Exhibit 99.1

The information presented herein may contain predictions, estimates and other forward-looking statements within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. Although the Company believes that its expectations are based on reasonable assumptions, it can give

no assurance that its goals will be achieved. Important factors that could cause actual results to differ materially from those included in the forward-looking statements

include the timing and extent of changes in commodity prices for oil and gas, the need to develop and replace reserves, environmental risks, competition, government

regulation and the ability of the Company to meet its stated business goals.

4th Annual Small-Cap

Oil & Gas Conference

“Building Blocks”

February 21-22, 2008

1

AMEX: ABP

Company Overview

Abraxas Petroleum Corporation

AMEX:ABP

Market capitalization ~ $180 million

Total enterprise value ~ $172 million

$0 debt & $8 million in cash

Options: CBOE and PCX

Fully diluted shares outstanding ~ 50 million

Ownership ~ 15% insider

~ 28% institutional

Average trading volume ~ 235,000 shares per day

2

2

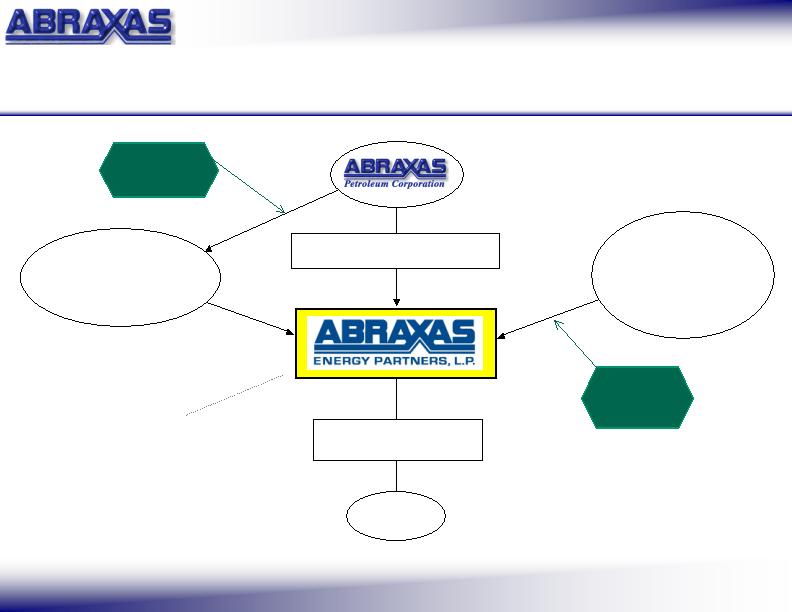

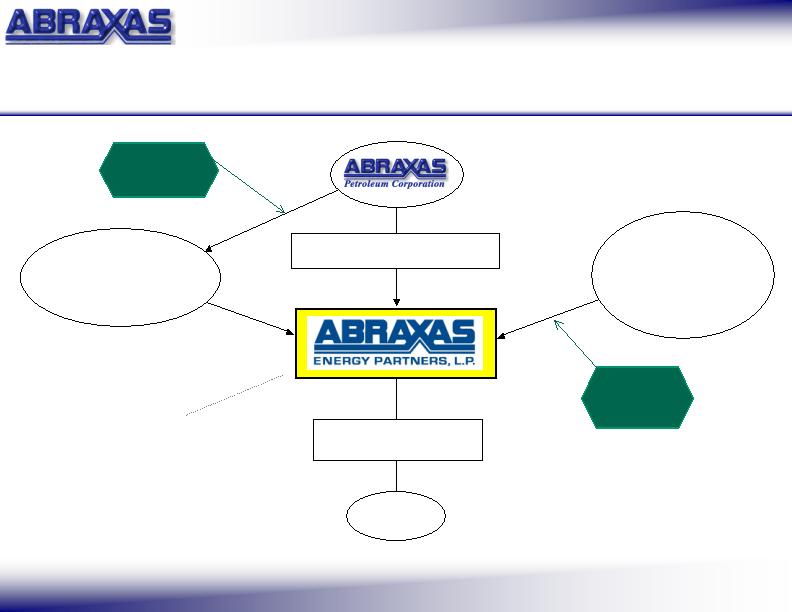

Abraxas Energy Partners, L.P.

Properties

Abraxas Operating, LLC

Private Investors

6.0 million common units

Abraxas General Partner, LLC

227,232 general partner units

Abraxas Energy

Investments, LLC

5.13 million common units

100%

100%

100%

100%

45%

2%

53%

Lehman Fiduciary

Citigroup Merrill Lynch

Third Point Tortoise

Others

No incentive distribution rights or

subordinated units !

11.36 million units

outstanding

AMEX: ABP

Contributed

$100 million

Contributed 65

Bcfe

3

3

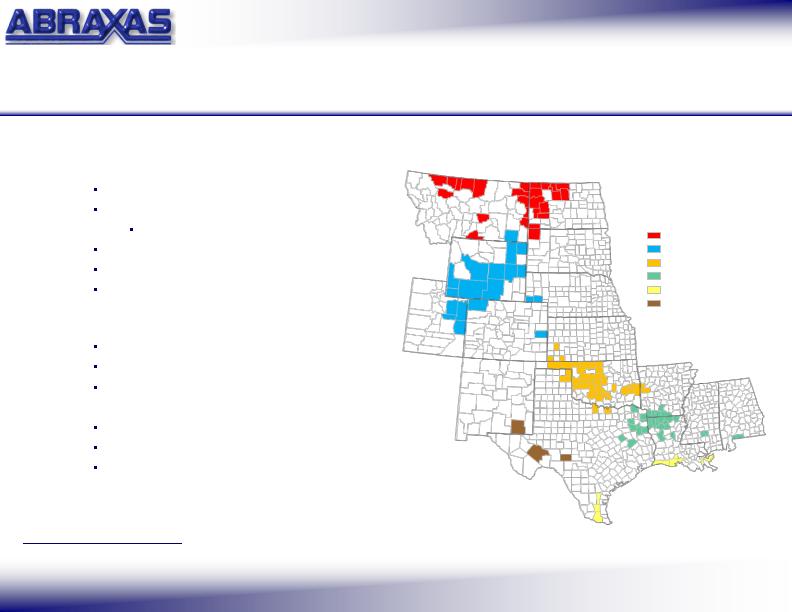

St. Mary Land & Exploration Property Acquisition

Closed: January 31, 2008

Rockies & Mid-Continent

~1,500 gross (240 net) wells

Top 80% PV: 196 gross (94 net)

82% PDP / 52% Oil

R/P Ratio: ~14 years

Swaps: $87.50 / $8.27

Abraxas Energy

$126.0 million

Net Reserves: 57.2 Bcfe (9,525 MBOE)

Net Production: 11.7 MMcfepd

Abraxas Petroleum

$5.6 million

Net Reserves: 4.3 Bcfe (725 MBOE)

Net Production: 0.6 MMcfepd

AMEX: ABP

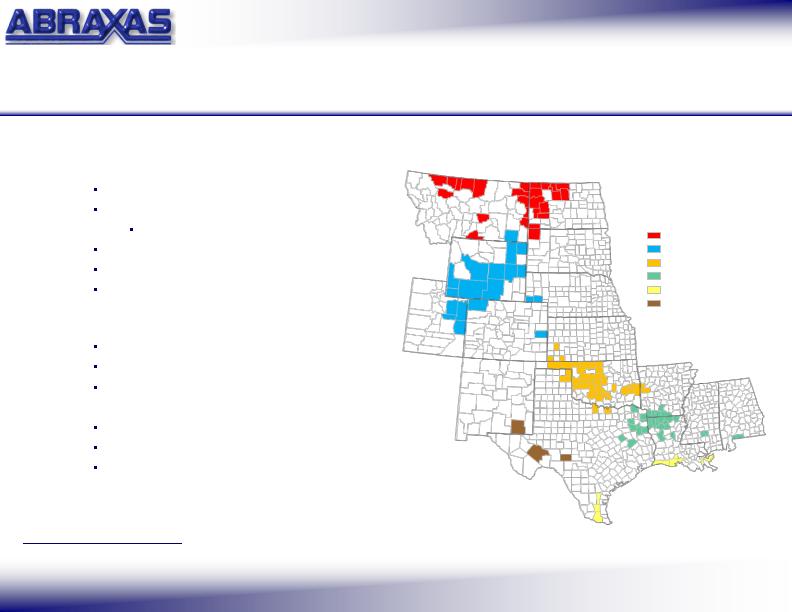

Recent Events

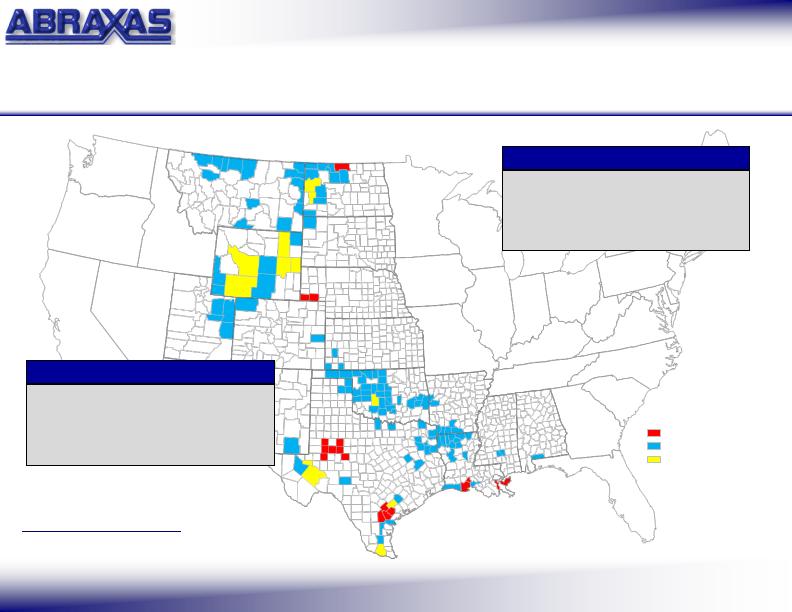

ND

SD

MT

WY

CO

UT

NM

TX

NE

KS

OK

AR

LA

AL

MS

Net proved reserves as of December 1, 2007

Estimated daily net production for January, 2008

4

Northern Rockies

Southern Rockies

Mid-Continent

ARK-LA-TEX

Gulf Coast

Permian

4

AMEX: ABP

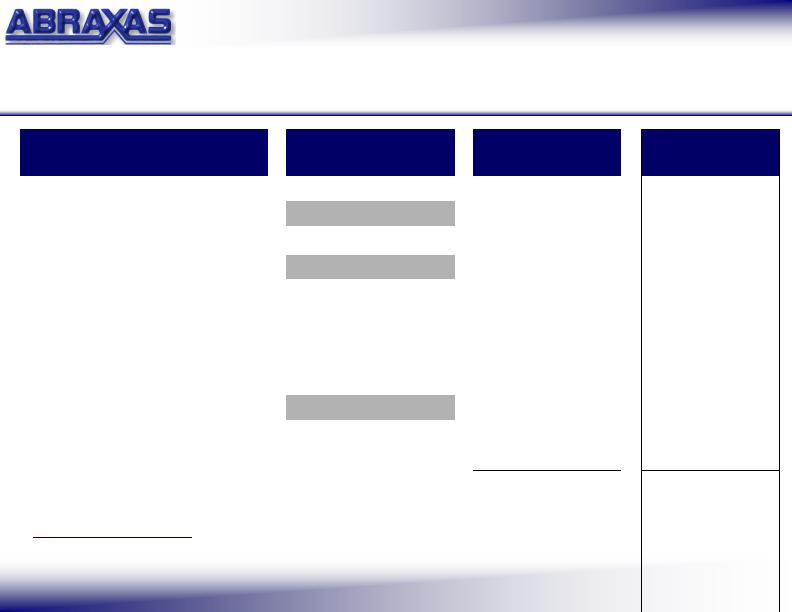

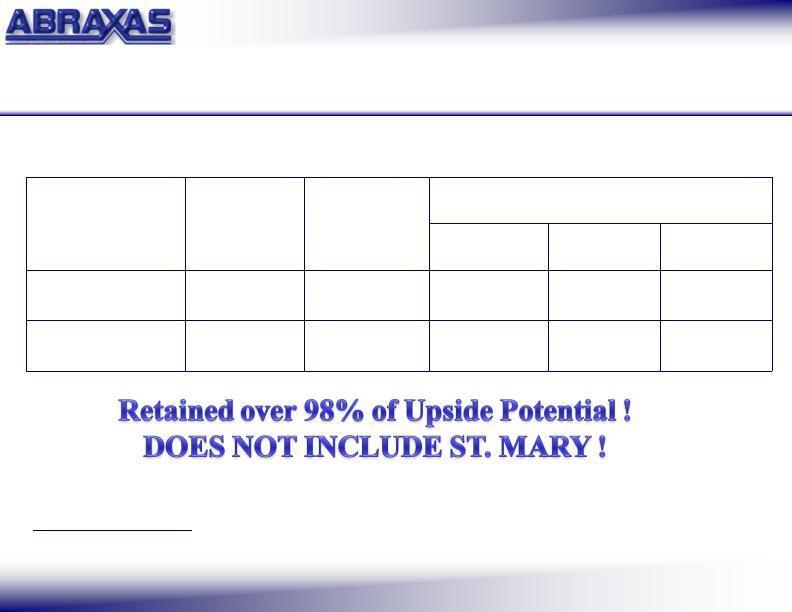

‘Do the Math’

Original MLP

St. Mary

Acquisition

MLP pro-forma

% PDP

63%

82%

73%

% Oil

10%

52%

32%

R/P Ratio

10 years

14 years

12 years

Transaction Value / Mcfe

$3.43

$2.28

~$3.00

Cash Distributions / Unit

$1.50

Accretive

?

5

5

Property Overview

AMEX: ABP

ND

SD

MT

WY

CO

UT

NM

TX

NE

KS

OK

AR

LA

AL

MS

Proved Reserves (Bcfe): 37.7

- Proved Developed: 29%

- Natural Gas: 67%

Daily Production (Mcfepd): 3,500

- Operated ~95%

Abraxas Petroleum Corporation

Proved Reserves (Bcfe): 115.2

- Proved Developed: 74%

- Natural Gas: 68%

Daily Production (Mcfepd): 25,000

- Operated ~75%

Abraxas Energy Partners, L.P.

ABP net proved reserves as of December 31, 2006

Abraxas Energy original net proved reserves as of June 30, 2007

St. Mary net proved reserves as of December 1, 2007

Estimated daily net production for January 2008, incl. St. Mary

Abraxas Petroleum

Abraxas Energy

ABE & ABP

6

6

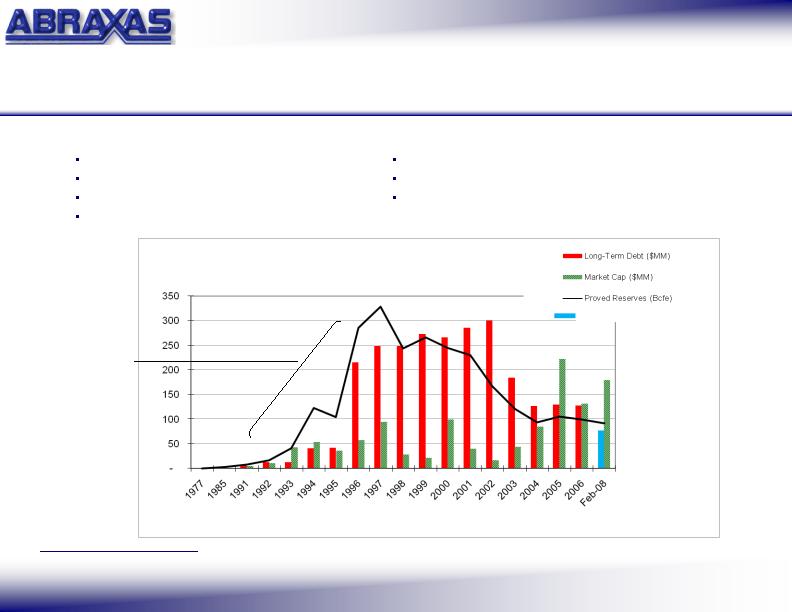

Quality assets

High ownership interest (79% WI)

Operational control (~95%)

Large acreage positions

Substantial upside

Product balanced (~60% gas)

Operations in Texas, Mid-Continent & Rockies

> 10 year inventory of projects on existing leasehold

High impact projects

AMEX: ABP

Asset Base

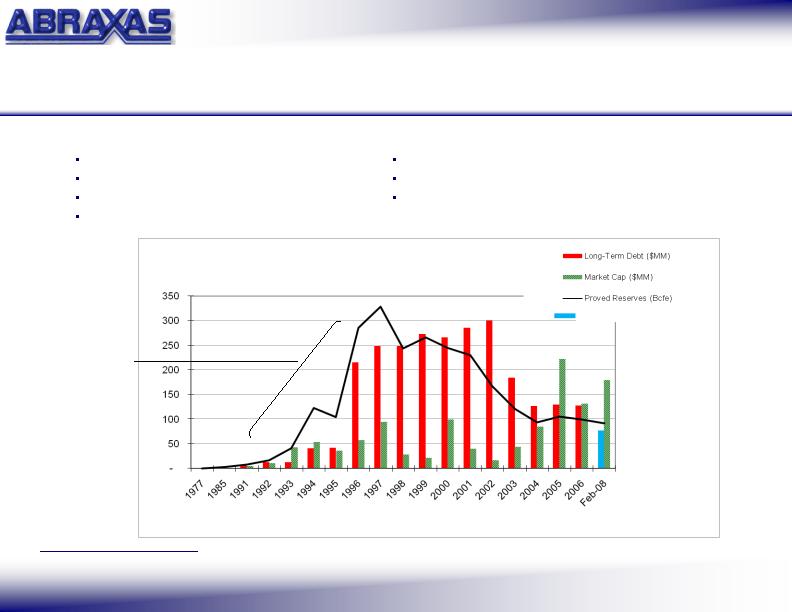

Feb-08 reflects the MLP formation & St. Mary acquisition

and includes 47% of the MLP’s proved reserves

Dec 31,

Acquisitions:

< $0.65 / Mcfe

7

ABP Share of MLP Debt

7

AMEX: ABP

ABP (Stand-Alone) Valuation

ABP Assets

Multiple Range

Valuation Range

($MM)

Valuation

Midpoint ($MM)

In-Ground Value

Proved Reserves (Bcfe):

37.7

$ 2.00 - $3.00

$ 75 - $ 113

$ 94

Undeveloped Acreage (inc. seismic):

Price Per Acre

- Mowry Shale

- Woodford Shale

- Wilcox Exploratory

46,50

0

15,00

0

2,500

$ 300 - $ 700

$ 800 - $ 1,200

$ 400 - $ 700

$ 14 – $ 33

$ 12 – $ 18

$ 1 – $ 2

$ 23

$ 15

$ 1

Price Per Unit

Abraxas MLP units (MM)

5.36

$ 16.66

$ 89

$ 89

Cash and other assets (1)

$ 15

$ 15

Total Value:

$ 207 – $ 270

$ 238

Less: Debt

$ 0

$ 0

Total ABP Equity

Value:

$ 207 – $ 270

$ 238

Shares Outstanding

(MM)

49.0

Value Per Share

$ 4.22 - $ 5.51

$ 4.86

(1)

Cash, GWE common stock

workover rigs, vehicles, and

surface acreage / yards

8

8

AMEX: ABP

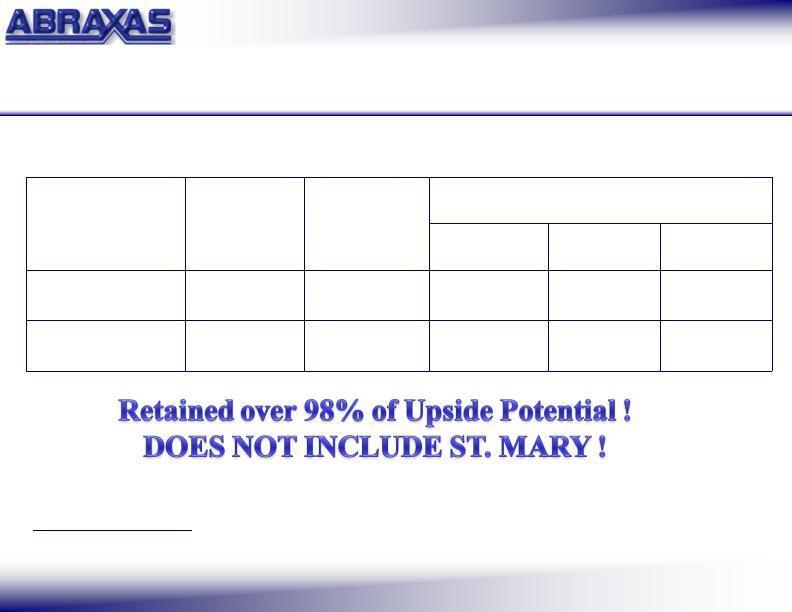

Upside Potential

Number of

potential /

identified

projects

Upside

Potential

Bcfe (1)

Value Matrix ($MM)

$0.50

per Mcfe

$1.00

per Mcfe

$1.50

per Mcfe

Total

559

1,256

$ 628

$ 1,256

$ 1,884

Upside Potential

Value per Share

$ 13

$ 25

$ 38

(1) Capital required $1.8 billion – volumes and resultant values are mid-point of range

9

9

Drill Bit Growth

targeting Conventional Reservoirs

& emerging Resource Plays

Increase Shareholder Value

through……

AMEX: ABP

Operational Goals

Reserve Ratio Improvement

by converting

proved undeveloped and un-booked reserves

to the proved developed category

10

Accretive Acquisitions

Abraxas Energy

Joint (Abraxas Energy / Abraxas Petroleum)

10

AMEX: ABP

Conventional Reservoirs

Developing Existing Proved Reserves

Projects for 2008 and beyond…

“the low hanging fruit”

Edwards

Wilcox

Delaware

Mississippian / Devonian / Montoya

IRA

Clearfork / Spraberry / Strawn Reef

Oates SW

Devonian

11

11

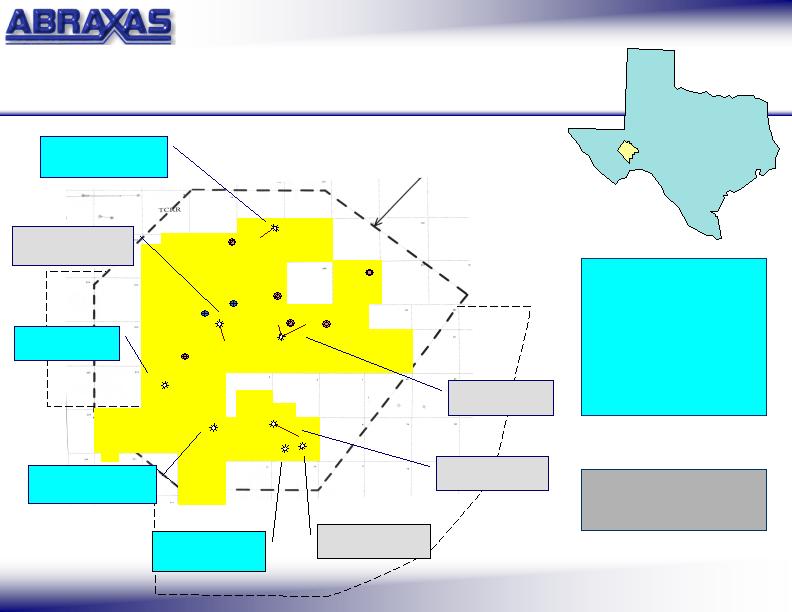

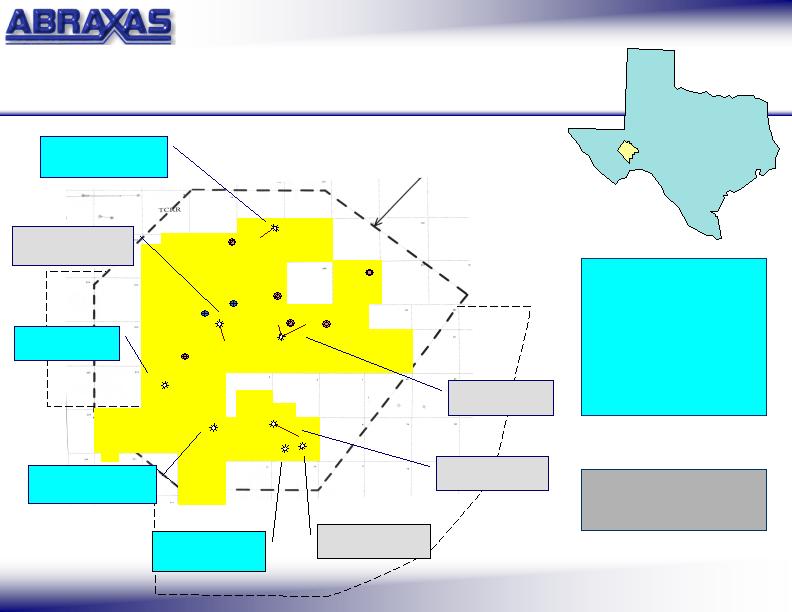

Oates SW Field

Wellbores available for re-entry

Pecos Co.

~15,000 acres

AMEX: ABP

> 75 sq. miles of 3-D

Hudgins 11-1:

Woodford

La Escalera 5-1:

Lower Wolfcamp

Manzanita 1H:

2007 Devonian

La Escalera 2:

Atoka

ABP retained wells

ABP retained the following:

Surface rights

Mineral rights

Executive rights

All formations from MLP

wells w/o proved reserves

Hudgins 37-1H:

Devonian

Elsinore Cattle 56:

Devonian

Hudgins 34-2H:

Devonian

La Escalera 1AH:

Devonian

Wells contributed to MLP

(plus 3 Devonian PUDs &

2 Montoya PUD completions)

12

12

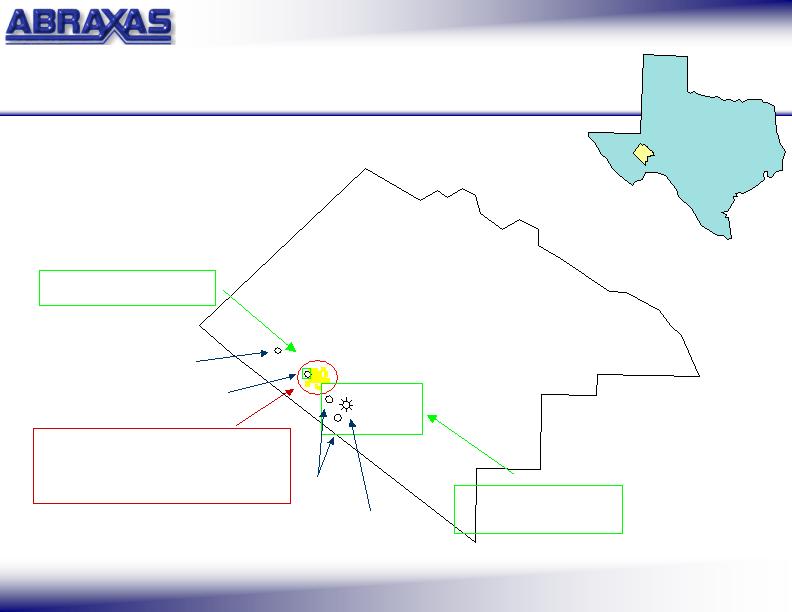

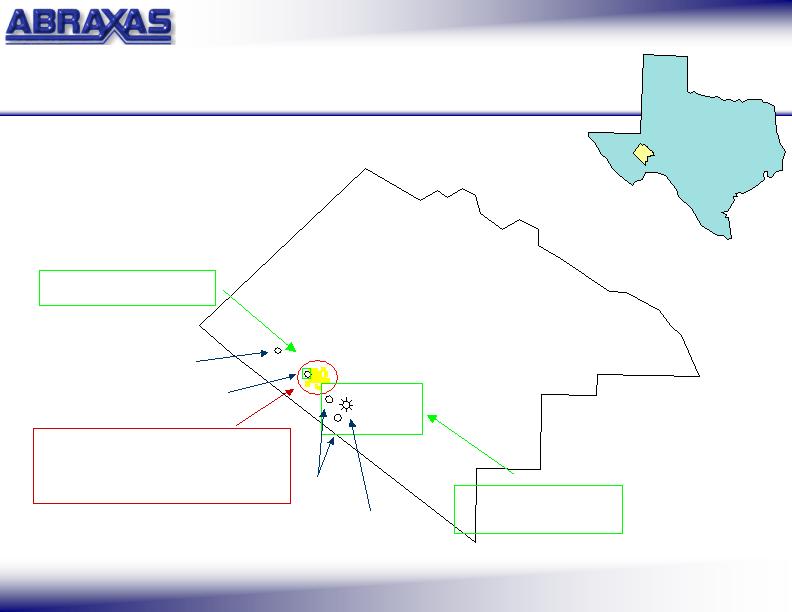

Pecos

ABP: Oates SW Field

~ 15,000 acres

(gained valuable reservoir knowledge &

producing small amount of dry gas from the

Woodford)

CHK 50% / Petro-Hunt 50%

~100,000 acres

3-D seismic swap

1 flowing gas)

Petro-Hunt

(2 permitted &

Reliance / CHK / PXD

3-D seismic & data swap

PXD

(1 drilled &

1 permitted)

AMEX: ABP

Woodford Shale Play

13

13

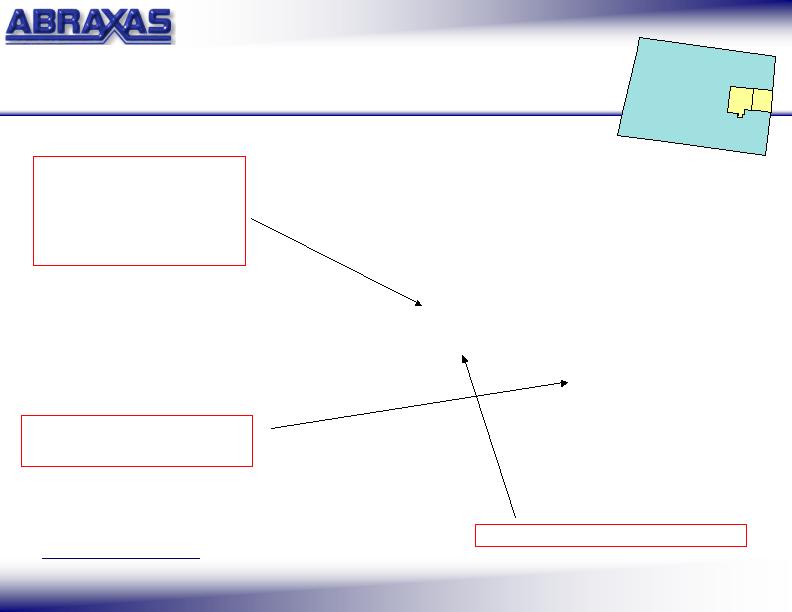

AMEX: ABP

14

Mowry Shale Oil Play

ABP: Brooks Draw

10 wells

(5 horizontal / 5 vertical)

4 vertical wells producing from

Mowry

(commingled with other zones)

23 sq. miles proprietary 3-D seismic survey

(1) Gross acres (>92% MI), >12,000 HBP

AEZ/BEXP: Krejci

Horizontal Mowry Shale

~ 15 to the SE of Brooks Draw

Brooks Draw

~50,000 acres (1)

Converse & Niobrara Counties, Wyoming

Map of leasehold in Converse & Niobrara Counties, Wyoming

14

AMEX: ABP

Exploratory Plays

Potentially High Impact

Targeting the Wilcox Formation

Tuleta Prospect,

Bee County

Janssen Prospect,

Karnes County

(completing)

Plummer Prospect,

Bee County

(producing)

15

15

Capital Expenditure Budget:

ABP: $35 million

ABE: $20 million

$55 million

Single well impact to guidance !

Historically, $ 4,500 of capital expended = 1 Mcfepd

$ 3,300 of capital expended = 1 Mcfepd for ABE properties

AMEX: ABP

2008

16

16

Niche exploration and production company

Exceptional balance sheet - no debt, cash on-hand

High quality assets with substantial upside

Control of Abraxas Energy for accretive acquisitions & future drop-downs

Goals:

Drill Bit Growth

Reserve Ratio Improvement

Accretive Acquisitions

AMEX: ABP

Summary

CONTINUE TO INCREASE SHAREHOLDER VALUE

17

17

www.abraxaspetroleum.com

Manzanita 1H

Hudgins Ranch,

Delaware Basin, West

Texas

18