Executive Summary

6

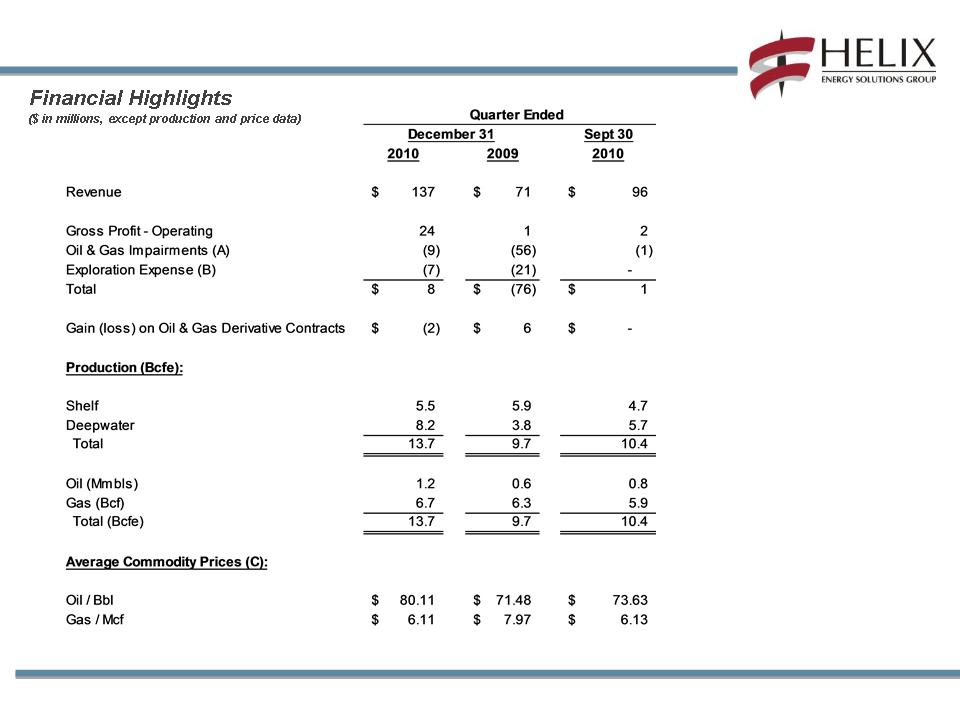

• Q4 2010 as reported EPS of $(0.48) per share

o Non-cash impairment charge of $16.7 million to write-off the carrying value of goodwill and a $7.1

million deferred tax asset valuation allowance attributable to our Southeast Asia well operations

subsidiary (total of $23.9 million after-tax)

o Impairment charges totaling $9.2 million primarily associated with a reduction in carrying values of

certain oil and gas properties and $6.4 million related to expiring offshore leases ($10.2 million

after-tax)

o Loss associated with the Lufeng project offshore China of $21.4 million ($22.4 million after-tax)

related to weather, downhole and mechanical issues

o Above three items totaled $53.8 million pre-tax ($56.5 million after-tax), or a loss of $(0.54) per

share

• Balance sheet continues to improve

o Cash increased to $391 million at 12/31/2010 from $325 million at 9/30/2010

o Liquidity* increased to $787 million at 12/31/2010 from $700 million at 9/30/2010

o Net debt decreased to $967 million at 12/31/2010 from $1.03 billion at 9/30/2010

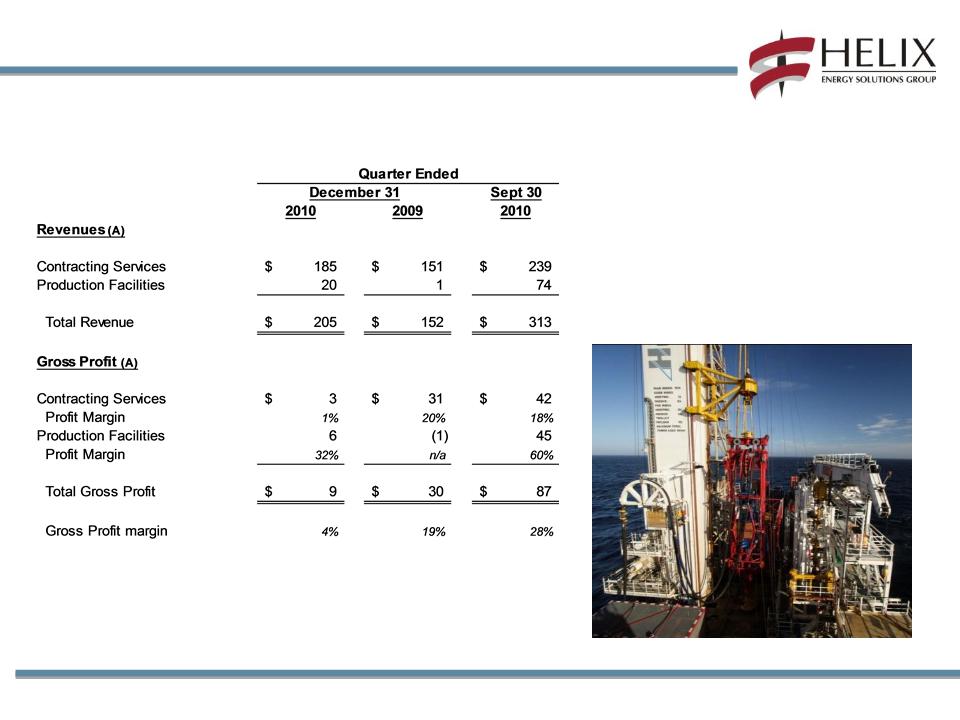

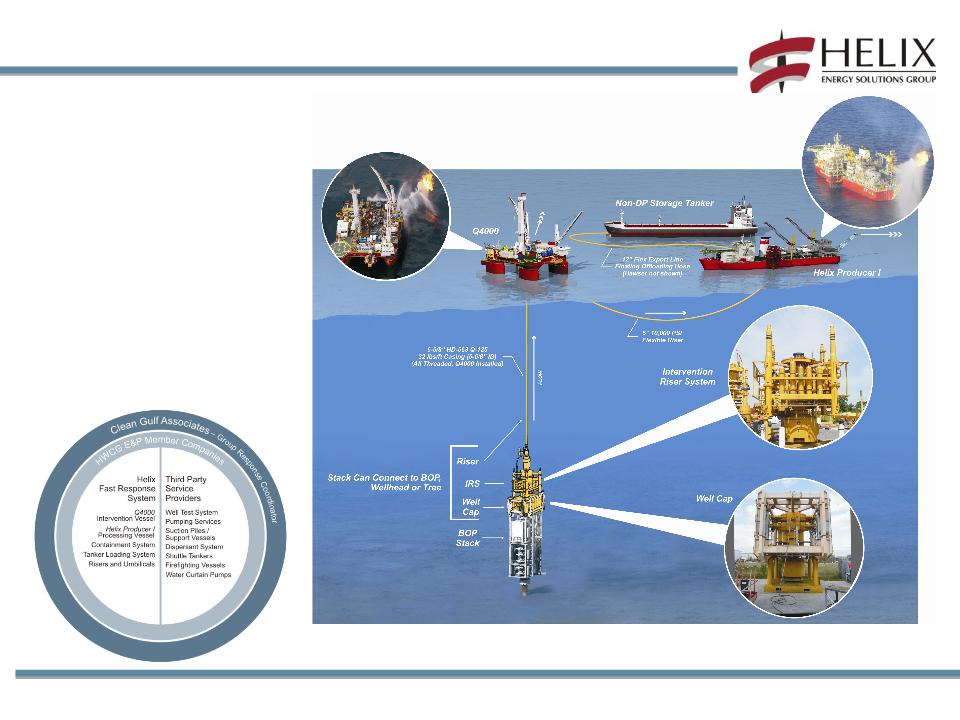

• Contracting Services and Production Facilities

o Helix Producer I (HP I) began to process Phoenix field production in October

o Helix Fast Response System (HFRS) utilization agreements signed with 20 independent E&P

operators in the GOM (Q1 2011)

*Liquidity as we define it is equal to cash and cash equivalents ($391 million), plus available capacity under our revolving credit facility ($396 million).