For Immediate ReleaseContact:

Vance Adkins

Chief Financial Officer

Email: vadkins@severnbank.com

Phone: 410.260.2000

Severn Bancorp, Inc. Announces Second Quarter Earnings

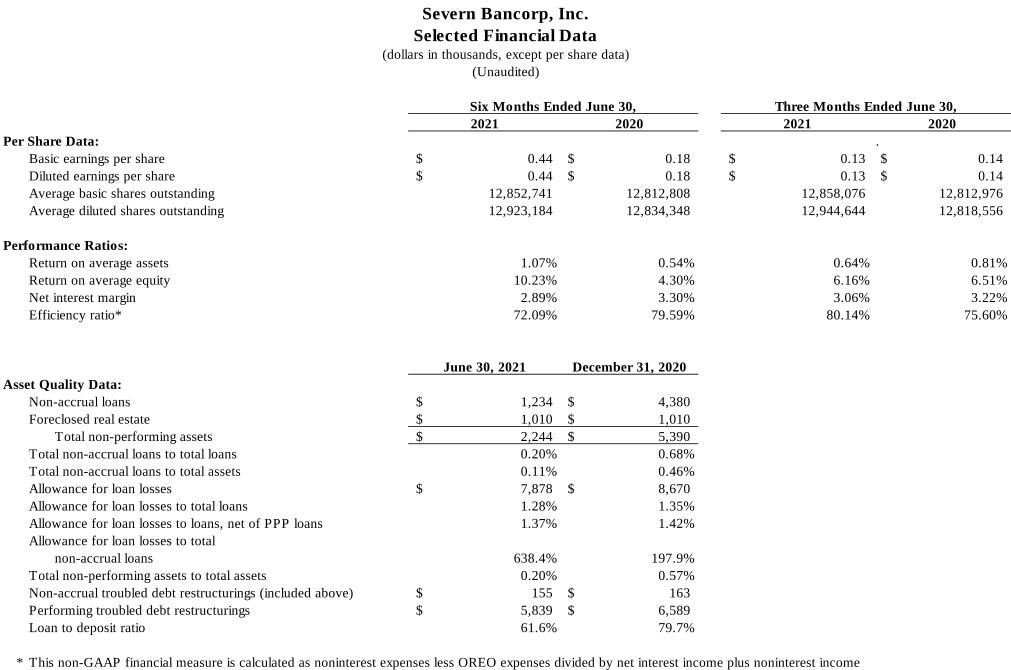

Annapolis, MD, July 27, 2021 (PRNewswire) – Severn Bancorp, Inc. (the Company) (NASDAQ: SVBI), the parent company of Severn Bank (the Bank), reported net income of $1.7 million for the second quarter ended June 30, 2021 and $5.6 million for the six months ended June 30, 2021 compared to $1.7 million and $2.3 million for the same periods in 2020. Earnings per share on a fully diluted basis were $0.13 for the second quarter and $0.44 for the first six months of 2021 compared to $0.14 and $0.18, respectively, from the second quarter and first six months of 2020.

Reaction to COVID-19

The Company continues to be vigilant regarding COVID-19. While branches and offices remain fully open at this time, remote working arrangements and social distancing remain in place. The Company is aware of the recent surge in COVID-19 infections arising out of the so-called Delta variant and is prepared to restore other protocols, as may prove to be necessary.

“The Company has experienced a significant amount of loan payoffs and maintains an extraordinarily high degree of liquidity,” said Alan J. Hyatt, President and Chief Executive Officer. “Despite substantial loan originations, loan payoffs have resulted in negative loan growth. In this low interest rate environment very little can be earned on liquidity, so as a result, earnings were less than desired in the second quarter. The Bank’s loan pipeline remains robust, and if there is a slowing of loan payoffs positive loan growth should take place going forward.”

“Residential mortgage originations remain steady, with low rates continuing to fuel that activity, resulting in fee income to the Bank,” said Mr. Hyatt.

“The pending merger between the Company and Shore Bancshares, Inc. continues to move forward with closing anticipated later this year,” Mr. Hyatt stated.

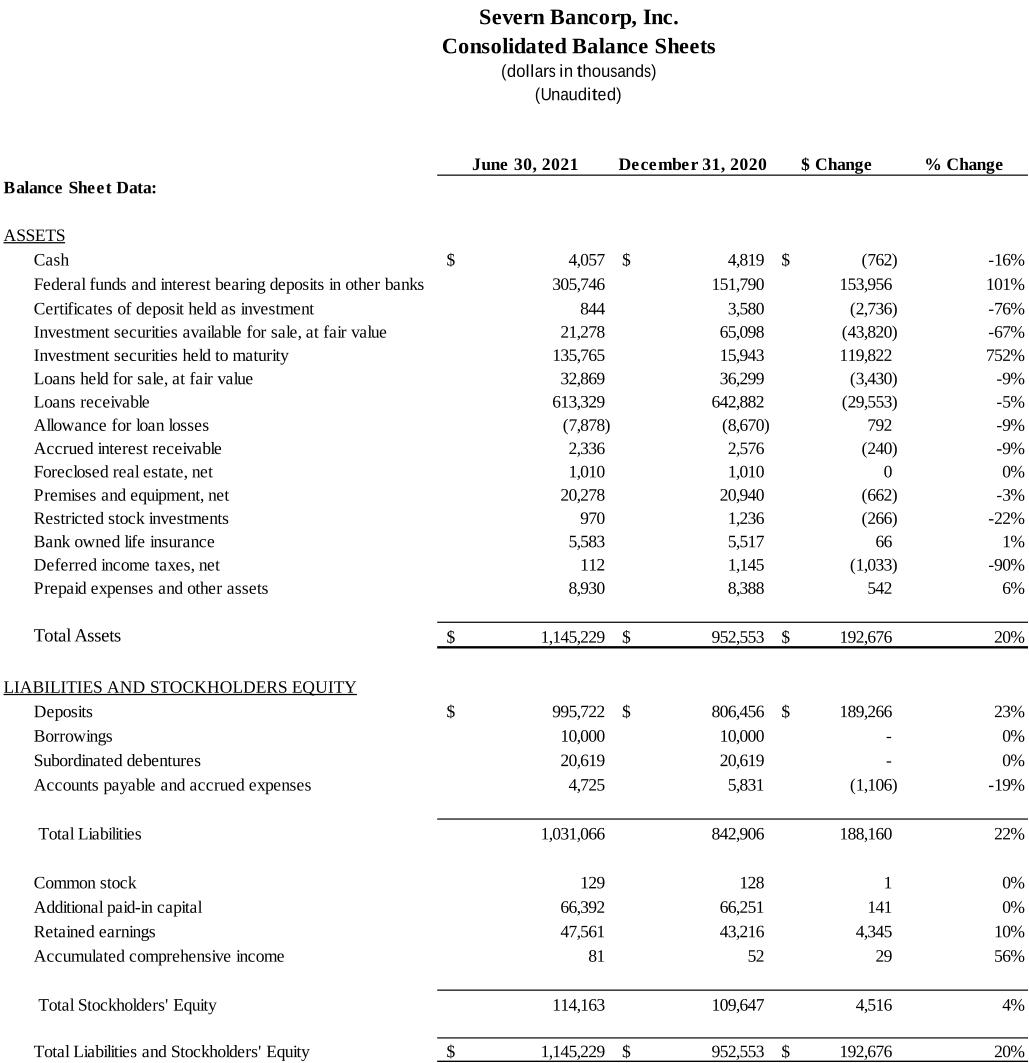

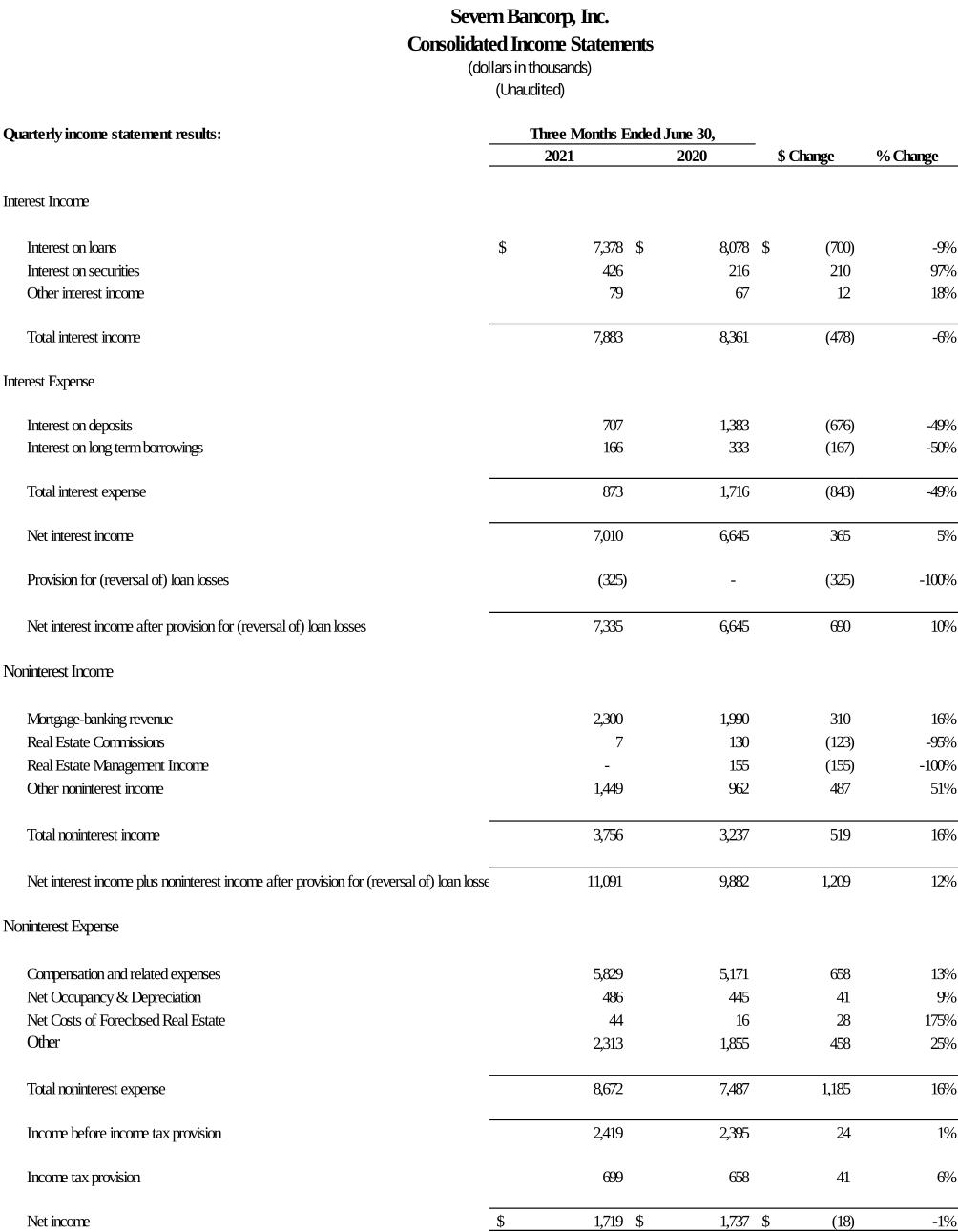

Income Statement

Net interest income was $7.0 million for the second quarter ended June 30, 2021 and $14.7 million for the six months ended June 30, 2021 compared to $6.6 million and $13.4 million for the same periods in 2020. The increases in interest income was driven by higher volumes of earning assets, including a significantly higher volume of medical-use cannabis related deposits that were invested in the securities portfolio as well as held in fed funds and interest bearing deposits with other banks. Also, a reduction in interest expense from lower deposit rates and less reliance on borrowings contributed to the increased net interest income. These benefits were slightly offset by lower loan interest income from lower average loan volumes as well as lower yielding SBA Paycheck Protection Program (“PPP”) loans.

The Company recorded a reversal of provision of $(325) thousand for the second quarter ended June 30, 2021 and $(1.1) million for the six months ended June 30, 2021. The ratio of the allowance for loan losses to gross loans was 1.28% at June 30, 2021 compared to 1.35% at December 31, 2020 and 1.24% at June 30, 2020. Excluding PPP loans, the ratio of the allowance for loan losses to gross loans was 1.37% at June 30, 2021 compared to 1.42% at December 31, 2020 and 1.33% at June 30, 2020. The reversal of provisions in the first and second quarters of 2021 and the decline in the balance of the allowance for loan losses as compared to year end 2020 was attributable to a decline in total loans, net of PPP loans, which are excluded from the allowance due to their underlying guarantees.