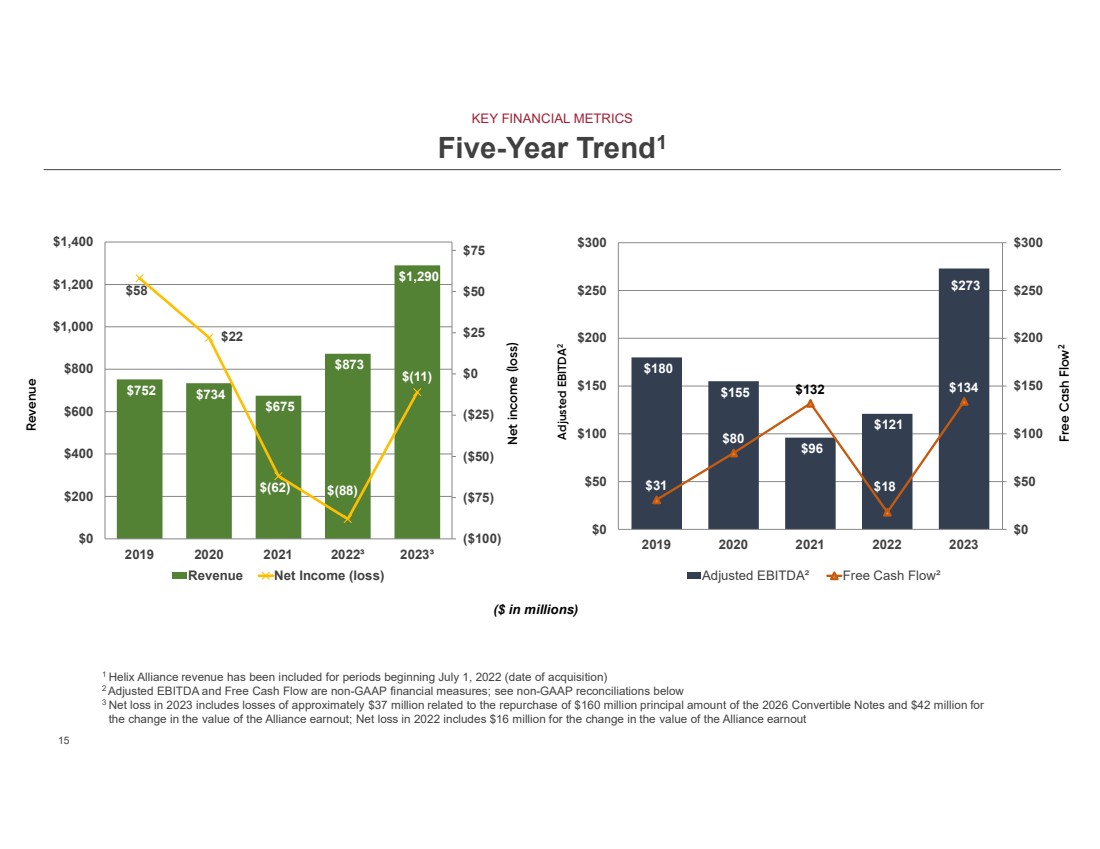

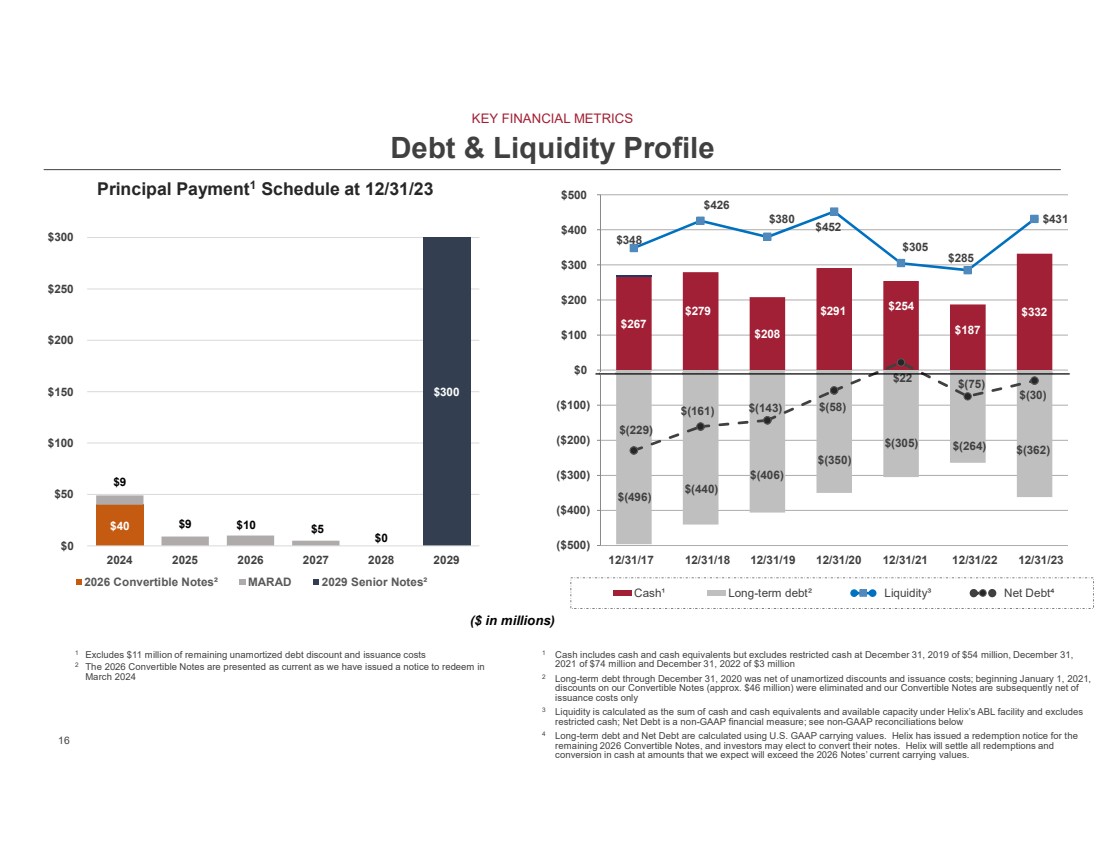

| 22 22 Non-GAAP Reconciliations ($ in thousands, unaudited) 12/31/2019 12/31/2020 12/31/2021 12/31/2022 12/31/2023 Reconciliation from Net Income (Loss) to Adjusted EBITDA: Net income (loss) 57,697 $ 20,084 $ (61,684) $ (87,784) $ (10,838) $ Adjustments: Income tax provision (benefit) 7,859 (18,701) (8,958) 12,603 18,352 Net interest expense 8,333 28,531 23,201 18,950 17,338 Other (income) expense, net (1,165) (4,724) 1,490 23,330 3,590 Depreciation and amortization 112,720 133,709 141,514 142,686 164,116 Goodwill impairment - 6,689 - - - Non-cash gain on equity investment (1,613) (264) - (8,262) - EBITDA 183,831 165,324 95,563 101,523 192,558 Adjustments: (Gain) loss on disposition of assets, net - (889) 631 - (367) Acquisition and integration costs - - - 2,664 540 General provision (release) for current expected credit losses - 746 (54) 781 1,149 (Gain) loss on extinguishment of long-term debt 18 (9,239) 136 - 37,277 Change in fair value of contingent consideration - - - 16,054 42,246 Realized losses from foreign exchange contracts not designated as hedging instruments (3,761) (682) - - - Adjusted EBITDA 180,088 $ 155,260 $ 96,276 $ 121,022 $ 273,403 $ Free Cash Flow: Cash flows from operating activities 169,669 $ 98,800 $ 140,117 $ 51,108 $ 152,457 $ Less: Capital expenditures, net of proceeds from sale of assets (138,304) (19,281) (8,271) (33,504) (18,659) Free cash flow 31,365 $ 79,519 $ 131,846 $ 17,604 $ 133,798 $ Net Debt: Long-term debt and current maturities of long-term debt 405,853 $ 349,563 $ 305,010 $ 264,075 $ 361,722 $ Less: Cash and cash equivalents and restricted cash (262,561) (291,320) (327,127) (189,111) (332,191) Net Debt 143,292 $ 58,243 $ (22,117) $ 74,964 $ 29,531 $ NON-GAAP RECONCILIATIONS |