29

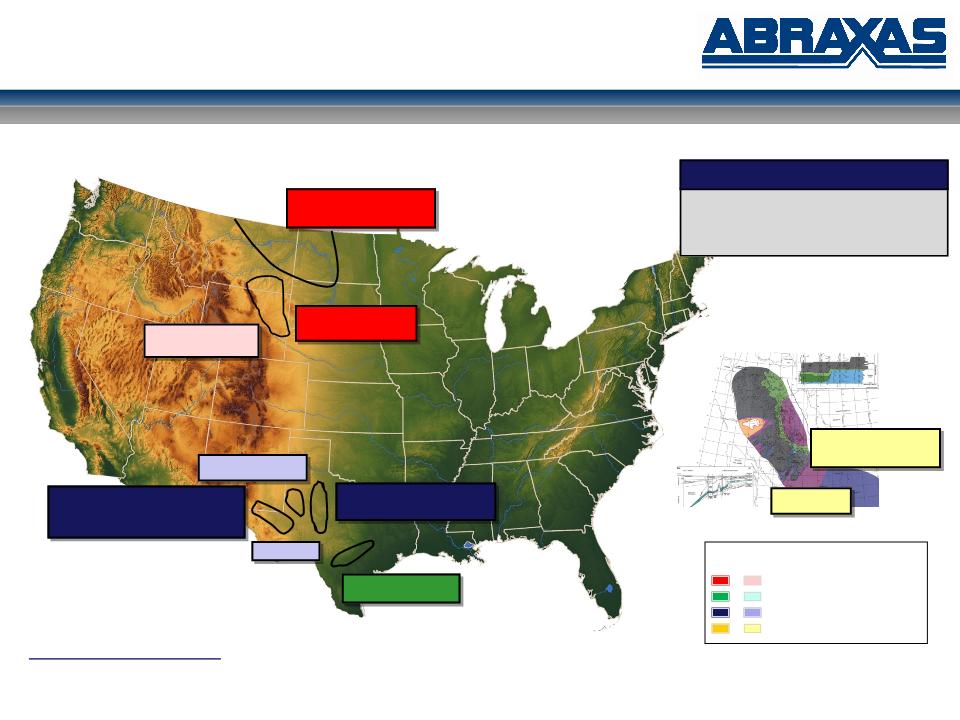

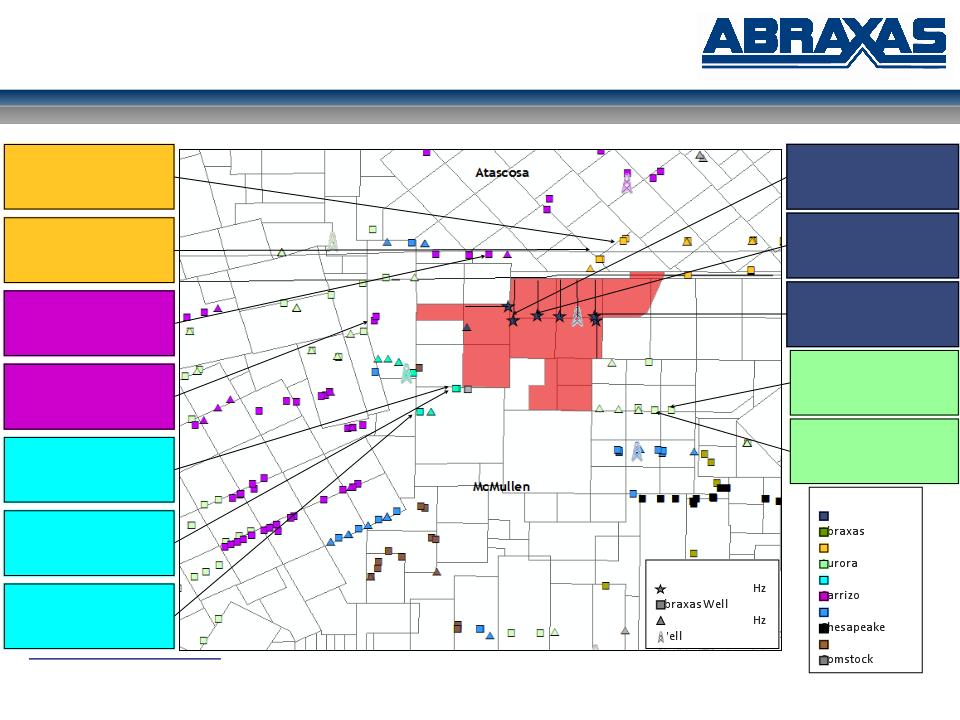

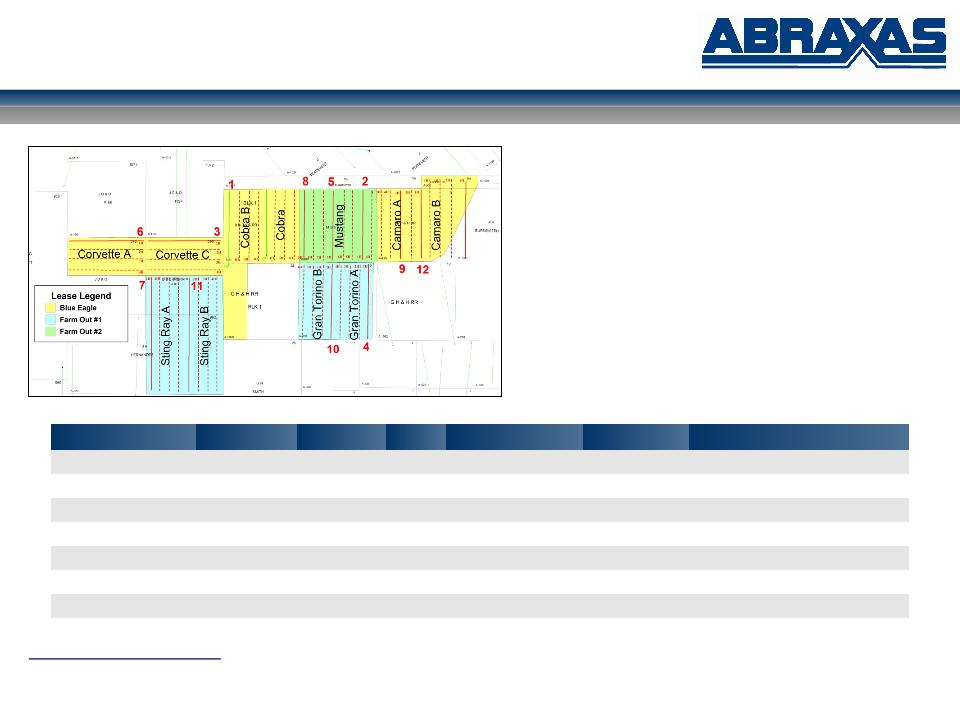

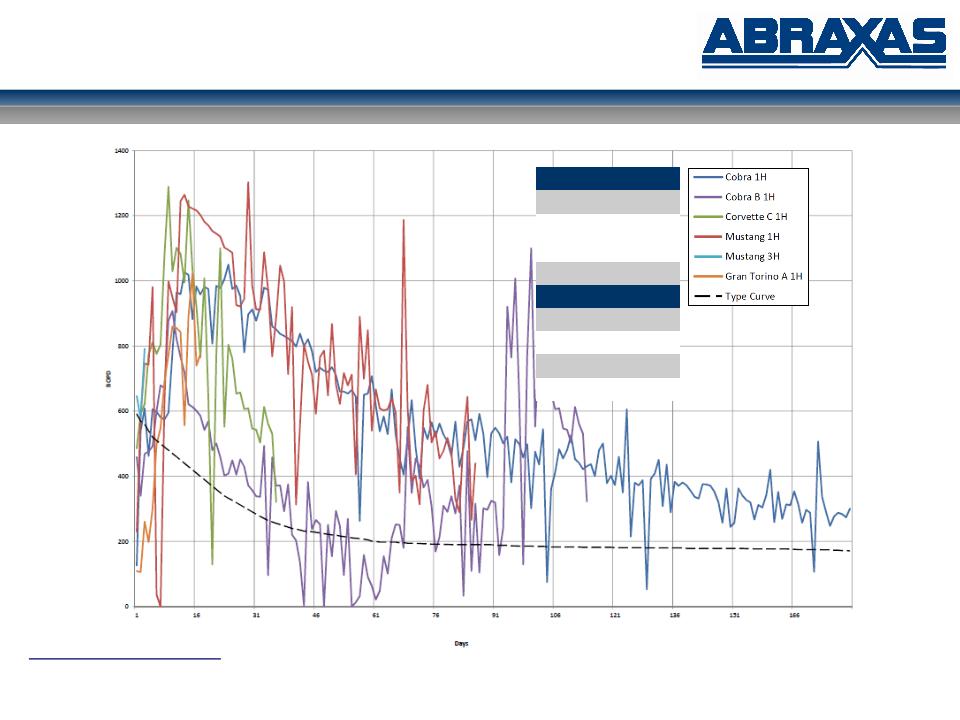

Edwards (South Texas)

§PDP: 10.3 bcfe (net)

§ Nordheim 2H: 7.0 bcfe gross

§ Keuster 1H: 10.5 bcfe gross

§ Previous risked offsetting PUD locations: 27.9 bcfe (net)

§ 11 gross / 7 net locations dropped to PRUD (SEC 5 year rule)

§7 gross / 5 net locations drilled / completed, yet to be frac’d: unbooked

§Edwards economics

§ New drill: $7.0 million well / 4.0 bcfe EUR / F&D $1.73/mcfe

§ 20% ROR at $4.30/mcfe realized price

§ Refrac: $0.7 million well / 0.5 bcfe EUR / F&D $1.40/mcfe

§ 20% ROR at $1.98/mcfe realized price

Montoya / Devonian (Delaware Basin, West Texas)

§PDP 28.0 bcfe (net)

§ Caprito 98 98 01U Devonian: 39.0 bcfe gross

§ Howe GU 5 1 Devonian: 31.7 bcfe gross

§Previous risked offsetting PUD locations: 29.7 bcfe (net)

§ 12 gross/ 6 net locations dropped to PRUD (SEC 5 year rule)

§Montoya economics

§ $5.0 million well / 6.6 bcfe EUR / F&D $.75/mcfe

§ 20% ROR at $3.16/mcfe realized price

§Devonian economics

§ $5.8 million well / 7.6 bcfe EUR / F&D $0.76/mcfe

§ 20% ROR at $2.51/mcfe realized price

Other

§Eagle Ford Shale, Yoakum: 1,908 net acres / ~24 net locations, unbooked

§PRB, Turner (~50% gas): 2 gross (1.7 net) PUD / 50 gross (13 net) PRUD locations,

40.6 bcfe (net)

§Delaware Basin, Hudgins Ranch: 3 gross / 2.6 net PSUD locations, 9.1 bcfe (net)

§Delaware Basin, Nine Mile Draw: 40 gross / 31 net PSUD locations, 18.0 bcfe (net)

§Wind River, Cow Hollow Field: 5 gross / .06 net PRUD locations, 0.7 bcfe (net)

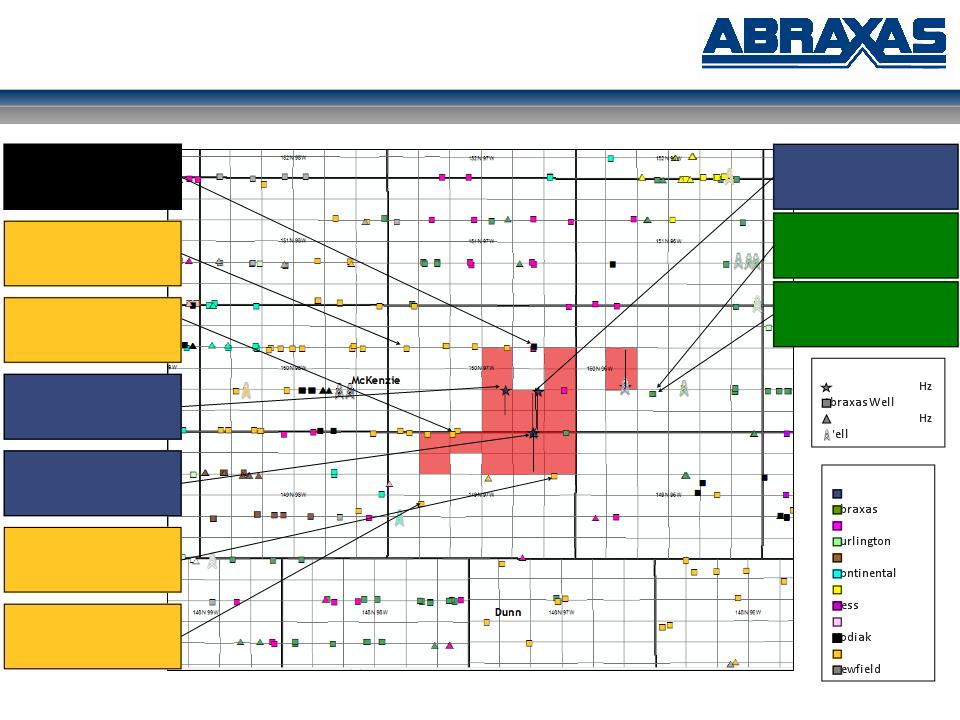

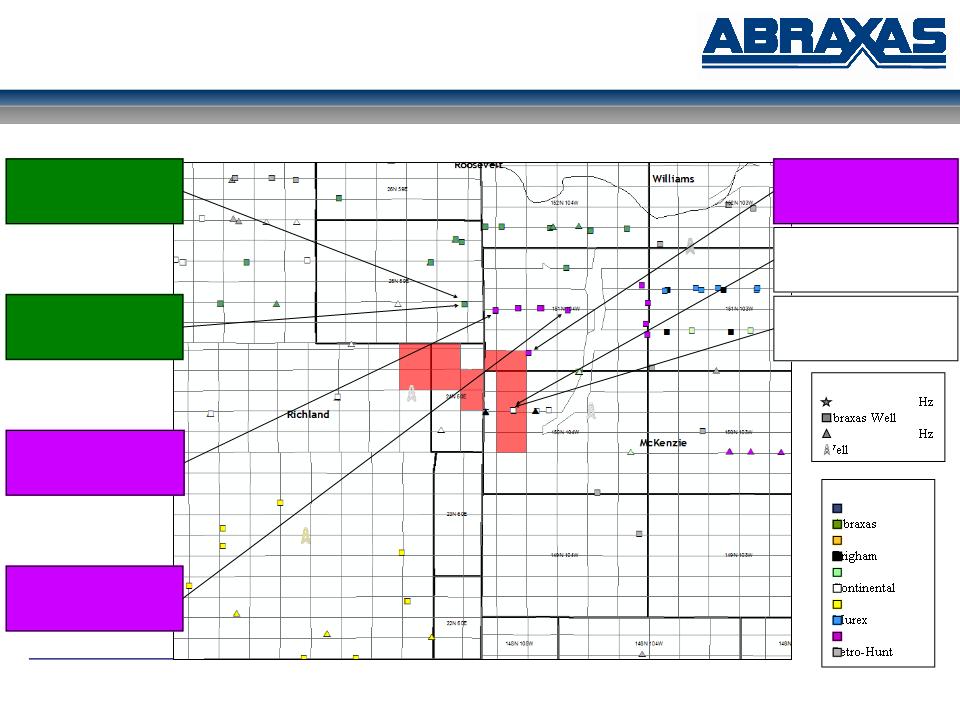

§Williston Basin, Red River: 1 gross / .8 net PRUD location, 2.1 bcfe (net)

§Uinta, Chapita Wells, unbooked

(1) Net of purchase price adjustments

(2) PV10 calculated using strip pricing as of 5/1/12 = $2.29

2012 Ward County Acquisition

§Acquisition of Partners’ Interests in West Texas

§ Purchase Price $6.7mm(1)

§ PDP PV -15 $6.7mm(2)

§ Production 1,440 mcfepd

§ Reserves 7.613 bcfe

§ Production $4,650/mcfe/day

§ Reserves: $.88/mcfe

Abraxas’ “Hidden” Gas Portfolio