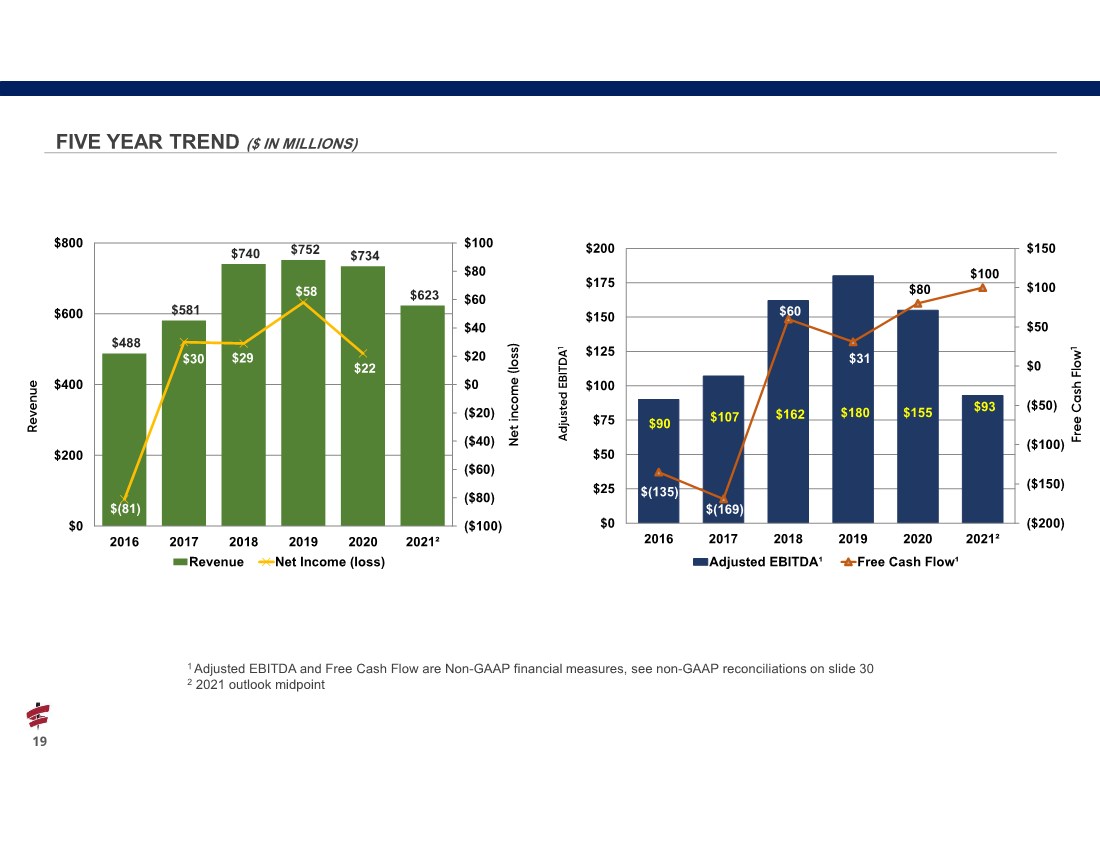

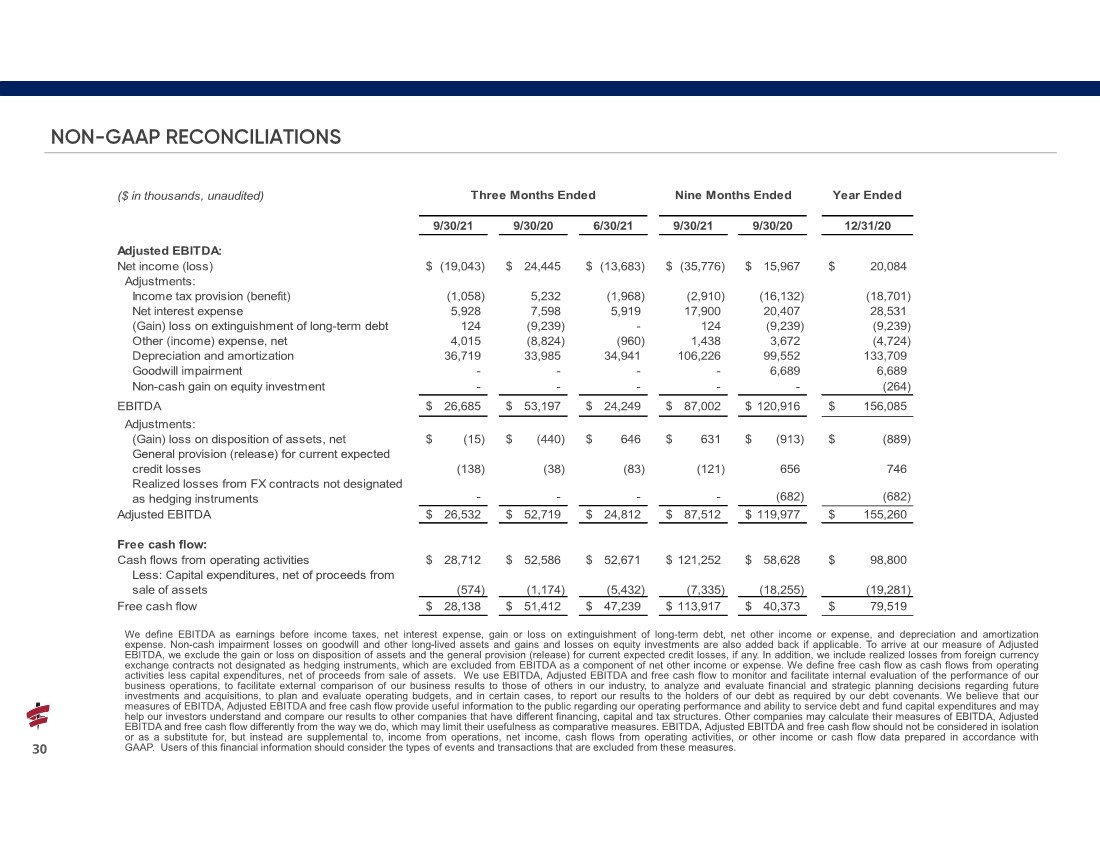

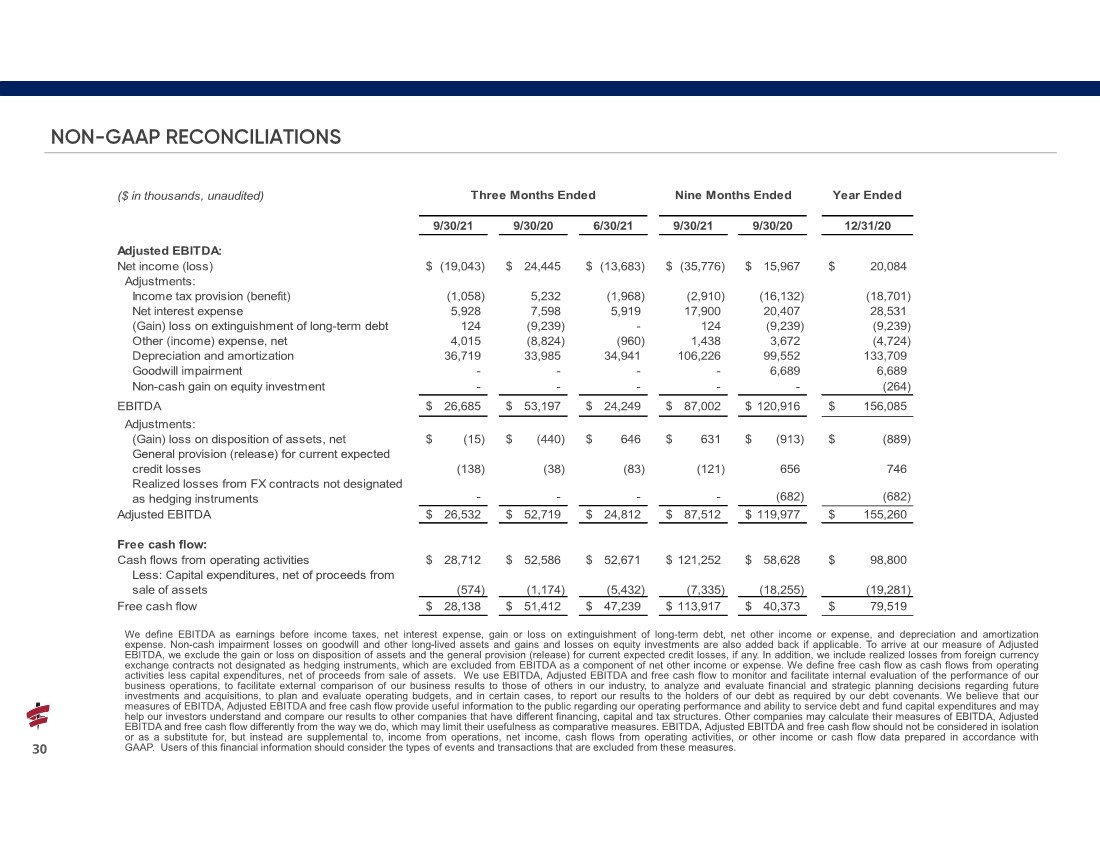

| 30 NON-GAAP RECONCILIATIONS ($ in thousands, unaudited) Three Months Ended Year Ended 9/30/21 9/30/20 6/30/21 9/30/21 9/30/20 12/31/20 Adjusted EBITDA: Net income (loss) (19,043) $ 24,445 $ (13,683) $ (35,776) $ 15,967 $ 20,084 $ Adjustments: Income tax provision (benefit) (1,058) 5,232 (1,968) (2,910) (16,132) (18,701) Net interest expense 5,928 7,598 5,919 17,900 20,407 28,531 (Gain) loss on extinguishment of long-term debt 124 (9,239) - 124 (9,239) (9,239) Other (income) expense, net 4,015 (8,824) (960) 1,438 3,672 (4,724) Depreciation and amortization 36,719 33,985 34,941 106,226 99,552 133,709 Goodwill impairment - - - - 6,689 6,689 Non-cash gain on equity investment - - - - - (264) EBITDA 26,685 $ 53,197 $ 24,249 $ 87,002 $ 120,916 $ 156,085 $ Adjustments: (Gain) loss on disposition of assets, net (15) $ (440) $ 646 $ 631 $ (913) $ (889) $ General provision (release) for current expected credit losses (138) (38) (83) (121) 656 746 Realized losses from FX contracts not designated as hedging instruments - - - - (682) (682) Adjusted EBITDA 26,532 $ 52,719 $ 24,812 $ 87,512 $ 119,977 $ 155,260 $ Free cash flow: Cash flows from operating activities 28,712 $ 52,586 $ 52,671 $ 121,252 $ 58,628 $ 98,800 $ Less: Capital expenditures, net of proceeds from sale of assets (574) (1,174) (5,432) (7,335) (18,255) (19,281) Free cash flow 28,138 $ 51,412 $ 47,239 $ 113,917 $ 40,373 $ 79,519 $ Nine Months Ended We define EBITDA as earnings before income taxes, net interest expense, gain or loss on extinguishment of long-term debt, net other income or expense, and depreciation and amortization expense. Non-cash impairment losses on goodwill and other long-lived assets and gains and losses on equity investments are also added back if applicable. To arrive at our measure of Adjusted EBITDA, we exclude the gain or loss on disposition of assets and the general provision (release) for current expected credit losses, if any. In addition, we include realized losses from foreign currency exchange contracts not designated as hedging instruments, which are excluded from EBITDA as a component of net other income or expense. We define free cash flow as cash flows from operating activities less capital expenditures, net of proceeds from sale of assets. We use EBITDA, Adjusted EBITDA and free cash flow to monitor and facilitate internal evaluation of the performance of our business operations, to facilitate external comparison of our business results to those of others in our industry, to analyze and evaluate financial and strategic planning decisions regarding future investments and acquisitions, to plan and evaluate operating budgets, and in certain cases, to report our results to the holders of our debt as required by our debt covenants. We believe that our measures of EBITDA, Adjusted EBITDA and free cash flow provide useful information to the public regarding our operating performance and ability to service debt and fund capital expenditures and may help our investors understand and compare our results to other companies that have different financing, capital and tax structures. Other companies may calculate their measures of EBITDA, Adjusted EBITDA and free cash flow differently from the way we do, which may limit their usefulness as comparative measures. EBITDA, Adjusted EBITDA and free cash flow should not be considered in isolation or as a substitute for, but instead are supplemental to, income from operations, net income, cash flows from operating activities, or other income or cash flow data prepared in accordance with GAAP. Users of this financial information should consider the types of events and transactions that are excluded from these measures. |