© 2011 SunPower Corporation

2011 Non-GAAP Guidance Footnotes

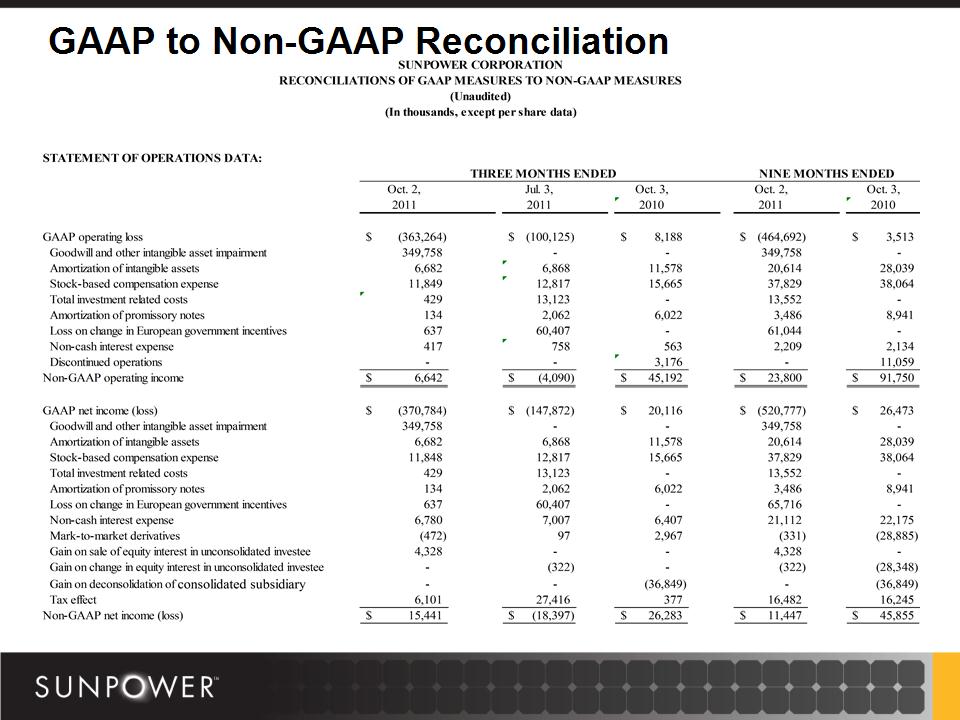

(a) Estimated non-GAAP amounts above for Q4 2011 include the estimated revenue for a UPP project and R&C leases of approximately $98.0

million.

(b) Estimated non-GAAP amounts above for FY 2011 include the estimated revenue for a UPP project and R&C leases of approximately $98.0

million.

(c) Estimated non-GAAP amounts above for Q4 2011 reflect adjustments that include the gross margin of approximately $21.0 million related

to the non-GAAP revenue adjustments that are discussed above. In addition, the estimated non-GAAP amounts exclude estimated stock-

based compensation expense of approximately $3.6 million and estimated non-cash interest expense of approximately $0.4 million.

(d) Estimated non-GAAP amounts above for FY 2011 reflect adjustments that include the gross margin of approximately $21.0 million related

to the non-GAAP revenue adjustments that are discussed above. In addition, the estimated non-GAAP amounts exclude amortization of

intangible assets of approximately $0.4 million, estimated stock-based compensation expense of approximately $14.5 million, estimated non-

cash interest expense of approximately $2.6 million and loss on change in European government incentives of approximately $48.5 million.

(e) Estimated non-GAAP amounts above for Q4 2011 reflect adjustments that include the gross margin of approximately $21.0 million related

to the non-GAAP revenue adjustments that are discussed above. In addition, the estimated non-GAAP amounts exclude estimated stock-

based compensation expense of approximately $12.3 million, estimated non-cash interest expense of approximately $6.8 million, estimated

Total investment-related costs of approximately $1.1 million, amortization of intangible assets of approximately $1.0 million and the related tax

effects of these non-GAAP adjustments.

(f) Estimated non-GAAP amounts above for FY 2011 reflect adjustments that include the gross margin of approximately $21.0 million related to

the non-GAAP revenue adjustments that are discussed above and a net gain related to sale of stock and change in equity interest in

unconsolidated investee of approximately $4.0 million. In addition, the estimated non-GAAP amounts exclude goodwill and other intangible

asset impairment of approximately $349.8 million, amortization of intangible assets of approximately $21.6 million, estimated stock-based

compensation expense of approximately $50.1 million, estimated non-cash interest expense of approximately $27.9 million, estimated Total

investment-related costs of approximately $14.7 million, amortization of promissory notes of approximately $3.5 million, loss on change in

European government incentives of approximately $65.7 million, net gain on mark-to-market derivatives of approximately $0.3 million and the

related tax effects of these non-GAAP adjustments.

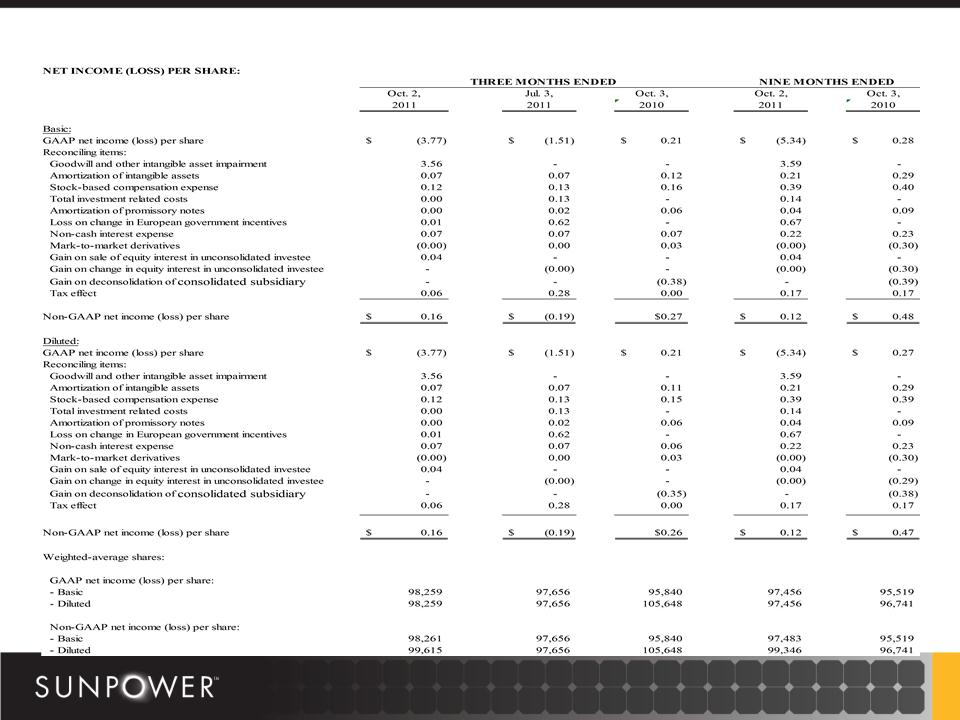

(g) Weighted average shares used in the calculation of diluted earnings per share is based on the not converted method.

15