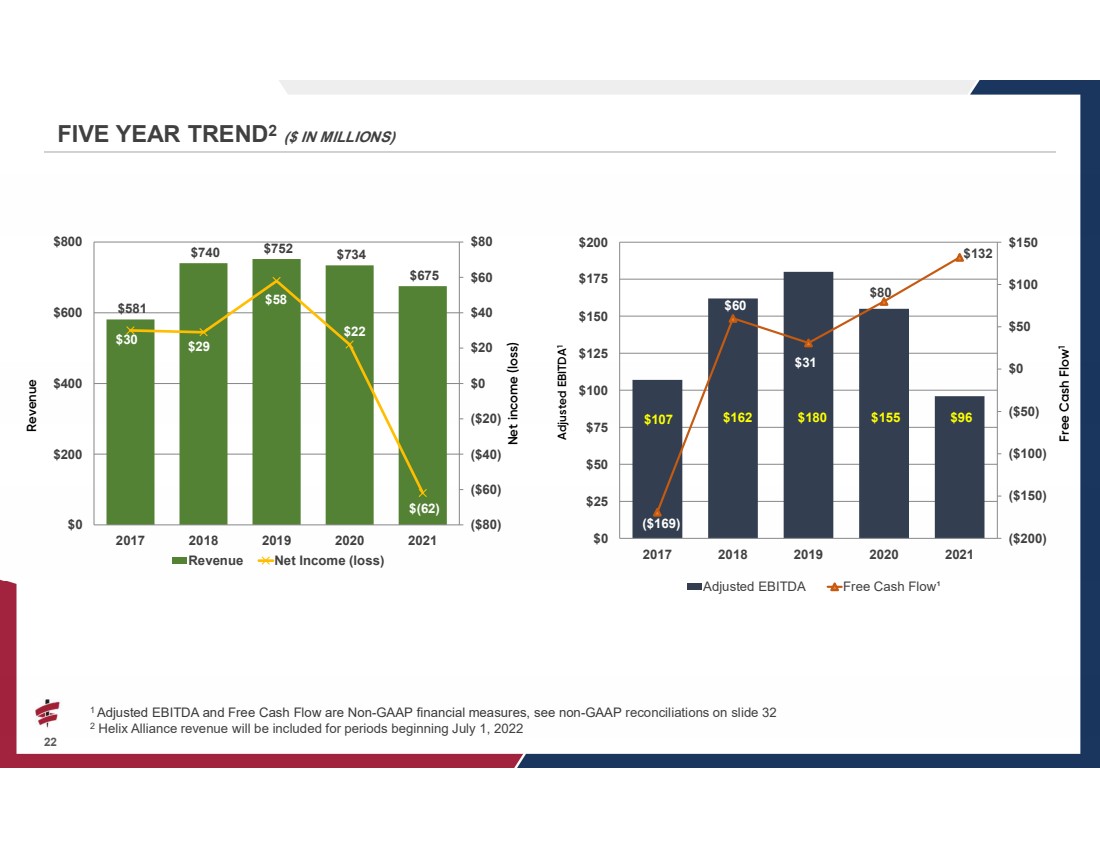

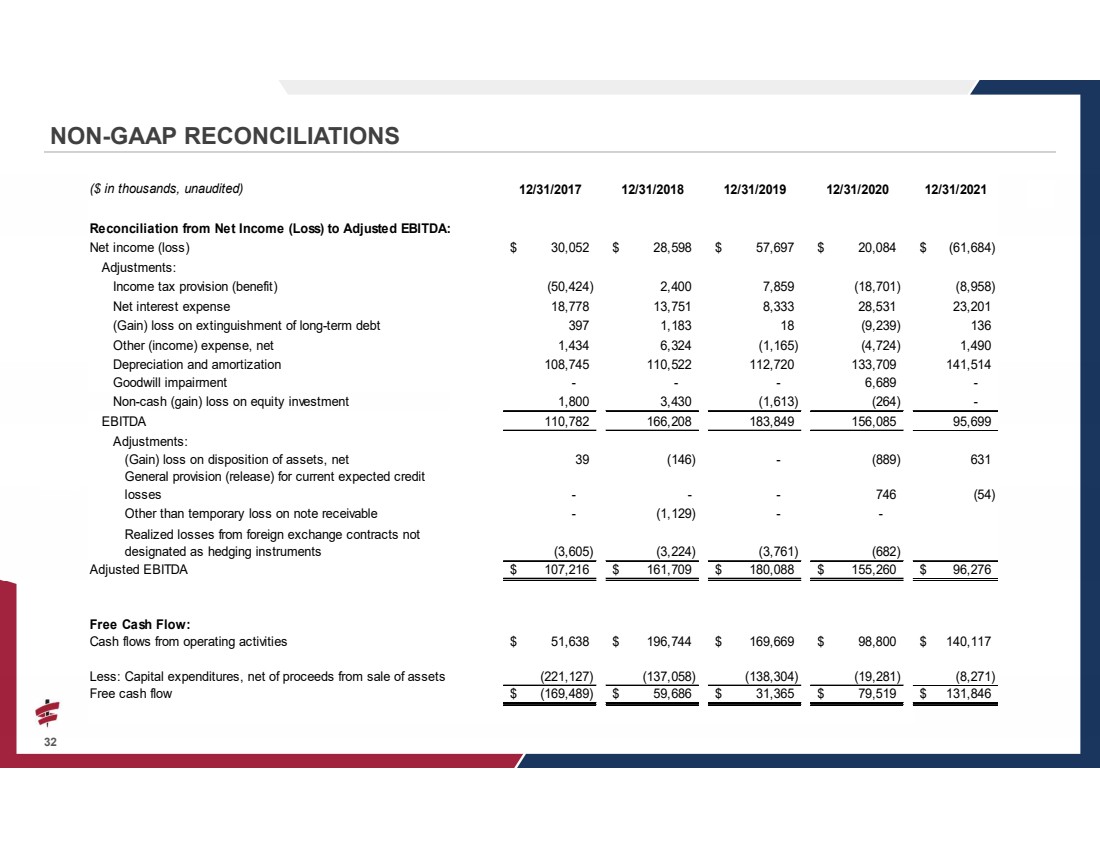

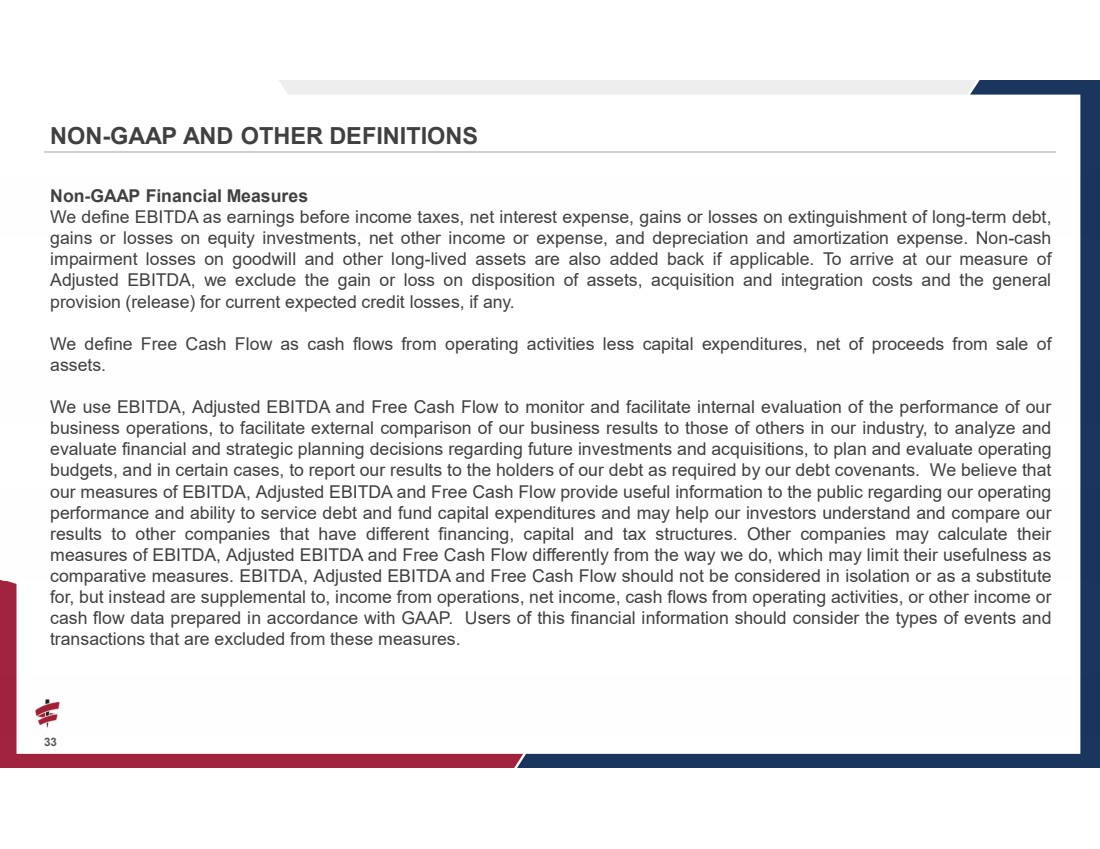

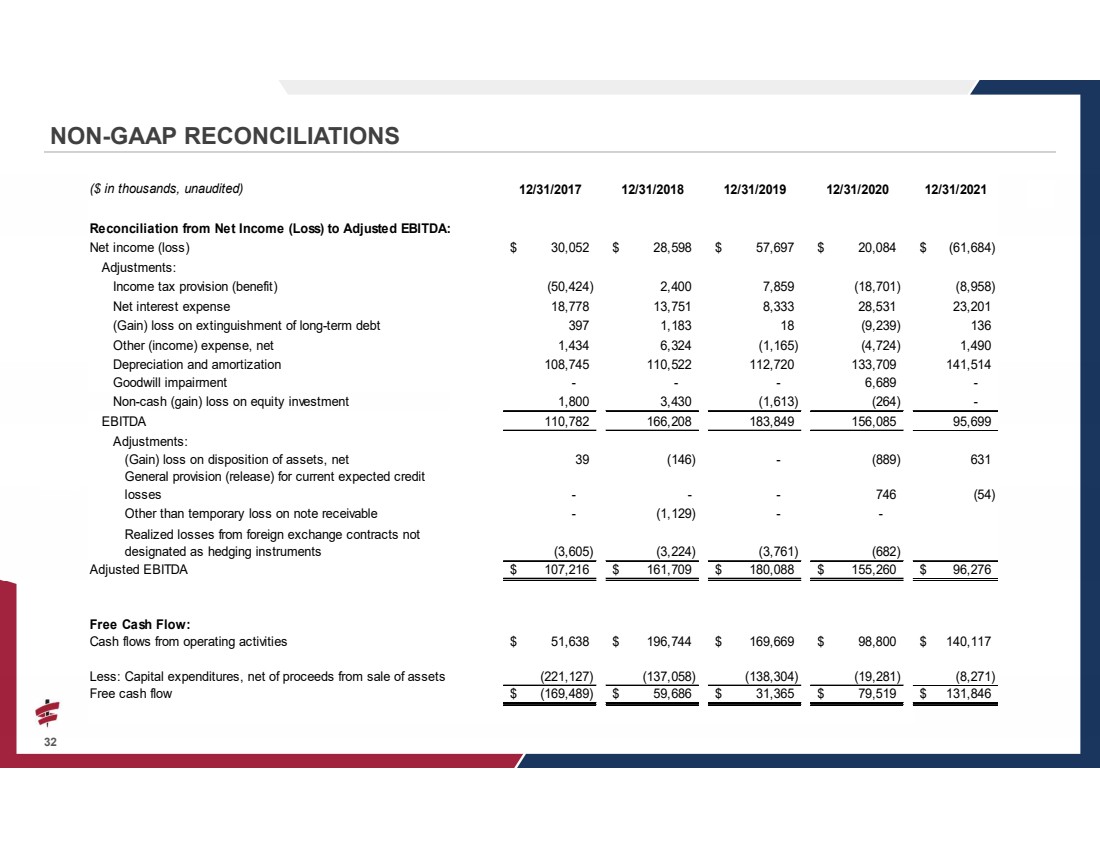

| NON-GAAP RECONCILIATIONS ($ in thousands, unaudited) 12/31/201712/31/201812/31/201912/31/202012/31/2021 Reconciliation from Net Income (Loss) to Adjusted EBITDA: Net income (loss)30,052 $ 28,598 $ 57,697 $ 20,084 $ (61,684) $ Adjustments: Income tax provision (benefit)(50,424) 2,400 7,859 (18,701) (8,958) Net interest expense18,778 13,751 8,333 28,531 23,201 (Gain) loss on extinguishment of long-term debt397 1,183 18 (9,239) 136 Other (income) expense, net1,434 6,324 (1,165) (4,724) 1,490 Depreciation and amortization108,745 110,522 112,720 133,709 141,514 Goodwill impairment- - - 6,689 - Non-cash (gain) loss on equity investment1,800 3,430 (1,613) (264) - EBITDA110,782 166,208 183,849 156,085 95,699 Adjustments: (Gain) loss on disposition of assets, net39 (146) - (889) 631 General provision (release) for current expected credit losses- -- 746 (54) Other than temporary loss on note receivable- (1,129) - - Realized losses from foreign exchange contracts not designated as hedging instruments(3,605) (3,224) (3,761) (682) Adjusted EBITDA107,216 $ 161,709 $ 180,088 $ 155,260 $ 96,276 $ Free Cash Flow: Cash flows from operating activities51,638 $ 196,744 $ 169,669 $ 98,800 $ 140,117 $ Less: Capital expenditures, net of proceeds from sale of assets(221,127) (137,058) (138,304) (19,281) (8,271) Free cash flow(169,489) $ 59,686 $ 31,365 $ 79,519 $ 131,846 $ 32 |