Washington, D.C. 20549

Nuveen California Investment Quality Municipal Fund, Inc.

Kevin J. McCarthy

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

Table of Contents

| Chairman’s Letter to Shareholders | 4 |

| | |

| Portfolio Manager’s Comments | 5 |

| | |

| Fund Leverage and Other Information | 9 |

| | |

| Common Share Dividend and Price Information | 11 |

| | |

| Performance Overviews | 13 |

| | |

| Portfolios of Investments | 20 |

| | |

| Statement of Assets and Liabilities | 65 |

| | |

| Statement of Operations | 67 |

| | |

| Statement of Changes in Net Assets | 69 |

| | |

| Statement of Cash Flows | 72 |

| | |

| Financial Highlights | 74 |

| | |

| Notes to Financial Statements | 84 |

| | |

| Annual Investment Management Agreement Approval Process | 96 |

| | |

| Reinvest Automatically, Easily and Conveniently | 106 |

| | |

| Glossary of Terms Used in this Report | 108 |

| | |

| Additional Fund Information | 111 |

Chairman’s

Letter to Shareholders

Dear Shareholders,

Investors have many reasons to remain cautious. The challenges in the Euro area are casting a shadow over global economies and financial markets. The political support for addressing fiscal issues is eroding as the economic and social impacts become more visible. At the same time, member nations appear unwilling to provide adequate financial support or to surrender sufficient sovereignty to strengthen the banks or unify the Euro area financial system. The gains made in reducing deficits, and the hard-won progress on winning popular acceptance of the need for economic austerity, are at risk. To their credit, European political leaders press on to find compromise solutions, but there is increasing concern that time will begin to run out.

In the U.S., strong corporate earnings have enabled the equity markets to withstand much of the downward pressures coming from weakening job creation, slower economic growth and political uncertainty. The Fed remains committed to low interest rates and announced on September 13, 2012 (after the close of this reporting period) another program of quantitative easing (QE3) to continue until mid-2015. Pre-election maneuvering has added to the already highly partisan atmosphere in Congress. The end of the Bush-era tax cuts and implementation of the spending restrictions of the Budget Control Act of 2011, both scheduled to take place at year-end, loom closer.

During the last year, U.S. based investors have experienced a sharp decline and a strong recovery in the equity markets. The experienced investment teams at Nuveen keep their eye on a longer time horizon and use their practiced investment disciplines to negotiate through market peaks and valleys to achieve long-term goals for investors. Experienced professionals pursue investments that will weather short-term volatility and at the same time, seek opportunities that are created by markets that overreact to negative developments. Monitoring this process is an important consideration for the Fund Board as it oversees your Nuveen Fund on your behalf.

As always, I encourage you to contact your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

October 22, 2012

Portfolio Manager’s Comments

Nuveen California Municipal Value Fund, Inc. (NCA)

Nuveen California Municipal Value Fund 2 (NCB)

Nuveen California Performance Plus Municipal Fund, Inc. (NCP)

Nuveen California Municipal Market Opportunity Fund, Inc. (NCO)

Nuveen California Investment Quality Municipal Fund, Inc. (NQC)

Nuveen California Select Quality Municipal Fund, Inc. (NVC)

Nuveen California Quality Income Municipal Fund, Inc. (NUC)

Portfolio manager Scott Romans examines key investment strategies and the six-month performance of the Nuveen California Municipal Funds. Scott, who joined Nuveen in 2000, has managed NCA, NCP, NCO, NQC, NVC and NUC since 2003. He added portfolio management responsibility for NCB at its inception in 2009.

What key strategies were used to manage these California Funds during the six-month reporting period ended August 31, 2012?

During this reporting period, municipal bond prices generally rallied, as strong demand and tight supply combined to create favorable market conditions for municipal bonds. Although the availability of tax-exempt supply improved over that of the same six-month period a year earlier, the pattern of new issuance remained light compared with long-term historical trends. This supply/demand dynamic served as a key driver of performance. Concurrent with rising prices, yields continued to decline across most maturities, especially at the longer end of the municipal yield curve, and the yield curve flattened. During this period, we saw an increasing number of borrowers come to market seeking to take advantage of the low rate environment, with approximately 60% of new municipal paper issued by borrowers that were calling existing debt and refinancing at lower rates.

In this environment, we continued to take a bottom-up approach to discovering sectors that appeared undervalued as well as individual credits that had the potential to perform well over the long term and helped us keep the Funds fully invested. During this period, the Funds found value in several areas of the market, including health care. The Funds also took advantage of opportunities to move out of local general obligation (GO) bonds and into state GOs and, more broadly speaking, away from GO bonds in general and into revenue bonds. These moves were intended to reduce the Funds’ exposure to some of the fiscal problems faced by local governments in California, including local real estate valuations and Proposition 13’s constraints on property taxes, as well as pension issues. One example of revenue credits that we purchased during

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

this period were water bonds issued by the San Francisco Public Utilities Commission for water service to the city and Bay Area.

We also continued to add exposure to redevelopment agency (RDA) bonds in the secondary market. Because of recent changes to the RDA program, we remained very selective in our purchases in this area, evaluating issuers on a case by case basis. (In 2011, as part of cost saving measures to close gaps in the California state budget, all 400 RDAs in the state were ordered to dissolve by February 1, 2012, and successor agencies and oversight boards were created to manage obligations that were in place prior to the dissolution and take title to the RDAs’ housing and other assets.) In addition to finding opportunities in specific sectors, we also focused on taking advantage of short-term market opportunities created by supply/demand dynamics in the municipal market during this period. While demand for tax exempt paper remained consistently strong throughout the period, supply fluctuated widely. We found that periods of substantial supply provided good short term buying opportunities not only because of the increased number of issues available but also because some investors became more hesitant in their buying as supply grew, causing spreads to widen temporarily.

In general during this period, we focused on bonds with longer maturities. This enabled us to take advantage of attractive yields at the longer end of the municipal yield curve and also provided some protection for the Funds’ duration and yield curve positioning. We also purchased lower rated bonds when we found attractive opportunities, as we believed these bonds continued to offer relative value.

Cash for new purchases during this period was generated primarily by the proceeds from a meaningful number of bond calls resulting from the increase in refinancings. During this period, we worked to redeploy these proceeds as well as those from maturing bonds to keep the Funds as fully invested as possible. In addition, as discussed above, the Funds sold some local GOs and appropriation bonds and reinvested the proceeds in state GOs. Overall, selling was minimal because the bonds in our portfolios generally embedded higher yields than those on bonds available in the current marketplace.

As of August 31, 2012, all of these Funds continued to use inverse floating rate securities. We employ inverse floaters for a variety of reasons, including duration management, income enhancement and total return enhancement. As part of our duration management strategies, NCB also used forward interest rate swaps to reduce price volatility risk to movements in U.S. interest rates relative to the Fund’s benchmarks. During this period, these derivatives functioned as intended. At period end, we continued to use forward interest rate swaps in NCB to reduce duration.

How did the Funds perform?

Individual results for these Nuveen Funds, as well as relevant index and peer group information, are presented in the accompanying table.

Average Annual Total Returns on Common Share Net Asset Value*

For periods ended 8/31/12

| Fund | 6-Month | 1-Year | 5-Year | 10-Year |

| NCA** | 4.85% | 12.81% | 6.20% | 5.32% |

| NCB ** | 5.51% | 15.16% | N/A | N/A |

| NCP | 5.66% | 18.26% | 7.81% | 6.51% |

| NCO | 6.44% | 21.35% | 8.08% | 6.71% |

| NQC | 7.21% | 19.47% | 8.13% | 6.48% |

| NVC | 7.21% | 21.55% | 8.95% | 7.12% |

| NUC | 6.33% | 18.80% | 8.66% | 6.94% |

| | | | | |

| S&P California Municipal Bond Index*** | 3.55% | 10.79% | 6.12% | 5.35% |

| S&P Municipal Bond Index*** | 3.24% | 9.35% | 6.00% | 5.28% |

| Lipper California Municipal Debt Funds Classification Average*** | 6.38% | 19.48% | 6.76% | 6.14% |

For the six months ended August 31, 2012, the cumulative returns on common share net asset value (NAV) for all of these California Funds exceeded the returns on the S&P California Municipal Bond Index and the S&P Municipal Bond Index. For the same period, NCO, NQC and NVC outperformed the average return on the Lipper California Municipal Debt Funds Classification Average, NUC performed in line with this Lipper classification, and NCA, NCB and NCP lagged the Lipper average.

Key management factors that influenced the Funds’ returns during this period included duration and yield curve positioning, credit exposure and sector allocation. In addition, the use of regulatory leverage was an important positive factor in performance during this period. The primary reason that the returns of NCA and NCB trailed those of the other five Funds for this six-month period was that these two Funds do not use regulatory leverage. Leverage is discussed in more detail later in this report.

In an environment of declining rates and flattening yield curve, municipal bonds with longer maturities generally outperformed those with shorter maturities during this period. Overall, credits at the longest end of the municipal yield curve posted the strongest returns, while bonds at the shortest end produced the weakest results. Among these Funds, NVC and NQC were the most advantageously positioned in terms of duration and yield curve, with overweights in the outperforming longer part of the yield curve and underexposure to the shorter end of the curve that produced weaker returns. Overall, duration and yield curve positioning was generally a positive contributor to the performance of these Funds, although the net impact varied depending upon each Fund’s individual weightings along the yield curve. The performance of NCP, for example, was impacted by its shorter positioning relative to the other Funds in

| | Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. |

| | |

| | For additional information, see the Performance Overview for your Fund in this report. |

| | |

| * | Six-month returns are cumulative; all other returns are annualized. |

| | |

| ** | NCA and NCB do not use regulatory leverage. |

| | |

| *** | Refer to Glossary of Terms Used in this Report for definitions. Indexes and Lipper averages are not available for direct investment. |

this report. In addition, NCA, NCO, NQC and NVC benefited from their overweightings in zero coupon bonds, which generally outperformed the market during this period due to their longer durations. NCB, NCP and NUC were underweighted in these bonds.

Credit exposure was another important factor in the Funds’ performance during these six months, as lower quality bonds generally outperformed higher quality bonds. This outperformance was due in part to the greater demand for lower rated bonds as investors looked for investment vehicles offering higher yields. As investors became more comfortable taking on additional investment risk, credit spreads or the difference in yield spreads between U.S. Treasury securities and comparable investments such as municipal bonds, narrowed through a variety of rating categories. As a result of this spread compression, the Funds generally benefited from their holdings of lower rated credits. NCB’s credit profile, which included a heavy weighting in bonds rated BBB and the smallest allocation of AAA bonds among these Funds, enabled this Fund to outperform NCA, the other unleveraged Fund, which (together with NUC) had the largest allocations of AAA bonds.

During this period, revenue bonds as a whole outperformed the general municipal market. Holdings that generally made positive contributions to the Funds’ returns included health care (together with hospitals), education, housing, transportation (including toll roads), redevelopment agencies (RDA) and tax increment financing (TIF) district credits. NVC and NQC, in particular, had strong contributions from their overweightings in toll roads and TIF districts. In addition, all of these Funds, especially NCB, benefited from good weightings in the health care sector. Tobacco credits backed by the 1998 master tobacco settlement agreement also performed very well, as these bonds benefited from several market developments, including increased demand for higher yielding investments by investors who had become less risk-averse. In addition, based on recent data showing that cigarette sales had fallen less steeply than anticipated, the 46 states participating in the agreement, including California, stand to receive increased payments from the tobacco companies. As of August 31, 2012, these Funds held tobacco credits, which benefited their performance as tobacco bonds rallied.

In contrast, pre-refunded bonds, which are often backed by U.S. Treasury securities, were the poorest performing market segment during this period. The underperformance of these bonds can be attributed primarily to their shorter effective maturities and higher credit quality. As of August 31, 2012, NUC and NCA had the largest allocations of these bonds, which detracted from their performance, while NCB, NQC and NVC held the fewest pre-refunded bonds. General obligation (GO) bonds and utilities credits also lagged the performance of the general municipal market for this period.

Fund Leverage and

Other Information

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the return of the Funds relative to their benchmarks was the Funds’ use of leverage. As mentioned previously, NCA and NCB do not use regulatory leverage. The Funds use leverage because their managers believe that, over time, leveraging provides opportunities for additional income and total return for common shareholders. However, use of leverage also can expose common shareholders to additional volatility. For example, as the prices of securities held by a Fund decline, the negative impact of these valuation changes on common share net asset value and common shareholder total return is magnified by the use of leverage. Conversely, leverage may enhance common share returns during periods when the prices of securities held by a Fund generally are rising. Leverage had a positive impact on the performance of the Funds over this reporting period.

THE FUND’S REGULATORY LEVERAGE

As of August 31, 2012, the following Funds have issued and outstanding Variable Rate Demand Preferred (VRDP) Shares as shown in the accompanying table. As mentioned previously, NCA and NCB do not use regulatory leverage.

VRDP Shares

| | VRDP Shares Issued |

| Fund | at Liquidation Value |

| NCP | $ | 81,000,000 |

| NCO | $ | 49,800,000 |

| NQC | $ | 95,600,000 |

| NVC | $ | 158,900,000 |

| NUC | $ | 158,100,000 |

(Refer to Notes to Financial Statements, Footnote 1 – General Information and Significant Accounting Policies for further details on VRDP Shares.)

RISK CONSIDERATIONS

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. Past performance is no guarantee of future results. Fund common shares are subject to a variety of risks, including:

Investment and Market Risk. An investment in common shares is subject to investment risk, including the possible loss of the entire principal amount that you invest. Your investment in common shares represents an indirect investment in the municipal securities owned by the Fund, which generally trade in the over-the-counter markets. Your

common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Price Risk. Shares of closed-end investment companies like these Funds frequently trade at a discount to their NAV. Your common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Leverage Risk. Each Fund’s use of leverage creates the possibility of higher volatility for the Fund’s per share NAV, market price, distributions and returns. There is no assurance that a Fund’s leveraging strategy will be successful.

Tax Risk. The tax treatment of Fund distributions may be affected by new IRS interpretations of the Internal Revenue Code and future changes in tax laws and regulations.

Issuer Credit Risk. This is the risk that a security in a Fund’s portfolio will fail to make dividend or interest payments when due.

Interest Rate Risk. Fixed-income securities such as bonds, preferred, convertible and other debt securities will decline in value if market interest rates rise.

Reinvestment Risk. If market interest rates decline, income earned from a Fund’s portfolio may be reinvested at rates below that of the original bond that generated the income.

Call Risk or Prepayment Risk. Issuers may exercise their option to prepay principal earlier than scheduled, forcing a Fund to reinvest in lower-yielding securities.

Inverse Floater Risk. The Funds invest in inverse floaters. Due to their leveraged nature, these investments can greatly increase a Fund’s exposure to interest rate risk and credit risk. In addition, investments in inverse floaters involve the risk that the Fund could lose more than its original principal investment.

Common Share Dividend

and Price Information

DIVIDEND INFORMATION

During the six-month reporting period ended August 31, 2012, the dividends of all of the Fund’s in this report remained stable.

All of the Funds in this report seek to pay stable dividends at rates that reflect each Fund’s past results and projected future performance. During certain periods, each Fund may pay dividends at a rate that may be more or less than the amount of net investment income actually earned by the Fund during the period. If a Fund has cumulatively earned more than it has paid in dividends, it holds the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s NAV. Conversely, if a Fund has cumulatively paid dividends in excess of its earnings, the excess constitutes negative UNII that is likewise reflected in the Fund’s NAV. Each Fund will, over time, pay all of its net investment income as dividends to shareholders. As of August 31, 2012, all of the Funds in this report had positive UNII balances, based upon our best estimate, for tax purposes and positive UNII balances for financial reporting purposes.

COMMON SHARE REPURCHASES AND PRICE INFORMATION

As of August 31, 2012, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their common shares as shown in the accompanying table. Since the inception of the Funds’ repurchase programs, NCA, NCB and NQC have not repurchased any of their outstanding common shares.

| | Common Shares | % of Outstanding |

| Funds | Repurchased and Retired | Common Shares |

| NCA | — | — |

| NCB | — | — |

| NCP | 28,300 | 0.2% |

| NCO | 24,900 | 0.3% |

| NQC | — | — |

| NVC | 41,400 | 0.2% |

| NUC | 40,000 | 0.2% |

During the six-month reporting period, the Funds did not repurchase any of their outstanding common shares.

As of August 31, 2012, and during the current reporting period, the Funds’ common share prices were trading at (+) premiums and/or (-) discounts to their common share NAVs as shown in the accompanying table.

| | 8/31/12 | Six-Month Average |

| Fund | (+) Premium/(-) Discount | (+) Premium/(-) Discount |

| NCA | (-)0.77% | (-)0.02% |

| NCB | (-)4.31% | (-)3.12% |

| NCP | (+)1.14% | (+)0.41% |

| NCO | (-)0.50% | (+)0.43% |

| NQC | (+)1.20% | (+)1.44% |

| NVC | (+)3.19% | (+)1.72% |

| NUC | (+)3.35% | (+)2.40% |

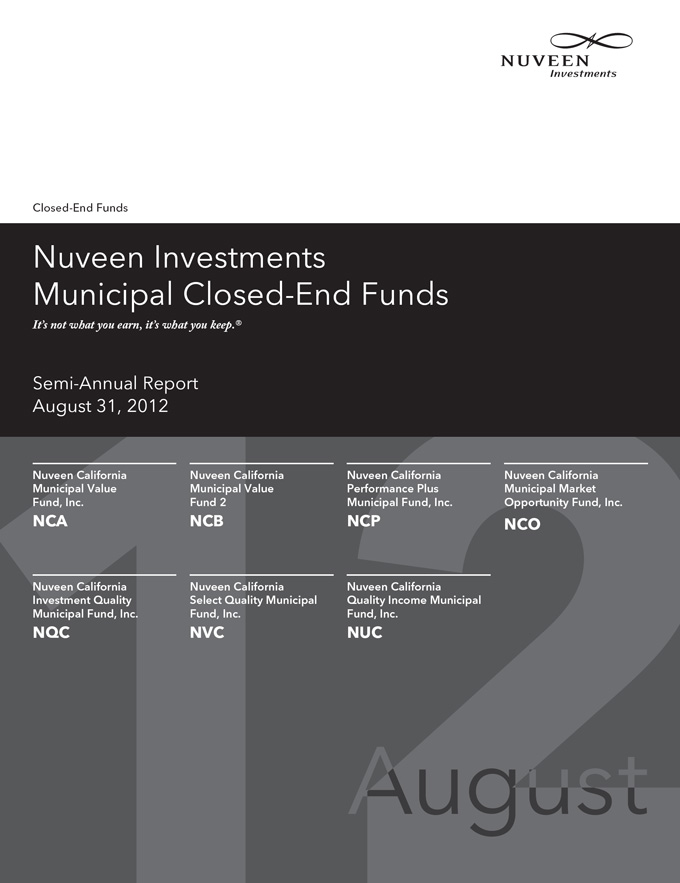

| NCA | | Nuveen California |

| Performance | | Municipal Value |

| OVERVIEW | | Fund, Inc. |

| | | as of August 31, 2012 |

| | | | | |

| Fund Snapshot | | | | |

| Common Share Price | | $ | 10.25 | |

Common Share Net Asset Value (NAV) | | $ | 10.33 | |

| Premium/(Discount) to NAV | | | -0.77 | % |

| Market Yield | | | 4.57 | % |

Taxable-Equivalent Yield1 | | | 7.00 | % |

Net Assets Applicable to Common Shares ($000) | | $ | 261,050 | |

| Leverage | | | | |

| Regulatory Leverage | | | N/A | |

| Effective Leverage | | | 1.69 | % |

| Average Annual Total Returns | | | | | | | |

| (Inception 10/07/87) | | | | | | | |

| | | On Share Price | | On NAV |

| 6-Month (Cumulative) | | | 3.54 | % | | 4.85 | % |

| 1-Year | | | 21.44 | % | | 12.81 | % |

| 5-Year | | | 6.72 | % | | 6.20 | % |

| 10-Year | | | 5.82 | % | | 5.32 | % |

Portfolio Composition3 | | | | |

| (as a % of total investments) | | | | |

| Tax Obligation/Limited | | | 20.5 | % |

| Tax Obligation/General | | | 17.9 | % |

| U.S. Guaranteed | | | 15.7 | % |

| Health Care | | | 15.3 | % |

| Utilities | | | 7.6 | % |

| Water and Sewer | | | 7.1 | % |

| Consumer Staples | | | 4.2 | % |

| Other | | | 11.7 | % |

| | Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund’s Performance Overview page. |

| 1 | Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a combined federal and state income tax rate of 34.7%. When comparing this Fund to investments that generate qualified dividend income, the Taxable-Equivalent Yield is lower. |

| 2 | Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies. |

| 3 | Holdings are subject to change. |

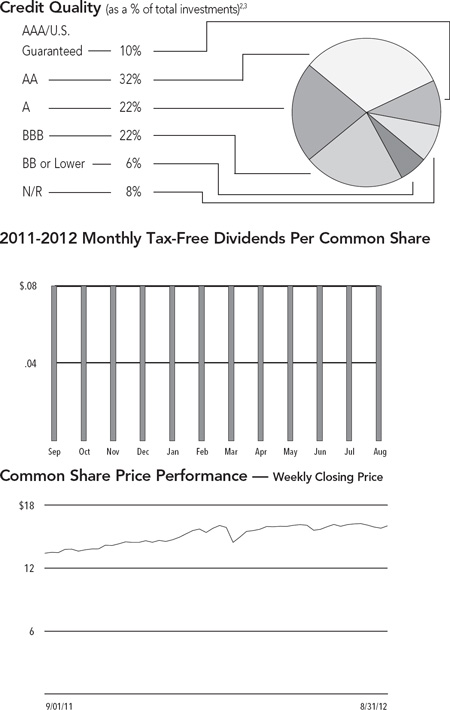

| NCB | | Nuveen California |

| Performance | | Municipal Value |

| OVERVIEW | | Fund 2 |

| | | as of August 31, 2012 |

| | | | | |

| Fund Snapshot | | | | |

| Common Share Price | | $ | 16.43 | |

| Common Share Net Asset Value (NAV) | | $ | 17.17 | |

| Premium/(Discount) to NAV | | | -4.31 | % |

| Market Yield | | | 4.86 | % |

Taxable-Equivalent Yield1 | | | 7.44 | % |

| Net Assets Applicable to Common Shares ($000) | | $ | 56,442 | |

| | | | | |

| Leverage | | | | |

| Regulatory Leverage | | | N/A | |

| Effective Leverage | | | 9.59 | % |

| Average Annual Total Returns | | | | | | | |

| (Inception 4/28/09) | | | | | | | |

| | | On Share Price | | On NAV |

| 6-Month (Cumulative) | | | 3.08 | % | | 5.51 | % |

| 1-Year | | | 20.16 | % | | 15.16 | % |

| Since Inception | | | 8.43 | % | | 11.07 | % |

Portfolio Composition3,5 | | | | |

| (as a % of total investments) | | | | |

| Health Care | | | 23.8 | % |

| Tax Obligation/Limited | | | 18.6 | % |

| Utilities | | | 14.1 | % |

| Tax Obligation/General | | | 9.2 | % |

| Water and Sewer | | | 8.1 | % |

| Education and Civic Organizations | | | 7.4 | % |

| Housing/Single Family | | | 6.6 | % |

| Consumer Staples | | | 5.1 | % |

| Other | | | 7.1 | % |

| | Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund’s Performance Overview page. |

| 1 | Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a combined federal and state income tax rate of 34.7%. When comparing this Fund to investments that generate qualified dividend income, the Taxable-Equivalent Yield is lower. |

| 2 | Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies. |

| 3 | Holdings are subject to change. |

| 4 | The Fund paid shareholders a capital gains distribution in December 2011 of $0.0234 per share. |

| 5 | Excluding investments in derivatives. |

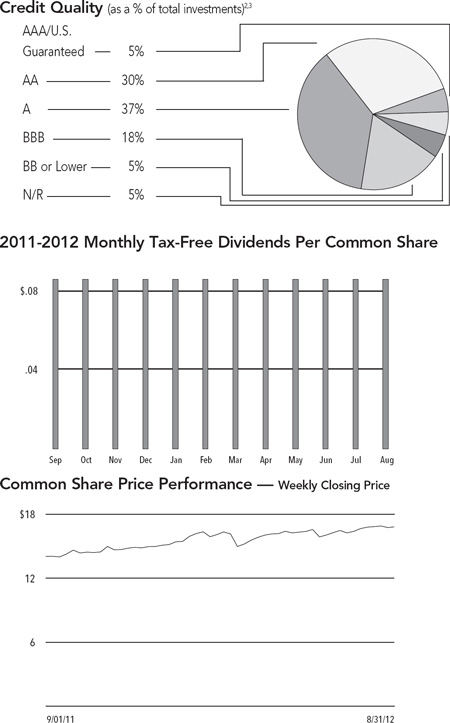

| NCP | | Nuveen California |

| Performance | | Performance Plus |

| OVERVIEW | | Municipal Fund, Inc. |

| | | as of August 31, 2012 |

| | | | | |

| Fund Snapshot | | | | |

| Common Share Price | | $ | 15.96 | |

| Common Share Net Asset Value (NAV) | | $ | 15.78 | |

| Premium/(Discount) to NAV | | | 1.14 | % |

| Market Yield | | | 6.13 | % |

Taxable-Equivalent Yield1 | | | 9.39 | % |

| Net Assets Applicable to Common Shares ($000) | | $ | 204,792 | |

| | | | | |

| Leverage | | | | |

| Regulatory Leverage | | | 28.34 | % |

| Effective Leverage | | | 34.75 | % |

| Average Annual Total Returns | | | | | | | |

| (Inception 11/15/89) | | | | | | | |

| | | On Share Price | | On NAV |

| 6-Month (Cumulative) | | | 4.62 | % | | 5.66 | % |

| 1-Year | | | 26.96 | % | | 18.26 | % |

| 5-Year | | | 9.66 | % | | 7.81 | % |

| 10-Year | | | 7.33 | % | | 6.51 | % |

Portfolio Composition3 | | | | |

| (as a % of total investments) | | | | |

| Tax Obligation/Limited | | | 29.4 | % |

| Health Care | | | 17.6 | % |

| Tax Obligation/General | | | 16.5 | % |

| U.S Guaranteed | | | 10.2 | % |

| Utilities | | | 6.8 | % |

| Water and Sewer | | | 4.5 | % |

| Consumer Staples | | | 4.4 | % |

| Other | | | 10.6 | % |

| | Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund’s Performance Overview page. |

| 1 | Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a combined federal and state income tax rate of 34.7%. When comparing this Fund to investments that generate qualified dividend income, the Taxable-Equivalent Yield is lower. |

| 2 | Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies. |

| 3 | Holdings are subject to change. |

| NCO | | Nuveen California |

| Performance | | Municipal Market |

| OVERVIEW | | Opportunity Fund, Inc. |

| | | as of August 31, 2012 |

| | | | | |

| Fund Snapshot | | | | |

| Common Share Price | | $ | 16.04 | |

| Common Share Net Asset Value (NAV) | | $ | 16.12 | |

| Premium/(Discount) to NAV | | | -0.50 | % |

| Market Yield | | | 5.99 | % |

Taxable-Equivalent Yield1 | | | 9.17 | % |

| Net Assets Applicable to Common Shares ($000) | | $ | 131,476 | |

| | | | | |

| Leverage | | | | |

| Regulatory Leverage | | | 27.47 | % |

| Effective Leverage | | | 34.78 | % |

| Average Annual Total Returns | | | | | | | |

| (Inception 5/17/90) | | | | | | | |

| | | On Share Price | | On NAV |

| 6-Month (Cumulative) | | | 4.44 | % | | 6.44 | % |

| 1-Year | | | 28.16 | % | | 21.35 | % |

| 5-Year | | | 9.27 | % | | 8.08 | % |

| 10-Year | | | 7.06 | % | | 6.71 | % |

Portfolio Composition3 | | | | |

| (as a % of total investments) | | | | |

| Tax Obligation/Limited | | | 21.4 | % |

| Tax Obligation/General | | | 19.4 | % |

| Health Care | | | 19.2 | % |

| Water and Sewer | | | 12.0 | % |

| U.S. Guaranteed | | | 6.6 | % |

| Consumer Staples | | | 5.0 | % |

| Transportation | | | 4.7 | % |

| Other | | | 11.7 | % |

| | Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund’s Performance Overview page. |

| 1 | Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a combined federal and state income tax rate of 34.7%. When comparing this Fund to investments that generate qualified dividend income, the Taxable-Equivalent Yield is lower. |

| 2 | Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies. |

| 3 | Holdings are subject to change. |

| NQC | | Nuveen California |

| Performance | | Investment Quality |

| OVERVIEW | | Municipal Fund, Inc. |

| | | as of August 31, 2012 |

| | | | | |

| Fund Snapshot | | | | |

| Common Share Price | | $ | 16.07 | |

| Common Share Net Asset Value (NAV) | | $ | 15.88 | |

| Premium/(Discount) to NAV | | | 1.20 | % |

| Market Yield | | | 6.20 | % |

Taxable-Equivalent Yield1 | | | 9.49 | % |

| Net Assets Applicable to Common Shares ($000) | | $ | 216,250 | |

| | | | | |

| Leverage | | | | |

| Regulatory Leverage | | | 30.66 | % |

| Effective Leverage | | | 34.80 | % |

| | | | | | | | |

| Average Annual Total Returns | | | | | | | |

| (Inception 11/20/90) | | | | | | | |

| | | On Share Price | | On NAV |

| 6-Month (Cumulative) | | | 4.66 | % | | 7.21 | % |

| 1-Year | | | 27.48 | % | | 19.47 | % |

| 5-Year | | | 10.53 | % | | 8.13 | % |

| 10-Year | | | 7.20 | % | | 6.48 | % |

Portfolio Composition3 | | | | |

| (as a % of total investments) | | | | |

| Tax Obligation/Limited | | | 27.1 | % |

| Tax Obligation/General | | | 20.7 | % |

| Health Care | | | 16.1 | % |

| Education and Civic Organizations | | | 8.6 | % |

| Transportation | | | 7.6 | % |

| Water and Sewer | | | 7.3 | % |

| Other | | | 12.6 | % |

| | Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund’s Performance Overview page. |

| 1 | Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a combined federal and state income tax rate of 34.7%. When comparing this Fund to investments that generate qualified dividend income, the Taxable-Equivalent Yield is lower. |

| 2 | Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies. |

| 3 | Holdings are subject to change. |

| NVC | | Nuveen California |

| Performance | | Select Quality |

| OVERVIEW | | Municipal Fund, Inc. |

| | | as of August 31, 2012 |

| | | | | |

| Fund Snapshot | | | | |

| Common Share Price | | $ | 16.82 | |

| Common Share Net Asset Value (NAV) | | $ | 16.30 | |

| Premium/(Discount) to NAV | | | 3.19 | % |

| Market Yield | | | 6.14 | % |

Taxable-Equivalent Yield1 | | | 9.40 | % |

| Net Assets Applicable to Common Shares ($000) | | $ | 378,435 | |

| | | | | |

| Leverage | | | | |

| Regulatory Leverage | | | 29.57 | % |

| Effective Leverage | | | 35.92 | % |

| Average Annual Total Returns | | | | | | | |

| (Inception 5/22/91) | | | | | | | |

| | | On Share Price | | On NAV |

| 6-Month (Cumulative) | | | 6.02 | % | | 7.21 | % |

| 1-Year | | | 29.40 | % | | 21.55 | % |

| 5-Year | | | 11.26 | % | | 8.95 | % |

| 10-Year | | | 7.81 | % | | 7.12 | % |

Portfolio Composition3 | | | | |

| (as a % of total investments) | | | | |

| Tax Obligation/General | | | 24.5 | % |

| Tax Obligation/Limited | | | 21.1 | % |

| Health Care | | | 20.4 | % |

| Water and Sewer | | | 7.6 | % |

| Utilities | | | 6.3 | % |

| Consumer Staples | | | 5.2 | % |

| Other | | | 14.9 | % |

| | Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund’s Performance Overview page. |

| 1 | Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a combined federal and state income tax rate of 34.7%. When comparing this Fund to investments that generate qualified dividend income, the Taxable-Equivalent Yield is lower. |

| 2 | Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies. |

| 3 | Holdings are subject to change. |

| NUC | | Nuveen California |

| Performance | | Quality Income |

| OVERVIEW | | Municipal Fund, Inc. |

| | | as of August 31, 2012 |

| | | | | |

| Fund Snapshot | | | | |

| Common Share Price | | $ | 16.97 | |

| Common Share Net Asset Value (NAV) | | $ | 16.42 | |

| Premium/(Discount) to NAV | | | 3.35 | % |

| Market Yield | | | 6.19 | % |

Taxable-Equivalent Yield1 | | | 9.48 | % |

| Net Assets Applicable to Common Shares ($000) | | $ | 326,443 | |

| | | | | |

| Leverage | | | | |

| Regulatory Leverage | | | 30.37 | % |

| Effective Leverage | | | 37.23 | % |

| Average Annual Total Returns | | | | | | | |

| (Inception 11/20/91) | | | | | | | |

| | | On Share Price | | On NAV |

| 6-Month (Cumulative) | | | 4.07 | % | | 6.33 | % |

| 1-Year | | | 25.48 | % | | 18.80 | % |

| 5-Year | | | 11.10 | % | | 8.66 | % |

| 10-Year | | | 7.35 | % | | 6.94 | % |

Portfolio Composition3 | | | | |

| (as a % of total investments) | | | | |

| Tax Obligation/Limited | | | 22.2 | % |

| Health Care | | | 21.1 | % |

| U.S. Guaranteed | | | 15.8 | % |

| Tax Obligation/General | | | 15.4 | % |

| Water and Sewer | | | 5.8 | % |

| Education and Civic Organizations | | | 5.2 | % |

| Other | | | 14.5 | % |

| | Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund’s Performance Overview page. |

| 1 | Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a combined federal and state income tax rate of 34.7%. When comparing this Fund to investments that generate qualified dividend income, the Taxable-Equivalent Yield is lower. |

| 2 | Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies. |

| 3 | Holdings are subject to change. |

| | | Nuveen California Municipal Value Fund, Inc. |

| NCA | | Portfolio of Investments |

| | | August 31, 2012 (Unaudited) |

| | Principal | | | Optional Call | | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | | Ratings (3) | | | Value | |

| | | | Consumer Staples – 4.2% (4.2% of Total Investments) | | | | | | | |

| $ | 385 | | California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Sonoma County Tobacco Securitization Corporation, Series 2005, 4.250%, 6/01/21 | 6/15 at 100.00 | | BB+ | | $ | 374,682 | |

| | | | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Series 2007A-1: | | | | | | | |

| | 5,940 | | 5.750%, 6/01/47 | 6/17 at 100.00 | | BB– | | | 5,058,682 | |

| | 3,500 | | 5.125%, 6/01/47 | 6/17 at 100.00 | | BB– | | | 2,699,340 | |

| | 3,570 | | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Series 2007A-2, 0.000%, 6/01/37 | 6/22 at 100.00 | | BB– | | | 2,835,758 | |

| | 13,395 | | Total Consumer Staples | | | | | | 10,968,462 | |

| | | | Education and Civic Organizations – 1.1% (1.0% of Total Investments) | | | | | | | |

| | 140 | | California Educational Facilities Authority, Revenue Bonds, University of Redlands, Series 2005A, 5.000%, 10/01/35 | 10/15 at 100.00 | | A3 | | | 146,188 | |

| | | | California Educational Facilities Authority, Revenue Bonds, University of the Pacific, Series 2006: | | | | | | | |

| | 95 | | 5.000%, 11/01/21 | 11/15 at 100.00 | | A2 | | | 102,625 | |

| | 125 | | 5.000%, 11/01/25 | 11/15 at 100.00 | | A2 | | | 133,203 | |

| | 700 | | California Statewide Communities Development Authority, School Facility Revenue Bonds, Alliance College-Ready Public Schools, Series 2011A, 7.000%, 7/01/46 | 7/21 at 100.00 | | BBB | | | 769,020 | |

| | 1,500 | | California Statewide Community Development Authority, Certificates of Participation, San Diego Space and Science Foundation, Series 1996, 7.500%, 12/01/26 | 6/12 at 100.00 | | N/R | | | 1,598,310 | |

| | 2,560 | | Total Education and Civic Organizations | | | | | | 2,749,346 | |

| | | | Health Care – 15.3% (15.3% of Total Investments) | | | | | | | |

| | | | California Health Facilities Financing Authority, Revenue Bonds, Rady Children’s Hospital – San Diego, Series 2011: | | | | | | | |

| | 560 | | 5.000%, 8/15/31 | 8/21 at 100.00 | | A+ | | | 608,160 | |

| | 670 | | 5.250%, 8/15/41 | 8/21 at 100.00 | | A+ | | | 724,907 | |

| | 5,365 | | California Health Facilities Financing Authority, Revenue Bonds, Sutter Health, Series 2007A, 5.250%, 11/15/46 (UB) | 11/16 at 100.00 | | AA– | | | 5,686,042 | |

| | 1,000 | | California Health Facilities Financing Authority, Revenue Bonds, Sutter Health, Series 2011B, 6.000%, 8/15/42 | 8/20 at 100.00 | | AA– | | | 1,200,330 | |

| | 3,870 | | California Municipal Financing Authority, Certificates of Participation, Community Hospitals of Central California, Series 2007, 5.250%, 2/01/27 | 2/17 at 100.00 | | BBB | | | 4,040,667 | |

| | 560 | | California Statewide Communities Development Authority, Revenue Bonds, Adventist Health System West, Series 2005A, 5.000%, 3/01/35 | 3/15 at 100.00 | | A | | | 579,466 | |

| | 1,000 | | California Statewide Communities Development Authority, Revenue Bonds, ValleyCare Health System, Series 2007A, 5.125%, 7/15/31 | 7/17 at 100.00 | | N/R | | | 1,029,580 | |

| | 3,000 | | California Statewide Community Development Authority, Insured Health Facility Revenue Bonds, Catholic Healthcare West, Series 2008K, 5.500%, 7/01/41 – AGC Insured | 7/17 at 100.00 | | AA– | | | 3,251,340 | |

| | 1,460 | | California Statewide Community Development Authority, Revenue Bonds, Kaiser Permanente System, Series 2001C, 5.250%, 8/01/31 | 8/16 at 100.00 | | A+ | | | 1,634,718 | |

| | 2,710 | | California Statewide Community Development Authority, Revenue Bonds, Sherman Oaks Health System, Series 1998A, 5.000%, 8/01/22 – AMBAC Insured | No Opt. Call | | A1 | | | 3,001,569 | |

| | 1,890 | | California Statewide Community Development Authority, Revenue Bonds, Sutter Health, Series 2005A, 5.000%, 11/15/43 | 11/15 at 100.00 | | AA– | | | 2,006,178 | |

| | 1,615 | | Loma Linda, California, Hospital Revenue Bonds, Loma Linda University Medical Center, Series 2005A, 5.000%, 12/01/22 | 12/15 at 100.00 | | BBB | | | 1,645,120 | |

| | 1,525 | | Loma Linda, California, Hospital Revenue Bonds, Loma Linda University Medical Center, Series 2008A, 8.250%, 12/01/38 | 12/17 at 100.00 | | BBB | | | 1,785,318 | |

| | 2,940 | | Palomar Pomerado Health Care District, California, Certificates of Participation, Series 2009, 6.750%, 11/01/39 | 11/19 at 100.00 | | Baa3 | | | 3,307,647 | |

| | Principal | | | Optional Call | | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | | Ratings (3) | | | Value | |

| | | | Health Care (continued) | | | | | | | |

| $ | 2,900 | | Palomar Pomerado Health Care District, California, Certificates of Participation, Series 2010, 6.000%, 11/01/41 | 11/20 at 100.00 | | Baa3 | | $ | 3,111,352 | |

| | 1,750 | | San Buenaventura, California, Revenue Bonds, Community Memorial Health System, Series 2011, 7.500%, 12/01/41 | 12/21 at 100.00 | | BB | | | 2,125,725 | |

| | 3,000 | | Santa Clara County Financing Authority, California, Insured Revenue Bonds, El Camino Hospital, Series 2007A, 5.750%, 2/01/41 – AMBAC Insured | 8/17 at 100.00 | | A+ | | | 3,257,910 | |

| | 1,000 | | Sierra View Local Health Care District, California, Revenue Bonds, Series 2007, 5.250%, 7/01/37 | 9/17 at 100.00 | | A | | | 1,033,730 | |

| | 36,815 | | Total Health Care | | | | | | 40,029,759 | |

| | | | Housing/Multifamily – 2.3% (2.2% of Total Investments) | | | | | | | |

| | 1,035 | | California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas Projects Series 2010A, 6.400%, 8/15/45 | 8/20 at 100.00 | | BBB | | | 1,133,242 | |

| | 1,060 | | California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas Projects Series 2012A, 5.500%, 8/15/47 | 8/22 at 100.00 | | BBB | | | 1,115,586 | |

| | 2,370 | | California Statewide Community Development Authority, Multifamily Housing Revenue Bonds, Harbor City Lights, Series 1999Y, 6.650%, 7/01/39 (Alternative Minimum Tax) | 1/13 at 100.00 | | N/R | | | 2,370,521 | |

| | 1,265 | | San Dimas Housing Authority, California, Mobile Home Park Revenue Bonds, Charter Oak Mobile Home Estates Acquisition Project, Series 1998A, 5.700%, 7/01/28 | 1/13 at 100.00 | | N/R | | | 1,265,848 | |

| | 5,730 | | Total Housing/Multifamily | | | | | | 5,885,197 | |

| | | | Housing/Single Family – 0.9% (0.9% of Total Investments) | | | | | | | |

| | 2,125 | | California Department of Veteran Affairs, Home Purchase Revenue Bonds, Series 2007, 5.000%, 12/01/42 (Alternative Minimum Tax) | 12/16 at 100.00 | | AA | | | 2,180,824 | |

| | 145 | | California Housing Finance Agency, Home Mortgage Revenue Bonds, Series 2006H, 5.750%, 8/01/30 – FGIC Insured (Alternative Minimum Tax) | 2/16 at 100.00 | | BBB | | | 151,351 | |

| | 2,270 | | Total Housing/Single Family | | | | | | 2,332,175 | |

| | | | Long-Term Care – 3.8% (3.8% of Total Investments) | | | | | | | |

| | | | ABAG Finance Authority for Non-Profit Corporations, California, Cal-Mortgage Revenue Bonds, Elder Care Alliance of Union City, Series 2004: | | | | | | | |

| | 1,850 | | 5.400%, 8/15/24 | 8/14 at 100.00 | | A– | | | 1,899,266 | |

| | 2,130 | | 5.600%, 8/15/34 | 8/14 at 100.00 | | A– | | | 2,182,994 | |

| | 4,000 | | ABAG Finance Authority for Non-Profit Corporations, California, Health Facility Revenue Bonds, The Institute on Aging, Series 2008A, 5.650%, 8/15/38 | 8/18 at 100.00 | | A– | | | 4,279,480 | |

| | 1,470 | | California Statewide Community Development Authority, Certificates of Participation, Internext Group, Series 1999, 5.375%, 4/01/17 | 10/12 at 100.00 | | BBB | | | 1,475,630 | |

| | 9,450 | | Total Long-Term Care | | | | | | 9,837,370 | |

| | | | Tax Obligation/General – 18.0% (17.9% of Total Investments) | | | | | | | |

| | 415 | | California State, General Obligation Bonds, Series 2004, 5.000%, 2/01/20 | 2/14 at 100.00 | | A1 | | | 436,468 | |

| | | | California State, General Obligation Bonds, Various Purpose Series 2009: | | | | | | | |

| | 2,500 | | 6.000%, 4/01/38 | 4/19 at 100.00 | | A1 | | | 2,949,050 | |

| | 1,000 | | 6.000%, 11/01/39 | 11/19 at 100.00 | | A1 | | | 1,193,190 | |

| | 2,000 | | California State, General Obligation Bonds, Various Purpose Series 2010, 5.500%, 3/01/40 | 3/20 at 100.00 | | A1 | | | 2,295,240 | |

| | | | California State, General Obligation Bonds, Various Purpose Series 2011: | | | | | | | |

| | 3,520 | | 5.000%, 9/01/41 | 9/21 at 100.00 | | A1 | | | 3,866,157 | |

| | 4,000 | | 5.000%, 10/01/41 | 10/21 at 100.00 | | A1 | | | 4,396,320 | |

| | | | California State, General Obligation Bonds, Various Purpose Series 2012: | | | | | | | |

| | 1,000 | | 5.250%, 2/01/28 | No Opt. Call | | A1 | | | 1,177,530 | |

| | 9,000 | | 5.000%, 4/01/42 | 4/22 at 100.00 | | A1 | | | 9,917,459 | |

| | 1,500 | | Los Angeles Unified School District, California, General Obligation Bonds, Series 2006F, 5.000%, 7/01/24 – FGIC Insured | 7/16 at 100.00 | | Aa2 | | | 1,702,155 | |

| | 2,000 | | Puerto Rico, General Obligation and Public Improvement Bonds, Series 2002A, 5.500%, 7/01/20 – NPFG Insured | No Opt. Call | | Baa1 | | | 2,225,520 | |

| | 270 | | Roseville Joint Union High School District, Placer County, California, General Obligation Bonds, Series 2006B, 5.000%, 8/01/27 – FGIC Insured | 8/15 at 100.00 | | AA+ | | | 297,559 | |

| | | Nuveen California Municipal Value Fund, Inc. (continued) |

| NCA | | Portfolio of Investments |

| | | August 31, 2012 (Unaudited) |

| | Principal | | | Optional Call | | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | | Ratings (3) | | | Value | |

| | | | Tax Obligation/General (continued) | | | | | | | |

| $ | 11,875 | | San Mateo Union High School District, San Mateo County, California, General Obligation Bonds, Election 2010 Series 2011A, 0.000%, 9/01/41 | 9/36 at 100.00 | | Aa1 | | $ | 6,225,350 | |

| | 1,320 | | Tahoe Forest Hospital District, Placer and Nevada Counties, California, General Obligation Bonds, Series 2010B, 5.500%, 8/01/35 | 8/18 at 100.00 | | Aa3 | | | 1,472,262 | |

| | 20,860 | | Yosemite Community College District, California, General Obligation Bonds, Capital Appreciation, Election 2004, Series 2010D, 0.000%, 8/01/42 | No Opt. Call | | Aa2 | | | 8,787,900 | |

| | 61,260 | | Total Tax Obligation/General | | | | | | 46,942,160 | |

| | | | Tax Obligation/Limited – 20.6% (20.5% of Total Investments) | | | | | | | |

| | 1,000 | | Artesia Redevelopment Agency, California, Tax Allocation Revenue Bonds, Artesia Redevelopment Project Area, Series 2007, 5.375%, 6/01/27 | 6/15 at 100.00 | | BBB+ | | | 1,002,570 | |

| | | | Bell Community Redevelopment Agency, California, Tax Allocation Bonds, Bell Project Area, Series 2003: | | | | | | | |

| | 3,000 | | 5.500%, 10/01/23 – RAAI Insured | 10/13 at 100.00 | | N/R | | | 2,970,450 | |

| | 1,000 | | 5.625%, 10/01/33 – RAAI Insured | 10/13 at 100.00 | | N/R | | | 932,240 | |

| | 2,400 | | Calexico Community Redevelopment Agency, California, Tax Allocation Bonds, Merged Central Business and Residential District Project, Series 2003C, 5.000%, 8/01/28 – AMBAC Insured | 8/13 at 102.00 | | A– | | | 2,445,840 | |

| | 1,000 | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Series 2009G-1, 5.750%, 10/01/30 | 10/19 at 100.00 | | A2 | | | 1,179,530 | |

| | 2,000 | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Series 2009-I, 6.375%, 11/01/34 | 11/19 at 100.00 | | A2 | | | 2,428,680 | |

| | 340 | | Capistrano Unified School District, Orange County, California, Special Tax Bonds, Community Facilities District, Series 2005, 5.000%, 9/01/24 – FGIC Insured | 9/15 at 100.00 | | BBB | | | 349,425 | |

| | 1,005 | | Chino Redevelopment Agency, California, Merged Chino Redevelopment Project Area Tax Allocation Bonds, Series 2006, 5.000%, 9/01/38 – AMBAC Insured | 9/16 at 101.00 | | A– | | | 1,016,286 | |

| | 1,000 | | Folsom Public Financing Authority, California, Special Tax Revenue Bonds, Refunding Series 2007A, 5.000%, 9/01/23 – AMBAC Insured | 9/17 at 100.00 | | N/R | | | 1,046,300 | |

| | 750 | | Fontana Redevelopment Agency, California, Jurupa Hills Redevelopment Project, Tax Allocation Refunding Bonds, 1997 Series A, 5.500%, 10/01/27 | 4/13 at 100.00 | | A– | | | 750,795 | |

| | 675 | | Inglewood Redevelopment Agency, California, Tax Allocation Bonds, Merged Redevelopment Project, Subordinate Lien Series 2007A-1, 5.000%, 5/01/25 – AMBAC Insured | 5/17 at 100.00 | | BBB+ | | | 686,752 | |

| | | | Irvine, California, Unified School District, Community Facilities District Special Tax Bonds, Series 2006A: | | | | | | | |

| | 150 | | 5.000%, 9/01/26 | 9/16 at 100.00 | | N/R | | | 155,046 | |

| | 355 | | 5.125%, 9/01/36 | 9/16 at 100.00 | | N/R | | | 361,479 | |

| | 2,500 | | Kern County Board of Education, California, Certificates of Participation, Series 2006A, 5.000%, 6/01/31 – NPFG Insured | 6/16 at 100.00 | | A | | | 2,564,650 | |

| | 750 | | Lancaster Redevelopment Agency, California, Tax Allocation Bonds, Combined Redevelopment Project Areas Housing Programs, Series 2009, 6.000%, 8/01/24 | 8/19 at 100.00 | | BBB+ | | | 829,808 | |

| | 615 | | Los Angeles Community Redevelopment Agency, California, Lease Revenue Bonds, Manchester Social Services Project, Series 2005, 5.000%, 9/01/37 – AMBAC Insured | 9/15 at 100.00 | | A1 | | | 629,865 | |

| | 795 | | Milpitas, California, Local Improvement District 20 Limited Obligation Bonds, Series 1998A, 5.650%, 9/02/13 | 3/13 at 103.00 | | N/R | | | 821,410 | |

| | | | Modesto Schools Infrastructure Financing Agency, Stanislaus County, California, Special Tax Revenue Bonds, Series 2004: | | | | | | | |

| | 1,045 | | 5.250%, 9/01/22 – AMBAC Insured | 9/14 at 100.00 | | N/R | | | 1,072,494 | |

| | 1,145 | | 5.250%, 9/01/23 – AMBAC Insured | 9/14 at 100.00 | | N/R | | | 1,172,251 | |

| | 1,255 | | 5.250%, 9/01/24 – AMBAC Insured | 9/14 at 100.00 | | N/R | | | 1,276,900 | |

| | 370 | | National City Community Development Commission, California, Tax Allocation Bonds, National City Redevelopment Project, Series 2011, 6.500%, 8/01/24 | 8/21 at 100.00 | | A– | | | 457,061 | |

| | 140 | | Novato Redevelopment Agency, California, Tax Allocation Bonds, Hamilton Field Redevelopment Project, Series 2011, 6.750%, 9/01/40 | 9/21 at 100.00 | | A– | | | 161,532 | |

| | 420 | | Oakland Redevelopment Agency, California, Subordinate Lien Tax Allocation Bonds, Central District Redevelopment Project, Series 2003, 5.500%, 9/01/18 – FGIC Insured | 3/13 at 100.00 | | A– | | | 426,544 | |

| | Principal | | | Optional Call | | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | | Ratings (3) | | | Value | |

| | | | Tax Obligation/Limited (continued) | | | | | | | |

| $ | 8,000 | | Palmdale Elementary School District, Los Angeles County, California, Special Tax Bonds, Community Facilities District 90-1, Series 1999, 5.800%, 8/01/29 – AGM Insured | 2/13 at 100.00 | | AA– | | $ | 8,016,640 | |

| | | | Perris Union High School District Financing Authority, Riverside County, California, Revenue Bonds, Series 2011: | | | | | | | |

| | 125 | | 6.000%, 9/01/33 | 3/13 at 103.00 | | N/R | | | 129,363 | |

| | 275 | | 6.125%, 9/01/41 | 3/13 at 103.00 | | N/R | | | 284,460 | |

| | 1,130 | | Pittsburg Redevelopment Agency, California, Tax Allocation Bonds, Los Medanos Community Development Project, Refunding Series 2008A, 6.500%, 9/01/28 | 9/18 at 100.00 | | BBB | | | 1,220,151 | |

| | 440 | | Rancho Santa Fe CSD Financing Authority, California, Revenue Bonds, Superior Lien Series 2011A, 5.750%, 9/01/30 | 9/21 at 100.00 | | BBB+ | | | 483,754 | |

| | 290 | | Rialto Redevelopment Agency, California, Tax Allocation Bonds, Merged Project Area, Series 2005A, 5.000%, 9/01/35 – SYNCORA GTY Insured | 9/15 at 100.00 | | A– | | | 293,013 | |

| | 80 | | Riverside County Redevelopment Agency, California, Tax Allocation Bonds, Jurupa Valley Project Area, Series 2011B, 6.500%, 10/01/25 | 10/21 at 100.00 | | A– | | | 89,352 | |

| | 5,000 | | Riverside County Redevelopment Agency, California, Tax Allocation Housing Bonds, Series 2004A, 5.000%, 10/01/37 – SYNCORA GTY Insured | 10/14 at 100.00 | | A– | | | 4,996,250 | |

| | 360 | | Roseville, California, Certificates of Participation, Public Facilities, Series 2003A, 5.000%, 8/01/25 – AMBAC Insured | 8/13 at 100.00 | | AA– | | | 365,872 | |

| | 1,000 | | San Diego County Regional Transportation Commission, California, Sales Tax Revenue Bonds, Series 2012A, 5.000%, 4/01/42 | 4/22 at 100.00 | | AAA | | | 1,153,320 | |

| | 65 | | San Francisco Redevelopment Finance Authority, California, Tax Allocation Revenue Bonds, Mission Bay North Redevelopment Project, Series 2011C, 6.750%, 8/01/41 | 2/21 at 100.00 | | A– | | | 76,088 | |

| | | | San Francisco Redevelopment Financing Authority, California, Tax Allocation Revenue Bonds, Mission Bay South Redevelopment Project, Series 2011D: | | | | | | | |

| | 65 | | 7.000%, 8/01/33 | 2/21 at 100.00 | | BBB | | | 75,144 | |

| | 80 | | 7.000%, 8/01/41 | 2/21 at 100.00 | | BBB | | | 91,410 | |

| | 2,750 | | San Jose Financing Authority, California, Lease Revenue Refunding Bonds, Convention Center Project, Series 2001F, 5.000%, 9/01/20 – NPFG Insured | 3/13 at 100.00 | | AA | | | 2,759,735 | |

| | | | San Jose Redevelopment Agency, California, Tax Allocation Bonds, Merged Area Redevelopment Project, Series 2006C: | | | | | | | |

| | 400 | | 5.000%, 8/01/24 – NPFG Insured | 8/17 at 100.00 | | BBB | | | 404,848 | |

| | 590 | | 5.000%, 8/01/25 – NPFG Insured | 8/17 at 100.00 | | BBB | | | 595,859 | |

| | 780 | | San Jose Redevelopment Agency, California, Tax Allocation Bonds, Merged Area Redevelopment Project, Series 2006D, 5.000%, 8/01/23 – AMBAC Insured | 8/17 at 100.00 | | BBB | | | 788,767 | |

| | 110 | | Signal Hill Redevelopment Agency, California, Project 1 Tax Allocation Bonds, Series 2011, 7.000%, 10/01/26 | 4/21 at 100.00 | | N/R | | | 121,241 | |

| | 1,000 | | Simi Valley, California, Certificates of Participation, Series 2004, 5.000%, | 9/14 at 100.00 | | A+ | | | 1,039,770 | |

| | | | 9/01/24 – AMBAC Insured | | | | | | | |

| | 1,450 | | Tehachapi Redevelopment Agency, California, Tax Allocation Bonds, Series 2007, 5.250%, 12/01/37 – RAAI Insured | 12/17 at 100.00 | | BBB– | | | 1,361,246 | |

| | 1,925 | | Travis Unified School District, Solano County, California, Certificates of Participation, Series 2006, 5.000%, 9/01/26 – FGIC Insured | 9/16 at 100.00 | | N/R | | | 1,950,737 | |

| | 875 | | Vista Joint Powers Financing Authority, California, Special Tax Lease Revenue Refunding Bonds, Community Facilities District 90-2, Series 1997A, 5.875%, 9/01/20 | 3/13 at 100.00 | | N/R | | | 875,770 | |

| | 1,730 | | West Contra Costa Healthcare District, California, Certificates of Participation, Series 2004, 5.375%, 7/01/21 – AMBAC Insured | 7/14 at 100.00 | | A– | | | 1,800,792 | |

| | 190 | | Yorba Linda Redevelopment Agency, Orange County, California, Tax Allocation Revenue Bonds, Yorba Linda Redevelopment Project, Subordinate Lien Series 2011A, 6.500%, 9/01/32 | 9/21 at 100.00 | | A– | | | 217,641 | |

| | 52,420 | | Total Tax Obligation/Limited | | | | | | 53,929,131 | |

| | | | Transportation – 3.8% (3.8% of Total Investments) | | | | | | | |

| | 2,500 | | Bay Area Toll Authority, California, Revenue Bonds, San Francisco Bay Area Toll Bridge, Series 2006F, 5.000%, 4/01/31 (UB) | 4/16 at 100.00 | | AA | | | 2,805,325 | |

| | 5,500 | | Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Refunding Bonds, Series 1999, 5.875%, 1/15/27 | 1/14 at 101.00 | | BBB– | | | 5,718,570 | |

| | | Nuveen California Municipal Value Fund, Inc. (continued) |

| NCA | | Portfolio of Investments |

| | | August 31, 2012 (Unaudited) |

| | Principal | | | Optional Call | | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | | Ratings (3) | | | Value | |

| | | | Transportation (continued) | | | | | | | |

| $ | 1,250 | | Fresno, California, Airport Revenue Bonds, Series 2000A, 5.500%, 7/01/30 – AGM Insured | 1/13 at 100.00 | | AA– | | $ | 1,252,138 | |

| | 215 | | Palm Springs Financing Authority, California, Palm Springs International Airport Revenue Bonds, Series 2006, 5.550%, 7/01/28 (Alternative Minimum Tax) | 7/14 at 102.00 | | N/R | | | 209,462 | |

| | 9,465 | | Total Transportation | | | | | | 9,985,495 | |

| | | | U.S. Guaranteed – 15.8% (15.7% of Total Investments) (4) | | | | | | | |

| | 5,010 | | Burbank Redevelopment Agency, California, Tax Allocation Bonds, Golden State Redevelopment Project, Series 2003, 5.750%, 12/01/33 (Pre-refunded

12/01/13) – FGIC Insured | 12/13 at 100.00 | | N/R (4) | | | 5,336,802 | |

| | | | California State, General Obligation Bonds, Series 2004: | | | | | | | |

| | 85 | | 5.000%, 2/01/20 (Pre-refunded 2/01/14) | 2/14 at 100.00 | | Aaa | | | 90,721 | |

| | 2,845 | | 5.250%, 4/01/34 (Pre-refunded 4/01/14) | 4/14 at 100.00 | | Aaa | | | 3,070,808 | |

| | 2,065 | | Contra Costa County, California, GNMA Mortgage-Backed Securities Program Home Mortgage Revenue Bonds, Series 1988, 8.250%, 6/01/21 (Alternative Minimum Tax) (ETM) | No Opt. Call | | Aaa | | | 2,818,477 | |

| | 1,265 | | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Series 2003A-1, 6.250%, 6/01/33 (Pre-refunded 6/01/13) | 6/13 at 100.00 | | Aaa | | | 1,319,812 | |

| | 2,750 | | Los Angeles County Schools, California, Certificates of Participation, Pooled Financing Program, Regionalized Business Services Corporation, Series 2003A, 5.000%, 9/01/28 (Pre-refunded 9/01/13) – AGM Insured | 9/13 at 100.00 | | AA– (4) | | | 2,877,765 | |

| | 3,000 | | Orange County Sanitation District, California, Certificates of Participation, Series 2003, 5.250%, 2/01/27 (Pre-refunded 8/01/13) – FGIC Insured | 8/13 at 100.00 | | AAA | | | 3,139,020 | |

| | 8,565 | | Palmdale, California, GNMA Mortgage-Backed Securities Program Single Family Mortgage Revenue Bonds, Series 1988A, 0.000%, 3/01/17 (ETM) | No Opt. Call | | AAA | | | 8,212,549 | |

| | 20,415 | | San Bernardino County, California, GNMA Mortgage-Backed Securities Program Single Family Home Mortgage Revenue Bonds, Series 1988A, 0.000%, 9/01/21 (Alternative Minimum Tax) (ETM) | No Opt. Call | | AA+ (4) | | | 13,538,614 | |

| | 625 | | San Mateo Union High School District, San Mateo County, California, Certificates of Participation, Phase 1, Series 2007A, 5.000%, 12/15/30 (Pre-refunded 12/15/17) – AMBAC Insured | 12/17 at 100.00 | | AA– (4) | | | 763,569 | |

| | 46,625 | | Total U.S. Guaranteed | | | | | | 41,168,137 | |

| | | | Utilities – 7.6% (7.6% of Total Investments) | | | | | | | |

| | 2,445 | | California Statewide Community Development Authority, Certificates of Participation Refunding, Rio Bravo Fresno Project, Series 1999A, 6.500%, 12/01/18 | 12/12 at 100.00 | | N/R | | | 2,382,066 | |

| | 1,800 | | Long Beach Bond Finance Authority, California, Natural Gas Purchase Revenue Bonds, Series 2007A, 5.500%, 11/15/37 | No Opt. Call | | A | | | 1,968,966 | |

| | 21,500 | | Merced Irrigation District, California, Certificates of Participation, Water and Hydroelectric Series 2008B, 0.000%, 9/01/23 | 9/16 at 64.56 | | A | | | 11,413,489 | |

| | 605 | | Merced Irrigation District, California, Electric System Revenue Bonds, Series 2005, 5.125%, 9/01/31 – SYNCORA GTY Insured | 9/15 at 100.00 | | N/R | | | 620,276 | |

| | 3,470 | | Puerto Rico Industrial, Tourist, Educational, Medical and Environmental Control Facilities Financing Authority, Co-Generation Facility Revenue Bonds, Series 2000A, 6.625%, 6/01/26 (Alternative Minimum Tax) | 12/12 at 100.00 | | Ba1 | | | 3,483,984 | |

| | 29,820 | | Total Utilities | | | | | | 19,868,781 | |

| | | | Water and Sewer – 7.1% (7.1% of Total Investments) | | | | | | | |

| | 1,480 | | California Department of Water Resources, Water System Revenue Bonds, Central Valley Project, Series 2005AD, 5.000%, 12/01/22 – AGM Insured | 6/15 at 100.00 | | AAA | | | 1,649,490 | |

| | 1,500 | | Castaic Lake Water Agency, California, Certificates of Participation, Series 2006C, 5.000%, 8/01/36 – NPFG Insured | 8/16 at 100.00 | | AA– | | | 1,573,515 | |

| | 410 | | Healdsburg Public Financing Authority, California, Wastewater Revenue Bonds, Series 2006, 5.000%, 4/01/36 – NPFG Insured | 4/16 at 100.00 | | AA– | | | 431,025 | |

| | 500 | | Los Angeles County Sanitation Districts Financing Authority, California, Senior Revenue Bonds, Capital Projects, Series 2003A, 5.000%, 10/01/23 – AGM Insured | 10/13 at 100.00 | | AA+ | | | 524,040 | |

| | Principal | | | Optional Call | | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | | Ratings (3) | | | Value | |

| | | | Water and Sewer (continued) | | | | | | | |

| $ | 5,000 | | Los Angeles Department of Water and Power, California, Waterworks Revenue Bonds, Series 2007A-2, 5.000%, 7/01/44 – AMBAC Insured | 7/17 at 100.00 | | AA | | $ | 5,600,200 | |

| | | | Madera Irrigation District, California, Water Revenue Refunding Bonds, Series 2008: | | | | | | | |

| | 1,850 | | 5.500%, 1/01/33 | 1/18 at 100.00 | | A– | | | 2,028,969 | |

| | 3,000 | | 5.500%, 1/01/38 | 1/18 at 100.00 | | A– | | | 3,270,390 | |

| | 3,500 | | Woodbridge Irrigation District, California, Certificates of Participation, Water Systems Project, Series 2003, 5.625%, 7/01/43 | 7/13 at 100.00 | | A+ | | | 3,531,045 | |

| | 17,240 | | Total Water and Sewer | | | | | | 18,608,674 | |

| $ | 287,050 | | Total Investments (cost $238,391,956) – 100.5% | | | | | | 262,304,687 | |

| | | | Floating Rate Obligations – (1.7)% | | | | | | (4,490,000 | ) |

| | | | Other Assets Less Liabilities – 1.2% | | | | | | 3,235,355 | |

| | | | Net Assets – 100% | | | | | $ | 261,050,042 | |

| (1) | | All percentages in the Portfolio of Investments are based on net assets applicable to Common shares unless otherwise noted. |

| (2) | | Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic principal paydowns. |

| (3) | | Ratings: Using the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. |

| (4) | | Backed by an escrow or trust containing sufficient U.S. Government or U.S. Government agency securities, which ensure the timely payment of principal and interest. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. |

| N/R | | Not rated. |

| (ETM) | | Escrowed to maturity. |

| (UB) | | Underlying bond of an inverse floating rate trust reflected as a financing transaction. See Notes to Financial Statements, Footnote 1 – General Information and Significant Accounting Policies, Inverse Floating Rate Securities for more information. |

See accompanying notes to financial statements.

| | | Nuveen California Municipal Value Fund 2 |

| NCB | | Portfolio of Investments |

| | | August 31, 2012 (Unaudited) |

| | Principal | | | Optional Call | | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | | Ratings (3) | | | Value | |

| | | | Consumer Staples – 5.0% (5.1% of Total Investments) | | | | | | | |

| $ | 3,500 | | Tobacco Securitization Authority of Northern California, Tobacco Settlement Asset-Backed Bonds, Series 2005A-1, 5.500%, 6/01/45 | 6/15 at 100.00 | | B– | | $ | 2,831,780 | |

| | | | Education and Civic Organizations – 7.2% (7.4% of Total Investments) | | | | | | | |

| | 500 | | California Educational Facilities Authority, Revenue Bonds, University of Redlands, Series 2005A, 5.000%, 10/01/25 | 10/15 at 100.00 | | A3 | | | 534,175 | |

| | 920 | | California Educational Facilities Authority, Revenue Bonds, University of the Pacific, Series 2009, 5.500%, 11/01/39 | 11/19 at 100.00 | | A2 | | | 1,025,506 | |

| | 1,965 | | California State Public Works Board, Lease Revenue Bonds, University of California Department of Education Riverside Campus Project, Series 2009B, 5.750%, 4/01/23 | 4/19 at 100.00 | | A2 | | | 2,348,804 | |

| | 150 | | California Statewide Communities Development Authority, School Facility Revenue Bonds, Alliance College-Ready Public Schools, Series 2011A, 7.000%, 7/01/46 | 7/21 at 100.00 | | BBB | | | 164,790 | |

| | 3,535 | | Total Education and Civic Organizations | | | | | | 4,073,275 | |

| | | | Health Care – 23.2% (23.8% of Total Investments) | | | | | | | |

| | 1,000 | | ABAG Finance Authority for Non-Profit Corporations, California, Cal-Mortgage Insured Health Facility Revenue Bonds, Saint Rose Hospital, Series 2009A, 6.000%, 5/15/29 | 5/19 at 100.00 | | A– | | | 1,123,740 | |

| | 1,900 | | California Health Facilities Financing Authority, Revenue Bonds, Catholic Healthcare West, Series 2009A, 6.000%, 7/01/39 | 7/19 at 100.00 | | A+ | | | 2,243,919 | |

| | 1,000 | | California Health Facilities Financing Authority, Revenue Bonds, Childrens Hospital of Orange County, Series 2009A, 6.500%, 11/01/38 | 11/19 at 100.00 | | A | | | 1,213,720 | |

| | 850 | | California Municipal Financing Authority, Certificates of Participation, Community Hospitals of Central California, Series 2007, 5.250%, 2/01/27 | 2/17 at 100.00 | | BBB | | | 887,485 | |

| | 700 | | California Statewide Communities Development Authority, Revenue Bonds, Adventist Health System West, Series 2007B, 5.000%, 3/01/37 – AGC Insured | 3/18 at 100.00 | | AA– | | | 754,600 | |

| | | | California Statewide Community Development Authority, Revenue Bonds, Kaiser Permanante System, Series 2006: | | | | | | | |

| | 125 | | 5.000%, 3/01/41 | 3/16 at 100.00 | | A+ | | | 131,906 | |

| | 2,000 | | 5.250%, 3/01/45 | 3/16 at 100.00 | | A+ | | | 2,125,540 | |

| | 1,500 | | California Statewide Community Development Authority, Revenue Bonds, Sutter Health, Series 2004D, 5.050%, 8/15/38 – AGM Insured | 8/18 at 100.00 | | AA | | | 1,630,290 | |

| | 800 | | Delaware County Hospital Authority, Indiana, Hospital Revenue Bonds, Cardinal Health System, Series 2006, 5.000%, 8/01/24 | 8/16 at 100.00 | | Baa2 | | | 855,696 | |

| | 850 | | Illinois Finance Authority, Revenue Bonds, Sherman Health Systems, Series 2007A, 5.500%, 8/01/37 | 8/17 at 100.00 | | BBB | | | 918,774 | |

| | 725 | | Palomar Pomerado Health Care District, California, Certificates of Participation, Series 2010, 6.000%, 11/01/41 | 11/20 at 100.00 | | Baa3 | | | 777,838 | |

| | 380 | | San Buenaventura, California, Revenue Bonds, Community Memorial Health System, Series 2011, 7.500%, 12/01/41 | 12/21 at 100.00 | | BB | | | 461,586 | |

| | 11,830 | | Total Health Care | | | | | | 13,125,094 | |

| | | | Housing/Multifamily – 1.0% (1.1% of Total Investments) | | | | | | | |

| | 230 | | California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas Projects Series 2010A, 6.400%, 8/15/45 | 8/20 at 100.00 | | BBB | | | 251,832 | |

| | 70 | | California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas Projects Series 2012A, 5.500%, 8/15/47 | 8/22 at 100.00 | | BBB | | | 73,671 | |

| | 250 | | California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas Projects Series 2012B, 7.250%, 8/15/47 | 8/22 at 100.00 | | A1 | | | 260,878 | |

| | 550 | | Total Housing/Multifamily | | | | | | 586,381 | |

| | Principal | | | Optional Call | | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | | Ratings (3) | | | Value | |

| | | | Housing/Single Family – 6.5% (6.6% of Total Investments) | | | | | | | |

| $ | 1,205 | | California Housing Finance Agency, California, Home Mortgage Revenue Bonds, Series 2008L, 5.500%, 8/01/38 | 2/18 at 100.00 | | BBB | | $ | 1,225,798 | |

| | 2,500 | | California Housing Finance Agency, Home Mortgage Revenue Bonds, Series 2006K, 4.625%, 8/01/26 (Alternative Minimum Tax) | 2/16 at 100.00 | | BBB | | | 2,421,075 | |

| | 3,705 | | Total Housing/Single Family | | | | | | 3,646,873 | |

| | | | Industrials – 1.6% (1.6% of Total Investments) | | | | | | | |

| | 900 | | California Enterprise Development Authority, Sewer Facilities Revenue, Anheuser-Busch Project, Senior Lien Series 2007, 5.300%, 9/01/47 (Alternative Minimum Tax) | 11/12 at 100.00 | | A | | | 900,819 | |

| | | | Long-Term Care – 2.1% (2.1% of Total Investments) | | | | | | | |

| | 1,000 | | California Health Facilities Financing Authority, Insured Revenue Bonds, Community Program for Persons with Developmental Disabilities, Series 2011A, 6.250%, 2/01/26 | 2/21 at 100.00 | | A– | | | 1,173,070 | |

| | | | Materials – 1.1% (1.1% of Total Investments) | | | | | | | |

| | 585 | | Courtland Industrial Development Board, Alabama, Solid Waste Revenue Bonds, International Paper Company Project, Series 2005A, 5.200%, 6/01/25 (Alternative Minimum Tax) | 6/15 at 100.00 | | BBB | | | 604,925 | |

| | | | Tax Obligation/General – 9.0% (9.2% of Total Investments) | | | | | | | |

| | 2,000 | | California State, General Obligation Bonds, Various Purpose Series 2007, 5.000%, 6/01/37 – NPFG Insured | 6/17 at 100.00 | | A1 | | | 2,139,620 | |

| | 2,100 | | Carlsbad Unified School District, San Diego County, California, General Obligation Bonds, Series 2009B, 0.000%, 5/01/34 | 5/24 at 100.00 | | AA | | | 1,684,935 | |

| | 1,120 | | Oakland, California, General Obligation Bonds, Measure DD Series 2009B, 5.250%, 1/15/29 | 1/19 at 100.00 | | Aa2 | | | 1,259,955 | |

| | 5,220 | | Total Tax Obligation/General | | | | | | 5,084,510 | |

| | | | Tax Obligation/Limited – 18.2% (18.6% of Total Investments) | | | | | | | |

| | 500 | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Series 2010A-1, 6.000%, 3/01/35 | 3/20 at 100.00 | | A2 | | | 591,780 | |

| | 160 | | Fontana Redevelopment Agency, California, Jurupa Hills Redevelopment Project, Tax Allocation Refunding Bonds, 1997 Series A, 5.500%, 10/01/27 | 4/13 at 100.00 | | A– | | | 160,170 | |

| | 145 | | Inglewood Redevelopment Agency, California, Tax Allocation Bonds, Merged Redevelopment Project, Subordinate Lien Series 2007A-1, 5.000%, 5/01/25 – AMBAC Insured | 5/17 at 100.00 | | BBB+ | | | 147,524 | |

| | 1,000 | | Lancaster Redevelopment Agency, California, Tax Allocation Bonds, Combined Redevelopment Project Areas Housing Programs, Series 2009, 6.875%, 8/01/39 | 8/19 at 100.00 | | BBB+ | | | 1,138,760 | |

| | | | National City Community Development Commission, California, Tax Allocation Bonds, National City Redevelopment Project, Series 2011: | | | | | | | |

| | 1,135 | | 5.000%, 8/01/16 | No Opt. Call | | A– | | | 1,243,200 | |

| | 80 | | 6.500%, 8/01/24 | 8/21 at 100.00 | | A– | | | 98,824 | |

| | 30 | | Novato Redevelopment Agency, California, Tax Allocation Bonds, Hamilton Field Redevelopment Project, Series 2011, 6.750%, 9/01/40 | 9/21 at 100.00 | | A– | | | 34,614 | |