ADP Earnings Call & Webcast 4Q Fiscal 2019 July 31, 2019 Copyright © 2019 ADP, LLC

Forward Looking Statements This presentation and other written or oral statements made from time to time by ADP may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature and which may be identified by the use of words like “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could” “is designed to” and other words of similar meaning, are forward-looking statements. These statements are based on management’s expectations and assumptions and depend upon or refer to future events or conditions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. Factors that could cause actual results to differ materially from those contemplated by the forward-looking statements or that could contribute to such difference include: ADP's success in obtaining, and retaining, clients, and selling additional services to clients; the pricing of products and services; the success of our new solutions; compliance with existing or new legislation or regulations; changes in, or interpretations of, existing legislation or regulations; overall market, political and economic conditions, including interest rate and foreign currency trends; competitive conditions; our ability to maintain our current credit ratings and the impact on our funding costs and profitability; security or cyber breaches, fraudulent acts, and system interruptions and failures; employment and wage levels; changes in technology; availability of skilled technical associates; the impact of new acquisitions and divestitures; and the adequacy, effectiveness and success of our business transformation initiatives. ADP disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. These risks and uncertainties, along with the risk factors discussed under “Item 1A. Risk Factors” of our most recent Annual Report on Form 10-K, and in other written or oral statements made from time to time by ADP, should be considered in evaluating any forward-looking statements contained herein. Non-GAAP Measures Adjusted EBIT, adjusted EBIT margin, adjusted diluted earnings per share, adjusted effective tax rate, constant currency, and organic constant currency are all non-GAAP financial measures. Please refer to the fourth quarter fiscal 2019 earnings release available at investors.adp.com for a discussion of why ADP believes these measures are important and for a reconciliation of non-GAAP financial measures to their comparable GAAP financial measures. We have not provided a reconciliation of our adjusted EBIT, adjusted EBIT margin, adjusted effective tax rate, or adjusted EPS outlook to their most comparable GAAP measures for years beyond fiscal 2020 because it would be potentially misleading and is not practical given the difficulty of projecting event-driven transactional and other non-core operating items that are included in the GAAP metrics, including transformation initiatives, gains/losses on sales of businesses and assets, and certain income tax adjustments. The reconciliation for the historical periods presented in our fourth quarter fiscal 2019 earnings release is indicative of the reconciliation that will be prepared upon completion of the periods beyond fiscal 2020 covered by the non-GAAP outlook. This presentation is a supplement to our fourth quarter fiscal 2019 earnings release; it is intended to be read in conjunction with, not as a substitute for, or in isolation from, the earnings release. Copyright © 2019 ADP, LLC 2

CEO’s Perspective • Continued momentum through transformation 6% revenue growth, 7% organic constant currency (a) Robust 160bps Adj. EBIT (a) margin expansion 20% adjusted diluted EPS growth (a) • Solid ES New Business Bookings performance with 8% growth to $1.6B • Investments to improve the client experience driving 40 basis point increase in ES Revenue Retention to 90.8% • Continued investments in differentiated technology aimed at addressing the evolving world of work • Executing transformation to build sustainable long-term shareholder value (a) For a reconciliation of these non-GAAP financial metrics to their closest comparable GAAP metrics Copyright © 2019 ADP, LLC see our 4Q 2019 earnings release available at investors.adp.com. 3

Fiscal 2019 Financial Highlights (unaudited) Total Revenues Adjusted EBIT (a) Adjusted Diluted EPS (a) h 6% h 15% h 20% h 7% Organic Constant Currency (a) $5.45 $14.2B $3.2B $13.3B $2.8B $4.53 2018 2019 2018 2019 2018 2019 Copyright © 2019 ADP, LLC (a) For a reconciliation of these non-GAAP financial metrics to their closest comparable GAAP metrics see our 4Q 2019 earnings release available at investors.adp.com. 4

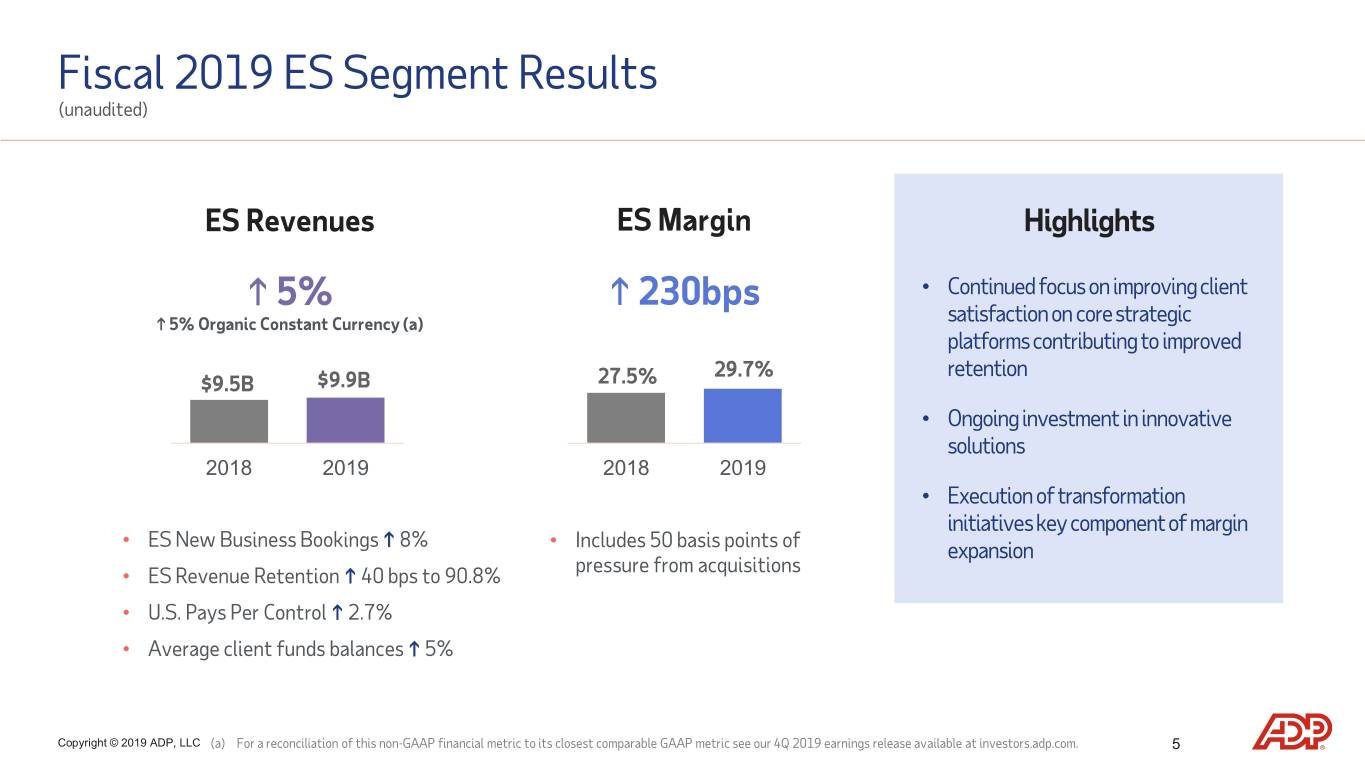

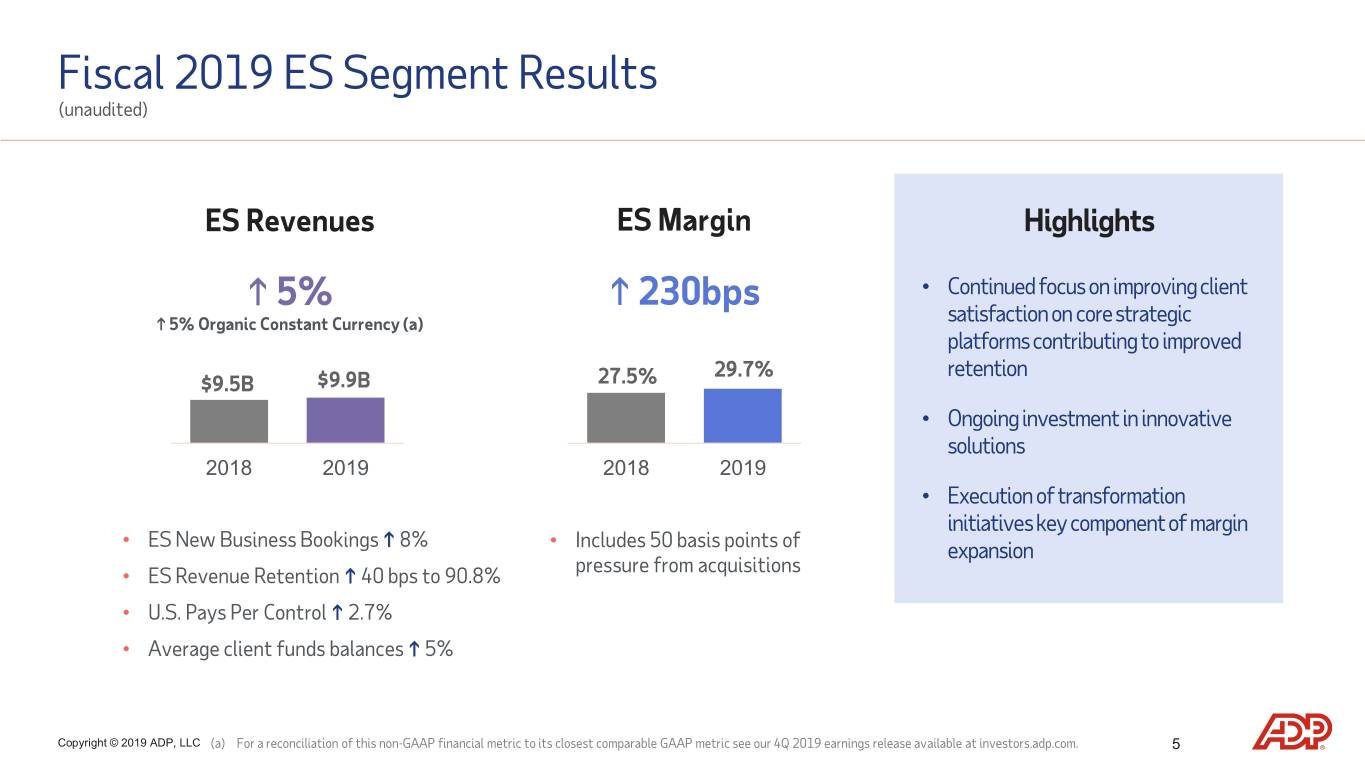

Fiscal 2019 ES Segment Results (unaudited) ES Revenues ES Margin Highlights h 5% h 230bps • Continued focus on improving client h 5% Organic Constant Currency (a) satisfaction on core strategic platforms contributing to improved 29.7% retention $9.5B $9.9B 27.5% • Ongoing investment in innovative solutions 2018 2019 2018 2019 • Execution of transformation initiatives key component of margin • ES New Business Bookings h 8% • Includes 50 basis points of expansion pressure from acquisitions • ES Revenue Retention h 40 bps to 90.8% • U.S. Pays Per Control h 2.7% • Average client funds balances h 5% Copyright © 2019 ADP, LLC (a) For a reconciliation of this non-GAAP financial metric to its closest comparable GAAP metric see our 4Q 2019 earnings release available at investors.adp.com. 5

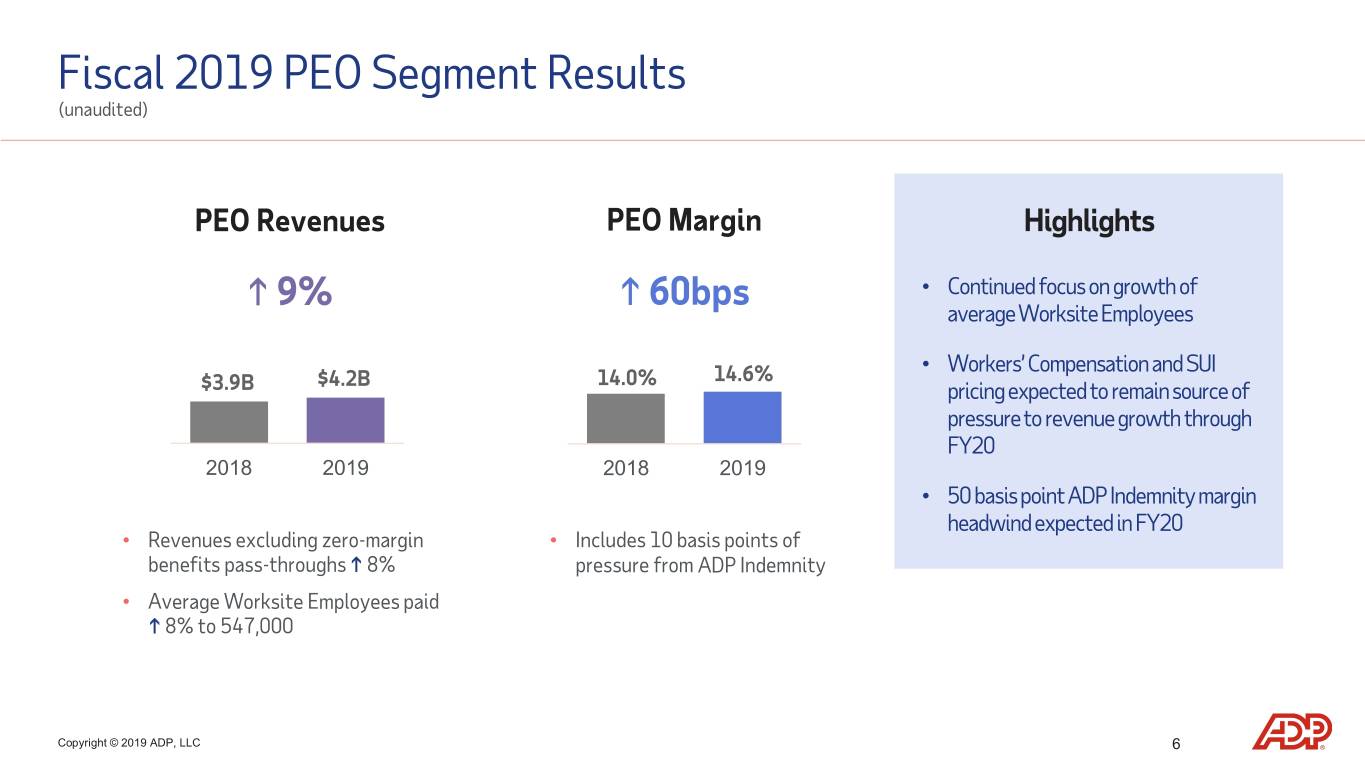

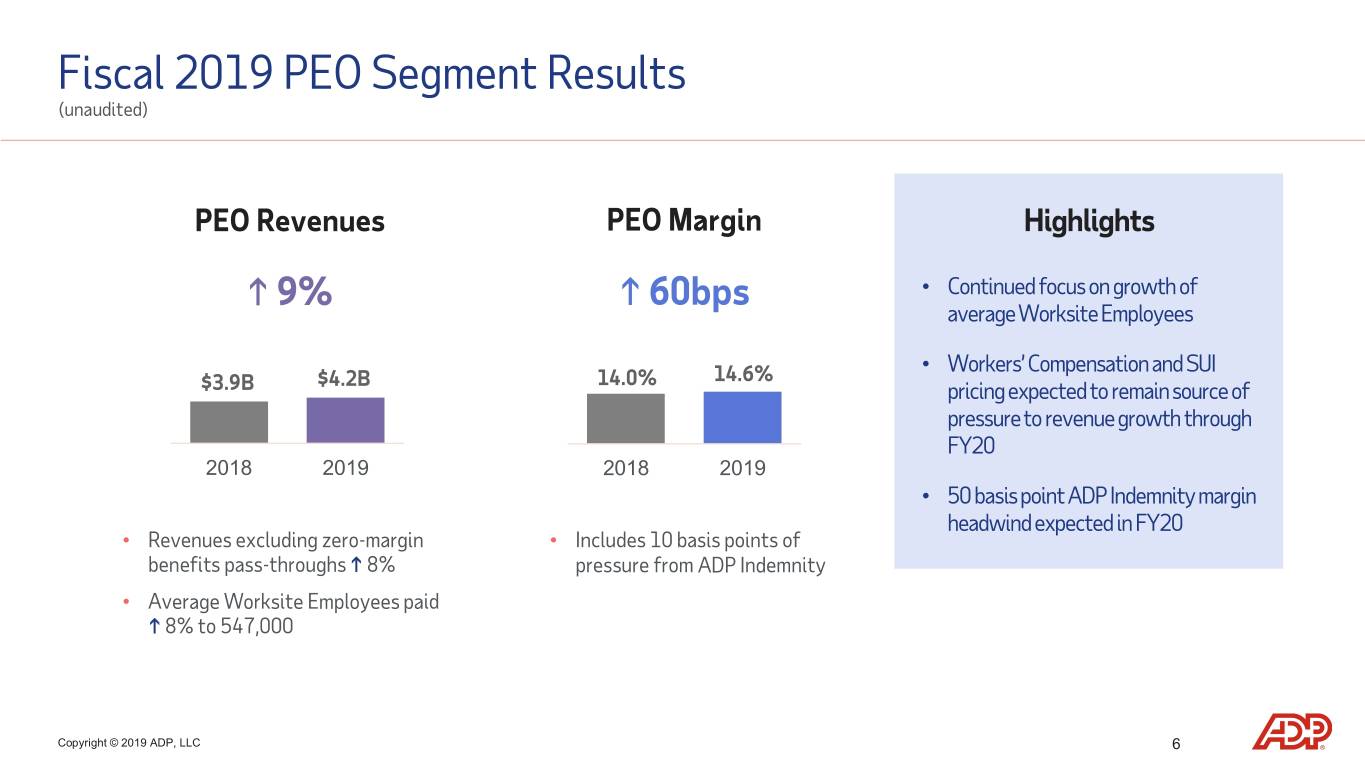

Fiscal 2019 PEO Segment Results (unaudited) PEO Revenues PEO Margin Highlights h 9% h 60bps • Continued focus on growth of average Worksite Employees • Workers’ Compensation and SUI $4.2B 14.0% 14.6% $3.9B pricing expected to remain source of pressure to revenue growth through FY20 2018 2019 2018 2019 • 50 basis point ADP Indemnity margin headwind expected in FY20 • Revenues excluding zero-margin • Includes 10 basis points of benefits pass-throughs h 8% pressure from ADP Indemnity • Average Worksite Employees paid h 8% to 547,000 Copyright © 2019 ADP, LLC 6

Cash Flow and Balance Sheet Strength (unaudited) Robust Cash Flow Year-End Balance Sheet Strong track record of cash generation $1.9B in cash $2.2B in combined dividends and share $2.0B in debt repurchases AA credit rating • Target 55-60% dividend payout ratio • Includes A1+/P1 commercial paper rating • 44 years of dividend increases • Share repurchases flexible tool to return Multiple liquidity sources support high margin excess cash client funds investment strategy • $10.3B commercial paper program • Approximately 79% of client funds portfolio invested in liquid AAA/AA securities Copyright © 2019 ADP, LLC 7

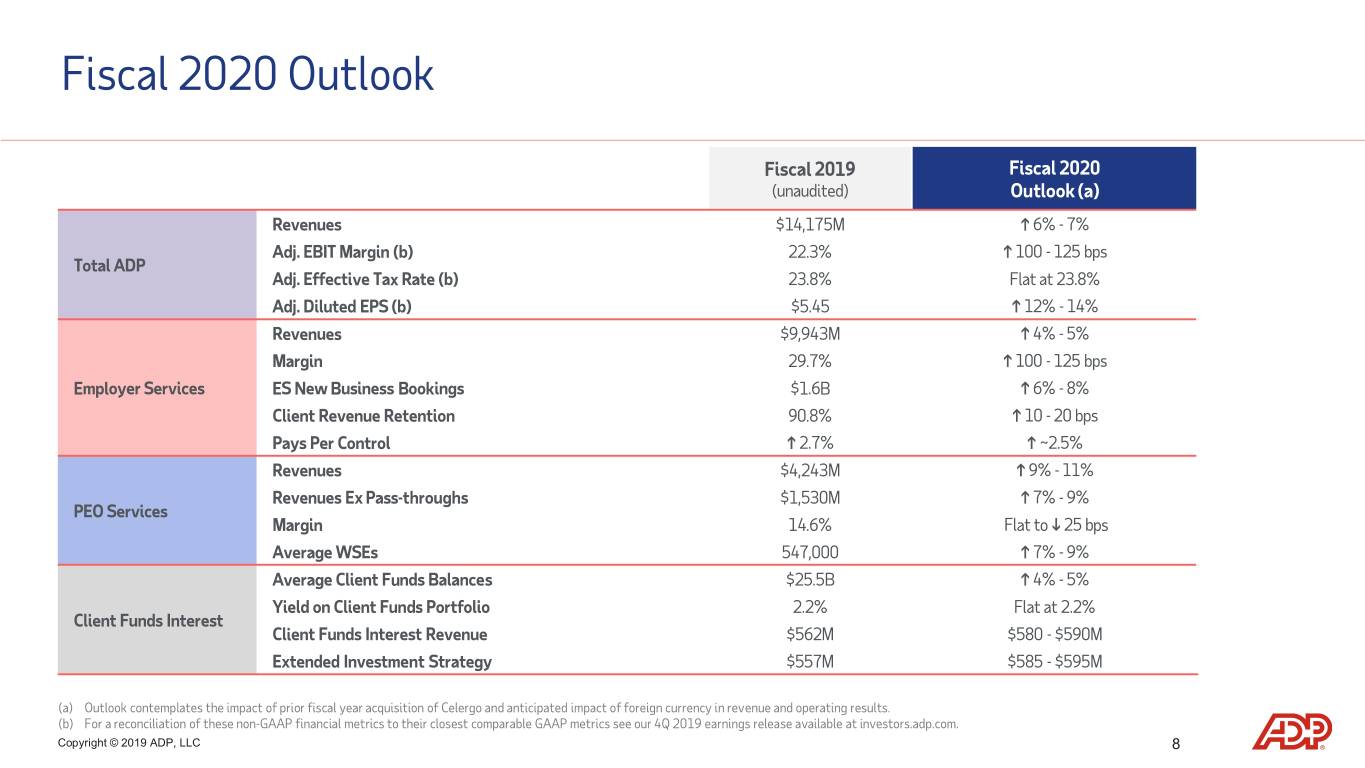

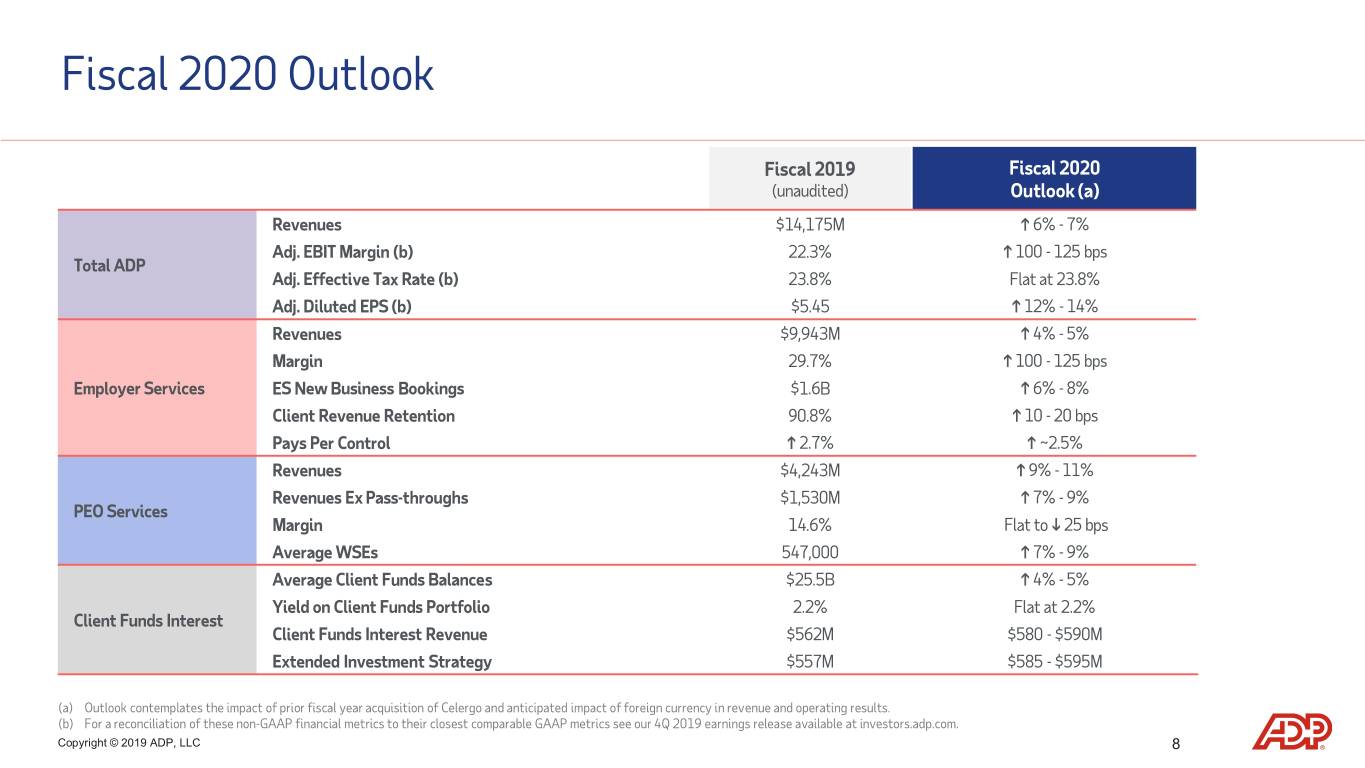

Fiscal 2020 Outlook Fiscal 2019 Fiscal 2020 (unaudited) Outlook (a) Revenues $14,175M h 6% - 7% Adj. EBIT Margin (b) 22.3% h 100 - 125 bps Total ADP Adj. Effective Tax Rate (b) 23.8% Flat at 23.8% Adj. Diluted EPS (b) $5.45 h 12% - 14% Revenues $9,943M h 4% - 5% Margin 29.7% h 100 - 125 bps Employer Services ES New Business Bookings $1.6B h 6% - 8% Client Revenue Retention 90.8% h 10 - 20 bps Pays Per Control h 2.7% h ~2.5% Revenues $4,243M h 9% - 11% Revenues Ex Pass-throughs $1,530M h 7% - 9% PEO Services Margin 14.6% Flat to 25 bps Average WSEs 547,000 h 7% - 9% Average Client Funds Balances $25.5B h 4% - 5% Yield on Client Funds Portfolio 2.2% Flat at 2.2% Client Funds Interest Client Funds Interest Revenue $562M $580 - $590M Extended Investment Strategy $557M $585 - $595M (a) Outlook contemplates the impact of prior fiscal year acquisition of Celergo and anticipated impact of foreign currency in revenue and operating results. (b) For a reconciliation of these non-GAAP financial metrics to their closest comparable GAAP metrics see our 4Q 2019 earnings release available at investors.adp.com. Copyright © 2019 ADP, LLC 8

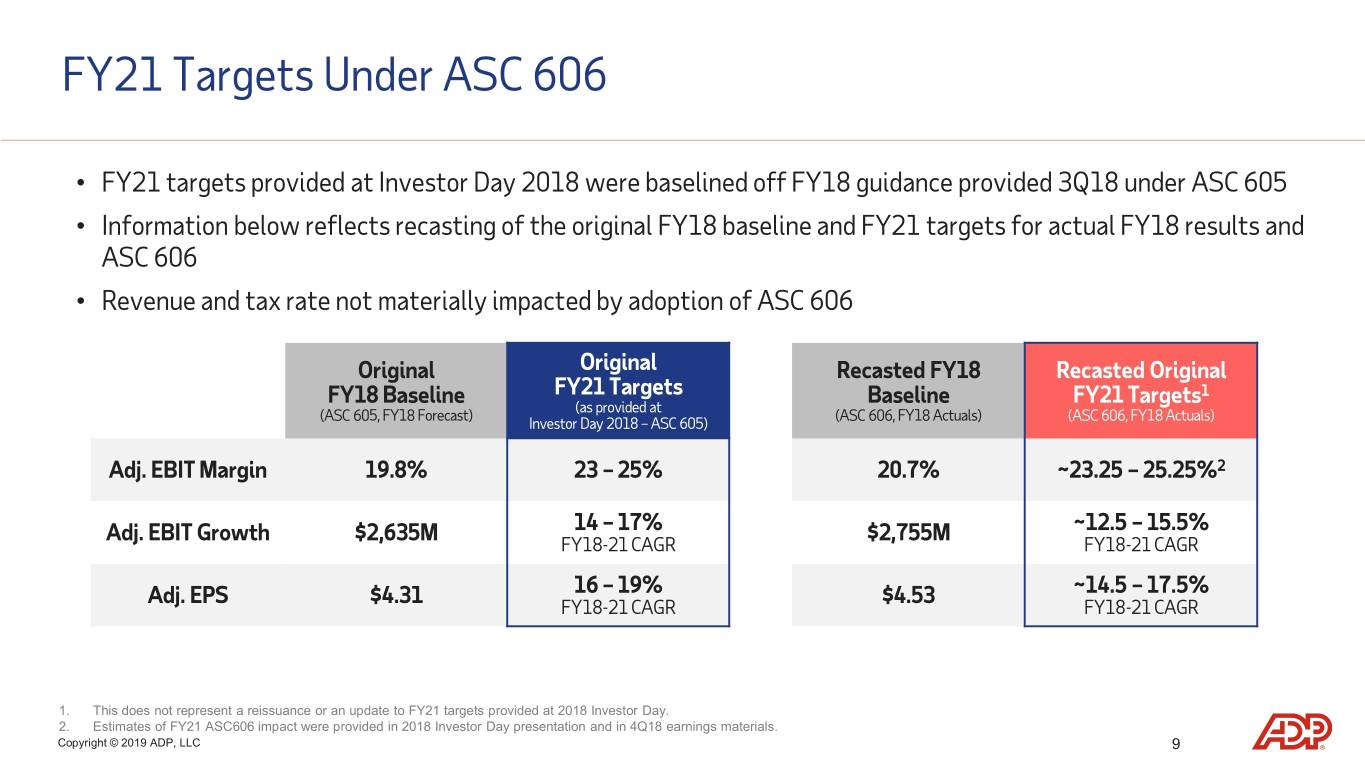

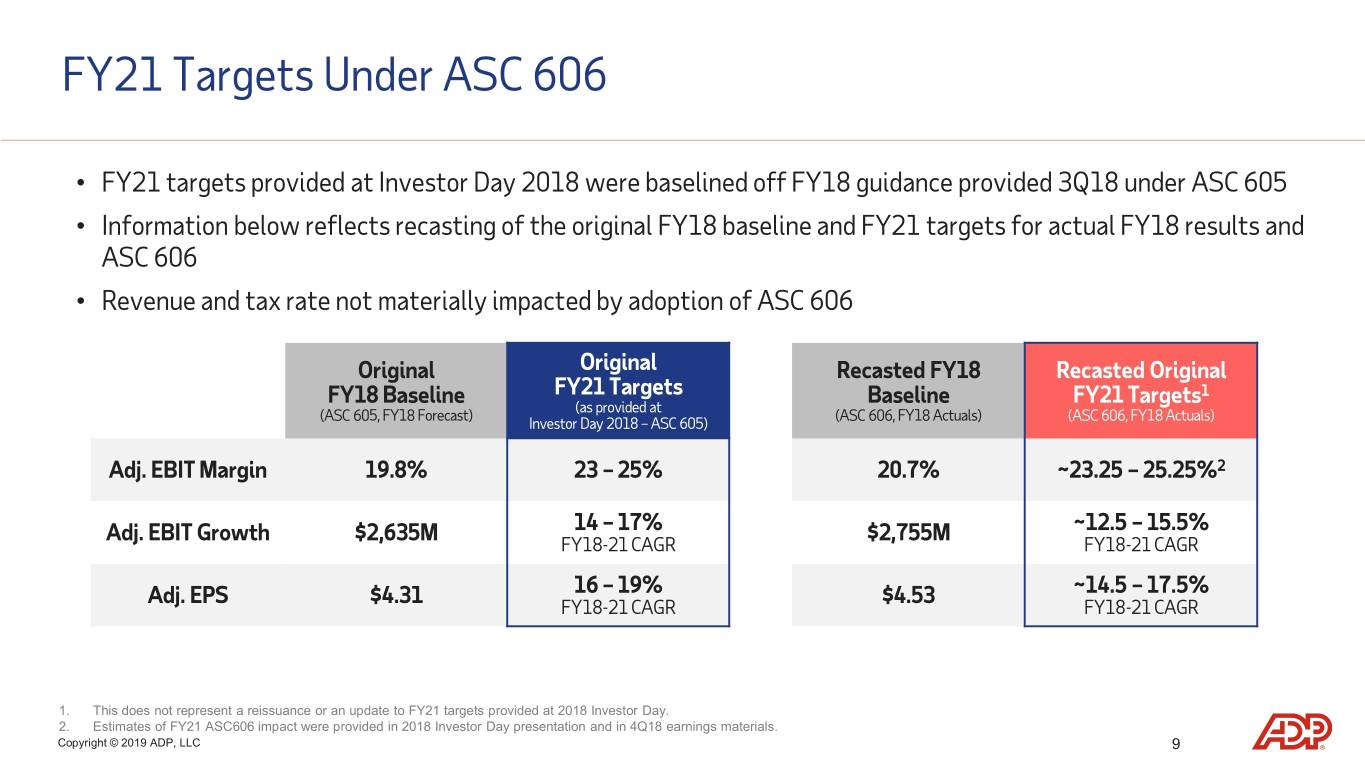

FY21 Targets Under ASC 606 • FY21 targets provided at Investor Day 2018 were baselined off FY18 guidance provided 3Q18 under ASC 605 • Information below reflects recasting of the original FY18 baseline and FY21 targets for actual FY18 results and ASC 606 • Revenue and tax rate not materially impacted by adoption of ASC 606 Original Original Recasted FY18 Recasted Original FY18 Baseline FY21 Targets Baseline FY21 Targets1 (as provided at (ASC 605, FY18 Forecast) (ASC 606, FY18 Actuals) (ASC 606, FY18 Actuals) Investor Day 2018 – ASC 605) Adj. EBIT Margin 19.8% 23 – 25% 20.7% ~23.25 – 25.25%2 Adj. EBIT Growth $2,635M 14 – 17% $2,755M ~12.5 – 15.5% FY18-21 CAGR FY18-21 CAGR Adj. EPS $4.31 16 – 19% $4.53 ~14.5 – 17.5% FY18-21 CAGR FY18-21 CAGR 1. This does not represent a reissuance or an update to FY21 targets provided at 2018 Investor Day. 2. Estimates of FY21 ASC606 impact were provided in 2018 Investor Day presentation and in 4Q18 earnings materials. Copyright © 2019 ADP, LLC 9

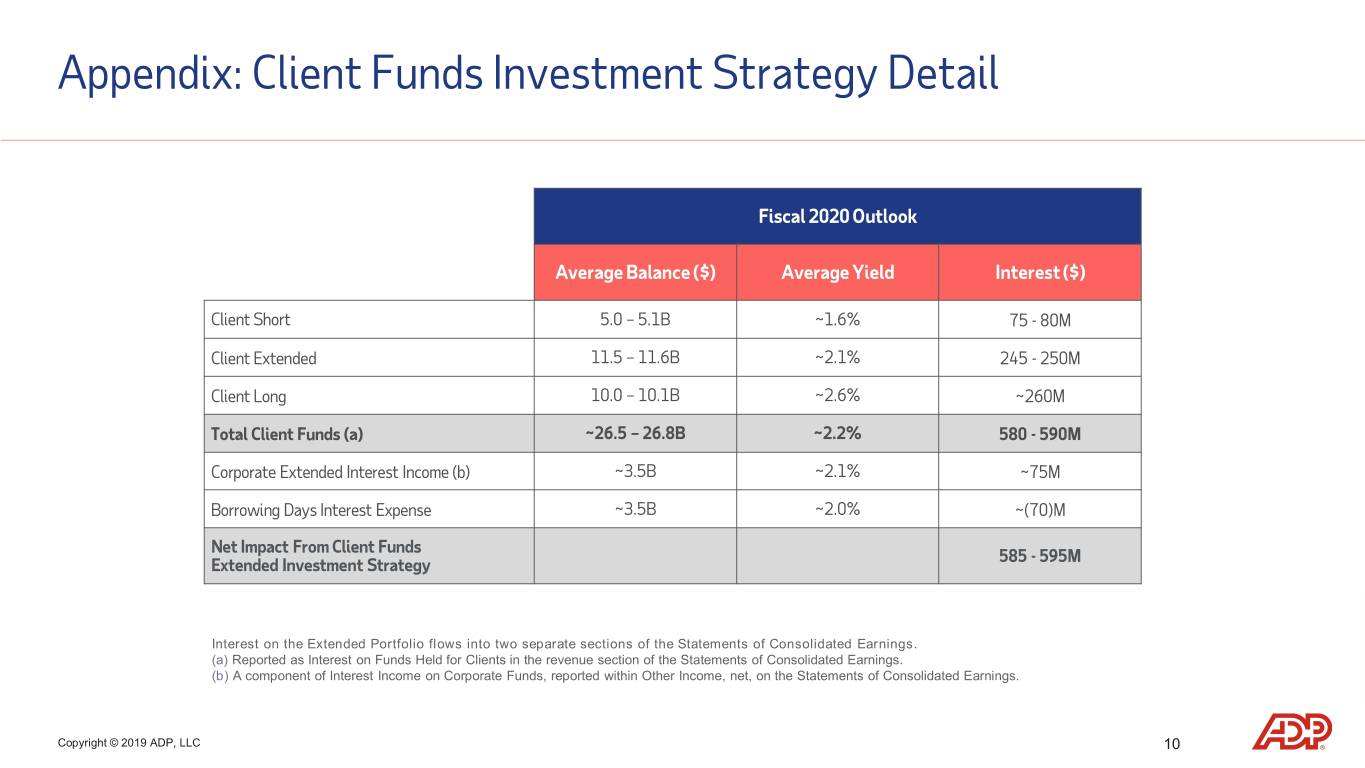

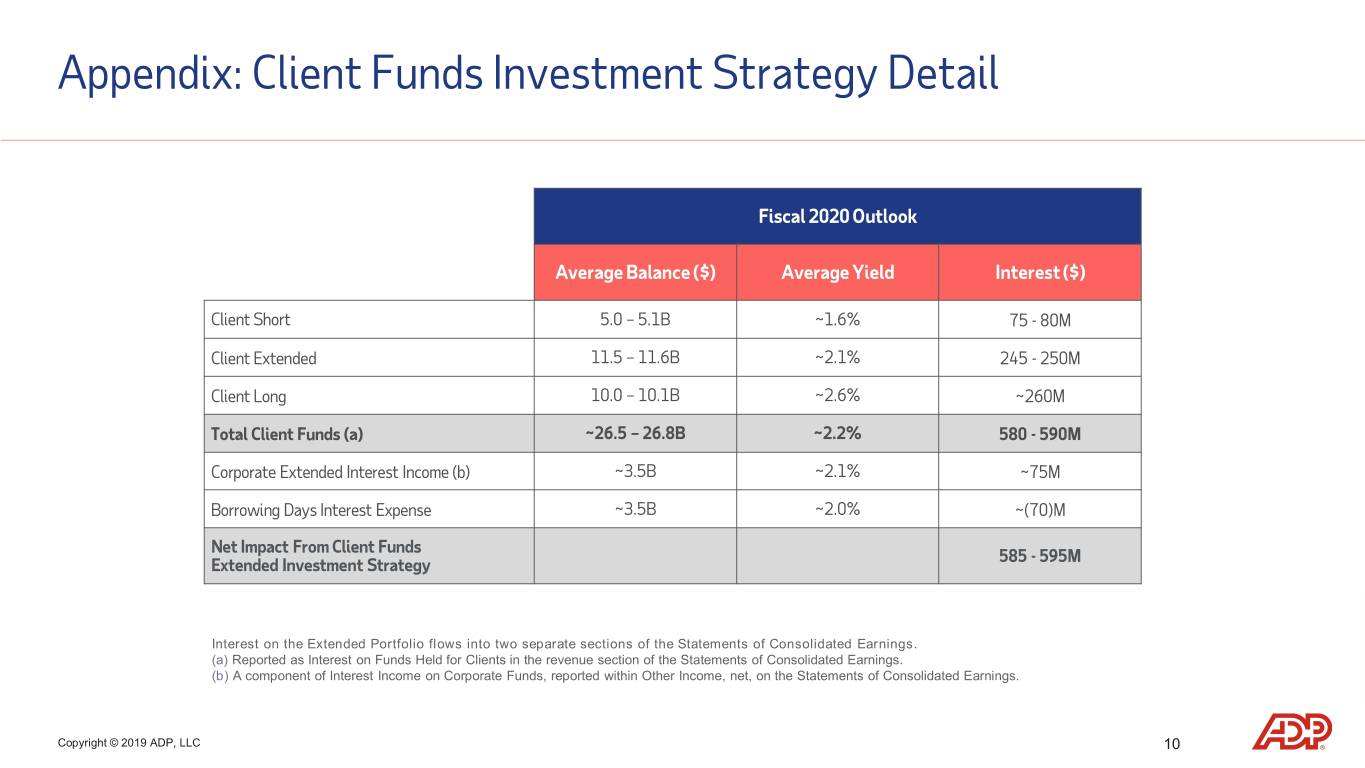

Appendix: Client Funds Investment Strategy Detail Fiscal 2020 Outlook Average Balance ($) Average Yield Interest ($) Client Short 5.0 – 5.1B ~1.6% 75 - 80M Client Extended 11.5 – 11.6B ~2.1% 245 - 250M Client Long 10.0 – 10.1B ~2.6% ~260M Total Client Funds (a) ~26.5 – 26.8B ~2.2% 580 - 590M Corporate Extended Interest Income (b) ~3.5B ~2.1% ~75M Borrowing Days Interest Expense ~3.5B ~2.0% ~(70)M Net Impact From Client Funds 585 - 595M Extended Investment Strategy Interest on the Extended Portfolio flows into two separate sections of the Statements of Consolidated Earnings. (a) Reported as Interest on Funds Held for Clients in the revenue section of the Statements of Consolidated Earnings. (b) A component of Interest Income on Corporate Funds, reported within Other Income, net, on the Statements of Consolidated Earnings. Copyright © 2019 ADP, LLC 10

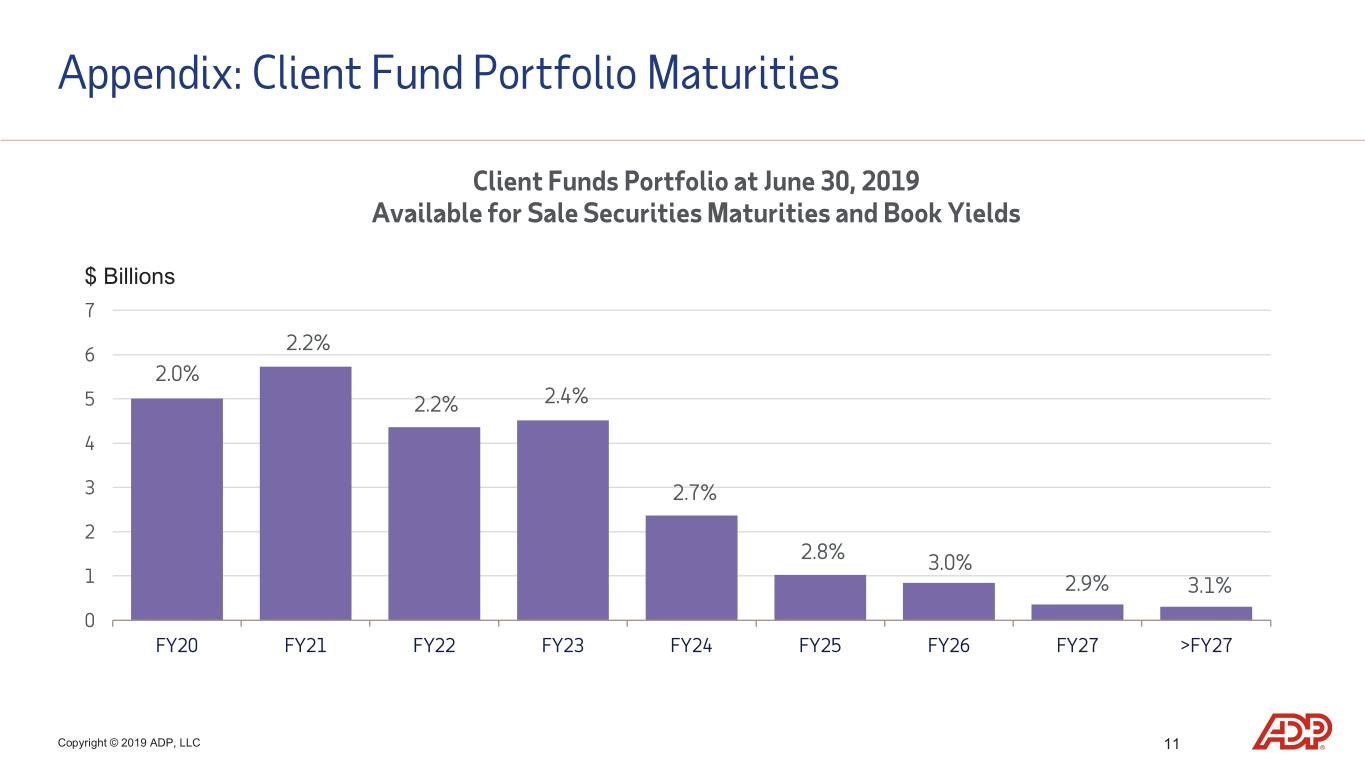

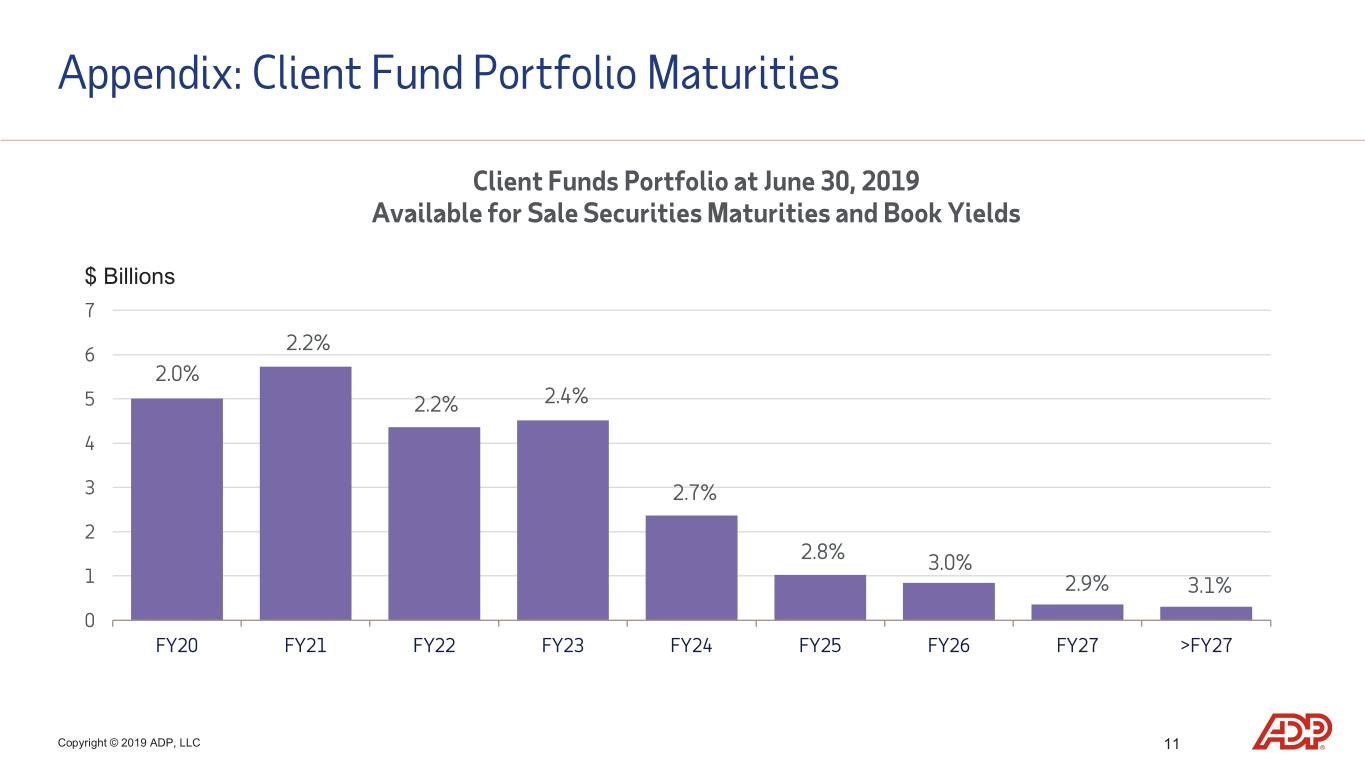

Appendix: Client Fund Portfolio Maturities Client Funds Portfolio at June 30, 2019 Available for Sale Securities Maturities and Book Yields $ Billions 7 2.2% 6 2.0% 5 2.2% 2.4% 4 3 2.7% 2 2.8% 3.0% 1 2.9% 3.1% 0 FY20 FY21 FY22 FY23 FY24 FY25 FY26 FY27 >FY27 Copyright © 2019 ADP, LLC 11