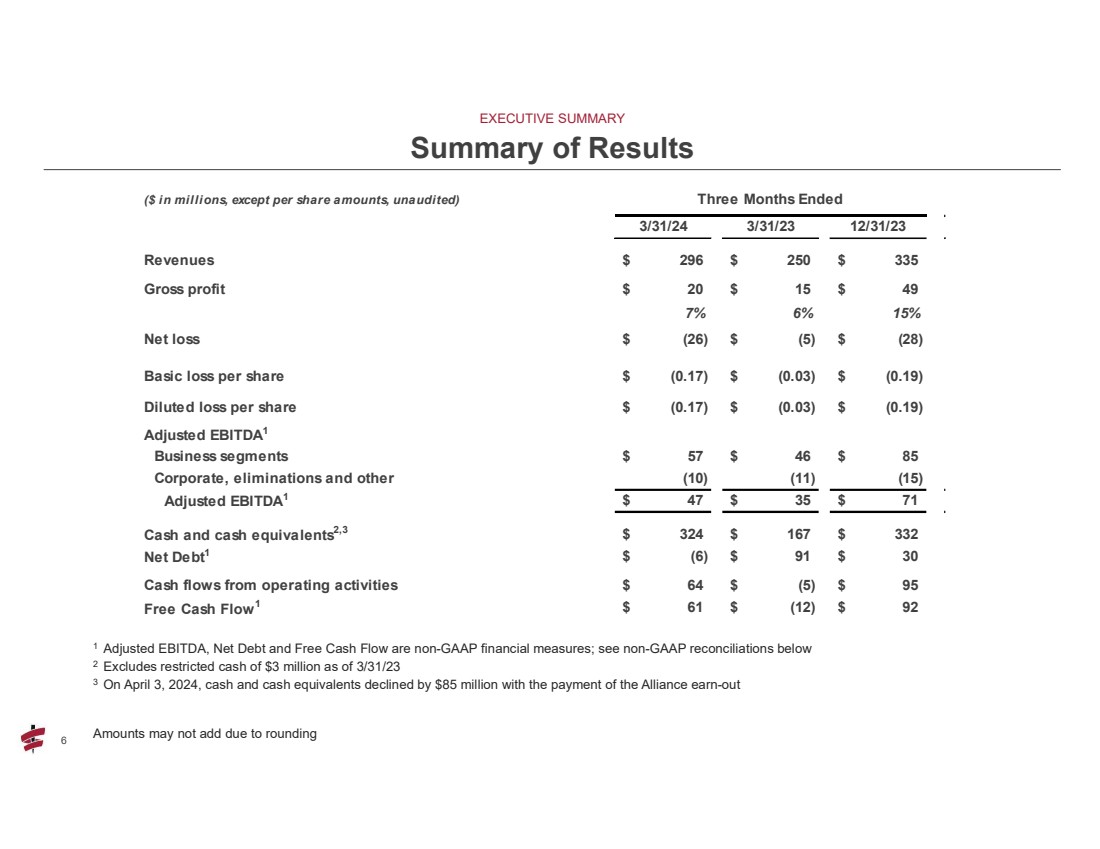

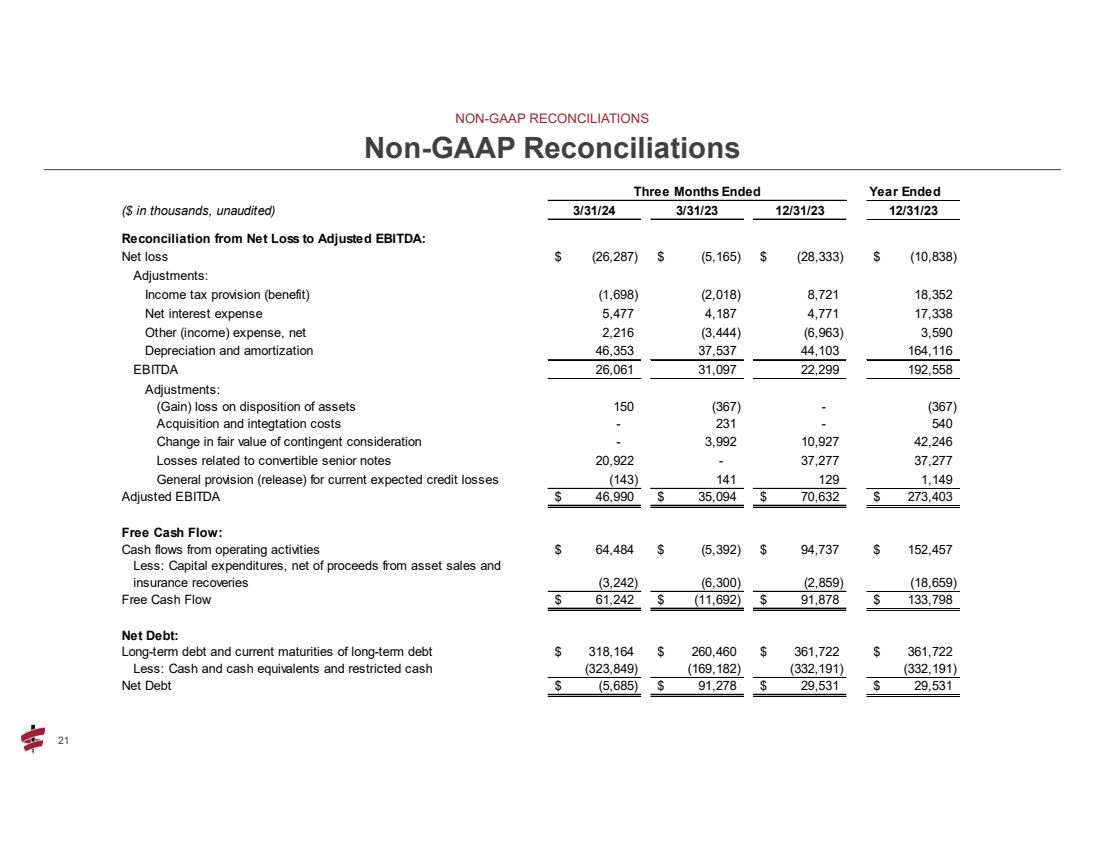

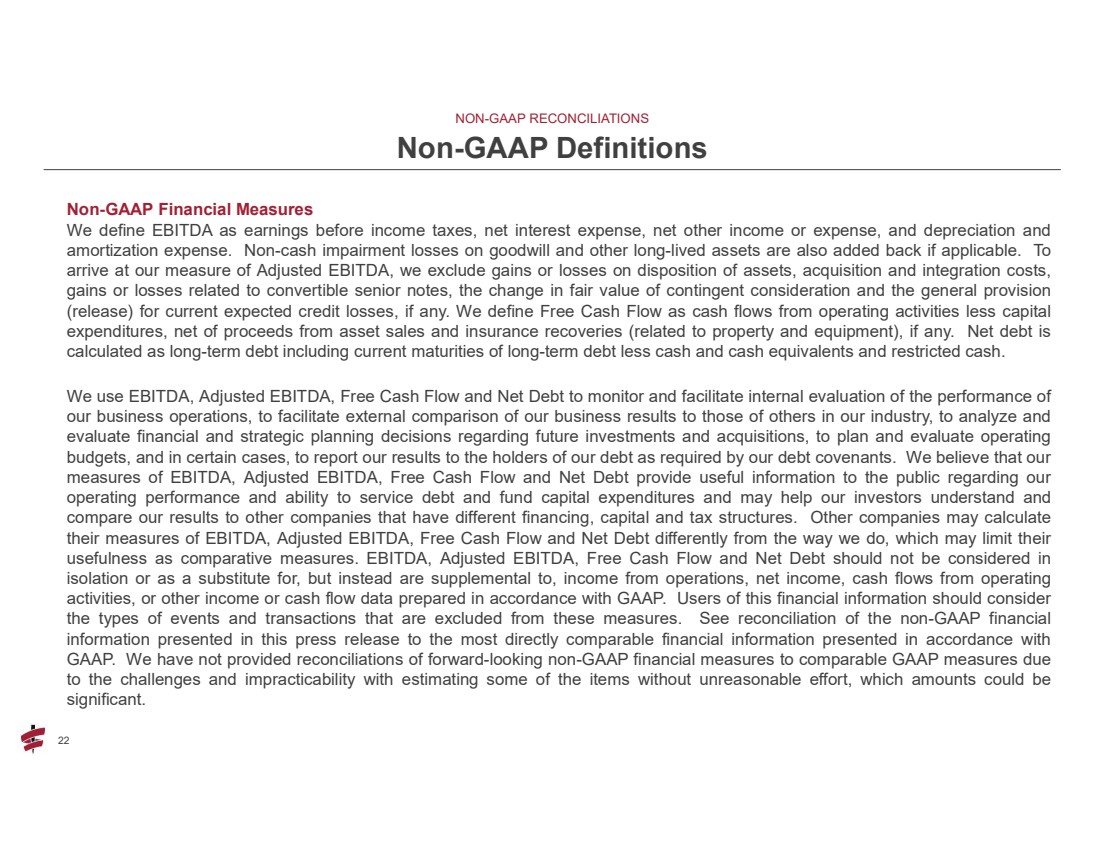

| 21 21 NON-GAAP RECONCILIATIONS Non-GAAP Reconciliations Year Ended ($ in thousands, unaudited) 3/31/24 3/31/23 12/31/23 12/31/23 Reconciliation from Net Loss to Adjusted EBITDA: Net loss (26,287) $ (5,165) $ (28,333) $ (10,838) $ Adjustments: Income tax provision (benefit) (1,698) (2,018) 8,721 18,352 Net interest expense 5,477 4,187 4,771 17,338 Other (income) expense, net 2,216 (3,444) (6,963) 3,590 Depreciation and amortization 46,353 37,537 44,103 164,116 EBITDA 26,061 31,097 22,299 192,558 Adjustments: (Gain) loss on disposition of assets 150 (367) - (367) Acquisition and integtation costs - 231 - 540 Change in fair value of contingent consideration - 3,992 10,927 42,246 Losses related to convertible senior notes 20,922 - 37,277 37,277 General provision (release) for current expected credit losses (143) 141 129 1,149 Adjusted EBITDA 46,990 $ 35,094 $ 70,632 $ 273,403 $ Free Cash Flow: Cash flows from operating activities 64,484 $ (5,392) $ 94,737 $ 152,457 $ Less: Capital expenditures, net of proceeds from asset sales and insurance recoveries (3,242) (6,300) (2,859) (18,659) Free Cash Flow 61,242 $ (11,692) $ 91,878 $ 133,798 $ Net Debt: Long-term debt and current maturities of long-term debt 318,164 $ 260,460 $ 361,722 $ 361,722 $ Less: Cash and cash equivalents and restricted cash (323,849) (169,182) (332,191) (332,191) Net Debt (5,685) $ 91,278 $ 29,531 $ 29,531 $ Three Months Ended |