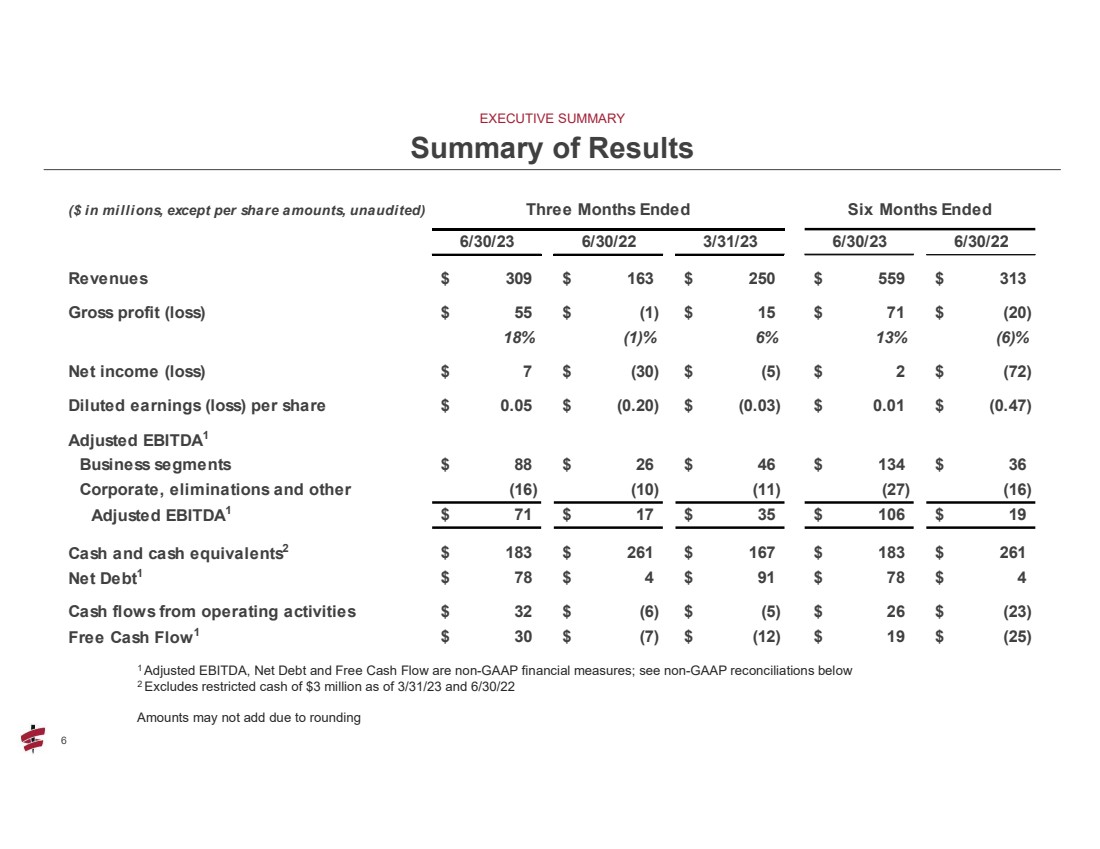

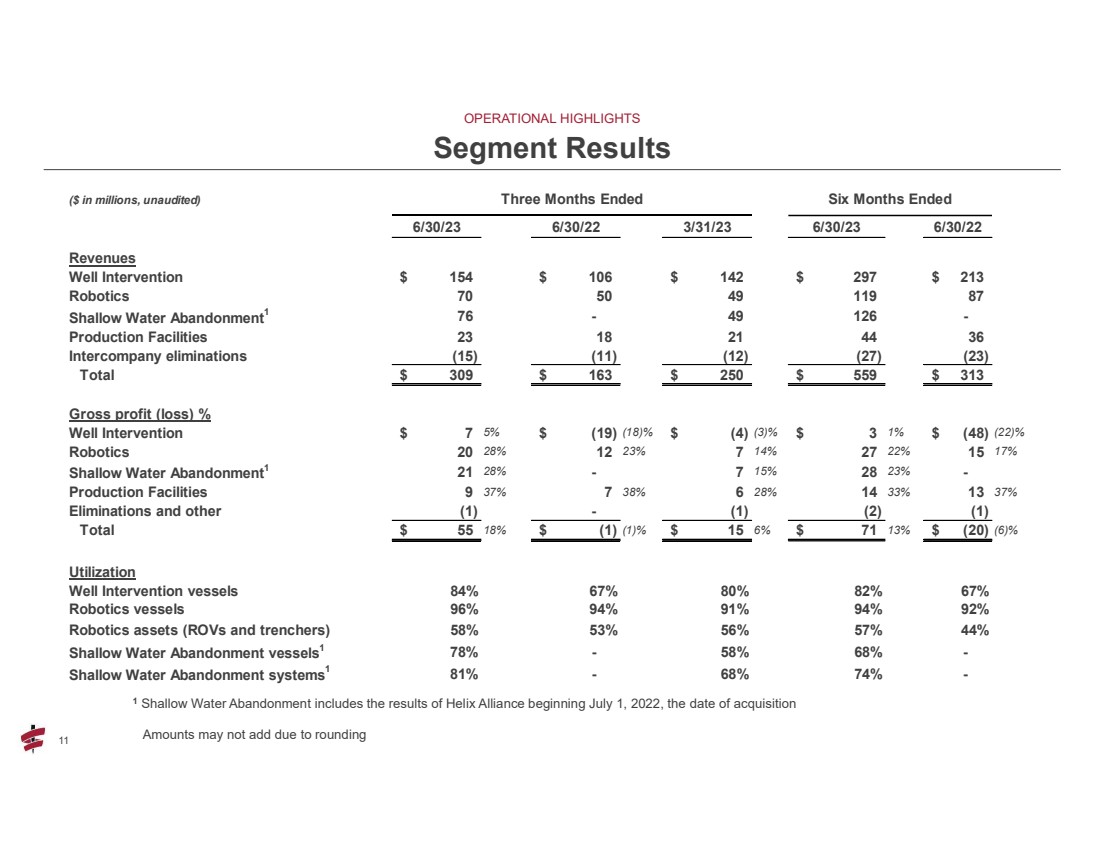

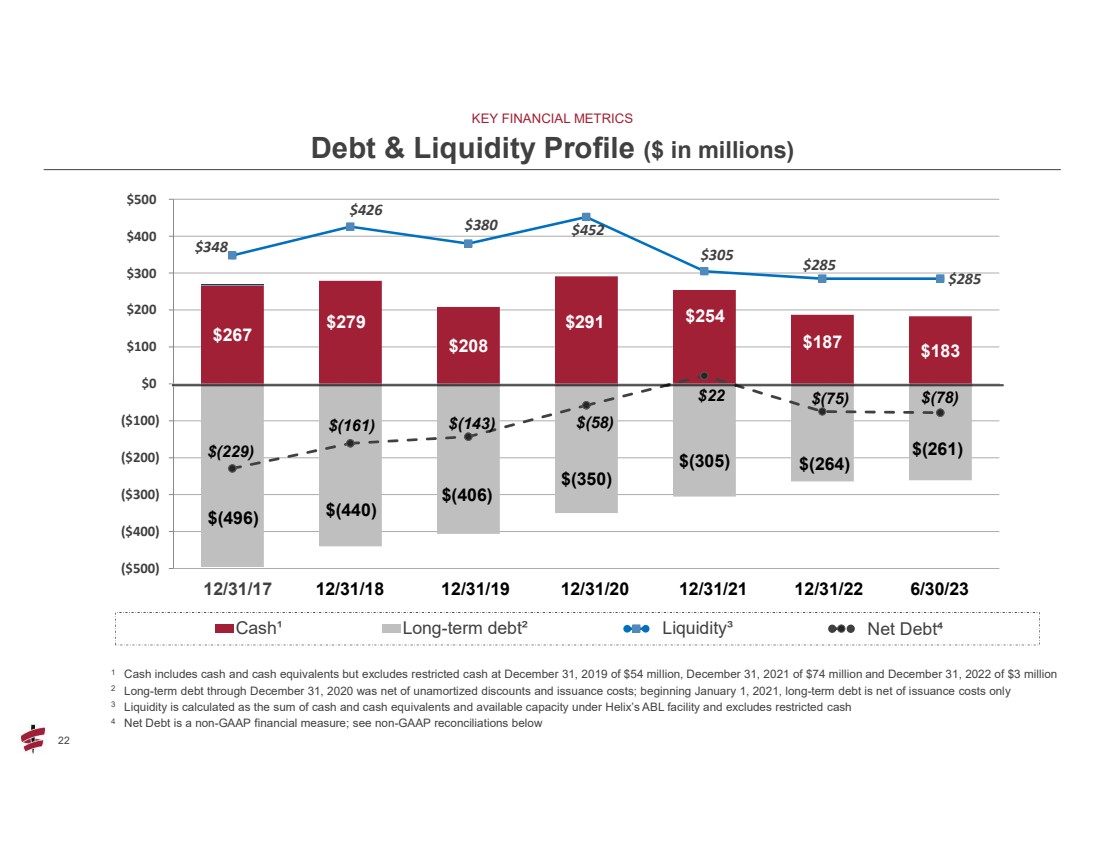

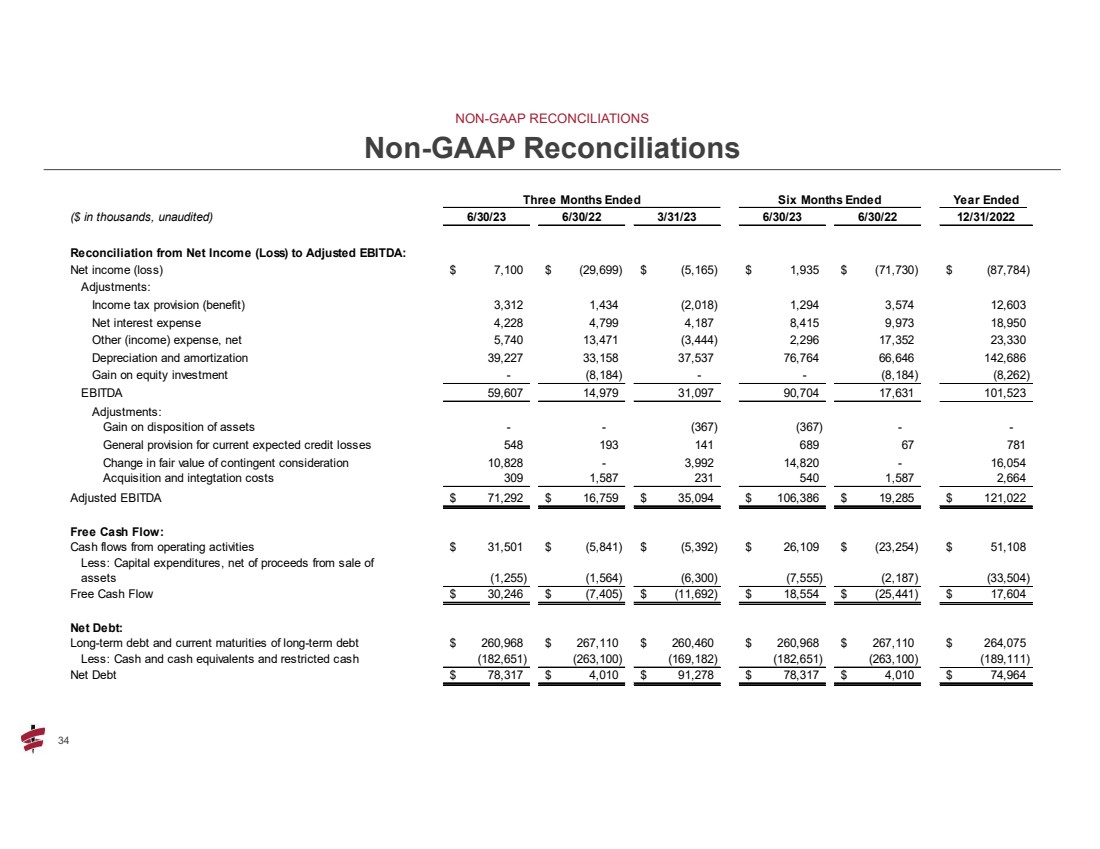

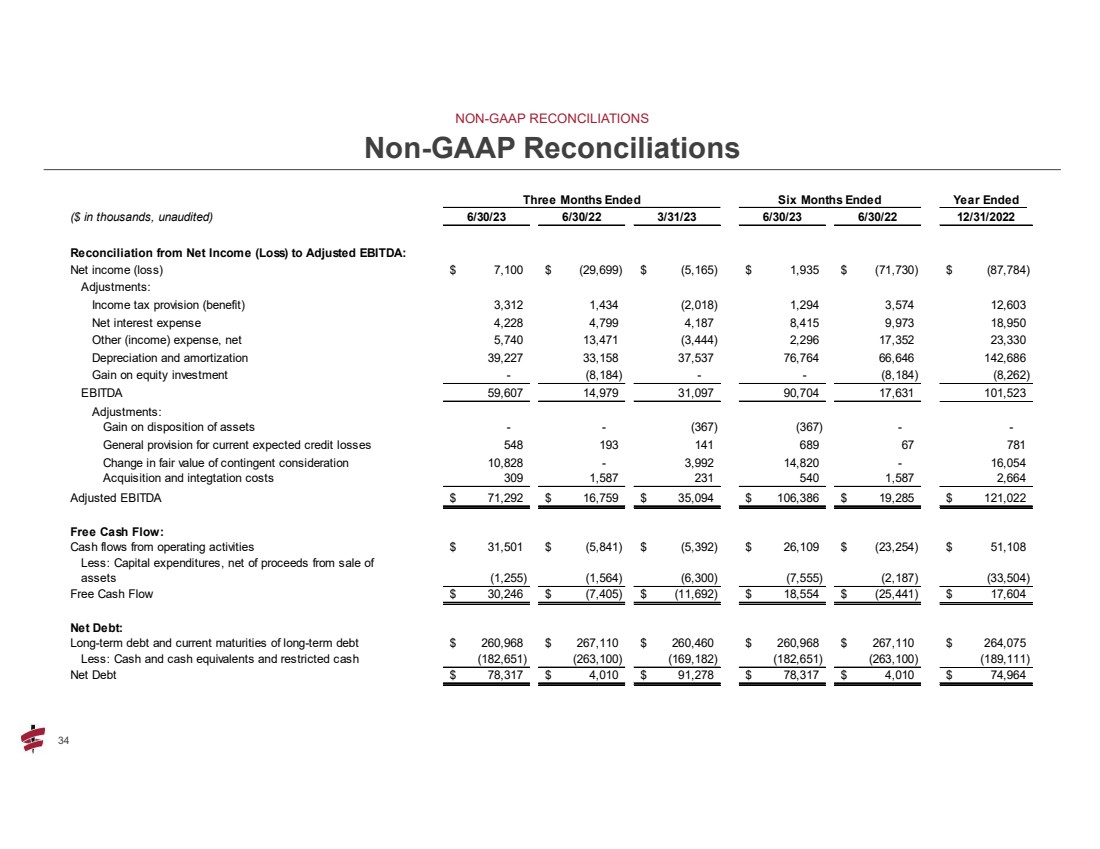

| 34 34 NON-GAAP RECONCILIATIONS Non-GAAP Reconciliations Year Ended ($ in thousands, unaudited) 6/30/23 6/30/22 3/31/23 6/30/23 6/30/22 12/31/2022 Reconciliation from Net Income (Loss) to Adjusted EBITDA: Net income (loss) 7,100 $ (29,699) $ (5,165) $ 1,935 $ (71,730) $ (87,784) $ Adjustments: Income tax provision (benefit) 3,312 1,434 (2,018) 1,294 3,574 12,603 Net interest expense 4,228 4,799 4,187 8,415 9,973 18,950 Other (income) expense, net 5,740 13,471 (3,444) 2,296 17,352 23,330 Depreciation and amortization 39,227 33,158 37,537 76,764 66,646 142,686 Gain on equity investment - (8,184) - - (8,184) (8,262) EBITDA 59,607 14,979 31,097 90,704 17,631 101,523 Adjustments: Gain on disposition of assets - - (367) (367) - - General provision for current expected credit losses 548 193 141 689 67 781 Change in fair value of contingent consideration 10,828 - 3,992 14,820 - 16,054 Acquisition and integtation costs 309 1,587 231 540 1,587 2,664 Adjusted EBITDA 71,292 $ 16,759 $ 35,094 $ 106,386 $ 19,285 $ 121,022 $ Free Cash Flow: Cash flows from operating activities 31,501 $ (5,841) $ (5,392) $ 26,109 $ (23,254) $ 51,108 $ Less: Capital expenditures, net of proceeds from sale of assets (1,255) (1,564) (6,300) (7,555) (2,187) (33,504) Free Cash Flow 30,246 $ (7,405) $ (11,692) $ 18,554 $ (25,441) $ 17,604 $ Net Debt: Long-term debt and current maturities of long-term debt 260,968 $ 267,110 $ 260,460 $ 260,968 $ 267,110 $ 264,075 $ Less: Cash and cash equivalents and restricted cash (182,651) (263,100) (169,182) (182,651) (263,100) (189,111) Net Debt 78,317 $ 4,010 $ 91,278 $ 78,317 $ 4,010 $ 74,964 $ Three Months Ended Six Months Ended |