Abraxas’ Upcoming Catalysts August 2016 Raven Rig #1; McKenzie County, ND Exhibit 99.1

2 The information presented herein may contain predictions, estimates and other forward- looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although the Company believes that its expectations are based on reasonable assumptions, it can give no assurance that its goals will be achieved. Important factors that could cause actual results to differ materially from those included in the forward-looking statements include the timing and extent of changes in commodity prices for oil and gas, availability of capital, the need to develop and replace reserves, environmental risks, competition, government regulation and the ability of the Company to meet its stated business goals. Forward-Looking Statements

3 Headquarters.......................... San Antonio Employees(1)............................ 88 Shares outstanding(2)……......... 135.1 mm Market cap(4) …………………….... $156.7 mm Net debt(3)………………………….. $98.7 mm Debt/TTM EBITDA(10)………….. 2.25x 2016E CAPEX………………………. $30-40 mm (1) As of July 31, 2016. Does not include nine employees associated with the Company’s wholly owned subsidiary, Raven Drilling. (2) Shares outstanding as of June 30, 2016. (3) Total debt including RBL facility, rig loan and building mortgage less cash as of June 30, 2016. (4) Share price as of July 31, 2016. (5) Enterprise value includes working capital deficit (excluding current hedging assets and liabilities) as of June 30, 2016, but does not include building mortgage or rig loan. Includes RBL facility, rig loan and building mortgage less cash as of June 30, 2016. (6) Average production for the quarter ended June 30, 2016. (7) Calculation using average production for the quarter ended June 30, 2016 annualized and net proved reserves as of December 31 , 2015. (8) Proved reserves as of December 31, 2015. Uses SEC YE2014 average pricing of $50.12/bbl and $2.63/mcf. See appendix for reconciliation of PV-10 to standardized measure. (9) Net book value of other assets as of June 30, 2016. (10) EBITDA calculated per bank loan covenant, which includes realized hedge settlements. Please see Appendix for calculation. EV/BOE(3,4,5)………………………... $6.06 Proved Reserves(8).…………..... 43.2 mmboe PV-10(8)……………………………….. $197.3 mm NBV Non-Oil & Gas Assets(9).. $26.4 mm Production(6).……………………… 4,883 boepd R/P Ratio(7)…………………………. 24.2x NASDAQ: AXAS Corporate Profile

4 Williston: Bakken / Three Forks Powder River Basin: Turner Eastern Shelf: Conventional & Emerging Hz Oil Eagle Ford Shale / Austin Chalk Delaware Basin: Bone Spring & Wolfcamp Rocky Mountain Gulf Coast Permian Basin Legend Proved Reserves (mmboe)(1): 43.2 Proved Developed(1): 32% Oil(1): 56% Current Prod (boe/d) (2): 4,883 Abraxas Petroleum Corporation Core Regions (1) Net proved reserves as of December 31, 2015. (2) Average production for quarter end June 30, 2016 2016 Capex Focus Areas

5 Area Capital ($MM) % of Total Gross Wells Net Wells Permian - Delaware $10.0 25.0% 2.0 1.0 Austin Chalk 5.7 14.3% 1.0 1.0 Bakken 12.0 30.0% 7.0 5.0 Other 12.3 30.8% Total $40.0 100% 10.0 7.0 2016 Operating and Financial Guidance 2016 Capex Budget Allocation 2016 Operating Guidance Operating Costs Low Case High Case LOE ($/BOE) $8.0 $10.5 Production Tax (% Rev) 9.0% 12.0% Cash G&A ($mm) $8.0 $12.0 Production (boepd) 6,000 6,400 (1) Yearly CAPEX for each year ending December 31, 2011, 2012, 2013, 2014 and 2015. 2016 represents the midpoint of guidance. (2) 2016 estimate assumes the midpoint of 2016 guidance of 6,000 – 6,400 boepd. (Boep d) Daily Production vs Yearly CAPEX(1) Ye arl y C ap ex ($ M) 3,484 3,937 4,298 5,720 5,975 6,200 $0 $50,000 $100,000 $150,000 $200,000 $250,000 0 1,00 2,000 3,000 4,000 5,000 6,000 7,000 20 11 A 20 12 A 20 13 A 20 14 A 20 15 A 20 16 E ( 2)

6 Upcoming Catalysts

7 Catalyst #1 Bakken / Three Forks 3,902 net HBP acres located in the core of the Williston Basin in Mckenzie County, ND – de-risked Bakken and Three Forks ▫ 36 operated completed wells ▫ 1 non-operated well waiting on completion ▫ Expected to bring on production 1Q17 ▫ 60 additional operated wells at 660-1320 foot spacing Impact on Abraxas ▫ Average 30-day IPs of 999 Boe/d on last 25 wells drilled ▫ 6 wells X .64 net revenue interest X 999 boepd = potential for ~3,800 boepd in first 30 days of production

8 Bakken / Three Forks Exceptional Well Performance versus Type Curve 12/31/14 Type Curve = 420 MBO/well 12/31/15 Type Curve = 440 MBO/well

9 First 2 AC wells 7,776 total net acres located in the Jourdanton Field perspective for the Austin Chalk in Atascosa County, TX $5.0 million D&C costs for 5,000’ laterals Targeted EURs of ~400 mbo for 5,000’ lateral Fist well, Bulls Eye 101H ▫ 5,865’ effective lateral ▫ Completing ▫ First production expected early September Impact on Abraxas ▫ With success, ~90 Gross/Net well locations ▫ Additional acreage Catalyst #2 Austin Chalk

10 Atascosa Trough Vertical Chalk Production (Cumulative Oil) Jourdanton Lease Block Karnes Trough Atascosa Trough

11 Karnes Trough Vertical and Horizontal Austin Chalk Production (Cumulative Oil) Blackbrush Kolodziej-Pawelek Unit 102H CUM Production Oil: 208 MBO Gas: 389 MMCF 7 Months EOG Leonard AC Unit 101H 30-Day IP: 2,100 Bopd and 2,715 Boepd CUM Production Oil: 65 MBO Gas: 87MMCF 1 Month Blackbrush Annie Trail/Yanta 11 – 14 Months

12 Catalyst #3 Permian Basin – Wolfcamp & Bone Spring – Ward/Reeves 5,248 net HBP acres located on the eastern edge of the Delaware Basin in Reeves/Ward County ▫ Four identified potential zones (Bone Spring, Wolfcamp) ▫ Potential gross locations ▫ Caprito: 5 target intervals, 16 locations for each; 80 laterals ▫ BLK 16: 4 target intervals, 2 locations for each; 8 laterals ▫ GT Hall: 5 target intervals; 3 locations on strike for 3, 2 locations for 2; 13 laterals ▫ Fee 57: 4 target intervals; 4 locations; 16 laterals ▫ Howe: 3 target laterals; 12 locations; 36 laterals ▫ Fidelity Tr: 3 target intervals; 2 location; 6 laterals Offset operator 24-hour IP’s up to 1,700 Boe/d (~84% oil) $5.95 million D&C costs for 5,000’ laterals Wolfcamp A targeted EURs of ~500 mboe First well drilling Multiple offers made to consolidate working interests in units Exploring additional opportunities to expand position

13 Additional Delaware Acreage Permian Basin – Wolfcamp & Bone Spring – Pecos 563 net acres located in Pecos County Held by Production Four potential gross locations (Wolfcamp A)

14 3rd Bone Spring and Wolfcamp A thickness similar to basinal wells Horizontals target top of Wolfcamp Lower Wolfcamp interval much thicker in basin 3rd Bone Spring and Wolfcamp Comparison of Abraxas Leases to WC/BS Horizontal Activity Target

15 3rd Bone Spring and Wolfcamp Abraxas Lease Areas: 3rd Bone Spring and Wolfcamp A present, relatively consistent Lower Wolfcamp and underlying Penn. interval, variable

16 3rd Bone Spring-Wolfcamp A Thickness Isopach (Thickness) Map of 3rd Bone Spring & Wolfcamp A with Wolfcamp/Bone Spring wells drilled after January 1, 2012 Contour interval = 25 ft ▫ Purple is thick (600-700 ft) ▫ Green is moderate (400-550 ft) ▫ Red is thin (250 ft) Recent well results ▫ Jagged Peak wells reflecting significant outperformance vs. ~500 Mboe EUR type curve ▫ Pecos County - Parsley operated Tree State 16 recorded Company’s 2nd best 30 day IP rate per 1,000’ at 252 boe/d ▫ Felix Energy Holdings II – Recently permitted four wells offsetting Abraxas R.O.C. acreage (dashed red lines) ▫ Entire AXAS acreage block prospective for Wolfcamp and 3rd Bone Spring offering significant upside to estimated net locations Whiskey River 0927-7-1H (Jagged Peak) Peak 24-hour IP: 1,728 Boe/d Lateral Length: 9,442’ Target: Wolfcamp Whiskey River 0927-7-2H (Jagged Peak) Peak 24-hour IP: 1,774 Boe/d Lateral Length: 9,857’ Target: Wolfcamp Tree State 16-1H (Parsley Energy) Peak 24-hour IP: 1,558 Boe/d Peak 30-day IP: 1,151 Boe/d Lateral Length: 4,562’ Target: Wolfcamp Cilantro 2524-C3-1H (Jagged Peak) Peak 24-hour IP: 2,175 Boe/d Peak 30-day IP: 1,501 Boe/d Lateral Length: 8,279’ Target: Wolfcamp Whiskey River 98-34-2H(Jagged Peak) Recently completed Lateral Length: ~10,000’ Target: Wolfcamp Pyote Flats 98-34-1H (Jagged Peak) 11 mos Oil / Gas cum.: 161 mbo / 182 mmcf Lateral Length: ~10,000’ Target: Wolfcamp Felix Energy Holdings II, LLC Recent Permits

17 Strong Offset Operator Results NEW Abraxas’ acreage is located on the eastern platform of the play Jagged Peak has been the most active operator in the area to date achieving attractive results in both the Wolfcamp and Bone Spring ▫ 3 month cum avg: 56,000 boe ▫ 6 month cum avg: 90,000 boe Jagged Peak Ten Well Cum Results(1) Pyote Flats Whiskey River 98-34 Eiland Trinity 15-33 1H (Bone Spring) Whiskey River 1H Cilantro Whiskey River 2H (1) Jagged Peak cumulative production data from the Texas Railroad Commission / HPDI. Felix Rock of Ages Four Mile Echo Canyon Lead King

18 Catalyst # 4 Additional Assets Opportunity Overview Abraxas Assets 2016 Development Powder River Basin Stacked pay, liquids-rich horizontal opportunities in Campbell, Converse and Niobrara Counties, Wyoming Primarily in Converse and Campbell counties Appx 2,088 net acres at Porcupine and 14,245 net acres at Brooks Draw Hedgehog State 16-2H: Cum prod. (38 mos): 366 mboe, 23% Oil No capital budgeted for 2016 Portilla Large inventory conventional targets; EOR potential Avg production ~150 boepd, ~87% oil (1) No capital budgeted for 2016 Raven Drilling Abraxas 100% wholly owned subsidiary $15.8 million in NBV secured against $1.9 million in rig debt (2) One 2,000 horsepower, SCR walking rig currently pad drilling in the Bakken Subsidiary includes man camp and additional related rig equipment No capital budgeted for 2016 Surface / Yards / Field Offices / Building Surface ownership in numerous legacy areas Net book value of $11.2 million (3) Surface : 610 acres Scurry, TX; 1,769 acres in San Patricio, TX; 12,178 acres Pecos, TX; 590 acres McKenzie, ND; 50 acres DeWitt, TX; 15 acres Atascosa, TX Yards/Offices/Structures: Sinton, TX; Scurry, Texas; McKenzie, ND; 21,000 square foot office building No capital budgeted for 2016 (1) Average for month of June 30, 2016 (2) As of March 31, 2016 (3) As of December 31, 2015 Abraxas is currently marketing several non-core assets. If successful, proceeds will be used to further reduce borrowings with little Borrowing Base impact

19 Abraxas Hedging Profile (1) Straight line average price. Q2 2016 Q3 2016 Q4 2016 2017 2018 Oil Swaps (bbls/day) 1948 1948 2500 1908 1500 NYMEX WTI (1) $39.04 $39.04 $43.25 $55.39 $46.39

20 Appendix

21 Abraxas’ Eagle Ford Properties ~10,819 Net Acres Jourdanton Area Atascosa County Black oil 7,352 net acres Cave Area McMullen County Black oil 411 net acres Dilworth East Area McMullen County Oil/condensate 1,148 net acres Yoakum Area (not shown) Dewitt and Lavaca County Dry gas 1,908 net acres Jourdanton Area Cave Area Dilworth East Area

22 Eagle Ford Jourdanton Jourdanton 7,352 net acre lease block, 100% WI 90+ well Eagle Ford potential North Fault Block ▫ Held by production ▫ Eight wells drilled ▫ 36+ additional potential well locations South Fault Block ▫ One well drilled ▫ 42+ additional potential well locations

23 Eagle Ford Dilworth East Dilworth East 1,148 acre lease block, 100% WI 11 additional locations (red) ▫ Eight, 5,000-5,500’ lateral locations ▫ Three, 8,500’ lateral locations R. Henry 2H ▫ 30 day IP: 780 boepd (1) ▫ On production R. Henry 1H ▫ 30 day IP: 703 boepd (1) ▫ On production (1) The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

24 Eagle Ford Cave Cave 411 net acre lease block, 100% WI Lower Eagle Ford fully developed ▫ Four 9,000’ lateral locations Best month cumulative oil shown in green ▫ Offset operators : 8-10 mbo ▫ Abraxas Dutch 2H: 29 mbo Dutch 1H ▫ 30 day IP: 786 boepd (1) Dutch 2H ▫ 30 day IP: 1,093 boepd (1) Dutch 3H ▫ 30 day IP: 888 boepd (1) Dutch 4H ▫ 30 day IP: 926 boepd (1) (1) The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

25 Well Area Lat. Length (1) Stages (1) 30-day IP (boepd) Status T-Bird 1H Nordheim 5,102 15 1,202 (2) Sold 13 WyCross Wells WyCross 5,000 – 7,500 18 – 29 466 – 1,184 (2,3) Sold Blue Eyes 1H Jourdanton 5,000 22 527 (2,4) Producing Snake Eyes 1H Jourdanton 5,000 18 759 (2,4) Producing Spanish Eyes 1H Jourdanton 5,000 19 213 (2,4) Producing Eagle Eyes 1H Jourdanton 3,800 18 249 (2,4) Producing Ribeye 1H Jourdanton 7,000 21 240 (2,4) Producing Ribeye 2H Jourdanton 7,000 28 389 (2,4) Producing Cat Eye 1H Jourdanton 7,000 26 491 (2,4) Producing Grass Farm 2H Jourdanton 5,000 29 193 (2,4) Producing Dutch 2H Cave 9,000 36 1,093 (2) Producing Dutch 1H Cave 9,000 37 786 (2) Producing Dutch 3H Cave 9,000 37 888 (2) Producing Dutch 4H Cave 9,000 37 926 (2) Producing R Henry 2H Dilworth East 5,000 19 780 (2) Producing R. Henry 1H Dilworth East 5,000 34 703 (2) Producing Eagle Ford Focused on Execution (1) Represents the approximate, average lateral length and number of stages for each well. (2) The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas. (3) Represents the range for WyCross wells. (4) 30 day IP equivalent to highest 30 days of production after the well was placed on sub-pump.

26 Powder River Basin Turner Sandstone Horizontal Play Powder River Basin: Turner Sandstone Isopach of Turner thickness Multiple producing vertical wells, tight sandstone Horizontal exploitation with multi-stage fracs recently Porcupine Area ▫ Approximately 2,088 net acres Brooks Draw Area ▫ Approximately 14,245 net acres

27 Edwards (South Texas) PDP: 6.9 bcfe (net)(3) Previous risked offsetting PUD locations: 27.9 bcfe (net) (4) ▫ 11 gross / 7 net locations dropped to PRUD (SEC 5 year rule) 7 gross / 5 net locations drilled / completed, yet to be frac’d: unbooked Edwards economics ▫ New drill: $7.0 million well / 4.0 bcfe EUR / F&D $1.73/mcfe (4) ▫ 20% ROR at $4.30/mcfe realized price (4) ▫ Refrac: $0.7 million well / 0.5 bcfe EUR / F&D $1.40/mcfe (4) ▫ 20% ROR at $1.98/mcfe realized price (4) Montoya / Devonian (Delaware Basin, West Texas) PDP 17.1 bcfe (net) (3) PUD locations: 22.5 bcfe (net) (4) ▫ 12 gross/ 6 net locations ▫ $22.1 million PV-10 value at $2.36 realized gas(3) Other Eagle Ford Shale, Yoakum: 1,908 net acres / ~24 net locations, unbooked Williston Basin, Red River: 1 gross / .8 net PRUD location, 2.1 bcfe (net) (4) (1) Net of purchase price adjustments (2) PV10 calculated using strip pricing and internal reserve report as of 5/1/12; production and reserves as of 5/1/12. (3) Based on December 31, 2015 reserves. (4) Management estimate 2012 Ward County Acquisition Acquisition of Partners’ Interests in West Texas Purchase Price $6.7mm(1) PDP PV -15 $6.7mm(2) Production 1,440 mcfepd(2) Reserves 7.613 bcfe(2) Production $4,650/mcfe/day Reserves: $.88/mcfe Abraxas’ “Hidden” Gas Portfolio

28 Sharon Ridge/Westbrook: Clearfork Trend 89 active wells ▫ San Andres, Glorietta, Clearfork ▫ Cooperative water flood on some leases 110 potential (1) new-drills, recompletes or workovers Abraxas New Drill Type Curve ▫ 31 Mbo (100% oil) ▫ Gross/Net CWC: $0.75/$0.6 million Permian Basin Sharon Ridge - Westbrook: Clearfork Trend (1) Potential locations and prospective acres based on an internal geologic and technical evaluation of the area and offset activity. These locations have yet to be audited by our third party engineer Degolyer & Macnaughton.

29 EBITDA Reconciliation EBITDA is defined as net income plus interest expense, depreciation, depletion and amortization expenses, deferred income taxes and other non-cash items. The following table provides a reconciliation of EBITDA and Adjusted EBITDA to net income for the periods presented. (In thousands) 2013 2014 2015 Net income $38,647 $63,268.73 ($119,055) Net interest expense 4,577 2,009 3,340 Income tax expense 700 (287) (37) Depreciation, depletion and amortization 26,632 43,139 38,548 Amortization of deferred financing fees 1,367 934 1,130 Stock-based compensation 2,114 2,703 3,912 Impairment 6,025 0 128,573 Unrealized (gain) loss on derivative contracts (2,561) (24,876) (18,417) Realized (Gain) loss on interest derivative contract 0 0 0 Realized (Gain) loss on monetized derivative contracts 0 0 5,061 Earnings from equity method investment 0 0 0 (Gain) loss on discontinued operations (33,377) (1,318) 20 Other non-cash items 539 0 883 EBITDA $44,663 $85,572 $43,957 Credit facility borrowings $33,000 $70,000 $134,000 Debt/EBITDA 0.74x 0.82x 3.05x

30 TTM EBITDA Reconciliation EBITDA is defined as net income plus interest expense, depreciation, depletion and amortization expenses, deferred income taxes and other non-cash items. The following table provides a reconciliation of EBITDA and Adjusted EBITDA to net income for the periods presented. (In thousands) Three Months End 30-Sep-15 31-Dec-15 31-Mar-16 30-Jun-16 TTM Net income ($52,372) ($67,661) ($40,880) ($46,937) ($207,850) Net interest expense 847 983 1,103 1,015 3,948 Income tax expense 0 (37) 0 0 (37) Depreciation, depletion and amortization 10,165 7,677 5,892 5,669 29,403 Amortization of deferred financing fees 162 162 164 448 936 Stock-based compensation 835 826 807 835 3,304 Impairment 59,891 68,682 35,085 28,735 192,393 Unrealized (gain) loss on derivative contracts (10,474) (3,608) 4,642 12,374 2,935 Realized (Gain) loss on interest derivative contract 0 0 0 0 0 Realized (Gain) loss on monetized derivative contracts 0 0 4,360 10,010 14,370 Earnings from equity method investment 0 0 0 0 0 (Gain) los discontinued operations 0 0 0 0 0 Expenses incurred with offerings and execution of loan agreement 0 0 0 1,665 1,665 Other non-cash items 144 457 583 36 1,221 EBITDA $9,199 $7,480 $11,756 $13,851 $42,287 Credit facility borrowings $95,000 Debt/EBITDA 2.25x

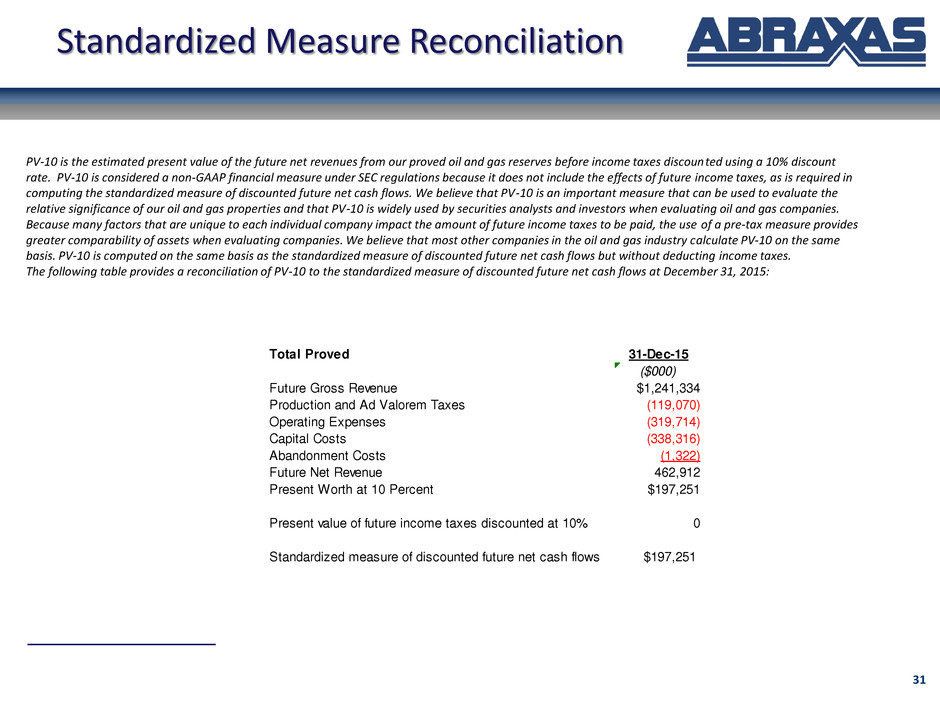

31 Standardized Measure Reconciliation PV-10 is the estimated present value of the future net revenues from our proved oil and gas reserves before income taxes discounted using a 10% discount rate. PV-10 is considered a non-GAAP financial measure under SEC regulations because it does not include the effects of future income taxes, as is required in computing the standardized measure of discounted future net cash flows. We believe that PV-10 is an important measure that can be used to evaluate the relative significance of our oil and gas properties and that PV-10 is widely used by securities analysts and investors when evaluating oil and gas companies. Because many factors that are unique to each individual company impact the amount of future income taxes to be paid, the use of a pre-tax measure provides greater comparability of assets when evaluating companies. We believe that most other companies in the oil and gas industry calculate PV-10 on the same basis. PV-10 is computed on the same basis as the standardized measure of discounted future net cash flows but without deducting income taxes. The following table provides a reconciliation of PV-10 to the standardized measure of discounted future net cash flows at December 31, 2015: Total Proved 31-Dec-15 ($000) Futu e G oss Revenue $1,241,334 P oduction a d Ad Valorem Taxes (119,070) Oper ting Expenses (319,714) Capital Cost (338,316) Abandonment Costs (1,322) Future Net Revenue 462,912 Present Worth at 10 Percent $197,251 Present value of future income taxes discounted at 10% 0 Standardized measure of discounted future net cash flows $197,251

32 NASDAQ: AXAS