©2021 1 SunPower Confidential and Proprietary | © 2021 SunPower Corporation Announcement of Acquisition of Blue Raven Solar October 5, 2021

©2021 2 Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding (a) our expectations for our acquisition of Blue Raven, including impacts on our business and financial results, and our competitive positioning and positioning for future success; (b) our areas of investment and focus, and anticipated impacts on our business and financial results; (c) future plans for our commercial and industrial solutions business, including our expectations regarding market opportunity and growth potential, and our strategic plans and options with respect to the business; (d) expectations regarding our performance versus guidance for the third fiscal quarter of 2021; and (e) our expectations for fiscal 2022, including residential outlook, residential unit-level customer value, areas of investment, and related assumptions. These forward-looking statements are based on our current assumptions, expectations and beliefs and involve substantial risks and uncertainties that may cause results, performance or achievement to materially differ from those expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: (1) challenges in executing transactions key to our strategic plans, including regulatory and other challenges that may arise; (2) regulatory changes and the availability of economic incentives promoting use of solar energy; (3) potential disruptions to our operations and supply chain that may result from epidemics or natural disasters, including impacts of the Covid-19 pandemic; (4) competition in the solar and general energy industry and downward pressure on selling prices and wholesale energy pricing; (5) risks related to the introduction of new or enhanced products, including potential technical challenges, lead times, and our ability to match supply with demand while maintaining quality, sales, and support standards; (6) changes in public policy, including the imposition and applicability of tariffs; (7) our dependence on sole- or limited-source supply relationships, including our exclusive supply relationship with Maxeon Solar Technologies; (8) the success of our ongoing research and development efforts and our ability to commercialize new products and services, including products and services developed through strategic partnerships; (9) our liquidity, indebtedness, and ability to obtain additional financing for our projects and customers; and (10) challenges managing our acquisitions, joint ventures and partnerships, including our ability to successfully manage acquired assets and supplier relationships. A detailed discussion of these factors and other risks that affect our business is included in filings we make with the Securities and Exchange Commission (SEC) from time to time, including our most recent reports on Form 10-K and Form 10-Q, particularly under the heading “Risk Factors.” Copies of these filings are available online from the SEC or on the SEC Filings section of our Investor Relations website at investors.sunpower.com. All forward-looking statements in this presentation are based on information currently available to us, and we assume no obligation to update these forward-looking statements in light of new information or future events.

©2021 3 1. Today, we closed the acquisition of Blue Raven Solar for up to $165m in cash, funded with operating cash and the sale of 1m of our Enphase shares for $178m proceeds. 2. Blue Raven complements SunPower’s dealer network, with minimal market overlap. 3. Allows us to move faster and serve more customers in new states with Direct sales & installs. 4. Day 1 margin accretive before synergies. Increasing Our Residential Footprint Complements existing dealer network while boosting sales and installation speed and volume

©2021 4 Blue Raven – SunPower’s Newest Bright Spot Ahead of the curve on customer service and loan origination 1. Preliminary estimate. This soon after the close of the quarter, the company is not able to provide a quantitative reconciliation of non-GAAP LTM EBITDA margin to the corresponding GAAP measure without unreasonable efforts. 2. Ratings on Google, Solar Reviews, EnergySage, Glassdoor, Indeed, Yelp, and others 1. Founded: 2014 2. Large geographic footprint, focusing on underpenetrated markets 3. Customer Satisfaction: 4.5/5 stars average rating across review platforms2 4. High quality loan origination with >90% credit acceptance and an average FICO 768 5. Efficient operators with expertise in local permitting in new markets and crews “install-ready” in under 4 weeks Key Business Highlights$136M LTM Revenue >10% LTM EBITDA margin1 20k Cumulative customers at close, with 6k added LTM >100% 2015-2020 MW CAGR 40 MW deployed, LTM 14+ States in which Blue Raven operates

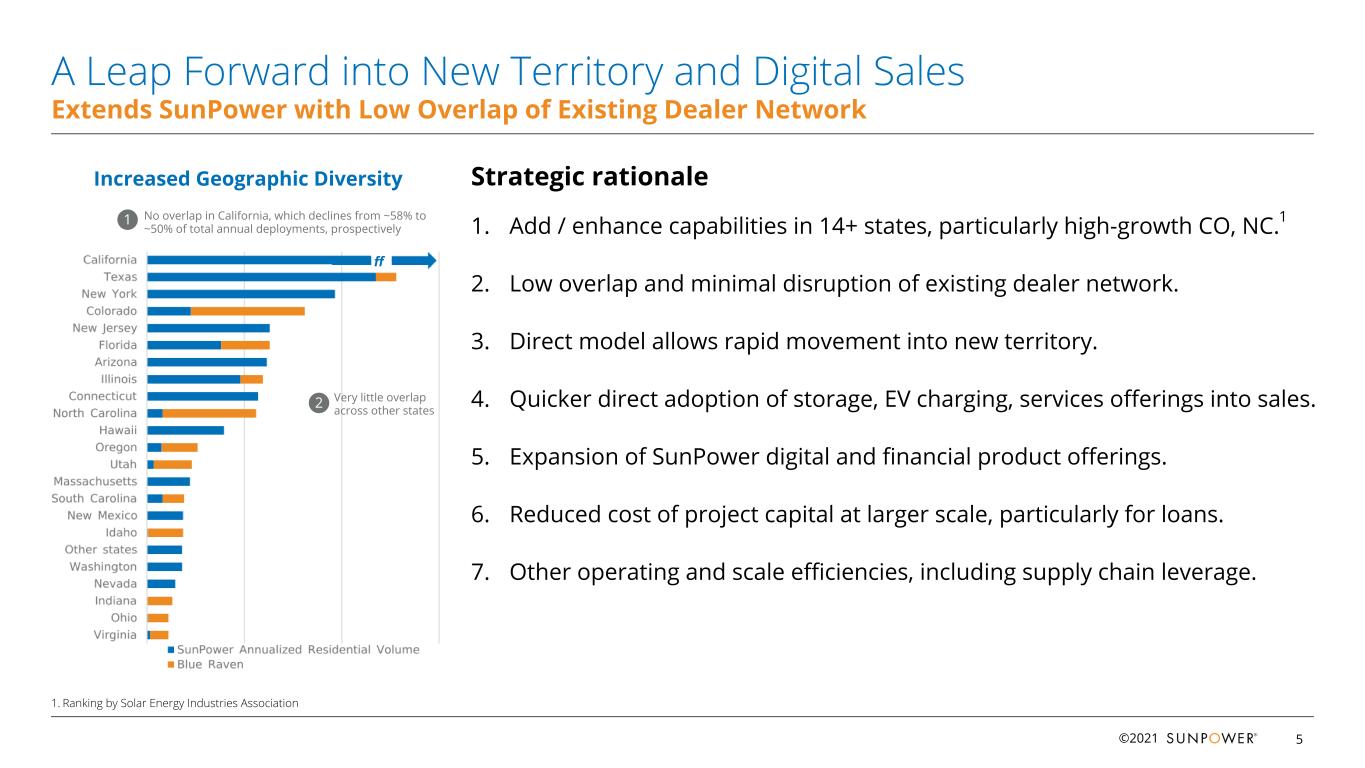

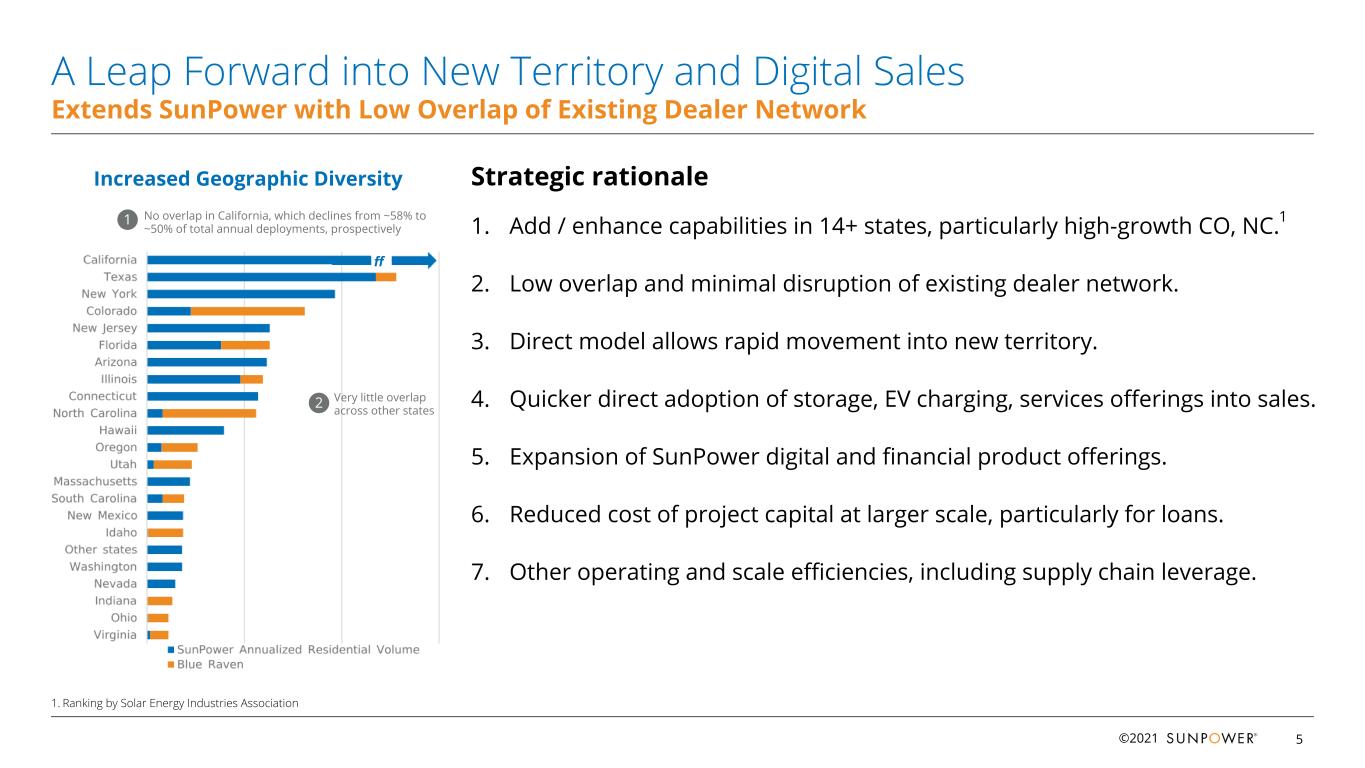

©2021 5 A Leap Forward into New Territory and Digital Sales Extends SunPower with Low Overlap of Existing Dealer Network Strategic rationale 1. Add / enhance capabilities in 14+ states, particularly high-growth CO, NC.1 2. Low overlap and minimal disruption of existing dealer network. 3. Direct model allows rapid movement into new territory. 4. Quicker direct adoption of storage, EV charging, services offerings into sales. 5. Expansion of SunPower digital and financial product offerings. 6. Reduced cost of project capital at larger scale, particularly for loans. 7. Other operating and scale efficiencies, including supply chain leverage. 1. Ranking by Solar Energy Industries Association No overlap in California, which declines from ~58% to ~50% of total annual deployments, prospectively 1 Very little overlap across other states2 Increased Geographic Diversity ff

©2021 6 1. CIS TAM is expanding with Biden Plan tailwinds: Building retrofits, ITC extension, Direct Pay provisions. 2. Market leader with new, high growth opportunities: Community Solar, Front of the Meter storage. 3. CIS will be better positioned to succeed with an investor base that is optimally aligned with its strategic and financial goals. 4. SunPower is doubling down on the Residential business, cementing alignment with investors that expect more clarity of focus. 5. SunPower’s capital is more efficiently deployed into Residential Product and Digital investment with higher gross margins and stronger growth. Considering Strategic Options for Commercial & Industrial Solutions Optimizing capital sourcing and deployment

©2021 7 Financial Update Redeploying ENPH sale proceeds on Product & Digital investment 1. Focus on Residential and Light Commercial segment going forward. 2. Q4’21 Standalone RLC remains strong. Higher Product & Digital investment opex is offset by Blue Raven accretion. 3. Q3’21: Key guidance metrics are projected to be below the low end of the prior guidance ranges, primarily due to CIS project schedule delays and costs as well as performance of our Light Commercial business. 4. Strong sequential bookings growth from both RLC and CIS, and our cash position remains strong. 5. Residential outlook and Residential unit-level Customer Value expected to continue to grow in 2022 and beyond.1 i. Planning to invest an incremental ~$30-$35m Product & Digital investment opex in 2022 (included in Adjusted EBITDA), funded with ENPH proceeds from Q3’21 sale (excluded from non-GAAP). ii. SunVault bookings on track for $100m run rate by year-end 2021 1. Customer Value creation is defined as Adjusted EBITDA of our Residential & Light Commercial business, excluding any products and digital investment plus change in SunPower’s share of lease net retained value.

©2021 8 SunPower Confidential and Proprietary | © 2021 SunPower Corporation Thank You Changing the way our world is powered