Exhibit 99.2

Acquisition of

July 30, 2015

Forward Looking Statements

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). Such forward-looking statements include but are not limited to statements about the benefits of the business combination transaction involving Glacier Bancorp and Cañon

Bank Corporation, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those projected, including but not limited to the following: the possibility that the merger does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which GBCI and Cañon Bank Corporation operate; the ability to promptly and effectively integrate the businesses of Glacier Bank and Cañon Bank Corporation; the reaction to the transaction of the companies’ customers, employees, and counterparties; and the diversion of management time on merger-related issues. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management’s current estimates, projections, expectations and beliefs. Glacier Bancorp undertakes no obligation to publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this release. This statement is included for the express purpose of invoking PSLRA’s safe harbor provisions.

Transaction Overview

Glacier Bancorp will acquire Cañon National Bank, a leading community bank in south central Colorado, with $253 million in assets

Transaction marks the fifth Glacier acquisition announcement in the past two and a half years

Total transaction value of $31.8 million, consisting of $15.52 million in GBCI stock 554,229 and $16.25 million in cash

Based on recent GBCI stock price of $28.01

Cañon Bank Corporation, (holding company for Cañon National Bank) will be merged into Glacier Bancorp

Cañon National Bank will be merged into Glacier Bank and become part of the Bank of the San Juans banking division

Closing of transaction is subject to required regulatory approvals, Cañon shareholder approval, and customary closing conditions

Targeted closing date in fourth quarter of 2015

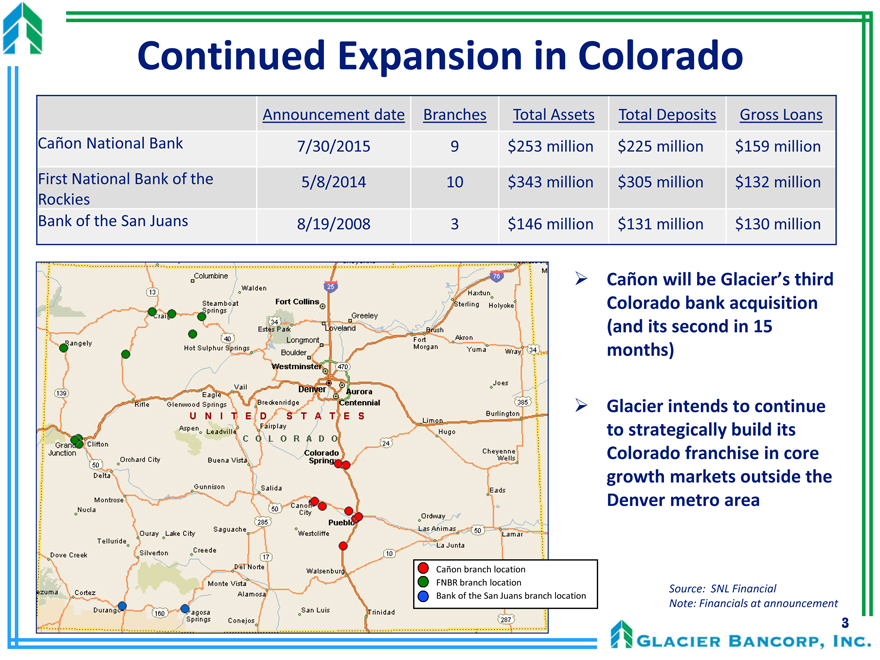

Continued Expansion in Colorado

Announcement date Branches Total Assets Total Deposits Gross Loans Cañon National Bank 7/30/2015 9 $253 million $225 million $159 million First National Bank of the 5/8/2014 10 $343 million $305 million $132 million Rockies Bank of the San Juans 8/19/2008 3 $146 million $131 million $130 million

Cañon will be Glacier’s third

Colorado bank acquisition (and its second in 15 months)

Glacier intends to continue to strategically build its Colorado franchise in core growth markets outside the Denver metro area

Cañon branch location FNBR branch location

Source: SNL Financial

Bank of the San Juans branch location

Note: Financials at announcement

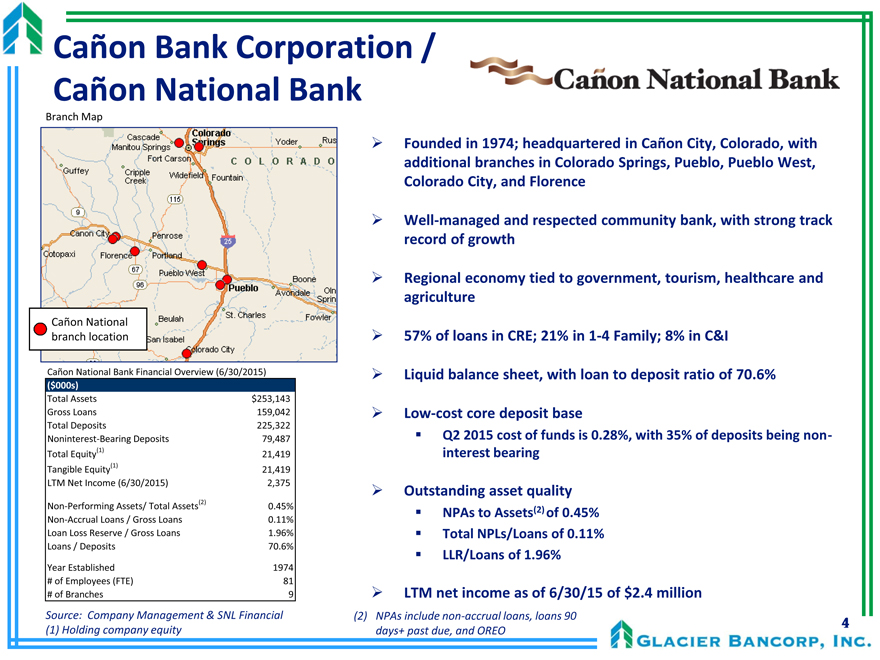

Cañon Bank Corporation / Cañon National Bank

Branch Map

Founded in 1974; headquartered in Cañon City, Colorado, with additional branches in Colorado Springs, Pueblo, Pueblo West, Colorado City, and Florence

Well-managed and respected community bank, with strong track record of growth

Regional economy tied to government, tourism, healthcare and agriculture

Cañon National

branch location

57% of loans in CRE; 21% in 1-4 Family; 8% in C&I

Cañon National Bank Financial Overview (6/30/2015)

Liquid balance sheet, with loan to deposit ratio of 70.6%

($000s)

Total Assets $253,143

Gross Loans 159,042

Low-cost core deposit base

Total Deposits 225,322 Q2 2015 cost of funds 0.28%, with 35% of deposits being non-

Noninterest-Bearing Deposits 79,487

is

Total Equity(1) interest bearing

21,419 Tangible Equity(1)

21,419 LTM Net Income (6/30/2015) 2,375

Outstanding asset quality

Non-Performing Assets/ Total Assets(2)

0.45% (2)

NPAs to Assets of 0.45%

Non-Accrual Loans / Gross Loans 0.11%

Loan Loss Reserve / Gross Loans 1.96%

Total NPLs/Loans of 0.11% Loans / Deposits 70.6%

LLR/Loans of 1.96%

Year Established 1974

# of Employees (FTE) 81

# of Branches 9

LTM net income as of 6/30/15 of $2.4 million

Source: Company Management & SNL Financial (2) NPAs include non-accrual loans, loans 90

(1) | | Holding company equity days+ past due, and OREO |

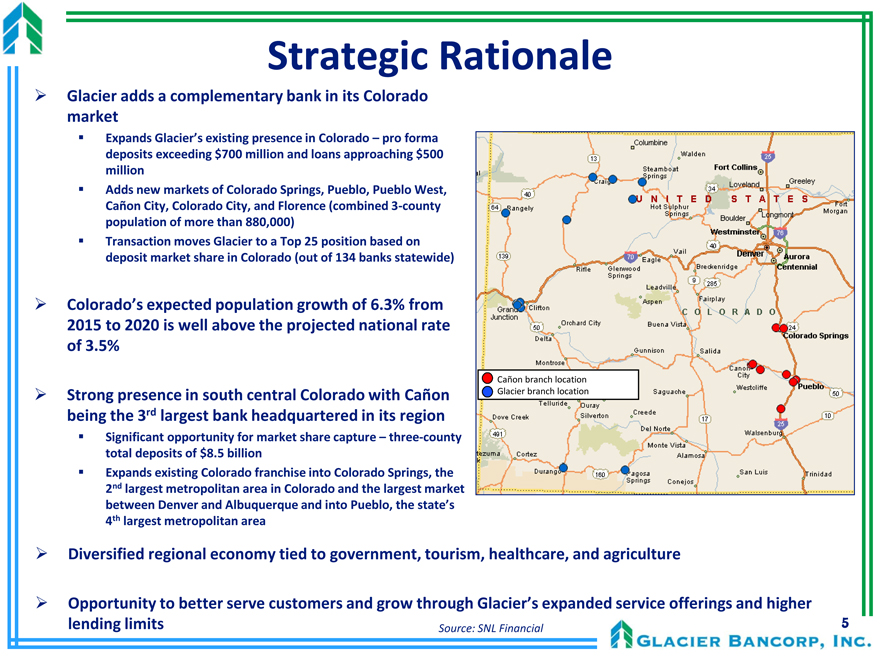

Strategic Rationale

Glacier adds a complementary bank in its Colorado market

Expands Glacier’s existing presence in Colorado – pro forma deposits exceeding $700 million and loans approaching $500 million

Adds new markets of Colorado Springs, Pueblo, Pueblo West, Cañon City, Colorado City, and Florence (combined 3-county population of more than 880,000)

Transaction moves Glacier to a Top 25 position based on deposit market share in Colorado (out of 134 banks statewide)

Colorado’s expected population growth of 6.3% from 2015 to 2020 is well above the projected national rate of 3.5%

Cañon branch location

Strong presence in south central Colorado with Cañon Glacier branch location being the 3rd largest bank headquartered in its region

Significant opportunity for market share capture – three-county total deposits of $8.5 billion

Expands existing Colorado franchise into Colorado Springs, the 2nd largest metropolitan area in Colorado and the largest market between Denver and Albuquerque and into Pueblo, the state’s 4th largest metropolitan area

Diversified regional economy tied to government, tourism, healthcare, and agriculture

Opportunity to better serve customers and grow through Glacier’s expanded service offerings and higher

lending limits Source: SNL Financial

Financial Benefits

Glacier adds a $159 million high-quality, growing loan portfolio, with further diversification in geography and industry

Glacier adds $221 million in core deposits, 35% of which are non-interest bearing

Average Q2 cost of funds: 0.28%

Excellent asset quality metrics contribute to favorable trends at Glacier

Further realization of Glacier’s capital deployment strategy

Glacier anticipates immediate EPS accretion of 1.6%(1)

Cañon’s strong recent trends in earnings should drive continued growth

Glacier Tangible Book Value/Share dilution of 0.5%; estimated EPS accretion provides TBV dilution payback in less than 2 years

(1) | | Excluding one-time transaction costs |

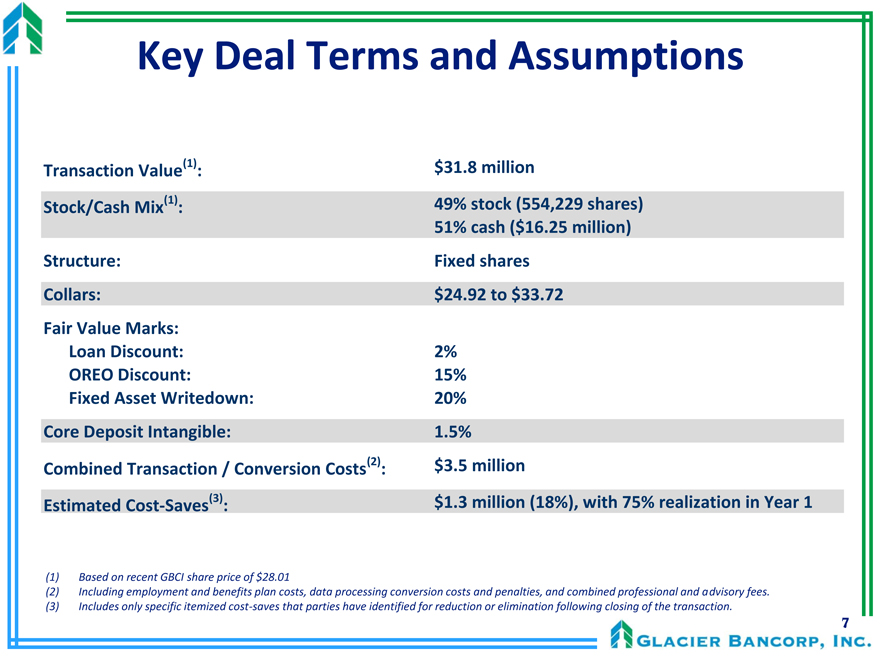

Key Deal Terms and Assumptions

Transaction Value(1): $31.8 million

(1) | | 49% stock (554,229 shares) Stock/Cash Mix : 51% cash ($16.25 million) |

Structure: Fixed shares

Collars: $24.92 to $33.72

Fair Value Marks:

Loan Discount: 2% OREO Discount: 15% Fixed Asset Writedown: 20%

Core Deposit Intangible: 1.5%

(2) | | $3.5 million Combined Transaction / Conversion Costs : |

(3) | | $1.3 million (18%), with 75% realization in Year 1 Estimated Cost-Saves : |

(1) | | Based on recent GBCI share price of $28.01 |

(2) Including employment and benefits plan costs, data processing conversion costs and penalties, and combined professional and advisory fees. (3) Includes only specific itemized cost-saves that parties have identified for reduction or elimination following closing of the transaction.

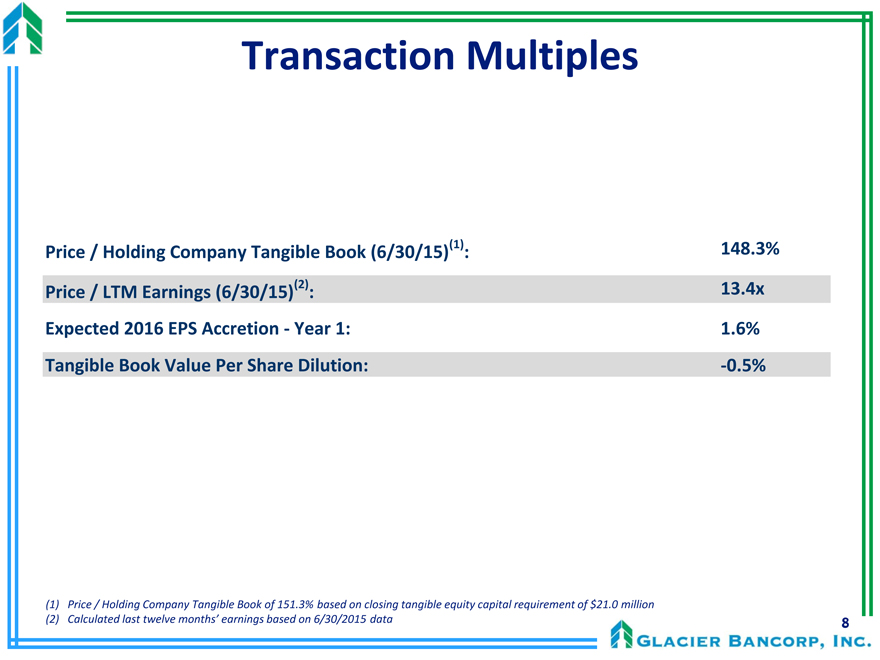

Transaction Multiples

Price / Holding Company Tangible Book (6/30/15) :

Price / LTM Earnings (6/30/15)(2): 13.4x

Expected 2016 EPS Accretion—Year 1: 1.6%

Tangible Book Value Per Share Dilution: -0.5%

(1) Price / Holding Company Tangible Book of 151.3% based on closing tangible equity capital requirement of $21.0 million

(2) | | Calculated last twelve months’ earnings based on 6/30/2015 data 8 |

Concluding Observations

Cañon National Bank acquisition continues Glacier’s tradition of adding high-quality regional banks that fit the Glacier community banking model

Pricing metrics, deal structure, and conservative assumptions reflective of Glacier’s disciplined approach to acquisitions

Opportunity to expand into the growing south central Colorado market, with Cañon adding to Glacier’s existing Colorado footprint

Cañon management and staff provide Glacier with additional management talent, deep market knowledge, and strong customer relationships

Under Glacier structure, Cañon’s employees will be able to focus even greater attention on customers and communities

With Glacier providing regulatory, operational, and financial support

Transaction should enhance GBCI’s long-term shareholder value

9