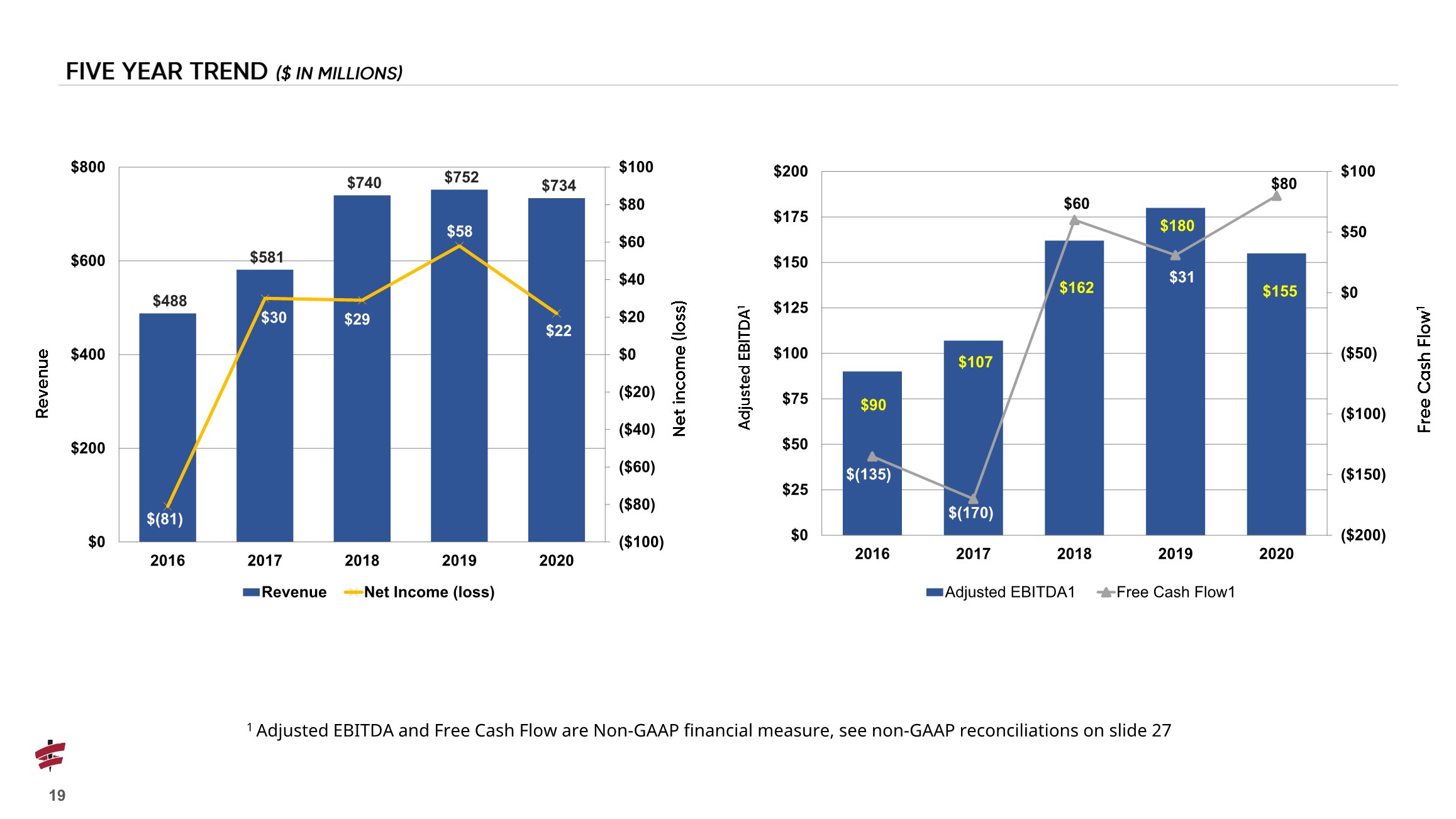

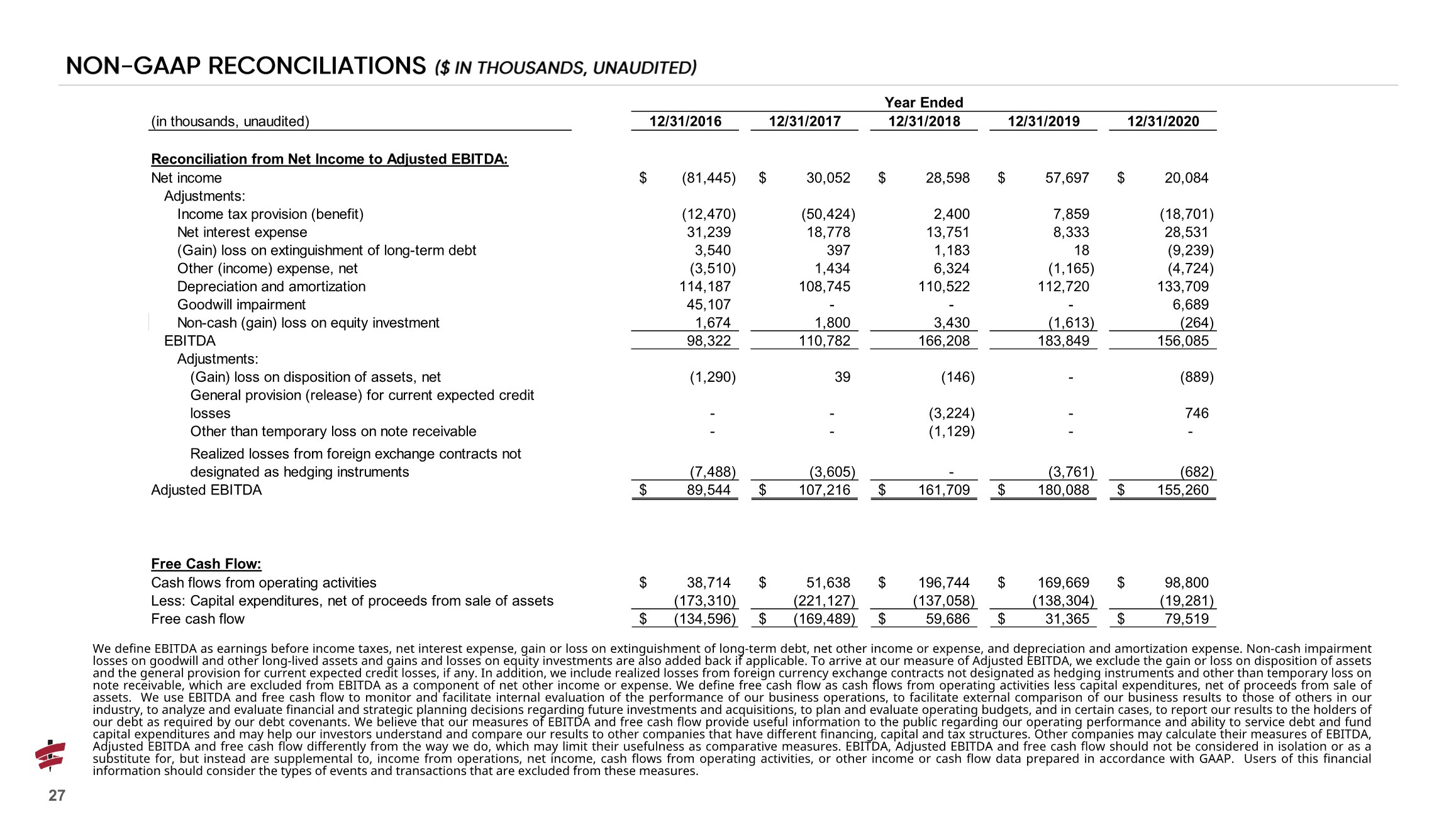

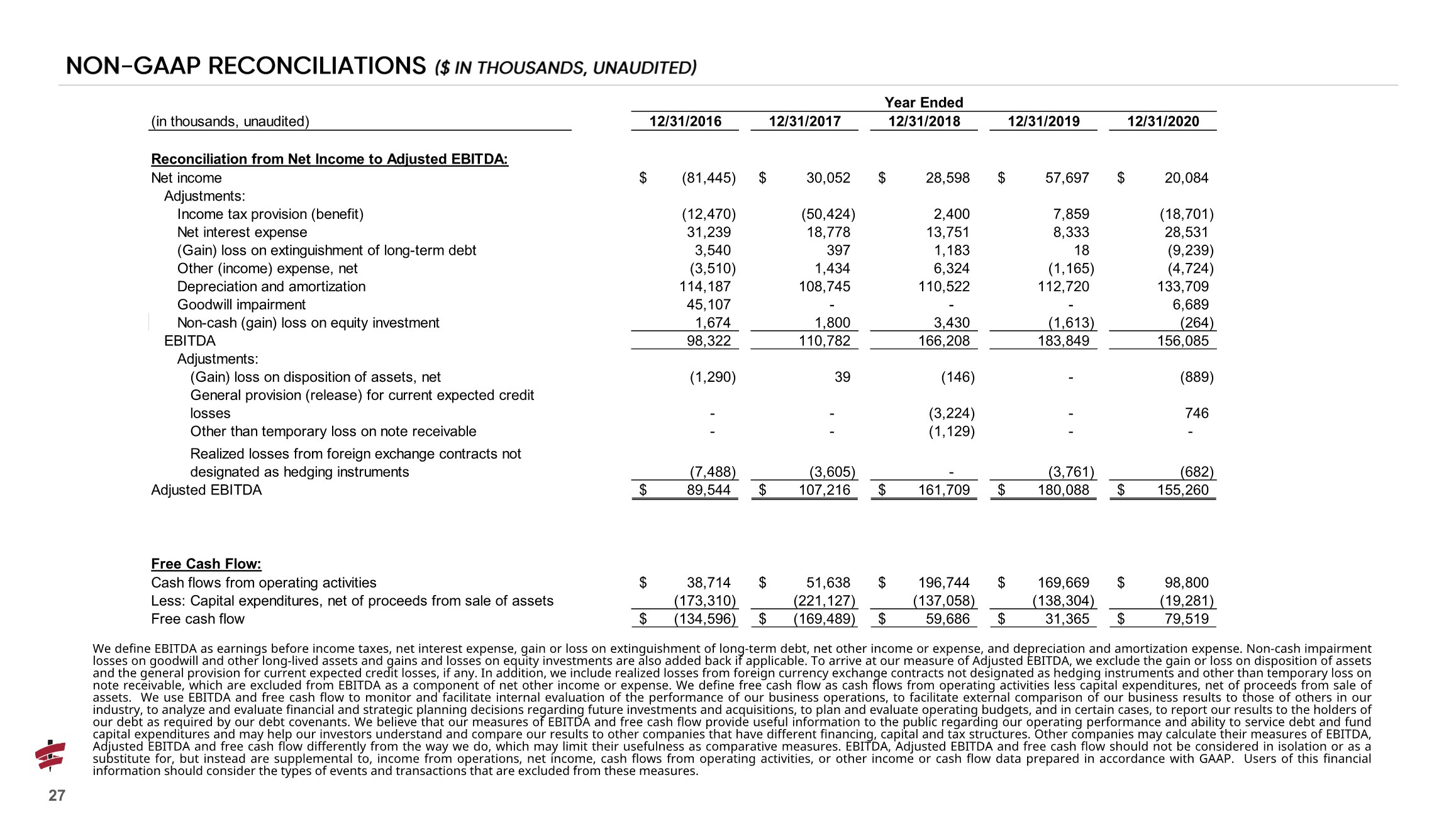

| We define EBITDA as earnings before income taxes, net interest expense, gain or loss on extinguishment of long-term debt, net other income or expense, and depreciation and amortization expense. Non-cash impairment losses on goodwill and other long-lived assets and gains and losses on equity investments are also added back if applicable. To arrive at our measure of Adjusted EBITDA, we exclude the gain or loss on disposition of assets and the general provision for current expected credit losses, if any. In addition, we include realized losses from foreign currency exchange contracts not designated as hedging instruments and other than temporary loss on note receivable, which are excluded from EBITDA as a component of net other income or expense. We define free cash flow as cash flows from operating activities less capital expenditures, net of proceeds from sale of assets. We use EBITDA and free cash flow to monitor and facilitate internal evaluation of the performance of our business operations, to facilitate external comparison of our business results to those of others in our industry, to analyze and evaluate financial and strategic planning decisions regarding future investments and acquisitions, to plan and evaluate operating budgets, and in certain cases, to report our results to the holders of our debt as required by our debt covenants. We believe that our measures of EBITDA and free cash flow provide useful information to the public regarding our operating performance and ability to service debt and fund capital expenditures and may help our investors understand and compare our results to other companies that have different financing, capital and tax structures. Other companies may calculate their measures of EBITDA, Adjusted EBITDA and free cash flow differently from the way we do, which may limit their usefulness as comparative measures. EBITDA, Adjusted EBITDA and free cash flow should not be considered in isolation or as a substitute for, but instead are supplemental to, income from operations, net income, cash flows from operating activities, or other income or cash flow data prepared in accordance with GAAP. Users of this financial information should consider the types of events and transactions that are excluded from these measures. (in thousands, unaudited) 12/31/2016 12/31/2017 12/31/2018 12/31/2019 12/31/2020 Reconciliation from Net Income to Adjusted EBITDA: Net income (81,445) $ 30,052 $ 28,598 $ 57,697 $ 20,084 $ Adjustments: Income tax provision (benefit) (12,470) (50,424) 2,400 7,859 (18,701) Net interest expense 31,239 18,778 13,751 8,333 28,531 (Gain) loss on extinguishment of long-term debt 3,540 397 1,183 18 (9,239) Other (income) expense, net (3,510) 1,434 6,324 (1,165) (4,724) Depreciation and amortization 114,187 108,745 110,522 112,720 133,709 Goodwill impairment 45,107 - - - 6,689 Non-cash (gain) loss on equity investment 1,674 1,800 3,430 (1,613) (264) EBITDA 98,322 110,782 166,208 183,849 156,085 Adjustments: (Gain) loss on disposition of assets, net (1,290) 39 (146) - (889) General provision (release) for current expected credit losses - - (3,224) - 746 Other than temporary loss on note receivable - - (1,129) - - Realized losses from foreign exchange contracts not designated as hedging instruments (7,488) (3,605) - (3,761) (682) Adjusted EBITDA 89,544 $ 107,216 $ 161,709 $ 180,088 $ 155,260 $ Free Cash Flow: Cash flows from operating activities 38,714 $ 51,638 $ 196,744 $ 169,669 $ 98,800 $ Less: Capital expenditures, net of proceeds from sale of assets (173,310) (221,127) (137,058) (138,304) (19,281) Free cash flow (134,596) $ (169,489) $ 59,686 $ 31,365 $ 79,519 $ Year Ended 27 |