Exhibit 99.2

Safe Harbor Statement

To the extent that this presentation discusses expectations about market conditions or about market acceptance and future sales of the Company’s products and our bank lines of credit or otherwise makes statements about the future, such statements are forward-looking and are subject to a number of risks and uncertainties that could cause actual results to differ materially from the statements made. Such forward looking statements or comments include or relate to, but are not limited to; Trikon’s ability to respond to economic, commercial and technical trends such as the market acceptance of Trikon’s products, ability to expand its sales and marketing efforts, management of its cost structure, our ability to return to profitability, the resolution of copper/low k integration and devise shrink development efforts at device companies, development efforts in the field of low k dielectrics, long implementation periods in the semiconductor industry, acceptance of new products by individual customers and by the marketplace, the availability of credit under its facility and other factors discussed in the Business Description and Management’s Discussion and Analysis sections of the Private placement memorandum, Company’s Report on Form 10-Q for the six months ended June 30 and Annual Report to Shareholders.

Introduction

PIPE Offering

| | | |

| |  | Offering size: 500,000 Units |

| | |  | 4 Common shares and 1 Warrant per Unit |

| | |  | 125,000 Unit over-allotment option |

| |  | Common shares post-Offering: 16.1 million |

| |  | Pricing: Mid-October |

| |  | Use of proceeds: Primarily working capital |

| |  | Registration rights |

| | |  | Filing in 30 days |

| | |  | Effectiveness in 90 days |

| |  | NasdaqNM: TRKN |

| |  | Agent: Oppenheimer & Co. |

Participants

| | | | |

| | Jihad Kiwan, President & Chief Executive Officer |

| | | | |

| | | | 22 years in the semiconductor industry |

| | | | |

| | | | President and CEO since March 30, 2003 |

| | | | |

| | | | Prior to Trikon, Senior Vice President and General Manager

of Amkor Technology, Inc., Wafer Fabrication Services and

previously, Hewlett Packard |

| | | | |

Bill Chappell, Chief Financial Officer

| | |  | CFO since 2001 |

| | |  | 20 years of collective CFO and chartered accountant |

| | | | experience including PricewaterhouseCoopers |

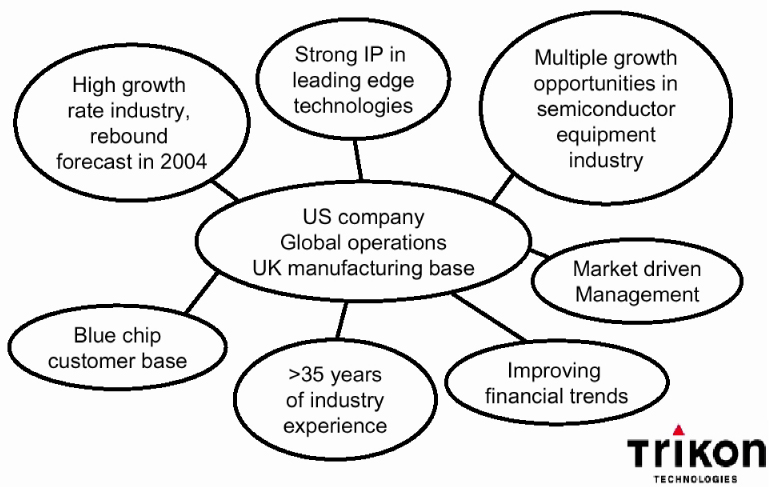

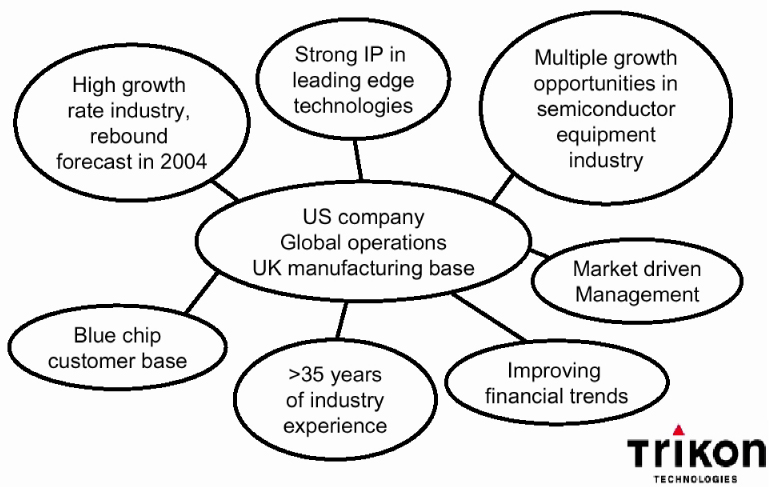

Investment Highlights

Mission

To continuously improve our customers’

competitiveness by providing them with advanced

technology etching and deposition solutions.

Growth Strategy

| |  | Deliver niche applications to major customers |

| | | |

| |  | Expand sales and marketing effort |

| | | | |

| | |  | Asia |

| | | | |

| | |  | “Top-20” semi companies |

| | | |

| |  | Focus on R&D to remain technology leader |

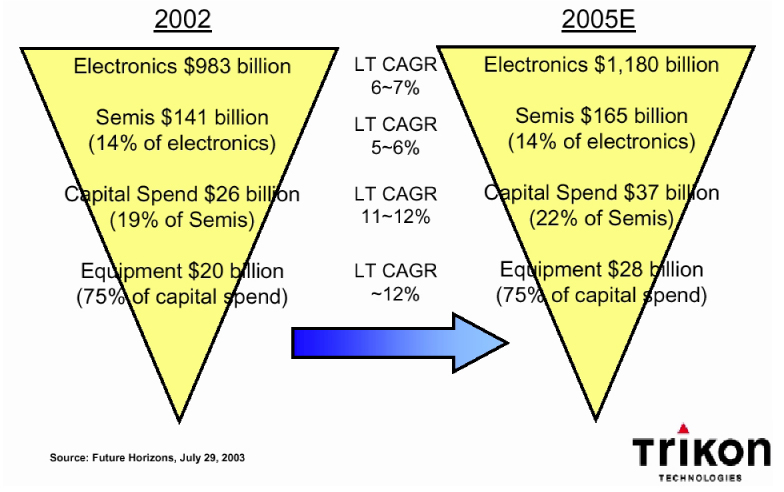

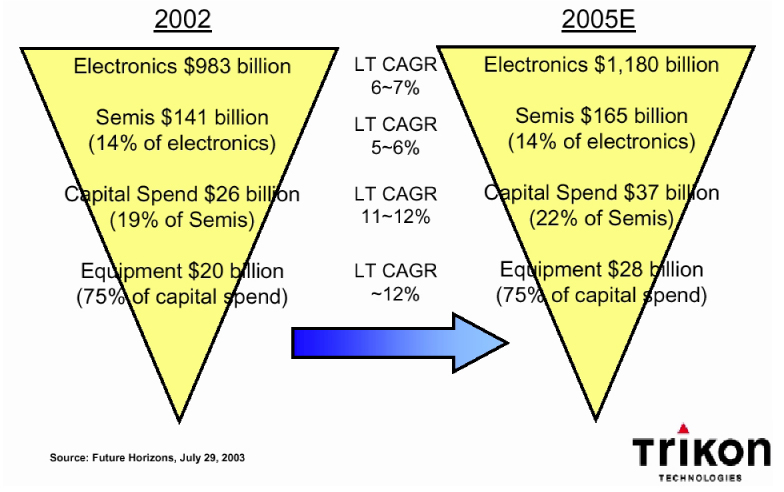

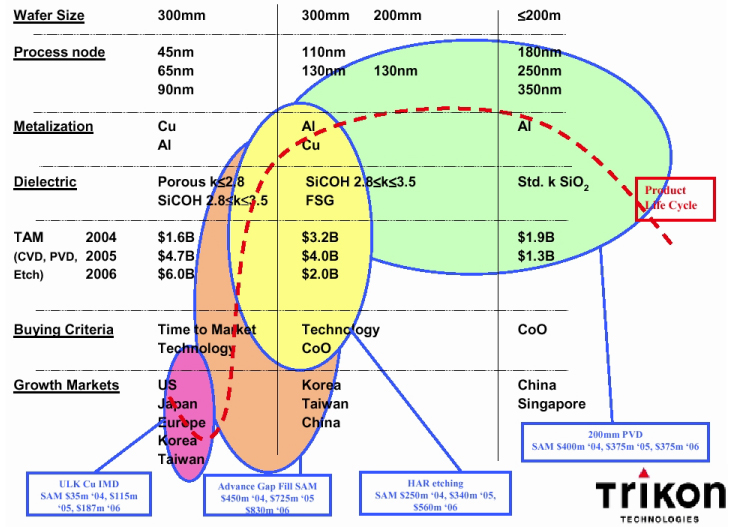

Semiconductor Equipment Market

Semiconductor Industry

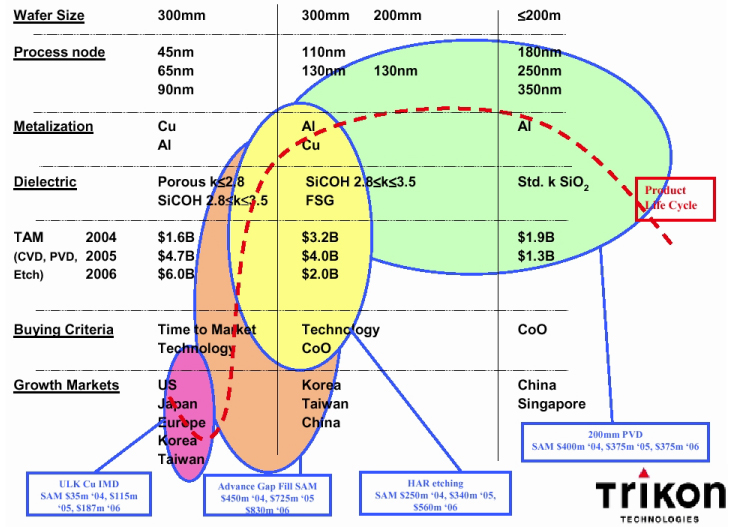

Products

Revenue Mix by Product

Planar 300TM - dielectric CVD

| |  | 100mm- 300mm CVD tool |

| | | | |

| | |  | In volume production since 1995 at LSI Logic |

| | | | |

| | | | |

| |  | Flowfill® process |

| | | | |

| | |  | @ 90nm in pilot production |

| | | | |

| | |  | @ <100nm Potential STI gap-fill solution |

| | | | |

| | |  | Qualified for Inter-Metal and Pre-Metal Dielectric applications |

| | | | |

| | |  | Offers superior gap-fill and lower cost to Spin-on and HDP |

| | | | |

| | |  | Can reduce/eliminate CMP budget |

| | | | |

| | | | |

| |  | Orion® process |

| | | | |

| | |  | @ 65nm in on-site qualification at 2 top-ten semi companies |

| | | | |

| | |  | Only CVD solution with achievable k values of <2.2 |

| | | | |

| | |  | Integrated into 9LM and packaged at k = 2.5 and 2.2 |

| | | |

| | | |

| |  | ASP of $3.0-5.0 million |

Sigma 300TM and fxP - Metalization tool

| |  | 300mm and £200mm metalization tools in volume production since 1993 at Infineon |

| | | | |

| | |  | 30 tools at Infineon in production |

| | | | |

| | |  | @ 110nm in production with ionized liners |

| | | | |

| | |  | Long throw and ionized liners, barriers and seed layers |

| | | | |

| | |  | MOCVD of TiN and Ti(Si)N capability demonstrated |

| | | | |

| | |  | Ti and Co silicides |

| | | | |

| | |  | Aluminum slab |

| | | | |

| | |  | In place/on-their-way for FBAR development at Sony, Epcos and Infineon |

| | | | |

| | | | |

| |  | ASP of $2.5-4.0 million |

Omega fxP- high aspect ratio etcher

| Newly launched £200mm etch tool entering volume production at Philips |

| | | |

| |  | 116 previous generation tools installed, 28 at Philips |

| | | |

| |  | Current generation entering volume production at Philips and in evaluation at IR for power trench etching |

| | | |

| |  | International SEMATECH set record high aspect ratio contact etch in 1999 at 30:1 aspect ratio, 25nm |

| | | |

| |  | Infineon R&D have etched 27nm polysilicon gates with Omega |

| | | |

| |  | Deep Silicon Etching in evaluation at Robert Bosch |

| | | |

| ASP $2.0-3.5 million |

Blue Chip Customer Base

Strong IP portfolio

| |  | 31 US and 56 foreign patents |

| | | |

| |  | 32 US and169 foreign patent applications |

| | | |

| |  | Covering equipment and processes |

| | | | |

| | |  | Barriers |

| | | | |

| | |  | Low-k dielectrics |

| | | | |

| | |  | STI |

| | | | |

| | |  | Damascene processing |

| | | | |

| | |  | FBAR |

| | | | |

| | |  | Electrostatic chucks |

| | | | |

| | |  | Plasma sources (M0RI) |

| | | | |

| | |  | Showerheads |

| | | | |

| | |  | Precursor delivery systems |

Management and Resources

Management and Employees

| Strong sales and marketing focus from new CEO, Dr. Jihad Kiwan |

| | |

| Experienced operational management led by new COO Richard Deep |

| | |

| Best practices with advanced management tools |

| | |

| Employees |

| | Sales & Marketing | 24 | | | |

| | | | | | |

| | Customer support | 77 | | | |

| | | | |  | One-Third are Degree Qualified |

| | Research & Development | 62 | |

| | | | | | |

| | Manufacturing | 62 | |  | 28 are PhDs |

| | | | | | |

| | Administration | 35 | | | |

| | |

| | | |

| | Total | 260 | | | |

| | | | | | |

Manufacturing Resources

| First class 110,000 sq ft. facility within 2 hours of London/Heathrow |  |

| | |

| Class 1000 Manufacturing area |

| | |

| Class 100 Engineering clean room |

| | |

| Class 10 Demonstration clean room |

| | |

| Purpose-built training suite with complete machines and computer-based training systems |

| | |

| ISO 9001:2000 (quality) and 14001 (Environmental) registered |

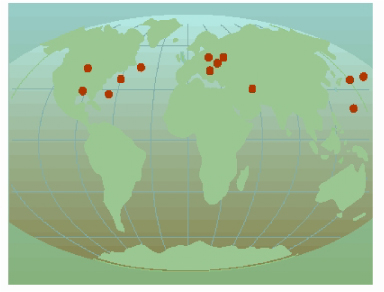

Local Customer Support

| Regional Centres | | | Local Offices | |

| | | | | | |

| USA | |  | Dallas, TX | |

| Korea |  | Portland, OR | |

| UK |  | New Haven, CT | |

| Germany |  | Manchester | |

| France |  | Nijmegen | |

| Taiwan |  | Migdael Haemek | |

| | |  | Regensburg | |

| | |  | Dresden | |

| | |  | Toulouse | |

Distributors

| Fastgate – Japan |

| Hermes Epitek – Taiwan, China and Singapore |

Financials

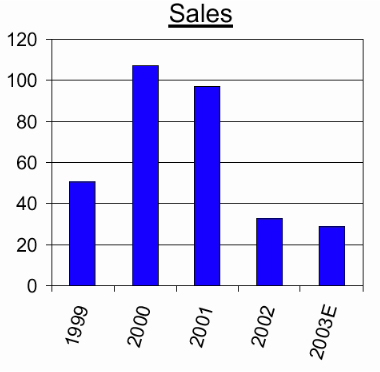

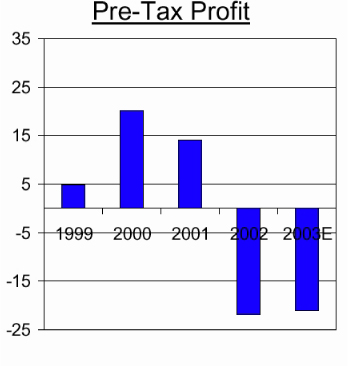

Financial Performance

($’Millions)

| |  | Heavy exposure to telecoms |

| | | |

| |  | Under exposure to Asia |

| | | |

2003 Performance to Date

($’Millions except per-share)

| | Q1 2003 | | Q2 | |

| |

| |

| |

| 2003 | | | | | | |

| | | | | | |

| | | | | | | |

| Sales | | 5.1 | | | 6.0 | |

| Gross Margin | | 0.8 | | | 1.2 | |

| Operating Expenses | | 7.1 | | | 7.0 | |

| | | | | | | |

| Operating loss | | 6.3 | | | 5.3 | |

| Loss per Share | ( | 0.50) | | ( | 0.35) | |

| Pension | ( | 0.06) | | ( | 0.15) | |

| One-off corp. costs | | | | ( | 0.06) | |

| RIFF | | | | ( | 0.04) | |

| Loss per Share (GAAP) | ( | 0.56) | | ( | 0.60) | |

| | | | | |

| | | | |  |

Operating Model

| | Peak | | Trough | | Go- | |

| | 2000 | | 2002 | | Forward | |

| |

| |

| |

| |

| Revenue | 100 | % | | 100 | % | | 100 | % | |

| | | | | | | | | | |

| | | | | | | | | | |

| Gross Margin | 48 | % | | 25 | % | | 50 | % | |

| SG&A | 21 | % | | 40 | % | | 18 | % | |

| R&D | 8 | % | | 33 | % | | 12 | % | |

| | | | | | | | | | |

| | | | | | | | | | |

| EBITDA | 23 | % | | (46 | %) | | 24 | % | |

| Operating Income | 19 | % | | (66 | %) | | 20 | % | |

| | | | | | |

| | | | | | |

New Credit Facility

| | |

| £5 million ($8 million) revolver agreed July 2003 |

| | |

| 2 year facility to June 2005 |

| | |

| Interest rate is 1.75% over LIBOR |

| | |

| Limited financial covenants |

| | |

Balance Sheet @ June 30, 2003

| | ($’millions) | |

| | | |

| | | |

| Cash | 30.3 | |

| | | |

| Working Capital | 34.9 | |

| | | |

| Fixed Assets | 18.0 | |

| | | |

| Long Term Debt | 0.4 | |

| | | |

| Shareholders’ Equity | 52.6 | |

| | | |

| |  |