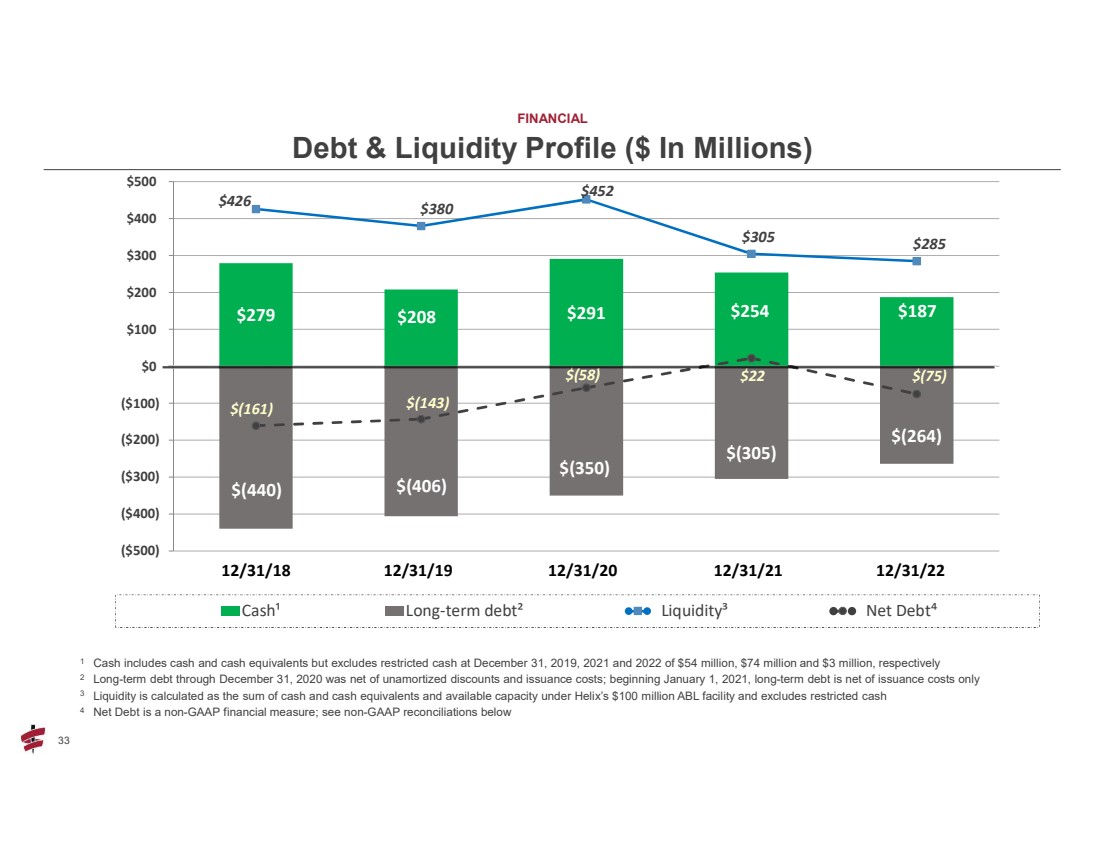

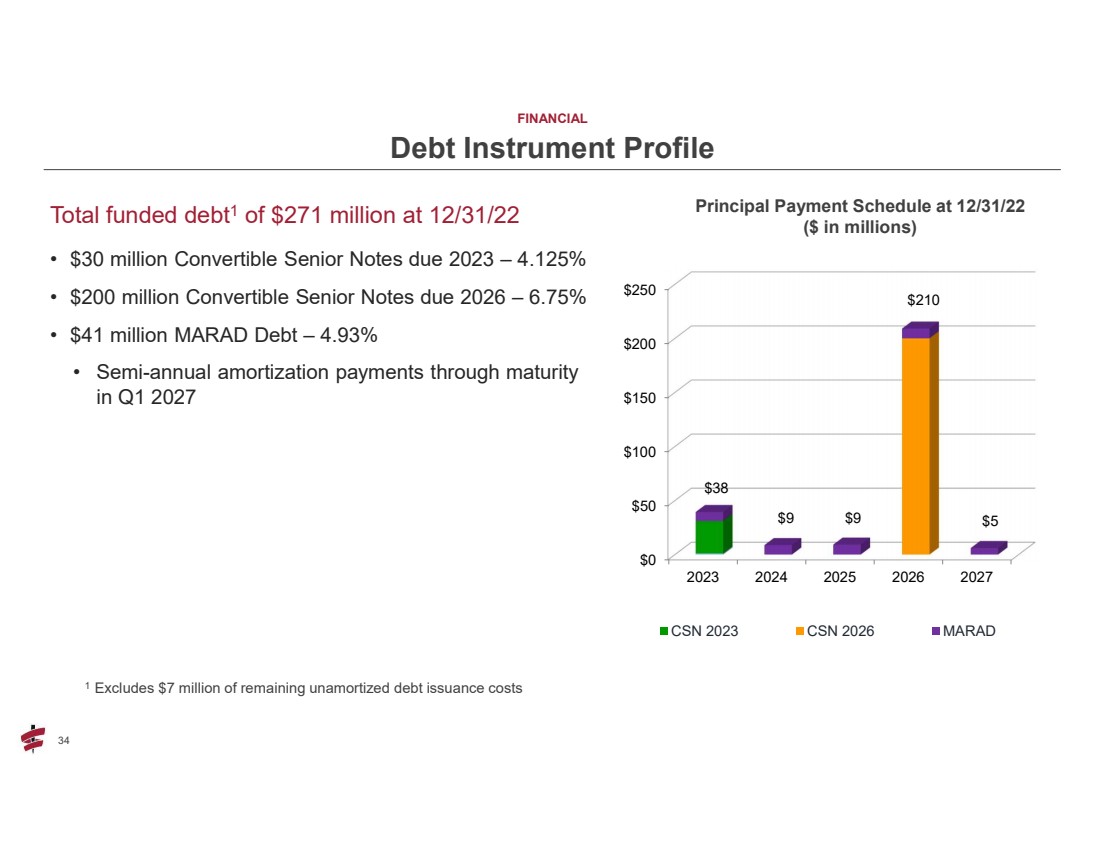

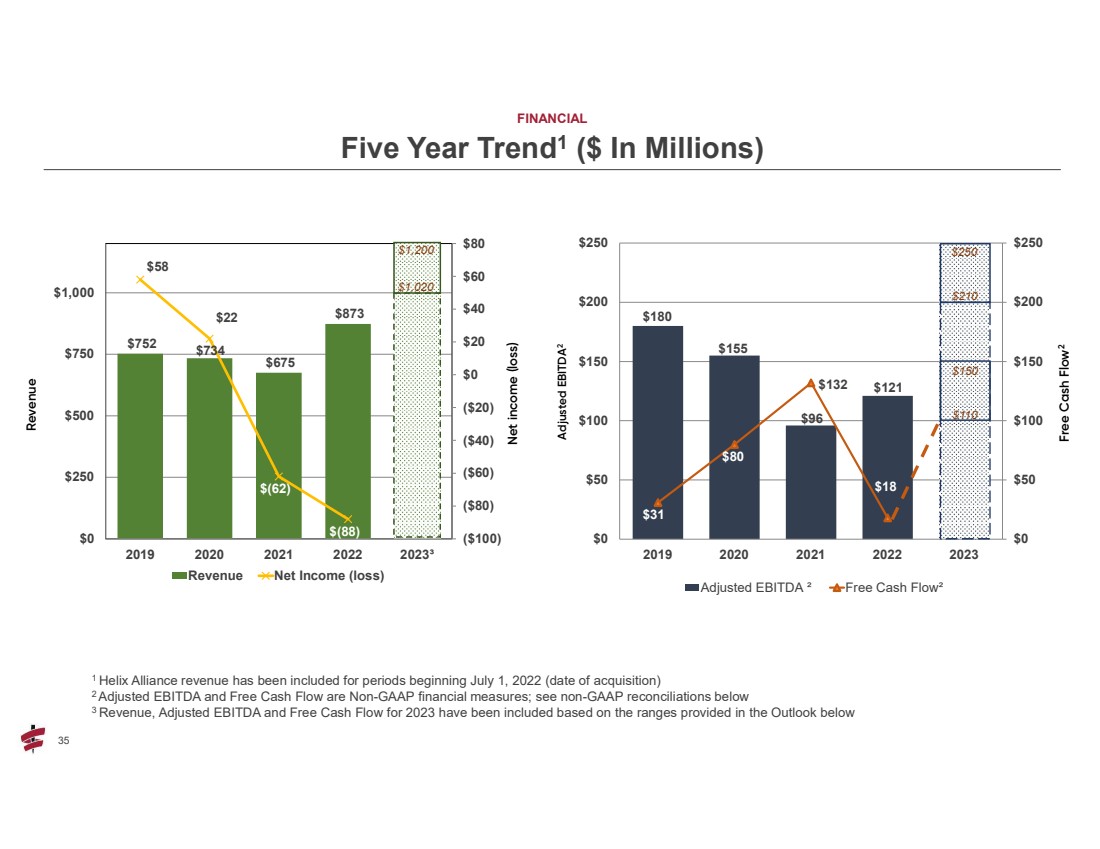

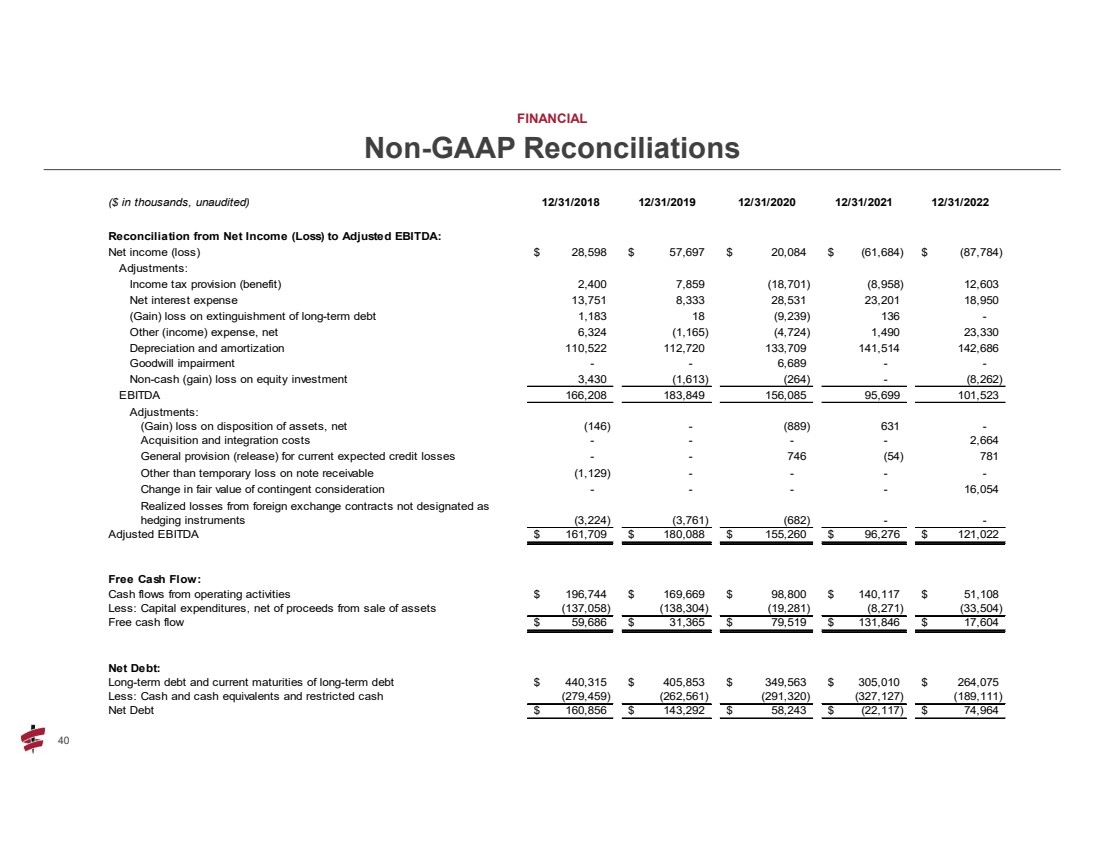

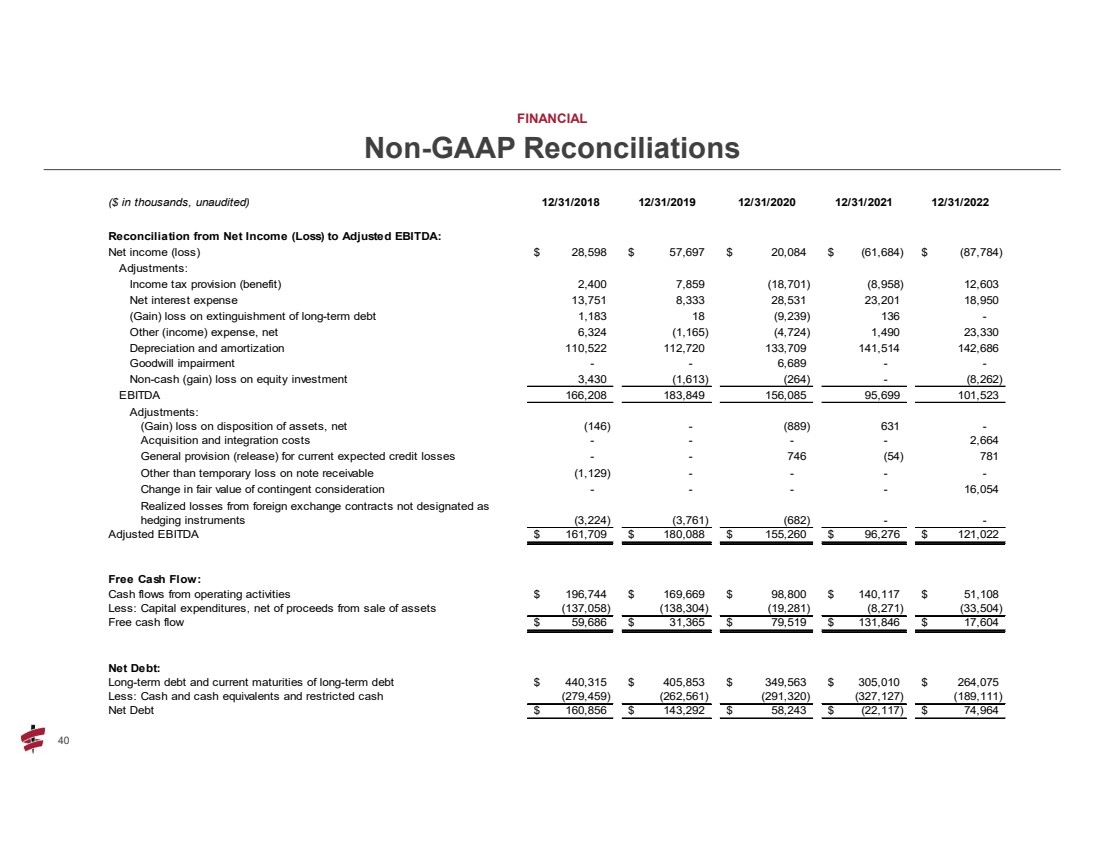

| 40 40 FINANCIAL Non-GAAP Reconciliations ($ in thousands, unaudited) 12/31/2018 12/31/2019 12/31/2020 12/31/2021 12/31/2022 Reconciliation from Net Income (Loss) to Adjusted EBITDA: Net income (loss) 28,598 $ 57,697 $ 20,084 $ (61,684) $ (87,784) $ Adjustments: Income tax provision (benefit) 2,400 7,859 (18,701) (8,958) 12,603 Net interest expense 13,751 8,333 28,531 23,201 18,950 (Gain) loss on extinguishment of long-term debt 1,183 18 (9,239) 136 - Other (income) expense, net 6,324 (1,165) (4,724) 1,490 23,330 Depreciation and amortization 110,522 112,720 133,709 141,514 142,686 Goodwill impairment - - 6,689 - - Non-cash (gain) loss on equity investment 3,430 (1,613) (264) - (8,262) EBITDA 166,208 183,849 156,085 95,699 101,523 Adjustments: (Gain) loss on disposition of assets, net (146) - (889) 631 - Acquisition and integration costs - - - - 2,664 General provision (release) for current expected credit losses - - 746 (54) 781 Other than temporary loss on note receivable (1,129) - - - - Change in fair value of contingent consideration - - - - 16,054 Realized losses from foreign exchange contracts not designated as hedging instruments (3,224) (3,761) (682) - - Adjusted EBITDA 161,709 $ 180,088 $ 155,260 $ 96,276 $ 121,022 $ Free Cash Flow: Cash flows from operating activities 196,744 $ 169,669 $ 98,800 $ 140,117 $ 51,108 $ Less: Capital expenditures, net of proceeds from sale of assets (137,058) (138,304) (19,281) (8,271) (33,504) Free cash flow 59,686 $ 31,365 $ 79,519 $ 131,846 $ 17,604 $ Net Debt: Long-term debt and current maturities of long-term debt 440,315 $ 405,853 $ 349,563 $ 305,010 $ 264,075 $ Less: Cash and cash equivalents and restricted cash (279,459) (262,561) (291,320) (327,127) (189,111) Net Debt 160,856 $ 143,292 $ 58,243 $ (22,117) $ 74,964 $ |