oversight responsibility for material risks, and delegates oversight of other risks to the appropriate committees |

| Average tenure of independent directors is 9 years |

| Three of our eight directors are diverse in gender and/or ethnicity |

| Median age of independent directors is 63 years |

| Robust clawback policy for executive compensation plans |

| 3 | Proxy Statement Summary | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

EXECUTIVE COMPENSATION HIGHLIGHTS

Our compensation objective is to develop and maintain an industry-competitive compensation program that attracts, retains, motivates and rewards our executive officers and other senior officers and key executives. The compensation program is designed to emphasize performance-based compensation in alignment with our business strategy.

Our compensation programs are designed to maximize shareholder value by allocating a significant portion of executive compensation to performance-based pay that is dependent on the achievement of our performance goals. Our annual cash incentive program and equity-based Performance Share Unit awards (PSUs) utilize a variety of key strategic and financial performance metrics and are designed to reward positive financial performance and limit unnecessary risk taking. Stock ownership guidelines align the interests of executives and shareholders by ensuring that executives bear the economic risk of share ownership.

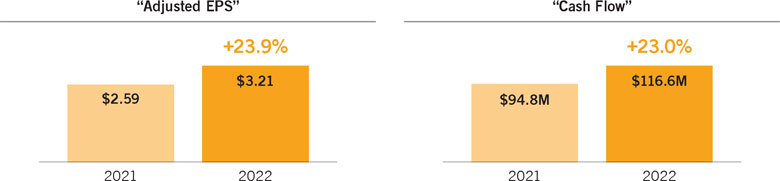

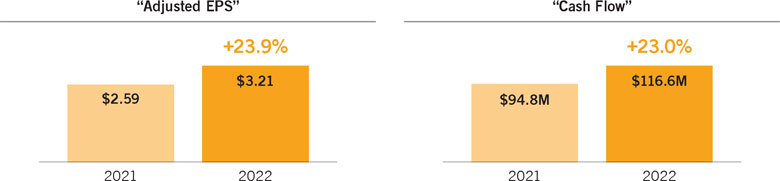

For 2022, our Human Resources and Compensation Committee continued the use of historic performance metrics, “Adjusted EPS” and “Cash Flow,” to determine cash incentive plan compensation earned during fiscal 2022 and thereby incent the participants and align cash incentive compensation with business objectives. These metrics are non-GAAP measures; for a detailed description and a reconciliation to the nearest GAAP measures, see 2022 Cash Incentive Metrics in the Compensation Discussion and Analysis section.

Below are the 2021 and 2022 performance results of these metrics:

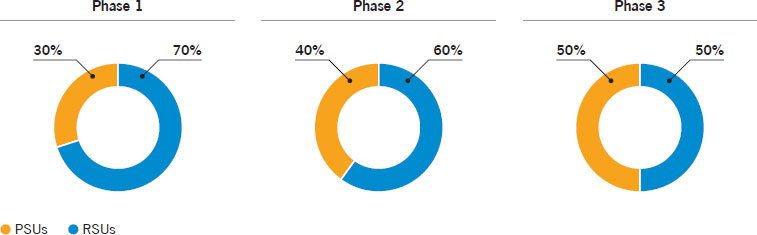

In 2022, we added PSUs to our long-term equity incentive (LTI) program in addition to the Restricted Share Units (RSUs) which were added to the program in 2021. If earned by achievement of the performance targets, PSUs are distributed in shares after a three-year performance period.

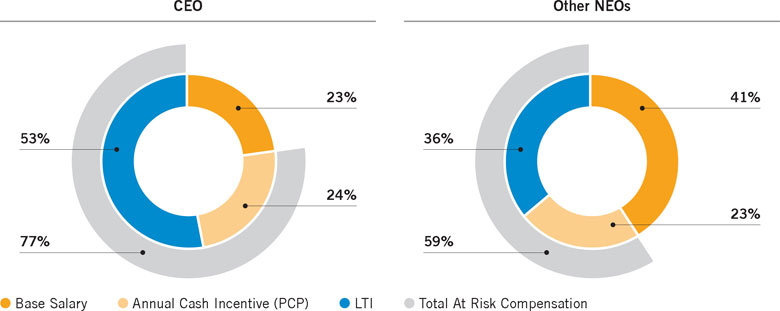

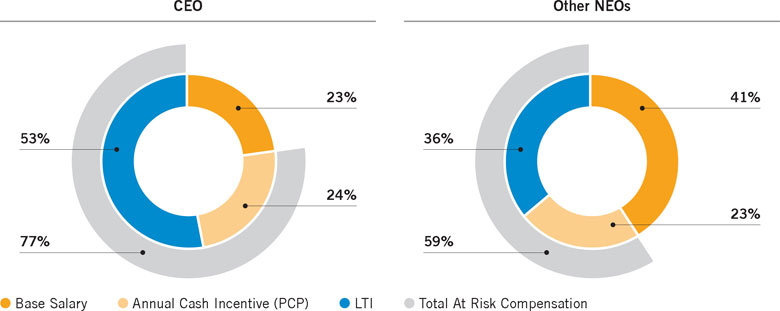

The following tables summarize the 2022 pay mix for the CEO and the other named executive officers, with 77% of the CEO’s target direct compensation at risk and 59% of the average of the other named executive officers’ target direct compensation at risk. Target direct compensation is defined as the sum of the executive officer’s base salary, annual cash incentive award, and annual long term incentive awards, in each case calculated at the target level approved by the Committee.

| 4 | Proxy Statement Summary | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

| Voting |

Whether or not you expect to be present in person at the Meeting, please vote in advance using one of the voting methods described in the Important Notice Regarding the Availability of Proxy Materials sent to the shareholders on or about December 14, 2022, which contained instructions on how to access the proxy materials and vote electronically via the Internet, by telephone, by mail, or in person. That Notice also contained instructions on how to request a paper or e-mail copy of the proxy materials, including the Company’s 2022 Annual Report to Shareholders, this Proxy Statement, and a proxy card. The 2022 Annual Report to Shareholders and this Proxy Statement are also available for review on the Company’s website, www.escotechnologies.com.

| ● | You may vote on each proposal, by proxy or by voting in person or via the Internet or by telephone, in which case your shares will be voted in accordance with your choices. |

| ● | You may abstain from voting on any one or more proposals, or withhold authority to vote for any one or more directors, which will have the effect described under Required Vote below. |

| ● | You may return a properly executed proxy form without indicating your preferences, in which case the proxies will vote the shares according to the Board’s recommendations. |

You will have the right to revoke your proxy at any time before it is voted by giving written notice of revocation to the Secretary of the Company, or by duly executing and delivering a proxy bearing a later date, or by attending the Meeting and casting a contrary vote in person.

| Via the Internet | By Telephone | By Mail | At the Meeting |

|  |  |  |

| www.investorvote.com/ESE | 1-800-652-VOTE (8563) in the U.S. or Canada | Follow the instructions on the proxy card | Attend the Meeting in person and vote by ballot |

At the Meeting, shareholders will be entitled to cast one vote for each share held by them of record on the record date. There is no cumulative voting with respect to the election of directors. The Company has no non-voting shares.

The affirmative vote of the holders of a majority of the shares represented in person or by proxy at the Meeting and entitled to vote on the matter in question will be required to elect directors, to approve each of the individual proposals described in this Proxy Statement (other than the advisory vote on the frequency of Say-on-Pay votes, with respect to which a plurality will be considered to represent the recommendation of the shareholders), and to act on any other matters properly brought before the Meeting.

The Company’s Corporate Governance Guidelines provide that an incumbent director who fails to obtain a majority vote must promptly offer his or her resignation to the Chairman, and the remaining directors shall meet to consider whether it is in the best interests of the Company to accept the resignation or to permit the incumbent to remain on the Board for such period of time as the Board may determine or until a successor is elected and qualified.

| 5 | Voting | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

Shares represented by proxies which are marked “Withhold” authority to vote for the election of one or more of the nominees for election as directors, marked “Abstain” on any one or more of the other individual proposals described in this Proxy Statement, or marked to deny discretionary authority on any other matters brought before the Meeting will be counted for the purpose of determining the number of shares represented by proxy at the Meeting; but other than with respect to the advisory vote on the frequency of Say-on-Pay votes, proxies so marked will have the same effect as if the shares were voted against such nominee or nominees, such proposals, or such other matters.

Under the Rules of the NYSE, the proposal to approve the appointment of independent registered public accountants is considered a “discretionary” item, which means that brokerage firms may vote in their discretion on this matter on behalf of clients who have not furnished voting instructions at least 10 days before the date of the Meeting. In contrast, the election of directors and the other items on the Meeting agenda are “non-discretionary” items, which means that brokerage firms that have not received voting instructions from their clients on these proposals may not vote on them. These so-called “broker non-votes” will, if the underlying shares are otherwise represented at the Meeting, be considered to be present for purposes of determining a quorum, but will be treated as not entitled to vote on such non-discretionary or matters; they will therefore not be considered in determining the number of votes necessary for approval and will have no effect on the outcome of the votes for directors or the other matters to be considered at the Meeting.

If your shares are held by a broker, it is important that you provide voting instructions to your broker so that your votes will be counted.

| 6 | Voting | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

| Proposal 1: Election of Directors |

The Board of Directors recommends a vote FOR all nominees.

The Board is divided into three classes, with the terms of office of each class ending in successive years. The terms of directors Patrick M. Dewar, Vinod M. Khilnani and Robert J. Phillippy will expire at the Meeting, and the Board has nominated each of them to serve for an additional three-year term expiring at the 2026 Annual Meeting.

If elected, the nominees would serve until the expiration of their terms and until their successors have been elected and qualified. Proxies cannot be voted for more than three nominees. Should any one or more of the nominees become unable or unwilling to serve (which is not expected), the proxies unless marked to the contrary will be voted for such other person or persons as the Board may recommend.

NOMINEES FOR TERMS ENDING IN 2026

» Age: 62 » Director since 2017 » Board Committees: » Qualifies as an audit committee financial expert under SEC rules

|

Patrick M. Dewar Mr. Dewar’s extensive strategic and operational experience in the aerospace and defense markets makes him well-qualified to assist in guiding Company strategy at the highest levels.

Principal Occupation and Business Experience 2016–present: Chief Executive of The Trenton Group, LLC (investment and strategy consulting firm focused on security, aerospace and defense technology companies) 2010–2013: Senior Vice President, Strategy and Business Development for Lockheed Martin Corporation Prior to 2010: Held various positions with Lockheed Martin and GE Aerospace

Other Public Company Directorships Within Past Five Years 2018–present: Butler America Aerospace, LLC, a subsidiary of HCL Technologies Ltd. (provider of engineering, design IT and support services primarily to US aerospace and defense markets)

Other Experience and Education M.S. in Electrical Engineering, Drexel University; B.S. in Engineering, Swarthmore College. Member of the Council on Foreign Relations; senior adviser to numerous investment firms on aerospace and defense matters |

| 7 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

» Age: 70 » Director since 2014 » Board committees: » Qualifies as an audit committee financial expert under SEC rules | Vinod M. Khilnani As a former public company executive, Mr. Khilnani brings to the Board of Directors a wealth of management experience and business knowledge regarding operational, financial and corporate governance issues, as well as extensive international experience with global operations.

Principal Occupation and Business Experience 2013: Executive Chairman of the Board of Directors of CTS Corporation (designer, manufacturer and seller of electronic components and sensors) 2009–2013: Chairman and Chief Executive Officer of CTS 2007–2009: President and Chief Executive Officer of CTS

Other Public Company Directorships Within Past Five Years 2009–present: Materion Corporation (manufacturer of highly engineered advanced materials, performance alloys and composites, and precision coatings for global markets) 2013–present: 1st Source Corporation (bank holding company) 2014–2021: Gibraltar Industries (manufacturer and distributor of products for the building markets)

Other Experience and Education M.B.A. from the University of New York at Albany; B.A. in Business Administration from Delhi University |

» Age: 62 » Director since 2014 » Board Committees: Audit (Chair), Governance » Qualifies as an audit committee financial expert under SEC rules

| Robert J. Phillippy Along with his experience as chief executive officer of a publicly held technology company, Mr. Phillippy brings to the Board of Directors extensive experience in mergers and acquisitions as well as in new product innovation and international business development.

Principal Occupation and Business Experience 2016–present: Executive consultant to technology companies on a range of strategic, operational and organizational issues 2007–2016: President, Chief Executive Officer and a director of Newport Corporation (developer, manufacturer and supplier of lasers, optics and photonics technologies, products and systems for scientific research, microelectronics, defense and security, life and health sciences and industrial markets worldwide) 2004–2007: President and Chief Operating Officer of Newport Corporation 1984–1996: Held various sales and marketing management positions at Square D Company (now Schneider Electric) (electrical equipment manufacturer)

Other Public Company Directorships Within Past Five Years 2018–present: Materion Corporation (manufacturer of highly engineered advanced materials, performance alloys and composites, and precision coatings for global markets) 2016–2018: MKS Instruments (provider of technology solutions for semiconductor manufacturing, advanced electronics and specialty industrial applications

Other Experience and Education M.B.A. from Northwestern University’s Kellogg School of Management; B.S. in Electrical Engineering from the University of Texas at Austin |

| 8 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

DIRECTORS CONTINUING IN OFFICE

» Age: 63 » Director since 2022 » Term expires 2025 » Board Committees: Governance | Janice L. Hess Ms. Hess’s four decades of operational, financial and leadership experience, commitment to continuous improvement, and demonstrated performance in growing traditional, adjacent and emerging markets similar to those served by the Company, make her well-qualified to assist the Board in guiding Company strategy at the highest levels.

Principal Occupation and Business Experience 2014–2022: President, Engineered Systems Segment of Teledyne Technologies Incorporated (diversified multinational company providing enabling technologies for industrial growth markets requiring advanced technology and high reliability; the Engineered Systems Segment provides innovative systems engineering and integration and advanced technology development, and is a U.S. Government contractor serving defense, space, energy and maritime markets) 2000–2014: Held a number of other positions with Teledyne, including Executive Vice President and Chief Financial Officer of Engineered Systems 1984–2000: Held positions of increasing responsibility with Intergraph Corporation (now Hexagon AB), including Vice President, Finance and Administration and Chief Financial Officer, Computer Systems

Other Experience and Education B.S.B.A. from Auburn University; staff accountant with PricewaterhouseCoopers LLP from 1981 to 1983; former Certified Public Accountant |

» Age: 74 » Director since 2014 » Term expires 2025 » Board Committees: Governance (Chair) | Leon J. Olivier Mr. Olivier’s broad utilities industry experience in all aspects of strategy and operations, including conventional and nuclear generation, renewable energy development (hydro, wind and solar), electric and gas transmission, distribution and development, and Smart Grid strategy and design, and including his extensive experience in senior leadership and management roles, makes him well qualified to serve on the Board of Directors and to assist in guiding strategy at the highest levels.

Principal Occupation and Business Experience 2014–2020: Executive Vice President, Enterprise Energy Strategy and Business Development, of Eversource Energy (formerly Northeast Utilities) (public utility holding company engaged in generation, transmission and distribution of electricity and distribution of natural gas to customers in Connecticut, Massachusetts and New Hampshire)

Other Experience and Education M.B.A. from Northeastern University; served in the U.S. Navy submarine service; former director of Essex Financial Services, Essex, CT |

| 9 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

» Age: 65 » Director since 2002 » Term expires 2024 » Board Committees: Executive

| Victor L. Richey Mr. Richey’s current position as Chairman and Chief Executive Officer as well as his previous positions of ever-increasing responsibilities with the Company during his many years of service make him uniquely qualified to provide the Board of Directors with valuable insights and perspectives concerning all areas of the Company’s business.

Principal Occupation and Business Experience 2003–Present: Chairman, President (since 2006) and Chief Executive Officer of the Company 1990–2003: Held various positions of increasing responsibility with the Company, including Vice President of Sales and Marketing for a former division, Vice President of Administration, Vice President responsible for Communications and Test segments, and Chief Operating Officer 1986–1990: Held a variety of positions with Emerson Electric Co. (international technology and engineering company) in its Electronics and Space Division (predecessor to the Company)

Other Public Company Directorships Within Past Five Years 2010–present: Nordson Corporation (leading manufacturer of precision dispensing equipment for applying industrial liquid and powder coatings, adhesives and sealants to consumer and industrial products during manufacturing operations)

Other Experience and Education B.A. from Western Kentucky University; M.B.A. from Washington University in St. Louis; served in U.S. Army as a Military Intelligence Officer |

» Age: 79 » Director since 1999 » Term expires 2024 » Board Committees: Executive, Audit, Compensation » Lead Director of the Company » Qualifies as an audit committee financial expert under SEC rules

| James M. Stolze Mr. Stolze’s experience in the accounting profession as well as in corporate finance and treasury matters and domestic and foreign manufacturing enables him to provide valuable advice and direction to the Company, and as Lead Director he adds significant value to the Company’s goals of maintaining a strong balance sheet and accurately and transparently fulfilling its financial reporting obligations.

Principal Occupation and Business Experience 2004–2009: Vice President and Chief Financial Officer of Stereotaxis, Inc. (manufacturer of medical instruments) 1995–2003: Executive Vice President and Chief Financial Officer of MEMC Electronic Materials Inc. (later SunEdison Inc.)

Other Experience and Education B.S. in Mechanical Engineering from the University of Notre Dame; M.B.A. from the University of Michigan; licensed Certified Public Accountant; member of the Board of Trustees of Maryville University, St. Louis; former member of the Board of Directors of ISTO Technologies, Inc. (an orthobiologics company). |

| 10 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

» Age: 60 » Director since 2019 » Term expires 2025 » Board Committees: Compensation, Governance

| Gloria L. Valdez Ms. Valdez’s extensive strategic and operational experience in the defense markets as well as her management and financial expertise allow her to provide valuable assistance to the Board in guiding the Company’s strategy at the highest levels.

Principal Occupation and Business Experience 2021–Present: Member of the Naval Shipbuilding Expert Advisory Panel providing advice to the Commonwealth of Australia on its National Naval Shipbuilding Enterprise 2015–2018: Deputy Assistant Secretary of the Navy within the Office of the Assistant Secretary of the Navy (ASN) for Research, Development and Acquisition (executive oversight of all naval shipbuilding programs, major ship conversions, and maintenance, modernization and disposal of in-service ships) 1986–2015: Served in a number of other civilian positions within the Navy Department including as Executive Director for the Program Executive Office for submarines (responsible for civilian management, design, acquisition and construction for submarine platform and undersea systems), Director of the Investment and Development division within the Office of the ASN for Financial Management and Comptroller, and Director for Naval and Commercial Construction in the Office of the ASN for Ship Programs; also served as Budget Director for U.S. Immigration and Customs Enforcement within the Department of Homeland Security.

Other Experience and Education M.S. in management from Florida Institute of Technology; B.S. in Mechanical Engineering from the University of New Mexico; recipient of the Department of the Navy’s Distinguished, Superior and Meritorious Civilian Service Awards; recipient in 2014 of the Pioneer award from Great Minds in STEM; sponsor of the Virginia Class submarine USS Vermont (SSN 792) commissioned in 2020. |

Responsibilities

The Company’s Board of Directors is ultimately responsible for the conduct of the business of the Company in accordance with ethical and honorable business practices and applicable laws, to justify the confidence that the shareholders have placed in the Company by their investment in its shares. Among the Board’s core responsibilities are to:

| ● | Oversee the conduct of the Company’s business in order to evaluate whether the business is being properly managed |

| ● | Review and, where appropriate, approve the Company’s major strategic and financial plans and goals, and evaluate results compared to those plans and goals |

| ● | Oversee the Company’s global risk management framework |

| ● | Review and approve significant indebtedness, significant capital allocations including dividends and stock repurchase plans, and significant transactions not arising in the ordinary course of business |

| ● | Review management’s determinations of major issues in respect of the auditing and accounting principles and practices used in the preparation of the Company’s financial statements; review and approve the Company’s financial controls and reporting systems; and review and approve the Company’s financial statements and financial reporting |

| ● | Select individuals for election to the Board and evaluate the performance of the Board and Board committees |

| ● | Select, evaluate and compensate the CEO and monitor the same decisions with respect to other executive officers; approve and evaluate compensation plans for senior management in conjunction with the Compensation Committee |

| ● | Oversee the conduct of the Company’s Environmental, Social and Governance (ESG) program including annually reviewing the Governance Committee’s ESG program assessment |

| 11 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

Composition

The Board is currently comprised of eight directors divided into three classes, with the terms of office of each class ending in successive years. Former non-management director Larry W. Solley retired in February 2022 and Ms. Hess was elected to the Board in May 2022. There have been no other changes in the composition of the Board since the beginning of fiscal 2022. As previously announced, in view of Mr. Richey’s upcoming retirement as Chief Executive Officer and President on December 31, 2022, the Board has resolved to increase the size of the Board from eight to nine members effective January 1, 2023, and to elect Bryan H. Sayler, the Company’s incoming Chief Executive Officer and President, as a director to fill the position thereby created, to serve for an initial term expiring at the 2024 Annual Meeting. Following his retirement as an executive officer, Mr. Richey will continue as a director during a transition period, with the title of Executive Chairman of the Board.

Independence

Mr. Richey is the only Board member who is a member of the Company’s management. The Board of Directors has affirmatively determined that none of the other seven, non-management directors has any material relationship with the Company other than in his or her capacity as a director and shareholder, and that therefore all of these directors are, and at all times during their service in fiscal 2022 were, independent as defined under the Company’s Corporate Governance Guidelines and the listing standards of the NYSE. In addition, Mr. Solley was affirmatively determined to be independent during his service prior to his retirement.

Meetings

The Board of Directors held four meetings during fiscal 2022. All of the directors attended, either in person or by conference call, at least 75% of the meetings of the Board and of each of the committees on which they served which were held during their periods of service. The Company’s policy requires that all directors attend the Annual Meeting of Shareholders, except for absences due to causes beyond the reasonable control of the director. All of the directors attended, either in person or by conference call, the 2022 Annual Meeting held at the offices of the Company’s subsidiary VACCO Industries in El Monte, California.

Diversity is one of the factors that the Governance Committee considers in identifying the pool of director search candidates. The Board appreciates the benefits diversity brings and strives to assemble a Board with not only a variety of business and professional backgrounds, but also diversity in areas such as race, ethnicity and gender. In 2022, our Board welcomed Ms. Hess as a director and appointed her to the Governance Committee. Ms. Hess recently retired from her position as President of the Engineered Systems Segment (ESS) and Teledyne Brown Engineering of Teledyne Technologies Incorporated (NYSE:TDY), a diversified multinational company serving energy, space, maritime, and defense markets. She previously served in several positions of increasing financial, operational, and executive responsibility with Teledyne from 2000 to 2014, including as ESS’s Executive Vice President and Chief Financial Officer.

| 12 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

The members of the Board of Directors are appointed to various committees. The standing committees of the Board are the Executive Committee, the Audit and Finance Committee (Audit Committee), the Nominating and Corporate Governance Committee (Governance Committee), and the Human Resources and Compensation Committee (Compensation Committee). Until his retirement in February 2022, Mr. Solley was Chair of the Governance Committee and a member of the Compensation Committee.

Each Committee operates under a written charter adopted by the Board of Directors. The charters are posted on the Company’s website, www.escotechnologies.com, under the Investor Center/Committees & Charters tab, and a copy of each Committee’s charter is available in print to any shareholder who requests it.

Executive Committee

CURRENT MEMBERS

Richey

Stolze

1 meeting in fiscal 2022

| ● | May exercise the powers of the Board between Board meetings, subject to limitations specified in the committee charter | ||

| ● | May not: | |||

| ● | Declare dividends | |||

| ● | Amend the Bylaws | |||

| ● | Approve, propose or recommend for approval any action requiring approval by the shareholders | |||

| ● | Elect directors or fill vacancies on the Board | |||

| ● | Change the membership or composition of committees | |||

Audit Committee

The Audit Committee assists the Board in fulfilling its oversight responsibilities for the integrity of the Company’s financial statements; the Company’s compliance with legal and regulatory requirements; the qualifications, independence and performance of the Company’s independent public accounting firm (the Accounting Firm); and the performance of the Company’s internal audit function.

CURRENT MEMBERS

Phillippy (Chair)

Dewar

Khilnani

Stolze

4 meetings in fiscal 2022

| ● | Appoints, retains and oversees the Accounting Firm and its performance of the annual audit | |

| ● | Annually evaluates the qualifications, independence and performance of the Accounting Firm | ||

| ● | Reviews the scope of the Accounting Firm’s work and approves its annual audit fees and any non-audit service fees | ||

| ● | Reviews the Company’s internal controls with the Accounting Firm and the internal audit executive, and reviews with the Accounting Firm any problems it may have encountered during the annual audit | ||

| ● | Discusses the Company’s Form 10-K and 10-Q reports with management and the Accounting Firm before filing; reviews and discusses earnings press releases | ||

| ● | Discusses major financial risk exposures with management | ||

| ● | Reviews management’s assessment and oversight of information security, cybersecurity and IT risks, breaches (if any), and any preventive or remedial actions taken on a quarterly basis | ||

| ● | Reviews the annual internal audit plan and associated resource allocation | ||

| ● | Retains the outside firm overseeing the Company’s internal audit function and evaluates its performance and the results of the annual internal audit | ||

| ● | Reviews the Company’s reports to shareholders with management and the Accounting Firm and receives certain assurances from management | ||

| ● | Issues the Committee Report required to be included in this Proxy Statement pursuant to the regulations of the SEC (see Audit-and Finance Committee Report on page 58) | ||

| 13 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

The Board of Directors has determined that all members of the Committee are financially literate and have accounting or related financial management expertise, as those terms are defined under the Company’s Corporate Governance Guidelines and the applicable listing standards of the NYSE, and are “audit committee financial experts” within the meaning of Item 407(d)(5)(ii) of SEC Regulation S-K.

Governance Committee

The Governance Committee assists the Board in fulfilling its Corporate Governance responsibilities.

CURRENT MEMBERS

Olivier (Chair)

Hess

Phillippy

Valdez

4 meetings in fiscal 2022

| ● | Identifies individuals qualified to become Board members and recommends them for election to the Board at the Annual Meeting of shareholders or for appointment to fill vacancies occurring between Annual Meetings (see Director Candidates and Nominations below) | |

| ● | Reviews the size of the Board and recommends any appropriate changes to the Board | ||

| ● | Reviews the composition of Board committees and recommends any appropriate changes to the Board | ||

| ● | Develops and recommends to the Board effective corporate governance guidelines | ||

| ● | Reviews the Company’s corporate governance and compliance programs | ||

| ● | Assists the Board in its oversight of the Company’s ESG program and annually provides an assessment of the program for the Board | ||

| ● | Oversees the Company’s ethics programs | ||

| ● | Reviews any conflicts of interest involving Related Persons, and oversees and administers the Company’s policy on Related Person transactions | ||

| ● | Leads the Board in its annual review of the Board’s performance | ||

Director Candidates and Nominations

To be considered for nomination to the Board, candidates must be persons of the highest integrity, have extensive and varied business experience and have demonstrated their ability to interact effectively with associates and peers. They preferably will also have experience and expertise in business areas related to the Company and its technologies, industries and customers. In addition, the Committee will seek out candidates with the ability to interact constructively with the existing Board membership, in order to enable the Board to act in the long-term interests of the Company’s shareholders. While the Committee has not established specific minimum qualifications for candidates, it may establish specific membership criteria as appropriate from time to time if the Board determines there is a need for specific skills and industry experience.

Although the Committee does not have a formal policy on diversity, it seeks the most qualified candidates without regard to race, color, national origin, gender, religion, disability or sexual orientation. However, the Committee appreciates the benefits that diversity, including gender diversity, brings to a board of directors, and both the Committee and the full Board are committed to requiring the inclusion of women and underrepresented minorities in the initial pool of director search candidates.

The Committee may identify new candidates for nomination based on recommendations from Company management, employees, non-management directors, shareholders and other third parties. It also has the authority to engage third party search firms to identify candidates, and it has done so from time to time. Consideration of a new candidate typically involves the Committee’s review of information pertaining to such candidate and a series of internal discussions, and may proceed to interviews with the candidate. New candidates are evaluated based on the above-described criteria in light of the specific needs of the Board and the Company at the time. Incumbent directors whose terms are set to expire are evaluated based on the above-described criteria, as well as a review of their overall past performance on the Board of Directors.

| 14 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

The Committee will consider director candidates recommended by shareholders, and will evaluate such individuals in the same manner as other candidates proposed to the Committee. All candidates must meet the legal, regulatory and exchange requirements applicable to members of the Board of Directors. Shareholders who wish to recommend individuals for consideration as director candidates for the 2024 Annual Meeting of Shareholders should notify the Committee no later than August 31, 2023 in order to allow time for their recommendations to be considered by the Committee. Submissions are to be addressed to the Nominating and Corporate Governance Committee, c/o David M. Schatz, Corporate Secretary, ESCO Technologies Inc., 9900A Clayton Road, St. Louis, MO 63124-1186, which submissions will then be forwarded to the Committee. The Committee is not obligated to nominate any such individual for election.

Compensation Committee

The Compensation Committee’s basic responsibility is to assure that the Company’s directors, key executives and other senior officers are compensated in a manner consistent with and in furtherance of Company strategy, competitive practices, and the requirements of the appropriate regulatory bodies.

CURRENT MEMBERS

Khilnani (Chair)

Dewar

Stolze

Valdez

4 meetings in fiscal 2022 | ● | Reviews and approves corporate goals and objectives relevant to the compensation of the Chief Executive Officer; evaluates the Chief Executive Officer’s performance in light of these goals and objectives, and determines the Chief Executive Officer’s compensation based upon the evaluation in conjunction with the full Board | |

| ● | Approves and evaluates the compensation plans for senior management | ||

| ● | Reviews, approves and evaluates incentive compensation plans, equity-based plans and other compensation plans, to ensure that they provide compensation and incentives consistent with the strategy of the Company and competitive practice | ||

| ● | Reviews and approves the compensation of the Company’s non-management directors in conjunction with the full Board | ||

| ● | Reviews, approves and evaluates benefit programs which exceed the inherent prerogatives of management, including material new programs and material changes to existing programs | ||

| ● | Reviews the performance and development of, and succession planning for, Company senior management | ||

| ● | Oversees the Company’s Charitable Contributions Program | ||

| ● | Reviews and discusses with management the Company’s annual Compensation Discussion and Analysis, and recommends its inclusion in the Company’s annual proxy statement and the Company’s Form 10-K filed with the SEC (see Compensation Committee Report on page 31) | ||

Compensation Committee Interlocks and Insider Participation

During fiscal 2022, none of the members of the Compensation Committee (named under “Committees” above) (i) was an officer or employee of the Company; (ii) was formerly an officer of the Company; or (iii) had any other relationship requiring disclosure under any paragraph of Item 404 or under Item 407(e)(4) of SEC Regulation S-K. In addition, during fiscal 2022, none of the Company’s executive officers served as a member of the board of directors or compensation committee of any entity that had one or more executive officers serving as a member of the Company’s Board of Directors or the Compensation Committee.

| 15 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

CORPORATE GOVERNANCE INFORMATION

Governance Policies and Management Oversight

The Board of Directors has adopted Corporate Governance Guidelines to guide its actions, as well as a Code of Business Conduct and Ethics applicable to all of the Company’s directors, officers and employees. Additionally, the Board has adopted a Code of Ethics for Senior Financial Officers applicable to the Company’s Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Controller and persons performing similar duties. These documents are posted on the Company’s web site, www.escotechnologies.com, under the Investor Center/ Governance Documents tab, and a copy of any of these documents is also available in print to any shareholder who requests it.

As permitted in the Corporate Governance Guidelines, the Board has determined that Mr. Richey will continue to hold the positions of both Chief Executive Officer and Chairman of the Board of Directors until his retirement as an executive officer on December 31, 2022, and that thereafter he will continue to serve as Executive Chairman of the Board for a mutually agreed upon transition period. The Board believes that Mr. Richey has been a strong leader at both the Company and the Board levels, and believes that because he has had primary responsibility for managing the day-to-day operations of the Company he has also been well positioned to provide Board leadership that is aligned with shareholder interests and the needs of the Company. Furthermore, the Board believes that having Mr. Richey serve as both Chairman of the Board and Chief Executive Officer has enabled the Company to speak with one voice, and has reduced the chance of confusion about leadership roles and responsibilities.

At the same time, the Board remains very cognizant of its oversight responsibilities, and has had in place structural safeguards to preserve the Board’s independent oversight of management. In view of Mr. Richey’s dual role as Chief Executive Officer and Chairman, and in accordance with the Corporate Governance Guidelines, the Board appointed Mr. Stolze as Lead Director, to chair all meetings of the independent directors, which normally occur in conjunction with each Board meeting; to provide regular input to the Chairman regarding the content of the agendas for meetings of the Board; to advise the Chairman of the quality, quantity and timeliness of the information required by the Board to effectively and responsibly perform its oversight duties; and to act as liaison between the Board and the Chairman on sensitive issues.

The Board believes that these safeguards have been effective in preserving the Board’s independent oversight of management. However, in view of Mr. Richey’s upcoming retirement as Chief Executive Officer and President, the Board has determined that although Mr. Richey and Mr. Stolze will continue to serve as Executive Chairman of the Board and Lead Director, respectively, during the transition period after Mr. Richey’s retirement, from and after the end of the transition period a new Board Chair will be elected solely from among the independent directors and the position of Lead Director will be eliminated.

The Board’s Role in Risk Oversight

The Company’s management is responsible for managing the Company’s risks on a day-to-day basis, and has adopted an ongoing enterprise risk management process that it uses to identify and assess Company risks. Management has identified risks in four general areas: Financial and Reporting; Legal and Compliance; Operational; and Strategic. Periodically, management advises the Board and the appropriate Board committee of the risks identified; management’s assessment of those risks at the business unit and corporate levels; its plans for the management of these identified risks or the mitigation of their effects; and the results of the implementation of those plans.

While the Board as a whole has responsibility for and is involved in the oversight of management’s risk management processes, plans and controls, some of the identified risks are given further review by the Board committee most closely associated with the identified risks. For example, the Audit Committee provides additional review of the risks in the areas of accounting and auditing, liquidity, credit, tax, information security and cybersecurity. Similarly, the Compensation Committee provides additional review of risks in the area of compensation and benefits and human resource planning. The Governance Committee devotes additional time to the review of risks associated with corporate governance, ethics, legal and ESG issues.

The Board’s current leadership structure combines the positions of Chairman of the Board and Chief Executive Officer but includes the additional position of Lead Director, enabling the Chief Executive Officer to ensure that the directors receive the information necessary to discharge their oversight role responsibly, while ensuring that the independent directors maintain independence in their oversight role. However, after a transitional period following Mr. Richey’s retirement as Chief Executive Officer, the Board Chair will be selected solely from among the non-management directors and the position of Lead Director will be eliminated.

| 16 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

Cybersecurity

Global information technology security threats and targeted computer crime are increasing in frequency and sophistication. As these risks increase, we have enhanced our use of technologies and internal controls to protect our systems, networks and data. ESCO’s cybersecurity program includes employee training and testing, information security policies and procedures, third-party monitoring of our networks and systems, and maintenance of backup and other protective systems. Governmental authorities, including the United States government, have increasingly focused on cybersecurity requirements for government contractors. Our subsidiaries that serve in these capacities are increasingly focused on cybersecurity as they seek to comply with the US Department of Defense Cybersecurity Maturity Model Certification program and related governmental mandates.

Our Board’s Audit Committee annually reviews the major financial risk exposures including cybersecurity and policies or controls management has implemented to manage and mitigate risks. On a quarterly basis, the Committee reviews management’s assessment and oversight of cybersecurity and information technologies risks and any required remediation actions.

Succession Planning

The Compensation Committee of the Board conducts an annual review of the Company’s long-term succession plan for the CEO. Having this succession plan in place enabled the Board to name Mr. Sayler as Mr. Richey’s successor promptly after Mr. Richey notified the Board of his decision to retire. Additionally, the Board has in place an emergency succession plan for the CEO in order to minimize the uncertainty associated with an emergency succession event.

Independence and Related Person Determinations

All of the Company’s directors except Mr. Richey and (beginning January 1, 2023) Mr. Sayler are and will be independent of Company management. Additionally, all of the members of the Audit Committee, the Compensation Committee and the Governance Committee are independent as defined by the New York Stock Exchange and set forth in the Company’s Corporate Governance Guidelines.

The Company has implemented a written policy not only to ensure that all non-management directors meet the independence standards defined under the Company’s Corporate Governance Guidelines and the listing standards of the NYSE but to ensure that all Company transactions in which a “Related Person” has or will have a direct or indirect interest will be at arm’s length and on terms generally available to an unaffiliated third-party under the same or similar circumstances. “Related Persons” include the Company’s directors, director nominees and executive officers, holders of 5% or more of the Company’s stock, and the immediate family members of each. The policy contains procedures requiring Related Persons to notify the Company of any such transaction and for the Governance Committee to review the material facts of the proposed transaction and determine whether to approve or disapprove the transaction. The Committee will consider whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances. If advance Committee approval is not feasible or is not obtained, the policy requires submission of the transaction to the Committee after the fact, and the Committee is empowered to approve, ratify, amend, rescind or terminate the transaction. In such event, the Committee will also request the General Counsel to evaluate the Company’s controls and procedures to ascertain whether any changes to the policy are recommended.

The Company has developed and implemented processes and controls to obtain information about Related Person transactions for the purpose of determining, based on the facts and circumstances, whether a Related Person has a direct or indirect material interest in the transaction. Pursuant to these processes and controls, all directors and executive officers must annually complete, sign and submit a Directors’ and Officers’ Questionnaire and a Conflict of Interest Questionnaire that are designed to identify Related Person transactions and both actual and potential conflicts of interest, and are required to update their responses in the event of any changes. Additionally, the holders of 5% or more of the Company’s shares (all of whom are institutional investors), are annually requested to respond to certain questions designed to identify direct or indirect material interests by such 5% or more shareholder in any transactions with the Company.

Based on its review and processes, the Company has determined that there has been no transaction since the beginning of the Company’s 2022 fiscal year, and there is no transaction currently proposed, in which the Company was or is to be a participant and in which any Related Person had or will have a direct or indirect material interest.

| 17 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

Communications with Directors

Interested parties desiring to communicate concerns regarding the Company to the Lead Director or to the non-management Directors as a group may direct correspondence to: Mr. James M. Stolze, Lead Director, ESCO Technologies Board of Directors, ESCO Technologies Inc., 9900A Clayton Road, St. Louis, MO 63124-1186. Alternatively, interested parties who wish to communicate with an individual director or any group of directors may write to such director(s) at ESCO Technologies Inc., 9900A Clayton Road, St. Louis, MO 63124-1186, Attn: Secretary. All such letters will be forwarded promptly to the relevant director(s).

The responsibilities and the substantial time commitment of a director at a public company require that the Company provide reasonable compensation to incentivize the directors’ performance and ensure their willingness to continue to serve. The Company strives to engage and retain well-qualified directors with significant experience at companies of similar size and complexity. To ensure this is achieved, the Company regularly reviews the compensation provided to its directors. The Company’s non-employee directors are compensated pursuant to the Sub-Plan for Compensation of Non-Employee Directors under the 2018 Omnibus Incentive Plan (Director Compensation Plan) based upon their respective levels of Board participation and responsibilities. The Compensation Committee obtains competitive market and peer data and periodically retains a compensation consultant to evaluate the competitiveness of its director compensation. The Committee approves the directors’ compensation, but any changes are ratified by the full Board. As employees of the Company, Mr. Richey does not receive, and following the commencement of his term as a director Mr. Sayler will not receive, compensation for service as a director.

Components of 2022 and 2023 Director Compensation

| Cash Compensation1 | 2022 | 2023 |

| Annual Retainer (all non-management directors) | $50,000 | $50,000 |

| Lead Director | $25,000 | $25,000 |

| Committee Chairs: | ||

| Audit | $7,000 | $12,500 |

| Compensation | $5,000 | $10,000 |

| Governance | $5,000 | $8,000 |

| Equity Compensation | 2022 | 2023 |

| Restricted Share Award (all non-management directors)2 | $180,000 | $180,000 |

| 1 | In January 2022, in anticipation of his retirement, Mr. Solley received a partial year cash retainer of $13,750; and following her election as a director Ms. Hess received a $37,500 cash retainer for the remainder of calendar 2022. |

| 2 | Mr. Solley did not receive an equity award for 2022 due to his retirement. |

The annual equity award consists of a number of RSUs equal to $180,000 divided by the NYSE closing price of the common stock on the award date, rounded to the nearest whole share and vesting one year after the award date. The equity award for calendar 2022 was made on January 3, 2022 and will vest on January 3, 2023. Based on the January 3, 2022 NYSE closing stock price of $88.66 it amounted to 2,030 RSUs per director. On May 27, 2022 following her election as a director, Ms. Hess received a partial year award for the remainder of calendar 2022 of $135,000 divided by the $66.01 NYSE closing price on that date, or 2,045 RSUs, which will vest on May 27, 2023.

During the vesting period, each director’s RSU account accrues an additional number of unvested RSUs equivalent to the quarterly dividends that would have been paid on a like number of shares of common stock, divided by the NYSE closing price on the dividend date; and on the vesting date the accrued RSUs vest and are converted into a whole number of shares of common stock plus cash equal to the value of any fractional shares, based on the NYSE closing price on the vesting date.

| 18 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

Changes for 2023

The Compensation Committee reviewed the directors’ annual compensation program in August 2022, and based on its recommendations the Board approved changes in the committee chair fees and timing of the annual payments, in order to be more consistent with prevailing director compensation practices. Accordingly, beginning with calendar 2023:

| ● | The additional annual cash retainers for the chairs of the Audit, Compensation and Governance committees (which have not changed since 2012) will be increased as shown in the above table; and |

| ● | All compensation for the non-management directors will be paid or awarded, as the case may be, on and as of the first NYSE trading day after each Annual Meeting of Shareholders. |

Election to Defer Compensation

Directors may elect in advance to defer receipt of all of their cash compensation and/or all of their stock compensation. If deferral is elected, the deferred amounts are credited to the director’s deferred compensation account in common stock equivalents. If cash compensation is deferred, the number of common stock equivalents credited is equal to the amount deferred divided by the NYSE closing price of the common stock as of the date on which the deferral occurs (or if that is not a trading day, then the last preceding trading day). If stock compensation is deferred, the number of common stock equivalents credited is equal to the number of shares whose receipt is deferred. Common stock equivalents in the director’s deferred compensation account have no voting rights, but earn dividend equivalents on each dividend payment date equal to the dividends payable on a like number of shares of common stock; and the dividend equivalents earned are credited to the director’s deferred compensation account as additional common stock equivalents valued at the NYSE closing price on the dividend date. A director’s deferred compensation account becomes distributable when the director leaves the Board, or at such other date as may be specified by the director consistent with the terms of the Director Compensation Plan; distribution will be accelerated in certain circumstances, including a change in control of the Company. The account is distributable at the election of the director either in cash or in shares; however, any stock portion which has been deferred may only be distributed in shares. During fiscal 2022, Mr. Dewar, Ms. Hess, Mr. Olivier and Ms. Valdez deferred receipt of their cash compensation and stock compensation, as described in the footnotes to the Fiscal 2022 Compensation table below. In addition, Mr. Phillippy’s and Mr. Stolze’s stock compensation from certain prior years continued to be deferred pursuant to prior deferral elections which they had terminated as to future compensation.

Director Stock Ownership Guidelines

Directors are subject to stock ownership guidelines. Under these guidelines, within five years after their appointment to the Board each non-management director is expected to acquire and hold shares or common stock equivalents having a total cash value equal to at least five times the annual cash retainer. All directors currently exceed the ownership guidelines, except Ms. Hess, who was elected in February 2022 and is expected to meet the guidelines within the five-year period.

Extended Compensation Plan for Certain Directors

Under the Company’s Directors’ Extended Compensation Plan, a plan for non-management directors who began Board service prior to April 2001, Mr. Stolze is eligible to receive for life an annual benefit of $20,000 beginning after his service as a director ceases. In the event of his subsequent death, 50% of the benefit will be paid to his surviving spouse for life; if Mr. Stolze dies before retirement, 50% of the benefit, determined as if the director had retired on the date of death, will be paid to his surviving spouse in a lump sum. The plan permits Mr. Stolze to elect to receive the actuarial equivalent of the benefit in a single lump sum after retirement; and in compliance with section 409(a) of the Internal Revenue Code, Mr. Stolze has made this election. Mr. Solley was also a participant in the Directors’ Extended Compensation Plan until his retirement in February 2022, and on April 1, 2022 he received a lump sum payment of $205,393 in satisfaction of his benefit entitlement.

| 19 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

Fiscal 2022 Compensation

The following table sets forth the compensation of the Company’s non-management directors for fiscal 2022. As an executive officer, Mr. Richey did not receive any additional compensation for his service as a director; his compensation is described under Proposal 3: Advisory Vote on Executive Compensation beginning on page 30.

| Name | Fees Earned or Paid in Cash | Stock Awards1 | Option Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value and Nonqualified Deferred Compensation Earnings2 | All Other Compensation | Total |

| Patrick M. Dewar | $50,0793 | $180,612 | — | — | $n/a | — | $230,691 |

| Janice L. Hess | $37,5004 | $135,200 | — | — | $n/a | — | $172,700 |

| Vinod M. Khilnani | $55,0795 | $180,612 | — | — | $n/a | — | $235,691 |

| Leon J. Olivier | $55,0796 | $180,612 | — | — | $n/a | — | $235,691 |

| Robert J. Phillippy | $57,0797 | $180,612 | — | — | $n/a | — | $237,691 |

| Larry W. Solley | $13,8298 | — | — | — | 0 | — | $13,829 |

| James M. Stolze | $82,0799 | $180,612 | — | — | 0 | — | $262,691 |

| Gloria L. Valdez | $50,07910 | $180,612 | — | — | $n/a | — | $230,691 |

| 1 | Dollar amounts represent the aggregate fair values of 2,030 RSUs awarded to Mr. Dewar, Mr. Khilnani, Mr. Olivier, Mr. Phillippy, Mr. Stolze and Ms. Valdez on January 3, 2022 and 2,045 RSUs awarded to Ms. Hess on May 27, 2022, based on the NYSE closing prices of the underlying common stock of $88.66 and $66.01 on those dates, respectively; plus the values of the dividend equivalents accrued on the respective directors’ RSUs held during 2022 as of the respective dividend dates. See Components of 2022 and 2023 Director Compensation above. |

| 2 | Represents the changes in actuarial present value of the participating directors’ accumulated benefits under the Directors’ Extended Compensation Plan, described above, during fiscal 2022. See Extended Compensation Plan for Certain Directors above. Following his retirement in February 2022, Mr. Solley received a lump-sum payment of $205,393 in satisfaction of his benefit entitlement. For fiscal 2022, overall pension values decreased for Mr. Solley and Mr. Stolze in the amounts of ($9,512) and ($40,467) respectively, partly due to the effect of changes in actuarial assumptions from the preceding year. The change in pension value for Mr. Stolze due to assumption changes was ($30,433). The change in pension value for Mr. Solley is the change from his September 30, 2021 present value to his actual payout as of April 1, 2022. Pursuant to SEC regulations, the amounts in the table do not include these decreases. The present value is based on a discount rate assumption of 5.45%, and the post-retirement mortality assumption is based on the Pri-2012 White Collar Healthy Retiree mortality table with projected mortality improvements from 2012 with scale MP-2021. |

| 3 | Represents cash retainer of $50,000 and $79 in exchange for vested fractional RSUs; however, Mr. Dewar elected to defer receipt of his cash compensation and to receive in lieu of cash approximately 567 RSUs having the same aggregate value on the issue date. |

| 4 | Represents cash retainer of $37,500; however, Ms. Hess elected to defer receipt of her cash compensation and to receive in lieu of cash approximately 568 RSUs having the same aggregate value on the issue date. |

| 5 | Represents cash retainer of $50,000, committee chair fee of $5,000, and $79 in exchange for vested fractional RSUs. |

| 6 | Represents cash retainer of $50,000, committee chair fee of $5,000, and $79 in exchange for vested fractional RSUs; however, Mr. Olivier elected to defer receipt of his cash compensation and to receive in lieu of cash a total of approximately 632 RSUs having the same aggregate value on their respective issue dates. |

| 7 | Represents cash retainer of $50,000, committee chair fee of $7,000, and $79 in exchange for vested fractional RSUs. |

| 8 | Represents partial year cash retainer of $12,500, partial year committee chair fee of $1,250, and $79 in exchange for vested fractional RSUs. |

| 9 | Represents cash retainer of $50,000, lead director cash retainer of $25,000, committee chair fee of $7,000, and $79 in exchange for vested fractional RSUs. |

| 10 | Represents cash retainer of $50,000 and $79 in exchange for vested fractional RSUs; however, Ms. Valdez elected to defer receipt of her cash compensation and to receive in lieu of cash approximately 567 RSUs having the same aggregate value on the issue date. |

| 20 | Proposal 1 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

| Proposal 2: Extension and Amendments of the Company’s 2018 Omnibus Incentive Plan |

The Board of Directors recommends a vote FOR this Proposal.

Our shareholders approved the Company’s 2018 Omnibus Incentive Plan (the “Omnibus Plan” or “Plan”) at the 2018 Annual Meeting. The Company believes that the Plan has successfully supported the Company’s efforts to attract, retain, motivate and reward employees and non-employee directors by means of appropriate incentives to achieve long-range goals. Equity-based incentives such as those awarded under the Plan also align the participants’ interests with those of the Company’s stockholders in growing the value of the Company’s equity and enhancing long-term shareholder returns.

Accordingly, for the reasons described below, the Company is seeking shareholder approval to amend the Plan and extend its term for an additional five years.

DESCRIPTION OF PROPOSED EXTENSION AND AMENDMENTS

Summary of Proposal

The Board recommends approval of the following amendments to the Plan, which are described below and specifically set forth in Appendix A:

| ● | Extending the term of the Plan for five years, until the 2028 Annual Meeting, |

| ● | Increasing the total number of shares available under the Omnibus Plan by 550,000, from 977,878 to 1,527,878, |

| ● | Removing the options-only use restriction on 100,000 of the current Plan shares, and |

| ● | Adding or modifying provisions to clarify (and conform to current Company policies and practice) the treatment of share-based awards in the event of a Change of Control, the clawback of awards, the ability to accrue dividend equivalents on unvested awards, and minimum ownership requirements; and other technical, non-substantive amendments. |

Extension of Plan Term

As part of our continuing incentive compensation program, and upon the consideration and recommendation of the Board of Directors, the Plan was submitted to and approved by our shareholders at the 2018 Annual Meeting. The Plan is currently scheduled to expire on February 2, 2023, the day before the 2023 Annual Meeting.

Because of the success of the Plan, the Board has deemed it advisable to extend the term of the Plan, and therefore recommends that the shareholders approve an extension of the term of the Plan for another five years, until the close of the 2028 Annual Meeting of Shareholders. If the extension is not approved, the Company will be unable to issue new incentive awards under the Plan after the date of the Annual Meeting, which would be very detrimental to the Company’s compensation program.

Increase in Number of Available Plan Shares

As originally adopted, the Omnibus Plan allows the issuance of share based awards issuable as or convertible into a maximum of 977,878 shares of Company common stock. As of November 30, 2022, awards representing a total of 488,990 shares had been granted under the Omnibus Plan, leaving 428,888 shares available for future “full value” (non-option) awards during the Omnibus Plan term. The Company expects that the additional 550,000 shares being requested will be sufficient to satisfy the Company’s needs for stock-based awards for the five-year extended term of the Plan, including a reserve for contingencies. The number of shares actually required will depend in part on the Company’s stock prices at the times of the various stock-based awards.

Accordingly, in order to accommodate the equity awards currently anticipated to be granted during the proposed five-year extension of the Omnibus Plan and allow for a cushion to cover unexpected circumstances, the Board recommends that the shareholders approve increasing the total number of shares authorized under the Omnibus Plan by 550,000 shares, from 977,878 to 1,527,878, and removing the current use restriction on an additional 100,000 currently-authorized shares, as described below.

| 21 | Proposal 2 | Notice of 2023 Annual Meeting & Proxy Statement // ESCO Technologies Inc. |

Elimination of Options-Only Use Restriction on Certain Previously-Authorized Plan Shares

The Plan currently provides that 100,000 of the currently-authorized Plan shares may be used only for stock options or other awards which require the participant to make a payment to the Company in order to receive actual shares. However, the Company has not issued any awards of these types in recent years. The Company will continue to grant “full value” awards or other types of awards as the Company and market practices determine from time to time, including those described in detail under Compensation Discussion and Analysis beginning on page 31 and Director Compensation beginning on page 18).