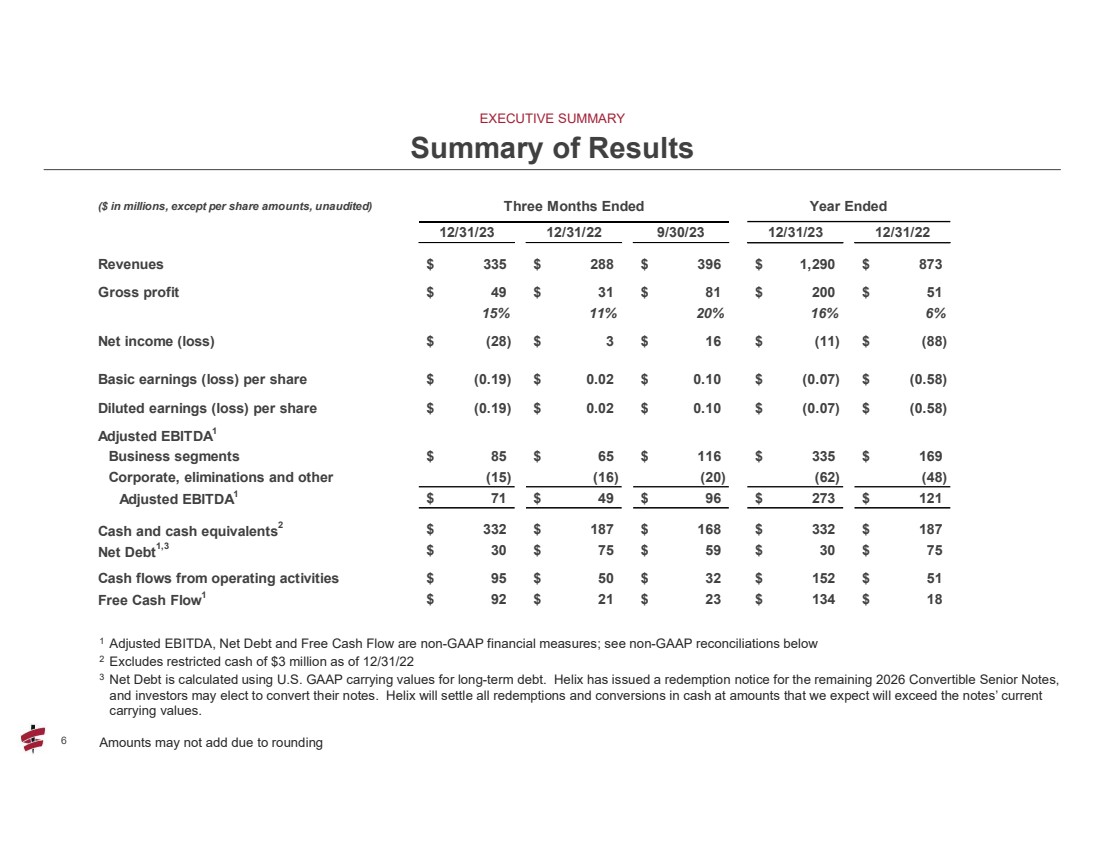

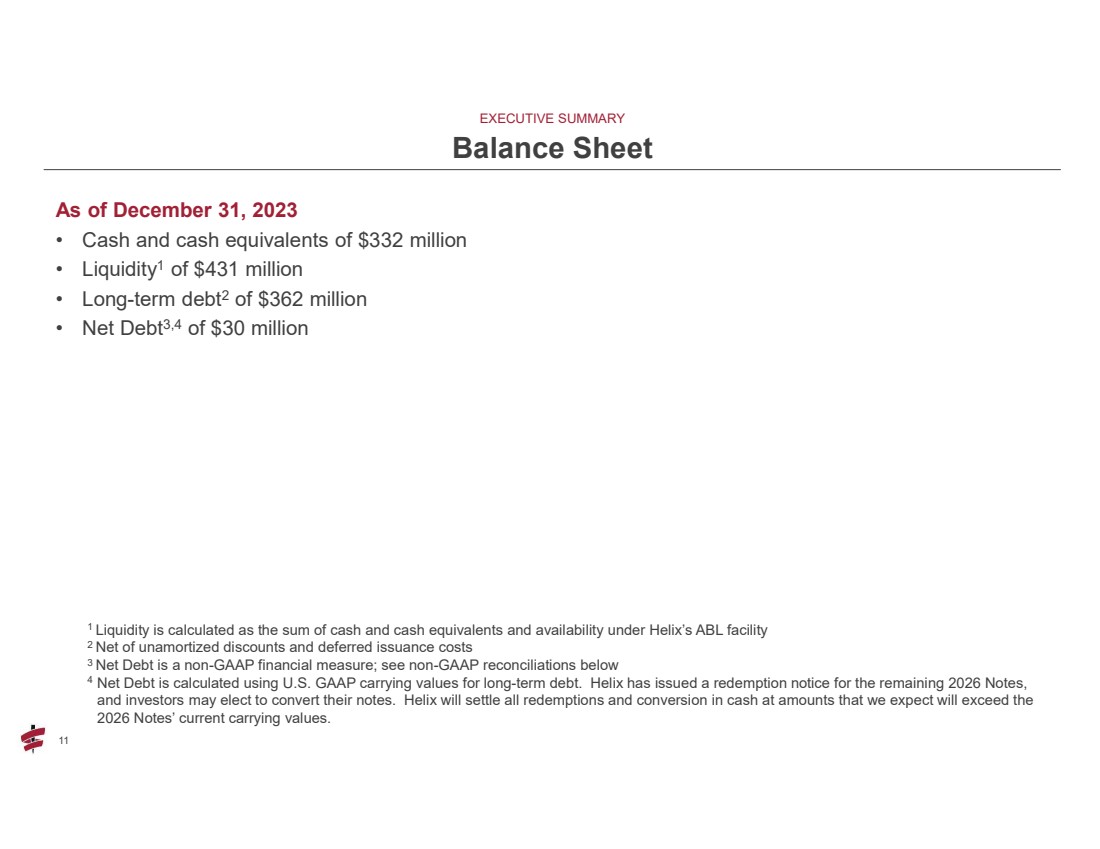

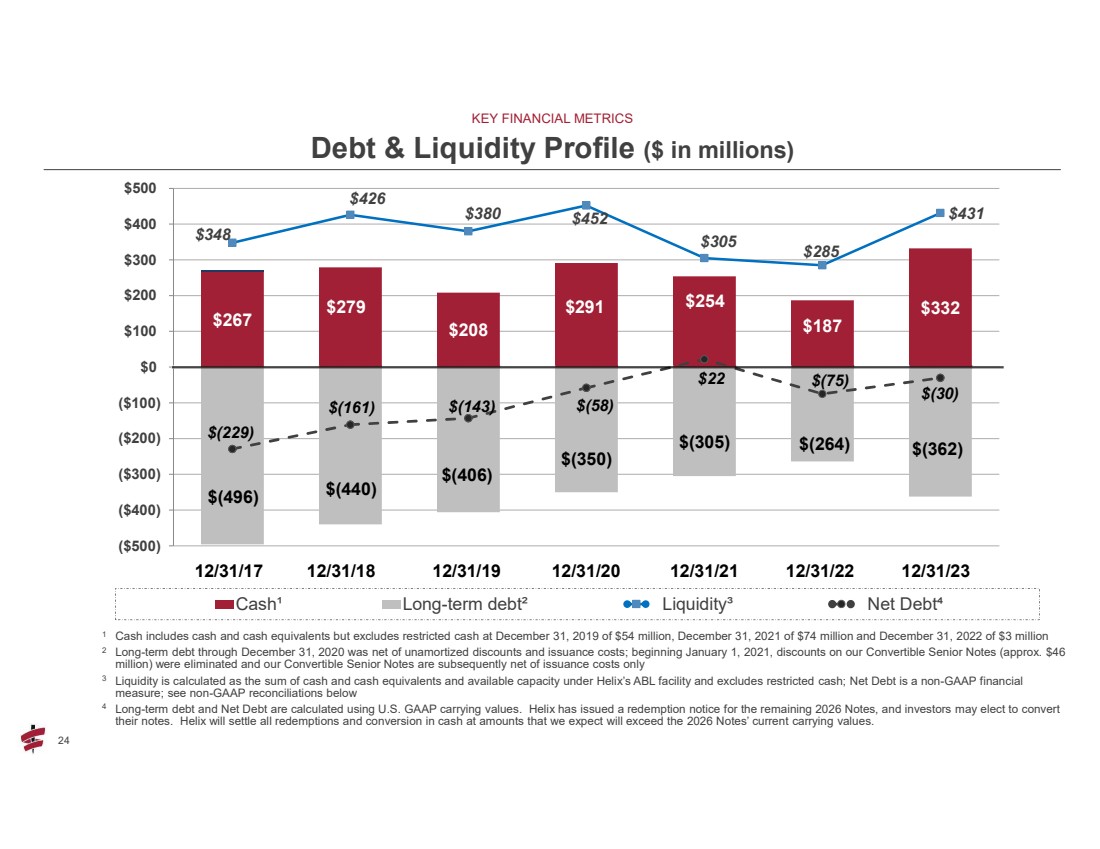

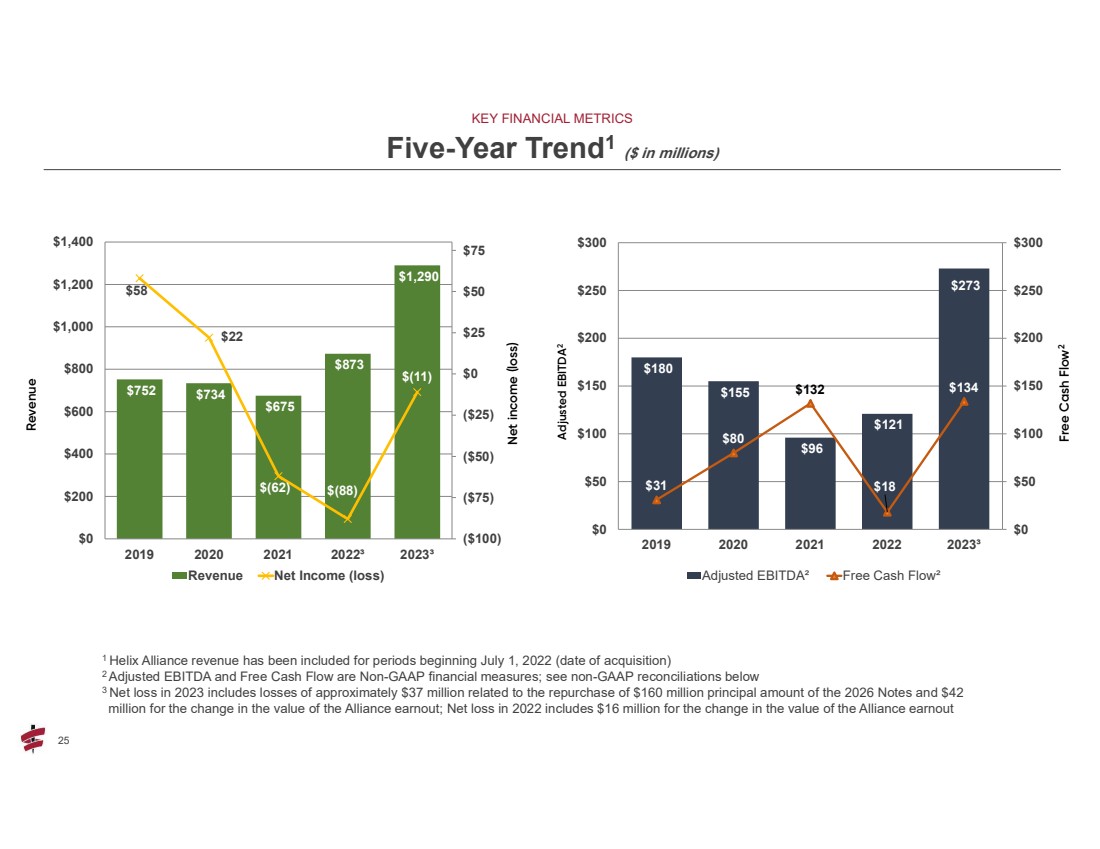

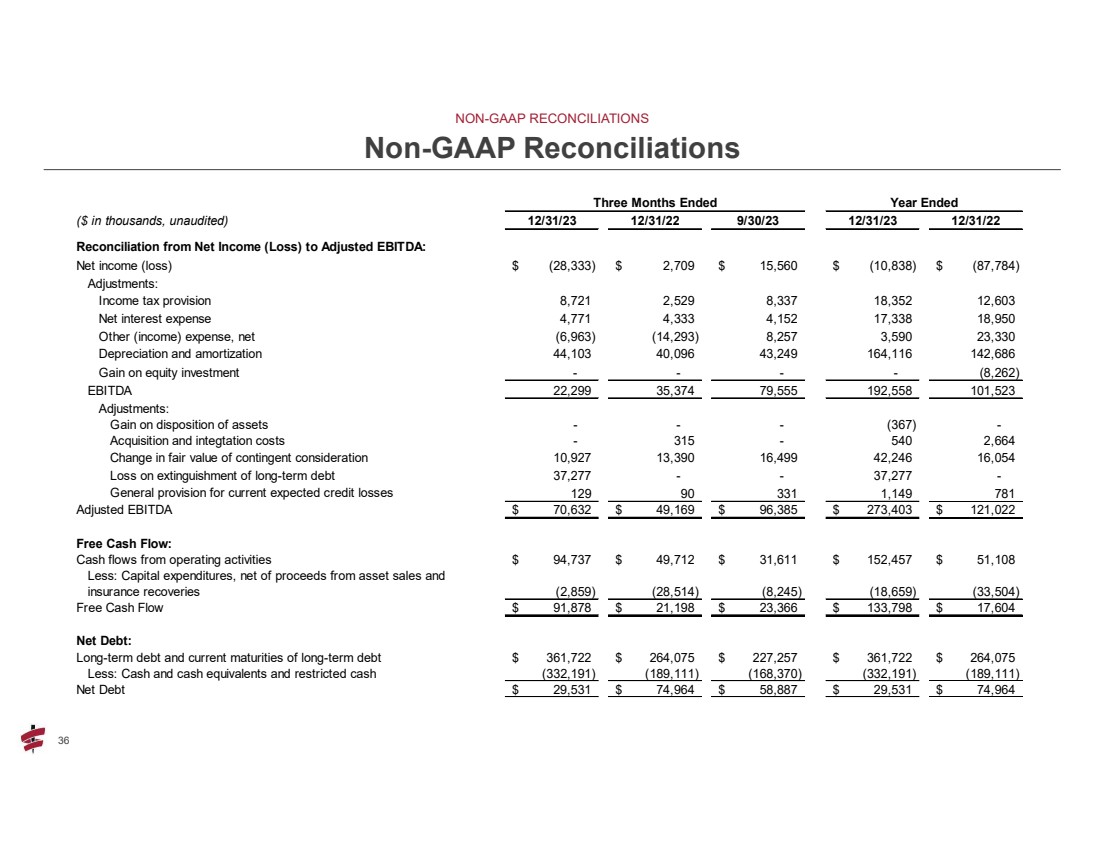

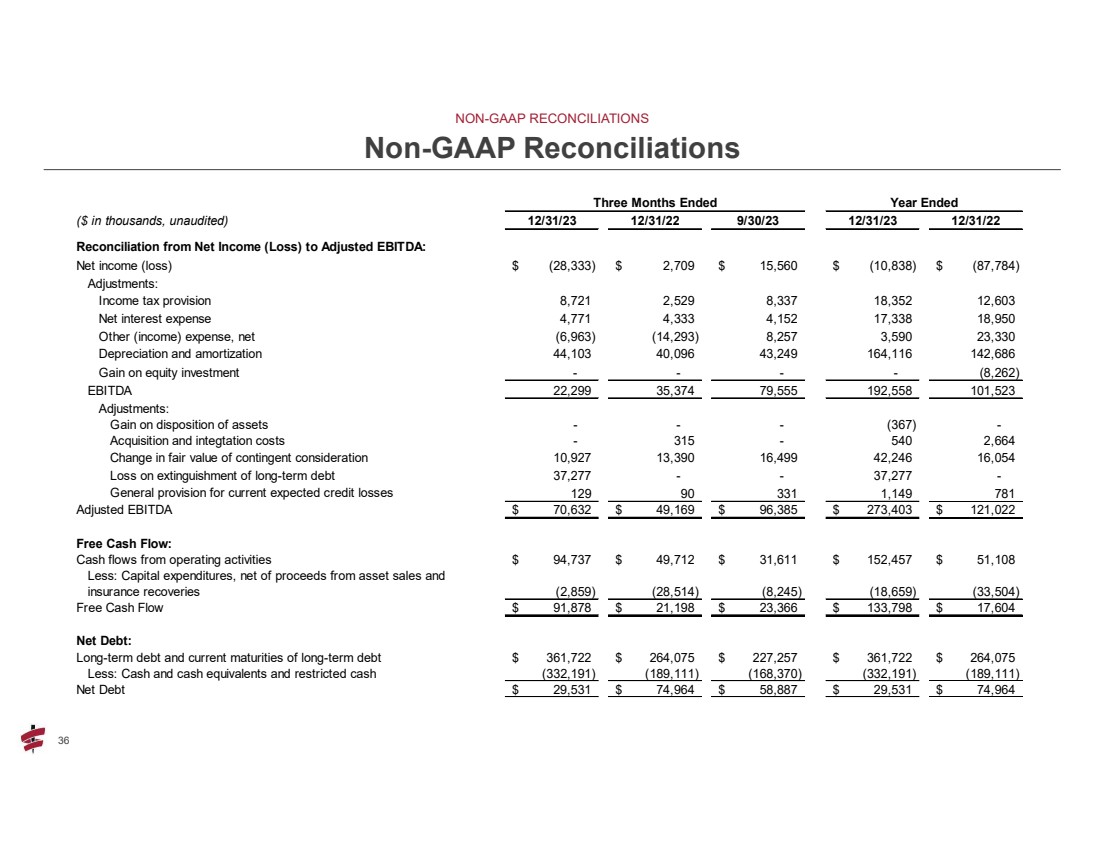

| 36 36 NON-GAAP RECONCILIATIONS Non-GAAP Reconciliations ($ in thousands, unaudited) 12/31/23 12/31/22 9/30/23 12/31/23 12/31/22 Reconciliation from Net Income (Loss) to Adjusted EBITDA: Net income (loss) (28,333) $ 2,709 $ 15,560 $ (10,838) $ (87,784) $ Adjustments: Income tax provision 8,721 2,529 8,337 18,352 12,603 Net interest expense 4,771 4,333 4,152 17,338 18,950 Other (income) expense, net (6,963) (14,293) 8,257 3,590 23,330 Depreciation and amortization 44,103 40,096 43,249 164,116 142,686 Gain on equity investment - - - - (8,262) EBITDA 22,299 35,374 79,555 192,558 101,523 Adjustments: Gain on disposition of assets - - - (367) - Acquisition and integtation costs - 315 - 540 2,664 Change in fair value of contingent consideration 10,927 13,390 16,499 42,246 16,054 Loss on extinguishment of long-term debt 37,277 - - 37,277 - General provision for current expected credit losses 90 129 331 1,149 781 Adjusted EBITDA 70,632 $ 49,169 $ 96,385 $ 273,403 $ 121,022 $ Free Cash Flow: Cash flows from operating activities 94,737 $ 49,712 $ 31,611 $ 152,457 $ 51,108 $ Less: Capital expenditures, net of proceeds from asset sales and insurance recoveries (2,859) (28,514) (8,245) (18,659) (33,504) Free Cash Flow 91,878 $ 21,198 $ 23,366 $ 133,798 $ 17,604 $ Net Debt: Long-term debt and current maturities of long-term debt 361,722 $ 264,075 $ 227,257 $ 361,722 $ 264,075 $ Less: Cash and cash equivalents and restricted cash (332,191) (189,111) (168,370) (332,191) (189,111) Net Debt 29,531 $ 74,964 $ 58,887 $ 29,531 $ 74,964 $ Three Months Ended Year Ended |