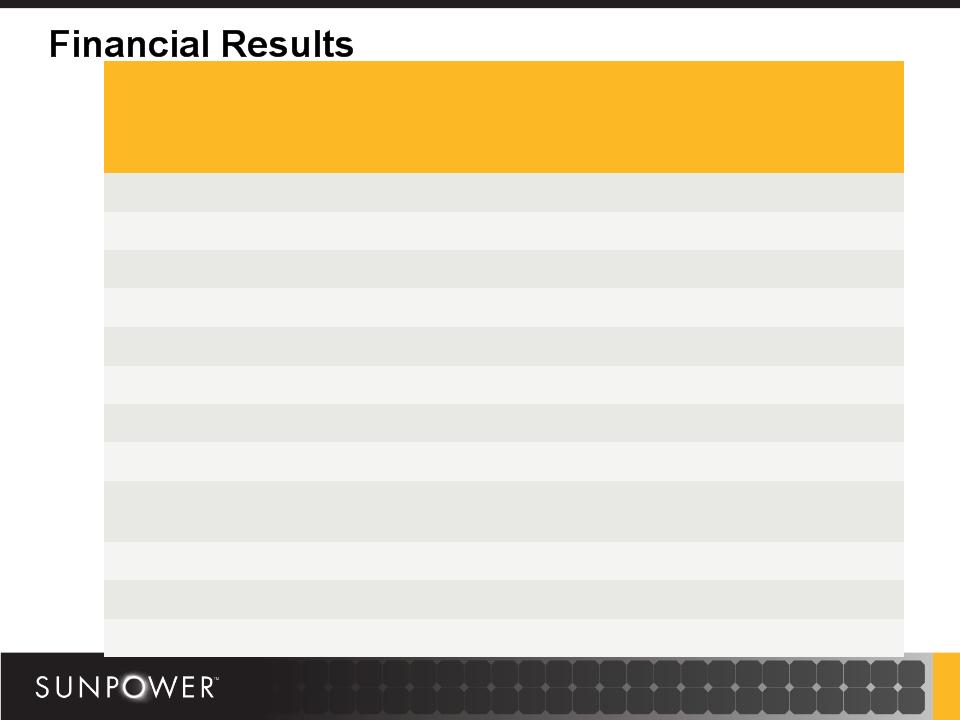

Earnings Per Share Calculation

19

Three Months Ended October 3, 2010

GAAP

Non-GAAP

(in thousands)

If Converted Method

Not Converted

Method

If Converted Method

Not Converted

Method

Net income

$ 20,116

$ 20,116

$ 26,283

$ 26,283

Net income allocated to unvested restricted stock awards

(24)

(24)

(31)

(31)

Net income allocated to class A and class B common stock

20,092

20,092

26,252

26,252

Basic weighted-average shares

95,840

95,840

95,840

95,840

Net income per share - basic

$ 0.21

$ 0.21

$ 0.27

$ 0.27

Net income

$ 20,116

$ 20,116

$ 26,283

$ 26,283

(A)

Interest expense on 4.75% debentures, net of tax

1,666

-

1,666

-

Net income allocated to unvested restricted stock awards

(23)

(24)

(30)

(31)

Net income allocated to class A and class B common stock

21,759

20,092

27,919

26,252

Diluted weighted-average shares before consideration of 4.5% debentures

96,936

96,936

96,936

96,936

Shares issued if 100% of 4.5% Debentures are converted to equity

8,712

-

8,712

-

Diluted weighted-average shares

105,648

96,936

105,648

96,936

Net income per share - diluted

$ 0.21

$ 0.21

$ 0.26

$ 0.27

(A)

Under the "If Converted Method" we calculated diluted earnings per share using the more dilutive of the following two methods:

Method One:

Numerator = Income Available to Common Shareholders + Interest on 4.5% Debentures, Net of Tax

Denominator = Stock Outstanding + Common Shares Issued if 100% Coversion of 4.5% Debentures

Method Two:

Numerator = Income Available to Common Shareholders

Denominator = Stock Outstanding