UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

Sonic Corp.

(Name of Registrant as specified in its Charter)

(Name of Person(s) filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which the transaction applies: |

| | (2) | | Aggregate number of securities to which the transaction applies: |

| | (3) | | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of the transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

SONIC CORP.

NOTICE OF 2016 ANNUAL

MEETING OF SHAREHOLDERS

including Proxy Statement

300 Johnny Bench Drive

Oklahoma City, Oklahoma 73104

December 14, 2015

Dear Fellow Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Sonic Corp. (“the Company”) to be held at 1:30 p.m., Central Time, on Thursday, January 28, 2016, at the Sonic Building, 300 Johnny Bench Drive, Oklahoma City, Oklahoma. Please see the Notice of Annual Meeting on the next page for more information.

Your vote is very important to us. Regardless of the number of shares you own, please vote. The Board has reviewed each voting item and provided you with its recommendation on how to vote. You can vote your shares by internet, by telephone or, if you request that the proxy materials be mailed to you, by completing, signing and returning the proxy card enclosed with those materials. Please see page 1 of the proxy statement for more detailed information about your voting options.

We hope to see you at the annual meeting. On behalf of the Board of Directors, thank you for your continued support.

Very truly yours,

Clifford Hudson

Chairman, Chief Executive Officer and President

|

NOTICE OF 2016 ANNUAL MEETING OF SHAREHOLDERS |

Thursday, January 28, 2016

1:30 p.m., Central Time

Sonic Building, 300 Johnny Bench Drive, Oklahoma City, Oklahoma

Record Date: November 30, 2015

Matters to be Voted upon: These items are more fully described in the following pages, which are a part of this Notice.

| | • | | To elect as directors the four nominees named in the accompanying proxy statement for terms expiring at the 2019 annual meeting of shareholders; |

| | • | | To ratify and approve the selection of KPMG LLP as the Company’s independent registered public accounting firm; |

| | • | | To hold an advisory vote on executive compensation; |

| | • | | To consider and vote upon the shareholder proposal set forth in this Proxy Statement, if presented; and |

| | • | | To act upon any such other matters as may properly come before the meeting or any adjournments or postponements thereof. |

Whether or not you plan to attend the meeting, we encourage you to vote as promptly as possible by the internet or by telephone. If you request a printed copy of the proxy materials, you may complete and return by mail the proxy or voting instruction card you will receive, or you can vote by the internet or by telephone. If you attend the meeting and wish to change your vote, you can do so by voting in person at the meeting.

By Order of the Board of Directors,

Carolyn C. Cummins

Vice President and Corporate Secretary

Oklahoma City, Oklahoma

December 14, 2015

TABLE OF CONTENTS

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS OF

SONIC CORP.

To Be Held Thursday, January 28, 2016

VOTING AND THE MEETING

Purpose of the Meeting

At the annual meeting of the Company’s shareholders, we will be voting upon:

| • | | the election of four directors for terms expiring in 2019; |

| • | | the ratification of our Audit Committee’s choice of independent registered public accounting firm for fiscal year 2016; |

| • | | the approval, by a non-binding advisory vote, of our executive compensation; |

| • | | a shareholder proposal, if properly presented at the meeting; and |

| • | | any other business that may properly come before the meeting. |

Our Board of Directors strongly encourages you to exercise your right to vote on these matters. Voting early through the internet, by telephone or by a proxy or voting instruction card will help ensure that your shares are presented at the meeting.

Recommended Vote

The Board of Directors unanimously recommends that you vote:

PROPOSAL 1: FORthe election of R. Neal Black, Clifford Hudson, Federico F. Peña and Susan E. Thronson, as directors of the Company for terms expiring in 2019.

PROPOSAL 2: FORthe ratification of the Audit Committee’s selection of KPMG LLP as our independent registered public accounting firm for fiscal year 2016.

PROPOSAL 3: FORthe approval of our executive officers’ compensation.

PROPOSAL 4: AGAINSTthe shareholder proposal.

Voting by Proxy and Eligibility to Vote

Our Board of Directors is asking for your proxy, which is a legal designation of another person to vote the shares you own at the close of business on November 30, 2015 (“record date”). We have designated two officers of the Company to vote your shares at the meeting in the way you instruct. You may vote if your shares are recorded directly in your name (“shareholder of record”). You may also vote if you are a shareholder as of the record date who holds shares in “street name,” through holder of record such as a bank, broker or other holder. You may direct how to vote your shares by following the instructions that you will receive from the holder of record.

A list of shareholders entitled to vote at the meeting will be available for examination at our corporate offices located at 300 Johnny Bench Drive, Oklahoma City, Oklahoma 73104, for a period of at least 10 days prior to the meeting and during the meeting.

SONIC CORP. - 2016 Proxy Statement 1

VOTING AND THE MEETING

How to Cast Your Vote

You may vote by any of the following methods:

Internet. Go towww.proxyvote.com 24 hours a day, seven days a week, and follow the instructions. You will need the 12-digit control number that is included in the Notice of Internet Availability of Proxy Materials, proxy card or voting instructions form that is sent to you. The internet voting system allows you to confirm that the system has properly recorded your votes. This method of voting will be available until 10:59 p.m. Central Time, on January 27, 2016.

Telephone. Call toll-free 1-800-690-6903 24 hours a day, seven days a week, and follow the instructions. You will need the 12-digit control number that is included in the Notice of Internet Availability of Proxy Materials, proxy card or voting instructions form that is sent to you. As with internet voting, you will be able to confirm that the system has properly recorded your votes. This method of voting will be available until 10:59 p.m. Central Time, on January 27, 2016.

Mail. If you are a shareholder of record and you elect to receive your proxy materials by mail, you can vote by marking, dating and signing your proxy card exactly as

your name appears on the card and returning it by mail in the postage-paid envelope that will be provided to you. If you hold your shares in street name and you elect to receive your proxy materials by mail, you can vote by completing and mailing the voting instructions form that will be provided by your bank, broker or other holder of record. You should mail the proxy card or voting instruction form in plenty of time to allow delivery prior to the meeting. Do not mail the proxy card or voting instruction form if you are voting over the internet or by telephone.

At the annual meeting. Whether you are a shareholder of record or a street name holder, you may vote your shares at the annual meeting if you attend in person. Even if you plan to attend the annual meeting, we encourage you to vote over the internet or by telephone prior to the meeting. It is fast and convenient, and it saves us significant postage and processing costs. In addition, your vote is recorded immediately, and there is no risk that postal delays will cause your vote to arrive late and therefore not be counted.

Notice and Access

On or about December 14, 2015, we will mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders who have not previously requested paper proxy materials advising them that they can access this proxy statement, the 2015 annual report and voting instructions over the internet atwww.proxyvote.com, or they may request that a printed set of the proxy materials be sent to them by following the instructions in the Notice.

The Notice also provides instructions on how to inform us to send future proxy materials to you electronically by e-mail or in the printed form by mail. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to

those materials or a link to a special website to access our proxy materials. Your election to receive proxy materials by e-mail or printed form by mail will remain in effect until you change your election.

If you receive more than one Notice, it means that your shares are held in more than one account. To ensure that all shares are voted, please vote each account. We also encourage you to register all of your shares in the same name and address by contacting the Shareholder Services Department at our transfer agent, Computershare, 211 Quality Circle, Suite 210, College Station, Texas 77845 or by phone at 1-800-884-4225. If you hold your shares in street name, you may contact your bank or broker and request consolidation.

2 SONIC CORP. - 2016 Proxy Statement

VOTING AND THE MEETING

Revocation of Proxy

You may revoke your proxy before it is voted at the meeting by:

| • | | Submitting a later vote by internet or telephone; |

| • | | Submitting a new proxy card or voting instruction form with a later date; |

| • | | Notifying the Company before the meeting by writing to the Corporate Secretary, Sonic Corp., 300 Johnny Bench Drive, Oklahoma City, Oklahoma 73104; or |

| • | | Voting in person at the meeting. |

Attendance at the meeting will not revoke a proxy unless the shareholder actually votes in person at the meeting.

Annual Meeting Admission

Only Sonic Corp. shareholders may attend the annual meeting. Proof of ownership of Sonic Corp. common stock, along with valid photo identification (such as a driver’s license or passport), must be presented in order to be admitted to the annual meeting. If your shares are held in street name and you plan to attend the annual

meeting in person, you must bring a brokerage statement, the proxy card mailed to you by your bank or broker or other proof of ownership to be admitted to the annual meeting. No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the annual meeting.

Shareholder Proposals

In order for the Company to include a shareholder proposal in the proxy materials for the next annual meeting of shareholders, a shareholder must deliver the proposal to the Corporate Secretary of the Company no later than August 15, 2016.

For any proposal that is not submitted for inclusion in next year’s proxy statement but is instead sought to be presented directly at the next annual meeting, the Company’s Bylaws require shareholders to give advance notice of such proposals. The required notice, which must include the information and documents set forth in the Bylaws, must be given no more than 120 days and no less than 90 days prior to the first anniversary of the

preceding year’s annual meeting. If the date of the annual meeting is more than 30 days earlier or more than 60 days later than such anniversary date, notice must be received not earlier than the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. Accordingly, with respect to our next annual meeting, our Bylaws require notice to be provided to the Corporate Secretary of the Company no earlier than September 29, 2016 and no later than October 29, 2016.

Costs of Proxy and Proxy Solicitation

We are paying the cost related to the preparation, printing and distribution of all the proxy materials. We also may use the services of our directors, officers and employees to solicit proxies by mail, email, facsimile, personally or by telephone. We will reimburse any holder

of record for its reasonable expenses incurred in completing the mailing of shareholder requested proxy materials to the beneficial owners of our voting common stock.

Householding

We are permitted to send a single set of proxy materials to shareholders who share the same last name and address. This procedure is called “householding” and is designed to reduce our printing and postage costs. If you would like to receive a separate copy of a proxy statement

or annual report, either now or in the future, please contact the Corporate Secretary at Sonic Corp., 300 Johnny Bench Drive, Oklahoma City, Oklahoma 73104. Such requests by street name holders should be made through their holder of record.

SONIC CORP. - 2016 Proxy Statement 3

VOTING AND THE MEETING

Quorum and Voting Requirements

As of the close of business on the record date, November 30, 2015, the Company had 49,323,389 shares of common stock issued and outstanding. Each share has one vote. All shares of common stock may vote on all matters coming before the annual meeting, and a majority of all of the outstanding shares of common stock of the Company entitled to vote at the meeting, represented in person or by proxy, will constitute a quorum for the meeting. If you submit a proxy, your shares will be counted to determine whether we have a quorum even if you withhold authority to vote, abstain or fail to provide voting instructions on any of the proposals listed on the proxy card. If your shares are held in street name, these shares also will be counted for purposes of determining the presence or absence of a quorum for the transaction of business to the extent such holder of record exercises its discretion to vote your uninstructed shares on certain matters at the annual meeting.

The Company will treat all abstentions and “broker non-votes,” as hereafter defined, as present or represented at the meeting for the purposes of determining whether a quorum exists for the meeting. Holders of record who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on certain matters (“discretionary matters”), but they do not have discretion to vote uninstructed shares as to certain other matters (“non-discretionary matters”). A broker may return a proxy card on behalf of a beneficial owner from whom the broker has not received voting instructions that casts a vote with regard to discretionary matters but expressly states that the broker is not voting as to non-discretionary matters. The broker’s inability to vote with respect to the non-discretionary matters for which the broker has not received voting instructions from the beneficial owner is referred to as a “broker non-vote.”

The voting requirements that apply to the proposals discussed in this proxy statement are as follows:

| | | | | | | | |

| Proposal | | Vote Required | | | Discretionary

Voting Allowed? | |

1. Election of Directors | | | Plurality | | | | No | |

2. Ratification of Independent Registered Public Accounting Firm | | | Majority | | | | Yes | |

3. Advisory Vote on Executive Officers’ Compensation | | | Majority | | | | No | |

4. Shareholder Proposal | | | Majority | | | | No | |

A “plurality” means, with regard to the election of directors, that the four nominees for director receiving the greatest number of “for” votes from our shares entitled to vote will be elected. Abstentions and broker non-votes (discussed below) will not affect the outcome of the election because only a plurality of the votes actually cast is needed to elect directors. An incumbent director who does not receive a majority of the votes cast will continue to serve, but will tender his or her resignation to the Nominating and Corporate Governance Committee. The Nominating and

Corporate Governance Committee will then make a recommendation to the Board on whether to accept or reject the director’s resignation. The Board will act on the Nominating and Corporate Governance Committee’s recommendation and publicly disclose its decision and the rationale for such decision.

A “majority” means a majority of the shares of common stock present in person or represented by proxy and entitled to vote at the meeting. Therefore, abstentions will have the effect of a vote against approval. Broker non-votes will not affect the outcome of the vote.

Voting Results

We will announce preliminary results at the meeting and publish final results in a current report on Form 8-K within four business days after the meeting.

4 SONIC CORP. - 2016 Proxy Statement

CORPORATE GOVERNANCE

Board of Directors

The Board is currently composed of 10 independent directors and Clifford Hudson, the Chairman of the Board, Chief Executive Officer and President.

The Board of Directors of the Company held five meetings during the Company’s last fiscal year. The independent directors met in executive session at each quarterly meeting. Each director attended at least 75% of the meetings of the Board and the Board committees on which he or she served. The Company encourages its Board members to attend the annual meeting of shareholders and schedules Board and committee meetings to coincide with the shareholder meeting to facilitate the directors’ attendance. All directors attended the annual meeting of shareholders held in January 2015.

The Board recognizes the necessity of effective corporate governance to enable the Board to adequately oversee, advise and monitor the management of the Company. Sonic’s policies and practices reflect corporate governance initiatives that are compliant with the listing standards of NASDAQ and the corporate governance regulations of the Sarbanes-Oxley Act of 2002. Copies of the Corporate Governance Guidelines and the Code of Business Conduct and Ethics can be found on Sonic’s website,www.sonicdrivein.com, by going to the corporate governance section of the website. Among other things,

the Corporate Governance Guidelines address the following:

| • | | The Nominating and Corporate Governance Committee is required to review with the Board annually the composition of the Board as a whole, including the directors’ independence, skills, experience, age, diversity and availability of service to the Company. |

| • | | The Board is required to conduct periodic self-evaluation through the Nominating and Corporate Governance Committee. |

| • | | The Nominating and Corporate Governance Committee is required to review and report to the Board at least annually on succession planning for the CEO, and the CEO is required at all times to make available to the Board his or her recommendations of potential successors. |

| • | | The independent directors are required to meet in conjunction with each regularly scheduled quarterly Board meeting and at other appropriate times. |

| • | | The Board and all committees are authorized to hire their own advisors. |

| • | | Directors who change job responsibilities are required to notify the Board and give the Board the opportunity to review whether they should continue to serve as Board members. |

Board Leadership Structure

Chairman. The Board reserves the right to determine from time to time how to configure the leadership of the Board and the Company in the way that best serves the Company and its shareholders. The Board specifically reserves the right to vest the responsibilities of Chairman of the Board and CEO in the same individual. The Board believes that the most effective leadership model for the Company at this time is to have the roles of Chairman and CEO combined. However, the Board regularly reviews and reassesses its leadership structure.

Lead Independent Director.The Board believes that the appointment of a lead independent director allows it to maintain effective oversight of management.

The Company’s 10 non-management directors, all of whom are independent, have appointed Mr. Nichols as the Board’s lead independent director. The Board has adopted lead director guidelines that provide for the lead director to fulfill the following functions:

| • | | preside over the executive session of the Board meetings and other meetings where Mr. Hudson is not present; |

| • | | provide the Chairman with input as to the schedule and agenda of Board meetings; |

| • | | develop the agenda for executive sessions of the independent directors; |

SONIC CORP. - 2016 Proxy Statement 5

CORPORATE GOVERNANCE

| • | | advise the Chairman about the quality, quantity and timeliness of information provided to the Board; |

| • | | serve as a liaison for consultation and communication between the independent directors and the Chairman; |

| • | | work with the Board to guide management on strategic issues and long-term planning; |

| • | | work with the Nominating and Corporate Governance Committee to ensure a succession plan is in place for the CEO; |

| • | | work with the Chairman and Nominating and Corporate Governance Committee on Board succession planning; and |

| • | | facilitate the performance evaluation of the CEO. |

Director Independence

Upon recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has affirmatively determined that each member of the Board of Directors, with the exception of our Chairman and CEO, Clifford Hudson who is the only employee member of the Board, is independent under the criteria established by NASDAQ for director

independence. The NASDAQ criteria include various objective standards and a subjective test. The objective element consists of specific relationships that automatically preclude a finding of independence. The subjective component requires the Board to make an affirmative determination that there are no other relationships that would impair independence.

Practices for Considering Diversity

The charter of the Nominating and Corporate Governance Committee provides that it shall annually review the appropriate characteristics of members of the Board of Directors in the context of the then-current composition of the Board. This assessment includes the following factors: independence, skills, experience, age,

diversity (including diversity of skills, background and experience) and availability. It is the practice of the Nominating and Corporate Governance Committee to consider these factors when screening and evaluating candidates for nomination to the Board of Directors.

Board Involvement in Risk Oversight

The day-to-day responsibility for the identification, assessment and management of the various risks that the Company faces belongs with management. The full Board has primary responsibility for risk oversight, with the Board’s standing committees supporting the Board by addressing the risks inherent in their respective areas of oversight. The Board’s ongoing risk oversight in the

context of specific aspects of our business is supplemented by a formal risk review process conducted by management. This review identifies the Company’s key overall risks and facilitates consideration of those risk exposures, strategic objectives and risk management programs. This formal risk review is discussed with the full Board on at least an annual basis.

6 SONIC CORP. - 2016 Proxy Statement

CORPORATE GOVERNANCE

Compensation of Directors

In accordance with the Compensation Committee Charter, non-employee director compensation is determined annually by the Board of Directors acting upon the recommendation of the Compensation Committee, except that equity and equity-based compensation is determined only by the Compensation Committee.

For calendar year 2015, commencing with the Board of Directors meeting in January, cash fees earned by the non-employee directors for their services were as follows:

| • | | Annual cash fee of $42,000; |

| • | | Audit Committee Chair annual cash fee of $15,000; |

| • | | Compensation Committee Chair annual cash fee of $12,500; |

| • | | Nominating and Corporate Governance Committee Chair annual cash fee of $10,000; |

| • | | Lead Independent Director annual cash fee $22,500; |

| • | | Additional fee of $2,500 for each quarterly Board meeting attended; |

| • | | Additional fee of $1,000 for each Committee meeting attended; and |

| • | | Additional fee of $1,000 for any special telephonic meetings attended. |

On the date of the second quarterly Board meeting during the fiscal year, each non-employee director receives an annual equity award grant valued at $85,000 on the date of the grant, comprised 50% of seven-year, nonqualified stock options and 50% of restricted stock units (“RSUs”). Both the stock options and RSUs vest in one year. The exercise price of the stock options is equal to the market value of the common stock on the date of the grant.

SONIC CORP. - 2016 Proxy Statement 7

CORPORATE GOVERNANCE

Director Compensation Table

The following table sets forth information as to compensation during fiscal year 2015 paid to each non-employee director of the Company.

| | | | | | | | | | | | | | | | |

| Name(1) | | Fees Paid in Cash ($) | | | Stock Awards ($)(2) (3) | | | Option Awards ($)(2) (3) | | | Total ($) | |

Tony D. Bartel | | | 58,750 | | | | 42,492 | | | | 42,504 | | | | 143,746 | |

Lauren R. Hobart | | | 57,750 | | | | 42,492 | | | | 42,504 | | | | 142,746 | |

Kate S. Lavelle | | | 72,250 | | | | 42,492 | | | | 42,504 | | | | 157,246 | |

J. Larry Nichols | | | 83,375 | | | | 42,492 | | | | 42,504 | | | | 168,371 | |

Federico F. Peña | | | 62,750 | | | | 42,492 | | | | 42,504 | | | | 147,746 | |

Frank E. Richardson | | | 71,438 | | | | 42,492 | | | | 42,504 | | | | 156,434 | |

Robert M. Rosenberg | | | 67,375 | | | | 42,492 | | | | 42,504 | | | | 152,371 | |

Jeffrey H. Schutz | | | 62,500 | | | | 42,492 | | | | 42,504 | | | | 147,496 | |

Kathryn L. Taylor | | | 56,250 | | | | 42,492 | | | | 42,504 | | | | 141,246 | |

Susan E. Thronson | | | 28,000 | | | | 31,880 | | | | 31,878 | | | | 91,758 | |

| | (1) | Clifford Hudson, the Company’s Chairman of the Board, Chief Executive Officer and President, is not included in the table as he is an employee of the Company and thus receives no compensation for his services as a director. The compensation received by Mr. Hudson as an employee of the Company is shown in the Summary Compensation Table. |

| | (2) | In January 2015, the Company granted options to purchase 4,780 shares of common stock of the Company at $31.29 per share and 1,358 RSUs to Mses. Hobart, Lavelle and Taylor and Messrs. Bartel, Nichols, Peña, Richardson, Rosenberg and Schutz. Ms. Thronson was appointed to the Board to fill a vacant position on April 9, 2015, at which time the Company granted options to her to purchase 3,404 shares of common stock of the Company at $31.69 per share and 1,006 RSUs. The dollar amounts reflect the aggregate grant date fair values of the stock and option awards. These amounts do not include any reduction in the value for the possibility of forfeiture. See Note 13 of the Notes to Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for the year ended August 31, 2015 regarding assumptions underlying valuation of equity awards. |

| | (3) | The following table represents the number of unvested stock awards and the number of outstanding and unexercised option awards held by each of our non-employee directors as of August 31, 2015. |

| | | | | | | | |

| Name | | Outstanding

Stock Awards | | | Outstanding

Option Awards | |

Bartel | | | 1,358 | | | | 11,002 | |

Hobart | | | 1,358 | | | | 11,002 | |

Lavelle | | | 1,358 | | | | 11,002 | |

Nichols | | | 1,358 | | | | 59,207 | |

Peña | | | 1,358 | | | | 39,501 | |

Richardson | | | 1,358 | | | | 81,735 | |

Rosenberg | | | 1,358 | | | | 81,735 | |

Schutz | | | 1,358 | | | | 11,002 | |

Taylor | | | 1,358 | | | | 11,002 | |

Thronson | | | 1,006 | | | | 3,404 | |

8 SONIC CORP. - 2016 Proxy Statement

CORPORATE GOVERNANCE

Stock Ownership Guidelines for Directors

The Board has adopted stock ownership guidelines for non-employee directors. These guidelines require each non-employee director to hold all stock awards granted to the director until he or she owns stock valued at three times or more the annual cash fee amount paid to the

director. Each of the incumbent non-employee directors, except for Mr. Bartel and Ms. Hobart whose terms began in January 2014 and Ms. Thronson whose term began in April 2015, currently hold stock and RSUs in an amount exceeding the stock ownership requirement.

Director Nominations

Annually, the Nominating and Corporate Governance Committee follows a process designed to consider the re-election of existing directors and seek individuals qualified to become new Board members for recommendation to the Board for any vacancies.

With respect to nominating existing directors, the Nominating and Corporate Governance Committee reviews relevant information available to it, including an assessment of the directors’ continued ability and willingness to serve as directors. The Nominating and Corporate Governance Committee also assesses each director’s contribution in light of the mix of skills and experience the Nominating and Corporate Governance Committee has deemed appropriate for the Board. In accordance with the Company’s Corporate Governance Guidelines, a director cannot be elected or appointed to a term that extends beyond his or her 75th birthday.

With respect to considering nominations of new directors, the Nominating and Corporate Governance Committee conducts a thorough search to identify candidates based upon criteria the Nominating and Corporate Governance Committee deems appropriate and considering the mix of skills and experience necessary to complement existing Board members. The Nominating and Corporate Governance Committee then reviews selected candidates and makes a

recommendation to the Board. The Nominating and Corporate Governance Committee may seek input from senior management in identifying candidates.

Each candidate for director must possess the following specific minimum qualifications:

| • | | Each candidate shall be an individual who has demonstrated integrity and ethics in his or her professional life and has established a record of professional accomplishment in his or her chosen field. |

| • | | No candidate shall have any material personal, financial or professional interest in any present or potential competitor of the Company. |

| • | | Each candidate shall be prepared to participate fully in activities of the Board of Directors, including active membership in at least one committee of the Board of Directors and attendance at, and active participation in, meetings of the Board of Directors and the committee(s) of the Board of which he or she is a member. |

The Nominating and Corporate Governance Committee will consider nominations for the Board by shareholders the same way it evaluates other individuals for nomination as a new director. Such nominations must be made in accordance with the Company’s bylaws.

Communications with Directors

Shareholders may contact our non-employee members of the Board of Directors by writing to the Board, c/o Carolyn C. Cummins, Corporate Secretary of the Company. All written submissions that appear to be good faith efforts to communicate with Board members about matters involving the interests of the Company and its shareholders will be delivered to the appropriate

Board member for review. Any concerns relating to accounting, internal accounting controls or auditing matters will be brought immediately to the attention of the Company’s Vice President of Internal Audit and handled in accordance with the procedures established by the Audit Committee. All correspondence is kept anonymous and kept confidential to the extent possible.

SONIC CORP. - 2016 Proxy Statement 9

|

| PROPOSAL NO. 1 - ELECTION OF DIRECTORS |

General

Our certificate of incorporation provides for a classified board of directors, with three classes of directors each nearly as equal in number as possible. Each class serves for a three-year term, and one class is elected each year. The Nominating and Corporate Governance Committee has recommended to the Board of Directors, and the Board of Directors has nominated for election by the shareholders, four individuals. Nominated for re-election are incumbent directors,Clifford Hudson, Federico F. Peña andSusan E. Thronson,whose terms will expire at the 2016 annual meeting. Also nominated for election as a new director isR. Neal Black. If elected, Messrs. Black, Hudson and Peña and Ms. Thronson will each serve as a director for a three-year term expiring at the annual meeting to be held in 2019.

If any of the nominees becomes unable or unwilling to accept the election or to serve as a director (an event which the Board of Directors does not anticipate), the person or persons named in the proxy will vote for the election of the person or persons recommended by the Board of Directors.

Robert M. Rosenberg, one of our incumbent directors, is not standing for re-election. Mr. Rosenberg has served as a director since 1993.

Nominees

The following table sets forth the name, year in which the individual first became a director, year in which the director’s term will expire (if elected) and age for each nominee for election as a director at the annual meeting of shareholders.

| | | | | | | | | | | | |

| Name | | First Became

a Director | | | Term

Expires | | | Age | |

R. Neal Black | | | Nominee | | | | 2019 | | | | 60 | |

Clifford Hudson | | | August 1993 | | | | 2019 | | | | 61 | |

Federico F. Peña | | | January 2001 | | | | 2019 | | | | 68 | |

Susan E. Thronson | | | April 2015 | | | | 2019 | | | | 54 | |

The following is certain biographical information about each of the four nominees for directors, including their principal occupations. Also included is a description of their experience, qualifications, attributes and skills.

| | |

| | |

R. Neal Black Former Chief Executive Officer and President of Jos. A. Bank Clothiers, Inc. | | R. Neal Black served as Chief Executive Officer, President and Director of Jos. A. Bank Clothiers, Inc. from 2008 to 2014, having joined Jos. A. Bank in 2000 as Executive Vice President of Merchandising and Marketing. Prior to joining Jos. A. Bank, Mr. Black held executive positions at Saks Incorporated, Venture Stores, Gottschalks Incorporated and May Company. |

| |

| SKILLS AND QUALIFICATIONS: | | Mr. Black is a seasoned executive with more than 35 years of retail management experience in supply chain, product development and marketing as well as experience as a director of a publicly traded company. The Board will benefit from Mr. Black’s strategic planning skills along with his significant leadership and operating knowledge. |

| |

Clifford Hudson Chairman, Chief Executive Officer and President, Sonic Corp. | | Clifford Hudson has served as the Company’s Chairman of the Board since January 2000 and Chief Executive Officer since April 1995. Mr. Hudson served as President of the Company from April 1995 to January 2000 and reassumed the position of President from November 2004 until May 2008 and again in April 2013 to the present. He has served in various other offices with the Company since 1984. Mr. Hudson has served on the Board of Trustees of the |

10 SONIC CORP. - 2016 Proxy Statement

ELECTION OF DIRECTORS

| | |

| |

| | Ford Foundation since January 2006 and on the Board of Trustees of the National Trust for Historic Preservation from January 2001 until 2011, where he served as its Chairman from 2008 until 2011. He served as Chairman of the Board of the Securities Investor Protection Corporation, the federally chartered organization which serves as the insurer of customer accounts with brokerage firms, from 1994 to 2001. |

| |

| SKILLS AND QUALIFICATIONS: | | In his more than 30 years with the Company, Mr. Hudson has gained meaningful leadership experience and quick-service restaurant knowledge. As CEO, he is responsible for determining the Company’s strategy and clearly articulating priorities as well as aligning and motivating the organization to execute effectively. These capabilities, combined with Mr. Hudson’s understanding of the Company and unwavering commitment to the Sonic brand, make him uniquely qualified to serve on the Board. |

| |

Federico F. Peña Senior Advisor, Vestar Capital Partners | | Federico F. Peña has served as a Senior Advisor of Vestar Capital Partners since January 2009, and previously served as a Managing Director of Vestar from 1999 to 2009. Vestar is a global private equity firm that specializes in management buyouts, recapitalizations and going private transactions. Prior to joining Vestar, Mr. Peña served as the United States Secretary of Energy from 1997 to 1998 and the United States Secretary of Transportation from 1993 to 1997. Mr. Peña served as the Mayor of the City and County of Denver, Colorado from 1983 through 1991, the first Latino to hold that elected office. Mr. Peña founded Peña Investment Advisors in 1991 and was its President and Chief Executive Officer from 1991 until 1993. He served in the Colorado House of Representatives from 1979 until 1983 and practiced law for 10 years in Colorado. Mr. Peña is a Director of Wells Fargo & Company and a member of Toyota’s North American Diversity Advisory Board, as well as a member of several non-profit organizations. |

| |

| SKILLS AND QUALIFICATIONS: | | Mr. Peña has demonstrated sound leadership skills and brings his extensive investment experience to the Board. |

| | |

Susan E. Thronson Former Senior Vice President, Global Marketing, Marriott International, Inc. | | Susan E. Thronson served in a variety of marketing management positions from 1989 to July 2013 at Marriott International, Inc., a worldwide operator, franchisor and licensor of hotels and corporate housing properties. Her most recent positions with Marriott were Senior Vice President, Global Marketing from July 2005 to July 2013 and Senior Vice President, International Marketing, International Lodging Organization from January 1997 to June 2005. Ms. Thronson is a National Association of Corporate Directors (NACD) Governance Fellow and also serves as a director of Angie’s List, Inc. |

| |

| SKILLS AND QUALIFICATIONS: | | Ms. Thronson provides extensive global and brand marketing expertise to the Company, including digital marketing platforms as well as leadership experience with global operations and franchising. |

Proxies cannot be voted for more than four nominees.

The Board of Directors recommends a vote “For” the election of each of the four nominees as a director.

SONIC CORP. - 2016 Proxy Statement 11

ELECTION OF DIRECTORS

Other Directors

The following table sets forth the name, year in which the individual first became a director, year in which the director’s term will expire and age for each director who will continue as a director after the annual meeting of shareholders.

| | | | | | | | | | | | |

| Name | | First Became

a Director | | | Term

Expires | | | Age | |

Tony D. Bartel | | | January 2014 | | | | 2017 | | | | 51 | |

Lauren R. Hobart | | | January 2014 | | | | 2017 | | | | 47 | |

Kate S. Lavelle | | | January 2012 | | | | 2018 | | | | 50 | |

J. Larry Nichols | | | January 2007 | | | | 2018 | | | | 73 | |

Jeffrey H. Schutz | | | August 2010 | | | | 2017 | | | | 64 | |

Kathryn L. Taylor | | | January 2010 | | | | 2017 | | | | 60 | |

Frank E. Richardson | | | March 1991 | | | | 2018 | | | | 76 | |

The following is certain biographical information about each of the seven persons who will continue as a director after the annual meeting of shareholders, including their principal occupations. Also included is a description of their experience, qualifications, attributes and skills.

| | |

| | |

Tony D. Bartel Chief Operating Officer, Gamestop Corporation | | Tony D. Bartel has over 20 years of experience in the consumer products industry, including 14 years in the restaurant industry. Mr. Bartel has served as Chief Operating Officer of Gamestop Corporation since 2014. He served as President of Gamestop Corporation from 2010 to 2014, Executive Vice President of Merchandising and Marketing for Gamestop from 2007 until 2010 and as Senior Vice President of International Finance for Gamestop from 2005 until 2007. Prior to that, Mr. Bartel worked for NCH Corporation for two years and Pizza Hut, Inc. for 14 years, serving in various management positions including Chief Financial Officer, Vice President of Strategic Planning and Vice President of Field Finance. He is a certified public accountant and began his career with KPMG LLP where he served for three years as a tax specialist. |

| |

| SKILLS AND QUALIFICATIONS: | | Mr. Bartel’s experience in marketing and strategy for multi-unit retail and restaurant brands provides a significant broad-based understanding of retailing, including marketing and strategic planning. In addition, Mr. Bartel’s background in finance, tax and accounting provides the Board with valuable perspective on the Company’s strategic initiatives, financial oversight and stewardship of capital. |

| | |

Lauren R. Hobart Executive Vice President and Chief Marketing Officer, Dick’s Sporting Goods, Inc. | | Lauren R. Hobart has served as Chief Marketing Officer of Dick’s Sporting Goods, Inc. since 2011. Ms. Hobart has also served as the Executive Vice President of Dick’s Sporting Goods and as the President of The Dick’s Sporting Goods Foundation since September 2015 and as Chelsea Collective General Manager of Dick’s Sporting Goods since June 2015. She served as Senior Vice President of Dick’s Sporting Goods from 2011 until September 2015. Ms. Hobart held a variety of management positions with Pepsi-Cola North America from 1997 until 2011, including Chief Marketing Officer, Carbonated Soft Drinks Brand. She began her career in the banking industry having five years of experience with JPMorgan Chase & Company and Wells Fargo Bank. |

| |

| SKILLS AND QUALIFICATIONS: | | Ms. Hobart brings to the Board her marketing and strategic planning skills as a senior marketing executive at Fortune 500 companies. She also provides valuable insight into consumer needs and marketplace trends currently influencing the retail industry. |

12 SONIC CORP. - 2016 Proxy Statement

ELECTION OF DIRECTORS

| | |

Kate S. Lavelle Former Executive Vice President and Chief Financial Officer, Dunkin’ Brands, Inc. | | Kate S. Lavelle has over 20 years of experience in finance and accounting, including 12 years in the restaurant and food service industry. Ms. Lavelle served as the Executive Vice President and Chief Financial Officer of Dunkin’ Brands, Inc. from December 2004 until July 2010. She served as Global Senior Vice President for Finance and Chief Accounting Officer of LSG Sky Chefs, a wholly owned subsidiary of Lufthansa Airlines, from January 2003 until August 2004. Ms. Lavelle served in various other management positions for LSG Sky Chefs, from March 1998 until January 2003. She began her career at Arthur Andersen LLP where for more than 10 years she served as Senior Audit Manager in charge of administration of audits and other professional engagements. From 2005 until July 2007, Ms. Lavelle served as a Director of Swift & Company, an American food processing company which was acquired in 2007 by JBS S.A., a Brazilian company. From May 2013 to May 2015, she served as a director of Jones Lang LaSalle, a global financial and professional services firm specializing in commercial real estate services and investment management. |

| |

| SKILLS AND QUALIFICATIONS: | | With over 20 years of experience in the finance and accounting industry, and six of those years as the Chief Financial Officer of a large, multi-brand, franchised quick-service restaurant business, Ms. Lavelle brings to the Board her extensive expertise in finance and direct knowledge and understanding of franchising, restaurant operations and management. |

| |

J. Larry Nichols Executive Chairman, Devon Energy Corporation | | J. Larry Nichols is a co-founder of Devon Energy Corporation (“Devon”) and has served as Executive Chairman of the Board of Directors of Devon since June 2010. Mr. Nichols served as Chairman of the Board of Devon from 2000 to June 2010 and as Chief Executive Officer from 1980 to June 2010. Mr. Nichols also serves on the Nominating and Governance Committee and as Lead Director of Baker Hughes Incorporated. He served as Chairman of the Board of the American Petroleum Institute from 2009 to 2010 and is a Director of the American Natural Gas Alliance, the National Association of Manufacturers and the National Petroleum Council. |

| |

| SKILLS AND QUALIFICATIONS: | | Mr. Nichols has demonstrated strong business, management and leadership skills, as evidenced by his successful performance as Chairman and Chief Executive Officer of Devon. |

| | |

Frank E. Richardson Chairman, F.E. Richardson & Co., Inc. | | Frank E. Richardson has served as Chairman of F. E. Richardson & Co., Inc. of New York City, a firm specializing in acquisitions of and investments in growth companies, since June 1995. From 1986 to June 1995, Mr. Richardson served as President of Wesray Capital Corporation, a firm which also specialized in acquisitions of and investments in growth companies. From 1997 to June 2006, he served as Chairman of Enterprise News Media, Inc., which owned newspapers in Brockton, Quincy, Plymouth and several other towns in Massachusetts. Mr. Richardson serves as an Emeritus Trustee of the Metropolitan Museum of Art in New York, a Director of the American Friends of the National Gallery, London, England, and a Director of the New York Genome Center. Mr. Richardson has served on the boards of many public companies, including Alex Brown, Wilson Sporting Goods, Avis (Europe) and others. |

| |

| SKILLS AND QUALIFICATIONS: | | Mr. Richardson’s knowledge and experience in investments and financial matters and his experience with growth companies are valuable assets to the Board and to the Company. |

| |

Jeffrey H. Schutz Managing Director, Centennial Ventures | | Jeffrey H. Schutz is a managing director of Centennial Ventures, a Denver-based venture capital firm with approximately $500 million of assets currently under management. Mr. Schutz has been a general partner in seven Centennial-sponsored partnerships and involved with the start-up, growth and development of approximately 50 companies over the past |

SONIC CORP. - 2016 Proxy Statement 13

ELECTION OF DIRECTORS

| | |

| |

| | 23 years. In his position with Centennial Ventures, Mr. Schutz has directly contributed to the strategic planning and direction of these companies. Prior to joining Centennial Ventures in 1987, Mr. Schutz was Vice President and Director of PNC Venture Capital Group, an affiliate of PNC Financial. |

| |

| SKILLS AND QUALIFICATIONS: | | As a result of his background in building and growing entrepreneurial businesses, Mr. Schutz provides knowledgeable advice to the Company’s other directors and to senior management as the Company continues to strengthen its brand and grow its market share. |

| |

Kathryn L. Taylor Chief Executive Officer, Impact Tulsa | | Kathryn L. Taylor serves as Chief Executive Officer of Impact Tulsa, a partnership of business and education leaders working to improve student outcomes. She previously worked as Chief of Education Strategy and Innovation for the State of Oklahoma from January 2010 until January 2011, a cabinet-level position to which she was appointed by the Governor of Oklahoma. She was elected the Mayor of the City of Tulsa, Oklahoma in 2006, and completed her term as Mayor in December 2009. Ms. Taylor was a partner in the Oklahoma law firm of Crowe and Dunlevy, serving as the Chair of the Franchising and Distribution Section from 1994 until 1998. From 1994 to 1997, Ms. Taylor also served as a principal owner and director of National Car Rental. From 1988 to 1994, she served as the Executive Vice President and General Counsel of Dollar-Thrifty Car Rental. Both National Car Rental and Dollar-Thrifty Car Rental operate and franchise car rental locations world-wide. |

| |

| SKILLS AND QUALIFICATIONS: | | Ms. Taylor provides significant knowledge to the Board on franchising, corporate governance and financial matters. She also provides broad insight into executive leadership, strategy and public affairs. |

14 SONIC CORP. - 2016 Proxy Statement

ELECTION OF DIRECTORS

Committees of the Board of Directors

The Board of Directors has three standing committees: the Nominating and Corporate Governance Committee, the Audit Committee and the Compensation Committee. The charters for each of these committees has been adopted by the Board of Directors and are available at no charge in the corporate governance section of the Company’s website,www.sonicdrivein.com. All members of each of these committees are independent directors.

The directors serving on each committee are appointed by the Board. These appointments are made at least annually, for terms expiring at the next annual meeting of shareholders.

The following table lists each committee’s current membership as of the date of this proxy statement, each committee’s functions and the number of meetings each committee held in fiscal 2015:

| | | | | | | | |

| Members(1) | | Functions of Audit Committee | | Number of Meetings in 2015 | |

Kate S. Lavelle, Chair Tony D. Bartel J. Larry Nichols Frank E. Richardson Kathryn L. Taylor | | • | | Provides assistance to the Board in fulfilling its oversight responsibility relating to the Company’s financial statements and the financial reporting process, the systems of internal accounting and financial controls, the internal audit function, the annual independent audit of the Company’s financial statements and compliance by the Company with certain legal and regulatory requirements | | | Seven | |

| | • | | Encourages free and open communication among the committee members, the Company’s independent registered public accounting firm and management of the Company | | | | |

| | • | | Pre-approves all audit and permissible non-audit services | | | | |

| | • | | Periodically meets with representatives of the Company’s independent registered public accounting firm and also meets with representatives of the internal audit function without management present | | | | |

| | • | | Reviews the quarterly financial statements prior to the releases of earnings to the public | | | | |

| | (1) | The Board of Directors has determined that each member of the Audit Committee is an “Audit Committee financial expert” as defined in Item 407(d) of Regulation S-K. |

SONIC CORP. - 2016 Proxy Statement 15

ELECTION OF DIRECTORS

| | | | | | | | |

| Members | | Functions of Compensation Committee | | Number of

Meetings in 2015 | |

Jeffrey H. Schutz, Chair Lauren R. Hobart Federico F. Peña Robert M. Rosenberg Susan E. Thronson | | • | | Establishes, implements and continually monitors adherence to the Company’s compensation philosophy | | | Five | |

| | • | | Reviews and approves the base salary, annual and long-term cash incentive awards and long-term equity incentive awards to the executive officers of the Company other than the CEO | |

| | • | | Reviews and recommends to the Board of Directors the compensation of the CEO | |

| | • | | Oversees and reviews the Company’s equity and cash incentive plans | |

| | |

| Members | | Functions of Nominating and Corporate Governance Committee | | Number of

Meetings in 2015 | |

J. Larry Nichols, Chair Federico F. Peña Frank E. Richardson Robert M. Rosenberg | | • | | Identifies and recommends individuals qualified to become Board members | | | Five | |

| | • | | Performs CEO succession planning | |

| | • | | Monitors significant developments in the law and practice of corporate governance | |

Compensation Committee Interlocks and Insider Participation

None of the Compensation Committee members has ever been an officer or employee of Sonic or any of its subsidiaries or had any relationship with Sonic requiring disclosure under Item 404 of Regulation S-K. No executive officer of Sonic has served on the board of directors or compensation committee of any other entity that has or has had one or more executive officers who served as a member of the Company’s Board of Directors or the Compensation Committee during fiscal year 2015. None of the Compensation Committee members have interlocking relationships as defined by the SEC.

Executive Session Meetings

The independent directors of the Company meet without the management director at executive sessions in conjunction with each quarterly board meeting and at other appropriate times. The independent directors have designated J. Larry Nichols as the lead director to preside at all meetings of the independent directors.

16 SONIC CORP. - 2016 Proxy Statement

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This compensation discussion and analysis describes the Company’s executive compensation philosophy, objectives and program regarding the compensation of our named executive officers or “NEOs” (our Chief

Executive Officer or “CEO,” Chief Financial Officer and three other most highly compensated executives) for fiscal 2015:

| | |

| Name | | Title |

Clifford Hudson | | Chairman of the Board, Chief Executive Officer and President |

Claudia S. San Pedro | | Executive Vice President and Chief Financial Officer |

John H. Budd III | | Senior Vice President and Chief Development and Strategy Officer |

Craig J. Miller | | Senior Vice President and Chief Information Officer |

Todd W. Smith | | Senior Vice President and Chief Marketing Officer |

Executive Summary

Our executive compensation program is designed to (a) motivate our executives to increase profitability and shareholder returns, (b) to pay a significant portion of

compensation based on performance and (c) to compete for and retain talent.

2015 BUSINESS PERFORMANCE

Fiscal 2015 saw continued strong financial and operational results for the Company. Our media and product innovation initiatives drove much of our same-store sales increases, which resulted in increased income from operations and an increase in earnings per share (“EPS”) on a year-over-year adjusted basis. This increase, combined with our first quarterly dividend program

implemented in fiscal 2015 and our share repurchase program, provided a strong return to our shareholders. The following table illustrates the Company’s growth in fiscal 2015 in terms of income from operations, EPS, same-store sales and stock price relative to performance in fiscal 2014 and fiscal 2013.

| | | | | | | | | | | | | | | | |

| | | 2015 | | | 2014 | | | 2013 | | | Change from 2013 to 2015 | |

Income from Operations (in thousands) | | $ | 116,428 | | | $ | 98,677 | | | $ | 89,248 | | | | 30.4% | |

EPS (Diluted) | | $ | 1.20 | | | $ | .85 | | | $ | .64 | | | | 87.5% | |

Same-Store Sales Growth | | | 7.3 | % | | | 3.5 | % | | | 2.3 | % | | | (1) | |

Stock Price per Share at Fiscal Year End | | $ | 27.00 | | | $ | 21.11 | | | $ | 15.96 | | | | 69.2% | |

| | (1) | The Company’s cumulative same-store sales growth from the beginning of fiscal 2013 to the end of fiscal 2015 was 13.1%. |

SONIC CORP. - 2016 Proxy Statement 17

EXECUTIVE COMPENSATION

The Company’s performance during fiscal 2015, and for the three-year period ending with fiscal 2015, demonstrated significantly improved financial results and

a corresponding strong growth in the Company’s stock price.

2015 COMPENSATION PROGRAM KEY EVENTS

| • | | Base salaries of NEOs increased, on average, by 10%. (The average percentage is skewed by a 35% mid-year increase in the base salary of one NEO as a result of a promotion to his current position.) |

| • | | Annual cash incentive award payout for fiscal 2015 performance was 131% of target, reflecting strong financial performance in fiscal 2015. |

| • | | Long-term cash incentive award payout for the three-year performance period ending fiscal 2015 was 116% of target, reflecting strong financial performance for the three fiscal years 2013, 2014 and 2015. |

Executive Compensation Practices

Our executive compensation practices support good governance and mitigate excessive risk-taking.

What we do:

| • | | Pay for Performance. The majority of compensation is tied to performance. |

| • | | Stock Ownership. We have stock ownership requirements for our CEO, requiring him to own stock equal in value to at least five times his annual salary. As of September 30, 2015, our CEO owned Sonic stock equal in value to more than 12 times his base salary. In fiscal 2015, the Board adopted stock ownership guidelines for all other officers. Officers are given five years to attain the requirements. |

| • | | Cash Incentives. Our long-term (three-year) cash incentives and short-term (annual) cash incentive require growth in EPS to yield a payout. Both our short-term and long-term cash incentives utilize caps on potential payments. |

| • | | Clawbacks. In August 2012, we adopted compensation recovery, or “clawback,” provisions in our employment agreements that will apply to all incentive compensation programs. We intend to adopt a comprehensive clawback policy after the SEC finalizes its proposed rules regarding clawbacks issued in July 2015. |

| • | | Change in Control. Our employment agreements are double-trigger, meaning that none of the Company’s executive officers are eligible to receive cash payments solely as a result of a change in control of the Company. Severance payments will be provided following a change in control only if the executive is terminated without cause or resigns for good reason. |

| • | | Independent Compensation Committee. The Compensation Committee is comprised solely of independent directors. |

| • | | Independent Consultant. The Compensation Committee benefits from its utilization of an independent compensation consultant, and the compensation consultant acts at the sole direction of the Compensation Committee. |

| • | | Equity Plans. Our 2006 Long-Term Incentive Plan provides for a three-year minimum vesting period for all time-based vesting equity awards for employees. |

What we don’t do:

| • | | Special retirement programs. The Company does not have any special executive retirement programs that are specific to executive officers. |

| • | | Tax Gross-ups. The Company does not provide any tax gross-ups with respect to payments made in connection with a change in control. |

| • | | Company Stock Transactions. The Company prohibits its executive officers from engaging in hedging or other speculative transactions in Company stock. |

| • | | No Repricing of Underwater Stock Options. The Company does not re-price or backdate stock options. If our stock price declines or stays flat, our NEOs realize no benefit from their outstanding underwater stock options. We believe this is appropriate because our shareholders also would not have benefited from owning shares of Sonic common stock during this time. |

| • | | Perquisites. The Company does not have excessive perquisites for executives. |

18 SONIC CORP. - 2016 Proxy Statement

EXECUTIVE COMPENSATION

OUR COMPENSATION OBJECTIVES

Our fundamental objective is to create value for our shareholders on a consistent long-term basis. To accomplish this goal, the Compensation Committee designs executive compensation programs that:

| • | | Emphasize Pay for Performance by aligning incentives with business strategies to reward executives who achieve or exceed Company goals. |

| • | | Pay Competitively to attract and retain talent by setting target compensation opportunities to be competitive |

| | | with other companies in our industry of similar size and value. |

| • | | Focus on Long-Term Success by including equity as a cornerstone of our executive pay programs and using a combination of short-term and long-term incentives to ensure a strong connection between Company performance and actual compensation realized. |

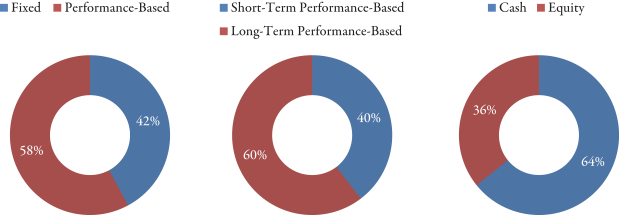

EMPHASIZING PAY FOR PERFORMANCE

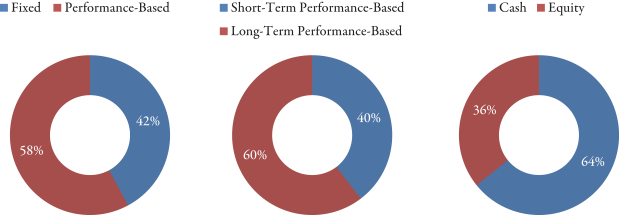

Our executive compensation program consists of four key components: base salary, short-term cash incentive awards, long-term cash incentive award and equity awards. We designed our program so that NEO compensation varies by type (fixed versus performance-based), length of performance period (short-term versus long-term) and form (cash versus equity). We believe that such variation is necessary to (1) strike the appropriate balance between short- and long-term

business goals; (2) encourage appropriate behaviors and discourage excessive risk-taking; and (3) align the interests of the Company’s executives with our shareholders.

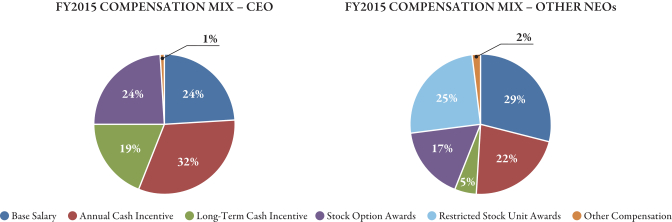

The mix of components is designed to incent both individual accountability and collaboration to build long-term shareholder value. The charts below show the average mix of the key components of fiscal 2015 NEO compensation by type, length and form.

Consistent with our design principles, performance-based programs pay out at 100% when goals are achieved. Payouts below 100% occur when goals are not achieved, and payouts above 100% are possible when goals are exceeded. For example, over the past 10 years, the short-term incentive award payout ranged from a low of 0% to a high of 131%. The long-term cash incentive

award was started in fiscal 2011, with the first payment period ending in fiscal 2013. The long-term cash incentive award payout has ranged from a low of 0% to a high of 116%. These payouts were based on the results achieved as compared to the pre-established performance targets, highlighting the clear link between pay and performance that underlies our compensation programs.

SONIC CORP. - 2016 Proxy Statement 19

EXECUTIVE COMPENSATION

PAYING COMPETITIVELY

In making compensation decisions, the Compensation Committee compares each element of total compensation against our “compensation peer group,” which is a benchmarking peer group of publicly traded restaurant companies, as augmented by survey data where position matches were not available. Our compensation peer group is carefully selected in consultation with Mercer based on criteria including restaurant industry, operating structure and size. The peer group is periodically reviewed and updated by the Compensation Committee to consist of companies

against which the Compensation Committee believes we compete for talent. Changes to the peer group are carefully considered and made infrequently to assure continuity from year to year. For calendar 2015, the Compensation Committee removed Biglari Holdings Inc. (dissimilar pay practices) and CEC Entertainment (no longer has publicly available information) and added Fiesta Restaurant Group (restaurant company the Compensation Committee deemed relevant for comparative purposes).

The companies comprising our compensation peer group for 2015 were:

| | | | |

BJ’s Restaurants Bob Evans Farms Buffalo Wild Wings Denny’s DineEquity Domino’s Pizza | | Einstein Noah Restaurant Fiesta Restaurant Group Jack in the Box Panera Bread Papa John’s | | Popeye’s Louisiana Kitchen Red Robin Ruby Tuesday Texas Roadhouse Wendy’s |

At the time of setting 2015 compensation in January 2015, the Compensation Committee considered fiscal 2013 data, which was the most recent financial and compensation data of our peer group available at that time. For comparison purposes, the Company’s annual revenues in fiscal 2014 were below the 25th percentile in revenues of our compensation peer group, and the Company’s market value was between the 25th percentile and the median in market value of our compensation

peer group companies. The Company’s system-wide sales were above the 75th percentile in terms of system-wide sales of our peer group. While the target total compensation for our NEOs is set considering the median target total compensation within our peer group, actual compensation varies depending on the NEO’s experience in the particular role, as well as total Company and individual performance.

FOCUS ON LONG-TERM SUCCESS

One-half of the NEO’s long-term incentive awards are granted in the form of stock options. The stock options granted vest over a period of three years and only have value if our stock price appreciates after the options are granted. From time to time, in addition to regular stock option grants, the Compensation Committee makes special equity grants in the form of RSUs to senior executives to encourage retention of the key talent necessary to manage the Company successfully.

Historically, we have encouraged our executives to own Company stock and have monitored ownership levels. The Company has had stock ownership guidelines in

place for the CEO for several years that provide that he own Company stock valued at a minimum of five times his base salary. As of September 30, 2015, Mr. Hudson owned Company stock valued at more than 12 times his base salary. In fiscal 2015, the Company adopted stock ownership guidelines for all officers. For the NEOs other than the CEO, the guideline is that the NEO own either 12,500 shares or shares having a value of at least $400,000. Officers are given five years to attain either ownership level. Outstanding vested stock options are counted in determining the minimum value, but not in determining the minimum amount of shares.

20 SONIC CORP. - 2016 Proxy Statement

EXECUTIVE COMPENSATION

Components of Compensation

The significant elements of our executive compensation program are as follows:

| | | | | | |

| Direct Compensation Elements(1) | | Performance-based | | Primary Metric | | Terms |

Base Salary | | | | n/a | | Evaluated annually, based on such factors

as competitive benchmarks, Company

performance and individual performance |

Short-Term Cash Incentive (Annual Bonus) | | X | | EPS | | Based solely on financial metric |

Long-Term (Three-year) Cash Incentive | | X | | EPS | | Based solely on financial metric |

Stock Options | | X | | Time-based vesting; value

based on appreciation in

stock price | | Vest one-third each year; seven-year term |

Restricted Stock Units | | | | Time-based vesting; value

based on stock price on

vesting date | | Vary with minimum vesting over at least

three years |

| | (1) | Indirect compensation elements include retirement programs and other limited personal benefits as described below under “Other Elements of Compensation.” |

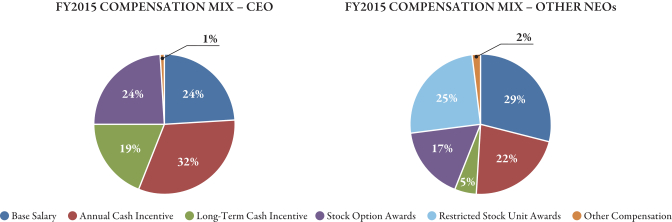

The following charts illustrate how each compensation component for fiscal 2015 disclosed in the Summary Compensation Table was weighted for our Chief Executive Officer and the other NEOs as a group.

BASE SALARY

For fiscal 2015, base salaries of NEOs increased, on average, by 10% over fiscal 2014. Not including Mr. Smith, who received a mid-year increase based on his promotion and increased responsibilities, fiscal 2015 base salaries of NEOs increased, on average, by 6% over fiscal 2014.

We provide competitive base salaries to our NEOs in recognition of their job responsibilities. In determining base salaries, we consider each NEO’s experience, unique skills, individual performance and future potential with

Sonic, along with salary levels for similar positions in our peer group and internal pay equity. Our compensation philosophy is to target base salaries close to the median of our compensation peer group for each NEO. Base salaries are reviewed annually during our benchmarking process. For fiscal 2015, the base salaries for the NEOs ranged from 63% to 115% of the peer group median base salary for fiscal 2013 (based on the information available when compensation was reviewed in January 2015). Ms. San Pedro was promoted to Chief Financial

SONIC CORP. - 2016 Proxy Statement 21

EXECUTIVE COMPENSATION

Officer in April 2015, so there is a material deviation from her fiscal 2015 compensation and the peer group median. Excluding Ms. San Pedro, the base salaries of the NEOs ranged from 86% to 115% of the peer group median base salary for fiscal 2015.

Base salaries for NEOs are reviewed on a calendar year basis. Mr. Hudson’s base salary was increased 8.9% for calendar 2015. The remaining NEOs received increases ranging from 2.5% to 5%. Changes were made as a result of the strong performance in fiscal 2014 and to move salaries closer to the respective officer peer-group medians. Mr. Smith received an additional increase of 35% effective March 1, 2015 as a result of his promotion to his current position of Senior Vice President and Chief Marketing Officer and his increased responsibilities. Ms. San Pedro received additional increases of 16.8% effective April 8, 2015 and 21%

effective August 1, 2015 as a result of her promotion to her current position of Executive Vice President and Chief Financial Officer and her increased responsibilities.

The annual base salaries for our NEOs as of the date of this proxy statement are as follows:

| | | | |

| Name | | ($) | |

Clifford Hudson | | | 802,093 | |

Claudia S. San Pedro(1) | | | 354,167 | |

John H. Budd III | | | 400,391 | |

Craig J. Miller | | | 302,428 | |

Todd W. Smith | | | 364,583 | |

| | (1) | While the base salaries for all NEOs will be considered for increases at the January 2016 Compensation Committee meeting, a more aggressive increase in Ms. San Pedro’s base salary will be considered in connection with her promotion to Chief Financial Officer in fiscal 2015, for the purpose of more closely aligning her base salary with the peer group median. |

SHORT-TERM CASH INCENTIVE (ANNUAL BONUS)

The Company achieved 30% growth in EPS in fiscal 2015, excluding certain non-GAAP adjustments. Short-term cash incentives paid out at 131% of target as a result of this performance.

We establish competitive annual performance opportunities as a percent of salary for our named executive officers that:

| • | | motivate attainment of short-term goals and |

| • | | link annual cash compensation to achievement of the annual strategic objectives of the business. |

Annual cash incentive awards for fiscal 2015 were granted under the Executive Cash Incentive Plan (the “Cash Plan”) adopted by the Company’s shareholders in 2012. The Cash Plan allows for both short-term and long-term performance-based cash incentive awards that are intended to qualify as performance-based compensation for purposes of Section 162(m) of the Internal Revenue Code, as amended.

The Compensation Committee measures the Company’s performance against an annual business plan prepared by management and reviewed and approved by the Board of Directors prior to the fiscal year. Achievement of the EPS target set forth in the annual business plan will result in a cash incentive award payment equal to a percentage of the NEO’s base salary. The EPS target is approved by the Board and designed to reinforce our focus on profitability and enhancement of long-term

shareholder value. We consider EPS a key indicator of how well management is executing the Company’s strategy.

The target short-term cash incentive awards are generally set at the median of our compensation peer group, taking into account individual performance, program costs and total compensation targets. The Compensation Committee periodically reviews these target award levels. The base salary target percentages for purposes of setting target short-term incentive awards for each NEO are based on the NEO’s responsibilities, internal pay equity among NEOs with similar responsibilities and competitive considerations. The base salary target percentages for our NEOs for fiscal 2015 and 2014 were as follows:

| | | | | | | | |

| Name | | 2015 (%) | | | 2014 (%) | |

Clifford Hudson | | | 100 | | | | 100 | |

Claudia S. San Pedro(1) | | | 50 | | | | 50 | |

John H. Budd III | | | 75 | | | | 75 | |

Craig J. Miller | | | 50 | | | | 50 | |

Todd W. Smith(2) | | | 75 | | | | 50 | |

| | (1) | Subsequent to the end of fiscal 2015, Ms. San Pedro received an increase from 50% to 75% based on her promotion and increased responsibilities. The increased percentage will apply to awards beginning in fiscal 2016. |

| | (2) | Effective March 1, 2015, Mr. Smith received an increase from 50% to 75% based on his promotion and increased responsibilities. |

22 SONIC CORP. - 2016 Proxy Statement

EXECUTIVE COMPENSATION

The Company must achieve an 80% threshold level of the established EPS target in order for NEOs to be rewarded with 25% of their target annual incentive awards. Incremental progress from 80% to 100% of the established EPS goal will allow the remaining 75% of the target incentive award to be earned. Consistent with our pay-for-performance philosophy, only when performance meets the EPS target will NEOs be able to realize the entirety of their target incentive awards. The Board of Directors sets the EPS target to require strong performance in order to achieve the target incentive awards.

To encourage exceptional performance, achievement in excess of the EPS target will result in the payment of an incentive award equal to an additional 3% of the target incentive award for every 1% EPS exceeds the EPS target. For example, if the Company achieved 103% of the EPS target for the fiscal year, the NEO would be entitled to receive 109% of his or her target incentive award. The award is capped at 116% of the EPS target (or 150% of the target annual incentive award).

The Compensation Committee will make adjustments for all items of gain, loss or expense that are related to

special, unusual or nonrecurring items, consistent with our publicly reported adjusted EPS. The Compensation Committee retains discretion to reduce, but not increase, the annual incentive awards in light of unusual or unforeseen developments that impact the Company or the restaurant industry.

For fiscal 2015, the EPS target was $1.00. Actual performance in fiscal 2015, as adjusted, was $1.10 which resulted in a payout of 131% of the target.

Short-term cash incentive award payouts for fiscal 2015 and the prior four fiscal years are shown below:

| | | | | | |

| Fiscal Year | | | | Incentive Award Payout as % of Target(1) | |

2015 | | | | | 131.0 | |

2014 | | | | | 102.8 | |

2013 | | | | | 113.8 | |

2012 | | | | | 85.0 | |

2011 | | | | | 114.0 | |

| | (1) | The Compensation Committee has not exercised discretion to alter any individual short-term awards paid under the Cash Plan. |

LONG-TERM INCENTIVES

A key component of our NEO compensation program includes rewards for long-term strategic accomplishments and enhancement of long-term shareholder value through the use of long-term cash and equity-based incentives. As a result, our officers’ interests are closely aligned with shareholders’ long-term interests. We believe that long-term incentive compensation performs an essential role in attracting and retaining executive talent and provides executives with incentives to maximize the value of shareholders’ investments. The annualized value of the long-term incentives awarded to our NEOs is intended to be the largest component of our incentive compensation package. Target long-term incentive award values are determined by the Compensation Committee by analyzing benchmark data, individual performance, program cost and total compensation targets.