EXHIBIT 99.1

The information presented herein may contain predictions, estimates and other forward-looking statements within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. Although the Company believes that its expectations are based on reasonable assumptions, it can give

no assurance that its goals will be achieved. Important factors that could cause actual results to differ materially from those included in the forward-looking statements

include the timing and extent of changes in commodity prices for oil and gas, the need to develop and replace reserves, environmental risks, competition, government

regulation and the ability of the Company to meet its stated business goals.

April 29, 2008

Turning to the Right

1

AMEX: ABP

Company Overview

Abraxas Petroleum Corporation

AMEX:ABP

Market capitalization ~ $210 million

Total enterprise value ~ $202 million

$0 debt & $8 million in cash

Options: CBOE and PCX

Fully diluted shares outstanding ~ 50 million

Ownership ~ 15% insider

~ 28% institutional

Average trading volume ~ 200,000 shares per day

2

2

AMEX: ABP

The Market Doesn’t Understand…

We trade like we are…

OVER-LEVERED – in fact, we’re debt-free for the first time in 30 years

NOT PROFITABLE – in fact, we’ve been profitable for the past 5 years

NOT GROWING RESERVES – in fact, we’re up 8% in 2007 w/ reserve replacement of 219%

NOT INCREASING PRODUCTION – in fact, we have over 60% from L7M(1) average

NO PIZZAZZ – in fact, we have pizzazz – pay attention to the new ABP …

(1 ) L7M - Consolidated average for the last 7 months of 2007

3

3

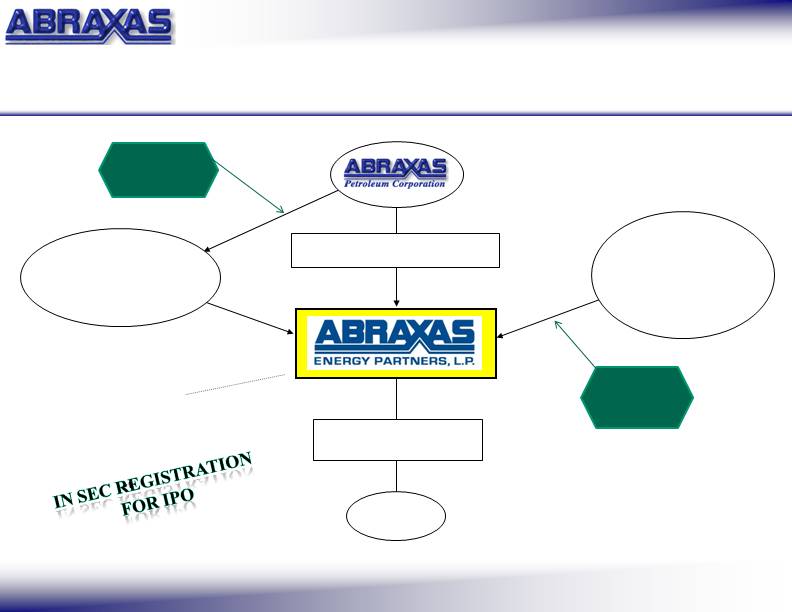

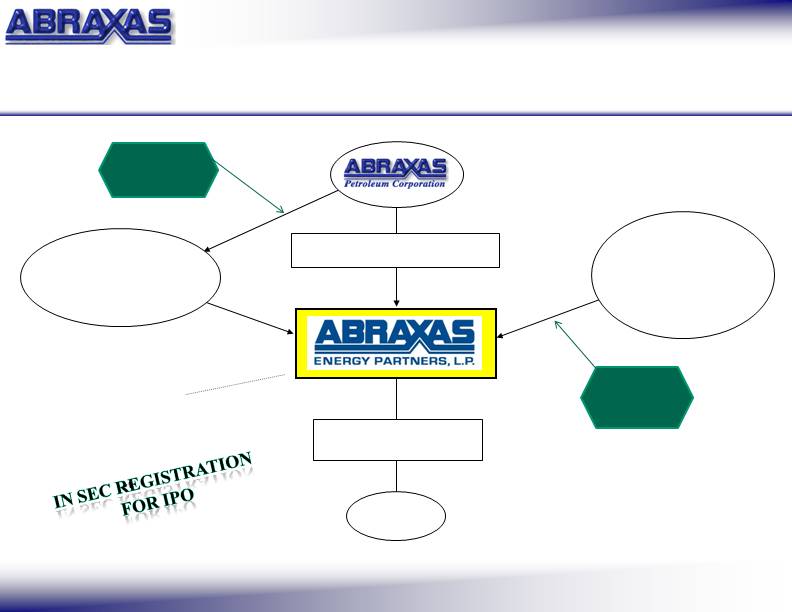

Abraxas Energy Partners, L.P.

Properties

Abraxas Operating, LLC

Private Investors

6.00 million common units

Abraxas General Partner, LLC

227,232 general partner units

Abraxas Energy

Investments, LLC

5.13 million common units

100%

100%

100%

100%

45%

2%

53%

Lehman Fiduciary

Citigroup Merrill Lynch

Third Point Tortoise

Others

No incentive distribution rights or

subordinated units !

11.36 million units

outstanding

AMEX: ABP

Contributed

$100 million

Contributed 65

Bcfe

4

4

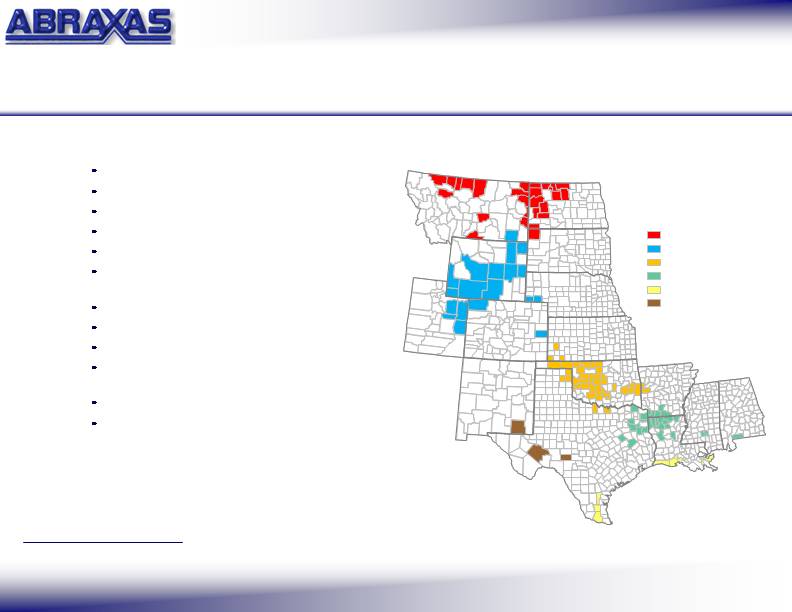

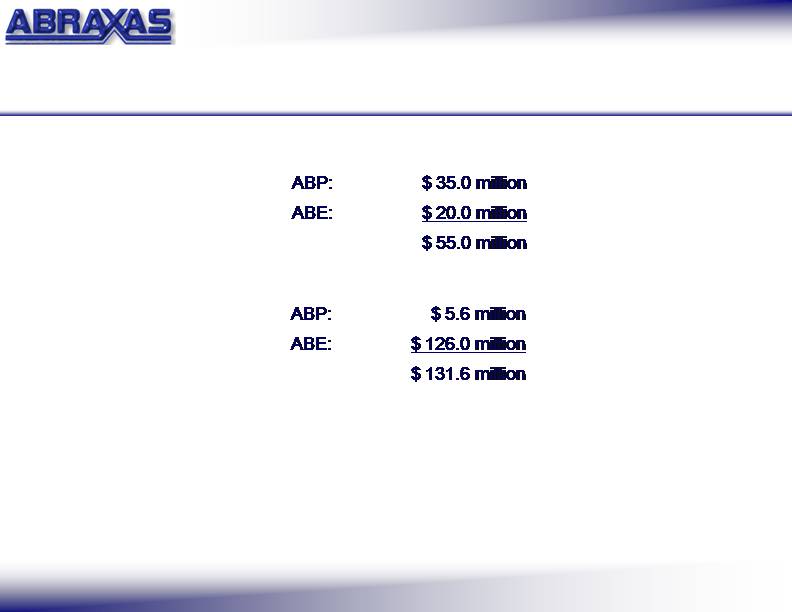

Property Acquisition

Closed: January 31, 2008

Rockies & Mid-Continent

$131.6 million

10.1 MMBOE ($12.99/BOE)

85% PD / 56% Oil

R/P Ratio: ~15 years

Abraxas Energy

$126.0 million

$13.34/BOE

Swaps: $87.50 / $8.27

Accretive to DCF

Abraxas Petroleum

$5.6 million

$8.17/BOE

AMEX: ABP

St. Mary Acquisition

ND

SD

MT

WY

CO

UT

NM

TX

NE

KS

OK

AR

LA

AL

MS

Net proved reserves as of December 31, 2007

5

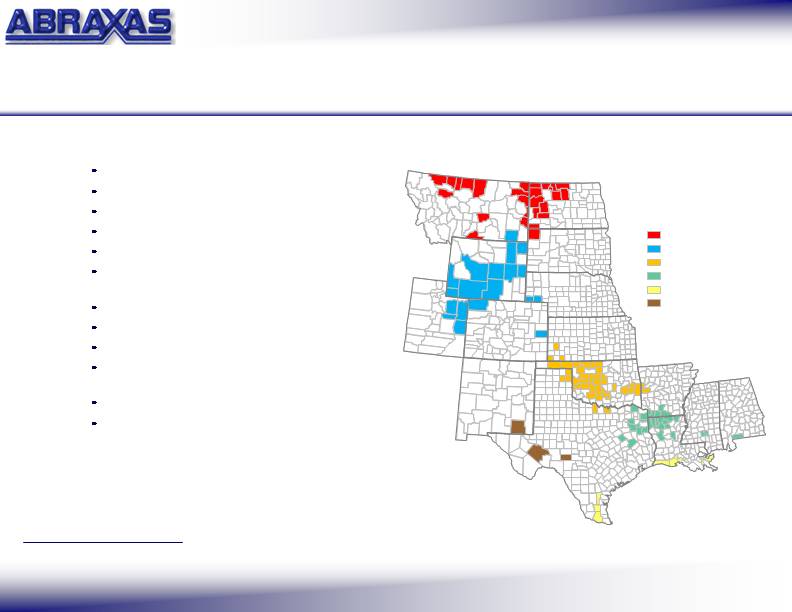

Northern Rockies

Southern Rockies

Mid-Continent

ARK-LA-TEX

Gulf Coast

Permian

5

AMEX: ABP

2007 Annualized…

ABP (Stand-Alone) 2007 Annualized (1 )

Daily production – 583 Boepd (31% oil)

LOE (2) / Boe – $ 8.35

G&A (3) / Boe – $ 13.45

D/D/A / Boe – $ 10.75

Net realized oil price (4) – $ 74.54

Oil differential: ($ 6.16)

Net realized gas price (4) – $ 5.70

Gas differential: ($ 1.00)

Cash flow (5) – $ 14.2 million, or $ 0.29 per share

Earnings (5) – $ 10.4 million, or $ 0.21 per share

6

(1)

Based on 7 months of actual (June-December 2007)

(2)

Excludes severance & ad valorem taxes of approximately 8% of oil and gas revenue

(3)

Excludes extraordinary items

(4)

Net realized prices based on actual 7 months (not annualized)

(5)

Excludes extraordinary items and includes $1.50 per unit annual cash distribution

GAAP requires

consolidated financials =

confused investors

6

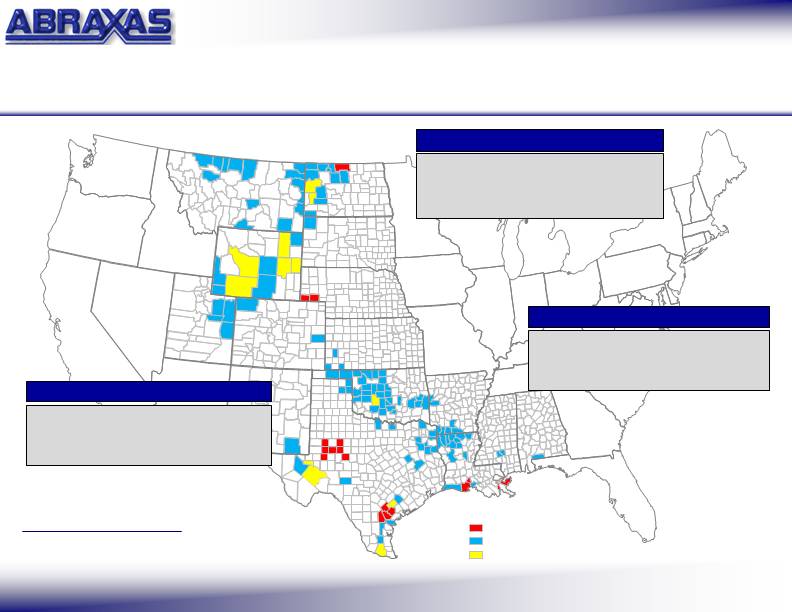

High Quality Assets

AMEX: ABP

ND

SD

MT

WY

CO

UT

NM

TX

NE

KS

OK

AR

LA

AL

MS

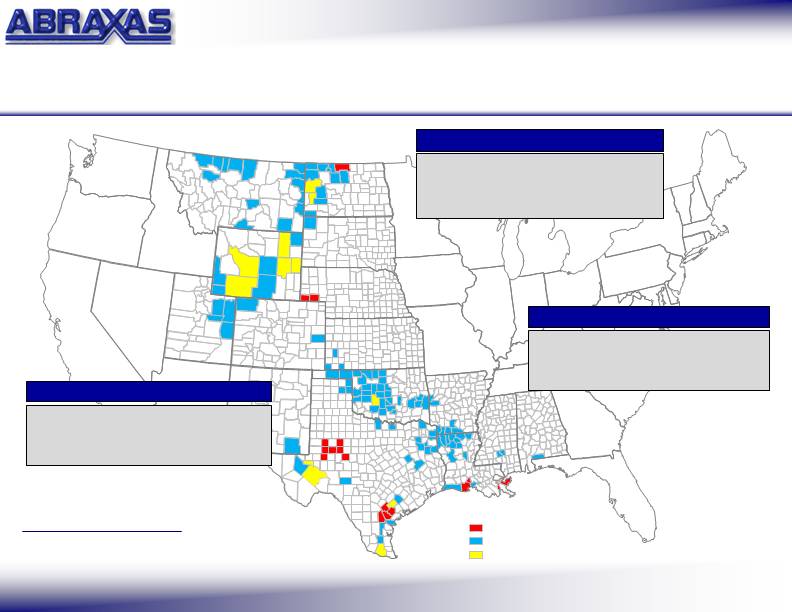

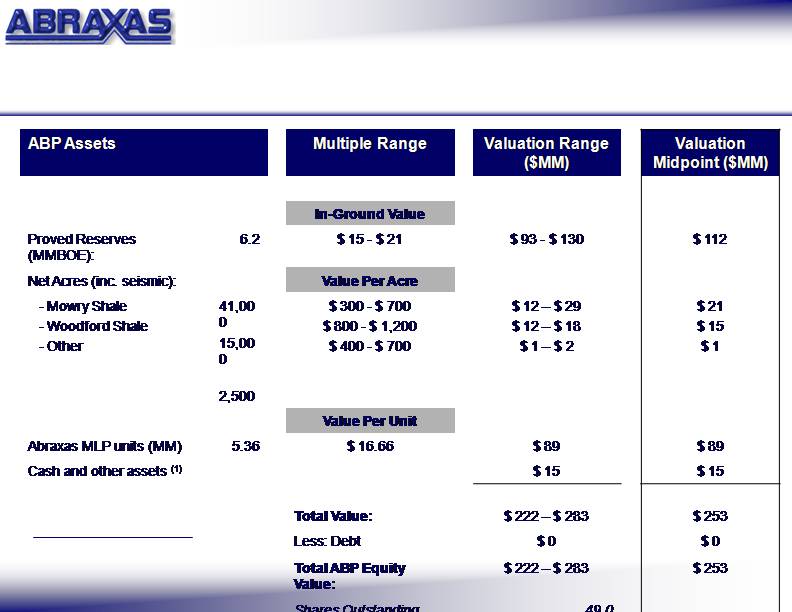

Proved Reserves (MMBOE): 6.2

- Proved Developed: 34 %

- Natural Gas: 63%

- Operated: 97%

Abraxas Petroleum Corporation

Proved Reserves (MMBOE): 21.7

- Proved Developed: 67%

- Natural Gas: 70%

- Operated: 70%

Abraxas Energy Partners, L.P.

Net pro forma proved reserves as of December 31, 2007

ABP owns 47% of ABE

Abraxas Petroleum (ABP)

Abraxas Energy (ABE)

ABE & ABP

7

Proved Reserves (MMBOE): 27.9

- Proved Developed: 59%

- Natural Gas: 69%

- Operated: 77%

CONSOLIDATED

7

AMEX: ABP

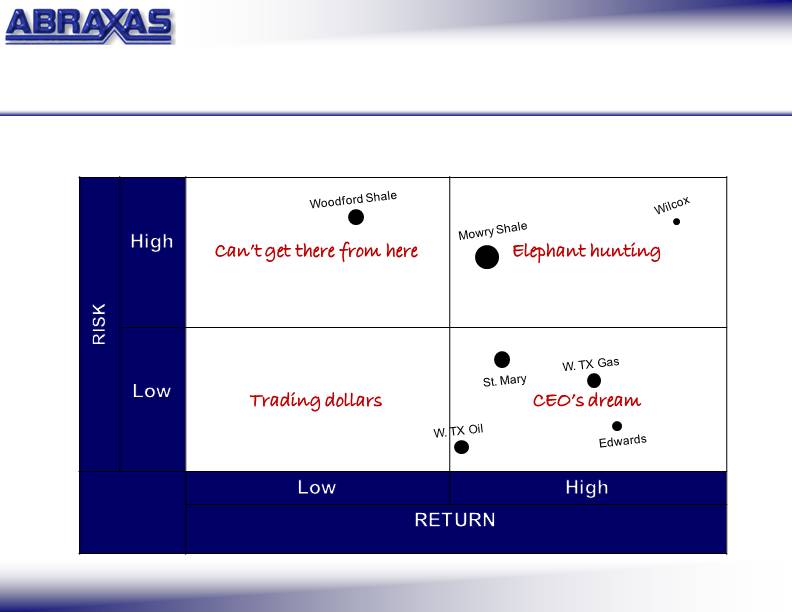

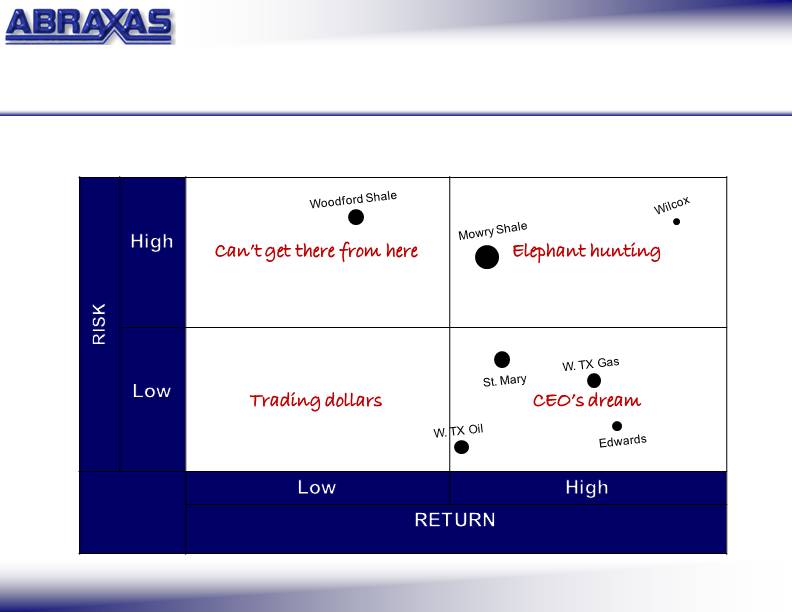

Project Inventory Matrix

8

> 10 year inventory of projects on existing leasehold

8

Drill Bit Production Growth

targeting conventional reservoirs

& emerging resource plays

AMEX: ABP

Objectives

Reserve Ratio Improvement

by converting

proved undeveloped and un-booked reserves

to the proved developed category

9

Accretive Acquisitions

Abraxas Energy

Joint (Abraxas Energy / Abraxas Petroleum)

9

AMEX: ABP

10

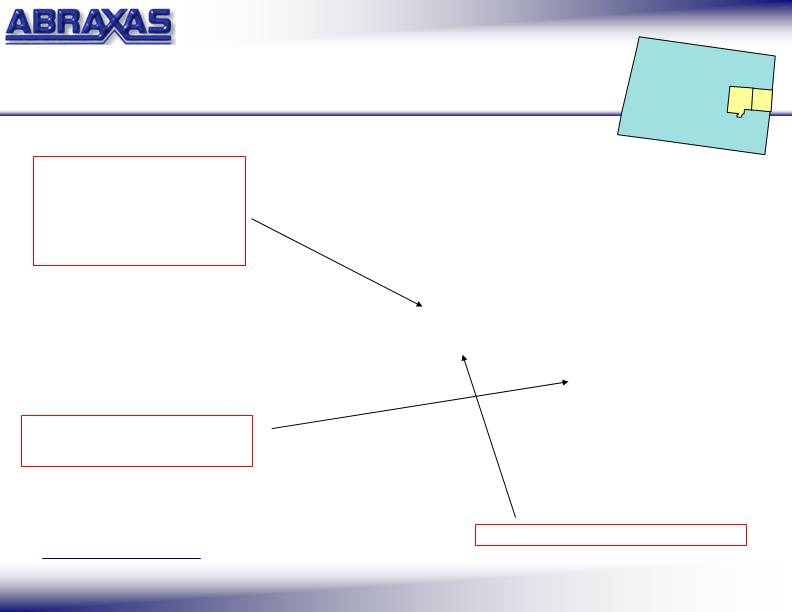

Mowry Shale Oil Play

ABP: Brooks Draw

10 wells

(5 horizontal / 5 vertical)

4 vertical wells producing from

Mowry

(commingled with other zones)

23 sq. miles proprietary 3-D seismic survey

AEZ/BEXP: Krejci

Horizontal Mowry Shale

~ 15 to the SE of Brooks Draw

Converse & Niobrara Counties, Wyoming

Map of leasehold in Converse & Niobrara Counties, Wyoming

(1) Gross acres (41,000 net), >12,000 HBP

Brooks Draw

~46,500 acres (1)

10

2008 Capital Expenditure Budget:

Excludes St. Mary acquisition in Jan-08:

Historically, we’ve added 1 Boepd for every $ 27,000 expended

($ 19,800 on ABE’s properties)

EXPECT SIGNIFICANT PRODUCTION GROWTH IN 2008 !

AMEX: ABP

Capital Budget 2008

11

11

AMEX: ABP

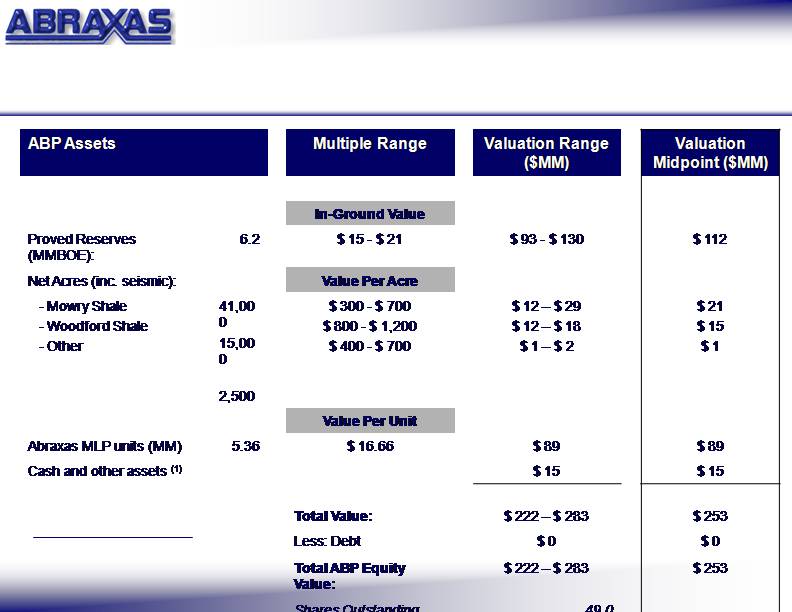

ABP (Stand-Alone) Valuation

(1)

Cash, GWE common stock

workover rigs, vehicles, and

surface acreage / yards

12

12

AMEX: ABP

Peer Group Valuation

(1) Assumes $16.66 per unit – each $1.00 increase equals $0.11 per share of ABP

(2) Net pro forma proved reserves as of December 31, 2007 of 6.2 MMBoe for ABP stand-alone

(3) Peer group includes Brigham Exploration, Callon Petroleum, Clayton Williams, Double Eagle, Edge Petroleum, Gasco

Energy, GMX Resources, Goodrich Petroleum, Meridian Resources, NGAS Resources, Parallel Petroleum, Petroquest

Energy, TXCO Resources, and Warren Resources – data on peer group from each Company’s 12/31/07 10-K filed with

the SEC

13

Valuation confirmed through peer group analysis !

13

AMEX: ABP

Show the Market…

What are we going to do…

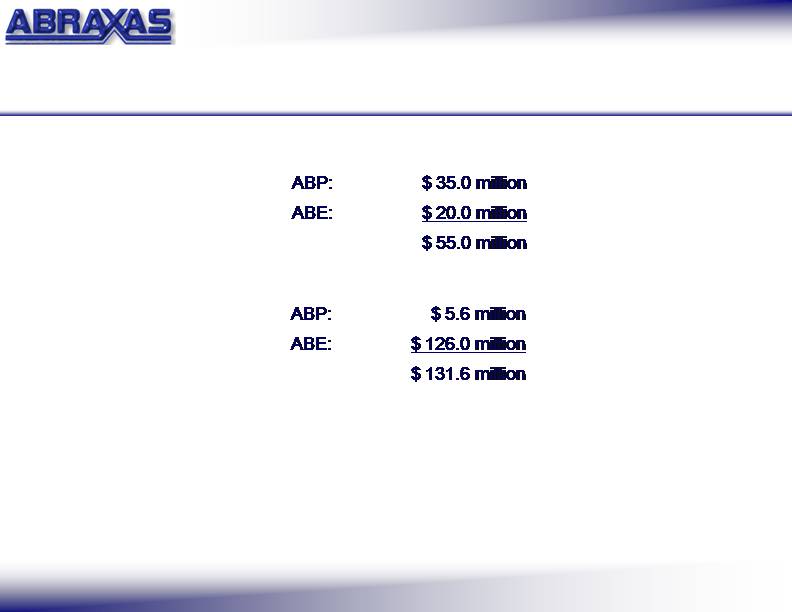

INCREASE ACTIVITY – 2008 capital expenditure budget = $55 million

INCREASE VISIBILITY – conferences, road shows, analyst coverage

… and the market will understand the new ABP

14

14

Small-cap exploration and production company

HEALTHY – Exceptional balance sheet

STABLE – High quality core assets

GROWTH – Large inventory of projects

CONTROL – Abraxas Energy Partners

Undervalued compared to our peer group !

AMEX: ABP

Summary

15

15

Turning to the Right

16